Annual Report & Accounts 2020

Insurance

that is personal,

inclusive and

a force for good

Direct Line Insurance Group plc Annual Report & Accounts 2020

Contents2020 highlights

Profit before

tax

£451.4m

(2019: £509.7m)

Return on

tangibleequity

1

19.9%

(2019: 20.8%)

Combined

operatingratio

1,2

91.0%

(2019: 92.2%)

Solvency

capitalratio

1,3

191%

(2019: 189% adjusted

4

)

Operating

profit

1

£522.1m

(2019: £546.9m)

Dividends and

capital returns

5

£595.2m

(Includes £195.5m special dividend

to replace the cancelled 2019

final dividend)

(2019: £128.6m adjusted

4

)

Customers

450k+

Customers benefited

from support measures

People

£3.8m

Invested in free shares

for our people

Society

£7m+

Donated to charities

and good causes

Planet

100%

Carbon neutral

via offsetting

Strategic report

Introduction 1

2020 highlights timeline 2

Investment case 4

Business model 6

Chair’s statement 8

Section 172(1) statement 10

Chief Executive Officer’s review 11

Market overview 16

Our key performance indicators 18

Finance review 20

Operating review 36

Sustainability 44

Streamlined Energy and Carbon

Reporting 68

Non-financial information

statement 68

Risk management 69

Governance

Chair’s introduction 76

Board of Directors 78

Executive Committee 81

Corporate governance report 83

Committee reports 97

Directors’ Remuneration Report 113

Directors’ report 140

Financial Statements

Contents 145

Independent Auditor’s report 146

Consolidated Financial Statements 157

Notes to the Consolidated

Financial Statements 162

Parent Company Financial

Statements 215

Notes to the Parent Company

Financial Statements 217

Other information

Additional information 222

Glossary and Appendices 224

Forward-looking Statements

Disclaimer 231

Contact information 232

Notes:

1. See glossary on pages 224 to 226 for definitions and Appendix A –Alternative

performance measures on pages 227 to 230 for reconciliation to financial

statement line items.

2. A reduction in the ratio represents an improvement as a proportion of net

earned premium, while an increase in the ratio represents a deterioration.

Seeglossary on page 224 for definitions.

3. Estimates based on the Group’s Solvency II partial internal model.

4. The 2019 comparatives for dividends and capital returns and the solvency capital

ratio have been adjusted to remove the cancelled 2019 final dividend and £120

million of share buyback. (The reported numbers were solvency capital ratio of

165% and capital returns of £447.0 million). See page 18 for further details.

5. See page 28 for the dividend policy.

For more information please visit

www.directlinegroup.co.uk

Introduction

Our vision is to create a world where

insurance is personal, inclusive and a force

for good.

To deliver this we need to build an insurance

company of the future with technology and

data at its core, adapting to an ever-changing

world, delivering more for customers at speed.

As we navigated the challenges that 2020

presented, we focused on supporting our

customers, the wellbeing of our people,

contributing to society and stepping up

our plans to tackle climate change.

We believe embracing sustainable practices

creates a better corporate culture, more

reliable products and brings long-term

rewards for our shareholders.

Strategic Report

www.directlinegroup.co.uk 1

£2m

distributed in

twoweeks

900+

travel insurance

customers

repatriated

Introduction

2020

January

Claims teams take

over 6,500 calls from

customers helping to

support them following

Storm Ciara

Sign Social

MobilityPledge

New ad campaign

launches for

Direct Line

March May

Green Flag refreshes

"Green Flag Rescue Me"

app allowing more claims

to be serviced digitally

Our Travel team continues

to settle claims for over

26,000 customers and

repatriate over 900

customers stranded

abroad

Our Finance team delivers

a new cloud-based Oracle

accounting ledger and

claims payment system

2020 Highlights

Privilege offers full end-to-

end motor insurance service

onnew platform, for both

new business andrenewal

customers

Direct Line for Business

rolls out new Van and

Tradesperson products

onits digital platform

Covid-19: The Group

moves the majority

ofitsoperations to

homeworking,

guaranteeing usual pay

regardless of whether

individual working

practices are affected

£3.5 million Community

Fund launches,

distributing £2 million

intwo weeks to charities

supporting the most vulnerable

2

Strategic Report

August October

Group announces intention

to set Science-Based

Targets to strengthen

ourdisclosures on

tacklingemissions

Strong Churchill

newbusiness growth,

increased share of new

business on PCWs across

Motor and Home

Group announces new

diversity and inclusion

targets for improving

Black, Asian and Minority

Ethnic representation in

senior leadership roles

New “Mileage

MoneyBack”

proposition offers

Direct Line Motor

customers

aflexible

approach

tomanage

their car

insurance

We’re reimagining how we work,

to be more agile. Empowering

you to transform what we do.

December

Group becomes a 100%

carbon-neutral business

by investing in high social

impact projects to offset our

Scope 1, 2 and 3

1

emissions

Launch a new counter

fraud operating system

Notes:

1. Scope 3 emissions which are under our direct control

– see page 61.

2. Payment deferrals, mileage refunds for motor customers,

waiving cancellation fees andreducing cover.

450k+

customers benefit from

support measures

2

Task Force on Climate-

related Financial

Disclosures: Issue

ourfirst comprehensive

disclosure on how

theGroup approaches

climate change risks and

opportunities

Find out more about our

plans for 2021 in the Chief

Executive Officer’s Review

on pages 11 to 17

Darwin live on four price

comparison websites

(“PCWs”)

Migrates to a new

mainframe platform

as part of the

Group’s technology

transformation

Group successfully

transitions a number

ofbusiness areas to

agileways of working

3

Investment case

Transforming to drive competitiveness

Diversified business

model

As a UK-focused company, we have the ability

to be a deep specialist in our chosen markets

and our range of channels and products gives

us real diversification and scale.

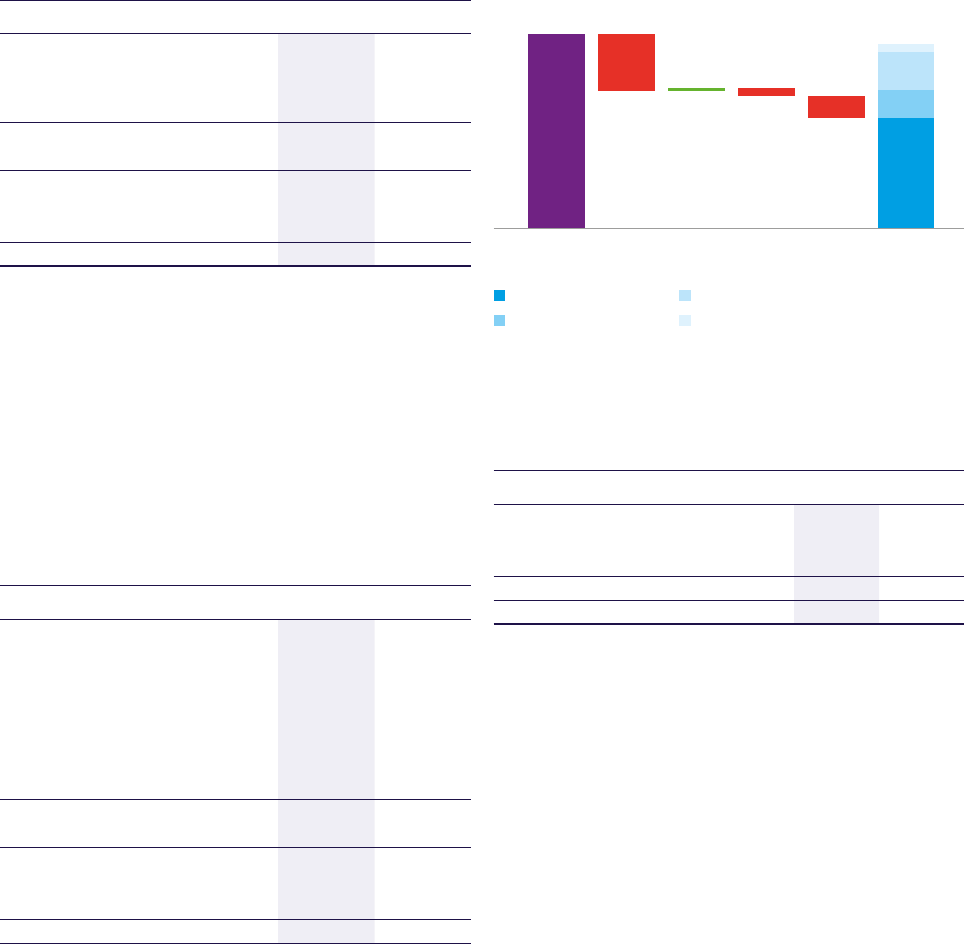

Gross written premiums (£m)

Operating profit (£m)

Delivering strong

shareholder returns

We have a track record of delivering strong

returns to shareholders, having distributed

£1.2 billion in dividends over the past three

years. This, together with our share price

performance, has delivered an attractive

totalshareholder return.

£1.2bn

Dividends paid to shareholders

in the last three years

2020: £3,180.4m

2020: £522.1m

567.8

417.8

577.9

1,616.9

528.9

436.0

586.6

1,651.6

50.4

6.8

101.4

363.5

54.6

39.1

150.6

302.6

Motor

Home

Rescue and other personal lines

Commercial

110

90

100

31 Dec

2018

31 Dec

2019

31 Dec

2020

1 Jan

2018

DLG

FTSE 350 (excluding investment trusts)

Total shareholder return (%)

This represents the cumulative dividends paid and

change in share price over a three-year period

2019: £3,203.1m

2019: £546.9m

4 Direct Line Group Annual Report and Accounts 2020

Strategic Report

Transforming to drive

competitiveness

We are transforming our technology and

changing the way we work to increase the

competitiveness of our business, with the

aimofimproving the quality of our earnings,

with agreater proportion coming from

current-yearbusiness.

Best at direct

To be the UK’s leading insurer, because we anticipate our

customers’ needs and develop services and products

they want to buy.

Win on price comparison websites (PCWs)

To deliver a step change in our pricing and trading

capability so that our leading PCW brands win

customers from our competitors.

Extend our reach

To utilise the potential of our investments and

capabilities to win more customers through acquisitions

and brand partnerships.

Technical edge

To use our data, scale, skill and insight across claims,

pricing and underwriting to deliver value to customers.

Nimble and cost efficient

To transform into an agile, cost effective business to drive

efficiency and simplicity for us and our customers.

Great people

A home for empowered people who celebrate difference,

and challenge the status quo to deliver for our customers.

See page 12 for more information

Improving the sustainability

of our earnings

In 2020 we made good progress against our

targets to improve the sustainability of our

earnings, growing current-year contribution

tooperating profit and delivering a strong

combined operating ratio. Our focus on

supporting our customers, our people and

wider society led to an increase in costs in 2020.

Costs

Target: Expense ratio

1,2

of20% in 2023

2020:

24.5%

Normalised current-year operating profit

1,3

Target: At least 50% contribution to total operating profit

by2021

2020:

65.4%

Following an elevated contribution in 2020 due to lower

claims frequency associated with Covid-19 disruption

Normalised combined operating ratio (“COR”)

1,4

Target: Between 93-95% throughout the medium term

2020:

91.7%

Return on tangible equity (“RoTE”)

1

Target: At least 15% per annum over the long term

2020:

19.9%

Notes:

1. See glossary on pages 224 to 226 for definitions and Appendix A – Alternative performance measures on pages 227 to 230 for

reconciliation to financial statement line items.

2. Applies to operating expenses excluding restructuring andone-off costs.

3. Normalised for weather and changes to the Ogden discountrate. Reported contribution 66.7%.

4. Normalised for weather and changes to the Ogden discountrate. Reported COR 91.0%.

www.directlinegroup.co.uk 5

Business model

Notes:

1. Includes Direct Line, Churchill, Privilege, Darwin and partner brands: RBS, NatWest. © Ipsos MORI 2021, Financial ResearchSurvey

(FRS), sixmonths ended January 2021. c. 14,000 adults (aged 16+) surveyed across Great Britain. Interviews were conducted online and

by telephone, and weighted to reflect the overall profile of the adult population.

2. Mintel Vehicle Recovery – September 2020.

3. Mintel Pet Insurance – August 2020 & Mintel Travel Insurance – February 2021.

Protecting our

customers

We know how to build brand value and

have some of the most loved brands

inthe UK which are available direct,

through PCWs, or via specialist brokers.

We also partner with some of the UK’s

leading banks.

Giving customers a choice

of brands and channels

We help people carry on with their

lives, giving them peace of mind now

and in the future.

Across the business we have a number

of real strengths and our customers

and our people are at the heart of

our business.

Motor

Home

Rescue and

other personal

lines

Commercial

We are one of the leading

providers of rescue, travel

and pet insurance in the UK.

Green Flag is the third largest

roadside recovery provider

2

.

We are also the second

largest travel and the

fourth largest pet insurer

3

We protect commercial

businesses through our brands,

including NIG and Direct Line

for Business

We are Britain’s leading

personal motor insurer

measured by in-force policies

1

,

mainly represented through

our well-known brands Direct

Line, Churchill, Privilege, our

Darwin brand, and also

through our partners

We are one of Britain’s leading

personal home insurers

measured by in-force policies

1

.

We reach our customers by

selling home insurance

products through our brands

Direct Line, Churchill and

Privilege, and our partner

NatWest Group

DLG

PARTNERSHIPS

6 Direct Line Group Annual Report and Accounts 2020

Strategic Report

Our customers

We earn our customers’ trust by

demonstrating how we are acting

intheir best interests.

Premiums

Our diversified model enables us

tooffer a range of products across

arange of distribution channels.

Investment return

Our diversified investment portfolio

provides additional income whilst

alsoensuring we can support our

long-term claim commitments.

Seepage 33.

Accident repair centres

We own 21 accident repair centres,

the largest owned network of any

insurer, delivering lower repair costs

and providing data-led insight

enabling us to react to emerging

trends and helping inform pricing.

Claims management

We have deep specialism in claims

handling, including market-leading

counter-fraud capability.

Costs

We invest in market-leading brands

and strong customer service, whilst

targeting cost reduction measures in

order to increase our competitiveness.

Tax

We manage our tax obligations

responsibly contributing either

directly or indirectly £888 million

intax to the Exchequer this year.

Seemore on page 35.

We have a number of

strengths, from strong

brands to rich data, to

leading claims skills, that are

hard to replicate and provide

real long-term value.

This is how we

create value

A triple win

We aim to deliver a

sustainable and thriving

business that generates

attractive shareholder

returns.

Our people

We encourage a culture that celebrates

difference and empowers people

sothat they can thrive.

Shareholders

We have a track record of delivering

strong returns to shareholders.

This, together with our share price

performance, has delivered an

attractive total shareholder return.

Society

We use our expertise to improve

outcomesfor society and the

communities weserve.

The planet

We protect our business from the

impact ofclimate change and give

back more to the planet than we

take out.

450k+

Customers benefited

from support measures

£7m+

Donated to charities

and good causes

100%

Carbon neutral

via offsetting

£3.8m

Invested in free

shares for our people

£1.2bn

Paid in dividends

over the last three

years

A win for customers

by sharing real value with them.

A win for our people and shareholders

who are invested in our success.

A win for society and the planet

because our long-term success is intrinsically linked to the

success of the community and environment around us.

www.directlinegroup.co.uk 7

Chair’s statement

I would like to start my first statement as Chair by

recognising the efforts of all my Direct Line Group

(the “Group”) colleagues in navigating the turbulent

conditions that we experienced in 2020.

The resilience and adaptability demonstrated by our

people has been commendable. The Covid-19 pandemic

has affected all our stakeholders and I am proud of

thesenior leadership team for responding swiftly and

effectively and for addressing the rapidly changing needs

of the Group’s stakeholders, including our customers,

ourworkforce and the communities we serve.

In the extraordinary market conditions caused by

lockdowns and market uncertainty related to Brexit

andother global economic factors, our disciplined

underwriting model produced a combined operating ratio

of 91.0% (2019: 92.2%). Profit before tax was down 11.4% to

£451.4 million (2019: £509.7 million) but our strong capital

position has enabled us to increase our final dividend to

14.7 pence and commence a share buyback of up to

£100 million. This is on top of the £30 million share buyback

we made in March 2020 before we prudently cancelled the

programme against a background of market volatility.

New leadership and Board changes

I am delighted to have been chosen by my fellow

Directors to succeed Mike Biggs as Chair following his

retirement from office in August 2020. It was a pleasure

tohave served with him as an independent Non-Executive

Director and, on behalf of the Board, I extend our thanks

to Mike for his exemplary stewardship of the Board as

Chair since before the Company separated from the

RoyalBank of Scotland and listed on the London Stock

Exchange in 2012. Mike formed the Board, led it through

the IPO and was instrumental in defining the Group’s

enviable culture and ambition. We are indebted to him

forhis wisdom, for the contribution of his deep experience,

honed over four decades in the financial services sector,

and for his legacy of inclusivity and solidarity in the Board’s

culture. The selection process which led to my appointment

as Chair is summarised in the Governance report on

page91.

Working for all

our stakeholders

In 2020, our resilience and agility enabled us to support

ourcustomers and communities, distribute surplus capital

andprogress building the capability designed to deliver

oursustainable strategy.

Danuta Gray

Chair of the Board

“The resilience and adaptability demonstrated

by our people has been commendable.”

We announced in December that Jane Hanson, who was

appointed as an independent Non-Executive Director in

December 2011, will be stepping down from the Board at

the conclusion of the Annual General Meeting in May 2021.

On behalf of the Board, I would like to thank Jane for her

energetic leadership of the Board Risk Committee and for

her hard work as a member of the Audit, Investment and

Sustainability Committees.

Adrian Joseph OBE joined the Board as an independent

Non-Executive Director on 1 January 2021. As the business

is transformed into a technology- and data-led company,

with the customer at its heart, Adrian’s deep experience of

digital, artificial intelligence and data will be an important

addition to the Board’s capabilities.

We are committed to our diversity and inclusion agenda,

including our target of increasing female representation

in our senior leadership team. Details about the progress

we are making on Board diversity appear in our

Nomination and Governance Committee report on pages

106 to 108 and further information about changes to the

Board and its Committees is set out on page 91.

8 Direct Line Group Annual Report and Accounts 2020

Strategic Report

Strategy

Our vision is to create a world where insurance is personal,

inclusive and a force for good. Our purpose is to help

people carry on with their lives, giving them peace of mind

now and in the future. We have worked exceptionally hard

to deliver against that purpose throughout the

challenging events of 2020.

Our strategic objectives aim to ensure that we build

technological and organisational capability to continue

providing products which meet our customers’ changing

needs and are available through multiple channels, to

continue providing outstanding customer service and

value for money, to create value for our investors, to

support our communities and to protect the environment.

Dividend and capital management

The Group’s solvency capital ratio as at 31 December 2020,

prior to any proposed dividends or incremental capital

returns, was 213%.The Board has recommended a final

dividend of 14.7 pence per share, an increase of 2.1% on

thespecial interim dividend of 14.4 pence announced

withour interim results, which reflected a full catch up

ofthe cancelled 2019 final dividend.

Reflecting the strength of the Group’s capital position,

andin line with our dividend policy to return capital

toshareholders which is expected to be surplus to the

Group’s requirements for a prolonged period, the Group

intends to commence a share buyback programme.

TheBoard has approved a share buyback programme

ofup to £100 million, with an initial tranche of up to

£50million expected to be completed by the time of

thehalf-yearresults.

After the proposed final dividend and £100 million share

buyback, the estimated solvency capital ratio was 191%

asat 31 December 2020. The Group has outstanding Tier 2

debt issued in 2012 with nominal value of £250 million and

a first call date during the first half of 2022. Excluding this

debt, the Group’s solvency ratio after the proposed final

dividend and share buyback would be 172%. In February

2021, the Group acquired the head lease of its Bromley

office site, which reduced the Group’s coverage ratio by

anadditional 6 percentage points.

Assuming a return to more normal circumstances, the

Group intends to move towards the middle of its risk

appetite range of 140% to 180% of its solvency capital

requirement, consistent with its previously stated target.

Our customers

Customer experience is at the heart of everything we do,

and it is the central element that connects all our people

regardless of role. We recognise that the Covid-19 pandemic

has had a huge, in some cases devastating, effect on many

of our customers and we have sought to respond with

sensitivity to customers whose travel plans have been

disrupted, who find themselves under financial strain, or

who have experienced bereavement. The Board oversees

the Group’s conduct, aiming to ensure that the Group acts

in our customers’ best interests and that there is an active

and constructive dialogue with its insurance regulators on

customer conduct matters.

Linking remuneration to performance

We remain focused on ensuring that executive pay is

aligned with the Group’s strategy of targeting sustainable

shareholder and customer value, that it reflects investor

experience and, particularly in respect of 2020, that it

reflects the way in which the business has interacted

withits customers, its people and its communities.

A significant proportion of executive remuneration is

delivered through shares and shareholding requirements

and our incentive schemes’ performance measures are

aligned with the long-term performance measures

considered important by investors.

Working for all

our stakeholders

The Group’s share price on 31 December 2020 was

319.0 pence (2019: 312.5 pence). Total shareholder return

(“TSR”), which includes dividend payments, increased by

9.0 percentage points for the year (2019: 7.0 percentage

point increase). During 2020, the Group’s share price grew

by 2.1% (2019: 1.9% decrease), reflecting increased investor

confidence following the Capital Markets Day at the end

of2019 and the delivery of strong financial results in

March2020. This was partially offset by concerns over

margin contraction in Motor and Home following the

publication of the FCA’s Pricing Practices Report (“PPR”)

which put pressure on UK Personal Lines stocks.

In April 2020, the Group took the difficult decision to

cancel the 2019 final dividend of 14.4 pence and the

£150million share buyback programme, in recognition

ofheightened uncertainty in the macroeconomic

environment due to Covid-19, although its solvency

position was strong. At the time of the interim results in

August 2020, the Group’s financial resilience in the face of

Covid-19 enabled it to declare a regular interim dividend

and catch-up on the cancelled 2019 final dividend. We are

grateful to our shareholders for their understanding

during this challenging period.

Over the past three years, the Group has delivered a TSR

of7.9% compared to the FTSE 350 (excluding investment

trusts) reduction of 5.0%, having returned £1.2 billion to

shareholders during the period.

More information on the Group’s remuneration policy and

share awards is disclosed in the Directors’ remuneration

report on pages 113 to 139.

“We have responded with sensitivity to the

huge disruption that Covid-19 has caused to

many of our customers.”

www.directlinegroup.co.uk 9

Chair’s statement continued

Sustainability and culture

In December 2020, we published our first Task Force on

Climate-related Financial Disclosures Report and our

firstSustainability Report. These set out the progress

theGroup has made against its Environment, Social

andGovernance agenda, including the Group’s intention

to setScience Based Targets which will strengthen our

disclosures across Scope 1, Scope 2 and Scope 3 emissions,

as well as the actions we took in response to the Covid-19

pandemic to support our people, customers and

communities. For definitions of terms used, please see

theglossary on pages 224 to 226.

Climate-related risks and opportunities have grown in

importance for us as a business. As an insurance company,

understanding and managing risk is of fundamental

importance, and we recognise that climate change poses

material long-term risks to the business.

We are embracing the sustainable practices that we

believe underpin a better corporate culture, offering

products that meet our customers’ needs and providing

greater long-term sustainability for investors.

The Board believes that working for all our stakeholders

isthe foundation needed for delivering long-term

sustainability. The Board recognises the importance of

setting the tone of the Group’s culture and embedding it

throughout the organisation. More information about this

can be found in the Governance introduction on page 76.

In November 2019, we set out our vision for building a

world where insurance is personal, inclusive and a force

forgood. At that time, we could not have anticipated

theextraordinary events of 2020 and now more than ever,

itisessential that we live up to that ambition and play

ourpartin supporting the communities we serve. The DLG

Community Fund of £3.5 million is being used to support

the communities where our largest sites are based as well

as several national charities.

Our People

We pride ourselves in having an empowering culture that

celebrates difference and authenticity, and encourages

each colleague to bring their whole self to work. The

Group’s success and resilience is due in no small part to

the contribution of its people. In a year which could have

produced very different outcomes, the Board and I are

grateful for the hard work, initiative and commitment of

our people, who have continued to live the Group’s values

and to demonstrate dedication to serving our customers.

I would also like to thank each member of the Board for

their significant contribution, commitment and service

and I look forward to my first full year as Chair of the Board

working with them in supporting and encouraging our

management team in the execution of the Group’s

ambitious strategy.

DANUTA GRAY

Chair of the Board

Section 172(1) statement

Direct Line Group is a leading motor, home and

commercial insurer which depends on its reputation

forhigh standards of business conduct and on the trust

and confidence of its stakeholders to operate sustainably

in the long term. The Group seeks to put its customers’

best interests first, continually invests in and engages

with its employees, supports the communities in which

it operates and strives to generate value for shareholders.

The Directors of Direct Line Insurance Group plc

(the “Company”) have been subject to the duties

codified in law, which include the duty to act in the

wayin which they consider, in good faith, would be

most likely to promote the success of the Group for

thebenefit of its members as a whole, having regard

tothe stakeholders and matters set out in Section 172(1)

ofthe Companies Act 2006 (“Section 172(1)”).

The Board recognises that the Group has a range of

stakeholders with diverse interests and an analysis of its

principal stakeholders can be found on pages 48 to 61

and on page 86.

Section 172(1) considerations are embedded in decision-

making at Board-level and are demonstrated

throughout its governance framework.

The underlying principles of promoting the success of

the Company for the benefit of its members as a whole,

and of considering stakeholders when making decisions

that could affect them, is understood by the senior

leadership team and consideration and respect for

stakeholders is demonstrated throughout the Group.

The Group has adapted to a change of working

practices throughout the year and keeps engagement

mechanisms under review so that they remain effective

and so that the Board understands the evolving needs

of its stakeholders.

In taking decisions, the Directors carefully consider

thebalance of interests of the stakeholders who might

be affected. The Board and its Committees discuss

stakeholders and their interests during the cycle of

Board meetings, and in 2020 we increased both the

frequency and length of meetings, not least to focus on

stakeholder needs as a result of the Covid-19 pandemic.

We are committed to ensuring that the Group takes

action both to protect the business and to reduce its

direct and indirect impact on the environment.

In March 2020, the Board considered it prudent to

cancel its share buyback programme and, in April 2020,

to cancel the 2019 final dividend as a result of

thevolatile conditions arising from the Covid-19

pandemic, although an interim and a special interim

dividend were paid later in the year when conditions

stabilised and on the basis of a strong capital position.

See pages 86 to 87 for more detailed examples of how

the Board considered Section 172(1) when making

decisions that affected its stakeholders.

10 Direct Line Group Annual Report and Accounts 2020

Strategic Report

Chief Executive Officer’s review

Navigating an

extraordinary year

I am proud of what the Group has achieved during 2020.

Once again, we have demonstrated financial resilience by

delivering another good set of results, whilst supporting

our customers, our people and local communities through

the challenges of the pandemic. Despite the disruption

and uncertainty that 2020 has brought, we have made

real progress towards becoming a technology-driven

business which can adapt quickly to the changing world

around us and deliver more for our customers at speed.

We could not have done this without our highly engaged

people, who have demonstrated the commitment and

flexibility needed to do what it takes for our customers

and to drive forward our business plans regardless of their

personal circumstances. I am grateful to them for their

dedication, skill and support.

Business performance and the impact

of Covid-19

In 2020, we delivered another year of strong profitability

atthe same time as growing our direct own brand policy

count. The investments we have made in systems and

capability over the last few years are showing through

inthis growth and are contributing to underlying

improvements in current-year underwriting profitability.

Overall Covid-19 led to a modest net benefit to the result.

Despite the impact of the pandemic, we made further

progress in delivering the change required to implement

the Group’s transformation plans.

Despite the many challenges we faced in the year as a result of

the Covid-19 pandemic, we traded well and prioritised support

forour customers, our people and local communities. I am proud

that our people, even when working remotely, have continued

both to care for our customers and to help us build an insurance

company of the future.

Penny James

Chief Executive Officer

We traded well through the year, delivering growth in

ourHome, Commercial and Green Flag Rescue businesses

despite prolonged periods of lockdown when new

business shopping dropped significantly. Retention has

held up well. In contrast average premiums have fallen as

risk mix has reduced, with fewer new drivers on the road

as no driving tests have been conducted for parts of the

year and fewer new cars have been purchased. In the

midst of these trends we are happy to see direct own

brand policy growth of 2.2% and gross written premium

broadly flat.

At a headline level we delivered operating profit of

£522.1million, a combined operating ratio of 91.0% and

areturn on tangible equity of 19.9%, well ahead of our

target of atleast 15% over the long term. Operating profit

of £522.1 million was £24.8 million lower than 2019

(£546.9 million) due to higher major weather costs

of£43.0 million (2019: £6.0 million) and reduced

prior-year reserve releases, partially offset by improved

current-yearprofitability.

“In 2020, we delivered another year of strong

profitability at the same time as growing our

direct own brand policy count.”

www.directlinegroup.co.uk 11

Do the right

thing

Aim higher Take

ownership

Say it like

it is

Work

together

Bring all

of yourself

to work

We help people carry on with

their lives, giving them peace

of mind now and in the future

We want to create a world

where insurance is personal,

inclusive and a force for good

Our vision and purpose

Our values

Customers

Sustainability pillars

People Society Planet Governance

– Superhero branding campaign

launched

– New Motor “Mileage MoneyBack”

proposition

– Launched Van and Tradesperson

products onnew Direct Line for

Business platform

– Green Flag awarded “Superbrand”

status

– Privilege Motor new business

andrenewals now live on the

newplatform

– Increased PCW focus including

Churchill Home

– Darwin brand launched on two

more PCWs

– Churchill Motor started roll-out to

new platform in Q1 2021

– Agreed a two-year extension with

NatWest Group for Home

– Enhanced API capabilities to enable

potential Home partners to link

andtest

– Increased our presence in the

on-demand mobility market

– Launched new market-leading

Motor counter-fraud system

– Expanded electric vehicle

repaircapabilities

– Launched a free on-line risk

management portal for every NIG

policyholder

– Green Flag launched a new

cloud-based claims system

– New agile operating model

embedded across digital, data

andpricing

– Increased proportion of service

interactions through digital

channels

– Launched new property strategy

following success of remote working

– Our people continued to deliver

ourtransformation agenda while

working remotely

– Our engagement scores remained

high as we focused on the security

and wellbeing of our people

– Awarding free shares and ensuring

all eligible employees receive a

bonus for the year

Performance against strategic objectives

See page 44 for more information

Technical edge Nimble and cost efficient Great people

Best at direct Win on price comparison

websites

Extend our reach

Forging ahead with our strategy

Chief Executive Officer’s review continued

12 Direct Line Group Annual Report and Accounts 2020

Strategic Report

Overall, the impact of the pandemic led to a modest net

benefit to our financial result, with the effects

concentrated in four main areas:

– Reduction in motor claims frequency falling to below

normal levels from Q2

– Increase in Travel claims, relating to both claims

volumes and claims handling costs as well as additional

commission payments

– An estimated £6 million in Covid-19 related business

interruption claims

– Investments to support our customers, people and

society totalling £93 million

Motor claims frequency levels were significantly lower

than normal due predominantly to lockdown restrictions

leading to claims frequency falling to around half normal

levels during Q2. Whilst it increased during the second

half of the year, claims frequency did not return to

pre-Covid-19 levels during 2020. However, severity costs

have increased due to the costs of making accident repair

centres Covid-19 safe, longer repair times and

consequently higher credit hire costs. We have seen an

increase in the volume of claims within our Travel business

and so have also incurred additional claims handling

costssupporting our customers. In terms of business

interruption, our standard wordings were clear from

theoutset and we were not party to the FCA’s test case

nor the appeal to the Supreme Court, which has been

relevant to many commercial insurers, and our overall

Covid-19 related business interruption claims are

estimated at £6million.

Consistent with our “Force for Good” vision, we have

invested extensively in our customers in the form of

premium refunds, waived fees and reduced premiums,

and also in our people by protecting jobs at the most

critical points in lockdown, preserving salaries and

incentives in return for flexibility and investing in

strengthening home working capability. And finally

wehave invested in society: we have helped local

communities with over £7 million of donations helping

100,000s of households and contributing to the ABI

Covid-19 Support Fund. In total these initiatives represent

an impact of around £93 million, of which £34 million is

within our operating expenses and £59 million is within

our loss ratio.

Prior to the pandemic we had set out to achieve

improvements in our current-year loss ratio and therefore

to improve the profitability of the business we write.

Offsetting this we had expected to see the level of releases

from prior year business reduce, reflecting changes in the

level of Motor excess of loss reinsurance some years ago.

During 2020, prior-year reserve releases reduced to

£173.8 million (2019: £294.5 million). Although the

improvements in our loss ratio undoubtedly benefited

from the impact of the Covid-19 pandemic, we are

confident we have made progress in increasing the

current-year contribution to operating profit.

Overall we have sought to do the right thing by all our

stakeholders throughout 2020, and believe the underlying

performance and quality of change delivery in the year

indicate we are on track to deliver on our targets.

Strategic update

2020 was always a critical change delivery year on our

path to building the insurance company of the future

– technology and data led but with the customer at its

heart. I have been very pleased by our ability to continue

delivering major transformational change, even from

ourhomes. The table opposite outlines some of our

keyachievements.

Many of the foundation blocks are now in place and we

are increasingly moving to extracting benefits from the

technology we have implemented rather than focusing

purely on technology delivery.

As we transform the business both in terms of the

technology we use and our agility, we are changing the

way the organisation works. We have found through 2020

that we can create and protect the culture of the Group,

even with almost everyone working from home, and our

regular people surveys tell us that our people want the

personal flexibility that homeworking offers. Our intention,

therefore, is to take this opportunity to change the way we

use our premises in future so they support collaboration,

training and teamwork rather than being an everyday

place of work for most people.

We will remain focused around our core hub sites so our

people can get together, but believe our approach gives

both cost savings and advantages for our people, allowing

us to support greater social mobility and assist us in

identifying top talent. To this end we are reviewing our

office site property strategy and have chosen to buy

outour Bromley lease, the run costs of which were above

market rate. This will accelerate the costs from the future

17 years of the lease and so we will take a charge to

Solvency II own funds in 2021 of £85 million as we

effectively de-leverage the business and, in return, make

savings in excess of £10 million per annum from 2022,

incremental to our original cost target plans. We will then

have greater freedom to create the nature of property

usage this business needs.

“As we transform the business both in terms of

the technology we use and our agility, we are

changing the way the organisation works.”

A further effect was felt in our investment portfolio where

we saw investment return fall from £134.6 million in 2019

to £95.1million in 2020, reflecting the dual impact of lower

reinvestment rates and a small number of writedowns

inthe investment portfolio. When we look at some of

thevolatility in the market over the period we are pleased

with the overall performance of the portfolio.

www.directlinegroup.co.uk 13

With the potential impact of the FCA Pricing Practices

report, discussed in the Market Overview section later,

combined with whiplash reform, currently due to be

effective from May 2021, a mixed picture is emerging in

terms of lockdowns in H1 and uncertainty over the

long-term level of driving in our new “normal”, and there

areclearly many moving parts.

That said, capital generation has been strong and our

perception is that the level of risk in the system, with

vaccines rolling out and a Brexit deal in place, is beginning

to reduce. As a result we are declaring a final dividend

of14.7 pence per share and announcing a share buyback

programme, as we reiterate our target of operating

around the middle of our risk appetite range of 140% to

180% in normal circumstances. The share buyback will

be for up to £100 million, with an initial tranche of up to

£50 million expected to be completed by the time of

the half-year results.

As you move through the Strategic report we will seek

notonly to guide you through understanding our financial

performance and how that positions us for the future

butalso to bring to life examples of the technology

development and the benefit we believe it will bring.

Ihope it will allow you to feel why we are so excited about

the progress we have made and the opportunity ahead.

Looking into 2021 we will be continuing the roll-out of

ourtechnology transformation and increasingly turning

our attention to utilising these new platforms to deliver

benefits for our customers.

Our plans include:

– Continuing the migration of Direct Line and Churchill

Motor policies onto our new platform, enabling us to

improve customers’ online journey and extend our

product range even further.

– Continuing the journey towards greater digitalisation,

applying advanced analytical techniques to enhance

the customer experience.

– Rolling out a new policy and pricing system for Green

Flag enabling it to grow beyond traditional breakdown

services and look after customers’ motoring needs in

and out of an emergency.

– Being well placed for customers and at a competitive

advantage to other players in a post FCA pricing

practices market.

We are also heavily focused on improving efficiency in

order to meet our cost targets by:

– Continuing organisational transformation to further

digitalise customer journeys, automate business

processes and adopt new ways of working, as we aim

tostep change both customer experience and the

efficiency of our cost base.

– Realising the benefits of agile ways of working

throughout the organisation with the aim of reducing

the cost and increasing the pace of change.

These plans are designed with fantastic customer experience

and propositions at their heart. Supporting ouractivities

and central to the long-term sustainability of the business,

we have deeply embedded and fundamental principles:

– Our values sit at the very heart of our everyday behaviours.

– Our sustainability pillars bring environmental, social and

governance (“ESG”) factors into the heart of our

strategic thinking, whether that’s our customers, our

people, our society, our planet, or the importance of

strong governance – they all play central roles in helping

deliver our business in a sustainable way.

‘Bring all of yourself to work’ is a value lived vibrantly

across the Group but after extensive discussions with

our people, we launched anewdiversity and inclusion

strategy and set ourselves stretching targets around

ethnicity and gender in our leadership so that we are

truly inclusive and reflect the customers weserve.

Chief Executive Officer’s review continued

14 Direct Line Group Annual Report and Accounts 2020

Strategic Report

2020 - a year like no other

Notes:

1. See glossary on pages 224 to 226 for definitions.

2. Scope 3 emissions which are under our direct control.

3. For more information please see our published 2020 TCFD Report on

the Group’s website at www.directlinegroup.co.uk/2020_TCFD.

Supporting

our customers

Supporting

ourpeople

Supporting

our communities

Supporting a

greener future

450k+

Over 450,000

customers supported

through payment

deferrals, waiving

cancellation feesand

mileage refunds

26k+

More than 26,000

customer travel claims

settled and over 900

customers repatriated

Free

Free Rescue cover,

fast-track claims and

free home emergencies

cover for NHS staff

9,000

Moved 9,000 people

tohome working and

supported our motor

accident repair centres

to open safely and keep

Britain moving

Protected

Protected roles and

salaries during initial

lockdown, without

government support,

and offered maximum

flexibility to help our

people manage home

and work

Free

shares

£3.8 million distributed

as a thank you to

ourpeople

£3.5m

Established our first

Community Fund which

distributed £3.5 million

to250 charities, helping

over 200,000 people

£1.5m

Extended our

Community Fund

into2021 with £1.5

million to support

charities dealing with

the impact ofthe

Covid-19 pandemic

£3.6m

Contributed

£3.6million to

theAssociation

of British

Insurers

Covid-19

Support

Fund

Reduce

Committed to setting

Science-Based Targets

1

for Scope

1

1, 2 and 3 to

help the Group reduce

itscarbonfootprint

Carbon

neutral

Became a 100% carbon-

neutral business by

investing in high social

impact projects to

offset our Scope

1

1, 2

and 3

2

emissions

Report

Published our first Task

Force on Climate-related

Financial Disclosures

(“TCFD”) Report

3

www.directlinegroup.co.uk 15

Chief Executive Officer’s review continued

Market overview

Consumer trends

In 2020 we saw a number of

trends emerging through the

year. Ultimately these tell us that

our strategy is the right one.

Those trends are:

– Consumers’ willingness to

interact digitally has been

transformed. Digitalisation is

atthe heart of our technology

transformation so this trend is

entirely aligned with our plans.

– Agility is a must. We need to

bequicker at implementing

changes to fulfil changing

customer needs.

– The working model has

changed. Knowing our people

can deliver from home has

provided an opportunity to

change how we use our offices

in a way that supports what

ourpeople tell us they want

and offers opportunities to

recruit people irrespective

ofgeography.

– Car technology continues

toevolve rapidly. Having the

largest owned repair network

of any UK insurer gives us the

opportunity to develop further

commercial insights.

– Cross collaboration is a must.

We can achieve more by

working together; co-operation

across industries is essential to

tackling climate change and

ensuring greater diversity.

Financial Conduct Authority

Pricing Practices

In September 2020 the FCA released

its General Insurance Pricing

Practices Final Report, which remains

a key focus for us. It included the

FCA’s proposed remedy package

aiming toensure retail home and

motor insurance products offer fair

value to customers. The FCA

recognised that insurers do not make

excessive profits and their key

proposal was that firms should offer

renewal prices no higher than the

equivalent new business price

through the same sales channel. The

consultation period ended on 25

January 2021 and we look forward to

understanding the final details some

time in Q2 2021.

This is an area where we have already

been proactive for several years by

implementing a range of measures

toreduce the differential in pricing

between our new business and

renewal customers. We are

supportive of the aims of the FCA and

believe that, in a world where prices

become less of a differentiator, our

strong brands, diversified business

model and the capabilities we are

building will enable us to win in the

future market. On the way there is

uncertainty around the detailed

application of the rules, the timelines

for implementation and the nature

ofshort-term volatility as the market

rebalances. We have prepared for a

range of outcomes and we continue

to work with the FCA to assist it

in navigating some of the issues

andareseeking to help shape the

right outcome for our customers

andshareholders.

Climate

The impact of climate change has far

reaching implications for economies

around the world. Our Planet pillar,

which aims to protect our business

from the impact of climate change

and give back to the planet more

than we take out, drives our

approach. We recognise that our

actions as a business can contribute

to climate risk mitigation and help

accelerate the transition to a low

carbon and sustainable future.

Wetake this seriously and have

continued to challenge ourselves

toreduce emissions and energy

consumption through greater

transparency.

We have previously published our

Scope 1 and 2 emissions

1

, but this year

we wanted to go further. For the first

time we broke down our emissions

across our offices and our accident

repair centres to help us to focus our

plans on where we can have the most

impact. Alongside this we evaluated

our Scope 3 emissions

1

starting with

those under our direct control and

purchased goods and services which

make a substantial contribution

toour overall emissions. Our first

comprehensive TCFD report

(seepage 62) provides us with a

roadmap to strengthen our strategic

response in tackling climate change

and we see the Bank of England’s

Climate Biennial Exploratory Scenario

(“CBES”), in which the Group has been

invited to participate, as a way to help

enhance our climate change scenario

analysis capability.

The Group’s focus in 2021 is to

evaluate the Scope 3 emissions

1

arising out of our investment portfolio

and we will begin to scope out

Science-Based Targets, which are a

set of goals to provide a clear route

“We recognise that our

actions as a business can

contribute to climate risk

mitigation and help accelerate

the transition to a low carbon

and sustainable future.”

16 Direct Line Group Annual Report and Accounts 2020

Strategic Report

“Given the progress we are making on our

transformation, we enter 2021 with real

momentum and are confident in delivering

ourvision of being a technology and data led

insurance company of the future with our

customers at its heart.”

Outlook

The capability delivered as the Group looks to transition

from technology transformation into business

transformation underpins the improvement in the

current-year profitability and provides a platform for

growth, underwriting improvements and cost efficiency.

Through increased digitalisation and self-serve, enabled

by new ways of working, we aim to deliver significant

customer and efficiency improvements and underpin

ourtarget of an operating expense ratio of 20% by 2023.

The new ways of working during 2020 have enabled us to

think more ambitiously about how we use our office space

and we have therefore launched a property strategy

which aims to help deliver incremental savings to this

target. In addition, greater pricing sophistication and

counter-fraud initiatives aim to continue the improvement

in the current-year loss ratio. The Group remains on track

to maintain the contribution from current-year operating

profit at more than half of the Group’s total operating

profit and we reiterate our ongoing target of achieving

atleast a 15% return on tangible equity per annum.

The Group targets a combined operating ratio of 93-95% for

2021 and over the medium term, normalised for weather,

although we acknowledge there will be increased

uncertainty for a period as we progress through the

implementation of the FCA pricing practices proposals and

as the market reacts to the ongoing Covid-19 pandemic.

2020 has been a testing year for everyone and I am proud

of how we have responded as a Group, demonstrating

throughout the resilience of our business model. We had

strong momentum coming into the Covid-19 crisis and

have delivered a good financial result whilst

simultaneously navigating the Covid-19 pandemic,

supporting our various stakeholders and staying true to

our vision and purpose throughout. Given the progress we

are making on our transformation, we enter 2021 with real

momentum and are confident in delivering our vision of

being a technology and data led insurance company of

the future with our customers at its heart.

Penny James

Chief Executive Officer

toreduce emissions, to submit to

the Science Based Target Initiative

(“SBTi”) for approval. Finally, we

know that we are on a journey

andcannot reduce our emissions

overnight, therefore we became

carbon neutral through offsetting,

aswe work to reduce our emissions

over time.

Note:

1. See glossary on pages 224 to 226

fordefinitions.

UK economy and Brexit

Following the recession in 2020,

economic uncertainty is expected to

remain high throughout H1 2021 as

aresult of the Covid-19 pandemic,

although the UK Government has

acted to support UK businesses

andemployees and prevent lasting

damage to the economy. However,

the uncertainty surrounding the

pandemic makes the overall impact

and recovery progress unclear.

The disruption to global trade

andsupply chains caused by the

pandemic could increase the risk

ofinflation in the long term. The

Group’s investment portfolio

ispositioned defensively and

additional steps could be taken,

such as further shifting the portfolio

towards ‘defensive’ sectors or

increasing more allocation to cash.

The portfolio also contains a

proportion of short-maturity bonds

which could be sold relatively

quickly if necessary.

As a UK-based business with UK

customers, we identified that the

biggest potential financial exposure

for theGroup, from a disruptive or

disorderly Brexit, would be to

market volatility. We continue

towork through the operational

effects of Brexit for customers and

supply chains but the potential

effects have been helped by a trade

deal which has avoided otherwise

expected tariffs on EU goods

needed to serve our customers.

www.directlinegroup.co.uk 17

Our key performance indicators

Combined operating

ratio

1

(%)

Definition Aim

Remuneration

Notes:

1. See glossary on pages 224 to 226 and Appendix A – Alternative performance measures on pages 227 to 230 for reconciliation to

financial statement line items.

2. The 2019 dividends and capital returns have been adjusted to remove the cancelled 14.4p final dividend and £120 million of the share

buyback as announced in March/April 2020. (The reported number were dividends and capital returns of £447.0 million).

3. The 2019 solvency capital ratio has been adjusted to remove the cancelled 14.4p final dividend and £120 million of the share buyback

as announced in March/April 2020. (The reported number was a solvency capital ratio of 165%.)

Expense ratio

Commission ratio

Loss ratio

16 17 18 19 20

25.311.5

9.1 25.7

7.1

8.6

6.5

60.9

56.0

61.9

57.9

61.9

23.2

23.2

24.5

97.7

90.8

91.6

92.2

91.0

Basic earnings

per share

1

(pence)

16 17 18 19 20

20.4

31.8

33.3

29.5

25.8

Capital returns

2

(£m)

Buybacks

Special

Ordinary

16 17 18 19 20

136.9199.5

279.0

287.6

98.6

30

100

205.3

113.7

595.2595.2

195.5195.5

299.7299.7

336.4

484.3

401.3

128.6

2020 COL BAR TO BE IN PANTONE 275

Return on tangible

equity

1

(%)

19.919.9

16 17 18 19 20

14.2

23.0

21.6

20.8

Buybacks

Special

Ordinary

16 17 18 19 20

136.9199.5

279.0

287.6

98.6

30

100

205.3

113.7

595.2595.2

195.5195.5

299.7299.7

336.4

484.3

401.3

128.6

2020 COL BAR TO BE IN PANTONE 275

This is calculated by

dividing the earnings

attributable to shareholders

less coupon payments

inrespect of Tier 1 notes

bythe weighted average

number of Ordinary Shares

in issue.

The amount of cash paid

individends to shareholders

and amount of share

buybacks funded from

theGroup’s retained

profits.(See page 192 for

dividend breakdown).

The return generated

onthecapital that

shareholders have in the

business. This iscalculated

by dividing adjusted

earnings by average

tangible equity.

A measure of financial year

underwriting profitability.

ACOR of less than

100%indicates profitable

underwriting. The COR is

the sum of claims, expense

and commission ratios and

compares the cost of doing

business against net

earned premium generated.

We have not set a target.

However, growing earnings

per share is considered

anindicator of a healthy

business.

We aim to grow the regular

dividend in line with

business growth.

Additionally, we look to

return any capital to

shareholders which is

expected to be surplus to

our requirements for a

prolonged period.

We aim to achieve at least

a15% RoTE per annum over

the long term.

We aim to make an

underwriting profit.

Thetarget in the medium

term is a COR inthe range

of 93% to 95% normalised

forweather.

This is a broad measure

ofearnings and reflects

theresults of the Group

after tax less Tier 1 coupon

payments. We base part

ofthe AIP awards on profit

before tax.

We base Long-Term

Incentive Plan (“LTIP”)

awards partly on relative

total shareholder return

performance, which

includes dividends.

Directors also receive

dividends on their

beneficial shareholdings

and accrue these on

unvested LTIP awards.

We base the LTIP awards

partly on adjusted RoTE

overa three-year

performance period.

We base part of the Annual

Incentive Plan (“AIP”)

awards on profit before tax.

The COR is closely linked

tothis.

For additional performance

information see page 24

For additional performance

information see page 27

For additional performance

information see page 28

For additional performance

information see page 27

For additional information

see pages 117 and 123

For additional information

see page 117 and 123

For additional information

see pages 117 and 127

For additional information

see page 117 and 127

Expense ratio

Commission ratio

Loss ratio

16 17 18 19 20

25.311.5

9.1 25.7

7.1

8.6

6.5

60.9

56.0

61.9

57.9

61.9

23.2

23.2

24.5

97.7

90.8

91.6

92.2

91.0

18 Direct Line Group Annual Report and Accounts 2020

Strategic Report

4. Estimates based on the Group’s Solvency II partial internal model.

5. On an aggregated 12-month rolling basis, with 2013 rebased to 100.

6. For the Group’s principal underwriter, U K Insurance Limited.

7. FCA complaints reporting requirements have changed for periods after 29 June 2016. Before 29 June 2016, only complaints resolved

after two business days were classed as FCA reportable. From July 2016 all complaints resolved are classed as FCA reportable.

Solvency capital

ratio

3,4

(%)

16 17 18 19 20

165.0

165.0

170.0

189.0

191.0191.0

Employee engagement

(%)

74.074.0

78.0

16 17 18 19 20

73.0

78.0

81.0

Net promoter score

5,6

(points)

158.0158.0

16 17 18 19 20

129.1

144.0

155.0

145.6

Customer complaints

6,7

(%)

0.510.51

16 17 18 19 20

0.89

0.78

0.77

0.63

Definition Aim Remuneration

For additional performance

information see page 28

For additional People

information see page 50

For additional performance

information see page 48

For additional information

see page 117

For additional information

see page 117 and 125

For additional information

see page 117 and 124

For additional information

see page 117 and 124

Engagement is about

being proud to work for

theGroup and helping us

to succeed. It means that

employees are not just

happy or satisfied, but

doing something to help us

achieve our Company goals.

Net promoter score (“NPS”)

is an index that measures

the willingness of

customers to recommend

products or services to

others. It is used to gauge

customers’ overall

experience with a product

or service, and customers’

loyalty to a brand.

The number of complaints

we received during the

yearas a proportion of

theaverage number of

in-force policies.

A risk-based measure

expressing the level of

capital resources held as

apercentage of the level

ofcapital that is required

under Solvency II.

To make the Group best

foremployees and best for

ourcustomers. We gauge

employee engagement

through our employee

opinion survey and we

aimfor high employee

engagement scores

eachyear.

We aim to increase our net

promoter score over time.

This measure indicates

where our customer service

has not met expectations

tothe extent that the

customer has initiated

acomplaint. We aim to

improve this over time.

Under normal

circumstances, the Group

aims to maintain a solvency

capital ratio around the

middle of the risk appetite

range of 140% to 180%.

The AIP awards include

aweighting to a balance

ofemployee metrics,

includingengagement.

The AIP awards include

aweighting to a balance

ofcustomer metrics,

includingNPS.

The AIP awards include

aweighting to a balance

ofcustomer metrics,

including complaints.

Solvency capital ratio

within our risk appetite

isan indicator ofcapital

strength, which is one of

the gateways for the AIP

awards and an underpin

forLTIP awards.

www.directlinegroup.co.uk 19

Finance review

We made good progress against our targets to improve the

sustainability of our earnings in a challenging environment

andmaintained our balance sheet strength.

Neil Manser

Acting Chief Financial Officer

Direct own brands in-force policies grew by 2.2% driven by

strong segments of growth across the business including

Home, Commercial and Green Flag Rescue, whilst Motor

was broadly stable. Total in-force policies reduced due to

lower partnerships and Travel volumes.

Direct own brands gross written premium was stable with

growth across Home and Commercial direct own brands

and Green Flag Rescue offset by lower average premiums

in Motor. Overall gross written premium reduced by 0.7%

due to falling partnership and Travel premium.

Increased major weather costs of £43.0 million (2019:

£6.0million) contributed to lower operating profit of

£522.1million, £24.8 million (4.5%) lower than 2019 (£546.9

million). Covid-19 restrictions reduced claims frequency in

Motor and Commercial, although this was partially offset

by investment in initiatives to protect our customers,

people and society, lower investment asset returns and

the impact of the Covid-19 pandemic on Travel. Overall,

the impact of the pandemic was a modest net benefit

tothe result.

Combined operating ratio improved to 91.0% (2019: 92.2%).

Normalised combined operating ratio

1

, of 91.7%, was ahead

of target of 93% to 95% predominantly due to the lower

claims frequency in Motor.

Progress on the Group’s transformation continued to drive

improved current-year profitability via increased pricing

and underwriting sophistication in Commercial and

improved counter-fraud capability in Motor.

Profit before tax of £451.4 million was £58.3 million lower

than 2019, following the reduction in operating profit

alongside £39.4 million of restructuring and one-off costs

as the Group invested in cost-saving initiatives.

Proposed final ordinary dividend of 14.7 pence per share,

increased 2.1%

2

and announcing a share buyback

programme of up to £100 million. Intention to move back

towards the middle of the Group’s capital risk appetite

range assuming more normal circumstances.

Notes:

1. See glossary on pages 224 to 226 for definitions and appendix A

– Alternative performance measures on pages 227 to 230 for

reconciliation to financial statement line items.

2. The 2019 final dividend of 14.4 pence was subsequently

cancelled and paid as a special interim dividend in 2020.

Financial highlights

Strong capital

position, good results

20 Direct Line Group Annual Report and Accounts 2020

Strategic Report

Financial highlights continued

FY 2020

£m

FY 2019

£m

In-force policies (thousands) 14,615 14,789

Of which: direct own brands (thousands) 7,454 7,290

Gross written premium 3,180.4 3,203.1

Of which: direct own brands 2,225.6 2,227.8

Net earned premium 2,960.5 2,984.9

Underwriting profit 267.8 232.1

Instalment and other operating income 159.2 180.2

Investment return 95.1 134.6

Operating profit 522.1 546.9

Restructuring and other one-off costs (39.4) (11.2)

Finance costs (31.3) (26.0)

Profit before tax 451.4 509.7

Tax (84.2) (89.8)

Profit after tax 367.2 419.9

Key metrics

Current-year attritional loss ratio

1,2

62.3% 71.6%

Loss ratio

1,2

57.9% 61.9%

Commission ratio

1,2

8.6% 7.1%

Expense ratio

1,2

24.5% 23.2%

Combined operating ratio

1,2

91.0% 92.2%

Investment income yield

2

2.1% 2.4%

Net investment income yield

2

1.8% 2.1%

Investment return yield

2

1.6% 2.2%

Basic earnings per share (pence) 25.8 29.5

Diluted earnings per share (pence) 25.5 29.2

Return on tangible equity

2

19.9% 20.8%

Return on equity 13.1% 15.5%

Dividend per share – interim (pence) 7.4 7.2

– final (pence) 14.7 14.4

– total ordinary (pence) 22.1 21.6

– special (pence) 14.4 –

Share buyback actioned (10.4 million shares) 30.0 –

Share buyback proposed

3

100.0 150.0

31 Dec

2020

31 Dec

2019

Net asset value per share (pence) 199.7 193.4

Tangible net asset value per share(pence) 141.5 142.0

Solvency capital ratio post dividends

3,4

191% 165%

Notes:

1. A reduction in the ratio represents an improvement as a proportion of net earned premium, while an increase in the ratio represents

adeterioration.

2. See glossary on pages 224 to 226 for definitions and appendix A – Alternative performance measures on pages 227 to 230 for

reconciliation to financial statement line items.

3. The solvency capital ratio as reported at 31 December 2019 is after taking into account the then expected 14.4p final dividend and

the£150 million share buyback announced on 3 March 2020. The impacts of the cancellation of the dividend (as announced on

8April2020) and of the share buyback programme (as announced on 19 March 2020 after £30 million of the buyback had been

executed) would have added 24 percentage points to the ratio as reported to give an adjusted solvency capital ratio of 189%.

4. Estimates based on the Group’s Solvency II partial internal model.

www.directlinegroup.co.uk 21

premium deflation; additional travel claims and claims

handling costs; and business interruption claims in

Commercial. These factors together had a net positive

impact on the underwriting result.

Outside of the impact from Covid-19, prior-year releases

reduced to £173.8 million during 2020 (2019: £294.5

million), reflecting changes in the level of Motor excess

ofloss reinsurance some years ago and were materially

offset by improvements in the underlying current-year

lossratio across Motor and Commercial.

Overall this delivered an increase in underwriting profit

to£267.8 million (2019: £232.1 million).

Lower motor premium and claims volumes, primarily

arising from the Covid-19 pandemic, led to a reduction in

instalment and other operating income to £159.2million

(2019: £180.2 million).

Investment return decreased to £95.1 million (2019:

£134.6million), reflecting the dual impact of lower

reinvestment rates and lower valuations on property in

the investment portfolio.

Taking all of this together, operating profit decreased

by£24.8 million to £522.1 million (2019: £546.9 million)

andcurrent-year operating profit, as a proportion of total

operating profit, improved to 66.7% (65.4% on a

normalised basis). Whilst current-year profitability has

benefited from the impact of Covid-19 related factors in

2020, the Group remains on track for its target of

achieving more than half of the Group’s annual operating

profit from current-year earnings by the end of2021.

In-force policies and gross written premium

In-force policies (thousands)

At

31 Dec

2020

31 Dec

2019

Direct own brands 3,943 3,921

Partnerships 118 122

Motor 4,061 4,043

Direct own brands 1,837 1,765

Partnerships 801 829

Home 2,638 2,594

Rescue 3,400 3,450

Travel 3,499 3,648

Pet 145 157

Other personal lines 61 122

Rescue and other personal lines 7,105 7,377

Of which: Green Flag direct 1,114 1,063

Direct own brands 560 541

NIG and other 251 234

Commercial 811 775

Total in-force policies 14,615 14,789

Of which: direct own brands 7,454 7,290

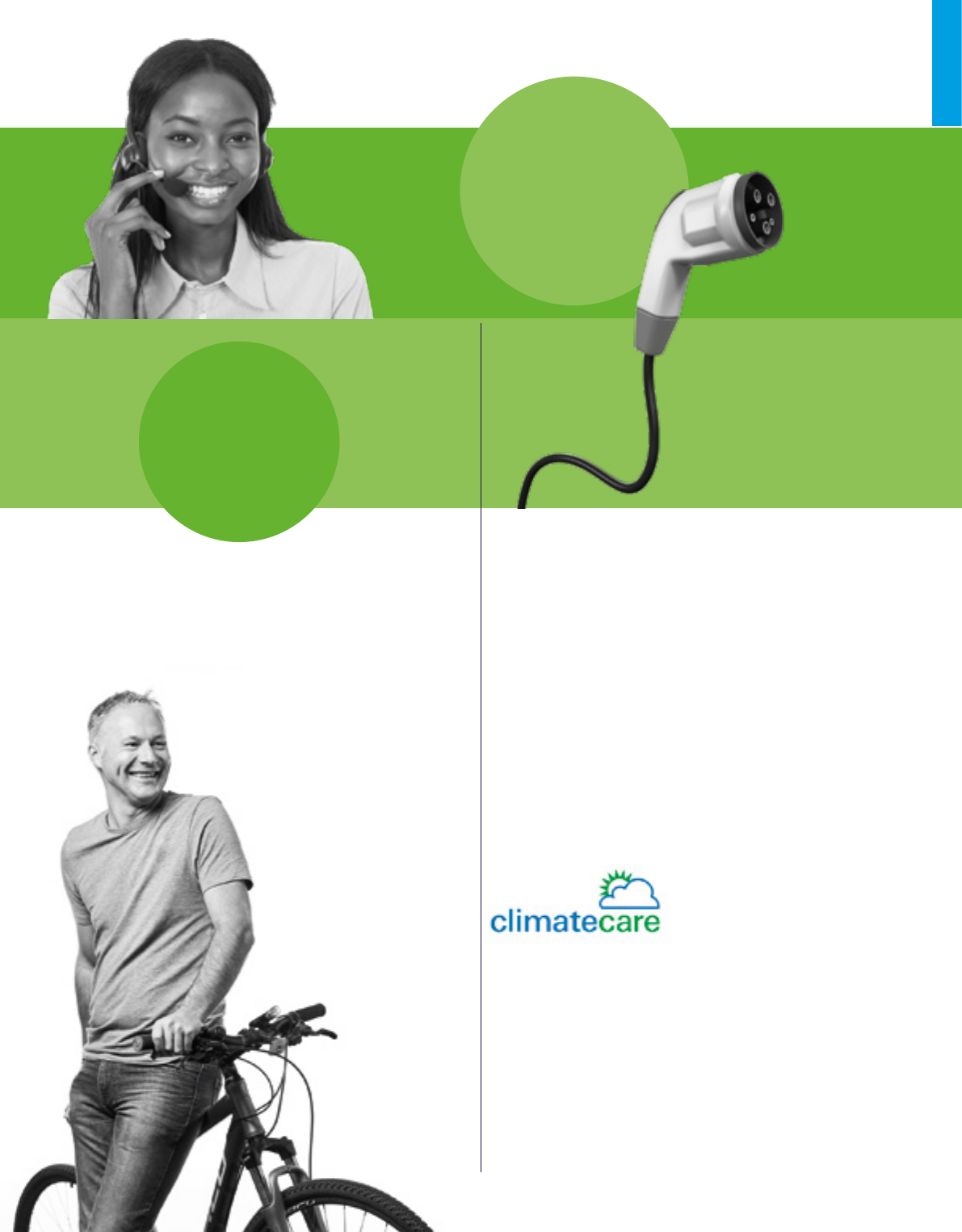

Operating profit (£m)

Current-year operating profit

Prior-year reserve releases

0

100

200

300

400 500 600

20

19

£173.8m (33.3%)

£294.5m (53.8%)

£348.3m (66.7%)

£252.4m (46.2%)

Performance

Operating profit

1

FY 2020

£m

FY 2019

£m

Underwriting profit 267.8 232.1

Instalment and