Fees

and

Charges

2023-24

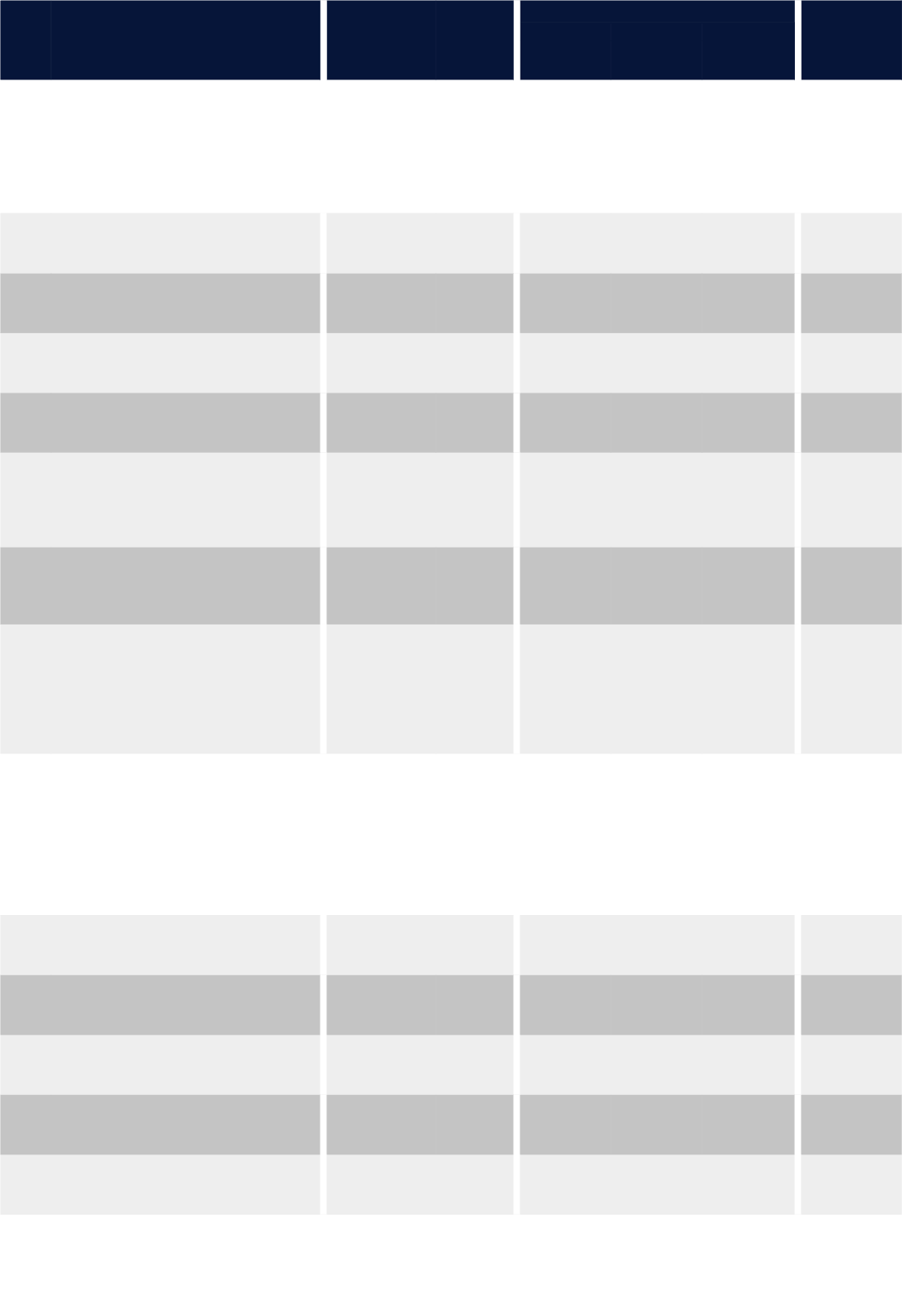

1

Price charged for this good/service is a

statutory charge set by regulation.

2

Price charged for this good/service reflects benchmarked market price.

Full cost of providing the goods/services including direct and corporate overheads and margin.

3

Price charged for this good/service

reflects full costs to provide the goods/services.

Full cost of providing the goods/services including direct and corporate overheads.

4

Price charged for this good/service reflects direct costs to provide the goods/services.

Full cost of providing the goods/services including direct overheads.

5

The price of this good/service is set at a level to make a contribution towards the cost of providing the service.

With the remainder of the costs being subsidised by Council in the provision of this service.

Fees and Charges

Fees and Charges for

2023-2024

In accordance with s. 608 of the

Local Government Act 1993

Council may charge and recover an approved fee for any

service it provides other than a service provided, or proposed to be provided, on an annual basis for which it may make

an annual charge under s. 501 of the

Local Government Act 1993.

A list of the fees to be charged by Council for the

2023-2024

financial year is set out in the attached Schedule of Fees.

Each fee within the Schedule of Fees has been determined using one of five pricing policies (as per the table below). The

pricing policy used as

the basis for determining each fee within the Schedule is disclosed in the Schedule of Fees.

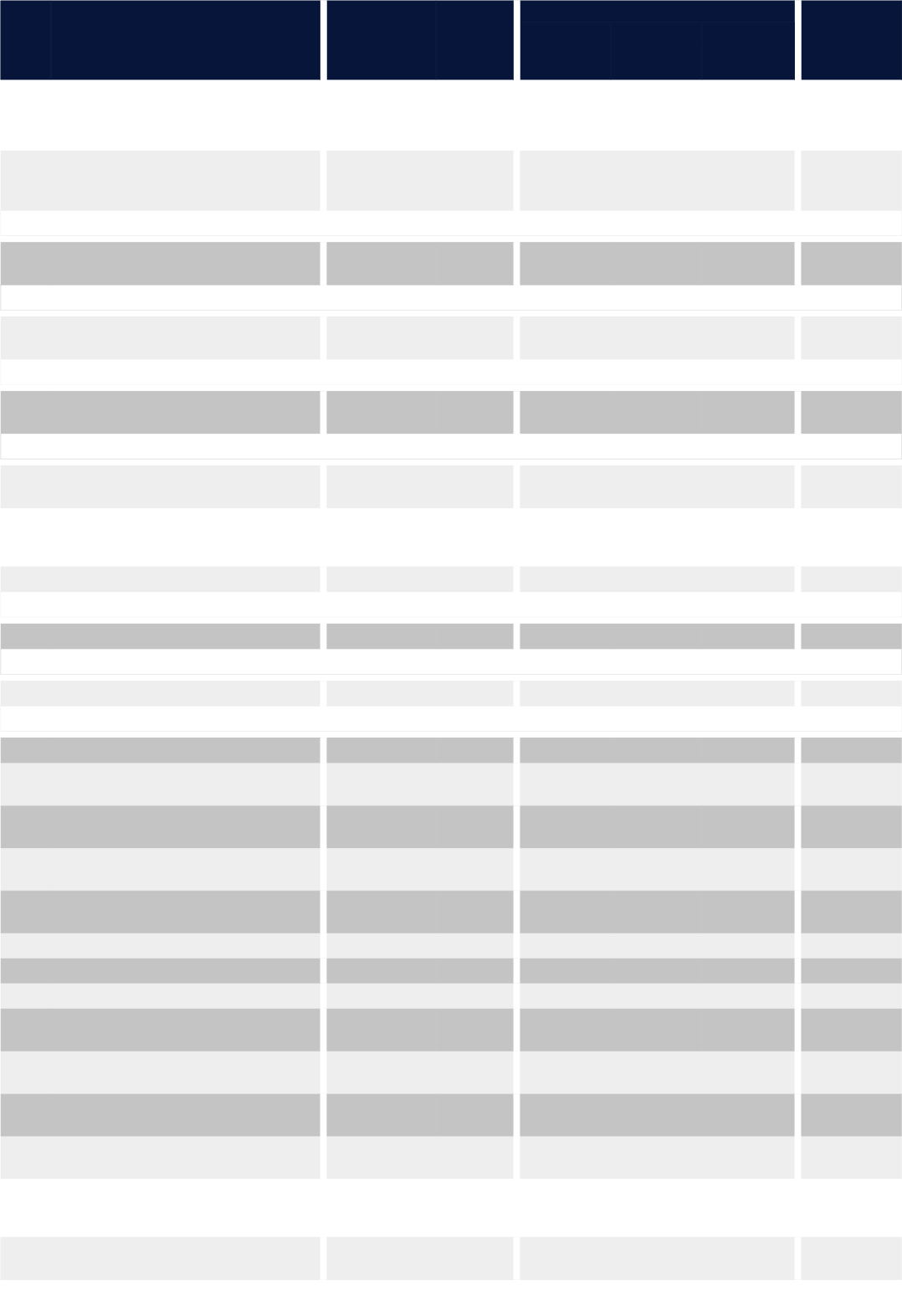

Categories of Pricing Policies in Respect of the Advertised Schedule of Fees

Code

Category Description

The fees shown in the Schedule of Fees are determined after allowing for the normal inflationary growth in the cost of

providing

these services. However, where the fee is based on the costs of providing the service, and those costs

increased extraordinarily during the year, Council reserves the right to amend the fees to recover the cost increase.

Fees levied under Category 1 are

not at the discretion of Council and are subject to amendment in accordance with

changes to the applicable legislation. This includes any changes to the application of GST.

Some of Council’s Fees and Charges have been calculated to pass through any applicable levies or taxes from NSW State

Government (for example the EPA levy on certain waste types).

The

Fees and Charges for

2023-2024

have been

updated

based on the

latest information available.

Other fees and charges are set externally by

other

levels of government

or other State Government Departments. They

are identified as Category 1 in the Fees and Charges schedule. Council cannot amend the amount of these legislated fees

and charges and they are subject to statutory amendment throughout the

year. If Category 1 fees and charges are

amended after Council has adopted the

2023-2024

Fees and Charges the amended fees will not be subject to public

advertisement as Council cannot determine the amount of the fee or charge and they will be applicable from the date

advised by the government authority concerned.

The Chief Executive Officer has the authority to waive or amend fees and charges for reasonable grounds provided in

writing.

Page 2 of 134

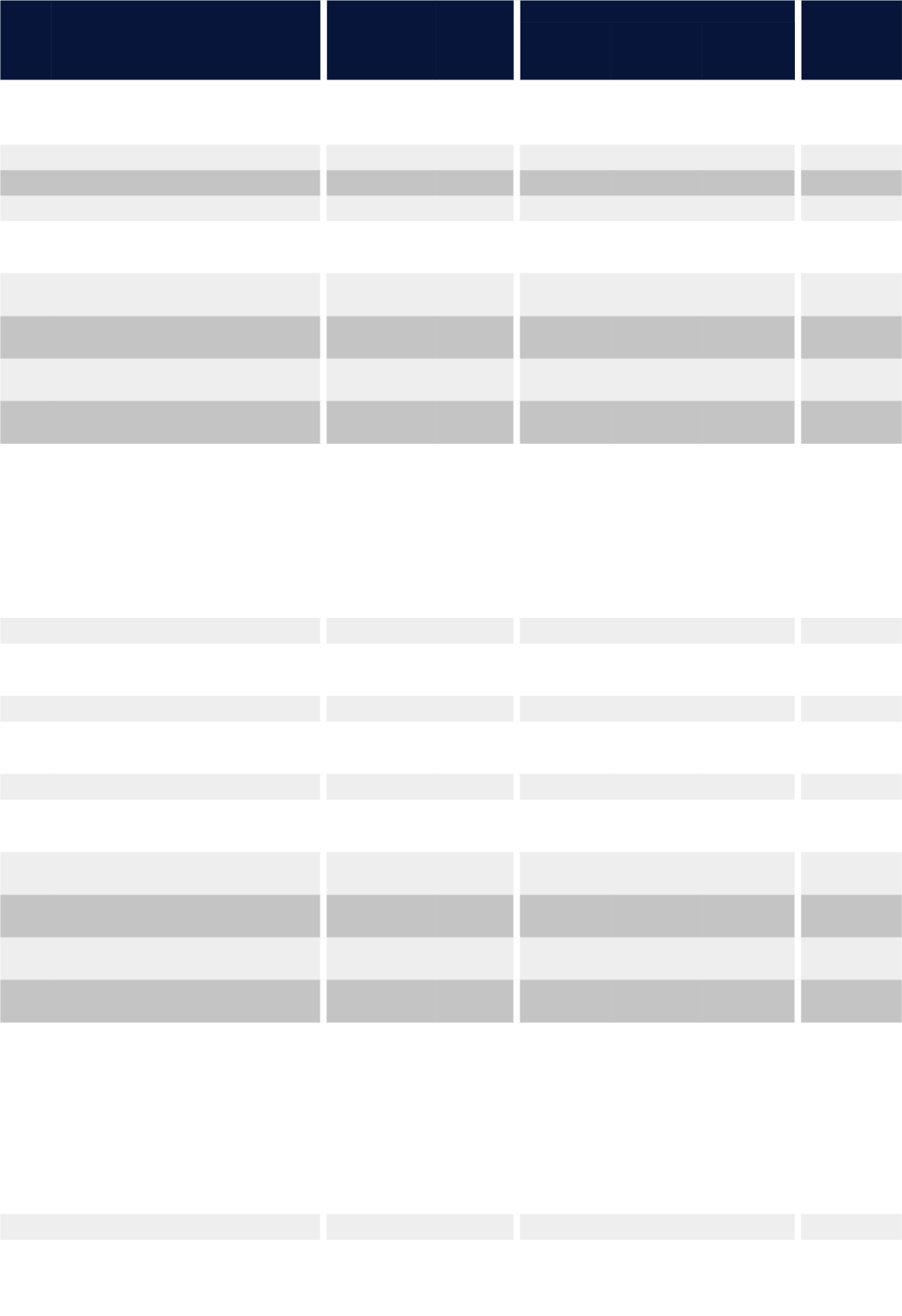

Table Of Contents

Central Coast Council........................................................................................................................................ 3

1. ABANDONED AND SEIZED ITEM RELEASE............................................................................................................... 3

2. ACTIVE OPEN SPACE (Sports Facilities, Parks, Reserves and Beaches) .............................................................. 3

3. AIRPORT – WARNERVALE ......................................................................................................................................... 14

4. ANIMAL REGISTRATION AND CONTROL................................................................................................................. 16

5. BOOKINGS – HALLS, CENTRES, GALLERIES AND THEATRES ............................................................................ 18

6. BOOKINGS – STADIUM AND PARKING .................................................................................................................... 30

7. BOOKS AND CORPORATE PUBLICATIONS............................................................................................................. 32

8. CEMETERIES ............................................................................................................................................................... 32

9. CERTIFICATES............................................................................................................................................................. 38

10. COMMUNITY EDUCATION AND LEARNING ........................................................................................................... 40

11. DEVELOPMENT ASSESSMENT AND APPLICATIONS ........................................................................................... 41

12. ENVIRONMENT.......................................................................................................................................................... 58

13. HOLIDAY PARKS ....................................................................................................................................................... 59

14. INFORMATION MANAGEMENT AND REQUESTS .................................................................................................. 95

15. MAPPING – GIS DATA AND MAPS........................................................................................................................... 96

16. LEGAL FEES.............................................................................................................................................................. 97

17. LEISURE AND LIFESTYLE (Leisure and Pools) ..................................................................................................... 98

18. LIBRARY SERVICES ............................................................................................................................................... 105

19. LICENCES, PERMITS AND INSPECTIONS ............................................................................................................ 106

20. MISCELLANEOUS ................................................................................................................................................... 114

21. PRINTING, COPYING, SCANNING AND DESIGN.................................................................................................. 115

22. PROFESSIONAL STAFF COSTS ............................................................................................................................ 115

23. ROADS, TRANSPORT AND DRAINAGE ................................................................................................................ 118

24. TOWN CENTRE MANAGEMENT AND TOURISM SERVICES............................................................................... 122

25. WASTE AND RECYCLING....................................................................................................................................... 125

26. WATER AND SEWERAGE ....................................................................................................................................... 127

Page 3 of 134

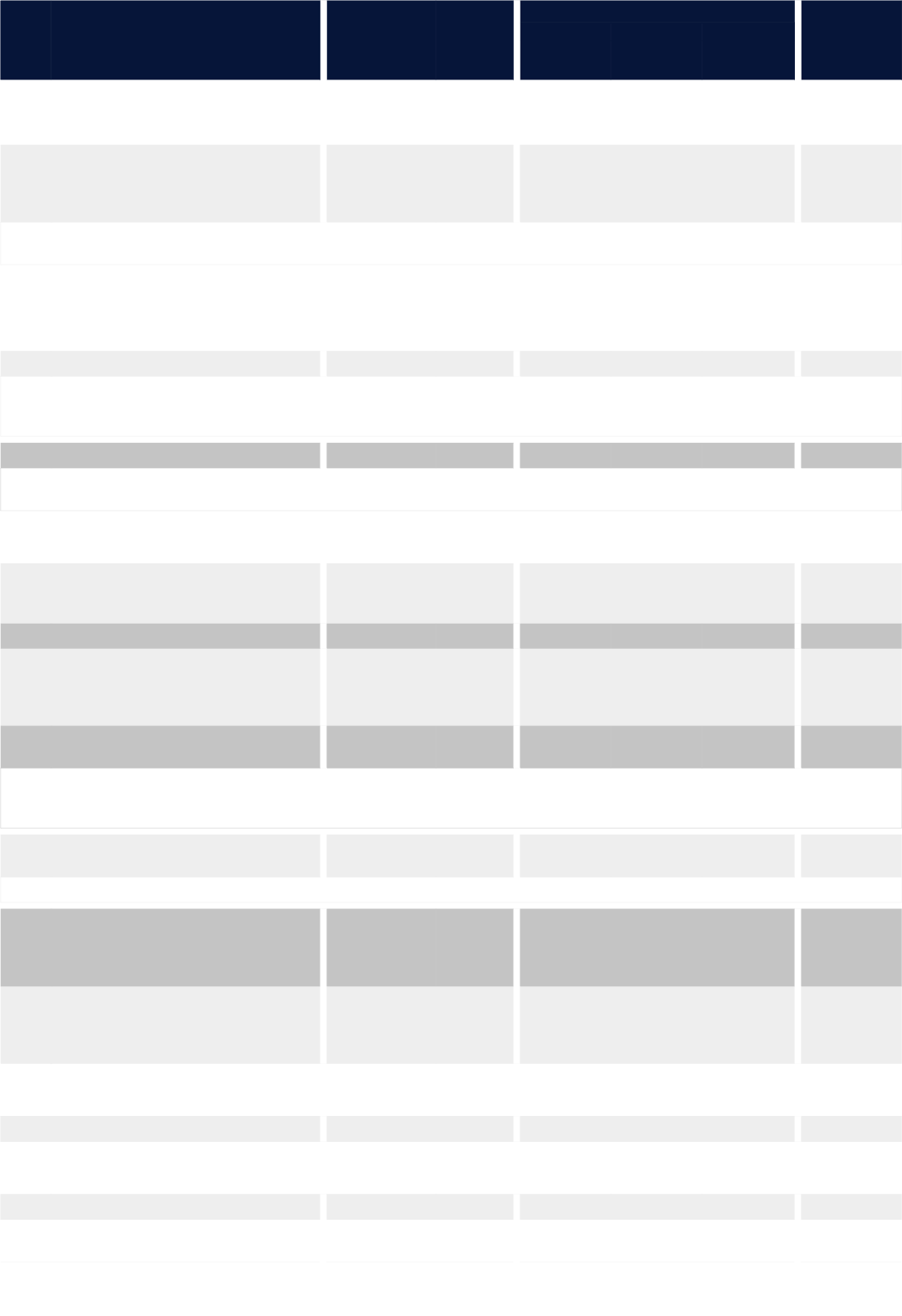

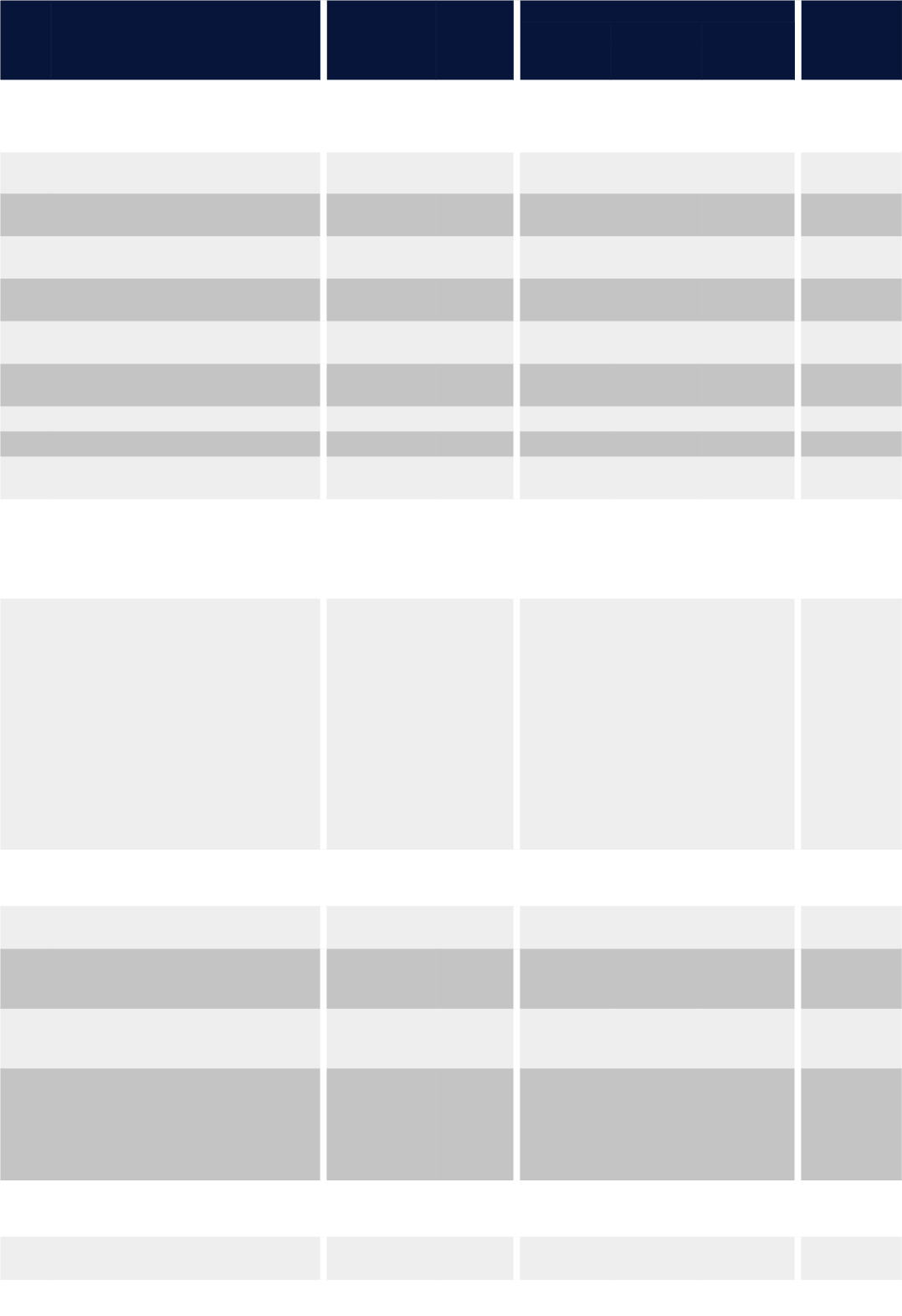

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Central Coast Council

1. ABANDONED AND SEIZED ITEM RELEASE

Costs and Release Fee

0001 Release of impounded class one item Per item 4 $85.00 $0.00 $85.00 -

0002 Release of impounded class two item Per article 4 $95.00 $0.00 $95.00 -

0003

Release of impounded of class three

item (motor vehicle)

Per vehicle

4

$385.00

$0.00

$385.00

-

Transportation Costs

0004

Transportation of class one or two

item (to impound holding facility)

Per kilometre

3

$5.00

$0.00

$5.00

-

0005

Transportation of class three item

(motor vehicle), (to impound holding

facility)

Per kilometre

3

$20.00

$0.00

$20.00

-

Storage Costs

0006

Daily storage fee for class three item

(motor vehicle), if released

Per vehicle,

per day

4

$30.00

$0.00

$30.00

-

2. ACTIVE OPEN SPACE (Sports Facilities, Parks, Reserves and Beaches)

Corporate Activities

0007

Activities conducted as a corporate/

commercial venture

Per

application

2

Price on application (inclusive of GST)

-

Fee to be determined upon application, based on a usage matrix. Clinics conducted through a seasonal sporting association will be

chargedtheapplicabledailyhirerate.

Events on Open Spaces (does not include weddings)

0008

Administrativefee–passiveevent

(non refundable)

Per

application

4

$51.22

$5.12

$56.34

-

0009

Administrativefee–mediumevent

(non refundable)

Per

application

4

$76.81

$7.68

$84.49

-

0010

Administrativefee–large–major

events (non refundable)

Per

application

4

$102.38

$10.24

$112.62

-

0011

Non Profit Organisation/Charity

Group–FullDayEvent

Per day

2

$104.91

$10.49

$115.40

-

0012

Non Profit Organisation/Charity

Group–HalfDayEvent

Per half day

(4 hours or

less)

2

$52.97

$5.30

$58.27

-

Wedding Booking

0013

Wedding Booking fee (non-

refundable within 6 months of

booking)

Per booking

2

$146.18

$14.62

$160.80

-

Special Events on Open Space Areas

An organised activity held on one or more of Council's Open Space Areas such as beach land, a reserve area or a sportsground

continued on next page ...

Page 4 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Special Events on Open Space Areas [continued]

0014

Medium Events - Based on Special

Event Matrix (listing available by

request)

Per day

2

$204.75

$20.48

$225.23

-

0015

Large Events - Based on Special

Event Matrix (listing available by

request). Events over 5 consecutive

days 30% discount, over 20

consecutive days 60% discount.

Excludes circuses and carnivals

Per day

2

$629.71

$62.97

$692.68

-

0016 Large Event Security Deposit Per event 2 $1,126.29 $0.00 $1,126.29 -

0017

Major Events - Based on Special

Event Matrix (listing available by

request). Events over 5 consecutive

days 30% discount, over 20

consecutive days 60% discount.

Per day

2

$1,105.77

$110.58

$1,216.35

-

0018 Major Event Security Deposit Per event 2 $2,252.55 $0.00 $2,252.55 -

Lighting Only

0019

Not for profit use of floodlights

Per hour per

facility

5

$19.97

$2.00

$21.97

-

0020

Commercialuseoffloodlights–

greater than 4 hours

Per hour per

facility

3

$29.95

$3.00

$32.95

-

0021

Tennis court or batting cage

floodlights

Per hour per

facility

3

$10.04

$1.00

$11.04

-

Access to Power

0022 Access to power outlets for events Per day 2 $18.87 $1.89 $20.76 -

Fireworks Display

0023

Fireworks display fee

Per display

2

Price determined on application

(excluding GST)

-

PROHIBITED in Natural Reserves, Sporting Fields and Public Parks/Reserves. Copy of licence required, fireworks display fee is to

be added to relevant Special Event Fee (Reserves, Parks and Beaches)

Concerts

0024

Commercial (entry fee charged)

Per concert

2

Price determined on application

(inclusive of GST)

-

State or National Titles and Special Cup Events

0025

State/National titles and special cup

games

Per event

2

Price determined on application

(inclusive of GST)

-

All state/national titles and special cup games where admission is charged, the hire fee is to be determined upon application. Please

note: seasonal allocation and fees are for competition and training purposes only.

Circuses and Carnivals

0026 Daily Fee Per day 2 $237.83 $23.78 $261.61 -

0027 Security Deposit Per event 2 $6,592.85 $0.00 $6,592.85 -

Page 5 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Licence to use open space – fitness

Hire and Drive Operators

0028

Temporary Licence - Avoca Lagoon,

Gosford Waterfront

Per location

up to 12

months

2

$4,505.13

$450.51

$4,955.64

-

0029

Temporary Licence - Terrigal Lagoon

Per location

up to 12

months

2

$3,620.05

$362.01

$3,982.06

-

Temporary Licensing of a Trade or Business on Open Space Areas

0030

Application Fee - an application fee

will be charged per licence

Per

application

2

$92.31

$0.00

$92.31

-

0031

Transfer Fee - a transfer fee will be

charged per licence to the Licensee

in the event of a sale of the business

Per transfer

2

$261.50

$0.00

$261.50

-

0032 Licence Fee Per site 2 Price on application (excludes GST) -

Surf School Operators

Category 1 is defined as a high priority location

Category 2 is defined as a low priority location

0033

Category1–TemporaryLicence

Per location

up to 12

months

2

$2,004.76

$0.00

$2,004.76

-

0034

Category2–TemporaryLicence

Per location

up to 12

months

2

$1,407.87

$0.00

$1,407.87

-

Elite Surf School Operators

A maximum of five (5) clients per session and only two (2) sessions per day from each elite surf coaching school is permitted

0035

Temporary Licence

Per location

up to 12

months

2

$3,604.09

$0.00

$3,604.09

-

Stand Up Paddleboard (SUP) Operators

Category 1 is defined as a high priority location

Category 2 is defined as a low priority location

0036

Category1–TemporaryLicence

Per location

up to 12

months

2

$2,004.76

$0.00

$2,004.76

-

0037

Category2–TemporaryLicence

Per location

up to 12

months

2

$1,407.87

$0.00

$1,407.87

-

Personal Trainers, Fitness Groups and Boot Camps

A combination of Category 1 and Category 2 sites will be subject to the Category 1 multiple site fee. Multiple location licences allow for

up to 3 locations only. Seasonal licences are allocated for Summer period only from October to March each year

Personal Trainers – Small Group (1 to 9)

Category 1 is defined as a high priority location

Category 2 is defined as a low priority location

Page 6 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Category 1

0038

SingleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$553.85

$55.39

$609.24

-

0039

SingleLocation–TemporaryLicence

Per licence

up to 12

months

2

$737.21

$73.72

$810.93

-

0040

MultipleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$870.32

$87.03

$957.35

-

0041

MultipleLocation–Temporary

Licence

Per licence

up to 12

months

2

$1,156.75

$115.68

$1,272.43

-

Category 2

0042

SingleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$368.63

$36.86

$405.49

-

0043

SingleLocation–TemporaryLicence

Per licence

up to 12

months

2

$553.89

$55.39

$609.28

-

0044

MultipleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$578.41

$57.84

$636.25

-

0045

MultipleLocation–Temporary

Licence

Per licence

up to 12

months

2

$854.10

$85.41

$939.51

-

Personal Trainers – Large Group (10 to 18)

Category 1 is defined as a high priority location

Category 2 is defined as a low priority location

Category 1

0046

SingleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$1,105.80

$110.58

$1,216.38

-

0047

SingleLocation–TemporaryLicence

Per licence

up to 12

months

2

$1,476.42

$147.64

$1,624.06

-

0048

MultipleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$1,730.37

$173.04

$1,903.41

-

0049

MultipleLocation–Temporary

Licence

Per licence

up to 12

months

2

$2,308.93

$230.89

$2,539.82

-

Category 2

0050

SingleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$829.33

$82.93

$912.26

-

0051

SingleLocation–TemporaryLicence

Per licence

up to 12

months

2

$1,105.80

$110.58

$1,216.38

-

continued on next page ...

Page 7 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Category 2 [continued]

0052

MultipleLocation–Seasonal

Temporary Licence

Per licence

up to 6

months

2

$1,269.66

$126.97

$1,396.63

-

0053

MultipleLocation–Temporary

Licence

Per licence

up to 12

months

2

$1,730.37

$173.04

$1,903.41

-

Corporate Group Training/Coaching and Clinics

0054 Temporary Licence Per licence 3 Price on application (inclusive of GST) -

Fee to be charged per activity and determined upon application based on location, participants and length of activity

Licence to use open space – beach access

Please note, this permit does not provide a guarantee of available beach access at designated access points. Beach accesses are

subject to coastal processes and other environmental conditions, and for these and other reasons may from time to time be

inaccessible or require closure. Full or partial refunds may not be offered in these situations.

0055

Administration fee (non-refundable)

Per year per

application

3

$92.30

$0.00

$92.30

-

0056

Commercial fisherman beach access

fee

Per year

2

$489.96

$0.00

$489.96

-

This access fee provides access for Commercial Fisherman to the following locations only:

* from Karagi car park north of The Entrance Channel

* the northern end of Curtis Parade, The Entrance North

* from Ocean Street, Budgewoi (it should be noted that north of this entry point is the Munmorah State Recreation Park)

* Hargraves Beach via Elizabeth Drive, Noraville

* the southern end of the car park at Soldiers Beach Surf Club (use of the beach north of this point is prohibited)

0057 Beach access key bond Per key 3 $337.90 $0.00 $337.90 -

Advertising Signage

0058

ApexPark–Wyongdisplaybanner

exhibition fee

Per sign

2

$680.89

$68.09

$748.98

-

0059 Other sites Per sign 5 Price on application (inclusive of GST) -

Community Sport Hire – Oval/Field Hire

Level 1 –Highest quality of facilities available –assessed on amenities, drainage, irrigation and sports field quality.

Level 2 –Medium quality of facilities available.

Level 3 –Lowestquality of facilities available.

Junior Competition and training fees are provided at a 25% reduced rate. Training without lighting and low impact activity is free of

charge (this is subject to council determination)

Sporting Groups Field Hire

0060

DailyFieldhire–Level1(asperfield

Categorisation sheet)

Per day per

field

5

$68.75

$6.88

$75.63

-

0061

DailyFieldhire–Level2(asperfield

Categorisation sheet)

Per day per

field

5

$63.52

$6.35

$69.87

-

0062

Daily Field hire - Level 3 - Seasonal

Users (as per field Categorisation

sheet)

Per day per

field

5

$43.31

$4.33

$47.64

-

0063

DailyFieldhire–WoyWoyOval

(Seasonal Users)

Per day per

field

5

$142.60

$14.26

$156.86

-

0064

DailyCasualFieldhire–Level1(as

per field Categorisation sheet)

Per day per

field

5

$137.42

$13.74

$151.16

-

continued on next page ...

Page 8 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Sporting Groups Field Hire [continued]

0065

DailyCasualFieldhire–Level2(as

per field Categorisation sheet)

Per day per

field

5

$127.13

$12.71

$139.84

-

0066

Daily Casual Field hire - Level 3 (as

per field Categorisation sheet)

Per day per

field

5

$86.58

$8.66

$95.24

-

0067

DailyCasualFieldhire–WoyWoy

Oval

Per day per

field

5

$286.22

$28.62

$314.84

-

0068

NightlyCasualFieldhire–withlights

Per night per

field

5

$127.13

$12.71

$139.84

-

Seasonal and Daily Field Hire

Seasonal charge. Gives user group use of the space for the season (excluding final series). A field is designated as a soccer, rugby/

league field, AFL ground, cricket field baseball/softball field and 2/3 Oz tag/Touch football/5 a side soccer fields.

0069

DailySeasonalFieldhire–Level1

(includes lighting for night

competitions)

Per day per

field

5

$1,374.36

$137.44

$1,511.80

-

As per field Categorisation sheet. 50% discount applies if field shared between 2 user groups on the same day.

0070

DailySeasonalFieldhire–Level2

(includes lighting for night

competitions)

Per day per

field

5

$1,271.04

$127.10

$1,398.14

-

As per field Categorisation sheet. 50% discount applies if field shared between 2 user groups on the same day.

0071

Daily Seasonal Field hire - Level 3

(includes lighting for night

competitions)

Per day per

field

5

$865.87

$86.59

$952.46

-

0072

DailySeasonalFieldhire–WoyWoy

Oval

Per day per

field

5

$2,852.08

$285.21

$3,137.29

-

50% discount applies if field shared between 2 user groups on the same day

Sporting Group Field Hire including lighting

0073

NightlyFieldhire–Allfields

Per night per

field

5

$63.52

$6.35

$69.87

-

Seasonal Field Hire including lighting

0074

NightlySeasonalFieldhire–Allfields

Per night per

field

5

$1,271.04

$127.10

$1,398.14

-

Sporting Group Field Hire excluding lighting

0075

NightlyFieldhire–Allfields

Per night per

field

5

$31.76

$3.18

$34.94

-

Seasonal Field Hire excluding lighting

0076

NightlySeasonalFieldhire–Allfields

Per night per

field

5

$635.53

$63.55

$699.08

-

0077

Nightly Seasonal Field hire - Low

Impact Sports - All fields

Per night per

field

5

$317.76

$31.78

$349.54

-

50% of fee without Floodlight use (inclusive of GST)

Page 9 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

School usage – ground only

Free school usage includes weekly sport, PDHPE lessons, knockout competitions and finals (local only), trials for regional teams and

team training where there is no requirement for amenities. All sports fields must be booked in advance. All other school bookings will be

subject to the community sport hire charges for the level of sports field selected. Guidelines are available for further clarification.

0078

School Carnival

Per field per

day

5

$137.45

$13.75

$151.20

-

Sundries

0080

Event Cancellation Fee (within 10

days of event)

Per event

4

50% of quoted fees (inclusive of GST)

-

0079

Late Application Fee (within 10 days

of event)

Per event

4

$34.31

$3.43

$37.74

-

0081 Special mowing requests Per request 4 $286.22 $28.62 $314.84 -

0082 Sports field/amenities cleaning fee Per hour 4 $75.42 $7.54 $82.96 -

0083

Linemarking(setupandpaint)–

excluding athletics

Per field

4

$436.11

$43.61

$479.72

-

0084

Linemarking(paintonly)–excluding

athletics

Per field

4

$216.99

$21.70

$238.69

-

0085 Linemarking(paintonly)–Athletics Per field 4 Price on application (inclusive of GST) -

Fines

Charged for all unauthorised use of parks, reserves or sports fields including but not limited to out of season use, usage of closed

grounds (wet weather or maintenance), or use without booking, licence or permission

0086 Fines–1stoffence Per offence 4 $554.49 $0.00 $554.49 -

0087 Fines–2ndoffence Per offence 4 $1,108.98 $0.00 $1,108.98 -

0088 Fines–3rdoffence Per offence 4 $1,885.26 $0.00 $1,885.26 -

Community Sport Hire – courts

0089 Casualdayfee–Smallcomplexes Per day 5 $38.21 $3.82 $42.03 -

0090

Casualdayfee–Largenetball

complexes (greater than 10 courts)

Per day

5

$159.15

$15.92

$175.07

-

0091

Seasonaldayfee–Allcomplexesper

court per day. All courts must be

booked at once.

Per season

per court per

day

5

$87.85

$8.79

$96.64

-

0092

Nightfee–BakerParkandAdcock

Park complex per hour including

lighting

Per hour

5

$31.76

$3.18

$34.94

-

0093

Nightfee–LemongroveComplexper

hour including lighting

Per hour

5

$31.76

$3.18

$34.94

-

0094

Nightfee–OtherComplexesper

night including lighting (Fees cover

the period from 4pm to 9.30pm)

Per night

5

$38.21

$3.82

$42.03

-

0095

Seasonal night fee - Large

Complexes including lighting

Per season

per court per

night

5

$94.16

$9.42

$103.58

-

0096

Seasonalnightfee–Other

Complexes–percomplexperseason

per night including lighting (Fees

cover the period from 4pm to 9.30pm)

Per season

per complex

per night

5

$635.53

$63.55

$699.08

-

0097

Batting Cage Hire (baseball) including

floodlights

Per season

per complex

per night

5

$651.41

$65.14

$716.55

-

Page 10 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Events/Functions

0098

Commercial event fee on sports field

Per day per

field

3

Price determined on application

(inclusive of GST)

-

0099

Event pre-function: non-scheduled

foreshore cleaning request

Per request

4

$294.43

$29.44

$323.87

-

0100

Event pre-function: non-scheduled

reserves and parks mowing request

Per request

4

$294.43

$29.44

$323.87

-

0101

Event/function clean up fee

Per event or

function

3

At cost (inclusive of GST)

-

Electrical Inspections (associated with events/functions)

0102

Electricalinspectionfee–commercial

Per

inspection

2

$390.85

$39.09

$429.94

-

0103

Electricalinspectionfee–notfor

profit

Per

inspection

4

$195.45

$19.55

$215.00

-

Key bonds

0104 Keybond–perfacility Per facility 4 $332.69 $0.00 $332.69 -

0105

Keybond–forassociations

Per

association

4

$2,217.95

$0.00

$2,217.95

-

0106 Schoolkeybond–oneset(termuse) Per facility 4 $33.27 $0.00 $33.27 -

Central Coast Regional Sporting Complex

NOTE: Major Sporting Events.

Events of National, State or Regional significance will take priority over local bookings. Sports grounds hire fees and charges for

National, State and Regional significant events may be reduced or waived by negotiation. Event setup costs for non-sporting events

(for example extra mowing, field / equipment preparations, line marking) are applicable and are negotiable.

0107

Event Cancellation Fee (within 4

weeks of event)

Per event

5

100% of quoted fees (inclusive of

GST)

-

0108

Event Cancellation Fee (within 8

weeks of event)

Per event

5

50% of quoted fees (inclusive of GST)

-

0109

Late Application Fee - small and not

for profit events

Per event

4

$34.31

$0.00

$34.31

-

When application is received within 8 weeks of event date (non refundable)

0110

Late Application Fee - medium, large

and major events

Per event

4

$92.20

$0.00

$92.20

-

Per event when application is received within 8 weeks of event date (non refundable)

0111 Administration Fee Per event 4 $84.68 $8.47 $93.15 -

Field Hire – Fields 1, 2, 3, 4, 6, 7 and 8 (per field) (excludes Field 5)

0112 Full Day (up to 8 hours*) Per day 5 $181.86 $18.19 $200.05 -

0113 Half Day (up to 4 hours) Per half day 5 $136.40 $13.64 $150.04 -

0114

Weekly (5 days maximum of 40

hours*)

Per week

5

$772.96

$77.30

$850.26

-

0115

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$22.74

$2.27

$25.01

-

Page 11 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Field Hire - Field 5

0116 Full Day (up to 8 hours*) Per day 5 $301.96 $30.20 $332.16 -

0117 Half Day (up to 4 hours) Per half day 5 $235.91 $23.59 $259.50 -

0118

Weekly (5 days maximum of 40

hours*)

Per week

5

$1,179.55

$117.95

$1,297.50

-

0119

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$37.74

$3.77

$41.51

-

Oval Hire – Ovals 12, 34 and 67 (per oval) (excluding Turf Cricket Pitch)

0120 Full Day (up to 8 hours*) Per day 5 $200.07 $20.01 $220.08 -

0121

Second consecutive day (up to 8

hours*)

Per day

5

$156.26

$15.63

$171.89

-

0122 Half Day (up to 4 hours) Per half day 5 $150.07 $15.01 $165.08 -

0123

Weekly (5 days maximum of 40

hours*)

Per week

5

$850.29

$85.03

$935.32

-

0124

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$25.01

$2.50

$27.51

-

Oval Hire – Ovals 12, 34 and 67 (per oval) (including Turf Cricket Pitch)

0125 Full Day (up to 8 hours*) Per day 5 $224.51 $22.45 $246.96 -

0126 Half Day Hire (up to 4 hours) Per half day 5 $172.59 $17.26 $189.85 -

0127

Second consecutive day (up to 8

hours*)

Per day

5

$156.26

$15.63

$171.89

-

0128

Weekly (5 days maximum of 40

hours*)

Per week

5

$954.12

$95.41

$1,049.53

-

0129

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$25.01

$2.50

$27.51

-

Premier Oval Hire – Field 9 (excluding Turf Cricket Pitch)

0130 Full Day (up to 8 hours*) Per day 5 $268.66 $26.87 $295.53 -

0131

Second consecutive day (up to 8

hours*)

Per day

5

$216.75

$21.68

$238.43

-

0132

Weekly (5 days maximum of 40

hours*)

Per week

5

$1,141.84

$114.18

$1,256.02

-

0133

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$33.55

$3.36

$36.91

-

Premier Oval Hire – Field 9 (including Turf Cricket Pitch)

0134 Full Day (up to 8 hours*) Per day 5 $322.61 $32.26 $354.87 -

0135 Half Day Hire (up to 4 hours) Per half day 5 $248.01 $24.80 $272.81 -

0136

Second consecutive day (up to 8

hours*)

Per day

5

$216.75

$21.68

$238.43

-

0137

Weekly (5 days maximum of 40

hours*)

Per week

5

$1,371.09

$137.11

$1,508.20

-

0138

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$33.80

$3.38

$37.18

-

Page 12 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Courts

0139

Casual day fee

Per court per

day

5

$38.21

$3.82

$42.03

-

Central Park Area Hire

0140 Full Day (up to 8 hours*) Per day 5 $62.01 $6.20 $68.21 -

0141 Half Day (up to 4 hours) Per half day 5 $43.35 $4.34 $47.69 -

0142

Weekly (5 days maximum of 40

hours*)

Per week

5

$263.54

$26.35

$289.89

-

0143

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$7.77

$0.78

$8.55

-

Canteen/Kiosk Hire/Boulevard

0144

Use of Boulevard

Per site per

day

5

Price determined on application

(inclusive of GST)

-

0145 Full Day (up to 8 hours*) Per day 5 $103.33 $10.33 $113.66 -

0146 Half Day (up to 4 hours) Per half day 5 $51.66 $5.17 $56.83 -

0147

Weekly (5 days maximum of 40

hours*)

Per week

5

$439.15

$43.92

$483.07

-

0148

* Per hour thereafter (only available

on Full Day or Weekly)

Per hour

5

$12.91

$1.29

$14.20

-

0149

MobileKiosk–SitewithPowerand

Water only

Per site per

day

5

$25.81

$2.58

$28.39

-

Field Lighting (Up to 4 hour block)

0150

Lighting (300 lux)

Per block per

field

5

$124.00

$12.40

$136.40

-

0151

Lighting (100 lux)

Per block per

two fields or

one oval

5

$108.53

$10.85

$119.38

-

Waste Management

0152

Waste bins on site

Per event per

day

3

At cost (inclusive of GST)

-

Pre-occupation Cleaning Fee

0153

Pre usage amenities cleaning fee

Per event or

amenities

area

5

$57.09

$5.71

$62.80

-

Standard Line Marking and/or Post Installation

0154

Line Marking and/or Post Installation

Fee

Per field or

oval

3

$71.09

$7.11

$78.20

-

Non Standard Line Marking and/or Post Installation

Price on application to be determined by Manager Open Space and Recreation and will reflect cost recovery

0155

Line Marking and/or Post Installation

Fee

Per field or

oval

3

At cost (inclusive of GST)

-

Page 13 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Commercial or Community Event

Price on application to be determined by existing Special Event Fees Matrix

0156 Commercial Event Per event 3 At cost (inclusive of GST) -

0157 Community Event Per event 3 At cost (inclusive of GST) -

Other Charges (Full Cost Recovery)

0158

Excessive waste removal or clean up

required

Per site

3

At cost (inclusive of GST)

-

0159

ElectricalInspection–forexample

tagging

Per event

3

At cost (inclusive of GST)

-

0160 Key or Padlock loss or damage Per item 3 At cost (inclusive of GST) -

0161 Excessive Amenities Cleaning Per event 3 At cost (inclusive of GST) -

0162

Ground, Equipment or Facility Loss/

Damage from negligence

Per event

3

At cost (inclusive of GST)

-

Other Fees

0163

Access to Council Managed Land -

Administration, Fitting and Retrieval

of Lock (all inclusive, applicable

bonds still apply)

Per lock

4

$686.50

$0.00

$686.50

-

This charge typically applicable to existing clear and accessible areas (For example: management trails, fire trails, fire breaks,

reserve access easements). Long Term Reserve Access (applications considered on merit, long term access applies for periods

exceeding one week).

0164

Access to Council Managed Land -

Additional Lock

Per lock

4

$96.36

$9.64

$106.00

-

This charge typically applicable to existing clear and accessible areas (For example: management trails, fire trails, fire breaks,

reserve access easements). Long Term Reserve Access (applications considered on merit, long term access applies for periods

exceeding one week).

0165

Application/Administration fee for

access permit to Council Managed

Land for the purpose of surveying or

constructing a boundary fence, or to

install nest boxes or salvaged hollows

or logs for specialist investigations

and reports (for example: associated

with proposed developments)

Per

application

5

$90.00

$0.00

$90.00

-

Applications considered on merit, conditions may apply, bond may apply based on foreseeable cost of potential damage that may be

incurred, additional fees may apply for specialist investigations and reports

0166

Fee for Council staff to undertake site

inductions and inspections associated

with an access permit/permit

application to Council Managed Land

for the purpose of surveying or

constructing a boundary fence, or to

install nest boxes or salvaged hollows

or logs and for specialist

investigations and reports (for

example: associated with proposed

developments)

Per hour or

part thereof

2

$169.09

$16.91

$186.00

-

Applications considered on merit, conditions may apply, bond may apply based on foreseeable cost of potential damage that may be

incurred, specialist investigations and reports will include ecological investigations

continued on next page ...

Page 14 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Other Fees [continued]

0167

Beach cleaning up to 2 hours

Minimum 2

hours

3

$313.18

$31.32

$344.50

-

Beach cleaning by Council crews for up to 2 hours. Applied for private beach cleaning requests above and beyond Council's

scheduled beach cleaning program. Typically for commercial film shoots and sporting events coordinated by external bodies.

0168

Additional Beach cleaning greater

than 2 hours

Per hour >2

hours

3

$168.64

$16.86

$185.50

-

Additional beach cleaning by Council crews greater than 2 hours. Applied for private beach cleaning requests above and beyond

Council's scheduled beach cleaning program. Typically for commercial film shoots and sporting events coordinated by external

bodies.

0169

Purchase of Council Nursery plants

by approved purchasers or

contractors

Per item

5

Price rate per plant provided on

application (inclusive of GST)

-

Adcock Park

Amenities Meeting Rooms

Community/Not for Profit Rates

0170 Large Meeting Room Hire Per hour 5 $48.01 $4.80 $52.81 -

0171 Large Meeting Room Hire - Weekly Per week 5 $397.75 $39.78 $437.53 -

0172 Medium Meeting Room Hire Per hour $20.45 $2.05 $22.50 -

0173 Medium Meeting Room Hire - Weekly Per week 5 $208.12 $20.81 $228.93 -

0174 Small Meeting Room Hire Per hour 5 $17.28 $1.73 $19.01 -

0175 Small Meeting Room Hire - Weekly Per week 5 $115.62 $11.56 $127.18 -

Bonds

0176 Large Meeting Room Bond Per event 5 $528.08 $0.00 $528.08 -

0177 Small/Medium Meeting Room Bond Per event 5 $264.05 $0.00 $264.05 -

Cleaning Fees

0178

Cleaning Fee - charged if room left

unclean

Per event

5

$144.02

$14.40

$158.42

-

3. AIRPORT – WARNERVALE

The following organisation is exempt from airport usage fees at Warnervale Airport –Angel Flight

Airport Usage Fees

Usage is defined as a Landing (LA), Touch and go (TG) or Stop and go (SG) –Based on MTOW (Certified Maximum Take-off Weight).

Annual usage fees paid in lieu of Airport Usage fees.

Warnervale Airport Charges

Paid in lieu of landing fees

0179

Up to 700 kgs (certified maximum

take-off weight) MTOW (per

serviceable aircraft)

Per year (pro

rata)

5

$595.45

$59.55

$655.00

-

0180

701 kgs to 2,000 kgs (certified

maximum take-off weight) MTOW

(per serviceable aircraft)

Per year (pro

rata)

5

$3,454.55

$345.45

$3,800.00

-

continued on next page ...

Page 15 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Warnervale Airport Charges [continued]

0181

2,001 kgs to 3,000 kgs (certified

maximum take-off weight) MTOW

(per serviceable aircraft)

Per year (pro

rata)

5

$4,084.55

$408.45

$4,493.00

-

0182

Over 3,001 kgs (certified maximum

take-off weight) MTOW (per

serviceable aircraft)

Per year (pro

rata)

5

$5,004.55

$500.45

$5,505.00

-

0183

Up to 3,000 kgs (certified maximum

take-off weight) MTOW

Per hour

5

$15.00

$1.50

$16.50

-

0184

Up to 3,000 kgs (certified maximum

take-off weight) MTOW

Per day, in

excess of 1

hour

5

$30.00

$3.00

$33.00

-

0185

Over 3,001 kgs (certified maximum

take-off weight) MTOW

Per hour

5

$25.00

$2.50

$27.50

-

0186

Over 3,001 kgs (certified maximum

take-off weight) MTOW

Per day, in

excess of 1

hour

5

$50.00

$5.00

$55.00

-

Adventure Sports

For example parachute jumping, ballooning

0187

Airport usage fees

Per tonne

(pro rata)

5

$23.00

$2.30

$25.30

-

Airport usage is defined as "a landing, touch and go, stop and go at the airport". Based on certified maximum take-off weight

(MTOW).

0188 Passenger fee (including instructor) Per person 5 $18.00 $1.80 $19.80 -

Other Fees

0189

Daily Aircraft parking and tie down fee

–Oncouncilland

Per day or

part thereof

5

$10.00

$1.00

$11.00

-

0190

Monthly Aircraft parking and tie down

fee - On council land

Per 10 days

or more in

any 30 day

period

5

$100.00

$10.00

$110.00

-

0191

Yearly Aircraft parking and tie down

fee–Oncouncilland

Per year (pro

rata -

minimum 1

month)

5

$1,200.00

$120.00

$1,320.00

-

0192

Application fee to Council for any use/

activity–Oncouncilland

Per

application

5

$560.00

$56.00

$616.00

-

0193

Airport or runway closure

Per day or

part thereof

5

$5,650.00

$565.00

$6,215.00

-

0194 Refuelling on council land Per refuel 5 $125.00 $12.50 $137.50 -

0195

Signage at Airport

Per square

metre per

year

5

$550.00

$55.00

$605.00

-

Advertising space per square metre (or part thereof) with a minimum of one square metre. The cost of the design, manufacture and

erection of the sign is at the advertiser's cost and must be approved by Council.

0196

Airport fees with organisations may

be determined through contract

negotiations

Per

negotiation

3

By contract negotiation (inclusive of

GST)

-

0197

Dedication of land from developers

administration fee

Per

dedication

4

$600.00

$0.00

$600.00

-

Page 16 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

4. ANIMAL REGISTRATION AND CONTROL

The Chief Executive Officer has delegated authority to amend statutory fees for changes to applicable legislation

Lifetime registration fee

0198

Cat - Desexed or not desexed

Per animal

1

$65.00

$0.00

$65.00

Director-

General

OLG

Companion

Animals

0199

Cat - Desexed and eligible pensioner

concession applies

Per animal

1

$32.00

$0.00

$32.00

Director-

General

OLG

Companion

Animals

0200

Cat - Desexed and sold by Pound/

Shelter

Per animal

1

No charge

Director-

General

OLG

Companion

Animals

0201

Cat - Not desexed with written

notification from a vet advising the cat

should not be desexed

Per animal

1

$65.00

$0.00

$65.00

Director-

General

OLG

Companion

Animals

0202

Cat - Not desexed with recognised

breeder concession

Per animal

1

$65.00

$0.00

$65.00

Director-

General

OLG

Companion

Animals

0203

Dog - Desexed by relevant age

Per animal

1

$75.00

$0.00

$75.00

Director-

General

OLG

Companion

Animals

0204

Dog - Desexed by relevant age and

eligible pensioner concession applies

Per animal

1

$32.00

$0.00

$32.00

Director-

General

OLG

Companion

Animals

0205

Dog - Desexed and sold by Pound/

Shelter

Per animal

1

No charge

Director-

General

OLG

Companion

Animals

0206

Dog - Not desexed or desexed after

relevant age

Per animal

1

$177 + applicable registration fees

(excludes GST)

Director-

General

OLG

Companion

Animals

0207

Dog - Not Desexed with written

notification from a vet advising the

dog should not be desexed

Per animal

1

$75.00

$0.00

$75.00

Director-

General

OLG

Companion

Animals

0208

Dog - Not desexed with recognised

breeder concession

Per animal

1

$75.00

$0.00

$75.00

Director-

General

OLG

Companion

Animals

continued on next page ...

Page 17 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Lifetime registration fee [continued]

0209

Dog - Working dog, assistance

animal or service of the state

Per animal

1

No charge

-

Other registration fees

0210

Late Fee if registration fee has not

been paid 28 days after the date on

which the companion animal is

required to be registered

Per animal

1

$21.00

$0.00

$21.00

Director-

General

OLG

Companion

Animals

0211

Annual Permit for owners of cats not

desexed by four months of age (in

addition to the one-off lifetime pet

registration fee)

Per animal

per year

1

$92 each year + one-off lifetime pet

registration fee (excludes GST)

Director-

General

OLG

Companion

Animals

0212

Annual Permit for owners of dogs of a

restricted breed or declared to be

dangerous (in addition to the one-off

lifetime pet registration fee)

Per animal

per year

1

$221 each year + one-off lifetime pet

registration fee (excludes GST)

Director-

General

OLG

Companion

Animals

Seizure/Impounding costs and release fee for dogs/cats

0213 Seizure release fee - same day Per animal 5 $45.00 $0.00 $45.00 -

0214 Seizure release fee - 1 to 3 nights Per animal 5 $90.00 $0.00 $90.00 -

0215 Seizure release fee - 4 to 8 nights Per animal 5 $225.00 $0.00 $225.00 -

0216 Seizure release fee - 9 to 14 nights Per animal 5 $275.00 $0.00 $275.00 -

0217

Daily sustenance (second and

subsequent days)

Per animal

per day

5

$55.00

$0.00

$55.00

-

0218 Veterinary care (if and as required) Per animal 4 By quote (excludes GST) -

Seizure/Impounding costs and release fee other animals

0219

Animal holding and release fee

Per animal

per day

5

$55.00

$0.00

$55.00

-

0220

Daily sustenance (second and

subsequent days)

Per animal

per day

3

$55.00

$0.00

$55.00

-

0221 Veterinary care (if and as required) Per animal 2 By quote (excludes GST) -

0222

Advertising/notification–forauction

only

Per animal

4

$145.00

$0.00

$145.00

-

0223

Animal collection and transportation

fee (to impound holding facility)

Per kilometre

3

$20.00

$0.00

$20.00

-

Sundry costs and services

0224

Dangerous dog enclosure compliance

certificate

Per

inspection

1

$150.00

$0.00

$150.00

-

0225

Processing of identification/

microchipping forms and all relevant

paperwork for the Companion

Animals Register (C.A.R) for

organisations that have access to and

can complete data entry on the C.A.R

Per form

5

$20.00

$0.00

$20.00

-

Page 18 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

5. BOOKINGS – HALLS, CENTRES, GALLERIES AND THEATRES

Erina Centre

Business/Private Rates

0226 Art Space 1, Meeting Space 2 and 3 Per hour 4 $26.36 $2.64 $29.00 -

0227 Erina Room 1 Per hour 4 $38.18 $3.82 $42.00 -

0228 Erina Room 2 Per hour 4 $38.18 $3.82 $42.00 -

0229 ErinaRooms–1and2 Per hour 4 $64.55 $6.45 $71.00 -

0230

Cancellation Fee - cancellations may

incur hirer paying full price of room if

not advised prior to booking

Per booking

4

Up to a maximum of $66.00 (inclusive

of GST)

-

0231

Clean up fee - charged if hall/room

left uncleaned

Per hire

4

$45.45

$4.55

$50.00

-

0232

Foyer Gallery Space (includes

promotion and exhibition support)

Per 2 week

hire

4

$727.27

$72.73

$800.00

-

0233

Foyer Gallery Space (includes

promotion and exhibition support)

Per 3 week

hire

4

$909.09

$90.91

$1,000.00

-

0234

Foyer Gallery Space (includes

promotion and exhibition support)

Per 4 week

hire

4

$1,090.91

$109.09

$1,200.00

-

Community/Not For Profit Rates

0235 Art Space 1, Meeting Space 2 and 3 Per hour 4 $20.91 $2.09 $23.00 -

0236 Erina Room 1 Per hour 4 $31.82 $3.18 $35.00 -

0237 Erina Room 2 Per hour 4 $31.82 $3.18 $35.00 -

0238 ErinaRooms–1and2 Per hour 4 $54.55 $5.45 $60.00 -

0239

Foyer Gallery Space (includes

promotion and exhibition support)

Per 2 week

hire

4

$290.91

$29.09

$320.00

-

0240

Foyer Gallery Space (includes

promotion and exhibition support)

Per 3 week

hire

4

$390.91

$39.09

$430.00

-

0241

Foyer Gallery Space (includes

promotion and exhibition support)

Per 4 week

hire

4

$490.91

$49.09

$540.00

-

Other Fees

0242

Booking Change Administration Fee

(applied when more than 1 change

per month is requested to a booking)

Per booking

5

$36.36

$3.64

$40.00

-

0243 Security/After hours call out fee Per call out 4 $136.36 $13.64 $150.00 -

Youth Services

0244

Long Term Hire (subject to lease or

agreement)

Per

agreement

4

By quote (inclusive of GST)

-

0245

Youth Services Program/Activity Fees

–pricesarebasedonactivity/

program/course

Per person/

per activity/

per course

4

Up to a maximum of $200.00

(inclusive of GST)

-

0246

Kitchen Facility - Community/Not For

Profit Rates (only available when

hiring Erina Rooms 1 and/or 2)

Per hire

4

$23.64

$2.36

$26.00

-

Page 19 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

The Hub Youth Venue (Erina)

Business/Private Rates

0247

Creative Media Suite

Per

application

4

Price on application, up to a maximum

of $250.00 (inclusive of GST)

-

0248 MainHall–Dayhire Per hour 4 $34.55 $3.45 $38.00 -

0249

PA set up/equipment

Per

application

4

Price on application (inclusive of GST)

-

Community/Not for Profit Rates

0250

Creative Media Suite

Per

application

4

Price on application (inclusive of GST)

-

0251 MainHall–Dayhire Per hour 4 $24.55 $2.45 $27.00 -

0252

PA set up/equipment

Per

application

4

Price on application (inclusive of GST)

-

Other Fees

0254

Booking Change Administration Fee

(applied when more than 1 change

per month is requested to a booking)

Per booking

5

$36.36

$3.64

$40.00

-

0256

Cancellation Fee - cancellations may

incur hirer paying full price of room if

not advised prior to booking

Per booking

4

Up to a maximum of $66.00 (inclusive

of GST)

-

0253

Clean up fee - charged if hall/room

left uncleaned

Per hire

4

$145.45

$14.55

$160.00

-

0255 Security/After hours call out fee Per call out 4 $136.36 $13.64 $150.00 -

Senior Services

0257

Community Activity Participation Fee

Per activity/

event

5

Up to a maximum of $200.00

(inclusive of GST)

-

0258

Cleaning Fee (as per conditions of

hire)

Per hour

2

$150.00

$15.00

$165.00

-

0259 Security/after hours call out fee Per call out 4 $145.45 $14.55 $160.00 -

50 + Leisure and Learning Centres – Gosford and Ettalong Beach

0260 Membership fee Per person 4 $9.09 $0.91 $10.00 -

0261

50+LeisureandLearningCentres–

Meals

Per person

per meal

3

Prices range between $1.00 and

$15.00 (inclusive of GST)

-

Community/Not for Profit Groups

0262

Gosford 50+ Leisure and Learning

Centre Meeting Room

Per hour

4

$17.27

$1.73

$19.00

-

0263

Gosford 50+ Leisure and Learning

Centre Small Room

Per hour

4

$8.64

$0.86

$9.50

-

0264

Gosford 50+ Leisure and Learning

Centre (hall hire)

Per hour

4

$20.91

$2.09

$23.00

-

0265

Ettalong 50+ Leisure and Learning

Centre Small Room

Per hour

4

$8.64

$0.86

$9.50

-

0266

Ettalong 50+ Leisure and Learning

Centre Meeting Room

Per hour

4

$17.27

$1.73

$19.00

-

continued on next page ...

Page 20 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Community/Not for Profit Groups [continued]

0267

Ettalong 50+ Leisure and Learning

Centre (hall hire)

Per hour

4

$20.91

$2.09

$23.00

-

0268 Kitchen hire Per hire 4 $25.45 $2.55 $28.00 -

Business/Private Groups

0269

Gosford 50+ Leisure and Learning

Centre Meeting Room

Per hour

4

$27.27

$2.73

$30.00

-

0270

Gosford 50+ Leisure and Learning

Centre Small Room

Per hour

4

$11.82

$1.18

$13.00

-

0271

Gosford 50+ Leisure and Learning

Centre (hall hire)

Per hour

4

$30.91

$3.09

$34.00

-

0272

Ettalong 50+ Leisure and Learning

Centre Small Room

Per hour

4

$11.82

$1.18

$13.00

-

0273

Ettalong 50+ Leisure and Learning

Centre Meeting Room

Per hour

4

$27.27

$2.73

$30.00

-

0274

Ettalong 50+ Leisure and Learning

Centre (hall hire)

Per hour

4

$30.91

$3.09

$34.00

-

0275 Kitchen hire Per hire 4 $31.82 $3.18 $35.00 -

Theatres

Event/Performance Cancellation Fee

Sunday to Saturday

0276

Event/Performance cancellation fee

(in addition to forfeiting deposit paid;

the event creation, ticketing and

refund fees payable).

Per

cancellation

2

$188.18

$18.82

$207.00

-

Applies to Laycock Auditorium Hire, Don Craig Room Hire and Peninsula Theatre Hire from Sunday to Saturday

Theatre Packages - Long Term Hire

0277

Theatre Package Deal

Per

agreement

2

By quote (inclusive of GST)

-

Long Term Hire (subject to agreement)

Laycock Auditorium Hire

Sunday to Thursday

0278 Community Hire Per hour 2 $170.00 $17.00 $187.00 -

0279

Community Performance

Per

performance

2

$679.09

$67.91

$747.00

-

0280

CommunityDeposit–20%of

Performance Fee

Per

performance

2

$136.36

$13.64

$150.00

-

0281 Commercial Non Performance Rate Per hour 2 $330.00 $33.00 $363.00 -

0282

Commercial Performance

Per

performance

2

$1,320.91

$132.09

$1,453.00

-

0283

CommercialDeposit–20%of

Performance Fee

Per

performance

2

$263.64

$26.36

$290.00

-

0284 Dance Schools Rehearsal Per session 2 $377.27 $37.73 $415.00 -

Page 21 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Friday to Saturday

0285 Community Hire Per hour 2 $212.73 $21.27 $234.00 -

0286

Community Performance

Per

performance

2

$849.09

$84.91

$934.00

-

0287

CommunityDeposit–20%of

Performance Fee

Per

performance

2

$170.00

$17.00

$187.00

-

0288 Commercial Rate Per hour 2 $405.45 $40.55 $446.00 -

0289

Commercial Performance

Per

performance

2

$1,622.73

$162.27

$1,785.00

-

0290

CommercialDeposit–20%of

Performance Fee

Per

performance

2

$324.55

$32.45

$357.00

-

0291 Dance Schools Rehearsal Per session 2 $566.36 $56.64 $623.00 -

Other Fees

0292

Dark Days Fee

Per

performance

2

20% of Daily Community Performance

rate (inclusive of GST)

-

Applies Thursday to Sunday as per Hire agreement

Don Craig Room Hire

Sunday to Thursday

0293 Community Hire Per hour 2 $75.45 $7.55 $83.00 -

0294

Community Performance

Per

performance

2

$301.82

$30.18

$332.00

-

0295

Additional performance same day

Per additional

performance

2

$150.91

$15.09

$166.00

-

0296

CommunityDeposit–20%of

Performance Fee

Per

performance

2

$60.91

$6.09

$67.00

-

0297 Commercial Per hour 2 $122.73 $12.27 $135.00 -

0298

Commercial Performance

Per

performance

2

$490.91

$49.09

$540.00

-

0299

Additional performance same day

Per additional

performance

2

$245.45

$24.55

$270.00

-

0300

CommercialDeposit–20%of

Performance Fee

Per

performance

2

$98.18

$9.82

$108.00

-

0301

Dance Schools hire (holding room) up

to 6 hours

Per session

up to 6 hours

2

$131.82

$13.18

$145.00

-

0302

DanceSchoolshire(holdingroom)–

more than 6 hours on the same day

Per session

more than 6

hours

2

$263.64

$26.36

$290.00

-

Friday to Saturday

0303 Community Hire Per hour 2 $84.55 $8.45 $93.00 -

0304

Community Performance

Per

performance

2

$340.00

$34.00

$374.00

-

0305

Additional performance same day

Per additional

performance

2

$170.00

$17.00

$187.00

-

0306

CommunityDeposit–20%of

Performance Fee

Per

performance

2

$68.18

$6.82

$75.00

-

0307 Commercial Per hour 2 $131.82 $13.18 $145.00 -

continued on next page ...

Page 22 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Friday to Saturday [continued]

0308

Commercial Performance

Per

performance

2

$527.27

$52.73

$580.00

-

0309

Additional performance same day

Per additional

performance

2

$263.64

$26.36

$290.00

-

0310

CommercialDeposit–20%of

Performance Fee

Per

performance

2

$105.45

$10.55

$116.00

-

0311

Dance Schools hire (holding room) up

to 6 hours

Per session

up to 6 hours

2

$131.82

$13.18

$145.00

-

0312

DanceSchoolshire(holdingroom)–

more than 6 hours on the same day

Per session

more than 6

hours

2

$263.64

$26.36

$290.00

-

Peninsula Theatre Hire

Sunday to Thursday

0313 Community Hire Per hour 2 $75.45 $7.55 $83.00 -

0314

Community Performance

Per

performance

2

$301.82

$30.18

$332.00

-

0315

Additional performance same day

Per additional

performance

2

$150.91

$15.09

$166.00

-

0316

CommunityDeposit–20%of

Performance Fee

Per

performance

2

$60.91

$6.09

$67.00

-

0317 Commercial Per hour 2 $122.73 $12.27 $135.00 -

0318

Commercial Performance

Per

performance

2

$490.91

$49.09

$540.00

-

0319

Additional performance same day

Per additional

performance

2

$245.45

$24.55

$270.00

-

0320

CommercialDeposit–20%of

Performance Fee

Per

performance

2

$98.18

$9.82

$108.00

-

Friday to Saturday

0321 Community Hire Per hour 2 $84.55 $8.45 $93.00 -

0322

Community Performance

Per

performance

2

$340.00

$34.00

$374.00

-

0323

Additional performance same day

Per additional

performance

2

$170.00

$17.00

$187.00

-

0324

CommunityDeposit–20%of

Performance Fee

Per

performance

2

$68.18

$6.82

$75.00

-

0325 Commercial Per hour 2 $131.82 $13.18 $145.00 -

0326

Commercial Performance

Per

performance

2

$527.27

$52.73

$580.00

-

0327

Additional performance same day

Per additional

performance

2

$264.55

$26.45

$291.00

-

0328

CommercialDeposit–20%of

Performance Fee

Per

performance

2

$105.45

$10.55

$116.00

-

Technical and Front of House Staffing

0329

Monday to Friday

Per person

per hour

2

$56.36

$5.64

$62.00

-

0330

Saturday

Per person

per hour

2

$70.91

$7.09

$78.00

-

continued on next page ...

Page 23 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Technical and Front of House Staffing [continued]

0331

Sunday

Per person

per hour

2

$84.55

$8.45

$93.00

-

0332

Public Holiday

Per person

per hour

2

$141.82

$14.18

$156.00

-

Catering

0333 Dressing room rider/event catering Per request 4 Cost plus 10% (inclusive of GST) -

0334 Use of commercial kitchen facilities Per day 2 $84.55 $8.45 $93.00 -

0335

Tea and coffee set up for Auditorium

meetings/events (includes tea/coffee/

water/biscuits plus one Front of

House staff for two hours)

Per request

per 2 hours

2

$377.27

$37.73

$415.00

-

0336

Tea and coffee set up for Don Craig

Roommeetings/events–Includes

tea/coffee/water/biscuits plus one

Front of House staff for two hours

Per request

per 2 hours

2

$189.09

$18.91

$208.00

-

Bar and Kiosk

0337

Bar and kiosk refreshments (items

available for purchase by patrons)

Per item

4

Retail price (inclusive of GST)

-

Cleaning

0338

Normal cleaning (included in venue

hire)

Per venue

hire

2

No charge

-

0339

Additional cleaning

Per hour, or

part thereof

2

$150.91

$15.09

$166.00

-

Costs incurred will be charged to the hirer at the discretion of the Venue Management. This includes, but is not limited to, stains on

carpets and other soft furnishings from make-up, glitter, chewing gum and spilt substances.

0340

Stains or damage to venue

furnishings and fittings will be

repaired, dry-cleaned and/or re-

fireproofedatthehirer’sexpense

Per venue

hire

3

By quote (inclusive of GST)

-

Repairs needed as a consequence of a hire of the venue will be charged to the Hirer. The venue reserves the right to withhold this

amountfromthehirer’saccount.

Marketing

Community and Commercial

0341

Commercial–Externalbillboard

(Artwork to be supplied)

2 month

period

dependent

upon

availability

2

$447.27

$44.73

$492.00

-

0342

Community–Externalbillboard

(Artwork to be supplied)

2 month

period

dependent

upon

availability

2

$447.27

$44.73

$492.00

-

0343

Newspaper advertisement and/or

development of marketing collateral

(Artwork to be supplied)

2

By quote (inclusive of GST)

-Per

advertisement

or application

Page 24 of 134

Fee

No.

Fee and Charge

Unit of

Measure

Pricing

Category

Year 23/24

Regulatory

Fees and

Charges

Paid to

Fee

GST

Fee

(excluding

GST)

Amount

(including

GST)

Merchandising

For use of merchandising space to sell programs and merchandise. No charge included in venue hire.

0344

Commercial Hirers - Additional staff

available at standard Front of House

rates

Per

application

4

By quote (inclusive of GST)

-

0345

Commercial Hirers - 10% commission

charged on merchandise sales

Per

application

4

By quote (inclusive of GST)

-

Security

0346

At request of Hirer or at discretion of

Council

Per

application

4

At cost (inclusive of GST)

-

Technical

0347

Production power. House lights and

general/foyer lighting are included in

basic rental

Per kilowatt

hour

1

As metered @ 25c per kilowatt hour

(inclusive of GST)

-

0348 Wireless handheld microphone - daily Per day 4 $42.73 $4.27 $47.00 -

0349

Wireless handheld microphone -

weekly

Per week

4

$127.27

$12.73

$140.00

-

0350 Wireless body microphone - daily Per day 4 $51.82 $5.18 $57.00 -

0351 Wireless body microphone - weekly Per week 4 $155.45 $15.55 $171.00 -

0352

Wireless Communications pack and

headset

Per day

4

$23.64

$2.36

$26.00

-

0353

Hazemachine–LookSolutions

Unique (daily)

Per day

4

$51.82

$5.18

$57.00

-

0354

Hazemachine–LookSolutions

Unique (weekly)

Per week

4

$155.45

$15.55

$171.00

-

0355

Smokemachine–JemZR33HiMass

DMX (daily)

Per day