HelloFresh at a Glance

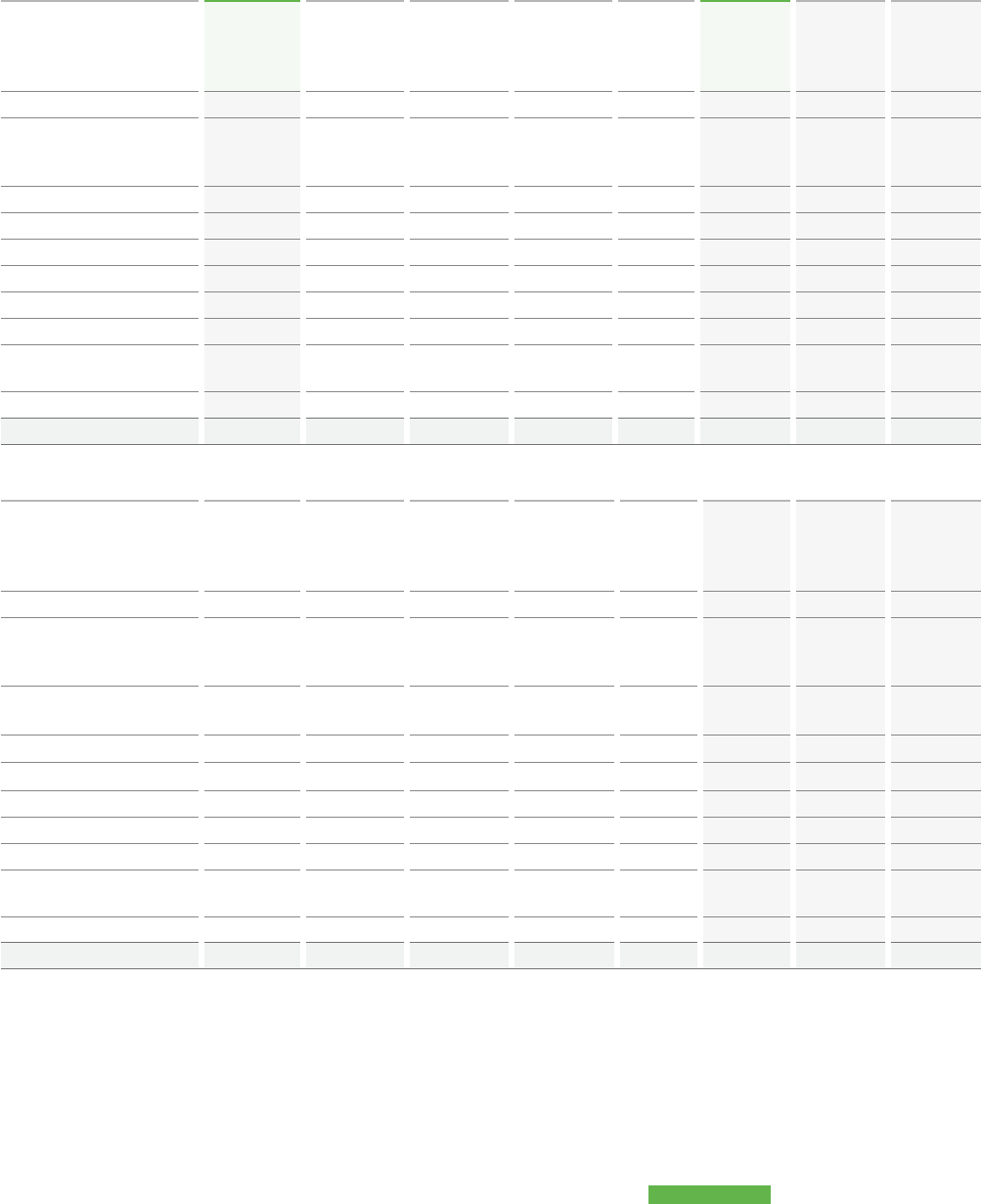

Key Figures

3 months

ended

31-Dec-21

3 months

ended

31-Dec-20

YoY

growth

12 months

ended

31-Dec-21

12 months

ended

31-Dec-20

YoY

growth

Key Performance Indicators

Group

Active customers (in millions) 7.22 5.29 36.5%

Number of orders (in millions) 29.47 22.00 34.0% 117.32 74.30 57.9%

Orders per customer 4.1 4.2 (2.4%)

Meals (in millions) 243.9 179.0 36.3% 964.3 601.2 60.4%

Average order value (EUR) 53.4 50.3 6.2% 51.0 50.4 1.2%

Average order value constant currency

(EUR)

51.4 50.3 2.2% 51.6 50.4 2.4%

USA

Active customers (in millions) 3.52 2.61 34.9%

Number of orders (in millions) 14.45 10.90 32.6% 59.25 38.70 53.1%

Orders per customer 4.1 4.2 (2.4%)

Meals (in millions) 111.1 80.1 38.7% 451.5 278.0 62.4%

Average order value (EUR) 59.2 53.6 10.4% 55.6 53.5 3.9%

Average order value constant currency

(EUR)

56.7 53.6 5.8% 57.7 53.5 7.9%

International

Active customers (in millions) 3.70 2.68 38.1%

Number of orders (in millions) 15.02 11.10 35.3% 58.07 35.70 62.7%

Orders per customer 4.1 4.2 (2.4%)

Meals (in millions) 132.8 98.9 34.3% 512.8 323.2 58.7%

Average order value (EUR) 47.8 47.1 1.5% 46.4 47.0 (1.3%)

Average order value constant currency

(EUR)

46.3 47.1 (1.7%) 45.3 47.0 (3.6%)

2 HelloFresh SE Annual Report 2021

Key Figures

3 months

ended

31-Dec-21

3 months

ended

31-Dec-20

YoY

growth

12 months

ended

31-Dec-21

12 months

ended

31-Dec-20

YoY

growth

Results of operations

Group

Revenue (in MEUR) 1,580.1 1,108.5 42.5% 5,993.4 3,749.9 59.8%

Revenue constant currency (in MEUR) 1,521.7 1,108.5 37.3% 6,057.2 3,749.9 61.5%

Contribution Margin (in MEUR)* 389.9 340.6 14.5% 1,517.7 1,056.0 43.7%

Contribution Margin (in % of Revenue)* 24.7% 30.7% (6.0 pp) 25.3% 28.2% (2.9 pp)

AEBITDA (in MEUR) 130.8 173.8 (24.7%) 527.6 505.2 4.4%

AEBITDA (in % of Revenue) 8.3% 15.7% (7.4 pp) 8.8% 13.5% (4.7 pp)

USA

Revenue (in MEUR) 855.4 584.4 46.4% 3,294.1 2,073.3 58.9%

Revenue constant currency (in MEUR) 820.0 584.4 40.3% 3,420.3 2,073.3 65.0%

Contribution Margin (in MEUR)* 216.5 184.9 17.1% 854.8 572.1 49.4%

Contribution Margin (in % of Revenue)* 25.2% 31.5% (6.3 pp) 25.9% 27.5% (1.6 pp)

AEBITDA (in MEUR) 77.7 93.4 (16.8%) 310.1 282.5 9.8%

AEBITDA (in % of Revenue) 9.1% 15.9% (6.8 pp) 9.4% 13.6% (4.2 pp)

International

Revenue (in MEUR) 724.6 524.1 38.3% 2,699.0 1,676.3 61.0%

Revenue constant currency (in MEUR) 701.7 524.1 33.9% 2,636.8 1,676.3 57.3 %

Contribution Margin (in MEUR)* 177.8 159.2 11.7% 681.2 496.5 37.2%

Contribution Margin (in % of Revenue)* 24.4% 30.3% (5.9 pp) 25.1% 29.5% (4.4 pp)

AEBITDA (in MEUR) 74.0 95.0 (22.1%) 297.5 275.5 8.0%

AEBITDA (in % of Revenue) 10.2% 18.1% (7.9 pp) 11.0% 16.4% (5.4 pp)

Group Financial Position

Net working capital (in MEUR) (289.5) (211.2) (289.5) (211.2)

Cash flow from operating activities (in

MEUR) 62.0 185.1 458.6 601.5

Cash and cash equivalents (in MEUR) 827.1 729.0 827.1 729.0

Free cash flow (in MEUR) (69.2) 137.3 181.3 499.0

*Net of share based compensation expenses

3 HelloFresh SE Annual Report 2021

Contents

A To Our Shareholders ............................................................................................................................................ 5

Letter by the Management Board ........................................................................................................................ 5

Report of the Supervisory Board ......................................................................................................................... 7

Corporate Strategy ............................................................................................................................................... 11

B Combined Management Report ......................................................................................................................... 13

1. Fundamentals of the Group ........................................................................................................................ 15

2. Performance Measurement System .......................................................................................................... 18

3. Economic Position ....................................................................................................................................... 20

4. Position of the Group .................................................................................................................................. 23

5. Risk and Opportunity Report ...................................................................................................................... 29

6. Outlook ......................................................................................................................................................... 36

7. Supplementary Management Report to the Separate Financial Statement of HelloFresh SE ............ 37

8. Corporate Governance Statement ............................................................................................................. 40

9. Combined Non-Financial Report ................................................................................................................ 41

10. Takeover Law ............................................................................................................................................... 42

C Consolidated Financial Statements .................................................................................................................. 46

Consolidated Statement of Financial Position .................................................................................................. 47

Consolidated Statement of Comprehensive Income ......................................................................................... 49

Consolidated Statement of Changes in Equity .................................................................................................. 50

Consolidated Statement of Cash Flows .............................................................................................................. 51

Notes to the Consolidated Financial Statements .............................................................................................. 53

D Further Information ............................................................................................................................................. 100

Responsibility Statement by the Management Board ...................................................................................... 100

Independent Auditor’s Report ............................................................................................................................. 101

Glossary ................................................................................................................................................................. 108

Financial Calendar ................................................................................................................................................ 110

Imprint ................................................................................................................................................................... 111

4 HelloFresh SE Annual Report 2021

A. To Our Shareholders

Edward Boyes Thomas Griesel Dominik Richter Christian Gaertner

Letter by the Management Board

Dear shareholders,

Marking the 10 year anniversary of our business, 2021 has been another exceptional year for the HelloFresh Group. We

close the year with record business performance and robust financial strength.

This year, the world continued to grapple with the challenges brought about by the Covid-19 pandemic. Consumers are

rethinking their priorities, while new technologies are transforming traditional routines. Our mission to change the way

people eat forever is increasingly resonating with customers seeking convenient, sustainable, healthy and delicious

solutions to their everyday food needs.

This year we were able to safely provide almost 1.0billion healthy and easy to prepare fresh meals to our customers

across seventeen markets. The physical fulfilment of this 243.0% increase over just 2 years has required a massive

scaling of operational capacity. In 2021, we grew internal headcount 80.0%, and tripled capital investment in physical

infrastructure to MEUR 234.5 in order to stabilise our fulfilment operations.

In addition to delivering this ongoing capacity expansion program, we have made significant progress on strategic steps

towards our ambition to becoming a world leading integrated food solutions group:

• We further expanded menu choice for customers across our markets:

- increasing the number of recipes on offer for weekly selection;

- tactically broadening our menu coverage of culinary preferences, be it cooking time, ingredient type, or flavour

profile;

- refining our market specific feedback and recipe graduation process;

• We refined our insights on the HelloFresh Market test offering in Benelux, whilst also expanding the range to 500

products by the close of the year;

▪ We launched HelloFresh Market in the US, offering a curated range of 100 products in our largest market;

5 HelloFresh SE Annual Report 2021

• We expanded our menu personalisation functionality, allowing customers to add, upgrade and swap ingredients

in their meals;

• We launched our service in Norway and Italy, whilst also making our first entry to an Asian market with the test

launch in Japan;

• We launched our premium brand, Green Chef, in the UK market;

• We acquired the Australian ready to eat meal company YouFoodz.

Our efforts resulted in the Group achieving constant currency revenue growth of 61.5%, thereby materially exceeding

capital markets expectations. From an AEBITDA perspective, we achieved MEUR 527.6, at a margin of 8.8%, continuing

to outperform other e-commerce peers. Both operating segments, the US and International, generated similarly strong

AEBITDA during the period with MEUR 310.1 and MEUR 297.5 respectively.

The direct supply chain model we use continues to provide our customers with a structurally more sustainable option

than traditional grocery alternatives. During the year we have maintained our focus on formalising and improving our

sustainability metrics. At our Capital markets day event in December 2021, we announced our decision to begin the

process of setting science based targets in the year ahead. We look forward to reporting on our ESG initiatives, progress

against our core sustainability KPIs of CO2 and food waste reduction, and further outlining our commitments as a

responsible industry leader in our sustainability report to be published in April 2022.

In keeping with the delivery of our mid-term growth and profitability objectives, 2022 will be another year of investment

for our business, with our strategic focus centered on:

• Continued expansion of fulfilment infrastructure across both segments, allowing us to:

- Regain the capacity lead on ongoing revenue growth;

- Maintain our pace of product innovation towards a fully integrated food solutions offer;

- Deliver greater operational flexibility and automation to regain productivity across the expanded fulfilment

network;

• Investment in our technology capabilities, improving interoperability across operations, optimising for customer

experience, and expanding the use of data based analytics in all facets of the Group;

• Increasing household penetration in our existing seventeen markets, including the additional launch of a

segment defining brand in one new territory;

• Entering two or more new geographic markets in the calendar year;

• Further increasing customer monetization through the further build out of add-ons, markets, and personalisation

offerings; and

• Scaling adjacent verticals outside of meal kits, which includes:

- the integration and development of the YouFoodz ready to eat business acquired at the end of 2021;

- the Organic launch of the Factor75 ready to eat offer in one of our international markets.

Global economic uncertainty continues to be a feature for all businesses to navigate in the years ahead. Given the

comparative stability of our operating markets, our inherent operational agility, business capabilities, pricing power,

and balance sheet strength, we remain confident to perform well in a number of potentially disruptive macro scenarios.

Our diverse team of 21.4k people across the Group continue in their commitment to serving our growing customer base

with passion and diligence. We want to thank them for what they have contributed in 10 years to making HelloFresh the

business it is today, and thank you as shareholders for your ongoing support of our ambitious goals.

Berlin, 28 February 2022

Dominik Richter Thomas Griesel Christian Gaertner Edward Boyes

Chief Executive Officer Chief Executive Officer

International

Chief Financial Officer Chief Commercial Officer

6 HelloFresh SE Annual Report 2021

Report of the Supervisory Board

Dear Shareholders,

Ladies and Gentlemen,

We look back on the fiscal year 2021 as another very successful year for the HelloFresh Group. In all its operating

markets, the Company continues to admirably navigate commercial and operational challenges that have been a result

of the COVID-19 pandemic. Through its ongoing financial strength, global reach and environmental leadership, the

Company now ranks amongst leading German corporations.

In 2021, we worked closely with the Company to maintain the standards of excellence that are commensurate with its

market leading status. This entailed among other matters (i) investing in the Company’s production capacity and

capabilities, (ii) further investment into tech and data capabilities, (iii) ensuring that the Company’s prime financial

strength was maintained at all times, (iv) supporting the Company in the evaluation and prioritization of additional

strategic initiatives and (v) supporting the company in evaluating a balanced compensation system and in evaluating

further the ESG strategy of the company.

Management oversight and other key Supervisory Board activities

The Supervisory Board duly performed its duties in accordance with the statutory requirements, the Articles of

Association of HelloFresh SE, the rules of procedure of the Supervisory Board dated 18December 2020, including the

amendments adopted by resolution of the Supervisory Board on 26May 2021, (the “Supervisory Board Rules of

Procedure”) and the German Corporate Governance Code. It obtained regular and detailed information, written and

oral, about business policy, significant financial investment and personnel planning matters, and the course of

business. In particular, the Management Board discussed and agreed on the Company’s strategic alignment with the

Supervisory Board. Furthermore, the Supervisory Board was directly involved in all fundamental decisions.

Before adopting a resolution, any transactions which, according to the Articles of Association and/or the Management

Board Rules of Procedure, require Supervisory Board approval, were explained by the Management Board and

discussed by the Supervisory Board and the Management Board. Discussions took place in meetings of the entire

Supervisory Board or its committees or in informal communications with the Management Board outside the

Supervisory Board meetings. The Chairman of the Audit Committee discussed audit-related topics with the auditor

outside the meetings and without the involvement of the Management Board. The Chairman of the Audit Committee

was in regular interaction with the CFO and senior financial team on key financial matters.

The Chairman of the Supervisory Board was also in regular contact with the Management Board outside the

Supervisory Board meetings.

The Supervisory Board discussed and reviewed the following topics in fiscal year 2021:

• The separate and consolidated financial statements for the fiscal year 2020 and the results for the first half of

2021;

• Ongoing business performance, including the development of the Company’s revenue and profitability, liquidity

position, market position and business strategy;

• Specific material investments, including the build-out of new fulfilment centers and the expansion of operations

to new markets;

• A report by the Audit Committee on the Company’s key controls, processes and information security

environment;

• The audit planning and quarterly reports of the internal audit department, with strategic considerations on

positioning and presence in North America, Australia, and new territories;

• The budget of HelloFresh Group for 2022, including revenue and margin plans for each segment and capex plans

per geography;

• The strategic positioning and structure of the Group and the corporate organization, including succession

planning;

• The invitation to and agenda for the ordinary Annual General Meeting for 2021 with proposed resolutions;

• Implementation of the new remuneration program for the Management including conclusion of new service

agreements with all members of the Management Board;

7 HelloFresh SE Annual Report 2021

• The granting of additional virtual stock options and restricted stock units (pursuant to the VSOP 2019, and RSUP

2019) to the Management Board as part of their remuneration package;

• Implementation of a modified equity program for incentivization of key employees as well as acting members of

the Management Board (VSOP 2019 and RSUP 2019);

• Acquisition of the YouFoodz business in Australia;

• Rewording of the Management Board Rules of Procedure; and

• Declaration of compliance with the German Corporate Governance Code.

For general and specific further development, the members of the Supervisory Board took part in internal meetings on

new legal developments in stock corporation law (ARUG II) and the new German Corporate Governance Code. Insofar as

the members of the Supervisory Board attended events on their own responsibility, the Company provided them with

support. Lastly, members of the Supervisory Board could meet members of the Board of Management and senior

managers with specialist responsibility to exchange views on fundamental issues, and gain an overview of specific

Company topics.

Cooperation between Supervisory Board and Management Board

The Management Board and Supervisory Board once again cooperated closely for the benefit of the Company in fiscal

year 2021. In an ongoing, intensive dialog between the boards, the Supervisory Board discussed strategy, planning,

business development and risk management issues with the Management Board.

The Chairman of the Supervisory Board is immediately notified of important events that the Supervisory Board is

required to approve: certain transactions of fundamental importance or materiality; transactions by members of the

Management Board and related persons with the Company; and the acceptance of sideline work outside the entity.

In addition to meeting attendance, the Supervisory Board members informally perform the following activities:

• Informal dialogue with, and advice to the Management Board and senior executives;

• Investor outreach and consultation on Company matters;

• Fulfilment operations site visits;

• Internal audit consultation and support;

• Additional 3rd party outreach as necessary, for example with the Company’s external auditors and advisors;

• ongoing qualification on regulatory requirements.

The members of the Supervisory Board have frequent bilateral communication between themselves, and meet privately

for the discussion of certain matters and sub-committee meetings. For all plenary meetings of the Supervisory Board in

fiscal year 2021, the full Management Board was in attendance.

Changes in the Supervisory Board

There were two personnel changes with regard to the composition of the Supervisory Board in the reporting year. At the

Annual General Meeting of 26May 2021, Susanne Schröter-Crossan and Stefan Smalla were elected as new members of

the Supervisory Board for a period of 2 years.

New Supervisory Board members were on boarded by way of an internal briefing on their legal obligations and the

German Corporate Governance Code. Onboarding sessions were held with the Chairman of the Supervisory Board, and

through topic focussed introductions with the members of the Management Board. Lastly, certain members of the

Group executive leadership met directly to provide insight on functional topics relevant to that Supervisory Board

member’s relevant expertise.

Jeffrey Liebermann and Ugo Arzani left the Supervisory Board when their terms of office expired at the Annual General

Meeting of 26May 2021. John H. Rittenhouse was proposed at the Annual General Meeting and elected by the

Supervisory Board as the new Chairman of the Supervisory Board.

Composition of the Supervisory Board and committees

According to the Articles of Association of HelloFresh SE, the Supervisory Board currently has five (5) members. All

members of the Supervisory Board are elected by the Annual General Meeting as shareholder representatives. The

Supervisory Board is not subject to employee co-determination.

8 HelloFresh SE Annual Report 2021

The members of the Supervisory Board have comprehensive competencies for effectively monitoring the work of the

Company’s Management Board. The Chairman and the Supervisory Board members have considered that these

competencies accurately reflect the risk and success factors relevant to the business. As of now, the competencies are

broken down among the individual members as follows:

Functional Experience

Sector

Exp.

Diversity Term

Accounting

Controlling/Risk

Management

Marketing

ESG

Capital Markets/

Investor Relations

Corporate Governance/

Compliance

Managing public

companies

US and International

Markets

FMCG

Digital and Internet

Food

Age

Gender

Nationality

Work Stage

Independence

Other Mandates

Initial Election

End of Term

John H.

Rittenhouse

(Chairman)

Y Y Y Y Y Y Y Y Y Y 65 M US exec Y 3 2015 2023

Ursula Radeke-

Pietsch (Deputy

Chairwoman)

Y Y Y Y Y Y Y Y Y 63 F DE exec Y 2 2015 2023

Derek Zissman Y Y Y Y Y Y Y Y Y 77 M GB post Y 4 2015 2023

Stefan Smalla Y Y Y Y Y Y Y 45 M DE exec Y 1 2021 2023

Susanne

Schröter-Crossan

Y Y Y Y Y Y Y 42 F DE exec Y 1 2021 2023

The other board mandates of the Supervisory Board members are as follows:

• John H Rittenhouse: Chairman and CEO, Cavallino Capital, LLC; Vice Chairman Supervisory Board, Jumia

Technologies AG; Advisory Board Member, Flaviar Inc.

• Ursula Radeke-Pietsch: Global Head Strategic Projects, Siemens AG; Deputy Chair Supervisory Board, Autodoc AG

• Derek Zissman: Director, Crossroads Partners Ltd., Non-Executive Directory. Sureserve Group Plc.; Non-Executive

Director, 600 Group Plc.; Non-Executive Director, Revolution Beauty Plc.

• Stefan Smalla: CEO, Westwing Group AG

• Susanne Schröter-Crossan: CFO, LEG Immobilien SE

Changes in the Management Board

There was no personnel or structural change in the Management Board in the reporting year.

Corporate governance disclosures

Both the Management Board and Supervisory Board are committed to upholding principles of good corporate

governance and transparency. In lieu of this report, the Group has published, or will publish supplementary

information on its website, www.hellofreshgroup.com, in the Governance sub-section of the Investor Relations

pages that includes:

• A declaration by the Supervisory Board and Management Board of conformity for HelloFresh SE in accordance

with Sec. 161 German Stock Corporation Act (“AktG”) as part of its reporting on fiscal year 2021, whereby

exceptions from the German Corporate Governance Code are explained;

• The Corporate Governance Report 2021, which details:

- the working methods and accountabilities of the Management Board, the Supervisory Board and its

Committees;

- the composition profile of the Management Board and Supervisory Board;

- an outline of the self-assessment process adopted by the Supervisory Board;

9 HelloFresh SE Annual Report 2021

• The Compensation Report; and

• The Group code of ethics.

Meetings of the Supervisory Board and its committees

In the fiscal year 2021, the Supervisory Board met six (6) times and had four sub-committees which met as set forth

below.

Supervisory

Board

Committees

Attendance %

Audit Remuneration

Executive and

Nomination

ESG

John H. Rittenhouse 6 of 6 7 of 7 2 of 2 3 of 3 2 of 2 100%

Ursula Radeke-Pietsch 6 of 6 7 of 7 2 of 2 n/a n/a 100%

Derek Zissman 6 of 6 7 of 7 n/a 3 of 3 n/a 100%

Stefan Smalla 4 of 4 n/a 2 of 2 n/a 2 of 2 100%

Susanne Schröter-

Crossan

4 of 4 n/a n/a 3 of 3 2 of 2 100%

The Supervisory Board and its committees conducted its business through video and conference call meetings.

Furthermore, the Supervisory Board, the Executive and Nomination Committee and the Remuneration Committee

adopted several resolutions by circulation and by e-mail voting.

Audit of the standalone and consolidated financial statements

KPMG AG Wirtschaftsprüfungsgesellschaft, Berlin was elected as auditor for fiscal year 2021 by the Annual General

Meeting, and proposed by the Supervisory Board. The Supervisory Board confirmed the terms, audit focus areas and

engagement, all of which were negotiated by the Audit Committee. KPMG were first appointed as auditor for fiscal year

2019, and the auditor primarily responsible for the performance of the engagement is Marius Sternberg, having acted in

this role for a period of 3 years.

The Supervisory Board has engaged KPMG to audit the annual financial statements for the year ended 31 December

2021, together with the accounting records, the management report, as well as the risk monitoring system. The auditor

issued an unqualified audit opinion on both the financial statements and the management report.

The Audit Committee satisfied itself with the auditor’s independence and obtained a written declaration in this respect.

The financial statements and the auditor’s long-form reports were sent to the members of the Audit Committee and the

Supervisory Board, who reviewed the separate and consolidated financial statements and the combined management

report of HelloFresh SE. The results of the review by the Audit Committee and the results of its own review are fully

consistent with the results of the auditor’s audit. Having completed its review, the Audit Committee and the Supervisory

Board have no reason to raise any objections to the audit of the financial statements. The Supervisory Board has

therefore approved the standalone and consolidated financial statements of HelloFresh SE for fiscal year 2021. The

financial statements of HelloFresh SE for 2021 are therefore ratified.

The Supervisory Board would like to thank the Management Board and all employees of HelloFresh for their excellent

work and their high level of commitment in fiscal year 2021.

Berlin, 28 February 2022

On behalf of the Supervisory Board

10 HelloFresh SE Annual Report 2021

Corporate Strategy

Our vision is to build the world’s leading integrated food solutions group – being a pioneer as the nascent online food

market expands manyfold over the coming years. Our direct-to-consumer value chain allows us to offer superior

“product fit” when compared to a traditional grocery shopping experience, and over time we will become relevant for

more and more households as we advance our value proposition, expand our product portfolio, and appeal to new

customer segments. We have built over time significant capabilities and expertise across: recipe creation, menu

development and demand forecasting skills powered by a large volume of proprietary data and software; a highly

reliable and direct-to-consumer supply chain of perishable goods in multiple markets; efficient production processes in

our fulfilment centers; cost efficient and reliable logistic solutions; a well-known brand and powerful growth marketing

& digital platform. These capabilities have allowed us to build a strong competitive position not only in our original meal

kit market, but - following our acquisitions of Factor75 and YouFoodz - also now in the direct-to-consumer ready-to-eat

meal market, adding another meaningful vertical to our fully integrated food solutions group.

Increase Our Market Penetration

We believe there is significant room for growth in our current countries of operation. During the three months ended 31

December 2021, we had 7.22million customers, compared to our addressable market of roughly 176 million households

in the seventeen countries we operate in. In the US segment we are targeting roughly 77 million households across our

HelloFresh, EveryPlate, Green Chef, and Factor75 brands by offering a diverse range of products at different price points.

In the International segment we are targeting roughly 99 million households with the HelloFresh, EveryPlate, YouFoodz

(Australia), and Chef’s Plate (Canada) brands.

Both of our operating segments are currently operating at modest penetration rates, being 4.6% of our addressable

market in the US, and 3.7% in our International geographies. Whilst this has increased during the fiscal year, it indicates

a significant opportunity remains for expansion in our current markets. In the midterm we are planning to roughly

double the current level of penetration. This will primarily be driven by continued expansion of our product and service

offering - improving the level of convenience, selection and value we offer customers. For example, in our most

advanced markets we have expanded our menu from 6 to 30-40 weekly recipes over the last 5 years. This will continue

to expand over time to 50-100 menu options, enabling us to attract, retain and reactivate customers with a wider range

of dietary needs or preferences.

Selectively Increase our Geographic Reach

We believe that there are attractive opportunities to selectively expand geographically. We started our operations in

Germany, Austria, Australia, the Netherlands and the United Kingdom in 2012; and then expanded to the United States

in 2013 and Belgium in 2015. In the second quarter of 2016, we further expanded our operations into Switzerland and

Canada. During 2017, we rolled out operations into Luxembourg and expanded into Western Australia. In 2018 we

launched our operations in New Zealand and in France. In 2019, we launched our service in Sweden and in 2020 in

Denmark. And more recently, in 2021, Norway, Italy and Japan were launched. During 2022, we plan to launch 2 or more

new geographic markets.

Increase Customer Monetization

Expansion of our product offering will not only drive higher market penetration, but also improved customer

monetization. We can monetize customers on top of their regular subscription plan both within our core meal kit

product (via a portfolio of upcharge offerings, such as “premium meals”, extra recipes, or additional portions) and also

by cross-selling products targeting other meal occasions (via our recent launch of “HelloFresh Market”). “HelloFresh

Market” allows customers to purchase products such as salads, quick-prep lunches, desserts, snacks, or breakfast. In

our pilot BeNeLux region we now offer customers up to 500 products, and have so far seen strong uptake. Based on

these strong results, we will expand “HelloFresh Market” to several of our other major geographies over the course of

2022.

Launch and Scale Adjacent and New Verticals

As part of our vision to become the world’s leading food solutions group, we are also planning to enter new verticals,

which leverage the strong capabilities we have established whilst building our core meal kit business. The acquisitions

of the ready-to-eat meals providers Factor75 and YouFoodz were steps in this direction. This expansion allows us to

appeal to an even broader range of households, who are less inclined to cook regularly from scratch, indexing more

towards single households and a male audience.

11 HelloFresh SE Annual Report 2021

Similar to our successful expansion to the ready-to-eat space, we see many additional opportunities to apply our

leading direct-to-consumer food capabilities to serve other large, attractive and incremental customer segments over

time.

Scaling our Capabilities and Infrastructure

In order to realize our vision, we continue to invest in building strong internal capabilities. Within our supply chain, this

includes capacity expansion, selective investments into our own last mile infrastructure, and further automating our

fulfilment centers across our territories. Fulfilment center automation will not only improve our unit economics, but

also allow for faster and more efficient product expansion over time. For that purpose, we are in the process of testing

and implementing additional automation solutions in our fulfilment centers.

Outside of supply chain, we plan to further invest in building our tech organization, which is responsible for creating

bespoke solutions to drive performance enhancements across all key HelloFresh functions. Our tech capabilities not

only generate value for our core meal kit businesses, but can be leveraged for other direct-to-consumer verticals which

enable us to expand organically or via M&A. Following the successful integration of prior acquisitions (Factor75, Green

Chef, and Chef’s Plate) to our tech platform, we have seen significant improvements in customer profitability. As a

result, we believe our continued investment into tech capabilities will be a key enabler of further successful expansion

to other verticals over time.

12 HelloFresh SE Annual Report 2021

B. Combined Management Report

1 Fundamentals of the Group .................................................................................................................................... 15

1.1 Business Model .................................................................................................................................................. 15

1.1.1 General Information ................................................................................................................................ 15

1.1.2 Business Activities ................................................................................................................................... 15

1.2 Research and Development ............................................................................................................................. 17

2 Performance Measurement System ...................................................................................................................... 18

2.1 Financial Performance Indicators ................................................................................................................... 18

2.2 Non-Financial Performance Indicators .......................................................................................................... 19

3 Economic Position ................................................................................................................................................... 20

3.1 General Economic Conditions ......................................................................................................................... 20

3.1.1 International Market ............................................................................................................................... 20

3.1.2 USA ........................................................................................................................................................... 20

3.2 Food Market Condition ..................................................................................................................................... 21

3.3 Course of Business ............................................................................................................................................ 21

3.4 HelloFresh Share and Share Capital Structure .............................................................................................. 22

3.5 Overall Statement of the Management Board on the Course of Business and Economic Environment ..

22

4 Position of the Group ............................................................................................................................................... 23

4.1 Earnings Position of the Group ........................................................................................................................ 23

4.2 Financial Position of the Group ....................................................................................................................... 24

4.3 Asset Position of the Group ............................................................................................................................. 25

4.4 Financial Performance of the Reportable Segments .................................................................................... 26

4.4.1 Financial Performance of US Segment .................................................................................................. 26

4.4.2 Financial Performance of International Segment ................................................................................. 27

5 Risk and Opportunity Report ................................................................................................................................. 29

5.1 Risk Report ........................................................................................................................................................ 29

5.1.1 Countermeasures and Internal Control System .................................................................................... 30

5.1.2 Risk Reporting and Methodology ........................................................................................................... 30

5.1.3 Risk Areas ................................................................................................................................................ 31

5.2 Opportunities Report ....................................................................................................................................... 35

6 Outlook ...................................................................................................................................................................... 36

6.1 Economic Conditions ........................................................................................................................................ 36

6.2 Target Attainment 2021 ................................................................................................................................... 36

6.3 Outlook 2022 ..................................................................................................................................................... 36

7 Supplementary Management Report to the Separate Financial Statement of HelloFresh SE ..................... 37

7.1 Basic Information ............................................................................................................................................. 37

7.2 Performance of HelloFresh SE ......................................................................................................................... 37

7.2.1 Financial Performance of HelloFresh SE ................................................................................................ 37

7.2.2 Net Assets of HelloFresh SE .................................................................................................................... 38

7.2.3 Financial Position of HelloFresh SE ........................................................................................................ 39

7.3 Risks and Chances ............................................................................................................................................ 39

7.4 Outlook 2022 ..................................................................................................................................................... 39

13 HelloFresh SE Annual Report 2021

8 Corporate Governance Statement ........................................................................................................................ 40

9 Combined Non-Financial Report ............................................................................................................................ 41

10 Takeover Law ........................................................................................................................................................... 42

14 HelloFresh SE Annual Report 2021

1. Fundamentals of the Group

1.1. Business Model

Since its foundation as a meal kit provider in 2011, HelloFresh continues to be a leading innovator in the food at home

industry. Over the past decade the Group has built a strong, trusted brand for providing personalized, home-delivered

meal solutions in numerous regions around the world. In addition to our most prominent brand, HelloFresh, the Group

also owns Chefs Plate, EveryPlate, Factor75, Green Chef and YouFoodz, providing personalized meal solutions to

7.22million active customers (in the three months ended 31 December 2021).

The mission of the Company is to change the way people eat forever, providing customers with a safe, convenient way

to enjoy fresh home cooked or fully-prepared meals with no planning and no shopping required. These are delivered

directly to customers’ homes, through an efficient centrally fulfilled operating model.

1.1.1 General Information

Founded in Berlin in 2011, HelloFresh was one of the first companies to offer meal kit solutions as they are known

today. Shortly after our two founders assembled the first meal kits in their kitchens, they quickly ramped up

operations to offer nationwide coverage in Germany, the Netherlands and the United Kingdom. Subsequently,

HelloFresh expanded to Austria, Australia, the contiguous United States, Belgium, Canada, Switzerland, Luxembourg,

France , New Zealand, Sweden, and Denmark. In 2021, HelloFresh started operations in Norway, Italy and Japan. With

operations in seventeen countries across four continents, HelloFresh has grown to become one of the largest players

globally in the meal kit market in terms of geographic coverage, revenue, and number of active customers.

HelloFresh’s business is managed based on two geographical regions which form our operating and reporting

segments: “International” and “USA”. International segment comprises our operations in Australia, Austria, Belgium,

Canada, Denmark, Germany, Italy, Japan, Luxembourg, France, the Netherlands, New Zealand, Norway, Sweden,

Switzerland, and the UK. The USA segment comprises our businesses in the United States of America (‘USA’).

1.1.2 Business Activities

Our business model differs from that of a retailer or grocer, as it rethinks the traditional food supply chain model. By

starting with the consumer and working upstream with a “pull model”, we largely eliminate the need for intermediaries

such as distributors or wholesalers. We work closely with our supplier network, many of who are local suppliers, to

ensure we can purchase the ingredients for our meal solutions on a just-in-time basis and in the required quantities. We

operate on a low inventory basis for perishable products. We in principle only order from our suppliers what we have

confirmed to sell to our customers. The ingredients for our meal kits, and ready-to-eat meals, are packed in our

refrigerated fulfilment centers that are expanded where possible to support our expected future growth. From there, our

food solutions are delivered using insulated packaging or refrigerated vehicles, which allow us to deliver the ingredients

with a high level of freshness.

In addition to the core meal kits, in BeNeLux and US, we also offer our customers a more comprehensive portfolio of

solution-oriented food through HelloFresh Market. There, we provide an extensive choice of add-on products, such as

desserts, soups, snacks and selected grocery items, like meat and dairy products. We also provide customers in certain

geographies with ready-to-eat meals in a primarily direct-to-consumer model.

Our core business processes are data and technology driven. Our customized suite of software tools allows us, for

example, to transform weekly menus into efficient ingredient purchasing decisions, and to feedback information about

pricing and availability into the menu planning. Our technology automatically sets up weekly schedules for both

production and delivery to our customers within their preferred delivery selection and provides us with data to further

improve our products and processes. Our technology platform also helps our marketing team to understand multiple

customer touch points, and to dynamically allocate our marketing budget across markets and channels. This allows us

to optimize customer profitability, i.e., projected profit contribution generated during the entire commercial

relationship with particular customer cohort, as compared to customer acquisition costs.

A Meal Kit Plan That Fits

Our value proposition rests on five pillars: great tasting healthy food; personalization; providing high value for money;

high convenience; and an enjoyable product experience. Our customers can pick a plan depending on their dietary

preferences, schedule and household size. Depending on the market, our customers can choose from among our two,

three, four or five-person food boxes. Our customers can select in most markets from 30 to 40 chef-designed recipes that

change on a weekly basis. Our dedicated team of chefs and dietitians curate a weekly menu which features new dishes

that on average take approximately thirty minutes to prepare. When creating new recipes and combining recipes into

15 HelloFresh SE Annual Report 2021

weekly menus, our chefs and dietitians make use of our underlying data and analytics tools to cover a wide and diverse

range of tastes and dietary preferences such as family-friendly, vegetarian, vegan, low-calorie, and quick and easy

options. In addition, customers are able to swap, upgrade, or add recipes and portions in menu to further personalize

their choices.

Our premium meal kit brand Green Chef, acquired in March 2018, offers our US and UK customers a variety of easy-to

follow meal plans for every lifestyle and diet, from keto to plant-powered and beyond. Green Chef US is a certified

organic company. Additionally, in the US and Australia with EveryPlate we offer a great value by delivering familiar,

filing, pre-portioned ingredients with simple recipes. In Canada, Chefs Plate makes our product accessible to customers

with tighter budgets. In 2020, with the acquisition of Factor75 in the US, we unlocked a new customer segment by

delivering healthy and fresh ready-to-eat meals. Moreover, recently in October 2021, we acquired Youfoodz in Australia,

which is offering ready-to-eat meals, protein-packed snacks and cold-pressed juices.

Data-Driven Meal Design and Menu Optimization

Our meal design process relies on both quantitative and qualitative design principles. Our recipes are created by

combining the market specific input from our chefs’ experience and their knowledge of food trends as well as

customer inputs, in particular customer ratings and ingredient-based data points.

Our weekly menu selection is also highly quantitative and allows us to combine any number of recipes in such a fashion

that a variety of tastes, dietary preferences, lifestyle choices and other characteristics can be covered. Our software

optimization tool allows us to collect and analyze all quantitative and qualitative recipe reviews we receive every week

with respect to, for example, price, ingredients, and flavor combinations of our recipes. This helps us to further optimize

our offering and to identify our customers’ needs with respect to protein, cuisine and variety, rare ingredient and menu

mix.

Product Innovation

The quality of our meals and product offering is the result of a structured and data-driven product development

approach. Product innovation complements our recipe development and menu planning. We have rolled-out

across major geographies a portfolio of upcharge offerings, such as premium meals, double-portions, extra-

recipes. We also offer an increasing selection of add-ons, such as soups, snacks, fruit boxes, desserts, ready-to-eat

meals and seasonal boxes (e.g. for Christmas). New initiatives are evaluated through a rigorous test and learn

philosophy that leverages data to optimize for product range and presentation.

Flexible Ordering Model

Our business generally operates on a flexible ordering model, i.e. our customers sign up to a plan, which they can

customize for parameters such as household size, number of meals, delivery window, and taste preference/diet.

Customers can also pause deliveries for the weeks they do not wish to receive a meal box, for example while on

holiday. Our customers can pause or cancel at any time, and are only required to pay for the deliveries they

actually receive.

Close Cooperation with Our Growers, Focus on Seasonal Produce, Technology and Data Driven Demand

Forecasting

We work closely with our growers and producers to ensure that our customers receive fresh, seasonal and healthy

ingredients in the exact quantities needed for their meals. We use technology and data in all steps of our menu

development and sourcing process from designing and choosing seasonal recipes to forecasting demand or

testing the attractiveness of different menus ahead of time.

We are able to indicate estimated demand to our suppliers through our ordering tool several weeks in advance which in

turn allows us to provide visibility to our suppliers, lock-in prices and reduce over/under-ordering of any particular

ingredient. This estimate is further refined during the customer recipe selection phase in advance of the final order cut-

off. Following the weekly cut-off time for customer selection, we are able to specify exact quantities to our suppliers,

and the exact day and time when certain quantities need to be delivered to fulfilment centers.

Just-In-Time Delivery / low Inventory

We operate a just-in-time delivery model to minimize perishable inventory, placing an emphasis on straight to line

production and assembly rather than warehousing operations in our fulfilment centers. Typically, dry goods are

delivered once a week to our fulfilment centers, while perishables goods are delivered daily. We assemble and pack

the individual deliveries with all the necessary ingredients. Ingredients are typically pre-portioned to match the

16 HelloFresh SE Annual Report 2021

corresponding recipes. The food boxes are then either handed to our logistics partners for delivery or, in the case in

the BeNeLux (Belgium/Netherlands/Luxembourg ), Australia, parts of Germany, Canada and US delivered through our

own logistics operation. Depending on the market, ingredients are either delivered in boxes layered with insulating

liners and ice packs to keep perishable ingredients cool or using refrigerated vehicles.

1.2 Research and Development

HelloFresh does not have a traditional research and development department; however, we constantly strive to

optimize our existing processes and pursue development projects which will create future economic benefits. Given that

most steps across our value chain rely on our strong technology competencies, tech represents one of the largest

expense items in our central holding expenses. In 2021 we spent MEUR 88.0 (2020: MEUR 55.4) on technology, including

salaries for our several hundred developers and data engineers.

Of our technology expenditure, HelloFresh capitalized MEUR 17.3 of internally developed software in the year ended 31

December 2021 (2020: MEUR9.9). Amortization totaled MEUR 3.8 in 2021 (2020: MEUR2.1).

17 HelloFresh SE Annual Report 2021

2. Performance Measurement System

We have designed our internal performance management system, and defined appropriate performance indicators.

Detailed weekly and monthly reports are an important element of our internal management and control system. The

financial performance measures we use are oriented toward our investors’ interests and expectations. We use both

financial and non-financial performance indicators to measure the success in implementing our strategy.

2.1 Financial Performance Indicators

HelloFresh steers its operations with revenue and AEBITDA as leading key financial performance indicators.

Revenue

Revenue is primarily generated from the sale of meal kits, containing recipes and the corresponding

ingredients, add-ons, and ready-to-eat meals as well as shipping fee. Revenue is recognized when the goods

have been delivered to the customer. Revenue represents amounts receivable for goods supplied, stated net

of promotional discounts, customer credits, refunds, and VAT.

Revenue is an indicator of the demand for our products, and an important factor for the long-term increase

in corporate value.

AEBITDA

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, and Results from Investment in

Associates, “AEBITDA”, is calculated by adjusting EBITDA for special items, and on segment level, holding

fees. Special items consist of share-based compensation expenses, and other special items of a nonrecurring

nature, which include expenses related to legal, and other services incurred in connection with M&A-

transactions, one-off costs related to reorganizations and restructurings, and prior period related effects.

Special Items do not adjust for any potential impact that the COVID-19 pandemic may have had on the result

of the Group. Holding fees represent a remuneration for high value-adding services performed by HelloFresh

SE, and for using the HelloFresh intellectual property rights.

AEBITDA is an indicator for evaluating underlying operating profitability as it does exclude items that we

believe are not reflective of the underlying business performance, i.e., share-based compensation expenses,

and certain special items that are of a nonrecurring nature, and on segment level, holding fees.

In addition to the above-stated key financial performance indicators, the following auxiliary financial performance

indicators are relevant to an evaluation of our performance and the cash flows generated by our business, although

they are not employed as the basis for managing the Group as a whole.

Contribution

margin

Revenue less procurement expenses net of share-based compensation expenses included in procurement

expenses, and less fulfilment expenses net of share-based compensation expenses included in fulfilment

expenses.

Contribution margin is an indicator for evaluating our operating performance, and margin development

before marketing and G&A.

EBITDA

Earnings before Interest, Taxes, Depreciation, and Amortization, and results from investment in associates,

“EBITDA” is operating profit (EBIT) before Depreciation and Amortization.

EBITDA is an indicator for evaluating operating profitability.

AEBIT

Adjusted Earnings before Interest, and Taxes, represents AEBITDA minus Depreciation and Amortization, and

results from investment in associates.

AEBIT is an indicator for evaluating operating profitability

Net working

capital

We calculate net working capital as the sum of inventories, trade receivables, VAT receivables, and

similar taxes less trade payables, contract liabilities, VAT payables, and similar taxes.

Net working capital is an indicator of the capital efficiency of the business.

Capital

expenditure

Cash used for purchase of Property, Plant, and Equipment, software development expenditure, and purchase

of software licenses.

Cash expenditure is an indicator for the cash used in the operations for investment purposes.

Cash flow used in

operating

activities

Net income adjusted for all non-cash income/expenses plus/minus cash inflow/outflow from net working

capital.

Cash flow used in operating activities is an indicator of the operating cash flows generated by the business.

Free cash flow

Cash flow from operating activities reduced by net capital expenditure (excluding investments in subsidiaries,

time deposits, and restricted cash) and repayment of leases (excluding interest).

Some of the indicators described above are, or can be, so-called non-GAAP financial measures. Other companies, that

use financial measures with a similar designation, may define them differently.

18 HelloFresh SE Annual Report 2021

2.2 Non-Financial Performance Indicators

HelloFresh’s results of operation, and financial condition are subject to a range of influences that in turn depend on

several factors. In addition to the above-stated financial performance indicators, the Group uses a range of non-

financial performance indicators in order to measure the economic success of business activities. HelloFresh steers

its operations by evaluating the number of active customers.

Active customers

Number of uniquely identified customers, who at any given time, have received at least one box within the

preceding three months (including first time and trial customers, customers who received a free or discounted

box, and customers who ordered during the relevant period but discontinued their orders and registration

with us before period end), counted from the end of the relevant period.

The growth in active customers typically correlates closely with our revenue growth.

In addition, the following auxiliary non-financial performance indicators are relevant for evaluation of our performance

with respect to customers, the market, our offerings and our environmental impact but are not employed as the basis

for managing the Group as a whole:

Meals delivered

Meals delivered or Number of meals is defined as the number of individual recipes that have been delivered

within the corresponding period.

Orders

Orders represent the number of orders shipped to customers in a given period. An order typically consists of

several meals, and can also contain additional add-on products.

Orders per

customer

The number of orders in a given quarter divided by the number of active customers in the same period.

Average order

value

Total revenue divided by the number of orders in the corresponding period.

Food waste

Food waste produced by the Group's own fulfilment centers that is disposed of in landfills or by incineration,

per euro of sales (food waste per euro of revenue)

Carbon emissions

CO2 emissions produced by the Group's own fulfilment centers per euro of revenue (CO2 emissions per euro of

revenue)

We believe that organic growth will continue to be a major driver of our future growth. We currently intend to increase

the penetration in our markets by enlarging our customer base across our brands. In addition, we are targeting to

expand our average order value, partly by expanding our HelloFresh Market offering and surcharge offerings.

With regards to the environmental KPIs, food waste and carbon emissions, we refer to our Non Financial Report, which

is published separately (see also Section 9 ).

19 HelloFresh SE Annual Report 2021

3. Economic Position

3.1 General Economic Conditions

The global economy is still recovering, although somewhat hampered by COVID-19 variants outbreaks and supply

bottlenecks. In October 2021

1

, the World Economic Outlook (‘WEO’) issued by the International Monetary Fund (‘IMF’)

estimated a global economic growth of 5.9% for 2021, which remains unchanged on its update published in January

2022

2

.

During 2021, focus on global health strategy continued to be the top priority in order to disrupt the effect of

forthcoming virus variants. Also, due to the rapid variant spreads, it was observed that mobility restrictions, border

closures, and financial markets volatility towards the end of 2021 have increased again

2

. As a response, countries have

implemented large-scale vaccination and booster campaigns in 2021, together with tests, treatments and required

use of personal protection equipment. While 70%

2

of the population in high-income countries are fully vaccinated by

the end of 2021, many low-income countries are struggling with the campaigns.

Supply and transportation bottlenecks as well as rising commodity prices pose another risk. During 2021, advanced

economies, especially in Europe and the United States, observed a shift to goods consumption which overloaded

global supply chains, causing struggles in transportation, staffing and inventory. The supply disruption led to

shortages and higher prices for imported consumer goods. Together with increases in commodity prices, this has lead

to rising inflation during the global economic recovery

2

.

3.1.1 International Market

Pandemic effects were mitigated by the implementation of vaccinations programs in all our international markets.

Together with sizable fiscal support, this has lead to an economic recovery in 2021 after the contraction noted in 2020.

From an economic point of view, the IMF estimated that the euro area grew by 5.2% in 2021

2

. After strong growth in the

first half of the year, real GDP growth slowed in the fourth quarter 2021

2

. Supply constraints and COVID disruptions have

slightly reduced the growth momentum alongside with exposure to supply chain shocks in the fourth quarter 2021.

Monetary policies vary according to country-specific inflation in the euro area

2

.

According to the IMF, the economy of the United Kingdom grew by 7.2 % in 2021

2

. All industry sectors showed a positive

dynamic leading to an economic output exceeding its pre-pandemic level for the first time in November with further

downturn in December impacted by Omicron. There was a noticeable inflation increase in December: the annual

consumer price index reached 5.4% vs 5.1% in November. According to the ECB, the inflationary pressure is expected to

stay strong in the upcoming months

3

.

The IMF estimated that the economy in Japan grew by 1.6% in 2021

2

. After a downturn in summer, the recovery

occurred mostly in the fourth quarter 2021, mainly due to pent-up demand and increased production capacity

supported by the automotive sector

3

.

In respect of other international markets, in 2021 the economy grew by 4.2% in Australia and by 4.7% in Canada

2

.

3.1.2 USA

According to the 2021 WEO Update, the economy of the United States grew by 5.6% which represents a lower growth

rate than initially expected. Economic activity in the US experienced unanticipated headwinds, including COVID-19

outbreaks, supply shortages, rising wages and energy prices and reduced pandemic-related fiscal support

2

.

On the other side, consumer price inflation has rapidly increased, on one hand due to pandemic outbreak and weather

disruptions which caused supply chain interferences and on the other hand due to increased demand for consumer

goods and higher commodity prices. Additionally, there has been a rapid reduction in unemployment resulting in

accelerating nominal wage growth and a tight labor market in the United States.

20 HelloFresh SE Annual Report 2021

1

https://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021

2

https://www.imf.org/en/Publications/WEO/Issues/2022/01/25/world-economic-outlook-update-january-2022

3

https://www.ecb.europa.eu/pub/economic-bulletin/html/eb202201.en.html

3.2 Food Market Condition

Food remains one of the biggest areas of consumer spending. According to a study done by Citi Research

1

in September

of 2020 the sum of total food spent, across the markets HelloFresh operates in, equates to roughly EUR 2.7 trillion

annually. Ongoing growth in the adoption of food e-commerce saw US category penetration increase to 5% in 2021,

according to eMarketer, which remains meaningfully behind other non-perishable consumer categories.

With our seventeen countries of operation, we are currently targeting approximately 176 million households. We seek to

tap into these households by further increasing brand awareness through our quantitatively calibrated paid marketing

channels, and through referrals from our customer base consisting of 7.22million active customers (in the three months

ending 31 December 2021). We believe that growth in our markets will be driven by the fundamental tailwinds that are

shifting consumer behaviors towards a healthier and more food conscious lifestyle, a focus on both cognitive and

physical convenience, a trend towards customers seeking sustainable higher quality solutions, and a general trend

towards food purchases online. Our ongoing investment in service and product development is aligned to these trends

as a foundation for our growth outlook.

In many of our operating markets, inflationary factors played a role in upward pricing pressure for consumers. This is

influenced by increased labour cost in the supply chain, and broader ingredient input cost inflation. As a centrally

fulfilled, directly sourced food solutions Company, HelloFresh is well positioned to deliver real terms pricing benefit to

consumers versus traditional retail competitors in such an environment.

There are several direct and indirect competitors for meal kit solutions in each of the individual markets in which we

operate. Among the direct competitors of size are companies such as Home Chef in the USA, Gousto in the UK, Marley

Spoon in Australia and the US, Linas Matkasse in the Nordics region, and Good Food in Canada. Our ready-to-eat offer in

the US directly competes with Freshly.

In addition, we also indirectly compete with online and/or offline grocery stores and grocery delivery platforms,

supermarket chains as well as with restaurants and takeout platforms.

3.3 Course of business

Given the actual conditions, HelloFresh further increased its strong year-on-year growth trajectory. This is reflected by a

revenue increase of 61.5% on a constant currency basis driven by strong customer growth, continued high order rates,

and high average order value. Due to the stronger than initially anticipated growth in 2021, HelloFresh has accelerated

its investment into capacity expansion and infrastructure, resulting in an AEBITDA for the Group of MEUR 527.6 in 2021

(MEUR 505.2 in 2020).

For the International segment, HelloFresh delivered a high revenue growth rate of 57.3% in 2021 on a constant currency

basis. This was mostly due to an increased number of orders within our existing markets. Also, the geographical

expansion of our business to Norway and Italy and the acquisition of YouFoodz in October 2021 as an established ready-

to-eat focussed business in Australia contributed to the growth. In May 2021, the Group also launched its Green Chef

brand in the UK alongside its existing HelloFresh brand. In addition to meal kits, HelloFresh offers an increasing choice

of add-on products in certain markets. These include desserts, soups, snacks, and selected grocery items. As a result of

ongoing investments in strong customer growth, menu extension, and geographic expansion, our International segment

achieved an AEBITDA of MEUR 297.5 in 2021 (MEUR 275.5 in 2020).

For the US segment, HelloFresh is seeing strong growth, leading to a full year revenue growth rate of 65.0% on a

constant currency basis. In addition, our US segment achieved an AEBITDA of MEUR 310.1 in 2021 (MEUR 282.5 in 2020).

HelloFresh Group has also further expanded its product portfolio with the acquisition of Factor75 in December 2020

which contributed for the first time in 2021 to the Group’s revenues.

To enable its strong growth momentum, HelloFresh has meaningfully expanded its production capacities in 2021,

especially in the US, UK, Australia, Canada and BeNeLux.

21 HelloFresh SE Annual Report 2021

1

Citigroup Global Markets Inc. "Global Online Winner? A Recipe (Box) for Success” (23 September 2020), www.citivelocity.com

3.4 HelloFresh Share and Share Capital Structure

The HelloFresh shares are listed on the Frankfurt Stock Exchange (Prime Standard). In June 2018, HelloFresh was

included in the SDAX Index; in March 2020 HelloFresh was moved to the MDAX Index; and recently, in September 2021

HelloFresh was upgraded to the DAX Index, Germany’s leading stock market index. Additionally, the HelloFresh shares

are also member of the STOXX 600 Europe Index since 23 December 2019, and of the MSCI Europe and MSCI World

indexes since 30 November 2020.

HelloFresh’s share price increased by 6% during 2021.

The HelloFresh Share

Type of shares Ordinary bearer shares with no par value

Share Capital EUR 173,942,278

Number of shares issued 173,942,278

Total number of shares outstanding at 31 Dec 21 (net of Treasury

shares)

173,710,324

ISIN DE000A161408

WKN A16140

Share Performance 2021

High 2021 (26 August 2021) EUR 96.18

Low 2021 (08 March 2021) EUR 55.75

Closing Price (30 December 2021) EUR 67.54

Trading Liquidity 2021

Average daily trading volume (shares)* 752,780

Average daily trading volume 2021 (EURm)* 57.1

*Based on trading on XETRA

For further details in respect to share capital structure refer to the NOTE 18 to the Consolidated Financial statements.

3.5 Overall Statement of the Management Board on the Course of Business and Economic

Environment

With constant currency revenue growth in 2021 of 61.5% year on year, the performance of the business has exceeded

our initial growth expectations, whilst maintaining AEBITDA at MEUR 527.6. In parallel, we have invested MEUR 234.5 of

capital expenditure primarily into the expansion of fulfilment capacity, with an associated impact on marginal

fulfilment efficiency as these new facilities ramp up production. We have also invested into the further expansion of our

technology teams to deliver robust operational and product development that ensures the ongoing growth of the

business. Lastly, we have continued to deliver on our program of geographic and brand expansion across the Group.

2021 saw the economic environment emerge from the disruption propagated by the COVID-19 pandemic in most of our

markets. This resulted in a return to a more traditional seasonal pattern. We consider HelloFresh to be overall well

positioned to execute its ongoing capability investments during 2022, and to deliver its financial and strategic objectives

for the midterm.

22 HelloFresh SE Annual Report 2021

4. Position of the Group

The consolidated financial statements of HelloFresh were prepared in accordance with IFRS, as adopted by the

European Union.

4.1 Earnings Position of the Group

During 2021 HelloFresh’s revenue grew from MEUR3,749.9 in 2020 to MEUR5,993.4 in 2021, representing a growth of

59.8% on euro basis, and 61.5% on constant currency basis. Revenue growth has been driven by: a year-on-year

increase in active customers by 36.5%, which reached 7.22 million for the fourth quarter of 2021, compared to

5.29million in the same period of 2020; an increase in the average order value due to ordering of more meals, add-on

and surcharge products per order; which is slightly offset by a mild decrease in average orders per customer. For the

whole calendar year 2021 HelloFresh delivered 964.3million meals up from 601.2million meals in 2020. Average order

value (AOV) further increased to EUR 51.0 (2020: 50.4)against a strong prior year benchmark, primarily driven by an AOV

expansion in our US segment. Average order rate per customer has slightly decreased to 4.1 (2020: 4.2), mainly caused

by a return towards more normal seasonality during the third quarter 2021 compared to the previous year. Overall, we

have seen continued strong customer engagement and retention throughout the whole year.

Contribution margin (excluding shared-based compensation expenses) as a percentage of revenue in 2021 has

decreased to 25.3% compared to 28.2% in the prior year. Across the Group, procurement expenses as a percentage of

revenue have slightly increased from 34.0% in 2020 to 34.1% in 2021, which was due to certain underlying inflationary

trends in ingredient pricing primarily during the second half of 2021. Fulfilment expenses as a percentage of revenue

increased more meaningfully from 37.9% in 2020 to 40.9% in 2021. This was primarily driven by (i) a continued rapid

expansion of our fulfilment capacity and associated launch and ramp-up costs, (ii) a more normal seasonality which

means lower fixed cost utilization and higher packaging expenses in the peak summer months July and August, (iii)

certain increases in production-related wages, and (iv) market driven increases in logistic costs. Our International

segment, which had on a relative basis benefited more from rising capacity utilization in 2020, and was less affected by

Covid-headwinds, saw a steeper relative increase in fulfilment expenses compared to our US segment. During Q3 2021,

certain exceptional events, relating to storm-related damages impacting US ready-to-eat production volume for two

weeks and Covid-related quarantine measures for some of our production colleagues in Australia and New Zealand

impacted production capability over several weeks.

Marketing expenses (excluding share-based compensation) as a percentage of revenue increased to 14.4% in 2021

compared to 12.4% in 2020. The increase is driven by a normalization in customer demand and customer acquisition

costs in comparison with the same period last year, which was still meaningfully impacted by Covid effects.

General and Administrative expenses and Other operating income and expenses (including share-based compensation

expenses), as a percentage of revenue, have remained stable at 4.1% in 2021. In absolute terms, those expenses

increased from MEUR 155.5 in 2020 to MEUR 244.9 in 2021. General and Administrative expenses and Other operating

income and expenses (excluding share-based compensations expenses) as a percentage of revenue increased from

3.7% in 2020 to 4.0% in 2021.

Reported EBIT amounts to MEUR 391.8 in 2021, a positive margin of 6.5%, compared to a positive margin in 2020 of

11.4%. This is a result of the factors described above.

AEBITDA amounts to MEUR 527.6 in 2021, a margin of 8.8%, compared to MEUR 505.2 in 2020, a margin of 13.5%.

AEBIT amounts to MEUR 430.8 in 2021, a margin of 7.2%, compared to MEUR 458.1 in 2020, a margin of 12.2%.

23 HelloFresh SE Annual Report 2021

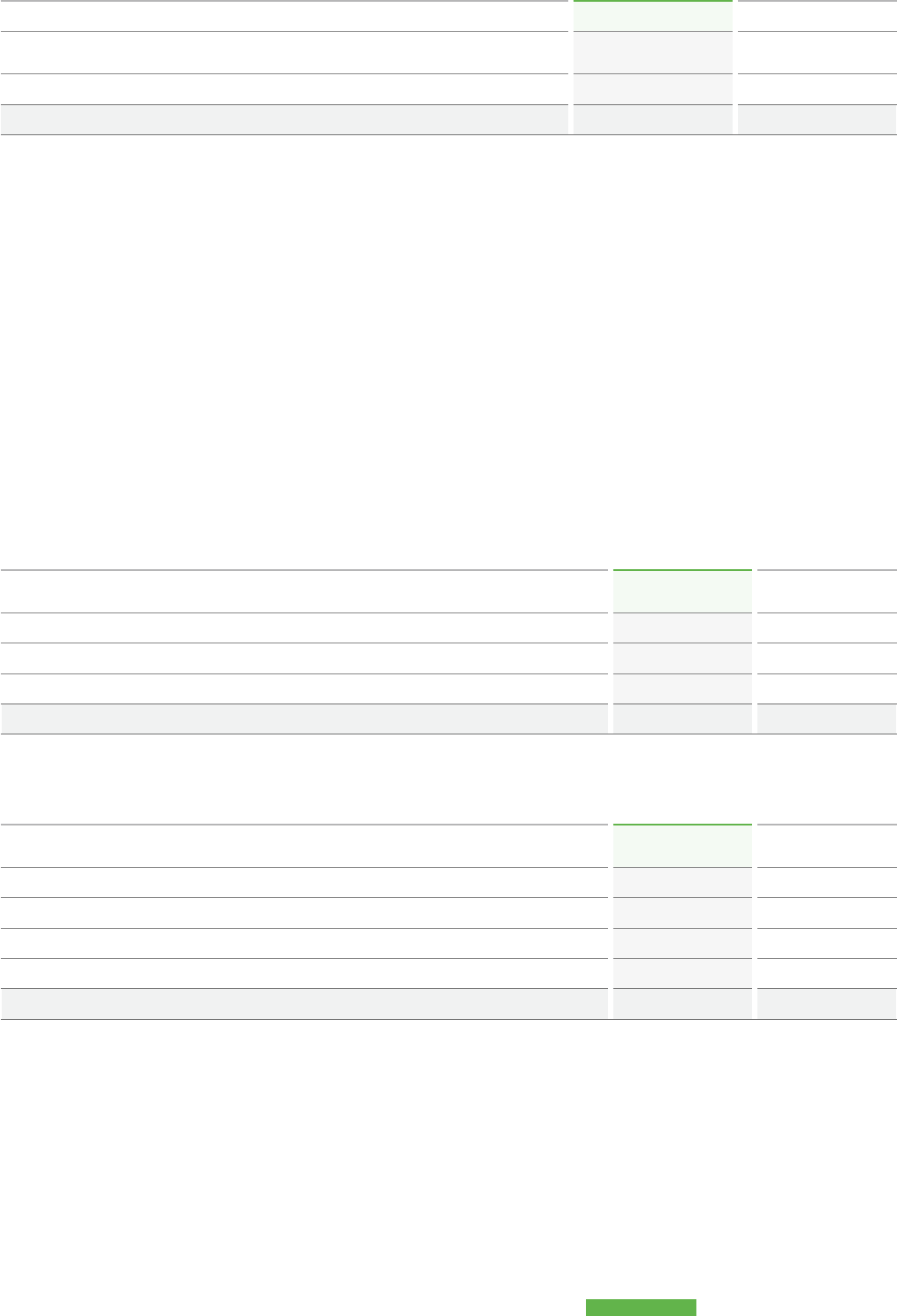

In MEUR 2021 2020 YoY

Revenue 5,993.4 3,749.9 59.8%

Procurement Expenses (2,046.4) (1,276.7) (60.3 %)

% of revenue (34.1%) (34.0%) (0.1 pp)

Fulfilment expenses (2,448.7) (1,422.1) (72.2%)

% of revenue (40.9%) (37.9%) (3.0 pp)