2

Miami Association of REALTORS

®

(MIAMI)

Teresa King Kinney, CAE, RCE, CIPS, TRC, AHWD, RSPS, GRI, e-PRO®

Chief Executive Officer

Chris Umpierre, AHWD

VP of Communications

National Association of REALTORS

®

Lawrence Yun, Ph.D.

Chief Economist and Senior Vice President, Research

Matt Christopherson

Senior Research Analyst

©2022 Miami Association of REALTORS

®

and the National Association of REALTORS

®.

This Report may be cited

with the proper attribution.

December 2022

Objective

The 2022 survey provides information on the international

residential transactions of Miami Association of REALTORS

®

(MIAMI) members from August 2021–July 2022. In this report, the

year 2022 refers to this period, and previous years refer to the

prior 12-month periods.

Respondents

3

The association sent the online survey to its

approximately 55,000 members, of which 2,051

responded during the survey period from August

15–September 19, 2022. Among these

respondents, 605 reported they had a foreign

buyer.

Among respondents who provided information:

• 68% of the respondents were from Miami-

Dade County

• 6% reported a CIPS designation (among 1,065

respondents)

• 85% have been in business for over one year

(among 1,127 respondents)

About the 2022 Miami Association of REALTORS® (MIAMI)

Survey

64.9%

29.7%

4.9%

0.1%

0.4%

69.6%

28.2%

1.8%

0.4%

0.1%

67.8%

29.8%

1.8%

0.3%

0.3%

MIAMI- DADE BROWARD PALM BEACH MARTIN OTHER*

DISTRIBUTION OF RESPONDENTS'

PRIMARY BUSINESS AREA

BY COUNTY

2020 2021 2022

$6.8 billion

Dollar volume of foreign buyer residential purchases during August 2021‒July 2022

(34% increase from 2021 volume; nationally, the dollar volume of foreign buyer purchases rose by 8.5%)

17%

Foreign buyer share to MIAMI dollar sales volume

(higher than the 14% share in 2021 and the 3% share nationally)

72%

Fraction of MIAMI foreign buyers who primarily resided abroad

(higher than 43% nationally)

$500,000

MIAMI foreign buyer median purchase price

(higher than $420,200 MIAMI median sales price)

2022 Profile of International Homebuyer Transactions of

Miami Association of REALTORS

®

Members

66%

Share of all-cash purchases

(compared to 44% nationally)

Top Foreign Buyers

Argentina (16%), Colombia (13%), Canada (8%), Peru (8%), Chile (6%), Mexico (6%), Venezuela (6%),

Brazil (6%). Foreign buyers came from 54 countries

Destination of Foreign Buyers

Miami-Dade County (67%), Broward County (27%), Palm Beach County (2%), and Other counties (4%)

73%

Fraction of MIAMI foreign buyers who purchased for vacation and/or rental use

(compared to 44% nationally)

2022 Profile of International Homebuyer Transactions of

Miami Association of REALTORS

®

Members

58%

Fraction of MIAMI foreign buyers who purchased condominiums

(compared to 16% nationally)

94%

Fraction of MIAMI foreign buyers who visited Florida at least once before buying a property

56%

Fraction of respondents who had an international customer

(higher share than the 50% share in 2021 and the national share of 12%)

78%

Fraction of leads/referrals/customers from personal/business contacts or former customers

79%

Fraction of respondents who are fluent in a language other than English

2022 Profile of International Homebuyer Transactions of

Miami Association of REALTORS

®

Members

ECONOMIC ENVIRONMENT

• Economic Conditions

• Florida Real Estate Home Prices

Tourist Arrivals: Continuing to Recover

5.8

0.2

5.2

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

JAN/2020

FEB/2020

MAR/2020

APR/2020

MAY/2020

JUN/2020

JUL/2020

AUG/2020

SEP/2020

OCT/2020

NOV/2020

DEC/2020

JAN/2021

FEB/2021

MAR/2021

APR/2021

MAY/2021

JUN/2021

JUL/2021

AUG/2021

SEP/2021

OCT/2021

NOV/2021

DEC/2021

JAN/2022

FEB/2022

MAR/2022

APR/2022

MAY/2022

JUN/2022

JUL/2022

MILLIONS

MONTHLY TOURIST ARRIVALS TO THE UNITED

STATES (MILLIONS)

Source: National Travel and Tourism Office

Tourist Arrivals to the United States by Region of Origin

Tourist Arrivals to the United States

August 2019-

July 2020

August 2020 -

July 2021

August 2021-July

2022

% Chg,

2020-2022

From all countries 49,781,687 13,796,420 38,387,213 -23%

From Asia and Oceania 8,082,099 674,903 3,125,502 -61%

From Canada 13,241,539 963,619 8,693,767 -34%

From Latin America 4,257,966 2,705,388 5,027,446 18%

From Argentina 480,743 184,073 456,329 -5%

From Brazil 1,274,496 72,756 809,210 -37%

From Colombia 541,941 730,946 1,019,742 88%

From Venezuela 227,834 144,159 226,123 -1%

From Europe 9,196,637 593,883 7,182,969 -22%

Source: NTTO

10% of MIAMI Realtors® Reported an International

Transaction Did Not Close Due to the Travel Ban

19%

81%

14%

86%

10%

90%

YES NO

PERCENT OF RESPONDENTS WHO REPORTED

THEY HAD AN INTERNATIONAL TRANSACTION

THAT DID NOT CLOSE DUE TO THE

CORONAVIRUS-RELATED TRAVEL BAN

2020 2021 2022

9% Increase in U.S. Foreign Buyer Purchases During April

2021-March 2022* to $59.0 Billion

$33.2

$41.2

$34.8

$46.7

$54.5

$43.5

$74.9

$53.0

$33.2

$33.0

$22.0

$24.9

$33.2

$41.2

$33.4

$45.5

$49.4

$59.1

$78.1

$67.9

$44.7

$41.0

$32.4

$34.1

$66.4

$82.5

$68.2

$92.2

$103.9

$102.6

$153.0

$121.0

$77.9

$74.0

$54.4

$59.0

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

DOLLAR VOLUME OF EXISTING-HOME PURCHASES BY

FOREIGN BUYERS IN THE UNITED STATES

(BILLION DOLLARS)

Non-resident (Type A) Resident (Type B)

*Based on transactions in the 12 months ending March of each year.

Florida #1 U.S. Destination for Foreign Buyers for Last 14

Years

FL CA TX AZ NY NC NJ IL SC VA

2009 23% 13% 11% 7% 2% 3% 1% 4% 2% 3%

2010 22% 12% 8% 11% 4% 2% 2% 1% 2% 2%

2011 31% 12% 9% 6% 3% 2% 3% 3% 1% 2%

2012 26% 11% 7% 7% 4% 2% 1% 3% 1% 1%

2013

23% 17% 9% 9% 3%

1% 2% 2% 1% 3%

2014 23% 14% 12% 6% 3% 2% 3% 3% 1% 2%

2015 21% 16% 8% 5% 3% 2% 3% 3% 1% 2%

2016 22% 15% 10% 4% 4% 3% 4% 4% 1% 1%

2017 22% 12% 12% 4% 3% 3% 4% 3% 1% 2%

2018 19% 14% 9% 5% 5% 3% 4% 3% 1% 3%

2019 20% 12% 10% 5% 3% 3% 4% 3% 2% 2%

2020 22% 15% 9% 3% 5% 3% 4% 3% 1% 3%

2021 21% 16% 9% 5% 4% 3% 4% 3% 1% 2%

2022 24% 11% 8% 7% 4% 4% 3% 3% 2% 2%

Top 10 list is based on the most recent year.

Share of Top 10 States to Total Foreign Buyer Purchases

More Out-of-State Buyers in MIAMI Area in 2022*

*Survey reference periods are from August of the prior year to July of current year

12%

43%

46%

9%

45%

46%

9%

43%

48%

LIVED ABROAD FLORIDA OUT-OF-STATE

WHERE BUYERS (DOMESTIC OR FOREIGN) LIVED IN

2020 2021 2022

New York, California, and New Jersey: 51% of Out-of-State

Buyers in MIAMI Area in 2022*

*NY, CA, NJ accounted for 52% of out-of-state buyers in 2021 survey

28%

15%

8%

5%

5%

4%

3%

3%

3%

29%

15%

9%

5%

4%

4%

3%

3%

2%

28%

10%

10%

4%

4%

3%

4%

4%

3%

New York

California

New Jersey

Texas

Georgia

Illinois

Connecticut

Massachusetts

Michigan

DISTRIBUTION OF TOP OUT-OF-STATE BUYERS

2022

2021

2020

Metropolitan Statistical Area

August 2020-July 2021 August 2021-July 2022 % Change

Punta Gorda, FL $270,000 $350,995 30%

Ocala, FL $200,745 $260,000 30%

Naples-Immokalee-Marco Island, FL $436,000 $560,000 28%

Lakeland-Winter Haven, FL $242,000 $309,900 28%

Cape Coral-Fort Myers, FL $294,950 $376,000 27%

Homosassa Springs, FL $205,000 $260,000 27%

North Port-Sarasota-Bradenton, FL $340,000 $430,000 26%

Sebring, FL $180,000 $226,000 26%

Tampa-St. Petersburg-Clearwater, FL $280,000 $350,000 25%

Port St. Lucie, FL $289,000 $360,000 25%

Deltona-Daytona Beach-Ormond Beach, FL $266,000 $330,000 24%

The Villages, FL $279,900 $347,083 24%

Palm Bay-Melbourne-Titusville, FL $272,000 $330,000 21%

Orlando-Kissimmee-Sanford, FL $301,000 $365,000 21%

Jacksonville, FL $285,000 $345,000 21%

Panama City, FL $290,000 $351,000 21%

Pensacola-Ferry Pass-Brent, FL $263,275 $315,900 20%

Sebastian-Vero Beach, FL $285,000 $339,000 19%

Gainesville, FL $245,200 $285,000 16%

Miami-Fort Lauderdale-West Palm Beach, FL $350,000 $404,100 15%

Crestview-Fort Walton Beach-Destin, FL $381,000 $431,900 13%

Tallahassee, FL $235,000 $258,623 10%

Source: Florida Realtors®

All counties

Strong Price Growth in Florida’s Metro Areas

Slightly Stronger Dollar Aided by Price Appreciation

33%

32%

19%

19%

18%

Euro/US$

Pound/US$

Yuan/US$

Canadian$/US$

New Peso/US$

Year-over-Year Percent Change in the Value of the

Dollar as of July 2022 Against Other Currency

As of July 2022, 1 US Dollar equals:

0.98 Euro; 0.83 Pound; 6.73 Yuan; 1.29 Canadian Dollar; 20.49 New Peso

FOREIGN BUYER PURCHASES

• Dollar Volume

• Origin and Destination

• Foreign Buyer Preferences

34% Increase in Dollar Volume of MIAMI Foreign Buyer

Residential Purchases in 2022*― More than 9% Increase

Nationally

$6.2 $6.2

$7.1

$8.7

$6.9

$5.6

$5.1

$6.8

2015 2016 2017 2018 2019 2020 2021 2022

MIAMI FOREIGN BUYER DOLLAR VOLUME

(IN BILLION DOLLARS)

*Survey reference periods are from August of the prior year to July of current year

25% Year-over-Year Increase in MIAMI Foreign Buyer

Residential Purchases in 2022*― 8% Decline Nationally

10,800

10,900

15,300

14,300

11,500

9,200

7,500

9,400

2015

2016

2017

2018

2019

2020

2021

2022

MIAMI FOREIGN BUYER PURCHASES

*Survey reference periods are from August of the prior year to July of current year

MIAMI Foreign Buyer Market Share Increased in 2022

22%

24%

35%

33%

26%

23%

13%

16%

37%

39%

44%

50%

38%

32%

14%

17%

2015 2016 2017 2018 2019 2020 2021 2022

FOREIGN BUYERS AS A PERCENT OF MIAMI

CLOSED SALES

Foreign Buyer Purchases as a Percent of MIAMI Closed Sales

Foreign Buyer Dollar Volume as a Percent of MIAMI Sales Dollar Volume

Higher Foreign Buyer Market Share in MIAMI Market

Compared to Nationally

37%

39%

44%

50%

38%

32%

14%

17%

8%

7%

10%

8%

5%

4%

3%

3%

0%

10%

20%

30%

40%

50%

60%

2015 2016 2017 2018 2019 2020 2021 2022

FOREIGN BUYER RESIDENTIAL PURCHASES AS A

PERCENT OF CLOSED SALES

MIAMI U.S.

72% of MIAMI Foreign Buyers Primarily Resided Abroad―

A Higher Share Compared to Nationally

67%

69%

63%

72%

74%

74%

72%

41%

42%

39%

40%

39%

42%

43%

2016 2017 2018 2019 2020 2021 2022

SHARE OF NON-RESIDENT FOREIGN BUYERS

MIAMI U.S.

62% of Foreign Buyers Held B1-B2 Visas

42%

23%

11%

7%

5%

4%

8%

41%

26%

9%

5%

8%

3%

9%

38%

24%

9%

5%

7%

5%

12%

B2 B1 EB5 F AND J E1-E2 L OTHER

VISAS

VISAS HELD BY INTERNATIONAL CUSTOMERS

2020 2021 2022

MIAMI Foreign Buyers Came from 54 Countries

Top Tier Countries of Origin:

Primarily from Latin America

16%

13%

8% 8%

6% 6% 6% 6%

3% 3%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

ARGENTINA

COLOMBIA

PERU

CANADA

VENEZUELA

MEXICO

CHILE

BRAZIL

FRANCE

ITALY

MIAMI TOP FOREIGN BUYERS

Miami-Dade County: 67% of MIAMI Foreign Buyers

*Remaining 4% of MIAMI foreign buyers purchased properties in other Florida counties

63%

25%

4%

65%

31%

4%

77%

19%

2%

70%

26%

2%

65%

27%

3%

67%

27%

2%

MIAMI-DADE COUNTY BROWARD COUNTY PALM BEACH COUNTY

DESTINATION OF FOREIGN BUYERS

2017 2018 2019 2020 2021 2022

Foreign Buyers Share by County 2018-2022

34%

31%

29%

33%

16%

12%

26%

18%

12%

13%

11%

10%

14%

12%

7%

MIAMI-DADE BROWARD PALM BEACH

FOREIGN BUYERS AS A PERCENT OF MIAMI

MEMBERS' CLOSED SALES* PER COUNTY

2018 2019 2020 2021 2022

*Single-family homes, townhouses, condominiums

Miami-Dade County:

Latin Americans Were Major Buyers

Other buyers were from Italy, France, Costa Rica, Dominican Republic, Ecuador, China, Spain,

Bolivia, Honduras, Panama, Germany, Russia, and Sweden.

13%

12%

8%

8%

7%

7%

7%

5%

Argentina

Colombia

Mexico

Peru

Chile

Canada

Venezuela

Brazil

MAJOR FOREIGN BUYERS IN MIAMI-DADE

COUNTY

Broward County:

Latin Americans Were Major Buyers

Other buyers were Israel, Bahamas, Dominican Republic, Ecuador, Mexico, France, Romania,

Russa, and the United Kingdom of Great Britain and Northern Ireland.

21%

16%

11%

8%

6%

6%

4%

Argentina

Colombia

Canada

Peru

Brazil

Venezuela

Chile

MAJOR FOREIGN BUYERS IN BROWARD

COUNTY

Palm Beach County:

Latin Americans Were Major Buyers

38%

25%

25%

13%

Colombia

Canada

United Kingdom of Great

Britain and Northern…

South Africa

MAJOR FOREIGN BUYERS IN PALM BEACH

COUNTY

Destinations of Argentine Buyers

Miami-Dade,

60%

Broward, 37%

Lee, 3%

DESTINATIONS OF ARGENTINE BUYERS

Destinations of Colombian Buyers

Miami-Dade,

61%

Broward, 30%

Palm Beach, 5%

Osceola, 2%

Indian River, 2%

DESTINATIONS OF COLOMBIAN BUYERS

Destinations of Peruvian Buyers

Miami-Dade,

68%

Broward, 29%

Collier, 3%

DESTINATIONS OF PERUVIAN BUYERS

Destinations of Canadian Buyers

Miami-Dade,

54%

Broward, 34%

Palm Beach, 6%

Brevard, 3%

Lee, 3%

DESTINATIONS OF CANADIAN BUYERS

Foreign Buyer Median Purchase Price: $500,000―

Higher than Median Price in MIAMI Area

$337,100

$339,200

$339,300

$373,000

$375,600

$357,100

$386,200

$500,000

$359,600

$404,100

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

$550,000

2015 2016 2017 2018 2019 2020 2021 2022

MEDIAN PURCHASE PRICE AMONG FOREIGN AND

ALL BUYERS

Foreign Buyers All Buyers

Chileans and Mexicans Typically Purchased More Expensive

Properties

$718,800

$701,900

$611,100

$516,700

$494,400

$469,200

$450,000

$333,300

CHILE

MEXICO

CANADA

COLOMBIA

BRAZIL

VENEZUELA

PERU

ARGENTINA

MEDIAN PURCHASE PRICE

66% of Foreign Buyers Paid All Cash―

Higher than 44% of Foreign Buyers Nationally

All Cash

66%

U.S.Mortgage

30%

Home Country

Mortgage

2%

Other

2%

Don't Know

1%

SOURCE OF PAYMENT

Peruvian Buyers ―

Highest Fraction Among Top Foreign Buyers Who Paid Cash

78%

74%

67%

62%

57%

55%

50%

43%

PERU

ARGENTINA

CANADA

MEXICO

COLOMBIA

BRAZIL

VENEZUELA

CHILE

ALL-CASH PURCHASES

72% of Foreign Buyers Purchased for Vacation and/or Rental

―A Higher Fraction than Among U.S. Foreign Buyers*

*44% of all U.S. foreign buyers intended to use the property for vacation and/or rental

2%

4%

2%

16%

17%

20%

39%

Don't Know

Other

Student Use

Vacation and Rental

Vacation Home

Primary Residence

Residential Rental

INTENDED USE

Argentina and Chile ―

Highest Fraction Who Intend to Rent Out Property

17%

13%

36%

26%

26%

22%

4%

14%

51%

48%

9%

48%

57%

26%

54%

27%

11%

17%

24%

13%

13%

4%

14%

10%

15%

24%

6%

13%

30%

33%

41%

5%

6%

6%

ARGENTINA

COLOMBIA

CANADA

PERU

CHILE

MEXICO

VENEZUELA

BRAZIL

USE FOR VACATION OR INVESTMENT RENTAL

Other Student use

Primary residence Both of the above

Residential rental property for investment Vacation home for family and friends

58% of Foreign Buyers Purchased Condominiums ―

A Higher Fraction than Among U.S. Foreign Buyers*

2%

1%

14%

25%

58%

OTHER

RESIDENTIAL LAND

TOWNHOUSE/ROWHOUSE

SINGLE-FAMILY, DETACHED

CONDOMINIUM

TYPE OF PROPERTY

*16% of all U.S. foreign buyers purchased condominiums

Argentina and Mexico―Highest Fraction Among Top Foreign

Buyers Who Purchased Condominiums

12%

23%

24%

19%

26%

22%

29%

27%

8%

23%

9%

25%

9%

4%

29%

9%

73%

52%

67%

56%

65%

70%

42%

64%

ARGENTINA

COLOMBIA

CANADA

PERU

CHILE

MEXICO

VENEZUELA

BRAZIL

TYPE OF PROPERTY

Detached single-family Townhouse/row house/duplex

Condominium or Cooperative Land

64% Purchased in Central City/Urban Area―

Increase in Suburbs Compared to 2021

64%

25%

3%

8%

0%

10%

20%

30%

40%

50%

60%

70%

80%

2017 2018 2019 2020 2021 2022

TYPE OF AREA

Central City/Urban Area Suburban Area

Small Town/Rural Area Resort Area

Mexicans― Highest Fraction Among Top Foreign Buyers

Who Purchased Property in a City/Urban Area

57%

59%

39%

63%

74%

91%

79%

59%

29%

31%

33%

22%

13%

9%

17%

27%

0%

11%

8%

21%

13%

9% 9%

ARGENTINA

COLOMBIA

CANADA

PERU

CHILE

MEXICO

VENEZUELA

BRAZIL

AREA WHERE MAJOR FOREIGN BUYERS

PURCHASED PROPERTY

Central city/urban area Suburban area

Small town Rural area

Resort area

61% of Foreign Buyers Visited Florida Only 2 Times

or Less Before Purchasing a Property

6%

28%

27%

17%

5%

10%

5%

1%

0%

5%

10%

15%

20%

25%

30%

35%

0 1 2 3 4 5 TO 7 8 TO 10 MORE

THAN

10

NUMBER OF TIMES BUYER VISITED FLORIDA

BEFORE MAKING A PURCHASE

2018 2019 2020 2021 2022

WORKING WITH

INTERNATIONAL CUSTOMERS

• International Business Trends

• Factors Affecting the Decision

to Purchase Property

• Leads and Referrals

• Customer Interaction

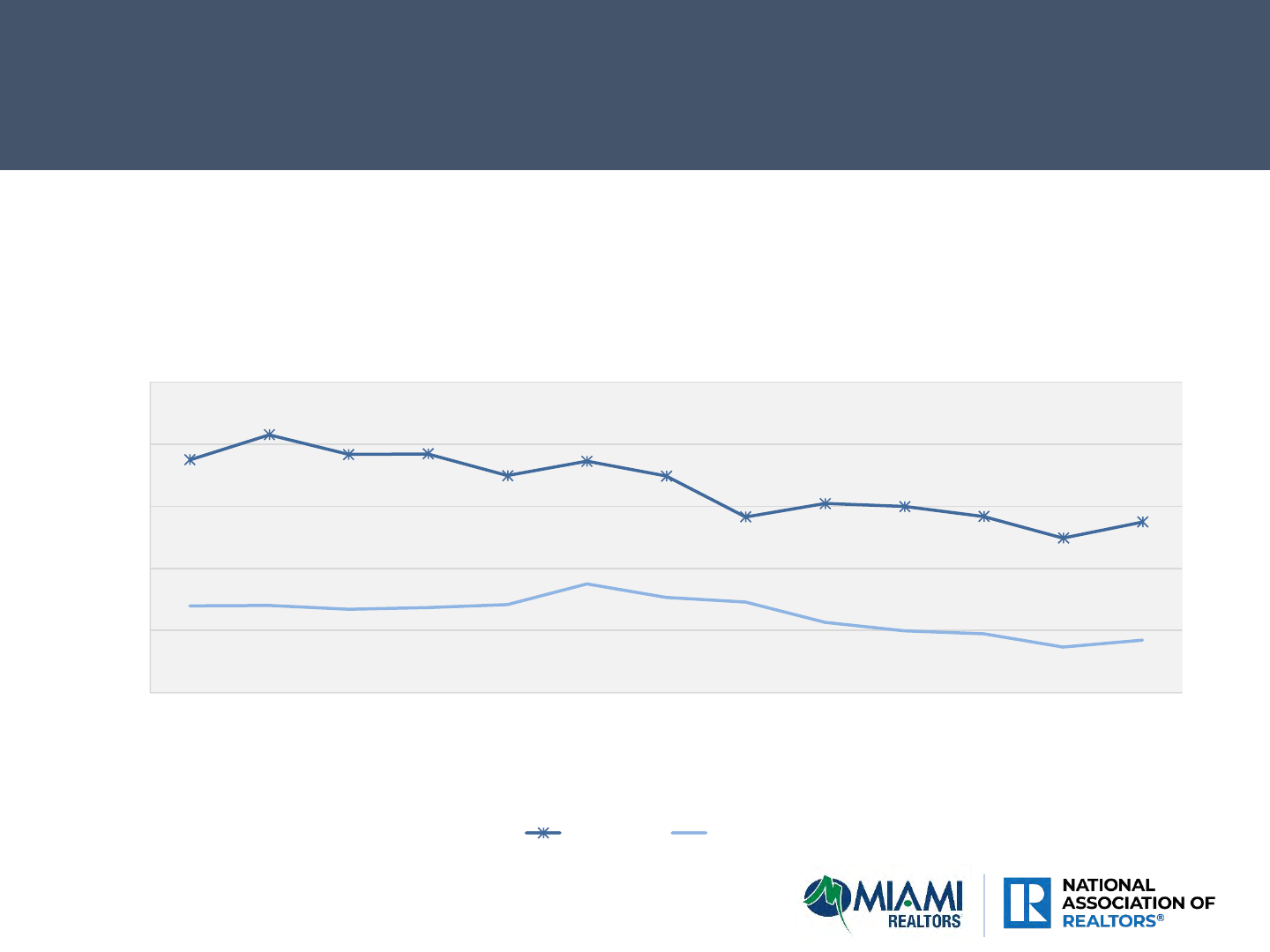

55% of MIAMI REALTORS

®

Had an International Customer*―

Significantly Higher than National Share of 17%

*Whether customer purchased property or not

75%

83%

77%

77%

70%

75%

70%

57%

61%

60%

57%

50%

55%

17%

0%

20%

40%

60%

80%

100%

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

PERCENT OF REALTORS® WHO WORKED WITH AN

INTERNATIONAL CUSTOMER

IN THE PAST 12 MONTHS

MIAMI U.S.

35% of MIAMI REALTORS

®

Reported an Increase in

International Business in the Past Year

43%

37%

20%

27%

29%

45%

24%

42%

35%

DECREASED STAYED ABOUT THE

SAME

INCREASED

CHANGE IN INTERNATIONAL BUSINESS IN

THE PAST YEAR

2020 2021 2022

*Among respondents who worked with an international customer

48% of MIAMI REALTORS

®

Reported an Increase in

International Business Over the Past 5 Years

* Among respondents who worked with an international customer

35%

33%

33%

20%

28%

52%

18%

34%

48%

DECREASED STAYED ABOUT THE

SAME

INCREASED

CHANGE IN PERCENTAGE OF INTERNATIONAL

CUSTOMERS IN THE PAST 5 YEARS

2020 2021 2022

58% of MIAMI REALTORS

®

Expect an Increase in

International Business in Next 12 Months

* Among respondents who worked with an international customer

24%

17%

42%

17%

10%

17%

65%

8%

12%

22%

58%

8%

DECREASE REMAIN THE

SAME

INCREASE DON'T KNOW

OUTLOOK ON INTERNATIONAL BUSINESS IN

THE NEXT 12 MONTHS

2020 2021 2022

Investment Security and Desirable Location: Main Reasons

Foreign Buyers Purchase Property in MIAMI Area

Secure

Investment, 35%

Profitable

Investment, 27%

Desirable

Location, 34%

Don't Know, 2%

Other, 3%

WHY FOREIGN BUYERS PURCHASE PROPERTY IN

MIAMI

Major Reasons Customers Did Not Purchase Property:

Cost, Could Not find Property, Condo Fees

2%

7%

0%

3%

3%

5%

7%

8%

5%

9%

12%

16%

22%

3%

6%

1%

3%

5%

5%

5%

5%

7%

7%

11%

17%

26%

DON'T KNOW

OTHER

LOSS OF HOME COUNTRY BENEFITS

EXPOSURE TO U.S. TAX LAWS

INSURANCE COSTS

COULD NOT OBTAIN FINANCING

PROPERTY TAXES

IMMIGRATION LAWS

EXCHANGE RATE

CANNOT MOVE MONEY

CONDO FEES

COULD NOT FIND A PROPERTY

COST OF PROPERTY

REASONS CUSTOMERS DECIDED NOT TO PURCHASE

PROPERTY

2022 2021

71% of MIAMI REALTORS

®

Reported Customers Found U.S.

Prices to be More Expensive than in Home Country ―

An Increase from the Past Year*

*Among respondents who worked with an international customer

15%

14%

43%

43%

52%

56%

54%

68%

71%

0%

20%

40%

60%

80%

100%

2016 2017 2018 2019 2020 2021 2022

HOW INTERNATIONAL CUSTOMERS VIEWED U.S.

HOME PRICES

Less expensive than prices in home country

About the same as prices in home country

More expensive than prices in home country

78% of Foreign Buyer Leads/Referrals Were

Personal/Business Contacts and Previous Customers

1%

1%

1%

2%

1%

6%

15%

25%

41%

1%

2%

3%

3%

5%

8%

16%

19%

38%

SIGNS/ADS ON BOARDS/YARDS

WALK-IN/OPEN HOUSE/PHONE CALL

OUTSIDE U.S. BUSINESS CONTACT

U.S. BUSINESS CONTACT

WEBSITE/INTERNET (PAID AD)

WEBSITE/INTERNET ORGANIC SEARCH

FORMER CUSTOMER

PREVIOUS CUSTOMER REFERRAL

PERSONAL CONTACT REFERRAL

SOURCE OF LEAD OR REFERRAL

2022

2021

82% of MIAMI REALTORS

®

Reported No Problem Working

with International Customers ―An Increase from Past Years*

* Among respondents who worked with an international customer

67%

77%

71%

69%

77%

80%

80%

82%

25%

21%

27%

29%

19%

16%

17%

16%

2015 2016 2017 2018 2019 2020 2021 2022

CULTURAL OR LANGUAGE BARRIERS WORKING

WITH FOREIGN CUSTOMERS

No Problems Few Problems Significant Problems

79% of MIAMI REALTORS

®

are Fluent in Another Language

73%

76%

66%

69%

82%

81%

83%

79%

2015

2016

2017

2018

2019

2020

2021

2022

PERCENT OF REALTORS® WHO

ARE FLUENT IN ANOTHER

LANGUAGE

62%

49%

55%

66%

66%

71%

65%

2016

2017

2018

2019

2020

2021

2022

PERCENT OF RESPONDENTS

WHO ARE FOREIGN-BORN

MIAMI Association of REALTORS® - More than A Century of Excellence

The MIAMI Association of Realtors (MIAMI) is the largest local Realtor® association in the U.S. and the second largest in the

world, serving nearly 60,000 real estate professionals across South Florida.

MIAMI is celebrating 102 years of excellent training, outstanding service, and exceptional member support. MIAMI is

comprised of six organizations: MIAMI RESIDENTIAL, MIAMI COMMERCIAL; BROWARD-MIAMI, a division of MIAMI

Realtors; JTHS-MIAMI, a division of MIAMI Realtors in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young

Professionals Network Council; and the award-winning MIAMI Global Council.

MIAMI has official partnerships with 230 international organizations worldwide, the most of any Realtor® association in the

U.S. These alliances create business opportunities for MIAMI members, enhance Miami’s global position and strengthen the

local real estate market and economy.

MIAMI is home to one of the most successful international councils in the world. MIAMI hosts the award-winning MIAMI

Global Real Estate Congress each fall with many of our distinguished partners participating in the three-day event. MIAMI is

the first National Association of Realtors Diamond Global Council. MIAMI’s Global Property Exchange (GlobalPropX) features

MIAMI Partner Property Searches worldwide, all on one platform and provides even more global exposure for MIAMI member

listings.

MIAMI offers members the best tools and resources available to successfully do global business, including global property

portals, websites with automatic translation in 19 languages, B2B platforms for networking and referrals, global designations

and certifications, and access to agents and consumers worldwide. MIAMI also generates worldwide exposure for members

and the South Florida market through events, outreach, media relations and other highly effective initiatives.

MIAMI properties are linked to more than 2 million professionals worldwide, and MIAMI properties are featured on global

property portals Proxio Pro, Juwaii, Realtor.com, International MLS and more. Learn about our local Global Referral Network,

foreign partners, global market research and more: www.MiamiRealtors.com/global

The National Association of REALTORS® is America’s largest trade association, representing more than 1.5 million

members, including NAR’s institutes, societies and councils, involved in all aspects of the real estate industry. NAR

membership includes brokers, salespeople, property managers, appraisers, counselors and others engaged in both

residential and commercial real estate.

The term REALTOR® is a registered collective membership mark that identifies a real estate professional who is a

member of the National Association of REALTORS® and subscribes to its strict Code of Ethics.

Working for America’s property owners, the National Association provides a facility for professional development,

research and exchange of information among its members and to the public and government for the purpose of

preserving the free enterprise system and the right to own real property.

NATIONAL ASSOCIATION OF REALTORS®

RESEARCH GROUP

The Mission of the NATIONAL ASSOCIATION OF REALTORS® Research Group is to produce timely, data-driven

market analysis and authoritative business intelligence to serve members, and inform consumers, policymakers and the

media in a professional and accessible manner.

To find out about other products from NAR’s Research Group, visit https://www.nar.realtor/research-and-statistics

NATIONAL ASSOCIATION OF REALTORS®

Research Group

500 New Jersey Avenue, NW

Washington, DC 20001

202-383-1000

data@nar.realtor

2022 Profile of International Homebuyer Transactions of Miami Association of REALTORS® Members

©2022 All rights reserved.

Miami Association of REALTORS®

National Association of REALTORS®

This Report may be cited with the proper attribution: See https://www.nar.realtor/research-and-statistics/citation-guidelines-for-nar-

research-statistics