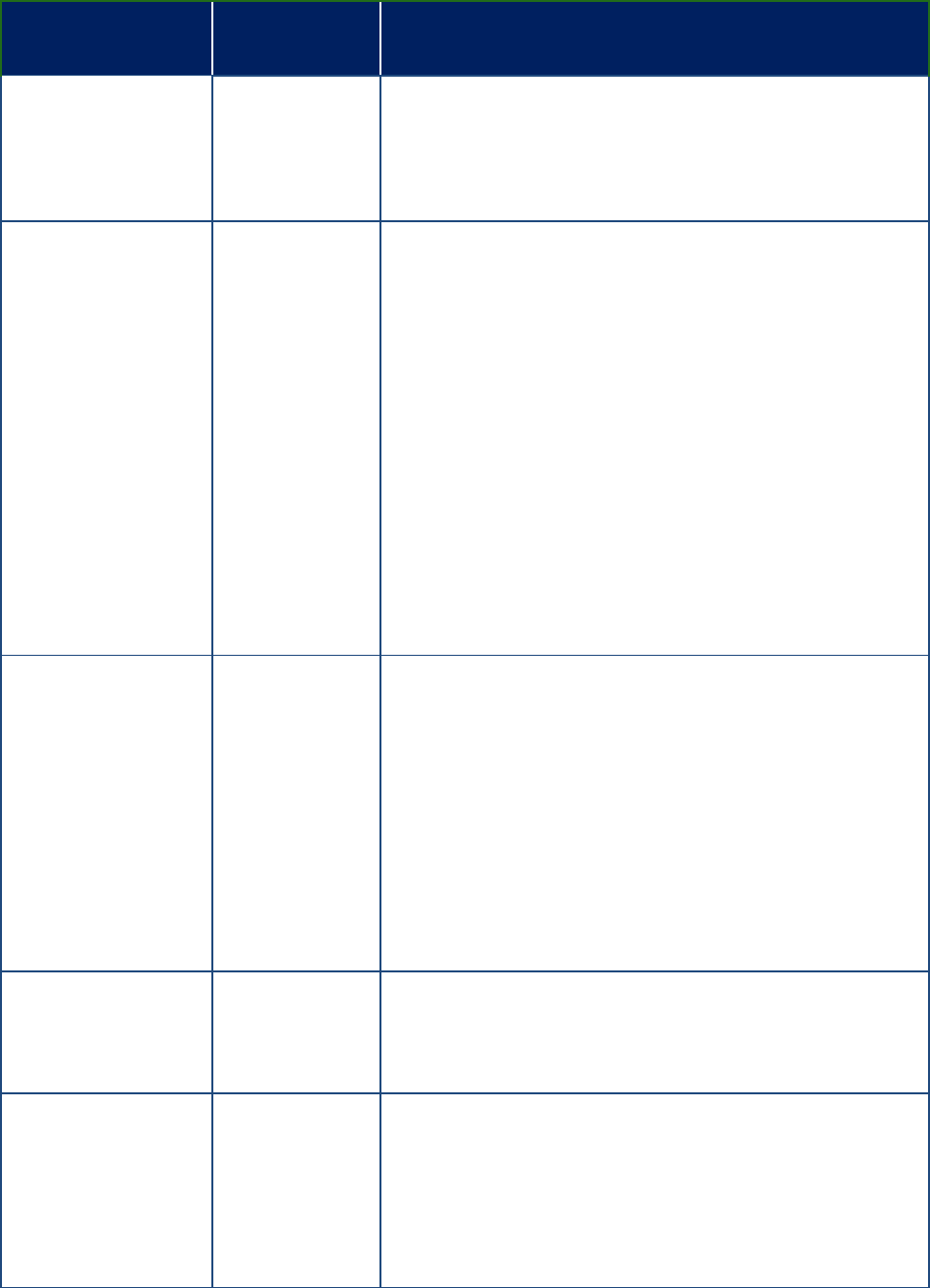

Allowable and Unallowable Summarized Costs and Activities

All Specialty Crop Block Grant Program (SCBGP) awards are subject to the terms and conditions,

Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards,

and other considerations described in the most recent SCBGP Terms and Conditions of Award. All

costs must be allowable in accordance with the Federal cost principles outlined in 2 CFR part 200

Subpart E.

Sub-recipients and contractors under grants are subject to the requirements of the cost principles

otherwise applicable to their type of organization and the AMS-SCBGP’s General Award Terms and

Conditions.

Selected Cost Items

The following list summarizes allowable and unallowable costs in common categories project

budgets. This section is not intended to be all-inclusive. Reference Subpart E-Cost Principles of 2

CFR part 200 for a complete explanation of the allow ability of costs.

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Advisory Councils

ALL with

exceptions

Unallowable for costs incurred by advisory councils or

committees, unless specifically fulfilling the purpose or approved

activities of a grant program or project.

Alcoholic Beverages

ALL with

exceptions

Unallowable for alcoholic beverages unless the cost is associated

with fulfilling the purpose of the grant program and either

approved in the application or with prior written approval.

Buildings and Land –

Construction

ALL with

exceptions

Unallowable for the acquisition of buildings, facilities, or land or

to make new constructions, additions, improvements,

modifications, replacements, rearrangements, reinstallations,

renovations, or alterations of an existing building or facility

(including site grading and improvement, and architecture fees),

unless the cost is associated with fulfilling the purpose of the

grant program or with prior written approval. This also includes

construction-related materials, which may include, but are not

limited to, the purchase of building materials such as wood, nails,

concrete, asphalt, roofing, gravel, sand, paint, insulation, drywall,

or plumbing.

Allowable for rental costs of land and building space. However,

lease agreements to own (i.e., lease-to-own or rent-to-own) are

not allowable. The lease or rental agreement must terminate at

the end of the grant cycle.

A building is any permanent structure designed or intended for

support, enclosure, shelter, or protection of people, animals, or

property, and having a permanent roof supported by columns or

walls.

Conferences

ALL with

exceptions

Allowable if the conference fulfills the grant program’s purpose.

Allowable conference costs paid by the non-Federal recipient as a

sponsor or host of the conference may include rental of facilities,

speakers’ fees, costs of meals (see

Meals for restrictions), and

refreshments, local transportation, and other items incidental to

such conferences with the exception of entertainment costs that

are unallowable. If registration fees are collected, the recipient

must report fees as program income (see

Program Income).

Allowable to rent a building or room for training; however, where

appropriate, AMS encourages the use of technologies such as

webinars, teleconferencing, or videoconferencing as an

alternative to renting a building or a room. The recipient should

use the most cost-effective facilities, such as State government

conference rooms if renting a building or a room is necessary.

Contingency Provisions

ALL

Unallowable for miscellaneous and similar rainy-day funds for

events the occurrence of which cannot be foretold with certainty

as to the time or intensity, or with an assurance of their

happening. Unallowable for working capital for activities/items

not already in place.

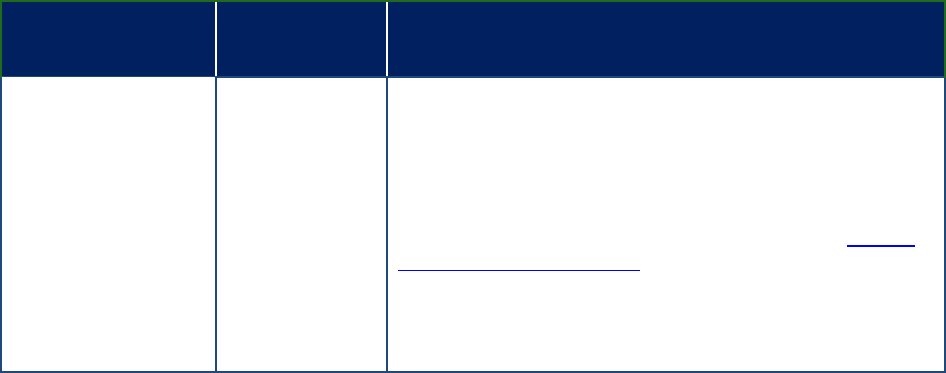

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Contractual/Consultant

Costs (Professional

Services)

ALL

Allowable subject to limitations. Contractual/consultant costs

are expenses associated with purchasing goods and/or procuring

services performed by an individual or organization other than

the recipient in the form of a procurement relationship.

Allowable for contractor/consultant employee rates that do not

exceed the salary of a GS-15 step 10 Federal employee in the area

(for more information, visit the OPM

we

bsite) and travel that is

reasonable and necessary. This does not include fringe benefits,

indirect costs, or other expenses. If rates exceed this amount, the

recipient is required to justify the allowability of the cost aligning

with 2 CFR §§ 200.317-327.

Contributions or

Donations

ALL

Unallowable for contributions or donations, including cash,

property, and services, made by the recipient to other entities. A

nonfederal entity using grant funds to purchase food or services

to donate to other entities and/or individuals is unallowable.

Electronic Benefit

Transfer (EBT)

Machines

ALL

Unallowable for the purchase/lease of Supplemental Nutrition

Assistance Program (SNAP) EBT equipment.

Entertainment Costs

ALL with

exceptions

Unallowable for entertainment costs including amusement,

diversion, and social activities and any costs directly associated

with such costs (such as bands, orchestras, dance groups, tickets

to shows, meals, lodging, rentals, transportation, and gratuities).

Entertainment costs are defined in

2 CFR § 200.438.

Allowable where the specific cost is considered to meet the

requirements of the sponsored program and are authorized in

the approved budget or with prior written approval.

Equipment – General

Purpose

ALL

Unallowable for acquisition costs of general purpose equipment

or lease agreements to own (i.e., lease-to-own or rent-to-own).

Allowable for rental costs of general purpose equipment when

provided in the approved budget or with prior written approval.

‘General Purpose’ vehicles may not be purchased and may only

be leased with prior written approval (and only if specific to

fulfilling the purpose of the grant). The lease or rental agreement

must terminate at the end of the grant cycle.

For vehicle and equipment leases or rentals with an acquisition

cost that equals or exceeds $5,000, rates should be in light of

factors such as: rental costs of comparable vehicles and

equipment, if any; market conditions in the area; alternatives

available; and the type, life expectancy, condition, and value of

the vehicle or equipment leased.

Allowable if special purpose equipment (and NOT general

purpose equipment). Special purpose equipment is defined below

in this chart under “Equipment – Special Purpose.”

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Equipment –

Information

Technology Systems

and

Telecommunications

ALL

Unallowable for information technology systems having a useful

life of more than one year and a per-unit acquisition cost that

equals or exceeds the lesser of the capitalization level established

in accordance with GAAP by the recipient for financial statement

purposes or $5,000. Acquisition costs for software include those

development costs capitalized in accordance with GAAP.

Information technology systems include computing devices,

ancillary equipment, software, firmware, and similar procedures,

services (including support services), and related resources.

Computing devices means machines used to acquire, store,

analyze, process, and publish data and other information

electronically, including accessories (or “peripherals”) for

printing, transmitting and receiving, or storing electronic

information. Examples of unallowable information technology

systems include service contracts, operating systems, printers,

and computers that have an acquisition cost of $5,000 or more.

See also special prohibition on the purchase of certain

telecommunications and video surveillance described in

2 CFR §

200.216.

Allowable for special purpose systems specific to the food and

agricultural sectors and specific to the activities in the grant.

Examples include food sales and traceability applications, systems

and software that support specialized equipment by design and

website development, mobile apps, etc.,

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Equipment – Special

Purpose

ALL

Allowable when provided in the approved budget or with prior

written approval for acquisition costs and rental costs of special

purpose equipment provided the following criteria are met:

1. Necessary for the research, scientific, or other technica

l

ac

tivities of the grant agreement;

2. Not otherwise reasonably available and accessible;

3. The type of equipment is normally charged as a direct

cost by the organization;

4. Acquired in accordance with organizational practices;

5. Must be used solely to meet the legislative purpose of

the grant program and objectives of the gran

t

agreement;

6. More than one single commercial organization,

commercial product, or individual must benefit from the

use of the equipment;

7. Must not use special purpose equipment acquired wit

h

g

rant funds to provide services for a fee to compete

unfairly with private companies that provide equivalent

services; and

8. Equipment is subject to the full range of acquisition, use,

management, and disposition requirements under

2 CFR

§ 200.313 as applicable.

Examples of special purpose equipment in the agricultural sector

include, but are not limited to: sorting equipment, packing and

labeling equipment, food processing equipment essential to the

grant-funded project, purpose specific vehicles or trailers, such as

refrigerated vans that will not be used as personal vehicles.

Farm, Gardening, and

Production Activities

and Supplies

ALL with

exceptions

Unallowable for farm, gardening, and production activities,

materials, supplies, and other related costs including but not

limited to soil, seeds, shovels, gardening tools, greenhouses, and

hoop houses.

Allowable where the specific cost is considered to meet the

requirements of grant and is authorized in the approved budget

or with prior written approval.

Fines, Penalties,

Damages and Other

Settlements

ALL

Unallowable for costs resulting from violations of, alleged

violations of, or failure to comply with, Federal, State, tribal, local,

or foreign laws and regulations.

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Fixed Amount

Subawards

ALL with

exceptions

Unallowable for cost related to fixed amount subawards.

Allowable to meet the requirements of the grant award

(noncompetitive) or with prior written approval. A recipient may

provide subawards based on fixed amounts up to the simplified

acquisition threshold, provided that the subawards meet the

requirements for fixed amount awards in 2 CFR § 200.201

.

Fundraising and

Investment

Management Costs

ALL

Unallowable for organized fundraising, including financial

campaigns, solicitation of gifts and bequests, and similar

expenses incurred to raise capital or obtain contributions,

regardless of the purpose for which the funds will be used. This

includes salaries of personnel involved in activities to raise

capital.

General Costs of

Government

ALL

Unallowable for:

Salaries and expenses of the Office of the Governor of a State or

the chief executive of a local government or the chief executive

of an Indian tribe;

Salaries and other expenses of a State legislature, tribal council,

or similar local governmental body, such as a county supervisor,

city council, school board, etc., whether incurred for purposes of

legislation or executive direction;

Costs of the judicial branch of a government;

Costs of prosecutorial activities unless treated as a direct cost to a

s

pecific program if authorized by statute or regulation (however,

this does not preclude the allowability of other legal activities of

the Attorney General as described in

2 CFR § 200.435 Defense

and prosecution of criminal and civil proceedings, claims, appeals

and patent infringements); and

Costs of other general types of government services normally

provided to the general public, such as fire and police, unless

provided for as a direct cost under a program statute or

regulation.

Goods or Services for

Personal Use

ALL

Unallowable for costs of goods or services for personal use of the

recipient’s employees regardless of whether the cost is reported

as taxable income to the employees.

Indirect Costs –

Unrecovered

ALL with

exceptions

Unallowable for unrecovered indirect costs.

Allowable for projects with match requirements to use

unrecovered indirect costs as part of cost sharing or matching.

Insurance and

Indemnification

ALL

Allowable when provided in the approved budget or with prior

written approval as indirect costs for insurance and

indemnification.

Lobbying

ALL

Unallowable as defined in 2 CFR § 200.450.

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Meals

ALL

Unallowable for business meals when individuals go to lunch or

dine together although no need exists for continuity of a meeting.

Such activity is considered an entertainment cost.

Unallowable for conference attendee breakfasts. It is expected

attendees will have adequate time to obtain this meal on their

own before a conference begins.

Unallowable for meal costs that duplicate a meeting participant’s

per diem or subsistence allowances.

Allowable for lunch or dinner meals if the costs are reasonable,

and a justification is provided that such activity maintains the

continuity of the meeting and to do otherwise will impose

arduous conditions on the meeting participants.

Allowable for meals consumed while in official travel status. They

are considered per diem expenses and should be reimbursed in

accordance with the organization’s established written travel

policies.

Memberships,

Subscriptions, and

Professional Activity

Costs

ALL

Unallowable for costs of membership in any civic or community

organization.

Allowable for costs of membership in business, technical, and

professional organizations when provided in the approved budget

or with prior written approval.

Organization Costs ALL

Unallowable for costs of investment counsel and staff and similar

expenses incurred to enhance income from investments.

Allowable with prior approval for organization costs per 2 CFR §

200.455.

Participant Support

Costs

ALL

Allowable when provided in the approved budget or with prior

written approval for such items as stipends or subsistence

allowances, and registration fees paid to or on behalf of

participants or trainees (but not employees) in connection with

approved conferences, training projects, surveys, and focus

groups.

Political Activities

ALL

Unallowable for development or participation in political

activities, in accordance with provisions of the Hatch Act (5

U.S.C.§§ 1501-1508 and §§ 7324-7326).

Pre-Award Costs (see

also section 9.5 below)

ALL

Allowable when provided in the approved budget or with prior

written approval of such costs are necessary for efficient and

timely performance of the project’s scope of work. Such costs are

allowable only to the extent that they would have been allowable

if incurred after the date of the Federal award. If charged to the

award, these costs must be charged to the initial budget period of

the award, unless otherwise specified by AMS. A recipient may

incur pre-award costs 90 calendar days before the award.

Expenses more than 90 calendar days pre-award require prior

approval. These costs and associated activities must be included

in the recipient’s project narrative and budget justification. All

costs incurred before the award are at the potential recipient’s

risk. The incurrence of pre-award costs in anticipation of an

award imposes no obligation on AMS to award funds for such

costs.

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Printing and

Publications

ALL

Allowable to pay the cost of preparing informational leaflets,

reports, manuals, and publications relating to the project;

however, the printing of hard copies is discouraged given the

prevalence of electronic/virtual publication means. If charged to

the award, these costs must be charged to the final budget period

of the award, unless otherwise specified by AMS.

Salaries and Wages

ALL

Allowable as part of employee compensation for personnel

services in proportion to the amount of time or effort an

employee devotes to the grant-supported project or program

during the period of performance under the Federal award,

including salaries, wages, and fringe benefits. Such costs must be

incurred under formally established policies of the organization,

be consistently applied, be reasonable for the services rendered,

and be supported with adequate documentation.

Salary and wage amounts charged to grant-supported projects or

programs for personal services must be based on an adequate

payroll distribution system that documents such distribution in

accordance with generally accepted practices of like

organizations. Standards for payroll distribution systems are

contained in the applicable cost principles (other than those for

for-profit organizations).

Unallowable for salaries, wages, and fringe benefits for project

staff who devote time and effort to activities that do not meet

the purpose of the grant program.

Selling and Marketing

Costs – Promotion of

an Organization’s

Image, Logo, or Brand

Name

ALL

Unallowable for costs designed solely to promote the image,

logo, or brand for a specific organization or business, unless

specifically to fulfill the purpose of the program or grant project.

Allowable for more general branding that aligns with the purpose

of the grant. For example, in Specialty Crop Block Grant,

promotional items could say “Buy STATE/COUNTY Grown Apples”

but not “XYZ Grown”, which promotes XYZ generically, to ensure

funds are supporting specialty crop stakeholders. Similarly, a

promotional campaign to increase producer sales of

“STATE/COUNTY Grown fruits and vegetables” is acceptable while

increasing membership in “STATE/COUNTY Grown” generally is

not.

Selling and Marketing

Costs – Promotion of

Venues that do not

Align with Grant

Program Purpose

ALL

Unallowable for costs for promotion of specific venues,

tradeshows, events, meetings, programs, conventions, symposia,

seminars, etc. that do not align with the purpose of the grant

program as stated in the RFA.

Selling and Marketing

Costs – Promotional

Items, Gifts, Prizes, etc.

ALL with

exceptions

Unallowable for promotional items, swag, gifts, prizes,

memorabilia, and souvenirs.

Allowable with conditions to meet the requirements of the grant,

in the approved application or with prior approval for marketing

activities directly related to the funded project. Promotional

items include point-of-sale materials, promotional kits, signs or

streamers, automobile stickers, table tents, and placemats, or

promotional items of a personal nature (e.g., t-shirt, hats, etc.).

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Selling and Marketing

Costs – Coupons,

Incentives or Other

Price Discounts

ALL

Unallowable for costs of the value of coupon/incentive

redemptions or price discounts (e.g., the $5.00 value for a $5.00

clip-out coupon).

Allowable for costs associated with printing, distribution, or

promotion of coupons/tokens or price discounts (e.g., a print

advertisement that contains a clip-out coupon) as long as they

benefit more than a single program or organization.

Selling and Marketing

Costs – Food for

Displays, Tastings,

Cooking

Demonstrations

ALL with

exceptions

Unallowable for purchasing food for displays, tastings, and

cooking demonstrations.

Allowable where the specific cost is considered to meet the

programmatic purpose of the grant and is authorized in the

approved budget or with prior written approval.

Selling and Marketing

Costs – General

Marketing Costs

ALL with

exceptions

Unallowable for costs designed solely to promote the image of

an organization, general logo, or general brand.

Allowable for costs designed to promote products that align with

the purpose of the grant program.

Selling and Marketing

Costs – Sponsorships

ALL

Unallowable for costs associated with sponsorships. A

sponsorship is a form of advertising in which an organization uses

grant funds to have its name and/or logo associated with certain

events and where the organization does not necessarily know

how the funds associated with sponsorship costs will be used.

These costs also benefit only the organization offering funding,

limiting the beneficiaries to the sponsor organization.

Selling and Marketing

Costs – Use of Meeting

Rooms, Space, exhibits

that do not Align with

Grant Program Purpose

ALL

Unallowable for costs associated with trade show

attendance/displays, meeting room reservations, and/or any

other displays, demonstrations, exhibits, or rental of space where

activities do not specifically align with the purpose of the grant

program. See Conferences for more information.

Supplies and Materials,

Including Costs of

Computing Devices

ALL

Allowable for costs incurred for materials, supplies, and

fabricated parts necessary to carry out a Federal award.

Purchased materials and supplies must be charged at their actual

prices, net of applicable credits. Withdrawals from general stores

or stockrooms should be charged at their actual net cost under

any recognized method of pricing inventory withdrawals,

consistently applied. Incoming transportation charges are a

proper part of materials and supplies costs. Only materials and

supplies used for the performance of a Federal award may be

charged as direct costs.

A computing device is a supply if the acquisition cost is less than

the lesser of the capitalization level established by the recipient

for financial statement purposes or $5,000, regardless of the

length of its useful life. In the specific case of computing devices,

charging as a direct cost is allowable for devices that are essential

and allocable, but not solely dedicated, to the performance of a

Federal award. Where Federally donated or furnished materials

are used in performing the Federal award, such materials will be

used without charge.

Training

ALL

Allowable when the training is required to meet the objectives of

the project or program, including training that is related to

Federal grants management.

Cost Category

Affected

AMS Grant

Program(s)

Description, Guidance and Exceptions

Travel – Domestic and

Foreign

ALL

Allowable for travel, when provided in the approved budget or

with prior written approval when costs are limited to those

allowed by formal organizational policy and the purpose aligns

with the purpose of the program.

The allowable travel cost of recipients that do not have formal

travel policies and for-profit entities may not exceed those

established by the Federal Travel Regulation, issued by

General

Services Administration (GSA), including the maximum per diem

and subsistence rates prescribed in those regulations. If a

recipient does not have a formal travel policy, those regulations

will be used to determine the amount that may be charged for

travel costs.