California Employer Health Benefits:

Are Workers Covered?

CALIFORNIA

Health Care Almanac

AUGUST 2021

CALIFORNIA HEALTH CARE FOUNDATION 2

Between 2000 and 2020, the percentage of employers offering health benefits declined in California

from 69% to 60%. Workers are shouldering more of the cost for their health benefits, paying both a

larger share of premiums and higher deductibles and copays. The prevalance of plans with deductibles

over $1,000 increased from 6% in 2006 to 54% in 2020, largely due to enrollment shifts into different

plan types.

California Employer Health Benefits: Are Workers Covered? presents data compiled from the 2020 California

Employer Health Benefits Survey.

KEY FINDINGS FROM THE 2020 SURVEY:

• Forty-five percent of Californians pay more than 25% of the premium for single coverage, compared to 21%

of workers nationally.

• The average monthly health insurance premium in California, including the employer contribution, was

$653 for single coverage and $1,717 for family coverage.

• Seventy-two percent of workers in small firms (3 to 199 workers) faced an annual deductible of at least

$1,000 for single coverage, compared to 48% of workers in larger firms.

• About one in eight firms (13%) that employ many workers with lower wages (those earning $25,000 or less)

offered health coverage to employees in 2020.

• In the past year, 14% of California firms reported that they increased cost sharing for their workers.

• Twenty-four percent of California firms stated they are “very likely” to increase the amount workers pay for

premiums in 2022.

California Employer Health Benefits

CONTENTS

Overview ..................................... 3

Coverage ..................................... 4

Cost of Health Insurance ......................13

Benefits and Cost Sharing .......................21

Employer Views and Practices . . . . . . . . . . . . . . . . . . . .35

Methods .....................................40

Executive Summary

Executive Summary

Note: See the current and past editions of California Employer Health Benefits at www.chcf.org/collection/california-employer-health-benefits-almanac.

CALIFORNIA HEALTH CARE FOUNDATION 3

1%<1%

US

CA

US

CA

US

CA

■

3–9

■

10–49

■

50–199

■

200–999

■

1,000+

Employers*

Workers

Covered Workers

9% 18% 14% 12% 46%

7% 16% 13% 14% 49%

4%

11% 14% 16% 56%

61% 31% 6%

59% 33% 6%

1%2%

4%

12% 16% 13% 54%

Overview

California Employer Health Benefits

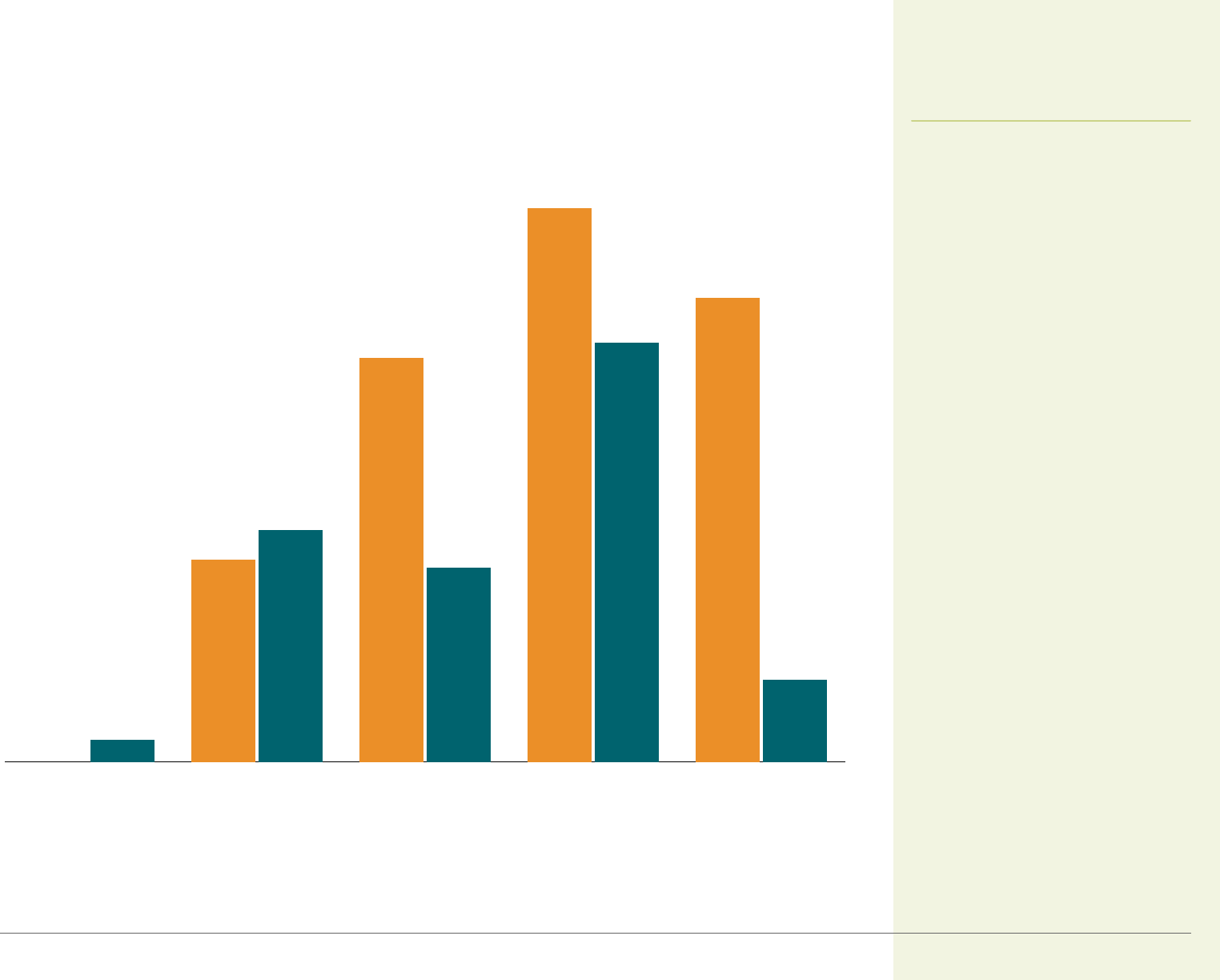

Employers, Workers, and Covered Workers, by Firm Size

California vs. United States, 2020

In 2020, California firms with 3 to

49 workers accounted for 92% of

all employers, but just 27% of all

workers, and 16% of workers with

health coverage, similar to national

firms.

NUMBER OF WORKERS

* Estimates are statistically different between California and US.

Note: Segments may not total 100% due to rounding.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and author analysis of Employer Health Benefits Survey public use file (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 4

60%

56%

202020192018201720162015201420132012201120102009200820072006200520042003200220012000

56%

60%

58%

61%

63%*

73%

70%

71%71%

67%

67%

70%

71%

61%

53%

57% 57%

56%

57%

55%

57%

60%*

69%*

59%

63%

59%

61%

60%

63%

66%66%

68%

55%

57%

60%

69%*

70%

69%

68%

California United States

Coverage

California Employer Health Benefits

Employers Offering Health Benefits

California vs. the United States, 2000 to 2020

The percentage of California

employers offering health insurance in

2020 (60%) was similar to the overall

US rate of 56%. The offer rate among

California firms has been fairly stable

since 2012.

* Estimates are statistically different from the previous year shown.

Note: The survey was not conducted in California in 2019.

Sources: California Employer Health Benefits Survey (2007–18 and 2020), CHCF/NORC; California Employer Health Benefits Survey (2005–6), CHCF/HSC; California Employer Health

Benefits Survey (2004), CHCF/HRET; California Employer Health Benefits Survey (2000–3), Kaiser/HRET; Employer Health Benefits Survey (2018–20), KFF; and Employer Health Benefits

Survey (2000–17), Kaiser/HRET.

CALIFORNIA HEALTH CARE FOUNDATION 5

No Union Workers

At Least Some Union Workers

Fewer Part-Time Workers*

Many Part-Time Workers*

Fewer Workers with Lower Wages*

Many Workers with Lower Wages*

All Firms

60%

64%

31%

66%

58%

92%

13%

Coverage

California Employer Health Benefits

Employers Offering Health Benefits, by Firm Characteristics

California, 2020

Whether a firm offers health insurance

coverage to its employees varies

widely by firm characteristics. Firms

that employ many workers with

lower wages or part-time workers

were much less likely to offer health

insurance than those that employ

fewer of these workers. Most

companies with union workers (92%)

offered coverage.

* Estimate is statistically different from all other firms.

Notes: Many workers with lower wages firms are those with 35% or more of workers earning $25,000 or less per year. Fewer workers with lower wages firms are those with less than 35% of

workers earning that amount. Many part-time workers is defined as 35% or more of the workforce working part time. Fewer part-time workers is the inverse.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 6

1,000+200 to 99950 to 199*10 to 493 to 9All Firm Sizes

■

California

■

United States

Number of Workers

60%

56%

52%

48%

63%

61%

98%

92%

100%

99%

100%

99%

Coverage

California Employer Health Benefits

Employers Offering Health Benefits, by Firm Size

California vs. United States, 2020

About half (52%) of California’s

smallest firms (three to nine workers)

offered coverage in 2020, while the

vast majority of larger firms did so.

Offer rates for California employers

were similar to national figures.

* Estimates are statistically different between California and US.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and author analysis of Employer Health Benefits Survey public use dataset (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 7

Covered WorkersEligible Workers

83%

82%

63%

64%

■

California

■

United States

78%

75%

Eligible Workers Who…

Take Up Coverage

Coverage

California Employer Health Benefits

Employee Eligibility, Take-Up Rates, and Coverage

California vs. United States, 2020

Not all employees are eligible for

health insurance offered by their firm,

and not all who are eligible elect to

participate. Eighty-three percent of

people working in California firms

offering coverage were eligible for

health benefits in 2020. Of those

eligible, 75% elected to enroll,

resulting in a 63% coverage rate.

Note: Tests found no statistically different estimates between California and US.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 8

Large Firms (200+ workers)

Small Firms (3 to 199 workers)

All Firms

65%

67%

68%

63%

63%

■

2020

■

2018

■

2016

■

2014

■

2012

63%

62%

62%

64%

66%

65%

65%

63%

62%

63%

61%

62%

62%

65%

68%

Coverage

California Employer Health Benefits

Worker Coverage Rates Among Firms Offering Health Benefits

by Firm Size, California, 2012 to 2020, Selected Years

Insurance coverage rates among

California employers offering health

benefits have been fairly stable since

2012. Large and small firms had

similar coverage rates.

Note: Tests found no statistically different estimates from previous year shown within firm size.

Source: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 9

HMO*PPOHDHP/SO*POSConventional*

■

California

■

United States

11%

62%

56%

74%

54%

26%

31%

27%

3%

<1%

Coverage

California Employer Health Benefits

Covered Worker Health Plan Options, by Type

California vs. United States, 2020

Covered workers in California were

more likely to have an HMO option

than workers nationally. Sixty-

two percent of covered workers

in California had an HMO option,

compared to only 11% of covered

workers nationally.

* Estimates are statistically different between California and US.

Notes: POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least $2,000 for family

coverage.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 10

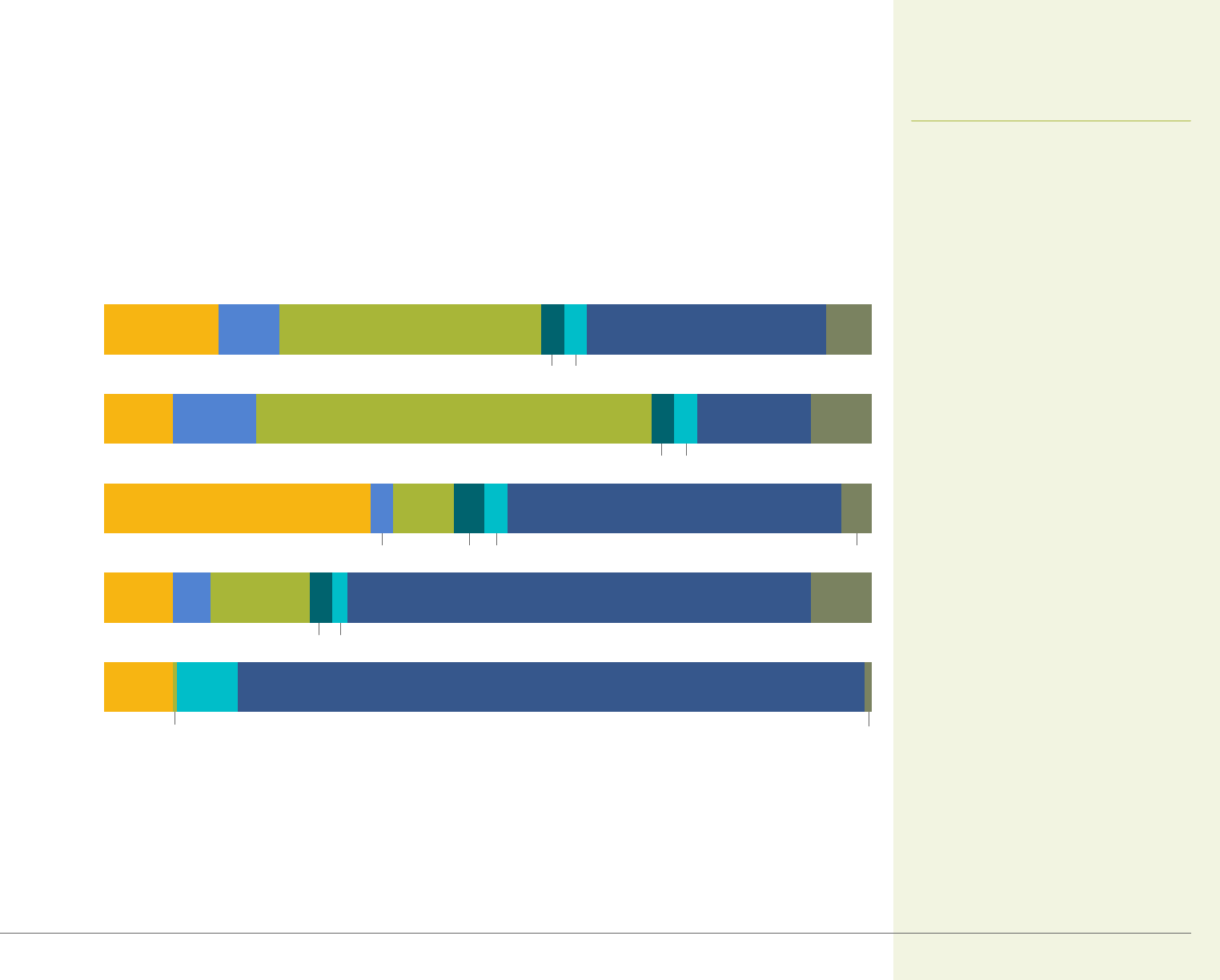

2020

2018

2016

2014

2012

■

Conventional

■

HMO

■

PPO

■

POS

■

HDHP/SO

California

2020

2018

2016

2014

2012

United States

<1%

<1%

10%

15%

13%

10%

5%

14%

13%

5%

8%

7%

30%

28%

31%

29%

33%

46%

45%

51%

54%

55%

<1%

<1%

<1%

<1%

1%

31%

29%

29%

20%

19%

8%

6%

9%

8%

9%

47%

49%

48%

58%

56%

13%

16%

15%

13%

16%

Coverage

California Employer Health Benefits

Enrollment of Covered Workers, by Plan Type

California vs. United States, 2012 to 2020, Selected Years

The proportion of covered workers

in HMO plans in California has fallen

from 55% in 2012 to 46% in 2020.

HMO enrollment is still dramatically

higher in California relative to the

United States as a whole.

Notes: POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least $2,000 for family

coverage. Segments may not add to 100% due to rounding. Conventional plan enrollment in both California and the US was 1% or less in 2012–20.

Sources: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC; author analysis of data from Employer Health Benefits Survey public use files (2018–20), KFF; and

Employer Health Benefits Survey public use files (2012–17), Kaiser/HRET.

CALIFORNIA HEALTH CARE FOUNDATION 11

HDHP with HSAHDHP with HRAOer High-Deductible Plan

■

All Firms

■

Small Firms

■

Large Firms

(3–199 workers) (200+ workers)

73%

72%

82%

8%

7%

17%

41%

40%

52%

Coverage

California Employer Health Benefits

Firms Offering a High-Deductible Plan, by Firm Size

California, 2020

Compared to other plan types, HDHPs

typically expose workers to higher

out-of-pocket costs. Seventy-three

percent of all California firms offered a

high-deductible health plan (HDHP)

in 2020. Of these firms, 8% offered an

HDHP with a health reimbursement

arrangement (HRA), while 41%

offered an HDHP with a health savings

account (HSA).

Notes: Tests found no significant differences between small firms and large firms. HDHPs (high-deductible health plans) have a deductible of at least $1,000 for single coverage and at

least $2,000 for family coverage. HRAs (health reimbursement arrangements) are employer-sponsored accounts that provide financial assistance for out-of-pocket health care expenses,

and HSAs (health savings accounts) allow employers or employees (and their families) to contribute to a tax-advantaged account, which can be used to help pay for IRS-approved

health care expenses.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 12

PPOHDHP/SOPOSHMO*All Plans*

■

California

■

United States

75%

38%

43%

13%

24%

67%

11%

72%

55%

Coverage

California Employer Health Benefits

Workers in Self-Insured Plans, by Plan Type

California vs. United States, 2020

Twenty-four percent of covered

workers in California were enrolled

in a partly or completely self-insured

plan in 2020, compared with 67%

nationally. The difference between

the state and national figures is likely

associated with California’s high HMO

enrollment, since HMOs are less likely

than other plans to be self-insured.

* Estimate is statistically different between California and US.

Notes: Self-insured plans are plans for which an employer assumes some or most of the responsibility for paying health care claims rather than buying coverage from an insurer. POS is

point-of-service plan. HDHP/SO is high-deductible plan with a savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least $2,000 for family coverage.

POS was not reported for US due to small sample size.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 13

PPO

POS

HMO

HDHP/SO

All Plans

PPO

POS

HMO

HDHP/SO

All Plans

Single

Family

$7,838

$7,935

$8,413*

$7,053*

$6,736*

$20,602

$18,010

$24,311*

$19,676

$22,696*

Cost of Health Insurance

California Employer Health Benefits

Average Annual Premiums, by Plan Type

Single vs. Family Coverage, California, 2020

In California, average annual

premiums were $7,838 for single

coverage and $20,602 for family

coverage. Annual PPO premiums were

the highest of all plan types.

* Estimate is statistically different from all-plans figure.

Notes: POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage and at least $2,000 for family

coverage.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 14

POSHDHP/SOPPOHMOAll Plans

3.5%

3.8%

1.4%

5.2%

5.9%

Cost of Health Insurance

California Employer Health Benefits

Average Increase in Annual Premiums, by Plan Type

California, 2020

In 2020, overall premiums increased

by 3.5% from the previous year.

PPO plans experienced the smallest

increase.

Notes: Tests found no significantly different estimates between All Plans and other plan types. POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs

have a deductible of at least $1,000 for single coverage and at least $2,000 for family coverage.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 15

HDHP/SO

POS

PPO

HMO

All Plans

HDHP/SO

POS

PPO

HMO

All Plans

■

California

■

United States

Single Coverage

Family Coverage

$623

$653

$607

$661

$657

$701

$624

$588

$574

$561

$1,779

$1,717

$1,734

$1,501

$1,854

$2,026

$1,706

$1,640

$1,697

$1,891

Cost of Health Insurance

California Employer Health Benefits

Average Monthly Premiums, by Plan Type

California vs. United States, 2020

Overall average monthly premiums

for single and family coverage were

similar in California and nationwide.

Notes: Tests found no statistically different estimates between California and the US. POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a

deductible of at least $1,000 for single coverage and at least $2,000 for family coverage.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 16

202020192018201720162015201420132012*2011*201020092008*2007*20062005*2004*2003*2002*2001*2000*

$607

California United States

$661

$187

$163

Cost of Health Insurance

California Employer Health Benefits

Average Monthly HMO Premiums, Single Coverage

California vs. United States, 2000 to 2020

From 2000 to 2010, California’s

average monthly HMO premium for

single coverage stayed below that

of the US, except in 2006. In 2011, it

exceeded the national rate and has

often done so since.

* Estimates are statistically different between California and US.

Notes: Annual rate of change for HMO single premiums should not be calculated by comparing dollar values from one year with the previous year, due to both the survey’s sampling

design and the way in which plan information is collected. Rates of change in family premiums are collected directly as a question in the survey (no change data for single premiums is

collected). The survey was not conducted in California in 2019.

Sources: California Employer Health Benefits Survey (2007–18 and 2020), CHCF/NORC; California Employer Health Benefits Survey (2005–6), CHCF/HSC; California Employer Health

Benefits Survey (2004), CHCF/HRET; California Employer Health Benefits Survey (2000–3), KFF/HRET; Employer Health Benefits Survey (2018–20), KFF; and Employer Health Benefits

Survey (2000–17), Kaiser/HRET.

CALIFORNIA HEALTH CARE FOUNDATION 17

US

CA

US

CA

■

Worker

■

Employer

Single Coverage

Family Coverage

$1,950*

$6,227*$1,243*

$5,888* $7,838*

$7,470*

$6,723*

$15,754*$5,588*

$13,880* $20,602*

$21,342*

Cost of Health Insurance

California Employer Health Benefits

Annual Worker and Employer Premium Contributions

California vs. United States, 2020

California workers contributed an

average of $1,950 annually for

single coverage and $6,723 for

family coverage in 2020. Worker

contributions to single and family

premiums were higher in California

than nationally.

* Estimates are statistically different between California and US within coverage type.

Note: Segments may not add to totals due to rounding.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 18

2%

1%

US

CA

US

CA

■

No Contribution

■

1%–25%

■

26%–50%

■

>50%

Single Coverage

Family Coverage

<1%

4%

7%

11%

48%

69%

43%

20%

35%

54%

45%

32%

20%

11%

Cost of Health Insurance

California Employer Health Benefits

Workers’ Share of Premium

California vs. United States, 2020

Distribution of workers' share of

premium varied between California

and the nation. Twenty percent of

California workers paid more than half

of the premium for family coverage,

compared to 11% of workers

nationwide.

Notes: Tests found no statistically different estimates between California and the US. Segments may not add to 100% due to rounding.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 19

<1%

2%

Large Firms*

(200+ workers)

Small Firms*

(3–199 workers)

All Firms

Single Coverage

Large Firms*

(200+ workers)

Small Firms*

(3–199 workers)

All Firms

Family Coverage

3%

1%

7%

9% 50% 40%

50%

5%43%

48% 43%

41%41%

23%

35%

19%

23%53%

45% 20%

■

No Contribution

■

1%–25%

■

26%–50%

■

>50%

Cost of Health Insurance

California Employer Health Benefits

Workers’ Share of Premium, by Firm Size

California, 2020

Workers’ share of premium vary by

firm size for both single and family

coverage, with those in small firms

generally paying more. For family

coverage, 23% of workers in small

firms paid more than half of the

premium, compared to 19% of

workers in large firms.

* Difference is statistically different between small and large firms within coverage type.

Note: Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 20

Single Family

12%

202020192018201720162015201420132012201120102009

13%

25%

15%

27%

17%

27%

16%*

26%*

22%*

33%*

17%

26%

17%

29%

16%

26%

14%

27%

27%

33%

20%

Cost of Health Insurance

California Employer Health Benefits

Workers’ Share of Premium, Single and Family Coverage

California, 2009 to 2020

California workers paid an average of

20% of the total premium for single

coverage and 33% for family coverage

in 2020. The corresponding annual

premium contributions were $1,950

and $6,723 for single and family (not

shown).

* Estimates are significantly different from previous year shown.

Note: The survey was not conducted in 2019.

Source: California Employer Health Benefits Survey (2009–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 21

1%

<1%

<1%

1%

2020

2018

2016

2014

2012

■

$5

■

$10

■

$15

■

$20

■

$25

■

$30

■

Other

<1% 2%

18%

10%

8%

13%

12%

19%

20% 33%

42%

11%

10%

39% 15%

18%

11% 20%

41% 11%

10% 13%37%

14% 10%

8%9%

13% 6%

9%

15%

Benefits and Cost Sharing

California Employer Health Benefits

Workers with Primary Care Office Visit Copayments

California, 2012 to 2020, Selected Years

About 86% of workers in California

had a copay for primary care office

visits (not shown). A copay of $20

was the most common in 2020.

PER VISIT COPAY

Notes: Tests found no significantly different estimates between years shown. Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 22

2020

2018

2016

2014

2012

■

$5

■

$10

■

$15

■

$20

■

$25

■

$30

■

Other

HMO

2020

2018

2016

2014

2012

PPO

(in-network)

2020

2018

2016

2014

2012

POS

(in-network)

8%

8%

9%

9%

9%

9%

13%

10%

8%

10%

19%

15%

10%

10%

51%

30%

42%

46%

30%

21%

13%

9%

20%

24%

20%

11%

1%

5%

23%

24%

16%

11%

10%

8%

15%

9%

12%

15%

19%

14%

21%

40% 9% 8%

22%

30%

34%

37%

15%

16%

22% 11%

10%

36%

9%

7%

13%

46%

20%

17%

9%

15%

22%

26%

6%

20%

23%

18% 16%

7%

24%

12%

9%

9%

14%

17% 33%

36%15%

57%7%

<1% 1%

1%

2%

1% 2%

7%

3%

3%

4%

3%

3%

4%

Benefits and Cost Sharing

California Employer Health Benefits

Workers with Primary Care Office Visit Copayments, by Plan Type

California, 2012 to 2020, Selected Years

Distribution of copayments for

primary care office visits for workers

with HMO or PPO coverage has shifted

since 2012, with a smaller percentage

of workers having copayments of $5

or $10.

Notes: Distributions are statistically similar from previous year shown. POS is point-of-service plan. Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 23

HDHP/SOPPO

†

(in-network)

POS*

†

(in-network)

HMO*

†

All Plans

■

California

■

United States

47%

83%

15%

49%

63%

76%

79%

82%

100% 100%

$1,298

$1,644

$2,436

$1,201

$1,472

$1,714

$716

$1,204

$2,602 $2,303

Benefits and Cost Sharing

California Employer Health Benefits

Workers with Annual Deductible, Single Coverage

by Plan Type, California vs. United States, 2020

In 2020, 47% of workers with single

coverage had a deductible in California

compared to 83% in the nation as a

whole. Those enrolled in HMO and

POS plans in California were less likely

to have a deductible than enrollees

nationwide.

* Percentages are significantly different between California and US.

†

Average deductibles are significantly different between California and US.

Notes: POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage. Dollar figures represent

average annual deductibles.

Sources: California Employer Health Benefits Survey (2020), CHCF/NORC; and Employer Health Benefits Survey (2020), KFF.

CALIFORNIA HEALTH CARE FOUNDATION 24

202020192018201720162015201420132012201120102009200820072006

California United States

57%

10%

6%

51%

25%

51%

25%

58%

31%

55%

46%

22%

41%

20%

38%

17%

34%

14%

31%

13%

27%*

14%

22%*

12%

18%*

9%

12%*

10%

54%

Benefits and Cost Sharing

California Employer Health Benefits

Workers with a Large Deductible ($1,000+), Single Coverage

California vs. United States, 2006 to 2020

About half of California workers

with single coverage had an annual

deductible of $1,000 or more,

compared to 57% nationwide. The

share of California workers with a

large deductible increased from 6% in

2006 to 54% in 2020.

* Estimate is statistically different from previous year shown.

Note: The survey was not conducted in California in 2019.

Sources: California Employer Health Benefits Survey (2007–18 and 2020), CHCF/NORC; California Employer Health Benefits Survey (2006), CHCF/HSC; Employer Health Benefits Survey

(2018–20), KFF; and Employer Health Benefits Survey (2006–17), Kaiser/HRET.

CALIFORNIA HEALTH CARE FOUNDATION 25

202020192018201720162015201420132012201120102009200820072006

All Firms Small Firms (3–199 workers) Large Firms (200+ workers)

7%

6%

25%

43%

15%

25%

41%

17%

22%

41%

11%

20%

32%

14%

31%

49%

21%

13%

27%

5%

14%

27%

5%

12%

21%*

6%

9%

14%

5%

11%

10%

10%

14%

26%

8%

17%

32%

9%

48%

54%

72%

5%

Benefits and Cost Sharing

California Employer Health Benefits

Workers with a Large Deductible ($1,000+), Single Coverage

by Firm Size, California, 2006 to 2020

Large-deductible ($1,000+) plans

were more common among workers

in smaller firms. The percentage of

workers in both small and large firms

with large-deductible plans was

much higher in 2020 than in 2018.

* Estimate is statistically different from previous year shown same-sized firms.

Note: The survey was not conducted in 2019.

Sources: California Employer Health Benefits Survey (2007–18 and 2020), CHCF/NORC; and California Employer Health Benefits Survey (2006), CHCF/HSC.

CALIFORNIA HEALTH CARE FOUNDATION 26

1%

2%

HDHP/SO*

POS

(in-network)

PPO*

(in-network)

HMO

All Plans

■

<$500

■

$500–$999

■

$1,000–$1,999

■

$2,000+

10%

58%

28%

87%

36%

39%

47%

49%

41%

35%12%25%

9%7%

6% 6%

Benefits and Cost Sharing

California Employer Health Benefits

Deductibles for Single Coverage, by Plan Type

California, 2020

Among the 47% of California workers

who faced a deductible for single

coverage (not shown), 28% had a

deductible of $2,000 or more.

* Distribution is statistically different from All Plans.

Notes: Data based on workers with a deductible. POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for

single coverage. Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 27

2020

2018

2016

2014*

2012

■

<$500

■

$500–$999

■

$1,000–$1,999

■

$2,000+

38%

28%

13%

19%29%

26%

24%

24%

16%23%

25% 12% 35%

16%19%52%

20%31%

22% 30%

Benefits and Cost Sharing

California Employer Health Benefits

Deductibles for Single Coverage

All Plans, 2012 to 2020, Selected Years

The distribution of deductible amounts

has changed since 2012. Among

workers with single coverage and a

deductible, the percentage with a

deductible of $2,000 or more doubled

between 2012 and 2020. During the

same time, the percentage of workers

with a deductible of less than $500

decreased from 52% to 25%.

* Distribution is statistically different from previous year shown.

Notes: Data based on workers with a deductible. Includes in-network use only. Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 28

3%

1% 3%

HDHP/SO

POS

PPO*

HMO

All Plans

■

<$500

■

$500–$999

■

$1,000–$1,999

■

$2,000+

14%13%

8%8%

14% 25% 43%18%

70%

70%

84%

100%

26%

Benefits and Cost Sharing

California Employer Health Benefits

Deductibles for Family Coverage, by Plan Type

California, 2020

Among California workers with a

family deductible in 2020, 70% faced

a deductible of $2,000 or more.

* Distribution is statistically different from All Plans.

Notes: Data based on workers with a deductible. POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $2,000 for

family coverage. No test was done comparing HDHP/SO with All Plans. Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 29

4%

3%

2020

2018

2016

2014*

2012

■

<$500

■

$500–$999

■

$1,000–$1,999

■

$2,000+

58%

70%

31%

18%12%

22%8%

16%20%5%

13% 14%

15%32%23%

66%

12% 58%

Benefits and Cost Sharing

California Employer Health Benefits

Deductibles for Family Coverage

All Plans, 2012 to 2020, Selected Years

In 2020, 7 in 10 workers with an

aggregate family deductible faced a

deductible of $2,000 or more.

* Distribution is statistically different from previous year shown.

Notes: Data based on workers with an aggregate family deductible. Workers who had a separate per-person deductible were not included. Includes in-network use only. Segments

may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 30

1% 2%

■

<$1,000

■

$1,000–$1,499

■

$1,500–$1,999

■

$2,000–$2,499

■

$2,500–$2,999

■

$3,000+

■

No Limit

1%

3%

3% 3%

<1% <1%

1%

7%18%

44% 5%

14%

60%39%

11%

30%8% 5%5%

58%

32%17%

10%

8%

60%

32% 7%

4%4%

4%

4%

HDHP/SO*

POS

PPO*

HMO

All Plans

Benefits and Cost Sharing

California Employer Health Benefits

Annual Out-of-Pocket Limits, Single Coverage

by Plan Type, California, 2020

Out-of-pocket limits help limit costs

for consumers and are capped by the

Affordable Care Act. While nearly all

covered workers with single coverage

had an out-of-pocket limit, 32% had

a limit of $3,000 or more.

* Distribution is statistically different from All Plans.

Notes: POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of at least $1,000 for single coverage. Segments may not add to

100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 31

3%

2%

3% 4% 4%3%

3%

3%

3% 3%

<1%

1%

■

<$2,000

■

$2,000–$2,999

■

$3,000–$3,999

■

$4,000–$4,999

■

$5,000–$5,999

■

$6,000+

■

No Limit

HDHP/SO*

POS

(in-network)

PPO*

(in-network)

HMO

All Plans

31%33%8% 6%15%

15% 8%53%

44%35% 8%

13%9% 61% 8%5%

11%9%

8%9%

82%

Benefits and Cost Sharing

California Employer Health Benefits

Annual Out-of-Pocket Limits, Family Coverage

by Plan Type, California, 2020

Only 15% of California workers with

family coverage had an annual out-

of-pocket limit of less than $2,000,

while 31% had a limit of $6,000 or

more. Six percent of covered workers

with family coverage had no out-of-

pocket limit.

* Distribution is statistically different from All Plans.

Notes: POS is point-of-service plan. HDHP/SO is high-deductible plan with savings option. HDHPs have a deductible of $2,000 or more for family coverage. Segments may not add to

100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 32

■

One Tier

■

Two Tier

■

Three Tier

■

Four Tier

■

Other

1%

2%

3%

3%

2020

2018

2016

2014

2012

2%

California

4%

4%

37% 50%

15%

22%

18% 6%

8%20%

42%

45%

43%

33%

36%

25%

29%

5%

5%

7%

37%

2020

2018

2016

2014

2012

United States

10%

10%

5%7%

5% 5%

6%6%

4%

4%

4%

4%

51%

32%

20%

14%63%

60%

52%

37%

7% 6% 35% 48%

Benefits and Cost Sharing

California Employer Health Benefits

Workers' Cost Sharing for Prescription Drugs

California vs. United States, 2012 to 2020, Selected Years

In 2020, 53% of California workers

with coverage had a three- or four-tier

cost-sharing formula for prescription

drugs, compared to 83% nationally.

The share of California workers with

four tiers has increased substantially

over time, from 4% in 2012 to 20% in

2020.

Notes: Tests found no significantly different estimates between years shown. One tier is the same cost share regardless of drug type. Two tier is one payment for generic drugs and

one for brand name. Three tier is one payment for generic drugs, another for preferred drugs, and a third for nonpreferred drugs. Four tier is three-tier cost sharing plus a fourth tier for

lifestyle or other specified drugs. Other for California includes "no cost sharing" and "none of the above"; Other for US includes "other" and "no cost sharing after the deductible is met."

Preferred drugs are listed in a plan's formulary. Nonpreferred drugs are not listed in the formulary. Segments may not add to 100% due to rounding.

Sources: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC; author analysis of data from Employer Health Benefits Survey public use files (2018–20), KFF; and

Employer Health Benefits Survey public use files (2012–17), Kaiser/HRET.

CALIFORNIA HEALTH CARE FOUNDATION 33

Nonpreferred Drugs

Preferred Drugs

Generic Drugs

■

2012

■

2014

■

2016

■

2018

■

2020

$9.79

$12.11

$11.93

$10.64

$9.91

$25.80

$30.82

$32.05

$29.01

$29.73

$47.62

$45.67

$52.79

$47.94

$53.36

Benefits and Cost Sharing

California Employer Health Benefits

Average Prescription Drug Copayments, by Drug Type

California, 2012 to 2020, Selected Years

Among firms with four or more tiers

of prescription cost sharing, average

copayments for generic drugs were a

third of what they were for preferred

drugs, and a fifth of what they were

for nonpreferred drugs.

Notes: Tests found no significantly different estimates between years shown. Data are shown for firms with four or more tiers. Preferred drugs are listed in a plan's formulary. Nonpreferred

drugs are not listed in the formulary. Fourth-tier data are not shown due to small sample sizes.

Source: California Employer Health Benefits Survey (2012–18 and 2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 34

Retail ClinicTelemedicine

Telemedicine Includes Behavioral Health Visits

■

Small Firms (3–199 workers)

■

Large Firms (200+ workers)

■

All Firms

73%

74%

73%

48%

49%

49%

93%

80%

81%

Benefits and Cost Sharing

California Employer Health Benefits

Firms Covering Telemedicine and Retail Clinics

Plans with Largest Enrollment, by Firm Size, California, 2020

Nearly 95% of large firms reported

that their health plan with the largest

enrollment offered coverage for

telemedicine services, and nearly 75%

of these firms' plans with the largest

enrollment also included coverage for

behavioral health telemedicine visits.

About half of all firms reported that

their plan with the largest enrollment

covered care from a retail clinic.

COVERAGE INCLUDES...

Note: Tests found no significant differences between small and large firms.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 35

Large Firms*

(200+ workers)

Small Firms*

(1–199 workers)

All Firms

■

Yes

■

No

■

Don’t Know

4%

77%16%

77%

7%

8%

16%

76%

20%

(200+ workers)

Employer Views and Practices

California Employer Health Benefits

Firms That Offered a Narrow Network Plan to Reduce Plan Costs

by Firm Size, California, 2020

Sixteen percent of small firms offered

a narrow network plan in 2020 to

reduce plan costs.

OFFERED A NARROW NETWORK PLAN

* Difference is statistically different between small and large firms.

Notes: A narrow network is one that limits the number of providers who can participate, or limits some services to certain facilities. These plans’ networks are more restrictive than a

standard HMO network.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 36

3%

3%

2%

Large Firms

(200+ workers)

Small Firms

(1–199 workers)

All Firms

■

Yes

■

No

■

Don’t Know

90% 7%

90% 7%

6%

92%

Employer Views and Practices

California Employer Health Benefits

Firms That Eliminated Hospitals or Health Systems from

Provider Network to Reduce Plan Costs

by Firm Size, California, 2020

Three percent of firms eliminated

hospitals or health systems from

provider networks to reduce plan

costs.

ELIMINATED HOSPITALS OR HEALTH SYSTEMS

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 37

1%

1%

<1%

2%

Drop Coverage Entirely

Restrict Employee Eligibility for Coverage

Increase the Amount Employees Pay for Prescription Drugs

Increase the Amount Employees Pay for Copays or Coinsurance

Increase the Amount Employees Pay for Deductibles

Increase the Amount Employees Pay for Premiums

■

Very

■

Somewhat

■

Not Too

■

Not at All

■

Don’t Know

24%

14% 12%

48%

57%

60%

55% 7%

90%

91%

15%10%10%

12% 11% 15%

12%14%14%

4%

3%

3%5%

4% 3%

4%

Employer Views and Practices

California Employer Health Benefits

Likelihood of Firms Making Changes in the Next Year

by Type of Change, California, 2020

Thirty-eight percent of California firms

reported they are very or somewhat

likely to increase the amount that

workers pay for premiums in the next

year. Twenty-eight percent of firms

stated that they are very or somewhat

likely to increase employees’

deductibles, and 20% stated that

they are very or somewhat likely to

increase what employees pay for

copays or coinsurance.

Note: Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 38

3% 3%

4%

Large Firm*

(200+ workers)

Small Firm*

(3–199 workers)

Large Firm

(200+ workers)

Small Firm

(3–199 workers)

■

Very Likely

■

Somewhat Likely

■

Not Too Likely

■

Not at All Likely

■

Don’t Know

Increase Amount Employees Pay for Premiums

Increase Amount Employees Pay for Copays or Coinsurance

2%

1%

15% 12% 48%

37%13%11%38%

23%

10%

8%

10% 15% 60%

17% 70%

Employer Views and Practices

California Employer Health Benefits

Likelihood of Employers Making Selected Changes in the Next Year

by Firm Size, California, 2020

Compared to small firms, large firms

in California were more likely to report

that they are very likely to increase the

amount employees pay for insurance

premiums in the coming year.

* Estimate is statistically different between small and large firms.

Note: Segments may not add to 100% due to rounding.

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 39

INCREASED

COST SHARING

MOVED BENEFIT

OPTIONS TO

HRA OR HSA*

REDUCED SCOPE

OF COVERED

BENEFITS

INCREASED

INCENTIVES TO

USE LESS COSTLY

PROVIDERS

FIRM SIZE

Small Firms (3–199 workers) 14% 3% 3% 5%

Large Firms 16% <1% 1% 1%

•

200–999 workers 14% <1% 0% 1%

•

1,000+ workers 20% <1% 4% 0%

REGION

Los Angeles 19% 0% 1% 2%

San Francisco 22% 0% 9% 9%

Rest of State 8% 5% 1% 4%

All Firms 25% 39% 4% 7%

Employer Views and Practices

California Employer Health Benefits

Firms That Made Changes in the Past Year

by Firm Size and Region, California, 2020

In the past year, 14% of California

firms increased cost sharing for

workers, 5% increased incentives

to use less costly providers, and 3%

reduced covered benefits.

* Asked only of firms offering a HDHP/SO.

Notes: Tests found no significant difference between estimates shown. Los Angeles and San Francisco are defined as the metropolitan statistical area (MSA).

Source: California Employer Health Benefits Survey (2020), CHCF/NORC.

CALIFORNIA HEALTH CARE FOUNDATION 40

FOR MORE INFORMATION

California Health Care Foundation

1438 Webster Street, Suite 400

Oakland, CA 94612

510.238.1040

www.chcf.org

California Employer Health Benefits

ABOUT THIS SERIES

The California Health Care Almanac is an online

clearinghouse for data and analysis examining

the state’s health care system. It focuses on issues

of quality, affordability, insurance coverage and

the uninsured, and the financial health of the

system with the goal of supporting thoughtful

planning and effective decisionmaking. Learn

more at www.chcf.org/almanac.

AUTHORS

Heidi Whitmore, Principal Research Scientist

Jennifer Satorius, Senior Research Scientist

NORC at the University of Chicago

The California Employer Health Benefits Survey is a joint product of the California Health Care Foundation (CHCF) and NORC at the University of

Chicago. The survey was designed and analyzed by researchers at NORC, and administered by Davis Research (Davis). The findings are based on

a random sample of 454 interviews with employee benefit managers in private firms in California. Davis conducted interviews from August to

December 2020. The sample of firms was drawn from a Dynata database of private employers with three or more workers. Some exhibits do not sum

to 100% due to rounding effects.

KFF (Kaiser Family Foundation) sponsored this survey of California employers from 2000 to 2003. A similar employer survey was also conducted in

1999 in California, in conjunction with the Center for Health and Public Policy Studies at the University of California, Berkeley. The Health Research

and Educational Trust (HRET) collaborated on these surveys from 1999 to 2004. The Center for Studying Health System Change collaborated on these

surveys from 2005 to 2006.

This survey instrument is similar to a national employer survey conducted annually by KFF. The US results in this study are either from the published

reports or from author calculations from the surveys’ public use files. A full analysis of the US data set is available on KFF’s website at www.kff.org. Both

the California and US surveys asked questions about health maintenance organizations (HMOs), preferred provider organizations (PPOs), point-of-

service (POS) plans, and high-deductible health plans with a savings option (HDHP/SO). Conventional (fee-for-service) plans are generally excluded

from the plan type analyses because they compose such a small share of the California market.

Many variables with missing information were identified as needing complete information within the database. To control for item nonresponse bias,

missing values within these variables were imputed using a hot-deck approach. Calculation of the weights follows a common approach. First, the

basic weight is determined, followed by a survey nonresponse adjustment. Next, the weights are trimmed in order to reduce the influence of weight

outliers. Finally, a post-stratification adjustment is applied.

All statistical tests in this chart pack compare either changes over time, a plan-specific estimate with an overall estimate, or subcategories versus all

other firms (e.g., firms with three to nine workers vs. all other firms). Tests include t-tests and chi-square tests and significance was determined at p <

.05 level.

A important note about the methodology. Rates of change for total premiums, for worker or employer contributions to premiums, and other

variables calculated by comparing dollar values in this report to data reported in past CHCF or KFF publications should be used with caution, due to

both the survey’s sampling design and the way in which plan information is collected. Rates calculated in this fashion not only reflect a change in the

dollar values but also a change in enrollment distribution, thus creating a variable enrollment estimate. However, rates of change in premiums are

collected directly as a question in the California survey. This rate of change holds enrollment constant between the current year and the previous year

thus creating a fixed enrollment estimate. Because the survey does not collect information on the rate of change in other variables, additional rates

are not reported. The national survey conducted by Kaiser/HRET, however, stopped collecting directly rates of change in premiums in its 2008 survey.

Therefore, the rate of change in total premiums in the US provided in this report uses a variable enrollment estimate.

Please note that due to a change in the post-stratification methods applied in 2003, the survey data published in this chart book may vary slightly

from reports published prior to 2003.

Methods