1Financial Aid FAQ

GW Tuition, Billing and Financial Aid FAQs

Tuition and Billing 2

GW Student Portal 4

Financial Aid at George Washington University 5

Free Application for Federal Student Aid (FAFSA) 8

Direct Unsubsidized Loan 9

Direct Graduate PLUS Loan 11

Loan Deferment and Repayment 14

Military Education Benefits 15

Tax Benefits for Education 17

2Financial Aid FAQ

Financial Aid FAQ

Tuition and Billing

How much does the MPH@GWU program cost?

Tuition is based on the number of credits for which

you register. Current tuition rates can be found on

the MPH tuition and nancial aid page.

Are there additional fees assessed on top of tuition?

For online students, there is a $35 registration fee

assessed every semester. Visit the Student Accounts

page for information on graduate tuition and fees.

Can any fees be waived for online students?

Fees cannot be waived for online students.

How much is the enrollment deposit, and when is

it due?

There is a $300 non-refundable enrollment deposit

due once admitted.

Can I use nancial aid to cover the deposit?

Federal student aid cannot be used to pay the deposit.

Will I be able to view my award package before

submitting the deposit?

There will be an estimated award letter made

available to you prior to completing your deposit.

It takes about 4-6 weeks to process an estimated

award letter. Please keep this timeline in mind and

apply for admissions and nancial aid sooner rather

than later to view everything in a timely manner.

Please note that you will not be able to view or

accept your loan on BanWeb until after the deposit

has been paid.

When will I receive a tuition bill and when is

payment due?

Payment deadlines are listed on the Student

Accounts page.

How do I view my bill?

The George Washington University bills by semester

according to the residential academic calendar.

Tuition costs are determined by the number of credits

enrolled. Statements are available approximately

4-6 weeks prior to the start of the Fall and Spring

semesters and approximately 3-4 weeks prior to

the Summer semester. An email notication is sent

when the bill is ready to view. We do not mail paper

statements; all billing is done electronically through

the Student Account eBill. Students always have

access to their eBill and Student Account status

through GWeb. Students are strongly encouraged to

check their Student Account regularly to ensure that

the account is in good standing. Students can add

Authorized Users (e.g., a parent, relative, spouse, etc.)

so they may also review account activity and/or make

online payments on the Student Account’s page.

What are the accepted forms of payment?

For students using personal funds the accepted

forms of payments are electronic checks, credit

cards, or paper checks.

How does my employer go about paying the school?

Information about Third Party Billing can be found at

the Student Accounts page. Email thirdparty@gwu.

edu for more information.

Are payment plan options available for online

students?

The GW Student Accounts Ofce provides an option

to pay tuition in monthly payments, with xed due

dates for each term. The monthly payment plan

enables students or their authorized users to pay

current Fall and Spring semester tuition and fees

in ve equal payments per semester and current

Summer semester tuition in three equal payments.

Read more information on the Monthly Payment Plan.

3Financial Aid FAQ

What are the consequences if my tuition bill is not

paid when classes begin?

The Student Accounts Ofce applies nancial

fees and holds for outstanding balances, returned

checks, and bad addresses. These holds prevent

students from registering for additional courses,

receiving transcripts, and receiving their diploma.

If I’m eligible to receive a refund, what is

the process?

Student accounts that have been overpaid will

show a credit balance. Refunds resulting from the

crediting of Title IV funds will be automatically

generated within time frames as required by federal

regulations. For all other refunds, students can

choose to leave the credit on the account to apply

to a future term, move all or a portion of the credit

to their GWorld card, or request a refund. For the

policy and procedures for refunds, please review the

Student Tuition Refund Policy.

What is the Title IV Authorization?

By completing the Title IV Authorization, found in

MyGW, GW can apply your federal aid to all your

charges, such as medical insurance, parking nes

and other miscellaneous charges.

Who can I contact at GWU for billing and

payment questions?

For questions regarding billing and payments,

connect with the Student Accounts Ofce.

4Financial Aid FAQ

Financial Aid FAQ

GW Student Portal

What is GWU student portal?

Your MyGW account includes access to academic

records, billing, nancial aid, direct deposit set up,

and more. You will need your GWU ID and Password

to log into MyGW.

How do I set up my GWU ID and Password?

The GWeb Information System, sometimes referred

to as Banner or Banner Self Service, allows online

access to GW student services, such as registering

for classes, viewing student accounts, viewing

grades and accepting nancial aid. Students are

assigned a GWeb account and pin when they have

been accepted and signied their intent to attend

GW, by paying a deposit. Faculty and staff are

assigned a GWeb account and pin as part of the

Human Resources hiring and intake process.

To log into GWeb, you must use your GWid,

which is an alphanumeric value used to identify

an individual’s records within GW’s administrative

systems. Your GWid is the letter G followed by an

8-digit number. You must also use a PIN, which is

usually a 6-digit number, to log in to the GWeb

Information System. If you have forgotten your

GWid, you may submit a GWid retrieval request.

How do I set up my GWU email address?

For information regarding setting up your GWU

email address please visit the “Activate your GWU

email” webpage.

5Financial Aid FAQ

Financial Aid FAQ

Financial Aid at GW

Does GWU offer internal scholarships to

online students?

GWU awards both merit-based scholarships and

partner organization benets to outstanding

students whose professional and academic

achievements set them apart as leaders in the eld.

Please reach out to your Admissions Counselor

about scholarship opportunities.

Are there GWU specic supplemental nancial aid

forms I need to complete?

If you plan to apply for federal student aid, you will

need to complete the Free Application for Federal

Student Aid (FAFSA), Entrance Counseling, and

Loan Agreement (MPN) in order for your loans to

be disbursed. Complete Loan Counseling on the

Federal Student Aid website. Be sure to complete

the documentation for the appropriate loan. If

you are borrowing the Direct Unsubsidized Loan,

complete the requirements listed as subsidized/

unsubsidized loan.

If you plan to borrow the graduate PLUS loan or a

private/alternative loan, you are also required to

complete the Loan Questionnaire Form. Make sure

you select the appropriate academic year for the

appropriate form.

What federal student aid is available to

graduate students?

The types of federal student aid graduate students

are eligible to apply for include the Federal Direct

Unsubsidized Loan and the Federal Direct Graduate

PLUS loan. The FAFSA is the unsubsidized loan

application, meaning if you complete the FAFSA

you will automatically be considered for the federal

unsubsidized loan. If you need an additional federal

loan, you may apply for the graduate PLUS loan

which has additional requirements to the FAFSA.

Learn more about the types of federal student aid.

Why are graduate students not eligible for the

Federal Pell Grant or the Federal Subsidized Loan?

The Department of Education awards Federal Pell

Grants and Direct Subsidized Loans to eligible

undergraduate students who demonstrate nancial

need and have not yet completed their bachelor’s

degrees. The Department of Education does not

evaluate need or income for loans at the graduate or

professional level. Therefore, graduate students are

not eligible for the Federal Pell Grant nor the Direct

Subsidized Loan.

Are there academic requirements I must meet to

receive federal student aid?

Students must maintain Satisfactory Academic

Progress (SAP) to continue receiving nancial aid.

The requirements include the following:

• Maintaining a 3.00 GPA both cumulative and

per semester;

• Pass 67% of all credits attempted both

cumulative and and per semester;

• Complete the degree within 150% of the

credits and timeframe expected for the degree.

Students who fail to meet the SAP requirements will

receive a warning on their rst offense. Students

who are on a warning semester are still eligible to

receive federal nancial aid during that semester to

allow for an opportunity to meet SAP requirements.

Those who fail to meet SAP requirements at the end

of that semester will not be eligible for nancial aid.

Students with extenuating circumstances may

complete an appeal. If denied, students can turn to

private/alternative loans or pay out of pocket until

SAP requirements are met.

6Financial Aid FAQ

What is the minimum number of credits required to

receive federal student aid?

You must be registered for a minimum of 4.5 credits

during the Fall and Spring semesters, and 3 credits

for the Summer semester in order to be eligible

for federal student aid. Fall semester consists of

the September term. Spring semester consists of

both January and April terms combined. Summer

semester is the July term.

What are private loans?

Private education loans, also known as alternative

loans, are offered by private lenders to help students

bridge the gap between the cost of education and

the amount the government allows you to borrow

in federal loans. Lenders offer private educational

loans with different rates, fees, repayment terms, and

approval requirements.

Does GWU recommend specic private lenders?

GWU does not have a preferred lender list, so we do

not recommend particular lenders to students. We

will work with the lender of your choice, so be sure

to do your research and determine the lender you

would like to work with.

When will I receive my nancial aid award?

Financial aid offers typically take 4-6 weeks from

the time you complete the FAFSA or the date you

were admitted to the program, whichever is latest.

Make sure you complete your FAFSA early to speed

up the process. You do not need to be admitted

to complete the FAFSA. When awards are ready to

view, students will receive an email.

How do I accept my nancial aid award?

You can do this by logging into your GWeb by using

your GWID and PIN. Once logged in, please follow

the steps below to access your award:

1. Click on Student Financial Aid Menu

2. Click on My Award Information

3. Click on Award by Aid Year

4. Select appropriate “Financial Aid Year” from the

aid year drop-down menu

5. Click on the “Accept Award” tab on the top

6. You will see options to accept/decline loan

funding and to enter the amount (if any) you

wish to borrow.

Am I required to accept the full amount that I am

offered on my award letter?

No, you do not have to accept the full amount

offered. Students are encouraged to borrow only

what is needed. You can choose to accept all,

part, or none of your nancial aid awards. Once all

your requirements are completed, and your loan is

posted on your student account, you can accept/

decline on your GWeb.

If you decline a portion of your loan, but would like

to access the declined portion at some point during

the academic year, you may do so by completing the

Supplementary Loan Questionnaire.

Does my Direct Loan eligibility cover the entire

cost of the program?

Assuming you are eligible for both the Direct

Unsubsidized Loan and the Direct Graduate PLUS

Loan, you can request enough aid to cover the full

Cost of Attendance for the entirety of your program.

The unsubsidized loan on its own can fully cover 18

credits total per academic year.

How soon will loans be disbursed to my student

account?

Disbursements begin on the rst day of classes

each term (spring I and spring II are combined into

one spring term with one disbursement), provided

all disbursement requirements are satised. Please

note that GW disburses aid based on the campus

academic calendar.

When disbursement runs, it pays any charges that

you have on your account, including tuition and fees.

If you have a negative balance after your tuition and

fees have been paid, you will receive a refund. The

refund process is a separate process and is initiated

after the disbursement. Make sure that you enroll in

direct deposit to receive your refund faster.

7Financial Aid FAQ

Can I use loans to cover additional expenses such

as living expenses, books, supplies, etc.?

Your cost of attendance (COA) for the academic

year consists of direct and indirect expenses. Direct

expenses include costs that you pay directly to

the university, including tuition and fees. Indirect

expenses are costs that you pay during the course

of your education but are not paid directly to the

university. This includes housing, meals, books,

transportation, and personal/miscellaneous items.

The COA is not a bill, but rather a budget to help

with planning for costs related to your education.

You can view a sample cost of attendance on the

SPH nancial aid website. You can also download

the COA spreadsheet from our website for a more

accurate budget based on your planned enrollment.

Who can I contact at GWU for nancial aid

questions?

If you have any questions about tuition and nancial

aid at GWU, please contact the Milken Institute

School of Public Health (SPH) Financial Aid Team by

calling 202-994-1950 or email GWSPHnaid@gwu.

edu.

8Financial Aid FAQ

Financial Aid FAQ

Free Application for Federal Student Aid (FAFSA)

What is the FAFSA?

The Free Application for Federal Student Aid

(FAFSA) is the application the Department of

Education uses to determine if you are eligible to

receive federal student aid.

Where can I nd the FAFSA?

The FAFSA is available online at Studentaid.gov. The

FAFSA is a free application; you will not be asked

to pay. You can also complete the FAFSA on the

myStudentAid App. The GWU school code is 001444.

Do I need to include my social security number

(SSN) in my application for admission to be eligible

for aid?

Yes, you will need to include your SSN in your

application for admissions, in order for GWU to

retrieve your FAFSA from the federal database.

Please contact the SPH Financial Aid Team by

emailing GWSPH[email protected] or calling 202-994-

1950 if you nd any discrepancies or a missing SSN.

Please do not provide your SSN via email, but be

sure to include your GWID for all inquiries. .

Do I need my parents’ tax information to complete

the FAFSA?

If you are applying for graduate school, you are

considered an independent student, and do

not need to include your parents’ information to

complete the FAFSA.

What is the Expected Family Contribution (EFC)?

The Expected Family Contribution (EFC) is a

measurement of your ability to contribute toward

your educational costs. As a graduate/professional

student your EFC is not a factor in your eligibility for

federal student loans.

When should I complete the FAFSA?

The FAFSA is available every October 1st for the

upcoming academic year. New students planning

to use federal student aid should complete a FAFSA

while applying for admission. You do not need to

wait until you are admitted to complete the FAFSA.

Continuing students will need to submit a FAFSA

each year they plan to receive federal student aid.

Please reference the chart below to determine which

FAFSA to complete based on your desired start date:

Start Term FAFSA Year

January 2022 Spring 1 2021–2022

April 2022 Spring 2 2021–2022

July 2022 Summer 2021–2022

September 2022 Fall 2022-2023

Do I need to complete the FAFSA each year?

Yes. Because eligibility for federal student aid does

not carry over from one award year to the next, you

will need to complete the FAFSA for each award

year for which you are or plan to be a student.

What constitutes an academic year for federal

student aid?

An academic year at GWU starts in the fall and ends

in the summer. This is used to calculate your federal

eligibility for one academic year.

9Financial Aid FAQ

What is the Federal Direct Unsubsidized Loan?

The Federal Direct Unsubsidized Loan is a federal

loan offered to students to help with the cost of

education. The Federal Unsubsidized Loan is not

based on income or nancial need. There is an

annual limit of $33,000 for the unsubsidized loan

as well as a lifetime eligibility limit based on your

program of study.

What criteria is used to determine eligibility for

federal student aid?

In order to apply for federal student aid, you must:

• Be a U.S. citizen or eligible noncitizen

• Have a valid Social Security Number (SSN)

• Be registered with Selective Service, if you

are male (must register between the ages of

18 and 25), or meet the waiver requirement

• Be enrolled or accepted for enrollment in an

eligible degree program

• Be enrolled at least half-time (4.5 credits in

the fall/spring and 3 credits in the summer)

• Maintain satisfactory academic progress (SAP)

• Not currently be in default on previous

federal student loans

• Not have exceeded the maximum aggregate

loan limit

Learn more about federal student aid eligibility

criteria on the Federal Student Aid website.

What is the aggregate loan limit?

The aggregate loan limit is the total amount that

you may borrow in federal student loans for

undergraduate and graduate study. In addition

to borrowing limitations based on the cost of

attendance for the program, students are also limited

in terms of lifetime borrowing. The aggregate loan

limit for the MPH@GWU is $224,000.

If the total loan amount you receive over the course

of your education reaches the aggregate loan

limit, you are not eligible to receive additional

unsubsidized loans. However, if you repay some

of your loans to bring your outstanding loan debt

below the aggregate loan limit, you could then

borrow again, up to the amount of your remaining

eligibility under the aggregate loan limit. You can

learn more about graduate annual loan limits on the

Federal Student Aid website.

How do I nd out if I am near my aggregate loan limit?

Log in on the StudentAid.gov homepage to view

your federal student loan borrowing history, and

loan servicer details. Please note that private

education loans are not listed on this site.

Studentsin default are not eligible for additional

federal loans. Contact your lender for default

resolution options.

What is the difference between a Direct Subsidized

Loan and a Direct Unsubsidized Loan?

Direct Subsidized Loans do not accrue interest while

enrolled at least part-time. Undergraduate students

with determined nancial need are eligible for

subsidized loans. Graduate students are not eligible

for any subsidized loans.

The Direct Unsubsidized Loan is available to

undergraduate and graduate students and does

not require demonstration of nancial need.

The Unsubsidized Loan begins accruing interest

as soon as funds are disbursed. Learn more

about the difference between unsubsidized and

subsidized loans.

How much am I eligible for with the Direct

Unsubsidized Loan?

Most graduate level students are potentially eligible

to receive up to $20,500 per academic year in

Direct Unsubsidized Loans. However, students in

the MPH@GW and MHA@GW programs are eligible

for additional unsubsidized loan funds totalling

$33,000 per academic year between fall and

Financial Aid FAQ

Federal Direct Unsubsidized Loan

10Financial Aid FAQ

spring semesters. Students taking at least 3 credits

in the summer term are eligible for an additional

unsubsidized loan.

These amounts are based on maximum annual

loan limits for students who have not reached their

aggregate lifetime loan limit. Learn more about

graduate annual loan limits.

If I am currently enrolled in another program and

use federal student aid in that program, can I also

apply for and use federal student aid at GWU at the

same time?

No, you can only use federal aid at one academic

program at a time. If you have already received

nancial aid for a term at another institution, you

will not be able to access any federal aid at GW for

that term.

If I’m currently enrolled in another program and

using Federal Student Aid can I use Federal

Student Aid for this program as well?

You can only use Federal Student Aid for one

program at a time.

How do I apply for the Direct Unsubsidized Loan?

To apply for the Direct Unsubsidized Loan, you

must complete and submit the Free Application for

Federal Student Aid (FAFSA). The process takes

4-6 weeks from the date you submit the FAFSA or

are admitted into the program, whichever is latest.

Once your loan is ready to view and accept, you will

receive an email. You will need to accept your loan

on GWeb.

What is the current Direct Unsubsidized Loan

interest rate?

The Direct Unsubsidized Loan interest rate is

determined annually on July 1st. Learn more about

interest rates on the Federal Student Aid website.

Are there any additional loan fees for the Direct

Unsubsidized Loan?

There is a loan origination fee that is a percentage

of the total loan amount. The loan origination fee is

deducted from each loan disbursement you receive.

Please note that you are still responsible for repaying

the full loan amount including any origination fees

that are deducted from the loan amount.

Information on unsubsidized and PLUS loan

origination fees can be found on the Interest Rates

and Fees page of the Federal Student Aid website.

11Financial Aid FAQ

up to the cost of attendance annually as determined

by GWU. This includes direct fees: tuition and other

fees, and indirect fees: housing, food, transportation,

books, and personal/miscellaneous items. You can

view a sample cost of attendance, just note that the

only portion that will be adjusted is the number of

credits you will be enrolled in.

When can I apply for the Direct Graduate PLUS Loan?

You can apply for the Direct Graduate PLUS Loan

within 180 days of the start of your program, or once

you are enrolled. The PLUS Loan opens for each

academic year on July 1 for the fall start term. This is

to make sure that your credit check does not expire

during the academic year.

How do I apply for the Direct Graduate PLUS Loan?

1. In order to apply for the Direct Graduate

PLUS loan, you must rst complete the Free

Application for Federal Student Aid (FAFSA). .

2. Apply for the loan at Studentaid.gov and click

on the “in school” tab. Click on the second link

on the right-hand side titled “Apply for a PLUS

Loan for Graduate School.”

What is the Direct Graduate PLUS Loan?

The Direct Graduate PLUS Loan is a federal loan

that graduate or professional degree students can

use to help pay education expenses in addition to

the Direct Unsubsidized Loan. Learn about Direct

PLUS Loans.

Do Direct PLUS Loans affect my aggregate

loan limit?

No, only Direct Subsidized/Direct Unsubsidized

Loans (formerly referred to as Stafford loans) and

federal loans made through the Federal Family

Education Loan (FFEL) Program count toward your

lifetime aggregate loan limit.

What are the eligibility criteria to apply for the

Direct Graduate PLUS Loan?

A soft credit check will be conducted when applying

for the Direct Graduate PLUS Loan. In addition to

the federal student aid eligibility criteria, applicants

cannot have an adverse credit history. If you are

denied, there are options to either appeal the credit

decision or seek an endorser.

What are the credit criteria to receive the Direct

Graduate PLUS Loan?

One of the eligibility requirements to receive a

Graduate PLUS Loan is that you must not have

an adverse credit history. A soft credit check is

performed to determine whether a Graduate PLUS

Loan applicant meets this requirement.

You will also need to complete the Supplementary

Loan Questionnaire outlining how much of the loan

you would like to borrow per term. Be sure to select

the appropriate academic year to complete the

proper form.

How much can I borrow from the Direct Graduate

PLUS Loan?

If approved for the Grad PLUS Loan, you can borrow

Financial Aid FAQ

Federal Direct Graduate PLUS Loan

12Financial Aid FAQ

You will then be taken to another page that

will allow you to log in using your FSA ID

and password:

3. Make sure you complete the Supplementary

Loan Questionnaire:

Ɖ Please keep in mind that a loan fee applies

to each disbursement, which will reduce

the net loan. The current loan fee is 4.236%,

For example, if you borrow $10,000 in

PLUS loans, you will receive $9,576.40 (loan

minus the loan fee).

Ɖ If you are borrowing for 2 semesters,

please make sure that you double the loan.

For example if you want $5,000 for the fall

and $5,000 in the spring make sure you

borrow the total $10,000.

• In Section 2, choose the semester for which

you would like the loan.

• Select where your courses are held.

• For the number of credits, please make sure

you include the credits for all terms under the

correct campus.

• Check “no” for the last question: “If you will

register for fewer than 4.5 credits in the fall

or spring semesters, or less than 3 over the

summer term, will you submit a HalfTime/Full-

Time Certication Request with your advisor?”

• You can sign the form by using approved Adobe

signature technology that datestamps your

signature or print and sign the form manually.

Once you’re done, email the form to

What are the next steps if I’m approved for the

Direct Graduate PLUS Loan?

If approved, complete the Master Promissory Note

for the PLUS Loan. Make sure you complete the

PLUS MPN even if you completed the unsubsidized

MPN. These are two different promissory notes.

Go to Studentaid.gov and click on the “in school”

tab. On the right-hand click on “complete a loan

agreement (master promissory note)”. This will take

you to another page, and you will want to complete

the loan agreement for the unsubsidized loan,

which is the rst option. Log in with your FSA ID and

password, the same one that you use to log in to

your FAFSA.

Sometimes the federal government may require you

to complete a Credit Counseling prior to disbursing

your loan. If you are selected to complete this

requirement, you will be notied by the Department

of Education at the time you are approved for the

PLUS loan.

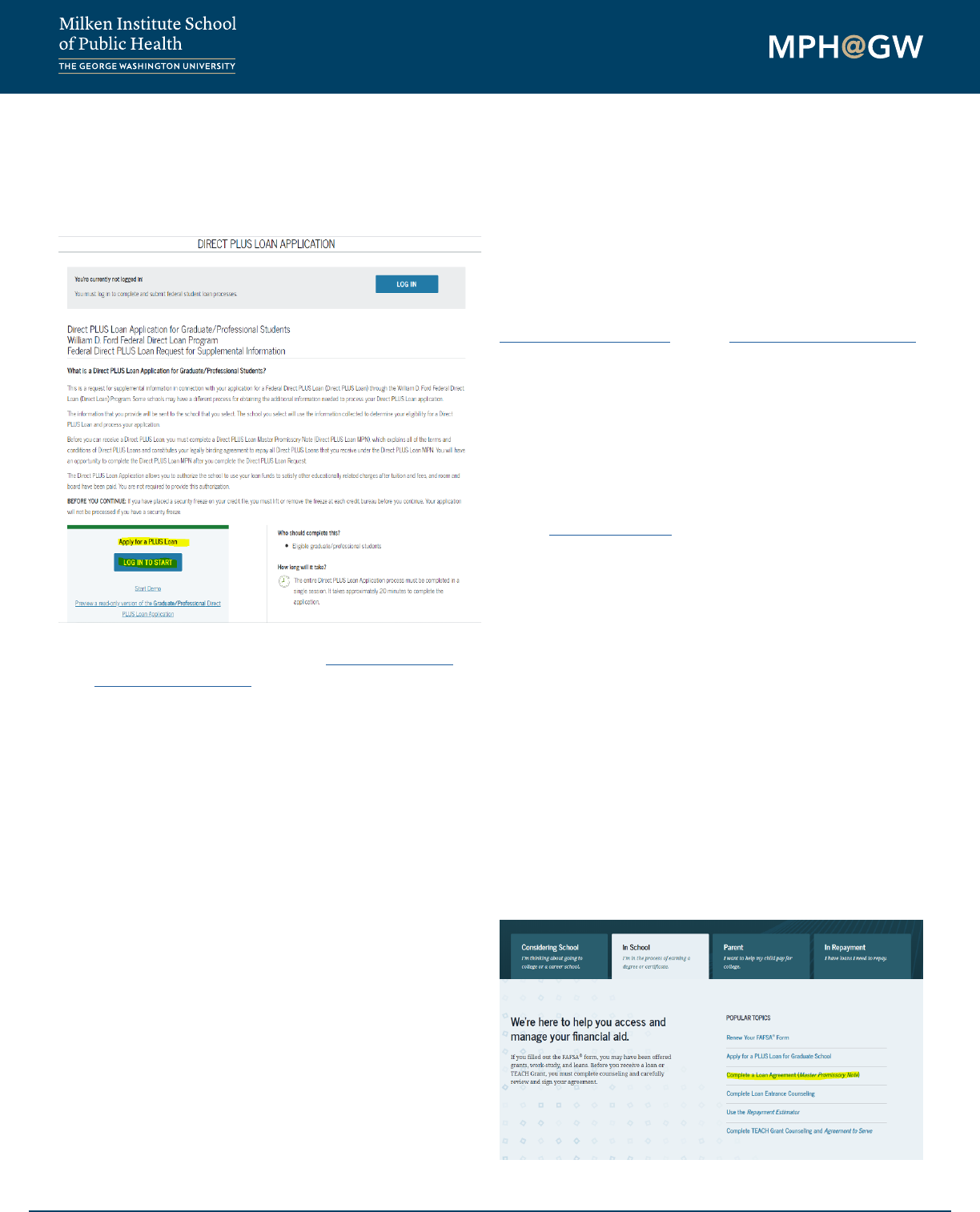

This is a screen shot of the studentaid.gov website

with the links needed to complete highlighted:

13Financial Aid FAQ

Second link for Loan Agreement will take you to this

page:

What are my options if I’m denied the Direct

Graduate PLUS Loan?

If you are denied the Graduate PLUS loan, you

may add an endorser or follow the instructions on

the Department of Education’s website to appeal

the denial.

If those options are not feasible, you can look to a

private/alternative lender.

What is the Direct Graduate PLUS Loan current

interest rate?

The Direct Graduate PLUS Loan interest rate is

determined at the beginning of each academic year,

and is available on the Federal Student Aid website’s

Interest Rates and Fees page.

Are there any additional loan fees for the Direct

Graduate PLUS Loan?

There is a loan origination fee that is a percentage

of the total loan amount. The loan origination fee

is deducted from each loan disbursement you

receive. Information on Direct Graduate PLUS Loan

origination fees can be found on the Interest Rates

and Fees page of the Federal Student Aid website.

14Financial Aid FAQ

Do I have to repay my student loans while I’m

in school?

You are not required to make any payments on

your student loans while you are enrolled at least

half-time. Repayment for federal loans begins 6

months after you drop-below half-time enrollment

or graduate from the program. Your servicer will

contact you with information on how to set up your

payment when you enter repayment.

You can also request to pay the interest while you

are in school in order to avoid capitalization on your

loans. Capitalization occurs when your borrowed

amount and interest combine and charge interest on

the total amount. This occurs every time your loans

enter repayment. If you are interested in enrolling

in interest payments, contact your servicer at least 4

weeks after your loan is disbursed.

A loan servicer is assigned to your loan about 4

weeks after the loan is disbursed. If you are not

sure who your servicer is, please contact Federal

Student Aid.

Most private/alternative loans also have deferred

payment options while you are in school. However,

please conrm with your lender.

When do I have to repay my loan?

After you graduate, leave school, or drop below

half-time enrollment, you will have a 6-month grace

period before you are required to begin repayment.

During this period, you’ll receive repayment

information from your loan servicer, and you will be

notied of your rst payment due date. Payments

are usually due monthly. You are not required to pay

while in school, however if you choose to, there is no

penalty to begin making payments on your loan or

the interest. Learn more about repayment timelines.

What are the repayment plan options and how do I

select one?

The Department of Education (ED) offers multiple

options for repayment. You may visit the DOE website

for more information on loan repayment plans.

Is there a repayment calculator or estimator that I

can use?

Yes, visit the ED website for repayment calculators.

Can I consolidate my graduate loans and my

undergraduate loans?

A Direct Consolidation Loan allows you to

consolidate (combine) multiple federal education

loans into one loan including both graduate and

undergraduate loans. The result is a single monthly

payment instead of multiple payments. This can

be an option for some, be sure to review all the

requirements. Learn more about loan consolidation.

Are there any loan forgiveness options available?

In certain circumstances, all or a portion of a

borrower’s federal student loans may be forgiven

under the federal government’s loan forgiveness

program. Please review the Department of

Education website for more information on federal

loan forgiveness programs.

Financial Aid FAQ

Loan Deferment and Repayment

15Financial Aid FAQ

How do I apply for military education benets?

To begin the process of applying for eligible military

education benets, visit the U.S. Department of

Veterans Affairs website. Questions regarding

eligibility should be directed to the VA at 1-(888)-

442-4551.

Are there scholarship opportunities or tuition

discounts for military students or family members?

There are several scholarships available to military-

afliated students, available from the George

Washington University (GW), from Military and

Veteran Services, and from outside sources.

What documents are required to process military

education benets?

Visit VA.gov to access and manage your VA

education benets. If you are applying for Post-

9/11 GI Bill benets, complete the Education

Benets Application, which generates a request

for a Certicate of Eligibility (COE). The COE is

mailed to you within 6-8 weeks from submitting the

application. A copy of the COE must be provided to

the Ofce of Military and Veteran Student Services

After being admitted to GW, follow the steps

on the Admitted Students Checklist to use your

educational benets.

What are the eligibility factors for the Post 9/11

GI bill?

You are potentially eligible if you have at least 90

days of aggregate active duty service after Sept.10,

2001, and are still on active duty, or if you are an

honorably discharged Veteran or were discharged

with a service-connected disability after 30 days, you

may be eligible for this VA-administered program.

Learn more about the Post-9/11 GI Bill.

How often do I need to request recertication?

As soon as you register for courses, be sure to

complete your ”Request for Certication” through

the GWeb Information System by going to the

Veteran Menu in “Student Records and Registration”

and selecting “Veteran Certication Request.”

This request needs to be submitted before every

semester you wish to use benets.

Will my military benets cover the entire cost of the

program?

Please visit the GI Bill comparison tool to view what

your VA benets will cover at GWU.

Students who are at the 100% eligibility rating for

Post 9/11 GI Bill and are eligible for the Yellow

Ribbon Program typically have little to no out of

pocket cost for year-round full-time enrollment.

How are Post-9/11 GI Bill® benets calculated

at GWU?

Military and Veteran Services reports all applicable

tuition and fees to the VA. Per VA policy, all tuition

specic scholarships are deducted from what is

billed to the VA.

What other military benets does GWU accept

aside from the Post-9/11 GI Bill?

The George Washington University is committed

to providing our student veterans, dependents,

and military personnel with excellence in service

through timely and accurate benet processing,

high-quality customer service, and supportive

community-building activities. In addition to

assistance with education benets, students will have

access to career, social, and wellness/mindfulness

programmatic activities.

Financial Aid FAQ

Military Education Benets

16Financial Aid FAQ

What is the deadline to apply for VA

education benets?

Students must request certication before the add/

drop period in a given semester to avoid incurring late

fees or nance charges related to an account balance.

What are current rates of benets including the

Monthly Housing Allowance (MHA)?

The tuition and fee payment rate, and MHA are

determined at the beginning of each military

academic year on August 1st. The current rate table

is located on the Education and Training page of the

U.S. Department of Veterans Affairs site.

Because GWU is a private university, students who

receive Post-9/11 GI Bill benets are subject to

a maximum tuition and fee reimbursement per

academic year (August 1 through July 31). The

amount of the national cap changes each year on

August 1, and is available to be used from August 1

to July 31 of the following year.

When VA benets are calculated, the amount of

this national cap must be expended before Yellow

Ribbon Program benets can be awarded.

What is the Yellow Ribbon Program (YRP)?

The Yellow Ribbon Program allows degree-granting

colleges and universities to voluntarily enter into

an agreement with the VA to fund tuition and fee

expenses that exceed the national maximum per

academic year.

Participating institutions choose their contribution

amount, the VA matches that amount, and

issue payment directly to the school. Additional

information on the Yellow Ribbon Program available

benets and eligibility, visit the U.S. Department of

Veterans Affairs website.

Does GWU participate in the Yellow Ribbon

Program (YRP)?

Yes GWU participates in the Yellow Ribbon Program.

This program allows institutions of higher learning

(degree granting institutions) in the United States

to voluntarily enter into an agreement with the

Department of Veterans Affairs (VA) to fund tuition

expenses that exceed the maximum base pay amount.

Who can I contact at GWU for questions about

using Military Education Benets?

For questions about military education benets, visit

the GWU Veterans Services Department page.

17Financial Aid FAQ

How do I qualify for a tuition tax credit?

For details on tax benets for education, see IRS

Publication 970. Tax Benets for Higher Education,

which provides detailed information. George

Washington University is unable to provide tax

advice. We urge you to contact your tax advisor or

the IRS at 800-829-1040 or visit www.irs.gov if you

have any questions regarding the HOPE or Lifetime

Learning Tax Credits.

What is the 1098-T Form?

It is an informational form led with the Internal

Revenue Service to report the amounts billed to you

for qualied tuition, related expenses, and other

related information. The primary purpose of the IRS

Form 1098-T is to inform you that we have provided

this required information to the IRS.

Form 1098-T reports amounts paid for qualied

tuition, scholarship and grants processed in 2018 to

students enrolled in courses at GWU for which they

receive academic credit. The information reported

on the 1098-T form helps students evaluate whether

he or she is eligible for an educational tax credit..

How do I obtain my 1098-T Form?

The 1098-T is available to eligible students by

January 31st of each year. You can either opt into

receiving your 1098-T electronically. Please make

sure to add @ecsi.net to your list of trusted emails.

If you don’t opt in, then the forms are mailed to the

billing address on le.

If you have any questions relating to your 1098-T,

please contact ECSI at 1-866-428-1098, or visit

the FAQs.

Financial Aid FAQ

Tax Benets for Education