FY24 INVESTOR DAY 6-PAGERS

OUR PLATFORM-POWERED BIG BETS

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

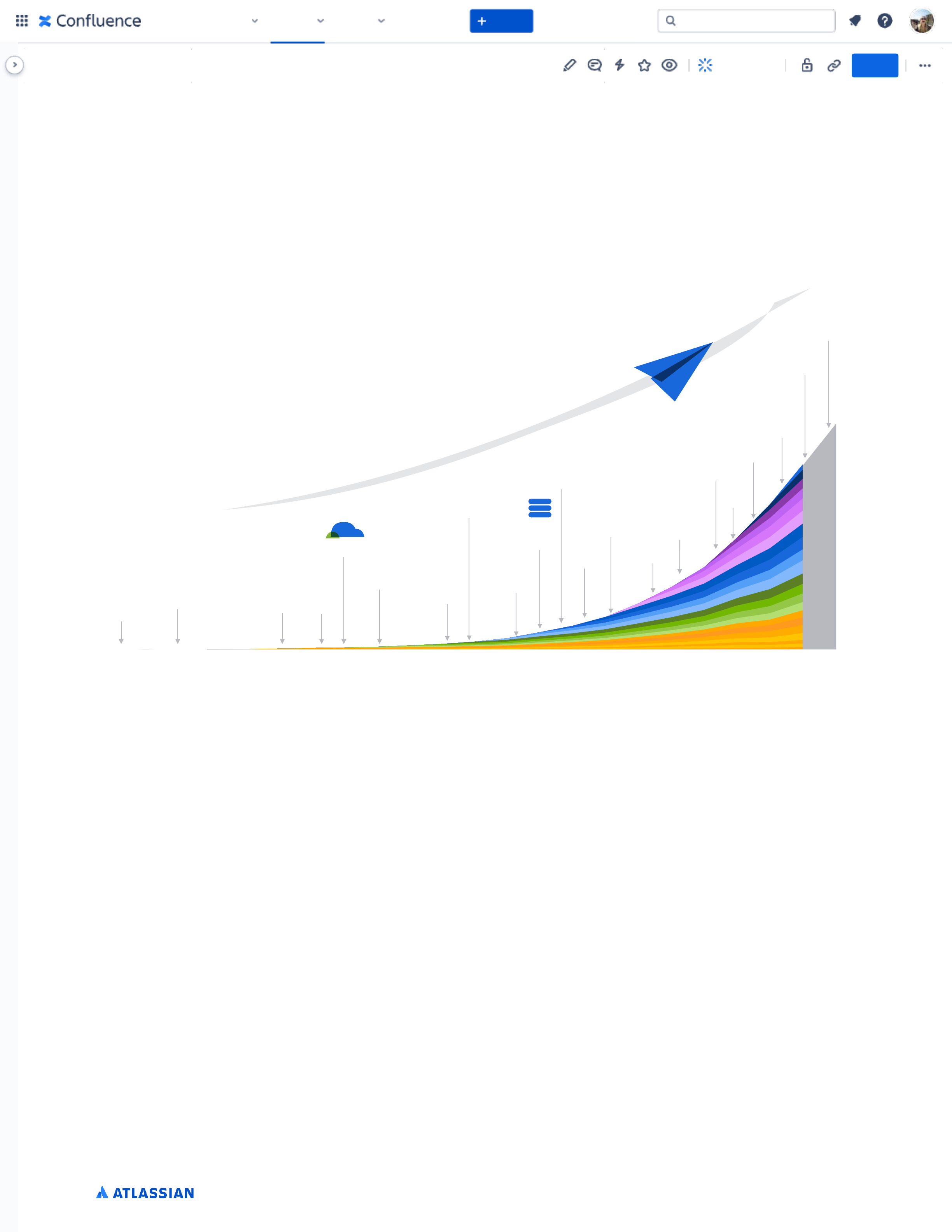

We have a strong track record of successful, long-term strategic bets over the past

two decades which has led to us scaling to over $4 billion in revenue today.

At each step of our journey, we've been explicit about our big bets and then backed

them up by executing against those initiatives. As an R&D-led company, these bets are

longer-term in nature, so in this section, we’ll cover our progress and the growing

opportunity ahead of us, all powered by our world-class platform.

These include: doubling down on ITSM, accelerating cloud migrations, supporting

enterprises, and now, AI.

Building a world-class platform

We chose to do the hard thing and invest in building a best-in-class cloud platform

from the ground up. Dividing up our R&D muscle between individual product

capabilities and building a platform as the foundation of our entire cloud portfolio was

a significant investment, but we knew it was the right decision for the long term.

Today, we have a unified cloud platform that supports our portfolio of products. We’re

able to accelerate innovation by building capabilities at the platform level and

surfacing them in multiple products. You’ve seen us flex this muscle. For example, we

built core AI capabilities centrally and implemented those capabilities across our

product portfolio. This mirrors our work with other key collaboration capabilities our

customers are seeking like analytics and automation.

Our data and insights help drive cross-sell and up-sell when customers see what’s

possible to achieve across our entire platform. From a customer experience

perspective, our platform creates a sleek, smooth experience with opportunities to tap

into capabilities only a platform can provide. We’ve built out a ladder of editions of our

Cloud products with Free, Standard, Premium, and Enterprise for our customers,

allowing them to either take it step-by-step as their needs evolve or skip to more

powerful versions straightaway.

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017

FY2018

FY2019

FY2020

FY2021

FY2022

FY2023

FY2024E

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017

FY2018

FY2019

FY2020

FY2021

FY2022

FY2023

JIRA BORN

CLOUD

Cloud Premium

& Enterprise

$1B

REVENUE

$

DIVEST

STRIDE

Enter

ITSM

50,000

CUSTOMERS

+

DATA

CENTER

Marketplace

$10 starter

Channel

Enterprise

Support

CONFLUENCE

5,000

CUSTOMERS

+

~$4B

REVENUE

$

$100M

REVENUE

$

ACQUIRED

LOOM

$2B

REVENUE

$

Strong Track Record

of Successful Big Bets

ACQUIRED

TRELLO

$3B

REVENUE

$

Free

14

The legal disclaimer and information about our non-GAAP financial measures including a reconciliation of GAAP to non-GAAP measures can be found at the end of this document.

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

We’re seeing customers respond incredibly well to the innovation we’re delivering in

our higher-level editions:

Atlassian’s cloud platform also makes building new products easier. Out of our new

product incubator program, Point A, we’ve launched Jira Work Management, Jira

Product Discovery, Compass, and Atlas – all only available in the cloud. Jira Work

Management’s ARR is growing 50% year-over-year, and we’ll carry this momentum

forward with Jira. Jira Product Discovery and Compass are off to a flying start with

less than a year in market. We have over 6,500 customers using Jira Product

Discovery since GA last May, and Compass has seen monthly active instances grow

2.5x since GA in October.

We’ve built our platform to make it easier to integrate acquired products. Since

acquiring Loom at the end of 2023, we’ve been quickly integrating its' capabilities

across the Atlassian platform, to extend the value of async video to help our

customers collaborate in richer, more human ways. Now, team members can provide

more context by seamlessly embedding a Loom within Confluence when writing a

strategy document or by creating an action item within Loom that exports to Jira in a

single click.

While competitors are determined to position themselves as a one-stop shop for the

software development lifecycle, we've never aspired to be the end-to-end toolchain

for developers. Instead, we’ve leaned into being the central nervous system for

software teams, integrating with the best 3rd-party tools, and bridging technical users

with their business teammates via our powerful platform.

And integrate they will! With over 5,700 3rd party apps and integrations, we empower

teams to use an open toolchain. In turn, this drives faster expansion and stickier

customers, both big and small. Enterprise customers with 3rd party apps grow with us

roughly 20% faster than those without an app. And for SMB customers, those with 3rd

party apps have a 1/3 lower churn rate.

Our platform strategy accelerates innovation and serves as the springboard for our

other big bets. Through the platform, we’re able to deliver a significantly better

experience for customers in the cloud and open up additional expansion vectors. It is

the base we use to build for enterprise customers, create exceptional service

management experiences for teams of all types, and now, it’s what gives us the

competitive edge in the AI space.

All roads lead to platform, as they say.

32%

23%

Premium

Standard

Enterprise

98%

2%

Data as of March 31, 2024.

Premium

Standard

Cloud Edition Paid

Seat Mix

15

FY20

Q3 FY24

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

Doubling down on Service Management

Jira Service Management (previously Jira Service Desk) emerged from Shipit, our quarterly

24-hour hackathon. It was built in response to customers who were adapting Jira to handle

service requests.

Four years ago, as the lines continued to blur between software development and IT, we

declared we would double down on the ITSM market. Atlassian is uniquely positioned to

bring dev and IT together onto a single platform. And we’re able to unlock high-velocity

service for customers at a price point that’s more accessible and quicker to deploy than

the competition. To accelerate our strategic vision and ITSM capabilities, we’ve

complemented our internal innovation with M&A, acquiring Statuspage, Opsgenie, Halp,

Mindville, ThinkTilt, Percept.AI, and, more recently, Airtrack.

Underpinned by our platform, we’ve been able to create a holistic, service management

solution that empowers development, IT, operations, and business teams to deliver

exceptional service experiences. As of Q3’24, Jira Service Management is now an

approximately $600 million annual revenue business and is the fastest-growing of our at-

scale products.

Today, over 50,000 customers rely on Jira Service Management to deliver legendary

service. But we’re still in the early days. Large companies are recognizing Jira Service

Management as an enterprise-grade service management offering. What’s more, Jira

Service Management was recognized as a Leader in the Forrester Wave™: Enterprise

Service Management, Q4 2023, achieving the highest possible score in the strategy

category. We’re also seeing more and more use cases outside of IT, as customers bring Jira

Service Management to service teams like HR, legal, facilities, and even customer support.

In fact, over 60% of Jira Service Management customers are now using it outside of IT.

The power we harness with all the knowledge stored in Confluence, plus the potential for

generative AI to unleash it, adds up to an enviable position. Atlassian is poised to do big

things in the service management market across both IT and business teams.

Our multi-year cloud journey

To help our customers realize their full potential, we knew we needed to accelerate their

journey to the cloud. Since announcing Server end of support (EOS) three-and-a-half years

ago, we’ve been laser-focused on migrating Server customers to our Cloud and Data

Center products, as well as driving Data Center-to-Cloud migrations.

For our customers, Cloud is the obvious final destination. Not only does it facilitate the best

experience and all the latest innovations like automation, analytics, and now AI, but it also

has a lower total cost of ownership and is exclusively home to new products like Loom, Jira

Product Discovery, and Compass.

Cloud now represents 61% of total revenue, up from 43% when we announced Server EOS

in October 2020.

$4,166

$3,535

$2,803

$2,089

$1,614

FY20

FY21

FY22

FY23

TTM Q3'24

$264

$401

$525

$608

$565

$264

$229

$202

$177

$139

$1,114

$819

$560

$336

$214

$2,524

$2,085

$1,515

$968

$697

Revenue by deployment

By fiscal year, U.S. $ in millions

CLOUD

DATA CENTER

MARKETPLACE & OTHER

SERVER

By fiscal year, U.S. $ in millions

16

Note: revenue totals may not foot due to rounding

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

We’ve increased the number of paid seats in the Cloud by over 3x during that time –

well exceeding our initial cloud migration projections, driven by strong Data Center-to-

Cloud migrations. We also saw less churn than we initially expected.

We’ve consistently said that migrations would be a multi-year effort, and Server EOS

was just one milestone on this journey. Today, we have more paid seats in the cloud

than on-premises. Plus, the overall opportunity to migrate our massive Data Center

installed base to Cloud in the coming years is bigger than we anticipated.

Data Center is a stepping stone for our customers to ultimately get to Cloud. The vast

majority of customers who have migrated from Data Center to Cloud began their

Atlassian journey on Server. We’ve seen Data Center-to-Cloud migrations building

each year, demonstrating customers' desire to move to the Cloud. All of this adds to

our confidence in the migration journey as these customers ultimately shift to Cloud in

future years.

Beginning

Ending

Future

Notes:

Ending balance includes an estimate of active Server seats post-end of support date.

Future is illustrative of the paid seat composition at an unspecified future date.

Cloud

Data center

Server

(10/31/20)

(3/31/24)

Paid Seats by Deployment

FY21

FY22

FY23

FY24E

Data Center to Cloud Migrations

Migrated seats

17

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

When we look at our remaining base of Data Center customers, they’re composed of

larger, more complex enterprises, including many of our largest customers. 94% of

Data Center migrators are choosing Premium or Enterprise editions in the Cloud,

driven by the enterprise-grade capabilities we’ve built and the innovation we’re

delivering in these higher-value editions, including analytics, automation, and now

Atlassian Intelligence.

The strong uptake of Premium and Enterprise editions upon migration yields

attractive economics:

What’s more, when we look at the customers that have migrated to Cloud, we’ve seen

great returns. The cohorts of customers that have migrated to the cloud expand their

number of seats by over 25% on average, one year post-migration. Cross-sell also

improves, for example, customers are twice as likely to own Jira Service Management

after migrating to Cloud.

Our platform investments have equipped us with building blocks for the future,

and we will leverage these to drive new product growth (both organic and inorganic).

Because of our common data model and deep understanding of teamwork, we’ve

built an in-product recommendation engine that helps customers adopt the next best

product for them.

All this results in a win-win situation for our customers and Atlassian. Our customers

get a significantly better experience in the cloud and solve more of their collaboration

challenges. This drives greater customer lifetime value in Cloud. When we look at the

cohorts of customers that had completed their migrations from Server or Data Center

to Cloud, their total annual spend in the Cloud was, on average, more than 2x higher

than their spend on-premises. You can understand why we’re excited about the

larger-than-expected opportunity to migrate our Data Center customers to Cloud

over the coming years.

Cloud

Standard

Cloud

Premium

Cloud

Enterprise

$227,000

$281,000

$343,000

$515,000

Data Center

DATA CENTER

5,000 user tier

CLOUD EQUIVALENT

4,250 users - Cloud Standard, Premium,

and Enterprise editions

ILLUSTRATIVE EXAMPLES OF CUSTOMER PRICING

DATA CENTER VS. CLOUD ANNUAL

Note: this represents annual Data Center and Cloud list prices as of March 31, 2024.

94% of Data Center migrators are choosing Premium or Enterprise editions in the Cloud.

CY20

CY21

CY22

CY23

20K users

Premium uptime SLAs

Data Residency in

Germany

35K users

Atlassian Analytics

& data lake

Data Residency in

Singapore and Canada

20K agents in JSM

Data residency for

United States,

European Union,

AU

SOC 2

Mobile app

management

Encryption at rest

Compliance for

regulated industries:

HIPAA, BaFIN, EBA

External user security

Privacy & security tab

in Marketplace

BYOK encryption

Compliance for

regulated industries:

TISAX compliance

10K users

GDPR,

ISO 27001

SAML SSO

policies

CY24

CY25+

Data Residency for India,

Japan, South Korea,

Switzerland, United Kingdom

Atlassian Guard Premium

Granular data opt out controls

50K users in JSW

150K users in Confluence

App access rule

BYOK: Customer-initiated keys

FedRAMP

Expanded compliance for

regulated industries:

StateRAMP, IL5, ITAR, C5,

IRAP

SHIPPED

Data Residency for Forge

SHIPPED

COMING SOON

94%

Atlassian Guard

18

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

Serving Enterprises

Over the past few years, we’ve increased our investment across product and go-to-

market in order to better serve our enterprise customers. This strategy has meant

strong growth in the segment and an even stickier customer base, as these larger

customers have a logo retention rate of 98%+.

We’re executing well against our strategy, with enterprise continuing to grow as a

proportion of our overall business:

$500K+

Customers

FY20

FY21

FY22

FY23

Q3'24

1,188

882

611

412

267

FY20

FY21

FY22

FY23

Q3'24

493

353

232

178

104

Total Sales

Data as of March 31, 2024.

Enterprise

Large Customer Growth

98%+ RETENTION RATE

Total SMB/ENT Mix

19

55% Y/Y

64% Y/Y

SMB

FY20

TTM Q3’24

61%

83%

39%

17%

39%

17%

$1M+

Customers

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

As well as in our cloud business:

And in a world increasingly focused on data compliance and regulation, our platform

becomes a huge advantage for our customers at the big end of town. We can build

these requirements into our platform from day one, so all products benefit. We believe

this will become an advantage as more data compliance and regulations roll out in the

different geographies and jurisdictions where our customers operate.

Looking ahead, we see a $14 billion opportunity within our existing enterprise

customer base alone. In the cloud, enterprise customers have a Net Expansion Rate

(NER) 10 points higher than the NER of our total Cloud customer base. We already

have a firm foothold within the largest enterprises in the world. 84% of the Fortune

500 and 61% of the Global 2000 are already Atlassian customers. Yet these two

cohorts only represent 9% and 23% of our business, respectively.

Looking forward, we have a runway to reach more technical users, and a significant

opportunity to address the collaboration needs of their business teammates. And we

know the bigger the customer, the more products they purchase - with customers

spending $500k+ and $1M+ annually, purchasing 7+ products on average.

10% 30%

FinTech Company

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

FY23

Clothing Retailer

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

FY23

Media Company

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

FY23

20

Enterprise

Cloud SMB/ENT Mix

SMB

Cloud Platform Sales

Data as of March 31, 2024.

FY20

TTM Q3’24

70%

90%

30%

10%

30%

10%

Annual spend

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

Accelerating AI

AI presents a game-changing opportunity for Atlassian. We believe there’s an infinite

appetite for software in this world, and software development is supply-constrained.

As AI increases the speed at which software is shipped, more software and more value

will be created. This is a great thing for Atlassian as it means a greater number of

people will be involved in building and operating software.

Thinking beyond just the software teams opportunity, we have been incredibly

thoughtful in how we can create a differentiated experience for customers with

Atlassian Intelligence. Being an R&D-led company gives us a disproportionate

advantage over many of our competitors as we have the talent and resources to

develop powerful capabilities that harness the unique teamwork data and knowledge

we have across our platform.

This product-led approach means creating high-value features that unleash the

potential of teams and drive sustained adoption.

A year ago, we launched Atlassian Intelligence at Team `23 to help teams boost

productivity with AI. The first wave of Atlassian Intelligence capabilities allows teams

to create pages of business-critical content in seconds, automate routine tasks by

asking in natural language, instantly summarize long-winded content, and easily

access context-specific help. We made these capabilities, along with Virtual Service

Agents, available exclusively in the Premium and Enterprise editions of our products.

To date, over 30,000 customers are using Atlassian Intelligence, with monthly active

users increasing 3x since launching to general availability in December 2023. Nearly

80% of users report saving time using AI search functions, and weekly users of

Atlassian Intelligence in Confluence tell us they’re saving over 45 minutes on average.

Beyond these capabilities, at Team `24 we have announced another 30 Atlassian

Intelligence features and capabilities deeply infusing AI ineveryAtlassian product and

platform experience.Loom AI furthers our commitment, with its AI capabilities

boosting viewer engagement by 18%, with 23 million videos enhanced by Loom AI,

and counting.

Introducing Atlassian Rovo

We’re now turning our attention to solving the highly complex problem of enterprise

search and knowledge discovery. We have over 20 years of data on how teams go

about planning and tracking work, setting goals, and unleashing knowledge. This,

paired with our cloud platform and open approach to integrations, means we’ve built

an extensive “teamwork graph” using first-party and third-party data. Our platform

investments in areas like Smart Links are used by millions of people each week,

meaning we have tons of information on how customers pull work together across all

their tools.

This has culminated in a brand-new product: Rovo. Although powered by Atlassian

Intelligence, Rovo will be sold separately. Rovo takes human-AI collaboration to the

next level by integrating contextual information, conversational AI, and agents into

workflows. It accelerates finding, learning, and acting on information dispersed across

a range of internal tools.

21

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

22

Enterprise search:

Search across data, tools, and platforms (yes, even third-party and home-grown

systems) to get contextual results within the Atlassian experience.

While central search is already part of the existing cloud experience, Rovo also takes

third-party data into account, leveraging the teamwork graph to improve the results

and rank content. Enterprise search not only works across third party tools, but

customers can bring in data from home-grown systems by connecting them to Rovo.

Chat and learn:

Provide a comprehensive understanding of companies' data through AI-driven

insights, knowledge cards, and AI chat for deeper data exploration.

Our always-available AI assistant leverages enterprise search and the teamwork graph

to enhance users' productivity in their daily use of Atlassian products. Our AI assistant

is unique because it exists within the workflow of our apps, optimizing for team over

individual productivity, which other AI assistants focus on.

Agents:

Partner with specialized agents to delegate tasks, organize work and help solve

complex problems.

Agents are AI-powered “teammates” that simplify specific tasks or rituals for

individuals and their teams. These agents can be tailored to the different needs of

each organization, and customers can even create their own. Rovo’s agents are

unique; they pair quality customer data and the teamwork graph, empowering every

team to build their own agents.

Rovo allows teams to @mention agents and bring them into the conversation across

workflows, or assign them work in Jira. Agents can create code and complete specific

tasks per the team’s instruction, and can also help write content on tailored company

knowledge.

Atlassian Rovo is the result of a continued and thoughtful investment in our AI future.

We know that with our breadth of users and team-centric data, we are in a unique

position to realize the huge opportunities that open up with AI.

We look forward to providing you updates about our progress and the big bets we’re

making with AI in the years to come.

Out-of-the-box

Build yourself

Marketplace

Rovo Agents

Search

Home

Recent

Spaces

Teams

Templates

Create

Share

Updates

/

...

/

FY24 Investor Day

Summarize

Q3 FY24

LEGAL DISCLAIMER

These FY24 Investor Day materials contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. All statements other than

statements of historical fact could be deemed forward looking. In some cases, you can identify these statements by forward-looking words such

as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “should,” “estimate,” or “continue,” and similar expressions or variations, but

these words are not the exclusive means for identifying such statements.

Atlassian undertakes no obligation to update any forward-looking statements made in these FY24 Investor Day materials to reflect events or

circumstances after the date of this event or to reflect new information or the occurrence of unanticipated events.

The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties, and

assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the

results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of

future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made.

These FY24 Investor Day materials include certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a

substitute for or superior to, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to

the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP

financial measures differently or may use other measures to evaluate their performance, any of which could reduce the usefulness of our non-

GAAP financial measures as tools for comparison. We have provided a reconciliation of these measures to the most directly comparable GAAP

measures on an Investor Relations data sheet on our Investor Relations website.

Further information on these and other factors that could affect our financial results is included in filings we make with the Securities and

Exchange Commission from time to time, including the section titled “Risk Factors” in our most recent Forms 10-K and 10-Q. These documents are

available on the SEC Filings section of the Investor Relations section of our website at: https://investors.atlassian.com.

ABOUT NON-GAAP FINANCIAL MEASURES

In addition to the measures presented in our condensed consolidated financial statements, we regularly review other measures that are not

presented in accordance with GAAP, defined as non-GAAP financial measures by the SEC, to evaluate our business, measure our performance,

identify trends, prepare financial forecasts and make strategic decisions. The key measures we consider are non-GAAP gross profit and non-GAAP

gross margin, non-GAAP operating income and non-GAAP operating margin, non-GAAP net income, non-GAAP net income per diluted share and

free cash flow (collectively, the “Non-GAAP Financial Measures”). These Non-GAAP Financial Measures, which may be different from similarly titled

nonGAAP measures used by other companies, provide supplemental information regarding our operating performance on a non-GAAP basis that

excludes certain gains, losses and charges of a non-cash nature or that occur relatively infrequently and/or that management considers to be

unrelated to our core operations. Management believes that tracking and presenting these Non-GAAP Financial Measures provides management,

our board of directors, investors and the analyst community with the ability to better evaluate matters such as: our ongoing core operations,

including comparisons between periods and against other companies in our industry; our ability to generate cash to service our debt and fund our

operations; and the underlying business trends that are affecting our performance.

Our Non-GAAP Financial Measures include:

•

Non-GAAP gross profit and Non-GAAP gross margin. Excludes expenses related to stock-based compensation, amortization of acquired

intangible assets, and restructuring charges.

•

Non-GAAP operating income and non-GAAP operating margin. Excludes expenses related to stock-based compensation, amortization of

acquired intangible assets, and restructuring charges.

•

Non-GAAP net income and non-GAAP net income per diluted share. Excludes expenses related to stock-based compensation, amortization of

acquired intangible assets, restructuring charges, gain on a non-cash sale of a controlling interest of a subsidiary, and the related income tax

adjustments.

•

Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of

property and equipment.

We understand that although these Non-GAAP Financial Measures are frequently used by investors and the analyst community in their

evaluation of our financial performance, these measures have limitations as analytical tools, and you should not consider them in isolation or as

substitutes for analysis of our results as reported under GAAP. We compensate for such limitations by reconciling these Non-GAAP Financial

Measures to the most comparable GAAP financial measures. We encourage you to review the tables in this shareholder letter titled

“Reconciliation of GAAP to Non-GAAP Results” and “Reconciliation of GAAP to Non-GAAP Financial Targets” that present such reconciliations.

We define the number of customers with Cloud ARR greater than $10,000 at the end of any particular period as the number of organizations with

unique domains with an active Cloud subscription and greater than $10,000 in Cloud ARR.

We define annual recurring revenue (“ARR”) as the annualized recurring run-rate revenue of subscription agreements to our Cloud and Data Canter

offerings at a point in time. We calculate ARR by taking the monthly recurring revenue (“MRR”) run-rate for Cloud and Data Center subscriptions

and multiplying it by 12. Cloud MRR for each month is calculated by aggregating monthly recurring revenue from committed contractual amounts

at a point in time. Data Center MRR for each month is calculated based on the annual contract value from committed contractual amounts at a

point in time. Cloud ARR on a single product basis is defined as Cloud ARR from subscriptions for that specific product. ARR and MRR should be

viewed independently of revenue and do not represent our revenue under GAAP, as they are operational metrics that can be affected by contract

start and end dates and renewal rates.

We calculate net expansion rate at a point in time by dividing MRR at the end of a reporting period (“Current Period MRR”) by the MRR for the

same group of customers at the end of the prior 12-month period. Current Period MRR includes existing customer expansion net of existing

customer contraction and attrition but excludes MRR from new customers in the current period.

23

Q3 FY24

ATLASSIAN CORPORATION

Reconciliation of GAAP to non-GAAP results

(U.S. $ and shares in thousands, except percentages)

(unaudited)

-G8FF8.CECE8GC

C8GCC1--5GC4C1--508878EGF

7E3CGF

2(%%)

1--5ECFFA8E ,%

:2:.-4.5:15

:41151.-15501.::.:

4C1--5ECFFA8E ,(

1--5CE8GA8E %

:2:.-4.5:15

:41151.-15501.::.:

4C1--5CE8GA8E ,

7J3CGF

2(%%)

1--5CE8GA8E (%

:2:.-4.5:15

:41151.-15501.::.:

4C1--5CE8GA8E (%

24

2

14FGFA

$$ $( ,,) )) $)(, )$ ), , ,,) )(( ,(

4CL-7F:FGAF

$)$) $,, $( $)$ $(( $, $$)) ))( $)$ $,$ $

4CL-FAQAFFLAAA:C

,(, , ), (), (), (),) () ( ( () $(

4CL 2-6LLA %

, (( ,$,

3F14FGFA

$,() $,,((( )$ $, , ,$,) ,,)(( , ,$ $(,,

02

14FA

,( ,( ,( , , , , , , , ,

4CL-7F:FGAF

% % % %

4CL-FAQAFFLAAA:C

% % % % % R R % R R %

4CL 2-6LLA %

R R R R R % R R R R R

3F14FA

, , , ,) ,) ,) ,( ,) ,( ,( ,)

14

14CFGG

,,, $,$ ,,) )) ( (( $),$ $ (), (),

2-7:GPG

$))( , , $$$, $), $)$, $($) (,( $() $$, $,

2-FAQAFFLAAA:C

$))

$)

,

,

,

,

,

,

,

4CL 2-6LLA %

$ $ $,

3F14CFGG

()$( $( ,)(( $ $),$ $,$ $, $$, ) )

3204

14ACG

,( $) (($( $)$ $)$,$ ,$ )$ ),)$ $,() ($ $

2-7:GPG

), ( ), $,( $() )) ,$$ $,, $ $)

2-FAQAFFLAAA:C

$) ,$, , (( () )( ( ,, )( $ ))

4CL 2-6LLA %

$) $ )

3F14ACG

(, $), () $ $((, $(, $))( ))$), $(,$ $,) $)(

4222

14CAAAG

)() $$ ($, $, $()$$ $)($ $( ))) $$ $( $((,(

2-7:GPG

((, ( ,), , ( )( $( ) )( ,

4CL 2-6LLA %

$, , )(

3F14CAAAG

$( (( ),( $$$,, $$), $( $($, ,, $ $$),, $$))$

202

14FGAAF CF

( $$) ,,, $)$() (, ( $), ,) $

4CL-7F:FGAF

)(( $ ( $)$ )(( () ($ ,$ (($ ,( ($,

4CL-FAQAFFLAAA:C

(( $( , ,) ,) $(( $ $ ,)$ $)$,

4CL 2-6LLA %

, ,( ,),

3F14FGAAF

)) ($, ) $, $ $,$$ (( )$$ , () $)($

2002

14FGAA

( ( %% %, ) % ) %

4CL-7F:FGAF

% % %, % , ( , )

4CL-FAQAFFLAAA:C

% % % % % % % % %

4CL 2-6LLA %

%% R R R R

3F14FGAA

) %, (

14

14GFA:PFGAAAA

(,( ,,) $ , $((( (), ( )$$$ $)),() ,(, ()(,

2-GACGAL

(, $( ( $),) ),$ ( ()( )), ( $(

0CFN

,) ( ()$ (,) $)( ,) ( (, $) )$ ((

%6LLAACLF:FGAFGCF:CAFFLF5085(0808

%

Reconciliation of GAAP to non-GAAP financial targets