AUGUST 2022

SEE DISCLOSURE APPENDIX OF THIS REPORT FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS

HELLOFRESH: PAYING PEOPLE

TO EAT

A smaller TAM and weak business model will limit long-

term growth expectations

The HelloFresh business model is structurally weak. Selling expensive meal kits with

heavy discounts and high marketing spend has created a business that is churning

through its customers at a rapid rate.

The TAM is small, and TAM penetration is already high. A HelloFresh meal box is 125-

300% more expensive than supermarkets. Meanwhile, our proprietary analysis suggests

TAM penetration is high at 35-40%.

With high discounting and weak customer relationships, HelloFresh is effectively paying

people to eat, barely earning back customer acquisition costs.

We rate HelloFresh Underperform.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

1

PORTFOLIO MANAGER'S SUMMARY

Paying people to eat. HelloFresh is churning through customers at a rapid rate, acquiring

and reactivating customers at deep discount, and not earning back customer acquisition

costs over the lifetime of customers. It's a meal kit company, a product of its time (the

2010s) when capital was abundant, the TAM limitless, customers embraced new concepts,

and subscriptions smoothed the frictions of daily life. Our work on the stock, the company,

and its smaller-than-expected market opportunity are the subjects of this Blackbook.

Our bear case since our initiation of coverage in July 2021 has focused on three key points:

(1) a structurally weak business model; (2) a small TAM and high TAM penetration; and (3)

a flawed growth strategy. HelloFresh’s results show high churn, high marketing spending,

high discounting, and a very expensive product appropriate for city dwellers and people

who work in large corporations. The positives around changing consumer habits and

healthy eating do not capture consumer hearts fast enough to offset weak customer loyalty.

The numbers. The business is flawed. It is built upon high levels of discounting (>20% off

on average), high levels of churn (90% of customers don't purchase in Q4), and high levels

of marketing spend (>15% of sales). This leads to a business model that is predicated on

acquiring and churning through customers at a rapid rate.

The product is too expensive, and the TAM is small. HelloFresh resells a highly

commoditized product at significant markups (2-4x more than expensive than buying from

a supermarket), with a HelloFresh box for two people for three meals in the US costing $60

(vs. average US food spending of $85 per week). Discounts devalue the brand. The TAM is

smaller than what management claims, and TAM penetration is high at 35-40%. As a result

of a small TAM, expensive product, high churn, and high discounting, it barely earns back

its customer acquisition cost (CAC) with a customer lifetime value (CLTV) to CAC ratio of

just 0.8x (vs. 4x at best-in-class companies). Effectively, HelloFresh is paying people to eat.

You can't have your cake and eat it too. We struggle to reconcile long-term expectations of

high revenue growth and margin expansion. It will likely become harder to grow post-

pandemic with high inflation and expand margins with pressure on COGS, high marketing

spend, and the additional complexity introduced by its growth strategy. This strategy to

transform into a "food solutions group" is just a clever name for a "grocer." New verticals,

more recipes, customization, and grocery add-ons bring significant complexity to the

operation without fundamentally improving the relationship with customers. We would

prefer them to transform into a cash cow, focus on their most loyal and affluent customers,

and pull back on massive TAM expansion. Shareholder returns would improve, and the

business would be more sustainable.

August 3, 2022

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

2

HELLOFRESH: PAYING PEOPLE TO EAT

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

3

TABLE OF CONTENTS

SIGNIFICANT RESEARCH CONCLUSIONS 5

INTRODUCTION TO MEAL KITS 15

What is a meal kit? What are the unit economics?

BULL VS. BEAR 25

Laying out arguments from both sides

HELLOFRESH CUSTOMERS: GOODBYE FRESH CUSTOMERS 37

Proprietary deep dive into customer database and churn

HEAVY DISCOUNTING, TRADING DOWN RISK, AND HIGH LOGISTICS COST

EXPOSURE 61

How HelloFresh fares in an increasingly inflationary environment

CUSTOMER LIFETIME VALUE (CLTV) 73

HelloFresh effectively pays people to eat with a CLTV:CAC ratio of 0.8x

WOULD YOU PAY 2X, 3X, OR 4X MORE TO EAT? 81

Putting HelloFresh's high price points into context

READY, STEADY, COOK — A MEAL KIT TASTE TEST 89

How meal kits from different providers compare

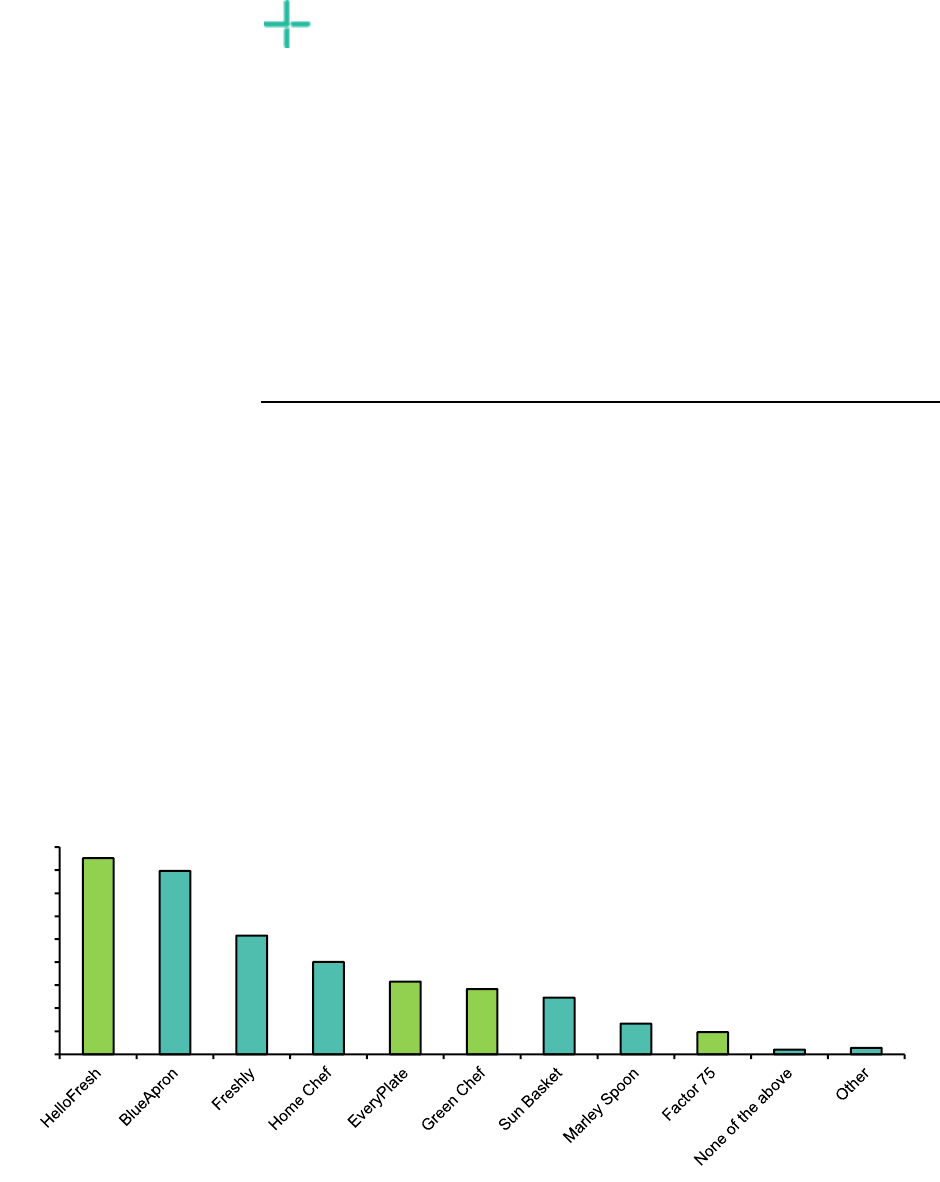

PROPRIETARY US CONSUMER MEAL KIT SURVEY – PART 1 105

Meal kit users

PROPRIETARY US CONSUMER MEAL KIT SURVEY – PART 2 119

Non-meal kit users and demographics

FOUR KEY TAKEAWAYS FROM THE 2021 CMD 131

FY22 margins hit, medium-term guidance unchanged

THE CASH COW POTENTIAL 143

If we were in control, how we would steer the company

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

4

HELLOFRESH: PAYING PEOPLE TO EAT

EXHIBIT 1: Financial overview

Note: HFG.GR is benchmarked against the MSCI Europe, which had a closing price of €145.1 as of close July 28, 2020.

Source: Bloomberg, and Bernstein estimates and analysis

Rating

Target price

Current price (28/07/2022)

Downside

Market cap (EUR mn)

Stock price move

52w range

TTM performance

TTM relative performance

Bernstein & Consensus EBITDA

forecasts

Bernstein

EBITDA

forecast

Bernstein

EBITDA

margin

EV/EBITDA on

Bernstein

forecast

Consensus

EBITDA

Consensus

EBITDA

margin

2021A 528 8.8%

2022E 490 6.4% 9.7x 483 6.4%

2023E 517 6.4% 9.2x 631 7.4%

2024E 772 8.8% 6.2x 815 8.5%

2025E 847 9.1% 5.6x 931 8.7%

2026E 902 9.1% 5.3x 1,010 8.6%

HelloFresh key operational metrics

Orders (mn) 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

65.2 68.4 73.5 76.4 79.5

International

64.7 67.9 72.4 75.3 78.3

Total 129.9 136.3 145.9 151.7 157.8

AOV (€) 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

67.9 67.1 66.8 68.2 69.5

International

49.7 51.8 53.6 54.6 55.7

Group 58.9 59.5 60.2 61.4 62.7

Active Customers 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

4.0 4.2 4.4 4.6 4.8

International

4.1 4.4 4.6 4.8 5.0

Total 8.1 8.6 9.0 9.4 9.8

Total Orders per Customer 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

16.4 16.2 16.6 16.6 16.6

International

15.6 15.5 15.7 15.7 15.7

Group 16.2 16.2 16.1 16.1 16.1

Revenue (€mn) 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

4,427 4,591 4,911 5,209 5,526

International

3,219 3,520 3,879 4,115 4,365

Holding

0 0 0 0 0

Total 7,646 8,111 8,789 9,324 9,891

Meals (mn) 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

508 534 573 596 620

International

572 601 637 663 689

Group 1,081 1,135 1,210 1,259 1,309

EBITDA (€mn) 2022FYE 2023FYE 2024FYE 2025FYE 2026FYE

US

375 410 515 550 585

International

162 141 308 351 374

Holding

-46 -34 -51 -54 -57

Total 490 517 772 847 902

€97.50 - €24.57

-68%

-63%

HelloFresh Group

Underperform

€24.00

€26.71

11.3%

€4,645

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

5

SIGNIFICANT RESEARCH CONCLUSIONS

THESIS OVERVIEW

HelloFresh is the global leader in meal kits, selling and delivering boxes of prepared

ingredients and recipes to customers on subscription. The industry remains immature as it

has only existed at scale for the last few years, with growth supercharged by the Covid-19

pandemic.

At a structural level, HelloFresh has a weak business model with high churn, high marketing

spend, and high discounting. 90% of customers aren't buying by Q4, discounting is >20%

on average, customers are bombarded with discounts once they sign up, and marketing

spend is >15%. The business is churning through customers at a rapid rate due to weak

product-market fit, limited change in consumer habits, and the high cost of the product.

With this business model, we think it will become increasingly hard to scale the business,

maintain the growth in customers, and improve profitability — all at the same time.

It's also expensive relative to a normal food shop, which limits the TAM and brings into

question TAM penetration. A HelloFresh box is 125-300%+ more expensive than cooking

from scratch and unaffordable for the average consumer. A box for two people for three

meals in the US costs $60, while the average US family spends just $80 on food for a week.

This average family is included in management's TAM. We think that the TAM is smaller than

the company identifies. With the high levels of churn, we expect TAM penetration to be

between 35-40%.

As a result of a smaller TAM, expensive product, high churn, and high discounting, we think

HelloFresh is barely earning back its CAC with a CLTV to CAC ratio of just 0.8x (vs. >4x for

best-in-class businesses). Effectively, HelloFresh is paying people to eat.

EXHIBIT 2: HelloFresh thesis summary in one chart

Source: Bernstein analysis

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

6

HELLOFRESH: PAYING PEOPLE TO EAT

STRUCTURALLY WEAK BUSINESS MODEL

The business model is hard with high levels of discounting, high churn, and high marketing

spend, leading to HelloFresh working its way through its TAM at a rapid rate. Customers

come in and leave just as quickly, leading to an unhealthy customer database and weak

relationships with customers (see Exhibit 7). It makes us concerned about long-term

growth.

◼ Discounting — the opposite of pricing power — is high, which devalues the brand. The

product is unaffordable for most people, and HelloFresh is artificially stimulating

growth by acquiring non-core TAM customers (e.g., students who buy on a discount),

and by propping up customer numbers at the end of a quarter with deep discount

emails. Looking at the history, frequent use of high levels of discounts has been a

consistent theme at ~20% in the US and 10-17% in the International segment (see

Exhibit 3).

◼ Churn is high at 90%; customers aren’t buying after Q4 (see Exhibit 6). Customers

aren't sticking with the product due to the high costs and weak product-market fit.

Reactivations are increasing (which the company is positive about), but we think they

are mainly discount-driven, and customers churn just as quickly once reactivated.

Although this isn't a subscription product and we don't expect customers to buy every

week, we would expect greater customer engagement, given the product is a staple.

◼ Marketing spend is high, and there is limited operational leverage. This shows that

HelloFresh has to work the business quite hard to maintain the same levels of growth.

We struggle to see marketing spend getting below 15% in the long term unless it

manages to fix the consumer relationship and improve retention. In addition, as a DTC

company, HelloFresh is advertising in the traditionally lower ROI venues such as TV

and public transportation with deep discounts, further reducing marketing efficiency

and the likelihood of the expense remaining higher (see Exhibit 4).

◼ As a result, HelloFresh is effectively paying consumers to eat with a CLTV-to-CAC ratio

at 0.8 (see Exhibit 8). HelloFresh fails to earn back its customer acquisition costs due

to its structurally weak business model — we estimated customer lifetime value over

three years at €59 vs. the acquisition cost of €75.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

7

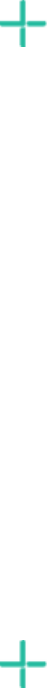

EXHIBIT 3: US segment has an average discount of

~20%

EXHIBIT 4: HelloFresh London tube advertising — 60%

off and 35% off on next three boxes

Source: Company reports, and Bernstein estimates and analysis

Source: Bernstein photo

EXHIBIT 5: Due to high churn, including lost customers,

HelloFresh has worked its way through 35% TAM in

the US based on our TAM

EXHIBIT 6: We calculate that churn is high, with only

30% of customers retained in Q4; two-thirds of

retained customers have been reactivated

Source: Company reports, and Bernstein estimates (all data) and analysis

Source: Bernstein estimates (all data) and analysis

US 2019FY 2020FY 2021FY

Orders 21 39 59

Meals 138 278 452

Revenue € 1,025 € 2,073 € 3,294

Revenue per meal (EUR) € 7.4 € 7.5 € 7.3

Revenue per meal (USD) $8.6 $8.7 $8.5

Meals per order 6.7 7.2 7.6

Full price box for 8 meals

(inc. delivery) (USD)

$85.9 $85.9 $85.9

Price per meal $10.7 $10.7 $10.7

Average discount % -20% -19% -21%

5%

6%

24%

25%

0%

5%

10%

15%

20%

25%

30%

US International

HelloFresh: Active vs. total customer

TAM penetration % Q2-21

Active customer TAM penetration %

Total customer TAM penetration %

0%

20%

40%

60%

80%

100%

Q1 Q2 Q3 Q4 Q5 Q6 Q7 Q8

HelloFresh estimated customer

retention rates (Q1-Q8)

Discount & ditch Regularly reactivated

Seasonal customers Frequent customers

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

8

HELLOFRESH: PAYING PEOPLE TO EAT

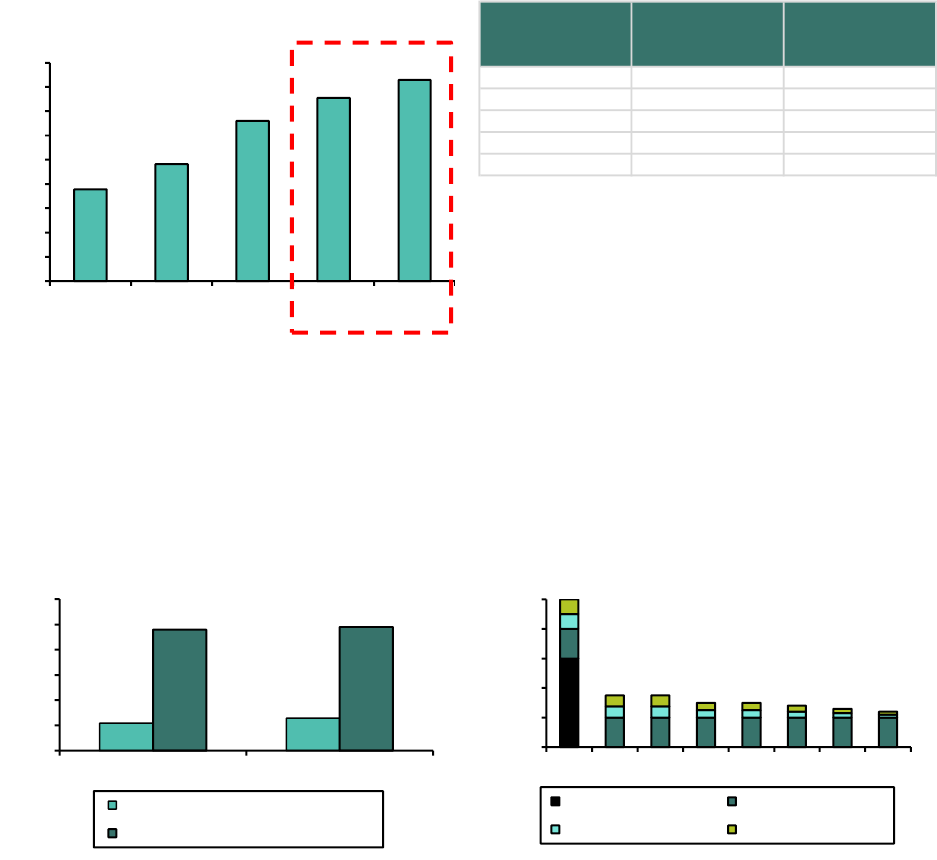

EXHIBIT 7: 13 million customers have been acquired and lost in the US, trying HelloFresh and not sticking with

the product over the last four years

Source: Company reports, and Bernstein estimates (all data) and analysis

EXHIBIT 8: Bernstein customer lifetime value calculation: Ratio to CAC is dismal at 0.8x

Source: Company reports, and Bernstein estimates (all data) and analysis

EXPENSIVE COMMODITIZED PRODUCT = SMALLER TAM

HelloFresh's business model is quite simple. It creates recipes, buys the ingredients, and

puts both the recipe and pre-portioned ingredients into a box. The ingredients are typically

low-margin commodities (e.g., potatoes). HelloFresh is then able to sell these products at a

70% gross margin, well above the 30% gross margin that supermarkets might achieve. As

a result, the product is very expensive at 125-300%+ more expensive than cooking from

scratch (see Exhibit 11 and Exhibit 12). In our surveys, customers dislike how expensive the

-0.3

-0.6

-0.9

-1.2

-1.6

-2.1

-2.7

-3.2

-3.6

-4.1

-4.7

-5.3

-5.9

-6.8

-8.2

-8.8

-10.0

-11.1

-13.0

0.4

0.6

0.7

0.8

0.9

1.2

1.1

1.1

1.1

1.4

1.4

1.5

1.8

2.6

2.0

2.5

2.6

3.7

3.8

-14

-12

-10

-8

-6

-4

-2

0

2

4

6

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

2018

Q1

2018

Q2

2018

Q3

2018

Q4

2019

Q1

2019

Q2

2019

Q3

2019

Q4

2020

Q1

2020

Q2

2020

Q3

2020

Q4

2021

Q1

2021

Q2

HFG - Total customer base (millions): active and lost customers (US)

Cumulative customers lost Active customers

1st Order Year 1 Year 2 Year 3 Notes

Gross revenue per order € 62 € 62 € 62 € 62 Full price for 2 people, 3 meals in the US

Discount -€ 37 -€ 19 -€ 12 -€ 12 Calculation

% discount 60% 30% 20% 20% Bernstein calculation

Net / reported revenue per order € 25 € 43 € 50 € 50 Reported AOV ~50 EUR

Frequency per year 1 16 16 16 Reported order frequency

Contribution margin % 27% 27% 27% 27% Avg. achieved CM % over last few years

Retention marketing spend % 11% 11% 11% Backcalculated based on CAC to achieve target marketing spend

SG&A % 4% 4% 4% 4% Reported SG&A

Contribution € 11 € 95 € 95 € 95 Calculation

Net retention rate 30% 25% 20% Bernstein calculation

Net contribution € 7 € 29 € 24 € 19 Calculation

Discount rate 8%

3 year CLTV inc. discounting (NPV) € 64 Calculation

Customer Acquisition Cost (CAC) € 100

CLTV:CAC 0.6x Calculation

Total marketing spend modelled 15.2% Reported marketing spend ~15%

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

9

product is and is one of the key reasons why they churn (see Exhibit 9). Plus, the high cost

of the product limits the TAM which, when combined with the structurally weak business

model, suggests that HelloFresh is burning through its TAM at a rapid pace.

The product is expensive, and the higher cost does not outweigh the benefits of

convenience and discovery of new recipes. 53% of non-meal kit users quoted "too

expensive" as the reason for not using the product, while the net promoter score (NPS)

score is -29 (should be at least positive) (see Exhibit 10) among meal kit users, as only 22%

of people would actively recommend meal kits. This makes us cautious on the long-term

ability of HelloFresh to change consumer habits, convert customers into meal kit users, and

sustain long-term growth.

Compared with cooking from scratch, HelloFresh is very expensive. We deconstructed a

selection of recipes which shows that the cost of cooking with HelloFresh ingredients is

125-300%+ more expensive than cooking from scratch. In an environment of higher

inflation and consumer spending squeeze, this will make growth more difficult.

As a result, TAM penetration is high. Building a bottom-up view of churn and lost customers,

TAM penetration is ~35% (see Exhibit 13). While surveying US consumers, almost 40% of

affluent customers had used a meal kit at any point. This brings into question the headroom

to further growth as HelloFresh churns its way through its addressable market.

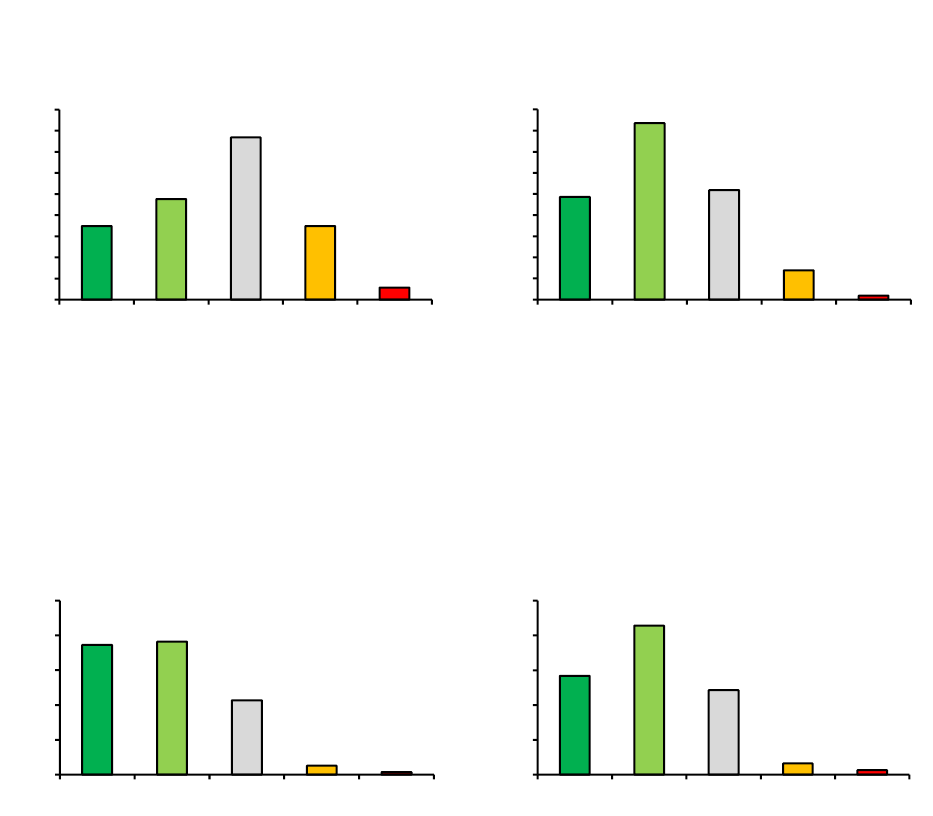

EXHIBIT 9: Top reasons for not using meal kits are that

they are too expensive and people don't like the

business model

EXHIBIT 10: NPS of -29, with the majority of people

being detractors and only 22% of respondents

actively promoting meals

Note: Sample = 763

Source: Survey Monkey Panel and Bernstein analysis

Note: Sample = 327

Source: Survey Monkey Panel and Bernstein analysis

53%

33%

25%

20%

19%

18%

10%

7%

8%

0%

10%

20%

30%

40%

50%

60%

Non-meal kit users: Why haven't you

tried meal kits?

7.4%

3.1%

4.0%

3.7%

6.4%

14.1%

11.7%

16.0%

12.0%

6.7%

15.0%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

0 -

Not

likely

1 2 3 4 5 6 7 8 9 10 -

Very

likely

Detractor Neutral Promoter

Meal kit users: How likely are you to

recommend meal kits to a friend or

colleague?

NPS = -29

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

10

HELLOFRESH: PAYING PEOPLE TO EAT

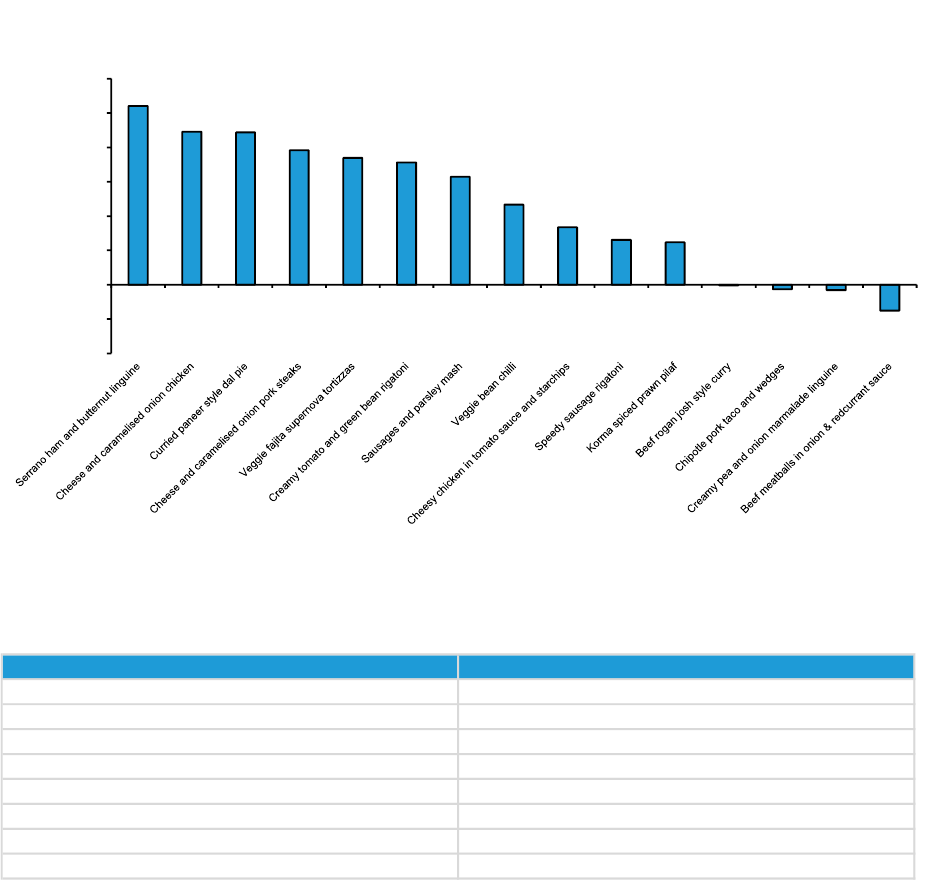

EXHIBIT 11: Premium of HelloFresh meal vs. cooking from scratch (adjusted for recipe quantities)

Source: Tesco website, HelloFresh website, and Bernstein analysis

EXHIBIT 12: Even for the highest quintile of earners

(US), a HFG box takes up 46% of weekly food

spending

EXHIBIT 13: With ~40% penetration of food spending

quintiles, we think it is difficult for HFG to extend

into lower income groups due to affordability

Source: USDA, US Census Bureau, company website, and Bernstein analysis

Note: Sample = 327

Source: Survey Monkey Panel and Bernstein analysis

300%

275%

218%

215%

211%

209%

193%

187%

177%

172%

164%

158%

149%

138%

125%

0%

50%

100%

150%

200%

250%

300%

350%

HelloFresh vs. cooking from scratch - HFG pricing vs. cost of items (adjusted for quantity used in recipe)

US food

spending by

income quintile

Food spending

at home per

week

HFG box (three

meals, two

people)

Lowest quintile $54 117%

2nd quintile $71 89%

3rd quintile $85 74%

4th quintile $100 63%

Highest quintile $137 46%

19%

25%

33%

36%

43%

40%

0%

10%

20%

30%

40%

50%

$0-50 $50-75 $75-100 $100-125 $125-150 $150+

Meal kit users: penetration of

consumers by food spending per

week

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

11

FLAWED GROWTH STRATEGY

New growth initiatives add complexity to the previously simple business model with limited

impact on growth, putting into question the mid-term margin target. At the 2021 CMD,

there was a raft of new growth initiatives announced, including expansion into new markets

and other meal occasions, more recipes, and grocery add-ons, to achieve mid-term target

of €10Bn revenue and 10-15% margins. While geographic expansion and new products

will likely add to top line growth, impacts from other initiatives will be small. HelloFresh also

plans to reduce lead times and bring in recipe customization. We think the business is

becoming increasingly complex with the new initiatives, which puts into question mid-term

margins as operational complexity eats into efficiency. With these growth levers,

HelloFresh is hoping to lay the path toward a "food solutions group," which we think is just

a clever name for "grocer," by rebundling the weekly shopping basket it initially claimed to

unbundle. However, we don't think this will work as HelloFresh will struggle to compete

against food retailers on range, price, or speed.

However, we think at the core of HelloFresh is a small group of core affluent customers

who love the product and are highly profitable. Even with very high churn, we expect there

to be almost three million regular core customers at present. Therefore, we think

HelloFresh should pivot from being the Amazon of meal kits or creating a food solutions

group to targeting this core of affluent customers and focusing on growing strong

sustainable margins and FCF as opposed to discount-driven, churn-intensive, and Capex-

intensive growth at all costs. This will likely lead to a much lower top line growth, but

increase margins significantly and increase FCF. It will increase the company's product-

market fit, enable it to pass on inflation, and improve customer satisfaction.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

12

HELLOFRESH: PAYING PEOPLE TO EAT

EXHIBIT 14: We think new geographies and product lines have the greatest business benefit

Source: HelloFresh reports and Bernstein analysis

Lever Initiative What is it?

Business

benefit

Complexity Bernstein perspective

Quicker lead

times

Go from 4-5 day lead times to 2-

3 days, speeding up delivery to

customer and cut off times

Low Easy

Quicker lead times would increase

competitiveness vs. grocers, but 2-3 days is

still uncompetitive. This would reduce the

effectiveness of the supply chain &

inventory/labor forecasting.

More recipes

Increase from 35 recipes to 50-

100 recipes and full market

rollout of all brands

Low Medium

More recipes would help order frequency and

may attract some new customers (e.g. vegan).

It adds to complexity of operations in handling

combinations.

Value

Become more competitive on

price reducing price vs market

by -25 to 40% vs. the 2016

baseline (2021 at -20 to -30%)

High Hard

Reducing prices would open up the TAM but

create significant challenges for unit

economics. Price gap is significant vs. grocers.

New meal kit

brands

Rollout GreenChef (premium

offer) and EveryPlate (reduced

cost offer)

Low Hard

New brands are cannibalistic, require more

marketing spend, and the operations are

duplicated with dedicated sites to each brand.

Limited synergies, and the same TAM.

New

geographies

Expand into new markets such

as Italy and Norway (both in

2021), and Japan (2022)

High Medium

New markets are attractive as an organic

growth source. Italy and Norway are small.

Japan will be challenging, given no experience

in Asian markets or with Japanese cuisine.

New product

lines

Continue expansion of RTE

(ready to eat) products through

Factor 75 and YouFoodz;

Factor 75 to launch in a new

market in 2022

High Medium

High growth rates in short term due to low

levels of sales today. TAM is very small, given

very high cost of the product, requires more

labour to prepare, complexity of ops is

increased, and sites are duplicated.

New meal

occasions

Focus on getting greater share

of weekly meal occasions (e.g.,

breakfast and lunch)

Low Easy

Meal kits have limited appeal to consumers

due to cost and take time to prepare. On

breakfast, we question the value added by a

meal kit compared with cheap options such as

cereal or toast. On lunch, we question the

value/time trade off vs. sandwiches and

salads.

Grocery

product add-

ons

Rollout of HelloFresh Market to

4 new markets (as well as US)

with private label and ~1000

SKUs. Market is effectively a

grocery offering of ready meals,

and "solution-oriented" items

Low Hard

We don't think HelloFresh can compete on

range, price, or convenience vs. grocers.

Adding 1,000 SKUs to the warehouses will

increase food waste, add complexity to

picking, and require significant investment in

technology (e.g. WMS/IMS/OMS).

Recipe

customization

Driving additional AOV and

orders by allowing customers to

swap ingredients, upgrade

ingredients, and add

ingredients to meal kits

Low Medium

Increases complexity of operations (e.g. not

just a single pick of individual recipes) whilst

driving limited incremental AOV growth.

TAM

penetration

TAM

expansion

Additional

monetization

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

HELLOFRESH: PAYING PEOPLE TO EAT

13

EXHIBIT 15: HFG current strategy (our published model) vs. our corporate action strategy

Source: Company reports, and Bernstein estimates and analysis

European Food Retail: We value stocks in our coverage through the following steps: (1) We

use a market-based approach to valuation. We take data for a set of comparable companies

and assess how multiples relevant to the sector (PE, EV/EBITDA, EV/sales, EV/EBIT, FCF

yield) change relative to expected growth rates, creating a regression of each multiple vs.

expected growth; (2) We generate earnings forecasts for the company, compare those

forecasts with consensus expectations, and seek to reflect events that may happen during

the 12 months that are likely to move consensus expectations; (3) We value the stock by

applying the relevant multiple (as determined by our industry valuation regressions) to our

earnings forecast; and (4) Where appropriate, we break down the company into its parts

(e.g., by geography) and value it as a sum of those parts. Note that we make several

adjustments to our valuation analysis: (1) For company-specific tax rates, habits of

recurring one-off charges, or other company-specific traits; (2) To separate non-operating

assets if we feel their inclusion is distorting the valuation multiples; and (3) To include

pension deficits, non-operating provisions, and seasonality of debt in our net debt

calculation.

HelloFresh SE: We value HelloFresh using an average of a 15-year DCF, PE, and

EV/EBITDA.

FY21 FY22E FY23E FY24E FY25E

Model - HFG current strategy 7.2 8.1 8.7 9.3 9.6

Corporate Action strategy 7.2 4.9 4.1 4.1 4.2

Model - HFG current strategy 5993 7126 7788 8421 8933

Corporate Action strategy 5993 4674 4179 4390 4612

Model - HFG current strategy 59.8% 18.9% 9.3% 8.1% 6.1%

Corporate Action strategy 59.8% -22.0% -10.6% 5.1% 5.1%

Model - HFG current strategy 25.3% 23.9% 25.1% 25.9% 26.1%

Corporate Action strategy 25.3% 28.4% 32.0% 32.8% 33.5%

Model - HFG current strategy 528 448 574 710 791

Corporate Action strategy 528 619 795 868 940

Model - HFG current strategy 8.8% 6.3% 7.4% 8.4% 8.9%

Corporate Action strategy 8.8% 13.2% 19.0% 19.7% 20.4%

Model - HFG current strategy 1.4 1.1 1.5 1.8 2.0

Corporate Action strategy 1.4 1.8 2.4 2.7 3.0

Model - HFG current strategy 181 -138 39 149 209

Corporate Action strategy 181 150 394 468 519

Model - HFG current strategy 276 101 134 283 492

Corporate Action strategy 276 289 776 1244 1763

Basic EPS

FCF

Net Cash / (Debt)

Active Customers (m)

Group Revenue

Revenue growth %

Contribution margin %

Adj EBITDA

Adj EBITDA %

VALUATION METHODOLOGY

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

14

HELLOFRESH: PAYING PEOPLE TO EAT

European Food Retail: There are certain risks that are common to all the companies in our

coverage: (1) Prevailing economic conditions — in each of the territories our coverage

companies operate in, the food retail spend is correlated to prevailing economic conditions.

Thus, any unexpected deterioration or improvement in the macroeconomic conditions in

these countries will likely impact the growth assumptions applied to those operations; and

(2) New Entrants — all companies in our coverage are at risk from new entrants either at a

local/regional level (i.e., a new supermarket opening locally to an incumbent) or national

level (a new entrant entering a whole market). Currently, the greatest expansion is being

seen at the lower (Lidl/Aldi in the discount sector) and higher (Waitrose/Wholefoods) ends

of the market or online (Amazon). These companies may continue to outpace the sector and

impact the growth of the companies in our sector. Similarly successful operators in certain

regions/countries, e.g., E.Leclerc in France, could expand beyond their current boundaries.

As a lot of the non-coverage companies are privately held, it can be difficult to assess the

ability and willingness of these companies to expand further.

HelloFresh SE: The upside risks to our target price include: (1) Pandemic behavior sticks

and new customers continue ordering; (2) Cost reduction sticks post-pandemic and

marketing spend stays low vs. 2019 levels; (3) Further acquisitions that grow the business;

and (4) New strategic initiatives or geographies provide material upside.

We rate HelloFresh Underperform with a target price of €24. HelloFresh operates a hard

business model with high discounting, high churn, and high marketing spend. The TAM is

smaller than management expects due to the commoditized and expensive nature of the

product. In addition, retention is poor, which means the already limited TAM is being

churned through quickly. We think it will become increasingly harder to scale the business,

maintain the growth in customers, and improve profitability. But consensus expectations

remain high, expecting +15.5% revenue CAGR during FY 2021-26 and expanding EBITDA

margin by +100 bps at the same time. We project a 10.5%+ CAGR with -240 bps margin

decline into FY22 and recovery to FY21 level in FY24.

RISKS

INVESTMENT IMPLICATIONS

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

INTRODUCTION TO MEAL KITS

15

INTRODUCTION TO MEAL KITS

What is a meal kit? What are the unit economics?

OVERVIEW

A meal kit is a selection of prepared, pre-portioned ingredients delivered directly to a

consumer's home (D2C) for home cooking of a pre-selected recipe. However, the concept

of a meal kit is not new. It bridges the gap between a ready meal (fully prepared meal to

cook at home) and scratch cooking (selecting raw ingredients to cook a meal of your

choosing). Meal kits have been sold in some form for many years by supermarkets, with Old

El Paso (a General Mills brand, covered by Alexia Howard) being a prime example. The D2C

meal kit emerged in the early 2000s in the Nordics and evolved into its current guise in the

2010s, with HelloFresh, Blue Apron, Gousto, and HomeChef being some of the largest

global players.

Not all meal kits were born equal. There's a significant difference between the supermarket

meal kit (e.g., Old El Paso fajitas); a classic DIY meal kit (e.g., HelloFresh) where pre-

portioned ingredients are sold D2C via a subscription; the more recent cook-it-yourself

meal kit (e.g., Pasta Evangelists) where a meal is delivered that just needs cooking; to

prepared ready meals (e.g., Factor 75) where a selection of ready meals is delivered to your

door. We focus on the classic DIY meal kit as it makes up the majority of the market.

Meal kit unit economics are attractive and relatively simple to understand. They are

attractive because on a single unit basis, a meal kit company is selling simple commoditized

products at very high gross margins (65% vs. supermarkets' gross margin of 25-30%).

Although shipping the product is expensive and involves a high variable cost (40% of

revenue), this is more than compensated for by the high gross margin. Whilst the single unit

economics look attractive, the big problem is below contribution margin (revenue –

procurement – fulfillment) where marketing spend is high and will remain high, leading to

lower EBITDA margins. This is further compounded by weak customer relationships, high

churn, and weak product-market fit, which brings into question the sustainability of growth.

History of meal kits is checkered. The number of meal kit companies mushroomed in the

D2C explosion of 2015-17, and while the D2C market consolidated, it was due to failures

rather than to structural consolidation. Many smaller competitors ran out of cash as a result

of the challenging business model, while HelloFresh survived through strong execution and

a push toward profitability. As a result, HelloFresh has a strong global market share, but it

doesn't matter. Consumers aren't shifting from HelloFresh to other meal kits but are instead

shifting back to grocery stores, which are still cheaper, easier, and simpler to shop from.

We think the threat of meal kits to food retailers is limited, given the high cost of the product.

On valuation, we think HelloFresh should be compared with other staples retailers, and we

value the business based on PE, EV/EBITDA, and a DCF.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

16

HELLOFRESH: PAYING PEOPLE TO EAT

WHAT IS A MEAL KIT?

◼ A meal kit is a selection of prepared, pre-portioned ingredients that are delivered

directly to a consumer's home (D2C) for home cooking of a pre-selected recipe. They

are typically run as subscription services where a consumer signs up to several recipes

each week. For example, one could choose to have three meals delivered (cheese &

caramelized pork steaks; a sticky Thai rice bowl; and a lamb ragu) and receive the exact

ingredients required for each meal in the box (e.g., for lamb ragu, 500g tomatoes,

500g lamb mince, a small sachet of herbs, one onion, two cloves of garlic, etc.). One

could then prepare these at home following the recipe cards (see Exhibit 17 to

Exhibit 21).

◼ The concept of a meal kit is not new. It bridges the gap between a ready meal (fully

prepared meal to cook at home) and scratch cooking (selecting raw ingredients to

cook a meal of choice). Meal kits have been sold in some form for many years by

supermarkets, with Old El Paso (a General Mills brand, covered by Alexia Howard)

being a prime example. Old El Paso has had fajita or taco kits on supermarket shelves

for years, where a box contains tortillas, a spice mix, and some tomato salsa. All the

consumer needed to do was follow the recipe on the back and buy some fresh chicken,

peppers, and onions. This is the original form of the meal kit that has evolved into a

D2C model.

◼ D2C model of meal kits started in the 2000s in the Nordics with Linas Matkasse (not

covered) and expanded with the growth of players such as HelloFresh, Blue Apron (not

covered), and other startups. These new D2C players focused on delivering the boxes

directly to the home (thereby disintermediating food retailers) and focusing on

improving the offer with more fresh products, all the ingredients included, and a wider

range of innovative recipes (e.g., a Massaman fish curry cooked at home on a Tuesday).

◼ Meal kit companies have a broad appeal, but they normally claim that their target

customers are young women in their early 30s with two children under the age of five,

where both parents are working. Given the expense of the products, they typically

target more affluent, urban professionals, and some are only available in major urban

centers.

◼ However, "meal kits" is a bit of a catch-all term with different variants.

Supermarket meal kit (e.g., Old El Paso fajita kit): Sold on a supermarket shelf,

contains a few ingredients to make a recipe (consumers need to buy the

remaining ingredients), and often focuses on "world cuisines" (e.g., Mexican, Thai,

Indian, etc.).

Classic DIY meal kit (e.g., HelloFresh or Blue Apron): Sold D2C via a subscription

model, contains all the ingredients for a recipe; the meal kit typically contains

three or four recipes for two people and is delivered D2C.

CIY meal kits (e.g., Pasta Evangelists or Nonna Tonda — both private): Cook-it-

yourself (CIY) meal kits are often a specific meal delivered to your door; are one-

step away from a ready meal and, in the case of the pasta kits, include freshly

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

INTRODUCTION TO MEAL KITS

17

made pasta and a sauce which need to be cooked separately and then served.

They tend to be much quicker, focus on the convenience, and come with high-

quality fresh pasta and sauce.

Prepared ready meals (e.g., Freshly (owned by Nestlé and covered by Bruno

Monteyne), AllPlants (private), and Factor 75 (owned by HelloFresh)): These are

effectively D2C ready meal boxes but are often targeted at consumers who want

to know all the nutritional information about what they are eating and are

therefore typically perceived as healthier than traditional supermarket ready

meals. In a prepared ready meal kit, a selection (e.g., 12) of ready meals which can

be heated and eaten is delivered. There is limited preparation time. Often, they

target specific dietary needs (e.g., AllPlants is vegan and others target

bodybuilders).

EXHIBIT 16: Meal kits sit in between cooking from scratch and ready meals, along a spectrum of level of

preparedness

Source: Bernstein analysis

EXHIBIT 17: Ready meals have evolved from frozen meals in the 1970s to traditional meal kits and fresh ready

meals with the most recent iteration of meal kits such as HelloFresh, ready meals delivered, and new FMCG

channels

Source: Company websites and Bernstein analysis

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

18

HELLOFRESH: PAYING PEOPLE TO EAT

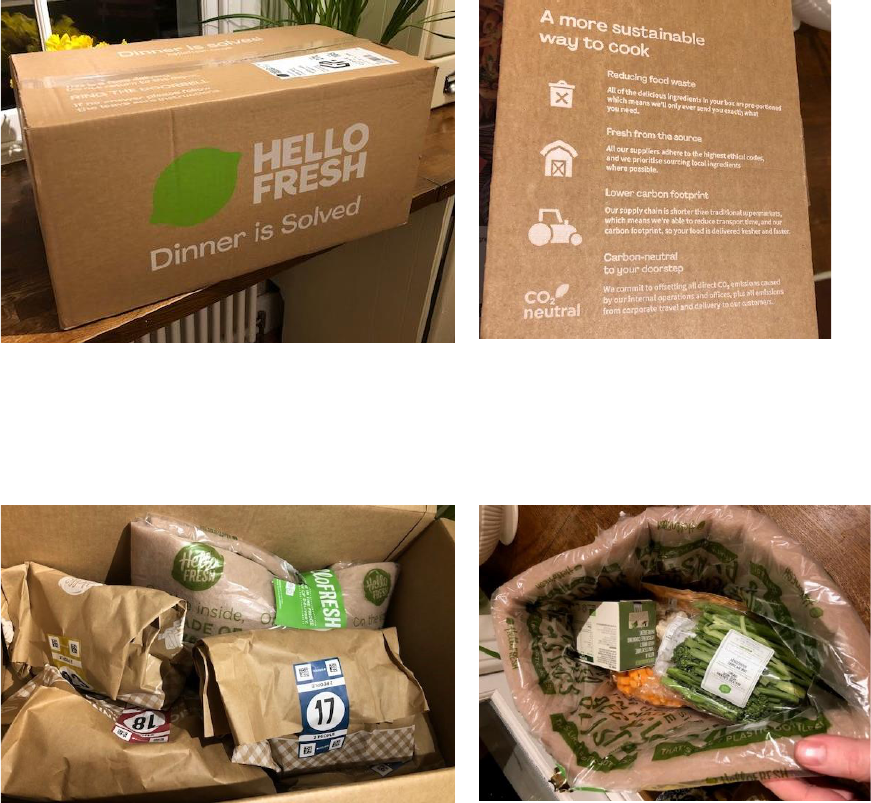

EXHIBIT 18: HelloFresh meal kit

EXHIBIT 19: HelloFresh ingredients for pasta recipe

Source: Company website

Source: Bernstein photo

EXHIBIT 20: Pasta Evangelists

EXHIBIT 21:Factor 75 ready meals

Source: Company website

Source: Company website

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

INTRODUCTION TO MEAL KITS

19

UNIT ECONOMICS AND AN EIGHT-LINE P&L

◼ Meal kit unit economics are attractive and relatively simple to understand. They are

attractive because on a single unit basis, a meal kit company is selling simple

commoditized products at very high gross margins (65% gross margin vs.

supermarkets' gross margin of 25-30%). Although shipping the product is expensive

and involves a high variable cost (40% of revenue), this is more than compensated for

by the high gross margin. While the single unit economics look attractive, the big

problem is below contribution margin (revenue – procurement – fulfillment) where

marketing spend is high and will remain high, leading to lower EBITDA margins. This is

further compounded by weak customer relationships, high churn, and weak product-

market fit, which brings into question the sustainability of growth.

◼ The unit economics of a meal kit are quite simple.

Revenue = customers x orders per customer x average order value (AOV)

AEBITDA = revenue – procurement – fulfillment – marketing & SG&A

EXHIBIT 22: Simple eight-line HelloFresh/meal kit P&L

Source: Bernstein analysis

◼ Revenue = customers x orders per customer x average order value (AOV)

Customer numbers are typically measured by active customers in the quarter (i.e.,

a customer who bought at least once). Customers are driven by acquisition,

retention, and reactivations. Acquiring new customers is critical to maintaining

growth; retention is typically quite weak, but there will be a core of regular users;

and reactivations are lost customers (i.e., those who have purchased before to

come back), encouraged often by discounts. Web traffic, app data, and Google

Trends tend to have a good relationship with customer numbers.

Orders per customer is the number of times the average customer orders in a

period. It is a signal of usage and behavior change, as higher orders per customer

would signal more consistent usage and good product-market fit. Currently,

HelloFresh achieves roughly four orders per customer per quarter, which

suggests that people aren't on average using the product all the time (as expected

and partly driven by the mix effect of customers).

Average order value is a factor of order size (meals per order, revenue per meal,

and any add-ons). Meals per order has stayed flat around eight, which suggests

that the most common box size is four meals for two people (in line with their

target customer of a working couple with kids). Revenue per meal has been

CUSTOMER

NUMBERS

ORDERS PER

CUSTOMER

AOV REVENUE

REVENUE

PROCUREMENT

COSTS (COGS)

FULFILMENT

COSTS

MARKETING &

SG&A

AEBITDA

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

20

HELLOFRESH: PAYING PEOPLE TO EAT

increasing as some inflation (not all) is passed on, some add-ons are added to the

boxes, and delivery fees are increased. There are lots of moving parts to revenue

per meal (including the mix effect of higher and lower value propositions such as

EveryPlate and Factor 75). AOV is net of discounts (with discounts not being

disclosed).

◼ AEBITDA = revenue – procurement – fulfillment – marketing & SG&A

Procurement costs (35-40% of revenue) are the COGS that go into the meal kit,

including both the cost of food and the cost of packaging. We like to look at

procurement costs on a percentage basis and a per order basis, as it helps

understand movements in top line and underlying trends. There is an argument

that procurement costs as a percentage should decrease because of buying

scale, but we're cautious, given that most meal kit companies are still subscale vs.

supermarkets. Inflation is also a key driver here as food prices rise, which can be

in part offset by management decisions on ingredients and recipes.

Fulfillment costs (~35-40% of revenue) include the cost of picking, packing,

dispatching, and fulfilling the order. It is difficult to model in detail due to lots of

moving parts of new fulfillment facilities, efficiency and capacity in existing

fulfilment centers, and parcel rates. Fulfillment costs should increase with

inflation and parcel spot rates, and become more efficient as sites increase

capacity and automation is introduced.

Marketing & SG&A (~20% of revenue) is mainly composed of marketing spend

(>15% of sales) and general costs (~4-5% of revenue). Marketing spend includes

both acquisition and retention marketing, but does not include discounts, which

are netted off revenue (not disclosed). Marketing spend is likely to remain high, as

the business is a high churn model, which requires constant customer

engagement and promotion to drive demand. SG&A should stay relatively flat, but

HelloFresh has recently hired a significant number of data analysts to increase

their capabilities, which could put pressure on margins.

◼ Although P&L and unit economics might be simple, the business model is hard.

HelloFresh operates on a high discounting model where new customers are given

40-60% off to get them signed up, and reactivated customers are prompted with

very regular discounts (often toward the end of the quarter) to sign up. We think

this devalues the brand, encourages discount chasing, and creates an unhealthy

customer base. It also means that HelloFresh acquires a large number of

customers who aren't in its TAM (i.e., students), who are given money to eat for

free. It also means that the reliability of active customer numbers is lower due to

customers using multiple accounts to get the discounts. For example, I recently

had a door-to-door marketer come to my house and offer me a discount. I said I

had bought before so I wouldn't be eligible, and they encouraged me to use a

different email address.

High churn, where 90% of customers don't buy by Q4 because they come for the

discounts, find the product too expensive at full price, and the product doesn't fit

their lifestyles. This means that more discounting and more marketing spend are

required to acquire more customers. Reactivations are portrayed as a good thing

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

INTRODUCTION TO MEAL KITS

21

(i.e., getting customers to come back), but we think that they are discount-driven

and that customers churn just as quickly.

As a result, high marketing spend is required to consistently acquire and

reactivate customers, and will be needed in the long term without a significant

improvement to the underlying customer relationship, retention, and discounting.

Marketing would become less effective as the TAM is churned through, and

HelloFresh needs to acquire more customers (who are less like their target

customers and less affluent).

High variable costs mean that there is limited fixed operating leverage. Marketing

spend and COGS grow with revenue, and while there are some potential

efficiencies in procurement (e.g., better processes in warehouses), the business

doesn't scale that efficiently.

EXHIBIT 23: Meal kits are a difficult business model

Source: Bernstein analysis

THE INDUSTRY

◼ Meal kits were born out of the D2C explosion in 2015-17 when many D2C business

models received significant amounts of funding to disrupt the CPG and food retail

landscapes. Dollar Shave Club (now owned by Unilever, covered by Bruno Monteyne)

was the prime example. They were mainly subscription business models aimed at

fragmenting the traditional weekly shop, often with some form of vertical integration.

◼ The D2C market "consolidated," as did the meal kit market, not due to structural

consolidation but due to failure. Many of these D2C businesses were overhyped with

huge growth potential to build a brand that could capture consumer spending.

However, many failed by running out of cash due to a high discounting, high churn, and

high marketing spend business model with a product that didn't fit with consumers'

needs. It is still easier, cheaper, and quicker to go to a supermarket and buy all the

products together.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

22

HELLOFRESH: PAYING PEOPLE TO EAT

However, HelloFresh is constantly under attack from the "attack of the ants."

There are hundreds of small meal kit providers that pop up in markets all over the

world to disrupt the segment. They often target new segments (e.g., vegan) or new

models (ready meals or cook-it-yourself). This puts pressure on HelloFresh to

constantly innovate and spend on discounting and marketing to avoid being

attacked by newer, more interesting solutions.

◼ HelloFresh is one of the survivors through strong execution, a push toward

profitability, and a well-timed entry into the US market. It is one of the lucky ones of the

D2C boom that managed to continue growing and fund itself to profitability. It was also

opportunistic in that it was able to grow in the US while Blue Apron (not covered) was

struggling, therefore capturing customers from a competitor and boosting

performance.

◼ HelloFresh has a strong global market share, but it doesn't matter. We are often asked

about HelloFresh's market share of the meal kit market, and it simply doesn't matter.

Consumers aren't switching from HelloFresh to another meal kit provider (by and

large). They are churning from meal kits (or HelloFresh) and trading back to

supermarkets.

◼ Discretionary or staple? We are often asked whether HelloFresh is a discretionary

product that competes with restaurants and food delivery or a staple that competes

with grocers. We think it is a staple because you have to cook it and because of the

frequency of use (3x+ per week). Many people justify the high cost of the product by

saying it competes more with restaurants, but it does not consider that the majority of

people might spend £20/$30 a month on one food delivery as a treat, and it is very

difficult to spend $60 on a meal kit box. We would expect customers who churn to

return to supermarkets rather than restaurants.

◼ However, meal kits do meet many consumer trends, making them an attractive trend-

driven investment. They are a convenient, digitally enabled, and healthy option

focusing on the provenance of items and encouraging more interesting eating. We

don't dispute the fact that they meet many consumer trends, but we think this is offset

by the challenges of the business model and the small TAM.

◼ In a recession or consumer spending squeeze, we would expect meal kits to struggle,

given the high cost of the product. We would expect trading down to supermarkets as

inflation squeezes budgets. The only saving grace is discounting, which we would

expect to help drive additional acquisition, but long-term retention rates will suffer.

◼ The threat of meal kits to food retailers is minimal. Meal kits remain a tiny part of the

market. HelloFresh's revenue was $3.3Bn in the US in FY21 vs. a grocery market that

is close to $1Tn, leading to a total market share of <0.3%. Grocery is a highly price-

sensitive category and very difficult to execute on (high volume, low margin, and

challenging supply chain). We think meal kits will struggle to gain significant share.

While some food retailers (e.g., Kroger) have purchased meal kit companies, this is

more in a test & learn approach to D2C and digital grocery, and they remain a small

part of overall sales.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

INTRODUCTION TO MEAL KITS

23

◼ On the flip side, food retailers pose a significant threat to meal kit companies. The risk

of disintermediation is high. Food retailers typically have strong new product

development (NPD) capabilities, and if they saw a significant opportunity in meal kits,

it would not be hard to replicate the product and put it on their shelves at a significantly

lower price. For example, Ahold Delhaize has already created meal kit-like products.

This also takes out the significant cost of fulfillment, which is a challenge to unit

economics. Also, Kroger has brought its meal kits to stores (see Exhibit 24).

EXHIBIT 24: Kroger's Home Chef brand in-store

proposition

EXHIBIT 25: Ahold Delhaize — beef bourguignon meal

kit

Source: Company photo

Source: Company photo

VALUATION

◼ We approach valuation using a three-part methodology and use an average of PE,

EV/EBITDA, and DCF. We value HelloFresh based on its profitability, given its relative

maturity to other "new food businesses" such as food delivery. One of the key positives

that investors highlight about HelloFresh is its ability to generate cash and profits;

therefore, we think it's reasonable to value it on these metrics.

◼ Compared with food retailers, HelloFresh looks expensive relative to peers, given its

EBITDA and EPS growth trajectory. We think EBITDA growth will be stifled by a tough

demand outlook (high inflation leading to trade down, potential recession, and post-

pandemic reset) and pressures to profitability (investment strategy, inflation on COGS,

ramping production facilities, and higher marketing spend to support growth).

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

24

HELLOFRESH: PAYING PEOPLE TO EAT

EXHIBIT 26: EU Food Retail NTM+1 EV/EBITDA

EXHIBIT 27: EU Food Retail NTM+1 PE

Source: Bloomberg, and Bernstein estimates and analysis

Source: Bloomberg, and Bernstein estimates and analysis

EXHIBIT 28: HFG vs. peers on EV/EBITDA

Source: Bloomberg, and Bernstein estimates and analysis

EXHIBIT 29: HFG vs. peers on PE

Source: Bloomberg, and Bernstein estimates and analysis

7.6

6.8

6.2

6.0

5.1

5.0

0

1

2

3

4

5

6

7

8

HFG JMT TSCO AD SBRY CA

EU Food Retail (ex. OCDO) - NTM+1

EV/EBITDA (Bernstein forecast)

23.6

18.0

10.1

10.0

9.6

9.1

0

5

10

15

20

25

HFG JMT SBRY TSCO CA AD

EU Food Retail (ex. OCDO) - NTM+1

PE (Bernstein forecast)

ConsHFG

BernHFG

Target

TSCO

SBRY

JMT

AD

CA

AMZN

BABA

ASC

BOO

ZAL

R² = 0.2137

0

2

4

6

8

10

12

14

16

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

NTM EV/EBITDA

NTM - NTM+1 EBITDA growth

EBITDA growth vs. EV/EBITDA

Supermarkets

Online retailers

ConsHFG

BernHFGTarget

TSCO

SBRY

JMT

AD

CA

AMZN

BABA

ASC

BOO

ZAL

R² = 0.374

0

5

10

15

20

25

30

35

40

45

0% 20% 40% 60% 80% 100% 120%

NTM P/E

NTM - NTM+1 EPS growth

EPS growth vs. P/E multiple

Supermarkets

Online retailers

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

BULL VS. BEAR

25

BULL VS. BEAR

Laying out arguments from both sides

OVERVIEW

Of any name in our coverage, we have the most polarized discussions about HelloFresh.

Investors are typically either completely bought into the long-term shift in consumer habits,

the power of the business model, and the huge opportunity of the growth levers, or they are

left perplexed by high churn, high marketing spend, high discounting, and a very expensive

product, which brings into question the TAM and TAM penetration, as well as both post-

pandemic and long-term growth and margins. Below, we outline what we understand to be

the bull case and the bear case, and provide our response.

◼ Bull case: HelloFresh is the strongest executor globally in the meal kits space with

strong top line growth and profitability over 2020 and 2021, which is expected to

continue. It is profitable and cash generative. Meal kits meet many consumer trends,

and the long-term growth opportunity is huge (e.g., grocery, new products, and new

geographies).

◼ Bear case: The business model is hard (high churn, high discounting, and high

marketing spend), and the product is expensive. The TAM is smaller than management

claims and is almost 40% penetrated. Growth levers aren't material and add

complexity to the business. Post-pandemic demand will be squeezed, and inflation

pressures top line and margins.

BULL CASE

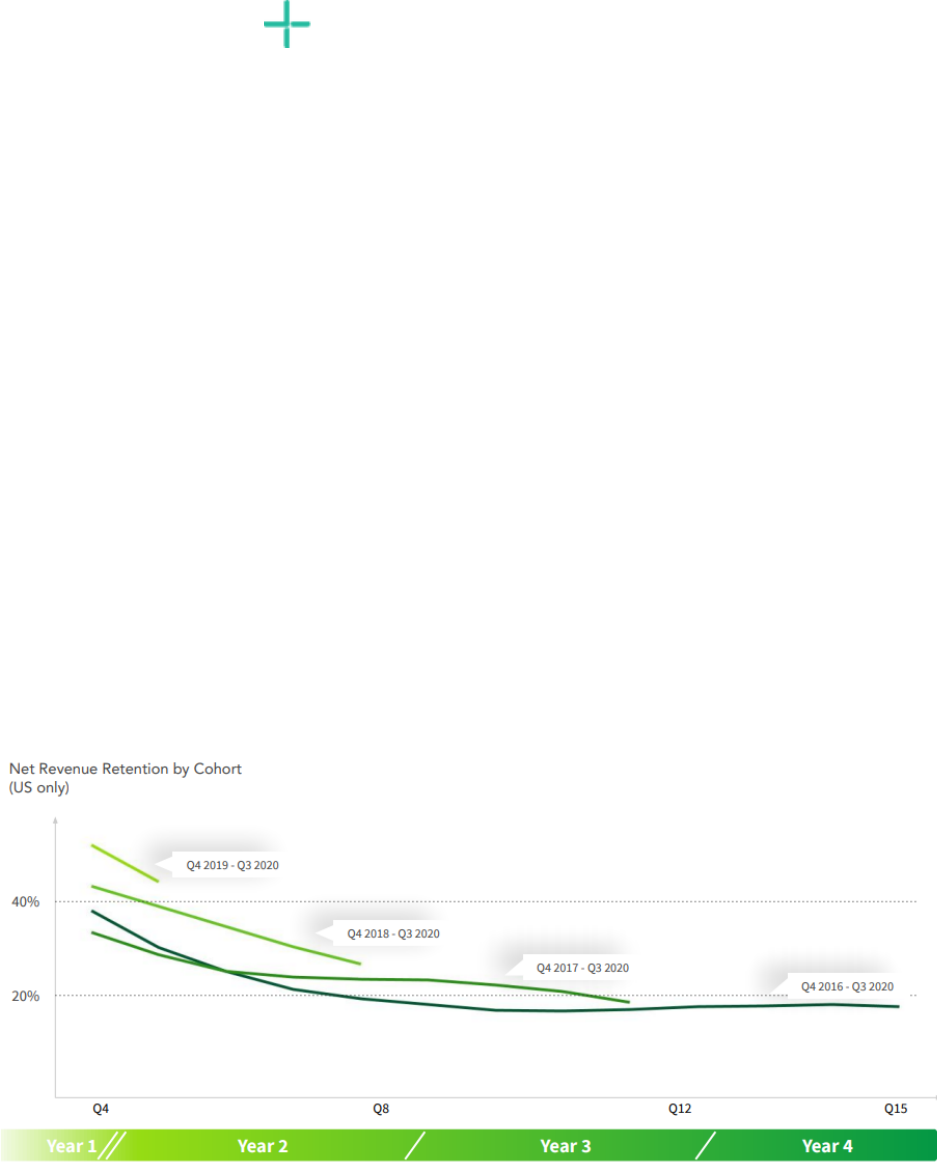

◼ Strong growth during the pandemic with stickier, better cohorts: HelloFresh

demonstrated strong growth through the pandemic with >100% growth in FY20 and

~60% growth in FY21 (see Exhibit 30). The pandemic has accelerated the pace of

consumer take-up, and the quality of customer acquisition during the pandemic has

been stronger. As a result, retention metrics have improved and more consumers have

changed their eating habits, which is expected to stick post-pandemic (see Exhibit 32).

There is latent demand post-pandemic as HelloFresh was operating at full capacity for

most of 2020 and was not actively recruiting new customers, suggesting there could

be further growth post-pandemic.

Retention metrics are improving yoy, reactivations are good, and CAC payback is

quick. Retention metrics are improving by each cohort, and cohorts have stuck

with the product during the pandemic (see Exhibit 32). Reactivation is a low-cost

way of reengaging customers with the product and leads to greater engagement.

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

26

HELLOFRESH: PAYING PEOPLE TO EAT

Payback of the CAC is quick as a result and improving, which demonstrates that

discounting and the marketing strategy are going in the right direction.

Pricing is becoming more attractive and is opening the product to a wider

audience. Over time, HelloFresh has not passed on as much inflation and,

therefore, the product is becoming more affordable in real terms relative to

normal grocery shopping. This widens the TAM along with cheaper alternatives

such as EveryPlate (see Exhibit 35).

◼ Execution has been the strongest of peers, and HelloFresh has a high market share:

Many D2C meal kit companies have failed due to lack of demand and funding, and

weak execution. Listed peers such as Blue Apron (not covered) have struggled with

top line demand and profitability over the past couple of years. However, HelloFresh

has come out dominant with a strong US market share, significant scale (5-6x larger

than peers), and the majority share of the global meal kit market. Its strong ability to

execute and innovate has put it in a dominant position, and the flywheel benefits only

increase. The company has scale buying benefits, scale logistics benefits, and a digital

food network infrastructure capable of delivering food across many countries.

◼ HelloFresh is one of the only profitable and cash-generative "new" food companies: It

became profitable in 2019 (0.9% AEBITDA margins), and generated 12.6% margins

and nearly €500Mn FCF in FY20. Recently announced share buybacks reinforce

management's conviction in the business, and there is room for further buybacks and

cash return in the future.

◼ Meal kits meet many emerging consumer demands and trends: The growth of meal

kits and HelloFresh fits within many longer-term secular consumer trends such as the

increasing digitalization of food; the need for provenance, convenience, and helping

the time-poor; a desire to eat healthier; and a desire to reduce food wastage. Millennial

consumers will likely become increasingly affluent over the next 5-10 years and have

families, for which HelloFresh is perfectly suited.

◼ Long-term growth opportunity is huge: The TAM is underpenetrated, and there is room

to grow by: (1) monetizing the existing customer base; (2) increasing penetration of

the core product; and (3) expanding the TAM through new products. We often hear

that HelloFresh will be the CPG company of the next 100 years (akin to Nestlé, covered

by Bruno Monteyne). Management says that it is only currently serving a fraction

(<0.45%; see Exhibit 33) of its TAM's meal consumption. New brands (GreenChef and

EveryPlate) are ramping well, and new brands such as Factor 75 and new geographies

are ramping quickly and made up 25% revenue in Q3-21. Plus, there's a huge

opportunity to improve the existing proposition (quicker lead times, more recipes, and

customization) as well as boost AOV with add-ons, customization, and grocery.

Grocery opportunity is huge. Cracking the multi-billion-dollar grocery market

globally could provide material upside. HelloFresh can do this by capturing more

meal occasions and providing simple, convenient ordering of add-on products to

the box, thereby consolidating a household's grocery spending. It can do this by

moving toward becoming a "food solutions" group that encompasses meal kits,

ready meals, and individual SKUs by HelloFresh Market (see Exhibit 36).

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

BULL VS. BEAR

27

Investments for growth in production facilities and in technology and data teams

set the business up for future growth. Given the capacity constraints during the

pandemic, new production facilities will likely enable HelloFresh to capture the

latent demand it couldn't serve during 2020 and 2021. The investments in

technology and data could enable HelloFresh to be at the forefront of customer

experience, enable new growth levers such as grocery, and reduce costs by

optimizing market spend (acquisition and retention).

TAM expansion provides compelling growth in the medium term with the option

to launch new brands, ready meals, and the core proposition into new markets.

HelloFresh recently entered Norway and Italy, which will boost growth, and

further entered Japan during 2022, opening a new region of untapped growth

(see Exhibit 37 and Exhibit 38). The new brands and ready meals are expected to

bolster the offer in existing markets and help in the move toward a food solutions

group.

◼ ESG is a huge boost. HelloFresh helps consumers reduce their food wastage and has

a clear focus on providing a sustainable food solution. It is planning on reducing its

carbon footprint by 60% (2022 vs. 2019), reducing food waste by 50% (2022 vs.

2019), and becoming the first global carbon-neutral meal kit company. It is working

across upstream and downstream areas as well as its operations to optimize for

sustainability (see Exhibit 39 and Exhibit 40). For example, it has worked hard to

reduce ice and introduce linerless boxes. As a result, it has a dedicated ESG board

subcommittee, sustainability targets in management remuneration, and strong

disclosure on ESG.

◼ Management has been a strong executor and has a strong vision for the future of the

business. The CEO and CFO are well-liked and have steered the HelloFresh business

through periods of very strong growth. They have brought HelloFresh to profitability,

been sensible about capital allocators, and have a clearly identified and wide-reaching

growth strategy. They have consistently beat and raised on guidance, surpassing

expectations.

EXHIBIT 30: Strong revenue growth demonstrated

before and during the pandemic

EXHIBIT 31: Profitability has steadily increased

Source: Company reports, and Bernstein estimates and analysis

Source: Company reports, and Bernstein estimates and analysis

52%

41%

41%

107%

60%

0%

20%

40%

60%

80%

100%

120%

2017FY 2018FY 2019FY 2020FY 2021FYE

HFG - Bernstein YoY sales growth

(FY17-FY21E)

-13.8%

-7.7%

-4.3%

2.6%

13.5%

8.8%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

2016FY 2017FY 2018FY 2019FY 2020FY 2021FY

HFG - Adj. EBITDA margin

(FY16-FY21E)

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

28

HELLOFRESH: PAYING PEOPLE TO EAT

EXHIBIT 32: Retention rates by cohort are increasing YoY

Source: Company reports

EXHIBIT 33: Significant upside potential for TAM penetration, with <0.45% penetration today

Note:

1

Assumes 2.5 heads per household with 10 weekly meals from home over 52 weeks;

2

Delivering 1 billion meals annually

Source: Company reports

EXHIBIT 34: Management claims very low TAM

penetration across both segments

EXHIBIT 35: Pricing relative to grocery shopping has

come down over time

*Total addressable market

Source: Company reports

Source: Company reports

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

BULL VS. BEAR

29

EXHIBIT 36: Creation of a food solutions group could provide significant upside

Source: Company reports

EXHIBIT 37: Upsell and cross-sell products are expected

to make up 15-20% revenue in the future

EXHIBIT 38: TAM levers already make up 25% revenue

in Q3-21

Source: Company reports

Source: Company reports

EXHIBIT 39: Carbon emissions are coming down

EXHIBIT 40: Food waste is low and reducing

Source: Company reports

Source: Company reports

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

30

HELLOFRESH: PAYING PEOPLE TO EAT

BEAR CASE

◼ Structural Underperform: We remain cautious on HelloFresh from a structural

perspective with challenges to the business model, an expensive product with a small

TAM, and very high TAM penetration.

Business model is hard, leading to a revolving door of customers in and customers

out. High discounting (~20% on average with high introductory discounts of

>50% and reactivation of 40% off on multiple boxes) devalues the brand and

creates weak customer relationships. Churn is high at 90% of customers churned

by Q4, and we don't see any improvement in retention rates. We think most of the

cohort improvement is driven by one-off improvements from the pandemic as well

as increasing reactivation rates, which we think are driven by high discounting,

and customers tend to churn just as quickly when they are reactivated. Marketing

spend is high at ~15%, and we expect this to continue at a high level over the next

five years.

Product is expensive and TAM is smaller. A HelloFresh box is very expensive as it

is essentially a commoditized product with a very high markup. When looking at

an average meal, a HelloFresh meal is ~1.6-2.4x as expensive as cooking from

scratch or a ready meal (see Exhibit 49). There is nothing wrong with an expensive

product, but we think this significantly limits the potential TAM for HelloFresh.

When you look at food spending in the US by income quintile, for an average

family, a HelloFresh box would make up 74% of weekly spending for just three

meals and two people, leaving only $22 for 18 other meals, snacks, and other

family members (see Exhibit 42). Even for the most affluent (top quintile), a

HelloFresh box would make up 46% of weekly food spending. Whilst there is

more elasticity in food spending in the top quintile, we think a HelloFresh box is

unaffordable for the middle quintile, which the company includes in its TAM.

TAM penetration is high. As a result of high churn, we think HelloFresh is working

its way through its TAM at a rapid rate and runs the risk of hitting the brick wall of

TAM saturation. When surveying US consumers, ~40% of the top earners have

used a meal kit product (see Exhibit 41), and when we look at our bottom-up

proprietary retention analysis, we think HelloFresh has worked its way through

>16 million customers in the US, leading to a TAM penetration of >35% in the US

(see Exhibit 43 and Exhibit 47). We think this puts the longer-term growth runway

of HelloFresh at risk.

◼ Short-term Underperform: We remain Underperform in the shorter term over 2022 as

we expect post-pandemic demand to be weaker as consumers return to normal habits

and higher inflation to encourage consumers to trade down (as they do with other

grocery items) to supermarkets, discounters, and private label. As a result, we think

margins will be squeezed further as a result of inflation hitting logistics and food costs

as well as slower growth hurting newly ramped production facilities.

Post-pandemic demand is in question. As consumers return to normal activities,

we expect HelloFresh to be a post-pandemic loser as people start eating out more

and pressure on time shifts consumers back to simpler, quicker meals and/or

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

BULL VS. BEAR

31

ready meals. The comps are tough from the high growth rate in 2020 and 2021,

and with heavy churn and a potential relapse in retention metrics, we think

continued strong growth will be difficult. We model +16% YoY growth in FY22 vs.

company guidance of 20-26%.

Higher inflation will pressure both consumers and the cost lines of the P&L. As

higher food inflation hits consumers in the US and Europe (along with energy

prices and other consumer products increasing too), we expect this to hurt

HelloFresh. Given the high cost of the product relative to grocery products (which

tend to be the most price-sensitive of consumer categories, given the large

proportion of household earnings they make up), we expect consumers to trade

down to cheaper alternatives such as traditional grocery store shopping and

private label items. Furthermore, we expect inflation to hit the HelloFresh P&L

significantly as price costs increase on food (and HelloFresh have limited buying

power) and logistics costs continue to creep up (which make up 40% sales). This

will pressure margins.

Margins squeezed by mistimed growth investments. HelloFresh took multiple

margin hits over the last year, explained by management as investments for

growth. We are very cautious as we think these are mistimed. It is opening several

new production facilities, which drag on margins due to the need to ramp up the

facilities in terms of demand and efficiency, as well as doubling the size of its

technology and data teams, which increases SG&A. Given the uncertain demand

trajectory, we think management has overegged the pudding and been too

aggressive on investments.

◼ Longer-term Underperform: Over the long term, we remain cautious on consensus

expectations for strong growth (+15.5% revenue CAGR for 2021-26) and margin

expansion (+100 bps) due to the structural challenges of the business model, weak

product-customer fit, limited growth levers, and additional complexity of the business.

We model +10.5% revenue CAGR and +50 bps expansion.

Growth vs. margins dilemma: At the core of HelloFresh, there is an affluent set of

customers who love the product and buy it at full price. We expect they make up

all the EBITDA of the business. The problem with consensus expectations is that

we think it is going to be very difficult over the five-year horizon to both growth at

a fast rate and expand margins. We think HelloFresh cannot have its cake and eat

it too — it could choose to grow quickly at the expense of margins or retrench to

grow slower but become more profitable. Historically, the focus has been on

growth, but with higher TAM penetration and post-pandemic challenges, we think

this will become tougher. We think a strategy of slower, more targeted growth

with a highly profitable customer base could be attractive in the long run.

Customer feedback & product-market fit is weak: We don't think the HelloFresh

product is changing consumer habits. Churn is at 90% and NPS from our US

survey is at -29 (where you should expect it to be at least positive). The meal kit

product is not shifting consumer behavior away from grocery shopping toward

pre-portioned meal kit shopping, and when we tried the product ourselves, it was

an okay experience, in that, the recipes were interesting and the food was good

quality, but packaging wastage is strong, the recipes took a long time to prepare,

642734_50312053-cabc-445b-9541-3140c14c8c8d.pdf

BERNSTEIN

32

HELLOFRESH: PAYING PEOPLE TO EAT

and we found the product expensive. This perspective was reinforced by the

consumers that we surveyed in the US, meaning that there is likely to be limited

long-term uptake of the meal kit concept.

Discounting will continue to be strong and discount-driven reactivations could

provide boosts to quarterly numbers but risks to long-term stability. Deeply

discounted trials are capital-destructive, and we think on average HelloFresh only

achieves a CLTV:CAC of 0.8x, suggesting that it is effectively paying people to eat

food over a three-year lifetime. We think the increasing number of reactivations

(likely driven by discounts) demonstrates the weaker top line customer

acquisition, and we typically receive reactivation emails toward the end of a

quarter (useful for boosting quarterly growth). We think these discounts devalue

the brand, encouraging customers to only buy the product at a discount. We

question whether on the longer term, this discount-led strategy can continue

within the context of weak customer feedback and question how many times

customers will continue to reactivate at a discount before churning again.

Growth levers will provide only limited growth at a significant cost (see Exhibit 50).

Attempts to reduce lead times and add more recipes aim to improve customer

perception and thereby increase retention, but we think that within the context of

a very expensive product, this will have a limited effect on the overall TAM. New

meal kit brands such as EveryPlate are cannibalistic and add additional cost

through complexity and marketing spend. New geographies are a good expansion

route, but the list of opportunities gets smaller and less interesting (e.g., Norway

is small), new product lines such as Factor 75 will provide a short-term boost to

growth, but the overall TAM is very small, given the very expensive nature of the

product. On new "meal occasions," we struggle to see the size of the prize and

rationale for breakfast and lunch — they may add to AOV, but we struggle to see

HelloFresh being competitive with alternatives (e.g., toast and cereal for

breakfast, which are quicker and cheaper). And on the grocery opportunity, we

struggle to see how HelloFresh can compete on price and range vs. a typical