travel.dod.mil 1 August 2024

INFORMATION PAPER

What is a Valid Receipt?

August 14, 2024

Introduction

For reimbursement of official travel expenses *you will create your travel voucher in the

Defense Travel System (DTS) and attach a receipt for all lodging and expenses of $75.00 or more

per the Joint Travel Regulations (JTR). The purpose of this information paper is to provide the

official definition of a valid receipt, explain invalid documents submitted as receipts, and outline

key points when processing travel documents to ensure receipt compliance.

*In this information paper, unless stated otherwise, “you” are a traveler; however, the actions

described also apply to anyone who creates documents for you, such as a Non-DTS Entry Agent

or travel clerk.

Receipt Definition

Per the DoD Financial Management Regulation (DoD FMR), Vol. 9, Definitions, the DoD’s official

definition of a receipt is:

“A legibly written/printed/electronic document (or facsimile thereof) provided by a service

provider or vendor to a customer, which provides documentary evidence that the service

provider or vendor has been paid for services or goods, provided to the customer. To be

considered valid, a receipt must contain the name of the entity providing the good(s)/service,

the date(s) that the good(s)/service was/were provided/purchased, the price of the

good(s)/service, any tax levied, the total monetary amount due, and must indicate that the total

monetary amount due was paid.”

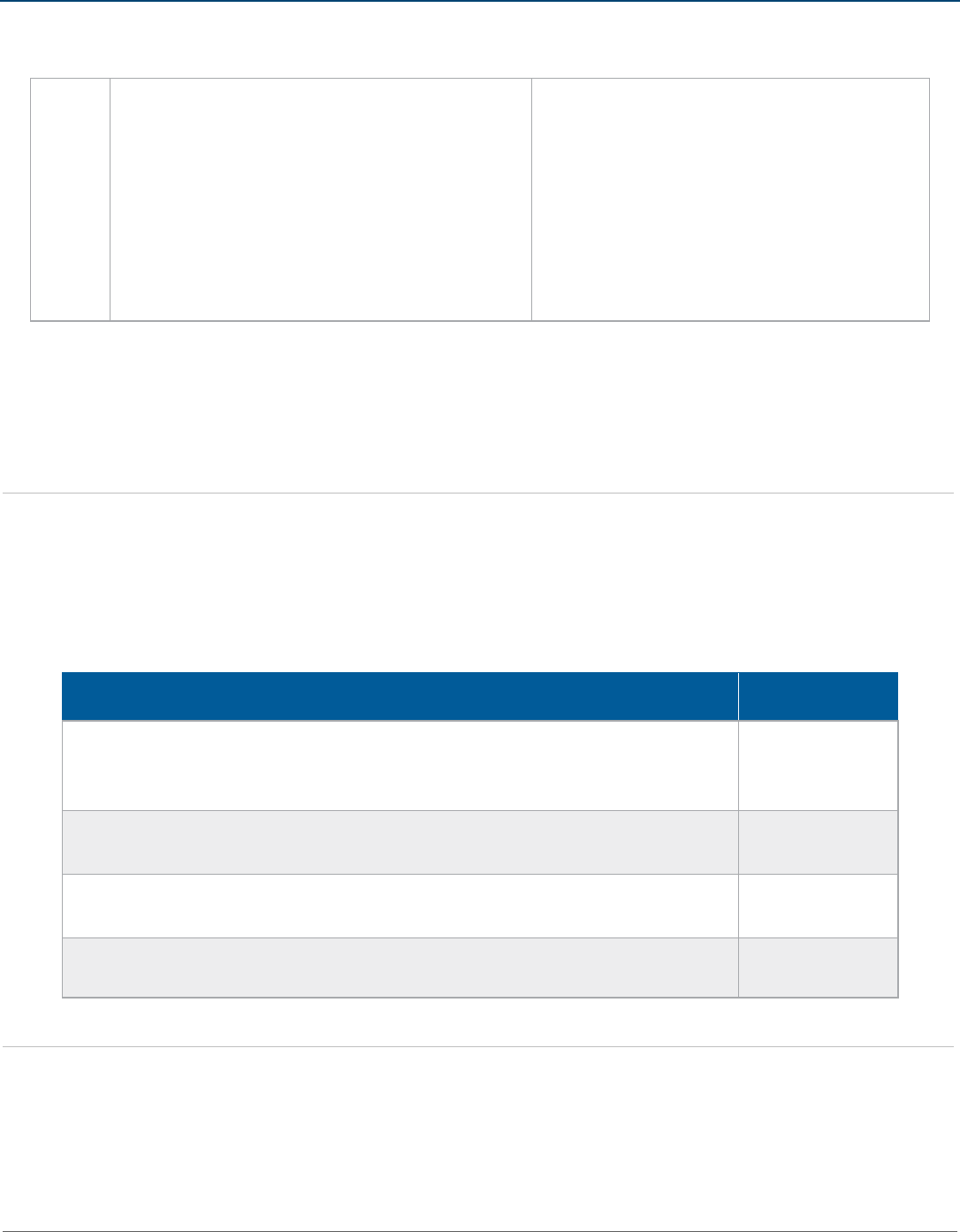

In Table 1, the official wording is translated into plain language:

Table 1

Ref.

The Statements…

…Means…

1

A legibly written/printed/electronic document

You must be able to read it.

2

(or facsimile thereof)

It doesn’t need to be the original; it can be a

copy.

3

provided by a service provider or vendor to a

customer

The vendor or their agent* must create it.

4

which provides documentary evidence that the

service provider or vendor has been paid for

services or goods, provided to the customer.

It must prove that you made a payment and

what that payment was for.

5

To be considered valid, a receipt must contain:

A receipt MUST show …

• … the vendor’s name …

INFORMATION PAPER: What is a Valid Receipt?

Defense Travel Management Office 2 August 2024

• the name of the entity providing the

good(s)/service

• the date(s) that the good(s)/service

was/were provided/purchased

• the price of the good(s)/service

• any tax levied

• the total monetary amount due

• and must indicate that the total monetary

amount due was paid.

• … when you bought the goods or used

the service …

• … the base amount you owed for each

item you paid for …

• … the taxes on that base amount

• … the total amount you owed …

• … everything on this list must be shown;

no exceptions … it must show that you

paid the full amount you owed

*An “agent” sells goods or services for a vendor. For example, when the Travel Management

Company (TMC) sells tickets for an airline, they are acting as the vendor’s agent. On the other

hand, the Government Travel Charge Card (GTCC) vendor makes payments at your request, and

you reimburse them, so in a way, they are your agent, not the vendor’s. Keep that in mind. It’s

important.

Invalid Receipt

Infrequent or new travelers may not understand what represents an invalid receipt. Table 2

reflects situations where travelers provide documents and why they are not compliant. The

reference numbers listed in the second column equate to those in the first column of Table 1.

Table 2

Item

Violates*

Any document you received before you made the final payment, such as

a reservation/booking confirmation, a contract/agreement, or an

estimate, itinerary, deposit, or pre-payment

Ref. numbers

4, 5

Any document that is not fully itemized, such as a GTCC statement,

credit card summary receipts, online booking confirmations

Ref. numbers

4, 5.

Any document produced by anyone besides the vendor or their agent,

such as a bank or GTCC statement

Ref. numbers

3, 5

Screen shot from any DTS screen

Ref. numbers

4, 5

Document Processing

There are a few considerations for processing documents and receipt requirements:

1. You must provide an itemized receipt for all lodging expenses and any single purchase of

$75 or more* (per the Joint Travel Regulations (JTR), par. 010301-A). You only need to

INFORMATION PAPER: What is a Valid Receipt?

Defense Travel Management Office 3 August 2024

provide receipts for multiple purchases that total $75 or more if you combine them and

claim them as a single expense. Consider these examples:

a. You bought gas three times on your trip, spending $30 each time, and claimed them

as three separate gas expenses. Even though the total of those expenses is $90, they

were not a single purchase, so no receipt is required.

b. You bought gas three times on your trip, spending $30 each time, but totaled them

and claimed a single gas expense of $90. Even though there were three separate

expenditures, because you claimed a single $90 expense, you must supply the three

receipts that support that $90 claim.

c. You parked your car in an airport parking lot for 12 days at a cost of $10 per day.

Upon your return, you paid the full amount of $120. Even though each day only cost

$10, you paid for the days all at once, so this is a single purchase and a receipt is

required.

Note: *This is true regardless of the payment method. If your airfare was paid by a Centrally-

Billed Account (CBA), you must still provide the required receipt. (DoD FMR, Vol. 10, Ch. 12, par.

5.5)

2. If you lose a receipt, you must provide a statement that explains the circumstances of the

loss and contains the same information as the lost receipt. (JTR, par. 010301-B) You can

provide this on any document and in any format that your local or Component business

rules allow.

3. Although you do have to show that you paid the full amount you owe, there is no

requirement that your receipt also show a zero-dollar outstanding balance.

4. Although there is no DoD-level regulatory requirement for your receipt to be written in

English, check your Component or local business rules on this point. After all, it’s clear that

the certifying officer must be able to review all provided receipts to validate the accuracy of

your expense claims. (DoD FMR Vol. 9, Ch. 5, par. 2.2) If the certifying officer cannot read

the receipt, they will not be able to do this, so they may legitimately reject the claim.

5. Reimbursement to a traveler for paying another traveler’s expenses is strictly forbidden.

(DoD FMR, Vol. 9, Ch. 8, par. 4.1.8)

6. All receipts must be retained for 10 years after the final payment. (DoD FMR, Vol. 1, Ch. 9,

Figure 9-1) Although the system retains electronic copies of all submitted receipts, travelers

should consider retaining the originals for the same length of time.

Final Words

Remember that it is not sufficient merely to provide a valid receipt. You must also ensure that in

EVERY case:

INFORMATION PAPER: What is a Valid Receipt?

Defense Travel Management Office 4 August 2024

1. Combining expense types on a single receipt is a common hotel practice. Even so, you must

only submit a claim for reimbursable expenses, even if your receipt shows both

reimbursable and non-reimbursable expenses.

2. You must always claim the precise amount shown on the receipt for those reimbursable

expenses – no more, no less.

If you need assistance with creating documents or have policy questions, contact your AO or

DTA for support.

Resources

The DTMO provides a variety of resources in the Training Search Tool at

https://www.travel.dod.mil/Training/Training-Search/. You can find the specific resources

addressed in this document and many more on the DTMO website.

• For more on travel policy, see the DOD FMR

• For more on travel policy, see the JTR

• For more on the DoDI GTCC: Volume 4, see the GTCC Regulations

• For information on DoDI DTS: Volume 3, see the DTS Regulations