August 2022

Doc

umentation for the 41st Session of the ICAO Assembly in 2022

INTERNATIONAL CIVIL AVIATION ORGANIZATION

Overview of Regulatory

and Industry Developments

in International Air Transport

August 2022

Documentation for the 41st Session of the ICAO Assembly in 2022

INTERNATIONAL CIVIL AVIATION ORGANIZATION

Overview of Regulatory

and Industry Developments

in International Air Transport

Published in English only by the

INTERNATIONAL CIVIL AVIATION ORGANIZATION

999 Robert-Bourassa Boulevard, Montréal, Quebec, Canada H3C 5H7

For ordering information and for a complete listing of sales agents

and booksellers, please go to the ICAO website at www.icao.int

Overview of Regulatory and Industry Developments in International Air Transport

August 2022

ISBN 978-92-9265-886-1

© ICAO 2022

All rights reserved. No part of this publication may be reproduced, stored in a

retrieval system or transmitted in any form or by any means, without prior

permission in writing from the International Civil Aviation Organization.

(iii)

AMENDMENTS

Amendments are announced in the supplements to the Products and

Services Catalogue; the Catalogue and its supplements are available

on the ICAO website at www.icao.int. The space below is provided to

keep a record of such amendments.

RECORD OF AMENDMENTS AND CORRIGENDA

AMENDMENTS

CORRIGENDA

No.

Date

Entered by

No.

Date

Language

Entered

by

(v)

CONTENTS

Page

Introduction........................................................................................................................................................... (ix)

REGULATORY DEVELOPMENTS)

Chapter 1. Liberalization ................................................................................................................................... 1-1

1.1 Background ......................................................................................................................................... 1-1

1.2 Bilateral liberalization........................................................................................................................... 1-

1.3 Regional liberalization ......................................................................................................................... 1-11

1.4 Global multilateral liberalization ........................................................................................................... 1-24

1.5 Unilateral liberalization ........................................................................................................................ 1-25

1.6 Impact of the COVID-19 pandemic on air transport industry and regulatory support measures .......... 1-26

1.7 Liberalization of “soft rights” ................................................................................................................ 1-33

Chapter 2. Connectivity and economic development .................................................................................... 2-1

2.1 Background ......................................................................................................................................... 2-1

2.2 Passenger connectivity ........................................................................................................................ 2-1

2.3 Intermodal connectivity ........................................................................................................................ 2-2

2.4 Air cargo connectivity .......................................................................................................................... 2-3

Chapter 3. Competition policies ....................................................................................................................... 3-1

3.1 Background ......................................................................................................................................... 3-1

3.2 Areas of competition under air transport that are regulated ................................................................. 3-1

3.3 ICAO’s work in preventing anti-competitive behaviours in international air transport .......................... 3-2

3.4 Implementation of competition regulatory framework at bilateral level ................................................ 3-

3 3.5 Implementation of competition regulatory framework at the regional or multilateral level .................... 3-6

Chapter 4. Consumer protection policies ....................................................................................................... 4-1

4.1 Background ......................................................................................................................................... 4-1

4.2 ICAO’s work on consumer protection .................................................................................................. 4-2

4.3 Implementation of consumer protection polices among States ........................................................... 4-3

4.4 Implementation of consumer protection policies within bilateral, regional

and multilateral arrangements ............................................................................................................. 4-14

Chapter 5. Space transportation systems ....................................................................................................... 5-1

5.1 Background ......................................................................................................................................... 5-1

5.2 Policy and regulations — recent development .................................................................................... 5-1

Chapter 6. Unmanned aviation ......................................................................................................................... 6-1

6.1 Regulatory framework for unmanned aircraft system (UAS) ............................................................... 6-1

6.2 States’ policy and regulatory framework .............................................................................................. 6-2

(vi) Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

INDUSTRY DEVELOPMENTS

Chapter 7. Industry responses ......................................................................................................................... 7-1

7.1 Background ......................................................................................................................................... 7-1

7.2 Technology .......................................................................................................................................... 7-1

7.3 Airlines’ commercial strategy ............................................................................................................... 7-2

7.4 Environment ........................................................................................................................................ 7-3

Chapter 8. Airline alliances ............................................................................................................................... 8-1

8.1 Background ......................................................................................................................................... 8-1

8.2 Star Alliance ........................................................................................................................................ 8-3

8.3 oneworld .............................................................................................................................................. 8-4

8.4 SkyTeam ............................................................................................................................................. 8-4

8.5 Other new alliances ............................................................................................................................. 8-4

Chapter 9. Mergers and acquisitions ............................................................................................................... 9-1

9.1 Background ......................................................................................................................................... 9-1

9.2 Recent mergers and acquisitions ........................................................................................................ 9-1

9.3 Cross border mergers and acquisitions: ICAO Draft Convention on foreign investment in airlines ..... 9-3

Chapter 10. Hubs ............................................................................................................................................... 10-1

10.1 Background ......................................................................................................................................... 10-1

10.2 Recent development............................................................................................................................ 10-2

Chapter 11. Privatization ................................................................................................................................... 11-1

11.1 Background ......................................................................................................................................... 11-1

11.2 Airline privatization .............................................................................................................................. 11-1

11.3 Airport privatization .............................................................................................................................. 11-3

Chapter 12. International air cargo transportation ......................................................................................... 12-1

12.1 Commercial trends of the air cargo industry between 2016 and 2021 ................................................. 12-1

Chapter 13. Commercial space transportation ............................................................................................... 13-1

13.1 Latest commercial updates on the space transportation industry ........................................................ 13-1

Chapter 14. Commercial operations of unmanned aircraft/vehicles ............................................................. 14-1

14.1 Latest commercial updates of the unmanned aircraft/vehicles industry............................................... 14-1

Appendix A. List of regional multilateral liberalization arrangements ......................................................... A-1

Contents (vii)

LIST OF FIGURES

Figure 1-1. Level of traffic rights exchanged in ASAs deposited to WASA up to May 2022 .............................. 1-2

Figure 1-2. States with highest number of ASAs deposited to WASA as of May 2022 ...................................... 1-3

Figure 1-3. Open skies progress between 2016 and 2022 ................................................................................ 1-3

Figure 1-4. Bilateral ASAs entered by the United States up to May 2022 ......................................................... 1-4

Figure 1-5. Bilateral ASAs entered by Rwanda up to May 2022 ........................................................................ 1-5

Figure 1-6. States with at least one Liberal Air Services Agreement in 2016 vs 2020 ....................................... 1-6

Figure 1-7. States with the highest number of ASAs with a principal place of business provision

as designation criteria ..................................................................................................................... 1-8

Figure 1-8. Venues of ICAN............................................................................................................................... 1-9

Figure 1-9. ICAN continues to facilitate States’ bilateral negotiations ................................................................ 1-10

Figure 1-10. States within the African Union that subscribed to Solemn Commitment ........................................ 1-12

Figure 1-11

. Regional economic groups in Central and Latin America ................................................................ 1-16

Figure 1-12. Multilateral air transport liberalization in Asia and Pacific region ..................................................... 1-20

Figure 1-13. Status of EU’s air transport arrangements with partner States as on June 2022 ............................ 1-22

Figure 1-14. States that ratified the Damascus Convention ................................................................................ 1-23

Figure 1-15. States that ratified MALIAT ............................................................................................................. 1-25

Figure 1-16. Impact of past disease outbreaks on aviation ................................................................................. 1-26

Figure 1-17. World passenger traffic evolution (1945-2022) ................................................................................ 1-27

Figure 1-18. Comparison of total seat capacity by region (7-day average, year-over-year compared to 2019) .. 1-28

Figure 2-1. Global connectivity by States between year 2016 and 2022 ........................................................... 2-2

Figure 3-1. Categories of anti-competitive behaviours relevant to international air transport ............................ 3-2

Figure 3-2. Provisions provided in TASA in deterring anti-competitive practices within the

operations of international air transport ........................................................................................... 3-4

Figure 3-3. Types of fair competition provisions in ASAs and related arrangements ......................................... 3-5

Figure 3-4. Inclusion of provisions on fair competition in ASAs and their amendments ..................................... 3-5

Figure 4-1. Timeline of ICAO’s work on consumer protection............................................................................ 4-2

Figure 4-2. Signatory States to Warsaw Convention ......................................................................................... 4-7

Figure 4-3. Signatory States to Montreal Convention ........................................................................................ 4-8

Figure 8-1. Three major alliances and the current fleet size of their home carriers ........................................... 8-3

(viii) Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

LIST OF TABLES

Table 1-1. Air transport liberalization arrangements within ASEAN that are currently in force ............................ 1-17

Table 1-2. Air transport liberalization arrangements between the ASEAN and dialogue partners ....................... 1-18

Table 1-3. New progress made in air transport liberalization in the ASEAN ........................................................ 1-18

Table 1-4. Air transport liberalization arrangements within ASEAN subregions that are in force ........................ 1-19

Table 1-5. World passenger traffic evolution (1945-2022) ................................................................................... 1-27

Table 1-6. Highlights of State regulatory support measures ................................................................................ 1-31

Table 2-1. Examples of airlines intermodal services with rail service providers .................................................. 2-3

Table 3-1. Highlights of ICAO’s support measures to States in area of competition............................................ 3-3

Table 3-2. Regional legal frameworks on competition ......................................................................................... 3-7

Table 3-3. Regional cooperation on competition ................................................................................................. 3-11

Table 4-1. Areas of air transport consumer rights and protection ........................................................................ 4-2

Table 4-2. Consumer aspects in TASA ............................................................................................................... 4-5

Table 4-3. Regional frameworks on aviation consumer protection ...................................................................... 4-5

Table 5-1.

Example of recent policy and regulatory framework implemented by States

on space transportation systems ........................................................................................................ 5-3

Table 6-1. Example of recent policy and regulatory framework implemented by States on UAS ........................ 6-2

Table 8-1. Global airline alliances ........................................................................................................................ 8-1

Table 9-1. Recent airline mergers and acquisitions ............................................................................................. 9-2

Table 10-1. Comparison of hubs by airlines — increase ..................................................................................... 10-2

Table 10-2. Comparison of hubs by airlines — de-hubbing ................................................................................. 10-3

Table 10-3. Hubs of airlines of major alliances .................................................................................................... 10-3

______________________

(ix)

INTRODUCTION

This overview provides the latest air transport regulatory developments and the industry’s commercial trends globally. It

is divided into two parts:

(i) Global regulatory development of international air transport

This section focuses on progress in the fields of policies and regulatory framework of international air

transport implemented by States. It focuses on three main economic elements of the industry: (i) market

access; (ii) competition; and (iii) consumerism.

The regulatory development of market access is examined through progress of liberalization, particularly

on market access performed by States, regional economic groupings and organizations at bilateral,

regional, multilateral and national levels (unilateral). It also reports on policies and regulations in the

fields of competition and consumer protection applied by States. The works performed by the

International Civil Aviation Organization (ICAO) in the areas of market liberalization, competition and

consumerism is also presented in this section.

The direct implication of the implemented policies and regulations on international air transport globally

is provided in this section through an overview of the global air transport connectivity. The regulatory

development for space transportation and the unmanned aircraft vehicles (UAV) are also presented in

this section.

(ii) Commercial trends in the international air transport industry

The section reports on the commercial developments of international air transport in the pre-, during

and after COVID-19 pandemic period. Airlines’ commercial activities include the diversification of

business models; forming alliances, mergers, acquisitions and privatization are also analysed in this

section.

The section also provides an overview of the operational development of commercial space aircraft and

UAV.

______________________

1-1

REGULATORY DEVELOPMENTS

Chapter 1

LIBERALIZATION

1.1 BACKGROUND

1.1.1 Throughout the 21st century, international air transport has rapidly emerged as pertinent to social and

economic development globally with complex interconnected functions across other industries. However, challenges for

this industry remains the achievement of a workable equilibrium between demand and supply in order to attain and sustain

the desired financial standings and sustainability at large. The recent COVID-19 pandemic has reaffirmed the delicateness

of this industry to externalities, which adds complexity to its existing characteristics.

1.1.2 Article 6 of the Convention on International Civil Aviation (Chicago Convention) laid the fundamentals to the

uniqueness of international air transport. Operations of scheduled international air service would require special

permission or other authorization of a State. This rendered the market access of international air transport as a crucial

commodity from an air transport economic perspective and therefore is heavily regulated by States. However, realizing

the critical role of this industry to the development of the economy and social welfare, deregulation and liberalization were

actively pursued, mainly through bilateral arrangements even though multilateralism is increasingly engaged.

1.1.3 Based on a study performed by the International Civil Aviation Organization (ICAO) in 2013 on the Global

Quantitative Indicators for Evaluating the Degree of Liberalization, liberalization of the air services agreement (ASA)

reflects changes in the economic regulatory environment. In order to provide a coherent approach to this subject, two

types of agreements were selected as representative of liberalized ASAs:

a) Bilateral open skies agreements (ASAs) contain at least the following liberal elements:

1) unrestricted traffic rights (at a minimum covering Third, Fourth and Fifth Freedom Rights);

2) multiple airline designations;

3) no limitation on routings;

4) free determination of capacity; and

5) free pricing tariff regime or at least a dual disapproval tariff regime.

b) Multilateral open skies arrangements, contains free determination of capacity at least up to Third, Fourth

and Fifth Freedom Rights.

1.1.4 As competitiveness intensified, the industry required improved access to capital markets in order to meet its

financial obligations in implementing its business strategies. Therefore, relaxation of ownership and control of the

regulatory regime is another significant indicator of liberalization that is being considered by States. The aftermath of the

COVID-19 pandemic has reaffirmed this approach as a necessity, considering airlines’ struggle to not only rebuild

1-2 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

capacities that were severely crushed as a result of unprecedented prolonged closures of borders globally, but also to

reconstruct their financial standings that were destroyed by zero earnings, soaring expenditures and increased passenger

refund cases.

1.1.5 Considering 1.1.3 and 1.1.4 of this overview, the remaining discussion on liberalization is based on the

liberalization indicators.

1.2 BILATERAL LIBERALIZATION

Air Services Agreements

1.2.1 Access to international air transport market through bilateral arrangements remain the primary approach for

most States ever since the Bermuda I Agreement was signed in 1946. Up to May 2022, based on records available in the

ICAO World Air Services Agreements (WASA) database

1

, more than 40 bilateral ASAs were concluded between the

period of 2017 and 2019

2

, adding to the thousands of bilateral arrangements (including amendments and/or Memoranda

of Understanding) that were reportedly concluded during the past decade. As of May 2022, more than 4 000 ASAs were

deposited to WASA with various levels of market access exchanges.

1.2.2 The most common degree of market access exchanges is the Third and Fourth Freedom Rights, which

makes 55.38 per cent of the total ASAs deposited to WASA. This was followed by the exchange of Fifth Freedom (37.92%),

Sixth Freedom (3.86%), Seventh Freedom (2.61%) Rights and cabotage rights (0.23%), as depicted in Figure 1-1.

Source: ICAO WASA

Figure 1-1. Level of traffic rights exchanged in ASAs deposited to WASA up to May 2022

1.2.3 The top five States with the highest number of ASAs

3

deposited to WASA as of May 2022 are the United

States (109), China (82), United Kingdom (67), United Arab Emirates (66) and Germany (57).

1

The WASA online tool replaces the original “Database of the World’s Air Services Agreement” published as ICAO Doc 9511

(provisional edition, 2003). The WASA contains texts of bilateral air services agreements and amendments as well as codified

“Summaries of Provisions” of bilateral ASAs and amendments, which are filed with ICAO by its Member States as well as non-

registered agreements obtained from other sources such as national websites.

2

Years 2020 and 2021 were less active due to the closure or minimization of many business activities globally as a result of the

COVID-19 pandemic.

3

Including amendments and/or Memoranda of Understanding.

55.39

37.92

3.86

2.61

0.23

3rd/4th 5th 6th 7th Cabotage

Chapter 1. Liberalization 1-3

Source: ICAO WASA

Figure 1-2. States with highest number of ASAs deposited to WASA as of May 2022

Open skies agreements

1.2.4 Policy dialogue concerning air transport has long been difficult, often associated with strong attachment to

nationalism, such as State identities, national interest and protectionism to State-owned flag carriers. Since the first open

skies agreement between the Netherlands and the United States in 1992, States have actively concluded a significant

number of open skies arrangements. In 2016, over 900 open skies agreements were signed, involving more than

150 States. As of May 2022, this figure rose to more than 1 000 open skies arrangements. These agreements contain at

least free capacity determination of Third and Fourth Freedom Rights. The number of agreements that liberalized the

market up to Fifth Freedom Rights also increased to more than 720 in 2022; meanwhile, liberalization for up to Seventh

Freedom Rights increased to more than 160 agreements. Several cabotage agreements were also concluded by States,

which signify States’ increasing appetite in liberalizing market access while acknowledging the positive impacts that

liberalization brought to socioeconomic development.

Figure 1-3. Open Skies progress between 2016 and 2022

4

4

Up to May 2022.

0

20

40

60

80

100

120

China Germany United Arab

Emirates

United

Kingdom

United States

Number of ASAs

Op

en

Skie

s P

rog

ress

Up to Third and

Fourth Freedom

rights

2016

2022

>900 ASAs

>1 000 ASAs

2016

2022

>700 ASAs

>720 ASAs

2016

2022

>160 ASAs

>160 ASAs

2022

2016 >12 ASAs

>12 ASAs

Up to Fifth Freedom

rights

Up to Seventh Freedom

rights

Cabotage

Source: ICAO WASA

1-4 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

1.2.5 The United States remains the country with the highest number of open skies agreements with

131 Agreements

5

. Meanwhile, the country that entered into the most number of open skies agreements between 2017

and 2022

6

is Rwanda with 11signed agreements

7

.

Figure 1-4. Bilateral ASAs entered by the United States up to May 2022

5

Open Skies Agreements Currently Being Applied | US Department of Transportation.

6

The last overview of regulatory and industry developments in international air transport was made by the ICAO Secretariat in 2016.

7

Source: WASA based on at least free capacity determination up to Fifth Freedom Rights.

+

–

Selected

Country

1st/2nd

Freedom

3rd/4th

Freedom

5th Freedom

6th Freedom

7th Freedom

Cabotage

Source: ICAO WASA

Chapter 1. Liberalization 1-5

Figure 1-5. Bilateral ASAs entered by Rwanda up to May 2022

+

–

Selected

Country

1st/2nd

Freedom

3rd/4th

Freedom

5th Freedom

6th Freedom

7th Freedom

Cabotage

Source: ICAO WASA

1-6 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

1.2.6 Before 2016, there were 48 States with at least one Liberal Air Services Agreement. By 2020, the number

increased by 12.5 per cent, which represents 28 per cent of ICAO Member States, as shown in Figure 1-6.

Figure 1-6. States with at least one Liberal Air Services Agreement in 2016 vs 2020

Source: ICAO WASA

States with open skies

agreement before year 2016

States with open skies

agreement between year 2016

and 2020

Chapter 1. Liberalization 1-7

1.2.7 Over the years, focus on regulatory relaxation has no longer been limited to hard rights. Regulatory relaxation

has also included other business measures, such as rights for third-party code-sharing, co-terminal and lenient tariffs

measures of dual disapproval of free pricing. The number of ASAs that includes these liberalized measures have been

reportedly steadily increasing over the years. For example, the number of ASAs that permits for third-party code-sharing

increased by 100 per cent in 2022 as compared to 2016 where zero of such provisions were included in any ASAs up to

year 2002. Similarly, inclusion for liberal arrangements for pricing in ASAs has also increased by 360 per cent with more

than 230 agreements that permit free pricing as of May 2022, as compared to just more than 50 ASAs in 2002.

Relaxation in the ownership and control regulatory regime

1.2.8 The objective of regulatory liberalization in this area should be to create an operating environment in which

air carriers can operate efficiently and economically without compromising safety and security. One strategy States may

liberalize or facilitate the liberalization of air carrier ownership and control regulation is to apply certain broadened criteria

for airline designation and authorization that include permission for an airline that has its principal place of business in the

territory of the designating State to be designated under provisions made in the said ASA. The evidence of principal place

of business may be determined through the following:

The airline:

a) is established and incorporated in the territory of the designating party in accordance with the relevant

national laws and regulations;

b) has a substantial amount of its operations and capital investment in physical facilities in the territory of

the designating party;

c) pays income tax;

d) registers and bases its aircraft in the territory of the designating party; and

e) employs a significant number of locals in managerial, technical and operational positions.

1.2.9 States may also treat the ownership and control requirement of foreign designated airlines with more

flexibility to accommodate the needs of other States wishing to liberalize in this area. Some measures may include:

a) allowing its bilateral partner to use the broadened criteria for those partners’ designated carriers while

retaining the traditional criteria for its own designated carriers;

b) accepting the designated carriers of its bilateral partners that meet the traditional ownership and control

criteria if these carriers meet other overriding requirements such as safety and security; and

c) making public its position on the conditions under which it would accept foreign designations.

1.2.10 As of May 2022, more than 13 per cent of total ASAs that were deposited to WASA contain provisions that

allow for airlines with a principal place of business to be designated to operate under the terms of the said ASAs, as

compared to only 7.08 per cent in 2002. Figure 1-7 displays countries with the highest number of ASAs containing

provisions of a principal place of business as the designation criteria.

1-8 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

Source: ICAO WASA

Figure 1-7. States with the highest number of ASAs with a principal place

of business provision as designation criteria

1.2.11 The increase in relaxation of ownership requirements allowed for better opportunities and flexibility for

airlines financially and operationally, which reflected through several mergers and acquisitions that took place globally.

This directly resulted in increased capacity and connectivity of international air transport. It also encouraged new entrants

into the market, which shall generate added capacity, improved connectivity and healthy competition ultimately benefiting

passengers and the economy at large.

ICAO Long-term Vision for International Air Transport Liberalization

1.2.12 The ICAO Council, during its 205th session, endorsed the recommendation made by the Sixth Worldwide

Air Transport Conference (ATConf/6) to adopt the ICAO Long-term Vision for International Air Transport Liberalization.

The 40th Assembly urged all Member States to consider, and apply, the ICAO Long-term Vision for International Air

Transport Liberalization in their policymaking and regulatory practices.

1.2.13 In supporting this vision, ICAO continues to provide guidance and assistance through harmonizing the global

regulatory framework by developing and updating policy and guidance material for States’ reference, as detailed below:

a) Policy and Guidance Material on the Economic Regulation of International Air Transport (Doc 9587)

This document was updated in 2017 to incorporate new policy guidance of relevant text from other

Assembly Resolutions and Council Resolutions and relevant documentation developed by the Air

Transport Regulation Panel (ATRP) and have since been endorsed by the Council.

b) Manual on the Regulation of International Air Transport (Doc 9626)

This document was updated in 2018 to expand its content of the developments in international air

transport and its regulation since 2004. The 2018 edition includes several new topics such as fair

competition, consumer protection and funding of aviation system upgrade and regulatory oversight. A

number of new air transport terms and definitions were also added, including some that were non

existent when the previous editions were published (such as connectivity, aviation system

upgrade, etc.).

0

10

20

30

40

50

60

China (Hong

Kong)

China (Macau) Rwanda United Arab

Emirates

United States

Number of ASAs

Chapter 1. Liberalization 1-9

c) ICAO’s Policies on Taxation in the Field of International Air Transport (Doc 8632)

This document includes the text of the consolidated Council Resolutions on taxation of international air

transport and associated commentary on the Resolutions. This document serves as policy guidance to

ICAO Member States. At the Third Meeting of its 156th Session, the Council adopted the consolidated

Resolution on Taxation in the Field of International Air Transport, which appears in Doc 8632, Third

Edition.

ICAO Air Services Negotiation (ICAN) event

1.2.14 ICAO assisted States in conducting their air services negotiations and business to business networking with

various stakeholders, by providing a central meeting place for States to conduct multiple bilateral air services negotiations

and consultations. Through ICAN, States’ regulatory efficiency is increased while a reduction in States’ regulatory financial

costs and time frames are expected to be made

8

. ICAN has also emerged as a forum for wider range of participants (not

only limited to regulators) to learn about current trends, discuss topical issues and exchange experiences.

Figure 1-8. Venues of ICAN

8

Costs that relate to attending and/or hosting bilateral and multilateral negotiations.

Source: ICAO WASA

1-10 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

1.2.15 The first ICAN was organized in Dubai, United Arab Emirates, in 2008 with participation from 27 States.

Since then, 13 ICANs were organized in 13 different cities, with participation of more than 150 States, representing

80 per cent of ICAO Member States, with more than 5 000 bilateral meetings conducted and close to 4 000 agreements

and arrangements concluded and signed.

Figure 1-9. ICAN continues to facilitate States’ bilateral negotiations

700

600

500

400

300

200

100

0

100

200

39

200

60 65

340

62

350

73

485

458

550

500

95

588

550

67

430

400

66

456

417

71

470

420

61

420

71

341

300

27

78

D

u

b

a

i

,

U

A

E

(

2

0

0

8

)

I

n

s

t

a

n

b

u

l

,

(

2

0

0

9

)T

r

k

i

y

e

ü

Ki

n

g

s

t

o

n

,

J

a

m

a

i

c

a

(

2

0

1

0

)

M

u

m

b

a

i

,

I

n

d

i

a

(

2

0

1

1

)

J

e

d

d

a

h

,

S

a

u

d

i

A

r

a

b

i

a

(

2

0

1

2

)

D

u

r

b

a

n

,

S

o

u

t

h

A

f

r

i

c

a

(

2

0

1

3

)

B

a

l

i

,

I

n

d

o

n

e

s

i

a

(

2

0

1

4

)

A

n

t

a

l

y

a

,

(

2

0

1

5

)T

r

k

i

y

e

ü

N

a

s

s

a

u

,

B

a

h

a

m

a

s

(

2

0

1

6

)

C

o

l

o

m

b

o

,

S

r

i

L

a

n

k

a

(

2

0

1

7

)

N

a

i

r

o

b

i

,

Ke

n

y

a

(

2

0

1

8

)

Aq

a

b

a

,

J

o

r

d

a

n

(

2

0

1

9

)

B

o

g

o

t

,

C

o

l

o

m

b

i

a

(

2

0

2

1

)

á

Participating States

Agreements/Arrangements

Bilateral Meetings

Linear (Agreements/Arrangements)

400

120

20

52

60

130

Source: ICAO

Chapter 1. Liberalization 1-11

1.2.16 Despite various challenges brought by the COVID-19 pandemic, ICAN remains a relevant negotiation

platform among States. The ICAN events display resilience and evolve in meeting existing demands and circumstances.

For example, the organization of ICAN 2021 took into consideration ongoing limitations, such as the then globally imposed

travel restrictions, making the event the first hybrid event, which allowed States to participate either in person or virtually.

The ICAN 2022 event, which will be held in Abuja, Nigeria from 5 to 9 December 2022, will continue to accommodate

participation via both alternatives to allow for a wider range of participation.

1.3 REGIONAL LIBERALIZATION

1.3.1 Multilateralism, on a worldwide scale, has not yet reached a globally accepted agreement for the exchange

of commercial air transport rights, while regional multilateralism, however, is widely accepted by States as an approach to

reach common goals. The progress made through regional liberalization has been substantial: some regional

arrangements not only serve as supplementary regulatory documentation to existing bilateral air services arrangements,

but also provide better rights, hence increasing its significance in developing States’ international air transport.

1.3.2 Even though the modalities, pace, size and level of development of regional liberalization varies from one

region to another, they can exhibit consistency in terms of a regions’ objectives, which is to harmonize regulatory

approaches and allow better access to the shared market through regional common participation with end goals of shared

economy and social prosperity.

1.3.3 This section will provide an overview of progress made by key regional liberalization initiatives and their

impact on regional air transport development. More details and a full list of all regional liberalization agreements are

available in Appendix A.

Africa

1.3.4 African countries have long recognized multilateralism’s integral role in fostering development, prosperity

and peace. The forming of the Yamoussoukro Declaration in 1988 and the Abuja Treaty

9

in 1994 reinforced the multilateral

approach within the African region, in creating a common market among its members. The Yamoussoukro Declaration

affirmed commitments by States to make all necessary efforts to integrate their airlines within eight years to the new

African air transport policy, in order to liberalize the African air transport market, and which led to the signing of the

Yamoussoukro Decision (YD) in 2000.

1.3.5 In 2015, the Assembly of Head of States and Governments, during the 24th Ordinary Session of the African

Union, established a Single African Air Transport Market (SAATM) and the Solemn Commitment towards advancing

concrete and unconditional implementation of the YD. SAATM was launched in 2018 with the participation of 23 committed

States, which has now increased to 35

10

. SAATM is also designated as one of the flagship projects of the African Union

Agenda 2063.

9

Abuja Treaty is a treaty that establishes the African Economic Community (AEC). It was adopted on 3 June 1991, entered into force

on 12 May 1994 and signed by all Member States of the Organization of African Unity (OAU), except Eritrea.

10

https://www.saatmbenefits.org/about/saatm-states/

1-12 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

Figure 1-10. States within the African Union that subscribed to Solemn Commitment

Source: AFCAC

Members States of the African Union

Countries that subscribed to

the SAATM Solemn Commitment

Chapter 1. Liberalization 1-13

1.3.6 The YD also encourages the African subregional economic groupings to pursue and to intensify their efforts

in the implementation of the Solemn Commitment. The air transport liberalization progress made by each of these

subregional groupings are wide-ranging, as listed below:

a) North Africa: The Arab Maghreb Union (AMU)

11

While AMU recognized the need to liberalize air services within the union, liberalization within this

subregional group is dominated by bilateral arrangements.

b) West Africa: The Economic Community of West African States (ECOWAS)

12

Air transport matters are addressed by two subregional groupings:

1) Banjul Accord Group (BAG)

13

The establishment of BAG in 2004 aimed primarily to accelerate the implementation of the YD,

which led to the signing of the Multilateral Air Services Agreement (MASA) in 2004, by all members

of BAG. MASA provides for unlimited market access up to Fifth Freedom Rights and other air

transport liberalization elements that are fully compatible with the provisions and obligations of the

YD.

2) West African Economic and Monetary Union (WAEMU)

14

In 2002, WAEMU’s Council of Ministers adopted a common air transport programme with an aim

to foster development of air transport industry of the subregion. The programme consists of four

main strategies: (a) ensuring that infrastructure and equipment comply with ICAO Standards and

Recommended Practices (SARPs); (b) harmonizing air transport regulations; (c) enhancing the air

transport system; and (d) liberalizing air transport services, which allows for full freedom to market

access up to cabotage rights.

c) Central Africa: The Central African Economic and Monetary Community (CEMAC)

15

The CEMAC Council of Ministers adopted the Agreement on Air Transport in 1999 that provides the

basis to develop CEMAC’s intraregional air transport sector liberalization in order to establish greater

access within the region, through lifting restrictions on capacity up to Fifth Freedom Rights. Several

other provisions of the Agreement are also in line with the YD, such as multiple designation and free

tariff determination.

11

AMU was established in 1989 by a treaty that was signed by Algeria, Libya, Mauritania, Morocco and Tunisia and modelled after the

European Community in order for Member States to achieve progress and prosperity, preserve peace, develop a common policy in

certain domains and gradually achieve free movement of people and transfer of service, goods and capital.

12

ECOWAS was established in 1975 by 15 countries through the Treaty of Lagos, to promote economic cooperation and integration.

Cape Verde (Cabo Verde) joined in 1976.

13

Seven West African States established BAG in 2004 via the signing of BAG Agreement: Cabo Verde, Gambia, Ghana, Guinea,

Liberia, Nigeria and Sierra Leone.

14

WAEMU was established in 1994 to create a common market based on the free flow of persons, goods, services and capital within

West Africa. The members are Benin, Burkina Faso, Côte D’Ivoire, Mali, Niger, Senegal and Guinea Bissau.

15

CEMAC was established in 1994 through a treaty signed between Central African Republic, Chad, Democratic Republic of the

Congo, Equatorial Guinea and Gabon with an aim to harmonize development of Member States within the institutional framework

of the Economic Union and Monetary Union.

1-14 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

d) Southern and East Africa

There are three regional economic communities in the Southern and East Africa region that address the

air transport sector; namely: (a) Common Market of Eastern and Southern Africa (COMESA)

16

;

(b) Southern African Development Community (SADC)

17

; and (c) East African Community (EAC)

18

.

1) COMESA

COMESA’s policy on air transport is contained in Article 87 of the COMESA Treaty, which, among

others, requires its Member States to liberalize the granting of air traffic rights with a view to increase

efficiency and profitability of their airlines. In 1999, COMESA’s Council of Ministers issued the

Regulation for the Implementation of the Liberalized Air Transport Industry (Legal Notice No. 2)

which became binding on its Member States. Through this regulation, liberalization within COMESA

provides for unlimited capacity up to Fifth Freedom Rights. As of 2019, 17 Member States had

incorporated Legal Notice No. 2 in their domestic regulation

19

.

2) SADC

The SADC Protocol on Transport, Communications and Meteorology, signed in 1996, contained a

policy statement by Member States to develop a harmonized regional aviation policy that includes

the gradual liberalization of intra-regional air transport for SADC airlines, which is in-line with the

YD.

3) EAC

The EAC Treaty, signed in 1999, among others, outlines the modalities of corporation in the field of

air transport in terms of adopted policies and implementation programmes, which include

liberalizing the granting of air traffic rights and other aspects that matched with the elements of the

YD.

1.3.7 The African region is one of the regions that demonstrate consistency and perseverance in liberalizing its air

transport market through multilateral approaches. Despite diverse economic, social, political and vast economies and

geographical coverage, the region remains committed in pursuing regional integration of the air transport market through

phased approaches, as well as tailored strategies and implementation plans.

The Americas

1.3.8 Deregulation of air transport within the United States in 1978 had set off a chain of events, which over the

next decades were to spark the transformation of international air transport globally, from a protected and highly regulated

industry into one that is more open and competitive. Deregulation had led into renegotiations of many United States air

16

COMESA was established in 1994 to replace the Preferential Trade Area for Eastern and Southern Africa signed in 1981, to foster

economic prosperity through regional integration within its 21 Member States.

17

SADC was formed as a loose alliance of nine States in Southern Africa known as the Southern African Development Coordination

Conference (SADCC). SADCC was established in 1980 following the adoption of Lusaka Declaration – Southern Africa: Towards

Economic Liberation within 15 Member States.

18

EAC was established in 1999 through a treaty and consists of seven Members States: Democratic Republic of the Congo, Burundi,

Kenya, Rwanda, South Sudan, Uganda and the United Republic of Tanzania. The aim of EAC is to widen and deepen economic,

political, social and cultural integration in order to improve the quality of life of the people of East Africa.

19

Status of ICT Sector and proposed Strategy review terms of Reference (comesa.int) Annex 1 of Report on the Status of

Implementation and Domestication of COMESA Programmes in Infrastructure dated June 2019.

Chapter 1. Liberalization 1-15

transport bilateral arrangements to more liberalized measures that included opening up of market access up to Seventh

Freedom Rights, which remains active until this day. Therefore, multilateralism in liberalizing air transport within the North

American market is not as prevalent as any other regions.

1.3.9 Central and Latin America are, however, more active in pursuing liberalization via multilateralism. Since the

1990s, several subregional liberalization arrangements were formalized, as listed below:

a) Andean Community

20

In 1991, the Member States of the Andean Community had established a supra-national legal regime

on intra- and extra- subregional air transport arrangements via the Integration of Air Transport in the

Andean Sub-region, which allows for unlimited capacity up to Fifth Freedom Rights.

b) Caribbean Community (CARICOM)

21

CARICOM initially concluded a Multilateral Agreement concerning the operation of air transport services

within the Caribbean Community in 1998 (MASA 1998). The agreement was revised in 2018 to

implement the liberalized air transport services regime envisaged by the Revised Treaty of

Chaguaramas

22

. The revised Multilateral Air Services Agreement (revised MASA), which entered into

force in 2020, aims to establish a single market for air transport services by removing barriers to airline

ownership to allow for establishment of community carrier and liberalized market access up to cabotage

rights.

c) Southern Common Market (MERCOSUR)

23

Pursuant to a decision to establish a common market, the Sub-regional Agreement on Air Services

(Fortaleza Agreement) was signed in 1991. The agreement co-exists with the existing bilateral ASAs as

it only enables for the operations on routes different from those effectively operated under the existing

bilateral ASAs.

d) Association of Caribbean States (ACS)

24

The Air Transport Agreement between the Member States and Associate Members of the Association

of Caribbean States was signed in 2004, which liberalized the market up to Fifth Freedom Rights

25

. The

Agreement entered into force in 2008 and was ratified by 12 States.

20

Andean Community was established in 1969 though the signing of Cartagena Agreement by Bolivia, Colombia, Ecuador and Peru,

with an aim to create custom unions among its Member States. In 2005, Argentina, Brazil, Paraguay, Uruguay and Chile joined as

Associate Members.

21

CARICOM was established in 1973 through the signing of the Treaty of Chaguaramas, which was revised in 2002 to establish a

single market within the grouping.

22

The Revised Treaty of Chaguaramas, which established the Caribbean Community including the CARICOM Single Market, was

signed in 2001. Revision to MASA 1998 was made pursuant to Article 33 (Removal of restrictions on the right of establishment) and

Article 37 (Removal of restriction on provision of services) of the Revised Chaguaramas Treaty. Revised Treaty of Chaguaramas

(caricom.org)

23

MERCOSUR was established in 1991 through the Treaty of Asuncion and Protocol of Ouro Preto in 1994, to create a common

economic market. The current members are Argentina, Brazil, Paraguay, Uruguay and Venezuela. The Associate Members are

Bolivia, Chile, Colombia, Ecuador, Guyana, Peru and Suriname.

24

ACS was established in 1994 through the signing of the Convention Establishing the Association of Caribbean States by 25 countries

to promote consultation, cooperation and concerted action among the countries in the Caribbean.

25

Parties to the agreement have the liberty to exercise the Fifth Freedom Rights either by granting it to all Parties or to exercise the

rights on reciprocal and liberal exchanges of rights among the Parties concerned.

1-16 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

1.3.10 In March 2008, the Latin American Civil Aviation Commission (LACAC) initiated a multilateral open skies

agreement to unify all of its 22 Member States under a single aviation market. The Open Skies Multilateral Agreement for

Member States of the LACAC was finalized in 2010 and entered into force in 2019 upon ratification of three Member States,

namely: Brazil, Panama and Uruguay. The agreement allows for maximized market access up to cabotage rights with

flexibility to extend the granting of Fifth and Sixth Freedom Rights to third-party States.

Figure 1-11. Regional economic groups in Central and Latin America

ACS Members

Andean Community Members

ACS and Andean Community Members

MERCOSUR Members

ACS and MERCOSUR Members

CARICOM and ACS Members

Source: ACS, Andean Community, MERCOUSUR and CARICOM

Chapter 1. Liberalization 1-17

1.3.11 States within Latin America have actively and consistently pursued liberalization of air transport at a regional

level ever since the initial deregulation exercise took place in the 1970s. Multilateralism is also widely accepted among

the subregional economic groupings despite different levels of advancement and participation.

Asia and Pacific

1.3.12 Regional liberalization in Asia is mainly centralized in the Southeast Asia region through the Association of

Southeast Asian Nations (ASEAN). In 2007, the 13th ASEAN Summit endorsed the establishment of the ASEAN Single

Aviation Market (ASAM) by 2015 in support of the development of the ASEAN Economic Community. ASAM aims to

liberalize the ASEAN market up to Seventh Freedom Rights with cabotage rights and consider the introduction of the

ASEAN Community Carrier via relaxation of ownership and control requirements. The development of ASAM was

supported by the Roadmap for Integration of Air Travel Sector (RIATS), which, through this, a progressive liberalization

approach of the ASEAN market among its 10 Member States

26

was established, as listed in Table 1-1. These agreements

are still in force.

Table 1-1: Air transport liberalization arrangements within ASEAN that are currently in force

No

Legal modalities

Scope

Signing year

Enter into

force

1

ASEAN Multilateral Agreement on

the Full Liberalization of Air

Freight Services

Unlimited Third, Fourth and Fifth Freedom

Rights among all points with international

airports in the ASEAN.

May 2009

November

2009

2

ASEAN Multilateral Agreement on

Air Services (MAAS)

Unlimited Third, Fourth and Fifth Freedom

Rights between ASEAN capital cities.

May 2009

December

2009

3 ASEAN Multilateral Agreement on

Full Liberalization of Passenger

Air Services (MAFLPAS)

Unlimited Third, Fourth and Fifth Freedom

Rights between any ASEAN cities.

November

2010

July 2011

Source: ASEAN Secretariat

1.3.13 ASAM is successful in implementing structured and progressive liberalization of market access up to Fifth

Freedom Rights among ASEAN Member States. Further liberalization up to cabotage rights and relaxation of ownership

regulations in allowing the formation of the ASEAN Community Carrier are still a work-in-progress.

26

ASEAN was established in 1967 to promote economic cooperation among its Member States. ASEAN’s Member States are Brunei

Darussalam, Cambodia, Indonesia, Lao People’s Democratic Republic, Malaysia, Myanmar, Philippines, Singapore, Thailand and

Viet Nam.

1-18 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

1.3.14 The ASEAN also extended the regional liberalization initiative to other dialogue partners as listed in Table 1-2.

Table 1-2. Air transport liberalization arrangements between the ASEAN and dialogue partners

No

Dialogue

partners

Legal modalities

Scope

Signing year

Enter into

force

1

China

Air Transport Agreement between

the Governments of the Member

States of the Association of

Southeast Asian Nations and the

Government of the People’s

Republic of China

Unlimited Third and Fourth

Freedom Rights between any

points in Contracting Parties,

Fifth Freedom Rights between

Contracting Parties.

January 2011

August

2011

2 European

Union

ASEAN-European Union

Comprehensive Air Transport

Agreement

Up to Fifth Freedom Rights

between points within the

territory of the Contracting

Parties.

Negotiation

concluded in

June 2021

TBA

3

Republic

of Korea

ASEAN-Republic of Korea Air

Services Agreements

In discussion

4

Japan

ASEAN-Japan Regional Air

Services Agreement

In discussion

Source: ASEAN Secretariat

1.3.15 Since 2017, progress in the liberalization of the air transport market was made within the ASEAN region, as

detailed below:

Table1-3. New progress made in air transport liberalization in the ASEAN

No

Legal modalities

Scope

Signing year

Enter into

force

1 Protocol 3 of MAFLPAS Domestic code-share rights

between points within the territory of

other ASEAN Member States.

October 2017 March 2019

2

Protocol 4 of MAFLPAS

Co-terminal rights between points

within the territory of any other

ASEAN Member States.

November

2018

August 2019

3

Protocol 3 to the Air Transport

Agreement between the Governments

of the Member States of the

Association of Southeast Asian Nations

and the Government of the People’s

Republic of China

Expansion of Fifth Freedom Rights

between Contracting Parties.

November

2019

Not in force

Source: ASEAN Secretariat

Chapter 1. Liberalization 1-19

1.3.16 Besides ASEAN, several other smaller regional groupings, such as Cambodia, Lao People’s Democratic

Republic, Myanmar and Viet Nam (CLMV)

27

, Brunei Darussalam, Indonesia, Malaysia and Philippines East ASEAN

Growth Area (BIMP-EAGA)

28

, Indonesia, Malaysia, Thailand Growth Triangle (IMT-GT)

29

are also active in liberalizing the

subregional air transport market access through arrangements as listed in Table 4.

Table

1-4. Air transport liberalization arrangements within ASEAN subregions that are in force

No

Legal modalities

Scope

Signing

year

Enter into

force

1

CLMV Multilateral Agreement on Air

Services

Unlimited Third, Fourth and Fifth

Freedom Rights between designated

points in Contracting Parties, Fifth

Freedom Rights between Contracting

Parties.

2003

2003

2

Memorandum of Understanding on

Expansion of Air Linkages between

BIMP-EAGA

Unlimited Third, Fourth and Fifth

Freedom Rights between designated

points in Contracting Parties.

2007

2007

3 Memorandum of Understanding on Air

Linkages between IMT-GT

Unlimited Third, Fourth and Fifth

Freedom Rights between designated

points in Contracting Parties.

1995 1995

Source: ASEAN Secretariat

1.3.17 Regional liberalization in the Pacific is formed through the Pacific Islands Air Services Agreement (PIASA),

which aims to gradually integrate aviation services in order to support sustainable development of the Pacific Islands

countries. The implementation of PIASA was divided into three phases with the final goal of creating a Single Aviation

Market. The first stage involves the commencement of a single aviation market among the Forum Island Countries

30

. The

final stage allows for accession to PIASA by Australia and New Zealand. This Agreement, which entered into force in 2007,

enables unlimited Third, Fourth, Fifth and Sixth Freedom Rights between the territories of all parties to this Agreement. As

of 2019, six States had ratified PIASA, namely: Cook Islands, Nauru, Niue, Samoa, Tonga and Vanuatu.

27

CLMV is a country association within the ASEAN and operates through CLMV’s Economic Minister Meeting.

28

BIMP-EAGA was established in 1994 to spur development in remote and less developed areas within the Member States.

29

IMT-GT was formed in 1993 to speed the economic transformation in the least developed provinces within the Member States.

30

Members of Forum Island Countries are Cook Islands, Fiji, Kiribati, Marshall Islands, Micronesia (Federated States of), Nauru, Niue,

Palau, Papua New Guinea, Samoa, Solomon Islands, Tonga, Tuvalu and Vanuatu.

1-20 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

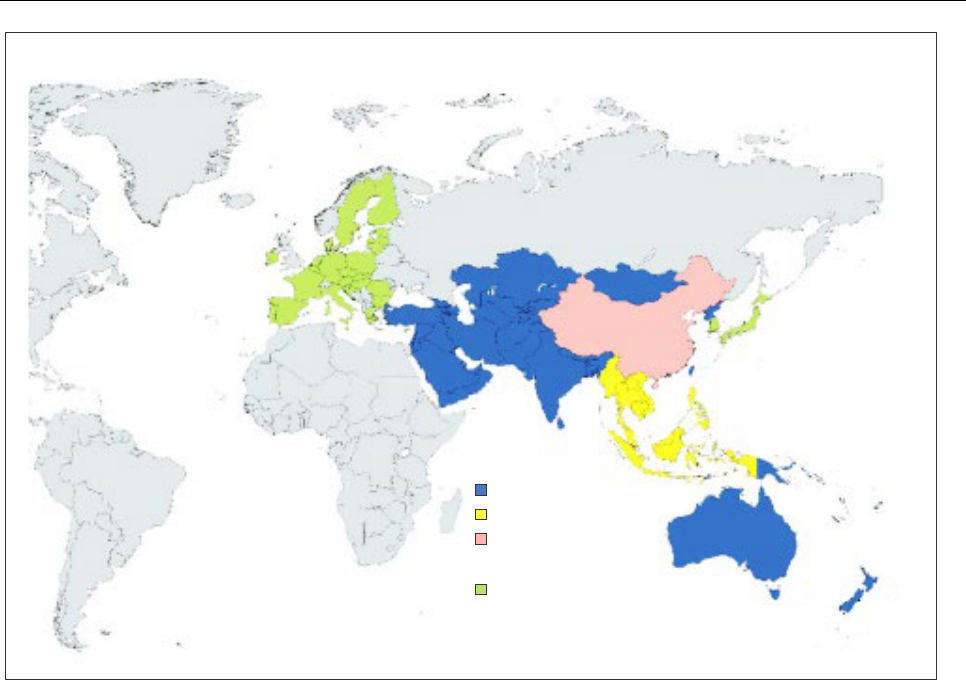

Figure 1-12. Multilateral air transport liberalization in the Asia and Pacific region

1.3.18 Multilateralism approaches in liberalizing the air transport market is slowly finding its place within the Asia

and Pacific region despite challenges of geographical barriers, economic standing disparity, diverse technological

development and differing socio-political climates. In some instances, it is proven as an effective and efficient modality in

accelerating air transport growth, such as enabling the spur of new low-cost carriers (LCCs) in Asia, specifically in ASEAN

countries. These LCCs initiated their services by operating on the lesser congested/saturated routes that have less direct

competition, which were made accessible through the market liberalization initiatives. Multilateralism also provides States

an opportunity for a better negotiation position, as displayed through the relationship of the ASEAN and its dialogue

partners.

Europe and North Atlantic

1.3.19 The air transport market within the European Union (EU) was progressively liberalized under the Single

Aviation Market between 1987 (First Package), 1990 (Second Package) and 1992 (Third Package). As a result, full

cabotage was implemented since 1997, substitution of national carriers with community carriers was implemented under

the Third Package and no restrictions to capacity, as well as free fare setting within the market was realized since the

implementation of the First and Second Package.

Source: ICAO

Countries in Asia and Pacific

Members of ASEAN

ASEAN’s Dialogue Partners

with implemented legal

instruments

ASEAN’s Dialogue Partners

with legal instruments in discussion

Chapter 1. Liberalization 1-21

1.3.20 Changes in the regulatory environment were made in two ways:

a) Bilaterally — through negotiation of ASAs with their partner States through either renegotiation of ASAs

or signing of a Horizontal Agreement. The EU had entered into separate bilateral negotiations with 73

partner States representing 340 bilateral ASAs. Meanwhile, horizontal negotiations were entered with

41 countries and one regional organization

31

with eight Member States, representing an additional 670

bilateral ASAs; and

b) Multilaterally — through actions initiated by the European Commission (EC) or the European Court of

Justice.

1.3.21 In 2005, the EU took further steps to extend its aviation policy beyond its internal borders, based on three

pillars:

a) amendments to bilateral ASAs that are not in line with EU law, which also include the via Horizontal

Agreements that include the principle of EU designation;

b) development of the Common Aviation Market with neighbouring countries to the South, South East and

East, which led to the signing of the European Common Aviation Area (ECAA) Agreement in 2006 and

the Euro-Mediterranean Aviation Agreements (EMAA) with several States

32

; and

c) negotiation of comprehensive agreements to include the EU aviation market with its key trading partners.

Most recent developments are as below:

1) EU-ASEAN

EU and ASEAN concluded the first bloc-to-bloc Air Transport Agreement in 2021, which aimed to

boost connectivity among the 37 Member States of both blocs.

2) EU-Qatar

EU and Qatar signed a comprehensive Air Transport Agreement in October 2021, the first one

between the EU and the Gulf region.

3) EU-Oman

EU and Oman signed a comprehensive Air Transport Agreement in December 2021.

4) EU- Armenia

EU and Armenia signed a Common Aviation Area Agreement in November 2021, which allows for

the gradual market opening between the EU and Armenia, alongside regulatory convergence

through the implementation of EU aviation rules.

31

The EU and WAEMU signed a horizontal agreement on air services in 2009.

32

EMAA was signed with Morocco (2006), Jordan (2010) and Israel (2013). Several progresses were made with other States: Tunisia

(EMAA was initialed in 2017), Lebanon (first round of negotiation took place in 2009 and the negotiations have been stalled since)

and Algeria (The Council of EU in 2008 adopted a decision authorizing the EC to open negotiation with Algeria but the negotiation

has yet to start). Status of aviation relations by country (europa.eu)

1-22 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

5) EU-Ukraine

EU and Ukraine signed a comprehensive Air Transport Agreement in October 2021, which opens

the way for a Common Aviation Area between both parties.

6) EU-United Kingdom

Following the result of the United Kingdom’s European Union Membership Referendum on 23 June

2016, the United Kingdom left the EU on 31 January 2020, which legally led the United Kingdom to

cease being part of the EU Single Aviation Market. Consequently, the Trade and Cooperation

Agreement was signed in January 2021 and entered into force on May 2021, which set out

preferential arrangements in various areas that include aviation.

Figure 1-13. Status of EU’s air transport arrangements with partner States as of June 2022

Source: EC (retrieved on June 2022)

ATLAS OF THE SKY

European

Commision

Comprehensive Aviation Agreements

European Commission Transport Atlas>>

United States

Trü kiye

Brazil

3 000 km

2 000 mi

Agreements signed

Request for future negotiations

Agreements under negotiations

EU Member States and territories

Negotiations suspended

Comprehensive agreements

Agreements pending negotiations

Canada

Chapter 1. Liberalization 1-23

1.3.22 In March 2022, the EC conducted a public consultation for revision of the air services regulation to ensure it

is in-line with moves to make aviation more sustainable, smarter, more resilient and socially responsible

33

. The revision

includes the matter of freedom to provide services, and when it can exceptionally be restricted.

1.3.23 After more than 20 years of liberalization of the European market, the region has been experiencing positive

impacts on the economy and on social developments, and thus remains consistent with its agenda for liberalization of air

transport. The EU Aviation Strategy adopted in 2015

34

had identified three key priorities: 1) Tapping into growth market;

2) Limiting limits to growth in the air and on the ground; and 3) Maintaining high EU safety and security standards. These

comprised. improving market access with third countries by targeting new growth markets where significant economic

opportunities could be generated in the following decades.

Middle East

1.3.24 Despite some Arab States having unilaterally adopted open skies policies, international air transport within

this region is still dominantly governed by bilateral arrangements. The Agreement on the Liberalization of Air Transport

between Arab States (Damascus Convention) remains the only multilateral arrangement that is currently in force within

this region. It liberalizes markets among its signatories up to Fifth Freedom Rights. The agreement was signed by 13 Arab

States in 2004, and entered into force in 2007, after eight States ratified it, namely: Jordan, Lebanon, Morocco, Oman,

Palestine, Syrian Arab Republic, Yemen and the United Arab Emirates.

Figure 1-14. States that ratified the Damascus Convention

33

Public consultation launched for revision of the Air Services Regulation (europa.eu)

34

EUR-Lex - 52015DC0598 - EN - EUR-Lex (archive-it.org)

Source: The Arab Civil Aviation Commission (ACAC)

States that notified

Damascus Convention

Member Countries of Arab

Civil Aviation Commission

1-24 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

1.4 GLOBAL MULTILATERAL LIBERALIZATION

1.4.1 Multilateralism at large, with different geographical regions, is not actively pursued by States for liberalizing

their air transport market. Major global multilateral liberalization initiatives that are still in force and are currently deliberated

are as below:

a) International Air Services Transit Agreement (IASTA)

IASTA was signed at Chicago on 7 December 1944. It allows for the access of First and Second

Freedom Rights among its signatory States. Sixty-nine per cent of the total of ICAO Member States are

signatories to this agreement, which represents an increase from 131 States in 2015 to 134 States in

2022.

The new signatory States are Mozambique (2016), Peru (2017), and Romania (2021).

b) Multilateral Agreement on the Liberalization of International Air Transportation (MALIAT)

MALIAT was signed and entered into force in 2001 with the purpose of promoting open skies air services

arrangements. The agreement enables for open market access up to Seventh Freedom Rights for air

cargo services with a relaxed airline ownership regulatory regime by adopting the principal place of

business while providing safeguard measures against flag of convenience carriers.

The Agreement is open to accession by any State that is a party to identified aviation security

Conventions

35

. As of May 2020, eight States remain signatories,

36

as two States withdrew, namely Peru

in 2005 and Samoa in 2019. (See Figure 1-15.)

c) New: Draft Convention on Foreign Investment in Airlines

At the Sixteenth Meeting of the Air Transport Regulation Panel (ATRP/16) held in April 2022, the panel

discussed a revised draft Convention on Foreign Investment in Airlines, which aimed at establishing a

liberalizing airline ownership regulatory regime at a multilateral level. The Air Transport Committee

(ATC) endorsed the continuation of the work to progress the development of the draft Convention.

d) New: Liberalization of Air Cargo

The ATC in May 2022 endorsed the ATRP to conduct an examination on whether there is a need for a

specific international agreement to facilitate further liberalization of air cargo services.

35

(i) The Convention on Offences and Certain other Acts Committed on Board Aircraft (1963); (ii) the Convention for Suppression of

Unlawful Seizure of Aircraft (1970); (iii) the Convention for the Suppression of Unlawful Acts against Safety of Civil Aviation (1971);

(iv) the Protocol for the Suppression of Unlawful Acts of Violence at Airports Serving International Civil Aviation (1988).

36

Brunei Darussalam, Chile, Cook Islands, Mongolia, New Zealand, Singapore, Tonga and the United States.

Chapter 1. Liberalization 1-25

Figure 1-15. States that ratified MALIAT

1.5 UNILATERAL LIBERALIZATION

1.5.1 While an increasing number of States adopt liberal or open skies policies in their bilateral and/or multilateral

arrangements

37

, some States have progressed by offering liberalization on a unilateral basis by way of opening their

markets to foreign airlines without the requirement of reciprocity. Among the most recent unilateral initiatives:

a) Hainan Province, China

On 3 June 2022, the Civil Aviation Administration of China issued the Implementation Plan to Trial the

Seventh Freedom Rights of the Air in Hainan Free Trade Ports, which allows for operations by foreign

airlines up to Seventh Freedom Rights for both passenger and cargo services in Hainan Province. Even

though the number of operations for Seventh Freedom Rights is capped (seven per week for passenger

and cargo services), there is no capacity limitation for Third, Fourth and Fifth Freedom Rights

38

.

37

Among States that adopted reciprocal open skies for their international air transport arrangements are Canada, Chile, Dominican

Republic, Ecuador, Nepal, New Zealand, Singapore, United Arab Emirates and the United States. In addition, several States signed

the IATA Agenda for Freedom in 2008 by which declared their intention to pursue bilateral relations with a more liberal approach on

areas of airline ownership, freedom to do business and pricing by safeguarding a fair and equal environment. The signatories are

Bahrain, Chile, Kuwait, Lebanon, Malaysia, Panama, Qatar, Singapore, Switzerland, United Arab Emirates and the United States.

38

Introducing the Fifth, Seventh Freedoms of the Air in Hainan FTP -- Transportation -- HAINAN FREE TRADE PORT (hnftp.gov.cn)

Source: MALIAT Website

(Multilateral Agreement on the Liberalization of International Air Transportation | Maliat)

Signatory of MALIAT

Withdrew from MALIAT

1-26 Overview of Regulatory and Industry Developments in International Air Transport (ICAO Secretariat)

b) Kazakhstan

In 2019, 11 international airports in Kazakhstan were open for operations by foreign airlines, up to Fifth

Freedom Rights. The airports are Nursultan Nazarbayev, Almaty, Shymkent, Aktau, Karaganda Sary-

Arka, Ust-Kamenogorsk, Pavlodar, Kokshetau, Taraz, Petropavlosk South and Semey.

1.6 IMPACT OF THE COVID-19 PANDEMIC ON