BEST PRACTICES REMINDER: The Office of the Commissioner of Political Practices strongly recommends that

candidates run every campaign expenditure out of their campaign bank account.

•

Best practices would be for candidates to obtain a debit card attached to the campaign bank account to

use for all campaign expenditures. Exclusive use of a debit card connected to the campaign bank account

when making campaign expenditures ensures that campaign funds are utilized and simplifies reporting

requirements for the candidate.

•

Exclusive use of a campaign debit card also reduces the chances that a candidate would need to provide

personal banking records or other personal financial information to the COPP in the event a campaign

finance complaint is filed. Limited use of a candidate’s personal bank account or funds for campaign

purposes is allowable if the activity is properly reported and disclosed by the candidate.

Candidate and Treasurer Guide to CERS Page 1

Introduction to the Campaign Electronic Reporting System

What is the Campaign Electronic Reporting System (CERS)?

Online reporting in CERS is required for all candidates and committees (13-37-225, MCA). CERS is a user-

friendly system that helps candidates and committees disclose and report the money they receive and spend

to support or oppose candidates and ballot issues.

Montana's campaign finance laws ensure that the public can engage with a transparent reporting of money in

elections. Each campaign finance report filed in CERS is publicly available and searchable (data is not public

until the report is filed). Candidates and committees ensure transparency in Montana’s democratic processes

by filing legally-required campaign finance reports. Campaign finance reports are reviewed by the Office of

Political Practices (13-37-121[1], MCA

).

COPP Compliance Specialists are available full-time during work hours (8:00 a.m. to 5:00 p.m., Monday-Friday)

to provide campaign finance reporting support to candidates and committees.

Who must use CERS to Register as a Candidate and Disclose Campaign Finance Reporting?

In accordance with 13-37-225 and 226, MCA, all candidates (statewide, state district, county, municipal, and

school candidates) must:

1.

File all forms electronically in the Campaign Electronic Reporting System (CERS).

2.

All candidates will follow the same reporting schedule (See the Reporting Calendars webpage for

report periods and report due dates).

To register, all candidates must first create a CERS account. Then, the candidate must file a Statement of

Candidate. This same account will be used to enter campaign finance reports.

Creating a CERS account and filing a Statement of Candidate is detailed below in Part 1.

Part 1: File a Statement of Candidate in CERS

Step 1: Access CERS

Access CERS through the COPP's homepage

Users should note that the Campaign Electronic Reporting System (CERS) is a standalone system that is

directly administered by the Office of Political Practices. To access CERS, you must log in via Okta. Okta is

a State of Montana application that is not unique to the COPP but is used as a portal to access a variety

of statewide resources. While users must use Okta to log into CERS, the two systems are different.

Whereas CERS is administered directly by the COPP, Okta is not.

Each candidate must log into their Okta account to access CERS. To access CERS:

1.

Visit the COPP’s website, https://politicalpractices.mt.gov/. From COPP’s homepage, click

the red ‘Access CERS’ icon on the right side of the screen.

2.

From the CERS dashboard, click the green ‘Access my Account’ icon. Doing so will prompt you

to login to CERS via Okta.

3.

Login to CERS via Okta:

•

If you already have an active Okta account, you may log in using that username and

password.

•

If you do not already have an active Okta account or cannot remember your login

information, Click the Login button. From there, Okta gives you the option to create a

new account (See the Okta home page).

•

If you have trouble accessing your Okta account, or do not remember your account’s

username or password, you can reset the username or password through Okta itself.

The COPP cannot assist you with resetting an Okta account username or password or

retrieving an existing username or password you have forgotten.

4.

After you successfully login via Okta, you will automatically be redirected back to the CERS

dashboard. If you are experiencing difficulty logging in through Okta or are not re-directed to

the CERS dashboard, please contact the COPP for assistance.

5.

To register a new candidate or campaign for a new election, make sure you have selected the

Candidates tab, and then click Add New Registration (See image below).

Candidate and Treasurer Guide to CERS

Page 4

Step 2: Determine if Your Candidate Name Already Exists in CERS. If Needed, Register Name

Before you can add a new registration, CERS requires you to search for the candidate’s name. This search avoids

duplicate entries for the same candidate for a single election year. If the candidate has previously filed a

Statement of Candidate in CERS, correctly searching and finding their name will auto-populate previously

entered information (e.g. candidate and treasurer contact and mailing information).

Regardless of whether you have ever filed a Statement of Candidate in CERS, you must search for the candidate

name. To search:

1.

Fill out the candidate’s last name and first name.

2.

Then, click the Search Candidate button.

3.

If the candidate previously registered in CERS for a prior election year, select that candidate by clicking

the box to the left of the prior registration for that candidate, and select the Add New Registration icon.

4.

If the candidate previously registered in CERS for the current election year, select that candidate

registration. If the candidate has already registered for the current election year but you are unable to

access the profile in CERS, please contact the COPP for assistance instead of creating a second profile.

5.

If the candidate’s name does not come up from a search, click Add New Registration to add a new

registration for that candidate for the current election year.

Candidate and Treasurer Guide to CERS

Page 5

Step 3: Enter in Candidate Campaign Information

1.

Click the upper dropdown option from the Statement of Candidate form and select your Campaign Type

(City, County, School, State District, or Statewide).

a.

Are you uncertain which specific office you will run for? Read about your options for filing as an

exploratory candidate here. Pursuant to 13-37-219, MCA,

a candidate who has not determined the

office to which the individual will seek nomination or election is subject to the lowest contribution

limitation of the offices the candidate is considering seeking.

2.

Fill out all information in the Candidate Information section. Any field with an *asterisk* is a required field

that must have data entered.

a.

In the field “Official campaign email address,” the email address entered will receive notifications

about filed campaign finance reports. This email address will also receive communications from the

Office of Political Practices (e.g. with report reminders, training opportunities, etc.).

b.

City, county, and school candidates must select whether their campaign will have a combined total

of contributions and expenditures of $500 or more in the Affidavit of Reporting Status section. Select

option B box for campaigns that will spend and receive under $500 combined, or option C for

campaigns that will spend and receive over $500 combined (Statewide and State District candidates

will not see this field).

c.

For information and guidance about campaign bank requirements, click here.

3.

Fill out information in the Campaign Treasurer Information section.

a.

A treasurer must be appointed and certified on the Statement of Candidate form. Candidates can

appoint themselves to be their own treasurers. If there are changes, an amended candidate

statement (C-1 or C-1A form) must be submitted within 5 days.

b.

Treasurers are responsible for depositing and disbursing funds and keeping accurate accounts. The

treasurer and deputy treasurer are the only people authorized to make deposits or draw checks on

the campaign account.

c.

Often candidates appoint themselves as either treasurer or deputy treasurer so they have access to

their campaign accounts.

4.

If relevant to your campaign, fill out the Deputy Treasurer Information section. Not all campaigns will have a

Deputy Treasurer. You will need to select the purple Add button, enter in the deputy treasurer’s information,

and click Submit.

5.

When all candidate information is entered, select Save at the bottom of the page.

6.

Verify all candidate information is correct. If you need to make edits, click the Edit Information button,

update info, and then click Save.

7.

Certify all information is true by clicking the Certification box at the bottom of the page.

8.

Select Submit and File.

9.

You will now receive an email verifying your successful filing to the email address you provided.

Candidate and Treasurer Guide to CERS

Page 6

10.

You have the option to file a Form C-3 (Code of Fair Campaign Practices) in CERS. Any candidate who desires

to subscribe to the Code of Fair Campaign Practices may file a Form C-3. Signing the form is voluntary, and a

failure or refusal to sign is not a violation of election law.

11.

You will now be able to navigate back to your CERS homepage. From this page, you can:

a.

Add a new registration or campaign finance report,

b.

View your registration,

c.

Amend your candidate statement or a campaign finance report,

d.

File and view C-3, and

e.

Create finance reports (Finance Reports).

Step 4: How to Update a Statement of Candidate

If any of the information in a candidate’s statement of candidate changes, the candidate must file an amended

Statement of Candidate that provides the new information within five days after the change occurs (13-37-204,

MCA, ARM 44.11.303(2)).

Your candidate registration must be updated in CERS if any of the below information changes:

•

The campaign type,

•

Candidate, treasurer, or deputy treasurer contact information (address, email, phone number, etc.),

•

Political party, and

•

Bank information.

To amend a candidate’s registration:

1.

Navigate to the CERS homepage, and login via Okta.

2.

Check the box next to the candidate’s name to select their current registration and click Amend Registration.

3.

Edit and amend the relevant information in the candidate’s Statement of Candidate. Click Save.

4.

Finally, check and certify that the registration information is true, complete, and correct, and then select

Submit and File to save the updates.

Candidate and Treasurer Guide to CERS

Page 7

CERS TIPS:

1.

A new campaign finance report cannot be created if a prior report has a status of

‘Pending.’

2.

Finance reports can be amended at any time after they have been successfully

filed (See Part 9 for details on amending reports).

3.

Campaign finance data can be entered at any time. Data is not public until a report

has been filed.

Part 2: Create a Campaign Finance Report

Select the Campaign Finance Report Type (C-5 C-7, or C-7E) and Set the Reporting Period

Once logged into CERS, candidates can easily file campaign financial reports. Click the Access My Accounts

button on the Welcome page (see below).

Select the candidate campaign account by checking the box next to the relevant election year and select the

Finance Reports button.

Candidate and Treasurer Guide to CERS

Page 8

From the following page, select the relevant campaign finance report to add (Add New C5, Add New C7, or Add

New C7E).

•

Form C-5 details all contributions received and expenditures made by a campaign during a specific

time frame and must be filed periodically by all statewide and state district candidates, as well as

county, city, and school candidates whose campaign contributions and expenditures meet or exceed

$500 (13-37-226, MCA

).

•

Form C-7, the Notice of Pre-Elections Contributions, must be filed by any candidate who receives $250

or more from a single source between the 15th day of the month preceding an election and the day

before the election (for both primary and general elections) and must be filed within two business

days after receipt of a contribution of $250 or more (13-37-226, MCA

).

•

Form C-7E, the Notice of Pre-Election Expenditures, must be filed by any candidate who makes a

campaign expenditure or incurs a debt of $250 or more between the 15th day of the month preceding

an election and the day before the election must file a C7-E disclosing that activity. Form C-7E must be

filed within two business days of the expenditure being made or the debt being incurred (13-37-226,

MCA).

After creating a new finance report, select the date range the report will cover by using the dropdown calendar

option (see image below).

This time period must mirror the reporting periods as defined on the COPP’s reporting page. The time period

covered by the report includes up to the fifth day before the due date of the appropriate report. All accounts

must be current up to the fifth day before the report due date.

Candidate and Treasurer Guide to CERS

Page 9

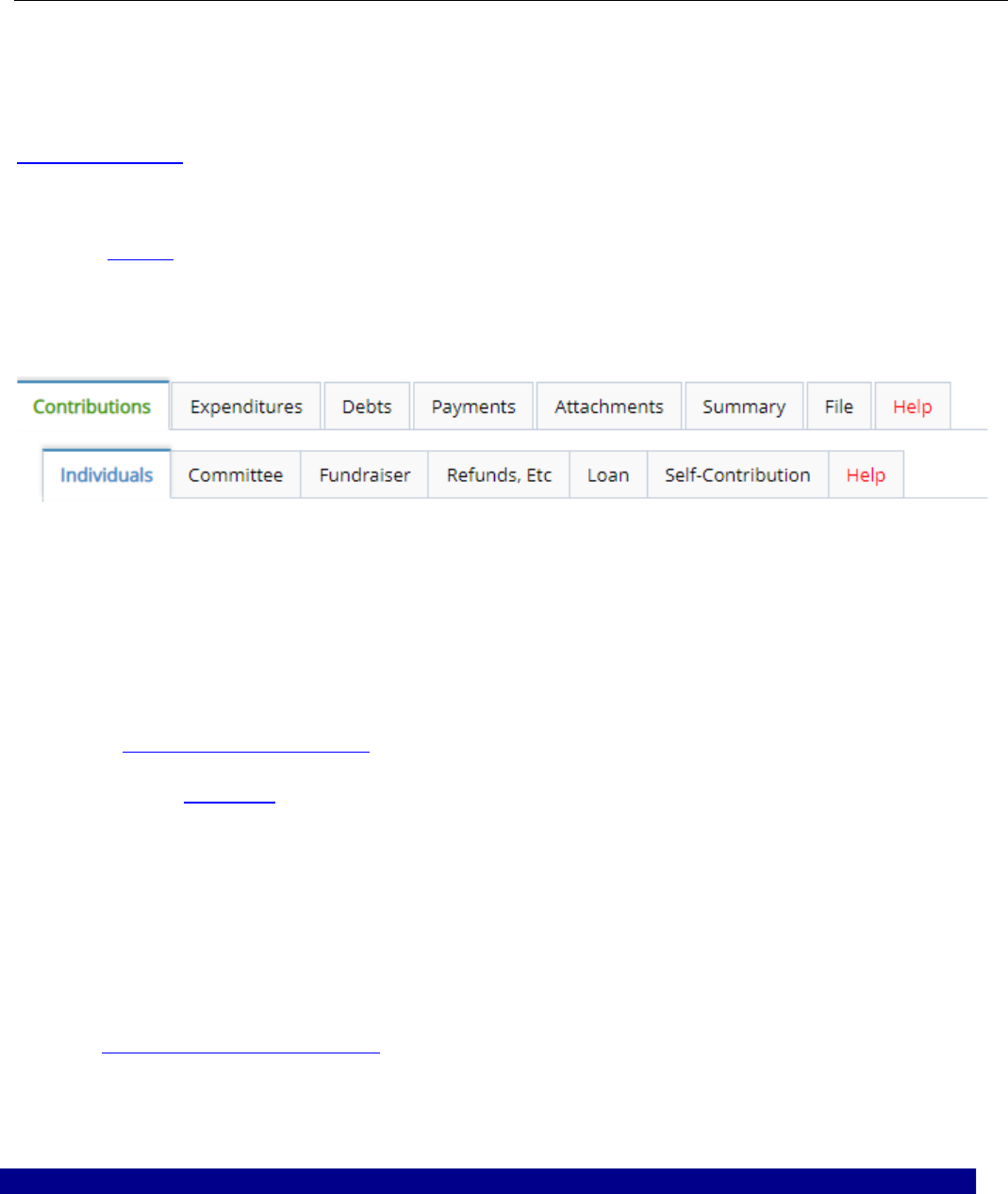

Navigate Tab Options in CERS (E.g. Contributions, Expenditures, Debts, Payments, etc.)

Campaign finance information is entered into CERS by candidates or treasurers via the following tabs (the

functions and purpose of each tab are detailed in Part 3 through Part 9):

1.

Contributions

By law (13-1-101(9), MCA

), a contribution is defined as a “…distribution of money or anything of

value to support or oppose a candidate or ballot issue.” If an individual, political committee, or other

entity provides a campaign with money or goods or services of value for free or at a reduced rate in

an effort to support your candidacy, that would be considered a contribution. In the Contributions

tab, report contributions received from 1) individuals, 2) committees, 3) fundraisers, 4) refunds, etc.,

4) loans, and 5) candidate contributions (contributions made personally by the candidate).

2.

Expenditures (Expenses)

By law (13-1-101 (19)(a), MCA

), an expenditure is defined as “a purchase, payment, distribution,

loan, advance, promise, pledge, or gift of money or anything of value made by a candidate or

political committee to support or oppose a candidate or ballot issue.” Expenditure details must be

disclosed in the Expenditures tab. An expenditure is any money a campaign spends in support of that

candidate. There are a few exceptions that do not need to be reported (

13-1-101(19)(b), MCA).

3.

Debts

A candidate must report the full name and mailing address of each person or entity to whom the

campaign owes a debt or financial obligation. Debt details must include: the amount, the date the

debt or obligation was contracted, and the purpose of the debt or contracted obligation. If the exact

amount is unknown at the time of filing, the estimated debt amount must be reported (ARM

44.11.506).

4.

Payments

A candidate must report information about all payments made on the campaign’s outstanding debts

or loans in the Payments tab. In this tab, previously reported debts or loans can be selected to

record payments.

Candidate and Treasurer Guide to CERS

Page 10

5.

Attachments

The ‘Attachments’ tab provides candidates the opportunity to add an invoice, receipt, or similar

documentation to their C-5 report as a means of fully explaining the purpose of a given expenditure.

Attachments must be PDF documents, and the file size must be under 5MB.

6.

Summary

The Summary tab keeps a running total of money received and spent by the campaign during the

current reporting period. The summary details the campaign’s bank balance at the start of the

reporting period, all reported contributions received by the campaign, total campaign expenses, and

the ending bank balance for both the primary and general election accounts.

7.

File

The File tab is where the final steps of filing a campaign finance report are completed. To file a

report, check the box to certify that all information is correct, and then click the “Certify and File”

button.

8.

Help

Help tabs are available at both the main tab and subtab levels. Reference these for tab overviews,

tips, and links to resources and Montana campaign finance law.

Candidate and Treasurer Guide to CERS

Page 11

Part 3: Add Contributions in CERS

Types of Contributions

Contributions can come from: individuals other than the candidate, political committees (ballot issue committees,

incidental committees, independent committees (PACs), and political party committees), joint fundraising

committees, and self-contributions from the candidate.

Contributions limits

exist for both a primary and general election and apply to all contributions received from

committees or individuals (candidate contributions to their own campaign are exempt from contribution limits).

If a candidate does not have a primary election, they can receive contributions only for the general election.

Reference this link

for information on bank requirements if a candidate may have both a primary and a general

election.

All contributions are entered into CERS under the Contributions parent (main) tab. A contribution will be entered in

the below subtabs based on the contribution type.

1. Individual Contributions

Contributions received from individuals other than the candidate must be entered in the “Individuals” tab.

Individual contribution details must include whether the contribution is designated for the primary or

general election, the date the contribution was received, information about the individual (name, address,

employer and occupation are all required for individuals who contribute $50 or more), and whether it was

a monetary or in-kind contribution. All in-kind contributions must include a description of the specific

items or services received by the campaign.

** Individual contribution limits

apply to all contributions received from individual donors and aggregate

contributions are automatically tracked by CERS. Candidates cannot accept anonymous contributions.

Details at 13-37-217, MCA.**

2. Committee Contributions

Contributions received from a political committee must be entered in the “Committee” tab. Committee

contribution details must include: whether the contribution is designated for the primary or general

election, the date the contribution was received, information about the committee (committee type,

committee name, and the committee address), and whether the contribution was a monetary or in-kind

contribution. All in-kind contributions must include a description of the specific items or services received

by the campaign.

** Committee contribution limits

apply and aggregate contributions are tracked and displayed in CERS.**

Candidate and Treasurer Guide to CERS

Page 12

3. Fundraiser Contributions

Contributions of $50 or less received at mass collection events (pass-the-hat event, selling campaign t-

shirts, raffle tickets, an auction, etc.) may be recorded and reported in the “Fundraiser” tab as one lump

sum entry. Each individual fundraising event held by the campaign should be reported separately as its

own event. For example, if you held a fundraising dinner that also had a silent auction and a pass-the-hat

activity, that represents three required reporting activities (dinner, silent auction, pass-the-hat).

Reported fundraiser information must include: whether the contributions received at the event go to the

candidate’s primary or general account, the date and location of the event, the type of event, the

approximate number of attendees, the number of tickets sold (if relevant), and the total amount raised

(ARM 44.11.406

). Any individual contributions of $50 or more received at a fundraiser event must be

reported in the Individual Contributors section of the report.

** Anonymous contributions are illegal. The source of contributions from a fundraiser must always be

recorded, even if an individual’s fundraising-related contribution does not meet the $50 reporting

threshold. This also ensures that if an individual contributes $50 in the aggregate or more, their

contributions can be correctly reported (Any individual contribution of $50 or more must be reported

under the “Contributions” tab’s “Individual” option). **

4. Refunds, Etc.

The “Refunds, etc.” tab is where refunds, rebates, or other indirect contributions received by the

campaign are reported. An example would be interest earned from the campaign’s bank account, rebates

given to a campaign for bills already paid to vendors, or refunds given to a campaign for services the

campaign reported paying for but were not actually provided, so the money was returned to the

campaign by the vendor.

5. Loan Contributions

By definition, any loan to a campaign is a contribution (ARM 44.11.405). All contribution limits apply to

campaign loans. Any loan (regardless of its amount) made to the campaign during the current reporting

period is reported in the “Loans” tab, even if the loan is repaid during the same reporting period. A

candidate would report their own personal loans made to their campaign in this “Loans” subtab. Any

repayment for a loan is reported in the Payments tab.

6. Self Contributions

Contributions made from a candidate to their own campaign are entered in the “Self Contribution” tab.

Candidate and Treasurer Guide to CERS

Page 13

Add a New Contribution

To add in contribution information, open the relevant Contributions subtab (Individual, Committee, Fundraiser,

Refunds, Etc., Loan, or Self), and select the purple Add button. Contribution information can also be edited and deleted

in the subtabs.

Once the purple Add button has been selected, the below screen will appear. Within the screen, there are two tab

options: Row Details and Entity Search.

The Entity Search tab is a great way to streamline entering in contribution data. This tab gives users the option to auto-

populate previously entered contributor information. If an individual or entity has already been entered into CERS, this

search option allows the information to be pulled up and does not require a manual entry.

To search for an individual or entity to identify them as the source of a contribution:

1.

Select the Entity Type (Bank, Business, or Individual).

2.

Enter in the entity or individual’s name.

3.

Make sure to select the Search All Campaigns box to search data beyond the data your campaign has entered

in CERS.

4.

Select the Search button to see if the entity or individual already exists in the system.

i.

If the correct information is in the “Entity Search Results” section, check the box next to the relevant

entity, and hit Select. You will then be redirected automatically to the Row Details screen.

ii.

If no “Entity Search Results” appear, click Create New Entity to manually enter the information. Once

the information is entered, click Submit. The next screen redirects to the Row Details screen.

Candidate and Treasurer Guide to CERS

Page 14

The Row Details tab is where users enter specific and identifying information about campaign contributions.

1.

Select the “Election Type” dropdown to designate the election the contribution will support (Primary or

General),

2.

The date the contribution was received (the date the contribution was received by the campaign must

be used, NOT the date the contributions was deposited into the campaign account),

3.

If the contributor was not found in the Entity Search tab, enter in the information to identify the

contributor source (e.g. name, address, occupation and employer for individual contributions, the

committee type, name, and address for committee contributions).

4.

An in-kind contribution means the furnishing of services, property, or rights without charge or at a

charge which is less than fair market value (ARM 44.11.403

). Frequently, in-kind contributions come in

the form of services for which charges usually are made but which are rendered to the campaign free of

charge or at a discounted amount. If something is sold to the campaign at less than fair market value,

the difference must be recorded as an in-kind contribution. A detailed description is required for all in-

kind contributions.

5.

The In-Kind Description section must describe the in-kind contribution the candidate has reported

receiving and must be detailed enough to distinguish between items or services that may be similar in

nature.

6.

When entering data into the Refunds, Etc. tab, select the dropdown Transaction Type (Refund, Rebate,

Interest, Other), and add in information about the original transaction (date, description).

Once all contribution details have been entered into the Row Details section, select the Submit button, and then select

the blue Save button.

The Save button must be selected after every entry or CERS may override that entry or duplicate the entity for each

subsequent entry you make.

Candidate and Treasurer Guide to CERS

Page 15

Often-Missed Contributions

1.

Reporting Payment for a Candidate’s Personal Expenditure Made on Behalf of Their Campaign:

For a candidate to reimburse themselves for personal expenditures made on behalf of the campaign, the

candidate must first report the activity as a loan provided to the campaign. This provides candidates two (2)

options:

Option 1 is for the candidate to provide a direct monetary loan from the candidate’s personal bank

account to the campaign, depositing those funds in the campaign bank account. This monetary

transfer would be reported as a loan from the candidate in Contributions tab and the Loan subtab on

the relevant campaign financial report. A candidate may use campaign funds to reimburse themselves

for any monetary loan they have made to their own campaign. Reimbursement payments made from

the campaign account would be recorded using the Payments tab.

Option 2 is for a candidate to report each campaign expenditure made using their personal bank

account or personal funds as an in-kind loan from the candidate in the Contribution tab’s Loan subtab.

Each In-Kind loan must provide the date the activity was carried out, the monetary value of the

activity, the name of the vendor or business entity the candidate originally paid, and an in-kind

description of the nature of the specific item(s) or service(s) provided. This description would require

the same level of detail or information as is required for campaign expenditures. Any reimbursement

payments made from the campaign account back to the candidate would be recorded using the

Payments tab.

Candidate and Treasurer Guide to CERS

Page 16

Part 4: Add Expenditures in CERS

All campaign expenditures must be entered in the Expenditures subtab.

To add in an expenditure, select the Expenditures subtab, and click the purple Add button. Expenditure information

can also be edited and deleted in this subtab.

Once the purple Add button has been selected, the below screen will appear. Within the screen, there are two tab

options: Row Details and Entity Search.

The Entity Search tab is a great way to streamline entering in expenditure data. This tab gives users the option to auto-

populate previously entered expenditure information. If an individual or entity has already been entered into CERS,

this search option allows the information to be pulled up and does not require a manual entry.

To search for an individual or entity to identify them as the source of an expenditure,

1.

Select the Entity Type (Bank, Business, or Individual).

2.

Enter in the entity or individual’s name.

3.

Make sure to select the Search All Campaigns box to search data beyond the data your campaign has

entered in CERS.

4.

Select the Search button to see if the entity or individual already exists in the system.

iii.

If the correct information is in the “Entity Search Results” section, check the box next to the relevant

entity, and hit Select. You will then be redirected automatically to the Row Details screen.

Candidate and Treasurer Guide to CERS

Page 17

PLEASE NOTE that the CERS software limits each field description to a 150-character limit. If more detail is

needed, you may add an attachment to the report as a PDF file. To add an attachment:

1.

First, check the box that states “check this box if you have attachments for this transaction”. Second,

2.

Navigate to the Attachments tab and add your attachment. Attachments must be in PDF format and

must be under 5MB in size.

Example attachments would include: a copy of an invoice received from ‘Very Good Building Co.’ for

campaign yard signs; a copy of a receipt received from ‘Mailers of Montana’ for campaign mailers; etc.

iv.

If no “Entity Search Results” appear, click Create New Entity to manually enter the information. Once

the information is entered, click Submit. The next screen redirects to the Row Details screen.

The Row Details tab is where users enter specific and identifying information about campaign expenditures.

1.

If the expenditure was not found in the Entity Search, enter in the information to identify the expenditure

entity (e.g. name and address of the vendor),

2.

Select the “Election Type” dropdown to designate the election the expenditure was made for (Primary or

General),

3.

The date of the expenditure,

4.

The amount of the expenditure,

5.

Check the box if the expenditure is a refund for a contribution that was over the contribution limit,

6.

Under “Description of Expense,” candidates are required to describe the expenditure (campaign mailers,

television advertisements, etc.). Please keep in mind that any expenditures made to a “consultant, advertising

agency, polling firm, or other person that performs services for or on behalf of a candidate, political

committee, or joint fundraising committee must be itemized and described in sufficient detail to disclose the

specific services performed by the entity to which payment or reimbursement was made”, (

13-37

-229(2)(b),

MCA),

7.

Once all expenditure information has been entered into the Row Details section, select the Submit button, and

then select the blue Save button. The Save button must be selected after every entry or CERS may override

that entry or duplicate the entity for each subsequent entry you make.

Candidate and Treasurer Guide to CERS

Page 18

Often-Missed Expenditures

1.

Candidate Filing Fee: The candidate’s filing fee is a mandatory reportable expenditure. The filing fee can be

paid either out of the candidate’s campaign account (if funds are available), or out-of-pocket by the candidate

using personal funds. If personal funds are used, the filing fee needs to be reported as either an in-kind

candidate contribution (if the candidate does not want to be reimbursed for that expense) or as an in-kind

candidate loan (if the candidate wants to be reimbursed).

2.

Social Media: Any campaign that spends money on social media ads must disclose this expenditure with the

same level of detail as any other expenditure. Best practice is to include the date(s) an individual ad ran, the

social media platform the ad appeared on, and a brief description of the ad.

3.

Payments to Consulting Firms, Advertising/PR Agencies: As noted above, any expenditure paid to a “consultant,

advertising agency, polling firm, or other person that performs services for or on behalf of a candidate, political

committee, or joint fundraising committee must be itemized and described in sufficient detail to disclose the

specific services performed by the entity to which payment or reimbursement was made”, (13-37-229(2)(b),

MCA),

4.

Vendor Fees (e.g. ActBlue, Revv, etc.)

Any vendor fees, processing fees, or other costs associated with a contribution-processing vendor (e.g. PayPal,

ActBlue, Win Red, etc.) must be reported as an expenditure.

Example: a candidate uses PayPal as an intermediary for individuals to make contributions to the campaign.

The campaign receives a $100.00 contribution from an individual via PayPal, and PayPal assesses a

processing fee of $2.00 on this transaction. The candidate would need to report receiving $100.00 (the

full amount of the contribution) from the individual, as well as an expenditure of $2.00 to PayPal for

the processing fee.

If a vendor fee, processing fee, or other cost is applied to contributions received, the following detail must

be included to fully describe the expenditure:

1.

Entity Name: The vendor name (e.g. PayPal, ActBlue, etc.),

2.

Election The election relevant to the contribution fees (primary or general), and

3.

Description of Expense: The dates and total value of the contributions represented by the fees. For

example: “$35 in ActBlue fees for $185 in contributions received from 10/1-10/15/20.”

Candidate and Treasurer Guide to CERS

Page 19

5.

Gas and Mileage: Gas and mileage must be reported as an expenditure if paid for from the campaign account

(e.g. with a campaign’s debit card).

•

If the candidate’s campaign uses a rental car for campaign-related expenses, the cost of the rental car

and the cost of fuel must each be reported as expenditures.

•

The COPP recommends that candidates who use their personal vehicle for campaign-related travel

report the use of the vehicle and fuel costs based on the federal reimbursement rate,

which accounts

for both the cost of the gas and the cost of the vehicle’s use.

•

If a candidate uses their personal vehicle, they would report the mileage as either an in-kind loan (if

they seek reimbursement from the campaign) or as an in-kind contribution.

Candidate and Treasurer Guide to CERS

Page 20

Part 5: Add Debts in CERS

All debts or other monetary obligations (e.g. debts or loans) owed by a campaign must be reported in the subtab of

the Debts tab.

To add in a debt or loan, select the Debt/Loan Payments subtab, and click the purple Add button. Debt and loan

information can also be edited and deleted in this subtab.

Just like with adding in contributions and expenditures, campaigns are also advised to use the Entity Search tab to

streamline entering in debt and loan data.

The Entity Search tab gives the option to auto-populate previously entered expenditure information. If an individual or

entity has already been entered in CERS, this search option allows the information to be pulled up and does not

require a manual entry.

To search for an individual or entity to identify them as the source of a debt or loan,

1.

Select the Entity Type (Bank, Business, or Individual).

2.

Enter in the entity or individual’s name.

3.

Make sure to select the Search All Campaigns box to search data beyond the data your campaign has entered

in CERS.

4.

Select the Search button to see if the entity or individual already exists in the system.

i.

If the correct information is in the “Entity Search Results” section, check the box next to the relevant

entity, and hit Select. You will then be redirected automatically to the Row Details screen.

Candidate and Treasurer Guide to CERS

Page 21

ii.

If no “Entity Search Results” appear, click Create New Entity to manually enter the information. Once

the information is entered, click Submit. The next screen redirects to the Row Details screen.

The Row Details tab is where users enter specific and identifying information about campaign debts and loans. To

enter a debt or loan, disclose:

•

The full name, entity type, and complete mailing address of the individual or business to whom the

debt is owed,

•

The election that the debt or loan serves,

•

The date the date was incurred/agreed to,

•

The debt or loan amount. If the exact amount of a debt or obligation is not known, the estimated

amount must be reported (ARM 44.11.506

).

•

A detailed description of the debt or loan in the Purpose of Debt section (a debt or loan description

must have the same level of detail as an expenditure description),

Once a new debt has been entered into the Row Details section, select the Submit button, and then select the blue

Save button. The Save button must be selected after every entry or CERS may override that entry or duplicate the

entity for each subsequent entry you make.

Candidate and Treasurer Guide to CERS

Page 22

Part 6: Add Payments (on Debts and Loans) in CERS

All outstanding loans reported in the Contributions tab and debts or obligations reported in the Debts tab appear in

the Payments tab.

To enter payments on a loan or debt,

1.

Select the check box next to the relevant loan or debt in the Payments tab.

2.

Then, select the purple + Add button to record a new payment.

3.

Enter in the date of the loan or debt payment, the amount paid, click Submit, and then Save. The Save button

must be selected after every entry or CERS may override that entry or duplicate the entity for each subsequent

entry you make.

To view recorded payments that have been made on a loan or debt,

1.

Select the check box next to the relevant loan or debt in the Payments tab,

2.

Then, reference the data in the Payments History section.

Candidate and Treasurer Guide to CERS

Page 23

Part 7: Understand the Summary Tab

The Summary tab keeps a running total of money received and spent by the campaign during the current reporting

period.

The Summary tab details the campaign’s bank balance at the start of the reporting period, all monetary contributions

received by the campaign, the total amount of all campaign expenditures, and the ending bank balance for both the

account (this is done for both the primary and general accounts).

•

Cash in Bank is the ending balance of the previous report (this will be $0 for the initial report). Please note

that the beginning balance (cash in bank) includes all funds the candidate reported as having received on

previous finance reports; this includes both contributions and loans.

•

Receipts represent all contributions received during the current reporting period. These are added to the

Cash in Bank balance and reflected in the Subtotal amount.

•

Expenditures represent all campaign expenditures made by the candidate during the current reporting

period and are subtracted from the Subtotal.

•

The difference between the Subtotal and current reporting period Expenditures is shown as Cash in Bank

– Ending Balance. This balance should correspond with the candidate’s accounts as of the closing date of

the reporting period; that is, the fifth day before the report is due.

Candidate and Treasurer Guide to CERS

Page 24

Part 8: File a Campaign Finance Report

Select the File tab to file a campaign finance report.

There are a few options on the File tab:

1.

Display the names and address of contributors who have contributed less than $50? Select this first box if

you want your publicly available campaign finance reports to show information about contributors who

made contributions less than $50. If the option is not selected, CERS automatically aggregates those

contributions and includes them as one mass contribution on the public view version of the report.

2.

Closing Report: Select the second box ONLY if this is the candidate’s closing report. A closing report should

ONLY be filed when a candidate’s debts and obligations are settled and no further activity will occur (13-37-

228(3), MCA). See this link for details about how to close a campaign account and disperse surplus funds.

3.

Certification: Select the third box to certify that the information in the report is true, complete, and correct

to the best of your knowledge. Then, click Certify and File.

If a filed campaign finance report needs to be amended later, this is possible by going back to the committee

dashboard, selecting the specific report, and selecting the “Update or Amend Report” button.

Candidate and Treasurer Guide to CERS

Page 25

Part 9: Report Review Process & How to Amend a Campaign Finance Report

The COPP reviews all campaign finance reports and sends the candidate an Inspection Report.

An Inspection Report is a COPP inspection that occurs each time a candidate files a campaign finance report leading

up to an election. The Inspection Report notes all changes a candidate must make to each campaign finance report in

order to comply with Montana law. A CFR Inspection Report will only detail one specific financial report, which will

be stated in the “Reference Report” field.

An Exam occurs after an election and serves as a final and cumulative inspection of all financial reports filed by a

candidate or committee (13-37-123, MCA

). All campaign finance reports are included in the Exam, and the COPP

alerts the candidate or committee to all outstanding items or issues that must be addressed by the candidate or

committee.

The COPP is available to assist candidates and committees in correcting or addressing all items noted in the CFR

Compliance report. However, it is the responsibility of the candidate or committee to ensure all reporting

requirements have been met.

With every Inspection Report and the Exam, the candidate must amend the specific campaign finance report where

issues are noted. A campaign finance report can be amended by navigating back to the candidate dashboard and

selecting the blue Finance Reports button. Then, select the relevant campaign finance report and select Update or

Amend Report. Update information as necessary. Save changes. Finally, re-file the campaign finance report.

Read more about the COPP’s inspection and exam process and view a sample Inspection Report here.

Candidate and Treasurer Guide to CERS

Page 26

Part 10: Post-Election Options for a Campaign Account

This section contains information managing surplus funds and outstanding debts for:

1.

Candidates who do not continue after the primary, and

2.

Candidates who continue to the primary.

The information in this part is also provided on COPP’s website.

Surplus Campaign Funds after the Primary Election

If you don't advance to the general after the primary election, and your primary campaign account has surplus funds,

you have two options for the funds. A candidate may:

1)

Return the contributions to contributors, or

2)

Donate the funds to a non-profit (this must be reported in a C-5 report as a campaign expenditure).

Note: A candidate may not contribute surplus campaign funds to another campaign, including the

candidate's own future campaign (for example, running for the same office during the next election), or use

the funds for personal benefit.

If you do advance to the general election, leftover funds may be moved from a candidate's primary account to the

general account.

•

To report this in a C-5, report the transfer in the C-5 that covers the date the money was transferred. You will

report the removal of money from the primary account as a primary expenditure under Expenditures. Then,

you will report the transfer of the primary funds to your general campaign account under Contributions

(Fundraiser subtab), as a general fundraiser contribution.

Surplus Campaign Funds after the General Election

If you dispose of all campaign funds by your post-general C-5 reporting deadline, all transactions can be detailed

on the post-general C-5 report. Your options to dispose of funds by the post-general C-5 due date are to:

1)

Return the funds to contributors. These returned contributions would be reported in your post-

general C-5 report as an expenditure. You must include the full name and mailing address of the

recipient.

2)

Donate the funds to a nonprofit. Report this transaction in a C-5 report as an expenditure.

If y

ou have funds remaining after the post-general C-5 report deadline, you must dispose of the surplus funds within

120 days after you've filed your closing C-5 campaign finance report. You have the following options for the surplus

funds:

1)

Donate the funds to a nonprofit. These donations must be reported on a C-118 campaign finance form.

2)

If elected, you can establish a constituent services account. This requires you to file a C-118C form and

put the money in a bank account with "constituent services" in the account title. Please note that there

are specific legal requirements for a constituent services account:

Candidate and Treasurer Guide to CERS

Page 27

a.

You will need to include a copy of the transaction where you've moved money from a campaign

account to a constituent services account.

b.

The C-118C form must be filed with 135 days after you've filed a closing campaign report.

c.

Any candidate who opens a constituent services account is required to file C-8 reports.

d.

Funds in a constituent services account are restricted to being used for certain activities and

require detailed accounting and period reports. See 13-37-402, MCA and ARM 44.11.701

through 44.11.711.

Post-Election Outstanding Debts

To pay down campaign debt, you can continue to receive contributions after an election.

•

For example, if you have primary campaign debt, whether you continue to the primary election or not, you

can continue to receive primary contributions to pay the campaign loans or debts down.

•

Please note that contribution limits apply, they apply per election, and each contribution must be

designated for either your campaign’s primary or general account and kept separate. You can continue to

receive contributions designated for a specific campaign as long as the individual or entity has not reached

their contribution limit for that specific election. This explains why general election contributions cannot

be applied retroactively to debt accrued and reflected by your primary campaign account.

•

Section 13-37-241, MCA, provides that, under certain circumstances, a candidate is not required to pay off

primary election debt with primary election funds. In addition, following the general election, the

candidate may repay a loan the candidate made to the campaign with primary or general election funds.

If you will no longer seek out contributions to pay for your campaign's debts or loans, you have a few options to

close your account and settle outstanding loans and debts:

1.

Option 1: You can forgive loans you made, as the candidate, to your campaign. First, the self-loan must

already have been reported as a loan in a previous C-5 report. Then, to forgive your personal loan to your

campaign, simply email the COPP at cppcompliance@mt.gov and state, "I am forgiving my candidate loan of

$XXXX money for my campaign."

2.

Option 2: If your campaign owes outstanding loans and/or debts made to entities that are not yourself (e.g.

to a printing company, a vendor, a business, etc.), you may use your personal funds (not your campaign

funds) to pay off those obligations.

i.

You will report this as an in-kind loan to your campaign (under Contributions, Loan [Use the blue

"Add Candidate Loan" button in the "Row Details" section], list the "In-Kind Description" as

"campaign debt/loan repayment," or something similar). This will then create a candidate loan for

the pending loans or debt balance. Your account will continue to reflect a negative balance with this

in-kind candidate loan.

Candidate and Treasurer Guide to CERS

Page 28

ii.

Then, 'forgive' this 'new' loan by emailing cppcompliance@mt.gov and stating in the email that you

will not personally seek reimbursement from the campaign for this in-kind loan, and that the loan

was made to pay off existing campaign obligations. You must include the 1) vendor, 2) date, and 3)

amount information for those obligations in the email. This explanation is needed because your

CERS account will continue to reflect a negative balance for the campaign even after this activity.

Candidate and Treasurer Guide to CERS

Page 29

Part 11: Filing a Closing Report

Every candidate must file a closing report. Closing reports must be filed when all debts and obligations are

satisfied, and no further campaign activity is anticipated following an election.

Some campaigns have continued to make expenditures after the election that are not campaign related. This is

not permissible. If all the debts and obligations of the campaign have been met, the closing report has been

submitted and there is still a balance in the campaign account the campaign has several options to choose

from to dispose of the surplus funds or property. Review Part 10 to understand your options on pending debt

and loans or surplus campaign funds.

A closing report is simply a final C-5 that is filed as a closing report. This can also be the candidate's required

post-general C-5 report if no campaign account transactions (e.g. paying back outstanding loans or debts)

remain.

To file a report as a closing report, check the "Is this a closing report" box on the File tab (see below image),

certify the information is true, complete, and correct, and file the report.

Part 12: Frequently Asked Questions and Additional Resources

1.

I forgot my Okta login information or I cannot access CERS through Okta. How do I regain

access to my CERS profile?

First, it’s important to know that Okta is a State of Montana application that is not unique to the

COPP but is used as a portal to access a variety of statewide resources. While users must use

Okta to log into their CERS profile, the two systems are different. Whereas CERS is administered

directly by the COPP, Okta is not.

If you have trouble accessing your Okta account, or do not remember your account’s username

or password, you can reset the username or password through Okta itself. The COPP cannot

assist you with resetting an account username or password in Okta or retrieving an existing

username or password you have forgotten.

To reset a username or password in Okta, click on the “Need help logging in?” prompt. Then

follow the instructions provided by Okta.

If you or someone connected to your campaign creates a new Okta profile, with a unique

username and password, this new Okta account will NOT provide instant access to your previous

CERS profile.

If you do not have the Access ID for a CERS profile, or you are trying to access CERS via a new or

reset Okta account, the COPP may be able to assist you. To do this, contact the COPP by

emailing cpphel[email protected] or cppcompliance@mt.gov,

ask for your Access ID, and briefly explain

the nature of your relationship with the campaign/committee whose CERS profile you wish to

access. Upon verification, the COPP will work with you to update your Access ID.

Once you receive an updated Access ID, log into CERS and enter that Access ID as described

a

bove. Once the Access ID for a certain CERS profile is reset by the COPP, any Okta accounts that

previously had access to that profile no longer will have access. Keep that in mind before a

request to reset the Access ID is made, as other individuals who had access to the CERS profile

before would no longer have access without using your newly created Okta account or entering

the new Access ID themselves.

Please note that the COPP reserves the right to deny an Access ID reset request depending on

the circumstances, timing, or nature of the request.

Candidate and Treasurer Guide to CERS

Page 31

2.

When does my campaign finance data in CERS become public?

Data entered into CERS is not public until a campaign finance report is filed. This means that a campaign can

enter in financial data the moment a transaction occurs. The COPP strongly advises campaigns to be proactive

in entering campaign finance data. There is always a five-day window between a period a report covers (e.g.

March 16-April 15) and when the report is due (e.g. April 20). It is not advised for campaigns to wait until the

last moment to enter a campaign finance report’s data.

3.

How do I include an attachment with my campaign finance report?

Candidates may add an attachment to any expenditure disclosed on a campaign finance report. For example, a

candidate could include a receipt or invoice received from a vendor as an attachment to fully disclose a

campaign expenditure. To add an attachment to your report:

First, check the box that states “check this box if you have attachments for this transaction”.

Then navigate to the Attachments tab and add your attachment (by clicking the ‘add’ icon). Attachments must

be in PDF format and must be under 5MB in size.

Click the ‘Add Attachment’ icon to select the PDF file. Provide a file name for the attachment, describe the

attachment under ‘Description’ (for example: Advertising Professionals of Montana social media invoices),

enter the Reference Date for the expenditure the attachment is meant to accompany, and choose the

Reference Type (expenditure).

Candidate and Treasurer Guide to CERS

Page 32

As with any other expenditure, be sure to ‘Submit’ and ‘Save’ your attachment!

4.

How do I report expenditures made to consultants, firms, agencies, etc.?

Individual consultants or other individual professional service providers and Consulting firms, advertising

agencies, P.R. groups, polling services, etc.

Candidates should keep in mind that any expenditures made “made to a consultant, advertising

agency, polling firm, or other person that performs services for or on behalf of a candidate, political

committee, or joint fundraising committee must be itemized and described in sufficient detail to

disclose the specific services performed by the entity to which payment or reimbursement was

made”, (13-37-229(2)(b), MCA

).

In other words, any expenditures made to a group providing professional services must be

described with sufficient detail to fully identify the specific service or services provided. If a group is

being compensated to provide more than one specific task or service, each individual task or service

they perform must be identified. As stated in Commissioner Mangan’s Dismissal in the matter of

Strandberg v. Cooney, COPP-2020-CFP-001,

for expenditures made to an individual consultant or

other individual providing a professional service “a combination of position and/or consultant

responsibilities are considered acceptable by the COPP for disclosure purposes”.

Words or phrases commonly used by candidates and committees alone to describe expenditures

made to individual consultants that the COPP will not consider as adequately detailed include

consulting; consulting services; general consulting; campaign services; professional services;

research; etc. These terms would be considered inadequate because they do not disclose or

identify the specific service or services provided.

Alternatively, the COPP will consider the following terms or phrases acceptable because they easily

identify the “position and/or consultant responsibilities”: digital media consulting; fundraising

consulting; campaign strategy consulting; social media ad design; digital fundraising; opposition

research; issue research- tax policy; candidate likeability polling; GOTV planning.

Candidate and Treasurer Guide to CERS

Page 33

Example: the Leslie Knope for City Council campaign hires an advertising agency to handle

the design of the campaign’s social media ads, research effective voter outreach and

advertising opportunities, and manage when the campaign’s television ads are run on local

stations. Under the requirements of

13-37-229(2)(b), MCA, candidate Knope would be

required to itemize and describe each specific service provided.

Expenditures that resemble this hypothetical example are frequently reported by Montana

candidates and committees but are often described using only generic terms such as

advertisements, research, or campaign services. These terms would be considered

inadequate because they do not disclose the specific services provided or easily identify all

services provided. Instead, the campaign would be required to use descriptors that more

accurately identify the specific services provided, such as social media ad design, voter

outreach research, and media commercial production.

Candidate and Treasurer Guide to CERS

Page 34

Campaign

travel

Any payments made to travel agencies, travel planners, firms, or other professional travel

service providers are subject to 13-37-229(2)(b), MCA’s requirement that the “specific

services provided” be identified.

Legal Payments or Legal Fees

When describing the expenditure of campaign funds for legal payments or legal fees, the

COPP will accept the following descriptions: legal services- compliance; legal services-

active representation/defense; or legal services-retainer fee.

Miscellaneous Items

“Bookkeeping,” “campaign bookkeeping/accounting,” or “budget work” will be

considered acceptable to describe budget management, budget balancing, bill

processing and payment, and/or campaign accounting work.

“Campaign compliance services” or “campaign reporting” will be considered

acceptable to describe payments made to another entity related to the compilation of

filing of financial reports with the COPP on behalf of the campaign or committee.

“Campaign meal” or “staff meal” will be considered acceptable to describe payments

made to cover food expenses incurred by campaign staff when campaigning if date or

location information is provided.

Additional Resources

It is a COPP priority that campaign finance be an accessible subject for voters, candidates, committees,

lobbyists, and all Montanans. For more details on campaign finance requirements for candidates and

treasurers, each candidate and treasurer should familiarize themselves with this Accounting and

reporting Manual for Candidates and Treasurers.

This list has links to all the webpages this guide referenced:

•

Campaign Finance Laws

•

Guide to Registering as a Candidate

•

Filing as an Exploratory Candidate

•

How to Report a Self-Loan to Your Candidate Campaign Account

•

How to Report a Paid Communications, Attribution (Paid for By) Information

•

Candidate Campaign Finance Forms

•

Candidate Reporting Calendar

•

Contribution Limits

•

The COPP’s Inspection and Exam Process

•

How to Close out a Candidate Campaign Finance Account

Candidate and Treasurer Guide to CERS Page 35

Questions? Contact the Office of Political Practices.

Candidates and treasurers should contact the COPP office when assistance is needed. We are available

to support all candidates and treasurers.

- Phone: (406) 444-2942

-

Office: 1209 8th Avenue, Helena, MT

-

General Email: cpphelp@mt.gov

-

Compliance Email: cppcompliance@mt.gov

- Fax: 406-444-1643

@MontanaCOPP

@MontanaCOPP