SDG

INDUSTRY

MATRIX

Financial Services

New Sustainable Development Goals to make our world more:

Prosperous • Inclusive • Sustainable • Resilient

Produced jointly by:

and

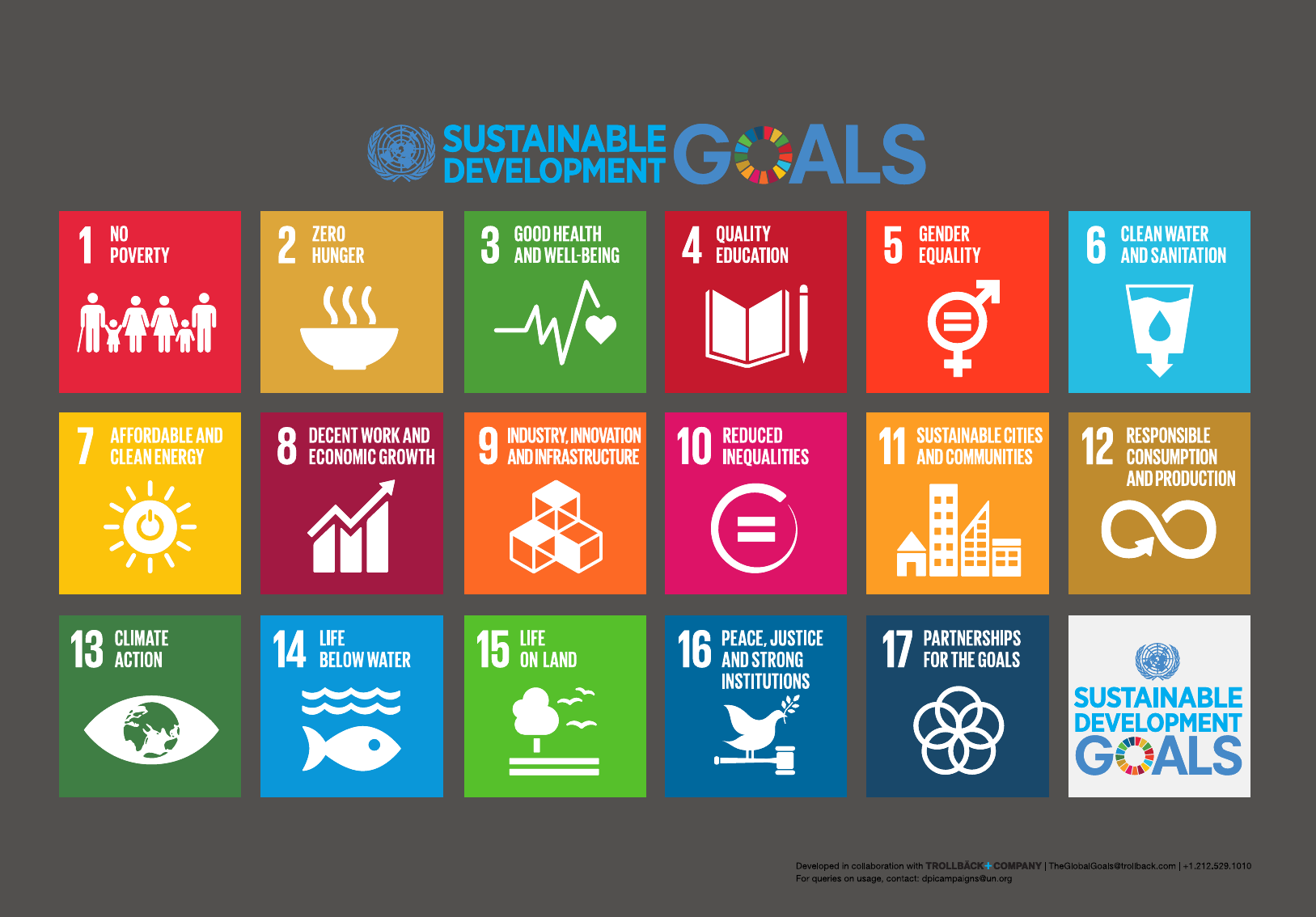

In September 2015, 193 member States

of the United Nations will meet in

New York to adopt 17 new Sustainable

Development Goals (‘SDGs’) to make

our world more prosperous, inclusive,

sustainable and resilient.

NEW GLOBAL GOALS

FOR SUSTAINABLE

DEVELOPMENT

GLOBAL GOALS

2015 - 2030

The SDGs are an ambitious plan of action

for people, planet and prosperity. They are

universal, applying to all nations and people,

seeking to tackle inequality and leave nobody

behind. They are wide ranging including ending

poverty and hunger, ensuring sustainable

consumption and production, and promoting

peaceful and inclusive societies.

The agreement on a new sustainable

development agenda expresses a consensus

by all Governments that the SDGs can only

be achieved with involvement of the private

sector working alongside Governments,

Parliaments, the UN system and other

international institutions, local authorities,

civil society, the scientific and academic

community – and all people. Hence,

Governments in the Post-2015 declaration

“…call on all businesses to apply their

creativity and innovation to solving

sustainable development challenges”.

Each and every SDG provides an opportunity

for business and two are worth highlighting as

cross-cutting themes:

SDG 12 focuses on production and

consumption and includes a specific target

on “adopting sustainable business practices

and reporting”;

SDG 17 includes two targets on multi-

stakeholder partnerships to ensure this

attracts sufficient focus.

SUSTAINABLE

DEVELOPMENT

GOALS

E

L

P

O

E

P

To ensure healthy

lives, knowledge,

and the inclusion

of women and

children.

D

I

G

N

I

T

Y

To end poverty

and fight

inequality.

P

R

O

S

P

E

R

I

T

Y

To grow

a strong,

inclusive, and

transformative

economy.

E

C

T

I

S

J

U

To promote safe

and peaceful

societies, and

strong institutions.

P

L

A

N

E

T

To protect our

ecosystems for

all societies and

our children.

P

A

R

T

N

E

R

S

H

I

P

To catalyze

global solidarity

for sustainable

development.

NO

POVERTY

ZERO

HUNGER

GOOD HEALTH

AND WELL-BEING

QUALITY

EDUCATION

GENDER

EQUALITY

CLEAN WATER

AND SANITATION

AFFORDABLE AND

CLEAN ENERGY

DECENT WORK AND

ECONOMIC GROWTH

INDUSTRY, INNOVATION

AND INFRASTRUCTURE

REDUCED

INEQUALITIES

SUSTAINABLE CITIES

AND COMMUNITIES

RESPONSIBLE

CONSUMPTION

AND PRODUCTION

CLIMATE

ACTION

LIFE

BELOW WATER

LIFE

ON LAND

PEACE, JUSTICE

AND STRONG

INSTITUTIONS

PARTNERSHIPS

FOR THE GOALS

Developed in collaboration with | [email protected] | +1.212.529.1010

For queries on usage, contact: [email protected]

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 4

CONTENTS

SDG INDUSTRY MATRIX................................................................................................................. 5

FINANCIAL SERVICES INDUSTRY HIGHLIGHTS

.................................................................................... 7

Opportunities for shared value ................................................................................................................ 8

The global financial system in context .........................................................................................................10

Financial policy & regulation ................................................................................................................... 11

Good practice principles & initiatives ..........................................................................................................12

Multi-stakeholder partnerships and collaborations .............................................................................................13

SDG INDUSTRY MATRIX FOR FINANCIAL SERVICES

.............................................................................16

SDG 1 End poverty in all its forms everywhere..............................................................................................17

SDG 2 End hunger, achieve food security and improved nutrition and promote sustainable agriculture ......................................19

SDG 3 Ensure healthy lives and promote well-being for all at all ages........................................................................21

SDG 4 Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all ..................................22

SDG 5 Achieve gender equality and empower all women and girls ..........................................................................25

SDG 6 Ensure availability and sustainable management of water and sanitation for all.......................................................27

SDG 7 Ensure access to affordable, reliable, sustainable and modern energy for all .........................................................28

SDG 8 Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all............30

SDG 9 Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation ...............................32

SDG 10 Reduce inequality within and among countries.......................................................................................33

SDG 1 1 Make cities and human settlements inclusive, safe, resilient and sustainable ........................................................35

SDG 12 Ensure sustainable consumption and production patterns............................................................................37

SDG 13 Take urgent action to combat climate change and its impacts ........................................................................39

SDG 14 Conserve and sustainably use the oceans, seas and marine resources for sustainable development .................................42

SDG 15 Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat

desertification, and halt and reverse land degradation and halt biodiversity loss

......................................................43

SDG 16 Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build

effective, accountable and inclusive institutions at all levels

..........................................................................45

SDG 17 Strengthen the means of implementation and revitalize the global partnership for sustainable development .........................47

KEY CONTRIBUTORS

....................................................................................................................48

SDG INDUSTRY MATRIX

A

PURPOSE

The SDG Industry Matrix

aims to inspire and inform

greater private sector

action to drive inclusive,

sustainable prosperity.

Recognising that the opportunities vary by industry, the Matrix provides

industry specific ideas for action and industry specific practical examples

for each relevant SDG. It profiles opportunities which companies expect to

create value for shareholders as well as for society.

The SDG Industry Matrix has been jointly conceived and led by the United

Nations Global Compact and KPMG International Cooperative (‘KPMG’)

to convert the interest stimulated by the Sustainable Development Goals

into strategic industry activities which grow in scale and impact. This could

be through sparking new innovative approaches, prompting companies

to replicate successful activities in new markets, catalysing new

collaborations and increasing participation in existing collaborations.

B

OPPORTUNITY

Through the lens of “shared

value” the private sector can

identify opportunity

in addressing social

and environmental

challenges.

In the context of the SDGs, “shared

value” represents the coming together of

market potential, societal demands and

policy action to create a more sustainable

and inclusive path to economic growth,

prosperity, and well-being

1

. The SDGs

provide an opportunity for companies to

create value for both their business and

society through:

Developing products, services,

technologies and distribution channels

to reach low-income consumers;

Investing in supply chains which are

ethical, inclusive, resource-efficient

and resilient;

Improving the skills, opportunities,

well-being and hence productivity of

employees, contractors and suppliers;

Increasing investment in renewable

energy and other infrastructure projects.

Several trends are making these

opportunities more compelling:

Demographics: The population in

developing regions is projected to

increase from 5.9 billion in 2013 to 8.2

billion in 2050 whilst the population of

developed regions will remain around

1.3 billion people;

Income growth: Between 2010 and

2020, the world’s bottom 40% will

nearly double their spending power

from US$3 trillion to US$5.8 trillion;

Technology: Rapid innovation is

catalysing improved market analysis,

knowledge sharing, product and

service design, renewable energy

sources, distribution models and

operational efficiencies. Technology is

also lowering market entry costs for

non-traditional actors and start-ups with

innovative ‘disruptive’ business models;

Collaborations: Governments,

businesses, international financial

institutions, the United Nations, civil

society and academia are developing

new ways of working with each other

in pursuit of compatible objectives.

1. ‘Unlocking the Power of Partnership: A Framework for Effective Cross-Sector Collaboration’, KPMG International

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 5

SDG INDUSTRY MATRIX (CONTINUED)

C

METHODOLOGY

The SDG Industry Matrix has

been compiled through

a participatory

three step process:

1.

KPMG and the United Nations Global Compact drew on their respective industry

insights to populate a preliminary draft with examples and ideas for action;

2.

The United Nations Global Compact circulated the draft to its network of private

sector participants, business associations and UN agencies requesting them to

submit further examples and ideas for action;

3.

KPMG and the United Nations Global Compact co-convened a multi-stakeholder

working roundtable (one per industry, each in a different continent) to agree the final

SDG Industry Matrix content, including the most significant opportunities to profile

in the ‘Industry Focus Highlights’ section.

D

SYNERGIES

The SDG Industry Matrix

draws on the commitment

that companies have already

expressed to the UN Global

Compact’s ten principles.

The SDG Industry Matrix builds on the recognition that all companies,

regardless of their size, sector or geographic footprint, have a responsibility

to comply with all relevant legislation, uphold internationally recognized

minimum standards and to respect universal human rights. The UN

Global Compact website includes key tools and resources which can help

companies meet their minimum responsibilities and guide them to take

supportive actions beyond these minimum responsibilities to advance social

and environmental goals.

The SDG Industry Matrix is also complemented by the SDG Compass

(produced by the Global Reporting Initiative, the United Nations Global

Compact and the World Business Council for Sustainable Development),

which guides companies on defining strategic priorities, setting goals,

assessing impacts and reporting.

Opportunities for Shared Value which are applicable to all industries are in italics

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 6

FINANCIAL SERVICES

INDUSTRY HIGHLIGHTS

This section profiles some of the most

significant opportunities, principles-

based initiatives and collaborations

for the Financial Services industry. It

also presents a simplified view of the

sources of capital within the financial

system to explain the context within

which these take place. The supporting

Matrix provides additional ideas and

examples submitted by companies

(it is not intended to be an exhaustive list).

FINANCIAL SERVICES

OPPORTUNITIES FOR SHARED VALUE

The Financial Services

industry is a vital enabler

for the real economy.

It supports improved

economic well-being which

then increases the ability of

families and Governments

to improve social

outcomes. The biggest

opportunities for shared

value – i.e. where we see

the coming together of

market potential, societal

demands and policy action

- are grouped around the

following themes:

Opportunities for shared value

ACCESS

Increasing financial inclusion for individuals (SDGs 1, 2, 3, 4, 10),

small and medium sized enterprises (SDGs 5, 8) and Governments

(SDG 13). This includes access to secure payment and remittance

facilities, savings, credit and insurance. These core financial

services:

Facilitate secure payment for goods and services including

regional and international trade;

Enable smoothing of cashflows and consumption over time;

Provide financial protection; and

Support more efficient allocation of capital.

INVESTMENT

Investing in, financing and insuring renewable energy (SDGs 7, 13)

and other infrastructure projects (SDGs 6, 9). This includes:

Ba

nks raising capital through the debt and equity markets for

Government and private sector investments;

Asset managers investing as part of a diversified portfolio as well

as to meet demands of impact investors;

International/development financial institutions and sovereign

wealth funds helping to de

-

risk investments for institutional

investors; and

Institutional investors and financial institutions with a longer

-

term

investment horizon – such as pension funds and insurers –

investing in infrastructure.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 8

FINANCIAL SERVICES

OPPORTUNITIES FOR SHARED VALUE

“

The world has never

before been united by

a set of global goals on

poverty, inequality, injustice

and climate change. Not

achieving these Goals would

be the biggest market

failure of our time. Financial

markets must play a vital

role in creating a sustainable

future for us all.

Mark Wilson, Chief Ex

”

ecutive

Officer, Aviva Plc

Opportunities for shared value

(CONTINUED)

RISK

Leveraging risk expertise to directly influence customer behavior

and to create more resilient nations through:

Developing innovative pricing models which incentivize more

sustainable living and production (SDG 12); and

Sharing non -proprietary risk data, risk analysis and risk

management expertise to inform public policy and practice (SDG

11). This includes insurers collaborating to develop open source

risk models which can inform disaster risk reduction policies and

actions such as land zoning, building codes and investment in

resilient infrastructure.

CROSS-CUTTING

Adoption of good practice principles, policies and risk frameworks

to guide business transactions and investments – particularly on

sensitive sectors or issues;

Pricing which reflects ESG risks and opportunities; and

Active investor stewardship

Posit

ively

influencing environmental, social and governance

(ESG) practices of corporate clients and investee companies (SDGs

13, 14, 15, 16). This can be achieved through:

Multi-stakeholder partnerships and collaborations will become increasingly important in realising

these shared value opportunities. Many solutions will include blended finance (e.g. combining a

financial institution’s finance with third party concessional funds), innovative financing mechanisms

such as development and climate bonds, and application of new technologies. There is critical

momentum of activity and the Sustainable Development Goals are accelerating the coming together

of market potential, societal demands and policy action.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 9

FINANCIAL SERVICES

THE GLOBAL FINANCIAL SYSTEM

IN CONTEXT

In order to provide context

for the opportunities and

examples, this depicts a

very simplified view of the

global financial system.

Importantly it shows how

the financial system relates

to the real economy, the

main sources of capital,

the key stakeholders and

financial flows. Policies,

rules, regulations,

structures and incentives

shape the framework

within which financial

institutions take decisions.

The global financial system

in context

• Good Governance & Rule of Law

• Enabling Environment

• Sustainable Financial Regulation

• Incentives & Catalytic Finance

• Public Private Partnership

• Private Finance for Public Investment

(ie. Sovereign and Municipal Debt,

Infrastructure)

• Taxes

Inclusive

Growth

•

Human Rights

•

Productivity & Taxes

•

Jobs & Labor

Standards

Natural

Resources

•

Food & Agriculture

•

Energy & Climate

•

Water & Sanitation

Human needs

& Capabilities

•

Health

•

Education

•

Women

Empowerment

Corporate

Governance

& Enabling

Environment

•

•

•

•

REAL ECONOMY FINANCIAL ECONOMY

Debt,

Insurance,

Guarantee

SDGs

Infrastructure

Technology

Human Rights

Anti-Corruption

ASSET

OWNERS

PEOPLE

GOVERNMENTS

BANKS AND INSURANCES

FOUNDATIONS

COMPANIES

INVESTMENT

MANAGERS

I

N

V

E

S

T

M

E

N

T

C

H

A

I

N

S

o

c

i

a

l

I

n

v

e

s

t

m

e

n

t

C

o

r

p

o

r

a

t

e

I

n

v

e

s

t

m

e

n

t

&

F

D

I

Portfolio Investment

Mandates

Institutional Investors

Source: ‘Private Sector Investment and Sustainable Development’ UN Global Compact, UNCTAD, UNEPFI, PRI (2015)

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 10

FINANCIAL SERVICES

FINANCIAL POLICY & REGULATION

Financial policy & regulation

Government policy and regulation influence the extent to which private sector capital aligns to sustainable development. There are

several global initiatives addressing this including the UN Environment Program’s Inquiry into the Design of a Sustainable Financial

System and Principles for Sustainable Insurance (PSI) Initiative, and the Access to Insurance Initiative. Whilst policy and regulation

are beyond the scope of this publication, its importance is articulated in paragraph 38 of The Addis Ababa Action Agenda of the

Third International Conference on Financing for Development agreed by 193 UN member states in July 2015:

We acknowledge the importance of robust risk-based regulatory frameworks for all

“

financial intermediation, from microfinance to international banking. We acknowledge that

some risk-mitigating measures could potentially have unintended consequences, such as

making it more difficult for micro, small and medium sized enterprises to access financial

services. We will work to ensure that our policy and regulatory environment supports financial

market stability and promote financial inclusion in a balanced manner, and with appropriate

consumer protection. We will endeavor to design policies, including capital market regulations

where appropriate, that promote incentives along the investment chain that are aligned with

long-term performance and sustainability indicators, and that reduce excess volatility.

”

“

The Sustainable Development

Goals serve as a global compass

which the financial community of

banks, insurers and investors can

use to guide their core business

towards achieving economic,

social and environmental

sustainability. In this context,

the insurance industry can lead

the way in placing sustainable

development at the heart of risk

management, and in placing

risk management at the heart of

sustainable development.

Butch Bacani, Program Leader, The U

”

N

Environment Program Finance Initiative ’s

(UNEP FI) Principles for Sustainable

Insurance (PSI)

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 11

FINANCIAL SERVICES

GOOD PRACTICE PRINCIPLES

& INITIATIVES

Good practice

principles & initiatives

In addition to the UN

Global Compact’s ten

principles in the areas

of human rights, labor,

the environment and

anti-corruption, there

are a number of good

practice principles and

initiatives which align with

the Financial Services

industry’s contribution to

sustainable development.

These include the

following:

EQUATOR PRINCIPLES

This is a risk management framework for determining,

assessing and managing environmental and social

risks in projects. The ten principles are primarily

intended to provide a minimum standard for

due diligence to support responsible risk decision-

making. As at July 2015 there are 80 Equator

Principles Financial Institutions covering over

70% of international project nance debt in

emerging markets.

GREEN BOND PRINCIPLES

These are voluntary process guidelines that provide

guidance to issuers on the key components involved

in launching a credible Green Bond; they aid investors

by ensuring availability of information necessary to

evaluate the environmental impact of their Green

Bond investments; and they assist underwriters by

moving the market towards standard disclosures

which will facilitate transactions. In addition three

banks have published a proposed Social Bond

and Sustainability Bond Appendix to encourage

transparency, disclosure and integrity in the

development of these new markets.

UNEP FINANCE INITIATIVE & THE

PRINCIPLES FOR SUSTAINABLE

INSURANCE (PSI)

Founded in 1992, UNEP FI is a unique global

partnership between the United Nations Environment

Program (UNEP) and the global nancial sector.

UNEP FI works with over 200 banks, insurers and

investors, and a range of partner organizations, to

better understand the impacts of environmental,

social and governance issues on nancial performance

and sustainable development. Its work includes

setting global principles and standards; pioneering

research and tools; building capacity and sharing best

practices; policy and stakeholder engagement; and

national, regional and global events and activities.

Endorsed by the UN Secretary-General and developed

by UNEP FI, the Principles for Sustainable Insurance

(PSI) were launched at the 2012 UN Conference

on Sustainable Development (Rio+20). The PSI are

a framework for the insurance industry to address

ESG risks and opportunities. They represent a

global roadmap for the insurance industry’s role in

sustainable development. Aligned with an insurer’s

spheres of inuence, the principles ask insurers to

embed in their decision-making ESG issues relevant

to their core business; to work together with clients,

business partners, Governments, regulators and other

key stakeholders; and to demonstrate transparency

and accountability. As at September 2015 there are

over 80 signatories, including insurers representing

20% of world premium volume and US$14 trillion in

assets under management, making the PSI the largest

collaborative initiative between the UN and the

insurance industry.

UN-SUPPORTED PRINCIPLES FOR

RESPONSIBLE INVESTMENT (PRI)

Investors publicly commit to adopt and implement

six principles, where consistent with their duciary

responsibilities, believing this will improve their

ability to meet commitments to beneciaries as

well as better align investment activities with the

broader interests of society. The principles include

incorporating environmental, social and governance

issues into investment analysis, decision-making

processes, ownership policies and processes. As

at July 2015 there are close to 1,400 signatories

representing US$59 trillion of assets under

management.

SUSTAINABLE STOCK EXCHANGES

INITIATIVE (SSE)

The SSE initiative provides an effective platform

for exchanges to engage with the UN, investors,

companies and regulators. By exploring how

exchanges can work with these actors, the SSE is

working to create more sustainable capital markets.

The SSE specically focuses on working in partnership

with exchanges, in collaboration with investors,

regulators, and companies, to enhance corporate

transparency – and ultimately performance – on

environmental, social and corporate governance

issues and encourage sustainable investment. As of

July 2015, the SSE has 23 Partner Stock Exchanges,

which list over 21,000 companies globally and

represent US$41 trillion in market capitalization.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 12

FINANCIAL SERVICES

MULTI-STAKEHOLDER PARTNERSHIPS

AND COLLABORATIONS

Multi-stakeholder partnerships

and collaborations

The SDG Industry Matrix

includes several examples

of collaborations which

advance sustainable

development. In addition,

some of the largest

global multi-stakeholder

collaborations for Financial

Services include:

BANKING ENVIRONMENT INITIATIVE

The Chief Executives of some of the world’s largest

banks created the Banking Environment Initiative (BEI)

in 2010 with the mission to lead the banking industry

in collectively directing capital towards socially and

environmentally sustainable economic development.

Convened by the University of Cambridge, the group

comprises 11 leading banks with over US$10 trillion

of assets. The BEI has developed a powerful model

of change, at the heart of which lies a simple thesis:

banks work for their clients and this group can only be

transformative if it truly aligns banks’ interests with

those of their clients. The BEI’s model is therefore to

form strategic partnerships with groups of leading

corporates, investors and even regulators that share

the BEI’s ambitions. The group then works to catalyze

mainstream change by (i) driving industry-level

standards that accelerate the emergence of new

business norms; (ii) innovating banking products and

services that address unmet needs in a sustainable

economy; and (iii) helping policy-makers and

regulators evolve a level playing eld for sustainable

business models.

THE INVESTMENT LEADERS

GROUP (ILG)

A group of eleven inuential investment managers

and asset owners aiming to drive the investment

chain towards responsible, long-term value creation.

Jointly conceived by the University of Cambridge and

Natixis Asset Management, the group is developing

a fresh approach for the industry based on a vision

of responsible investment and a set of actions and

tools to lead the industry there. One key focus of the

ILG is to enable investors to report to beneciaries

and manage the contribution of their investment

towards sustainable development. Inspired by the

UN Sustainable Development Goals, the group has

developed an Impact Evaluation Framework, which

claries which social and environmental impacts

investors should aim to disclose. It focuses on how

investment achieves environmental and social

outcomes across various asset classes and investment

styles, and aims to enable beneciaries and clients to

make practical choices about how they invest

their money.

THE PORTFOLIO DECARBONISATION

COALITION

A multi-stakeholder initiative that will drive

greenhouse gas emission reductions by mobilizing a

critical mass of institutional investors committed to

gradually decarbonizing their portfolios. Members of

the Coalition share a dual vision, setting themselves

two interconnected and intermediary targets to rst

measure and disclose their carbon exposure, and then

to take action to decarbonize.

GLOBAL PARTNERSHIP FOR

FINANCIAL INCLUSION

An inclusive platform for all G20 countries, interested

non-G20 countries and relevant stakeholders to carry

forward work on nancial inclusion, including the

implementation of the Financial Inclusion Action

Plan, endorsed at the G20 Summit in Seoul. Seven

implementing Partners coordinate the implementation

of the activities. The private sector participates

through those implementing partners, in particular

the International Finance Corporation, the Better Than

Cash Alliance, and the Consultative Group to Assist

the Poor.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 13

FINANCIAL SERVICES

MULTI-STAKEHOLDER PARTNERSHIPS

AND COLLABORATIONS

Multi-stakeholder partnerships

and collaborations

(CONTINUED)

CLIMATEWISE

Over 30 leading insurers are members of ClimateWise,

a global industry leadership platform convened by

the University of Cambridge, which aims to drive an

industry response to climate change. ClimateWise

pursues its mission by combining the expertise of

the University of Cambridge with leading insurer

practice, thereby creating a platform for collaboration

with stakeholders from across the insurance value

chain, Government and clients to tackle exposure to

climate-related risk. In recent years, ClimateWise

has collaborated with the UK Prudential Regulatory

Authority to inform its inquiry into the impacts of

climate change on the insurance industry and the

customers its serves; has worked with city authorities

in North America to identify ways that insurance

can make investments in support of climate resilient

cities; partnered with energy companies to develop

risk management solutions for emerging low carbon

energy technologies; and has worked to enable

insurers to direct more of their invested assets

towards building a low carbon, climate

resilient economy.

THE 1-IN-100 INITIATIVE

This applies the climate and natural hazard risk

stress tests that have transformed the resilience of

the insurance industry into the wider nancial sector

and across the economy. It includes the development

and adoption of risk assessment standards for

companies and public entities to evaluate the 1 in

100 year, 1 in 20 and annual average loss from these

risk and the integration of these disclosures into

nancial regulation, accounting and rating. Using

these techniques excess natural hazard risk will

proportionally decrease the value of assets, while

resilience will be recognized.

CLIMATE BO N DS INITIATIVE

An international, investor-focused not-for-prot

focused on mobilizing the US$100 trillion bond market

for climate change solutions. It is encouraging issuers,

supporting investors and developing standards

to provide assurance for investors regarding the

environmental integrity of climate bonds. Several

banks are partner organizations, along with

other stakeholders.

THE MUNICH CLIMATE INSURANCE

INITIATIVE

This strives to full four objectives, (i) develop

insurance-related solutions to help manage the

impacts of climate change; (ii) conduct and support

pilot projects, in partnerships and through existing

organizations and programs, sharing success

stories and lessons learned; (iii) promote insurance

approaches in cooperation with other organizations

and initiatives; (iv) Identify and promote loss reduction

measures for climate-related events.

THE ACCESS TO INSURANCE

INITIATIVE (A2II)

This aims to increase access to insurance by inspiring

and supporting supervisors to promote inclusive and

responsible insurance, thereby reducing vulnerability.

Pillar 1 supports supervisors with knowledge on nancial

inclusion topics by developing global and regional

learning tools and evidence-based synthesis of regulatory

good practices to inform globally accepted Insurance

Core Standards. Pillar 2 assists policymakers and

supervisors with the proportionate and access-oriented

implementation of the Insurance Core Principles in

national regulation and supervisory frameworks.

THE UNEP FI PRINCIPLES FOR

SUSTAINABLE INSURANCE (PSI)

INITIATIVE

The PSI is the largest collaborative initiative between

the UN and the insurance industry. The vision of the

PSI Initiative is of a risk aware world, where the insurance

industry is trusted and plays its full role in enabling a

healthy, safe, resilient and sustainable society. Its

purpose is to enable the global insurance industry to better

understand, prevent and reduce environmental, social

and governance risks, and better manage opportunities

to provide quality and reliable risk protection. A

concrete example of collaboration is the PSI Global

Resilience Project (GRP). The GRP brings together

insurers from around the world and key stakeholders to

build disaster-resilient communities and economies by

rebalancing approaches to natural disasters away from

post-disaster relief and recovery, to investing in upfront

measures that reduce disaster risk and build resilience.

The GRP is doing this by deepening understanding of

disaster risk reduction activities globally related to

natural hazards; assessing the economic and social costs

of disasters, the effectiveness of risk reduction measures,

and areas of high exposure and vulnerability; and engaging

Governments, communities, NGOs and businesses to

help them better manage and reduce disaster risk.

INSURANCE DEVELOPMENT FORUM

(IDF)

Formed in 2015 under the auspices of the Political

Champions Group for Disaster Resilience, this brings

together national and regional Governments, the

global insurance sector, UN Agencies and other

international institutions to enable the growth of

insurance related capabilities and capacity to support

disaster risk reduction and the wider objectives of the

SDGs. The IDF is co-chaired by a senior member of

the public sector and the insurance industry, with the

secretariat provided by the World Bank Global Facility

for Disaster Reduction and Recovery with support from

the International Insurance Society ‘and UNDP.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 14

FINANCIAL SERVICES

MULTI-STAKEHOLDER PARTNERSHIPS

AND COLLABORATIONS

Multi-stakeholder partnerships

and collaborations

(CONTINUED)

THE SMART RISK INVESTING

PROJECT

An insurance industry-wide initiative which

aims to encourage and enable all insurers to

incorporate sustainability considerations in their

asset management policies and practices. It raises

standards for insurers’ responsible investments by

harnessing their expertise in risk assessment and

applying it to asset management decisions. The Smart

Risk investing framework stimulates new ways of

thinking for insurers’ asset managers; by integrating

environmental and social risk considerations in the

selection of assets, they will have a rigorous, informed

basis for selecting assets that promote social and

environmental resilience, and for not selecting assets

that present high risk to our world.

MONTREAL CARBON PLEDGE

By signing the Montréal Carbon Pledge, investors

commit to measure and publicly disclose the carbon

footprint of their investment portfolios on an annual

basis. The Pledge was launched on 25 September

2014 at PRI in Person in Montréal, and is supported

by PRI and the UNEP FI. It aims to attract commitment

from portfolios totaling US$3 trillion in time for the

United Nations Climate Change Conference (COP 21)

in December 2015 in Paris. It allows investors (asset

owners and investment managers) to formalize their

commitment to the goals of the recently announced

Portfolio Decarbonization Coalition, which will

mobilize investors to measure, disclose and reduce

their portfolio carbon footprints at the scale of

hundreds of billions of dollars by the December 2015

UN Climate Change Conference.

GLOBAL IMPACT INVESTING

NETWORK

This Network provides a platform for like-minded

investors to meet and take part in activities that build

the impact investing industry from a practitioner’s

perspective. Network members gain access to industry

information, tools, and resources to enhance their

capacity to make and manage impact investments

and connect with one another through virtual and

in-person members-only events.

“

The Sustainable

Development Goals provide a

focus for the world’s efforts

to meet global challenges

including climate change,

water management and

sanitation and equitable

education. The opportunity

clearly exists for the

private sector to create and

commercialise sustainable

solutions at scale.

Stuart Gulliver, Group C

”

hief

Executive, HSBC Holdings plc

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 15

SDG INDUSTRY MATRIX

FOR FINANCIAL

SERVICES

The following pages outline

opportunities – under each of the 17

SDGs – for companies to create value

for their business whilst creating a

more sustainable and inclusive path

to economic growth, prosperity, and

well-being. It also profiles practical

company examples submitted through

the consultation process.

Photo: Alex Baluyut/World Bank

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 1

NO

POVERT Y

SDG 1

End poverty in all its forms everywhere

Photo: Edwin Huffman/World Bank

OPPORTUNITIES FOR SHARED VALUE

• Innovate to develop new nancial products, credit scoring methodologies, operating models and distribution

channels (including mobile banking) to advance nancial inclusion, including banking for the 2.5 billion

adults currently without a bank account and microinsurance to increase social protection.

LEADING BY EXAMPLE

• MasterCard, with US$11 million of funding from a

charitable foundation, has established MasterCard

Labs which is an innovation lab in East Africa

aiming to expand digital nancial services to 100

million people globally. It will generate new ideas

with local entrepreneurs, Government and other

stakeholders across East Africa and an additional

US$8 million is reserved for ideas reaching the

incubation phase.

• Blue Marble Microinsurance is a microinsurance

incubator developed by a consortium of insurers

and reinsurers to drive product, distribution and

operational innovation in the launch of 10 new

microinsurance ventures over the next 10 years. The

consortium includes Zurich Insurance Group; Yes;

American International Group, Inc.; Aspen Insurance

Holdings Limited; Guy Carpenter & Company; LLC

& Marsh & McLennan Companies, Inc.; Hamilton

Insurance Group Ltd.; Old Mutual plc.; Transatlantic

Reinsurance Company; and XL Catlin. Technology is

an integral part of the project.

• The International Cooperative and Mutual

Insurance Federation’s (ICMIF) 5-5-5

Development Strategy aims to extend the reach of

microinsurance as a crucial tool for socio-economic

strength to an additional (ie currently uninsured) ve

million homes (20 million persons) in ve emerging

countries in the next ve years. ICMIF is using its

technical development expertise to identify the

needs in those countries, develop appropriate

strategies, and develop relationships with local,

on-the-ground partners to bring specic actions for

microinsurance (in particular, healthcare and life

insurance) to reach poor populations which, without

it, would struggle to survive should disaster strike.

• Standard Chartered has committed to provide

nancing and technical assistance for micronance

institution (MFI) clients in Asia and Africa to enhance

their capacity to extend loans to more people in its

markets. From 2005 to 2014, Standard Chartered

provided more than US$1.6 billion in lending to 85

MFIs, impacting an estimated 10.4 million people.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 17

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 1

NO

POVERT Y

• Aviva is one of the largest microlife insurers on

the Indian sub-continent working with several

micronance companies and a host of co-operative

banks. Due to its vast branch network, Aviva

is able to serve nancially-excluded and rural

customers quickly and at low cost. In 2014 alone,

Aviva covered over 630,000 people through its

microinsurance products and close to 500,000

policies were sold in rural India.

• For almost 20 years, Aviva has worked closely with

Aon Limited and other insurance brokers, local

authorities and registered social landlords in the

UK to provide tenants with accessible, affordable

home contents insurance. The cover is paid mainly

with rent, on a weekly basis, with a zero excess

feature and in many cases without the need for a

bank account. Aviva works with 100 local authority

and registered social landlord schemes throughout

the country, an approach which it says helps to

overcome fears or mistrust in the nancial sector.

• Banco do Brasil started providing loans for small

rms and entrepreneurs through a nationwide

microcredit program (known locally by the acronym

MPO), helping more people to open bank accounts,

creating jobs and income, and combating poverty,

as part of the federal Government’s plan to end

extreme poverty (“Brasil sem miséria”). The

microcredit program is mainly for urban areas

and has originated more than 45,000 loans

totaling around US$100 million. Around half of

entrepreneurs reached are women.

• YES BANK has been applying the guiding principle

of Frugal Innovations for Financial Inclusion (FI4FI)

to systematically leverage technology and frugal

business models to offer direct microcredit,

microsaving, microinsurance and remittance

services across various geographical and socio-

economic contexts for the under-banked and

unbanked population in India. For example, YES

BANK launched the YES Kisan Dairy Plus as a

comprehensive suite of nancial products for the

dairy sector through an automatic milk testing

machine installed at the partnering dairy which

can provide immediate information on the quality

and quantity of milk supplied by the small dairy

farmer. The farmer can be paid immediately through

YES Kisan Dairy Plus into his saving account. The

farmer receives a conrmation of payment through

a mobile text message, and has two options to

either leave the amount in his account or make

withdrawals using YES SAHAJ, the Bank’s mobile

ATM solution.

• Scotiabank is working to advance nancial

inclusion and economic development of

communities through technology including mobile

banking, relevant products (including low/no fee

accounts), micro and consumer nancing, small

business lending, and nancial education.

• Nyati Sacco Society Limited is a savings and

credit co-operative serving the low income bracket

in Kenya with 90% of its membership comprising

security guards working for G4S (Kenya) and other

companies. It will soon start a savings bank service

(virtual) to enable its members to access more

affordable banking services in addition to cheaper

and more easily available credit.

Photo: Curt Carnemark/World Bank

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 18

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 2

SDG 2

End hunger, achieve food security and improved nutrition

and promote sustainable agriculture

OPPORTUNITIES FOR SHARED VALUE

• Collaborate with Governments and development nance institutions to increase nancing for sustainable

agriculture, including people that are often nancially excluded including women, persons with disabilities,

indigenous persons, and racial and ethnic minorities.

• Extend insurance protection for smallholder farmers (including parametric cover for which an index is a proxy

for assessment of actual losses), leveraging available technology such as mobile money transfer and satellite

monitoring. Explore collaborations with farm aggregators, impact investors and reinsurers to provide loan-linked

insurance, contract seed grower insurance, dairy livestock insurance and replanting guarantees.

• Join the Scaling Up Nutrition Business Network to collaborate with other companies, Governments and

civil society in order to identify new inclusive sustainable business opportunities (e.g. nancing seed and

micronutrient innovations).

• Implement responsible business policies in accordance with the Committee for World Food Security’s

Principles for Responsible Agricultural Investment and the United Nations Global Compact’s Food and

Agriculture Business Principles, such that investments and nancial products do not violate human and land

rights, contribute to food price volatility, or encourage speculative trading in food commodities.

LEADING BY EXAMPLE

• Standard Chartered commits to allocate capital

to key sectors in the economy including agriculture,

trade and infrastructure. In 2014, it nanced

US$31 billion through its Commodity Traders and

Agribusiness portfolio. Standard Chartered has a

Position Statement on Agribusiness setting out

the standards it uses to assess the capability of its

clients to manage social and environmental risks;

industry best practices, guidelines and bodies which

it will also use to determine effectives responses

to risks faced by clients; and the circumstances

under which the bank will restrict nancial services

(e.g. corporate and institutional clients which are

involved in the production of soy, cocoa and coffee

beans, sugarcane, cotton or livestock standards and

which fail to adhere to IFC standards).

• Rabobank generates, enhances and distributes its

extensive knowledge of the many links in the food

chain through its Food & Agribusiness Research

and Advisory department. It has developed 10 big

Photo: Sebastian Szyd/World Bank

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 19

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 2

ideas which could boost global food availability

and access over the next decade. These ideas are:

adopt big data in US agriculture; close the yield

gap in Central and Eastern Europe; improve China’s

food security; strengthen South-South trade; invest

in local storage; boost production in the Food &

Agribusiness engine room; develop cold chains in

China; grow aquaculture; lift dairy production in

India; and raise sugarcane’s productivity. These

are described in further detail together with case

studies in the report ‘Unleashing the Potential

of Global Food & Agribusiness’ for its business

customers.

• The Africa Risk Capacity Insurance Company

Ltd (ARC Ltd) is a sovereign-level mutual insurance

company established by the Africa Risk Capacity,

a specialized agency of the African Union, to

provide timely and reliable funds to participating

Governments to respond to food insecure

populations. It is an index-based weather insurance

mechanism through which satellite based rainfall

datasets quantify the impact of a severe drought

event, triggering payments to participating affected

countries within 2-4 weeks of harvest. Africa

RiskView is a software package developed by the

United Nations World Food Programme and is the

technical engine of the Africa Risk Capacity. ARC

Ltd was capitalized through 20-year interest-free

loans totaling US$95 million from the UK and

German development agencies. There are currently

26 country Government members of ARC Ltd who

are each required to have pre-approved contingency

plans in place which describe how insurance pay-

outs will be used should the coverage be triggered.

In its rst policy year US$26 million was paid out to

three participating countries in western Africa which

suffered low rainfall. Experts are working to expand

the early-warning tool to address other hazards

including oods and cyclones.

• Swiss Re has been committed to the Grow Africa

Partnership since 2012, an initiative launched

by a number of organizations to promote public-

private collaboration and investment in African

agriculture. Swiss Re’s commitment to the Grow

Africa Partnership includes three elements: 1) Give

farmers in Sub-Saharan Africa access to tools such

as weather and yield index insurance products; 2)

Invest about US$2 million per year in resources to

support the development of sustainable agricultural

risk management markets; 3) Provide agricultural

insurance for up to 1.4 million smallholder farmers.

To create effective insurance solutions, it works

closely with several partners such as Oxfam

America, the World Food Programme, USAID and

the Global Index Insurance Facility. By the end of

2014, it helped to establish a total of 20 programs

that brought weather insurance to two million

smallholder farmers in 12 Sub-Saharan countries,

reaching and exceeding the target ahead of

schedule. Swiss Re microinsurance products for

small-scale farmers include:

– In Kenya, Rwanda and Tanzania, Swiss Re

engages in the the ‘Kilimo Salama’ (safe farming)

project, which since its launch in 2009 has grown

to be the largest weather index insurance program

in Africa providing insurance protection to 185,000

smallholder farmers (as at December 2013). It

offers nancial protection against drought, excess

rain, crop yield volatility and diseases, and it is

being used for maize, beans, wheat, sorghum,

coffee, potatoes and livestock.

– In India, Swiss Re helps bring insurance to remote

farmers by supporting local insurers through its

expertise and various reinsurance products.

– Swiss Re has also started providing new data on

agriculture hotspots in Mozambique and Kenya,

which include overviews on the economics,

production and risks to agriculture.

– In 2014 Swiss Re helped establish the rst

weather index insurance program in Nigeria,

making automatic payments to smallholder

farmers when satellite data indicates adverse

weather patterns.

• Sompo Japan Nipponkoa Holdings, Inc. offers

agricultural insurance products in South East Asia

to reduce climate related risks to agriculture. It

launched weather index insurance in northeast

Thailand in 2010 to alleviate losses borne by rice

farmers when their crops are damaged by drought,

and the sales area expands every year. In 2014, it

launched Typhoon Guard Insurance in Mindanao

Island, the Philippines, which aims to alleviate the

losses borne by agricultural producers when they

are affected by typhoons. It is also developing

new insurance products, including one which will

alleviate agricultural losses in Myanmar due to

drought in the central dry zone, and similar products

for Indonesia.

• MasterCard and the World Food Programme

have rolled out an innovative e-voucher program

in Lebanon to deliver food assistance to Syrian

refugees. In April alone, nearly US$20 million was

injected into local markets. Today, about 715,000

refugees buy food at nearly 250 merchants who saw

a 6-12% increase in revenues. The program intends

to reach 1.1 million refugees in 2014. A similar

program in Jordan will distribute US$250 million in

food assistance and reach 710,000 Syrian refugees

this year.

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 20

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 3

SDG 3

Ensure healthy lives and promote well-being

for all at all ages

OPPORTUNITIES FOR SHARED VALUE

• Provide and/or raise capital for investment in healthcare institutions.

• Share anonymized morbidity and mortality data with Governments to inform public health policies without

jeopardizing data protection and privacy, leading to improved public health and thus lower underwriting risk.

• Scale health, disability, critical illness, life and funeral insurance policies for people on low incomes to lessen

the nancial impact of morbidity and mortality risks. Consider providing policies which use mobile money

services to efciently transfer funds to cover the ancillary costs associated with accessing Government-provided

health care (such as travel, medicine and child care).

• Collaborate with mobile phone providers and community organizations to support health promotion activities,

thereby reducing loan payment defaults and insurance claims arising from ill health.

• Support healthy employees, families, communities and nations by ensuring healthy and safe work

environments.

LEADING BY EXAMPLE

• The Standard Chartered ‘Living with HIV’ program

aims to reduce the spread of HIV by encouraging

behavior change through education. Employee

volunteers (‘HIV Champions’) raise awareness of

HIV/AIDS within the bank and community. Their

work also includes the development of tailored

workplace HIV education programs with external

organizations, and the training of volunteers inside

these organizations to act as peer educators,

all free of charge. Standard Chartered has a

complementary online initiative called AntiHIVirus

which makes HIV/AIDS facts available to young

people through engaging multimedia (-including

animated ‘edutainment’ modules and blogs in 10

languages) helping them make safe lifestyle choices

and reducing stigma. These group-wide initiatives

sit alongside the bank’s more local efforts to tackle

HIV/AIDS including use of ATM machines in a

number of markets (including Thailand, Malaysia

and Dubai) to communicate HIV/AIDS information.

• Aviva’s health insurance continues to extend

coverage and innovate to improve customer

outcomes. For example, it partners with cancer

care charities to reduce payout timescales and

improve support. Aviva publishes health and

lifestyle research and guidance via its website and

content marketing directed to its customers and

communities who could benet (e.g. Aviva Health

Library provides the latest health and wellbeing

news and views, from day to day lifestyle tips to

feature health articles). Aviva also shares data it

has on the incidence of specic health issues (e.g.

prostate cancer) to inform and support NGO and

public health campaigns.

• Banca Popolare di Sondrio offers its customers

the option of opening a Solidarity Account. In

addition to interest paid to the account holder, the

bank pays 0.5% of the average annual balance to

the account holder’s choice of one of ve charitable

health funds including UNICEF

.

Photo: Sebastian Szyd/World Bank

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 21

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 4

SDG 4

Ensure inclusive and equitable quality education and promote

lifelong learning opportunities for all

OPPORTUNITIES FOR SHARED VALUE

• Collaborate with development nance institutions and Governments to raise and/or invest in innovative

nancing (e.g. education bonds) for education projects.

• Expand access and use of personal savings and loan products to help families plan for and nance education

costs.

• Expand health, life and livelihood insurance coverage in developing markets to reduce the risk that children

are absent from school due to untreated medical conditions, or that they are withdrawn from school to care for

a sick relative or to undertake livelihood activities to supplement household income.

• Provide small and medium sized enterprises with accounting, customer service and business management

training to progress their lifelong learning, thereby building loyalty and success of SME customers and helping

to identify and attract new ones.

• Increase collaboration across the industry and explore best practices for advancing nancial literacy at scale

both in schools and for men and women, including marginalized groups (such as persons with disabilities,

indigenous persons, and racial and ethnic minorities). Explore collaboration with other stakeholders including

ministries of education and civil society.

• Mentor disadvantaged and marginalized youth to improve their learning outcomes and provide the industry

with access to a diverse talent pipeline, which can provide insights essential for advancing nancial inclusion.

LEADING BY EXAMPLE

• The Inter-American Development Bank (rated issued by a Multilateral Development Bank where

Aaa/AAA) launched a US$500 million Education, proceeds are placed in a segregated sub-account

Youth and Employment Bond for Latin America and to support projects strictly related to education

the Caribbean to nance early childhood care and and youth employment. The order book received a

education, formal primary and secondary education, signicant level of oversubscription and included

as well as labor market placement and vocational a high percentage of investors with a particular

training. This bond is the rst global benchmark interest in Socially Responsible Investment Bonds.

UN Photo Library

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 22

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 4

• In 2008 Credit Suisse launched the rst phase

of the Global Education Initiative focusing on

Millennium Development Goal 2 (access to and

quality of education), targeting school-aged children

in selected countries. Between 2008 and 2014,

the Initiative developed strong partnerships, with

programs reaching over 100,000 students in over

400 schools in 38 countries. More than 15,000

teachers were trained in subjects ranging from

science, technology, engineering, mathematics and

information technology to child-friendly teaching

methodologies. Based on this success, in 2014

Credit Suisse launched a Signature Program within

the Initiative focusing on Financial Education for

Girls. It aims to reach 100,000 girls and young

women with interventions to prepare them for the

challenges in life. The Global Citizens Program,

an integral part of the Global Education Initiative,

increases the impact of funding by enabling suitably

qualied employees to share their expertise with

local partners.

• YES BANK is partnering with the Bombay Stock

Exchange (BSE) and the Institute of Chartered

Accountants of India (ICAI) to improve nancial

literacy in India by conducting nancial literacy

camps throughout its pan-India branches, leveraging

the content leadership and association of investor

initiatives of the BSE and ICAI. The three partners

will also conduct joint knowledge events and

provide training and online courses to improve

nancial planning and savings among citizens, while

creating engaging content for including nancial

literacy courses in higher education.

• Barclays, in collaboration with Action for Children,

developed the Barclays Money Toolkit to help adults

and children learn about nancial planning and saving.

The toolkit provides guidance on: identifying ways of

improving participants’ nancial situations; learning

about nancial products and language in order to

make educated choices; and building on participants’

existing skills and applying them to nances.

• Standard Chartered has established nancial

education programs for youth and for entrepreneurs.

Commitments include providing training to 5,000

micro and small businesses, with at least 20 per

cent being women-owned or led, between 2013

and 2018. In 2013 and 2014, 1,400 micro and small

businesses, including approximately 36% women,

were trained.

• Citi is building partnerships with the communities

in which it operates to increase nancial literacy

and access to capital. For example, in Colombia

the Citi Foundation has supported Fundación

Capital’s LIFT Initiative to develop an innovative

tablet-based nancial education system. This

provides low-income individuals and their families

with personalized tools that help them to build their

assets, increase their nancial capabilities, and

support them as they transition out of poverty. The

program has helped 1,000 low-income women who

receive Government assistance through conditional

cash transfers to become active banking clients with

formal savings accounts.

• HSBC’s global nancial education program, JA

More than Money, is targeted at 7-11 year olds,

helping them to learn about earning, spending,

saving, investing and donating money, as well as

educating them about enterprise and potential

careers. The program is run in partnership with

JA Worldwide, the largest organization dedicated

to nancial literacy, entrepreneurship and work

readiness. More than 6,000 HSBC employees have

volunteered for the program since 2008, benetting

more than 379,000 students in 32 countries.

• Caixa Geral de Depósitos has a nancial

literacy program ‘Saldo Positivo’ comprising

two components: ‘Saldo Positivo Particulares’

which helps households better manage their

money; and ‘Saldo Positivo Empresa’s’ which

helps entrepreneurs and managers with nancial

management. Given the difcult economic context

in Portugal and the increase in unemployment,

more households are looking for information on

how to better manage their family budgets. Caixa

Geral de Depósitos responded by setting up www.

saldopositivo.cgd.pt which provides households with

information on budget management, and managers

and entrepreneurs information on launching,

planning and managing their companies.

• BancoEstado in Chile offers bank accounts to

children and youth and The Council for Economic

Education provides economics education resources

to teachers & students. These teach children

about social and nancial concepts like saving and

spending which will help to develop more nancially

responsible societies.

• DGB Financial Group runs a nancial museum

in South Korea to provide a venue for sharing the

regional nancial history and teaching nancial

literacy and economic knowledge to students in

the region. It has developed mobile applications

for senior citizens, non-Koreans and persons with

disabilities to meet the different needs of its

customers.

• Piraeus Bank supports the Knowledge Society by

organizing entrepreneurship programs in elds such

as agricultural development. It collaborates with

Greek tertiary education institutions/universities to

provide student internships, supporting education

agencies, and providing targeted educational

scholarships for low-income students. Piraeus Bank

also sponsors a savings program for 76 students in

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 23

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 4

the outlying islands of Arkoi and Leipsoi, with the

aim of supporting the students in the long-term as

well as promoting money-saving.

• In 2014 The Western Union Company announced

the launch of “Apna Sapna”, a nancial literacy

program created in eight languages for migrant

workers in the United Arab Emirates (‘UAE’) to help

them develop the awareness and skills to manage

their nances and plan for the future. “Apna Sapna”,

which in Hindi means “Our Dream”, is endorsed

by the UAE Labor Ministry and aims to address the

challenges of migrant workers who are often unsure

about how to achieve their long-term nancial goals.

• MasterCard has partnered with the Confederation

for All India Traders to promote the digitization of

payments among Indian traders, through knowledge

sharing and training sessions across the country, in

line with the Government’s ‘Digital India’ vision.

• Daiwa provides a free of charge Daiwa Internet

TV service for the general public in Japan. This

disseminates the latest information and in depth

market and economic analysis by Daiwa’s analysts,

strategists and economists, whilst also often

allowing viewers to directly ask questions. This

means information previously available exclusively

to institutional investors is now freely accessible by

individual investors through personal computers and

smart phones.

• The HSBC Education Program helps young

people to access education, develop life skills and

entrepreneurship, and build their international

and cultural understanding. HSBC’s work with

Junior Achievement/Young Enterprise in France,

Malta, Japan and the UK helps to inspire young

people and give them a taste for working in an

entrepreneurial environment, helping them build

their condence and become literate in nancial

and business matters. HSBC’s work with the

British Council China Program promotes cultural

awareness and understanding in UK schools. An

estimated 10,000 young people a year are taught

Mandarin Chinese and Chinese culture through

the program. HSBC provides more than 6,000

scholarships globally every year to students with

strong academic potential from disadvantaged areas

or families, enabling them to attend a school or

university supported by the program. One example

is the Chevening Scholarships, the UK Government’s

global scholarship program, managed by the Foreign

and Commonwealth Ofce. The program makes

awards to outstanding scholars from around the

world to study postgraduate courses at universities

in the UK. HSBC supports 30 scholars each year

from key countries, supporting the development of

talented individuals who may be future leaders.

Photo: Alex Baluyut/World Bank

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 24

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 5

SDG 5

Achieve gender equality and empower all women and girls

OPPORTUNITIES FOR SHARED VALUE

• View the women’s market as a distinct value proposition supported by the Board and Executive Management,

informed by market research and delivered with a tailored brand strategy driving progress towards clear, gender

disaggregated key performance indicators.

• Design new savings, credit and insurance products and distribution models which enable women in high-

growth markets to establish and grow businesses in both urban and rural environments.

• Adapt credit processes and lending methods to expand lending to women-led SMEs, for example offering

collateral free loans or accepting household goods or jewelry as collateral (when legislation or custom preclude

women from owning land or property title).

• Expand insurance for maternal health, where applicable including costs incurred in accessing public

health services.

• Increase the share of women on company Boards and in senior roles, and invest in policies and programs

which support women in the workforce and encourage organizations in the value chain to do the same.

• Integrate the Women’s Empowerment Principles into core business operations and value chain to ensure a

comprehensive approach to achieving gender equality, and encourage peers to do likewise.

LEADING BY EXAMPLE

• Citi Micronance, in partnership with the Overseas

Private Investment Corporation (OPIC), has provided

more than US$365 million to fund 40 micronance

institutions in 22 countries since 2006. This

investment has resulted in loans to more than

975,000 small business and individual borrowers,

nine in 10 of them women.

• Women’s World Banking Capital Partners is a

women-focused and women-managed micronance

equity fund. The 27 investors represent a mix of

development nance institutions, private pension

funds, micronance investment vehicles and

individual investors. It has more than US$50

million under management which is invested in

the provision of nancial products and services to

unbanked and under-banked women.

• Several nancial institutions are participating in

a Leadership and Diversity for Innovation Program

with Women’s World Banking, a not-for-prot

organization which increases the capacity of women

Photo: Shehzad Noorani/World Bank

SDG INDUSTRY MATRIX – FINANCIAL SERVICES | 25

FINANCIAL SERVICES

SDG INDUSTRY MATRIX – SDG 5

leaders of micronance institutions to successfully

serve low-income women, together with Wharton

business school and an executive coaching

consultancy. Participation provides nancial

institutions with access to expertise in nancial

inclusion, research, product innovation, business

and leadership insights.

• MasterCard has launched Girls4Tech, an

educational outreach program that targets teenage

girls to encourage STEM (science technology

engineering math) careers. This program is currently

live in India, Dubai, Frankfurt, and London.

• YES BANK runs ‘YES LEAP’ (Livelihood

Enhancement Action Program), a Banking Linkage

program through which YES BANK partners

with self-help promoting institutions to provide

comprehensive nancial services to women-centric

self-help groups, thus empowering women in rural

India and strengthening their nancial security.

In 2014-15, YES LEAP reached over 1.2 million

predominantly rural households in 250 districts.

YES BANK is enhancing the program by introducing

mobile tablets that can, among other roles, track

payments and receipts and play health and

hygiene messages.

• Pax World Management LLC has displayed

a strong focus on women’s empowerment.

Women make up half of Pax World’s mutual funds

managers, half of the vice presidents who sit on

the rm’s senior management committee, half of

the company’s sales representatives and half of

the company’s sustainability research analysts. In

addition, Pax has long integrated diversity analysis

and other gender criteria into the company research

it conducts for its mutual funds, including the Global

Women’s Equality Fund, the rst mutual fund in

America focused on investing in companies around

the world that are leaders in advancing gender

equality and women’s empowerment. Guided by

the Women’s Empowerment Principles, all of Pax’s

funds favor investments in companies with diverse

boards and management teams while seeking to

avoid companies that fail to provide a safe work

environment for women.

• The Pax Ellevate Global Women’s Index Fund seeks

returns that closely correspond to or exceed the

performance of the Pax Global Women’s Leadership

Index. It is the rst broadly diversied mutual fund that

invests in the highest-rated companies in the world

in advancing women’s leadership. The Pax Global

Women’s Leadership Index is a customized index of

the highest-rated companies in the world in advancing

women, as rated by Pax World Gender Analytics, and

that meet key environmental, social and governance

(ESG) standards, as rated by MSCI ESG Research.

• In 2014 Swedfund, the Swedish Development

Finance Institution, initiated Women4Growth

which is a talent program supporting women to

reach management levels. Together with Swedish

Wiminvest and two companies in Kenya − where

Swedfund is involved through direct or indirect

ownership − women from each company were

chosen to participate in workshops and seminars.

The two investee companies, a café chain and a

retailer, have many female customers and female

employees at the lower service levels, and both

companies understand the business case for more

equal career opportunities. The program identies

women who wish to climb the corporate ladder but

are held back by structures, attitudes and their own

self-image. Swedfund’s ambition is to apply the

concept to other sectors and countries.

• BLC, a leading Lebanese bank, is committed to

being Lebanon’s market leader in creating services

for women. To put this commitment into practice,

in 2014 BLC hosted a series of trainings for other

nancial institutions in the Middle East, North Africa

and Europe on best practices in: serving women’s

needs in the banking sector, improving women’s

market strategies, and implementing approaches for

women owned SMEs. This training series is part of

an ongoing capacity-building partnership with the

Global Banking Alliance for Women.

• CRISIL, a global analytics company majority owned

by Standard & Poor’s, a business unit of McGraw

Hill Financial, runs an Indian national nancial

awareness initiative: ‘Pragati – Progress through

Financial Awareness’. The Pragati workshops offer

training in basic savings and investment concepts,

to an audience primarily comprising rural women