PEBB Retiree Medicare Benefits

Engrossed Substitute Senate Bill 5187; Section 212(6); Chapter 475; Laws of 2023.

December 1, 2023

Employees and Retirees Benefits Division

P.O. Box 45502

Olympia, WA 98504

Phone: (360) 725-1612

Fax: (360) 586-9551

hca.wa.gov

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 2

Acknowledgement

HCA is appreciative of the participation of the PEBB members as well as the Stakeholders Medicare

Coalition in providing feedback on the retiree experience.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 3

Table of contents

Executive summary ............................................................................................................................................................................. 4

Background ............................................................................................................................................................................................ 5

PEBB Program overview .............................................................................................................................................................. 5

PEBB Medicare retirees – enrollment trends ................................................................................................................ 6

Overview of PEBB Medicare plans .................................................................................................................................. 13

Overview of CMS Medicare Advantage Program .................................................................................................... 26

Benefit of remaining in PEBB Medicare plans ........................................................................................................... 29

HCA survey of PEBB retirees ............................................................................................................................................. 30

2022 Proposal to consider closing UMP Classic Medicare Plan ....................................................................... 31

Findings ................................................................................................................................................................................................ 33

2023 PEBB retiree listening sessions ............................................................................................................................. 33

50 State comparison of state-sponsored health benefits for public sector Medicare retirees report

........................................................................................................................................................................................................ 50

Options and considerations to reduce UMP Medicare premiums .................................................................. 58

Conclusion ........................................................................................................................................................................................... 69

Appendix .............................................................................................................................................................................................. 72

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 4

Executive summary

Engrossed Substitute Senate Bill 5187 (2023) requires the Health Care Authority (HCA) to gather member

feedback about Public Employee Benefits Board (PEBB) retiree Medicare benefits and provide a final

report to the legislature with the intent to inform future health care plan selections.

By December 1, 2023, the authority must report to the legislature with its findings,

including an analysis of government self-insured plans with benefits that are equal to

or richer, and with more affordable premiums, than Uniform Medical Plan Classic

Medicare. (Sec. 212(6))

HCA invited PEBB retiree members to participate in listening sessions (held from February through May

2023) to assess retiree satisfaction with the current plan offerings. One hundred and ninety-three retirees

participated. Most had positive things to say about their plan and identified one or more challenges.

Feedback for each of the four PEBB Medicare health plan carriers includes:

• Kaiser members report their plan offers good coverage for an affordable price, although some

feel provider availability is limited and wait times to see a provider can be long.

• Premera plan members appreciate the coverage and the affordability of the plan, but wish the

plan covered additional benefits such as gym memberships, hearing aids, and naturopathy.

• UnitedHealthcare (UHC) members like the affordability of the premiums, and the additional

benefits such as massage and gym membership, but express frustration with UHC’s customer

service and the pharmacy coinsurance costs.

• Uniform Medical Plan (UMP) members speak highly about the quality of coverage and customer

service, but feel the plan is too costly, although some maintain the cost is worth it.

HCA completed an analysis of all 50 states’ government plan offerings to find examples of how to

maintain the quality and benefits UMP Classic Medicare offers, while reducing costs. The analysis found

Medicare supplement plans varied by state. No other state was found to have benefits equal to or richer

than UMP Classic Medicare with lower premiums. There are several pharmacy and medical coverage

alternatives for UMP Classic Medicare that could result in significant retiree monthly premium savings:

• The greatest savings would come from converting the UMP Medicare pharmacy benefit to a self-

funded Part D Employer Group Waiver Plan (EGWP), which would take advantage of federal

subsidies and drug discounts. Additionally, an EGWP could be customized to provide pharmacy

coverage that is like the current coverage offered through UMP. This would limit the impact to

retirees’ out-of-pocket costs, although there could be some disruption due to differences in how

the pharmacy benefit would be administered under Part D.

• Premiums could be lowered by changing the UMP coordination provisions when Medicare pays

primary. This would shift retiree costs from premium to out-of-pocket spending (deductible and

cost-share).

Finally, the pharmacy and medical options could be combined for even greater premium relief. For

example, changing the UMP coordination provisions to a carve out with no coordination of benefits

(COB) savings bank, combined with a standard self-funded Part D EGWP, could result in additional

savings. Milliman’s full report provides projected savings for each of these coverage combinations.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 5

Background

PEBB Program overview

HCA purchases and manages health care and other insurance benefits for more than 385,000 eligible

public employees, retirees, continuation coverage members, and their dependents through the PEBB

Program and over 273,000 eligible school employees and their dependents through the School

Employees Benefits Board (SEBB) Program. SEBB members are eligible for PEBB retiree benefits upon

retirement from school employment. Employers who access PEBB Program coverage include state

agencies, institutions of higher education, and a variety of public agencies who contract with HCA for

these benefits (e.g., counties, municipalities, tribal governments, and political subdivisions). The PEBB

Program in its current form dates to the 1980s. Before that, state employee and higher education

employee benefits were provided through the Department of Personnel and the State Employee

Insurance Board.

The PEBB Program is overseen by the PEB Board, which is comprised of 8 members appointed by the

Governor. Each Board member serves two-year terms; one of the Board members serves in a non-voting

capacity. The Board meets from January to July each year to authorize employee and retiree health care

benefits

1

, and each year approves the benefit design and premium rates that will be offered to employees

and retirees in the following year. The PEBB Program’s plan year for benefits coverage begins in January

and annual open enrollment occurs November of each year.

Proposals for new or enhanced benefits come from many sources including Federal and state regulatory

sources, the state Legislature, the PEB Board, HCA customer service, payers, and through monitoring of

trends in industry benefits. The timeline for consideration of a benefit enhancement can run from 12

months to 36 months, and is constrained by the calendar year plan design, competitive procurement

requirements, HCA staff workloads, and, in some cases, legislative action or input.

Figure 1 - PEBB Program benefit planning cycle

1

RCW 41.05.065 describes the duties of the PEB Board and establishes the level of benefits for employees

and retirees: RCW 41.05.065 (2) “The public employees' benefits board shall develop employee benefit

plans that include comprehensive health care benefits for employees.” (3) “To maintain the

comprehensive nature of employee health care benefits, benefits provided to employees shall be

substantially equivalent to the state employees' health benefit plan in effect on January 1, 1993.” (4)

“Except if bargained for under chapter 41.80 RCW, the public employees' benefits board shall design

benefits and determine the terms and conditions of employee and retired or disabled school employee

participation and coverage, including establishment of eligibility criteria...”

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 6

As shown in the above example, a decision in July 2023 (by the PEB Board or at the end of a legislative

session) may not be implemented until January 2025, and could be later if it involves a complex

procurement, or encounters complications or delays.

PEBB Medicare retirees – enrollment trends

As of June 2023, 76,547 PEBB Medicare retiree subscribers, and 30,229 spouses and dependents were

enrolled in one of the Medicare plans offered through the PEBB Program for a total of 106,776 PEBB

Medicare retiree members.

As shown in Chart 1 below, since 2018, the total number of PEBB Medicare subscribers has increased an

average of 2.9 percent per year increasing from 66,206 in 2018 to 76,547 subscribers in 2023.

Chart 1: PEBB Medicare retiree subscribers 2018 to 2023

Every year, approximately 5,400 PEBB and SEBB active employees retire from employment. During the

period from 2018 to 2022, an average of 2,890 PEBB subscribers and 2,525 SEBB subscribers changed to

retiree status each year. Some employees retire before reaching age 65 and are not eligible for the PEBB

Medicare plans upon retirement, but they may be able to continue with their PEBB or SEBB plans through

COBRA , choose a non-Medicare retiree plan, or defer PEBB coverage until they reach age 65.

2

An average of 8,184 PEBB and SEBB subscribers enrolled for the first time in one of the PEBB Medicare

health plans during each of the years 2021 and 2022.

As shown in Table 1 below, the proportion of Medicare retiree members (including spouses and

dependents) within PEBB compared to other PEBB & SEBB members (including active employees, retirees

2

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers the right to choose to

continue their group health benefits for limited periods of time after a job loss.

66,206

68,752

70,715

72,605

74,809

76,547

60,000

62,000

64,000

66,000

68,000

70,000

72,000

74,000

76,000

78,000

2018 2019 2020 2021 2022 2023

Subscribers

PEBB Medicare Retiree Subscribers

June 2023

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 7

who are not yet on Medicare, and spouses and dependents) has remained relatively stable since 2020. As

of June 2023, PEBB Medicare retiree membership (including spouses and dependents) comprised 16

percent of overall PEBB and SEBB membership; a proportion that has trended slightly upward since 2020.

Table 1: PEBB Medicare retiree members compared with total

2020

2021

2022

2023

PEBB Medicare Re�ree Members

98,942

101,743

104,815

106,776

Other PEBB & SEBB Members

540,803

546,214

549,516

558,348

Total PEBB & SEBB Members

639,745

647,957

654,331

665,124

Enrollment by plan

As of June 2023, approximately 42 percent of PEBB Medicare subscribers (32,455) were enrolled in

Uniform Medical Plan (UMP) Classic Medicare; 25 percent were enrolled in one of the Kaiser plans

(18,971); 20 percent were enrolled in Premera Plan F or G (14,894); and 13 percent were enrolled in one of

the UnitedHealthcare (UHC) plans (10,227).

Chart 2: PEBB Medicare subscribers by plan

During the period from 2021 to 2023, the Kaiser and UMP plans lost enrollment, while Premera and UHC

each gained enrollment in their plans. UHC added 7,221 new subscribers in 2023 and Premera gained

32,455

18,971

14,894

10,227

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

UMP Kaiser Premera UHC

Subscribers

PEBB Medicare Subscribers

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 8

1,003 new subscribers. This jump in enrollment for both UHC and Premera in 2023 coincided with a large

increase in premium costs in 2023 for the UMP Classic Medicare plan.

Table 2: Medicare subscriber enrollment by plan– 2021 to 2023

2021 2022 2023

Change

2021 - 2023

Pct. Change

2021 - 2023

UMP

38,965

38,784

32,455

(6,510)

-16.7%

Kaiser

19,425

19,128

18,971

(454)

-2.3%

Premera

13,036

13,891

14,894

1,858

14.3%

UHC

1,179

3,006

10,227

9,048

767.4%

Chart 3: PEBB Medicare subscriber enrollment by plan

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

UMP Kaiser Premera UHC

Subscribers

Medicare Subscriber Enrollment by Plan

2021 2022 2023

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 9

Chart 4: PEBB Medicare retiree Subscribers by age group 65 and older

Half (37,867) of all PEBB Medicare retiree subscribers are aged 65 to 74. Another 37 percent (28,574) are

aged 75 to 84; 12 percent (8,822) are age 85 to 94; and 1 percent (863) are age 95 or older.

Chart 5: 2023 PEBB Medicare Subscribers by plan and by age

13,056

8851

9,298

6,662

14,165

7643

3,737

3,029

4,567

2,184

1,616

455

420

221

201

21

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

UMP Kaiser Premera UHC

2023 Medicare Subscribers by Plan and by Age

65-74 75-84 85-94 95+

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 10

As of 2023, UMP had the oldest subscriber membership, with only 41 percent of UMP subscribers in the

age 65 to 74 group (compared with 50% in that age group for the PEBB Medicare population overall).

Forty-seven percent of Kaiser subscribers were in the 65 to 74 age group. UHC and Premera had the

youngest subscriber membership, 66 percent in UHC and 63 percent in Premera were in the 65 to 74 age

group.

Chart 6 below shows the aging trend for UMP since 2018. Those in the 65 to 74 age group have been

leaving the plan since 2018 with a steep drop from 2022 to 2023, again coinciding with large premium

increases for those last two years.

Chart 6: UMP subscribers by age 2018 to 2023

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 11

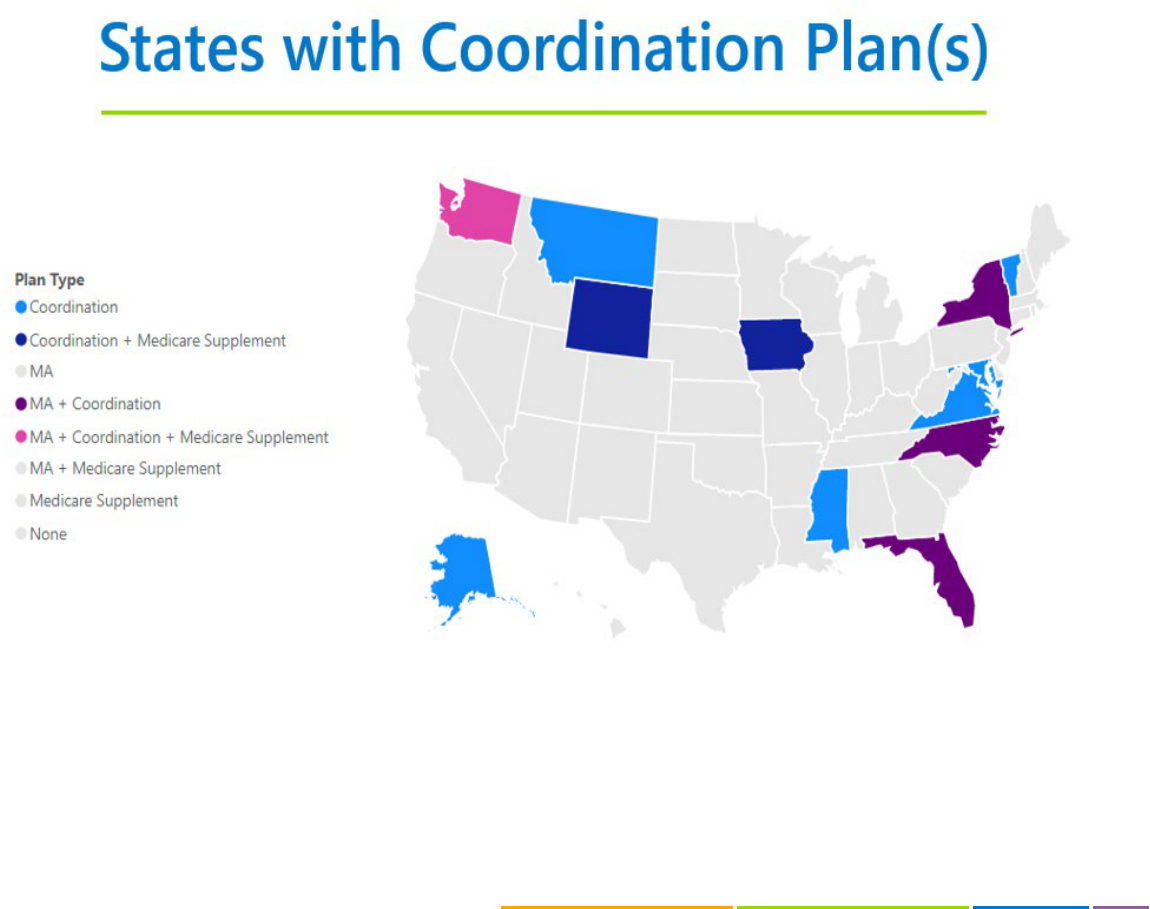

PEBB Medicare subscribers by state

Ninety-two percent of PEBB Medicare subscribers receive their benefits in Washington state, and the rest

are in every state in the US, plus Washington, D.C. The table below shows the top ten states (after

Washington) where PEBB Medicare subscribers receive their benefits, and the map on the following page

shows additional states where there are PEBB Medicare retirees. A full list of the number of subscribers by

state is shown in Appendix 1.

Table 3: PEBB Medicare retiree subscribers by state – Washington plus top 10

State

Subscribers

WA

70,375

AZ

1,243

ID

1,077

OR

1,007

CA

536

MT

269

TX

265

FL

249

NV

189

UT

124

CO

114

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 12

Figure 2: Map of PEBB Medicare subscribers by state

June 2023

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 13

Overview of PEBB Medicare plans

PEBB Medicare retiree risk pool and plan offerings

Under RCW 41.05.080, eligible state and school employees may continue their participation in PEBB

medical plans after retirement or disablement. The premium rates for those who are eligible for and enroll

in Medicare Part A and Part B are calculated separately from the non-Medicare risk pool, which includes

employees and non-Medicare retirees.

Since January 2021, the PEBB Program has offered four different Medicare plan types and eight distinct

plans to eligible retirees and their dependents who are enrolled in Medicare.

Figure 3: PEBB Program Medicare Plan Types

UMP Classic Medicare has the same benefits as UMP Classic offered to PEBB employees, but coordinates

coverage with Medicare for medical services covered by Medicare Part A and Part B

3

. This means that

Medicare is the primary payer (i.e., pays first) for these medical services, and UMP is the secondary payer

(pays after Medicare). UMP Classic Medicare also includes the same prescription drug benefits that

3

Medicare Part A covers inpatient care in hospitals, skilled nursing facility care, hospice care, and home

health care. Medicare Part B helps cover services from doctors and other health care providers.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 14

employees receive, but the plan is the only payer for these pharmacy claims. Original Medicare (Part A

and Part B) does not cover prescription drugs with the exception that some infusions and vaccines are

covered under Part B. The UMP Classic Medicare prescription drug benefit is creditable drug coverage,

not a Part D product, and does not receive several sources of federal funding that are only available to

Part D prescription drug plans.

The Kaiser Washington Original Medicare plan is only intended for PEBB Medicare retirees who are

outside of the Kaiser Washington Medicare Advantage (MA) service area. The premiums for this plan are

calculated independently and then blended with the Kaiser Washington MA plan premium based on

enrollment. Retirees who enroll in either plan pay the same blended premium.

The United HealthCare Medicare Advantage plus Part D (MA-PD) plans are the only plans in the PEBB

Medicare risk pool that offer prescription drug coverage through Part D. The Medicare Modernization Act

(MMA) of 2003 created Medicare Part D, which covers prescription drugs for Medicare enrollees through

private insurance plans. Part D plans may be offered through an employer, on the individual market, or

they may be integrated with medical coverage under an MA-PD plan.

• Employers - Part D Prescription Drug Plans (PDPs) can be offered exclusively by an employer to its

eligible retirees via an Employer Group Waiver Plan (EGWP).

• Individual Market - Part D Prescription Drug Plans (PDP) are available to all Medicare enrollees.

• Integrated - Medicare Advantage plans may also offer Part D prescription drug coverage. MA-PD

plans may be offered by employers or available to all Medicare enrollees on the individual market.

A plan’s list of covered drugs is called a “formulary,” and each plan has its own unique formulary. Plans

typically place drugs into different levels, called “tiers,” that have an associated patient cost-share. All

Medicare Part D drug plans must cover a wide range of prescription drugs including most drugs in

protected classes like cancer drugs, antivirals to treat HIV/AIDS, antipsychotics, and antidepressants.

Commercial prescription drug plans, such as that offered through UMP, and Medicare Part D drug plans

also have coverage rules for managing utilization, such as:

• Prior Authorization - the prescriber must contact the plan before covering certain prescriptions.

The prescriber may need to show that the drug is medically necessary for the plan to cover it.

• Quantity limits – for safety or cost reasons, plans may limit the amount of prescription drugs they

cover over a certain period. Some plans have an administrative process for requesting an

exception to the quantity limits.

• Step therapy –a type of prior authorization where the subscriber needs to try certain, less

expensive drugs on the plan’s formulary that are considered effective for most people with the

condition before they can move up a “step” to the requested drug.

PEBB Medicare subsidies

There are several different subsidies related to PEBB Medicare retiree coverage, as described in the table

below.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 15

Figure 4: Types of PEBB Medicare Subsidies

To the plan To retirees To the State

Federal Medicare subsidies

for Part C (Medicare

Advantage) and Part D

(Prescription Drug) plans

Washington State “Medicare

Explicit Subsidy”

Federal Retiree Drug Subsidy

(RDS)

•Provided by Centers for

Medicare and Medicaid

Services (CMS) to the plan to

reimburse for Medicare-

covered services and a large

portion of prescription drug

costs (for Part D Plans).

•Reduces overall plan costs and

the amount members pay in

premiums.

•Risk-adjusted and varies by

plan, but typically covers 100%

of Medicare-covered medical

services and ~74.5% of

pharmacy costs based on the

Standard Defined Part D

benefit.

•Described in the state budget.

•Subsidizes a portion of the

member’s monthly premium

(In 2024, $183 or 50% of the

carrier’s final bid rate,

whichever is less).

•Premiums approved by the

PEB Board have the subsidy

applied.

•A subsidy received by the state

and deposited into the

General Fund each year for

offering prescription drug

coverage to retirees that is at

least as generous as Medicare

Part D.

•Historically, the annual RDS

equals ~$22-$26M. This is

intended to offset the cost to

the employer of offering

prescription drug coverage.

Within UMP, the subsidy is a

small percentage of plan

spending on prescription

drugs.

•Not directly applied to

member premiums.

Federal Medicare subsidies for Part C (Medicare Advantage) and D (Prescription Drug) plans. Direct

and indirect funding for Part C and Part D plans is described in more detail in the following section.

Washington State “Medicare Explicit Subsidy”

This is described in RCW 41.05.085 and is provided to retirees via a reduction to monthly PEBB Medicare

health plan premiums. The amount of the premium reduction is established by the PEB Board and shall

not be more than fifty percent of the premium. The maximum value of the subsidy is set by the

Legislature in the state budget. For 2024 it is $183 or 50 percent of the plan’s premium, whichever is less.

The premiums approved by the Board have the maximum value of the subsidy applied. HCA collects the

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 16

subsidized (lower) premiums from the retiree and pays the health plans the full premiums (i.e., the “bid

rate”).

4

Federal Retiree Drug Subsidy (RDS)

The state also receives a subsidy for providing creditable prescription drug coverage through UMP Classic

Medicare, Kaiser Permanente Washington (Kaiser Permanente WA) Original Medicare and Medicare

Advantage, and Kaiser Permanente Northwest (Kaiser Permanente NW) Senior Advantage. To be eligible

for this subsidy, called the Retiree Drug Subsidy or RDS, prescription drug coverage must be at least as

rich as the standard Part D benefit. The total value of the subsidy is historically around $22-$26M but

varies based on enrollment and drug expenditures. It is deposited into the General Fund – State. Table 4,

below, shows how the maximum dollar limit of the subsidy has changed from 2016 to 2023.

Table 4: Medicare Explicit Subsidy maximum dollar limit, 2016 to 2024

2016

2017

2018

2019

2020

2021

2022

2023

2024

$150

$150

$150

$168

$183

$183

$183

$183

$183

MA and Medicare Part D subsidies

CMS pays a per beneficiary capitated payment to MA plans based on average spending under traditional

fee-for-service (FFS) Medicare, adjusted for the MA plan’s service area. This establishes the benchmark

that MA plans bid against based on their projected costs. Plans with bids above the benchmark have

higher premiums. Most plans bid below the benchmark and can use the resulting rebate to lower out-of-

pocket costs and/or cover supplemental benefits.

Medicare Part D plans and MA-PD plans receive federal funding to reimburse a portion of prescription

drug costs. This revenue reduces the plans’ overall costs and therefore the amount that is passed to

members as a monthly premium. The payments are adjusted based on the reported risk of the population

and cover about 74.5 percent of pharmacy costs based on the standard Part D benefit. This funding is

provided directly from CMS and indirectly through drug manufacturer discounts:

• A per beneficiary capitated payment from CMS, or direct subsidy, calculated as a share of the

adjusted national average of plan bids.

• Individual reinsurance through which CMS pays 80 percent per enrollee of drug spending above

the standard Part D out-of-pocket threshold.

• Manufacturer discount program, or drug manufacturer discounts for brand name drugs in the

Part D coverage gap.

Medicare also pays all or most of the premium for low-income beneficiaries up to a threshold that is

established based on the enrollment-weighted average premium per Part D region.

4

UMP Classic Medicare is a self-insured plan that pays its own claims; HCA does not pay a monthly

premium to Regence, the third-party administrator.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 17

Retiree Drug Subsidy Program

Congress enacted the Retiree Drug Subsidy (RDS) Program in December 2003 to reimburse plan sponsors

for a portion of their covered retirees' qualifying costs for prescription drugs. Through the subsidy, CMS

reduces employers’ financial obligation for offering non-Part D prescription drug coverage by reimbursing

the equivalent of 28 percent of each retiree’s allowable drug expenses that fall between the federally

designated cost threshold amount and the cost limit. The amount up to the cost threshold is not eligible

for subsidy, and the amount exceeding the cost limit is not eligible for subsidy. These amounts are

adjusted annually by CMS.

Table 5 5: RDS cost threshold and cost limit by plan year

Plan Year Ending

Cost Threshold

Cost Limit

2020

$435

$8,950

2021

$445

$9,200

2022

$480

$9,850

2023

$505

$10,350

2024

$545

$11,200

To qualify for the subsidy, a plan sponsor, in this case HCA, must show that its eligible plans’ drug

coverage is “actuarially equivalent” to, or at least as generous as, the defined standard Medicare Part D

benefit. This test looks at a plan’s spending on prescription drugs and the amount that enrollees pay for

premiums and cost-shares (copays/coinsurance and deductibles) compared to what they would pay under

the standard Part D benefit. It also factors in the value of employer financing of drug coverage, such as

the Medicare Explicit Subsidy.

RCW 41.05.068 authorizes HCA to participate as an employer-sponsored program to receive the RDS “for

continuing to provide retired employee health coverage, including a pharmacy benefit” and “any

employer subsidy moneys received from participation in the federal employer incentive program shall be

deposited in the state general fund.”

The HCA has qualified for the RDS since 2006 for UMP Classic Medicare, Kaiser Permanente WA Original

Medicare and Medicare Advantage, and Kaiser Permanente NW Senior Advantage plans. However, as

retiree premiums have increased, particularly for UMP Classic Medicare, the HCA may eventually no

longer meet the actuarial equivalence test to qualify for the RDS. The Medicare Explicit Subsidy is a key

component for PEBB to qualify for the RDS. If the explicit subsidy is fixed at a certain dollar amount,

eventually the plans’ increasing pharmacy costs will lower the value of the pharmacy benefit below the

standard Part D benefit. In other words, the plans will not pass the required actuarial equivalence test for

“net value” after the explicit subsidy is applied.

For 2024 the Legislature set the monthly retiree subsidy at a maximum of $183 per member per month.

Based on pharmacy claims costs through part of 2022 and pharmacy trend assumptions, HCA is projected

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 18

to retain eligibility for the RDS through 2025. However, this timeline may be earlier if pharmacy costs rise

more swiftly, or if changes are made to the pharmacy benefits offered by the plans.

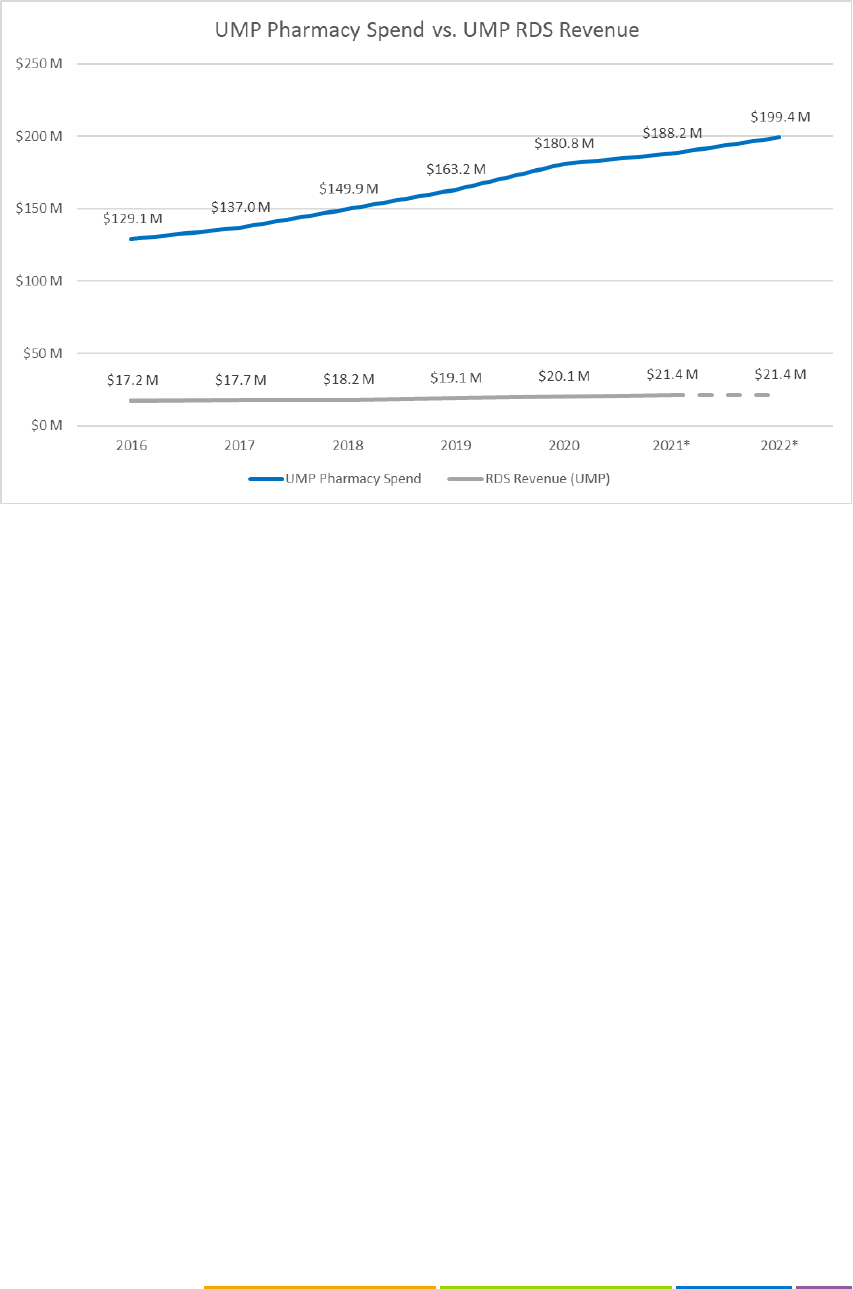

While the RDS provides revenue to the state, it is a small amount relative to what is spent on the Medicare

Explicit Subsidy and as a percentage of overall prescription drug spending. The line graphs below show: 1)

RDS revenue for all eligible plans (UMP Classic Medicare, Kaiser Permanente WA Medicare Advantage and

Original Medicare, and Kaiser Permanente NW Senior Advantage) compared to total state expenditure on

the Medicare Explicit Subsidy; and 2) RDS revenue attributed to UMP Classic Medicare from 2016 through

2021, which is the last reconciled year, compared to prescription drug spending by the plan gross of

rebates. Furthermore, the value of the RDS contributes indirectly to the explicit subsidy as a deposit into

the General Fund but is not directly factored into PEBB Medicare retiree premiums. If RDS revenue came

directly to HCA, the reduction to premiums would likely be minimal given the value compared to the

plan’s total drug costs. This would also represent an increase to the state’s investment in PEBB Medicare

premiums (i.e., the explicit subsidy).

Chart 7: Medicare Explicit Subsidy expenditures vs. RDS revenue,

2010 to 2022 (projected)

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 19

Chart 8: UMP Classic Medicare Prescription Drug Cost (Gross of Rebates) vs. RDS

Revenue, 2016 to 2021

UMP Classic Medicare

UMP Classic Medicare is a self-insured coordination of benefits (COB) plan with creditable (non-Part D)

prescription drug coverage. Due to this structure, and because the plan is not eligible for several sources

of federal funding only available to Part D plans, UMP’s premium is significantly higher than other PEBB

Medicare plans. Without structural changes to UMP Classic Medicare, this trend of steadily increasing

premiums that are higher than other plans will continue.

Coordination of Benefits & COB Savings Bank

There are several ways that plans can design coordination provisions for retirees who have Medicare as

their primary medical coverage (Original Medicare Part A and Part B):

• Carve-out: the plan calculates what it would pay toward the claim (the “normal benefit”), then

reduces its payment by the amount that Medicare pays. Any remaining amount is the member’s

cost-share.

• Maintenance of benefits (MOB): the plan subtracts Medicare payments from the total allowed

amount, then applies the plan’s benefit limits and cost sharing to whatever amount remains. Any

remaining amount is the member’s cost-share.

• Coordination of benefits (COB): Medicare is treated as the primary carrier and plans pay all

amounts not covered by Medicare up to the amount that would be paid in the absence of

Medicare. This typically results in no member cost-share for Medicare-covered services.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 20

UMP Classic Medicare uses a COB approach to pay secondary to Medicare for services covered by

Medicare Part A and Part B. This means that when UMP pays secondary to Medicare, the plan covers any

member cost-sharing. If the service is not covered at all by Medicare, UMP is the primary, or only, payer.

5

COB plans have the most generous coverage levels, followed by MOB and carve-out. The table below

provides a hypothetical illustration of how member cost-share is calculated under each of these types of

coordination provisions.

Table 6: Types of coordination plans - illustration

In this hypothetical scenario a provider bills $200 for a service. The plan allowed amount, which is also the

Medicare allowed amount, is $100. In each case, the member pays a 15 percent coinsurance, and the plan

pays the remaining 85 percent. If the plan were primary, it would pay $85 of the $100 allowed amount.

But Medicare is the primary payer, and covers 80 percent, or $80 of the $100.

Under a carve-out design, the plan calculates what it would pay toward the claim, which is $85, and

reduces its payment by the amount that Medicare pays, which is $80. The plan then pays $5, and the

retiree pays the remaining $15.

Under a maintenance of benefits design, the plan subtracts the Medicare payment ($80) from the total

allowed amount ($100) and applies the plan’s benefit limits and cost-sharing to the amount that remains.

In this case $20 remains, so the plan covers 85 percent of $20, or $17. The retiree then pays the remaining

example $3 for services.

Under a coordination of benefits design, Medicare pays first ($80), and the plan pays the rest of the

allowed amount ($20). The retiree pays $0. UMP Classic Medicare also has a unique feature that allows

members to use savings accrued in their “COB Savings Bank” to cover out-of-pocket costs for the UMP

deductible or services not covered by Medicare. The COB Savings Bank transfers the plan’s savings

(resulting from Medicare primary coverage) to the member, up to the amount of the member’s out-of-

pocket spending. In other words, the COB Savings Bank gives back to retirees the amount that the plan

5

In addition to medical services and prescription drugs, UMP Classic Medicare covers benefits not

covered by Original Medicare such as massage therapy, hearing aids, routine hearing exams, and vision

care. See the 2023 UMP Classic (PEBB) Certificate of Coverage for a full listing of benefits.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 21

saves with Medicare as the primary payer for Part A- and Part B-covered services. For services not covered

by Medicare Part A and Part B, such as massage therapy, hearing aids, or vision hardware, the amount of

COB savings is typically enough to cover any out-of-pocket costs for those services plus some or all the

UMP Classic Medicare deductible.

Below is an example of how COB savings are accrued after a retiree meets the $250 UMP medical

deductible:

Table 7: Illustration of how COB Savings are acrued

In 2022, more than 95 percent of UMP Classic Medicare members accrued COB savings. Regence as third-

party administrator (TPA) tracks how much members have paid out of pocket during the year, and the

amount of COB savings accrued. They send a check to pay back out-of-pocket expenses, such as the

medical deductible or retiree cost-share, for services not covered by Medicare. Members only receive a

COB Savings Bank check for non-Medicare covered services that they have paid for out-of-pocket; UMP

Classic Medicare does not reimburse members for more than they have paid. Members who use more

Medicare-covered services accrue greater COB savings which can be used to pay for non-Medicare

benefits. The COB Savings Bank lowers or eliminates cost-sharing for members who use non-Medicare

covered services but increases overall plan costs and therefore monthly premiums.

Rate development

UMP Classic Medicare is a self-insured plan

6

that coordinates coverage with traditional Medicare and is

administered by Regence BlueShield. As the TPA, Regence provides full claims services, manages the

provider network, performs utilization management, administers specialized benefit programs, and

provides member services including customer service, plan materials, and other resources. The HCA sets

6

In a self-insured, or self-funded plan, the sponsor (typically an employer or union) pays the health claims

of the members enrolled in the plan. This is in contrast with a fully insured plan, where the sponsor pays a

per member monthly premium to the health insurance company.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 22

UMP rates each year in consultation with contracted actuaries at Milliman. The goal of this annual process

is to set rates based upon projected costs to pay claims (including statutorily mandated reserves) and

administer the plan. UMP rates do not include a profit margin.

The bid rate reflects the total average price per member, per month, to enroll in a plan. The premium is

the amount that retirees pay per month for coverage and is calculated as the bid rate minus the Medicare

explicit subsidy, plus the HCA administrative fee. The value of the Medicare Explicit Subsidy is calculated

according to each plan’s final accepted bid rate, as illustrated in the example below.

Figure 5: Illustration of PEBB Medicare premium calculation

The UMP Classic Medicare bid rate is comprised of projected pharmacy and medical costs. While UMP

coordinates payment of Medicare-covered medical services with CMS, UMP is the only payer for

pharmacy; there is no coordination with Medicare for incurred pharmacy costs. Therefore, pharmacy costs

are a significant contributor to UMP Medicare’s annual bid rate development and represent more than

60% of plan spending, as reflected in Figure 6, below.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 23

Figure 6: UMP Classic Medicare percentage of total spend by major service

categories, 2018 -– 2022

Additionally, UMP Classic Medicare covers supplemental benefits such as vision and hearing instruments

that Medicare does not cover. For these medical services, UMP does not coordinate payment with

Medicare. UMP Classic Medicare’s unique COB Savings Bank, discussed earlier, is often applied to cover

out-of-pocket retiree costs for the UMP deductible and services not covered by Medicare. The COB

Savings Bank transfers the plan’s savings resulting from Medicare primary coverage to the member, up to

the member’s out-of-pocket spending, leaving most retirees with $0 out-of-pocket medical costs. If these

savings were to remain with the plan instead of being passed to the individual member, the premium for

all members would be reduced while most members’ out-of-pocket costs would increase. This is

discussed later in the Options and Considerations section of this report.

The UMP Medicare rate is significantly higher than other plans in the risk pool due to a combination of

the cost of prescription drug coverage (which is not offset by federal subsidies available to Part D plans),

coverage for many non-Medicare covered services, and low or no member cost-sharing for non-Medicare

covered medical services through the COB savings bank. The figure below captures this dynamic (all

numbers are for illustrative purposes only).

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 24

Figure 7: Illustration of impact of Medicare subsidies on premiums

For UMP Classic Medicare, the total average cost is $1,350 per member for monthly medical and

pharmacy claims. Medicare pays primary on the portion of the medical claims that are covered by

Medicare ($700). The medical cost ($250) and pharmacy cost ($400) are not covered by Medicare but are

covered by UMP and represent the total bid rate of $650. The bid rate is discounted by the state-applied

$183 Medicare Explicit Subsidy, leaving $467 to be paid by the retiree as a monthly premium.

For the MA-PD plan, the total average is $1,000 per member for monthly medical and pharmacy claims.

The Part C medical portion ($650) and the Part D pharmacy portion ($150) of the member’s costs is

covered by Medicare, for a total bid rate of $200. The total bid rate represents the cost of non-Medicare

covered benefits (supplemental benefits) and lower member cost-sharing compared to Original Medicare.

This amount is discounted by the $100 Medicare Explicit Subsidy, leaving $100 to be paid by the retiree as

a monthly premium.

Despite paying secondary to Medicare on most medical claims, UMP total plan costs and member

premiums are higher than the MA-PD plans. This is because UMP provides full coverage for certain non-

Medicare covered medical services, reimburses members through the COB savings bank, and does not

benefit from risk-adjusted CMS Part D subsidies and Part D pharmacy discounts. Part D plans are

significantly advantaged over creditable drug coverage plans because there are several different sources

of federal funding, as described earlier in this report (Risk-adjusted direct subsidy, Federal reinsurance, and

Coverage gap/manufacturer drug discount program) that cover a large portion of drug costs and keep

premiums low.

Chart 9 shows that even before the introduction of MA-PD plans in the PEBB Medicare risk pool, UMP

Medicare had historically higher bid rates than the other plan offerings. High annual rate increases for

UMP Medicare are expected to continue in future years, particularly if members continue to shift to the

other plans.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 25

Chart 9: PEBB Medicare bid rates, 2013 – 2024

In 2023 there was a large outflow of members from UMP Medicare when the monthly premium increased

by 20 percent, or $73. As described earlier, the UMP Medicare bid rate is the projected average per

member, per month cost for the members expected to be enrolled in the plan. For the 2024 UMP Classic

Medicare bid rate development, HCA’s contracted actuaries at Milliman used a clinical risk grouping tool

to determine the relative health status and cost of members who stayed in UMP following the large

enrollment shift in 2023. The analysis found that in 2023 relative to 2022, a greater proportion of less

healthy members, that is, those who use more benefits, were retained in UMP Classic Medicare, which

resulted in increased average projected per-member cost. As future UMP Classic Medicare rate increases

are realized, additional loss of members from UMP is expected. This phenomenon is likely to continue to

intensify future UMP Classic Medicare premium increases.

2018 Medicare portfolio expansion project

As a result of high and increasing UMP Classic Medicare premiums during the 2017 rate setting process

for 2018 plan year premiums, the Legislature provided funding in the 2018 supplemental budget and

directed HCA to analyze options for stabilizing costs in the Medicare portfolio. From mid-2018 through

the end of 2019, HCA researched options to provide greater choice and value to PEBB Medicare retirees.

The goal was to identify benefit options that would allow for lower retiree premiums and out-of-pocket

costs, while maintaining comprehensive benefits with coverage levels like that of UMP. This led to an 18

month-long competitive procurement to contract with one or more MA-PD plans. There were two

apparently successful bidders, and although contracts with both bidders were possible HCA was able to

complete negotiations and reach an agreement with only one bidder for the 2021 plan year. Two

UnitedHealthcare (UHC) MA-PD plans were then authorized by the PEB Board and added to the PEBB

Medicare portfolio beginning January 2021.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 26

Overview of CMS Medicare Advantage Program

MA plans are offered by private companies approved by Medicare, and they provide a member’s Part A

and Part B benefits. In addition, the plan may cover things that Original Medicare doesn’t cover, like gym

memberships, vision, hearing, and dental services.

This type of risk-based plan within Medicare had its beginnings in the 1980s and was introduced with the

goal of reducing costs, improving choice, and enhancing quality, but MA plans have undergone significant

policy changes since their beginnings.

7

Over the last decade, enrollment in MA plans has grown considerably and in 2022 more than 28 million

Medicare beneficiaries were enrolled in an MA plan (nearly half of the Medicare population).

8

In total,

3,998 MA plans were available nationwide for individual enrollment in 2023, 228 more plans than were

offered in 2022 and the largest number of plans offered since 2010. About 5 million beneficiaries were

enrolled in Employer Group Waiver Plans (EGWP) through their employers or unions, comprising about 29

percent of total MA plan enrollment in 2021.

9

Medicare Advantage enrollment is projected to increase to

60 percent of eligible Medicare beneficiaries by 2031.

10

7

Patel, Yash M., and Guterman, Stuart, The Evolution of Private Plans in Medicare, The Commonwealth

Fund, December 8, 2017. The Evolution of Private Plans in Medicare (commonwealthfund.org)

8

Freed, Meredith, Biniek, Jeannie Fuglesten, Damico, Anthony and Neuman, Tricia. Medicare Advantage

2023 Spotlight: First Look. KFF, November 10, 2022. Medicare Advantage 2023 Spotlight: First Look | KFF

9

Better Medicare Alliance, March 21, 2022, Separating Fact from Fiction on Medicare Advantage EGWPs.

Separating Fact from Fiction on Medicare Advantage EGWPs - Better Medicare Alliance

10

Medicare - May 2022 Baseline (cbo.gov)

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 27

Chart 10: MA enrollment 1990 to 2030 (projected)

Most MA plans (89 percent) include prescription drug coverage (MA-PDs), and in 2022, 69 percent of

enrollees in MA-PD plans paid no premium other than the Medicare Part B premium. (KFF). MA plans are

allowed to provide extra benefits that are not available in traditional Medicare and can use federal

subsidies to help cover the cost of these extra benefits such as vision, hearing, gym memberships,

telehealth, or dental benefits. Other extra benefits include over-the-counter items such as bandages, meal

delivery, transportation, massage, and adult day health services. (KFF)

During the last five years, concerns about “widespread and persistent problems related to inappropriate

denials of services and payments”

11

,

12

have led CMS to issue new rules aimed at addressing some of

these concerns. The new rules, issued by CMS on April 5, 2023, are intended to ensure timely access to

care through utilization management requirements, protect Medicare beneficiaries from confusing and

11

Medicare Advantage Plans Often Deny Needed Care, Federal Report Finds - The New York Times

(nytimes.com)

12

Some Medicare Advantage Organization Denials of Prior Authorization Requests Raise Concerns

About Beneficiary Access to Medically Necessary Care" (OEI-09-18-00260) (hhs.gov)

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 28

potentially misleading marketing, strengthen the Quality Star Ratings Program, advance health equity, and

improve access to behavioral health care.

13

Historical and projected Medicare spending

According to the Medicare Trustees report (April 2022), Medicare spending on Part A, Part B, and Part D

benefits in 2021 totaled $829 billion, up from $541 billion in 2011.

14

Projected spending growth for

Medicare is due in part to growing enrollment in Medicare due to the aging of the US population,

increased use of services and intensity of care, and rising health care costs. (KFF). Spending on benefits in

each part of Medicare (A, B, and D) increased in dollar terms between 2011 and 2021, but the distribution

of payments by Part has changed over time. Spending on Part B benefits, including physician services,

hospital outpatient services, physician-administered drugs, and other outpatient services now accounts for

the largest share of total spending on Medicare benefits. (KFF) Spending on Part D prescription drug

benefits has stayed roughly constant since the drug benefit began in 2006 and is expected to remain

constant through 2031 as shown in Chart 11 below.

Chart 11: Spending on Medicare services by Part A, B, and D

History of Medicare Advantage plans within PEBB

Group Health Cooperative of Puget Sound (GHC) was one of the earliest staff model HMOs (where the

HMO hires its own physicians) in the US and was offered as a Part C plan choice to state employees prior

13

2024 Medicare Advantage and Part D Final Rule (CMS-4201-F) | CMS

14

What to Know about Medicare Spending and Financing | KFF

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 29

to the creation of the PEBB Program. In 2003, GHC converted its Medicare+Choice plan to a MA plan with

the establishment of the Medicare Modernization Act of 2003. In 2017, GHC was acquired by Kaiser

Foundation Health plan of Washington and the plan was renamed “Kaiser Washington Medicare

Advantage” and as of May 2023 had 23,294 total members. The Kaiser Medicare Advantage plan includes

creditable coverage for prescription drugs, meaning that the plan offers prescription drug coverage at

least as generous as a Part D plan, but with a formulary that is not governed by CMS rules.

15

Kaiser Permanente NW has offered a managed care plan to PEBB members since the 1990s in counties

along the Columbia River that weren’t covered by Group Health. In 2003 when GHC adopted the Medicare

Advantage plan, Kaiser Permanente NW did the same, naming it the “Senior Advantage” plan. Today, the

Kaiser Permanente NW Senior Advantage plan is offered in Washington counties not covered by Kaiser

Permanente WA and select counties in Oregon. This plan also includes creditable drug coverage and as of

May 2023 total membership in this plan was 2,343.

In 2021 UnitedHealthcare began offering two MA-PD plans within the PEBB portfolio after negotiating the

benefit design with HCA and gaining PEBB Board approval in July 2020. The plan was designed to mirror

UMP benefits as closely as possible. The pandemic limited HCA’s ability to provide the kind of outreach it

would have liked to provide when introducing a new plan (e.g., there were no in-person benefits fairs),

and enrollment in the first year was low. As of May 2023, total membership in the two plans was 14,903.

Benefit of remaining in PEBB Medicare plans

As discussed above, SEBB and PEBB members have the opportunity, when they retire, to continue to

receive medical benefits through the PEBB Program either through COBRA or, if they are eligible, through

a PEBB Medicare plan. Because enrolling in Medicare can be a confusing process (as described in the

findings from the listening sessions, discussed later in this report), and there are many options available to

Medicare members in the individual market, the benefit of remaining in one of the plans offered through

PEBB may not be evident to PEBB members. Nevertheless, these can be substantial and include the

following:

• PEBB retirees have access to the state’s Medicare Explicit Subsidy that subsidizes a portion of their

monthly premium as described in RCW 41.05.085.

• PEBB retiree insurance coverage has less restrictive enrollment rules compared to individual

MA/Medigap products. PEBB retirees can choose any retiree plan that is available, whereas a

Medigap plan in the commercial market may deny their applications based on health status if

they apply outside of their guaranteed issued periods.

• PEBB retirees will be covered if they meet the eligibility and enrollment requirements.

In addition, there are differences in the MA-PD and Medicare Supplemental Plans offed through PEBB

versus in the individual market, including:

15

An MA-PD plan is required to offer a formulary governed by CMS’ formulary rules.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 30

MA-PD Plan:

• The PEBB MA-PD plan offerings are stable, unlike individual MA-PD plans which may terminate

after the end of a plan year.

• Some rural counties in Washington have limited access to individual MA-PD plans. PEBB members

who live in Klickitat, Pend Oreille, Lincoln, Skamania, Garfield, and Whitman counties each only

have one MA-PD plan available to them through the individual market.

• There is no enrollment limitation penalty within PEBB as there is in the individual market.

• Although some of the MA-PD plans in the individual market have $0 or low premiums, their

maximum out-of-pocket costs can be as high as $8,300. The PEBB MA-PD plan maximum out-of-

pocket costs are no more than $2,000.

• The UHC plans are rated 4.5/5 stars (a measure of quality). The individual MA-PD plans in

Washington State are rated between 2.5 and 4.5 stars.

• PEBB offers both local HMO and extended PPO plans (nation-wide coverage) whereas the

individual MA-PD plans offered in Washington State are either local HMO or local PPO.

• The Part D drug coverage offered by individual MA-PD plans has up to a $505 deductible; the

UHC plan offered through PEBB which has a $100 deductible amount.

Premera Medicare Supplement Plan F/G:

• PEBB Premera Plan G has no health screening or pre-existing condition waiting period. An

applicant who applies for a Medicare supplement plan in the individual market may be subject to

a 90-day pre-existing condition waiting period with a 90-day look back period if they apply

outside of their guaranteed issued period, such as during their Medicare initial enrollment period.

• The PEBB Medicare Supplement Plan G is one of the most affordable Plan G Supplement plans in

the market.

HCA survey of PEBB retirees

In 2020, HCA surveyed PEBB retirees to gain a better understanding of their needs. The survey was made

available on the HCA website over a three-week period in August 2020. To promote the survey HCA sent

emails to PEBB retirees through the GovDelivery system and promoted it through stakeholders. The

purpose of the survey was to hear what retirees’ priorities were when it came to their PEBB health

coverage, and to help HCA determine which areas to focus on to improve retirees’ experience with the

PEBB Program.

Responses were collected from 7,364 members, although not every member answered every question.

More than 4,500 members provided narratives, which were reviewed and analyzed by HCA staff. The

following is a summary of the survey responses.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 31

The question “How could we improve your experience as a PEBB Retiree?” had 4,212 respondents with-

34% reporting being satisfied, 29% feeling that improvements could be made to the cost of their benefits,

19% wanting improvements to coverage, and 18% listing improved customer service.

By far, the main concern of members responding to the survey was the cost of PEBB benefits, including

the monthly premiums and the out-of-pocket costs. Out of 6,766 responses: 4,397 chose “Affordable

monthly premiums”; 3,817 selected “Comprehensive benefits” including coverage for prescription drugs;

and 3,583 selected “Affordable costs” (deductibles coinsurance and copays), as the top three priorities.

(Respondents were allowed to select more than one priority.)

When asked to provide more detail, 929 members responded wanting better coverage for gym

memberships (23%), prescription drugs (20%), vision (19%), dental (12%), and hearing aids (7%).

There were 767 responses identifying the types of customer service support they felt would improve their

experience, with 30% identifying live customer service, 19% HCA communications, (15%) web customer

service, 12% outreach/other, 11% enrollment, 9% plan communications, and 4% payment options.

16

HCA has incorporated these responses into annual planning cycles and has begun to implement several

improvements which are detailed later in this report.

2022 Proposal to consider closing UMP Classic Medicare Plan

UMP Classic Medicare’s premium increases had become an issue as early as 2016 when retirees, who are

often on fixed incomes and particularly vulnerable to cost increases, began to raise concerns in public

comment at PEBB Board meetings. In 2021, HCA staff began hearing anecdotally that in some cases the

monthly premium for UMP Classic Medicare had exceeded the retiree’s monthly pension income.

Given retirees’ concerns about the cost of UMP, and projected increases in UMP premiums, in June 2022

HCA made a recommendation to the PEB Board to consider an orderly closing of the UMP Classic

Medicare plan at the end of the 2023 plan year. After many PEBB members and stakeholders voiced their

concerns with the possible closing of UMP, the PEB Board instead passed a resolution to “postpone action

on closure of the UMP Classic Medicare plan until at least January 2024 to allow staff to interact in earnest

with stakeholders.”

In September 2022, HCA began working with the Stakeholders Medicare Coalition,

17

to conduct a series of

statewide listening sessions with PEBB retirees regarding their health benefits. Although the initial request

16

Source: PEB Board meeting Briefing Book January 27, 2021 (wa.gov) Tab 6. The high response rate

requesting live customer service may have been a result of the pandemic, as such customer service

delivery methods had been suspended for months prior to the survey.

17

The Stakeholders' Medicare Coalition is made up of representatives from Retired Public Employees

Council, Washington Education Association Retirees, Puget Sound Advocates for Retirement Action,

Health Care as a Human Right, Washington State Alliance for Retired Americans, Washington State Senior

Citizens Lobby, Social Security Works Washington, the Washington Federation of State Employees, and the

Washington American Federation of Teachers. This Coalition includes a wide range of organizations who

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 32

was to offer six listening sessions with PEBB retirees, HCA ended up conducting 24 sessions. The Coalition

and HCA developed a joint statement that read:

“The UMP Classic Medicare is not closing and there is no recommendation, proposal, or intended action

by current HCA Leadership for the foreseeable future, demonstrating HCA listens to and respects the

voices of PEBB members.”

represent a significant number of the PEBB Program’s enrolled retiree population, there are also a

significant number of PEBB retirees who are represented by organizations that are not part of the

Coalition (such as Washington State School Retirees Association (WSSRA), University of Washington

Retiree Association, and Washington State University – Emeritus) and PEBB retirees who do not belong to

any formal retiree organization.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 33

Findings

2023 PEBB retiree listening sessions

From February 28 to May 31, 2023, HCA conducted 24 listening sessions with PEBB retirees to hear how

the portfolio of PEBB Medicare plans might better meet members’ needs. The sessions were facilitated by

a consultant from Ernst and Young. Twenty of the sessions were conducted virtually, and four were

conducted in person. Members were recruited largely through the Stakeholders Medicare Coalition and

were able to sign up for their preferred session via the HCA website. Participants were sent a list of

questions in advance that included what members liked about their current plan, what could be better,

and how they like to receive communication from HCA.

Participation in listening sessions

Two hundred and sixty-eight PEBB members registered for the sessions, and 193 participated. After the

initial five listening sessions, HCA researched the reasons why those who signed up may not have

ultimately participated and learned:

• The sign-up process limited the number of attendees for each group, unlike other Zoom meetings

that don’t have a capped number of attendees. Although most of the registrants were able to

access the meeting for which they had registered, it created some confusion and even impacted

the observers from the Coalition and HCA for the first few meetings. The issue was identified, and

participation instructions better clarified how to attend the meetings, which resolved the issue for

the rest of the listening sessions.

• HCA determined that users were having trouble finding the original confirmation email that they

had been sent, which has a unique login link. This was addressed by HCA resending the

confirmation email with the unique link the day before the event.

• HCA attempted to contact anyone who had registered but hadn’t logged in by the start of the

listening session to help with technical issues. These contacts were made either by email or by

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 34

phone, when possible. HCA also offered to help users sign up for a different session if they were

no longer able to attend the one they had signed up for.

• In some cases, HCA learned that a registered attendee had changed their mind and didn’t cancel

their registration. Reasons included not feeling well, needing to focus on home repairs, or

thinking that what they signed up for was a webinar. Some registrants never responded to the

day of outreach. HCA was able to change the Zoom confirmation language to highlight how to

cancel the registration if the attendee’s plans changed.

• Some registrants had technical challenges that could not be resolved. In those few cases, HCA

encouraged attending an in-person session if possible.

After discussion with the Coalition regarding recruitment efforts, HCA began connecting with retiree

organizations such as Washington State School Retirees Association (WSSRA), University of Washington

Retiree Association, and Washington State University – Emeritus (entities who are not part of the

Stakeholders Medicare Coalition) to encourage attendance. HCA staff also reached out to Eastern

Washington University, Central Washington University, and Evergreen State College to encourage retiree

participation in the in-person sessions near those campuses, as well as in the online sessions. In addition,

HCA created a script for the HCA customer service staff to use at the end of retiree phone calls and in-

person lobby visits.

While most participants were in Washington, there were members with experience accessing PEBB

Medicare benefits from Arizona, California, Florida, Idaho, Oklahoma, and Oregon. The ability to travel

while maintaining coverage was often cited as one of the benefits of several of the plans. Although an

effort was made to ensure broad participation from members in each plan, UMP and UHC members were

slightly over-represented in the listening sessions, while Kaiser and Premera members were

underrepresented. Of the 193 members participating in the listening sessions, 88 were in UMP, 46 in UHC,

32 in Kaiser, 15 were in Premera, and the balance was made up of participants who had not yet retired but

were interested in learning what other members were saying about their plans in anticipation of signing

up for Medicare.

18

Members’ experience with their plans ranged from as little as four months to as long as

40 years.

18

UMP membership is 42 percent of total PEBB members compared with 49 percent participation in the

listening sessions. UHC membership is 13 percent of total PEBB members compared with 25 percent

participation. Kaiser members are 23 percent of total PEBB membership compared with 18 percent

participation. Premera is 20 percent of PEBB membership but only 8 percent of participation in the

listening sessions.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 35

Chart 12: Listening session participation by plan

Limitations

While the number of listening sessions offered many opportunities for members to participate, it should

be noted that the opinions expressed through the listening sessions may not be fully representative of the

PEBB membership overall. Recruitment efforts for attendees prioritized retirees from the Coalition’s

organizations, which worked with HCA over a series of months to create the format and content of the

listening sessions. Members who are unaffiliated with the Stakeholders Medicare Coalition participating

retiree associations may not have been aware of the sessions and so were less likely to participate. In

addition, although most of the sessions were held online, which provided access to members regardless

of where they lived, it limited participation to members who have access to a computer and who are

comfortable using Zoom technology. The in-person sessions were held in four locations across the state

to allow face-to-face participation from members in different regions, however, lack of transportation may

have been an issue for some participants. In addition, the UHC enrollees had at most two years with the

plan (and many had only four months of experience), so comments, both negative and positive, may

reflect limited experience with that plan.

Qualitative analysis - themes from the listening sessions and public forums

Comments from the listening sessions were categorized into themes using the affinity diagram

methodology, where comments are organized into groups or themes based on their relationships.

Representative quotes from participants are included to demonstrate member feedback on their needs,

expectations, understandings, and desires for improvement. The full set of summary notes from the

listening sessions, including additional comments from the Coalition, is included in the appendices.

Summary comments and themes from the listening sessions are shown below first, by health plan, and

then, by overall theme.

0

20

40

60

80

100

UMP UHC Kaiser Premera

Participants

Participation by Plan

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 36

Health Plans

Kaiser

Positive Comments: Members reported that the plan offered good coverage and felt they paid very little

out-of-pocket even though they had received very expensive treatments. They felt the prescription drug

cost was affordable and liked the fact that they only had copays when seeking specialty care. One person

described it as a “self-contained system” with all the coordination between providers done internally

rather than the individual having to do it. Members liked the coordination and that they can get their lab

tests, x-rays, and prescriptions done in one place.

Negative Comments: A few members reported having been with Group Health previously and when it

was acquired by Kaiser, they felt that the quality of care had declined. Members commented on limited

provider availability and reported that wait times to see a doctor or get a response can be long,

sometimes as long as one or two months to get an appointment, and there is no guarantee that you can

see your primary care physician. Seeing a new doctor who is unfamiliar with your needs for each

appointment is a concern.

Some members felt that decisions were not made locally but with Kaiser in California. Several members

expressed disappointment that they were unable to have the same coverage in other states, even though

Kaiser has a presence there, and there was some confusion about the difference between Kaiser Original

Medicare and Kaiser Medicare Advantage plans.

Members in rural areas expressed frustration with the mail order prescription service known as “First Fill”

and worry that they can’t talk to their local pharmacy as they once could.

19

19

Kaiser Permanente WA’s First Fill Program was designed to be safer and more cost effective for

members by requiring that maintenance drugs—those for long-term use—would be filled via mail order.

The policy stated that members could fill their first prescription at any in-network pharmacy, where

pharmacists could review the prescription to ensure members avoided negative drug interactions and

other risks, but subsequent refills must be filled via mail order or at a Kaiser Permanente retail pharmacy.

This allowed the use of generic drugs when medically appropriate and allowed Kaiser Permanente

Washington to negotiate better drug prices. The program was removed for the 2024 plan year because of

member dissatisfaction and the inherent risks of delivery via mail for rural members without secure mail

drop points.

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 37

Premera Plan F/G

Positive Comments:

Members felt that the plan had good coverage, and liked the fact that there are no

deductibles, you never have to worry about copays, and it is affordable. They liked the flexibility the plan

offers in seeing physicians, and several reported that they haven’t had any issues. Members liked that it

was a “traditional Medicare” plan. One person reported having a rotator cuff injury and was able to go

straight to an orthopedic surgeon without seeing their family doctor first. They were able to get an MRI

within two days. Another participant noted that the lower cost of premiums made the cost of eyewear

more affordable.

One of the members felt that “Plan G does not get adequate exposure (i.e., positive promotion); after the

deductible it pays everything…PEBB needs to do a better job getting information out about Plan G.”

Negative Comments: Several members felt that the “benefits were skinny,” and wished the plan covered

things such as hearing, vision, a gym membership, and naturopathy.

Members did not like having to wait for approval to get a referral, and although they liked being on

“Original Medicare” they did not like the fact that they must sign up for a separate Part D plan, which is

not available through PEBB, and a separate dental plan. They felt that signing up for those additional

plans and then managing multiple bills is challenging.

Uniform Medical Plan

Positive Comments: Members liked the dependability of the plan and the fact that it can be used

anywhere. They felt secure that any health care needs will be taken care of.

• “You don’t need to worry about what will be paid or not. Health is stressful enough.”

There is no delay in treatment. They felt that it provided excellent access to providers, with a minimum of

pre-authorizations, denials, and appeals. Several stated that it had been important to have UMP as they or

their spouses experienced serious health concerns. They liked that it offered a seamless transition

between coverage as an employee and coverage as a retiree, and coverage includes benefits that

Medicare does not cover, including chiropractic, massage, acupuncture,

20

vision, and hearing aids.

Participants felt that the travel coverage was good, and several mentioned that their physicians are happy

that they have UMP coverage since Regence is known to pay physicians promptly.

The UMP members felt that the drug coverage was good, and at least one member indicated that they

were on a medication that is effective for them and that only UMP covers it. For the most part, members

reported receiving good customer service when they called the plan, and they appreciated the relative

ease of getting reimbursement for services such as naturopathy, and physical therapy. Participants liked

20

Starting in January 2020, Medicare began covering acupuncture for low back pain. Acupuncture

coverage (medicare.gov)

PEBB Retiree Medicare Benefits

December 1, 2023

Page | 38

the fact that UMP is a state-sponsored plan, and not operated by a private, for-profit company because

they are concerned about what they see as an increase in the privatization of Medicare. Finally,

participants liked that UMP is “traditional Medicare” and does not have the incentives that some MA plans

are perceived to have to deny coverage.

Negative Comments: Many UMP members reported that they felt that the cost of premiums was high,

although some members felt that the value they received was worth the cost. A few members said they

want the best coverage they can buy, even if they must pay more. As one member put it, when asked

what could be better about UMP: “The cost, but I wouldn’t trade benefits in order to lower costs.”

A few wondered why UMP was so expensive and if it was worth the cost. Some said that the increasing

cost of the premiums had driven them to try out another plan, even if only temporarily. Many of the

participants attributed the cost of the premiums to the fact that UMP does not receive the same federal

subsidies that the Medicare Advantage plans enjoy and would like to see HCA and their legislators work

to try to fix what they see as an unfair playing field. They objected to what they see as the privatization of

a federal program and were concerned that this was the direction that Medicare was taking.

A few members had concerns about the length of time to get an appointment, although acknowledging

that this may be due to provider shortages. In a related comment, one member said that there were no

massage therapists in their area who would take UMP because the provider payment is so low, and

another felt that UMP requirements for mental health counselors to continue to qualify made it more

difficult for their provider.

One member was unhappy with the process they had to go through to get the right medication but felt

this might be an issue that needs to be addressed at the federal level.

Some said that they would like to see an improved vision benefit, that dental services should be offered,

and they wished that the plan offered a gym membership.

United Healthcare

Positive Comments: Although most members had relatively little experience with this plan since it has

only been offered since 2021, many reported positive experiences with the plan. They liked the lower