An Examination of District Residents’ Experiences

with Utility Burdens and Affordability Programs

Report written for the Department of Energy and Environment

of the District of Columbia, Grant Number FY20-AED-760

Ariel Drehobl, Diana Hernández, Roxana Ayala, and Lauren Ross

March 2021

© American Council for an Energy-Efficient Economy

529 14th Street NW, Suite 600, Washington, DC 20045

Phone: (202) 507-4000 • Twitter: @ACEEEDC

Facebook.com/myACEEE • aceee.org

DOEE AFFORDABILITY PROGRAMS © ACEEE

i

Contents

Contents ................................................................................................................................................. i

About the Authors ..............................................................................................................................iii

Acknowledgments ..............................................................................................................................iii

Key Terms ............................................................................................................................................ iv

Executive Summary ............................................................................................................................ v

Introduction .......................................................................................................................................... 1

Project Overview and Methodology ..................................................................................... 1

Background .......................................................................................................................................... 3

Socioeconomic Context of the District of Columbia ........................................................... 3

Causes and Impacts of High Utility Burdens ....................................................................... 7

National Utility Affordability Programs and Policies ...................................................... 10

District Utility Affordability Policies and Programs ......................................................... 11

Energy and Water Burden Analysis ............................................................................................... 15

Methodology ........................................................................................................................... 15

Energy Burdens Findings ...................................................................................................... 17

Water Burden Findings ......................................................................................................... 22

Combined Utility Burden Findings ..................................................................................... 25

Utility Affordability Interview Findings ........................................................................................ 28

Interview Methodology ......................................................................................................... 29

Findings from Qualitative Interviews ................................................................................. 30

Policy Recommendations ................................................................................................................. 39

Program Awareness and Accessibility Recommendations .............................................. 40

Program Targeting Recommendations ............................................................................... 43

Program Design and Delivery Recommendations ............................................................ 46

DOEE AFFORDABILITY PROGRAMS © ACEEE

ii

Conclusion .......................................................................................................................................... 49

References ........................................................................................................................................... 50

Appendix A. District Utility Affordability Programs .................................................................. 56

Appendix B. Energy and Water Burden Methodology ................................................................ 59

Appendix C. Energy, Water, and Combined Burden Data ......................................................... 62

Energy Burden Data .............................................................................................................. 62

Water Burden Data ................................................................................................................ 64

Combined Energy and Water Burdens ............................................................................... 66

Appendix D. Interview Methodology ............................................................................................ 68

Appendix E. Interview Guides ........................................................................................................ 71

Participant Interview Guide ................................................................................................. 71

DOEE Program Staff and Administrator Interview Guide .............................................. 74

Appendix F. Interview Participant Data ........................................................................................ 77

DOEE AFFORDABILITY PROGRAMS © ACEEE

iii

About the Authors

Ariel Drehobl is a manager on ACEEE’s local policy team, where she leads work related to

energy equity, energy affordability, and low-income energy efficiency programs. Ariel

earned a master of science in environmental science, policy, and management from a joint-

degree program that awarded degrees from Central European University in Hungary, Lund

University in Sweden, and the University of Manchester in the United Kingdom. She earned

a bachelor of arts in history and international studies from Northwestern University.

Diana Hernández is a tenured Associate Professor of Sociomedical Sciences at Columbia

University’s Mailman School of Public Health. A sociologist by training, her work focuses

on the social and environmental determinants of health. Her research examines the impacts

of policy and place-based interventions on the health and well-being of socioeconomically

disadvantaged populations. Professor Hernández’ published work has appeared in leading

public health, social science, and housing and energy policy journals and her research has

been funded by several federal agencies and philanthropic organizations. Dr. Hernández

completed her doctoral training in Sociology at Cornell University and her undergraduate

degree at Hunter College of the City University of New York.

Roxana Ayala assists with research, writing, and technical support on local-level energy

efficiency policies and initiatives, with a focus on energy equity. Roxana earned a bachelor

of arts in environmental studies and urban studies from the University of California, Irvine.

Lauren Ross is Senior Director of Policy at ACEEE. She oversees state and local policy work

as well as utility regulation. She conducts program and policy research and provides

technical assistance to a variety of groups aimed at advancing equitable energy efficiency.

She has served as the lead on ACEEE’s work to expand policies and programs to improve

energy use in underserved communities, with an emphasis on advancing inclusive clean

energy solutions in affordable housing. She works to promote energy efficiency as a tool to

make communities more economically vibrant, healthier, and adaptable in the face of

climate change. Lauren earned a PhD in urban sociology from Temple University.

Acknowledgments

This report was funded through a grant from the District Department of Energy and

Environment (DOEE). The authors thank Columbia University-based research assistants

Miranda Ysabel Simes and Tasfia Rahman for their contributions to the qualitative

component of this study. Thanks also to Claire Cook with ONE DC for advising on all

stages of the project. The authors gratefully acknowledge reviewers who supported this

report. Reviewers from ACEEE included Rachel Gold, David Ribeiro, and Sara Hayes. The

authors also gratefully acknowledge the assistance of Mackenzie Mathews from DOEE for

managing the grant and providing her assistance and guidance, and also thank Taylor

Smith from DOEE for her assistance with scheduling and coordinating resident interviews.

The authors also thank DOEE staff who participated and provided their insights for this

project, including Thomas Bartholomew, Sharon Cooke, Kenley Farmer, Cyronda Goode,

LaWanda Jones, Jennifer Kulp, Taresa Lawrence, Mackenzie Mathews, Brooke Siegel, and

Denise Watson. Last, we would like to thank Mary Robert Carter for managing the editing

process, Mariel Wolfson for developmental editing, Rachel Siegel for copyediting, Phoebe

Spanier for proofreading, and Kate Doughty for graphics design.

DOEE AFFORDABILITY PROGRAMS © ACEEE

iv

Key Terms

Area median income (AMI). In each region, the income level at which half of households

earn more per year and half earn less per year. The U.S. Department of Housing and Urban

Development calculates AMI each year for every metropolitan region in the country based

on number of people in the household.

Energy burden. The percentage of annual household income spent on annual energy bills,

including electricity, natural gas, and other heating fuels.

Energy insecurity. The inability to adequately meet basic household heating, cooling, and

energy needs over time.

Federal level poverty (FLP). The measure of income used to determine eligibility for certain

programs and benefits. Poverty guidelines for households based on number of persons in

the household are set by the Department of Health and Human Services.

State median income (SMI). In each state, the income level at which half of households earn

more per year and half earn less per year, based on number of persons in the household.

Utility burden (combined burden). The percentage of annual household income spent on

annual bills for electricity, natural gas, other heating fuels, and water.

Water burden. The percentage of annual household income spent on water bills.

DOEE AFFORDABILITY PROGRAMS © ACEEE

v

Executive Summary

KEY FINDINGS

• Despite continued economic growth, racial inequities persist in the District of Columbia.

Historical and structural factors have produced stark disparities in homeownership,

employment, wealth, education, and health outcomes. The COVID-19 pandemic and

related economic fallout has had widespread impacts in the District, disproportionately

affecting Black, Latinx, and low-income residents.

• DC metro area residents with disproportionately high energy and water burdens include

low-income households, non-high school graduates, households with a family member

with a disability, older adults over 65, Black households, Hispanic households, renters,

and households in pre-1980 buildings.

• The median low-income household (≤60% SMI) in the DC metro area experiences energy

and water burdens about five times higher than the median non-low-income household.

• Interview findings reveal that energy assistance programs provide financial support and

stress relief to households facing acute or chronic hardships. While staff and program

participants agreed on many core issues, clearer communication is needed on program

details and their environmental impacts.

• This report’s recommendations, based on qualitative and quantitative analyses, note how

DOEE can improve the awareness and accessibility, targeting, design, and delivery of its

five energy and water affordability programs.

This report analyzes District residents’ experiences with utility burdens and energy and

water affordability programs offered by the Department of Energy and Environment

(DOEE). The report includes a literature review that explores the root causes and systemic

drivers of racial inequity in the District, quantitative analysis that calculates utility burden

data for households in the DC metro area, primary data collection based on qualitative

research on the experiences of DOEE utility assistance recipients, and recommendations

aimed at improving access to and utilization of these programs by District residents.

The report focuses on DOEE’s five affordability programs, including

• Low-Income Home Energy Assistance Program (LIHEAP)

• Utility Discount Program (UDP)

• Solar for All (SFA)

• Weatherization Assistance Program (WAP)

• Clean Rivers Impervious Area Charge (CRIAC) Residential Relief Program

Historical policies and practices that led to discrimination in zoning laws, mortgage lending,

employment, and access to quality education have led to long-standing patterns of racial

segregation and racial disparities in income and wealth, particularly affecting Black

residents in the District (Kijakazi et al. 2016). These structural barriers had and continue to

have implications for the racial wealth gap in the city and for residents’ ability to afford safe

and healthy housing, food, and utilities, among other basic necessities. The COVID-19

pandemic and subsequent recession have disproportionately affected Black, Latinx, and

low-income residents, exacerbating these inequities.

DOEE AFFORDABILITY PROGRAMS © ACEEE

vi

UTILITY BURDEN FINDINGS

Energy, water, and combined utility burden analyses paint a picture of energy and water

burdens in the District. Across these analyses, similar groups experienced

disproportionately high burdens, including low-income households (i.e., ≤60% SMI),

households who receive food stamps, non-high school graduates, households with a family

member with a disability, older adults over 65, Black households, Hispanic households,

renters, and households in pre-1980 buildings. These findings are representative of all

households in the DC metro area, the majority of which do not receive utility assistance.

These findings do not differentiate between households who receive and do not receive

utility assistance.

Energy Burden Findings

• The energy burden of low-income households is 4.5 times higher than that of non-

low-income households.

• The median energy burden for Black and Hispanic households is 45% higher than

that of white (non-Hispanic) households.

• Across the DC metro area, 64% of low-income households face a high energy burden

(above 6%), and 40% of low-income households face a severe energy burden (above

10%).

• One-fourth (25%) of low-income households experience an energy burden of at least

15%, which is 7.5 times the median for the DC metro area.

Water Burden Findings

• The median water burden of low-income households is 5.4 times higher than that of

non-low-income households.

• The median water burden of Hispanic households is 63% higher and of Black

households is 51% higher than it is for white (non-Hispanic) households.

• Low-income households have a median water burden that is 4.5 times higher than

the metro area median; similarly, low- to moderate-income households (≤100% AMI)

have a median water burden that is about 2 times higher.

• One-fourth (25%) of low-income households experienced a water burden of at least

7.4%, which is more than 12 times the median water burden in the DC metro area.

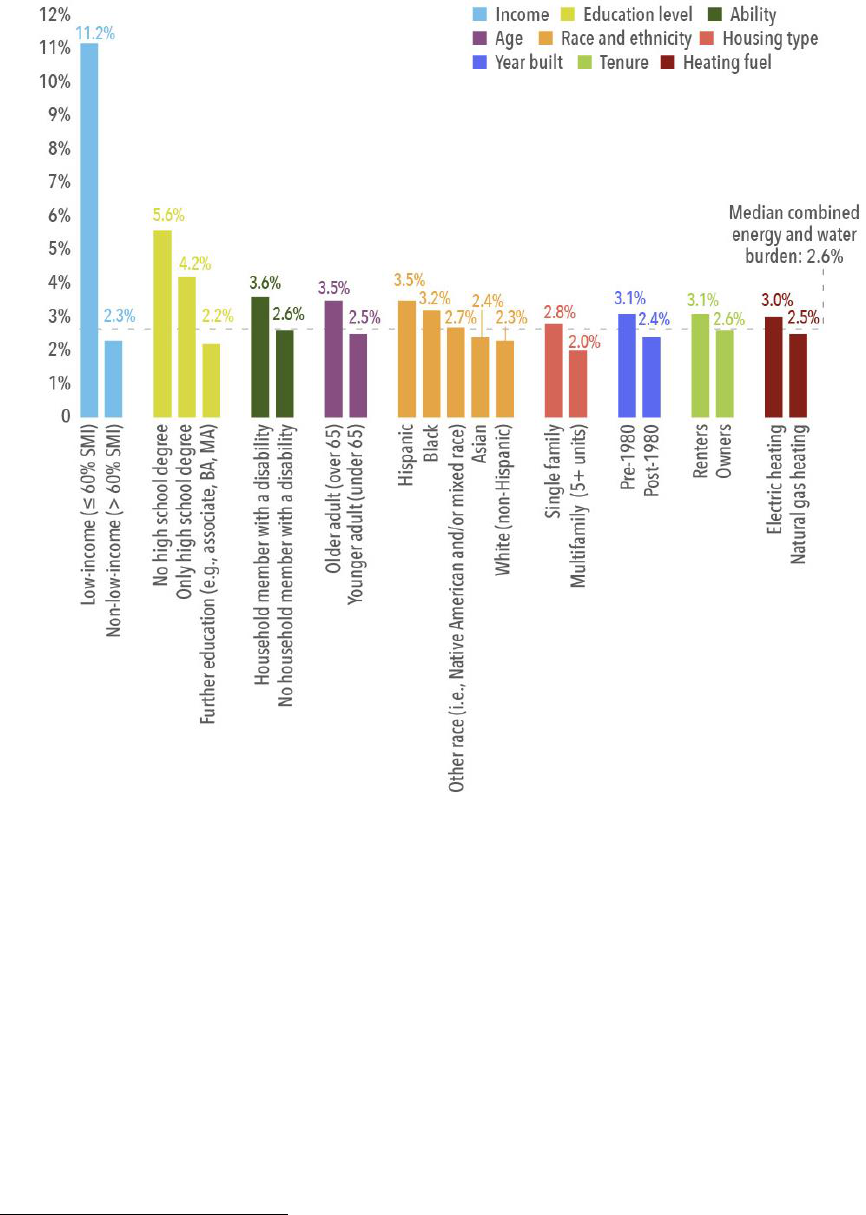

Combined Utility Burden Findings

• The median combined energy and water burden of low-income households is almost

5 times higher than that of non-low-income households.

• The median combined burden of Hispanic households is 55% higher and of Black

households is 42% higher than that of white (non-Hispanic) households.

• The median combined energy and water burdens accounts for up to 11.2% of income

for low-income households, which is 4.3 times higher than the combined burden for

the median DC metro area household.

DOEE AFFORDABILITY PROGRAMS © ACEEE

vii

INTERVIEW FINDINGS

The interviews with 30 participants of DOEE’s energy and water affordability programs

provided insights into participants’ household characteristics and experiences of energy

insecurity along with their experiences with DOEE programs. Through the interviews with

10 DOEE program staff and administrators, we identified staff perspectives on program

challenges, client and participant base, and impact of the COVID-19 pandemic on program

operations and outcomes. Below are key themes across interviews as well as points of

convergence and divergence across participants and program staff.

Participant Perspective

• Participants prioritized utility bills as a key household expense but faced energy

insecurity due to recent economic shocks or to chronic low or fixed household

incomes.

• In addition to seeking energy assistance benefits, households reduced energy use

and attempted minor weatherization interventions to save on energy bills and

maintain thermal comfort.

• Participants expressed gratitude for DOEE support and noted the impacts of energy

assistance on bill management and stress reduction.

• Preferences for benefits delivery was mixed, with some households preferring

monthly distributions and others preferring lump sum payments.

• Opportunities for enhanced communication and clarity on program details were

noted.

Program Staff and Administrator Perspectives

• DOEE staff expressed empathy and a commitment to delivering comprehensive

services, including adapting service delivery and program elements to better assist

participants.

• The COVID-19 pandemic accelerated the transition to online applications and

electronic communications with clients; however, a core aspect of their approach,

which involves strong customer relations, was significantly compromised. Staff

expressed concern that the elderly and technologically challenged may not be

adequately served, despite identifying continued need for additional supports.

Points of Convergence/Divergence

• Participants and staff agreed that DOEE program offerings and customer service

were robust and superior to available alternatives.

• Staff and administrators highlighted the connection between their energy assistance

programs and ensuring a just clean energy transition for District residents, yet

participants were unclear about how they could contribute to greater environmental

stewardship through DOEE programs.

DOEE AFFORDABILITY PROGRAMS © ACEEE

viii

• Gaps in service to rental and multiple unit housing residents were noted by both

participants and staff, while prioritizing energy and conservation/weatherization

was emphasized by participants.

POLICY RECOMMENDATIONS

We developed the following policy recommendations that identify barriers and

opportunities to increase the effectiveness of DOEE affordability programs. These

recommendations also aim to reduce high energy and water burdens in order to improve

utility affordability, home health and comfort, and overall economic prosperity of District

residents.

Program Awareness and Accessibility Recommendations

• Increase targeted direct program outreach and re-enrollment efforts

• Align water and energy affordability support and outreach

• Employ diverse methods of outreach and continued communication

• Provide follow-up confirmation on benefits and services

• Connect energy saving and clean energy messaging with environmental benefits

Program Targeting Recommendations

• Target resources towards households with disproportionately high utility burdens

• Target resources towards households experiencing disproportionate health burdens

• Provide resources for affordable housing building owners to help keep rents

affordable

• Develop and include additional equity-related goals to measure program success

• Consider tiered benefits to support moderate-income household needs

Program Design and Delivery Recommendations

• Continue building robust stakeholder and community engagement practices

• Increase structural solutions for utility affordability, such as weatherization and

solar energy

• Create a one-stop-shop model for program enrollment

• Maintain emergency water assistance and create a leak reduction program

• Validate and educate on energy conservation strategies

These recommendations are based on the qualitative analysis, and also reflect findings from

the literature review and quantitative utility burden analysis. The report includes

anonymized quotations from interviewees in relation to and in support of the

recommendations.

CONCLUSION

This report finds that even before the pandemic, many District residents experienced

systemic inequality and high utility burdens that led them to seek assistance. Low-income

District households are especially overburdened by utility bills as compared to low-income

households nationally. DOEE’s utility affordability programs reduce the District’s negative

DOEE AFFORDABILITY PROGRAMS © ACEEE

ix

environmental impact while improving affordability and comfort for low- and moderate-

income District residents. As the pandemic continues to affect the lowest income residents,

the recommendations from this report can help to increase equitable access to and

utilization of solar installations and energy efficiency and weatherization investments as a

means of supporting economic, environmental, and equity-related District goals.

DOEE AFFORDABILITY PROGRAMS © ACEEE

1

Introduction

The Department of Energy and Environment (DOEE) currently provides a set of programs

and services to assist low- and moderate-income residents facing high utility burdens. A

high utility burden⎯the percent of income spent by households on electricity, gas, fuel oil,

and/or water⎯can greatly impact a household’s ability to afford other basic necessities.

When residents have to choose between paying utility bills and other necessities, they may

endure significant health and financial impacts. To ease the utility burden on these

households, DOEE administers utility affordability programs that provide relief through

different mechanisms, including improved access to solar generation and weatherization,

subsidized rate structures, and one-time bill assistance payments.

DOEE administers five such utility assistance programs. Table 1 lists these programs,

income eligibility, and description of the services provided. This study analyzes these five

programs from the perspective of DOEE staff and program participants to provide

programmatic recommendations.

Table 1. Energy and water assistance programs studied in this report

DOEE program

Income

eligibility

Provided services

Low Income Home

Energy Assistance

Program (LIHEAP)

60% state

median

income (SMI)

One-time annual energy bill assistance between $250 and

$1,800, determined based on household size, total household

income, heating source, and dwelling type

Utility Discount

Program (UDP)

60% SMI

Utility bill discount of up to $475 per year on electric bills, up to

$276 for gas heating bills, and/or over $500 annually on water

and sewer bills

Weatherization

Assistance

Program (WAP)

60% SMI

Weatherizes homes with measures such as insulation, duct

sealing, heating and cooling systems repair or replacement, air

infiltration mitigation, and ENERGY STAR lighting and

appliances; improves home energy efficiency, lowers bills, and

improves home comfort

Solar For All (SFA)

80% area

median

income (AMI)

Free installation of solar photovoltaic systems on homes or

participation in community solar so that participants save about

$500 per year on electric bills

Clean River

Impervious Area

Change (CRIAC)

Residential Relief

Program

100% AMI

Monthly water bill discount for single-family and individual

homes; DC Water ratepayers fund the program; three tiers of

assistance ($75, $50, and $15 per month), determined by

household size and income; one-time emergency benefit of up

to $2,000 launched during the pandemic to provide emergency

relief for water bill arrearages

PROJECT OVERVIEW AND METHODOLOGY

This study uses qualitative and quantitative research methods to analyze utility burdens

among District residents and the experiences of utility affordability program participants, in

order to provide recommendations to improve the effectiveness, reach, and outcomes of

DOE’s utility assistance programs. To do this, we analyze household level data to estimate

utility burdens for District residents as well as conduct interviews with DOEE program staff

DOEE AFFORDABILITY PROGRAMS © ACEEE

2

and program participants. The recommendations provide guidance to create more equitable

program outcomes and benefits for District residents.

The intended audience for this report is DOEE staff who design, manage, and evaluate

energy utility assistance programs. The products of this research include a literature review

that explores the root causes and systemic drivers of racial inequity in the District,

quantitative analysis calculating utility burden data for households in the DC metropolitan

statistical area (MSA), primary data collection through qualitative research on the

experiences of DOEE utility assistance recipients, and recommendations aimed at

improving access and utilization of these programs by District residents.

Our research questions are

• How do socio-political factors in the District impact energy and water insecurity?

• Which households are the most utility-burdened in the DC metro area?

• What factors lead residents to seek energy and water assistance programs?

• How well do DOEE’s energy and water assistance programs serve the needs of

individual participants and the District population as a whole?

• How can DOEE remove barriers and increase the effectiveness of its energy and

water affordability programs in order to reduce high utility burdens and improve

health and economic outcomes for District residents?

This report includes our results organized by our four major research activities:

Background and literature review. We explore the causes and impacts of high utility

burdens through the socio-political context of the District of Columbia. We analyzed

academic articles, policy reports, agency reports, and relevant local news media and blogs

that provide insight on racial and economic equity in the District and growing affordability

challenges.

Energy and water utility burden analysis. We conducted an energy and water utility

burden analysis, using U.S. Census Bureau data for the DC metro area, that identifies which

demographic groups and types of households experience disproportionately high utility

burdens. We use the 2019 American Housing Survey (AHS) data to calculate energy, water,

and combined energy and water burdens for households across the DC metro area.

Analysis of interviews with DOEE program staff and program participants. We conducted

10 interviews with DOEE program staff who manage or support at least one of DOEE’s five

utility affordability programs to gain insights into how programs are currently operating.

We also conducted 30 interviews with District residents who participated in one or more of

those programs to learn about impacts on their financial stability, their perceptions and use

of energy and water, and their experience with DOEE’s energy assistance programs.

1

We

transcribed the interviews and developed a codebook that identified emerging themes that

characterize the nature of energy insecurity in the District. Performing an axial coding, we

1

See Appendix F for anonymous demographic information about program beneficiary interview participants.

DOEE AFFORDABILITY PROGRAMS © ACEEE

3

then identified and assessed data patterns and potential causal relationships, contextual

factors, impacting conditions, and barriers and facilitators to navigating local resources,

receiving, and benefiting from assistance.

2

Policy recommendations and conclusion. Based on our research, we developed

recommendations that are intended to address barriers and increase the effectiveness of

DOEE utility assistance programs so that they reduce high utility burdens and lead to

positive outcomes for District residents. These recommendations explore program

awareness and accessibility, targeting, design, and delivery.

In addition to the main report, the project team submitted supplemental documentation to

DOEE, including transcripts of resident interviews, the interview codebooks, and complete

energy and water burden calculations.

Background

In this section, we explore the causes and impacts of high utility burdens on District

residents, with a focus on the District’s social, political, and economic context that has given

way to persistent economic and racial inequality. We review academic articles, policy

reports, agency reports, and relevant local news media and blogs from the past five years to

gather information on the sociopolitical context of the District. We also explore literature on

energy and water affordability broadly and in the District, as well as the landscape of

programs available for District residents to address energy and water affordability needs.

SOCIOECONOMIC CONTEXT OF THE DISTRICT OF COLUMBIA

Historical policies and practices that led to discrimination in zoning laws, mortgage lending,

employment, and access to quality education have resulted in long-standing patterns of

racial segregation and racially based income and wealth disparities in the District,

particularly affecting Black residents (Kijakazi et al. 2016).

3

These structural barriers had and

continue to have implications for residents’ ability to afford safe and healthy housing, food,

and utilities, among other basic necessities. Since the 2000s, the city has experienced growth,

reflected in neighborhoods becoming wealthier, whiter, and younger (Rabinowitz 2017).

Over the past decades, the District’s growing economic prosperity has been uneven for

residents and neighborhoods: it has not benefited longtime Black residents as it has their

white counterparts and other newcomers.

Racial wealth and income gaps in the District remain stark. In 2016, the median household

income for the District’s Black residents was less than one-third that of white residents, and

Latinx median wealth was half that of white residents (Gebriel 2018). Incomes are lowest in

Wards 7 and 8, which have the highest concentration of Black residents. The District’s white

residents have a net worth 81 times greater than Black residents. White residents have

2

Axial coding is a technique used to identify core themes during qualitative data analysis through the process of

relating codes (categories and concepts) to each other.

3

For more of a historical overview of the context and structural barriers predicating the racial wealth gap in the

District see, The Color of Wealth in the Nation’s Capital, available at www.urban.org/research/publication/color-

wealth-nations-capital/view/full_report.

DOEE AFFORDABILITY PROGRAMS © ACEEE

4

wages that are twice that of Black residents, and lower unemployment rates compared to

Black residents (Kijakazi et al. 2016; Lassieter 2017). These factors also contribute to Black

residents’ higher rates of homelessness. Overall, 88% of people experiencing homelessness

in the District are Black, although Black residents make up 48% of the population

(Washington Legal Clinic for the Homeless 2019). As the economic recession and impacts of

the global pandemic continue to plague the city, Black and Latinx renters, both nationally

and in the District, face the greatest threat of eviction and homelessness (Wedeen 2021).

Researchers have also found that evictions are tied to an increase in coronavirus cases and

deaths, making this risk even more dire during this public health emergency (Leifheit et al.

2020).

Housing Affordability in the District

Persistent wealth inequity in the District has been worsened by wage increases not keeping

pace with other rising costs, such as housing. In 2020, even as the minimum wage increased

to $15 an hour—an additional $3.50 or 30% increase from the 2016 minimum wage—this

increase did not keep pace with rising housing costs. Transportation and food costs have

also increased in the District over time. According to the U.S. Bureau of Labor Statistics’

consumer price index, over the last 20 years, expenses for transportation, food, and housing

in the DC metro area have increased by 43%, 59%, and 70%, respectively (BLS 2021a).

Over the last two decades, the number of affordable housing units in the District has

decreased while the number of high-cost housing units has multiplied (District of Columbia

DHCD 2019). In 2002, 40% (58,000 rental units) of the District’s housing stock rented for less

than $800 per month, but by 2013 this fell to 20% (33,000 rental units) (Rivers 2015). The Fair

Market Rent (FMR) for a two-bedroom apartment in the District is roughly $1,700 per

month. In order to afford this level of rent and utilities, that is, without spending more than

30% of income on housing, a household must earn nearly $5,700 monthly (or $68,000

annually). Based on a 40-hour work week, this represents an hourly wage of about

$33⎯more than double the District’s current minimum wage⎯that is needed to afford

housing (NLIHC 2020). To put this number in a national context, the District has the fourth

highest “housing wage” in the country (following Hawaii, California, and Massachusetts)

(NLIHC 2020).

Over the last decade, many longtime District residents have experienced waves of

gentrification and displacements as the rise in housing costs outpaces incomes (ONE DC

2017; Rivers 2015). Between 2000 and 2013, nearly 40% of the District’s lower-income

neighborhoods experienced gentrification and 20,000 Black residents were displaced due to

increased costs of living in their neighborhoods, making DC the city with the highest

intensity of gentrification in the U.S. (Richardson, Mitchell, and Franco 2019; Richardson,

Mitchell, and Franco 2020). For example, over the past decade, Navy Yard has experienced

rapid and drastic changes, with a 29% increase in white residents, an 18% increase in the

proportion of households earning at least $100,000, and a 15% increase in the proportion of

young residents (Rabinowitz 2017). Additionally, between 2000 and 2010, the Columbia

Heights neighborhood experienced significant demographic change: the Black and Hispanic

population decreased by about 30% and 10%, respectively, and the white population grew

by nearly 140% (Tatian and Lei 2021).

DOEE AFFORDABILITY PROGRAMS © ACEEE

5

The increase in the cost of living, especially for Black communities and communities of

color, has led residents to forego necessities and resources needed for a healthy lifestyle and

has forced many into substandard housing that contributes to poor health outcomes (Woolf

et al. 2018). The relationship between health, wealth, and housing helps explain the

disparate health outcomes reflected in the District. The current public health crisis has also

continued to exacerbate these persistent health inequities.

Rising Utility Costs in the District

As housing costs have risen, utility costs in the District have also increased over time. From

2000 to 2019, the average electricity bill for District residents increased 78%, from $55 to $98

per month. Figure 1 shows the change in electric bills in the District from 2000 to 2019.

Similar numbers for natural gas are not available.

Figure 1. The average monthly electricity bill in the District of Columbia and U.S. from 2000 to 2019.

Data from

www.eia.gov/electricity/sales_revenue_price/.

DC Water bills have also been on the rise in recent years. In 2018, DC Water implemented a

new rate structure that increased the average residential bill by 5.9%, from $102.30 in 2018 to

$108.32 in 2019 (DC Water 2018). Recently, DC Water's board approved increasing their

residential and multifamily water rates for the fiscal years 2021 and 2022. With these new

rates, DC Water projects the average monthly residential water and sewer bill would be

$110.21 in 2021, up from $103.81 in 2020. This will increase water costs by an average of 6%,

or $89 per household annually in 2021 (DC Water 2020).

Increases in utility bill rates can exacerbate financial pressures for residents experiencing

hardship and may lead many to seek assistance and support. Between April 2019 and June

2020, the Office of the People's Counsel (OPC), the consumer advocate for District residents,

responded to over 450 complaints about high DC Water bills, disconnections, and payment

disputes (District of Columbia OPC 2020). OPC received the most complaints about water

affordability from Ward 7 residents, followed by Ward 4 and then Ward 5 residents (District

$55

$56

$62

$60

$61

$72

$72

$86

$94

$98

$109

$100

$89

$91

$92

$109

$99

$97

$101

$98

$73

$76

$78

$80

$81

$89

$96

$100

$104

$105

$111

$110

$107

$110

$114

$114

$113

$112

$118

$115

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

District of Columbia U.S.

DOEE AFFORDABILITY PROGRAMS © ACEEE

6

of Columbia OPC 2020). While the types of complaints varied across wards, they included

billing disputes, payment problems, leaks in public and private areas, meter issues, CRIAC

program issues, payment arrangements, high bills, and disconnections (District of Columbia

OPC 2020). OPC also received 912 complaints for the Potomac Electric Power Company

(PEPCO), 444 complaints for Washington Gas, and 164 complaints for third-party energy

providers during FY2019 (District of Columbia OPC 2021). This indicates the need for utility

affordability support, and DOEE can continue to ensure that residents have access and

information about available water affordability resources.

The Impact of COVID-19 on District Residents

As of January 2021, the COVID-19 pandemic and related economic fallout has had

widespread impact in the District, most notably affecting Black, Latinx, and low-income

residents. These disproportionate impacts reflect long-standing inequalities, often stemming

from historical policies that allowed for racial, wealth, and occupational discrimination,

segregation, and exclusion from institutional systems. This historical and present

socioeconomic context has made Black and Latinx communities and communities of color

most vulnerable to exacerbated food insecurity, energy insecurity, housing instability, and

access to proper health services during the pandemic (Gathright 2020; Crawford and

Huddleston 2020; CBPP 2021).

Low-income Black communities have been hit the hardest by the impacts of COVID-19,

especially Wards 7 and 8 (Gathright 2020; Kathpalia and Zickhur 2020). Before the

pandemic, neighborhoods located in the Northwest (i.e., Wards 1–6) had a higher health

index (high opportunity for good health) than neighborhoods in the Southeast (i.e., Wards

7–8) where more than 90% of the residents are Black. This difference is influenced by social

determinants of health such as race, education, housing, income, and social environment

(Woolf et al. 2018). The same patterns are playing out among children, where Black and

Hispanic children and children from low-income households are showing higher COVID

positivity rates than their white and more affluent counterparts (Goyal et al. 2020).

Across the District, many residents are experiencing an economic crisis, with

unemployment remaining as high as 7.9% and many households behind on mortgage and

rent payments (BLS 2021b). Between July 9 and 21, 2020, 11% of District renters reported not

paying their rent on time or deferring payment (CBPP 2021). In August 2020, rent-burdened

households in the District represented 48% of the total population and 25% of renters of

color in the District had missed or deferred rents (McCargo, Choi, and Walsh 2020).

4

During

the same time period, 12% of adults (63,000) and 25% of children (45,000) in the District

reported that they did not have enough to eat (CBPP 2021).

While the pandemic has compounded affordability challenges for many vulnerable

households, the unemployment rate has varied drastically across Wards. Between April and

May 2020, Ward 8 residents experienced a 20.7% unemployment rate, while Ward 1

4

The Urban Institute defines rent-burden households as households that spend more than 30% of their income

on rent.

DOEE AFFORDABILITY PROGRAMS © ACEEE

7

residents experienced an 8% unemployment rate, and Wards 2 and 3 had the smallest

increase in unemployment (Taylor 2020).

The Office of People’s Council has found that the financial fallout of the pandemic has

limited many households’ ability to keep up with their utility bills. The moratoriums have

helped to keep people connected to services, yet climbing and unpaid bills remain a

significant concern moving into 2021. OPC found that high bills topped its list of 1,782

complaints received in FY2019 (District of Columbia OPC 2021). Economic and social factors

such as job losses, less disposable income to pay bills, and more energy and water used at

home due to stay-at-home orders are leading to rising utility debt.

Total utility bill arrearages across all households are much higher than in the past,

indicating that many more households are in arrears. Table 2 includes total bill arrearages

for PEPCO, Washington Gas, and DC Water households, across all households and those

enrolled in low-income discount rate programs. As of September 2020, the average

residential customer was behind by $400 for electricity, $440 for natural gas, and $463 for

water bills. Due to the shut-off moratorium, households with arrearages are not being

disconnected from electricity, natural gas, or water services. However, household arrearages

continue to grow each month that bills remain unpaid. Utility assistance will be even more

urgent when the public health emergency ends, and households need to address unpaid

bills to keep their utility services connected.

Table 2. Total bill arrearages for PEPCO, Washington Gas, and DC Water customers in the District (as of September 2020)

Total

residential

arrearages

Total low-

income

arrearages

Total

residential

customers in

arrears

Total low-

income

customers in

arrears

Average

residential

customer

arrearage

Average low-

income

customer

arrearages

PEPCO

$25,776,277

$4,407,363

64,434

12,920

$400

$341

Washington Gas

$10,596,974

$1,914,961

24,099

3,579

$440

$535

DC Water

$10,142,444

N/A

21,899

N/A

$463

N/A

Data for PEPCO and Washington Gas from PUC Filings, edocket.dcpsc.org/public/search/casetype/ardir. PEPCO data from “Pepco’s

monthly Arrearages and Disconnections Report,” December 21, 2020. Washington Gas data from “WGL’s Arrearages and Disconnections

Report,” December 21, 2020. Data for DC Water from October 2020 report, “DC Retail Rates Committee Package,”

www.dcwater.com/sites/default/files/event_attachment/DC%20Retail%20Rates%20Committee%20Package%2010.20.20.pdf.

CAUSES AND IMPACTS OF HIGH UTILITY BURDENS

Researchers have explored how energy burdens differ across demographic groups, building

types, and locations. Many studies have found that certain demographic groups experience

disproportionately high energy burdens, including Black, Hispanic, Native American, and

older-adult households (Lewis, Hernández, and Geronimus 2019; Drehobl, Ross, and Ayala

2020). Researchers generally define a “high energy burden” as spending more than 6% of

income on energy bills.

5

Some policymakers have begun to design policies and plans to

5

Researchers estimate that housing costs should equate to no more than 30% of household income, and

household energy costs should be no more than 20% of total housing costs, so that affordable energy costs

DOEE AFFORDABILITY PROGRAMS © ACEEE

8

achieve an affordable energy burden level below the 6% threshold.

6

Similarly, the District’s

2020 LIHEAP Energy Burden Analysis study recommends a 3% energy burden goal for

LIHEAP participants (APPRISE 2020). This definition excludes transportation costs, which

have been found to disproportionately impact low-income communities and communities

of color as well. This number also does not include the added costs associated with late fees

and shutoffs that those who face high utility burdens are likely to encounter.

While low incomes are a substantial factor driving higher energy burdens, energy inefficient

housing also plays a large role. According to the 2017 American Housing Survey, 9% of total

U.S. households completed an energy efficient improvement in the past two years, but only

17% were low-income households (Drehobl, Ross, and Ayala 2020). Additional research

examining energy benchmarking data in a few major cities has found that households from

both the lowest- and highest-income brackets had the highest energy use intensity (EUI);

that is, they had the highest energy consumption per square foot. While consumption

behaviors are regarded as the driver for high EUI among higher-income households (i.e.,

likely to use large amounts of energy to power larger homes and more electronics and

devices), the researchers point to inefficient heating and lighting to help explain the high

EUI among low-income households (Kontokosta, Reina, and Bonczak 2019). This suggests

that inefficient infrastructures rather than inefficient behaviors lead to higher energy use

and expenditures for low-income households.

Table 3 includes the main drivers of high energy burdens, including physical,

socioeconomic, behavioral, and policy-related factors. High energy burdens are correlated

with negative health, economic, and social impacts. The high cost of household energy can

have mental health impacts, such as chronic stress, anxiety, and depression, associated with

fear and uncertainty around access to energy and the inability to control energy costs, as

well as compounding fears of late fees and shutoffs (Hernández 2016).

should be no greater than 6% of total income. For decades, researchers have used the thresholds of 6% as a high

burden and 10% as a severe burden (APPRISE 2005). ACEEE uses these thresholds in our most recent energy

burden report (Drehobl, Ross, and Ayala 2020). To clarify, high and severe energy burdens are not mutually

exclusive. All severe energy burdens (> 10%) also fall into the high burden category (> 6%).

6

See 2020 ACEEE report, How High Are Household Energy Burdens? An Assessment of National and Metropolitan

Energy Burdens across the U.S., for examples of city and state-led policies to address high energy burdens:

www.aceee.org/research-report/u2006.

DOEE AFFORDABILITY PROGRAMS © ACEEE

9

Table 3. Key drivers of high household energy burdens

Drivers

Examples of factors that affect energy burden

Physical

Housing age (i.e., older homes are often less energy efficient)

Housing type (e.g., manufactured homes, single-family, and multifamily)

Heating and cooling system (e.g., system type, fuel type, and fuel cost)

Building envelope (e.g., poor insulation, leaky roofs, inefficient and/or poorly maintained

HVAC systems, and/or inadequate air sealing)

Appliances and lighting efficiency (e.g., large-scale appliances such

as refrigerators, washing machines, and dishwashers)

Topography and location (e.g., climate, urban heat islands)

Climate change and weather extremes that increase the need for heating and cooling

Socioeconomic

Chronic economic hardship due to persistent low income

Sudden economic hardship (e.g., severe illness, unemployment, or disaster event)

Inability to afford (or difficulty affording) up-front costs of energy efficiency investments

Difficulty qualifying for credit or financing options to make efficiency investments due to

financial and other systemic barriers

Systemic inequalities relating to race and/or ethnicity, income, disability, and other

factors

Behavioral

Information barriers relating to available bill assistance and energy efficiency programs

and relating to knowledge of energy conservation measures

Lack of trust and/or uncertainty about investments and/or savings

Lack of cultural competence in outreach and education programs

Increased energy use due to occupant age, number of people in the household, health-

related needs, or disability

Policy-related

Insufficient or inaccessible policies and programs for bill assistance, energy efficiency,

and weatherization for low-income households

Utility rate design practices, such as high customer fixed charges, that limit customers’

ability to respond to high bills through energy efficiency or conservation

Source:

Drehobl, Ross, and Ayala 2020.

High energy burdens reduce a household’s disposable income and increase its likelihood of

staying trapped in the cycles of poverty (Bohr and McCreery 2019). In particular, Black

households are more likely to experience this pernicious cycle, which includes persistent

income inequality along with limited safety nets (i.e., savings, bill assistance, and social

capital) and thus limited ability to invest in homes or education, and high energy burdens

(Lewis, Hernández, and Geronimus 2019). Households that experience high monthly utility

bills are likely to engage in coping strategies such as using potentially dangerous secondary

heating equipment (e.g., stove, ovens, or space heaters) to compensate for failing heating

systems (Hernández, Phillips, and Siegel 2016). These coping measures can compromise

safety by creating fire hazards and/or increasing exposure to toxic gasses such as carbon

monoxide.

DOEE AFFORDABILITY PROGRAMS © ACEEE

10

Similar research on water burdens has recently emerged. The Environmental Protection

Agency measures affordable water bills as below 4.5% of income: 2.5% for water and 2% for

wastewater services (Kane 2018). Understanding that the percentage of income devoted to

an expenditure is “more important” to a household as income decreases, Colton (2020)

developed a range of affordable water burdens based on the ratio of income to Federal

Poverty Level (FPL). For those between 0%-200% FPL, the affordable water burden range is

3-4.5%. The base level of affordability was set at 4%. Colton applied this analysis to 12 cities

and found that all were in the midst of a water affordability crisis. Water and sewage prices

had grown by an average of 80% between 2010 and 2018, and in some cities 40% of residents

lived in neighborhoods with unaffordable bills. The research also found that the water

affordability crisis is likely to get much worse, with bills in many cities becoming

unaffordable (>4%) for the majority of low-income households over the next decade.

NATIONAL UTILITY AFFORDABILITY PROGRAMS AND POLICIES

Household energy is central to maintaining an individual’s well-being, yet even before the

pandemic, one in three U.S. households experienced some difficulty affording their energy

bills (EIA 2018). In 2017, nearly 25% of U.S. households experienced high energy burdens

(>6%), and 13% faced a severe energy burden (>10%); similarly, 67% of low-income

households nationally faced a high energy burden, and 60% of those households faced a

severe energy burden (Drehobl, Ross, Ayala 2020).

Currently, the need for assistance outpaces the national resources available to support

highly burdened households. Many of the funds and services available through the

Department of Health and Human Services’ (HHS) Low Income Home Energy Assistance

Program (LIHEAP) and the Department of Energy’s (DOE) Weatherization Assistance

Program (WAP) reach a small fraction of households that are income qualified. In 2018,

about 30 million households qualified for LIHEAP benefits and only about 20% (6 million)

of those households received them (NEADA 2018). Through DOE and other leveraged

funding sources (such as HHS and state and city funds), WAP typically serves about 100,000

homes per year (NASCSP 2020). Based on this rate, it would take 360 years to weatherize all

eligible households in the U.S. (Drehobl, Ross, Ayala 2020; NASCSP 2020). The public health

crisis and recession are continuing to increase the need for bill assistance and

weatherization.

Several states, including the District of Columbia, California, Colorado, New York, and

Minnesota, have solar policies that expand and encourage low-income participation in solar

photovoltaics (PV). But despite efforts to increase participation from low-income

communities at the state level, many low-income households continue to face barriers to

accessing the benefits of solar energy. A recent study found that on average, Black-,

Hispanic-, and Asian-majority census tracts had significantly less rooftop PV installation

compared to white-majority census tracts (Sunter, Castellanos, and Kammen 2019). Even

after accounting for home ownership and income, the study found that significant racial

disparity remains (Sunter, Castellanos, and Kammen 2019).

Water affordability is a growing issue nationally as aging infrastructure, fluctuating

population growth, regulatory compliance, and the impact of climate change are leading

some water utilities to increase their rates to cover their increased costs (Bipartisan Policy

DOEE AFFORDABILITY PROGRAMS © ACEEE

11

Center 2017). Many low-income renters may not see the direct impact of rising water costs

on their own finances because the cost of water is incorporated in their rent. In these cases,

rising water costs often contribute to increases in rent, higher housing cost burdens, and

housing instability (Joint Center for Housing Studies 2020).

In March 2021, the US Department of Health and Human Services announced the Low-

Income Home Water Assistance Program (LIHWAP) as part of the Consolidated

Appropriations Act of 2021 (NEADA 2021). LIHWAP will provide federal funding for water

assistance, similar to LIHEAP. The program will provide grants to assist low-income

households who spend “a high proportion of household income for drinking water and

wastewater services,” by providing funds to owners or operators of public water and

wastewater facilitates to reduce arrearages (HHS 2021). This will be the first large scale

federal program to offer water assistance, which has historically left support for water

affordability to water utilities, local governments, and nonprofits. LIHWAP will provide

much needed support.

Many income-eligible families are often unaware of water assistance programs, unfamiliar

with the application process, and/or have feelings of mistrust or stigma associated with

receiving financial assistance. Additionally, some low-income households face barriers to

program participation, such as lacking internet or phone access to complete the application

or not directly receiving a water bill due to living in a master-metered building or being a

renter (EPA 2016). While many water assistance programs assist homeowners and do not

provide support for renters, DC Water recently launched a new program to support

multifamily building tenants (see next section for more details).

In addition to water bill assistance, leak reduction programs can help lead to long-term

water affordability (Wong et al. 2014). Often, high bills are the result of a household leak,

and programs that can identify and address these leaks can mitigate subsequent high bills.

Some water utilities offer programs to alert customers of high bills. For example, DC Water

has a High Usage Notification Alert (HUNA) system, which can let customers know if they

have high use and a potential water leak. Some water utilities pair leak repairs with water

efficiency programs and water bill discounts, helping to optimize the effectiveness of water

affordability benefits. Leak programs come in a few forms, such as deploying home kits that

include leak detection devices, offering a comprehensive leak detection routine program, or

providing financial assistance for in-home leak repairs (Wong et al. 2014).

DISTRICT UTILITY AFFORDABILITY POLICIES AND PROGRAMS

In 2012, the District announced its Sustainable DC Plan, with ambitious citywide climate

and energy goals. Since then, the District’s clean energy policies and programs have

expanded and changed. The District published the initial draft of the Clean Energy DC Plan

in November 2016 and the final plan in August 2018. The recent adoption of the Clean

Energy Omnibus Amendment Act of 2018 introduces ambitious new policies and initiatives

focused on the District’s energy supply, energy use, and greenhouse gas emission from

vehicles. As a result, the District has implemented and expanded the number of programs

that aim to create new jobs and reduce household energy use and costs, all while

prioritizing community development investments (District of Columbia DOEE 2020). The

District is committed to embedding equity and affordability considerations into climate and

DOEE AFFORDABILITY PROGRAMS © ACEEE

12

energy actions, policies, and priorities, and hopes to achieve this by engaging and

supporting residents who have been traditionally excluded from the energy planning

process (District of Columbia DOEE 2018).

Energy and Water Affordability Programs in the District

DOEE, DC Water, the District of Columbia Sustainable Energy Utility (DCSEU), energy

utilities, and nonprofits offer programs that aim to help District residents reduce their

energy and water bills. Table 4 summarizes these various programs that address energy and

water affordability by providing residents with utility bill discounts, home upgrades,

repairs and weatherization, and renewable energy options. See Appendix A for more

detailed descriptions of utility affordability programs serving District residents.

Table 4. Energy and water assistance programs offered by DOEE, DC Water, DCSEU, and local nonprofits

Program

Program implementer

Income

qualification

limit

Utility discounts

Low Income Home Energy Assistance Program (LIHEAP)

DOEE

60% SMI

Utility Discount Program (UDP)

DOEE

60% SMI

Clean Rivers Impervious Area Charge (CRIAC)

Residential Relief Program

DOEE & DC Water

100% AMI

Multifamily Assistance Program (MAP)

DC Water

60% SMI

Residential Aid Discount Program (RAD)

PEPCO

60% AMI

Residential Essential Service (RES)

Washington Gas

60% AMI

Washington Gas Budget Plan

Washington Gas

No limit

Washington Area Fuel Fund (WAFF)

Salvation Army

60% SMI

Serving People by Lending a Supporting Hand (SPLASH)

Greater Washington

Urban League (GWUL)

60% SMI

PEPCO Energy Assistance

GWUL

60% SMI

Energy savings

Solar for All (SFA)

DOEE

80% AMI

DCSEU rebates

DCSEU

No limit

Home upgrades, repairs, and weatherization

Weatherization Assistance Program (WAP)

DOEE

60% SMI

Emergency HVAC

DOEE

60% AMI

Senior StayCool

Department of Aging

and Community Living

(DACL)

60% AMI

Lead-Based Paint Hazard Control Program (LHC)

DOEE

80% AMI

Lead Pipe Replacement Assistance Program (LPRAP)

DOEE & DC Water

No limit

DOEE AFFORDABILITY PROGRAMS © ACEEE

13

DOEE offers direct bill relief to income-qualified residents. Funding for this assistance

comes from three sources, including LIHEAP, the Energy Assistance Trust Fund (EATF),

and District local funds. DOEE also automatically qualifies income-qualified LIHEAP

households for three utility discount programs to lower monthly bills for customers:

PEPCO’s Residential Aid Discount Program (RAD), Washington Gas’s Residential Essential

Service (RES), and DC Water Customer Assistance Program (CAP). For higher income

thresholds, DOEE also approves households for CAP2 and CAP3, part of the CRIAC

Residential Relief Program, and the Solar for All program. Additional funds administered

by area nonprofits can also provide supplemental support, though program funding for

DOEE and utility programs may be more consistent due to regulatory and legislative

requirements.

DOEE’s Affordability and Efficiency Division also offers weatherization, emergency HVAC,

and lead pipe replacement programs. The WAP program is implemented by two

community-based organizations. During the pandemic, DOEE partnered with the District’s

Department of Aging and Community Living (DACL) to offer a senior cooling program.

Income qualification across all the programs varies due to funding source. Programs with

federal funding have stricter requirements, which can make it challenging to cross enroll

households while also meeting these federal reporting and documentation requirements.

In February 2021, DC Water launched a new Multifamily Assistance Program (MAP), which

aims to support tenants who pay for their water bills through their rent. The MAP program

provides benefits to building owners or HOAs of multifamily affordable housing properties

(i.e., four or more units). Building owners can apply for the program, and DC Water will

provide a credit to the property’s water service account. The HOA or owner is then required

to post 90% of the credit to the qualifying occupant’s rental or HOA account in order to

provide the benefits back to income-qualified tenants (DC Water 2021b).

The city is working to embed and ensure equity in all energy actions and programs. DOEE

has begun several innovative efforts to build capacity with local groups. For example, in

2020, DOEE hired a new staff member who will be dedicated to engaging with the

community on energy issues and to ensuring that equity is at the forefront of energy

planning and programs (meeting with DOEE staff, February 2, 2021). In addition, DOEE

was awarded an equity grant from the Urban Sustainability Directors Network in

partnership with the Consumer Health Foundation to develop a racial equity assessment

tool (District of Columbia DOEE 2020). DOEE will use the tool in the form of processes to

assess policies, plans, and programs through a racial equity lens.

DOEE Utility Affordability Program Outcomes and COVID Impacts

The pandemic has affected utility assistance and affordability program enrollments. The

stay-at-home order closed down in-person enrollment centers and in-person outreach

events. Across energy assistance programs, including LIHEAP, RAD, and RES, enrollment

was down in FY20 compared to FY19. While WAP funds were spent in FY20, LIHEAP

enrollment was down by about 25% (meeting with DOEE staff, February 2, 2021). DOEE

also worked to leverage additional programs alongside WAP, such as the Senior StayCool

program and efforts to integrate lead removal. WAP pivoted to spending additional funding

on health safety and PPE, while continuing to perform the same audit and evaluation

DOEE AFFORDABILITY PROGRAMS © ACEEE

14

process. In addition, although enrollment is down for these assistance programs, more

households are income eligible due to job losses and income changes. Table 5 includes total

program participants in FY2019 and FY2020 across all five utility assistance programs and

two energy utility assistance programs.

Table 5. Total program participants in FY2019 and FY2020

Program

FY2019

FY2020

LIHEAP

20,236

15,779

RAD

18,938

14,690

RES

9,019

7,017

WAP*

360

297

CRIAC (CAP, 2, and 3)

3,599

4,651

SFA

815

3,103

Data provided by DOEE through email. * Number of households receiving

energy efficiency services (e.g., WAP, Senior StayCool, emergency HVAC

repairs).

In contrast, both CRIAC and SFA enrollments have continued to increase, with FY21

enrollment on track to be at least twice as high as FY20. Both CRIAC and SFA are newer

programs and are continuing to ramp up enrollment and capacity each year. For FY21 (as of

January 2021), SFA has enrolled an additional 1,709 program participants, putting

enrollment on track to at least double if not triple compared to FY20 (data from DOEE

meeting on February 2, 2021). But even as interest in the SFA program remains steady, it is

now more difficult to interface with potential subscribers due to COVID, which makes it

more difficult for residents to sign up. DOEE currently relies on mailers for new SFA

subscriptions, whereas before the pandemic, DOEE staff enrolled about 30–40% of sign-ups

through energy enrollment centers (Mackenzie Mathews, in email to Ariel Drehobl, January

25, 2021).

Table 6 shows a summary of CRIAC participants across the three Customer Assistance

Program (CAP) levels and the new emergency assistance program in FY19 and FY20. The

Emergency Residential Relief Program (ERRP) benefit was established through the COVID-

19 Response Supplemental Emergency Amendment Act of 2020 in response to increased

average customer arrears in FY21.

7

CRIAC CAP 3 is now serving substantially more people

than before the pandemic: as of January 2021, CRIAC has assisted almost as many residents

in FY21 as in the entirety of FY2020. CRIAC wait times have not increased due to the

COVID-19 pandemic, and DOEE continues to respond to new applications within 1–2

business days (with up to 10 business days for very busy times).

7

COVID-19 Response Supplemental Emergency Amendment Act of 2020. 2020. D.C. Act 23-286.

code.dccouncil.us/dc/council/acts/23-286.html.

DOEE AFFORDABILITY PROGRAMS © ACEEE

15

Table 6. Number of DOEE customer approvals for CRIAC (CAP, 2, and 3) and Emergency

Water Assistance Programs in FY19, FY20, and FY21 (as of January)

Year

CAP 1

CAP 2

CAP 3

EERP

FY19

3,294

256

49

N/A

FY20

3,991

519

141

2,200

FY21 (as of Jan)

2,141

359

124

1,155

Data provided by email from DOEE on January 25, 2021.

Overall, the COVID-19 pandemic has exacerbated energy, water, and housing insecurity for

the District’s low- and moderate-income communities. Black and Hispanic District residents

are especially affected by the pandemic: they have the highest unemployment rates, highest

food and housing insecurity, and are more likely to experience homelessness or

displacement. Energy and water affordability programs geared to the most overburdened

households can support a fair and just recovery in the District by supporting residents who

face systemic inequities before and during the pandemic (Bohr and McCreery 2019).

Policymakers and program administrators have the opportunity to reevaluate and enhance

the process by which energy and water savings measures and bill assistance are distributed

to ensure that they support the most overburdened communities in a fair and equitable

manner (Reames, Reiner, and Stacy 2018).

Energy and Water Burden Analysis

Despite the number of utility affordability programs offered, many District residents

experience disproportionately high energy and water burdens. This utility burden analysis

provides an overview of how energy and water burdens differ for many households in the

DC metropolitan statistical area (MSA).

8

DOEE can use this information to better

understand which groups who do not currently receive utility assistance experience

disproportionately high utility burdens in order to better target utility affordability

resources towards these communities and households.

METHODOLOGY

This analysis follows the methodology used in ACEEE’s three energy burden reports

(Drehobl, Ross, and Ayala 2020; Ross, Drehobl and Stickles 2017; Drehobl and Ross 2016).

The study analyzes the American Housing Survey (AHS) 2019 data (released in October

2020), issued by the U.S. Department of Housing and Urban Development (HUD) for the

national population and for the Washington, DC metropolitan statistical area (MSA). The

AHS includes household-level income data and energy and water cost data that we use as

the basis of our energy, water, and combined burden calculations.

8

The DC metro area includes Washington, DC, Arlington, and Alexandria. For more information, see:

www.census.gov/programs-surveys/ahs/tech-documentation/help-guides/2015-

later/metro_oversamp_hist_2015.html.

DOEE AFFORDABILITY PROGRAMS © ACEEE

16

See Appendix B for the full description of the utility burden methodology and Appendix C for full

utility burden data tables.

For the utility burden analyses, we calculated energy burdens using the total annual cost of

electricity, natural gas, and other heating fuels and total annual household income. We

define households with high energy burdens as those spending more than 6% of their

income on electricity and heating fuel costs, and households with severe energy burdens as

those spending more than 10%.

9

These two categories are not mutually exclusive, as

households with severe energy burdens are a subset of those who have high energy

burdens. We calculated median water burdens for households in the DC metro area, and

then high water burdens as households spending more than 4% of their income on water

bills. For households with both water and energy data available, we calculated a combined

energy and water burden, and we calculated high combined burdens as those above 10% of

household income.

We analyzed energy, water, and combined burdens across a variety of factors including race

and ethnicity, age, education and ability, building tenure and age, and building type and

heating fuel. Figure 2 includes the demographic and housing-related groups included in the

analyses. We chose income thresholds to match those of DOEE’s utility affordability

program. For each analysis, we filtered out households who do not directly pay for their

energy and/or water bills and report a positive income. We also calculated energy, water,

and combined burdens for the 2019 AHS national sample to compare to the DC metro area

burden findings.

The dataset does not let us separate households who receive utility assistance and those

who do not. Therefore, these utility burden findings are representative of the DC metro area

as a whole, and likely include some households who receive assistance along with mostly

households who do not receive assistance. We recommend viewing these findings as

guidance on which households may be most in need of assistance for targeting and outreach

purposes. See Appendix B for additional limitations of this study.

9

HUD determines affordable housing costs to be 30% of total household income. Researchers have determined

that, typically, 20% of total housing expenses are energy costs. This equates to 6% of total income spent on

energy bills as an affordable level (Fisher, Sheehan & Colton 2020). We consider energy burdens above 6% to be

high burdens, with burdens above 10% to be severe. This method is in line with other research (APPRISE 2005).

DOEE AFFORDABILITY PROGRAMS © ACEEE

17

Figure 2. Demographic and housing factors analyzed across the energy, water, and combined utility burden analyses, including

race/ethnicity, age, education, ability, building tenure and age, and building type and heating fuel.

Source:

data from 2019 American

Housing Survey.

ENERGY BURDENS FINDINGS

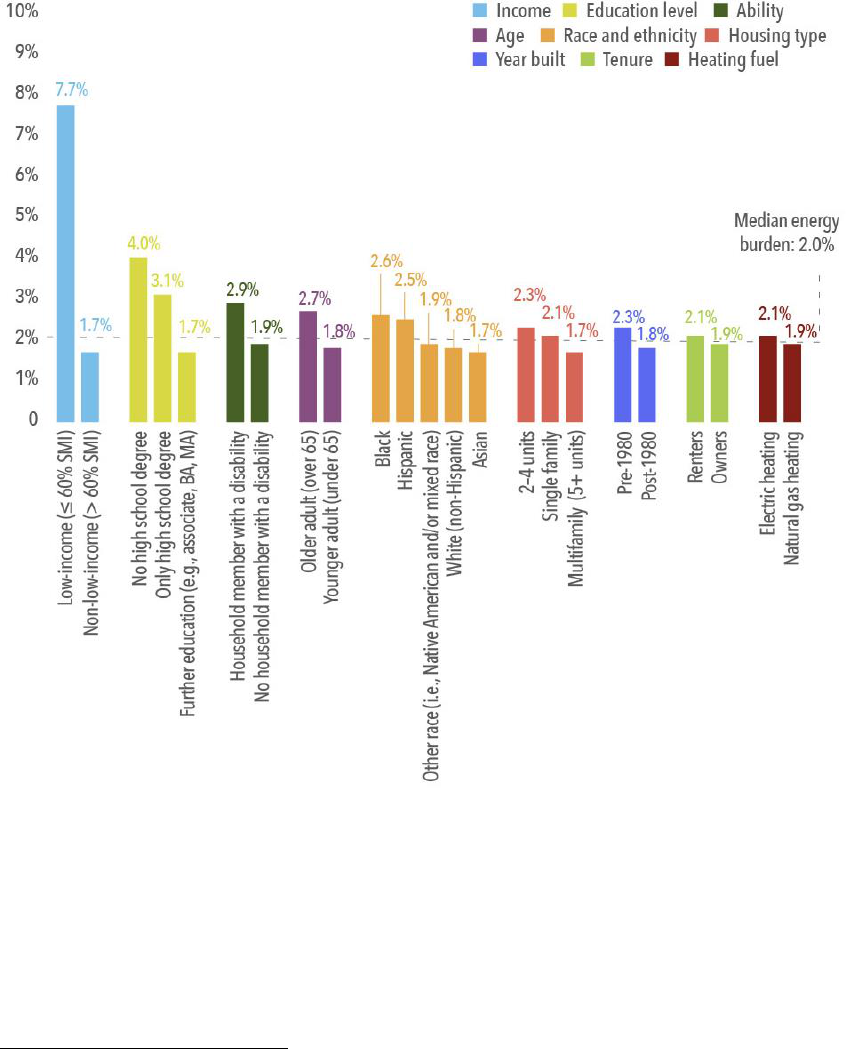

We analyzed the DC metro area energy burdens across demographic and building

categories and found that the groups with disproportionately high burdens reflect

households with physical and socioeconomic factors that exacerbate their energy burden,

such as having low incomes, living in older buildings, and facing longstanding systemic

DOEE AFFORDABILITY PROGRAMS © ACEEE

18

inequities.

10

We also analyzed what percentage of each group experience a high and severe

energy burden. These energy burdens reflect the landscape of households in the DC metro

aera, most of whom do not receive energy assistance. Figure 3 includes the median energy

burdens across demographic and housing type groups.

Figure 3. Energy burdens (i.e., electricity and heating fuel costs as a percentage of total income) across subgroups of houses in the

DC metro area, including income, education level, ability, age, race and ethnicity, housing type, year built, tenure status, and

heating fuels.

Source:

data from 2019 American Housing Survey.

10

Note that for the energy burden analysis, we analyze the DC metro area population of the AHS dataset who

directly pay for their electricity and main heating fuel (i.e., electricity, natural gas, or other) and report positive

income. Households who do not directly pay for their energy are excluded from this analysis.

DOEE AFFORDABILITY PROGRAMS © ACEEE

19

Main DC metro area energy burden findings include

11

• Across all households in the DC metro area, 64% of low-

income households face a high energy burden (above 6%),

and 40% of low-income households face a severe energy

burden (above 10%).

• One-fourth (25%) of low-income households experience

an energy burden of at least 15%, which is 7.5 times the

median for the DC metro area.

• Groups with above-median energy burdens in the DC

metro area include low-income households, households

who receive food stamps, non-high school graduates,

households with a family member with a disability, adults

over 65, Black households, Hispanic households, and

renters.

• Households with electric heat and natural gas heat did not

experience major differences in energy burdens (2.1% for

electric, 1.9% for natural gas).

12

The graphics to the right illustrate the greatest disparities

between groups in the energy burden analysis. For example, the

median low-income household experiences an energy burden 4.5

times higher than the median non-low-income household.

Energy Bills:

Of households who directly pay for their energy bills (excluding those