Note: The draft you are looking for begins on the next page.

Caution: DRAFT—NOT FOR FILING

This is an early release draft of an IRS tax form, instructions, or publication,

which the IRS is providing for your information. Do not file draft forms and do

not rely on draft forms, instructions, and pubs for filing. We incorporate all

significant changes to forms posted with this coversheet. However, unexpected

issues occasionally arise, or legislation is passed—in this case, we will post a

new draft of the form to alert users that changes were made to the previously

posted draft. Thus, there are never any changes to the last posted draft of a

form and the final revision of the form. Forms and instructions are subject to

OMB approval before they can be officially released, so we post drafts of them

until they are approved. Drafts of instructions and pubs usually have some

additional changes before their final release. Early release drafts are at

IRS.gov/DraftForms and remain there after the final release is posted at

IRS.gov/LatestForms. Also see IRS.gov/Forms.

Most forms and publications have a page on IRS.gov: IRS.gov/Form1040 for

Form 1040; IRS.gov/Pub501 for Pub. 501; IRS.gov/W4 for Form W-4; and

IRS.gov/ScheduleA for Schedule A (Form 1040), for example, and similarly for

other forms, pubs, and schedules for Form 1040. When typing in a link, type it

into the address bar of your browser, not a Search box on IRS.gov.

If you wish, you can submit comments to the IRS about draft or final forms,

instructions, or pubs at IRS.gov/FormsComments. Include “NTF” followed by the

form or pub number (for example, “NTF1040”, “NTFW4”, “NTF501, etc.) in the

body of the message to route your message properly. We cannot respond to all

comments due to the high volume we receive and may not be able to consider

many suggestions until the subsequent revision of the product, but we will

review each “NTF” message. If you have comments on reducing paperwork and

respondent (filer) burden, with respect to draft or final forms, please respond to

the relevant information collection through the Federal Register process; for

more info, click here.

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

Department of the Treasury

Internal Revenue Service

Publication 15-T

Cat. No. 32112B

Federal

Income Tax

Withholding

Methods

For use in 2024

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (Tiếng Việt)

Contents

Introduction .............................. 2

1. Percentage Method Tables for Automated

Payroll Systems and Withholding on

Periodic Payments of Pensions and

Annuities ............................. 9

2. Wage Bracket Method Tables for Manual

Payroll Systems With Forms W-4 From

2020 or Later ......................... 12

3. Wage Bracket Method Tables for Manual

Payroll Systems With Forms W-4 From

2019 or Earlier ........................ 27

4. Percentage Method Tables for Manual

Payroll Systems With Forms W-4 From

2020 or Later ......................... 56

5. Percentage Method Tables for Manual

Payroll Systems With Forms W-4 From

2019 or Earlier ........................ 62

6. Alternative Methods for Figuring

Withholding .......................... 65

7. Tables for Withholding on Distributions of

Indian Gaming Profits to Tribal Members ... 66

How To Get Tax Help ....................... 67

Future Developments

For the latest information about developments related to

Pub. 15-T, such as legislation enacted after it was

published, go to IRS.gov/Pub15T.

What’s New

IRS Tax Withholding Estimator updated for 2024. Em-

ployees and payees may now use the IRS Tax Withholding

Estimator, available at IRS.gov/W4App, when completing

their 2024 Form W-4, Employee's Withholding Certificate,

or their 2024 Form W-4P, Withholding Certificate for Peri-

odic Pension or Annuity Payments.

Reminders

Form W-4P and Form W-4R. Form W-4P was rede-

signed for 2022. Form W-4P is now used only to make

withholding elections for periodic pension or annuity pay-

ments. Previously, Form W-4P was also used to make

withholding elections for nonperiodic payments and eligi-

ble rollover distributions. Withholding elections for non-

periodic payments and eligible rollover distributions are

now made on Form W-4R, Withholding Certificate for

Nonperiodic Payments and Eligible Rollover Distributions.

Although the redesigned Form W-4P and new Form W-4R

were available for use in 2022, the IRS postponed the

Dec 12, 2023

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

requirement to begin using the new forms until January 1,

2023. Payers should have updated their system program-

ming for these forms in 2022.

Section 1 of this publication includes Worksheet 1B for

payers to figure withholding on periodic payments of pen-

sions and annuities based on a 2022 or later Form W-4P

or a 2021 and earlier Form W-4P. Worksheet 1B is used

with the STANDARD Withholding Rate Schedules in the

2024 Percentage Method Tables for Automated Payroll

Systems and Withholding on Periodic Payments of Pen-

sions and Annuities that are included in section 1. If a

payer is figuring withholding on periodic payments based

on a 2021 or earlier Form W-4P, the payer may also figure

withholding using the methods described in section 3 and

section 5. For more information about Form W-4P, see

Form W-4P, later. Also, see How To Treat 2021 and Earlier

Forms W-4P as if They Were 2022 or Later Forms W-4P,

later, for an optional computational bridge.

For more information about Form W-4R, see section 8

of Pub. 15-A, Employer's Supplemental Tax Guide.

Computational bridge for Form W-4. Employers may

use an optional computational bridge to treat 2019 and

earlier Forms W-4 as if they were 2020 or later Forms W-4

for purposes of figuring federal income tax withholding.

See How To Treat 2019 and Earlier Forms W-4 as if They

Were 2020 or Later Forms W-4, later, for more informa-

tion.

Electronic submission of Forms W-4 and W-4P. You

may set up a system to electronically receive Form W-4 or

Form W-4P from an employee or payee.

For each form that you establish an electronic submis-

sion system for, you must meet each of the following five

requirements.

1. The electronic system must ensure that the informa-

tion received by you is the information sent by the em-

ployee or payee. The system must document all occa-

sions of user access that result in a submission. In

addition, the design and operation of the electronic

system, including access procedures, must make it

reasonably certain that the person accessing the sys-

tem and submitting the form is the person identified

on the form.

2. The electronic system must provide exactly the same

information as the paper form.

3. The electronic submission must be signed with an

electronic signature by the employee or payee whose

name is on the form. The electronic signature must be

the final entry in the submission.

4. Upon request, you must furnish a hard copy of any

completed electronic form to the IRS and a statement

that, to the best of your knowledge, the electronic

form was submitted by the named employee or payee.

The hard copy of the electronic form must provide ex-

actly the same information as, but need not be a fac-

simile of, the paper form. For Form W-4, the signature

must be under penalty of perjury and must contain the

same language that appears on the paper version of

the form. The electronic system must inform the

employee that they must make a declaration con-

tained in the perjury statement and that the declara-

tion is made by signing the Form W-4.

5. You must also meet all recordkeeping requirements

that apply to the paper forms.

See Substitute Submissions of Form W-4, later, for ad-

ditional requirements specific to Form W-4 and Substitute

Submissions of Form W-4P, later, for additional require-

ments for a 2022 or later Form W-4P.

For more information on electronic submissions, see

Regulations section 31.3402(f)(5)-1(c) (for Form W-4) and

Announcement 99-6 (for Form W-4P). You can find An-

nouncement 99-6 on page 24 of Internal Revenue Bulletin

1999-4 at IRS.gov/pub/irs-irbs/irb99-04.pdf.

Introduction

This publication supplements Pub. 15, Employer's Tax

Guide. It describes how to figure withholding using the

Wage Bracket Method or Percentage Method, describes

the alternative methods for figuring withholding, and pro-

vides the Tables for Withholding on Distributions of Indian

Gaming Profits to Tribal Members.

Although this publication may be used in certain situa-

tions to figure federal income tax withholding on supple-

mental wages, the methods of withholding described in

this publication can’t be used if the 37% mandatory flat

rate withholding applies or if the 22% optional flat rate

withholding is used to figure federal income tax withhold-

ing. For more information about withholding on supple-

mental wages, see section 7 of Pub. 15.

Although this publication is used to figure federal in-

come tax withholding on periodic payments of pensions

and annuities, the methods of withholding described in

this publication can’t be used to figure withholding on non-

periodic payments or withholding on eligible rollover distri-

butions. Periodic payments are those made in installments

at regular intervals over a period of more than 1 year. They

may be paid annually, quarterly, monthly, etc. For more in-

formation about withholding on pensions and annuities,

see section 8 of Pub. 15-A.

Comments and suggestions. We welcome your com-

ments about this publication and suggestions for future

editions.

You can send us comments through IRS.gov/

FormComments.

Or, you can write to:

Internal Revenue Service

Tax Forms and Publications

1111 Constitution Ave. NW, IR-6526

Washington, DC 20224

Although we can’t respond individually to each com-

ment received, we do appreciate your feedback and will

consider your comments and suggestions as we revise

our tax forms, instructions, and publications. Don't send

2 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

tax questions, tax returns, or payments to the above ad-

dress.

Getting answers to your tax questions. If you have

a tax question not answered by this publication, check

IRS.gov and How To Get Tax Help at the end of this publi-

cation.

Getting tax forms, instructions, and publications.

Go to IRS.gov/Forms to download current and prior-year

forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instruc-

tions, and publications; call 800-829-3676 to order

prior-year forms and instructions. The IRS will process

your order for forms and publications as soon as possible.

Don't resubmit requests you've already sent us. You can

get forms and publications faster online.

Photographs of Missing

Children

The IRS is a proud partner with the National Center for

Missing & Exploited Children® (NCMEC). Photographs of

missing children selected by the Center may appear in

this publication on pages that would otherwise be blank.

You can help bring these children home by looking at the

photographs and calling 1-800-THE-LOST

(1-800-843-5678) if you recognize a child.

Form W-4

Beginning with the 2020 Form W-4, employees are no lon-

ger able to request adjustments to their withholding using

withholding allowances. Instead, using the new Form W-4,

employees provide employers with amounts to increase or

decrease the amount of taxes withheld and amounts to in-

crease or decrease the amount of wage income subject to

income tax withholding.

Form W-4 contains 5 steps. Every Form W-4 employers

receive from an employee in 2020 or later should show a

completed Step 1 (name, address, social security number

(SSN), and filing status) and a dated signature in Step 5.

Employees complete Steps 2, 3, and/or 4 only if relevant

to their personal situations. Steps 2, 3, and 4 show adjust-

ments that affect withholding calculations.

For employees who don’t complete any steps other

than Step 1 and Step 5, employers withhold the amount

based on the filing status, wage amounts, and payroll pe-

riod. But see Exemption from withholding, later.

For employees completing one or more of Steps 2, 3,

and/or 4 on Form W-4, adjustments are as follows.

Step 2. If the employee checks the box in Step 2, the

employer figures withholding from the “Form W-4, Step 2,

Checkbox” column in the Percentage Method or Wage

Bracket Method tables. This results in higher withholding

for the employee. If the employee chooses one of the

other options from this step, the higher withholding is in-

cluded with any other additional tax amounts per pay pe-

riod in Step 4(c).

Consider advising employees to use the IRS Tax

Withholding Estimator, available at IRS.gov/

W4App, when completing Form W-4 if they ex-

pect to work only part of the year; receive dividends, capi-

tal gains, social security, bonuses, or business income;

are subject to the Additional Medicare Tax or Net Invest-

ment Income Tax; or they prefer the most accurate with-

holding for multiple job situations.

Step 3. Employers use the amount on this line as an an-

nual reduction in the amount of withholding. Employers

should use the amount that the employee entered as the

total in Step 3 of Form W-4 even if it is not equal to the

sum of any amounts entered on the left in Step 3 because

the total may take into account other tax credits. If the

Step 3 total is blank, but there are amounts entered on

one or two of the left lines in Step 3, the employer may ask

the employee if leaving the line blank was intentional.

Steps 4(a) and 4(b). Employers increase the annual

amount of wages subject to income tax withholding by the

annual amount shown in Step 4(a) and reduce the annual

amount of wages subject to income tax withholding by the

annual amount shown in Step 4(b).

Step 4(c). Employers will increase withholding by the

per pay period tax amount in Step 4(c).

At the beginning of each year, consider reminding

employees to submit a new Form W-4 if they

made a mid-year change to their Form W-4 based

on their use of the IRS Tax Withholding Estimator availa-

ble at IRS.gov/W4App. Employees who made a mid-year

change may be underwithheld or overwithheld once their

Form W-4 is applied to the next full calendar year.

New employee fails to furnish Form W-4. A new em-

ployee who fails to furnish a Form W-4 will be treated as if

they had checked the box for Single or Married filing sepa-

rately in Step 1(c) and made no entries in Step 2, Step 3,

or Step 4 of Form W-4. However, an employee who was

paid wages before 2020 and who failed to furnish a Form

W-4 should continue to be treated as Single and claiming

zero allowances on a 2019 or earlier Form W-4.

Exemption from withholding. Employees who write

“Exempt” on Form W-4 in the space below Step 4(c) shall

have no federal income tax withheld from their paychecks

except in the case of certain supplemental wages. Gener-

ally, an employee may claim exemption from federal in-

come tax withholding because they had no federal income

tax liability last year and expect none this year. See the

Form W-4 instructions for more information.

TIP

TIP

Publication 15-T (2024) 3

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

Substitute Submissions of Form W-4

General requirements for any system set up to electroni-

cally receive a Form W-4 or Form W-4P are discussed

earlier under Electronic submission of Forms W-4 and

W-4P. This section provides specific requirements for

substitute submissions of Form W-4.

Electronic Substitute to Form W-4

Employers aren’t required to set up a system to electroni-

cally receive Form W-4 from an employee. If set up, how-

ever, the electronic system must meet all the requirements

and guidelines set forth in regulations and specified by the

IRS in forms, publications, and other guidance. The allow-

ance of an electronic substitute for Form W-4 isn’t a li-

cense to simplify or modify the Form W-4. In particular,

electronic Form W-4 systems set up as a substitute to pa-

per Forms W-4 must exactly replicate the text and instruc-

tions from the face of the paper Form W-4 beginning with

Step 1(c) through Step 4(c) (inclusive), and must allow an

employee access to and use of all parts of the calculation

shown on the paper Form W-4 and its worksheets.

No pop-ups or hoverboxes within those steps are per-

mitted for displaying such required information, and if the

electronic system has toggles for those steps that limit the

amount of text that is viewable, the toggles must be off as

the default. If the electronic system places steps on differ-

ent pages, users must be required to go to each page be-

fore they may electronically sign the form. The electronic

system must also include a hyperlink to Form W-4 on

IRS.gov and/or include the pages 2–4 instructions and

worksheets in their entirety in the electronic system inter-

face itself (inclusion of only some of this information re-

quires a link to the form).

Field required for claiming “Exempt.” The electronic

Form W-4 system must provide a field for employees who

are eligible and want to claim an exemption from withhold-

ing to certify that they are exempt (including, for example,

a checkbox) immediately below or after Step 4(c) to allow

users to elect no withholding from their payments. You

must also include the two conditions that taxpayers are

certifying that they meet: “you had no federal income tax

liability in 2023 and you expect to have no federal income

tax liability in 2024.”

Field required for nonresident alien status. You must

provide a field for nonresident aliens to enter nonresident

alien status.

Step 3 of 2024 Form W-4. To allow an employee access

to and use of all parts of the calculation shown on the pa-

per Form W-4, an electronic Form W-4 system can’t re-

strict Step 3 to dollar increments based on the number of

qualifying children or dependents the employee may claim

for purposes of the child tax credit or credit for other de-

pendents. The 2024 Instructions for Form W-4 indicate

that an employee can include other tax credits for which

they are eligible in Step 3 by adding an estimate of the

credit amount for the year to the credits for dependents

and entering the total amount. An employee should be al-

lowed to include an estimate of tax credits other than the

child tax credit or credit for other dependents when enter-

ing an amount in an electronic Form W-4 system for Step

3.

References to page numbers. Substitutes to the paper

form need not replicate references on the face of the form

to “page 2” or “page 3” of the Form W-4 when those refer-

ences are not applicable.

References to pages 2 and 3, when not applicable to

the substitute form, should be replaced by appropriate ref-

erences. For example, an electronic substitute form that

links directly to the deductions worksheet should not refer-

ence “page 3” but should provide a link to the deductions

worksheet.

Requiring an SSN and other personal information al-

ready stored in employer’s electronic system. An em-

ployer need not require an employee to resubmit an SSN

or other personal information when completing an elec-

tronic Form W-4 as long as:

•

The SSN and other personal information are stored in

the employer’s electronic system and the action being

taken by the employee in the system is directly or indi-

rectly linked to the electronically stored personal infor-

mation; and

•

The source of the SSN and other personal information

stored in the employer’s electronic system is a prior

submission of a complete Form W-4 or the U.S. Citi-

zenship and Immigration Services (USCIS) Form I-9,

Employment Eligibility Verification, that is signed by

the employee under penalty of perjury.

The employer’s electronic Form W-4 system must con-

tinue to ensure that the information received by the em-

ployer is the information sent by the employee and that the

person accessing the system and furnishing the Form W-4

is the employee identified on the form. See Electronic sub-

mission of Forms W-4 and W-4P, earlier. If an SSN or

other personal information is separately used by the elec-

tronic Form W-4 system to verify the identity of the em-

ployee, the employee will need to resubmit the information

for that purpose.

Implementation of new guidelines. Employers aren’t

required to set up a system to electronically receive Form

W-4 from an employee. If set up, however, the electronic

system must meet all the requirements and guidelines set

forth in regulations and specified by the IRS in forms, pub-

lications, and other guidance. When a guideline concern-

ing what an electronic Form W-4 system must provide the

employee is specified without an effective date, it is effec-

tive immediately and an employer must implement it in a

reasonable amount of time. In most cases, a reasonable

amount of time won’t extend beyond 90 days.

Paper Substitute to Form W-4

In lieu of the prescribed form, an employer may prepare

and provide to employees a substitute paper form the pro-

visions of which are identical to those of the prescribed

4 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

form, including the exact same wording from Steps 1(c)–

4(c) (inclusive), but only if the employer also:

•

Provides employees with all the tables, instructions,

and worksheets set forth in the Form W-4 in effect at

that time; and

•

Complies with all revenue procedures and other guid-

ance prescribed by the Commissioner relating to sub-

stitute forms in effect at that time.

Guidelines that apply to electronic substitutes for Form

W-4 don’t necessarily apply to a paper substitute Form

W-4. For example, a paper substitute Form W-4 must in-

clude the form's instructions and worksheets rather than

providing a web address where the payee can find them

on IRS.gov.

Employers are prohibited from accepting a substitute

form developed by an employee, and an employee fur-

nishing such form must be treated as failing to furnish a

Form W-4.

How To Treat 2019 and Earlier Forms

W-4 as if They Were 2020 or Later

Forms W-4

Employers may use an optional computational bridge to

treat 2019 and earlier Forms W-4 as if they were 2020 or

later Forms W-4 for purposes of figuring federal income

tax withholding. This computational bridge allows you to

use computational procedures and data fields for a 2020

and later Form W-4 to arrive at the equivalent withholding

for an employee that would have applied using the compu-

tational procedures and data fields on a 2019 or earlier

Form W-4. You must make up to four adjustments to use

this computational bridge.

1. Select the filing status in Step 1(c) of a 2020 or later

Form W-4 that most accurately reflects the employ-

ee’s marital status on line 3 of a 2019 or earlier Form

W-4. Treat the employee as “Single or Married filing

separately” on a 2020 or later Form W-4 if the em-

ployee selected either “Single” or “Married, but with-

hold at higher single rate” as their marital status on

their 2019 or earlier Form W-4. Treat the employee as

“Married filing jointly” on a 2020 or later Form W-4 if

the employee selected “Married” as their marital sta-

tus on their 2019 or earlier Form W-4. You can’t con-

vert an employee to a filing status of “Head of house-

hold” using this computational bridge.

2. Enter an amount in Step 4(a) on a 2020 or later Form

W-4 based on the filing status that you determined in

(1) above when you converted the employee’s marital

status on a 2019 or earlier Form W-4. Enter $8,600 if

the employee’s filing status is “Single or Married filing

separately” or $12,900 if the employee’s filing status is

“Married filing jointly.”

3. Multiply the number of allowances claimed on line 5 of

an employee’s 2019 or earlier Form W-4 by $4,300

and enter the result in Step 4(b) on a 2020 or later

Form W-4.

4. Enter the additional amount of withholding requested

by the employee on line 6 of their 2019 or earlier Form

W-4 in Step 4(c) of a 2020 or later Form W-4.

This computational bridge applies only for Forms

W-4 that were in effect on or before December 31,

2019, and that continue in effect because an em-

ployee didn’t submit a 2020 or later Form W-4. If an em-

ployee is required, or chooses, to submit a new Form W-4,

it doesn’t change the requirement that the employee must

use the current year’s revision of Form W-4. Upon putting

into effect a new Form W-4 from an employee, you must

stop using this computational bridge for the applicable

year of the new Form W-4. An employer using the compu-

tational bridge for a Form W-4 furnished by an employee

must retain the Form W-4 for its records.

Lock-in letters. The IRS may have notified you in writing

that the employee must use a specific marital status and is

limited to a specific number of allowances in a letter (com-

monly referred to as a “lock-in letter”) applicable before

2020. For more information about lock-in letters, see sec-

tion 9 of Pub. 15. For lock-in letters based on 2019 or ear-

lier Forms W-4, you may use this optional computational

bridge to comply with the requirement to withhold based

on the maximum withholding allowances and filing status

permitted in the lock-in letter.

Nonresident alien employees. You may use this com-

putational bridge to convert a nonresident alien employ-

ee’s 2019 or earlier Form W-4 to a 2020 or later Form

W-4. However, for the second adjustment of the computa-

tional bridge, always enter $4,300 in Step 4(a) on a 2020

or later Form W-4. If you convert a nonresident alien em-

ployee’s 2019 or earlier Form W-4 to a 2020 or later Form

W-4, be sure to use Table 2 when adding an amount to

their wages for figuring federal income tax withholding.

See Withholding Adjustment for Nonresident Alien Em-

ployees, later, for more information.

For more information, see Treasury Decision 9924,

2020-44 I.R.B. 943, available at IRS.gov/irb/

2020-44_IRB#TD-9924.

Withholding Adjustment for

Nonresident Alien Employees

You should instruct nonresident aliens to see No-

tice 1392, Supplemental Form W-4 Instructions

for Nonresident Aliens, before completing Form

W-4.

Apply the procedure discussed next to figure the

amount of federal income tax to withhold from the wages

of nonresident alien employees performing services within

the United States.

This procedure only applies to nonresident alien em-

ployees who have wages subject to income tax withhold-

ing.

CAUTION

!

TIP

Publication 15-T (2024) 5

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

Nonresident alien students from India and busi-

ness apprentices from India aren't subject to this

procedure.

Instructions. To figure how much federal income tax to

withhold from the wages paid to a nonresident alien em-

ployee performing services in the United States, use the

following steps.

Step 1. Determine if the nonresident alien employee has

submitted a Form W-4 for 2020 or later or an earlier Form

W-4. Then add to the wages paid to the nonresident alien

employee for the payroll period the amount for the applica-

ble type of Form W-4 and payroll period.

If the nonresident alien employee was first paid wages

before 2020 and has not submitted a Form W-4 for 2020

or later, add the amount shown in Table 1 to their wages

for calculating federal income tax withholding.

Table 1

Payroll Period Add Additional

Weekly ............................ $198.10

Biweekly ........................... 396.20

Semimonthly ........................ 429.20

Monthly ........................... 858.30

Quarterly .......................... 2,575.00

Semiannually ........................ 5,150.00

Annually ........................... 10,300.00

Daily or Miscellaneous (each day of the payroll

period) ............................ 39.60

If the nonresident alien employee has submitted a Form

W-4 for 2020 or later or was first paid wages in 2020 or

later, add the amount shown in Table 2 to their wages for

calculating federal income tax withholding.

Table 2

Payroll Period Add Additional

Weekly ............................ $280.80

Biweekly ........................... 561.50

Semimonthly ........................ 608.30

Monthly ........................... 1,216.70

Quarterly .......................... 3,650.00

Semiannually ........................ 7,300.00

Annually ........................... 14,600.00

Daily or Miscellaneous (each day of the payroll

period) ............................ 56.20

Step 2. Enter the amount figured in Step 1, earlier, as the

total taxable wages on line 1a of the withholding work-

sheet that you use to figure federal income tax withhold-

ing.

The amounts from Tables 1 and 2 are added to wages

solely for calculating income tax withholding on the wages

of the nonresident alien employee. The amounts from the

tables shouldn't be included in any box on the employee's

Form W-2 and don't increase the income tax liability of the

employee. Also, the amounts from the tables don't in-

crease the social security tax or Medicare tax liability of

the employer or the employee, or the FUTA tax liability of

the employer.

CAUTION

!

Example. An employer pays wages of $300 for a

weekly payroll period to a married nonresident alien em-

ployee. The nonresident alien has a properly completed

2019 Form W-4 on file with the employer that shows mari-

tal status as "Single" with one withholding allowance and

indicated status as a nonresident alien on Form W-4,

line 6 (see Nonresident alien employee's Form W-4 in sec-

tion 9 of Pub. 15 for details on how a 2024 Form W-4 must

be completed). The employer determines the wages to be

used in the withholding tables by adding to the $300

amount of wages paid the amount of $198.10 from Table 1

under Step 1 ($498.10 total). The employer has a manual

payroll system and prefers to use the Wage Bracket

Method tables to figure withholding. The employer will use

Worksheet 3 and the withholding tables in section 3 to de-

termine the income tax withholding for the nonresident

alien employee. In this example, the employer would with-

hold $31 in federal income tax from the weekly wages of

the nonresident alien employee.

The $198.10 added to wages for calculating income tax

withholding isn't reported on Form W-2 and doesn't in-

crease the income tax liability of the employee. Also, the

$198.10 added to wages doesn't affect the social security

tax or Medicare tax liability of the employer or the em-

ployee, or the FUTA tax liability of the employer.

Supplemental wage payment. This procedure for deter-

mining the amount of federal income tax withholding for

nonresident alien employees doesn't apply to a supple-

mental wage payment (see section 7 of Pub. 15) if the

37% mandatory flat rate withholding applies or if the 22%

optional flat rate withholding is being used to figure in-

come tax withholding on the supplemental wage payment.

Form W-4P

Payees use Form W-4P to have payers withhold the cor-

rect amount of federal income tax from periodic pension,

annuity (including commercial annuities), profit-sharing

and stock bonus plan, or IRA payments.

Using a 2022 or later Form W-4P. Payees provide pay-

ers with amounts to increase or decrease the amount of

taxes withheld and amounts to increase or decrease the

amount of pension/annuity payments subject to income

tax withholding. Form W-4P contains 5 steps. Every Form

W-4P payers receive from a payee in 2022 or later should

show a completed Step 1 (name, address, SSN, and filing

status) and a dated signature in Step 5. Payees complete

Steps 2, 3, and/or 4 only if relevant to their personal situa-

tions. Steps 2, 3, and 4 show adjustments that affect with-

holding calculations.

For payees completing one or more of Steps 2, 3,

and/or 4 on a 2022 or later Form W-4P, adjustments are as

follows.

Step 2. If the payee completes Step 2, the payer will use

the amount in Step 2(b)(iii) from a 2022 or later Form

W-4P in Worksheet 1B to figure income tax withholding.

6 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

Consider advising payees to use the IRS Tax

Withholding Estimator, available at IRS.gov/

W4App, when completing Form W-4P if they have

social security, dividend, capital gain, or business income;

are subject to the Additional Medicare Tax or Net Invest-

ment Income Tax; or they receive these payments or pen-

sion and annuity payments for only part of the year.

Step 3. Payers use the amount on this line as an annual

reduction in the amount of withholding. Payers should use

the amount the payee entered as the total in Step 3 of

Form W-4P even if it is not equal to the sum of any

amounts entered on the left in Step 3 because the total

may take into account other tax credits. If the Step 3 total

is blank, but there are amounts entered on one or two of

the left lines in Step 3, the payer may ask the payee if leav-

ing the line blank was intentional.

Steps 4(a) and 4(b). Payers increase the annual amount

of pension/annuity payments subject to income tax with-

holding by the annual amount shown in Step 4(a) and re-

duce the annual amount of pension/annuity payments

subject to income tax withholding by the annual amount

shown in Step 4(b).

Step 4(c). Payers will increase withholding on each pay-

ment by the tax amount in Step 4(c).

Payee fails to furnish Form W-4P or provides an in-

correct SSN on Form W-4P. In the case of a payer using

a 2022 or later Form W-4P, a payee who received the first

periodic pension or annuity payment after 2021 but who

fails to furnish a 2022 or later Form W-4P or fails to pro-

vide a correct SSN on a 2022 or later Form W-4P will be

treated as if they had checked the box for Single in Step 1

and had no entries in Step 2, Step 3, and Step 4 of a 2022

or later Form W-4P. In the case of a payer that used the

2021 Form W-4P for 2022 and hasn't received a 2022 or

later Form W-4P, a payee who received the first periodic

pension or annuity payment in 2022 but who failed to fur-

nish such a 2021 Form W-4P will continue be treated as if

they had no entries on lines 1 and 3 and completed line 2

indicating a status of Married, and claiming 3 allowances.

In the case of a payer that used the 2021 Form W-4P and

hasn't received a 2022 or later Form W-4P, a payee who

received the first periodic pension or annuity payment in

2022 but who failed to provide a correct SSN on the 2021

Form W-4P will continue to be treated as if they had no

entries on lines 1 and 3 and had completed line 2 indicat-

ing a status of Single, and claiming zero allowances. If a

payee received their first periodic pension or annuity pay-

ment before 2022 and had failed to furnish a Form W-4P

when those payments began, you must continue to with-

hold on those periodic payments as if the recipient were

married claiming three withholding allowances on a Form

W-4P for 2021 or earlier, unless the payee furnishes a

Form W-4P requesting a change in withholding. If a payee

is treated as married claiming three withholding allowan-

ces on a 2021 or earlier Form W-4P, tax will be withheld on

a payment that is at least $2,440 per month.

TIP

Choosing not to have income tax withheld. A payee

who writes “No Withholding” on a 2022 or later Form

W-4P in the space below Step 4(c) shall have no federal

income tax withheld from their periodic pension or annuity

payments. In the case of a payer that used the 2021 Form

W-4P for 2022, a payee who checked the box on line 1 on

the 2021 Form W-4P shall have no federal income tax

withheld from their periodic pension or annuity payments.

Regardless of the Form W-4P used, generally a payee

who is a U.S. citizen or a resident alien isn't permitted to

elect no withholding on payments that are to be delivered

outside of the United States or its territories.

Withholding on periodic pension and annuity pay-

ments to nonresident aliens and foreign estates.

Withholding methods on periodic pension and annuity

payments discussed in this publication don't apply to non-

resident aliens and foreign estates. See Pub. 515, With-

holding of Tax on Nonresident Aliens and Foreign Entities,

for more information.

Substitute Submissions of Form W-4P

General requirements for any system set up to electroni-

cally receive a Form W-4 or Form W-4P are discussed

earlier under Electronic submission of Forms W-4 and

W-4P. This section provides specific requirements for

substitute submissions of Form W-4P. For payers using

electronic or paper substitutes for Form W-4P, substitute

forms for the 2024 Form W-4P incorporating all changes

made to the 2024 Form W-4P and complying with the

guidelines provided here must be in use by the later of

January 1, 2024, or 30 days after the IRS releases the fi-

nal version of the 2024 Form W-4P.

Electronic Substitute to Form W-4P

Electronic systems set up as a substitute to paper 2022 or

later Forms W-4P must exactly replicate the text and in-

structions from the face of the paper Form W-4P begin-

ning with Step 1(c) through Step 4(c) (inclusive). No

pop-ups or hoverboxes within those steps are permitted

and if the electronic system has toggles for those steps

that limit the amount of text that is viewable, the toggles

must be off as the default. If the electronic system places

steps on different pages, users must be required to go to

each page before they may electronically sign the form.

References to pages 2 and 3, when not applicable to the

substitute form, should be replaced by appropriate refer-

ences. For example, an electronic substitute form that

links directly to the deductions worksheet shouldn't refer-

ence “page 3” but should provide a link to the deductions

worksheet. The electronic system must also include a hy-

perlink to Form W-4P on IRS.gov or include the instruc-

tions and worksheet in their entirety in the electronic sys-

tem interface itself (inclusion of only some of this

information requires a link to the form). Finally, the elec-

tronic system must provide a field (including, for example,

a checkbox) immediately below or after Step 4(c) to allow

users to elect no withholding from their payments.

Publication 15-T (2024) 7

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

Requiring an SSN and other personal information al-

ready stored in payer's electronic system. If you elec-

tronically store payee personal information, including

name, address, and SSN, and accept withholding elec-

tions through an account specifically tied to the payee, you

need not require the payee to submit this personal infor-

mation again when completing an electronic substitute, as

long as the account where the election is being made is

directly or indirectly linked to the electronically stored per-

sonal information.

Telephonic submissions of Form W-4P. Payers may

provide for telephonic submissions of Form W-4P. You

must use a script that includes all portions of the first page

of the paper Form W-4P from Steps 1(c)–4(c), including

the step titles and text between Steps 1 and 2, with the fol-

lowing exceptions.

•

On Step 2, the script can stop right before “See

page 2 for examples on how to complete Step 2” if,

when asked, the payee indicates the step doesn’t ap-

ply.

•

On Step 3, the script can stop right before “If your total

income will be $200,000 or less . . .” if, when asked,

the payee indicates the step doesn’t apply.

•

Where the language on the first page of Form W-4P

refers payees to later pages of the form, such as for

more information on how to elect to have no federal in-

come tax withheld, the telephonic script should refer

the payee to IRS.gov/FormW4P in addition to the ref-

erenced page numbers.

Paper Substitute to Form W-4P

When providing paper substitute forms for Form W-4P, you

should generally follow the same guidelines that apply to

electronic substitutes to Form W-4P, except where those

guidelines apply only in the context of electronic substi-

tutes (for example, instructions concerning pop-ups and

hoverboxes). Paper substitute forms must include the in-

structions and worksheets for Form W-4P rather than pro-

viding a web address to the instructions on IRS.gov.

How To Treat 2021 and Earlier Forms

W-4P as if They Were 2022 or Later

Forms W-4P

Payers may use an optional computational bridge to treat

2021 and earlier Forms W-4P as if they were 2022 or later

Forms W-4P for purposes of figuring federal income tax

withholding. This computational bridge can reduce system

complexity by allowing payers to permanently use compu-

tational procedures and data fields for a 2022 and later

Form W-4P to arrive at the equivalent withholding for a

payee that would have applied using the computational

procedures and data fields on a 2021 or earlier Form

W-4P. You must make up to four adjustments to use this

computational bridge, but it will simplify data storage and

eliminate some steps in Worksheet 1B.

1. Select the filing status in Step 1(c) of a 2022 or later

Form W-4P that most accurately reflects the payee's

marital status on line 2 of a 2021 or earlier Form W-4P.

Treat the payee as “Single or Married filing separately”

on a 2022 or later Form W-4P if the payee selected ei-

ther “Single” or “Married, but withhold at higher single

rate” as their marital status on their 2021 or earlier

Form W-4P. Treat the payee as “Married filing jointly”

on a 2022 or later Form W-4P if the payee selected

“Married” as their marital status on their 2021 or ear-

lier Form W-4P. You can't convert a payee to a filing

status of “Head of household” using this computa-

tional bridge.

2. Enter an amount in Step 4(a) on a 2022 or later Form

W-4P based on the filing status that you determined in

(1) above when you converted the payee's marital sta-

tus on a 2021 or earlier Form W-4P. Enter $8,600 if

the payee's filing status is “Single or Married filing

separately” or $12,900 if the payee's filing status is

“Married filing jointly.”

3. Multiply the number of allowances claimed on line 2 of

a payee's 2021 or earlier Form W-4P by $4,300 and

enter the result in Step 4(b) on a 2022 or later Form

W-4P.

4. Enter the additional amount of withholding requested

by the payee on line 3 of their 2021 or earlier Form

W-4P in Step 4(c) of a 2022 or later Form W-4P.

If you use this computational bridge, you will skip Steps

1(j)–(l) and any other instructions in Worksheet 1B that ref-

erence a 2021 or earlier Form W-4P.

This computational bridge applies only to Forms

W-4P (including default elections) that were in ef-

fect on or before December 31, 2021, and that

continue in effect because a payee didn't submit a 2022 or

later Form W-4P. If a payee chooses to submit a new Form

W-4P, it doesn't change the general requirement that the

payee must use the current year's revision of Form W-4P.

Upon putting in effect a new Form W-4P from a payee, you

must stop using this computational bridge for the applica-

ble year of the new Form W-4P. If a payer was unable to

put the 2022 Form W-4P in place during 2022, the compu-

tational bridge can also be applied to 2021 Forms W-4P

submitted in 2022.

Rounding

To figure the income tax to withhold, you may reduce the

last digit of the wages to zero, or figure the wages to the

nearest dollar. You may also round the tax for the pay pe-

riod to the nearest dollar. If rounding is used, it must be

used consistently. Withheld tax amounts should be roun-

ded to the nearest whole dollar by dropping amounts un-

der 50 cents and increasing amounts from 50 to 99 cents

to the next dollar. For example, $2.30 becomes $2 and

$2.50 becomes $3.

CAUTION

!

8 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

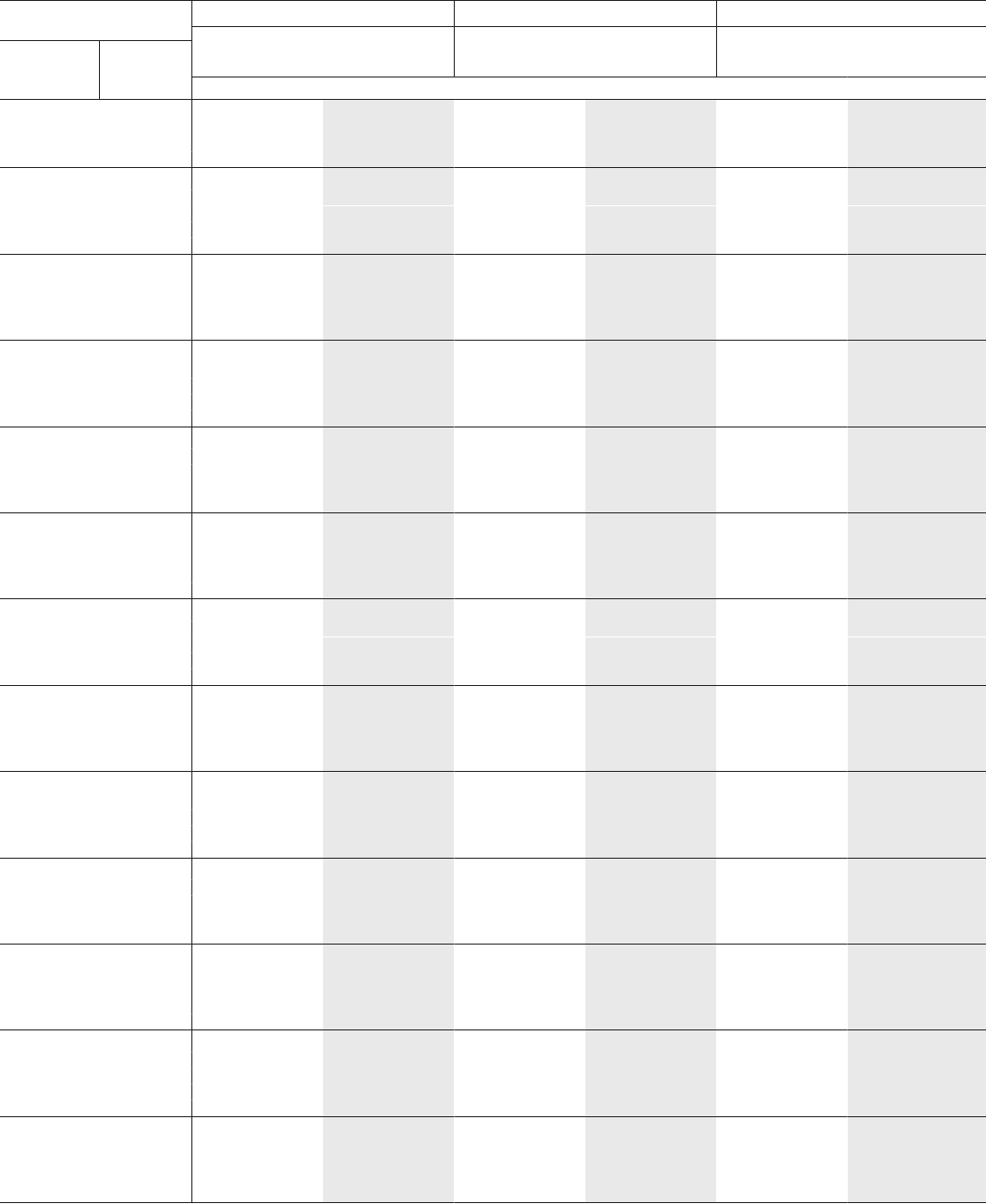

1. Percentage Method Tables

for Automated Payroll Systems

and Withholding on Periodic

Payments of Pensions and

Annuities

If you're an employer with an automated payroll system,

use Worksheet 1A and the Percentage Method tables in

this section to figure federal income tax withholding. This

method works for Forms W-4 for all prior, current, and fu-

ture years. This method also works for any amount of wa-

ges. If the Form W-4 is from 2019 or earlier, this method

works for any number of withholding allowances claimed.

If you're a payer making periodic payments of pensions

and annuities, use Worksheet 1B and the Percentage

Method tables in this section to figure federal income tax

withholding. This method works for Forms W-4P for all

prior, current, and future years. If a payer is figuring with-

holding on periodic payments based on a 2021 or earlier

Form W-4P, the payer may also figure withholding using

the methods described in section 3 and section 5.

Worksheet 1A. Employer’s Withholding Worksheet for

Percentage Method Tables for Automated Payroll Systems Keep for Your Records

Table 3

Semiannually Quarterly Monthly Semimonthly Biweekly Weekly Daily

2 4 12 24 26 52 260

Step 1. Adjust the employee's payment amount

1a Enter the employee’s total taxable wages this payroll period ..................................

1a

$

1b Enter the number of pay periods you have per year (see Table 3) ...............................

1b

1c Multiply the amount on line 1a by the number on line 1b .....................................

1c

$

If the employee HAS submitted a Form W-4 for 2020 or later, figure the Adjusted Annual Wage Amount as follows:

1d Enter the amount from Step 4(a) of the employee's Form W-4 .................................

1d

$

1e Add lines 1c and 1d ..............................................................

1e

$

1f Enter the amount from Step 4(b) of the employee's Form W-4 .................................

1f

$

1g If the box in Step 2 of Form W-4 is checked, enter -0-. If the box is not checked, enter $12,900 if the taxpayer

is married filing jointly or $8,600 otherwise .............................................. 1g

$

1h Add lines 1f and 1g ..............................................................

1h

$

1i Subtract line 1h from line 1e. If zero or less, enter -0-. This is the Adjusted Annual Wage Amount .......

1i

$

If the employee HAS NOT submitted a Form W-4 for 2020 or later, figure the Adjusted Annual Wage Amount as follows:

1j Enter the number of allowances claimed on the employee's most recent Form W-4 ...................

1j

1k Multiply line 1j by $4,300 ..........................................................

1k

$

1l Subtract line 1k from line 1c. If zero or less, enter -0-. This is the Adjusted Annual Wage Amount .......

1l

$

Step 2. Figure the Tentative Withholding Amount

based on the employee's Adjusted Annual Wage Amount; filing status (Step 1(c) of the 2020 or later Form W-4) or marital status (line 3 of

Form W-4 from 2019 or earlier); and whether the box in Step 2 of 2020 or later Form W-4 is checked.

Note. Don't use the Head of Household table if the Form W-4 is from 2019 or earlier.

2a Enter the employee's Adjusted Annual Wage Amount from line 1i or 1l above .....................

2a

$

2b Find the row in the appropriate Annual Percentage Method table in which the amount on line 2a is at least the

amount in column A but less than the amount in column B, then enter here the amount from column A of that

row ......................................................................... 2b

$

2c Enter the amount from column C of that row .............................................

2c

$

2d Enter the percentage from column D of that row ...........................................

2d

%

2e Subtract line 2b from line 2a ........................................................

2e

$

2f Multiply the amount on line 2e by the percentage on line 2d ...................................

2f

$

2g Add lines 2c and 2f ..............................................................

2g

$

2h Divide the amount on line 2g by the number of pay periods on line 1b. This is the Tentative

Withholding Amount ............................................................ 2h

$

Step 3. Account for tax credits

3a If the employee's Form W-4 is from 2020 or later, enter the amount from Step 3 of that form; otherwise,

enter -0- ...................................................................... 3a

$

3b Divide the amount on line 3a by the number of pay periods on line 1b ............................

3b

$

3c Subtract line 3b from line 2h. If zero or less, enter -0- .......................................

3c

$

Step 4. Figure the final amount to withhold

4a Enter the additional amount to withhold from the employee’s Form W-4 (Step 4(c) of the 2020 or later form, or

line 6 on earlier forms) ............................................................ 4a

$

4b Add lines 3c and 4a. This is the amount to withhold from the employee’s wages this

pay period .................................................................... 4b

$

Publication 15-T (2024) 9

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

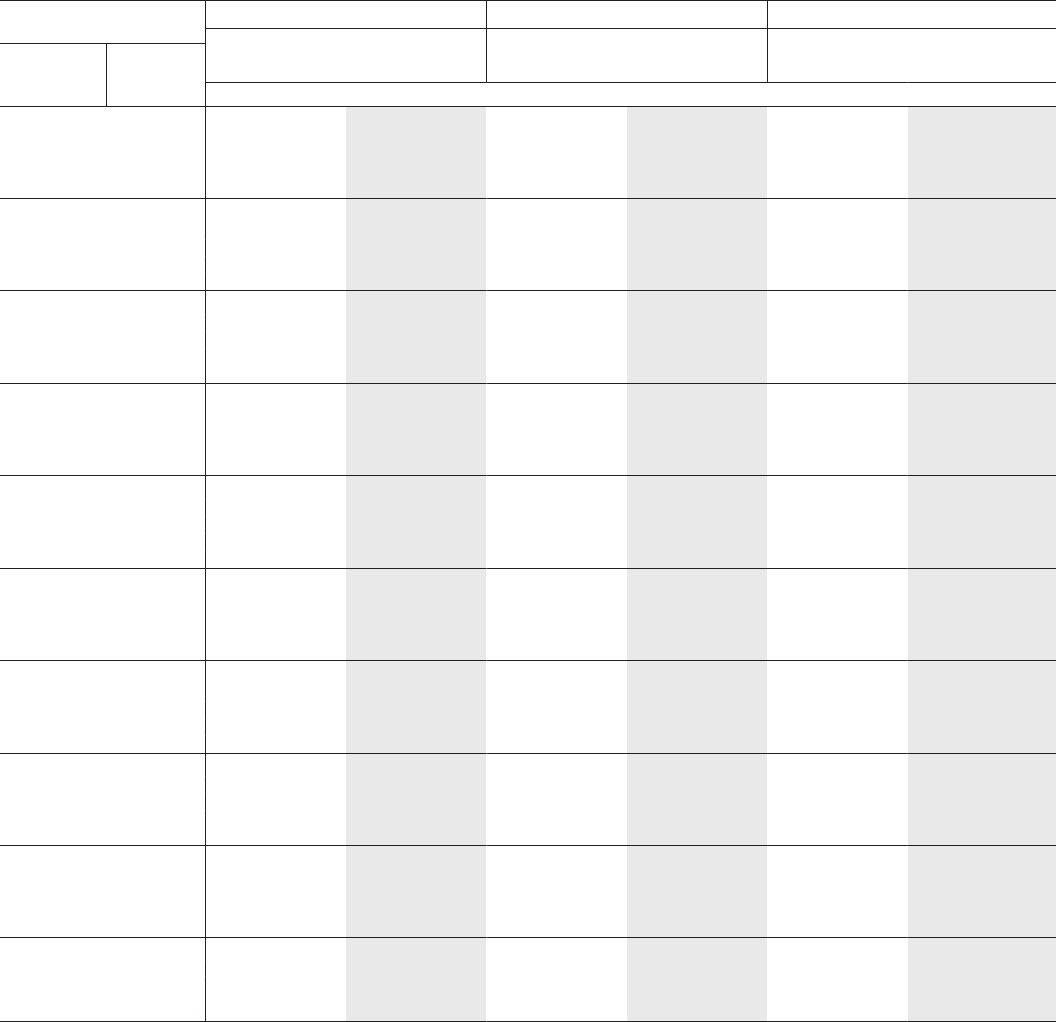

Worksheet 1B. Payer’s Worksheet for Figuring Withholding

From Periodic Pension or Annuity Payments Keep for Your Records

Table 4

Monthly Semimonthly Biweekly Weekly Daily

12 24 26 52 260

Step 1. Adjust the payee's payment amount

1a Enter the payee's total payment this period ................................................

1a

$

1b Enter the number of payment periods you have per year (see Table 4) ...............................

1b

1c Multiply line 1a by the number on line 1b .................................................

1c

$

If the payee HAS submitted a Form W-4P for 2022 or later, figure the Adjusted Annual Payment Amount as follows:

1d Enter the amount from Step 4(a) of the payee's Form W-4P .....................................

1d

$

1e Add lines 1c and 1d ...............................................................

1e

$

1f Enter the amount from Step 4(b) of the payee's Form W-4P .....................................

1f

$

1g Enter $12,900 if the taxpayer is married filing jointly or $8,600 otherwise .............................

1g

$

1h Add lines 1f and 1g ...............................................................

1h

$

1i Subtract line 1h from line 1e. If less than zero, enter it in parentheses. This is the Adjusted Annual

Payment Amount ............................................................... 1i

$

If the payee HAS NOT submitted a Form W-4P for 2022 or later, figure the Adjusted Annual Payment Amount as follows:

1j Enter the number of allowances claimed on the payee's most recent Form W-4P ........................

1j

1k Multiply line 1j by $4,300 ............................................................

1k

$

1l Subtract line 1k from line 1c. (If zero or less, enter -0-.) This is the Adjusted Annual Payment Amount .........

1l

$

Step 2. Figure the Tentative Annual Withholding Amount

based on the payee's Adjusted Annual Payment Amount and filing status (Step 1(c) of the 2022 or later Form W-4P) or marital status (line 2 of the 2021

or earlier Form W-4P).

If the payee HAS submitted a Form W-4P for 2022 or later AND Step 2(b)(iii) of Form W-4P contains a non-zero amount, complete Parts I, II, and III of Step 2.

Otherwise, complete Parts I and III only.

Part I: If the payee HAS submitted a Form W-4P for 2022 or later AND Step 2(b)(iii) of Form W-4P contains a non-zero amount, complete lines 2a–2c

and then resume on line 2e. Otherwise, begin on line 2d.

2a Enter the amount from Step 2(b)(iii) of Form W-4P ...........................................

2a

$

2b Enter $12,900 if the taxpayer is married filing jointly or $8,600 otherwise .............................

2b

$

2c Subtract line 2b from line 2a. (If the result is zero or less, enter -0-.) Then skip to line 2e ...................

2c

$

OR

2d If lines 2a–2c don’t apply: Enter the payee's Adjusted Annual Payment Amount from line 1i or 1l, but not less

than zero ..................................................................... 2d

$

2e Using the amount on line 2c or line 2d (whichever is not missing), find the row in the STANDARD Withholding Rate

Schedules of the Annual Percentage Method table in which the amount on line 2c or line 2d (whichever is not

missing) is at least the amount in column A but less than the amount in column B, and then enter here the amount from

column A of that row .............................................................. 2e

$

2f Enter the amount from column C of that row ...............................................

2f

$

2g Enter the percentage from column D of that row .............................................

2g

%

2h Subtract line 2e from line 2c or line 2d (whichever is not missing) ..................................

2h

$

2i Multiply the amount on line 2h by the percentage on line 2g .....................................

2i

$

2j Add lines 2f and 2i ................................................................

2j

$

Part II: (Complete Part II if there is an amount on line 2a above. Skip Part II if there is an amount on line 2d above.)

2k Enter the amount from Step 2(b)(iii) of the payee's Form W-4P, even if negative .........................

2k

$

2l Enter the payee's Adjusted Annual Payment Amount from line 1i above, even if negative .................

2l

$

2m Add lines 2k and 2l. If the result is zero or less, enter -0- ........................................

2m

$

2n Find the row in the appropriate STANDARD Withholding Rate Schedules of the Annual Percentage Method table in

which the amount on line 2m is at least the amount in column A but less than the amount in column B, and then enter

here the amount from column A of that row ................................................ 2n

$

2o Enter the amount from column C of that row ...............................................

2o

$

2p Enter the percentage from column D of that row .............................................

2p

%

2q Subtract line 2n from line 2m .........................................................

2q

$

2r Multiply the amount on line 2q by the percentage on line 2p .....................................

2r

$

2s Add lines 2o and 2r ...............................................................

2s

$

2t Subtract line 2j from line 2s. If zero or less, enter -0- ..........................................

2t

$

Part III: For ALL payees, identify the Tentative Annual Withholding Amount as follows:

2u If there is a non-zero amount in Step 2(b)(iii) of the payee's 2022 or later Form W-4P, enter the amount from line 2t.

Otherwise, enter the amount from line 2j .................................................. 2u

$

Step 3. Account for tax credits

3a If the payee has submitted a Form W-4P for 2022 or later, enter the amount from Step 3 of that form; otherwise,

enter -0- ...................................................................... 3a

$

3b Subtract line 3a from line 2u. If zero or less, enter -0- ..........................................

3b

$

Step 4. Figure the final amount to withhold

4a Divide the amount on line 3b by the number of payment periods from line 1b ..........................

4a

$

4b Enter the additional amount to withhold from the payee's Form W-4P (Step 4(c) of the 2022 or later Form W-4P or

line 3 of the 2021 or earlier Form W-4P) .................................................. 4b

$

4c Add lines 4a and 4b. This is the amount to withhold from the payee’s payment this payment period .......

4c

$

10 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

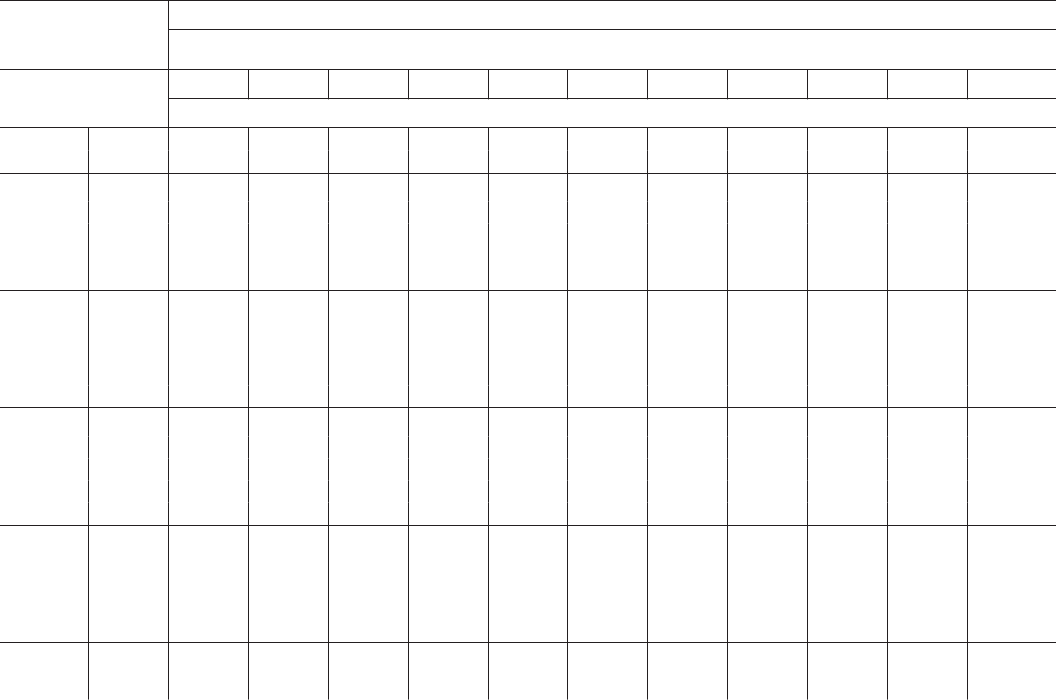

2024 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic

Payments of Pensions and Annuities

STANDARD Withholding Rate Schedules

(Use these if the Form W-4 is from 2019 or earlier, or if the Form W-4 is

from 2020 or later and the box in Step 2 of Form W-4 is NOT checked. Also

use these for Form W-4P from any year.)

Form W-4, Step 2, Checkbox, Withholding Rate Schedules

(Use these if the Form W-4 is from 2020 or later and the box in Step 2 of

Form W-4 IS checked)

If the Adjusted Annual

Wage Amount on

Worksheet 1A or

the Adjusted Annual

Payment Amount on

Worksheet 1B is:

The

tentative

amount to

withhold is:

Plus this

percentage—

of the

amount that

the Adjusted

Annual Wage

or Payment

exceeds—

If the Adjusted Annual

Wage Amount on

Worksheet 1A is:

The

tentative

amount to

withhold is:

Plus this

percentage—

of the

amount that

the Adjusted

Annual Wage

exceeds—At least—

But less

than— At least—

But less

than—

A B C D E A B C D E

Married Filing Jointly Married Filing Jointly

$0 $16,300 $0.00 0% $0 $0 $14,600 $0.00 0% $0

$16,300 $39,500 $0.00 10% $16,300 $14,600 $26,200 $0.00 10% $14,600

$39,500 $110,600 $2,320.00 12% $39,500 $26,200 $61,750 $1,160.00 12% $26,200

$110,600 $217,350 $10,852.00 22% $110,600 $61,750 $115,125 $5,426.00 22% $61,750

$217,350 $400,200 $34,337.00 24% $217,350 $115,125 $206,550 $17,168.50 24% $115,125

$400,200 $503,750 $78,221.00 32% $400,200 $206,550 $258,325 $39,110.50 32% $206,550

$503,750 $747,500 $111,357.00 35% $503,750 $258,325 $380,200 $55,678.50 35% $258,325

$747,500 $196,669.50 37% $747,500 $380,200 $98,334.75 37% $380,200

Single or Married Filing Separately Single or Married Filing Separately

$0 $6,000 $0.00 0% $0 $0 $7,300 $0.00 0% $0

$6,000 $17,600 $0.00 10% $6,000 $7,300 $13,100 $0.00 10% $7,300

$17,600 $53,150 $1,160.00 12% $17,600 $13,100 $30,875 $580.00 12% $13,100

$53,150 $106,525 $5,426.00 22% $53,150 $30,875 $57,563 $2,713.00 22% $30,875

$106,525 $197,950 $17,168.50 24% $106,525 $57,563 $103,275 $8,584.25 24% $57,563

$197,950 $249,725 $39,110.50 32% $197,950 $103,275 $129,163 $19,555.25 32% $103,275

$249,725 $615,350 $55,678.50 35% $249,725 $129,163 $311,975 $27,839.25 35% $129,163

$615,350 $183,647.25 37% $615,350 $311,975 $91,823.63 37% $311,975

Head of Household Head of Household

$0 $13,300 $0.00 0% $0 $0 $10,950 $0.00 0% $0

$13,300 $29,850 $0.00 10% $13,300 $10,950 $19,225 $0.00 10% $10,950

$29,850 $76,400 $1,655.00 12% $29,850 $19,225 $42,500 $827.50 12% $19,225

$76,400 $113,800 $7,241.00 22% $76,400 $42,500 $61,200 $3,620.50 22% $42,500

$113,800 $205,250 $15,469.00 24% $113,800 $61,200 $106,925 $7,734.50 24% $61,200

$205,250 $257,000 $37,417.00 32% $205,250 $106,925 $132,800 $18,708.50 32% $106,925

$257,000 $622,650 $53,977.00 35% $257,000 $132,800 $315,625 $26,988.50 35% $132,800

$622,650 $181,954.50 37% $622,650 $315,625 $90,977.25 37% $315,625

Publication 15-T (2024) 11

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

2. Wage Bracket Method Tables

for Manual Payroll Systems

With Forms W-4 From 2020 or

Later

If you compute payroll manually, your employee has sub-

mitted a Form W-4 for 2020 or later, and you prefer to use

the Wage Bracket Method, use the worksheet below and

the Wage Bracket Method tables that follow to figure fed-

eral income tax withholding.

These Wage Bracket Method tables cover a limited

amount of annual wages (generally, less than $100,000). If

you can't use the Wage Bracket Method tables because

taxable wages exceed the amount from the last bracket of

the table (based on filing status and pay period), use the

Percentage Method tables in section 4.

Worksheet 2. Employer’s Withholding Worksheet for Wage

Bracket Method Tables for Manual Payroll Systems With

Forms W-4 From 2020 or Later Keep for Your Records

Table 5

Monthly Semimonthly Biweekly Weekly Daily

12 24 26 52 260

Step 1. Adjust the employee’s wage amount

1a Enter the employee's total taxable wages this payroll period .............................

1a

$

1b Enter the number of pay periods you have per year (see Table 5) .........................

1b

1c Enter the amount from Step 4(a) of the employee's Form W-4 ...........................

1c

$

1d Divide the amount on line 1c by the number of pay periods on line 1b ......................

1d

$

1e Add lines 1a and 1d ..........................................................

1e

$

1f Enter the amount from Step 4(b) of the employee's Form W-4 ...........................

1f

$

1g Divide the amount on line 1f by the number of pay periods on line 1b ......................

1g

$

1h Subtract line 1g from line 1e. If zero or less, enter -0-. This is the Adjusted Wage Amount ......

1h

$

Step 2. Figure the Tentative Withholding Amount

2a Use the amount on line 1h to look up the tentative amount to withhold in the appropriate Wage

Bracket Method table in this section for your pay frequency, given the employee's filing status and

whether the employee has checked the box in Step 2 of Form W-4. This is the Tentative

Withholding Amount ........................................................ 2a

$

Step 3. Account for tax credits

3a Enter the amount from Step 3 of the employee’s Form W-4 .............................

3a

$

3b Divide the amount on line 3a by the number of pay periods on line 1b ......................

3b

$

3c Subtract line 3b from line 2a. If zero or less, enter -0- ..................................

3c

$

Step 4. Figure the final amount to withhold

4a Enter the additional amount to withhold from Step 4(c) of the employee’s Form W-4 ...........

4a

$

4b Add lines 3c and 4a. This is the amount to withhold from the employee’s wages this

pay period ................................................................ 4b

$

12 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

2024 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later

WEEKLY Payroll Period

If the Adjusted Wage

Amount (line 1h) is

Married Filing Jointly Head of Household Single or Married Filing Separately

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

At least

But less

than

The Tentative Withholding Amount is:

$0 $145 $0 $0 $0 $0 $0 $0

$145 $155 $0 $0 $0 $0 $0 $1

$155 $165 $0 $0 $0 $0 $0 $2

$165 $175 $0 $0 $0 $0 $0 $3

$175 $185 $0 $0 $0 $0 $0 $4

$185 $195 $0 $0 $0 $0 $0 $5

$195 $205 $0 $0 $0 $0 $0 $6

$205 $215 $0 $0 $0 $0 $0 $7

$215 $225 $0 $0 $0 $1 $0 $8

$225 $235 $0 $0 $0 $2 $0 $9

$235 $245 $0 $0 $0 $3 $0 $10

$245 $255 $0 $0 $0 $4 $0 $11

$255 $265 $0 $0 $0 $5 $0 $12

$265 $275 $0 $0 $0 $6 $0 $13

$275 $285 $0 $0 $0 $7 $0 $15

$285 $295 $0 $1 $0 $8 $1 $16

$295 $305 $0 $2 $0 $9 $2 $17

$305 $315 $0 $3 $0 $10 $3 $18

$315 $325 $0 $4 $0 $11 $4 $19

$325 $335 $0 $5 $0 $12 $5 $21

$335 $345 $0 $6 $0 $13 $6 $22

$345 $355 $0 $7 $0 $14 $7 $23

$355 $365 $0 $8 $0 $15 $8 $24

$365 $375 $0 $9 $0 $16 $9 $25

$375 $385 $0 $10 $0 $17 $10 $27

$385 $395 $0 $11 $0 $18 $11 $28

$395 $405 $0 $12 $0 $20 $12 $29

$405 $415 $0 $13 $0 $21 $13 $30

$415 $425 $0 $14 $0 $22 $14 $31

$425 $435 $0 $15 $1 $23 $15 $33

$435 $445 $0 $16 $2 $24 $16 $34

$445 $455 $0 $17 $3 $26 $17 $35

$455 $465 $0 $18 $4 $27 $18 $36

$465 $475 $0 $19 $5 $28 $19 $37

$475 $485 $0 $20 $6 $29 $20 $39

$485 $495 $0 $21 $7 $30 $21 $40

$495 $505 $0 $22 $8 $32 $22 $41

$505 $515 $0 $23 $9 $33 $23 $42

$515 $525 $0 $24 $10 $34 $24 $43

$525 $535 $0 $25 $11 $35 $25 $45

$535 $545 $0 $27 $12 $36 $27 $46

$545 $555 $0 $28 $13 $38 $28 $47

$555 $565 $0 $29 $14 $39 $29 $48

$565 $575 $1 $30 $15 $40 $30 $49

$575 $585 $2 $31 $16 $41 $31 $51

$585 $595 $3 $33 $17 $42 $33 $52

$595 $605 $4 $34 $18 $44 $34 $54

$605 $615 $5 $35 $19 $45 $35 $56

$615 $625 $6 $36 $20 $46 $36 $58

$625 $635 $7 $37 $21 $47 $37 $60

$635 $645 $8 $39 $22 $48 $39 $62

$645 $655 $9 $40 $23 $50 $40 $65

$655 $665 $10 $41 $24 $51 $41 $67

$665 $675 $11 $42 $25 $52 $42 $69

$675 $685 $12 $43 $26 $53 $43 $71

$685 $695 $13 $45 $27 $54 $45 $73

$695 $705 $14 $46 $28 $56 $46 $76

$705 $715 $15 $47 $29 $57 $47 $78

$715 $725 $16 $48 $30 $58 $48 $80

$725 $735 $17 $49 $31 $59 $49 $82

$735 $745 $18 $51 $32 $60 $51 $84

$745 $755 $19 $52 $33 $62 $52 $87

$755 $765 $20 $53 $34 $63 $53 $89

$765 $775 $21 $54 $35 $64 $54 $91

Publication 15-T (2024) 13

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

2024 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later

WEEKLY Payroll Period

If the Adjusted Wage

Amount (line 1h) is

Married Filing Jointly Head of Household Single or Married Filing Separately

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

At least

But less

than

The Tentative Withholding Amount is:

$775 $785 $22 $55 $37 $65 $55 $93

$785 $795 $23 $57 $38 $66 $57 $95

$795 $805 $24 $58 $39 $68 $58 $98

$805 $815 $25 $59 $40 $69 $59 $100

$815 $825 $26 $60 $41 $70 $60 $102

$825 $835 $27 $61 $43 $72 $61 $104

$835 $845 $28 $63 $44 $75 $63 $106

$845 $855 $29 $64 $45 $77 $64 $109

$855 $865 $30 $65 $46 $79 $65 $111

$865 $875 $31 $66 $47 $81 $66 $113

$875 $885 $32 $67 $49 $83 $67 $115

$885 $895 $33 $69 $50 $86 $69 $117

$895 $905 $34 $70 $51 $88 $70 $120

$905 $915 $35 $71 $52 $90 $71 $122

$915 $925 $36 $72 $53 $92 $72 $124

$925 $935 $37 $73 $55 $94 $73 $126

$935 $945 $38 $75 $56 $97 $75 $128

$945 $955 $39 $76 $57 $99 $76 $131

$955 $965 $40 $77 $58 $101 $77 $133

$965 $975 $41 $78 $59 $103 $78 $135

$975 $985 $42 $79 $61 $105 $79 $137

$985 $995 $43 $81 $62 $108 $81 $139

$995 $1,005 $44 $82 $63 $110 $82 $142

$1,005 $1,015 $45 $83 $64 $112 $83 $144

$1,015 $1,025 $46 $84 $65 $114 $84 $146

$1,025 $1,035 $47 $85 $67 $116 $85 $148

$1,035 $1,045 $48 $87 $68 $119 $87 $150

$1,045 $1,055 $50 $88 $69 $121 $88 $153

$1,055 $1,065 $51 $89 $70 $123 $89 $155

$1,065 $1,075 $52 $90 $71 $125 $90 $157

$1,075 $1,085 $53 $91 $73 $127 $91 $159

$1,085 $1,095 $54 $93 $74 $130 $93 $161

$1,095 $1,105 $56 $94 $75 $132 $94 $164

$1,105 $1,115 $57 $95 $76 $134 $95 $166

$1,115 $1,125 $58 $96 $77 $136 $96 $168

$1,125 $1,135 $59 $97 $79 $138 $97 $171

$1,135 $1,145 $60 $99 $80 $141 $99 $173

$1,145 $1,155 $62 $100 $81 $143 $100 $175

$1,155 $1,165 $63 $101 $82 $145 $101 $178

$1,165 $1,175 $64 $102 $83 $147 $102 $180

$1,175 $1,185 $65 $103 $85 $149 $103 $183

$1,185 $1,195 $66 $105 $86 $152 $105 $185

$1,195 $1,205 $68 $107 $87 $154 $107 $187

$1,205 $1,215 $69 $109 $88 $157 $109 $190

$1,215 $1,225 $70 $111 $89 $159 $111 $192

$1,225 $1,235 $71 $114 $91 $161 $114 $195

$1,235 $1,245 $72 $116 $92 $164 $116 $197

$1,245 $1,255 $74 $118 $93 $166 $118 $199

$1,255 $1,265 $75 $120 $94 $169 $120 $202

$1,265 $1,275 $76 $122 $95 $171 $122 $204

$1,275 $1,285 $77 $125 $97 $173 $125 $207

$1,285 $1,295 $78 $127 $98 $176 $127 $209

$1,295 $1,305 $80 $129 $99 $178 $129 $211

$1,305 $1,315 $81 $131 $100 $181 $131 $214

$1,315 $1,325 $82 $133 $101 $183 $133 $216

$1,325 $1,335 $83 $136 $103 $185 $136 $219

$1,335 $1,345 $84 $138 $104 $188 $138 $221

$1,345 $1,355 $86 $140 $105 $190 $140 $223

$1,355 $1,365 $87 $142 $106 $193 $142 $226

$1,365 $1,375 $88 $144 $107 $195 $144 $228

$1,375 $1,385 $89 $147 $109 $197 $147 $231

$1,385 $1,395 $90 $149 $110 $200 $149 $233

$1,395 $1,405 $92 $151 $111 $202 $151 $235

$1,405 $1,415 $93 $153 $112 $205 $153 $238

$1,415 $1,425 $94 $155 $113 $207 $155 $240

14 Publication 15-T (2024)

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

2024 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later

WEEKLY Payroll Period

If the Adjusted Wage

Amount (line 1h) is

Married Filing Jointly Head of Household Single or Married Filing Separately

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

At least

But less

than

The Tentative Withholding Amount is:

$1,425 $1,435 $95 $158 $115 $209 $158 $243

$1,435 $1,445 $96 $160 $116 $212 $160 $245

$1,445 $1,455 $98 $162 $117 $214 $162 $247

$1,455 $1,465 $99 $164 $118 $217 $164 $250

$1,465 $1,475 $100 $166 $119 $219 $166 $252

$1,475 $1,485 $101 $169 $121 $221 $169 $255

$1,485 $1,495 $102 $171 $122 $224 $171 $257

$1,495 $1,505 $104 $173 $123 $226 $173 $259

$1,505 $1,515 $105 $175 $124 $229 $175 $262

$1,515 $1,525 $106 $177 $125 $231 $177 $264

$1,525 $1,535 $107 $180 $127 $233 $180 $267

$1,535 $1,545 $108 $182 $128 $236 $182 $269

$1,545 $1,555 $110 $184 $129 $238 $184 $271

$1,555 $1,565 $111 $186 $130 $241 $186 $274

$1,565 $1,575 $112 $188 $131 $243 $188 $276

$1,575 $1,585 $113 $191 $133 $245 $191 $279

$1,585 $1,595 $114 $193 $134 $248 $193 $281

$1,595 $1,605 $116 $195 $135 $250 $195 $283

$1,605 $1,615 $117 $197 $136 $253 $197 $286

$1,615 $1,625 $118 $199 $137 $255 $199 $288

$1,625 $1,635 $119 $202 $139 $257 $202 $291

$1,635 $1,645 $120 $204 $140 $260 $204 $293

$1,645 $1,655 $122 $206 $143 $262 $206 $295

$1,655 $1,665 $123 $208 $145 $265 $208 $298

$1,665 $1,675 $124 $210 $147 $267 $210 $300

$1,675 $1,685 $125 $213 $149 $269 $213 $303

$1,685 $1,695 $126 $215 $151 $272 $215 $305

$1,695 $1,705 $128 $217 $154 $274 $217 $307

$1,705 $1,715 $129 $219 $156 $277 $219 $310

$1,715 $1,725 $130 $221 $158 $279 $221 $312

$1,725 $1,735 $131 $224 $160 $281 $224 $315

$1,735 $1,745 $132 $226 $162 $284 $226 $317

$1,745 $1,755 $134 $228 $165 $286 $228 $319

$1,755 $1,765 $135 $230 $167 $289 $230 $322

$1,765 $1,775 $136 $232 $169 $291 $232 $324

$1,775 $1,785 $137 $235 $171 $293 $235 $327

$1,785 $1,795 $138 $237 $173 $296 $237 $329

$1,795 $1,805 $140 $239 $176 $298 $239 $331

$1,805 $1,815 $141 $241 $178 $301 $241 $334

$1,815 $1,825 $142 $243 $180 $303 $243 $336

$1,825 $1,835 $143 $246 $182 $305 $246 $339

$1,835 $1,845 $144 $248 $184 $308 $248 $341

$1,845 $1,855 $146 $250 $187 $310 $250 $343

$1,855 $1,865 $147 $252 $189 $313 $252 $346

$1,865 $1,875 $148 $254 $191 $315 $254 $348

$1,875 $1,885 $149 $257 $193 $317 $257 $351

$1,885 $1,895 $150 $259 $195 $320 $259 $353

$1,895 $1,905 $152 $261 $198 $322 $261 $355

$1,905 $1,915 $153 $263 $200 $325 $263 $358

$1,915 $1,925 $154 $265 $202 $327 $265 $360

Publication 15-T (2024) 15

December 13, 2023

ONLY DRAFT

AND OMB USE

TREASURY/IRS

2024 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later

BIWEEKLY Payroll Period

If the Adjusted Wage

Amount (line 1h) is

Married Filing Jointly Head of Household Single or Married Filing Separately

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding

Standard

withholding

Form W-4, Step 2,

Checkbox

withholding