Cincinnati Financial Corporation

2010 Third-Quarter Letter to Shareholders

November 18, 2010

To Our Shareholders, Friends and Associates:

Your company, like others in our industry, faces signicant challenges as we continue to adapt our operations in a tough

insurance environment. Some insurers appear to be cutting prices to build market share and meet near-term goals. In keeping

with the Cincinnati philosophy, we choose to pursue adaptive solutions that align with long-term strategies and relationships.

Our solutions involve offering our independent agency partners more to sell in terms of value and service, along with reasonable

prices and a sound underwriting approach. We believe the best way to grow and prot is to help these agencies prosper. Our

commitment to our agent-centered mission requires that we steadfastly meet their current needs while also evolving and

adapting to become the company they and their clients need tomorrow.

We create opportunities to listen and fully understand the value agents place on current or proposed Cincinnati attributes and

services. Our extensive team of eld representatives interacts daily with agency staff; our executives travel regularly to meet

with agents in their ofces; and earlier this year we asked an independent rm to survey our agents.

The messages we hear are consistent. Agents tell us that a strong technology infrastructure is in a sense “the price of admission”

to earning their business, and we have responded with new policy administration systems. They say they would welcome

more direct client support before and after the sale, and we are working to do that with our new Target Markets programs,

CinciSafe™ loss control services and further development of online services for policyholders.

In any phase of the insurance market cycle, improving the value and service we give agents and policyholders is the best route

to assuring future solid performance of our property casualty insurance operations. One of our three overarching corporatewide

goals includes growing our share of business within our appointed agencies. Our target is to earn the No. 1 or No. 2 carrier

status in 80 percent of our agencies appointed for ve or more years, up from the current measure of approximately 75 percent.

To hit that target, we’re focusing on improving our handling of small business accounts and our interactions with consumers, so

agents can expect Cincinnati to give their clients a targeted, consistent, superior experience.

Inside this Letter to Shareholders, you’ll read about initiatives to support two more corporatewide goals. The rst goal is to

continue building our already strong capital to create long-term value. We have the investment-related part of our house in

good order to weather storms in nancial markets, but it will be challenging to nd opportunities to increase investment income

in the near future. To accomplish our objectives related to building capital, we must operate our insurance business more

protably. We’re harnessing the power of predictive analytics to assist in developing competitive, more precise pricing. The

models and metrics we set up will help us identify trends and challenges early, allowing for management decisions informed by

up-to-date, granular data. We expect to develop one-, three-, ve- and 10-year growth and protability plans for each territory,

state and agency.

The third corporatewide goal involves improving our internal processes, both to support our other goals and to reduce costs.

We are taking opportunities to implement straight-through processing for select life insurance products and working to

identify similar opportunities in our property casualty operations. Our new automation is bringing more efcient processes and

better use of staff resources. Ultimately, all of these efforts will reduce costs, improving our service, agent and policyholder

satisfaction and your shareholder return.

Respectfully,

John J. Schiff, Jr., CPCU Kenneth W. Stecher Steven J. Johnston, FCAS, MAAA, CFA

Chairman of the Board President and Chief Executive Ofcer Senior Vice President and Chief Financial Ofcer

/s/ John J. Schiff, Jr. /s/ Kenneth W. Stecher /s/ Steven J. Johnston

Investor

E-mail Alerts

Sign up for Investor E-mail Alerts by

visiting www.cinn.com/investors and

selecting E-mail Alerts at the bottom of

the page. This service sends shareholder

communications links to the e-mail

address of your choice as soon as

new communications are posted on

our website. E-mail alerts are the best

way to make sure you see our interim

reports such as the quarterly Letter

to Shareholders. Unlike Electronic

Delivery, E-mail alerts won’t stop

the paper versions of any required

shareholder mailings. In addition to

E-mail alerts, you’ll want to enroll

in Electronic Delivery to stop

paper mailings.

About the Company

Cincinnati Financial Corporation stands among the 25 largest property

casualty insurers in the nation, based on premium volume. A select

group of agencies in 39 states actively markets our property casualty

insurance within their communities. Standard market commercial lines

policies are available in all of those states, while personal lines policies

are available in 29 and surplus lines policies are available in 38 of the

same 39 states. Within this select group, we seek to become the life

insurance carrier of choice and to help agents and their clients – our

policyholders – by offering leasing and nancing services.

Three hallmarks distinguish our company, positioning us to build value

and long-term success:

• Commitment to our network of professional independent insurance

agencies and to their continued success

• Financial strength that lets us be a consistent market for our agents’

business, supporting stability and condence

• Operating structure that supports local decision making, showcasing

our claims excellence and allowing us to balance growth with

underwriting discipline

Table of Contents

Third-Quarter Earnings Release ...........................1

Connecticut Agency Appointed ............................11

Oregon Agency Appointed ...................................11

Inside Cincinnati ............................................. 12-13

Learning & Development .....................................13

Public Responsibility ............................................13

Safe Harbor Statement .........................................14

Contact Information ........................................... BC

Recent News Releases

Cincinnati Financial Reports Third-Quarter 2010 Results

Cincinnati, October 27, 2010 – Cincinnati Financial Corporation (Nasdaq: CINF) today reported:

• $156 million, or 95 cents per share, of net income for

the third quarter of 2010 compared with a net income of

$171 million, or $1.05 per share, in the third quarter of 2009.

• $56 million, or 34 cents per share, of operating income*

compared with operating income of $96 million, or 59 cents

per share.

• Net income and operating income for the third quarter of

2010 declined due to property casualty insurance results

that were lower by $42 million after taxes. For the rst nine

months of 2010, the contribution from property casualty

insurance rose $25 million over the year-ago period. The

contribution to net income from investments, including net

realized investment gains, rose $26 million for the quarter

and $42 million for the nine-month period.

• $30.80 book value per share at September 30, 2010, up

approximately 6 percent from June 30, 2010, and 5 percent

from December 31, 2009.

• 9.4 percent value creation ratio for the rst nine months of

2010, compared with 15.0 percent for the same period of 2009.

1

Financial Highlights

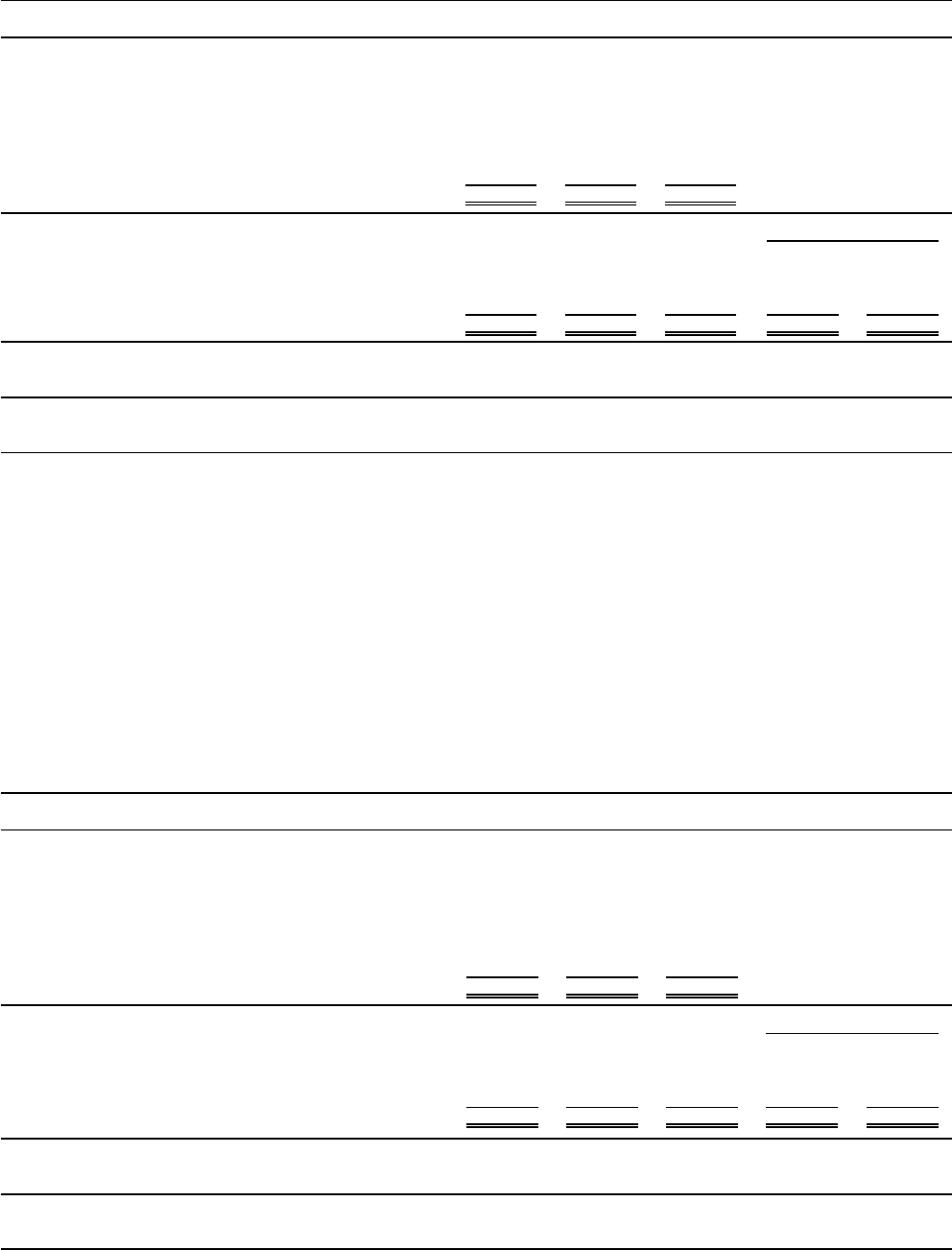

(Dollars in millions except share data) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Revenue Highlights

Earned premiums ............................................... $ 784 $ 766 2 $ 2,299 $ 2,301 0

Investment income, pre-tax ............................... 128 127 1 388 370 5

Total revenues .................................................... 1,071 1,007 6 2,836 2,770 2

Income Statement Data

Net income (loss) .............................................. $ 156 $ 171 (9) $ 251 $ 187 34

Net realized investment gains and losses .......... 100 75 33 90 58 55

Operating income (loss)* .................................. $ 56 $ 96 (42) $ 161 $ 129 25

Per Share Data (diluted)

Net income (loss) ............................................... $ 0.95 $ 1.05 (10) $ 1.53 $ 1.15 33

Net realized investment gains and losses .......... 0.61 0.46 33 0.55 0.36 53

Operating income (loss)* .................................. $ 0.34 $ 0.59 (42) $ 0.98 $ 0.79 24

Book value ......................................................... $ 30.80 $ 28.44 8

Cash dividend declared ...................................... $ 0.40 $ 0.395 1 $ 1.19 $ 1.175 1

Diluted weighted average shares outstanding ... 163,175,682 162,901,396 0 163,251,628 162,794,767 0

Insurance Operations Third-Quarter Highlights

• 103.9 percent third-quarter 2010 property casualty

combined ratio, up 8.8 percentage points from one year ago

primarily due to a lower benet from reserve development

on prior accident years and relatively higher weather-related

catastrophe losses.

• 1 percent increase in property casualty net written

premiums, including personal lines segment growth of

9 percent.

• $109 million property casualty new business written by

agencies, up $2 million from third-quarter 2009. $11 million

was contributed during the quarter by all agencies appointed

since the beginning of 2009.

• 4 cents per share contribution from life insurance to

third-quarter operating income, matching the year

ago contribution.

Investment and Balance Sheet Highlights

• Investment income, after income tax effects, grew 1 percent

in the third quarter of 2010. On a nine-month basis, it grew

4 percent, driven by pre-tax interest income growth of

7 percent.

• 5 percent nine-month increase in fair value of invested

assets plus cash at September 30, 2010, including bond

portfolio growth of 8 percent.

• Parent company cash and marketable securities of

$1.079 billion at September 30, 2010, up 8 percent

from year-end.

* The Denitions of Non-GAAP Information and Reconciliation to Comparable GAAP Measures on Page 9 denes and reconciles measures presented in this

release that are not based on Generally Accepted Accounting Principles.

** Forward-looking statements and related assumptions are subject to the risks outlined in the company’s safe harbor statement (see Page 14).

Attaining Milestones: Financial Strength

Kenneth W. Stecher, president and chief executive ofcer,

commented, “The balance sheet strength of Cincinnati

Financial Corporation grew as of September 30, 2010, with

assets topping $15 billion and shareholders’ equity reaching

$5 billion.

“Book value per share rose 6 percent during the third quarter

and 5 percent over the nine-month period. The increase for

both periods was primarily due to increased fair value of

our investment portfolio, with our common stock portfolio

growing more than the bond portfolio during the third quarter.

Investment income rose compared with the year-ago quarter,

but the trend for the sequential quarter declined as we

replaced matured or called bonds with ones that generally

pay lower interest.

“We sold our Verisk holding during the third quarter and

plan to reinvest the proceeds – more than $80 million of

after-tax realized gains – in dividend-paying equities.

Realized investment gains on equity sales more than offset

a negative income contribution from property casualty

insurance operations, with market and economic pressures

continuing to affect demand and pricing in our commercial

business segment.

“We expect initiatives already in progress to drive incremental

improvement of our insurance underwriting results. In the

interim, our exceptional level of nancial strength lets us

honor our strong relationships with shareholders, independent

agent representatives and policyholders by maintaining

consistency and a long-term approach. This month,

shareholders received a regular cash dividend that reected

50 consecutive years of annual increases, a record matched by

only a handful of public companies.”

Meeting Challenges: Insurance Operations

Growth and Profitability

Stecher noted, “With the support of our agents, we are

declining business we consider underpriced and, at the same

time, enjoying growth in states and lines of business that we

have targeted for premium growth. Our total new business

premiums rose $2 million over last year’s third quarter,

thanks to increases from states where we began marketing

since 2008, as well as from personal lines. Overall written

premiums, which include renewing policies at our high

policy retention rate, also rose slightly for the quarter. Written

premium growth in personal lines and excess and surplus

lines more than offset the 3 percent decline in our larger

commercial segment.

“Our overall property casualty combined ratio was

unsatisfactory at 103.9 percent for the quarter and

104.7 percent for the nine months. Protability of commercial

casualty, our largest line of business and representing nearly

one-third of our commercial segment, continued strong.

“Our challenge remains to improve performance of our

homeowner personal line of business and our workers’

compensation commercial line, which have been offsetting

otherwise protable overall underwriting results. One

of the ways we evaluate the effects of our underwriting

initiatives is to look at the loss and loss expenses ratio

before catastrophe losses and prior accident year reserve

development. For the nine months, that measure for

commercial lines came within 1 percentage point of full-

year 2009 although pricing trends worsened. The same

measure for personal lines, while still below a break-even

point, improved almost 3 percentage points.

“We believe pricing precision accounts for much of the

improvement, and we will repair our underperforming

lines by targeting further precision. We rst used predictive

analytics tools for this purpose in homeowners, then workers’

compensation and more recently for the personal auto line

of business, and we are developing them for our other major

lines of commercial business.

“In addition, we are addressing underwriting performance

through several other initiatives. We are taking selective

rate increases for homeowners, speeding up our response to

workers’ compensation claims, providing more specialized

staff support for that line and expanding our proactive loss

control services. All of these actions, together with our reserve

practices that consistently produce favorable development

over time, put us on track to resume historical underwriting

results well above industry averages.

“In conclusion, we remain condent in our ability to deliver

better results and shareholder value over the long term.

Our time-tested business model and nancial strength is

the foundation. Strategic initiatives to improve operating

performance are beginning to bear fruit and also place us in a

better position to grow earnings at a faster pace when market

conditions are more favorable.”

2

Consolidated Property Casualty Insurance Operations

(Dollars in millions) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Agency renewal written premiums ............................ $ 677 $ 669 1 $ 2,044 $ 2,030 1

Agency new business written premiums .................... 109 107 2 307 311 (1)

Other written premiums ............................................. (50) (46) (9) (110) (110) 0

Net written premiums ............................................. 736 730 1 2,241 2,231 0

Unearned premium change ........................................ 7 3 133 (62) (33) (88)

Earned premiums .................................................... 743 733 1 2,179 2,198 (1)

Loss and loss expenses ............................................... 532 459 16 1,560 1,623 (4)

Underwriting expenses ............................................... 240 238 1 722 716 1

Underwriting (loss) prot ....................................... $ (29) $ 36 nm $ (103) $ (141) 27

Ratios as a percent of earned premiums: Pt. Change Pt. Change

Current accident year before catastrophe losses ..... 75.5% 73.9% 1.6 72.3% 70.6% 1.7

Current accident year catastrophe losses ................ 4.3 1.2 3.1 7.2 8.4 (1.2)

Prior accident years before catastrophe losses ....... (7.7) (12.1) 4.4 (7.2) (4.9) (2.3)

Prior accident years catastrophe losses ................... (0.5) (0.3) (0.2) (0.7) (0.3) (0.4)

Total loss and loss expenses ....................................... 71.6 62.7 8.9 71.6 73.8 (2.2)

Underwriting expenses ............................................... 32.3 32.4 (0.1) 33.1 32.6 0.5

Combined ratio ....................................................... 103.9% 95.1% 8.8 104.7% 106.4% (1.7)

Contribution from catastrophe losses and prior

years reserve development ................................. (3.9) (11.2) 7.3 (0.7) 3.2 (3.9)

Combined ratio before catastrophe losses and

prior years reserve development ......................... 107.8% 106.3% 1.5 105.4% 103.2% 2.2

•$6 million or 1 percent increase in total third-quarter 2010

property casualty net written premiums, reecting various

targeted growth initiatives that produced increases of

$18 million in personal lines and $5 million in excess and

surplus lines.

•$2 million increase in new business written by agencies in

the third quarter of 2010 compared with the third quarter

of 2009, including a decrease of $2 million for commercial

lines that was offset by an increase of $4 million for

personal lines.

•1,227 agency relationships with 1,524 reporting locations

marketing standard market property casualty insurance

products at September 30, 2010, compared with 1,180

agency relationships with 1,463 reporting locations at year-

end 2009. Seventy-one new agency appointments were

made during the rst nine months of 2010, exceeding the

initial full-year target of 65. The company now markets

in 38 states including Connecticut, where its rst agency

appointment was announced in October.

•8.8 percentage-point rise in the third-quarter combined ratio,

including 2.9 points for higher catastrophe losses from

weather events.

•Underwriting results benetted from favorable prior

accident year reserve development of $61 million for the

third quarter of 2010, a lower level of benet compared

with $91 million for the same period of 2009, which

accounted for 4.2 percentage points of the increase in the

combined ratio.

•1.7 percentage point improvement in the nine-month

combined ratio was driven by a higher level of benet from

favorable prior accident year reserve development and lower

weather-related catastrophe losses.

3

The following table shows incurred catastrophe losses for 2010 and 2009.

(In millions, net of reinsurance) Three months ended Sept. 30, Nine months ended Sept. 30,

Commercial Personal Commercial Personal

Dates Cause of loss Region lines lines Total lines lines Total

2010

First quarter catastrophes $ (1) $ (1) $ (2) $ 8 $ 2 $ 10

Second quarter catastrophes – 1 1 51 42 93

Jun. 30 - Jul. 1 Hail, wind West 9 3 12 12 4 16

Jul. 20-23 Flood, hail, tornado, wind Midwest 5 4 9 5 4 9

All other 2010 catastrophes 6 5 11 19 11 30

Development on 2009 and prior catastrophes (2) (1) (3) (12) (4) (16)

Calendar year incurred total $ 17 $ 11 $ 28 $ 83 $ 59 $ 142

2009

First quarter catastrophes $ (1) $ 1 $ – $ 20 $ 47 $ 67

Second quarter catastrophes (10) 1 (9) 42 45 87

Sep. 18-22 Flood, hail, wind South 1 4 5 1 4 5

All other 2009 catastrophes 6 6 12 11 13 24

Development on 2008 and prior catastrophes (3) 1 (2) (10) 4 (6)

Calendar year incurred total $ (7) $ 13 $ 6 $ 64 $ 113 $ 177

Insurance Operations Highlights

Commercial Lines Insurance Operations

(Dollars in millions) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Agency renewal written premiums ............................ $ 479 $ 489 (2) $ 1,504 $ 1,535 (2)

Agency new business written premiums .................... 74 76 (3) 213 231 (8)

Other written premiums ............................................. (42) (37) (14) (86) (88) 2

Net written premiums ............................................. 511 528 (3) 1,631 1,678 (3)

Unearned premium change ........................................ 36 27 33 (23) (11) (109)

Earned premiums .................................................... 547 555 (1) 1,608 1,667 (4)

Loss and loss expenses ............................................... 387 329 18 1,118 1,159 (4)

Underwriting expenses ............................................... 179 184 (3) 529 539 (2)

Underwriting (loss) prot ...................................... $ (19) $ 42 nm $ (39) $ (31) (26)

Ratios as a percent of earned premiums: Pt. Change Pt. Change

Current accident year before catastrophe losses ... 76.6% 73.3% 3.3 73.1% 70.4% 2.7

Current accident year catastrophe losses .............. 3.5 (0.6) 4.1 5.9 4.4 1.5

Prior accident years before catastrophe losses ...... (9.1) (12.8) 3.7 (8.8) (4.6) (4.2)

Prior accident year catastrophe losses ................... (0.3) (0.6) 0.3 (0.7) (0.6) (0.1)

Total loss and loss expenses ....................................... 70.7 59.3 11.4 69.5 69.6 (0.1)

Underwriting expenses ............................................... 32.7 33.1 (0.4) 32.9 32.3 0.6

Combined ratio ..................................................... 103.4% 92.4% 11.0 102.4% 101.9% 0.5

Contribution from catastrophe losses and prior

years reserve development ................................. (5.9) (14.0) 8.1 (3.6) (0.8) (2.8)

Combined ratio before catastrophe losses and

prior years reserve development ......................... 109.3% 106.4% 2.9 106.0% 102.7% 3.3

4

• $17 million or 3 percent decrease in third-quarter 2010

commercial lines net written premiums. The third-quarter

and ninemonth periods trended similarly and were largely

driven by lower renewal written premiums reecting stable

policy retention and modest pricing declines.

• $2 million and $18 million declines in third quarter and

rst nine months of 2010 new business written premiums

compared with the same periods of 2009, due to continued

strong competition and our intention to avoid writing

business we considered underpriced. $13 million increase

for three newest states of operation during the nine-month

period while other states decreased by $31 million or

14 percent.

• 11.0 percentage-point third-quarter combined ratio

increase due primarily to higher weather-related losses and

a lower level of benet from favorable prior accident year

reserve development.

• 0.5 percentage point rise in the nine-month combined

ratio reected fairly stable current accident year results

and higher weather-related catastrophe losses offset by a

higher level of benet from favorable prior accident year

reserve development.

• 54.4 percent nine-month loss and loss expense ratio for the

largest line of business in the segment, commercial casualty,

in line with full-year 2009 at 54.6 percent.

• 73.1 percent nine-month ratio for current accident year

losses and loss expenses before catastrophes, increased

slightly from 72.5 percent full-year 2009.

Personal Lines Insurance Operations

(Dollars in millions) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Agency renewal written premiums ........................ $ 189 $ 177 7 $ 519 $ 490 6

Agency new business written premiums ................ 25 21 19 67 55 22

Other written premiums ......................................... (6) (8) 25 (19) (21) 10

Net written premiums ......................................... 208 190 9 567 524 8

Unearned premium change .................................... (26) (20) (30) (32) (11) (191)

Earned premiums ................................................ 182 170 7 535 513 4

Loss and loss expenses ........................................... 132 125 6 407 450 (10)

Underwriting expenses ........................................... 56 49 14 180 159 13

Underwriting loss ................................................ $ (6) $ (4) (50) $ (52) $ (96) 46

Ratios as a percent of earned premiums: Pt. Change Pt. Change

Current accident year before catastrophe losses 70.0% 76.1% (6.1) 68.1% 71.3% (3.2)

Current accident year catastrophe losses .......... 6.9 7.3 (0.4) 11.6 21.2 (9.6)

Prior accident years before catastrophe losses .. (3.7) (10.7) 7.0 (3.1) (5.8) 2.7

Prior accident year catastrophe losses ............... (0.9) 0.6 (1.5) (0.6) 0.8 (1.4)

Total loss and loss expenses ................................... 72.3 73.3 (1.0) 76.0 87.5 (11.5)

Underwriting expenses ........................................... 31.1 29.0 2.1 33.8 31.2 2.6

Combined ratio ............................................... 103.4% 102.3% 1.1 109.8% 118.7% (8.9)

Contribution from catastrophe losses and prior

years reserve development .............................. 2.3 (2.8) 5.1 7.9 16.2 (8.3)

Combined ratio before catastrophe losses and

prior years reserve development ..................... 101.1% 105.1% (4.0) 101.9% 102.5% (0.6)

• $18 million or 9 percent increase in third-quarter 2010

personal lines net written premiums, reecting improved

pricing and strong new business growth. The third-quarter

and nine-month periods trended similarly and were

largely driven by higher renewal and new business written

premiums that reected improved pricing.

• 1.1 percentage-point increase in the third-quarter combined

ratio as higher technology related costs in underwriting

expenses offset lower total loss and loss expenses.

• 8.9 percentage-point nine-month combined ratio

improvement driven by lower losses, primarily from

weather-related catastrophes, but also other losses that

included the effect of improved pricing.

• 68.1 percent nine-month ratio for current accident year

losses and loss expenses before catastrophes, improved from

70.9 percent fullyear 2009 primarily due to better pricing

and a 2.1 percentage point favorable effect from lower new

losses greater than $250,000.

5

Life Insurance Operations

(Dollars in millions) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Term life insurance ................................................ $ 25 $ 22 14 $ 72 $ 63 14

Universal life insurance ......................................... 10 5 100 29 20 45

Other life insurance, annuity, and disability

income products .................................................. 6 6 0 19 20 (5)

Earned premiums ............................................ 41 33 24 120 103 17

Investment income, net of expenses ...................... 32 31 3 97 90 8

Other income .......................................................... - - nm 1 1 0

Total revenues, excluding realized investment

gains and losses ............................................... 73 64 14 218 194 12

Contract holders benets ........................................ 44 40 10 129 118 9

Underwriting expenses ........................................... 19 9 111 51 34 50

Total benets and expenses ................................ 63 49 29 180 152 18

Net income before income tax and realized

investment gains and losses ................................ 10 15 (33) 38 42 (10)

Income tax .............................................................. 3 8 (63) 13 15 (13)

Net income before realized investment

gains and losses .................................................. $ 7 $ 7 0 $ 25 $ 27 (7)

• $8 million or 24 percent growth in third-quarter 2010

earned premiums and 17 percent nine-month growth,

reecting marketing advantages of competitive products,

personal service and policies backed by nancial strength.

Five percent rise in face amount of life policies in force to

$73.134 billion at September 30, 2010, from $69.815 billion

at year-end 2009.

• $37 million in third-quarter 2010 xed annuity deposits

received compared with $70 million in third-quarter 2009

and $181 million in full-year 2009. Cincinnati Life does not

offer variable or indexed products.

• Third-quarter 2010 prot was in line with 2009. Prot

for the nine-month period declined primarily due to the

unlocking of actuarial assumptions for our universal life

contracts, which increased underwriting expenses. Nine-

month expenses were also up from higher commissions

and expenses due to growth in term life insurance and

xed annuities.

• GAAP shareholders’ equity for The Cincinnati Life

Insurance Company increased during the third quarter of

2010 by $46 million, or 6 percent, to $776 million. Net

after-tax unrealized gains were up $38 million.

6

Investment and Balance Sheet Highlights

Investment Operations

(Dollars in millions) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Total investment income, net of expenses, pre-tax $ 128 $ 127 1 $ 388 $ 370 5

Investment interest credited to contract holders ... (21) (17) (24) (60) (50) (20)

Realized investment gains and losses summary:

Realized investment gains and losses, net ......... 151 106 42 170 180 (6)

Change in fair value of securities with

embedded derivatives .................................... 5 15 (67) 6 23 (74)

Other-than-temporary impairment charges ........ (1) (11) 91 (36) (113) 68

Total realized investment gains and losses, net 155 110 41 140 90 56

Investment operations income ............................. $ 262 $ 220 19 $ 468 $ 410 14

7

(Dollars in millions) Three months ended September 30, Nine months ended September 30,

2010 2009 Change % 2010 2009 Change %

Investment income:

Interest ............................................................... $ 104 $ 104 0 $ 318 $ 296 7

Dividends ........................................................... 25 24 4 73 74 (1)

Other .................................................................. 1 1 0 3 6 (50)

Investment expenses .......................................... (2) (2) 0 (6) (6) 0

Total investment income, net of expenses,

pre-tax ........................................................ 128 127 1 388 370 5

Income taxes ................................................... (31) (31) 0 (95) (87) (9)

Total investment income, net of expenses,

after-tax ...................................................... $ 97 $ 96 1 $ 293 $ 283 4

Effective tax rate ............................................. 24.3% 24.0% 24.4% 23.5%

Average yield pre-tax ...................................... 4.4% 4.9% 4.5% 4.7%

Average yield after-tax .................................... 3.4% 3.7% 3.4% 3.6%

•1 percent third-quarter 2010 and 5 percent nine-month

growth in pre-tax investment income. A steeper year-over-

year decline in bond yields slowed the current quarter rate of

growth relative to the nine-month period.

•$283 million or 27 percent third-quarter 2010 increase in

pre-tax unrealized investment portfolio gains, including

a $198 million or 36 percent for the bond portfolio and

$85 million or 17 percent for the equity portfolio.

(Dollars in millions except share data) At September 30, At December 31,

2010 2009

Balance sheet data

Invested assets .................................................................................................................. $ 11,305 $ 10,643

Total assets ....................................................................................................................... 15,070 14,440

Short-term debt ................................................................................................................ 49 49

Long-term debt ................................................................................................................. 790 790

Shareholders’ equity ......................................................................................................... 5,010 4,760

Book value per share ........................................................................................................ 30.80 29.25

Debt-to-capital ratio ......................................................................................................... 14.3 % 15.0 %

Three months ended September 30, Nine months ended September 30,

2010 2009 2010 2009

Performance measure

Value creation ratio ............................................. 7.1% 13.1% 9.4% 15.0%

• $11.750 billion in cash and invested assets at September 30,

2010, up from $11.200 billion at December 31, 2009.

• $8.466 billion bond portfolio at September 30, 2010, with

an average rating of A2/A and with an 8 percent increase in

fair value during the rst nine months of 2010.

• $2.757 billion equity portfolio was 23.7 percent of invested

assets, including $580 million in pre-tax net unrealized

gains at September 30, 2010.

• $3.641 billion of statutory surplus for the property casualty

insurance group at September 30, 2010, down slightly

from $3.648 billion at December 31, 2009. Ratio of net

written premiums to property casualty statutory surplus

for the 12 months ended September 30, 2010, of 0.8-to-1,

unchanged from the 12 months ended December 31, 2009.

• Value creation ratio of 7.1 percent for the third quarter of

2010 is the sum of 1.4 percent from shareholder dividends

plus 5.7 percent from change in book value per share.

For additional information or to hear a replay of our October 28 conference call webcast, please visit www.cinn.com/investors.

8

Cincinnati Financial Corporation

Condensed Balance Sheets and Statements of Operations (unaudited)

(Dollars in millions) September 30, December 31,

2010 2009

Assets

Investments ....................................................................................................................... $ 11,305 $ 10,643

Cash and cash equivalents ................................................................................................ 445 557

Premiums receivable ........................................................................................................ 1,035 995

Reinsurance receivable ..................................................................................................... 554 675

Other assets ....................................................................................................................... 1,731 1,570

Total assets ..................................................................................................................... $ 15,070 $ 14,440

Liabilities

Insurance reserves ............................................................................................................ $ 6,193 $ 5,925

Unearned premiums .......................................................................................................... 1,573 1,509

Long-term debt ................................................................................................................. 790 790

Other liabilities ................................................................................................................. 1,504 1,456

Total liabilities ............................................................................................................... 10,060 9,680

Shareholders’ Equity

Common stock and paid-in capital ................................................................................... 1,480 1,474

Retained earnings ............................................................................................................. 3,919 3,862

Accumulated other comprehensive income ...................................................................... 814 624

Treasury stock ................................................................................................................... (1,203) (1,200)

Total shareholders’ equity .............................................................................................. 5,010 4,760

Total liabilities and shareholders’ equity ....................................................................... $ 15,070 $ 14,440

(Dollars in millions except share data) Three months ended September 30, Nine months ended September 30,

2010 2009 2010 2009

Revenues

Earned premiums ................................................ $ 784 $ 766 $ 2,299 $ 2,301

Investment income, net of expenses ................ 128 127 388 370

Realized investment gains and losses .............. 155 110 140 90

Other income ................................................... 4 4 9 9

Total revenues ............................................... 1,071 1,007 2,836 2,770

Benets and Expenses

Insurance losses and policyholder benets ...... 575 498 1,686 1,737

Underwriting, acquisition and insurance

expenses ...................................................... 258 247 772 750

Other operating expenses ................................ 4 4 11 14

Interest expense ............................................... 13 14 40 42

Total benets and expenses .......................... 850 763 2,509 2,543

Income before income taxes ................................... 221 244 327 227

Provision for income taxes ..................................... 65 73 76 40

Net Income ............................................................ $ 156 $ 171 $ 251 $ 187

Per Common Share:

Net income – basic .............................................. $ 0.95 $ 1.05 $ 1.54 $ 1.15

Net income – diluted ........................................... $ 0.95 $ 1.05 $ 1.53 $ 1.15

Denitions of Non-GAAP Information and

Reconciliation to Comparable GAAP Measures

(See attached tables for 2010 reconciliations; prior-period reconciliations available at www.cinn.com/investors.)

Cincinnati Financial Corporation prepares its public nancial statements in conformity with accounting principles generally

accepted in the United States of America (GAAP). Statutory data is prepared in accordance with statutory accounting rules as

dened by the National Association of Insurance Commissioners’ (NAIC) Accounting Practices and Procedures Manual and

therefore is not reconciled to GAAP data.

Management uses certain non-GAAP and non-statutory nancial measures to evaluate its primary business areas – property

casualty insurance, life insurance and investments. Management uses these measures when analyzing both GAAP and

nonGAAP measures to improve its understanding of trends in the underlying business and to help avoid incorrect or misleading

assumptions and conclusions about the success or failure of company strategies. Management adjustments to GAAP measures

generally: apply to non-recurring events that are unrelated to business performance and distort short-term results; involve values

that uctuate based on events outside of management’s control; or relate to accounting renements that affect comparability

between periods, creating a need to analyze data on the same basis.

• Operating income: Operating income is calculated by excluding net realized investment gains and losses (dened as realized

investment gains and losses after applicable federal and state income taxes) from net income. Management evaluates

operating income to measure the success of pricing, rate and underwriting strategies. While realized investment gains (or

losses) are integral to the company’s insurance operations over the long term, the determination to realize investment gains

or losses in any period may be subject to management’s discretion and is independent of the insurance underwriting process.

Also, under applicable GAAP accounting requirements, gains and losses can be recognized from certain changes in market

values of securities without actual realization. Management believes that the level of realized investment gains or losses

for any particular period, while it may be material, may not fully indicate the performance of ongoing underlying business

operations in that period.

For these reasons, many investors and shareholders consider operating income to be one of the more meaningful measures for

evaluating insurance company performance. Equity analysts who report on the insurance industry and the company generally

focus on this metric in their analyses. The company presents operating income so that all investors have what management

believes to be a useful supplement to GAAP information.

• Statutory accounting rules: For public reporting, insurance companies prepare nancial statements in accordance with

GAAP. However, insurers also must calculate certain data according to statutory accounting rules as dened in the NAIC’s

Accounting Practices and Procedures Manual, which may be, and has been, modied by various state insurance departments.

Statutory data is publicly available, and various organizations use it to calculate aggregate industry data, study industry trends

and compare insurance companies.

• Written premium: Under statutory accounting rules, property casualty written premium is the amount recorded for policies

issued and recognized on an annualized basis at the effective date of the policy. Management analyzes trends in written

premium to assess business efforts. Earned premium, used in both statutory and GAAP accounting, is calculated ratably over

the policy term. The difference between written and earned premium is unearned premium.

Cincinnati Financial Corporation

Balance Sheet Reconciliation

Dollars are per share) Three months ended Sept. 30, Nine months ended Sept. 30,

2010 2009 2010 2009

Value creation ratio

End of period book value ...................................................................... $ 30.80 $ 28.44 $ 30.80 $ 28.44

Less beginning of period book value ...................................................... 29.13 25.49 29.25 25.75

Change in book value ............................................................................. 1.67 2.95 1.55 2.69

Dividend paid to shareholders ................................................................ 0.40 0.395 1.19 1.175

Total contribution to value creation ratio ............................................... $ 2.07 $ 3.35 $ 2.74 $ 3.87

Contribution to value creation ratio from change in book value* .......... 5.7 % 11.6 % 5.3 % 10.4 %

Contribution to value creation ratio from dividends paid to shareholders** 1.4 1.5 4.1 4.6

Value creation ratio ................................................................................. 7.1 % 13.1 % 9.4 % 15.0 %

* Change in book value divided by the beginning of period book value

** Dividend paid to shareholders divided by beginning of period book value

9

Net Income Reconciliation

(In millions, except per share data) Three months ended Nine months ended

September 30, 2010 September 30, 2010

Net income ........................................................................................... $ 156 $ 251

Net realized investment gains and losses .............................................. 100 90

Operating income ................................................................................. 56 161

Less catastrophe losses ......................................................................... (19) (93)

Operating income before catastrophe losses ...................................... $ 75 $ 254

Diluted per share data:

Net income ........................................................................................ $ 0.95 $ 1.53

Net realized investment gains and losses ........................................... 0.61 0.55

Operating income .............................................................................. 0.34 0.98

Less catastrophe losses ...................................................................... (0.11) (0.57)

Operating income before catastrophe losses ................................... $ 0.45 $ 1.55

Property Casualty Reconciliation

(Dollars in millions) Nine months ended September 30, 2010

Consolidated* Commercial Personal

Statutory ratio:

Statutory combined ratio 104.5% 105.5% 100.7%

Contribution from catastrophe losses 3.8 3.2 6.0

Statutory combined ratio excluding catastrophe losses 100.7% 102.3% 94.7%

Commission expense ratio 18.7% 19.0% 17.1%

Other expense ratio 14.2 15.8 11.3

Statutory expense ratio 32.9% 34.8% 28.4%

GAAP combined ratio:

GAAP combined ratio 103.9% 103.4% 103.4%

Contribution from catastrophe losses 3.8 3.2 6.0

Prior accident years before catastrophe losses (7.7) (9.1) (3.7)

GAAP combined ratio excluding catastrophe losses

and prior years reserve development 107.8% 109.3% 101.1%

(Dollars in millions) Nine months ended September 30, 2010

Consolidated* Commercial Personal

Statutory ratio:

Statutory combined ratio 104.4% 102.2% 108.8%

Contribution from catastrophe losses 6.5 5.2 11.0

Statutory combined ratio excluding catastrophe losses 97.9% 97.0% 97.8%

Commission expense ratio 18.3% 17.9% 19.0%

Other expense ratio 14.5 14.8 13.8

Statutory expense ratio 32.8% 32.7% 32.8%

GAAP ratio:

GAAP combined ratio 104.7% 102.4% 109.8%

Contribution from catastrophe losses 6.5 5.2 11.0

Prior accident years before catastrophe losses (7.2) (8.8) (3.1)

GAAP combined ratio excluding catastrophe losses and

prior years reserve development 105.4% 106.0% 101.9%

Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. Ratios are calculated based on whole dollar amounts.

* Consolidated property casualty data includes results from our surplus line of business.

10

Other News Releases

Connecticut Agency Appointed to Represent The Cincinnati Insurance Company

Cincinnati, October 20, 2010 – Cincinnati Financial

Corporation (Nasdaq: CINF) today announced that its

lead property casualty insurance subsidiary, The Cincinnati

Insurance Company, began marketing in Connecticut with

the appointment of Rose & Kiernan Inc., an independent

insurance agency serving Danbury, Connecticut. Cincinnati

Insurance executives formalized the relationship today at the

company’s headquarters, welcoming agency representatives

Sean Hickey, RPLU, ARM, senior vice president, and Arnold

Finaldi, Jr., CPCU, senior vice president. The agency is a

branch of Rose & Kiernan Inc. in East Greenbush, New York,

which has represented Cincinnati since 2001.

President and CEO Kenneth W. Stecher said, “Connecticut

is our 38

th

state of operation. We continually evaluate

opportunities for protable growth in areas that neighbor

our active states, especially areas that will help over time to

diversify our geographic footprint. Connecticut’s favorable

regulatory and political environment and its stable weather

patterns also attracted us. Opening Connecticut continues

our expansion initiative that, in recent years, has focused

almost exclusively in the West. In New Mexico and eastern

Washington, states entered in 2007, we appointed 13 agencies

through 2009, earning an almost 5 percent share of their total

agency annual premium volume as of the end of 2009. In

Texas, entered in late 2008, net written premiums for the

rst six months of 2010 rose to $15 million compared with

$3 million for the same period of 2009.”

Executive Vice President J.F. Scherer commented, “To

provide local support to agents in this new western

Connecticut and southeastern New York territory, we’ve

hired experienced eld marketing representative Vincent M.

Sinopoli, AAI, from Rocky Hill, Connecticut. Vincent will

meet with additional agencies to select those that share our

commitment to quality, value and service, with the goal of

getting those agencies up and running quickly to deliver

our steady underwriting approach to the businesses in this

territory. Agents in this area tell us they are eager to bring

their commercial clients Cincinnati’s industry-leading claims

service, broad coverages, highly competitive multi-year

policies and solid nancial strength.”

Oregon Agency Appointed to Represent The Cincinnati Insurance Company

Cincinnati, November 15, 2010 – Cincinnati Financial

Corporation (Nasdaq: CINF) today announced that its

lead property casualty insurance subsidiary, The Cincinnati

Insurance Company, appointed KPD Insurance Inc. in

Springeld, Oregon, as the rst independent agency in that

state to market its business insurance policies and services.

Cincinnati Insurance executives initiated the relationship

at the company’s headquarters, welcoming agency

representative James R. Ginger, CIC, president. Oregon is

the company’s 39

th

state of operation.

President and CEO Kenneth W. Stecher said, “We believe

that methodically adding new agency relationships, while

protecting the franchise value we offer to current agencies,

is a good long-term way to increase our market penetration.

For 2010, we’ve already exceeded our goal of appointing

approximately 80 independent agencies that in aggregate

write $1 billion in property casualty premiums annually

with all insurance companies they represent. The 81 new

agencies we’ve appointed to date write an aggregate of

nearly $1.5 billion in property casualty premiums annually

with various companies, for an average of approximately

$18 million per agency.

“We look to earn a 10 percent share of an agency’s business

within 10 years of its appointment. Our solid nancial

strength through all kinds of markets is due to the depth

of our relationship and service commitment to local

independent agents and our industry-leading claims

service, broad coverages and highly competitive

multi-year policies.”

Executive Vice President J.F. Scherer commented,

“Our experienced eld marketing director,

Roger D. Whitescarver II, AIS, CRIS, CIC, has relocated

to West Linn, Oregon. Roger led our efforts to begin doing

business in Idaho in 1999. He is adept at screening interested

agencies and selecting those with the highest professional

standards, compatible philosophies and formal marketing

plans to serve our policyholders. We plan a great partnership

with KPD and look forward to partnering with additional

independent agencies in Oregon.”

11

Inside Cincinnati

Subsidiary directors made two mid-year ofcer elections that demonstrate our commitment to continually improving our

processes relating to nancial systems, risk management and internal controls. Anthony W. Dunn, CPCU, CPA, CIA, who

leads our Internal Audit department, was promoted to vice president of The Cincinnati Insurance Company and its two standard

market subsidiaries and The Cincinnati Life Insurance Company.

Francis T. Obermeyer, CPA, PMP, CISA, was elected to assistant vice president of the same companies. He joined us from

Deloitte & Touche LLP to ll the position of internal audit manager.

Since our last Letter to Shareholders, these associates merited promotions:

Bond & Executive Risk

Bond State Agents-Field – Kim Borkholder; Brett Palmer

Underwriting Superintendents – Cary Barrow, AFSB;

Michael McGuire, CPCU

Underwriting Specialist – Steve Mikesell

Field Underwriter – Stuart Francis, AFSB

Commercial Lines

Senior Underwriting Managers – Miriam Pope, AIM, AU;

Keith Tenoever, CPCU, AIM, AU

Underwriting Director – Kevin Hedrick, CPCU, AIM, ASLI

Chief Underwriting Specialists – Regina Bobie, CPCU;

Kristie Bushman, AIS; Lisa Meloy;

Paul Miller, CPCU, AIM, APA, API, AU;

Roxanna Otto, AIS

Underwriting Superintendents – Scott Beckman;

Todd Gagnon, API; Gregory Kniey, CPCU, AIM;

Joy Kniey; Shawn Niehaus, CPCU, AIM, ARe;

Joseph Pierro, AU

Underwriting Specialists – Tim Breving, AINS;

Holly Sanders, CPCU; Jason Townsend, AU

Senior Underwriters – Kristen Barrett; Ryan Carpenter;

Nancy Felton; Jonathan Grimsley; Chris Hilton;

Julie Mienheartt; Sarah Naylor; Heather Rabbitt;

Brett Slonaker; Randall White

Field Claims

Manager, Field Claims-HQ – Dick Aten, CPCU, AIC, AIM

Regional Field Claims Manager –

Matt Muckleroy, CPCU, AIC, AIM

Field Claims Managers – Bobby Misztal, AIC, AIM, SCLA;

Bob Russum, CPCU, AIC, AIM

Field Claims Superintendents – Nancy Davis, AIC;

Philip Glesser, CPCU, CLU, FLMI, AIM;

Joe Jacques, CPCU, AIC; Dave Kaydo, AIC, AIM, AIS;

Todd Walker, AIC

Senior Claims Representatives – Chad Cioban, AIC, AIM;

David Guinn, AIC; Rick McIntosh; Brian Philpot;

Tom Resop, SCLA

Senior Claims Specialists – Michael Freson;

Jamie Gustafson, AIC; Paul Kaiser, AIC; Mike Mann;

Rebecca Overholser, AIC; Robert Scott;

Dana Scudder, AIC, AIS; Katie Stickel, AIC

12

Claims Specialists – Brian Callentine; Rick Cofer;

Susan Fuller; Matt Kentner, AIC; Aaron King;

Andrew Knipe, AIC, AIM; Cheryl Lee, AIC;

Kurt Scott; Matt Smith, AIC, SCLA; Shawna White

Headquarters Claims

Associate Manager, Casualty Claims – Ron Morrison

Superintendent, Executive Risk Claims – David Dietz, AIC

Associate Superintendent, Workers’ Compensation Claims –

Toni Postell

Associate Superintendent, Casualty Claims –

Glen Wooldridge, SCLA

Supervisor, Executive Risk Claims – Carrie Mishler, AIC, AIM

Claims Examiner – Lisa Bullock

Information Security Ofce

Supervisor, ISO – Scott Meisenbach

Senior Information Security Analyst – Anna Clemmons

Information Technology

Senior Group Managers – Jennifer Bransford;

Venkat Gannamraj

Group Manager – Donna Fleek

Architects – Michael Baker; Jake Northrup

Senior IT Specialist – David Murphy, AIT, API, AU

Systems Analysts – David Beckenhaupt, AAPA, ARA, FLMI;

Daffney McGary

Senior Programmer Analysts – Joe Corasaniti; Dylan Mason;

Fenzhi Ren; Jeffrey Rook, AIT

Programmer/Analyst – May Wolnger

Senior IT Developer – Peggy Krpata, AIT

Senior Programmers – Matt Leugers; Ernie Wang

Senior Analyst – Brian Seiter

Senior Business Analyst – Leigh Anne Apke

Programmers – Jared Bradley; Robert Cox, AFSB;

Johnny Dean

Internal Audit

Internal Audit Specialist – Kelly Chasteen

Internal Auditor – Patrick Demmer

Life Field Services

Senior Life Field Services Representative –

Pat Hale, ACS, AIAA

Loss Control Field

Loss Control Field Supervisor –

Jeff Evans, AIM, ARM, OHST

Senior Loss Control Consultant – Darrel Storey

Machinery & Equipment Specialties Field

Senior Machinery & Equipment Specialist –

Steve Tynes, AAI, ACS, AIC, ARM, AU

Machinery & Equipment Specialist – Ray Smith, Jr.

Personal Lines

Underwriting Superintendent – Nathan Perry II, API

Senior Underwriters – Adair Carmichael;

Kelby Wyse, AIM, API

Diamond Specialist – Kyle Crawford

Senior Diamond Support Analysts – Lorie Campbell;

Joe Osburn, AIM

Sales Field

Field Director – Bob Proudfoot, CPCU, CIC

Regional Director –

Michael Leininger, CPCU, AFSB, APA, ARM, AU, CIC

Staff Underwriting

Senior Regulatory Affairs Specialist – Kimberly Garner

Manager Filings –

Stephanie Wagner, CPCU, AIAF, AIS, ARC

Filings Superintendent – Melissa Butler, API

Senior Chief Technical Specialist –

Matt Broerman, AFSB, AIC, APA, API, AU, CLU

Senior Rate Filings Specialist – Charlene Naylor, CPCU, AIM

Filings Specialist – Matt Terrell, API

Learning & Development

We encourage and reward associates to continue their

professional insurance education, earning credentials by

meeting high academic, ethical and length-of-experience

standards. Congratulations to Mark Rutherford who

completed a series of courses to earn his Chartered Property

Casualty Underwriter (CPCU) designation.

The Above and Beyond the Call (ABC) Award recognizes

exemplary productivity, service and quality in exceptional

associates. Congratulations to fourth-quarter 2010 ABC

Award recipients Lisa Dysert, MCSA, senior network

administrator, IT Portfolio Management & Architecture and

Damen Proftt, AIT, programmer analyst, IT Diamond.

At the Queen City Club on October 26, Damen was named

ABC of the Year. This honor is awarded annually to just one

of the quarterly recipients. Damen works with associates,

outside vendors and testers to manage multiple Diamond

environments, keeping them stable while promoting builds,

patching into environments and troubleshooting defects.

Damen is key in making sure these processes run smoothly.

Public Responsibility

With the November 2010 elections now in the history books,

your company will monitor the impact of the 37 gubernatorial

and other statewide elections, which could result in up to two

dozen new state insurance commissioners taking ofce by

early next year. We look forward to working with the new

commissioners as they carry on the important work of state

insurance regulation.

As federal regulators begin to consider various rules and

regulations to implement the Dodd-Frank nancial regulatory

reform legislation, we will continue to remind them – and

Congress – that state regulation of insurance works best since

the business of insurance is uniquely local. State regulators

are in the best position to protect policyholders and respond

with regulations and insurance products appropriate to

their specic needs, which vary by state because of diverse

geographic, climatic and economic conditions.

13

Safe Harbor Statement

This is our “Safe Harbor” statement under the Private

Securities Litigation Reform Act of 1995. Our business is

subject to certain risks and uncertainties that may cause

actual results to differ materially from those suggested by the

forward-looking statements in this report. Some of those risks

and uncertainties are discussed in our 2009 Annual Report

on Form 10-K, Item 1A, Risk Factors, Page 23. Although we

often review or update our forward-looking statements when

events warrant, we caution our readers that we undertake no

obligation to do so.

Factors that could cause or contribute to such differences

include, but are not limited to:

• Unusually high levels of catastrophe losses due to

risk concentrations, changes in weather patterns,

environmental events, terrorism incidents or other causes

• Increased frequency and/or severity of claims

• Inadequate estimates or assumptions used for critical

accounting estimates

• Recession or other economic conditions resulting in lower

demand for insurance products or increased payment

delinquencies

• Delays in adoption and implementation of underwriting

and pricing methods that could increase our pricing

accuracy, underwriting prot and competitiveness

• Inability to defer policy acquisition costs for any business

segment if pricing and loss trends would lead management

to conclude that segment could not achieve sustainable

protability

• Declines in overall stock market values negatively

affecting the company’s equity portfolio and book value

• Events, such as the credit crisis, followed by prolonged

periods of economic instability or recession, that lead to:

o Signicant or prolonged decline in the value of a

particular security or group of securities and impairment

of the asset(s)

o Signicant decline in investment income due to reduced

or eliminated dividend payouts from a particular security

or group of securities

o Signicant rise in losses from surety and director and

ofcer policies written for nancial institutions

• Prolonged low interest rate environment or other factors

that limit the company’s ability to generate growth in

investment income or interest rate uctuations that result in

declining values of xed-maturity investments, including

declines in accounts in which we hold bank-owned life

insurance contract assets

• Increased competition that could result in a signicant

reduction in the company’s premium volume

• Changing consumer insurance-buying habits and

consolidation of independent insurance agencies that could

alter our competitive advantages

• Inability to obtain adequate reinsurance on acceptable

terms, amount of reinsurance purchased, nancial strength

of reinsurers and the potential for non-payment or delay in

payment by reinsurers

• Events or conditions that could weaken or harm the

company’s relationships with its independent agencies

and hamper opportunities to add new agencies, resulting

in limitations on the company’s opportunities for growth,

such as:

o Downgrades of the company’s nancial strength ratings

o Concerns that doing business with the company is too

difcult

o Perceptions that the company’s level of service,

particularly claims service, is no longer a distinguishing

characteristic in the marketplace

o Delays or inadequacies in the development,

implementation, performance and benets of technology

projects and enhancements

• Actions of insurance departments, state attorneys general or

other regulatory agencies, including a change to a federal

system of regulation from a state-based system, that:

o Restrict our ability to exit or reduce writings of

unprotable coverages or lines of business

o Place the insurance industry under greater regulatory

scrutiny or result in new statutes, rules and regulations

o Increase our expenses

o Add assessments for guaranty funds, other insurance

related assessments or mandatory reinsurance

arrangements; or that impair our ability to recover such

assessments through future surcharges or other rate

changes

o Limit our ability to set fair, adequate and reasonable rates

o Place us at a disadvantage in the marketplace

o Restrict our ability to execute our business model,

including the way we compensate agents

•Adverse outcomes from litigation or administrative

proceedings

•Events or actions, including unauthorized intentional

circumvention of controls, that reduce the company’s future

ability to maintain effective internal control over nancial

reporting under the Sarbanes-Oxley Act of 2002

•Unforeseen departure of certain executive ofcers or other

key employees due to retirement, health or other causes

that could interrupt progress toward important strategic

goals or diminish the effectiveness of certain longstanding

relationships with insurance agents and others

•Events, such as an epidemic, natural catastrophe or

terrorism, that could hamper our ability to assemble our

workforce at our headquarters location

•Difculties with technology or data security breaches could

negatively affect our ability to conduct business and our

relationships with agents, policyholders and others

Further, the company’s insurance businesses are subject

to the effects of changing social, economic and regulatory

environments. Public and regulatory initiatives have included

efforts to adversely inuence and restrict premium rates,

restrict the ability to cancel policies, impose underwriting

standards and expand overall regulation. The company also

is subject to public and regulatory initiatives that can affect

the market value for its common stock, such as measures

affecting corporate nancial reporting and governance.

The ultimate changes and eventual effects, if any, of these

initiatives are uncertain.

14

Contact Information

Communications directed to Cincinnati Financial Corporation’s secretary, Steven J. Johnston, FCAS, MAAA, CFA, chief

nancial ofcer, are shared with the appropriate individual(s). Or, you may directly access services:

Investors: Investor Relations responds to investor inquiries about the company and its performance.

Dennis E. McDaniel, CPA, CMA, CFM, CPCU – Assistant Vice President, Investor Relations

513-870-2768 or investor_inquiries@cinn.com

Shareholders: Shareholder Services provides stock transfer services, fullls requests for shareholder materials and assists

registered shareholders who wish to update account information or enroll in shareholder plans.

Jerry L. Litton – Assistant Vice President, Shareholder Services

513-870-2639 or shareholder_inquiries@cinn.com

Media: Corporate Communications assists media representatives seeking information or comment from the company

or its subsidiaries.

Joan O. Shevchik, CPCU, CLU – Senior Vice President, Corporate Communications

513-603-5323 or media_inquiries@cinn.com

CINCINNATI FINANCIAL CORPORATION

The Cincinnati Insurance Company

The Cincinnati Casualty Company

The Cincinnati Indemnity Company

The Cincinnati Specialty Underwriters Insurance Company

The Cincinnati Life Insurance Company

CSU Producer Resources Inc.

CFC Investment Company

Cincinnati Financial Corporation

2010 Second-Quarter Letter to Shareholders

August 19, 2010

To Our Shareholders, Friends and Associates:

Two years have gone by since we assumed our new roles on Cincinnati Financial’s executive team. Those two years turned out

to be unlike any other period in the company’s history, or for that matter, unlike anything experienced by the broader economy

in a long time. We continue to feel some effects.

Over these two years, we have pushed diligently to make necessary changes and to pursue new opportunities, and we are

grateful for the loyalty of our shareholders and the investment community, our agents, policyholders and associates. With your

support, we have successfully managed our capital, in large part by diversifying our investment portfolio and stabilizing our

investment income. New technology and other initiatives are helping to restore protability of our homeowners and workers’

compensation business, reducing future earnings volatility from catastrophe risk and improving pricing capabilities and tools.

Excluding those two challenging lines of business, we have maintained overall underwriting protability. And we have acted

to drive premium growth by expanding our product offerings and operating territories, achieving strong new business and

resuming premium growth in personal lines.

Our insurance operations already are seeing some benets from these efforts, and we are condent that most of the benets are

yet to come. By changing incrementally, we seek to continue as a source of stability now and in the future for our appointed

agencies and their clients. Our planning horizon is longer than the next earnings period or even the next two to three years that

is often the focus of investment analysts.

Our strategy has been to maintain exceptional capital strength through all market cycles. Our level of capital is very strong.

With this capital cushion, we can afford to focus on building for the long term, absorbing setbacks, while continuing to be the

predictable, reliable company you count on.

Solid reserves contribute to our nancial strength. In 2009, we gave up some of our current earnings in order to strengthen

our workers’ compensation reserves – a decision that supported our record of consistent, sound reserving practices. While this

decision added to our combined ratio, we believe it was the right choice. At this point in the insurance cycle, observers believe

some insurers are not making such decisions and may incur charges later to restore reserve adequacy. To us, this is a matter of

integrity; we do not knowingly borrow from future earnings.

We made many other capital management choices that increase balance sheet strength and nancial exibility. Among the most

important, Cincinnati Financial maintains more than $1 billion of assets at the parent company level, more than enough to retire

all of our corporate debt, while preserving our insurance subsidiaries’ very strong surplus and capacity for growth.

August 2, the anniversary of The Cincinnati Insurance Company’s charter, marked the beginning of your company’s 60

th

year.

Perhaps more noteworthy, our rst policy was written on January 25, 1951, and our anniversary recognitions will focus on

that date.

With the issue of that rst policy, the careful and diligent planning of our company’s founders became reality. We are,

in 2010, once again carefully and diligently planning for the future, moving into position by accomplishing initiatives related

to agency and geographic expansion, technology, products, expense management and investments. We are looking forward to

the real results and growth that we believe will ow from these efforts, creating value for shareholders, agents, policyholders

and associates.

Respectfully,

John J. Schiff, Jr., CPCU Kenneth W. Stecher Steven J. Johnston, FCAS, MAAA, CFA

Chairman of the Board President and Chief Executive Ofcer Senior Vice President and Chief Financial Ofcer

/s/ John J. Schiff, Jr. /s/ Kenneth W. Stecher /s/ Steven J. Johnston

Investor

E-mail Alerts

Sign up for Investor E-mail Alerts by

visiting www.cinn.com/investors and

selecting E-mail Alerts at the bottom of

the page. This service sends shareholder

communications links to the e-mail

address of your choice as soon as

new communications are posted on

our website. E-mail alerts are the best

way to make sure you see our interim

reports such as the quarterly Letter

to Shareholders. Unlike Electronic

Delivery, E-mail alerts won’t stop

the paper versions of any required

shareholder mailings. In addition to

E-mail alerts, you’ll want to enroll

in Electronic Delivery to stop

paper mailings.

About the Company

Cincinnati Financial Corporation stands among the 25 largest property

casualty insurers in the nation, based on premium volume. A select

group of agencies in 37 states actively markets our property casualty

insurance within their communities. Standard market commercial lines

policies are available in all of those states, while personal lines policies

are available in 29 and surplus lines policies are available in 36 of the

same 37 states. Within this select group, we seek to become the life

insurance carrier of choice and to help agents and their clients – our

policyholders – by offering leasing and nancing services.

Three hallmarks distinguish our company, positioning us to build value

and long-term success:

• Commitment to our network of professional independent insurance

agencies and to their continued success

• Financial strength that lets us be a consistent market for our agents’

business, supporting stability and condence

• Operating structure that supports local decision making, showcasing

our claims excellence and allowing us to balance growth with

underwriting discipline

Table of Contents

Letter to Shareholders ...................................... 1-10

Second-Quarter Catastrophe Losses ...................11

Regular Quarterly Cash Dividend Declared ......11

Inside Cincinnati ...................................................12

Learning & Development .....................................14

Safe Harbor Statement .........................................16

Contact Information ...........................................BC

Recent News Releases

Cincinnati Financial Reports Second-Quarter 2010 Results

1

* The Denitions of Non-GAAP Information and Reconciliation to Comparable GAAP Measures on Page 9 denes and reconciles measures presented in this release

that are not based on Generally Accepted Accounting Principles.

** Forward-looking statements and related assumptions are subject to the risks outlined in the company’s safe harbor statement (see Page 16).

• $27 million, or 17 cents per share, of net income for second-

quarter 2010 compared with a net loss of $19 million, or

12 cents per share, in the second quarter of 2009.

• $42 million, or 26 cents per share, of operating income*

compared with an operating loss of $5 million, or 3 cents

per share.

• Driving the improved second-quarter results were the after-

tax net effects of a $7 million rise in investment income and

a $44 million decrease in the property casualty insurance

underwriting loss. Underwriting results improved despite

high weather-related catastrophe losses that moderated

somewhat compared with second-quarter 2009 catastrophe

losses while exceeding early estimates announced on June

14. Partially offsetting the catastrophe losses were higher

contributions from favorable development of reserved

loss estimates for insurance claims related to events that

occurred prior to 2010.

• $29.13 book value per share at June 30, 2010, off

approximately 2 percent from March 31, 2010, and less

than 1 percent from December 31, 2009.

• 2.3 percent value creation ratio for the rst six months

of 2010, compared with 2.0 percent for the same period

of 2009.

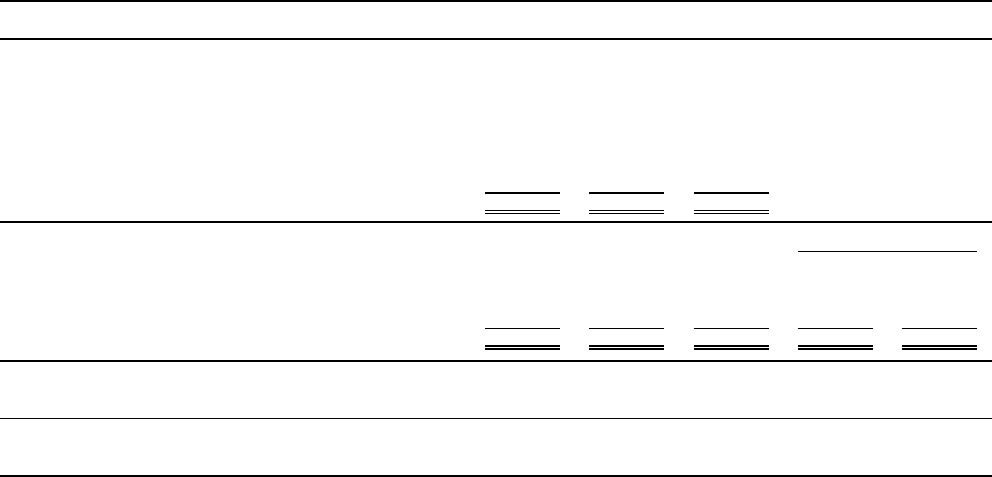

Financial Highlights

(Dollars in millions except share data) Three months ended June 30, Six months ended June 30,

2010 2009 Change % 2010 2009 Change %

Revenue Highlights

Earned premiums ................................................ $ 768 $ 770 0 $ 1,515 $ 1,535 (1)

Investment income, pre-tax ................................ 130 119 9 260 243 7

Total revenues ..................................................... 878 874 0 1,765 1,764 0

Income Statement Data

Net income (loss) ................................................ $ 27 $ (19) nm $ 95 $ 17 459

Net realized investment gains and losses ........... (15) (14) (7) (10) (15) 33

Operating income (loss)* ................................... $ 42 $ (5) nm $ 105 $ 32 228

Per Share Data (diluted)

Net income (loss) ................................................ $ 0.17 $ (0.12) nm $ 0.58 $ 0.10 480

Net realized investment gains and losses ........... (0.09) (0.09) 0 (0.06) (0.10) 40

Operating income (loss)* ................................... $ 0.26 $ (0.03) nm $ 0.64 $ 0.20 220

Book value .......................................................... 29.13 25.49 14

Cash dividend declared ....................................... 0.395 0.39 1 0.79 0.78 1

Diluted weighted average shares outstanding .... 163,284,013 162,556,327 0 163,293,335 162,738,081 0