Guidelines for Starting

Small Estate Application

[N.C.G.S. 29A-25-1; 28A-25-1.1]

F

F

o

o

r

r

D

D

e

e

c

c

e

e

d

d

e

e

n

n

t

t

s

s

D

D

y

y

i

i

n

n

g

g

O

O

n

n

o

o

r

r

A

A

f

f

t

t

e

e

r

r

J

J

a

a

n

n

u

u

a

a

r

r

y

y

1

1

s

s

t

t

2

2

0

0

1

1

2

2

This Packet Contains the following forms: Affidavit for Collection of Personal Property of Decedent,

Instruction Sheet, Resident Process Agent, Affidavit of Collection Disbursement and Distribution, and the

Estate Tax Certification.

Fillable forms are available online at www.nccourts.org. Click “forms” and enter the form numbers below (forms begin with AOC-E-__).

NOTE: Additional forms may be required to begin the qualification process and will be determined based upon the circumstances.

READ FORMS CAREFULLY AS THEY CONTAIN INSTRUCTIONS AND INFORMATION NECESSARY IN THIS PROCESS.

Affidavit for Collection of Personal Property of the Decedent is available for the following situations…

To appoint a person to handle the estate when the total asset value in the deceased party’s name is $20,000 or less in gross value. [This

amount may differ depending on who is applying, as well as other factors]

NOTE: This application cannot be used when:

The net combined assets in the deceased person’s name exceeds $20,000 in value (see above)

When less than 30 days have passed since the time of the decedent’s death

NOTE: If the decedent’s real property is to be sold within 2 years from the date of death, small estate administration might

not be appropriate.

STEPS FOR Qualification…

1. Fill out the Affidavit for Collection of Personal Property of Decedent (AOC-E-203B)

2. All beneficiaries/heirs must be listed on the form with full names and addresses

3. If you are not a North Carolina resident, please fill out the Resident Process Agent form (AOC-E-500) appointing a

resident process agent to provide a North Carolina point of contact for Court service. The appointed agent must sign

the form in front of a notary.

4. The Court Fee to start the process is $120 (Acceptable Forms: cash, certified check, or money order)

5. Completion of the Estate Tax Certification form (AOC-E-212)

6. Original Will (if one exists-the Will must be probated)

7. Death Certificate

8. Affidavit of Collection Disbursement and Distribution is the final affidavit you must file when you close the estate.

EXPLANATION OF TERMS:

• Decedent: The individual who passed away.

• Applicant or Affiant: Someone who is applying for the position of collector by affidavit.

• Intestate: The decedent died without leaving a will.

• Testate: The decedent died leaving a Last Will & Testament.

• Estate Tax Certification: Documentation as to whether or not estate or inheritance taxes are due.

• Beneficiary/Heir: A person who inherits or is entitled by law or by the terms of the Will to inherit the estate of another.

• Resident Process Agent: The North Carolina resident selected by the out-of-state applicant to accept mail and other service of process

regarding estate matters.

Completed filings should be submitted to the Clerk of Court of Mecklenburg County

Estates Division – Suite 3720, Mecklenburg County Courthouse – 832 E. 4

th

Street, Charlotte NC 28202

To file via mail: Mecklenburg County Clerk of Superior Court, Attn Estates, PO Box 37971, Charlotte NC 28237

Estates Phone Number: 704-686-0460

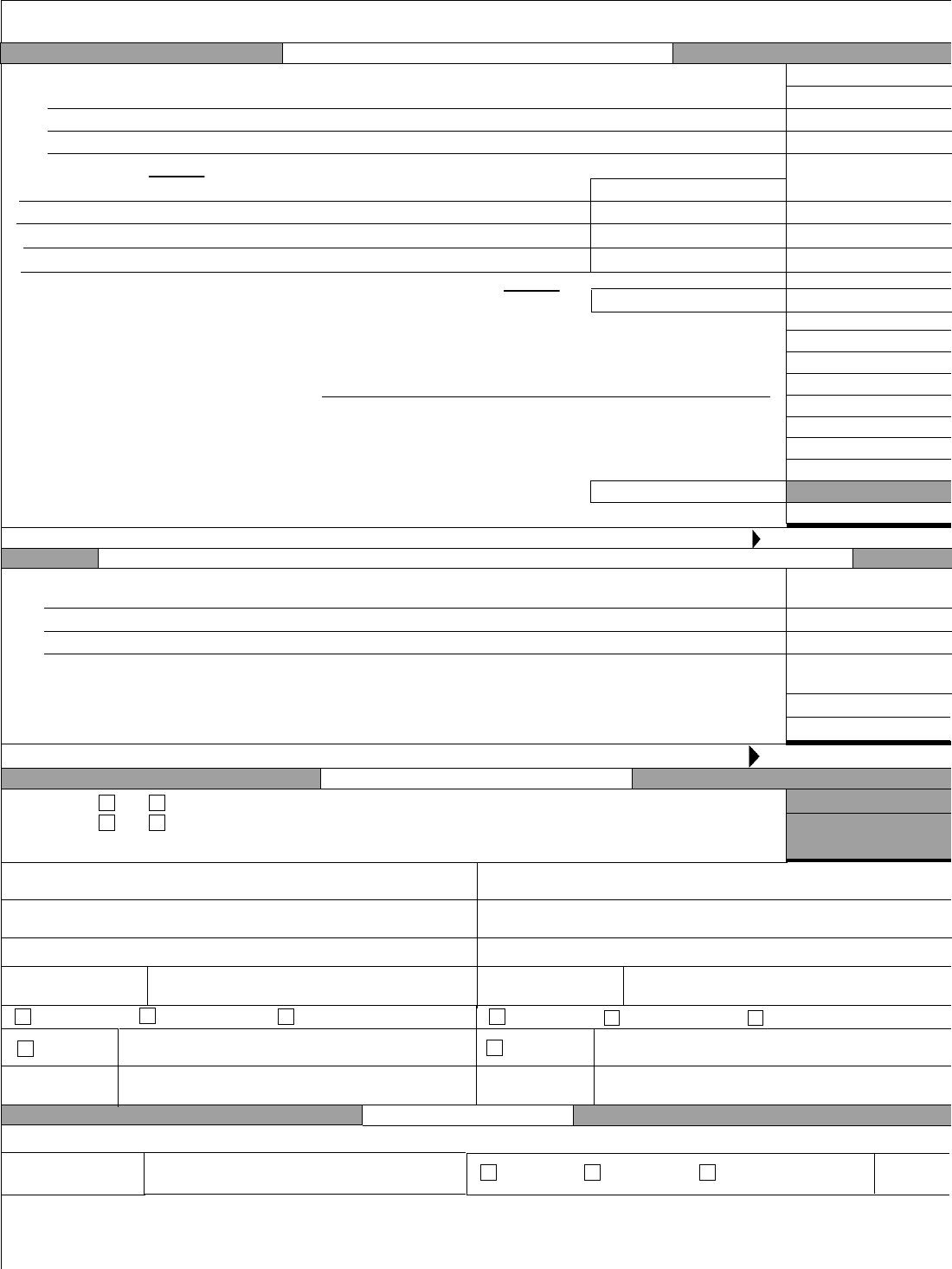

Date Of Will

The decedent died on or after 10/1/09 and the value of all personal property owned by the decedent less liens and

emcumbrances thereon, and less the spousal allowance under G.S. 30-15,

I am the surviving spouse and sole heir devisee of the decedent, the decedent died on or after 10/1/09, and the value of

all personal property, less liens and encumbrances thereon, and less the spousal allowance under G.S. 30-15, does

The decedent died intestate. testate.

At least thirty (30) days have passed since the date of the decedent's death.

No application or petition for appointment of a personal representative is pending or has been granted in any jurisdiction.

After diligent inquiry, I have determined that the persons listed below are all the persons entitled to share in the decedent's

estate. (

If there is a court-appointed guardian for any such person(s), list the guardian's name and address on an attachment.)

(Check if decedent died testate.) Decedent's will dated as shown above has been probated in each county in which is located any

real property owned by the decedent as of the date of death; and a certified copy of the decedent's will is attached to this

Affidavit.

I, the undersigned affiant, being first duly sworn, say that:

Original - File Copy - Fiduciary Copy - Clerk Mails Copy To Each Person Listed In Item No. 7

(Over)

(a)

(b)

I am an heir. an executor named in the will. a devisee named in the will. the public administrator

a creditor of the decedent. I am not disqualified under G.S. 28A-4-2.

1.

3.

4.

2.

6.

5.

7.

File No.

STATE OF NORTH CAROLINA

IN THE MATTER OF THE ESTATE OF:

Name, Street Address, City, State And Zip Code Of Decedent

(TYPE OR PRINT IN BLACK INK)

Telephone No.

Social Security No. (Last Four Digits)

Date Of Death

Telephone No.

Name, Street Address, PO Box, City, State And Zip Code Of Affiant 1

Legal Residence (County, State)

Name, Street Address, PO Box, City, State And Zip Code Of Attorney

County Of Domicile At Time Of Death

Place Of Death (If Different From County Of Domicile)

Telephone No.

Legal Residence (County, State)

Attorney Bar No.

Name, Street Address, PO Box, City, State And Zip Code Of Affiant 2

NAME AGE RELATIONSHIP MAILING ADDRESS

AOC-E-203B, Rev. 5/12

© 2012 Administrative Office of the Courts

In The General Court Of Justice

Superior Court Division

Before The Clerk

County

AFFIDAVIT FOR COLLECTION OF

PERSONAL PROPERTY OF DECEDENT

G.S. 28A-25-1; 28A-25-1.1

INTESTATE TESTATE

does not exceed $20,000.

not exceed $30,000.

(For Decedents Dying On Or After Jan. 1, 2012)

Joint accounts without right of survivorship (List bank, etc., each account no., balance and joint owners.)

SEAL

Cash and undeposited checks on hand.........................................................................................................

Household furnishings....................................................................................................................................

Farm products, livestock, equipment and tools..............................................................................................

Vehicles (include or attach descriptions)

Interest in partnership or sole proprietor businesses......................................................................................

Insurance, Retirement Plan, I.R.A., etc., payable to Estate...........................................................................

Notes, judgments, and other debts due decedent..........................................................................................

Miscellaneous personal property....................................................................................................................

Real estate willed to the Estate....................................................................

Estimated annual income of Estate................................................................................................................

Stocks/bonds/securities in sole name of decedent or jointly owned without

right of survivorship.............................................................................................

Accounts in sole name of decedent (List bank, etc., each account no. and balance.)

There is is not entireties real estate owned by decedent and spouse ..........................................

There are are not Insurance, Retirement Plan, I.R.A., accounts, etc., payable to named

beneficiaries....................................................................................................................................................

Joint accounts with right of survivorship (List bank, etc., each account no., balance and joint owners.)

Stocks/bonds/securities registered in beneficiary form and immediately transferred on death or jointly

owned with right of survivorship .....................................................................................................................

Other personal property recoverable G.S. 28A-15-10 ...................................................................................

Real estate owned by decedent and not listed elsewhere

(attach description).................................................

(Base bond on this amount, if applicable.) TOTAL PART I.

TOTAL PART II.

Signature

Deputy CSC Assistant CSC Clerk Of Superior Court

CERTIFICATION

I certify that the foregoing is a true and accurate copy as taken from and compared with the original on record in this office.

Date

SEAL

NOTE: This Affidavit for Collection of Personal Property of Decedent authorizes the named collector by affidavit to receive and administer ALL of the personal property

belonging to the named decedent pursuant to G.S. Chapter 28A, Article 25.

Date

SEAL

Notary

Deputy CSC Assistant CSC Clerk Of Superior Court

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

Signature Of Person Authorized To Administer Oaths

Date Commission Expires

County Where Notarized

Signature Of Collector By Affidavit 1

Name (Type Or Print)

% Owned By Dec.

3.

2.

3.

4.

1.

1.

2.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

PART II. PROPERTY WHICH CAN BE ADDED TO ESTATE IF NEEDED TO PAY CLAIMS

PART III. OTHER PROPERTY

1.

2.

$

$

$

PRELIMINARY INVENTORY

(Give values as of date of decedent's death. Continue on separate attachment if necessary.)

PART I. PROPERTY OF THE ESTATE

Est. Market Value

% Owned By Dec.

% Owned By Dec.

% Owned By Dec.

% Owned By Dec.

$

$

Signature Of Collector By Affidavit 2

Name (Type Or Print)

Notary

Deputy CSC Assistant CSC Clerk Of Superior Court

Date

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

Signature Of Person Authorized To Administer Oaths

Date Commission Expires

County Where Notarized

AOC-E-203B, Side Two, Rev. 5/12

© 2012 Administrative Office of the Courts

(Over)

INSTRUCTIONS FOR PRELIMINARY INVENTORY

ON SIDE TWO OF AFFIDAVIT FOR COLLECTION OF PERSONAL PROPERTY OF DECEDENT,

FORMS AOC-E-203A and AOC-E-203B, Rev. 1/12

THE CLERK IS THE JUDGE OF PROBATE AND CANNOT PRACTICE LAW OR GIVE LEGAL ADVICE.

ACCORDINGLY, THE CLERK'S STAFF CANNOT HELP YOU FILL OUT THIS FORM. PARTS OF THIS FORM ARE

SELF-EXPLANATORY. HOWEVER, FOR ANY NECESSARY ASSISTANCE, YOU SHOULD CONSULT AN ATTORNEY.

Affidavit For Collection Of Personal Property Of Decedent, Forms AOC-E-203A and AOC-E-203B, Rev. 1/12

Whether or not the decedent left a will, and regardless of the value of any real property owned by the decedent, if 1) the value of the decedent's personal

property, less liens and encumbrances (and less the spousal allowance under G.S. 30-15

$20,000 ($30,000 if the surviving spouse is the

anyone qualifying as personal representative, the

G.S. 28A-25-1.1. An executor named in the will, an heir,

the necessary affidavit using this form, and thereby qualify

the assets of the estate. This part of the form is intended

property, real and personal, wherever located, owned by

General Instructions:

Type or print neatly in

black ink.

All values reported should be the fair market value of the item as of the date of death. If there is not sufficient space on this form, continue on a

separate attachment.

Except where instructed to itemize, you should report in a lump sum the estimated total value of all property in each category. A complete itemization

and valuation of decedent's property must be listed on the final Affidavit Of Collection, Disbursement and Distribution form (AOC-E-204) and filed

with the clerk within three months after the filing of the initial affidavit (AOC-E-203A and AOC-E-203B).

PART I. PROPERTY OF THE ESTATE

Deposits In Sole Name Of Decedent - For each account, list the name of the institution, the account number and the balance on the date of death.

Joint Accounts Without Right Of Survivorship - For each account, list the name of the institution, the account number, and the name(s) of the

other joint owner(s). If the percentage owned by the decedent can be determined, report that percentage and the value of that percentage. If the

percentage owned by the decedent is unclear, report the percentage as 100%, and list the total amount on deposit on the date of death. A copy of

the signature card or depository contract should be attached either to this form or the final Affidavit Of Collection, Disbursement And

Distribution (AOC-E-204).

Stocks And Bonds In Sole Name Of Decedent Or Jointly Owned Without Right Of Survivorship - If the percentage owned by the decedent can

be determined, report that percentage and the value, in a lump sum, of that percentage. If the percentage owned is unclear, report the percentage

as 100%, and list the total value, in a lump sum, of all such stocks and bonds. A detailed itemization of these assets must be reported in the final

Affidavit Of Collection, Disbursement And Distribution (AOC-E-204).

through 7. These categories should be self-explanatory.

Interest in Partnership Or Sole Proprietor Businesses - Report all solely owned business interest and all partnerships in which the decedent was a

general or limited partner. List the name of the business or partnership, the names of the surviving partners, the decedent's percentage interest in

that partnership, and the value of that partnership interest or business.

through 11. These categories should be self-explanatory.

1.

2.

3.

4.

8.

9.

"Account" includes accounts in banks, savings and loans and other financial institutions, including money market accounts with brokerage

houses or similar institutions.

"Joint Account With Right Of Survivorship" is an account in the name of two or more persons in which the deposit agreement (1) is signed by

all parties and (2) expressly provides that, upon the death of one of the joint depositors, the interest of the decedent passes to the survivor(s).

Any joint account which is not "with right of survivorship" is a joint account without right of survivorship.

"Stocks Or Bonds With Right Of Survivorship" are securities in which the certificate clearly states that upon the death of one of the joint

owners the interest of the decedent passes to the survivor(s). Any jointly owned security which is not owned "with right of survivorship," is

owned without right of survivorship.

"Securities Registered In Beneficiary Form" means stocks, bonds, or other securities officially registered with the issuer of the security

indicating the current owner of the security and the person who will automatically become the new owner of the security upon the death of the

owner." (See G.S. 41-40 et. seq.)

AOC-E-203 Instructions, Rev. 1/12

© 2012 Administrative Office of the Courts

for a decedent dying on or after 1/1/12), does not exceed

sole heir or devisee of the decedent), and 2) at least 30 days have passed since the date of death without

estate may be administered by affidavit as a small estate pursuant to G.S. 28A-25-1 and

devisee or creditor of the estate, with the approval of the Clerk of Superior Court, may file

as collector by affidavit of the estate. Side Two of the form contains a preliminary listing of

as a preliminary report to the clerk, heirs and creditors of the nature and probable value of the

the decedent as of the date of death.

PART III. OTHER PROPERTY

This part of the form is used to list certain property, rights and claims which are not administered by the collector by affidavit as part of the decedent's

estate and which the collector cannot generally recover to pay debts of the decedent or claims against the estate. However, this property may be

included in the value of the "estate" for state or federal estate tax purposes, or which are listed for the information of heirs and others to whom the

property may pass.

Entireties Real Estate - Indicate whether or not there is real estate jointly owned by the decedent and his or her surviving spouse as tenants by the

entireties.

Insurance, Retirement Plan, IRA, Etc., Payable To Persons Other Than the Estate - This category includes all life insurance proceeds, death

benefits under pension and retirement plans, and the balance remaining in IRA, 401(k) and other similar accounts which, at the death of the

decedent, pass to a beneficiary other than the estate.

1.

2.

SIGNATURE - All applicants must sign. The signature of each must be separately notarized before a notary public or acknowledged before

the clerk, assistant, or deputy.

12.

13.

Real Estate Willed To The Estate - (NOTE: (a) Real property willed to any person or entity other than the estate must be reported in Part II,

Item 5. (b) If any real estate has been willed to the estate, a personal representative must be appointed.) Indicate only real estate which the

decedent devised (willed) to his or her estate or to his or her executor in the capacity as executor (not as an individual). Usually, such a devise is

accompanied by a direction to sell the real estate and distribute the proceeds as specified in the will. A listing of all such properties, together

with an identification or legal description of each parcel or tract should be reported here, using fair market value as of the date of death.

Estimated Annual Income Of The Estate - Income of the estate includes, for example, interest on checking and other accounts opened in the

name of the estate, dividends and interest on stocks and bonds owned in the name of the estate, and other income to the estate. Income of the

estate does not include interest on accounts, or dividends or interest on stocks or bonds, which pass directly to a surviving joint owner.

PART II. PROPERTY WHICH CAN BE ADDED TO ESTATE IF NEEDED TO PAY CLAIMS

This part of the form is used to list certain kinds of property which the decedent owned or in which the decedent had an interest during his or her life

time, which are not ordinarily part of the estate, but which may be recovered by the personal representative if the assets of the estate are not sufficient

to pay all the debts of the decedent and claims against the estate.

Joint Accounts With Right Of Survivorship Under G.S.41-2.1 - List all joint accounts with right of survivorship. For each account, list the name

of the financial institution, the account number, the names of the other joint owners, and the total balance on the date of death. Attach a copy of

the signature card or depository contract of each such account to the form or to your final Affidavit Of Collection, Disbursement And Distribution

(AOC-E-204).

Stocks/Bonds/Securities Registered In Beneficiary Form Or Jointly Owned With Right Of Survivorship. - A lump sum total of the value of all

such stocks or bonds should be reported here. A detailed itemization of these assets must be reported in the final Affidavit Of Collection,

Disbursement And Distribution (AOC-E-204). It also includes securities registered in beneficiary form and immediately transferrable on death.

Other Personal Property Recoverable Under G.S. 28A-15-10 - This category includes accounts which are called "Trustee Accounts" in the

signature card or deposit agreement or in which the decedent otherwise established a "Tentative" or "Totten" trust; securities registered in

beneficiary form and automatically transferred on death; property which the decedent gave to someone in contemplation of his or her own death;

and property transferred by the decedent, without receiving adequate consideration, with the intent to hinder, delay or defraud his or her creditors.

If you believe there may be any property which falls into this category, you may wish to consult an attorney.

Real Estate Owned By The Decedent And Not Listed Elsewhere - (NOTE: Real estate owned by the decedent and spouse as tenants by the

entireties should be reported in Part III. Do not report real estate in which the decedent had an interest only for his or her lifetime.) A detailed

listing of all other interests in real estate owned by the decedent together with an identification or legal description of each parcel or tract should

be reported here using fair market value as of the date of death.

1.

2.

3.

4.

AOC-E-203 Instructions, Side Two, Rev. 1/12

© 2012 Administrative Office of the Courts

Deputy CSC Assistant CSC Clerk Of Superior Court

STATE OF NORTH CAROLINA

File No.

Name Of Decedent/Incompetent

AOC-E-500, Rev. 1/14

© 2014 Administrative Office of the Courts

Name Of Resident Process Agent (Type Or Print)

Notary

Date

Date My Commission Expires

Signature Of Personal Representative Or Guardian

Date

Telephone County Of Residence

Name Of Personal Representative Or Guardian (Type Or Print)

I accept this appointment as resident process agent for the above named personal representative or guardian, and

agree to notify the personal representative or guardian of all citations, notices and processes served on me as his

resident process agent.

In The General Court Of Justice

Superior Court Division

Before The Clerk

County

G.S. 28A-4-2(4); 35A-1213(b)

I, the qualified personal representative or guardian of the above named estate, submit to the jurisdiction of the North

Carolina Courts in the above captioned matter, and appoint the resident process agent named below on whom may be

served citations, notices and processes in all actions or proceedings with respect to this estate.

Signature Of Resident Process Agent

Name, Street Address, PO Box, City, State And Zip Code Of Resident Process Agent

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

Signature Of Person Authorized To Administer Oaths

Date

SEAL

County Where Notarized

APPOINTMENT OF

RESIDENT PROCESS AGENT

IN THE MATTER OF THE ESTATE OF:

ACCEPTANCE OF APPOINTMENT

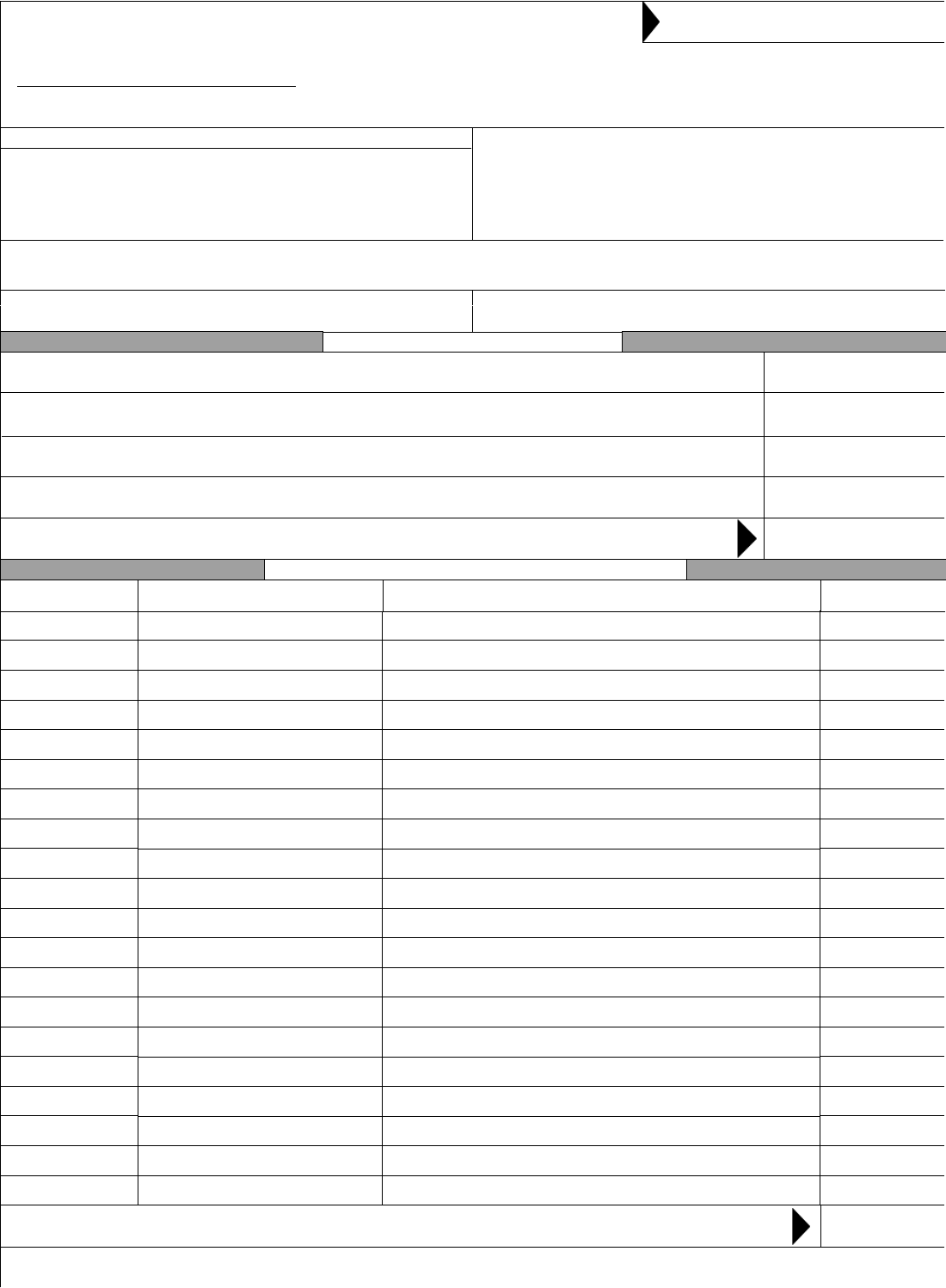

Minus Distributions To Heirs As Shown In Part IV ..................................................................................

Minus Spousal Allowance Approved By The Court Under G.S. 30-15 .....................................................

Total Personal Property Received As Shown in Part II ............................................................................

TOTAL RECEIPTS

DATE RECEIVED RECEIVED FROM DESCRIPTION VALUE

BALANCE AT THE END (This will always be zero)

2.

$

_

Name Of Decedent

$

STATE OF NORTH CAROLINA

File No.

(Over)

AFFIDAVIT OF COLLECTION,

DISBURSEMENT AND DISTRIBUTION

In The General Court Of Justice

Superior Court Division

Before The Clerk

County

G.S. 28A-25-3(a)(2)

I, the undersigned collector by affidavit, being first duly sworn, say that the following is a complete and accurate account of my

receipts, disbursements, and distributions as collector by affidavit of the personal property of this estate.

IN THE MATTER OF THE ESTATE OF

Extending ToAccounting Period From

AOC-E-204, Rev. 1/12

© 2012 Administrative Office of the Courts

PART I. SUMMARY

1.

$

4.

$

_

0.00

$

5.

PART II. PERSONAL PROPERTY RECEIVED

Minus Disbursements (Debts or Expense) As Shown In Part III .............................................................

3.

_

$

0.00

AOC-E-204, Side Two, Rev. 1/12

© 2012 Administrative Office of the Courts

TOTAL BALANCE

$

Deputy CSC Assistant CSC Clerk Of Superior Court

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

Date

Notary

SEAL

Signature

Date Commission Expires

County Where Notarized

Signature Of Affiant 2

TOTAL DISBURSEMENTS

$

DATE PAID TO FOR

AMOUNT

PART III. DISBURSEMENT (DEBTS OR EXPENSE)

HEIRS AMOUNT

$

PART IV. BALANCE DISTRIBUTED TO HEIRS

$

Signature Of Affiant 1

Deputy CSC Assistant CSC Clerk Of Superior Court

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

Signature

Date

Notary

Date Commission Expires

SEAL

County Where Notarized

0.00

0.00

a.

STATE OF NORTH CAROLINA

File No.

Decedent's Social Security Number (Last Four Digits)

NOTE: Use this form for decedents dying on or after 1/1/99. For decedent's dying before 1/1/99, use AOC-E-207.

Date Of Death

IN THE MATTER OF THE ESTATE OF:

Name Of Decedent

$650,000 (If decedent died on or after 1/1/1999).

$675,000 (If decedent died on or after 1/1/2000).

$1,000,000 (If decedent died on or after 1/1/2002).

$1,500,000 (If decedent died on or after 1/1/2004).

$2,000,000 (If decedent died on or after 1/1/2006).

$3,500,000 (If decedent died on or after 1/1/2009).

The gross value of the estate prior to the date of the decedent's death is less than: 1.

I, the personal representative/fiduciary/spouse in the above estate, certify that:

ESTATE TAX CERTIFICATION

(FOR DECEDENTS DYING ON OR AFTER 1/1/99)

G.S. 28A-21-2; -25-3;105-32.2

Original-File Copy-Taxpayer

In The General Court Of Justice

Before the Clerk

County

AOC-E-212, Rev. 8/13

© 2013 Administrative Office of the Courts

(TYPE OR PRINT IN BLACK INK)

b. The decedent died on or after 1/1/2010, and there is no federal estate tax due or payable.

3.

I am the surviving spouse and sole heir of the decedent.

Deputy CSC Assistant CSC Clerk Of Superior Court

Deputy CSC Assistant CSC Clerk Of Superior Court

Date

Notary

SEAL

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

NOTE TO PERSONAL REPRESENTATIVE/FIDUCIARY/SPOUSE AND CLERK:

No final accounting of an estate may be approved unless the personal representative files with the Clerk of Superior Court an Estate

Tax Certification, AOC-E-212, or a certificate issued by the Secretary of Revenue stating the estate tax liability has been satisfied.

G.S. 105-32.3(c).

Signature Of Person Authorized To Administer Oaths

Date

Date My Commission Expires

Date My Commission Expires

Notary

Signature Of Person Authorized To Administer Oaths

SEAL

County Where NotarizedCounty Where Notarized

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME

Date

Address Of Personal Representative/Fiduciary/Spouse

Title Of Personal Representative/Fiduciary/Spouse

Signature

Title Of Personal Representative/Fiduciary/Spouse

Address Of Personal Representative/Fiduciary/Spouse

Date Signature

2.

The decedent died on or after 1/1/2013, and therefore, no North Carolina estate tax is due or payable.