This report does not constitute a rating action

Insurance Brokers And

Servicers Sector View 2024:

Poised For Growth

Julie Herman

Director, Insurance Ratings

Joe Marinucci

Director, Insurance Ratings

Jan. 31, 2024

Key Takeaways

2

• We are maintaining our stable sector view for global insurance services, reflecting generally

resilient industry fundamentals across the subsectors.

• Current ratings and outlooks incorporate our expectation for real GDP growth dipping below

trend, core inflation inching down throughout the year, and modest federal funds rate cuts

beginning mid-year.

• Insurance brokers remain well positioned with continued, though slightly moderating, market

tailwinds from insurance pricing and still above-trend inflation.

• Non-brokers will continue to demonstrate mixed performance but should largely withstand

market headwinds, supported by generally steady retention, continued product and market

expansion, and effective expense management.

• We expect credit metrics will generally remain within rating tolerances, but often with thin

cushions, because most issuers have not tempered financial leverage despite the higher cost

of capital.

3

• Sector provides business services to the insurance industry with limited or no exposure to underlying insurance risk.

• 36 credits rated under corporate methodology; a subset of corporate business and consumer services.

• Majority in the ‘B’ rating category due to weak credit metrics and sponsor ownership.

Rating

distribution

Ownership

distribution

Subsector

distribution

Geography

distribution

Outlook

distribution

Insurance Services Portfolio Snapshot

67%

14%

8%

11%

Brokers

Healthcare Servicers

Claims Administrators

Warranty Administrators

83%

3%

14%

United States

Canada

Europe

As of Jan. 30, 2024. Source: S&P Global Ratings

2

1 1 1

3

4

17

6

1

0

2

4

6

8

10

12

14

16

18

92%

6%

3%

Stable

Negative

CW Positive

61%

14%

25%

Financial Sponsor

Other

Publicly Traded

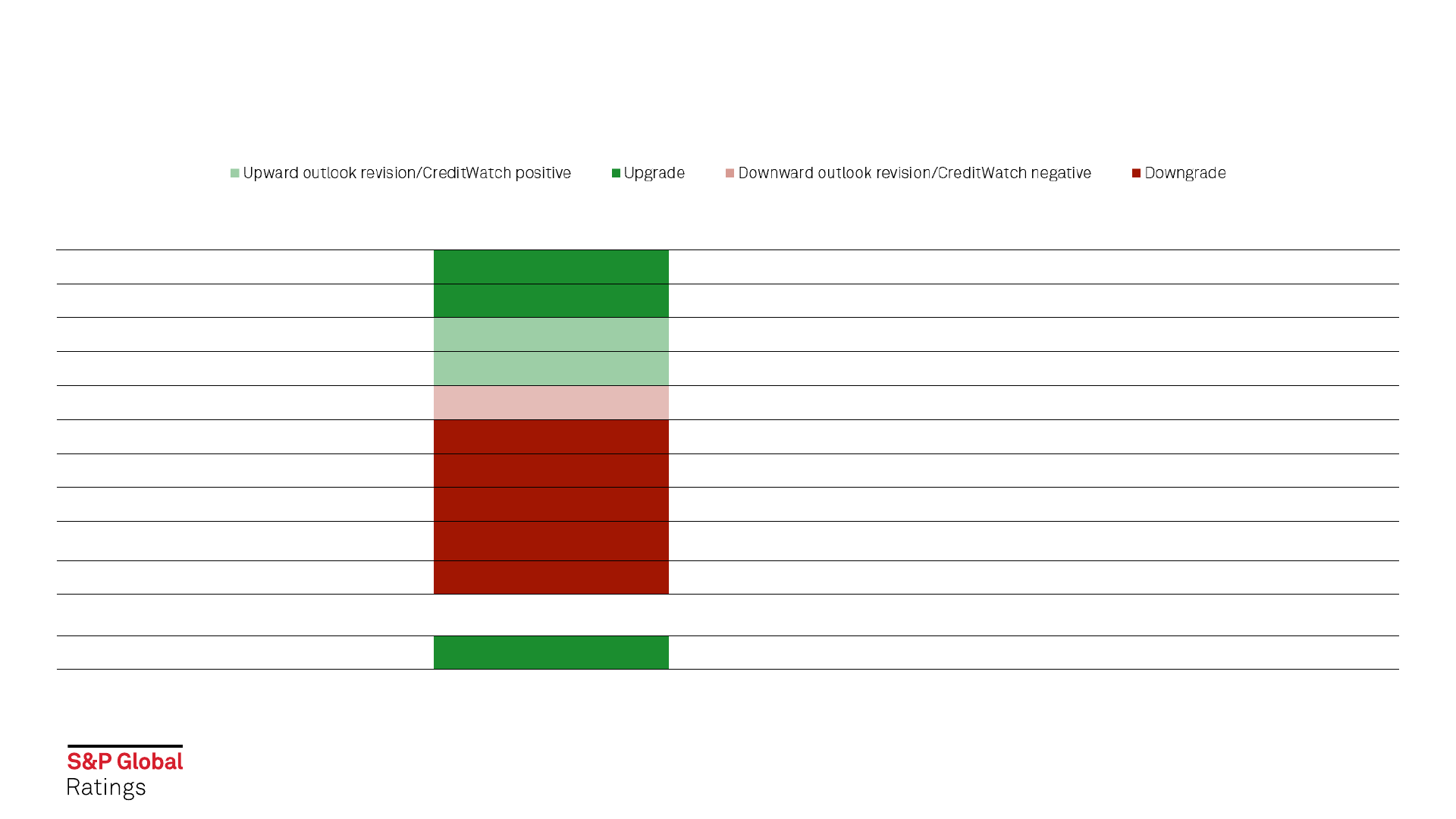

• Rating activity in the sector is generally modest relative to many other corporate sectors, partly because underlying insurance

purchases tend to be more stable (and often compulsory) versus other more discretionary products and services.

• Downgrade skew in 2023 is mostly issuer specific and doesn’t reflect industry strain.

Limited Rating Volatility Over Last Five Years

Insurance services rating actions (2019-2023)

-20

-15

-10

-5

0

5

10

15

20

2019 2020 2021 2022 2023

Upward outlook revision/CreditWatch positive Upgrade Downward outlook revision/CreditWatch negative Downgrade

4

Source: S&P Global Ratings

Insurance Services 2023 And Year-To-Date 2024 Rating Activity

2023

5

Company Subsector To From Rationale

Sedgwick L.P. Claims administrator B+/Stable B/Positive Sustained business position improvements as the largest global TPA by a sizable margin

Willis Towers Watson PLC Broker BBB+/Stable BBB/Positive Sustained leverage improvement on more conservative financial policy and stabilized performance

NFP Holdings LLC Broker B/Watch Pos B/Stable Expected credit profile improvements in conjunction with acquisition by higher-rated Aon

Zelis Holdings L.P. Health Servicer B/Positive B/Stable Improving credit metrics on robust underlying growth and more conservative financial policy

Aon PLC Broker A-/Negative A-/Stable Expected credit measure deterioration in conjunction with acquisition of NFP

BRP Group Inc. Broker B-/Stable B/Negative Elevated leverage on debt-funded M&A and costs related to growth initiatives

MedRisk Health Servicer B-/Stable B/Negative Slower deleveraging trajectory than anticipated on sluggish earnings growth

MultiPlan Corp. Health Servicer B/Stable B+/Stable Weakened credit metrics on lower utilization and contract renewal rates

One Call Corp. Health Servicer CCC+/Stable B-/Negative Unsustainable capital structure driven by performance misses on client insourcing and elevated costs

Saga PLC Broker B-/Negative B/Stable Tight liquidity in light of underperformance in motor brokerage and upcoming debt maturities

YTD 2024

Zelis Holdings L.P. Health Servicer B+/Stable B/Positive Material deleveraging on robust underlying growth trends and more conservative financial policy

Source: S&P Global Ratings

6

U.S.

• S&P Global Ratings now expects U.S.

economic expansion to decelerate to

1.5% in 2024 on an annual average

basis and 1.4% in 2025.

• Businesses are facing higher costs of

capital, which will lower capital

expenditures and hiring. The

unemployment rate will likely rise in

the next two years--to 4.6% in 2025

from 3.7% in 2023--slightly above the

longer-run steady state.

• As normalization in the product and

labor markets continues, disinflation

will endure, albeit unevenly.

• We think that the Federal Reserve will

pivot to rate cuts starting sometime in

mid-2024.

S&P Global Ratings: Economic Outlook

Source: S&P Global Ratings Economics.

Key indicators 2021 2022 2023F 2024F 2025F

Real GDP (annual avg % change) 5.8 1.9 2.4 1.5 1.4

Core CPI (annual avg % change) 3.6 6.2 4.8 2.8 2.3

Unemployment rate (%) 5.4 3.6 3.7 4.3 4.6

Payroll employment (mil.) 146.3 152.6 156.2 156.9 156.4

Federal funds rate (%) 0.1 1.7 5.1 5.3 3.2

Global

World GDP growth forecasts

(annual % change)

6.4 3.6 3.3 2.8 3.2

7

Brokers

8

Brokers – Peer Comparison

Business risk profile (BRP)

Financial risk profile (FRP)

Minimal Modest Intermediate Significant Aggressive Highly Leveraged

Excellent aaa/aa+ aa a+/a a- bbb bbb-/bb+

Strong

aa/aa- a+/a

a-/bbb+

Aon PLC (A-/Negative)

Marsh & McLennan Cos. (A-/Stable)

Willis Towers Watson PLC (BBB+/Stable)

bbb bb+ bb

Satisfactory a/a- bbb+

bbb/bbb-

Arthur J. Gallagher & Co. (BBB/Stable)

Brown & Brown Inc. (BBB-/Stable)

bbb-/bb+ bb b+

Fair bbb/bbb- bbb- bb+ bb

bb-

Ryan Specialty Group, LLC (BB-/Stable)

b

AmWINS Group Inc. (B+/Stable)

NFP Holdings LLC (B/Watch Pos)

Acrisure Holdings Inc. (B/Stable)

Alliant Holdings L.P. (B/Stable)

AssuredPartners Inc. (B/Stable)

Broadstreet Partners Inc. (B/Stable)

Diot-Siaci TopCo (B/Stable)

Howden Group Holdings Ltd. (B/Stable)

HUB International Ltd. (B/Stable)

Kereis SAS (B/Stable)

USI Inc. (B/Stable)

Weak bb+ bb+ bb bb- b+

b/b-

Cross Financial Corp. (B/Stable)

IMA Financial Group Inc. (B/Stable)

OneDigital Borrower LLC (B/Stable)

Amynta Holdings LLC (B-/Stable)

BRP Group Inc. (B-/Stable)

Navacord Corp. (B-/Stable)

Saga PLC (B-/Negative)

Vulnerable bb- bb- bb-/b+ b+ b b-

As of Jan. 30, 2024. Source: S&P Global Ratings

9

Brokers – At A Glance

The brokerage industry is:

Business risk profile characteristics

• Our business risk profile scores range from strong/satisfactory for market

leaders with a large account, global focus, and/or above-average profitability, to

fair/weak for the rest of the portfolio generally focusing on the competitive small-

to mid-market segments.

• Common strengths include performance stability through cycles given

largely nondiscretionary products, generally robust margins (typically 25%-35%),

and limited client/revenue concentrations.

• Common weaknesses include narrow product focus, limited market share,

and intense competition/limited differentiation in a crowded space.

Source: S&P Global Ratings

Financial risk profile characteristics

• Our financial risk profile scores are intermediate/aggressive for publicly

traded players, with moderate leverage fueled by high shareholder distributions

and debt-funded M&A.

• Our financial risk profile scores for all the private-equity-owned players are

highly leveraged, with weak credit protection measures for this group driven by

frequent flips and dividend recaps, as well as debt-driven M&A.

• The sector generally enjoys good free cash conversion and limited capex, with

a favorable maturity profile and limited financial covenants.

Bifurcated

• Marsh & McLennan, Aon, and Willis Towers Watson dominate the large

account space and the reinsurance broking universe (along with Arthur J.

Gallagher, which purchased Willis Re in late 2021). The rest of the industry

primarily services the vast middle-market and small account space.

Consolidating

• U.S. insurance agencies completed over 700 deals in 2023.

Highly fragmented

• Despite robust M&A activity in the space for well over the last decade,

there are still thousands of independent insurance agencies operating in

the U.S. No player in the middle-market space has significant market

share.

Private-equity-heavy

• Private equity presence has continued to intensify since entering the

sector over 15 years ago, attracted to the sector’s strong free cash flow.

Shifting to value

• The industry is increasingly moving from a relationship-driven model to an

analytics-driven model based on value-added services and specialized

expertise.

Rating distribution Outlook distribution

10

Our sector view on insurance brokers is stable, as naturally sticky revenue streams, continued favorable pricing, and net benefits from still above-trend

inflation mitigate expected below-trend economic growth.

Key expectations:

• Organic growth rates to remain robust in the mid-single digits or better on overall favorable market impact and steady new business and retention.

• Margins to hold steady or slightly improve on efficiency initiatives and operating leverage.

• M&A will remain robust despite higher funding costs and elevated valuations amid a continued fragmented space and strong buyer demand.

• Liquidity to stay healthy on strong free cash flow fundamentals and favorable debt maturity profiles.

• Credit metrics will remain steady as financial policies and leverage targets stay largely unchanged despite higher debt service.

Brokers – Credit Overview

8% 4% 4% 4% 4% 4% 54% 17%

A- BBB+ BBB BBB- BB- B+ B B-

As of Jan 30, 2024. Source: S&P Global Ratings.

88%

8%

4%

Stable

Negative

CW Positive

Source: Direct premiums written (DPW) from S&P Global Market Intelligence.

Nominal GDP forecast from S&P Global Ratings Economics.

Organic growth from company data and S&P Global Ratings. Commercial lines pricing from CIAB Pricing Survey

4%

5%

4%

-2%

10%

9%

5%

4%

5%

5%

5%

2%

9%

10%

10%

9%

4%

5%

5%

3%

9%

8%

8%

7%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

2017 2018 2019 2020 2021 2022 2023 2024f

U.S. Nominal GDP Growth U.S. P&C DPW Growth Median Organic Growth for Rated Brokers

Organic Growth Bolstered By Rising Insurance Premiums

U.S. P/C commercial lines pricing (standard business)

Growth in broker organic revenue relative to U.S. P/C DPW and U.S. nominal GDP

• Elevated premiums gains in recent years -- fueled by high

insurance price increases combined with inflation-driven

exposure unit growth -- have led to above-trend growth for

brokers.

• We expect premium growth to remain high in 2024, just

below 2023 levels, setting the stage for a continued

market tailwind for brokers.

• While rate trends vary widely by line, carriers will continue

to push for price increases in response to rising loss costs

and insured values from social and economic inflation and

more severe and frequent weather events.

• Modestly lower nominal GDP from moderating inflation

and slower real GDP growth will temper the insured

exposure side of the premium equation.

• Brokers with material wholesale, managing general agent,

or other specialty operations should continue to

outperform as premium growth in the excess and surplus

markets far exceeds standard lines.

• Company-specific trends will vary on strategic execution,

business mix, retention, and new business.

11

-5%

0%

5%

10%

15%

20%

25%

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

Average Commercial Property General Liability

Umbrella Commercial Auto Workers Compensation

• Margins have slightly moderated recently given wage inflation, an increase in travel and expense spending post-pandemic, and

investment in internal growth initiatives. Company-specific margins vary widely, but most remain 25%-35%.

• We expect stable to slightly positive margins in 2024 and beyond due to operating leverage and benefits from efficiency initiatives,

mitigated by gradual declines in fiduciary income and continued restructuring costs.

• AI initiatives in the sector are still in early stages, with many issuers engaged in pilot programs focused on efficiency gains, and a

handful also focused on front-end lead generation and sales tools.

Broker Margins Stabilize Above Pre-Pandemic Levels

Profitability of rated brokers

12

26.9%

28.9%

30.9%

32.3%

31.1%

29.4%

30.2%

24%

26%

28%

30%

32%

34%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2018 2019 2020 2021 2022 2023f 2024f

EBITDA margin

Mil. $

Median EBITDA Median Revenue Median EBITDA Margin

Company data, S&P Global Ratings.

Revenue growth composition for rated brokers

• Deal activity remained high in 2023, though down from 2022 on account of higher

interest rates, economic uncertainty, and continued valuation creep.

• Deal volume should remain robust due to enduring supply and demand characteristics:

– Persistent demand driven by a crowded buyers club (largely private equity-backed

and public companies), many of which are making more focused bets, though they

largely remain in the game.

– Abundant supply remains, with the industry still highly fragmented as acquired

targets are replenished quickly by scaling entrants.

• Majority of acquired companies are “tuck-ins” that further enhance the buyer’s core

competency, with an increasing focus on international and specialty-type operations.

13

Broker M&A Is A Mainstay

U.S. insurance agency M&A activity

Top 10 and top 100 broker revenue trends

Source: U.S. insurance agency M&A activity data from Marshberry Q4 2023 M&A Market Report.

Top 10 & Top 100 Broker Revenue Trends data from Business Insurance ranking reports (100 largest brokers of U.S. business). Revenue growth composition data from company data, S&P Global Ratings.

5%

3%

9%

8%

8%

7%

13%

10%

11%

11%

8%

8%

0%

5%

10%

15%

20%

2019 2020 2021 2022 2023f 2024f

Organic Revenue Growth Inorganic Revenue Growth

324

445

535

515

673

734

690

798

1066

903

751

7.4x

7.9x

8.7x

8.5x

8.8x

9.3x

9.8x

10.5x

11.9x

11.7x

12.4x

0x

2x

4x

6x

8x

10x

12x

14x

0

200

400

600

800

1,000

1,200

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Deal Count Purchase Price Multiple (Base price & realistic earnout)

74%

71%

70%

65%

60%

65%

70%

75%

0

20

40

60

80

2013 2016 2019 2022

Total U.S. Revenue of Top 10 Brokers

Total U.S. Revenue of Top 100 Brokers

Top 10 as % of Top 100

Cash flows for rated brokers

• Cash conversion consistently high supported by low capex and

working capital requirements.

• No material maturities across speculative-grade portfolio until

2027, and a well-laddered maturity profile across investment-

grade portfolio.

• With more favorable credit market conditions, capital markets

activity has picked back up since 2022, primarily on

opportunistic M&A and refinancing activity.

14

Broker Liquidity Supported By Favorable Cash Flow And Maturity Profile

Debt issuance activity for rated brokers

Upcoming debt maturities for rated

speculative-grade brokers**

* FCF Conversion defined as (Adj. EBITDA – CapEx) / Adj. EBITDA, **Excluding revolving credit facilities. Source: Company data, S&P Global Ratings

41

38

18

36

0

10

20

30

40

50

0

5

10

15

20

25

30

2020 2021 2022 2023

Bil. $

Value No. of Issuances

0

2

2

25

9

9

10

1

0

10

20

30

0

5

10

15

20

25

2024 2025 2026 2027 2028 2029 2030 2050

Bil $

Value No. of Maturites

IG WAM

of ~10

years

93%

95%

96%

94%

95%

95%

75%

80%

85%

90%

95%

100%

0

300

600

2019 2020 2021 2022 2023f 2024f

Median Cash Flow from Operations Median FCF Conversion*

Leverage for rated brokers

Leverage remained steady in 2023 and we expect that trend to

continue in 2024.

• Although their business model leads to natural deleveraging,

brokers tend to offset any credit improvements from

performance gains through frequent debt-funded M&A and

shareholder initiatives.

• While some issuers have gravitated toward the more

conservative end of their leverage targets given higher cost of

capital, most have not.

Coverage metrics, which have fallen for many issuers on higher

cost of capital, should remain largely stable in 2024.

• Investment-grade issuers have benefited from largely fixed-

rate debt.

• Many speculative-grade issuers have limited buffer remaining

within our ratings after year-on-year declines, but we think the

portfolio’s coverage metrics have past the trough.

15

Key Credit Metrics Expected To Be Stable

Coverage for rated brokers

2.9x

2.5x

2.2x

2.4x 2.4x 2.4x

6.8x

6.7x

7.6x

6.8x

7.1x

6.9x

0x

2x

4x

6x

8x

10x

2019 2020 2021 2022 2023f 2024f

Investment Grade

Median Debt-to-EBITDA

Speculative Grade

Median Debt-to-EBITDA

8.5x

8.9x

10.9x

9.5x

9.8x

9.3x

2.5x

2.6x

3.0x

2.4x

1.9x

2.0x

0x

5x

10x

15x

2019 2020 2021 2022 2023f 2024f

Investment Grade

Median EBITDA Int. Coverage

Speculative Grade

Median EBITDA Int. Coverage

Source: Company data, S&P Global Ratings.

Total revenue/growth

Aon (AON) : Through its pending acquisition of NFP, Aon is making a scaled

entry into the vast middle market. Because this is a high-growth segment

where Aon was largely absent, we view this transaction as strategically sound

and opportunistic. Aon’s margins, which are higher than most peers, will

come down modestly with the acquisition.

Arthur J. Gallagher (AJG): Bolstered by strong organic and acquisitive growth

and the addition of reinsurance, AJG has surpassed WTW in size to become

the third-largest broker (WTW remains third largest in the large account

space). We expect AJG to continue to focus on share gains, including further

international expansion, while maintaining margins near 30%.

Brown & Brown (BRO): In addition to robust organic growth, BRO has been

highly active in M&A, including a recent push into the international markets

after years of focusing exclusively on the U.S. The company’s margins are

peer-leading, which we expect to continue.

Marsh & McLennan (MMC): Through successful organic and acquisitive

growth initiatives, MMC's scale gap as the world's largest insurance broker

has widened over the years. S&P-adjusted EBITDA margins improved in 2023,

a trend we expect to persist on operating leverage and efficiency gains.

Willis Towers Watson (WTW): After a period of disruption following the Aon

deal termination, WTW has demonstrated notably improved organic growth.

S&P adjusted margins have come down on restructuring costs, but we expect

notable improvement in 2024 as these costs subside and increased savings

from the company’s transformation program are realized.

16

Investment-Grade Spotlight: Growth And Performance

Profitability

Source: Company data, S&P Global Ratings.

11%

9%

11%

15%

9%

8%

9%

7%

-10%

-5%

0%

5%

10%

15%

20%

25%

0

5

10

15

20

25

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

3023

2021 2022 2023f2024f

AON AJG BRO MMC WTW Average

Bil $

Total revenue Revenue growth Organic growth

32%

31%

31%

32%

0%

10%

20%

30%

40%

0

1

2

3

4

5

6

7

8

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 LTM

Q3

2023

2021 2022 2023f 2024f

AON AJG BRO MMC WTW Average

Bil. $

Total EBITDA EBITDA margin

17

Investment-Grade Spotlight: Financial Profile

Capital deployment: Three-year average*

AON: Credit metrics will be weak for the rating following the NFP acquisition, including leverage

above 3x, but we expect them to improve through performance gains, somewhat lower discretionary

spend on share buybacks and M&A post-transaction, and debt reduction.

AJG: We expect AJG to continue to maintain leverage at 2x-3x as it balances target leverage with

capital deployment, which is largely M&A focused (the company has not engaged in share buybacks).

BRO: BRO has lowered leverage comfortably below 3x following a spike in 2022 related to debt-

funded acquisitions. We expect leverage to further improve in 2024, depending on the scale of M&A.

MMC: Barring any opportunistic material acquisitions, we expect MMC to balance discretionary

spend on tuck-in M&A and shareholder activity, keeping leverage in the low 2x area.

WTW: We expect WTW to sustain leverage at 2.0x-2.5x as it adheres to a more conservative financial

policy. Shareholder distributions (which were elevated post Aon deal termination on excess cash) will

be dictated by levels of free cash flow and M&A, which we expect the company to resume in 2024.

Key credit metrics

*3Y Avg. reflects 2021 – LTM Q3 2023. Source: Company data, S&P Global Ratings.

17%

40%

36%

7%

0%

20%

40%

60%

80%

100%

AON AJG BRO MMC WTW 3Y Avg

Dividends Share repurchases M&A (inc. earnouts) CapEx

2.0x

2.5x

2.4x

2.5x

47%

30%

31%

30%

0%

20%

40%

60%

80%

100%

0x

1x

1x

2x

2x

3x

3x

2021 2022 LTM Q3

'23

2021 2022 LTM Q3

'23

2021 2022 LTM Q3

'23

2021 2022 LTM Q3

'23

2021 2022 LTM Q3

'23

2021 2022 2023f 2024f

AON AJG BRO MMC WTW Average

Median Debt-to-EBITDA (x) Median FFO-to-Debt (%)

Revenue growth composition

• In addition to benefiting from a favorable market impact, our portfolio

of mid-market brokers are largely focused on various growth

initiatives to keep organic growth high relative to historical levels

including:

– Enhancing and leveraging data and analytical capabilities to drive

premium flow and increase pricing power with carriers

– Significant producer recruitment

– Investments in specializations and industry verticals

– Internally placing wholesale and MGA business to capture a

greater share of the premium dollar in the insurance value chain.

– Risk mitigation/management expertise in existing and emerging

risks.

• Margins have compressed modestly from some upfront investments

related to these initiatives, among other items, but should begin to

stabilize and improve in 2024.

• Growth through M&A is substantial in the portfolio and many rated

brokers are expanding their geographic reach, scale, and content

capabilities through varying acquisition strategies.

18

Speculative-Grade Spotlight: Growth And Performance

Profitability

29%

31%

33%

31%

29%

29%

30%

25%

27%

29%

31%

33%

0

500

1000

1500

2000

2500

2019 2020 2021 2022 LTM Q3 '23 2023f 2024f

$ Mil.

Median Total Revenue Median EBITDA Median EBITDA Margin

Source: Company data, S&P Global Ratings.

5%

4%

9%

9%

8%

7%

15%

11%

13%

11%

9%

9%

20%

15%

23%

20%

17%

16%

0%

5%

10%

15%

20%

25%

2019 2020 2021 2022 2023f 2024f

Median Organic Revenue Growth Median Inorganic Revenue Growth

FOCF and FOCF-to-debt*

• Portfolio remains aggressively leveraged relative to many other corporate sectors given

robust cash flow.

• EBITDA “add-backs” are trending higher across many issuers (relating to items such as

producer hires and internal investments), creating wider divergences between company-

calculated leverage and S&P-calculated leverage.

• On the debt side, high earn-out obligations, prevalent preferred equity instruments, and

excess balance sheet cash from M&A pre-funding is also contributing to the divergence

between our and company-calculated leverage.

• The large portion of variable-rate debt has led to weakened coverage and cash flow to

debt from higher floating-rate benchmarks, although hedging instruments soften the blow.

• A wave of repricing activity beginning in late 2023 and into 2024, along with expected

gradual rate cuts beginning in mid-2024, should modestly help coverage metrics.

19

Speculative-Grade Spotlight: Financial Profile

Key credit metrics

Debt mix

6.8x

6.7x

7.6x

6.8x

7.1x

6.9x

2.5x

2.6x

3.0x

2.4x

1.9x

2.0x

0x

2x

4x

6x

8x

2019 2020 2021 2022 2023f 2024f

Median Debt-to-EBITDA Median EBITDA Int. Coverage

36%

26%

38%

64%

Variable Fixed Hedged Unhedged

Source: Company data, S&P Global Ratings.*FOCF is free operating cash flow

5.7%

6.8%

6.4%

4.1%

3.7%

4.8%

0%

2%

4%

6%

8%

0

50

100

150

200

250

2019 2020 2021 2022 2023f 2024f

Mil. $

Median FOCF ($) Median FOCF/Debt (%)

20

Non-Brokers

21

Non-Brokers – Peer Comparison

Business risk profile (BRP)

Financial risk profile (FRP)

Minimal Modest Intermediate Significant Aggressive Highly Leveraged

Excellent

aaa/aa+ aa a+/a a- bbb bbb-/bb+

Strong

aa/aa- a+/a

a-/bbb+

bbb bb+ bb

Satisfactory

a/a- bbb+ bbb/bbb- bbb-/bb+ bb b+

Asurion Group Inc.(B+/Stable)

Sedgwick L.P. (B+/Stable)

Fair

bbb/bbb- bbb- bb+ bb

Frontdoor Inc. (BB-/Stable)

HomeServe USA Corp. (BB-/Stable)

bb- b

MultiPlan Corp. (B/Stable)

Galaxy Finco Ltd. (B/Stable)

Weak

bb+ bb+ bb bb- b+

Zelis Holdings L.P. (B+/Stable)

b/b-

AIS HoldCo LLC d/b/a Franklin Madison (B/Stable)

Outcomes Group Holdings Inc. d/b/a Paradigm (B/Stable)

Bella Holding Co. d/b/a Medrisk (B-/Stable)

Mitchell TopCo Holdings Inc. (B-/Stable)

One Call Corp. (CCC+/Stable)

Vulnerable

bb- bb- bb-/b+ b+ b b-

As of Jan 30, 2024. Source: S&P Global Ratings.

22

Non-Brokers – At A Glance

The non-broker industry includes:

Business risk profile characteristics

• Our business risk profile scores range from satisfactory for market leaders

of significant size to fair/weak for the remainder of the portfolio generally

competing in smaller addressable markets with limited product diversification.

• Common strengths include top positions in specialized focus areas and

few formidable competitors.

• Common weaknesses include client concentrations, niche product

focuses, insourcing risk, and moderate revenue/cost volatility (generally higher

fluctuations relative to brokers).

• Median margin is about 20%, but performance varies widely by company/subgroup

(lowest ~0% and highest ~70%).

Source: S&P Global Ratings.

Financial risk profile characteristics

• Majority of credits are private-equity-owned with highly leveraged financial

risk profiles. Two are publicly traded.

• Weak credit protection measures driven by ownership considerations (frequent flips

and dividend recaps) and selective debt-driven M&A (acquisition activity

is lumpier/less frequent than brokers).

• Capex needs vary but are generally relatively modest (typically less than

5% revenues), and free cash flow is generally healthy.

• Favorable maturity profile and limited financial covenants.

Health care servicers

• Business-to-business outsourcing companies that help health care

payors control medical costs (such as out of network, pharmacy,

and radiology claims).

• Many of these credits are focused on using technology to serve

specific segments within the workers’ compensation space (ex.

physical therapy) and/or act as preferred provider organizations

(PPOs).

Claims administrators

• Independent providers of insurance claims management services to

insurance companies, self-insured companies, and captives.

• Some also offer additional services such as medical/administration

cost containment or specialty claims adjusting.

Warranty administrators

• Administrators of extended service contract programs that are

typically underwritten by third-party insurance carriers.

• These contracts can cover anything from smartphones and

electronics to home appliances and automobiles.

Rating distribution

Outlook distribution

23

Our sector view on insurance non-brokers is stable, with all credits on stable outlooks. We expect most companies to show relatively steady performance

as below-trend economic growth is absorbed by resilient insurance demand and company-specific product development.

Key expectations:

• Business growth and development to be mostly internally driven due to the specialty focus and composition of the marketplace, seeking deals to

round out competencies and incrementally improve scale, scope, and diversification.

• Health services companies to benefit from sustained demand for cost containment and payment solutions, given the enduring focus on trend

management and operational efficiency.

• Claim administrators to benefit from increasing outsourcing appetite from carriers, though performance is susceptible to underlying claim

volume.

• Warranty administrators remain most sensitive to economic drivers but benefit from normalizing supply chain and deepening client partnerships.

• Key credit metrics to be steady given underlying performance stability and consistent financial policy.

Non-Brokers – Credit Overview

18% 27% 27% 18% 9%

BB- B+ B B- CCC+

100%

Stable

Revenue trends

• Growth has been positive but subdued in the last couple of

years. Given fee-based revenue streams largely tied to claims

trend or services used, non-brokers have generally not

benefited from the market lift from rising premiums that our

commission-weighted broker portfolio has enjoyed.

• We expect growth will continue to vary widely based on

product suites and company-specific factors. However, the

market backdrop will provide revenue opportunity despite

sluggish economic growth and payroll as companies continue

to capture share and fill market space in their respective

niches.

• In contrast to the broker portfolio where inflation has been a

net benefit, inflation has been a net headwind for non-

brokers given added wage and cost pressures without the

top-line boost. However, most have successfully passed

through price increases to clients.

• Though easing inflation should help, ongoing industry factors-

- such as price competition, new client/contract

implementation, and technology/systems investments—will

keep margins in check.

24

Non-Brokers: Growth And Performance

Performance trends

8%

17%

3%

11%

4%

5%

6%

0%

5%

10%

15%

20%

-

400

800

1,200

1,600

2018 2019 2020 2021 2022 2023f 2024f

Mil. $

Median Revenue Median Revenue Growth

21%

21%

19%

20%

19%

21%

21%

0%

5%

10%

15%

20%

25%

-

50

100

150

200

250

300

350

2018 2019 2020 2021 2022 2023f 2024f

Mil. $

Median EBITDA Median EBITDA Margin

As of Jan. 30, 2024. Source: S&P Global Ratings.

Debt issuance activity

• Debt issuance in the last year has been predominantly refinancing

related. Following this activity, the portfolio has limited maturities

remaining until 2026.

• With generally steady performance and limited debt financing for

M&A or shareholder activity in the last year, most of the portfolio

had slightly lower leverage in 2023, but coverage declined due to

higher benchmark rates.

• We forecast generally steady credit metrics in 2024, but company-

specific factors and opportunistic M&A could easily swing

forecasts up or down.

25

Non-Brokers - Financial Profile

Key credit metrics

Upcoming debt maturities*

0

3

7

3

12

3

0

0

5

10

15

0

5

10

15

20

2024 2025 2026 2027 2028 2029 2030

Bil. $

Value No. of Maturites

4

16

3

5

0

2

4

6

8

10

12

14

16

18

0

5

10

15

20

2020 2021 2022 2023

Bil. $

Value No. of Non-Brokers

Debt mix

17%

60%

23%

83%

Variable Fixed Hedged Unhedged

Source: Company data, S&P Global Ratings.* Excluding revolving credit facilities

7.1x

6.7x

6.3x

6.4x

5.9x

6.0x

2.2x

2.6x

2.7x

2.3x

1.9x

2.1x

5%

7%

8%

7%

5%

6%

0%

2%

4%

6%

8%

10%

0x

2x

4x

6x

8x

2019 2020 2021 2022 2023f 2024f

Median Debt-to-EBITDA Median EBITDA Int. Coverage Median FOCF-to-Debt

26

Julie Herman

Director

Paul Lee

Senior Analyst

paul.lee2@spglobal.com

Francesca Mannarino

Associate Director

Brian Suozzo

Director

brian.suozzo@spglobal.com

Joe Marinucci

Director

Lawrence Wilkinson

Managing Director & Analytical Manager

Shivani Vaidya

CREDit Analyst

Prachi Meghani

Research Contributor

Megan O’Dowd

Associate Director

Analytical Contacts

27

Copyright © 2024 by Standard & Poor’s Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form

by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized

purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P

Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is

provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE,

FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall

S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and

opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions

(described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following

publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other

business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no

duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such

acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been

suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not

available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are

made available on its Web sites,

www.spglobal.com/ratings (free of charge) and www.ratingsdirect.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional

information about our ratings fees is available at

www.spglobal.com/ratings/usratingsfees.

Australia: S&P Global Ratings Australia Pty Ltd holds Australian financial services license number 337565 under the Corporations Act 2001. S&P Global Ratings' credit ratings and related research are not intended for and must not be

distributed to any person in Australia other than a wholesale client (as defined in Chapter 7 of the Corporations Act).

STANDARD & POOR'S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor's Financial Services LLC.

spglobal.com/ratings