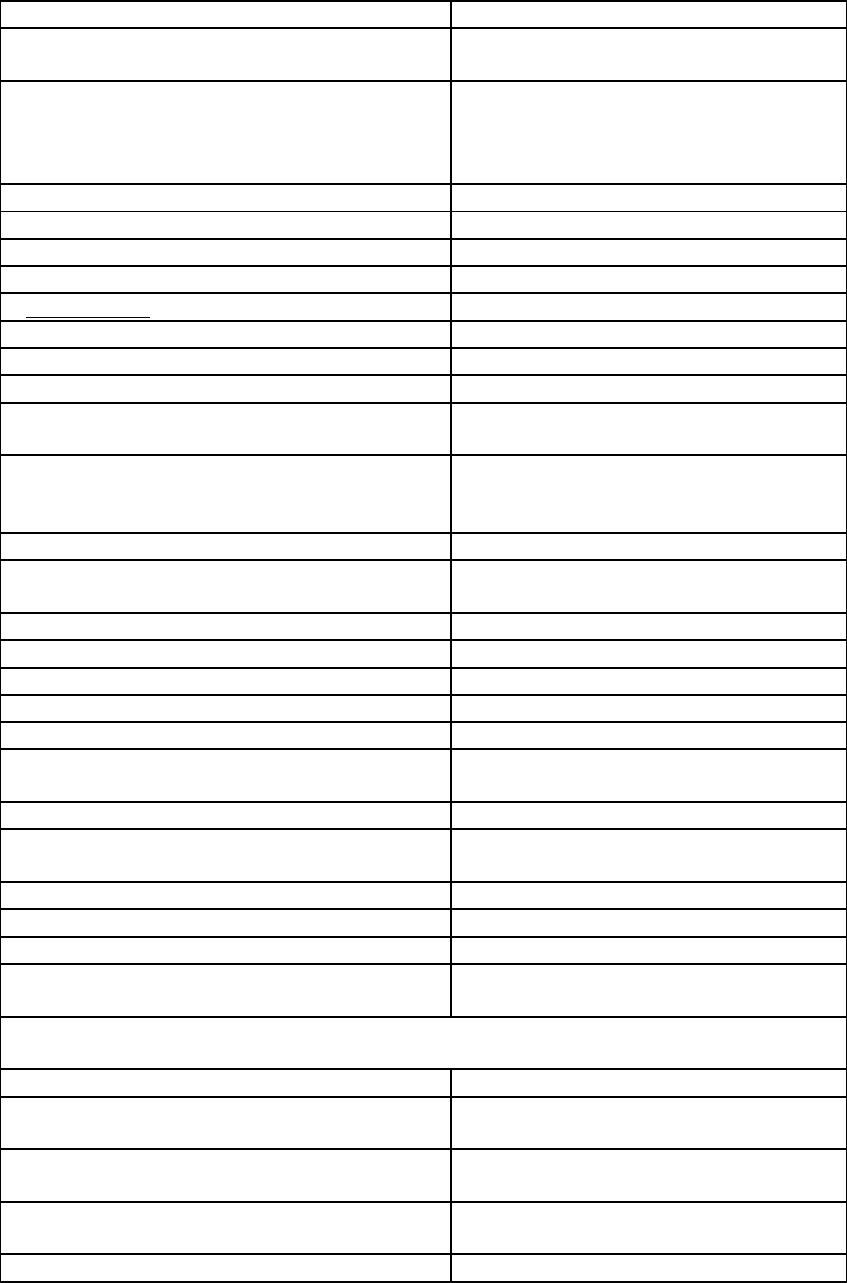

Service Charges - (Updates up to 01/01/2020) :

Rates in INR

Particulars

Service Charges

(I) SAVING DEPOSIT ACCOUNT

A)OPENING & MAINTENANCE OF

MINIMUM BALANCE IN THE ACCOUNT

Rs.10/-

i) GREATER SWEEKAR SAVING DEPOSIT

SCHEME - without Cheque Book

Rs.500/-

ii) GREATER SADHAN SAVING DEPOSIT

SCHEME - With Cheque Book

Rs.1000/-

iii) GREATER SIMPLE SAVING DEPOSIT

SCHEME - SSS A/c - No frill SB Scheme

Rs.10/-

B) PENALTY

i) Charges for failure to maintain minimum

balance (other than SSS A/c, Basic

Savings A/c & Greater Premium SB A/c)

Rs. 118/- per quarter

ii) Greater Premium Saving Deposit Scheme,

(failure to maintain average quarterly balance

Rs.5,000/-)

Rs. 266/- per quarter

GB Gold Savings Account Scheme

Rs. 1,570/- per quarter

Greater Sampoorna Saving Deposit Scheme

Rs. 523/- per quarter

GB Premier Salary Savings Account Scheme

Rs. 117/- per quarter

iii) More than 50 withdrawals in six months and

for SSS A/c’s more than 18 withdrawals in six

months. Basic Savings A/c: Monthly 4

withdrawals including ATM withdrawal; i.e. 48

withdrawals p.a. including ATM withdrawals.

C) CLOSURE OF ACCOUNT (other than SSS

A/c)

i) If closed within six months

Rs. 236/-

ii) If closed within 1 year

Rs. 118/-

iii) Closure of inoperative a/c

Rs. 59/-

D) RETURN OF CLEARING CHEQUE/ECS

i) For Outward Return charge

Upto Rs 1 lacs: Handling Charges Rs.120/-

+ Actual Postage.

ii) For Inward Return charge

SB: Rs. 2.36 per 1,000/- minimum Rs. 130/-

with maximum of Rs. 2,566/-

E) ISSUE OF CHEQUE BOOKS

i) Additional cheque book

(Not applicable to co-op. Society)

Rs. 3.54 per cheque 100 cheque instrument free

in a year (25 in 1st Half & 25 in 2nd Half)

F) ISSUE OF DUPLICATE STATEMENT/ PASS

BOOK

i) with present balance

Rs90/-

ii) with previous entries per Ledger page

Rs90/-

(Note: In case of computer statements 30 entries

or part thereof is treated as one ledger page).

G) In-operative Account (other than SSS A/c’s)

(i) More than 2 years

Rs. 59/- per half year

Note: If available credit balance is not sufficient to recover the aforesaid charges the amount

debited should be restricted to the balance available and close the account by sending

intimation to the depositor.

H) Charges for stop payment instructions per

instrument.

Rs. 120/-

I) Charges for issuance of Balance confirmation

at the request of the customer.

Rs. 59/- per certificate for all

J) Allowing operations through mandate

Rs. 89/- per mandate

Allowing operations through mandate / Recording

of fresh mandate / Change in Signatories (For

Saving Bank Customers)

K) Allowing operations in account through

power of Attorney in Current Accounts

Rs. 259/- per mandate

Allowing operations in account through power of

Attorney in Current Accounts Recording of fresh

mandate / Change in Signatories

L) Change of Authorized Signatory including

reconstruction

Rs. 259/- per mandate

M) Cash Withdrawal/Deposit Charges:Home

Branch

Above 1 lacs to 5 lacs

a) Saving Bank

Rs. 0.59 per thousand.

b) Current

Rs. 0.59 per thousand.

Above 5 lacs

a) Saving Bank

Rs. 0.89 per thousand.

b) Current

Rs. 0.89 per thousand.

Note: For Non Home Branch Withdrwal Limit for Self will be Rs 100000/-

& Other than Self: Rs 50000/- for SB & CA Accounts

(II) Monthly Recurring Deposit A/c (MRD)

a) MRD A/c opened with.

In the MRD A/c, Penalty for non payment of

installment on the due date

Deposits up to 5 years

Rs. 1.59 for every Rs 100/-p.m.

Deposits over 5 years

Rs. 2.12for every Rs 100/-p.m.

CURRENT \CC ACCOUNTS

A) Greater Convenient Current Deposit

Scheme

B) Charges for failure to maintain minimum

balance i.e.Rs.2,500/-

i) Opening & Maintenance of minimum balance in

the Account (other than Greater Premium Current

Deposit Scheme)

Rs. 118/- per month

ii) Greater Premium Current Deposit Scheme

(Penalty for failure to maintain average quarterly

balance Rs.10,000/- )

Rs. 535/- per quarter

C) Ledger Folio Charges for Operative Current

Account

Rs 59/- per page of 30 entries and part

thereof Quarter whichever higher.

D) CLOSURE OF CURRENT ACCOUNT

i) if closed within six months

Rs. 472/-

ii) if closed within 1 year

Rs. 236/-

Note: Above Charges inclusive of GST

iii) closure of inoperative a/c or trf of a/c from

inoperative to operative account

Rs. 118/-

E) a) ISSUE OF AD ON CHEQUE BOOK

Rs. 3.54 per cheque where operations in the

account exceed 50 per month

i) Ad- on printing charges

(‘Printing of Logo, A/c Payee, Not Over Rs.’ in

black and white.)

Rs. 0.30 paise per cheque.

ii) Printing of above details in colour

Rs. 1.18 per cheque

iii) Additional plain slip with cheque number and

others

Rs. 0.60 per cheque

b) ISSUE OF COMPUTER CHEQUE BOOK

(Courier/ Registered post actual charges for

delivery of cheque books upon the request of A/c

holder should be recovered immediately).

Rs. 2.41 per cheque with minimum of 5000

cheques

F) ISSUE OF DUPLICATE STATEMENT OF

ACCOUNT

For previous years Rs. 48/- per page of 30

entries

G) Charges for stop payment instructions per

instruction.

CA/CC/OD Rs. 120/-

H) RETURN OF CLEARING CHEQUES

i) for Outward Return charge

(including for ECS outward)

Handling Charges Rs180/- +Actual postage.

ii) for Inward Return charge

(including for ECS inward)

Rs. 3.54 per thousand (Minimum Rs 257/-

and Maximum of Rs. 10,261/-)

Note: Above Charges inclusive of GST

I) In-operative Account

i) More than 2 years

Rs. 118/- per half year*

*Note: If available credit balance is not sufficient

to recover the aforesaid charges, the amount

debited should be restricted to the balance

available and close the account by sending

intimation to the depositor.

J) Opening of account with restrictive operation –

CC / OD

Rs. 118/- per half year*

K) Allowing operations in account through power

Rs. 266/- per mandate

of Attorney in CC /OD

L) Change of Authorized Signatory including

reconstruction

Rs. 266/- per mandate

M) Drawings against un-cleared effects in CA/

CC/ OD (Circular No.82 dt.27/09/04, S. No.9)

This facility to be allowed up-to Rs. 2.00 lacs on

any day per account

Int.@ 16.5 % p.a. (min Rs. 20/- per

transaction)

TERM DEPOSITS

A) ISSUE OF DUPLICATE RECEIPT

Rs. 59/-

B) MINIMUM DEPOSIT ACCEPTED

i) Monthly Recurring Deposit

ii) Fixed Deposit

a) Regular Deposit

b) Monthly Income Int. Scheme

iii) R.B. Deposit

C) Penalty for Pre-mature withdrawal of Term

Deposit (conversion cost)

D) Addition / Deletion of names in Joint Accounts

/ change in operational instructions including

lockers

Rs. 24 per accounts

E) Premature closure of Recurring Deposit.

F) Premature Closure due to death of Account

Holder by the Nominee / Legal Heir

LOANS & ADVANCES, CASH CREDIT A/C

A) SUPPLY OF APPLICATION FORMS

i) Loan/Bank Guarantee/L.C. Application

Rs. 22/- per form

B) PROCESSING CHARGES

(i) New Applications

Fund based limits / Non Fund based limits

(LC’s, Guarantees other than DPG)

(a) New Commercial Loans

0.59% of applied loan amount

(b) Greater Four Wheeler Loan Scheme

1.18% of applied loan amount.( minimum

Rs. 1175/-)

(c) Renewal Proposal

0.30% of applied loan amount

(d) Retail & Housing Loans

Upto Rs.2.00 lakhs - Rs.1,098/-

Rs.2 lakhs to Rs.5 lakhs - Rs.2,196/-

Above Rs. 5 lakh -0.59 % of the applied

loan amount

Note: i. No processing charges for considering advances against Bank's deposits.

D) VEHICLES

i) Issue of NOC to R.T.O.

ii) Issue of HPTR to R.T.O.

Rs30/-

Rs.30/-

E) ASSIGNMENT / REASSIGNMENT /

ENCASHMENT OF LIC POLICY

Rs.59/- plus Life Insurance policy +actual

postage

iv) *Half yearly service charges to Operative Cash

Credit / overdraft with cheque book facility

Upto Rs. 5 Lacs

Rs. 120/-

Above Rs. 5 lacs to Rs.10 lacs

Rs. 240/-

Above Rs.10 lacs to Rs.25 lacs

Rs. 361/-

Above Rs.25 lacs

Rs. 600/-

Note:- i) In case of OD A/c. with cheque book facility only the said service charges are

applicable. ii) If CC A/c. is having continuously credit balance throughout the respective half

year, the said charges should not be debited.

v) Exchange of pledged shares

vi) Encashment of pledged shares (non demat

shares) (Charges inclusive of GST)

vii) Assignment of NSCs / KVPs

Rs. 22 per certificate+ actual travelling

charges not exceeding Rs 50/-+actual

postage

viii) Encashment of NSCs / IVP / KVP

ix) Reassignment of NSCs

(Charges Inclusive of GST)

Rs. 24 per certificate

MISCELLANEOUS SERVICES

A) SHARE DEPARTMENT

i) Issue of Duplicate Share Certificate

Rs50/-per certificate

ii) Transfer of Share Certificate

Rs24- per certificate

iii) Duplicate issue of Member ID Card

Rs30/- per ID card

B) Written fate enquiries from other Banks for the

cheques sent in clearing

i) Saving Account

Rs. 24/-

ii) Current / Cash Credit Account

Rs30/-

C) Charges to be collected for Loss of Token

Rs118/-

D) Requisition through ATM -cheque book,

statement of A/c, Product information

Rs.11/- or Actual courier charges,

whichever is higher.

E) Loss of cheque -book requisition slip

Rs.12/- for request of SB.

Rs.30/- in case of CA

F) Standing instruction other than Term Deposit &

Loan Installments & Locker Rent and MRD

transfer

G) Solvency Certificates

Upto Rs. 3 lacs - Rs. 520/-

Rs.3 lacs to Rs.5 lacs - Rs.782/-

Rs.5 lacs to Rs.10 lacs - Rs.1564/-

Rs.10 lacs to Rs.25 lacs - Rs.3128/-

Rs.25 lacs to Rs.50 lacs - Rs.5213/-

Above Rs.50 lacs to Rs.100 lacs - Rs.7820/-

Above Rs.100 lacs - Rs.10,425/-

Note: For issuance of Capacity Certificate for

obtaining visa for educational purpose for students

only 50% charges as mentioned above.

H) Safe Custody Charges

Rs. 6.26 per scrip. Minimum Rs.58/-p.a. or part

thereof .Sealed cover Rs 115/- per cover per

annum or part thereof. Banks own deposit rent

no charge.

I) Attestation of account holders signature

Rs.59/- per authentication

J) Issuance of No Dues Certificate

Rs.59/- per occasion

K) Providing Credit Report.

Rs.117/- per occasion

L) Enquiries relating to old records

Entries for 3 to 12 months: Rs 59 maximum

5 transaction. Above 5 transaction: Rs 30

per transactions.

Entries for Above 12 months: Rs 148 for 5

transactions. Above 5 transaction: Rs 59 per

transactions

M) Cash Transaction Charges (inclusive of GST)

are applicable to Cash Transaction

(Deposit/Withdrwal) of Rs.1 Lac and above

(excluding ATM withdrawal) or deposit of 10

bundles or more during the day in any branches

N) DEMAT CHARGEs

a) Account Opening Charges

NIL

b) Transaction Charges - Purchase / Credit

NIL

c) Transaction Charges - Sales / Debit

0.06 % (Subject ot minimum of Rs.25 per

transaction)

d) Demat Charges

Rs. 3.54 per Certificate +

Rs.36/- Courier

(Per Form)

e) Remat Charges

0.14% of Market Value (Subject to

minimum of Rs.43/- per request )

f) Account Maintenance Charges (per annum)

Rs. 425 for individuals’

Rs. 1180/- for others

g) Pledge/Unpledge/Invocation

Rs. 59/- per ISIN

h) Freeze Charges

Rs. 59/- per ISIN

i) Custody Fees

Nil

Note:- a) Account maintenance and Demat Charges are payable up front

b) Holding statement will be provided once a month if there are any transactions, else

statement will be sent on quarterly basis (Additional statement Rs.17/-) c) Bills for

transaction charges will be raised monthly. d) The delivery instruction has to be submitted one

day prior to the Execution Date or as such guidelines laid down by SEBI from time to time f)

All the Demat Charges / GST of Demat charges are recovered at Demat Cell itself by debiting

the respective accounts with the branches.

O) ATM SERVICES (w.e.f. October 2009)

i) Use of Greater Banks ATM’s

NIL

ii)Use of NFS ATM’s across the country

a) Cash Withdrawal

Upto 3 withdrawals no charge and beyond

that Rs 21/- per withdrawal

b) Balance Enquiry

Rs.11/-

First 3 transactions will be free for Saving

Account Holders in a month

iii) Annual Charges - RuPay Debit Card

Rs. 118/- p.a.

iv) Re-PIN Charges - ATM / RuPay Debit Card

Rs. 60/-

v) Issue of Duplicate ATM / RuPay Debit Card

Rs120/-

P) Franking Charges

Rs.10/- per Document

BANK GUARANTEE (FRESH/RENEWAL)

A) PARTLY SECURED BY TERM. DEPOSIT

i) Less than 50% of Bank Guarantee amount

30 paise per Rs 103/- per month

ii) 50% and above of Bank Guarantee amount

24 paise per Rs 103 per month

B) FULLY SECURED BY TERM DEPOSIT

8 paise per Rs103/- per month

C) Refund of commission on premature

cancellation of Bank Guarantee (BG)

ISSUE OF INLAND LETTER OF CREDIT

I] (a) Commitment charges

18.18 Paise per Rs.100 per quarter or part

thereof

(b) Usance Commission

i) Bill upto 7 days sight

18.18 Paise per Rs.100 per quarter or part

thereof

ii) Bill over 7 days to 3 month sight

24.07 Paise per Rs.100 per quarter or part

thereof

iii) Bill over 3 month sight

24.07 Paise per Rs.100 per quarter or part

thereof

II] (a) Simple Amendment

Rs.118/-

(b) Enhancement Commitment charges

Usance Comm. as above on amt. by which

L/C is enhanced sub. to minimum of

Rs116/-

(inclusive of GST)

(c) Extension

Usance Comm. as above on amt. by which

L/C is enhanced sub. to minimum of

Rs.118/-

(inclusive of GST)

(d) Postage etc.

Actual postal charges

BILLS AND CHEQUES SENT FOR

COLLECTION (Charges inclusive of GST)

A) (IBC/OBC)

Upto Rs.1000/-

Rs. 18 for Bills+Actual postage;

Cheques-Rs 37/- per instrument for SB &

Rs 52 for CA

Rs.1,001/- upto Rs.5,000/-

Bills-Rs37/=+actual postage;

Cheques-Rs 37/- per instrument for SB& Rs

52/- for CA

Rs.5,001/- upto Rs.10,000/-

Bills-Rs. 60/-+ actual postage;

Cheques-Rs 52/- per instrument for SB &

CA

Rs.10,001/- upto Rs.1 Lakhs

Bills - Rs. 7-per Rs. 1000/- + actual postage;

Cheques-Rs 103/- per instrument for SB &

CA

Above Rs.1 lakh

Bills- Rs.7 per 1,000/- subject to maximum

of Rs.4180/- Plus Actual postage ;

Cheques- Rs150/- per instrument for SB&

CA +actual postage

Handling charges for Bills / Cheques returned

unpaid (Local)

Bills- Local-Rs37/- per instrument ;

Cheques- Rs 19 /-per cheque+actual postage

;

Bills--Outstation :- 75% of the charges

initially collected or Rs. 35/- whichever is

higher;

Cheques Rs 18/- per cheque+actual postage

B) OUTWARD NATIONAL CLEARING

CHEQUE

Rs.12 per instrument

C) COLLECTION OF OUTSTATION BILLS

IBC / OBC / BD UNDER L/C

Upto Rs.1,000/-

Rs.18 Plus Actual postage

Above Rs.1,000/- upto Rs.5,000/-

Rs.37/- Plus Actual postage

Above Rs.5,000/- upto Rs.10,000/-

Rs. 60/- Plus Actual postageRs.10/- or

Actual courier charges, whichever is higher.

Above Rs.10,000/-

Rs. 3.00/- per Rs.1,000/- or part thereof Plus

Actual Postage

D) Collections of Deposits from other Banks on

maturity

Out of pocket expenses Rs. 120/- (min) +

actual postage

E) Charges for presentation of usance bills

Rs. 60/- per bill

a] E-TDS commission

TDS Amt Slab (Rs.)

Min

1-10,000

Rs. 177

10,001

Rs. 354

100,001

Rs. 708

500,001

Rs. 1,062

1,000,001

Rs. 1,416

Note: Above charges inclusive of GST

b] REMITTANCES

I) PAY ORDERS

Upto Rs.10,000/-

Rs47/-

Rs.10,001 upto Rs.1.00 Lakhs

Rs.47/- plus Rs.2.40/- per Rs.1,000/- above

Rs. 10000/-Maximum Rs.263/-

Rs.1,00,001 Lakhs and above

Rs.263- Plus Rs1.20 per Rs.1,000/-above Rs

1 lac, Maximum Rs.6964/-

II) CONCESSIONAL RATE FOR STUDENTS

EXAM FEES / PAYMENT TO COLLEGE /

UNIVERSITY/ PHYSICALLY HANDICAPPED

Free

III) SENIOR CITIZEN

50% of the above charges

IV) RE-ISSUE OF PAY ORDER

Rs60/-

V) CANCELLATION OF PAY ORDER

Rs.60/-

VI) RTGS Charges(above Rs 2,00,000/-)

Rs 30/-

i) for payments through account (Outward)

Rs.2,00,001 to Rs. 5,00,000 = Rs. 29/-

Rs.5,00,001 & above Rs. 58/-

ii) for receipts and crediting (Inward)

Nil

VIII) i) NEFT – Outward

Upto Rs.1,00,000/- = Rs.5/-, Rs.1,00,001 to

2,00,000/- = Rs18/-

& above Rs 2,00,000/- Rs 29/-

ii) NEFT Inward

Nil

IX) EFT/ECS Charges- Inward

Nil

EFT/ECS Charges- Outward

Nil

c] Commission to be charged while issuing at

par instruments (H.D.F.C / ICICI/ other Banks

DD)

Upto Rs.1,000/-

Rs36/-

Rs.1,001/- to Rs.5,000/-

Rs47/-

Rs.5,001/- to Rs.10,000/-

Rs59/-

Rs.10,001/- to Rs1,00,000/-

Rs. 3.53 per thousand +HO commission

Rs. 21

Rs.1,00,001/- to Rs.10.00 Lakhs

Rs.353/- plus Rs. 2.35 per thousand above

Rs.1 lacs (Max. Rs.2,470/-) +HO

CommissionRs.21/-

Above Rs.10.00 Lakhs

Rs 2,470/- plus Rs 2.35 per thousand above

Rs 10 lakh. + HO Commission Rs 20/-

Cancellation of Draft

Note: No refund of earlier commission already

charged

Rs60/-

Duplicate Draft

Rs60/-

Revalidation of Draft

Rs60/-

Foreign Exchange Charges

As per Agreement/Arrangement with

Saraswat Bank

SAFE DEPOSIT LOCKERS

A) OPENING OF LOCKER

(i) Key Deposit

Rs.5,000/- (At the time of let out)

(ii) Service Charges

Rs. 240/- plus Stamp charges

B) DELAY IN PAYMENT OF RENT

Rs.118/- per month

C) BREAK OPEN OF LOCKER IN CASE OF

LOSS OF KEY / NON PAYMENT RENT

Rs. 590/- + actual Breaking charges paid to

Godrej/ Steelage

D) SURRENDER OF LOCKER

The branch should immediately write to locker

manufacturer for replacement of locker and key

and the new key should be given to new allottee

in a company sealed pack.

Locker holder who have completed i) more

than three years & above no charges are

levied. ii) Less

than three years the charges are Rs. 1000/-

to be adjusted from key deposits.

E) If number of locker operations exceed 24 in a

Financial year.

Rs.59/- per visit in excess of 30 visits per

year.

F) RENT FOR YEAR (* w.e.f. 1

st

Jan 2020.*Rent is inclusive of GST.

Locker Rent :

Rates in INR

Locker Type

Locker Size

Locker Rent per annum

including GST

A

A

1500

B

B

2000

C

2A+

2,500

D

D

2,750

H1

2B+

3,500

E

2B+

3,500

F

4A+

5,500

G

2D+

6,000

H

4B+

7,000

L2

4D-

10,500

L/J/K

4D+

12,500