FY 2022-23

Annual Operating

and Capital Budget

Part I

City Council Budget Work Session

August 1-4, 2022

Part I

o FY22 Year-in-Review

o FY23 Executive Overview

o Property Taxes

o Debt & Investments

o General Fund Operating & Capital Budgets

Part II

o Enterprise Funds Operating & Capital Budgets

o Internal Services Operating & Capital Budgets

o Special Revenue Funds Summary

Part III

o Component Units

o Council Follow-Up & Guidance

2

Fiscal Year 2023 Workshop Schedule

August 1-4, 2022

Current Fiscal

Year Review

FY 2022

Adopted Operating Budget

& Capital Program

3

Property Taxes

Tax rate set to capture the full value of new properties added to the tax roll

Established a Maintenance & Operations (M&O) rate to account for inflationary increase to fund ongoing

needs

Continued management and reduction of Interest & Sinking (I&S, or “Debt”) rate

Proposed tax rate was a total reduction of 1.83 cents

Sales Tax

FY21 budgeted collections set at $74.8 million with actual collections at $82.3 million due to very strong

June-September collections (16.5% over budget)

FY22 budgeted collections set before knowing June-September actuals

o FY22 budget set at $80.9 million, an 8.1% increase to FY21 budget

o FY22 actual collections currently forecasted to end the year at $88.2 million, or 9.1% over budget

4

Fiscal Year 2022 Year-in-Review

Keeping Services to Citizens in line with Lubbock’s Growth and Development

FY 2020 FY 2021 FY 2022 Tax Rate Δ

Maintenance & Operations $ 0.403090 $ 0.398672 $ 0.381257 $ (0.017415)

Economic Development 0.023150 0.022468 0.021707 (0.000761)

Interest & Sinking 0.131780 0.120433 0.120266 (0.000167)

Total COL Tax Rate $ 0.558020 $ 0.541573 $ 0.523230 $ (0.018343)

Notable Rate Changes

Storm Water: No Rate Change

Water: ↑ $0.50 base rate to ¾” meter (pro-rated)

Wastewater: ↑ $0.05 base rate to ¾” meter (pro-rated)

Solid Waste Collection: ↑ $0.50 residential rate (pro-rated)

Solid Waste Landfill: ↑ $0.50 tipping fee (WTRDF & per ton special waste)

Staffing Growth to Meet Residential and Business Demand

5

Fiscal Year 2022 Year-in-Review

Keeping Services to Citizens in line with Lubbock’s Growth and Development

1 – HR Generalist

1 – Building Safety Development Tech

1 – Codes Inspector

1 – Codes Administrative Assistant

1 – Environmental Specialist

1 – Parks Marketing Coordinator

3 – Solid Waste Equipment Operators

1 – Emergency Planner

1 – LFR Public Information Officer

1 – Civic Center Assistant Director

2 – Water/Wastewater Hydrant Crew

1 – Water Environmental Compliance Specialist

1 – Wastewater Administrative Assistant

1 – CD Project Specialist

1 – CD Housing Inspection Specialist

1 – Assistant Director of Community Development

1 – Economic Development Specialist

10 – LP&L Employees

Street Maintenance Program

$11.0 million programmed for FY22; $1.0M increase over FY21

Capital Program, Vehicles, and Equipment

$89.8 million in capital improvements

o 74 total projects – 95% of projects cash funded

o 4 projects proposed for debt financing

• Public Safety CAD: $4.0 million (7-year Tax Note)

• Solid Waste Vehicles: $1.1 million (7-year Tax Note)

• Pump Station 2 Improvements: $6.0 million (Water/Wastewater Revenue Bond)

• South Lubbock Sanitary Sewer Extension: $2.2 million (Water/Wastewater Revenue Bond)

o $14.0 million in ARPA funding programmed for FY22

• 1 – Public Health Facility: $8.1 million

• 3 – Fire Rescue Vehicles: $3.1 million

• 52 – Police Patrol Vehicles: $2.8 million

$89.3 million in capital improvements

o Purchasing 102 vehicles – 99% Cash Funded

• Tax Note proposed for 1 Compactor for Solid Waste ($1.1 million)

• First year without Master Lease Take-Out

6

Fiscal Year 2022 Year-in-Review

Keeping Services to Citizens in line with Lubbock’s Growth and Development

Fiscal Year 2022 Year-in-Review

6.13

6.43

6.91

7.91

5.93

6.12

6.84

7.67

5.00

6.00

7.00

8.00

9.00

10.00

11.00

5/1/2019

6/1/2019

7/1/2019

8/1/2019

9/1/2019

10/1/2019

11/1/2019

12/1/2019

1/1/2020

2/1/2020

3/1/2020

4/1/2020

5/1/2020

6/1/2020

7/1/2020

8/1/2020

9/1/2020

10/1/2020

11/1/2020

12/1/2020

1/1/2021

2/1/2021

3/1/2021

4/1/2021

5/1/2021

6/1/2021

7/1/2021

8/1/2021

9/1/2021

10/1/2021

11/1/2021

12/1/2021

1/1/2022

2/1/2022

3/1/2022

4/1/2022

5/1/2022

Millions

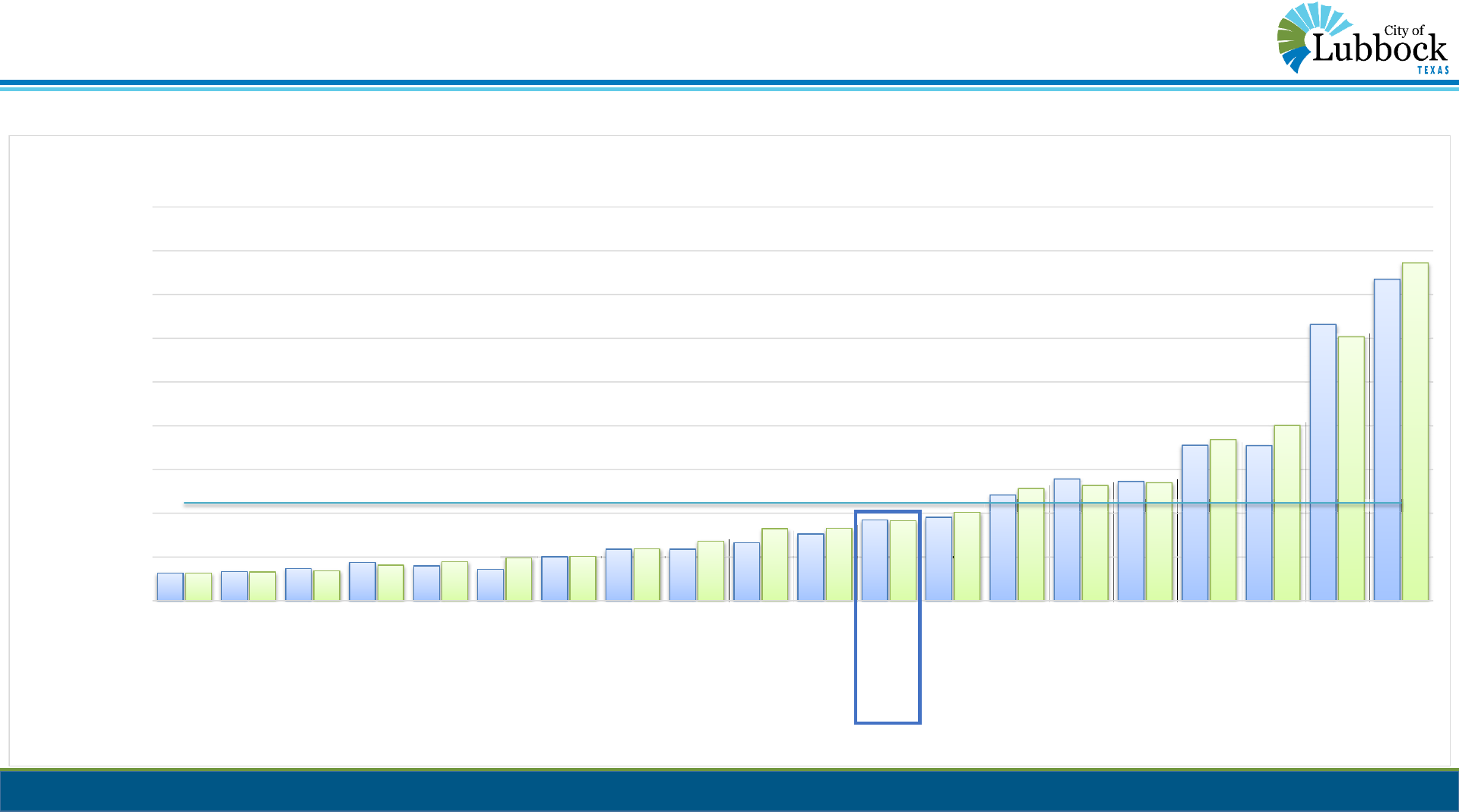

COL and LEDA 12-Month Average Collections - All Industries

12-mo Avg Mo Total

12-month average collections

through May 2022 up 14.4% over

May 2021 – 1.2%/month increase

7

Local Economic Highlights – Sales Tax Collections

Total from the Texas Comptroller includes both City of Lubbock 1.375% and LEDA 0.125% sales tax collections; does not include City of Lubbock Utility Retainage

Industry FYTD 2021 FYTD 2022 % Δ

Retail 28,101,915 31,298,406 11.4%

Food 7,500,458 8,579,885 14.4%

General Services 7,068,325 8,483,396 20.0%

Wholesale 4,845,937 6,031,172 24.5%

Professional Services 4,301,154 4,716,664 9.7%

Manufacturing 2,351,413 2,766,630 17.7%

Miscellaneous 774,592 811,659 4.8%

Agricultural 112,118 258,731 130.8%

Accomodation 42,589 81,806 92.1%

Total Collections 55,098,502 63,028,348 14.4%

251.2

276.8

282.4

372.6

442.3

292.2

359.1

504.7

607.9

625.1

121.9

204.2

274.7

239.7

326.9

171.9

337.2

142.6

221.1

464.5

97.2

56.3

58.2

132.7

137.0

66.6

89.0

143.9

76.9

81.7

$470.2

$537.3

$615.3

$745.1

$906.3

$530.7

$785.4

$791.2

$905.9

$1,171.2

-

200

400

600

800

1,000

1,200

1,400

FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FYTD 2022

Millions

Total New Res Total New Non-Res Total Add/Reno

8

Fiscal Year 2022 Year-in-Review

Local Economic Highlights – Building Stats

FY 2023

Executive

Overview

Proposed Operating Budget

& Capital Program

9

Proposed FY23 budget is balanced and fully funded. Current economic indicators are strong,

yet current and projected economic factors create challenges to operations

Inflation impacting every aspect of the City’s operations

Fleet challenges

o Many FY 22 vehicles ordered and not yet received, including Public Safety vehicles and large

equipment

o Inventory remains low for replacements; most FY23 Public Safety vehicles pre-purchased in FY22

o Significant cost escalations for vehicles, parts, and supplies

Property/Liability and Health insurance escalations

o City is experiencing significant escalations in property and liability insurance related to external

events (Winter Storm Uri, US wildfires, effects of the pandemic), new properties, and claims

o For FY23, City is moving from October 1 to April 1 renewal periods

• Will save money in the long-run but does cause City to pay an 18-month premium up-front (Oct 1, 2022

through March 31, 2024)

• Allows the City to go into the budget with actual insurance costs

• FY24 will return to 12-month renewals

10

Fiscal Year 2023 Economic Conditions

Current Economic Challenges Leading into Fiscal Year 2023

Fiscal Year 2023 Economic Conditions

US Consumer Price Index (Inflation) Pressure Lubbock Unemployment

11

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

2.4%

9.1%

3.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

Pre-Pandemic Pandemic Restriction Pandemic Recovery

1.8%

2.3%

1.5%

2.6%

4.2%

9.1%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

Jul-19

Sep-19

Nov-19

Jan-20

Mar-20

May-20

Jul-20

Sep-20

Nov-20

Jan-21

Mar-21

May-21

Jul-21

Sep-21

Nov-21

Jan-22

Mar-22

May-22

CPI Pre-Pandemic SMA Pandemic Restriction SMA Pandemic Recovery SMA

Fiscal Year 2023 Economic Conditions

WTI Spot Price Natural Gas Futures

12

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

$-

$20

$40

$60

$80

$100

$120

$140

7/1/2019

9/1/2019

11/1/2019

1/1/2020

3/1/2020

5/1/2020

7/1/2020

9/1/2020

11/1/2020

1/1/2021

3/1/2021

5/1/2021

7/1/2021

9/1/2021

11/1/2021

1/1/2022

3/1/2022

5/1/2022

7/1/2022

Pre-Pandemic Pandemic Restriction Pandemic Recover

$-

$1

$2

$3

$4

$5

$6

$7

$8

$9

Pre-Pandemic Pandemic Restriction Pandemic Recovery WS Uri

Natural Gas, Fuel, and Electric Costs

Inflation is driving FY23 budget increases by $4.5 million over FY22 budget for fuel, electric, and natural gas

o Unleaded and diesel price increases drive the FY23 budget higher by $2.5 million, a 57% one-year increase

o Electric costs, led by higher natural gas, is up $1.7 million over FY22, a 20.0% increase

$2.7 million increase, or 48%, in the General Fund, led by a 62% fuel cost increase of $2.2 million

Other Maintenance and Operations Inflationary Costs

$5.1 million increase City-wide for supplies, equipment, and professional services

$1.7 million increase to General Fund for supplies, equipment, and professional services

13

Fiscal Year 2023 Economic Conditions

Inflation Summary

Actual Budget Forecast Budget Budget Budget

City-wide FY 2021 FY 2022 FY 2022 FY 2023 $ Increase Increase %

Electric 8,598,675$ 8,439,076 9,083,441 10,129,800 1,690,724 20.0%

Natural Gas 841,840 966,854 1,103,726 1,268,029 301,175 31.1%

Unleaded Fuel 1,637,943 2,121,946 2,799,716 3,358,389 1,236,443 58.3%

Diesel 1,659,864 2,338,511 3,147,824 3,656,365 1,317,854 56.4%

Total City of Lubbock 12,738,323$ 13,866,387 16,134,707 18,412,582 4,546,195 32.8%

Actual Budget Forecast Budget Budget 3-Year

General Fund FY 2021 FY 2022 FY 2022 FY 2023 Increase Increase %

Electric 1,629,284$ 1,635,673 1,722,207 2,205,600 569,927 34.8%

Natural Gas 421,718 451,239 331,408 374,382 (76,857) -17.0%

Unleaded Fuel 1,314,492 1,710,510 2,265,915 2,718,069 1,007,559 58.9%

Diesel 1,408,846 1,914,198 2,713,662 3,152,062 1,237,864 64.7%

Total General Fund 4,774,340$ 5,711,620 7,033,192 8,450,113 2,738,493 47.9%

Total cost increase in property insurance of 78.5% ($4.8 million)

o 6.9% cost year-over-year increase in same property on a 12-month basis

o 53.4% cost increase in existing property attributable to 6-month addition

o New property coverage accounts for 18.1% cost increase (12.1% 12-month, 6.0% 6-month)

14

Fiscal Year 2023 Economic Conditions

Insurance Summary

FY 2022

Budget

FY 2023

Proposed

Variance to

Adopted

% Variance

to Adopted

Existing

Property

Existing Prop

% Inc/(Dec)

New Property

New Prop

% Inc/(Dec)

Existing

Property

Existing Prop

% Inc/(Dec)

New

Property

New Prop

% Inc/(Dec)

General Fund 890,737$ 1,386,711$ 495,974$ 55.7% 884,630$ -0.7% 39,844$ 4.5% 442,315$ 49.7% 19,922$ 2.2%

Lake Alan Henry 11,284 16,338 5,054 44.8% 10,892 -3.5% - 0.0% 5,446 48.3% - 0.0%

Electric 3,048,000 6,277,477 3,229,477 106.0% 3,635,289 19.3% 549,696 18.0% 1,817,644 59.6% 274,848 9.0%

Water 745,313 1,055,214 309,901 41.6% 690,413 -7.4% 13,063 1.8% 345,206 46.3% 6,532 0.9%

Wastewater 651,564 918,577 267,013 41.0% 612,385 -6.0% - 0.0% 306,192 47.0% - 0.0%

Aviation 492,386 878,344 385,958 78.4% 441,823 -10.3% 143,740 29.2% 220,911 44.9% 71,870 14.6%

Transit 32,622 47,235 14,613 44.8% 31,490 -3.5% - 0.0% 15,745 48.3% - 0.0%

Civic Center 246,129 364,369 109,462 44.5% 242,913 -1.3% - 0.0% 121,456 49.3% - -3.6%

Cemetery 4,854 7,028 2,174 44.8% 4,685 -3.5% - 0.0% 2,343 48.3% - 0.0%

Fleet 11,252 16,292 5,040 44.8% 10,861 -3.5% - 0.0% 5,431 48.3% - 0.0%

Warehouse 5,170 7,486 2,316 44.8% 4,991 -3.5% - 0.0% 2,495 48.3% - 0.0%

Radio Shop 26,086 37,770 11,684 44.8% 25,180 -3.5% - 0.0% 12,590 48.3% - 0.0%

Total City of Lubbock 6,171,016$ 11,012,841$ 4,841,825$ 78.5% 6,595,551$ 6.9% 746,343$ 12.1% 3,297,775$ 53.4% 373,172$ 6.0%

12-Month Renewal Effect

6-Month Renewal Effect

FY22 General Fund Beginning Excess Reserve Balance $ 42,564,895

Planned use of Excess Reserves for CIP in FY22 Budget $ 6,739,998

Unplanned uses of Excess Reserves, largely due to Inflation

o Budget Amendment #13 – 114

th

Street, Slide to Quaker 1,800,000

o Budget Amendment #21

• Avenue Q TAP 500,000

• 114

th

Street, Quaker to Indiana 3,000,000

o Budget Amendment #28 – Pre-Purchase of Vehicles 2,769,721

o Budget Amendment #32 – Electric, Unleaded Fuel, Diesel 1,449,639

Total use of Excess Reserves for FY22 $ 16,259,358

Planned use of Excess Reserves for CIP in FY23 Budget $ 10,514,587

FY23 General Fund Projected Ending Excess Reserve Balance $ 21,857,762

15

Fiscal Year 2023 Economic Conditions

Importance for Carrying Reserves

Property Taxes

Tax rate captures the full value of new growth and development

Maintenance & Operations (M&O) rate captures 2.31% of the 3.50% allowable increase

Continued management and reduction of Interest & Sinking (I&S, or “Debt”) rate

Proposed tax rate is a total reduction of 4.00 cents, totaling a 7.48 cent reduction over the last 3 years

Sales Tax

FY22 collections budgeted at $80.9 million, an 8.1% increase over FY21 budget

o FY21 collections ended the year at $82.3 million, 10.1% over budget and greater than FY22 budget

FY22 collections forecasted to end the year at $88.2 million, 9.1% over budget

FY23 collections budgeted at $90.1 million, 11.4% over FY22 budget. Equals 2.1% over FY22 EOY forecast

16

Fiscal Year 2023 Executive Overview

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

FY 2021 FY 2022 FY 2023 Tax Rate Δ

Maintenance & Operations $ 0.398672 $ 0.381257 $ 0.354866 $ (0.026361)

Economic Development 0.022468 0.021707 0.020047 (0.001660)

Interest & Sinking 0.120433 0.120266 0.108317 (0.011949)

Total COL Tax Rate $ 0.541573 $ 0.523230 $ 0.483230 $ (0.040000)

Notable Rate Schedule

Storm Water: No Rate Change

Water: No Rate Change

Wastewater: No Rate Change

Solid Waste General Collection: No Rate Change

Solid Waste WTRDF Tipping Fee: ↑$0.75/ton

Solid Waste Special Waste Tipping Fee: ↑$1.44/ton

17

Fiscal Year 2023 Executive Overview

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

Staffing Changes to Meet Service Demands

18

Fiscal Year 2023 Executive Overview

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

1 – Finance Revenue/Capital Analyst

1 – Building Safety Development Technician

1 – Engineering Development Construction Coordinator

2 – Animal Services Officers

1 – Fire Marshal Plans Examiner

2 – Fire Training Personnel

o 1 – Firefighter

o 1 – Equipment Operator

2 – Fire Suppression Medical Personnel

o 1 – Firefighter

o 1 – Equipment Operator

1 – IT Security & Compliance Analyst

1 – IT System Administrator

1 – Radio Shop Technician

1 – Water Meter Technician

1 – Water Pipeline Admin Assistant

2 – LP&L Transmission System Operators

Eliminated

Positions

(2) – 311 Call Takers

(1) – Water Industrial Electrician

(1) – Wastewater Industrial Electrician

Positions Moved

1 – Storm Water Utility Accounts Coordinator from

Engineering to Storm Water

Net Changes to Personnel (+13 Total Employees)

7 – General Fund

2 – Information Technology

1 – Radio Shop

2 – LP&L

1 – Storm Water

Street Maintenance Program

$12.0 million proposed for FY23; $1.0 million increase over FY22

Capital Program, Vehicles, and Equipment

$109.2 million in capital improvements planned for FY23

o 119 total projects – 95% of projects cash funded

o 6 projects proposed for debt financing – all but one fee supported

• Solid Waste Transfer Station $17.1 million (20-year Cert of Obligation)

• Fire Engines & Solid Waste Heavy Equip. $4.8 million (7-year Tax Notes)

• Downtown Sewer Line Replacement $6.5 million (10-year Revenue Bond)

• North Water Treatment Terminal Storage Reservoir $6.0 million (10-year Revenue Bond)

• Southeast Lubbock Water System Expansion $1.5 million (10-year Revenue Bond)

• West Lubbock Water System Expansion $1.9 million (10-year Revenue Bond)

o $7.8 million of ARPA/CARES funding for 4 projects

• Employee Education Assistance Program $0.5 million

• 3 – Splash Pads $5.1 million

• Airport Property Improvements $1.2 million

• Airport Roof Repair $1.0 million

19

Fiscal Year 2023 Executive Overview

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

Capital Program, Vehicles, and Equipment (continued)

o Purchasing 72 vehicles – 93% of vehicles cash funded

o Tax Notes proposed for 5 vehicles/equipment

• 3 – Fire Suppression E-1 Pumpers ($900k each; $2.7 million total)

• 1 – Solid Waste Track Dozer ($974k)

• 1 – Solid Waste Landfill Compactor ($1.1 million)

o 72 vehicles in FY23 budget does not include the 53 pre-purchased vehicles added during FY22 – all

vehicles were cash funded

• 39 – Police Patrol SUVs

• 1 – Police Special Operations vehicle

• 2 – Police Investigations vehicles

• 10 – Water/Wastewater vehicles

• 1 – Storm Water Maintenance vehicle

20

Fiscal Year 2023 Executive Overview

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

21

Proposed Compensation Adjustments

Lubbock Police Department – Civil Service; 17.3% Total Raise between FY22 and FY23

RANK STEP

FY22

COUNT

CURRENT SALARY

FY23

COUNT

FY23

SALARY FY23 RAISE SALARY IMPACT BENEFIT IMPACT

GEN FUND

COMP & BEN IMPACT

Cadet 30 52,127$ - 52,127$ 0.00% -$ -$ -$

Recruit 13 60,002 30 60,002 0.00% - - -

Officer Step A 29 62,972 12 65,853 4.57% 52,391 12,673 65,064

Officer Step B 33 66,121 57 69,145 4.57% 241,488 58,416 299,904

Officer Step C 52 69,426 45 72,602 4.57% 146,232 35,374 181,606

Officer Step D 34 73,592 35 76,594 4.08% 155,045 37,505 192,550

Officer Step E 14 76,536 21 82,339 7.58% 157,186 38,023 195,209

Officer Step F 70 81,128 75 88,514 9.10% 576,919 139,557 716,476

Corporal Step A 25 82,345 72 89,844 8.03% 480,580 116,252 596,832

Corporal Step B 50 83,581 - -

Sergeant Step A 18 90,268 13 94,334 4.50% 52,863 12,788 65,651

Sergeant Step B 14 92,749 16 99,052 6.80% 120,690 29,195 149,885

Sergeant Step C 36 95,299 39 104,994 10.17% 388,301 93,930 482,231

Lieutenant Step A 6 100,065 7 107,619 7.55% 52,882 12,792 65,674

Lieutenant Step B 5 102,816 4 113,000 9.90% 46,238 11,185 57,423

Lieutenant Step C 6 106,673 8 119,215 11.76% 108,052 26,138 134,190

Captain Step A 2 112,006 2 122,196 9.10% 20,380 4,930 25,310

Captain Step B 2

116

,486 1 125,251 7.52% 13,245 3,204 16,450

Captain Step C 2 121,145 4 129,008 6.49% 40,768 9,862 50,630

Asst Police Chief Step A 1 125,992 - 135,458 7.51% - - -

Asst Police Chief Step B - 132,481 1 142,232 7.36% 16,241 3,929 20,169

Asst Police Chief Step C 2 143,994 2 147,210 2.23% 6,431 1,381 7,812

TOTAL LPD CIVIL SERVICE 444 444 7.00% 2,675,932$ 647,134$ 3,323,066$

22

Proposed Compensation Adjustments

Lubbock Fire Rescue – Civil Service; 16.0% Total Raise between FY22 and FY23

# by Grade Current Avg New Avg % Avg Increase Current Total New Total $ Increase

FCS2 Equipment Operator 4 79,561 89,108 12.0% 445,754 492,733 46,979

FCS3 Lieutenant 7 88,252 98,842 12.0% 856,498 947,696 91,198

FCS4 Captain 3 96,926 108,557 12.0% 398,942 441,868 42,926

FCS5 Battalion Chief 2 110,237 123,466 12.0% 298,752 331,300 32,548

FCS6 Division Chief 3 123,535 138,360 12.0% 498,314 553,027 54,712

FCS7 Deputy Fire Chief 2 137,905 154,454 12.0% 367,688 408,403 40,716

21 12.0% 2,865,948 3,175,028 309,079

# by Grade Current Avg New Avg % Avg Increase Current Total New Total $ Increase

FNCS1 Probationary Fire Fighter 1 52,006 58,246 12.0% 76,695 84,372 7,677

FCS1 Fire Fighter 217 62,641 70,081 12.0% 19,412,175 21,577,870 2,165,696

FCS2 Equipment Operator 76 76,782 85,932 12.0% 7,992,577 9,062,360 1,069,783

FCS3 Lieutenant 58 83,605 93,638 12.0% 6,763,385 7,479,220 715,835

FCS4 Captain 26 94,201 105,505 12.0% 3,374,796 3,736,363 361,566

FCS5 Battalion Chief 9 107,815 120,753 12.0% 1,320,277 1,463,520 143,243

387 12.0% 38,939,905 43,403,705 4,463,800

408 41,805,853 46,578,733 4,772,879

TOTAL CIVIL SERVICE

Total 40-Hour Shift

Total Kelly Shift

Total Compensation Cost

Salary

Salary

Total Compensation Cost

40-HR

KELLY

Proposed 5.0% average raise for all City employees

Tiered to provide higher percentage raises at lower pay grades

o Lower bounds of pay grades increased by 4.0%

o Upper bounds of pay grades increased by tiered raise

23

Proposed Compensation Adjustments

City of Lubbock Tiered Raise Structure

Pay Grade Range FY22

Raise %

Number of

Employees

% of Non-CS

Employees

FY23 Proposed

Raise %

2-Year Total

Raise %

105 – 116 7.00% 370 29.4% 8.00% 15.00%

117 – 121 6.00% 524 41.5% 6.75% 12.75%

122 – 126 5.00% 210 16.6% 5.50% 10.50%

127 – 138 4.00% 131 10.4% 5.00% 9.00%

139 – 150 3.25% 27 2.1% 4.75% 8.00%

Health Benefits

City absorbing the majority of the health care cost increase

o City Allocation increasing by 10%

o Employee and Retiree Allocation increasing by 2%

Employee Education Assistance Program

City is allocating $500k of ARPA funds to assist employees wishing to advance their knowledge

and skills in a manner that will benefit the employee and the City of Lubbock

o Priority is for high school GED programs and job-specific certifications

o Associates, bachelors, and masters degrees eligible as well

24

Investments in Employees

FY22 Rate FY23 Rate $ Change % Change

City Allocations Medical 915.33$ 1,006.87 91.53 10.0%

Employee Medical

Employee Only 10.12 10.32 0.20 2.0%

Employee and Spouse 167.53 170.88 3.35 2.0%

Employee and Children 131.31 133.93 2.63 2.0%

Employee and Family 229.34 233.92 4.59 2.0%

25

Fiscal Year 2023 Summary of All Funding Sources

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

Actual Actual Actual Amended Budget % Change $ Change

(Values in $000s) FY 2018-19 FY 2019-20 FY 2020-21 FY 2021-22 FY 2022-23 from Budget from Budget

General Fund

Property Taxes 64,428$ 69,939 73,245 74,288 78,463 5.6% 4,175

Sales Taxes 71,647 73,978 82,500 80,864 90,077 11.4% 9,212

Other Taxes 1,743 1,471 1,772 1,734 1,760 1.5% 26

Franchise Fees 26,978 25,857 29,116 30,352 33,064 8.9% 2,711

Fees for Services 27,711 26,818 30,202 29,436 30,945 5.1% 1,509

Fees and Fines 7,663 7,116 7,492 7,184 8,077 12.4% 892

Other Revenue 13,627 21,606 14,689 13,960 14,431 3.4% 472

Transfers 6,254 16,592 7,027 7,355 8,164 11.0% 809

Excess Reserves (for CIP) 554 - - 16,259 10,515 -35.3% (5,745)

Total General Fund 220,606 243,378 246,042 261,433 275,495 5.4% 14,062

Internal Service Funds 61,397 65,983 70,986 75,937 84,751 11.6% 8,814

Enterprise Funds

Airport 15,569 13,689 13,766 12,341 14,667 18.8% 2,325

Lubbock Power & Light 219,113 223,756 278,599 312,390 346,075 10.8% 33,685

Storm Water 28,637 28,404 28,306 26,186 25,102 -4.1% (1,085)

Water/Wastewater 137,669 144,687 142,624 157,679 156,174 -1.0% (1,506)

Other Enterprise Funds 18,066 19,538 19,532 19,854 24,295 22.4% 4,441

Total Enterprise Funds 419,054 430,074 482,827 528,451 566,312 7.2% 37,861

Special Revenue Funds 45,876 51,273 66,904 56,656 58,297 2.9% 1,641

Debt Service Funds 54,061 64,549 69,646 43,127 41,285 -4.3% (1,842)

Total All Funding Sources 800,995$

855,258 936,403 965,606 1,

026,141 6.3% 60,535

Fiscal Year 2023 Summary of All Funding Sources

26

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

73

82

90

14

279

28

143

20

67

71

70

74

81

106

12

312

26

158

20

57

76

43

78

90

107

15

346

25

156

24

58

85

41

-

50

100

150

200

250

300

350

400

Millions

FY 2020-21 FY 2021-22 FY 2022-23

Prop Tax

78,462,506

Sales Tax

90,076,721

Other GF

106,955,756

Airport

14,666,596

LP&L

346,075,224

Storm Water

25,101,858

Water/Sewer

156,173,761

Other EF

24,294,703

Spec Rev

58,297,146

Int Svc

84,751,406

Debt Svc

41,285,452

FY 2022-23

27

Fiscal Year 2023 Summary of All Expenses

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

Actual Actual Actual Budget Budget % Change $ Change

(Values in $000s) FY 2018-19 FY 2019-20 FY 2020-21 FY 2021-22 FY 2022-23 from Budget from Budget

General Fund

Administrative Services 17,643$ 18,907 20,802 19,595 19,097 -2.5% (498)

Cultural & Recreation Services 15,165 14,304 14,909 17,483 18,118 3.6% 635

Development Services 6,183 6,153 6,743 7,719 8,014 3.8% 294

Public Works / Solid Waste 24,300 25,687 27,220 34,743 37,762 8.7% 3,019

Public Safety 127,658 122,344 130,861 144,560 151,176 4.6% 6,616

Other Expenses 29,658 26,622 32,174 37,333 30,996 -17.0% (6,337)

GF Compensation Adjustment 2,235 5.0% 2,235

Lubbock Fire Rescue Comp Adj 4,773 12.0% 4,773

Lubbock Police Comp Adj 3,323 7.0% 3,323

Total General Fund 220,606 214,018 232,709 261,433 275,495 5.4% 14,062

Internal Service Funds 59,763 64,930 67,487 75,720 84,641 11.8% 8,921

Enterprise Funds

Airport 12,774 13,515 13,486 12,341 13,434 8.9% 1,093

Lubbock Power & Light 216,530 223,756 259,343 312,390 346,075 10.8% 33,685

Storm Water 23,025 23,476 24,770 26,186 24,480 -6.5% (1,707)

Water/Wastewater 137,669 139,454 135,548 157,679 156,174 -1.0% (1,506)

Other Enterprise Funds 17,826 18,982 18,214 19,854 24,295 22.4% 4,441

Total Enterprise Funds 407,823 419,183 451,361 528,451 564,458 6.8% 36,006

Special Revenue Funds 42,661 48,451 63,623 54,281 55,535 2.3% 1,254

Debt Service Funds 50,747 64,549 69,646 43,127 41,285 -4.3% (1,842)

Total Expense Summary 781,601$ 811,131 884,826 963,013 1,021,414 6.1% 58,401

Fiscal Year 2023 Summary of All Expenses

28

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

233

13

259

25

136

18

64

67

70

261

12

312

26

158

20

54

76

43

275

13

346

24

156

24

56

85

41

-

50

100

150

200

250

300

350

400

Millions

FY 2020-21 FY 2021-22 FY 2022-23

General Fund

275,494,983

Airport

13,434,383

LP&L

346,075,224

Storm Water

24,479,646

Water/Sewer

156,173,761

Other EF

24,294,703

Spec Rev

55,535,289

Int Svc

84,640,672

Debt Svc

41,285,452

FY 2022-23

29

Fiscal Year 2023 Excess Reserves

Maintaining Services and Improving Efficiencies Amidst Economic Uncertainty

Fund

Available Cash as of

9/30/21

FY22 Net Change to

Excess Reserves

Policy Level

Reserves

FY22 Year End

Forecasted Excess

Reserves

FY23 Budgeted

Change to Excess

Reserves

FY23 Year End

Budgeted Excess

Reserves

Policy Level %

General Fund 90,080,772$ (8,978,489) 48,729,934 32,372,349 (10,514,587) 21,857,762 20%

Enterprise Funds

Airport Fund 14,335,058 (40,187) 2,396,588 11,898,283 - 11,898,283 25%

Water/Wastewater 56,570,293 (13,315,397) 35,353,040 7,901,856 (4,703,469) 3,198,387 25%

Civic Centers 1,833,740 (327,360) 79,557 1,426,823 (269,163) 1,157,660 15%

Storm Water 3,400,415 4,860,189 4,798,055 3,462,549 - 3,462,549 20%

Cemetery 886,872 (100,736) 37,070 749,066 (363,491) 385,575 10%

Lake Alan Henry 445,399 (21,264) 63,430 360,705 (66,422) 294,283 10%

Internal Service Funds

Fleet (1,915,104) 102,796 839,672 (2,651,980) - (2,651,980) 10%

Health Benefits 2,847,008 (1,562,166) 7,342,694 (6,057,852) (437,293) (6,495,145) 20%

Information Technology 5,336,946 (201,253) 1,020,688 4,115,005 (133,768) 3,981,237 10%

Radio Shop 1,413,840 125,214 257,815 1,281,239 - 1,281,239 10%

Investment Pool - - - - - -

Print Shop 96,674 (15,258) 17,447 63,969 (39,381) 24,588 8%

Central Warehouse 1,148,287 (166,049) 66,300 915,938 (68,303) 847,635 8%

Risk Management 9,633,248 (582,131) 5,000,000 4,051,117 (159,754) 3,891,363 Fixed

Special Revenue Funds

Gateway Streets 8,006,867 (397,778) 6,627,809 981,280 - 981,280

75% of revenue

Cable Services Fund 3,817,854 357,148 - 4,175,002 - 4,175,002

None

Debt Service Fund 6,296,056 (2,305,058) - 3,990,998 (853,812) 3,137,186

None

Hotel Occupancy Tax Fund 443,121 - - 443,121 - 443,121

None

Economic Development Fund 409,818 (587) - 409,231 - 409,231

None

Central Business District TIF 593,525 - - 593,525 - 593,525

Debt Svc Reserve

Lubbock Business Park TIF 671,890 619,798 - 1,291,688 - 1,291,688

None

North Overton TIF 6,782,283 1,591,886 - 8,374,169 (918,096) 7,456,073

Debt Svc Reserve

North & East Lubbock N&I Fund 514,507 - - 514,507 - 514,507

None

Total 213,649,369$ (20,356,682) 112,630,099 80,662,588 (18,527,539) 62,135,049

Tax Year 2022

Property Tax

Summary

Proposed Operating Budget

& Capital Program

30

31

Current Year Property Tax Rate Comparison

Top 15 Comparable Large Cities– FY 2022 Rates

0.36403

0.44820

0.44660

0.39681

0.51560

0.54157

0.59045

0.58750

0.59410

0.63400

0.62250

0.64626

0.74750

0.77623

0.78770

0.36719

0.44650

0.44660

0.48404

0.49766

0.52323

0.56582

0.58250

0.59410

0.61537

0.61980

0.64626

0.73250

0.76728

0.78510

0.578264

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

0.50

0.55

0.60

0.65

0.70

0.75

0.80

0.85

Midland

Plano

Frisco

Amarillo

McKinney

Lubbock

Denton

Carrollton

Irving

Laredo

Arlington

Corpus Christi

Fort Worth

Waco

Abilene

Ad Valorem Tax Rates Adopted FY 2021-22

FY21 Tax Rate FY22 Tax Rate FY22 Average

32

20-Year Property Tax Rate History

FY 2023 Operating and Capital Budget

0.415

0.335

0.356

0.361

0.354

0.325

0.332

0.332

0.342

0.357

0.361

0.385

0.392

0.378

0.388

0.388

0.403

0.399

0.381

0.355

0.101

0.095

0.061

0.071

0.071

0.091

0.084

0.094

0.102

0.106

0.117

0.114

0.123

0.137

0.127

0.137

0.132

0.120

0.120

0.108

0.030

0.030

0.030

0.030

0.030

0.030 0.030

0.030

0.030

0.029

0.027

0.023

0.023 0.023 0.023

0.023

0.023

0.022

0.022

0.020

0.545700

0.459700

0.447200

0.461990

0.455050

0.446400

0.446400

0.456170

0.474000

0.492110

0.504410

0.522400

0.538020

0.538020

0.538020

0.548020

0.558020

0.541573

0.523230

0.483230

$-

$0.1

$0.2

$0.3

$0.4

$0.5

$0.6

$0.7

FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023

PROPERTY TAX RATE (PER $100 VALUATION)

Maintenance & Operation Interest & Sinking Fund Economic Development

State Required Language (Revenue Year-over-Year Increase)

This budget will raise more

total property taxes than last year’s budget by $4,720,457, or 4.87%, and of

that amount, $2,969,882 is tax revenue to be raised from new property added to the roll this year.

The proposed tax rate decrease is still considered a tax increase

Tax Year 2022 Rates

o No-New-Revenue Rate: $0.476762

o Voter-Approval Tax Rate: 0.488963

o Unused Increment (UI): 0.003632

o Voter-Approval Tax Rate w/ UI: $0.492595

o FY 2023 Proposed Rate: $ 0.483230

o Tax Year 2022 Preliminary Values: $ 21,702,000,000

o Tax Year 2022 Certified Values: $ 23,609,040,118

o Tax Year 2021 Over-65 Exemption Levy: $ 8,166,705

o Tax Year 2022 Over-65 Exemption Levy: $ 7,640,820

Certified Net Taxable Value of the City of Lubbock rose to $23.6 billion, a 13.1% increase over prior

year, or $2.7 billion

33

FY23 Ad Valorem Taxes

FY 2023 Operating and Capital Budget

Ad Valorem Revenue Increase Breakdown

34

FY 2023 Operating and Capital Budget

$ 4,720,457

General Fund Economic Development Debt

$4,042,172 $195,718 $482,568

$2,180,970 $665,705$1,861,202 $72,511

$(183,137)

$123,207

Existing Property

New Property

Existing Property

New Property

Existing Property

New Property

FY22 – SFR Avg Taxable Value: $168,814 FY23 – SFR Avg Taxable Value: $191,081

35

Tax Rate and Appraisal Effect on Average Home

Average Single Family Residential Home will see a $40.07 increase in Property Taxes

SFR Taxable

Value Increase

13.2%

FY22 COL Taxes

$883.29

Appraisal Growth

$56.03

Tax Rate Decrease

($30.97)

FY23 COL Taxes

$923.36

COL Tax Increase: $40.07

Appraisal Growth

$116.50

Tax Rate Decrease

($76.43)

FY 2022-23

Debt &

Investments

Proposed Operating Budget

& Capital Program

36

Total Governmental Debt Comparison

37

Based on FY21 Comprehensive Annual Financial Reports

127

133

146

175

159

144

201

236

236

267

305

370

382

483

557

545

711

710

1,263

1,470

126

132

138

162

178

196

204

238

272

331

332

367

405

513

527

540

737

802

1,207

1,545

Average

448

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

Abilene

McAllen

Odessa

Killeen

Midland

Amarillo

Carrollton

Mesquite

Laredo

Denton

McKinney

Lubbock

Waco

Plano

Corpus Christi

Irving

Frisco

Fort Worth

Arlington

El Paso

MILLIONS

Total Governmental Debt FYE 2021

Total Governmental Debt per Capita Comparison

38

Based on FY21 Comprehensive Annual Financial Reports

762

879

688

1,032

1,146

901

872

1,168

1,388

1,457

1,624

1,705

1,561

1,680

2,250

2,125

1,891

2,756

3,233

3,508

842

857

973

1,003

1,026

1,031

1,160

1,169

1,381

1,460

1,585

1,659

1,673

1,781

2,196

2,227

2,241

2,897

3,068

3,481

Average

1,686

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

Fort Worth

McAllen

Amarillo

Abilene

Killeen

Laredo

Midland

Odessa

Lubbock

Carrollton

Mesquite

Corpus Christi

McKinney

Plano

Irving

El Paso

Denton

Waco

Arlington

Frisco

Governmental Debt per Capita FYE 2021

39

City of Lubbock Debt Profile

Tax and Fee Supported Debt Year-over-Year Comparison

FY 2022

Tax Supported

FY 2023

Tax Supported

Year over Year Change

% Increase /

(Decrease)

General Government

General Fund 287,590,907$ 263,233,716$ (24,357,191)$ -8.5%

Enterprise Funds

Civic Centers 3,986,752 3,536,577 (450,175) -11.3%

Subtotal Tax Supported 291,577,659$ 266,770,293$ (24,807,366)$

FY 2022

Fee Supported

FY 2023

Fee Supported

Year over Year Change % Total

Debt

General Government

Solid Waste 15,766,971$ 12,291,244$ (3,475,726)$ -22.0%

Enterprise Funds

Water / Wastewater 581,632,513 532,308,888 (49,323,625) -8.5%

Stormwater 118,430,223 106,240,110 (12,190,113) -10.3%

Airport 56,756,369 53,048,435 (3,707,933) -6.5%

Citibus 1,353,896 949,086 (404,810) -29.9%

Cemetery 308,545 232,805 (75,740) -24.5%

Lubbock Power & Light 672,238,519 733,621,703 61,383,184 9.1%

Internal Services 14,517,844 11,555,126 (2,962,718) -20.4%

Special Revenue Funds

Gateway 78,832,468 70,048,855 (8,783,613) -11.1%

Other SR Funds 30,481,966 26,337,040 (4,144,926) -13.6%

Subtotal Fee Supported 1,570,319,315$ 1,546,633,295$ (23,686,020)$ -1.5%

Total Debt 1,861,896,974$ 1,813,403,588$ (48,493,387)$ -2.6%

Tax Supported Debt Principal & Interest

Usage Fee Supported Debt Principal & Interest

FY 2023 Lubbock Power & Light total includes the proposed issuance to be considered at the August 9

th

Regular Council Meeting

$638.3

$532.3

$263.2

$106.2

$70.0

$53.0

$13.6

$12.3

$12.3

$3.7

$4.1

$3.8

$3.5

$0.9

$0.4

$0.2

-

100

200

300

400

500

600

700

TOTAL DEBT ($ MILLIONS)

City of Lubbock - Total Debt (P+I) by Fund

As of October 1, 2022

40

City of Lubbock Debt Profile

Total Debt by Fund

LP&L

37%

Water /

Wastewater

31%

General Fund

16%

Stormwater

6%

Gateway

4%

Airport

3%

Other

3%

User Fee

Supported

82.5%

Tax Supported

17.5%

City of Lubbock Investment Earnings

0.7

0.8

0.8

1.0

2.4

4.8

8.3

14.4

14.8

4.3

3.1 1.9

11.0

0.0%

0.3%

0.6%

0.9%

1.2%

1.5%

1.8%

2.1%

2.4%

-

2

4

6

8

10

12

14

16

FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

BENCHMARK TREASURY YIELD

PORTFOLIO EARNINGS ($MM)

Actual Earnings Estimated Earnings Treasury Yield

FY21 Investment Earnings per Capita

41

FY 2021 actuals based on ACFR; FY 2022 and 2023 projected on current market

Earnings down significantly due to portfolio

allocation relative to market yields

o Heavy weighting towards overnight pools

due to lack of investment opportunities

Lubbock portfolio continues to outperform

cities across Texas

17.84

17.29

14.19

14.11

12.86

12.10

10.97

10.54

7.95

4.69

3.05

3.03

2.39

1.77

-

2

4

6

8

10

12

14

16

18

20

INVESTMENT EARNINGS PER CAPITA ($)

General

Fund

Proposed FY 2022-23

Operating and Capital

Budget

42

43

General Fund Revenue

FY 2023 Operating and Capital Budget

Actual Actual Actual Amended Budget % Change $ Change

(Values in $000s) FY 2018-19 FY 2019-20 FY 2020-21 FY 2021-22 FY 2022-23 from Budget from Budget

General Fund

Property Taxes 64,428$ 69,939 73,245 74,288 78,463 5.6% 4,175

Sales Taxes 71,647 73,978 82,500 80,864 90,077 11.4% 9,212

Other Taxes 1,743 1,471 1,772 1,734 1,760 1.5% 26

Franchise Fees 26,978 25,857 29,116 30,352 33,064 8.9% 2,711

Fees for Services 27,711 26,818 30,202 29,436 30,945 5.1% 1,509

Fees and Fines 7,663 7,116 7,492 7,184 8,077 12.4% 892

Other Revenue 13,627 21,606 14,689 13,960 14,431 3.4% 472

Transfers 6,254 16,592 7,027 7,355 8,164 11.0% 809

Excess Reserves (for CIP) 554 - - 16,259 10,515 -35.3% (5,745)

Total General Fund 220,606$ 243,378 246,042 261,433 275,495 5.4% 14,062

General Fund Revenue

GF Revenue Highlights

Overall revenue increase of $14.1 million, or 5.4%

Property tax increase of $4.2 million

o $3.0 million for new property added to the tax rolls

o $1.2 million for existing property

Sales tax increase of $9.2 million over FY22 budget; $1.9 million, or 2%, over FY22 forecast

Franchise fees increasing due to higher projected natural gas prices

Fees for services increasing as a result of the City’s growth

Use of excess reserves for CIP programmed for $10.5 million, lower than the $16.2 million

used in FY22

GF Revenue Changes

44

45

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

Animal Services HLTH-ANIMAL SHELTER RECEIPTS 6502

Dangerous Animal License 100.00 150.00 50.00

Dangerous Wild Animal License 100.00 300.00 200.00

Multi - Pet Permit Application Fee 25.00 40.00 15.00

Multi - Pet Bi- Yearly Permit Fee (NEW) - 200.00 200.00

HLTH - QUARANTINE PROCESSING 6533

Rabies Specimen Fee-City residents (NEW) - 150.00 150.00

Rabies Specimen Fee - Outside City (NEW) - 200.00 200.00

Athletics & Aquatics FEE-KICK BALL LEAGUE REGISTRATION 6442

Late Fee 30.00 - (30.00)

Withdrawal/No Show Fee 50.00 - (50.00)

PR-SWIMMING INSTRUCTION 6542

Recertification - CPR, First Aid & Lifeguarding 50.00 70.00 25.00

PR-SWIM POOL CONCESSIONS 6543

Pool Concession Items (Packaged Food and Beverages) 0.25 -2 0.25-6 4.00

PR-SWIM POOL RENTAL 6544

Additional Lifeguard 30.00 - (30.00)

Rental fee for 1-75 people 175.00 - (175.00)

Rental fee for 76-125 people 275.00 - (275.00)

Rental fee for 126-200 people 325.00 - (325.00)

Rental Fee for 1-75 people, Clapp Pool - 300.00 300.00

Rental Fee for 76-200 people, Clapp Pool - 375.00 375.00

PR-VOLLEYBALL LEAGUE 6559

Youth League -Individual Fee/Individual Late Fee

(NEW)

- 40-50 40-50

PR-GYM RENTAL 6560

Rogers Gym Rental 60.00

$30/hr (2hr min)

N/A

PR-SOFTBALL ENTRY FEE 6561

Withdrawal/No Show 50.00 - (50.00)

Softball Sales 7-21 7-60 39.00

KICKBALL ENTRY FEE 6561.11123

Withdrawal Fee - 50.00 50.00

PR-FIELD RESERVATION 6562

Field Rental - Professional Services - Site Supervisor (if

required)

25.00 - (25.00)

Field Rental - Litter Deposit 500.00 100.00 (400.00)

46

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

Athletics & Aquatics PR-FIELD RESERVATION 6562

League Rental Non-Food Sales/ Concession Sales- Non-

Profit

25-50 - (50.00)

League Rental - Field Preparation Fee & Temporary

Fence

50-100 25-100 (25.00)

Camps/Clinic 75.00

$25/hr (3hr min)

N/A

Tournament Reservation Fee - Soccer Field

(grass/synthetic turf )

100-200 - (200.00)

Reservation fee - practice/other games

(grass/synthetic turf)

25-50 - (50.00)

Field Rental - Berl Huffman Athletic Complex

(Tournament/Practice/Other Games) 16 hrs-30 hrs

booked each reservation (NEW)

- 38.00 38.00

Field Rental - Berl Huffman Athletic Complex

(Tournament/Practice/Other Games) 31-50hrs booked

each reservation (NEW)

- 36.00 36.00

Field Rental - Berl Huffman Athletic Complex

(Tournament/Practice/Other Games) 51+ hours booked

each reservation (NEW)

- 34.00 34.00

Tournament Litter Fee (NEW) - 75-250 75-250

PR-USER FEES 6563

Non-Resident (Paid On Time/Paid Late) 7.5-15 8-15.5 0.50

Resident (Paid On Time/Paid Late) 5-10 5.5-10.5 0.50

PR-TENNIS INSTRUCTION 6565

Junior Development Group Lesson 55-100 60-105 5.00

Camp 26-29 40-50 14-21

Pro 1 Lesson 19-40 50-55 26-15

Pro 2 Lesson 15-30 40-50 25-20

Pro 3 Lesson 29-32 - (32.00)

47

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

Athletics & Aquatics PR-TENNIS TOURNAMENTS 6566

Entry fee (Tennis & Pickleball) 10-30 20-50 10-20

PR-BALL MACHINE RENTAL 6568

Members/ Non-Members (Hourly) 2.5-3.75 7.5-10 5-6.25

Members/ Non-Members (Annual) 75-100 100-125 25.00

PR-LEAGUES Member 6569

Member/Non-Member entry fees 15-25 20-30 5.00

PR-COURT FEES 6570

Non Member (Tennis & Pickleball) 2.00 3.00 1.00

Tournament Court Fee (non-BRTC) - singles/doubles

Tennis & Pickleball

2-4 3-5 1.00

League Court Fee (non-BRTC) - singles/doubles Tennis

& Pickleball

3-6 5-8 2.00

PR-MEMBERSHIPS 6571

Tennis Center Youth/Senior 50.00 75.00 25.00

Tennis Center Adult 100.00 125.00 25.00

Tennis Center Family 150.00 175.00 25.00

PR-FLAG FOOTBALL 6576

Withdrawal/No Show 50.00 - (50.00)

Entry fee 375.00 400.00 25.00

Youth League - Individual Fee/Individual Late Fee

(NEW)

- 60-80 60-80

PR-SOFTBALL TOURNAMENT 6579

Gate Fee 5 - 20 - (20.00)

Entry fee 176 - 300 - (300.00)

PR OUTDOOR REC ADVERTISING 6625

Field Signs (Berl Fields 1/2/3/4) 250-300 250-400 100.00

Scoreboards/ Bulletin Board 500.00 500-2200 1,700.00

Berl Entrance Gate 1,500.00

3,000/ year or

12,000/5 years

n/a

Line-up Cards 1,000.00 - (1,000.00)

City Secretary LIC-COIN OPERATED MACHINE PERMIT 6214

Background Check 50.00 75.00 25.00

Late Fee 100.00 150.00 50.00

LIC-PUBLIC RIGHT OF WAY PERMITS 6235

Banner 520.00 550.00 30.00

48

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

City Secretary LIC-PUBLIC RIGHT OF WAY PERMITS 6235

Carnival - Late Fee (NEW) - 100.00 100.00

FEE-SALE OF ORDIN BOOKS 6405

Revenue from the sale of photocopies of ordinances,

minutes, and other City documents: 100+ Pages

0.10 - (0.10)

Community Recreation PR-BUILDING RENT 6548

Party Houses - Clapp Party House 150.00 200.00 50.00

PR-INSTRUCTIONS/CLASSES 6549

Safety City Birthday Party w/ Cars 150.00 200.00 50.00

Trejo After School Program (ASP) Fee 10.00 15.00 5.00

Safety City Meeting/Classroom Reservation Per Hour 20.00 40.00 20.00

Safety City Camp 100.00 150.00 50.00

Safety City Birthday Party w/o Cars 100.00 150.00 50.00

Safety City Car Sponsorship Renewal - 2 Years 250.00 - (250.00)

Safety City Car Sponsorship New - 2 Years 500.00 - (500.00)

Engineering Inspection Services LIC - Right of Way Permit 6231

Application cost to process Right-of-Way construction

permit (NEW)

- 25.00 25.00

FEE - WIRELESS COMMUNICATIONS 6472

Annual cost to process permit for right of way

construction per node - Small cell (NEW)

- 298.00 298.00

Commercial Driveway Cut Inspection Fee 7505

Inspection fee Commercial Approach (NEW) - 150.00 150.00

Environmental Health LIC-CAFE PERMITS 6206

Sample Permit Maximum of 14 Days 7.00 10.00 3.00

Temporary Food Establishment Maximum of 14 Days 20.00 25.00 5.00

Food Risk Category 1 225.00 300.00 75.00

Food Manufacturing/Warehousing 0-1,000 Sq. Ft. 225.00 300.00 75.00

Food Manufacturing/Warehousing 1,001-5,000 Sq. Ft. 325.00 400.00 75.00

Food Risk Category 2 325.00 400.00 75.00

Food Manufacturing/Warehousing 5,001-10,000 Sq. Ft. 425.00 500.00 75.00

Food Manufacturing/Warehousing >10,000 Sq. Ft. 525.00 600.00 75.00

Food Risk Category 3 425.00 500.00 75.00

49

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

Environmental Health LIC-CAFE PERMITS 6206

Food Risk Category 4 525.00 600.00 75.00

LIC-REINSPEC. FEE/CAFE PMT 6210

Reinspection fee for Café Permit 150.00 175.00 25.00

LIC-GREASE HAULER PERMITS 6243

Grease Hauling Permit 125.00 150.00 25.00

Grease Facility Permit 175.00 200.00 25.00

LIC-TATTOO SHOP PERMITS 6244

Piercing 200.00 250.00 50.00

Body Art 200.00 250.00 50.00

LIC-SMOKING PERMITS 6248

Permit to allow on-premises smoking within city limits 125.00 200.00 75.00

LIC- HEALTH PLAN REVIEW 6252

Fee for initial plan review of a new food facility, pool,

spa, or public interactive water feature.

250.00 300.00 50.00

FEE-ANNUAL POOL SCHOOL 6429

The Health Department offers an annual pool school

for area pool operators.

35.00 45.00 10.00

FEE-HEALTH DEPARTMENT DUPLICATE PERMIT 6432

Fee for duplicate permit requests 15.00 20.00 5.00

FEE-FOSTER HOME INSPECTION 6433

Foster Home Inspection 60.00 70.00 10.00

FEE-GROUP HOUSING INSPECTION 6434

Group Housing Inspection 125.00 175.00 50.00

FEE-LATE PAYMENT 6435

Penalty fee for all health permit payments more than

10 days late.

55.00 65.00 10.00

HLTH-MISC FEES Smoking Signs 6514

Fee for costs associated with replacement smoking

signs

3.00 8.00 5.00

Fire Rescue LIC-FIRE WORKS PERMITS 6236

Fire Works Permit 115.00 500.00 385.00

Annual fire works permit 500.00 750.00 250.00

FEE-OPEN BURNING 6437

Open burn permit fee 350.00 500.00 150.00

Tent permit fee TBD

Fee collected for tent permit (NEW) - 15.00 15.00

Mobile Food Vendor fee TBD

Fee collected for annual fire inspection required to

obtain permit for operation (NEW)

- 30.00 30.00

Garden & Arts MEMBERSHIPS/DONATIONS 6599

Annual for non-profit groups 35.00 45.00 10.00

50

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

Garden & Arts PR-BUILDING RENT 6548.00516

Garden & Arts White Furniture Chairs - Outdoor 1.00 - (1.00)

Garden & Arts White Furniture Tables - Rounds 6.00 - (6.00)

Garden & Arts Wedding Packet 8 Hours Indoor/Outdoor 1,000.00 1,200.00 200.00

Garden & Arts Wedding Packet 4 Hours Indoor/Outdoor 500.00 700.00 200.00

Libraries FINE-LIBRARY FINE 6702

Fines charged for overdue library materials. 0.25 - (0.25)

Parks&Recreation PR-PARK USAGE 6550

Special Event usage fee for 50 people or fewer 50.00 - N/A

Special Event usage fee for Micro Event (51-200

people)\ For Profit/Non Profit

200-500 - N/A

Special Event usage fee for Micro Event (51-200

people) - For Non-Profit

100-200 - N/A

Special Event usage fee for Small Event (201+ people) -

For Profit

200-500 - N/A

Special Event usage fee for Small Event (201+ people) -

For Non-Profit

100-200 - N/A

Special Event usage fee (50 people or less) * - 50.00 50.00

Special Event usage fee (51-300 people) - For Profit /

Non-Profit *

- 100-500 N/A

Special Event usage fee (300-500 people) - For Profit /

Non-Profit *

- 500-1000 N/A

Special Event usage fee (501+ people) - For Profit / Non-

Profit *

- 750-1500 n/a

PR-PARK VENDOR COMMISSIONS 6555

NEW - Special Vendors (Serving Alcohol) - 200.00 200.00

NEW - Late Fee Special Vendors (Serving Alcohol) - 50.00 50.00

Vendor fee (6+) 50.00 150-300 n/a

51

City of Lubbock – General Fund Fee Changes

FY 2023 Operating and Capital Budget

Account Rate Budget Budget $ Change

Department Account Description Number Details 2021-22 2022-23 from Amended

Planning ZONING - PETITION ANNEXATION FEE 6412

Voluntary/Petition Annexation Requests 500.00 1,500.00 1,000.00

Solid Waste SW-GEN CONSUMER METERED 7523

Monthly commercial garbage charge for 6 cubic yard

dumpster.

128.62 - (128.62)

SW-MUN DISPOSAL FEE 6630

Per Ton Regular Trash Tipping Fee 37.25 38.00 0.75

Per Ton Special Waste Tipping Fee 71.42 72.86 1.44

Traffic Engineering LIC-LOADING ZONE PERMITS 6234

Initial Sign Cost - Installation for new permit fee 200.00 240.00 40.00

LIC- BARRICADE PERMITS 6250

Barricade permit fee 30.00 50.00 20.00

FEE-PARKING SIGNS 6439

Residential Parking Sign fee 200.00 240.00 40.00

Parking Control Sign fee 200.00 240.00 40.00

FEE-RESIDENTIAL PARKING SIGNS 6441

Resident Sign fee for parking within a specified

parameter

200.00 240.00 40.00

DEPT-STREET NAME MARKERS 7581

Street name sign fee 200.00 240.00 40.00

52

General Fund Expenditures

FY 2023 Operating and Capital Budget

Actual Actual Actual Budget Budget % Change $ Change

(Values in $000s) FY 2018-19 FY 2019-20 FY 2020-21 FY 2021-22 FY 2022-23 from Budget from Budget

General Fund

Administrative Services 17,643$ 18,907 20,802 19,595 19,097 -2.5% (498)

Cultural & Rec Services 15,165 14,304 14,909 17,483 18,118 3.6% 635

Development Services 6,183 6,153 6,743 7,719 8,014 3.8% 294

Public Works / Solid Waste 24,300 25,687 27,220 34,743 37,762 8.7% 3,019

Public Safety 127,658 122,344 130,861 144,560 151,176 4.6% 6,616

Other Expenses 29,658 26,622 32,174 37,333 30,996 -17.0% (6,337)

GF Non-CS Comp Adj - - - - 2,235 5.0% 2,235

LFR Comp Adj - - - - 4,773 12.0% 4,773

LPD Comp Adj - - - - 3,323 7.0% 3,323

Total General Fund 220,606$ 214,018 232,709 261,433 275,495 5.4% 14,062

General Fund Expenditures

GF Expenditure Highlights

Administrative, Cultural & Recreational, and Development Services departments remained largely

unchanged

Costs of supplies, materials, and equipment are the largest drivers of the increase in Public Works

Public Safety base increase of $6.6 million is primarily due to addition of personnel, mid-FY22

reclassifications, healthcare expenses, and inflationary increases for supplies and equipment

Less programmed use of excess reserves for CIP is the $6.3 million drop in Other category

General Fund Non-Civil Service proposed raise pool of 5% adds $2.2 million

LFR and LPD Civil Service raises at the proposed amount increases the GF budget by $8.1 million

GF Expenditure Changes

53

City of Lubbock – General Fund Analysis

GF Spending per Capita,

2022 Inf Adjusted

GF Staffing per 1,000

Population

54

FY 2014

6.28

FY 2023

6.05

1,400

1,450

1,500

1,550

1,600

1,650

1,700

5.7

5.8

5.9

6.0

6.1

6.2

6.3

6.4

TOTAL GENERAL FUND

EMPLOYEES

EMPLOYEES PER 1,000

POPULATION

GF Staff per 1,000 Population General Fund Staffing

FY 2014

$833.63

FY 2023

$859.58

150

170

190

210

230

250

270

760

780

800

820

840

860

880

TOTAL GENERAL FUND SPEND

($ MM)

COST/CAPITA ADJ FOR INFLATION

Cost / Capita - Inflation Adj (2022 Basis) General Fund Spending

Administrative Services Departments

City Attorney

City Council

City Manager

City Secretary

Facilities Management

Finance

Human Resources

Internal Audit

Non-Departmental

Communications & Marketing/311 Call Center

55

General Fund Administrative Services

FY 2023 Operating and Capital Budget

City Attorney

Budget Variance Explanation

Comp and benefits increases due to FY22

salary adjustments and health premiums

Professional services increasing for outside

legal counsel services but offset by

reductions in other line items

Scheduled charges increases are due to IT

charges and liability insurance

56

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 1,410,269$ 1,540,907 1,549,591 0.6%

Benefits 489,081 518,281 541,768 4.5%

Supplies 8,573 9,091 9,280 2.1%

Maintenance - - -

Professional Services/Training 37,326 52,905 56,905 7.6%

Other Charges 19,901 23,855 23,400 -1.9%

Scheduled Charges 162,662 166,762 177,353 6.4%

Capital Outlay/Reimbursements - - -

Total City Attorney 2,127,812$ 2,311,801 2,358,297 2.0%

* Total FY 2022-23 does not include proposed compensation adjustment

City Council

Budget Variance Explanation

Decrease in comp and benefits associated

with staff turnover of long tenured

employee

Professional services increase resulting from

higher costs associated with council

meetings

Scheduled charges increasing due to

increases in internal service charges

57

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 207,546$ 230,270 191,838 -16.7%

Benefits 138,274 165,041 161,988 -1.8%

Supplies 13,033 17,268 17,457 1.1%

Maintenance - - -

Professional Services/Training 107,751 67,300 70,800 5.2%

Other Charges 45,517 87,098 85,300 -2.1%

Scheduled Charges 74,962 92,291 96,129 4.2%

Capital Outlay/Reimbursements - - -

Total City Council 587,083$ 659,268 623,512 -5.4%

* Total FY 2022-23 does not include proposed compensation adjustment

City Manager

Budget Variance Explanation

Increase in comp and benefits resulting from

personnel reorganization and health

insurance increases

58

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 1,246,162$ 1,262,840 1,270,869 0.6%

Benefits 378,591 389,990 402,519 3.2%

Supplies 24,969 17,995 18,957 5.3%

Maintenance - - -

Professional Services/Training 46,178 43,600 40,500 -7.1%

Other Charges 8,080 9,800 10,500 7.1%

Scheduled Charges 95,570 104,946 106,347 1.3%

Capital Outlay/Reimbursements - - -

Total City Manager 1,799,551$ 1,829,171 1,849,692 1.1%

* Total FY 2022-23 does not include proposed compensation adjustment

City Secretary

Budget Variance Explanation

Increase in comp and benefits due to the

addition of an intern and health insurance

Supplies increase is for permeant books and

paper for historical resolutions and

ordinances, privacy blinds, and general office

supplies

Decrease in professional services due to only

budgeting for one special election

Increase in scheduled charges relates to

increases in IT services and liability insurance

59

FY 2023 Operating and Capital Budget

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 664,651$ 705,486 715,751 1.5%

Benefits 259,681 281,710 293,285 4.1%

Supplies 13,083 13,268 22,623 70.5%

Maintenance 2,397 1,690 1,690 0.0%

Professional Services/Training 651,516 862,493 461,022 -46.5%

Other Charges 6,194 13,075 14,025 7.3%

Scheduled Charges 172,584 190,809 215,386 12.9%

Capital Outlay/Reimbursements - - -

Total City Secretary 1,770,106$ 2,068,531 1,723,782 -16.7%

* Total FY 2022-23 does not include proposed compensation adjustment

Facilities Management

Budget Variance Explanation

Comp and benefits decreasing due to staff

turnover and elimination of one Field

Maintenance Tech position

Maintenance increase accounts for increase

in elevator service contract

Increase in scheduled charges is due to

changes in electric and natural gas costs and

property insurance premium increase

Capital outlay decrease is due to a one-time

expense in the prior year

60

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 779,587$ 933,999 924,971 -1.0%

Benefits 358,886 424,145 430,417 1.5%

Supplies 27,646 26,874 28,460 5.9%

Maintenance 700,348 331,301 368,355 11.2%

Professional Services/Training 1,211,470 1,261,486 1,457,344 15.5%

Other Charges 1,022,824 52,800 56,800 7.6%

Scheduled Charges 977,490 985,076 1,596,463 62.1%

Capital Outlay/Reimbursements 19,092 1,474,471 19,340 -98.7%

Total Facilities Management 5,097,344$ 5,490,152 4,882,150 -11.1%

* Total FY 2022-23 does not include proposed compensation adjustment

Finance

Budget Variance Explanation

Increase in comp and benefits is due to the

addition of one Finance Revenue Analyst and

one Senior Accountant position

Professional services increase is primarily

due to the annual increase in out external

audit contract and moving the GL expense

for purchasing contract management

software subscription

Decrease in capital outlay relates to the

move of the purchasing software to

professional services

61

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 1,671,702$ 1,826,474 2,011,035 10.1%

Benefits 707,448 782,411 888,895 13.6%

Supplies 27,513 38,436 35,977 -6.4%

Maintenance 384 - -

Professional Services/Training 218,219 324,196 349,525 7.8%

Other Charges 27,076 10,561 14,046 33.0%

Scheduled Charges 185,627 192,060 197,841 3.0%

Capital Outlay/Reimbursements - 7,400 - -100.0%

Total Finance 2,837,970$ 3,181,538 3,497,319 9.9%

* Total FY 2022-23 does not include proposed compensation adjustment

Human Resources

Budget Variance Explanation

Decrease in compensation related to

elimination of Assistant Director position,

offset by mid-year increases in three

positions’ salaries

Increase in supplies due to costs for new hire

orientation and increase in ERI software

costs

Professional services increase is for

compensation software services

Other charges increasing for Employee

Engagement Committee and updated

computer equipment

Scheduled charges primarily due to increase

in costs for IT services

62

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 429,543$ 540,257 520,463 -3.7%

Benefits 192,330 251,968 259,955 3.2%

Supplies 12,079 25,453 38,033 49.4%

Maintenance 3,934 - -

Professional Services/Training 17,493 27,287 35,560 30.3%

Other Charges 18,548 16,746 24,259 44.9%

Scheduled Charges 139,889 141,549 148,310 4.8%

Capital Outlay/Reimbursements - - -

Total Human Resources 813,816$ 1,003,260 1,026,580 2.3%

* Total FY 2022-23 does not include proposed compensation adjustment

Internal Audit

Budget Variance Explanation

Increase in comp and benefits due to

addition of a part-time intern position and

healthcare costs

63

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 138,962$ 256,361 273,087 6.5%

Benefits 62,479 96,583 100,867 4.4%

Supplies 1,356 3,068 3,957 29.0%

Maintenance - - -

Professional Services/Training 30,286 17,045 16,195 -5.0%

Other Charges 98 600 600 0.0%

Scheduled Charges 21,184 22,046 21,802 -1.1%

Capital Outlay/Reimbursements - - -

Total Internal Audit 254,365$ 395,703 416,508 5.3%

* Total FY 2022-23 does not include proposed compensation adjustment

Non-Departmental

Budget Variance Explanation

Professional services increase due primarily

to an increase in appraisal and collection

fees for LCAD

64

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 3,216$ - -

Benefits 1,710 500 500 0.0%

Supplies - - -

Maintenance - - -

Professional Services/Training 3,394,849 1,645,493 1,764,810 7.3%

Other Charges 1 167,500 167,500 0.0%

Scheduled Charges 892 1,371 1,629 18.8%

Capital Outlay/Reimbursements 1,353,383 - -

Total Non-Departmental 4,754,051$ 1,814,864 1,934,439 6.6%

* Total FY 2022-23 does not include proposed compensation adjustment

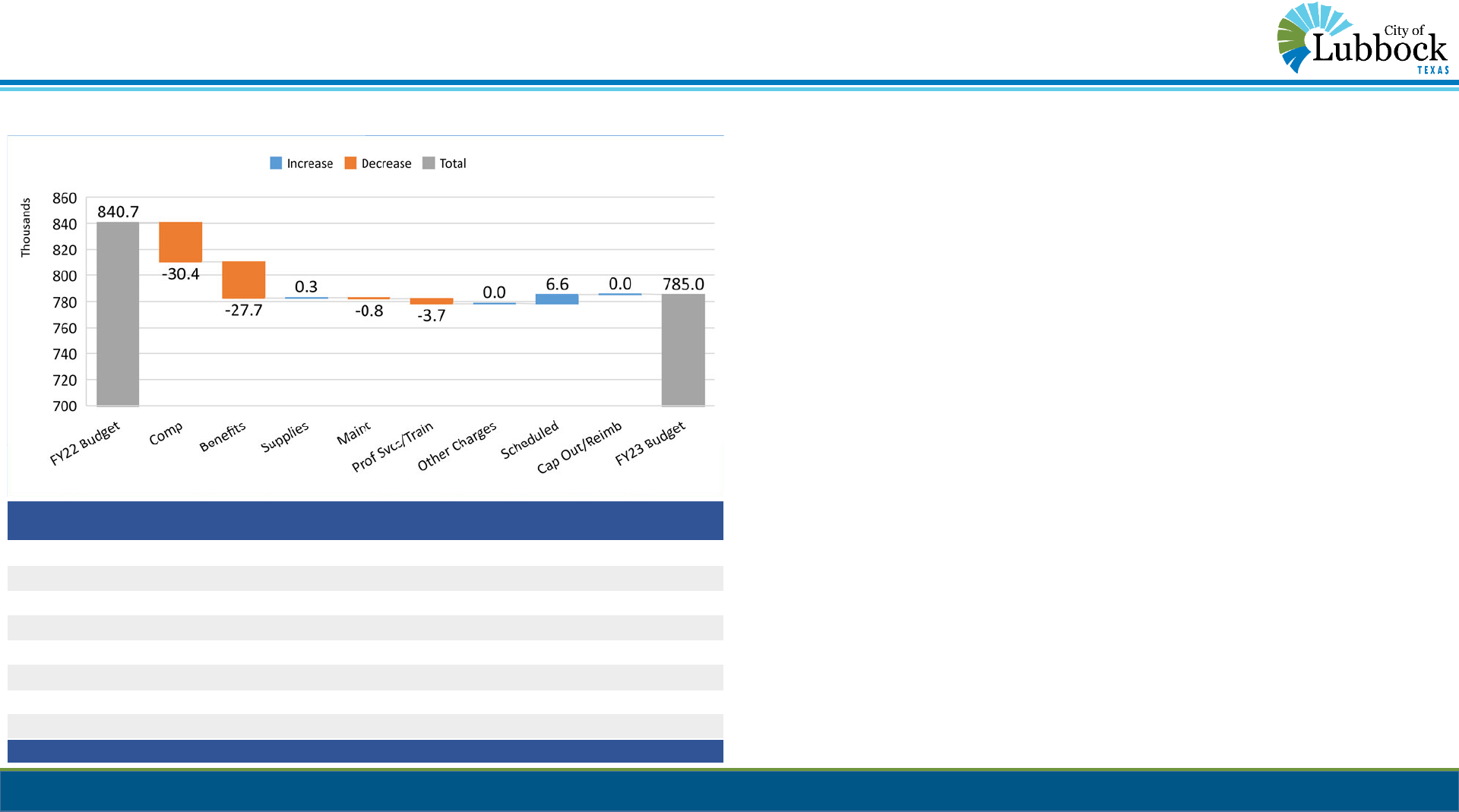

Communications & Marketing / 311 Call Center

Budget Variance Explanation

Decrease in comp and benefits due to

elimination of one 311 call taker position

and one Customer Service Supervisor, offset

partially by addition of temp and part-time

services

Increase in scheduled charges primarily ties

to increased IT service costs

65

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 435,886$ 452,910 422,525 -6.7%

Benefits 217,577 232,083 204,414 -11.9%

Supplies 3,286 6,736 7,034 4.4%

Maintenance 3,874 5,972 5,182 -13.2%

Professional Services/Training 11,054 38,700 35,000 -9.6%

Other Charges 1,348 - -

Scheduled Charges 87,007 104,264 110,843 6.3%

Capital Outlay/Reimbursements - - -

Total Comm & Marketing / 311 760,032$ 840,665 784,998 -6.6%

* Total FY 2022-23 does not include proposed compensation adjustment

Cultural & Recreational Services Departments

Libraries

Museums

Parks & Recreation

66

Cultural & Recreational Services

FY 2023 Operating and Capital Budget

Libraries

Budget Variance Explanation

Compensation decreasing due to

reorganizing one employee position to IT

Other charges increase related to Godeke

Library scheduled rent increase

Scheduled charges increase is for IT services,

liability insurance, and electric and natural

gas charges

67

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 1,668,458$ 1,742,125 1,690,429 -3.0%

Benefits 743,717 809,554 818,400 1.1%

Supplies 42,222 50,230 51,603 2.7%

Maintenance 110,082 164,625 166,700 1.3%

Professional Services/Training 38,380 70,519 70,569 0.1%

Other Charges 195,522 182,123 191,312 5.0%

Scheduled Charges 576,157 629,006 723,255 15.0%

Capital Outlay/Reimbursements 331,587 333,176 333,175 0.0%

Total Libraries 3,706,124$ 3,981,358 4,045,443 1.6%

* Total FY 2022-23 does not include proposed compensation adjustment

Museums

Budget Variance Explanation

Comp and benefits increase for part time

hours at Garden & Arts as well as health

premiums

Scheduled charges increase is a result of

increased IT services, property and liability

insurance, electric, and natural gas costs

68

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 502,140$ 623,218 627,711 0.7%

Benefits 193,807 228,391 238,296 4.3%

Supplies 25,313 36,374 40,537 11.4%

Maintenance 1,487 1,661 1,965 18.3%

Professional Services/Training 85,539 119,017 119,817 0.7%

Other Charges 13,513 24,650 25,010 1.5%

Scheduled Charges 218,715 250,625 291,576 16.3%

Capital Outlay/Reimbursements - - -

Total Museums 1,040,513$ 1,283,936 1,344,912 4.7%

* Total FY 2022-23 does not include proposed compensation adjustment

Parks & Recreation

Budget Variance Explanation

Compensation decrease is a result of reducing

part time hours and reclassifying one position

from pay grade 124 to a 122

Benefits increase is for health premiums

Supplies decrease is a reduction in pesticide and

botanical supplies

Maintenance increase is due to fleet

maintenance costs and increased costs for parks

street lighting, fences, and walkways

Professional services increase is for higher costs

for mowing contracts and litter disposal/removal

Scheduled charges increase relates to IT services,

property and liability insurance and utility costs

Decrease in capital outlay due to roll-off of tax

note debt

69

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 3,424,664$ 4,236,031 4,012,099 -5.3%

Benefits 1,627,431 1,884,279 1,974,064 4.8%

Supplies 806,127 1,078,735 1,006,632 -6.7%

Maintenance 1,018,830 1,061,012 1,234,417 16.3%

Professional Services/Training 1,567,741 2,309,661 2,800,853 21.3%

Other Charges 75,163 75,547 74,947 -0.8%

Scheduled Charges 1,137,847 1,210,404 1,424,771 17.7%

Capital Outlay/Reimbursements 504,997 361,657 199,828 -44.7%

Total Parks & Recreation 10,162,801$ 12,217,326 12,727,611 4.2%

* Total FY 2022-23 does not include proposed compensation adjustment

Development Services Departments

Building Safety

Codes Enforcement

Environmental Health

Planning

70

Development Services

FY 2023 Operating and Capital Budget

Building Safety

Budget Variance Explanation

Increase to comp and benefits relates to

additional certification/education pay and

health care costs

Supplies and maintenance increases are for

higher fuel prices and increased fleet

maintenance charges

Professional services expenses are due to

increased credit card fees

Scheduled charges increase is for IT and

liability insurance

71

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 1,398,360$ 1,524,412 1,542,827 1.2%

Benefits 652,764 724,020 780,259 7.8%

Supplies 40,017 61,802 67,241 8.8%

Maintenance 41,248 41,339 46,515 12.5%

Professional Services/Training 86,509 85,868 112,026 30.5%

Other Charges 1,767 8,801 3,470 -60.6%

Scheduled Charges 234,387 230,122 250,630 8.9%

Capital Outlay/Reimbursements 6,494 6,435 - -100.0%

Total Building Safety 2,461,545$ 2,682,799 2,802,968 4.5%

* Total FY 2022-23 does not include proposed compensation adjustment

Codes Enforcement

Budget Variance Explanation

Compensation decreased due to a move of

an employee to Environmental Health offset

by individual adjustments

Supplies and schedule charges increases

relate to inflationary costs for fuel and

liability insurance

Decrease in maintenance is due to less usage

of fleet maintenance

Professional services decrease is for

reduction in advertisements

Other charges decreased due to one-time

expenses from the prior year

72

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 880,717$ 1,036,935 1,034,688 -0.2%

Benefits 479,603 575,385 580,770 0.9%

Supplies 45,481 69,227 81,083 17.1%

Maintenance 116,651 124,641 114,365 -8.2%

Professional Services/Training 82,381 138,988 115,538 -16.9%

Other Charges 602,469 682,163 675,000 -1.1%

Scheduled Charges 316,879 315,179 340,628 8.1%

Capital Outlay/Reimbursements 3,483 3,502 - -100.0%

Total Codes Enforcement 2,527,665$ 2,946,020 2,942,072 -0.1%

* Total FY 2022-23 does not include proposed compensation adjustment

Environmental Health

Budget Variance Explanation

Increase in comp and benefits is due to the

move of an FTE from Codes

73

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 445,625$ 570,780 643,438 12.7%

Benefits 222,683 276,858 334,075 20.7%

Supplies 21,169 42,057 44,940 6.9%

Maintenance 18,776 22,787 24,306 6.7%

Professional Services/Training 17,760 28,745 32,115 11.7%

Other Charges 4,411 7,410 4,521 -39.0%

Scheduled Charges 105,399 108,535 108,110 -0.4%

Capital Outlay/Reimbursements 6,330 6,354 6,353 0.0%

Total Environmental Health 842,154$ 1,063,526 1,197,858 12.6%

* Total FY 2022-23 does not include proposed compensation adjustment

Planning

Budget Variance Explanation

Benefits increase is due to health premiums

Professional services increase to recover

costs for public hearing notices and

annexation notices

Scheduled charges increases for liability

insurance coverage

74

FY 2023 Operating and Capital Budget

Actual Budget Budget % Change

FY 2020-21 FY 2021-22 FY 2022-23 from Budget

Compensation 511,209$ 590,161 591,876 0.3%

Benefits 254,995 269,879 284,195 5.3%

Supplies 15,078 8,760 7,957 -9.2%

Maintenance - - -

Professional Services/Training 49,518 58,150 78,650 35.3%

Other Charges 3,343 16,304 14,373 -11.8%

Scheduled Charges 77,091 83,877 93,855 11.9%

Capital Outlay/Reimbursements - - -

Total Planning 911,234$ 1,027,131 1,070,906 4.3%

* Total FY 2022-23 does not include proposed compensation adjustment

Public Works Departments

Engineering

Solid Waste

Streets

Traffic

75

Public Works

FY 2023 Operating and Capital Budget

Engineering

Budget Variance Explanation

Addition of one Development Construction

Coordinator is the primary driver for

increases to comp and benefits

Supplies increase is due to increased costs

for PPE, small tools, and fuel

Maintenance increase is to cover costs for

additional vehicle and communication

equipment