Revised December 21, 2021 Page 1

Portland Public Schools

Portland Association of Teachers (PAT)

Benefit Summary

Portland Public Schools (PPS) offers a comprehensive benefit package designed to provide

employees and their families with a range of employer and employee paid benefit options. It is the

employee’s responsibility to enroll online in a timely manner to activate benefit elections and

process his/her employment with PPS. Additional benefits information may be found at

https://www.pps.net/Page/15959.

In this Summary, you will find information about the following:

Page Number

• What Benefits does PPS Offer? ............................................................................................ 2

• The Cost of Coverage ........................................................................................................... 2

• Covering a Domestic Partner ................................................................................................ 2

• How Do I Enroll Online? ........................................................................................................ 3

• Making Changes to My Benefits Plan

o Qualifying Events ........................................................................................................ 3

o Annual Open Enrollment ............................................................................................ 4

• Dependent Eligibility .............................................................................................................. 4

• Eligibility Timelines ................................................................................................................ 4

• Insurance ID Cards ............................................................................................................... 4

• When Will My Health Insurance Begin or End ....................................................................... 4

• Voluntary Benefits

o Voluntary Term Life Insurance.................................................................................... 5

o Voluntary Accident Insurance ..................................................................................... 5

o Flexible Spending Accounts (FSA) ............................................................................. 5

o Tri-Met Transit Pass ................................................................................................... 5

o Credit Union Memberships ......................................................................................... 5

• Employee Assistance Program (EAP) ................................................................................... 6

• Retirement Savings

o OPSRP – Oregon Public Services Retirement Plan ................................................... 6

o Tax Deferred Annuity 403(b) Plan (Voluntary) ............................................................ 6

o Retirement Benefits – Sunset Date September 30, 2019 ........................................... 6

• What Leave Plans Are Available to Me? ............................................................................... 7

• Tuition Reimbursement ......................................................................................................... 7

• Professional Improvement Funds .......................................................................................... 8

• PeopleSoft Employee Self Service ........................................................................................ 8

• Health Insurance Contact and Plan Information .................................................................... 9

Revised December 21, 2021 Page 2

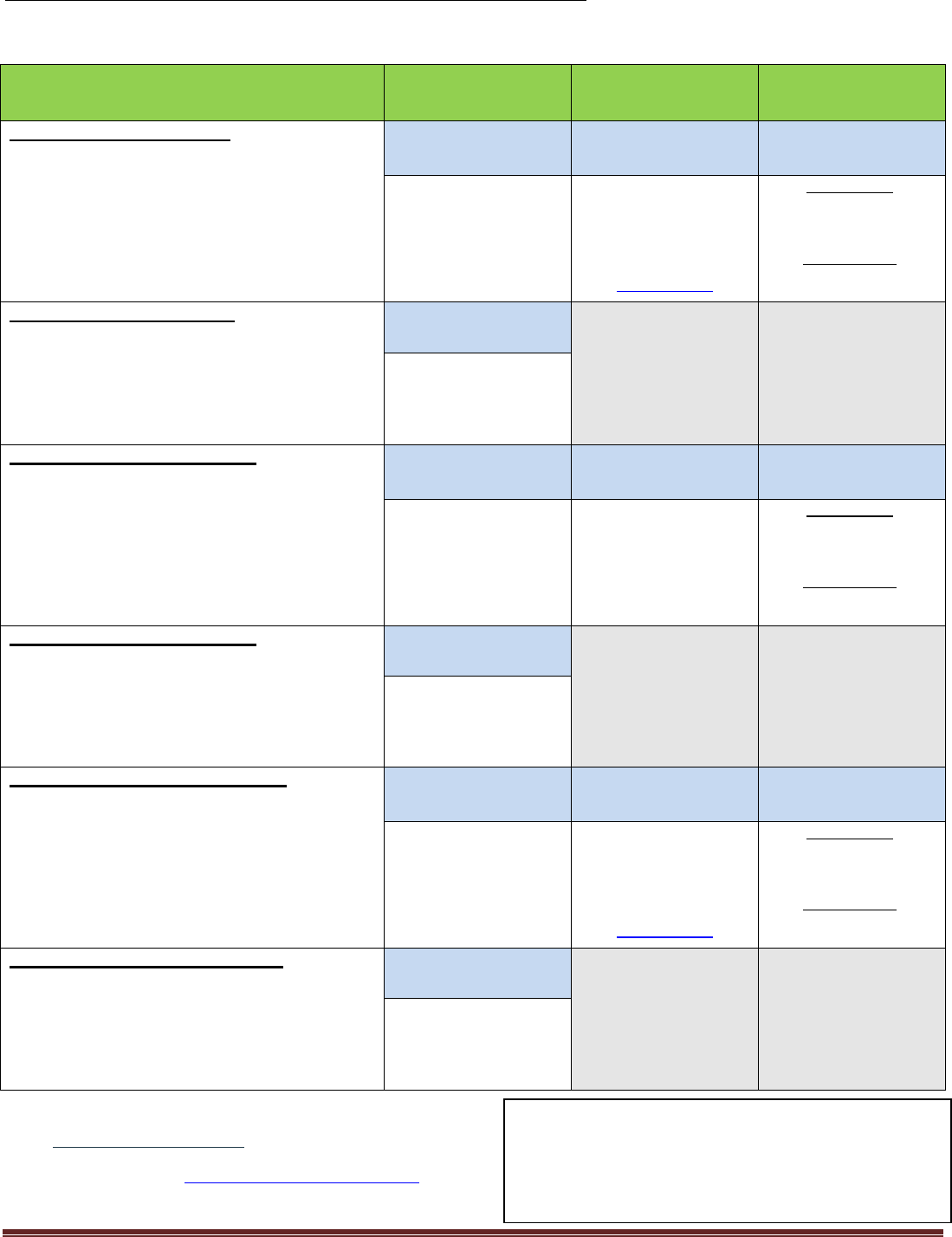

WHAT’S INCLUDED IN MY HEALTH INSURANCE PLAN?

Option 1 Insurance

for full-time or part-time

employees

Option 2 Insurance

for part-time employees only

Medical and Prescription Coverage

Yes

Yes

Vision Insurance

Yes

No

Dental Insurance

Yes

No

District Paid Life Insurance

Yes

Yes

District Paid Accidental Death and Dismemberment

Yes

Yes

Long-Term Disability

Yes

Yes

To qualify for full-time health insurance, you must work at least 30 hours per week (.75 FTE)

To qualify for part-time health insurance, you must work at least 20 hours per week (.5 FTE) to .74 FTE

• Medical and Prescription

PPS offers multiple medical plans to choose from. These include a Preferred Provider Plan (PPO), a

Health Maintenance Organization (HMO) Plan, and an In-Network Plan. These plans have no pre-existing

condition waiting periods. All medical plans include pharmacy benefits.

• Vision

Full-time and part-time employees enrolled in an Option 1 medical plan will have vision coverage. This

coverage will be through Vision Service Plan (VSP) if you are enrolled in Cigna plan, or through Kaiser, if

you are enrolled in the Kaiser medical plan. Part-time employees who enroll in an Option 2 medical plan do

not have this benefit.

• Dental

Full-time and part-time employees enrolled in an Option 1 medical plan will have two dental plan options:

Trust Dental Plan (administered by Delta Dental of Oregon) and Kaiser Dental. These are both traditional

fee-for-service plans. Please refer to the final page of this document for dental claims information. Part-time

employees who enroll in an Option 2 medical plan do not have this benefit.

Group Term Life, Group AD&D and Long-Term Disability – All eligible PAT employees working at least .5

FTE (20 hours per week) will be enrolled in the following plans:

• Group Term Life/AD & D The Standard Group Policy Number: 750971-A

Full-time and part-time employees are automatically enrolled in a district-paid $50,000 term life insurance

policy and a district-paid $50,000 accidental death and dismemberment (AD&D) insurance policy. We

strongly encourage you to add your beneficiary(ies) at the time you enroll.

• Long Term Disability (LTD) The Standard Group Policy Number: 750971-B

Long-Term Disability insurance is a salary replacement policy for an injury or illness sustained off the job.

Following a 90-day waiting period, benefits are payable at the rate of 60% of the employee’s earnings prior

to the disability, up to a maximum of $6,000 per month. Benefits are non-taxable. Employees pay the full

cost of the LTD insurance on an after-tax basis.

Full-time and part-time employees who waive health insurance, or fail to enroll in health insurance, are

automatically enrolled in the Group Term Life, AD&D and LTD plans.

THE COST OF COVERAGE

Most District employees share in the cost of health premiums. The payroll deductions for health insurance are

withheld from the employee’s pay on a pre-tax basis. Premiums are deducted the month prior to coverage, i.e.,

September 30

th

paycheck pays for October coverage. For monthly rates please see www.sdtrust.com.

COVERING A DOMESTIC PARTNER

For employees covering a domestic partner, the IRS requires the District to withhold federal and Social

Security taxes on the fair market value of the domestic partner and their dependents’ coverage. This is

in addition to the base premium that all employees pay based on the plan they choose. State taxes may also

be withheld depending on the employee’s situation. The Imputed Income is also subject to the 6% PERS

contribution for OPSRP Pension Members only (hired on or after August 29, 2003). Please contact the PPS

Benefits Department for more details.

If enrolling a domestic partner, the domestic partnership must have been established for at least six months

preceding the effective date of coverage. A Certificate of Registered Domestic Partnership, or a notarized

Revised December 21, 2021 Page 3

Affidavit of Domestic Partnership, must be reviewed by the Benefits Department before enrollment can be

completed. A link to the Affidavit is found in the “Forms” drop-down menu: https://www.pps.net/Page/15959.

HOW DO I ENROLL ONLINE?

New employees, or employees with job changes affecting benefits eligibility, will be notified by email from

[email protected] when the online system is ready for your enrollment. You have 31 calendar days from your start date or

change in status to enroll. Here are some things you can do to be prepared for enrollment:

• View the benefits plan comparison and rates sheet at www.sdtrust.com. Click on “Already Enrolled?” and then

select the PAT bargaining group (see screenshot below).

Select PAT

Select Active FT & PT

Click GO!

• The rate for full-time employees is a flat rate and does not increase with the addition of eligible dependents. Part-time

employees who elect an Option 2 medical plan have a tiered rate schedule.

• Gather the dates of birth and social security numbers for dependents and/or beneficiaries.

• If you will be covering a domestic partner, complete the Affidavit of Domestic Partnership and have it notarized.

• Log in to the PeopleSoft Employee Self Service portal at https://selfservice.pps.net. You will log in with your PPS

email username (do not enter “@pps.net”) and password. You may only enroll on a PPS computer, or connected to

the PPS wifi. To enroll from home, please follow the instructions at: https://www.pps.net/Page/637.

• For additional help enrolling in health insurance benefits, please visit www.pps.net/Page/7324 and click on the

“Enrollment Instructions” link. This document will take you through all of the steps to enroll successfully.

MAKING CHANGES TO MY BENEFITS PLAN

Qualifying Events – Must be made within 31-days of the event

IRS rules state that benefit selections may only be changed when an employee experiences a qualifying

event or during the annual Open Enrollment period. Examples of qualifying events and required

documentation follow:

Marriage

Marriage license required (both sides)

Divorce

Divorce decree required (pages with your names,

Judges Signature, and date finalized only). Please

submit even after 31-days.

Death of a spouse/domestic partner

Death certificate, if spouse/partner was enrolled in

Voluntary Term Life Insurance

Establishment of a domestic partnership

Affidavit of Domestic Partnership required or

Certificate of Registered Domestic Partnership

Dissolution of a domestic partnership

Email benefits@pps.net

Birth of a child

Birth certificate required

Adoption of a child

Adoption paperwork required

Guardianship of a child by court ordered judgment

Court order required

Loss of an employee’s dependents’ health coverage

from another group plan

Certificate of Creditable Coverage required

Returning to work after an unpaid leave of absence

which caused a loss of coverage

Email benefits@pps.net

Change in employee’s employment status (i.e., gaining

benefits eligibility, full-time to part-time and part-time to

full-time)

Email benefits@pps.net

Revised December 21, 2021 Page 4

Employees who experience a qualifying event must complete their benefits changes within 31 calendar

days from the date of the event. This change will be in two steps:

1. Begin the qualifying event by logging into PeopleSoft Employee Self-Service (ESS), create the

event and upload the required documentation. Documentation will be reviewed by the Benefits

Department and you will receive an email when you are able to proceed with the enrollment.

2. Once you receive the approval email, please log back into ESS and complete the enrollment.

Annual Open Enrollment Period

The annual Open Enrollment period typically takes place mid-October through mid-November and all

changes take effect January 1

st

. You may change medical plans or add or remove dependents. This is a

good time to update beneficiary information, as well. If you are enrolled in the Flexible Spending Account

(FSA), you must re-enroll, as it will not roll-over into the next calendar year. Please see page 5 for more

information on the FSA plans.

DEPENDENT ELIGIBILITY

• Eligible dependents may include a spouse, domestic partner (same sex or opposite sex), children

under the age of 26, or qualifying disabled adult children over age 26. For more information on covering

disabled adult children, please call the Health & Welfare Trust at (503) 486-2107.

• Secova Dependent Eligibility Verification – Upon enrollment, employees will be required to

verify all eligible dependents with Secova, an independent firm who specializes in dependent validation.

You will receive a packet from Secova with instructions, and a list of approved documents, and will

need to follow the instructions and respond within the required timeframe to avoid a lapse in coverage.

For more information, please click: https://www.pps.net/Page/10718.

• The Affordable Care Act (ACA) requires the District to collect social security numbers for all dependents

enrolled in the employee’s medical plan. The social security numbers are used as identifiers in

reporting health insurance coverage to the IRS. Dependents for whom social security numbers are not

provided may not be enrolled.

ELIGIBILITY TIMELINES

• Newly hired benefits-eligible employees must enroll in their choice of benefits plans within 31

calendar days of their start date. New employees will receive an e-mail when their online

benefits enrollment is available.

• Employees who have a qualifying change in FTE have 31 calendar days to make benefits changes.

Employees with job changes that impact benefits will receive an e-mail when their online benefits

enrollment is open.

• If the benefits eligible employee does not make a benefit election during these time periods, enrollment

will not be allowed until the next Annual Open Enrollment period or qualifying event.

INSURANCE ID CARDS

Insurance identification cards are issued directly from the insurance carriers. Processing time usually takes

three to four weeks from the date of enrollment. Should the employee need medical attention prior to receipt of

these cards, please call your medical insurance carrier directly. If the carrier is not showing coverage, contact

the Health & Welfare Trust Administrative Office for assistance. Contact information is listed on page 9.

WHEN WILL MY HEALTH INSURANCE BEGIN OR END?

• Regular or Temporary Employees who work the entire school year will have benefits from October 1

st

through September 30

th

of the following year, provided online enrollment is timely.

• Current employees who work at least half of the scheduled contract days of the month, including paid

holidays, will have coverage beginning the first day of the next calendar month. If the employee works

fewer than half of the scheduled contract days of the month, coverage will begin the first day of the

month following the month they became eligible.

• Coverage will terminate at the end of the month the employee resigns or ceases to be paid, unless

employee worked, or was paid, more than half the contract days of the month. Coverage will terminate

at the end of the following month in this case.

Revised December 21, 2021 Page 5

VOLUNTARY BENEFITS

• Voluntary Term Life Insurance The Standard Group Policy Number: 750971

Benefits-eligible employees may elect Voluntary Term Life Insurance. The employee must be enrolled

in a medical plan to be eligible to enroll in Voluntary Term Life Insurance. The employee’s

spouse/domestic partner and child(ren) may also be enrolled provided the employee is enrolled. New

Employees have a guarantee issue amount of up to $100,000, and their spouse/domestic partner has a

guarantee issue amount of up to $30,000, with no medical history questionnaire required. Elections

must be made within the eligibility timelines (see above). To enroll during open enrollment or to elect

amounts greater than the guarantee issue amount, the employee and spouse/domestic partner must

complete an Evidence of Insurability form. Additional information and forms may be found at

https://sdtrust.com/mybenefits_life_and_add.php.

An employee may elect from $10,000 of coverage to up to five (5) times their annual salary (to a

maximum of $500,000) in increments of $10,000 and may elect the same for their spouse/domestic

partner. Children under age 26 may be enrolled in Voluntary Term Life Insurance in increments of

$2,000 up to $10,000.

• Voluntary Accident Insurance (AD&D) The Standard Group Policy Number: 750971

Employees may purchase additional Voluntary AD&D insurance coverage in amounts from $25,000 to

$300,000 (in increments of $25,000) for themselves, or for themselves and their family members.

Employees who wish to enroll in the Voluntary Accident Insurance plan must be enrolled in a medical

plan and enroll during new hire enrollment or during Open Enrollment.

• Flexible Spending Accounts (FSA) Administered by PacificSource Administrators

Two tax-saving accounts are available: an “Unreimbursed Health-Related Expense Account (HRE)"

and a "Dependent Care Reimbursement Account (DCE)." Please visit our FSA web page for further

information: https://www.pps.net/Page/1652

HRE: Allows employees to set aside pre-tax money to pay for medically necessary healthcare

expenses that are not covered by a health plan. Eligible expenses may include health insurance

deductibles, co-payments, dental care, vision care, prescriptions, and preventative care expenses. Due

to IRS regulations, expenses for domestic partners are not eligible for reimbursement through the

Flexible Spending Account.

DCE: Allows employees to set aside pre-tax money to pay for dependent care expenses. A qualifying

dependent is defined as a dependent of the participant who is under age 13, or the dependent or

spouse of the participant, if the dependent or spouse is physically or mentally incapable of self-care.

Employees may either participate in the FSA, or take the IRS standard dependent care tax credit, or

both.

Eligible employees must enroll online at the time of initial enrollment if they wish to participate

in one or both of the above FSA plans. Or they must wait until the annual open enrollment period,

which is generally held in October, for an effective date of January 1.

Important notes about FSA accounts:

• Amounts not used by the end of the calendar year will be forfeited to the Plan.

• Employees must re-enroll every calendar year to remain in the Plan.

• Tri-Met Transit Passes

State and Federal tax laws allow you to pay for your Tri-Met monthly transit pass on a pre-tax basis.

This reduces your taxable earnings. You may get more information and fill out an enrollment form at:

http://www.pps.net/Page/1657.

• Credit Union Memberships

PPS employees and their immediate family members are eligible to join the following credit unions for

banking services such as savings, checking, IRAs, Certificates of Deposit, loans, and a variety of other

services.

• OnPoint Community Credit Union - Contact OnPoint Customer Service at 1-800-527-3932 for

more information.

• Consolidated Community Credit Union – Contact Consolidated Community Credit Union

Member Services at 503-232-8070.

Revised December 21, 2021 Page 6

EMPLOYEE ASSISTANCE PROGRAM (EAP)

The Reliant Behavioral Health (RBH) provides confidential counseling and referral services to all benefits

eligible employees and anyone living in the employee’s home. This plan is limited to six (6) free sessions per

situation, per year, and includes 24-hour emergency crisis intervention when experiencing personal, emotional

or substance dependency problems. Also provided are financial services, will preparation kits, legal services

and more.

Phone: 1-866-750-1327

www.MyRBH.com – access code: OEBB

RETIREMENT SAVINGS

• OPSRP - Oregon Public Services Retirement Plan (formerly PERS)

Employees hired on or after August 29, 2003 are eligible for OPSRP. This state retirement plan is for

employees who work at least 600 hours per year and is mandated by law. Membership is established

after completion of six (6) months of qualified employment, and requires an employee contribution of

6% of gross salary on a pre-tax basis. This contribution is not subject to Federal and State taxes until it

is withdrawn from the retirement system. Additionally, the District contributes an amount to OPSRP for

each covered employee. Vesting usually occurs after five (5) years of working at least 600 hours per

year. Members automatically vest at age 65, even if they have worked fewer than five years. Complete

information about the Oregon State retirement plan is available at http://www.oregon.gov/PERS.

On July 1, 2020, Senate Bill 1049 went into effect. SB 1049 redirects .75% of your monthly contribution

of 6% of your salary into the Employee Pension Stability Account (EPSA) if you are OPSRP. For PERS

Tier I or Tier 2, 2.5% of your contribution will be redirected into the EPSA. You may make voluntary

after-tax contributions into your IAP account to continue to have a full 6% contribution. Please go here

to learn more.

• Tax Deferred Annuity 403(b) Plan – Voluntary

Employees may elect, and/or make changes to, traditional pre-tax or Roth post-tax salary reductions for

retirement savings at any time during the year. Many self-directed investment options are available

through a variety of participating providers.

Employees who wish to participate in the Tax Deferred Annuity 403(b) plan must take the following

steps:

1. Choose a vendor – For a list of District approved 403(b) vendors, and maximum annual

contributions, please visit http://www.pps.net/Page/1660 and select “[current year] Annual Limits

and List of Vendors” document in the 403(b) drop down menu.

2. Open an account with the vendor of your choice. Vendor contact information is included in the

above list of vendors.

3. Log into the PeopleSoft Employee Self-Service portal and follow the instructions found at

http://www.pps.net/Page/7324 “403(b) Enrollment Instructions.” First time participants, or

employees changing vendors, must be certain their accounts are active under the vendor’s Plan

ID number. The District does not contribute towards this plan.

• Retirement Benefits – Sunset date September 30, 2020

Early retirees who meet the criteria of 15 years of accumulated service in a qualifying position with the

District on or before September 30, 2020 and are eligible to retire under PERS may receive District-

paid insurance. The paid insurance includes medical and prescription coverage for the retiree and one-

half of the premium paid for a spouse/domestic partner. Vision, dental and dependent children

premium, if applicable, will be paid by the retiree. The District-paid coverage may last up to 60 months

or until age 65 and/or Medicare eligibility, whichever comes first. The District-paid early retiree

insurance may not be deferred. Retirees must enroll in retiree coverage upon their resignation from

the District.

For early retirees who do not meet this 15-year criteria but do retire under PERS at the time of their

District resignation, they may access early retiree insurance on a self-pay basis until they turn age 65

and/or become Medicare eligible (ORS 243.303). Retirees must enroll in retiree coverage upon their

resignation from the District.

Revised December 21, 2021 Page 7

Early retirees who meet the criteria of 15 years of accumulated service in a qualifying position with the

District on or before September 30, 2020 are eligible to retire from PERS, may receive $425 per month

as an early retirement stipend. This stipend is paid by PPS Payroll over 60 months, or until age 62,

whichever comes first.

WHAT LEAVE PLANS ARE AVAILABLE TO ME?

• Sick Leave

Ten (10) days are accrued annually for all employees working in a regular or temporary position. Sick

leave is pro-rated based on FTE. All unused sick leave is carried over year to year.

• Paid Personal Leave

All benefits eligible employees receive three (3) paid personal leave days, which may only be used for

unavoidable personal business, attending to matters which cannot be scheduled outside the

employee’s work hours. One-week advance notice is required for the latter, except in the case of an

emergency. Paid personal leave shall not be used for recreation, other employment, union or political

activities, or to extend other leave categories, unless on an approved Federal Family Medical Leave Act

(FMLA) or Oregon Family Leave Act (OFLA). Paid Personal Leave is reset back to three (3) days July

1

st

of each year and any unused balance is forfeited on June 30

th

of the following year. Unit members

who commence employment after the end of the first semester shall be entitled to one (1) day of paid

personal leave.

• Unpaid Personal Leave

Benefits eligible employees are entitled to three (3) days of unpaid personal leave per year for personal

reasons. Except in the case of an emergency, one (1) week advanced notice is required.

• Family Illness Leave

All benefits eligible employees receive up to five (5) days family illness leave per school year with pay,

based on FTE, which is to be used in the event of illness of an immediate family member. Employees

who begin work after the end of the first semester shall be entitled to one and one-half (1-1/2) days of

family illness leave. “Immediate Family” is defined in the PAT union contract as the employee’s spouse,

domestic partner, children, parents, brothers, sisters, mother-in-law, father-in-law, grandparents,

grandchildren, stepparents, stepchildren, stepsiblings or other persons who regularly live in the

professional educator’s home. Family Illness Leave is reset on July 1

st

of each year and any remaining

balance is forfeited on June 30

th

the following year, if unused.

• Bereavement Leave

Employees may use one (1) day of funeral leave, plus one (1) additional day for travel (if required) for a

friend or relative. Employees may use four (4) days for the death of immediate family members. In the

case of a spouse, domestic partner or child(ren), six (6) days may be used. Immediate family member

is defined as spouse, domestic partner, children, parent, grandparent, grandchildren, mother-in-law,

father-in-law, brother or sister, stepparent, stepchildren and stepsibling.

Holidays

Six (6) specific holidays are designated and are paid as part of the teaching contract year.

• Professional Days

Employees accrue two (2) days per year to be used for professional leave such as attending

workshops, conferences etc. Up to four (4) days per year may be used.

• PAT Study Leave

Up to ten (10) FTE study leaves with District paid insurance shall be granted annually. The

requirements and procedures for study leaves are contained in the PAT contract.

Additional information regarding paid and unpaid absences is available in the PPS/PAT bargaining agreement.

TUITION REIMBURSEMENT

Members of PAT are eligible for Tuition Reimbursement for up to six (6) credits or maximum dollar amount,

whichever occurs first in a 12-month period. Teachers on leave of absence and substitute teachers are not

eligible for tuition reimbursement. For additional information regarding Tuition Reimbursement, please email

hrprofessionalgrow[email protected].

Revised December 21, 2021 Page 8

PROFESSIONAL IMPROVEMENT FUNDS

Members of PAT are allotted $1,500 once every three (3) years for approved professional improvement

activity. For additional information, please contact the Travel Desk in Accounting at [email protected] or

(503) 916-3112.

PEOPLESOFT EMPLOYEE SELF SERVICE (ESS) https://selfservice.pps.net

The PeopleSoft Employee Self Service Portal gives employees access to view and make changes to certain

personal information. Use your District email log in and password to access PeopleSoft ESS.

View and/or make changes to:

• Paychecks

• W-2

• Withholding Allowance (W-4)

• Direct Deposit

• Home Addresses

• Phone Numbers

• Personal Email Addresses

• Emergency Contacts

• Benefits Elections

• Dependent/Beneficiary Information

• Add Life Events

• 403(b) Changes

This is a secure site that will maintain data integrity while also allowing access to your vital information and is

only available from inside the PPS network.

In the event that any statement in this summary varies from any benefit contract in effect, the benefit contract

shall prevail.

Revised December 21, 2021 Page 9

HEALTH INSURANCE CONTACT AND PLAN INFORMATION

Following is information about your medical insurance plan. Please find your medical plan and read across the rows to

find the vendor for prescription, vision and dental coverage.

Medical Insurance Plans

Prescription

Information

Vision

Information

Dental

Information

Cigna PPO Plan – Option 1

Group #3344462-PPO1

Please call Cigna for more information on Health

Insurance and to get your member ID number -

(800) 244-6224

Express Scripts

VSP

(Vision Service Plan)

Trust Dental Plan (Delta

Dental) OR Kaiser

Dental

(800) 282-2881

ID #: employee’s SSN

RXBIN: 003858

RXPCN: A4

RXGRP: SDN1HWT

You receive a greater

benefit if you use a VSP

provider. For more

information please call

VSP at (800) 877-7195

www.vsp.com

Delta Dental:

(888) 217-2365

Group #10016949

Kaiser Dental:

(800) 813-2000

Group #1739-101

Cigna PPO Plan – Option 2

Group #3344462-PPO2

Please call Cigna for more information on Health

Insurance and to get your member ID number -

(800) 244-6224

Express Scripts

Vision Coverage not

available with Option 2

Dental Coverage not

available with Option 2

(800) 282-2881

ID #: employee’s SSN

RXBIN: 003858

RXPCN: A4

RXGRP: SDN1HWT

Kaiser Permanente – Option 1

Group #1739-001

Please call Kaiser Permanente for more information

on Health Insurance and to get your Health Record

Number - (800) 813-2000

Kaiser Permanente

Kaiser Permanente

Trust Dental Plan (Delta

Dental) OR Kaiser

Dental

Please call Kaiser for

more information on

your prescription

coverage

(800) 813-2000

Please call Kaiser for

more information on

your vision coverage

(800) 813-2000

Delta Dental:

(888) 217-2365

Group #10016949

Kaiser Dental:

(800) 813-2000

Group #1739-101

Kaiser Permanente – Option 2

Group #1739-004

Please call Kaiser Permanente for more information

on Health Insurance and to get your Health Record

Number - (800) 813-2000

Kaiser Permanente

Vision Coverage not

available with Option 2

Dental Coverage not

available with Option 2

Please call Kaiser for

more information on

your prescription

coverage

(800) 813-2000

Cigna In-Network Plan – Option 1

Group #3344462-OIN1

Please call Cigna for more information on Health

Insurance and to get your member ID number -

(800) 244-6224

Express Scripts

VSP

(Vision Service Plan)

Trust Dental Plan (Delta

Dental) OR Kaiser

Dental

(800) 282-2881

ID #: employee’s SSN

RXBIN: 003858

RXPCN: A4

RXGRP: SDN1HWT

You receive a greater

benefit if you use a VSP

provider. For more

information please call

VSP at (800) 877-7195

www.vsp.com

Delta Dental:

(888) 217-2365

Group #10016949

Kaiser Dental:

(800) 813-2000

Group #1739-101

Cigna In-Network Plan – Option 2

Group #3344462-OIN2

Please call Cigna for more information on Health

Insurance and to get your member ID number -

(800) 244-6224

Express Scripts

Vision Coverage not

available with Option 2

Dental Coverage not

available with Option 2

(800) 282-2881

ID #: employee’s SSN

RXBIN: 003858

RXPCN: A4

RXGRP: SDN1HWT

Trust Administrative Office (managed by Zenith American):

Email: [email protected]

Phone: 833-255-4123 (toll free) or 503-486-2107

Website/Secure Account: https://edge.zenith-american.com/

Mailing/Office Address:

12205 SW Tualatin Rd., Suite 200, Tualatin, OR 97062

Portland Public Schools recognizes the diversity and worth of all

individuals and groups and their roles in society. All individuals and

groups shall be treated with fairness in all activities, programs and

operations, without regard to age, color, creed, disability, marital status,

national origin, race, religion, sex or sexual orientation. This standard

applies to all Board policies and administrative directives. Board of

Education Policy 1.80.020-P.