NEW JERSEY TRAFFIC AND

REVENUE STUDY

New Jersey Turnpike & Route 440 Asset

Appraisal

Final Report

January 2008

Prepared for: Prepared by:

State of New Jersey

Department of Treasury

State House

125 West State Street

Trenton, NJ 08625

Steer Davies Gleave in association with CRA

International and EDR Group

28-32 Upper Ground

London

SE1 9PD

+44 (0)20 7919 8500

www.steerdaviesgleave.com

New Jersey Turnpike & Route 440 Asset Appraisal

Contents

Contents Page

1. INTRODUCTION 1

Statement of Objectives 1

Approach and Analysis Undertaken 1

Report Contents 2

2. THE NEW JERSEY TURNPIKE 3

Project Overview 3

2006 Traffic Levels 11

Behavioral Research 26

Summary 28

3. ROUTE 440 30

Project Overview 30

Tolling Regimes 32

Traffic Trends 32

4. THE FORECASTING METHODOLOGY 35

Introduction 35

Impact of Toll Changes and Congestion 37

Existing and Future Capacity Constraints 38

5. TRAFFIC GROWTH 39

Introduction 39

Economic Development 39

Trip Rates 41

WSA Forecasts 47

Steer Davies Gleave Forecasts 48

6. FORECASTS 56

Introduction 56

Toll Scenarios 58

NJTP Traffic and Revenue Forecasts 60

Route 440 Traffic and Revenue Forecasts 65

Review of Responses in Demand to Toll Changes 71

New Jersey Turnpike & Route 440 Asset Appraisal

Contents

A

PPENDICES

A: MAPS

B: FORECASTS

C: LANE EXPANSIONS

New Jersey Turnpike & Route 440 Asset Appraisal

Glossary

GLOSSARY OF DEFINED TERMS:

• Annual Average Weekday Traffic (AADTw)

• Atlantic City Expressway (ACE)

• Annual Average Daily Traffic (AADT)

• CRA International (CRAI)

• EDR Group (EDRG)

• Electronic Toll Collection (ETC)

• Federal Highway Administration (FHWA)

• Garden State Parkway (GSP)

• Gross Domestic Product (GDP)

• Gross Regional Product (GRP)

• Level of Service (LOS)

• Michael Baker Jr., Inc. (Baker)

• New Jersey Department of Transportation (NJDOT)

• North Jersey Regional Model (NJTPA)

• New Jersey Turnpike (NJTP)

• New Jersey Turnpike Authority (NJTA)

• Origin-Destination (O-D)

• Rutgers State University of New Jersey’s Economic Advisory Service (RECON)

• South Jersey Regional Model (SJTPO)

• US Highway 1/9 (US-1/9)

• U.S. Highway Capacity Manual (HCM)

• Vehicle Miles Traveled (VMT)

• Wilbur Smith and Associates (WSA)

New Jersey Turnpike & Route 440 Asset Appraisal

Disclaimer

DISCLAIMER

This report has been prepared for the State of New Jersey as an initial overview of issues relevant to

traffic and revenue projections to assist in the preparation of the possibility of monetizing a number

of the transport assets at present owned and operated by the State (or its agents). This report is

intended to provide an overview of relevant issues and does not provide investment grade analysis.

The analysis and projections of traffic and revenue contained within this document represent the

best estimates of Steer Davies Gleave at this stage. While the forecasts are not precise forecasts,

they do represent, in our view, a reasonable expectation for the future, based on the information

available as of the date of this report.

However, the estimates contained within this document rely on numerous assumptions and

judgments and are influenced by external circumstances that are subject to changes that may

materially affect the conclusions drawn.

In addition, the view and projections contained within this report rely on data collected by third

parties. Steer Davies Gleave has conducted independent checks of this data where possible, but

does not guarantee the accuracy of this data.

No parties other than the State of New Jersey can place reliance on it.

New Jersey Turnpike & Route 440 Asset Appraisal

1

1. INTRODUCTION

Statement of Objectives

1.1 The State of New Jersey is considering the possibility of monetizing a number of the

transport assets at present owned and operated by the State or certain authorities in, but

not of, the State. These include the New Jersey Turnpike (NJTP), the Atlantic City

Expressway (ACE), the Garden State Parkway (GSP) and Route 440 (between the New

Jersey Turnpike and the Outer Bridge Crossing).

1.2 The State has appointed a financial advisor to help it understand how such a process might

be carried out – and it has appointed Steer Davies Gleave, together with CRA

International (CRAI) and the EDR Group (EDRG), as traffic and revenue advisors. Our

brief is to provide assistance in the estimation of the traffic that might be carried on the

assets, and the toll revenue that might be generated.

1.3 Our overall work for this assignment consisted of two phases:

• Phase 1: Scoping; and

• Phase 2: Asset by Asset Appraisal of Future Traffic and Revenue streams.

1.4 The objective of the Phase 1 work was to prepare an initial review of the likely levels of

traffic and revenue on the target roads across the likely duration of the forecast period.

This work comprised the collection and collation of existing traffic data for each road, an

initial review of the key drivers of future traffic growth and a literature review of elasticity

parameters (a key determinant of traffic responsiveness to changes in tolls).

1.5 In Phase 2 work we have built on the analysis carried out for Phase 1 and developed a

modeling framework that can explore the base assignment to the target facility under a

range of scenarios – and for different traffic types. It has been built to allow sensitivity

testing of a range of factors including values of time – and allows for rapid testing of

different tolling scenarios. We have adopted a number of existing modeling tools to act as

focused network models and have developed separate spreadsheet based revenue models

to focus on the important traffic categories and the choices that road users would face.

Approach and Analysis Undertaken

1.6 In conjunction with our partners at CRAI and EDRG, we have undertaken the following

key tasks as part of both work phases:

• Developed an overview of traffic and revenue on the road assets to understand the

composition of traffic volumes by time of day and location;

• Reviewed the key economic issues and the likely impact on traffic of estimated

growth in key economic parameters;

• Developed a modeling framework to explore the base assignment to the target facility

under a range of scenarios – and for different traffic types;

New Jersey Turnpike & Route 440 Asset Appraisal

2

• Undertaken a number of travel time surveys to assist in the model validation process,

in particular to check that modeled travel times are representative of observed

journey times;

• Undertaken an internet based attitudinal surveys with New Jersey residents to support

our forecasting assumptions; and

• Reviewed relevant North American ‘price elasticity of demand’ studies to assess the

likely impact of toll changes on traffic volumes.

1.7 In carrying out this work we reviewed and relied on third party reports and data without

independent verification. However, in most instances we used recent data collected by

recognized experts or firms with nationally recognized credentials.

Report Contents

1.8 The purpose of this document is to present our traffic and revenue forecasts for the New

Jersey Turnpike and Route 440 and to provide an overview of the key assumptions made

as part of the process to develop these forecasts. A separate report describes the

background to our work and methodology in more detail.

1.9 This document is structured as follows:

• Chapters 2 and 3 provide an overview of the NJTP and Route 440 and present 2006

traffic and revenues for these facilities;

• Chapter 4 presents an overview of our forecasting methodology, discusses key

forecasting issues and summarizes key forecasting assumptions;

• Chapter 5 discusses how future traffic growth rates have been derived and defined;

and

• Chapter 6 presents traffic and revenue forecasts for the facilities.

1.10 Supporting documentation is included in a number of appendices.

New Jersey Turnpike & Route 440 Asset Appraisal

3

2. THE NEW JERSEY TURNPIKE

Project Overview

2.1 As shown in Figure 2.1, NJTP is a 148 mile tolled facility that runs from the south-west to

the north-east of New Jersey. The road opened in 1951 and has been managed and

operated ever since by the New Jersey Turnpike Authority (NJTA). The road forms a key

part of the I-95 corridor which connects the major economic centers along the eastern

seaboard of the United States including Washington D.C, Philadelphia and New York.

2.2 The NJTP commences in the south-west of New Jersey at the Delaware Memorial Bridge

and extends north-east to form part of an orbital route bypassing the city of Philadelphia.

The route then progresses northwards to serve the Newark and New York metropolitan

areas before terminating at the George Washington Bridge, where the I-95 route continues

north through Connecticut.

FIGURE 2.1 NJTP OVERVIEW

New Jersey Turnpike & Route 440 Asset Appraisal

4

2.3 The NJTP has two extensions, the Newark Bay Extension (8.3 miles), which connects into

the Holland Tunnel, providing a connection with Lower Manhattan and the Pennsylvania

Turnpike Extension leading into the Pennsylvania Turnpike from Exit 6 (6.6 miles). The

NJTP has interchanges with nearly all of the major highway routes and major access

points throughout New Jersey, including:

• ACE (Exit 3);

• GSP (Exit 11);

• Newark Liberty International Airport (Exit 13A);

• Holland Tunnel, providing access to New York City/Lower Manhattan (Exit 14); and

• Lincoln Tunnel, providing access to New York City (Exit 16E).

2.4 The NJTP forms part of the major I-95 corridor along the East coast of the United States.

As such, it serves North-South through traffic for commercial and personal vehicles. Its

links with the Port and Airport of Newark make it a major link along the northeast

corridor.

2.5 Within New Jersey, the NJTP links the metropolitan areas surrounding Philadelphia and

New York City. It also serves local commuters traveling into these employment locations.

2.6 Figure 2.2 shows the area served by the northern section of the NJTP in more detail.

Detailed maps showing the location of all entries and exits are included in Appendix A.

FIGURE 2.2 NJTP - OVERVIEW (NORTHERN SECTIONS)

New Jersey Turnpike & Route 440 Asset Appraisal

5

Road Configuration

2.7 The NJTP is a grade-separated limited access freeway with a speed limit of 65 mph in

rural sections (south of Exit 13) and 55 mph in urban sections (north of Exit 13). A

schematic summary of the lane geometry of the NJTP is shown in Figure 2.3.

F

IGURE 2.3 NJTP - LANE GEOMETRY

• South of Exit 4 the facility operates as a 4-lane (2 lanes per direction) highway;

• Between Exits 4 and 8A, NJTP operates as a 6-lane highway (3 lanes per direction)

to cater for the distribution of traffic to and from Philadelphia – traveling on the

NJTP by the Pennsylvania Turnpike Extension (3 lanes per direction) at Exit 6;

• Between Exits 8A and 14, the geometry of the facility widens considerably to allow

for between 10 and 14 lanes of traffic (5-7 lanes in each direction). In this section,

truck traffic is restricted to using the outer lanes (typically 2-3 lanes in each

direction), while the inner lanes (typically 3-4 lanes per direction) are exclusively

available to cars;

• At Exit 14, the Newark Bay Extension diverges from the mainline, providing a 4-lane

highway (2 lanes per direction) serving the Newark/Jersey City area; and

• From Exit 14, the NJTP splits into two spurs. The eastern spur, which serves Newark

Liberty International Airport and Manhattan, provides 6 lanes (3 lanes per direction)

of capacity. The western spur which acts as a bypass around the Jersey City/New

York metropolitan areas is also a 6-lane (3 lanes per direction) highway reducing to 4

lanes (2 lanes per direction) after Exit 18W.

Competing Routes

2.8 Across the length of the NJTP there are a number of competing routes. In the southern

section of the NJTP (between Exits 1 and 7) the I-295 and I-95 compete with the NJTP, as

can be seen in Figure 2.4.

2.9 I-295 runs almost parallel to NJTP between the Delaware Memorial Bridge and Trenton.

The route offers an un-tolled alternative to NJTP for journeys to and from the major

centers of Philadelphia and Trenton. The route has a 60 mph speed limit but does suffer

from considerable peak-hour congestion. Journey time savings carried out by Steer Davies

Gleave show that peak hour average speeds can be as low as 12 mph between Exit 34 and

the Pennsylvania Turnpike. However in the off-peak period, average speeds are much

higher and thus the I-295 provides a much more viable alternative.

New Jersey Turnpike & Route 440 Asset Appraisal

6

2.10 To the south, the I-95 route runs parallel to the NJTP and passes through the city of

Philadelphia. It provides direct access to and from Philadelphia and extends northwards to

form part of an orbital route to the north of Trenton. The predominant speed limit on the

route is 55 mph. Again this route has considerable peak-hour congestion relative to the

NJTP but offers a viable alternative in off-peak periods. Over time this route might

become more attractive with the completion of the interchange between the I-

95/Pennsylvania Turnpike Extension.

FIGURE 2.4 NJTP - COMPETING ROUTES (CENTRAL & SOUTHERN SECTIONS)

2.11 In the central section (between Exits 7 and 11) the only competing route is US Highway 1

(US-1) (see Figure 2.5), which runs parallel to the NJTP through Mercer and Middlesex

counties. US-1 is predominately an ‘at-grade’ facility with a speed limit of 50 mph and

therefore only an attractive alternative to the NJTP for shorter distance and local journeys.

Indeed our travel time survey shows average off-peak period speeds of just 36 mph.

2.12 In the northern section (between Exits 11 and 18E/W) the GSP and US Highway 1/9 (US-

1/9) compete with the NJTP. The GSP runs parallel to the NJTP between Exit 11 and 18E

and can act as an alternative for a number of destinations in the Newark area including

Newark Liberty International Airport. However, the GSP does not provide access to New

York City as does the NJTP.

New Jersey Turnpike & Route 440 Asset Appraisal

7

2.13 US-1/9 runs parallel to the NJTP between Exits 11 and 14. As shown in Figure 2.5, this

un-tolled alternative route competes with the NJTP for key destinations in the Newark

area including Newark International Airport, Elizabeth and Linden. The route provides

predominately ‘at-grade’ access and has a speed limit of 50 mph. Travel time surveys

carried out by Steer Davies Gleave show that even in off peak periods, average speeds are

typically less than 40 mph.

FIGURE 2.5 NJTP - COMPETING ROUTES (NORTHERN SECTION)

2.14 Table 2.1 summarizes the competing routes.

TABLE 2.1 NJTP - SUMMARY OF COMPETING ROUTES

Section Route Lane Geometry Speed Limit (mph)

I-295 3x3 60

Southern Section

(Exits 1 – 7)

I-95 4x4 60

Central Section

(Exits 7 – 11)

US-1 2x2 50

US-1/9 3x3/4x4 50

Northern Section

(Exits 11 – 18E/W)

GSP 5x5 55

Source: NJTA / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

8

Planned Infrastructure Improvements

2.15 The NJTA plans to expand 20 miles of the NJTP from Exit 6 (Pennsylvania Turnpike)

north to Exit 8A (NJ 32), most likely in a ten-lane (2-3-3-2) configuration. This project

will provide for the construction of an extension to the NJTP’s dual roadway from the

existing merge at Exit 8A to the interconnection of the mainline roadway with the

Pennsylvania Turnpike Extension at Exit 6. This project is scheduled to be completed in

2010. Further widening projects are planned for by the NJTA but have not been

committed to and scheduled. These include the widening between Exits 8A and 11,

between Exits 13 and 13A, and a widening from four to six lanes between Exit 1

(Delaware Memorial Bridge) and Exit 4 (New Jersey Route 73). Figure 2.6 shows

Planned Infrastructure Improvements in New Jersey.

2.16 A connection between the Pennsylvania Turnpike (I-276) and I-95 is planned by the

Pennsylvania Turnpike Commission. After completion of the project, a portion of I-276

will be renamed as I-95, assuring its continuity. As part of this project, I-276 will be

widened from two to three lanes in each direction from the Delaware River to US-1. A

bridge toll will be levied on westbound I-276 traffic after crossing the Delaware River

Bridge, allowing eastbound NJTP traffic to move unimpeded on the new I-95 northbound

into New Jersey. The Pennsylvania Turnpike Commission has indicated that they will

establish a mainline toll collection facility east of the new I-276/I-95 interchange, with E-

ZPass and conventional toll collection lanes. This part of the project is to be completed by

2008. Later phases of the project include the construction of an additional bridge over the

Delaware River to provide three lanes in each direction.

New Jersey Turnpike & Route 440 Asset Appraisal

9

F

IGURE 2.6 PLANNED INFRASTRUCTURE IMPROVEMENTS IN NEW JERSEY

New Jersey Turnpike & Route 440 Asset Appraisal

10

Tolling Regime

2.17 The NJTP operates as a ‘closed’ tolling system where users collect a ticket once entering

the NJTP and then surrender this ticket along with payment when exiting the facility.

Every exit point along the route has an operational toll plaza, making it theoretically

impossible for travelers to use any section of the NJTP without payment.

2.18 Since 2000, an Electronic Toll Collection (ETC) system called E-ZPass has been in

operation on NJTP. The system is governed by the E-ZPass Interagency Group which

oversees the ETC operation across various states and facilities helping to promote free-

flow tolling between collaborating states. Within this structure, NJTA manages its own

billing and customer service center.

2.19 E-ZPass allows vehicles equipped with an E-ZPass tag to drive through designated toll

lanes without the need to stop and manually pay a toll. Currently E-ZPass users have

dedicated lanes prohibited to cash payment but work is under way to incorporate the E-

ZPass technology into all toll lanes so that E-ZPass users are not just restricted to the

designated lanes.

2.20 Tolls are distance based, with the tolling ‘ticket’ system recognizing the entry and exit

point of each vehicle. Tolls are charged differentially according to vehicle size with the

toll classification based on the number of axles. Passenger cars, 2-axle, 3-axle, 4-axle, 5-

axle and 6-axle trucks make up Classes 1-6 respectively.

2.21 On a per mile basis tolls are not uniform across the length of the road with tolls for

movements at the northern end of the road being charged at a higher rate than those at the

southern end.

2.22 Users of the E-ZPass system benefit from an off-peak toll discount of 25%.

2.23 Table 2.2 below provides a matrix of tolls for journeys between some of the key

interchanges on the NJTP. The tolls presented are for Class 1 vehicles (passenger cars)

and for cash paying customers only.

TABLE 2.2 NJTP - 2006 TOLLS FOR SELECTED KEY MOVEMENTS (CLASS 1, CASH

PAYMENT)

Exit 1 Exit 6 Exit 7A Exit 14 Exit 18E

Exit 1 (South Termini) $2.55 $2.15 $5.75 $6.45

Exit 6 (Philadelphia) $2.55 $1.00 $3.75 $5.50

Exit 7A (Trenton) $2.15 $1.00 $2.85 $4.45

Exit 14 (New York) $5.75 $3.75 $2.85 $1.70

Exit 18E (North Termini/New York) $6.45 $5.50 $4.45 $1.70

Source: NJTA

New Jersey Turnpike & Route 440 Asset Appraisal

11

2.24 As mentioned, heavy vehicles are charged more, according to the number of axles on each

truck. A 6-axle truck will typically pay a toll 4.5 times greater than the Class 1 toll

whereas a 2-axle truck will pay a toll twice as much as the car toll.

2.25 There is currently no annual indexation of toll rates to price inflation. Instead toll rates

have only historically increased on an ad-hoc basis. Since 1970, there have only been five

increases with the most recent toll increases occurring in 2000 and 2003.

2.26 In Table 2.3 below we compare average toll rates per mile on NJTP to US average and

maximum toll rates, based on an analysis by WSA of most US toll facilities. Toll rates for

cars on NJTP are below average by US standards. Truck toll rates are roughly in line with

US averages.

TABLE 2.3 NJTP - 2006 AVERAGE TOLL PER VEHICLE MILE, US AVERAGE AND

MINIMUM

Vehicle Type

NJTP Average Toll

($/Mile)

US Average Toll ($/Mile)

US Maximum Toll

($/Mile)

Cars 0.055 0.09 to 0.14 1.00

Trucks 0.22 0.22 1.75

Source: NJTA / SDG Analysis

2006 Traffic Levels

2.27 Wilbur Smith and Associates (WSA) has worked for NJTA for many years, monitoring

the development of traffic and revenue. From their most recent work (which has been

provided to us as part of this study) we have a significant volume of past and present data

on the road. Furthermore NJTA has provided us directly with up-to-date 2006 Transaction

and Revenue Data for the NJTP. Based on this data and our own analysis of the

characteristics of the road, we have established an overview of the following:

• General traffic volumes and characteristics;

• Transactions and revenue by vehicle type;

• Time of day transactions profiles;

• Analysis and observations of traffic patterns on different sections of each road;

• Capacity constraints.

2.28 Data from the North Jersey and South Jersey regional models (NJTPA and SJTPO) and

New Jersey State-wide assignment model enabled us to establish traffic composition by

vehicle type and also enabled us to build up a picture of trip purposes on the NJTP.

Transactions

2.29 In 2006 over 250 million vehicles used the NJTP, equivalent to just over 690,000 vehicles

per day on average. Cars accounted for 85% of transactions, with trucks and buses

accounting for 15% of transactions.

New Jersey Turnpike & Route 440 Asset Appraisal

12

2.30 Figure 2.7 below shows the number of vehicles using the NJTP for the period 1970-2006.

As can be seen, traffic using the NJTP grew steadily from 1970 to 1990 except during the

mid-70s when traffic growth stagnated following the global oil crises of 1973 and 1976.

Traffic growth was rapid in the 1980s until the early 1990s when traffic growth slowed

due to the combination of economic recession and a NJTP toll increase. Since the 1990s,

traffic has continued to grow steadily with the only exception being 2003 when annual

traffic fell following another periodic toll increase.

FIGURE 2.7 NJTP - TRANSACTIONS: 1970-2006

0

50

100

150

200

2

50

300

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

Year

Transactions (M)

Light Vehicles Heavy Vehicles Total

Source: NJTA / SDG Analysis

2.31 Since 1970, traffic on the NJTP has grown 2.9% per annum on average. Over the same

period light vehicles have grown at an average of 3% per year, while heavy vehicles have

grown by 2.3% per annum. In recent years traffic growth has slowed slightly.

2.32 Table 2.4 overleaf shows that between 1996 and 2006, annual total traffic growth has

slowed to an average of 2.6% per annum, while over the last five years, traffic growth has

slowed to just 1.9% per annum.

2.33 Traffic growth in heavy vehicles has slowed to just 1.3% per annum over the last five

years. However the slow down in traffic growth over the last five years must be placed in

the context of the toll rate increases in late 2000 and 2003 and other events such as 9/11

and the rise in fuel prices.

New Jersey Turnpike & Route 440 Asset Appraisal

13

T

ABLE 2.4 NJTP - ANNUAL AVERAGE TRAFFIC GROWTH (TRANSACTIONS)

Period Light Vehicles Heavy Vehicles Total Vehicles

1970 – 2006 3.01% 2.29% 2.90%

1996 – 2006 2.52% 3.00% 2.58%

2001 - 2006 1.96% 1.29% 1.87%

Source: NJTA / SDG Analysis

2.34 Over time, traffic has not grown uniformly across the length of the NJTP. Figure 2.8

below shows an index of traffic growth by section for the period 1990-2006.

FIGURE 2.8 NJTP - TRAFFIC GROWTH BY SECTION: 1990-2006 (1990 = 100)

90

100

110

120

1

30

140

150

1

990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006

Year

Index of Daily Transactions

North Central South

Source: NJTA / WSA / SDG Analysis

2.35 As can be seen, traffic growth has been the highest in the southern section of the NJTP,

with traffic growing at 2.3% per annum between 1990 and 2006. In contrast, the more

heavily utilized northern section has grown at a slower rate of 1.4% per annum over the

same period.

2.36 In the southern section traffic has grown most rapidly at the exits offering access and

egress to the Philadelphia conurbation. Exit 3 which intersects I-76 and is the main

arterial access point to the east of Philadelphia has grown at an average of 4.3% per

annum over the past 16 years.

2.37 Exit 6 which intersects with the Pennsylvania Turnpike has witnessed growth of 2.6% per

annum. The exit with the lowest observed growth over the period is Exit 1, which has

seen growth of 1.8% per annum.

New Jersey Turnpike & Route 440 Asset Appraisal

14

Revenue

2.38 2006 revenue totaled nearly $540 million. Light vehicles accounted for 65% of revenue

whereas trucks accounted for 35% of revenue. Figure 2.9 below shows the development

of toll revenue for the period 1970-2006, both in current and 2006 price levels.

F

IGURE 2.9 NJTP - TOLL REVENUE: 1970-2006 ($M)

0

100

200

300

400

500

600

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

Year

Toll Revenue (Nominal $M)

Toll Revenue (Nominal) Toll Revenue (2006 prices) Year of Toll Increase

Source: NJTA / SDG Analysis

2.39 It can be seen that between 1970 and 1990, real toll revenues stagnated as toll rates failed

to increase at the same rate as price inflation. Only when toll rates were effectively

doubled in March 1991 was there a large surge in real toll revenues and a subsequent fall

in traffic. However since 1991 toll increases have still only remained periodic and as a

result toll revenues through the 1990s remained largely unchanged in real terms. In late

2000 and in 2003 tolls were further increased and this contributed to the increase in real

toll revenues witnessed in these years.

2.40 Thus with no specific indexation of tolls, the cost of using the turnpike has actually fallen

in real terms for users. Figure 2.10 overleaf shows the average real toll (2006 prices)

since 1970. As can be seen the average toll has fallen from $3.68 in 1970 to just $2.13 in

2006 when we express tolls in 2006 prices.

New Jersey Turnpike & Route 440 Asset Appraisal

15

F

IGURE 2.10 NJTP - AVERAGE TOLL PER TRANSACTION: 1970-2006 ($, 2006 PRICES)

0

.00

0.50

1.00

1.50

2.00

2

.50

3

.00

3

.50

4.00

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

Year

Average Toll ($ - 2006 Prices)

Average Toll (2006 prices) Year of Toll Increase

Source: NJTA / SDG Analysis

2.41 Table 2.5 summarizes traffic and revenue by payment method. The table shows that E-

ZPass transactions currently account for 67% of all transactions on NJTP and nearly 65%

of toll revenue. Over 30% of all transactions are made by vehicles taking advantage of the

E-ZPass toll discount in the off-peak period. Penalty tolls collected following violations

account for 2% of all transactions.

TABLE 2.5 NJTP - 2006 TRAFFIC AND REVENUE BY PAYMENT METHOD

Payment Method Vehicles (M) Revenue ($M)

% of Total

Vehicles

% of Total

Revenue

Cash 79.5 181.7 31% 34%

E-ZPass (Peak) 92.3 193.6 37% 36%

E-ZPass (Off-Peak) 76.6 153.0 30% 28%

Violations 4.2 10.6 2% 2%

Total 252.6 538.9 100% 100%

Source: NJTA / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

16

Traffic Patterns

2.42 The busiest sections of the turnpike are, as expected, to the north of Exit 11 as the route

approaches the New York and Newark metropolitan areas. The highest observed flow on

the route is the section between Exits 13 and 13A where Average Annual Daily Traffic

(AADT) flows in 2006 were in excess of 250,000 vehicles per day.

2.43 Traffic flows on the Eastern and Western spurs beyond Exit 15 are also very high, with

over 100,000 vehicles per day reported on all sections of both spurs, indicating significant

capacity constraints on what are only 3-lane sections of the Turnpike.

2.44 Figure 2.11 below shows observed 2006 AADT for all sections of the NJTP. Usage

increases on the approaches to Newark and New York are clearly visible.

FIGURE 2.11 NJTP - 2006 AADT BY SECTION

0

50,000

100,000

150,000

2

00,000

2

50,000

3

00,000

1-2

2-3

3-4

4-5

5-6

6-7

7-7A

7A-8

8-8A

8A-9

9-10

10-11

11-12

12-13

13-13A

13A-14

14-SMB

14-14A

14A-14B

14B-14C

SMB-15E E

15E-15W E

15W-15X E

15X-16E E

16E-NMB E

SMB-15E W

15E-15W W

15W-16W W

16W-18W W

18-NMB

Section

AADT

Cars Trucks and Buses

Source: NJTA / SDG Analysis

2.45 Journeys using the full length of the NJTP, that is, ‘through’ journeys entering the system

at Exit 1 and leaving at Exit 18W account for just 1% of total recorded transactions (just

over 7,100 transactions per day on average).

2.46 However, Figure 2.12 shows that through traffic as a proportion of total traffic is

significantly higher at the southern end of the NJTP.

New Jersey Turnpike & Route 440 Asset Appraisal

17

F

IGURE 2.12 NJTP - 2006 THROUGH-TRAFFIC BY SECTION (% OF AADT)

0%

2%

4%

6%

8%

10%

12%

14%

1

6%

1

8%

1-2

2-3

3-4

4-5

5-6

6-7

7-7A

7A-8

8-8A

8A-9

9-10

10-11

11-12

12-13

13-13A

13A-14

14-SMB

SMB-15E W

15E-15W W

15W-16W W

16W-18W W

18W-NMB

Sections

Proportion of Through Traffic

Source: NJTA / SDG Analysis

Trip Length Distribution

2.47 Figure 2.13 shows the cumulative trip length distributions for cars and trucks and buses

combined. The average trip length for cars is 22.9 miles, for trucks and buses it is 26.6

miles. These are very low compared to the length of the road and are due to a large

volume of relatively short distance trips in the northern part of the road and a relatively

low percentage of through trips.

New Jersey Turnpike & Route 440 Asset Appraisal

18

F

IGURE 2.13 NJTP - 2006 CUMULATIVE TRIP LENGTH DISTRIBUTION

Source: NJTA / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

19

Trip Purpose Distribution

2.48 We used the NJTPA to extract trip patterns by journey purpose. Figure 2.14 shows the

proportion of commuting trips into New York and Philadelphia for each section on the

NJTP. It can be seen that commuting flows into Philadelphia are important between Exits

5 and 11 only, but influence traffic levels elsewhere on the NJTP to a lesser extent.

Commuting flows into NY on the other hand are much more stable across the length of

the road, suggesting a much larger area from which people commute.

FIGURE 2.14 NJTP - ESTIMATED COMMUTING TRIPS BY SECTION (% AADT)

0%

2%

4%

6%

8%

10%

12%

14%

16%

1

8%

1-2

2-3

3-4

4-5

5-6

6-7

7-7A

7A-8

8-8A

8A-9

9-10

10-11

11-12

12-13

13-13A

13A-14

14-SMB

SMB-15E W

15E-15W W

15W-16W W

16W-18W W

18W-NMB

Sections

Proportion of Commuters

To/From New York To/From Philadelphia

Source: NJTA / SDG Analysis

Hourly Traffic Profiles

2.49 The high density of traffic in the northern section of NJTP naturally affects the profile of

traffic throughout the day. Figure 2.15 shows the hourly traffic profile for vehicles using

Exit 14C (heading into New York). With an urban intersection such as Exit 14C, there are

clearly defined peak periods in the morning and evening. However it is apparent that

these peak periods are relatively wide in the sense that peak traffic flows are maintained

over several hours. This is a common observation for congested links in urban areas and

particular affects the evening peak where in this instance peak conditions appear to

commence as early as 4:00 PM and finish as late as 7:00 PM.

New Jersey Turnpike & Route 440 Asset Appraisal

20

F

IGURE 2.15 NJTP - 2006 HOURLY TRAFFIC PROFILE EXIT 14C

0

500

1

,000

1

,500

2,000

2,500

3

,000

00:30

01:00

01:30

02:00

02:30

03:00

03:30

04:00

04:30

05:00

05:30

06:00

06:30

07:00

07:30

08:00

08:30

09:00

09:30

10:00

10:30

11:00

11:30

12:00

12:30

13:00

13:30

14:00

14:30

15:00

15:30

16:00

16:30

17:00

17:30

18:00

18:30

19:00

19:30

20:00

20:30

21:00

21:30

22:00

22:30

23:00

23:30

24:00

P

eriod End Time

Average Daily Traffic

Total Car Truck

Source: NJTA / SDG Analysis

2.50 In the southern sections of the NJTP, smaller peak periods are observed because of the

lower incidences of congestion. Figure 2.16 shows the hourly profile of traffic using Exit

8A. As can be seen, the peak periods are no less defined but clearly take place over a

much more narrow time period. For example, the PM peak period commences at 4:30 PM

and finishes at 6:30 PM, an hour less of peak conditions than that seen at Exit 14C.

FIGURE 2.16 NJTP - HOURLY TRAFFIC PROFILE EXIT 8A

0

500

1,000

1,500

2,000

2,500

00:30

01:00

01:30

02:00

02:30

03:00

03:30

04:00

04:30

05:00

05:30

06:00

06:30

07:00

07:30

08:00

08:30

09:00

09:30

10:00

10:30

11:00

11:30

12:00

12:30

13:00

13:30

14:00

14:30

15:00

15:30

16:00

16:30

17:00

17:30

18:00

18:30

19:00

19:30

20:00

20:30

21:00

21:30

22:00

22:30

23:00

23:30

24:00

Period End Time

Average Daily Traffic

Total Car Truck

Source: NJTA / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

21

2.51 In contrast, on certain sections of NJTP, traffic is relatively more stable across the day

with less well defined peak periods. An example of this is Exit 18W where traffic

movements will tend to be relatively longer-distance trips traveling beyond the Newark

and New York metropolitan area with relatively fewer commuter trips. Figure 2.17 shows

how this is reflected in the profile of traffic over the day. As can be seen, at Exit 18W,

there is clearly not the same significant decrease in flow in the period between the AM

and PM peaks. Instead, traffic flows remain relatively constant across the whole day.

FIGURE 2.17 NJTP - HOURLY TRAFFIC PROFILE EXIT 18W

0

500

1,000

1,500

2,000

2,500

3,000

3,500

00:30

01:00

01:30

02:00

02:30

03:00

03:30

04:00

04:30

05:00

05:30

06:00

06:30

07:00

07:30

08:00

08:30

09:00

09:30

10:00

10:30

11:00

11:30

12:00

12:30

13:00

13:30

14:00

14:30

15:00

15:30

16:00

16:30

17:00

17:30

18:00

18:30

19:00

19:30

20:00

20:30

21:00

21:30

22:00

22:30

23:00

23:30

24:00

Hour

Average Daily Traffic

Total Car Truck

Source: NJTA / SDG Analysis

Monthly Traffic Profiles

2.52 Traffic flows on the NJTP vary across the year and transaction activity at a number of

exits is shown in Figure 2.18. It can be seen that the monthly variations in traffic flow are

more profound away from urban areas where frequent commuter flows allow traffic levels

to remain relatively stable across the year.

2.53 This explains the relative flatness in the profile of Exit 16E which predominately serves

New York City. In contrast, less frequently used plazas in the South typically show more

seasonal variation, particularly during the winter months when discretionary trips like

those taken for leisure purposes normally fall. This appears to be the case for Exit 1,

although the difference is not as pronounced as that seen on the ACE and southern

sections of the GSP.

New Jersey Turnpike & Route 440 Asset Appraisal

22

F

IGURE 2.18 NJTP - MONTHLY TRAFFIC PROFILE EXIT1, EXIT 6 & EXIT 16E

0%

2%

4%

6%

8%

10%

12%

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

Month

Proportion of Annual Traffic

Exit 1 Exit 6 Exit 16E

Source: NJTA / SDG Analysis

Traffic Speeds and Congestion

2.54 As we have mentioned, in some sections of the NJTP, the route is typically serving in

excess of 200,000 vehicles per day. At such traffic flows, highway capacity constraints

will be binding and traffic speeds can be affected. The U.S. Highway Capacity Manual

(HCM) uses the concept of Level of Service (LOS) as a qualitative measure of describing

the extent of capacity problems on a section of highway. The HCM adopts a sliding scale

of LOS ranging from LOS A which represents almost entirely free-flow conditions to

LOS F which in contrast describes breakdowns in vehicular flow which result in

significant recurring congestion.

2.55 On a multi-lane grade-separated highway like NJTP, occurrences of LOS F are extremely

rare and instead a clearer understanding of the extent of capacity problems on NJTP can

be obtained by measuring if LOS D volumes are being observed. LOS D is believed to be

the point at which free-flow speeds begin to significantly decline and even minor incidents

can create queuing. Table 2.6 compares observed peak hour directional volumes on each

section of the NJTP to the equivalent service volumes at which LOS D typically occurs.

We adopted a link capacity of 2,250 vehicles/hour/lane to correspond to flow levels at

which HCM recommends a LOS D.

New Jersey Turnpike & Route 440 Asset Appraisal

23

T

ABLE 2.6 NJTP - 2006 PEAK HOUR SERVICE LEVELS

Section

Observed Peak

Hour Volumes

LOS D Service Volumes

Volume/LOS D Service

Volume (%)

1 – 2 1,563 4,500 35%

2 - 3 2,134 4,500 47%

3 - 4 2,318 4,500 52%

4 - 5 2,816 6,750 42%

5 - 6 2,856 6,750 42%

6 - 7 3,880 11,250 34%

7 – 7A 4,135 11,250 37%

7A - 8 5,045 11,250 45%

8 – 8A 5,513 11,250 49%

8A-9 6,786 11,250 60%

9 - 10 7,357 13,500 54%

10 – 11 7,115 13,500 53%

11 - 12 8,674 15,750 55%

12 - 13 8,868 15,750 56%

13 – 13A 8,773 15,750 56%

13A - 14 8,597 15,750 55%

14 - SMB 8,289 20,250 41%

SMB – 15E W 4,206 6,750 62%

15E – 15W W 4,498 6,750 67%

15W – 16W W 4,861 6,750 72%

16W – 18W W 2,677 6,750 40%

18 W - NMB 2,570 4,500 57%

Source: Highway Capacity Manual (TRB) / NJTA / SDG Analysis

2.56 In the northern sections of the road, it is apparent that peak hour volumes are close to the

LOS D threshold. Given that the volumes presented in the table above are average annual

peak hour volumes, it is likely that at various times of the year the northern section of the

route is experiencing LOS D or lower. In contrast, the southern sections of the road have

less capacity issues with the ratio of volume to LOS D service volume only ranging from

roughly 35% to 60%.

2.57 Analysis of the 2006 tolling system data provides further evidence of relatively less

capacity in the northern sections. Table 2.7 shows average traffic speeds in the AM Peak

over a range of sections on NJTP.

New Jersey Turnpike & Route 440 Asset Appraisal

24

T

ABLE 2.7 NJTP - AVERAGE AM PEAK TRAFFIC SPEED BY SECTION (MPH)

Section Northbound Speed (mph) Southbound Speed (mph)

1 - 3 60.0 69.0

3 - 7 65.4 68.1

7 - 9 65.2 70.9

9 - 11 54.4 54.8

11 - 14 45.1 61.3

14 – 18E 50.7 54.9

14 – 18W 49.6 58.0

14 – 14C 24.7 55.6

Source: NJTA / SDG Analysis

2.58 As can be seen, average peak time traffic speeds are typically below 55 mph in the

Newark/New York area. On the Newark Bay Extension between Exits 14 and 14 C,

average inbound traffic speeds are reported to be as low as 25 mph, these low speeds

through the Newark Bay Extension are believed to produce incidences of downstream

queuing on the main sections of NJTP, particularly in the event of traffic incidents such as

breakdowns and accidents. As expected, the effect of reduced capacity is mainly

restricted to the peak periods.

2.59 Figure 2.19 below shows a profile of average journey speeds over 30 minute periods

across the day for southbound journeys between Exit 16E and Exit 6. This data was made

available for 2 weeks in October 2006. As can be seen, there is clearly deterioration in

level of service in the evening peak period when the outbound flow from the New York

and Newark areas are at their highest. Speeds during the off-peak periods remain

relatively stable

FIGURE 2.19 NJTP - AVERAGE WEEKDAY TRAFFIC SPEEDS BETWEEN EXIT 16E AND

EXIT 6 FOR SOUTHBOUND JOURNEYS (MPH)

20

25

3

0

35

40

4

5

50

5

5

60

65

70

0:30

1:00

1:30

2:00

2:30

3:00

3:30

4:00

4:30

5:00

5:30

6:00

6:30

7:00

7:30

8:00

8:30

9:00

9:30

10:00

10:30

11:00

11:30

12:00

12:30

13:00

13:30

14:00

14:30

15:00

15:30

16:00

16:30

17:00

17:30

18:00

18:30

19:00

19:30

20:00

20:30

21:00

21:30

22:00

22:30

23:00

23:30

0:00

Time Period

AverageSpeed(mph)

Source: NJTA / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

25

2.60 Figure 2.20 shows a similar chart for northbound journeys. Here speeds are plotted for

journeys from Exit 9 to Exit 16. As can be seen there is a clearly defined deterioration in

speeds in the AM period.

FIGURE 2.20 NJTP - AVERAGE WEEKDAY TRAFFIC SPEEDS BETWEEN EXIT 9 AND EXIT

16E FOR NORTHBOUND JOURNEYS (MPH)

20

2

5

30

35

40

4

5

5

0

5

5

60

65

0:00

0:30

1:00

1:30

2:00

2:30

3:00

3:30

4:00

4:30

5:00

5:30

6:00

6:30

7:00

7:30

8:00

8:30

9:00

9:30

10:00

10:30

11:00

11:30

12:00

12:30

13:00

13:30

14:00

14:30

15:00

15:30

16:00

16:30

17:00

17:30

18:00

18:30

19:00

19:30

20:00

20:30

21:00

21:30

22:00

22:30

23:00

23:30

Time Period

Average Speed(mph)

Source: NJTA / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

26

Behavioral Research

2.61 As part of our literature review we concluded that it would be worthwhile undertaking

fieldwork to compare the markets served by the three roads of interest, and possibly also

to gather evidence on other key issues that the modeling process should address.

2.62 An online survey was undertaken to provide fresh evidence on certain key issues of

relevance to the study. As part of the survey, 333 NJTP users were interviewed between

Friday 16th March and Tuesday 20th March 2007. Further details of the survey

methodology and analysis can be found in Appendix C of the Background Report,

Behavioral Research.

2.63 Overall, the picture that emerges of NJTP users is that they are generally not deterred

from using it by the inconveniences of tolls, stress and congestion, and they are not very

sensitive to the price of the tolls at their present level. While NJTP users are undoubtedly

sensitive to the idea of the tolls going up, the survey presents an accumulation of findings

which show that currently many of them do not worry about the price of the tolls.

2.64 The NJTP users included a larger proportion of people with household income over

$100,000 pa, with more than a third of them classifying themselves in this category,

compared to about a quarter in the case of users of the GSP and the ACE. Of the NJTP

users, 43% lived in NJ, 41% in New York, and the remainder in the adjoining states of

Pennsylvania, Delaware and Connecticut.

2.65 While the NJTP users were more likely to complain of poor value for money, more likely

to experience congestion, and more likely to describe driving on the road as stressful,

compared to the users of the GSP and the ACE, these are all things that might have been

expected. The more significant findings were that most NJTP users (56%) described the

value for money of the tolls as being “average”, many of them do not think about how

much they spend on tolls, and congestion did not feature as a significant reason for using

the road less.

2.66 NJTP users were more likely to describe their recent trips on the road as important,

compared to users of the other roads, and they were also more likely to actually use the

NJTP and to reject alternative routes, compared to users of the GSP and the ACE. The

main alternative given to making a particular trip on the NJTP was to still use the NJTP,

but at a different time of day.

2.67 While the NJTP users tended to spend more on road tolls than users of the other toll roads

and tended to be more conscious of this spend, about half of NJTP users with E-ZPass do

not normally think about the cost of using the road (this proportion was even higher for

users of the other roads). The evidence on value of time showed that the proportion of

people with medium or high values of time was higher for the NJTP users than for the

users of the other roads, and the direct questions about toll price changes suggested that

the NJTP users may be less likely to change their behavior in response to toll price rises

than users of the other roads.

New Jersey Turnpike & Route 440 Asset Appraisal

27

2.68 Individuals did not report big changes in their usage of the toll roads, and the reasons

given for changes in usage were dominated by changes in personal circumstances. The

evidence suggests that there has been a slight worsening in congestion on the NJTP over

the last two years, but there is also evidence that the deterioration of conditions on

alternative routes has been at least as bad over the same time period.

2.69 When asked about changes to the tolls over the past two years (there have not been any

significant changes), only about 40% of the NJTP users correctly answered that the tolls

had not changed - most of the rest responded that the tolls had gone up, with 10% saying

that “tolls are now much higher” compared to two years ago. This adds to the impression

that many NJTP users do not have a clear idea of how much they are paying and whether

or not it has been changing.

2.70 The survey suggests that the gasoline price rises over the past two years have not had a big

impact on people’s use of the NJTP, and that many people would adapt to future gas price

increases by switching to vehicles with greater fuel-efficiency.

New Jersey Turnpike & Route 440 Asset Appraisal

28

Summary

• The NJTP is a 148 mile tolled facility which forms a crucial link through the state of

New Jersey and forms part of the I-95 corridor which connects the major centers on

the eastern seaboard of the USA;

• The facility intersects with the major highway routes within New Jersey including the

GSP and the Holland and Lincoln Tunnels providing access to New York City;

• NJTP is a limited access interstate-standard facility with a speed limit of 65 mph in

rural areas and 55 mph in urban areas. The number of lanes range from two per

direction in the south of the facility to seven lanes per direction in the northern

sections;

• NJTP has a number of alternative and competing routes. In the south, a network of

Interstate routes run parallel to the NJTP and serve the major centers of Philadelphia

and Trenton. In the north, less obvious alternatives are available, particularly for

access and egress to New York City. NJTP faces limited competition from the GSP

and US-1/9;

• NJTPA operates a ‘closed’ tolled system with toll plazas in operation on each NJTP

exit. Payment can be made in cash or by E-ZPass - the ETC system in place on the

facility. Vehicles with E-ZPass transponders receive a toll discount of roughly 25%

if they travel in the off peak period;

• The NJTP is an existing road and has been open for decades. As a result we have

precise knowledge about the amount of traffic that is currently carried by the road

and how much toll revenue is collected;

• Historic transaction data allows us to consider how traffic levels have changed over

time, how traffic has responded in the past to changes in toll rates and what the

relation between traffic on the NJTP and past economic growth has been;

• Traffic has grown steadily on NJTP since opening in 1951. Since 1970 annual traffic

growth has been 2.9% per annum. However in the last ten years traffic growth has

slowed slightly to 2.6% per annum, but it must be noted that this period has been

punctuated with two toll increases;

• The major traffic patterns observed on the NJTP are also understandably

concentrated in the north of the facility: with an average trip length of 22.9 miles for

cars and 26.6 for trucks and buses and the 10 most recorded entry and exit

movements all internal to the New York/Newark area accounting for 22% of all

transactions. Through traffic using the whole length of the facility accounts for just

1% of all movements;

New Jersey Turnpike & Route 440 Asset Appraisal

29

• Traffic growth has been most rapid in the central section of the route, while growth in

the north of the facility has stagnated – a possible cause of which is the growing

congestion and capacity problems in this section;

• Capacity constraints are evident as the route reaches the Newark/New York

metropolitan areas where traffic flows will typically reach in excess of 200,000

vehicles per day and average daily speeds can reach as low as 30 mph in peak

periods;

• The obvious congestion in the northern section of the facility appears to have

produced ‘peak spreading’ with peak conditions observed for several hours in the

morning and evening peaks;

• Toll increases have not been rigidly indexed to consumer prices and as a result NJTP

tariffs have failed to keep pace with inflation and the growth in real toll revenues has

been just 1.2% per annum since 1970 (2006 prices); and

• 65% of toll revenue is generated from car tolls with the remaining 35% generated

from truck tolls. E-ZPass usage accounts for 67% of all transactions and 65% of toll

revenue.

• A key issue is to understand how traffic levels will be changing over time and what

the impact of capacity constraints are. Important inputs into this process are

assumptions with regards to economic growth, population, and major developments

(mainly port and infrastructure) that are planned to take place in the study area or

surroundings and that may impact on traffic levels.

New Jersey Turnpike & Route 440 Asset Appraisal

30

3. ROUTE 440

Project Overview

3.1 Route 440 is a 13-mile un-tolled facility which extends from Exit 10 of the NJTP to

Hudson County, passing through Staten Island. It links I-287 to the area around Jersey

City where motorists can access New York City through Lincoln Tunnel.

3.2 The purpose of this section is to report on the 4 mile section between milepost 0 (MP 0) at

the intersection with the New Jersey Turnpike, to milepost 3.98 (MP 3.98) at the western

end of the presently tolled Outerbridge Crossing.

3.3 There are no major “free” alternatives to this section of Route 440. For journeys within

New Jersey, for instance for motorists traveling between Perth Amboy and Edison, the

only major alternative route is to drive along a combination of US-9 or GSP and the

NJTP. This is considerably longer than using Route 440 and presently incurs one, if not

two, toll charges. For vehicles traveling between Staten Island and New Jersey, the only

alternative is to divert north to Goethals Bridge which is also tolled.

FIGURE 3.1 ROUTE 440 – LOCATION AND COMPETING ROUTES

New Jersey Turnpike & Route 440 Asset Appraisal

31

3.4 The facility is a grade-separated freeway with a speed limit of 55 mph. The lane geometry

of Route 440 can be summarized as follows:

• From the intersection with the NJTP to the intersection with US-9 and the GSP,

Route 440 operates as a 7-lane highway (4 lanes westbound and 3 eastbound);

• Between the GSP intersection and State St, immediately before the Outerbridge

Crossing, the facility operates as a 6-lane highway (3 lanes per direction); and

• From State Street onto the Outerbridge Crossing into Staten Island, the facility

operates as a 4-lane highway (2 lanes per direction); and

• The rest of Route 440, from Staten Island to where it ends in Hudson County, is a 4-

lane highway (2 lanes per direction).

3.5 A schematic summary of the lane geometry of this part of Route 440 is shown in Figure

3.2 below.

FIGURE 3.2 ROUTE 440 - LANE GEOMETRY (MP 0 TO MP 5.2)

W

E

MP 0

Interchange

Interchange

MP 5.2

To western

New Jersey

General

Purpose Lanes

General

Purpose Lanes

General

Purpose Lanes

To Staten

Island

4

3

2

I-287

Outerbridge Crossing

General

Purpose Lanes

General

Purpose Lanes

General

Purpose Lanes

3

3

2

Rt. 440 Start

US-9 / GSP

State Street

3.6 The section of Route 440 studied provides motorists with a direct link from Exit 10 of the

NJTP to Staten Island, by way of the Outerbridge Crossing. Vehicles with two axles

traveling on this bridge pay a $6 toll when traveling eastbound during peak hours ($5 for

E-ZPass users). From Staten Island, motorists can drive on Route 440 into Brooklyn using

the Verrazano-Narrows Bridge. The majority of users of the facility are traveling to and

from the eastern or southern part of New Jersey and the New York City area.

New Jersey Turnpike & Route 440 Asset Appraisal

32

Tolling Regimes

3.7 Route 440 is currently an un-tolled highway, although vehicles do incur a charge to use

the Outerbridge Crossing. This bridge toll means that journeys between central New

Jersey and Staten Island are, in effect, already tolled. Other journeys not using the

Outerbridge Crossing are toll free.

3.8 Consultants Michael Baker Jr., Inc. (Baker) produced a report in 2006

1

that presents an

evaluation of toll collection options along Route 440 between the NJTP (MP 0) and the

Outerbridge Crossing (MP 5.2). Feasibility, right-of-way impact, environmental impact

and cost were examined for twelve different options.

3.9 The recommended solution in the Baker Report is an ETC option. This solution

simultaneously maximizes revenue and minimizes capital expenditure while also

minimizing right-of-way and environmental impacts.

3.10 We have assumed the following toll rates will apply, in line with those charged on the

NJTP (2006 prices).

• Cars: $0.12/mile

• Trucks: $0.45/mile

Traffic Trends

3.11 Figure 3.3 shows AADT for the period 1981-2005.

1

Engineering and Right of Way Assessment for New Jersey State Route 440 (M.P. 0.0 to M.P. 5.2), December 2006

New Jersey Turnpike & Route 440 Asset Appraisal

33

F

IGURE 3.3 ROUTE 440 - AADT OUTERBRIDGE CROSSING: 1981 - 2005

0

10,000

20,000

30,000

40,000

50,000

60,000

7

0,000

8

0,000

90,000

100,000

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Year

AADT

Source: NJDOT / SDG Analysis

3.12 As shown in Table 3.1 below, AADT at the Outerbridge Crossing on Route 440 has risen

from 44,000 in 1981 to 85,000 in 2005. This average annual increase of 2.7% is less than

the growth reported for the NJTP. Specifically, there are two periods when traffic

decreased. The toll increases on the Outerbridge Crossing (which for eastbound 2-axle

vehicles went from $3 to $4 in 1990, to $5 in 1991 and to $6 in 1993), explain that there

were fewer trips made across the tolled Outerbridge Crossing in the first half of the

nineties. The period following the 9/11 events also impacted the economy and the attitude

towards traveling, which explains the decrease in traffic during that time. In addition,

heavy maintenance work was carried out on the bridge’s deck on 2003, which also

explains the decrease during that time.

TABLE 3.1 ROUTE 440 - OUTERBRIDGE AADT AVERAGE ANNUAL GROWTH: 1981 -

2005

Year

AADT Beginning of

Period (thousands)

AADT End of Period

(thousands)

Average Annual

Growth

1981 – 1985 44 58 5.6%

1986 – 1990 61 70 2.9%

1991 – 1995 71 71 0.1%

1996 – 2000 74 83 2.2%

2001 - 2005 82 85 0.9%

1981 - 2005 44 85 2.7%

Source: NJDOT / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

34

3.13 We have used the State-wide model to derive traffic flows for the section of route between

the GSP and the NJTP – Table 3.2 below provides a summary of our assumptions.

However, going forward, we would recommend undertaking traffic counts at this site to

verify our assumptions.

TABLE 3.2 ROUTE 440 - ASSUMED AADT BY SECTION AND VEHICLE TYPE

Section Cars Trucks Total

NJTP-GSP 76,897 6,870 83,767

GSP- Crossing 78,402 7,004 85,406

Source: State-wide model / SDG Analysis

3.14 Figure 3.4 presents the hourly traffic profile by direction for Route 440. The main peak in

the AM period represents users traveling northbound, into New York. In the PM period,

the main peak represents southbound commuters, traveling into northern New Jersey.

FIGURE 3.4 ROUTE 440 - BI-DIRECTIONAL HOURLY TRAFFIC PROFILE

0

500

1,000

1,500

2

,000

2,500

3,000

3

,500

4

,000

4,500

5

,000

01:00

02:00

03:00

04:00

05:00

06:00

07:00

08:00

09:00

10:00

11:00

12:00

13:00

14:00

15:00

16:00

17:00

18:00

19:00

20:00

21:00

22:00

23:00

24:00

Period End Time

Traffic

Northbound Southbound

Source: Baker / SDG Analysis

New Jersey Turnpike & Route 440 Asset Appraisal

35

4. THE FORECASTING METHODOLOGY

Introduction

4.1 We have developed a modeling framework that can explore the base assignment to the

target facility under a range of scenarios – and for different traffic types. The key issue for

the NJTP concession is to understand how traffic levels will be changing over time and

what the impact of capacity constraints are. Important inputs into this process are

assumptions with regards to economic growth, population, and major developments

(mainly port and infrastructure) that are planned to take place in the study area or

surroundings and that may impact on traffic levels.

4.2 The central component of the modeling framework is a spreadsheet based revenue model

– this has been built to allow testing of different tolling scenarios and to carry out a wide

range of sensitivity tests to explore the impact on demand and revenue of a range of

factors including growth rates, values of time, changes in trip distribution etc. Our

forecasting methodology is illustrated in Figure 4.1 below.

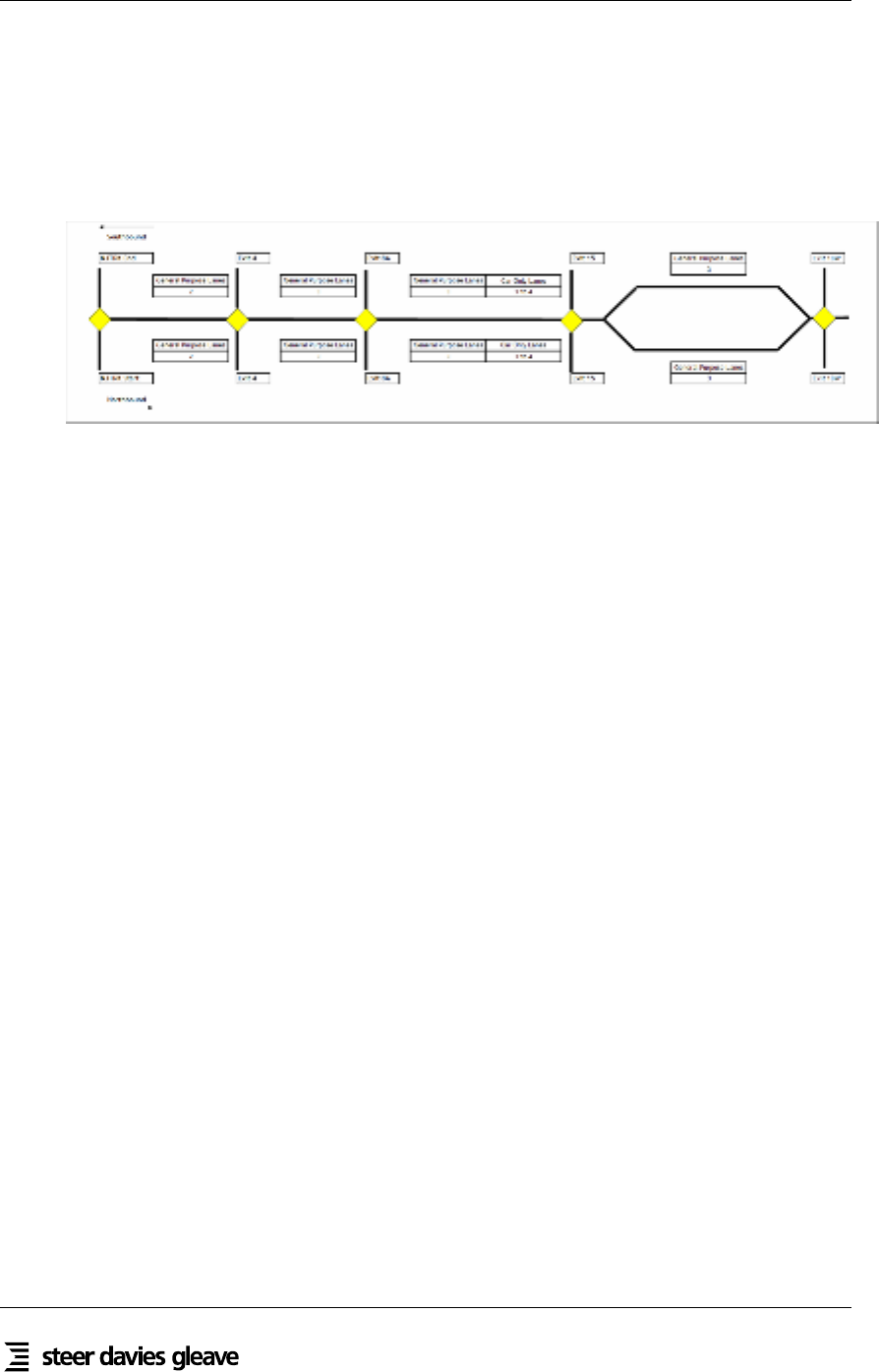

FIGURE 4.1 FORECASTING METHODOLOGY

STATEWIDE MODEL

Trip Distribution

Traffic Assignment

TRAFFIC FLOWS

(Scenario 1,2,3,…,n

REVENUE MODEL

Price Elasticity

Growth

WILLINGNESS TO PAY

FORECASTS

Scenario 1

O

RIGIN-DESTINATION

PATTERNS

(Car Matrices by trip

p

urpose - income and

truck matrices

GROWTH FACTORS

TOLL SCENARIOS

TOLL SCENARIOS 2

TOLL SCENARIOS 1

OBSERVED TRAFFIC

2006 transactions

Database

4.3 The model uses observed 2006 toll demand and revenue data as a basis from which future

year forecasts are derived. Within the model demand and revenue are segmented by:

• Geography (toll plazas and toll barriers);

• Time of day (AM Peak, PM Peak, Off-Peak);

• Day of Week (Weekday and Weekend);

• Vehicle Type (Cars and Trucks);

• Payment Method (Cash, E-ZPass); and

• Journey Purpose (Work and Other).

New Jersey Turnpike & Route 440 Asset Appraisal

36

4.4 We have adopted a number of existing modeling tools to inform the revenue model in

terms of:

• Impact of congestion;

• Changes in trip distribution;

• Diversion; and

• Traffic Growth.

4.5 The network models used are an updated version of the State-wide model, which was

initially developed over 10 years ago as an all day (24 hour) traffic assignment model.

For the purpose of our assignment, we have updated the trip tables, road network (base

and future) and assignment procedures.

4.6 The trip tables were updated with the information on trip patterns (Origin- Destination

and Journey Purpose split by time of the day) from the NJTPA and SJTPO. Car trips were

segmented into two journey purposes (home based work and other), with both journey

purposes split into four income groups. The four income groups are based on county-level

Census 2000 household income levels that fit into the income ranges of the four income

groups identified in the NJTPA (values grown to 2000). Commercial vehicles were

treated as one segment.

4.7 The road network for the area comprises the freeway, arterial and collector facilities.

Each road link contains information on the number of lanes, free flow speeds, capacity,

volume-delay relationships and toll charges at toll plazas. The link characteristics were

updated to reflect coding of the NJTPA and SJTPO networks for significant roads. Also a

future 2025 year network was built which incorporates those planned infrastructure

improvements in the New Jersey area that could have a significant impact on the road

network.

4.8 The link volume-delay relationships and factors to convert hourly capacity into each time

period were reviewed and updated using recent traffic count travel time data collected

specifically for the purpose of this assignment. The re-calibrated volume delay functions

provided a significantly improved fit to the observed travel time data.

4.9 The third component is the assignment process used to estimate how origin-destination

demand will route itself over the available network facilities. The vehicle (auto and truck)

assignments are based on a process that iterates until network or passenger travel times are

in equilibrium. The resulting outputs include vehicle (auto and truck) network volumes,

travel times and costs.

New Jersey Turnpike & Route 440 Asset Appraisal

37

Impact of Toll Changes and Congestion

4.10 There are several ways in which people can adapt to a change in toll levels and increased

levels of congestion, as follows:

• Time period - in the case of relative changes in the tolls applying to specific time

periods or congestion occurring at specific times;

• Route - in many cases, however, alternative routes offer considerably longer and

more uncertain journey times;

• Vehicle occupancy - ride sharing can reduce the trip costs per passenger / reduce

congestion;

• Mode - flying for long-distance through passenger traffic, rail for certain other

Origin-Destination (O-D) combinations (the NJ Transit rail network focuses on trips

to and from New York);

• Destination - in some cases people might consider going to a different city if there is

a big difference in the cost of the trip or congestion levels; and

• Activity - some people might offset the higher costs of travel by doing the activity

less often, or not at all.

4.11 Recent research by Ozbay et al

2

on the behavioral response to the time of day pricing

initiative on the NJTP showed that the most common responses to increased peak-hour

tolls and reduced off-peak tolls were to travel by alternative routes, to reduce use of the

NJTP, to increase ride sharing, and to increase travel in off-peak periods. However it is

important to note that approximately 93% of individuals did not change their travel

behavior at all in response to the changes to the toll schedule in the year 2000. The

research concluded that faced by a small differential between peak and off-peak tolls

being introduced, the demand was very inelastic.

4.12 Our modeling framework currently handles route choice and changes in travel times. Trip

suppression is due to changes in vehicle occupancy, mode-shifting, destination and

activity changes are not currently modeled explicitly, but we do allow for trip suppression

due to capacity constraints. However, we have checked the implied elasticities from the

model are reasonable compared to evidence from other roads.

2

Ozbay, K., J. Holguín-Veras, O. Yanmaz-Tuzel, S. Mudigonda, A. Lichtenstein, M. Robins, B. Bartin, M. Cetin, N. Xu,

J.C. Zorrilla, S. Xia, S. Wang, and M. Silas (2005). 'Evaluation Study of New Jersey Turnpike Authority's Time-

ofday Pricing Initiative'. Publication FHWA-NJ-2005-012.FHWA, U.S. Department of Transportation. Available

online at time of writing:

http://knowledge.fhwa.dot.gov/cops/hcx.nsf/All+Documents/BA2414CE1EAC182685256DC500674090/$FILE/njtpa_fin

al_report_may_31_2005.pdf

New Jersey Turnpike & Route 440 Asset Appraisal

38

Existing and Future Capacity Constraints

4.13 Initially a set of constrained traffic forecasts was developed. These were then used to

determine when lane expansions may be required over the life of the concessions of the

project facility. The basis for this was the requirement specified by the State that Service

Levels should not fall below “Level D”. Our method for estimating capacity constraints is

outlined below.

4.14 Firstly the 2006 transactions database was used to establish annual average weekday

traffic flows (AADTw) by section of road, time of day and direction of travel.

4.15 From this the number of vehicles per hour per lane for each road section for the AM Peak

period (defined as 6:00AM-9:00AM on weekdays) was derived. Traffic growth estimates

from the forecasting model were applied to derive this information for each of the

forecasting years.

4.16 Secondly on the basis of the HCM and speed/flow relationships calibrated on other inter-

urban highways, we adopted a link capacity of 2,250 vehicles/hour/lane to correspond to

flow levels at which HCM recommends a LOS D

3

.

4.17 When forecast traffic levels exceeded the LOS D definition capacity constrains are

believed to be binding and an expansion of one lane per direction has been assumed. The

triggered expansions are summarized in Appendix C. It can be seen that for certain road

sections a secondary expansion has been necessary due to further traffic growth. Finally

the traffic models were rerun to include the additional network capacities.

3

Our analysis is fully reliant on data supplied by NJDOT and its agencies, and is based on ‘average’ traffic conditions. It

is however apparent that at certain times of the year and on certain days, volumes will be considerably higher than

these averages. In addition unforeseen incidents may generate a severe breakdown in flow and these effects will be

‘smoothed’ by taking an average approach. However we feel this is the only method by which we can obtain an

accurate picture of the performance of a facility over an extended period of time and thus a fair assessment of

whether an expansion is genuinely required. The method applied is a ‘link-based’ assessment, i.e. it does not

explicitly consider the capacity of interchanges or the interaction of the facilities with the ‘secondary’ highway

network (from where downstream queuing often occurs because capacity is typically much less). By assessing

constraints purely on the basis of link volumes and capacities we are effectively isolating highway sections where

the provision of additional lane capacity will help solve prevailing congestion levels.

New Jersey Turnpike & Route 440 Asset Appraisal

39

5. TRAFFIC GROWTH

Introduction

5.1 To derive the extent to which traffic will grow in the future, we have undertaken the

following:

• Reviewed the extent of economic development in the region and derived appropriate

‘economic’ forecasts (e.g. we have used various recognized economic forecasting

sources to derive population and employment forecasts at a county level – based on

discussions with development agencies, we have also provided an ‘overlay’ to these

forecasts, depending on the extent new sites and developments will generate

additional population);

• Analyzed the extent to which travel-related parameters such as trip making by drivers

have changed over time (e.g. there is considerable evidence from official New Jersey

statistics that drivers are undertaking more mileage every year. For the appropriate

traffic categories, we have therefore adjusted the county-based economic forecasts

accordingly to reflect this); and

• So that the growth vectors can be incorporated into the traffic modeling framework,

we developed matrices containing vectors at the county level for each of the three

traffic categories. These reflect assumptions about growth to/from origins and

destinations. The growth vector matrices then form an input to the traffic models.

5.2 As discussed in this chapter, observed economic and traffic growth in New Jersey have

been extremely robust. Based on our review of all available data and forecasts, we believe

that these robust level of growth will continue into the future.

Economic Development

5.3 New Jersey is a key region of economic activity within the United States and is situated at

the centre of a metropolitan axis stretching from Washington, DC to Boston, MA. The

State is the most densely populated in the United States, at 1,174 residents per square

mile. According to the United States Census Bureau, it is also the second wealthiest state

per capita in the United States.

5.4 According to the US Bureau of Economic Analysis, the State’s median household income

is the highest in the nation, at $55,146 and it is ranked second in the nation by the number

of locations with per capita incomes above the national average of 76.4%. Nine of New

Jersey's counties are in the wealthiest 100 of the country.

5.5 New Jersey has an extensive industrial base that comprises the following:

• The Port Newark-Elizabeth Marine Terminal is one of the world's largest container

ports while Newark Liberty International Airport is ranked seventh among the

nation's busiest airports and among the top 20 busiest airports in the world;

New Jersey Turnpike & Route 440 Asset Appraisal

40

• New Jersey’s industrial outputs include pharmaceutical and chemical products, food

processing, electric equipment, printing and publishing, and tourism. Additionally,

New Jersey is home to the largest petroleum containment/storage system outside of

the Middle East;

• New Jersey hosts several business headquarters (fifty Fortune 500 companies have

headquarters in or conduct business from Morris County alone);

• New Jersey has several oil refineries and chemical plants;

• Its agricultural outputs are numerous and include nursery stock, horses, vegetables,

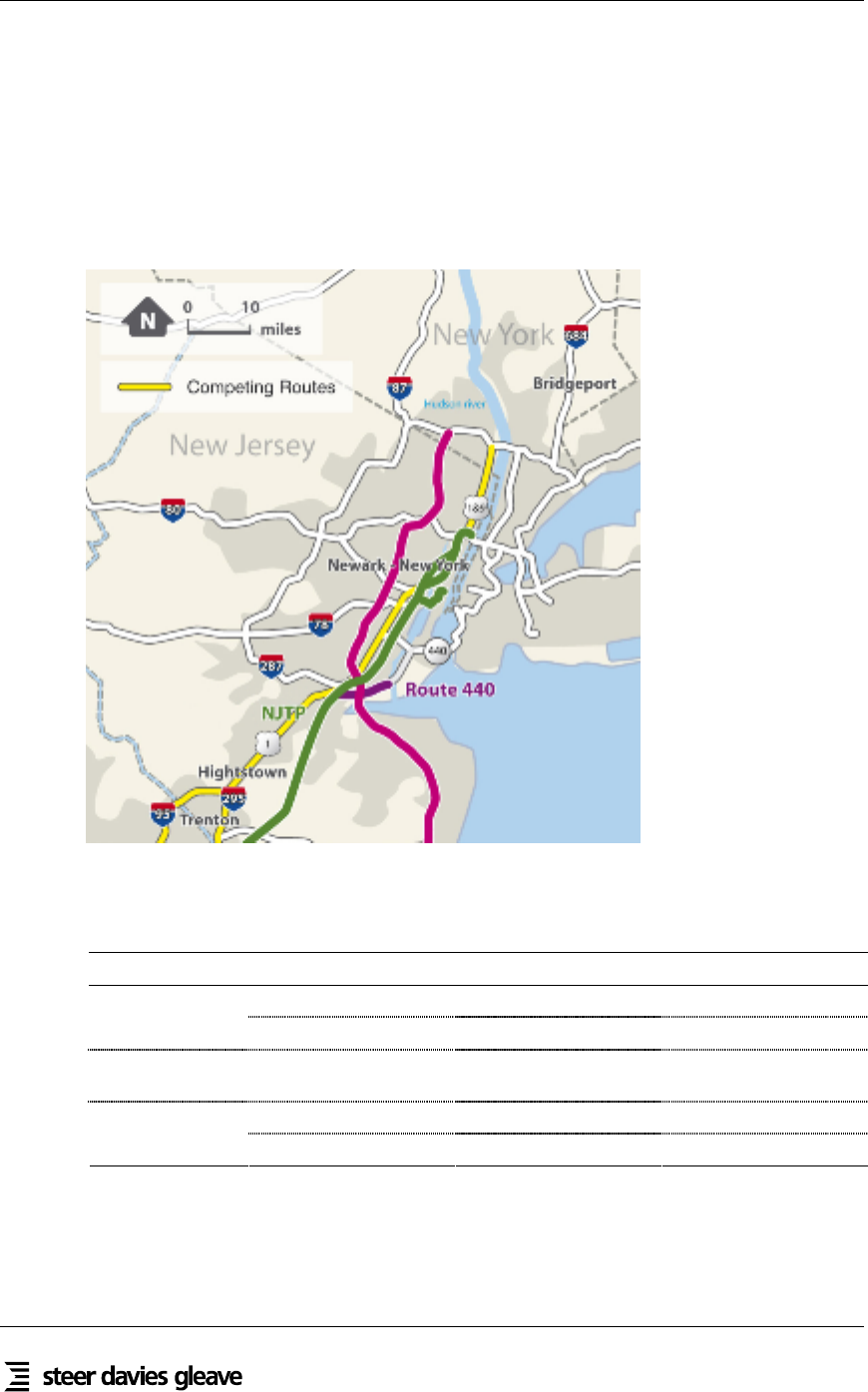

fruits and nuts, seafood and dairy products.