Residential Tenancies Authority

Annual Report

2021–22

RTA Annual Report 2021–22 | Page 2

Letter of compliance

Friday 9 September 2022

The Honourable Leeanne Enoch MP

Minister for Communities and Housing, Minister for Digital Economy and Minister for the Arts

GPO Box 806

Brisbane Qld 4000

Dear Minister

I am pleased to present the Annual Report 2021–22 and financial statements for the Residential Tenancies

Authority (RTA).

I certify this Annual Report complies with:

• the prescribed requirements of the Financial Accountability Act 2009 (Qld) and the Financial and

Performance Management Standard 2019 (Qld), and

• the detailed requirements set out in the Annual report requirements for Queensland Government

agencies.

A checklist outlining compliance with the annual reporting requirements can be found on page 88 of

this report.

Yours sincerely

Paul Melville

Board Chair, Residential Tenancies Authority

RTA Annual Report 2021–22 | Page 3

Contents

Accessibility

Page

The Queensland Government and the

RTA are committed to providing

accessible services to Queenslanders

from culturally and linguistically diverse

backgrounds. If you have difficulty in

understanding this report, you can access

the Queensland Government’s Translating

and Interpreting Services online

via www.qld.gov.au/help/languages or by

calling the RTA on 1300 366 311 and we will

arrange an interpreter to communicate this

report to you.

Additional online reporting

The following additional annual reporting

requirements can be accessed through the

Queensland Government Open Data website

(data.qld.gov.au):

•

consultancies

•

overseas travel

•

Queensland Language Services Policy.

Providing feedback

Readers are invited to comment on this report

or by calling the RTA Contact Centre

on 1300 366 311.

Copyright

© The Residential Tenancies Authority 2022

Licence

This Annual Report is licensed by the State of

Queensland (Residential Tenancies Authority)

under a Creative Commons Attribution (CC BY)

4.0 International licence. You are free to copy,

communicate and adapt this Annual Report, as

long as you attribute the work to the State of

Queensland Residential Tenancies Authority

Annual Report 2021–22. To view a copy of this

licence visit: creativecommons.org/licenses.

For more information on access and use visit:

https://www.qgcio.qld.gov.au/documents/in

formation-access-and-use-policy-is33.

ISSN 18388248

To read the Residential Tenancies Authority

Annual Report 2021–22 online visit:

rta.qld.gov.au/annualreport.

Letter of compliance 2

Chair’s message 4

CEO’s message 5

About us 6

Our operations 7

Our customers 8

Our customised services

13

Bond management 15

Contact Centre 16

Dispute resolution 17

Our sector

19

Tenancy support and stakeholder engagement 19

Regulatory and compliance activities 22

Our organisation

24

Organisational structure 24

Board of Directors 25

Executive Leadership Team 28

Corporate governance framework 30

Digital innovation and information systems 33

Our people

35

Performance highlights 37

RTA Service Delivery Statement 40

Our finances

42

Financial overview 42

General Purpose Financial Report 44

Management Certificate 84

Auditor’s report 85

Compliance checklist 88

Glossary 90

RTA Annual Report 2021–22 | Page 4

Chair’s message

It gives me great pleasure to present the Residential Tenancies Authority (RTA) Annual Report 2021–22,

which details the RTA’s ongoing efforts and achievements to help make renting work for everyone.

There were several changes this year designed to positively impact Queensland’s rental sector.

Firstly, the Residential Tenancies and Rooming Accommodation Act 2008 was amended with the passing of

the Housing Legislation Amendment Act 2021, following consultation with the sector, and the RTA is

currently implementing the changes. These amendments, which came into effect in October 2021, provide

critical protections and options to support tenants experiencing domestic and family violence. Over the next

two years, we will continue to support the sector as additional reforms are implemented around pets,

ending a tenancy, repair orders and minimum housing standards.

Secondly, due to sector dynamics and advancements at the RTA, a new strategic plan was launched earlier

than scheduled on 1 July 2022. The RTA Strategic Plan 2022–26 outlines a renewed focus on: improving

customer experience through the delivery of new digital services and experiences; continued influence and

partnerships with stakeholders across the sector; and building a sustainable and contemporary organisation

to support our staff. Recent changes to the RTA funding model also ensure the sustainability of our

operations and the delivery of the new strategic plan.

My appointment as Board Chair comes to an end on 31 October 2022. Since joining the RTA Board in May

2017, I’ve seen great progress achieved by our people in the face of a global pandemic, extreme weather

events, and low vacancy rates. It has been a privilege to witness and contribute to the growth of the

organisation, and I am confident this will continue under the direction of the next Board Chair and the Board.

Thank you to both the Honourable Leeanne Enoch MP, Minister for Communities and Housing, Minister for

Digital Economy and Minister for the Arts and the Honourable Mick de Brenni MP, former Minister for

Housing and Public Works, Minister for Digital Technology and Minister for Sport, as well as their teams, for

their ongoing work in helping the RTA achieve positive outcomes for the sector.

Finally, I would like to say a very big thankyou to all the wonderful people who work at the RTA. The

organisation has changed enormously over the last five years. It has had to deal with everything from

pandemics to significant legislative reforms whilst going through an operational transformation – all of which

was handled with the upmost skill and judgment. The team have been excellently led by our CEO Jennifer

Smith and the Executive Leadership Team. I would also like to thank my fellow Board members for their

support and counsel and wish them, and all at the RTA, every success over coming years. It has been a

pleasure to serve and be part of such a wonderful organisation.

Paul Melville Board Chair

RTA Annual Report 2021–22 | Page 5

CEO’s message

It’s been another challenging year for Queensland’s rental sector and I’m immensely proud of the work the

RTA has done in supporting Queenslanders. In the 2021–22 financial year, our Contact Centre received over

368,000 calls and conciliated over 19,000 disputes. Despite the challenges the sector faced, we retained

strong customer satisfaction rating of 83 per cent for our services.

This year we continued to work closely with our stakeholders, from consultation to help inform the

development of the new RTA Strategic Plan 2022–26, to ongoing engagement through the Stakeholder

Forum. We also collaborated with our Stakeholder Working Group on new resources to educate customers

on their rights and responsibilities.

This year we supported the sector by commencing implementation of the first stage of reforms under the

Housing Legislation Amendment Act 2021. We will continue to support the sector to understand and

navigate the additional upcoming reforms, which will be released in separate stages over the next two years.

To further support our customers in 2021–22, we:

• launched the final product in the RTA Web Services suite, the Bulk Bond Lodgement service

• launched our Proactive Compliance Program, allowing us to identify agencies with high rates of

non-compliance around lodging bonds within the required 10-day period, and provide tailored

education sessions

• delivered 70 tailored information and education activities, including 14 in-person and online

sessions for property managers and owners in Cairns, Gold Coast, Mount Isa, Gladstone, Ipswich

and the Redlands.

This year we also embarked on a Customer Experience Research Project. This saw extensive engagement

with our stakeholders and customers to better understand their experiences and how we can improve our

processes to better support them. This consultation will continue into the 2022–23 financial year, and I’m

looking forward to sharing the findings and outcomes with you in next year’s annual report.

I would like to recognise the significant efforts of RTA Board Chair Paul Melville, who in the last five years has

worked to improve the culture and reach of the organisation, with insightful conversations with the Board,

executives, staff and our customers. Paul has been deeply involved with the RTA’s transformation and has

united support from all of us. Paul, thank you for your service and for helping us map our future direction

through the RTA Strategic Plan 2022–26. I have every confidence that you have set us on the right course.

I look forward to continuing the excellent work we’re doing with the Honourable Leeanne Enoch MP,

Minister for Communities and Housing, Minister for Digital Economy and Minister for the Arts, and her staff.

I’d also like to thank Clare O’Connor, Director-General of the Department of Communities, Housing and

Digital Economy and her team, the RTA Board and members of our Stakeholder Forum and Stakeholder

Working Group. Finally, my greatest thanks and appreciation goes to all the staff and the Executive

Leadership Team at the RTA.

Jennifer Smith Chief Executive Officer

RTA Annual Report 2021–22 | Page 6

About us

Our vision and purpose

The Residential Tenancies Authority (RTA) is Queensland’s independent statutory authority that administers

the Residential Tenancies and Rooming Accommodation Act 2008 (RTRA Act). We offer a range of services to

uphold fairness, integrity and balance within the residential rental sector, and empower Queenslanders to

make informed renting choices.

In addition to providing tailored tenancy information, support, education and bond management services,

the RTA offers a free dispute resolution service to help parties resolve tenancy issues in a cost-effective

manner and potentially avoid legal action. We also provide education to our customers about their

legislative obligations and investigate alleged offences under the RTRA Act, with the aim to prevent repeat

offending and improve compliance.

With the rental landscape shifting rapidly in response to the COVID-19 pandemic, the RTA has continued to

monitor and research residential rental data and trends. We have strengthened our relationships with key

stakeholders and industry sector bodies, allowing us to proactively identify the challenges our customers

face, tailor our services to best serve their needs and concerns, and make renting work for everyone.

The RTA is governed by a Board of Directors, which is appointed by the Queensland Parliament’s Governor in

Council, and is responsible to the Minister for Communities and Housing, Minister for Digital Economy and

Minister for the Arts, the Honourable Leeanne Enoch MP.

Our objectives and strategies

The RTA Strategic Plan 2019–23 outlined four strategic objectives that guided our organisation, including our

people and our investments in projects and initiatives. Through this plan, we aimed to provide smart digital

services, improve business efficiency, build a customer-focused workforce, and ensure customers valued our

services. Our strategic plan reinforced our commitment to delivering excellent customer services and

experiences, and provided clear direction and performance indicators to guide us towards being a customer-

centric organisation. It also demonstrated our commitment to protect and promote human rights in our

decision-making and actions.

At the beginning of 2022, we made the decision to undertake a comprehensive review of the RTA Strategic

Plan 2019–23 and replace it one year ahead of schedule. This plan was developed in 2018 and no longer

reflected the landscape of Queensland’s rental sector, which has changed significantly over the past few

years. On 1 July 2022, we launched our new RTA Strategic Plan 2022–26. As this annual report reflects the

RTA’s achievements over the 2021–22 financial year, before the new strategic plan came into effect, all

reporting measures refer to those outlined in the RTA Strategic Plan 2019–23.

The RTA also supports the Queensland Housing Strategy 2017–2027, a 10-year framework led by the

Queensland Government, to create better housing pathways and help every Queenslander access a safe,

secure and affordable home.

Our contribution to community objectives

The RTA is committed to supporting the Queensland Government’s objectives for the community – Unite

and Recover – by backing our frontline services and providing easy to access services to support the

residential rental sector.

RTA Annual Report 2021–22 | Page 7

Our operations

Contact Centre phone enquiries

2017–18

2018–19

2019–20

2020–21

2021–22

401,069

360,399

426,615^

423,221*

368,695†

^Includes 30,786 COVID-19 hotline enquiries *Includes 7,071 COVID-19 hotline enquiries

†Includes 4,839 COVID-19 enquiries

New bond lodgements

1

2017–18

2018–19

2019–20

2020–21

2021–22

272,939

267,210

268,188

238,099

232,011

Number of bonds held

2

(30 June)

2017–18

2018–19

2019–20

2020–21

2021–22

607,053

621,960

638,481

631, 545

624,427

Value of bonds held

3

($’M 30 June)

2017–18

2018–19

2019–20

2020–21

2021–22

855.58

900.8^

943.4

971.0

1,025.0

^ Figure updated due to the definition of unclaimed bond monies being redefined

Conciliated disputes

4

2017–18

2018–19

2019–20

2020–21

2021–22

16,657

17,627

19,882^

21,163*

19,733†

^ Includes 1,791 COVID-19 related disputes *Includes 1,080 COVID-19 related disputes

†Includes 53 COVID-19 related disputes

Investigations finalised

2017–18

2018–19

2019–20

2020–21

2021–22

1,018

(Received

1,020

requests)

1,159

(Received

1,040

requests)

1,050

(Received

925 requests)

567

(Received 490

requests)

241

(Received 243

requests)

Website visits

2017–18

2018–19

2019–20

2020–21

2021–22

2,219,609

2,270,595

2,939,273

3,123,023

3,396,313

Operating surplus/(deficit) ($’M)

2017–18

2018–19

2019–20

2020–21

2021–22

(7.9)

8.6

(43.3)

35.3

(56.3)

1. Includes new bond lodgements for general tenancies and rooming accommodation.

2. Includes bonds held for general tenancies and rooming accommodation.

3. Excludes unclaimed bond monies.

4. Methodology changed in 2019–20 to more accurately reflect dispute resolution requests that proceeded to conciliation

in the last five years. This excludes dispute resolution requests where parties subsequently withdrew from the

conciliation process or were unable to be contacted.

RTA Annual Report 2021–22 | Page 8

Our customers

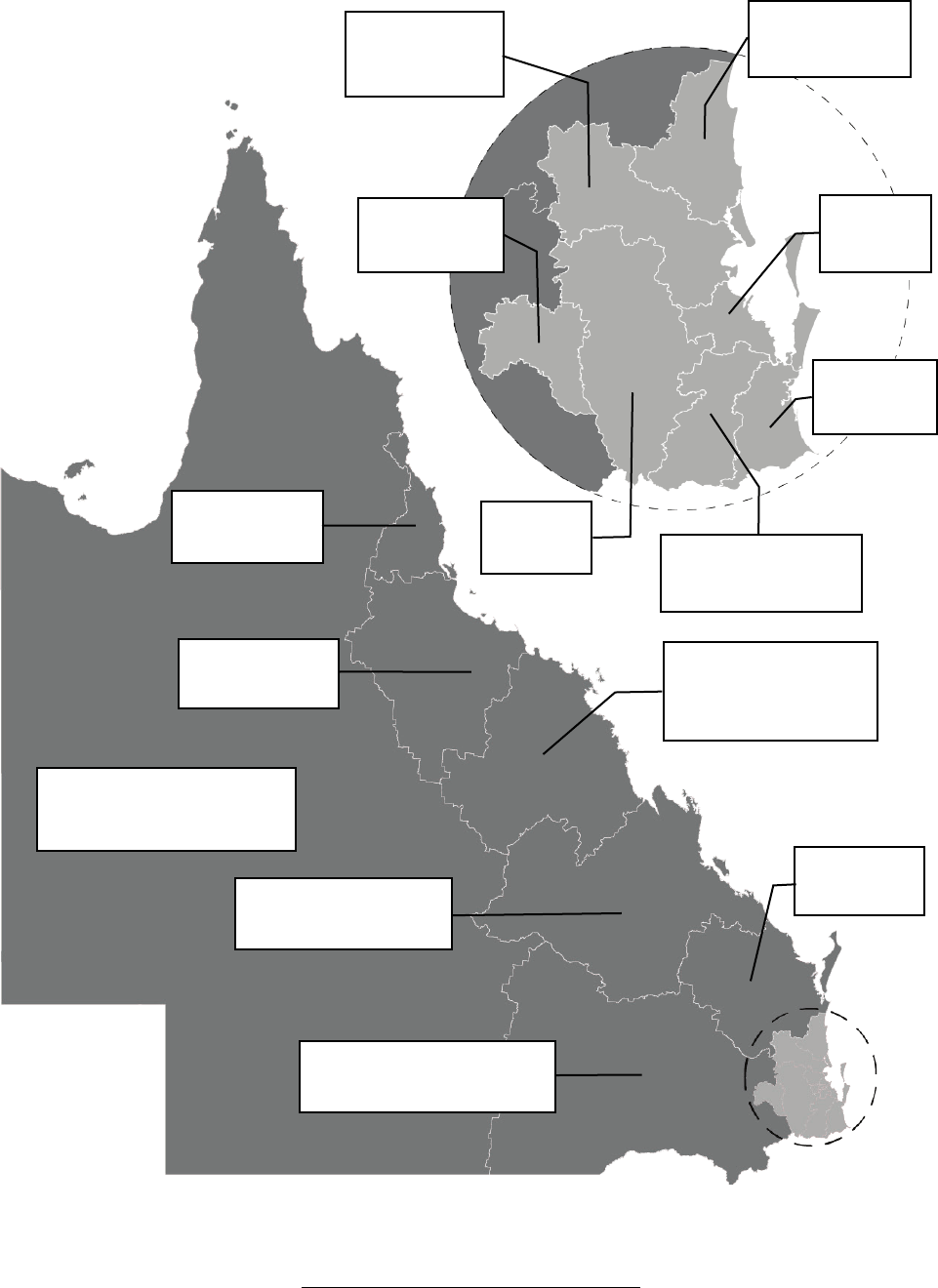

The data below is based on bonds held by the RTA as of 30 June 2022. Locations of major regions in

Queensland below are based on Statistical Area Level 4 (SA4s)

1

.

1. SA4s are the largest sub-state regions in the main structure of the Australian Statistical Geography Standard (ASGS) and

are designed for the output of a variety of regional data by the Australian Bureau of Statistics (ABS), representing labour

markets or groups of labour markets within each state and territory.

Sunshine Coast

6.3%

Moreton Bay

8.4%

Toowoomba

3.2%

Logan – Beaudesert

6.8%

Gold Coast

13.3%

Ipswich

6.9%

Brisbane

31.9%

Cairns

4.7%

Townsville

4.2%

Mackay – Isaac –

Whitsundays

3.2%

Queensland – Outback

1.1%

Darling Downs – Maranoa

1.9%

Wide Bay

4.2%

Central Queensland

3.9%

RTA Annual Report 2021–22 | Page 9

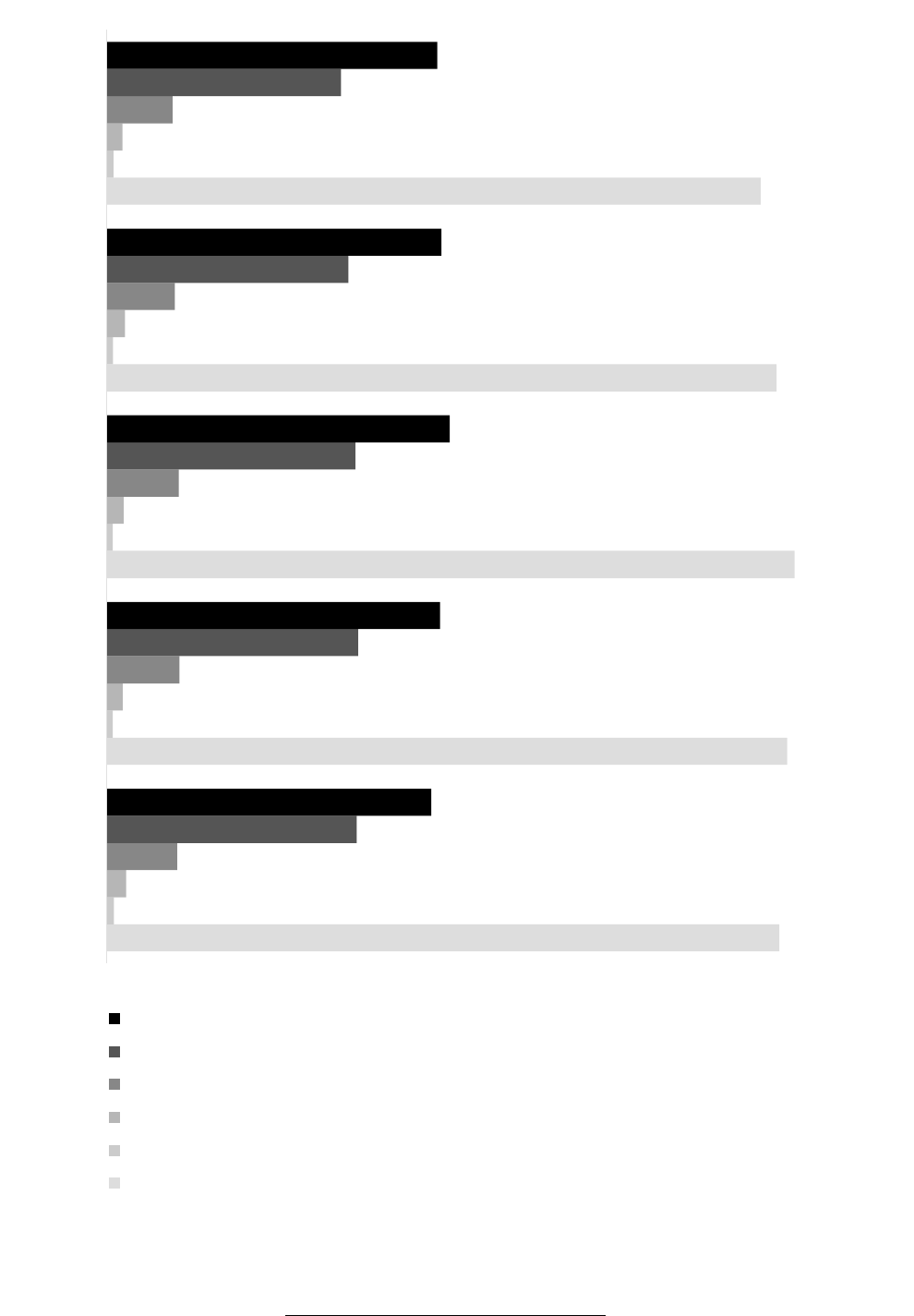

Total bonds held by dwelling type

The data below shows the total bonds held per dwelling type in the June quarter of each financial year

between 2017–18 and 2021–22.

624,427

631,545

638,481

621,960

607,053

7,009

5,835

5,901

6,071

6,476

18,156

14,848

16,029

17,103

14,778

65,597

67,841

67,091

63,505

61,177

232,326

233,406

230,752

224,396

217,627

301,339

309,615

318,708

310,885

306,995

2021–22

2020–21

2019–20

2018–19

2017–18

Houses

Units

Townhouses

Rooming accommodation

Other dwelling types

Total

RTA Annual Report 2021–22 | Page 10

Dwelling type

96% of dwellings are

houses, flats and townhouses

Who manages bonds?

Approximately 97.6%

of rental properties are managed by

real estate agents, property managers and owners

House 48.3%

Flat/unit 37.2%

Townhouse/semi-detached

house 10.5%

Rooming accommodation

2.9%

Moveable dwelling/site

0.7%

Other 0.4%

Agents 77.3%

Owners 9.8%

Managers/providers 10.5%

Community housing

organisations 1.3%

Moveable dwelling park

managers 0.3%

Other 0.8%

RTA Annual Report 2021–22 | Page 11

Median length of tenancies (months)

The data below shows median length of tenancies in Queensland between 2017–18 and 2021–22.

Weekly median rents

The data below shows median weekly rents for all dwelling types based on new bonds lodged in the June

quarter of each financial year between 2012–13 and 2021–22.

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

$350

$350

$350

$350

$350

$360

$360

$365

$370

$385

$450

8.6

8.9

6.7

6.6

6.7

15.2

13.9

13.4

13.1

12.8

21.5

18.8

17.9

17.5

16.7

0 5 10 15 20 25

2021–22

2020–21

2019–20

2018–19

2017–18

Houses

Units

Rooming accommodation

RTA Annual Report 2021–22 | Page 12

Median rents for Queensland and major centres

The data below is based on new bonds lodged with the RTA in the June quarters of 2021 and 2022. Locations

of major centres in Queensland below is based on Significant Urban Areas

1

.

2 bedroom flat/unit

3 bedroom house

Location

2021

2022

% change

2021

2022

% change

Brisbane

$405

$465

14.8%

$400

$480

20.0%

Bundaberg

$250

$310

24.0%

$320

$410

28.1%

Cairns

$320

$375

17.2%

$410

$480

17.1%

Emerald

$250

$280

12.0%

$335

$385

14.9%

Gladstone – Tannum Sands

$200

$280

40.0%

$275

$370

34.5%

Gold Coast – Tweed Heads

$450

$560

24.4%

$520

$700

34.6%

Gympie

$230

$300

30.4%

$310

$450

45.2%

Hervey Bay

$280

$370

32.1%

$350

$450

28.6%

Kingaroy

$225

$303

34.7%

$285

$365

28.1%

Mackay

$290

$350

20.7%

$380

$460

21.1%

Maryborough

$210

$260

23.8%

$290

$375

29.3%

Mount Isa

$250

$275

10.0%

$420

$450

7.1%

Rockhampton

$250

$290

16.0%

$320

$400

25.0%

Sunshine Coast

$400

$515

28.8%

$490

$620

26.5%

Toowoomba

$265

$300

13.2%

$335

$400

19.4%

Townsville

$280

$320

14.3%

$340

$390

14.7%

Warwick

$220

$245

11.4%

$280

$350

25.0%

Yeppoon

$310

$380

22.6%

$380

$480

26.3%

Queensland

$380

$450

18.4%

$380

$450

18.4%

1. Australian Bureau of Statistics. (2016) Significant Urban Areas. Australian Statistical Geography Standard (ASGS) (ABS Cat. 1270).

The Significant Urban Area (SUA) structure of the Australian Statistical Geography Standard (ASGS) represents significant towns and

cities of 10,000 people or more.

RTA Annual Report 2021–22 | Page 13

Our customised services

In 2021–22, the RTA supported Queenslanders to navigate extreme weather events, the

expiration of temporary COVID-19 Emergency Response measures, and the implementation

of Stage 1 of the Housing Legislation Amendment Act 2021 (HLA Act). We also continued our

journey of digital optimisation by investing in several projects to further deliver on our

strategic objectives of providing smart digital services which are valued by our customers.

RTA Web Services

On 6 December 2021, we released the Bulk Bond Lodgement Web Service which is the final product in the

RTA Web Services suite. The Bulk Bond Lodgement service allows joint lessors, agents, student

accommodation providers and property managers working on behalf of an organisation to lodge multiple

bonds and bond increases in a single online transaction.

As we celebrate the third year of RTA Web Services, the RTA has processed 1,368,343 requests in total

through this online platform. In 2021–22, through the RTA Web Services, we processed:

• 213,200 bond refund requests

• 215,610 single bond lodgements

• 7,782 bulk bond lodgement submissions, consisting of 48,914 lodgements/bond increases

• 142,644 requests to update customer details

• 13,089 bond dispute resolution requests

• 13,958 change of bond contributors requests

• 3,144 tenancy dispute resolution requests.

This financial year, we saw a 5 per cent increase in uptake across all RTA Web Services and 70.2 per cent of

all tenancy and bond forms were lodged through our digital channels.

To ensure accessibility for vulnerable customers and those without digital access, the RTA also provides

paper form options, contact centre support and services tailored to the needs of community housing

providers and support service providers.

Supporting Queenslanders through legislation changes

On 20 October 2021, the Housing Legislation Amendment Act 2021 (HLA Act) received royal assent and

became law. The HLA Act amends our existing legislation – the Residential Tenancies and Rooming

Accommodation Act 2008 and the Residential Tenancies and Rooming Accommodation Regulation 2009.

While the HLA Act became law in October 2021, the changes from the amendments are being implemented

in separate phases over a three-year period to provide sufficient time for the sector to adequately prepare

for, understand and adopt the changes.

The first phase, which commenced on 20 October 2021, incorporated the domestic and family violence

(DFV) provisions outlined in the temporary Residential Tenancies and Rooming Accommodation (COVID-19

Emergency Response) Regulation 2020, which expired on 30 April 2022. These provisions introduced greater

DFV protections for tenants and residents, allowing a person experiencing DFV to end their interest in a

tenancy quickly and leave the property, or take certain measures to ensure they can stay in the rental

property safely.

RTA Annual Report 2021–22 | Page 14

To help our customers understand these provisions, we:

• published a new DFV page on our website that provides information about what processes need to

be followed when a person experiences DFV in a rental property

• developed factsheets for tenants and residents to explain the process and legislative requirements

for when a tenant or resident leaves due to DFV, including educating all parties on the new DFV

bond refund process

• developed individual flowcharts outlining the process for tenants, property managers and rooming

accommodation residents and providers

• updated existing forms and created several new forms in line with the DFV provisions

• delivered two webinars on DFV provisions

• introduced new internal staff processes to reflect the new DFV provisions

• published a Talking Tenancies podcast on the provisions

• delivered 93 hours of DFV-specific training to our Customer Experience Officers and updated all

DFV-specific standard responses.

The second phase of the amendments, which includes legislation changes around renting with pets, ending a

tenancy and repair orders, will commence on 1 October 2022. The third phase, which will introduce

minimum housing standards, will commence for new tenancy arrangements from 1 September 2023 and all

tenancies from 1 September 2024.

We will continue to tailor and align our customer support services and resources in line with amended

legislation across all channels to ensure our customers understand their rights and responsibilities. We will

also continue to work with our key stakeholders to provide education on the reforms.

Customer Experience Research Project

As outlined under the RTA Strategic Plan 2019–23, we’re committed to improving customer experience and

investing in digital optimisation.

In light of this, in 2021–22, we engaged external consultants to help us:

• conduct comprehensive market research and industry benchmarking

• review the performance of our current service delivery to improve business efficiency and internal

capabilities

• engage with stakeholders, tenants, peak bodies and associations, and the Queensland Government

to gather feedback on current and future needs.

The outcomes of these actions will be provided in the form of key recommendations. These will allow us to

improve customer experience and internal capabilities across all our channels, including digital optimisation

and transformation.

Some findings and outcomes of this research project will be provided in the RTA Annual Report 2022–23.

RTA Annual Report 2021–22 | Page 15

Bond management

The RTA have implemented procedures to improve customer experience, including same day processing of

paper and online bond refund forms. For the 2021–22 period, bond refunds have been processed within 0.6

days on average.

In the third year of RTA Web Services, which were designed to deliver on the RTA’s strategic objective to

provide smart digital services, we released the Bulk Bond Lodgement Web Service. This service allows

customers to lodge and pay for multiple bonds in a single online transaction, while also reducing data

entry requirements for RTA staff. Since its launch, over 19.1 per cent of bond lodgement requests have

been submitted via this service.

Average processing times

Bond lodgements

Bond refunds

All channels (digital + paper)

3.0 days 0.6 days

Bond forms processed

2017–18 to 2021–22

2017–18

2018–19

2019–20

2020–21

2021–22

Bond lodgements and bond increases

424,416 418,557 396,674 364,262 451,366

Paper

-

-

72.8%

50.7%

41.6%

Digital

-

-

29.2%

49.3%

58.4%

Bond refunds

321,086 312,749 296,628 267,098 258,802

Paper

-

-

53.4%

13.4%

11.6%

Digital

-

-

46.6%

86.6%

88.4%

Bond change forms*

72,401 69,437 77,007 69,556 80,333

Paper

-

-

-

-

82.6%

Digital

-

-

-

-

17.4%

* Bond change forms

Change of rental property (Form 3)

Change of property manager/owner (Form 5)

Change of bond contributors (Form 6)

In 2021–22, tenants and residents were refunded an average of 74.9 per cent of their bond. While the number

of total bonds held by the RTA decreased in the 2021–22 financial year, the total number of bond lodgements

and bond increases processed by the RTA increased by 23.9 per cent. This is due to a significant rise in the

number of bond increases.

The total bond refunds processed reduced by 3.1 per cent compared to the previous year. The reduction in

refunds is consistent with the increase in the median length of tenancies and bond increases (see page 11).

Contributing factors for the reduced volume of refunds may include high rental demand and low rental

vacancy rates, which have been brought about by increased interstate migration, building delays following

the COVID-19 pandemic, and fewer properties available in Queensland’s primary rental market (South East

Queensland) following the 2022 Eastern Australia floods.

RTA Annual Report 2021–22 | Page 16

Contact Centre

The RTA Contact Centre provides customers with tailored tenancy information, helping tenants, residents,

property managers and owners to make informed decisions.

In 2021–22, the Contact Centre responded to 368,695 phone enquiries, which is a 12.9 per cent decrease

from last year. The reduced volume of calls was offset by an increase in the length and complexity of the

enquiries we received due to stresses in the rental market. The average talk time has increased to 483

seconds, a 15 per cent increase compared to 421 seconds in the previous year. RTA staff answered an

average of 1,440 calls each working day, which is down from 1,686* calls per day in 2020–21.

*

The average calls per day in 2020–21 did not include the 7,071 COVID-19 hotline enquiries received by an external contact centre

engaged by the RTA. This hotline was transferred back to the RTA to manage in December 2020.

Contact Centre phone enquiries

^ Includes 30,786 COVID-19 hotline enquiries

* Includes 7,071 COVID-19 hotline enquiries

In addition to enquiring on the phone, RTA customers can also self-service with information from other

channels and platforms including the website.

Customer feedback

The RTA values the opinions of our customers and actively encourages and seeks feedback about our

services. Customers have the option to provide feedback on the quality of service they have received

through a range of communication channels.

In 2021–22, 83 per cent of customers surveyed agreed that the RTA provided a high-quality service

year-round. Customers are asked to provide feedback on timeliness of response; ease of access; RTA staff

performance; service outcome; and overall satisfaction with the service provided. This year, customers rated

RTA staff performance as the highest quality aspect of their experience. We responded to 109 formal

customer complaints, with 90 resolved during initial contact and 19 requiring further action.

An average customer satisfaction rating of 83%

was recorded in 2021–22 for the delivery of

services to our customers

368,695

423,221*

426,615

^

360,399

401,069

320,000 340,000 360,000 380,000 400,000 420,000 440,000

2021–22

2020–21

2019–20

2018–19

2017–18

RTA Annual Report 2021–22 | Page 17

Dispute resolution

The RTA offers a free, impartial, and independent dispute resolution service to help tenants, residents,

property managers and owners resolve tenancy disputes and reach a mutually agreeable outcome. The

conciliation process provides customers with the opportunity to gain valuable negotiation and self-

resolution skills, sustain their tenancy, and preserve their relationship with the other party. Customers who

volunteer to participate in this process may also avoid the need for legal action through the Queensland Civil

and Administrative Tribunal (QCAT), saving them both time and money.

We triage all incoming dispute resolution requests to determine whether the matter is suitable for

conciliation. Disputing parties are contacted for further information and are given the opportunity to have

their say. A trained RTA conciliator then facilitates confidential negotiations between the disputing parties,

either through one-to-one phone calls or a group teleconference. Conciliators cannot make decisions about

disputes or enforce rules or regulations. Their role is to provide structure to the discussion, aid in

negotiations, educate parties on their rights and responsibilities and to help them reach an agreement.

In 2021–22, the RTA resolved 76.3%

of all disputes where parties

volunteered to participate

In 2021–22, we resolved over 76 per cent of all disputes where parties volunteered to participate. The

number of conciliated disputes below reflects all dispute resolution requests that proceeded to conciliation,

excluding instances where disputing parties subsequently withdrew from the conciliation process or were

unable to be contacted for conciliation.

Conciliated disputes

^ Includes 1,791 COVID-19 related disputes

* Includes 1,080 COVID-19 related disputes

28 per cent of disputes occur during a tenancy. Disputes which occur during a tenancy include disagreements

around repairs and maintenance, rent arears, entry to the property, water charges, and other disputes.

How a bond will be paid out at the end of a tenancy remains the primary reason for conciliated disputes.

Compensation claims for amounts more than the bond and claims submitted after the bond has been paid

out represent 9.5 per cent of all disputes.

Due to recent flood events, there has been an increase in disputes relating to repairs and maintenance and

disputes around ending a tenancy. The low vacancy rates currently being experienced in the Queensland

rental market have also led to an increase in disputes about rent increases.

Following the introduction of the new DFV provisions for tenants and residents in October 2021, the Dispute

Resolution Service has conciliated 157 disputes relating to bond claims for tenancies impacted by DFV and

120 disputes where the tenancy is ongoing but DFV has been experienced.

19,733

21,163*

19,882^

17,627

16,657

0 5,000 10,000 15,000 20,000 25,000

2021–22

2020–21

2019–20

2018–19

2017–18

RTA Annual Report 2021–22 | Page 18

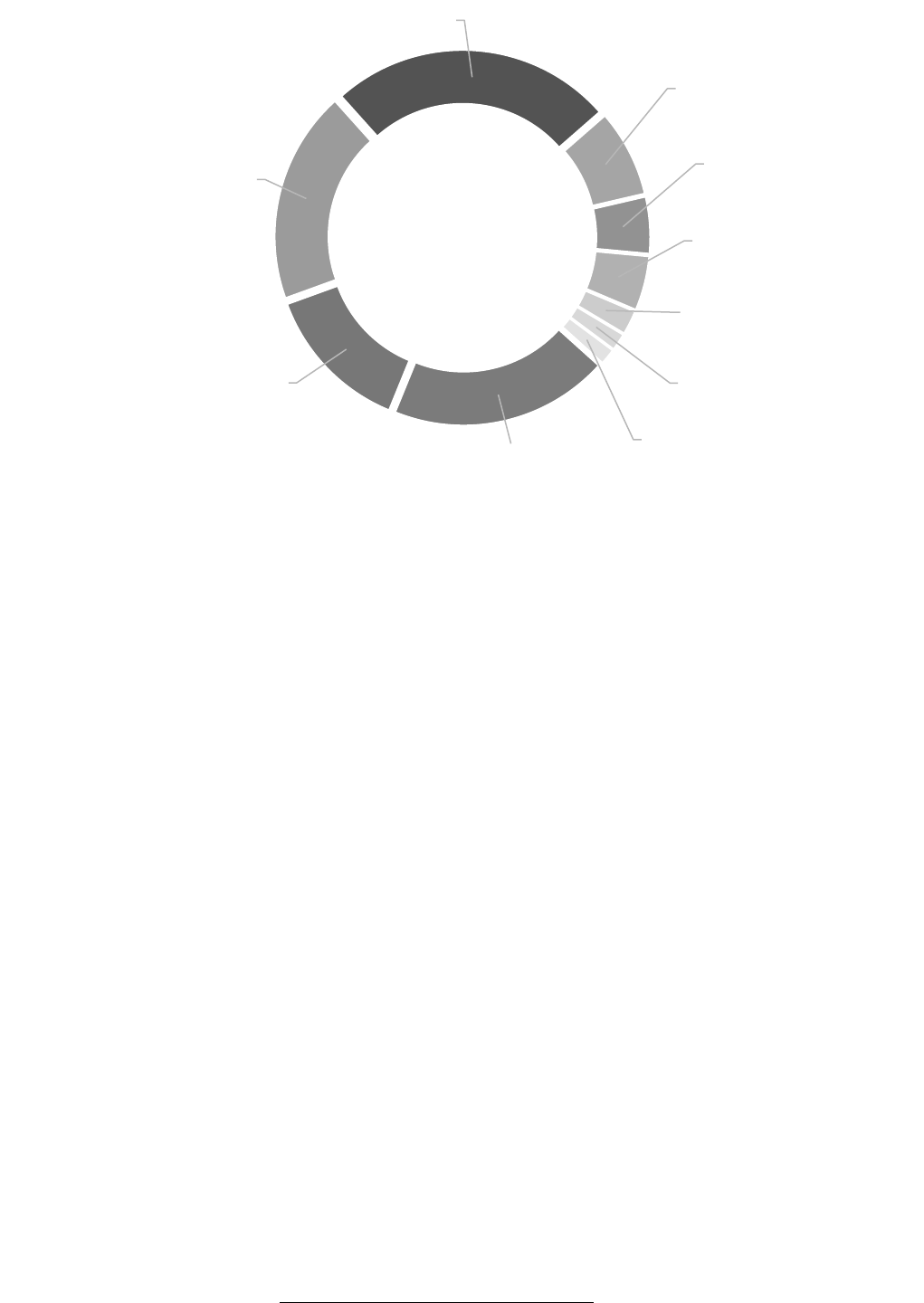

Dispute reasons

Parties who were unable to resolve disputes through conciliation were given information on how to seek

a ruling from QCAT if they wished. Note that not all parties took unresolved disputes to QCAT—some

chose not to pursue further action and others would later reach agreement between themselves. A total

of 1,611 conciliated disputes progressed to QCAT in 2021–22, which represents 8.2 per cent of all

conciliated disputes.

Bond 52.9%

Claim greater than bond 9.5%

Repairs and maintenance 8.6%

Ending a tenancy 5.9%

Rent arrears 3.4%

Non-lodgement of

bond 2.4%

Entry 2.0%

Water charges 1.3%

Other 14.0%

- Overpaid rent

- Tenancy database

- Rent reduction

- Rent increase

- No refund form

- Excessive hardship

- Break lease

- Lease variation/extension

- Owner wants to move into property

- Sale of property

RTA Annual Report 2021–22 | Page 19

Our sector

Tenancy support and stakeholder engagement

In 2021–22, the RTA delivered or participated in over 70 stakeholder engagement activities to provide

education and information on tenancy rights and responsibilities under the RTRA Act to over 2,800 people.

With the easing of COVID-19 restrictions, we were able to provide an increase in face-to-face engagement

activities compared to the previous financial year. The RTA maintained the delivery of education services

throughout the year with a strong focus on improving quality and expanding the resources available on our

digital channels.

The RTA Board also held two regional meetings during this financial year, the first in Cairns in October 2021

and the second in Mount Isa in May 2022. The Board and Chief Executive Officer met with regional sector

representatives in both cities to gain an understanding of local issues and to provide information about the

RTA and our services.

Improving the customer’s digital experience

As part of continued improvements to the RTA website, we undertook a review of the website’s content and

structure. New website content was developed and the website structure was updated to align with the

tenancy lifecycle. To support the launch of the Bulk Bond Lodgement Web Service, we developed quick

guides and website content to guide first-time users through the new digital service. In May 2022, we also

provided targeted information sessions about the new Web Service to identified customers who lodge

multiple bonds in bulk.

The RTA continued to release episodes of our Talking Tenancies podcast, which features our experts providing

practical tenancy information in a conversational and accessible format. The podcast is released fortnightly,

and there were 25 new podcast episodes published in 2021–22. We now have 44 podcast episodes

published on the RTA website, which received 4,415 listens this financial year.

During the 2021–22 financial year, the RTA published 39 news stories on the website covering a range of

topics including legislation changes, navigating a tight rental market, and providing information for different

stages of the tenancy cycle. Many of these stories were included in the RTA’s monthly electronic newsletter,

which goes out to approximately 3,700 subscribers. The RTA also responded to over 35 media requests, to

help educate the sector on rental legislation.

The RTA also undertook a campaign focused on students, in light of the increased return of international

students to student and private accommodation. This campaign included the creation of new website content

and factsheets, which were promoted through Google and Spotify advertising. The campaign received over

81,000 impressions through Spotify reach, Google impressions, and views of all other online resources.

Educational workshops and presentations

With the easing of COVID-19 restrictions, the RTA delivered face-to-face information sessions in Cairns and

on the Gold Coast. In Cairns, over 140 property owners and property managers attended two sessions in

October 2021, while over 365 managers and owners attended four sessions on the Gold Coast in June 2022.

The RTA maintained its commitment to customers across Queensland with virtual information sessions

focused on Ipswich, Redlands, Gladstone, and Mount Isa throughout the year.

The RTA produced 12 in-house webinars in the 2021–22 financial year, including two in collaboration with

agency and industry partners. We produced webinars with Queensland Fire and Emergency Services to

promote new smoke alarm laws which commenced in January 2022, and with the Tenancy Skills Institute

about their free Skillsets for Successful Tenancies course. Our webinars targeted different stakeholder

groups within the residential rental sector and delivered tenancy education to approximately 515 people.

RTA Annual Report 2021–22 | Page 20

Two webinars were about the new rental reforms, while other webinars addressed frequent questions from

customers and important topics such as DFV, resolving disputes, accuracy of data, and the introduction of

Bulk Bond Lodgement Web Services. Overall, our webinar recordings received more than 3,594 views on the

RTA Queensland YouTube channel.

59 stakeholder

engagement

activities

11 targeted

presentations with

stakeholders

The RTA worked closely with stakeholders in 2021–22 to deliver specialised education sessions to our

stakeholders. These included two information sessions for staff from Tenants Queensland/QSTARS and their

networks about RTA Web Services. A presentation on the RTA compliance and enforcement function was

also delivered to staff from Tenants Queensland, QSTARS, LawRight and their community partners.

The RTA also participated in and supported 11 online and face-to-face presentations and interactive

workshops hosted by stakeholders in 2021–22. These included:

• tailoring introductory and advanced training for staff from community housing providers and

specialist homelessness services, in conjunction with Q Shelter

• providing a guest speaker for a webinar in December 2021 with the Australian Resident

Accommodation Managers’ Association about changes to the legislation

• delivering a presentation to approximately 240 property managers at the Real Estate Institute of

Queensland Property Management Conference in March 2022

• presenting at regular face-to-face meetings of the Property Owners’ Association Queensland

• presenting a live Facebook webinar to students from the Queensland University of Technology (QUT)

which attracted over 900 live and recorded views

• delivering information sessions about DFV protections to staff from the Department of Communities,

Housing and Digital Economy, and attendees at Housing and Homelessness Forums in Bundaberg

and the Fraser Coast.

4,344 listens across

44 podcast episodes

4,109 views

across 12 webinar

recordings

Supporting the sector through changes to the COVID-19 Regulations and the 2022 floods

Throughout 2021–22, the RTA updated its website and forms for general tenancies and rooming

accommodation to reflect the gradual roll back of emergency COVID-19 Regulations. We regularly updated

our website and created news stories to update customers about these changes, which were published on

our website and in our electronic newsletter. The final COVID-19 provisions, which provided tenants and

residents with protections around rent arrears caused by COVID-19, expired on 1 May 2022.

In 2022, Queensland was affected by severe and widespread flooding. To support the rental sector through

this period, we updated our natural disasters webpage, created new factsheets for tenants and residents

and property managers and owners affected by the floods, and published news stories on our website.

RTA Annual Report 2021–22 | Page 21

Recognising the importance of collaboration

The RTA facilitated three meetings of its Stakeholder Forum in 2021–22. The Forum met by videoconference

in November 2021 and February 2022, and in a hybrid of in-person and online attendance in June 2022. The

Stakeholder Forum provides an avenue for members, the RTA Executive Leadership Team, and

representatives from the RTA Board to raise and discuss strategic issues and trends affecting the residential

rental sector. It allows the RTA to gain insights and to further understand the interests and concerns of

stakeholders and increases stakeholders’ understanding of the RTA’s role and its strategic direction.

Members of the RTA Stakeholder Forum include:

• Asia-Pacific Student Accommodation Association (APSAA)

• Australian Resident Accommodation Managers’ Association (ARAMA)

• Caravan Parks Association of Queensland (CPAQ)

• LawRight

• Property Owners’ Association of Queensland (POAQ)

• Queensland Shelter (Q Shelter)

• Queensland Council of Social Service (QCOSS)

• Real Estate Institute of Queensland (REIQ)

• Student Accommodation Association (SAA)

• Supported Accommodation Providers’ Association (SAPA)

• Tenants Queensland (TQ).

The RTA received positive feedback on the Forum meetings in 2021–22, with an average overall member

satisfaction rating of 79 per cent.

The Stakeholder Working Group (SWG) was established in early 2021 to provide the RTA with operational advice

and recommendations around customer communication and education. The group met monthly via

videoconference throughout 2021–22. The SWG has representatives from all Stakeholder Forum member

organisations, as well as the Queenslanders with Disability Network (QDN), Real Estate Excellence Academy

and the Tenancy Skills Institute. This cross-sector discussion and collaboration has allowed for different

perspectives to be considered in developing and delivering proactive and effective key messages for the

Queensland residential rental sector.

The SWG has continued to provide the RTA with practical advice on improving communication and education

throughout the tenancy cycle. With the support of the SWG, the RTA produced new factsheets in October

2021 to assist tenants, residents, property managers and owners to consider factors associated with taking

photos in a rental property, released a series of short videos aimed at making rental essentials quick and

easy to digest in May 2022 and ensured stakeholder feedback was incorporated into flow charts on the new

domestic and family violence protections.

RTA Annual Report 2021–22 | Page 22

Regulatory and compliance activities

In 2021–22, we continued to align our services to the RTA Compliance and Enforcement Strategy 2021‒23

and the Queensland Audit’s Office’s insights on good regulatory practices. We commenced new compliance

activities designed to be intelligence led, transparent and to measurably improve sector compliance with

the RTRA Act.

In June 2022, we launched our Proactive Compliance Program. This pilot program used data to identify

agencies with a high non-compliance rate of lodging bonds within ten days of receiving bond payments from

a tenant. This program was chosen based on historic RTA investigation trends, to proactively target the

ongoing industry compliance issue of late bond lodgements.

Our Compliance and Enforcement team proactively engaged agencies with high levels of non-compliance

around bond lodgement timeframes, offering them individually tailored and interactive education

sessions that:

• outlined the agency’s legislative obligations

• identified common challenges and trends that often lead to non-compliance

• showcased RTA services, like the Bulk Bond Lodgement Web Service

• provided practical solutions to help the agency meet their obligations.

The agencies which participated have since begun embedding changes and improvements in their bond

lodgement processes. The Compliance and Enforcement team will continue to monitor these agencies to

measure the success of the program, and the RTA will publicise its shared learnings from the program to

increase broader industry voluntary compliance with the RTRA Act.

To further support compliance rates, the RTA collaborated with the Office of Fair Trading (OFT) to amend the

Agents Financial Administration Regulation 2014. This amendment ensures that

all agencies can use modern

payments, such as BPAY, to pay for bonds from a trust account.

In December 2021, the RTA also launched a new Memorandum of Understanding (MOU) with the OFT. The

MOU provides clarity around which organisation will investigate offences by licensed agents, if they are in

breach of legislation administered by both the OFT and the RTA. Under the MOU, the RTA will direct

complainants requesting an investigation to the OFT regarding:

• late or non-lodgement of rental bonds by licensed agents and/or

• using rent money for another purpose (e.g. paying for a water bill).

The exception is if an investigation request is around these offences but also includes other unrelated

alleged breaches of the RTRA Act. In these cases, the RTA will handle the investigation.

In 2021–22, the RTA received 243 investigation requests. We also finalised 178 investigation cases and 63 non-

investigation cases (where the investigation request could not be actioned as: no offences were identified; the

case was outside statutory timeframes; or it was referred to the RTA’s dispute resolution service).

Some investigation cases involved multiple alleged offences and, in total, the RTA investigated 549 alleged

offences of the RTRA Act. This resulted in:

• providing education around 277 offences

• issuing cautions for 115 offences

• finding insufficient evidence for 105 offences

• the complainant ceasing contact or withdrawing their request for 29 offences

• no further action for 23 offences – this were identified as non-investigation cases.

RTA Annual Report 2021–22 | Page 23

Types of alleged offences investigated

^ Non-lodgement of bond also includes instances of late bond lodgement and failure to pay rental bond instalments.

Other offences include, but are not limited to:

s87(2): Rent in advance – not requiring rent from tenant in a period that rent has been paid

s203: Lessor or lessor's agent must not show tenant's possession in advertisements

s171: Supply of goods and services

s459: Restriction on listing on tenancy database

s514(1): Giving false or misleading documents to the RTA

Other, 19.5

Non-lodgement of bond^

13.3%

Failure to provide

documentation 18.9%

Unlawful entry,

25.2%

Agreement terms

breach, 7.8

%

Interfering with quiet

enjoyment 5.1%

Failure to provide rental

bond receipt 4.9%

Recovering possession of

premises unlawfully 2.2%

Applying rent payment for

any other purpose 1.6

%

Rent payment record 1.5%

RTA Annual Report 2021–22 | Page 24

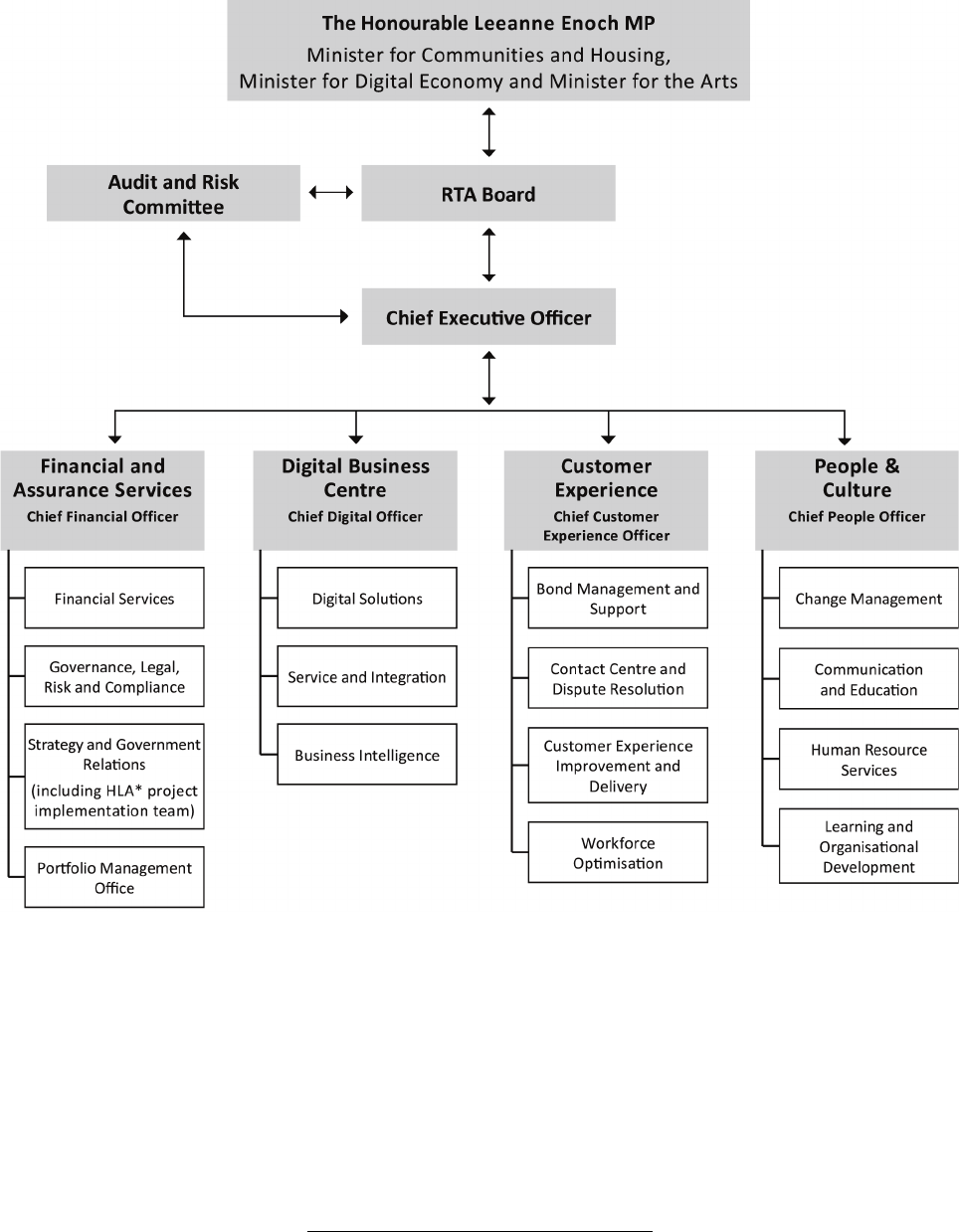

Our organisation

Organisational structure

* Housing Legislation Amendment

Audit and

Risk

Committee

l

Financial and

Assurance Services

Chief Financial Officer

-

Financial Services

-

Governance,

Legal,

Risk

and Compliance

Strategy

and

Government

Relations

.....

(including

HLA

* project

implementation

team)

.....

Portfolio Management

Office

The Honourable Leeanne Enoch

MP

Minister

for

Communities and Housing,

Minister

for

Digital Economy and

Minister

for

the

Arts

1

RTA

Board

I

Chief Executive Officer

I

l l

Digital Business Customer

Centre Experience

Chief Digital Officer Chief Customer

Experience Officer

--

Digital Solutions

-

Bond Management and

Support

--

Service and Integration

-

Contact Centre and

Dispute Resolution

--

Business Intelligence

Customer Experience

-

Improvement and

Delivery

Workforce

-

Optimisation

l

People &

Culture

Chief People Officer

-

Change Management

Communication

-

and Education

Human Resource

-

Services

Learning and

-

Organisational

Development

RTA Annual Report 2021–22 | Page 25

Board of Directors

The RTA Board reflects the diversity of the sector, with members bringing knowledge and expertise in sector

representation, commercial activities, corporate governance, and community service.

The Board is responsible for:

• guiding, reviewing and approving strategy

• setting values and standards

• endorsing our annual budget

• monitoring business performance

• monitoring investment activities and financial position

• identifying and effectively managing significant business risks

• regularly assessing the performance of the Board and management.

Board members are appointed for three-year terms by the Queensland Parliament’s Governor in Council

on the recommendation of the Minister. Their remuneration is determined through Cabinet-approved

procedures administered by the Queensland Government’s Department of the Premier and Cabinet.

Board member profiles

Board member

Profile

Paul Melville

(Chair)

Paul Melville has over 15 years of experience as a Director and Board member. He was

formerly the joint Managing Director of Halcyon and is a Board member of the Urban

Development Institute of Australia.

Paul has an extensive legal background, previously operating as a solicitor and senior

partner within his own firm. He holds a Bachelor of Laws from the Queensland

University of Technology and was admitted as a Solicitor of the Supreme Court

of Queensland.

Sally Watson

Sally Watson has extensive experience working in housing and homelessness services

across the public and not-for-profit sectors in Brisbane, Canberra, and Cairns. Sally is

currently the manager of the homelessness service, Shelter Housing Action Cairns.

Previously, she has lectured in Social Work at James Cook University, was North

Queensland Coordinator for the Tenants Union of Queensland and Executive Director

of Homelessness Australia. Sally holds a Bachelor of Social Work (UQ), a Master of

Public Policy (ANU) and a Bachelor of Laws (JCU). She is also currently a Board member

of both Tenants’ Queensland and the North Queensland Women’s Legal Service.

Steve Ryan

Steve Ryan is an experienced Board member with over 40 years of experience in

strategic leadership, governance, and service delivery. He has

worked across the public,

union, superannuation, health, and not-for-profit sectors. Steve is a current Board

member of GROW, a not-for-profit national mental illness program, and is the Acting

Chairperson of Health and Wellbeing Queensland, a targeted state government

statutory body within Queensland Health.

Steve was previously a Deputy Chairman of the Board of Directors and Board of

Trustees at QSuper, and a Board member of the Queensland Studies Authority’s

Governing Body. He is also a former State President of the Qld Teachers’ Union.

RTA Annual Report 2021–22 | Page 26

Janet Benson

Janet Benson is the owner and principal of Capstone Property Solutions and brings a

comprehensive understanding of the Queensland property sector – in particular,

residential property management. Janet has a background in the Queensland public

sector, previously working as the Executive Director of the Human Services CEO

Committee, and Executive Director of Homelessness Programs at the Department of

Housing and Public Works.

Janet brings extensive knowledge of social housing, rental affordability, and

homelessness issues in Queensland. She holds a Master of Arts (Public Sector Policy

and Leadership) from Griffith University and is a licensed real estate agent in

Queensland.

Christine Castley

Christine Castley is currently CEO of Multicultural Australia. Prior to this, she was

Deputy Director-General in the Department of the Premier and Cabinet and Deputy

Director-General, Housing, Homelessness and Sport in the Department of Housing and

Public Works. In this role she led the development of the Queensland Housing Strategy

2017–2027 and the transformation of housing and homelessness services. This was

delivered by 1,500 staff and involved managing a $1.4 billion business and a $15 billion

asset portfolio. In 2014–15, Christine led the Secretariat for the Special Taskforce on

Domestic and Family Violence, chaired by the Honourable Quentin Bryce, which

delivered the landmark ‘Not Now, Not Ever’ report.

Christine is an experienced executive with a strong track record of delivering significant

reform and innovation projects, including adult and youth criminal justice reform, disaster

management response and recovery, and public sector ethics and integrity reform.

Christine holds a Bachelor of Laws, Bachelor of Arts, Postgraduate Diploma of Arts and

Master of Public Administration from The University of Queensland.

Cara Walsh

Cara Walsh has 25 years of experience working as a leader in Silicon Valley, New York

City, and here in Queensland. She has undertaken large digital transformations for

RACQ, as well as the City of Brisbane. In the United States, she built customer-focused

digital products for AT&T, McAfee, and Thompson Financial.

Cara believes in human-centric design and not technology-led solutions. She is Global

Vice President of Customer for Outfit – a SaaS martech solution. She is also Chair of the

Business Advisory Board for QUT's Business School and a Mentor for Ethni – a non-

profit building skills for culturally diverse youth. Cara holds a Bachelor of Arts in

Communications from the State University of New York College at Oneonta.

Damian Wright

Damian Wright is a Chartered Accountant and has been working in the accounting

profession for some 30 years. Damian is currently the Partner in Charge of Audit at

BDO in Brisbane and provides services to a wide range of businesses, across a variety

of industries.

Damian has held a number of Board positions and currently chairs Lives Lived Well

Limited, a not-for-profit service provider in the health sector. He holds a Bachelor of

Commerce from The University of Queensland, is a Registered Company Auditor and

an Associate of the Institute of Chartered Accountants in Australia. He also has a

Graduate Diploma of Applied Finance and Investment from the Securities Institute of

Australia (now FINSIA).

RTA Annual Report 2021–22 | Page 27

Board meetings

A total of 10 scheduled meetings of the RTA Board of Directors occurred during 2021–22. All Board members

were members for the entire 2021–22 period.

Board member Number of attendances Departure/arrival

Paul Melville (Chair) 10/10 Member for entire period

Sally Watson 10/10 Member for entire period

Steve Ryan 10/10 Member for entire period

Janet Benson 9/10 Member for entire period

Christine Castley 9/10 Member for entire period

Cara Walsh 10/10 Member for entire period

Damian Wright 9/10 Member for entire period

See page 78 for remuneration information for the Board of Directors.

Audit and Risk Committee

The Audit and Risk Committee (ARC) meets four times a year to ensure the RTA operates within an appropriate

framework of internal control and risk management, while achieving its objectives and strategies efficiently

and effectively. The Chief Executive Officer (CEO) and Chief Financial Officer (CFO) report to the ARC.

The committee oversees the integrity of the financial statements and reports, our accounting policies and

practices, the scope, quality and independence of external audit arrangements, the monitoring of the internal

audit function, and the effectiveness of risk and compliance measures.

During 2021–22, the ARC was comprised of four Board members. The ARC observed the terms of its charter

with due regard to Queensland Treasury’s Audit Committee Guidelines.

ARC member Number of attendances Departure/arrival

Damian Wright (Chair) 4/4 Member for entire period

Steve Ryan 3/4 Member for entire period

Paul Melville (ex-officio) 0/4 Member for entire period

Cara Walsh 4/4 Member for entire period

RTA Annual Report 2021–22 | Page 28

Executive Leadership Team

Our Executive Leadership Team (ELT) includes the Chief Executive Officer (CEO) and four Chief Officers who

head each division. Together, they’re responsible for providing strategic and operational oversight of the RTA

and implementing strategies to help us achieve our vision - to make renting work for everyone.

Role of the Chief Executive Officer (CEO)

The CEO provides strategic advice to the RTA Board, Chair and Minister on the operation and monitoring of

Queensland’s residential tenancy legislation. The CEO also provides regular performance, operational and

compliance reports to the Board with updates on strategic and operational issues, and is responsible for all

aspects of management, staffing, and administration.

The CEO leads our executive and leadership teams to ensure progress and direction of our strategic priorities

and operations.

Name and role

Profile

Jennifer Smith

– Chief Executive

Officer (CEO)

Jennifer has a broad range of management experience and leadership skills with

demonstrated achievements in financial planning, corporate governance, policy

development and the delivery of services across both private and public sectors.

Prior to joining the RTA, Jennifer held various executive and senior roles at Brisbane City

Council. These roles included Assurance Delivery and Performance Manager, Financial

Projects Manager and within Corporate Treasury.

Jennifer holds a Bachelor of Business majoring in Accountancy from the Queensland

University of Technology and is an accredited Workplace Executive Coach.

Joanna Van Der

Merwe

– Chief Financial

Officer (CFO)

Joanna Van Der Merwe leads the Financial and Assurance Services division, which

includes finance, governance, legal, risk, compliance and enforcement, government

relations, portfolio management, strategy and business improvement.

Prior to joining the RTA in September 2019, Joanna held various executive roles at

Brisbane City Council as well as roles in the United Kingdom’s private sector at FMCG

and Consumer Electronics industries.

Joanna holds a Bachelor of Business and is a Chartered Management Accountant and a

member of CPA Australia.

Samantha Watson

– Chief Customer

Experience Officer

(CCXO)

Samantha Watson leads the RTA's Strategic and Operational Customer Experience function

which includes a diverse range of teams who offer extensive, differentiated services which

cater to the differing needs of our customers.

Samantha is an experienced executive who has led improvement and transformation

programs across several complex customer-focused organisational environments

in government, not-for-profit, global, and private sectors. She has extensive

experience in strategically leading innovation, change and improvement and has

successfully delivered enterprise-strategic change in customer experience, digital

and cultural spaces.

Samantha holds a double degree in Business and Organisational Psychology, is a

certified professional manager in Service Journey Thinking and also holds

qualifications in LEAN, Six Sigma and project management and marketing disciplines.

RTA Annual Report 2021–22 | Page 29

Greg Watts

– Chief Digital

Officer (CDO)

Greg Watts leads the RTA's Digital Business Centre, which supports the RTA's business

systems, standard operating environments and applications, and information

management processes. This includes the RTA’s records management and the business

intelligence teams which facilitate strategic direction and corporate decision-making.

Greg is an experienced information and communication technology (ICT) executive with

proven success in leading a range of digital and business transformation projects and

programs. For more than two decades, Greg has led and partnered with expert,

multidisciplinary teams to deliver business outcomes through digital strategy and

governance, cyber security, enterprise architecture, cloud transformation, high-

availability systems, and vendor and business applications management.

Greg holds a Master of Business Administration, Bachelor of Commerce and is a

Graduate Member of the Australian Institute of Company Directors.

Natalie Townsend

– Chief People

Officer (CPO)

Natalie Townsend leads the People and Culture division, overseeing the RTA's human

resources, training, organisational development, change management, media,

communication, and education teams.

Natalie brings extensive experience across a range of activities, this includes rolling out

the RTA's human resources information system, learning management system, and

performance framework and related systems. She has also led organisational

transformation activities and reform initiatives.

Natalie holds a Diploma of Business, a Bachelor of Business with double majors in

Management and Human Resource Management along with other accreditations in

tools such as DISC and Talegent.

Natalie is also a CAHRI member of the Australian Human Resources Institute.

RTA Annual Report 2021–22 | Page 30

Corporate governance

framework

Our commitment to the Queensland Government’s focus on integrity and accountability is underpinned by

our corporate governance framework. This framework is based on Queensland Treasury’s Corporate

Governance Guidelines for Government Owned Corporations and the Queensland Auditor-General’s model.

It includes far‑reaching accountability processes, which place a high priority on due diligence, compliance

and ensuring transparency in decision-making.

Committees and groups

The following committees and groups operated throughout 2021–22:

• The Consultative Committee (CC)

Provides a forum to discuss and consult on staffing matters including industrial relations with

Together Queensland Union representatives and ensures issues are managed appropriately. The CC

meets quarterly and as issues arise.

• The Portfolio Investment Board (PIB)

Reviews new and innovative business initiatives identified through operational planning, staff

feedback, government commitments or unforeseen events, and assesses their merit for inclusion in

the corporate portfolio. It ensures projects operate in an efficient, effective manner and are

sufficiently resourced to support our business and corporate needs. The PIB is chaired by the CFO

and includes the RTA executive leadership team.

• Project Boards

Established for each project in the portfolio, Project Boards are responsible for driving overall

direction and progress by monitoring and controlling projects within agreed parameters as approved

by the PIB. Project Board duties also include monitoring project risk, budget expenditure,

deliverables, timeframes, communications and supporting vendor and stakeholder engagement. The

PIB and the Project Board members attend a joint monthly meeting to discuss both portfolio and

project board items.

• The Legislation Consensus Group (LCG)

Contemplates new and proposed legislation and monitors emerging trends affecting existing

legislation. The LCG ensures the RTA provides accurate, consistent and timely information to its

stakeholders and customers.

• The Legislation Implementation Group (LIG)

Leads the implementation planning for the Stage 1 reforms to the Residential Tenancies and

Rooming Accommodation Act 2008. They are responsible for understanding and interpreting the

proposed reforms and providing clarification to RTA staff.

• The Health and Safety Committee (HSC)

Assists management in the prevention of accidents and incidents through the development and

implementation of measures to ensure employee and visitor health and safety at the RTA.

• The Information Security Committee (ISC)

Meets monthly to review and revise policies relating to information security, information

classification and information management. The ISC works closely with its managed services

provider to mitigate risks and complete the action plan under the IS18 checklist.

• The Diversity and Inclusion Committee

Oversees the delivery of the key commitments of the RTA’s Diversity and Inclusion Strategy 2021–24

and ensures a dedicated focus on diversity and inclusion priorities to build an inclusive culture.

RTA Annual Report 2021–22 | Page 31

Internal audit and external scrutiny

Each year, the RTA engages external experts to review and provide feedback on our internal processes,

policies and systems.

Under external scrutiny audit processes, we engaged:

• Pitcher Partners through the Queensland Audit Office, to conduct our annual financial audit services

• Exact Consulting, to ensure we were compliant and also implementing best practice approaches to

safety in a hybrid working environment.

No significant findings were reported through these reviews.

We also conduct a series of internal audits – usually via external experts – to assist the ARC in fulfilling its

obligations. These internal audits provide independent assurance of the effectiveness of RTA systems,

procedures, and controls to ensure compliance and management of risks. The RTA’s strategic audit plan sets

out the audits for identified areas to assist with our strategic goals which include:

• reliability and integrity of financial and other operating information

• adequacy and effectiveness of systems and controls

• workforce engagement and performance

• compliance with policies, laws, and regulations

• prevention of fraud and corruption.

Under internal audit processes, we engaged Protiviti to audit:

• payroll

• investigations and prosecutions

• general finance controls

• Portfolio Management Office (to be completed in 2022‒23).

We met all recommendations for the above audits in a timely manner.

Ethical standards

The RTA Code of Conduct provides a framework for ethical conduct of staff based on the principles and

values of the Public Sector Ethics Act 1994 and is reflected in our Human Resources policies,

procedures, initiatives and management standards. Under the Code, staff can carry out duties with

integrity, impartiality, accountability, transparency, and promote the public good. Mandatory Code of

Conduct training is completed by all staff through an online learning system, with refresher training

every 12 months.

Human rights disclosure

The RTA is committed to respecting, protecting and promoting human rights in our decision-making and

actions. This is reflected in the RTA Strategic Plan 2019–23. Processes have been established to integrate the

consideration of human rights and ensure compliance with the Human Rights Act 2019. In 2021–22, the RTA

implemented a Human Rights Framework to further support staff in assessing human rights when making

business decisions. Mandatory Human Rights training was completed by all staff.

The RTA did not receive any human rights complaints in 2021–22.

Public interest disclosure

All RTA employees have an ethical responsibility to report actual, or suspected, instances of official

misconduct, as defined in the Public Interest Disclosure Act 2010. There were no disclosures in 2021–22.

Open data disclosure

An overseas travel expenditure report for the 2021–22 reporting year was not required due to overseas

travel not being undertaken by any staff member within the organisation.

RTA Annual Report 2021–22 | Page 32

Performance review framework

The performance review framework ensures the monitoring and reviewing of the RTA’s performance,

conducted by the RTA Board and CEO, is undertaken with comprehensive knowledge of our functions.

The table below outlines our 2021–22 performance against the key elements of the framework.

Function

Purpose

Achievements 2021–22

Monthly financial

reporting

Reports level of revenue and

expenditure against the approved

budget at each Board meeting

Monthly dashboard and financial reports

presented at each operational Board

meeting

Performance

measures

Reports achievement of, or progress

towards, the delivery of objectives in

the RTA strategic plan

Provided the Board with quarterly updates

on selected Strategic Measures

(performance measures) as required under

the Financial and Performance

Management Standard 2019. Other than

the benchmarked annual return on

investment, which has been impacted by

fluctuations in global financial markets, all

measures achieved their target

Internal audit

program

Reports progress and

recommendations from internal audit

to the ARC

Resulting recommendations from

internal audits were implemented in

a timely manner

Service Delivery

Statement

Provides budgeted financial and non-

financial performance information for

each Ministerial portfolio for the

current and upcoming financial year

Outcomes for customer satisfaction, dispute

resolution and operational costs as a

proportion of the value of bonds held all

exceeded targets

Annual Report

Provides quality reporting on financial

and non-financial performance to

support transparency and drive

continuous performance

Full compliance with annual report

requirements for Queensland Government

agencies

Business and financial planning

The RTA’s strategic direction is documented and formalised through our strategic plan. The RTA Strategic

Plan 2019–23 outlined our priorities around customers valuing RTA services, providing smart digital services,

building a customer-focused workforce, and improving business efficiency.

During the 2021–22 financial year, the RTA undertook comprehensive industry wide consultation, engaging

an external provider to help inform our RTA Strategic Plan 2022–26 to reflect the significant changes in the

rental sector over the last few years. The RTA Strategic Plan 2022–26 commenced on 1 July 2022.

Our budget, which is endorsed by the Board and approved by the Minister, is developed through our

business planning processes.

In line with our funding model from previous years, in 2021–22 the RTA was self-funded through the investment

of rental bonds. However, from 1 July 2022 the RTA funding model changed. Under the new funding model, the

RTA will hold rental bonds in a bank account within the whole of government banking arrangement. We will

receive ongoing administered grant funding from the State Government to finance our operations.

The principal objective of the funding reform is to de-risk RTA investments by holding the rental bonds in a

financial institution bank account which is not exposed to market risk. This ensures complete preservation of

the rental bonds held for Queensland tenants, residents, property managers and owners.

RTA Annual Report 2021–22 | Page 33

Digital innovation and

information systems

The focus of our digital optimisation and innovation in 2021–22 was to leverage data and gather sector

insights, to plan for the future delivery of enhanced online services and to increase the RTA’s overall digital

presence. This planning and data gathering provides a foundation to transform the RTA’s online systems and

infrastructure, so we can deliver new processes and services, continue to meet our legislative requirements,

and support customer engagement.

In addition to planning for future delivery, the RTA launched the Bulk Bond Lodgement Web Service in late

2021. This was the final product in the Web Services project. The RTA now offers six Web Services to allow

customer to manage their bond and update their tenancy details quickly and easily online.

Enhancing information systems and security