RROOYYAALL CCAARRIIBBBBEEAANN CCRRUUIISSEESS LLTTDD..

22000022 aannnnuuaall rreeppoorrtt

A record 2.8 million guests sailed in 2002 on the 25 ships of Royal

Caribbean International and Celebrity Cruises, enabling Royal Caribbean

Cruises Ltd. to post a 38-percent increase in net income with record

revenues of $ 3.4 billion. Nearing the peak of expansion in 2002, the

company surpassed 50,000 double-occupancy berths and will reach

60,000 berths at the end of its current newbuilding program in 2004.

ROYAL CARIBBEAN CRUISES LTD.

ROYAL CARIBBEAN CRUISES LTD.

1

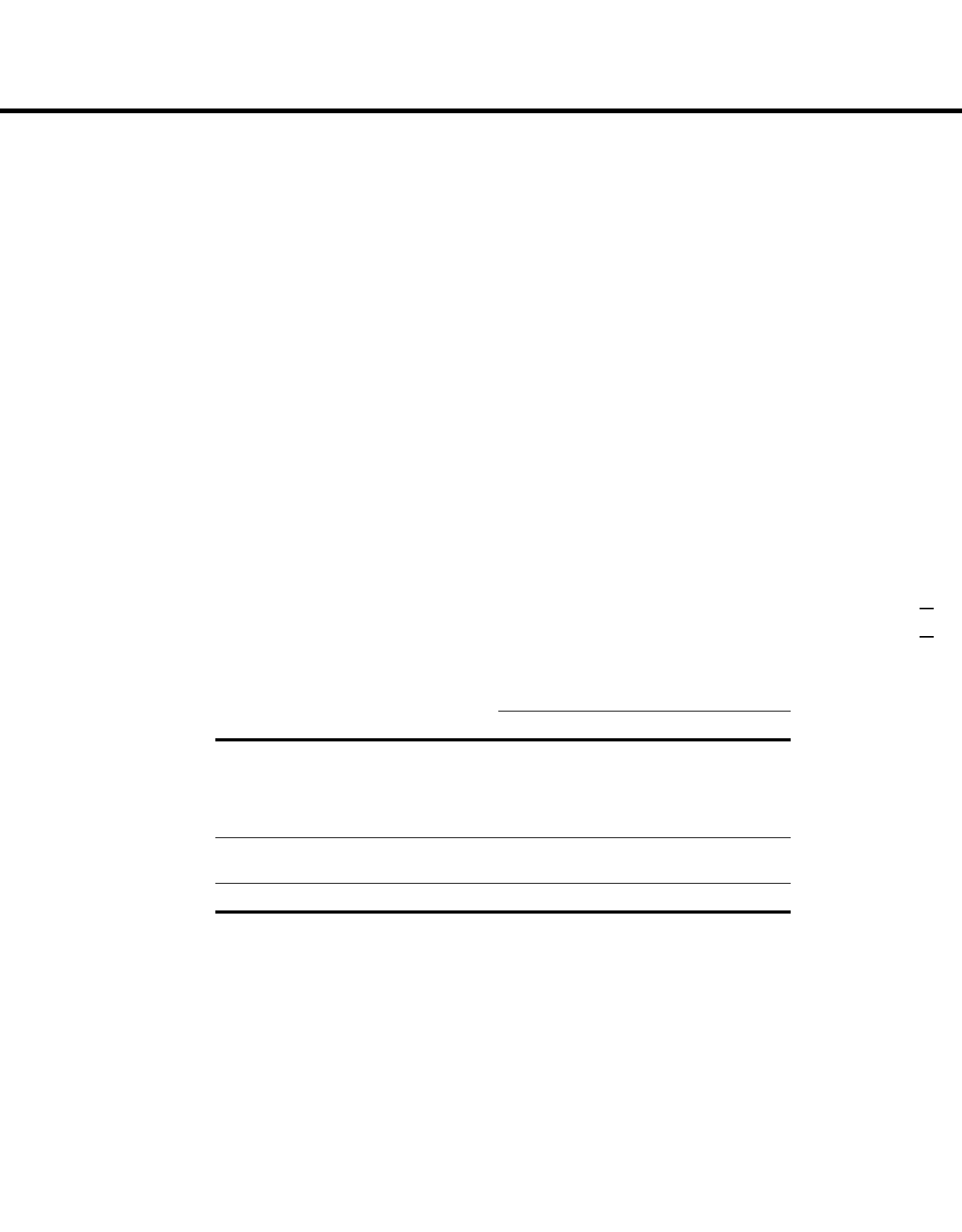

FINANCIAL HIGHLIGHTS

(dollars in thousands, except per share data) 2002 2001 2000

Revenues

Operating Income

Net Income

Earnings Per Share*

Shareholders’ Equity

$$33,,443344,,334477

555500,,997755

335511,,228844

$$ 11..7799

$$44,,003344,,669944

$3,145,250

455,605

254,457

$ 1.32

$3,756,584

$2,865,846

569,540

445,363

$ 2.31

$3,615,915

Revenues ($ millions) Net Income ($ millions) Shareholders’ Equity ($ millions)

88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02

523

567

698

760

1,013

1,113

1,171

1,184

1,357

1,939

2,636

2,546

2,866

3,145

3,434

14

42

52

4

61

107

137

149

151

175

331

384

445

254

351

(*diluted)

295

348

400

404

464

733

846

965

1,085

2,019

2,455

3,261

3,616

3,757

4,035

That ominous cloud of world tension con-

tinues to loom over global travel, heightened

now by the war in Iraq. We do not now know

the duration or full repercussions of this

conflict, nor can we predict the full impact

on the business of cruise vacations. However,

our performance during 2002 in the face of

economic and geopolitical uncertainty pro-

vides some comfort regarding the strength of

our company and of our industry. Within

months of the horrifying 9/11 terrorist

attacks, we experienced a dramatic rebound.

Rising demand and the lure of our ultra-

modern fleet enabled Royal Caribbean to

achieve Net Income of $351.3 million, or

$1.79 per share – a vigorous 38-percent

increase in profits. These are truly remark-

able results, given the negative influences that

buffeted all segments of the travel industry.

Unfortunately, the war-related uncertainties

have upset our expectations for a strong recov-

ery in cruise pricing in 2003. Recent booking

trends have been disappointing and indicate

another year of lackluster yields. Nevertheless,

the very strong booking trends we saw in most

of the second half of 2002 provide ample

evidence that the current weakness is not a

fundamental industry issue but rather a

shorter-term reaction to world events.

Revenues in 2002 climbed 9.2 percent to

$3.4 billion. More importantly, our key index

of net yields showed surprising firmness, edg-

ing down a mere seven-tenths of one percent.

During 2002, we had a capacity increase of

15.0 percent (one of the largest in our histo-

ry), and our ability to absorb this increase dur-

ing such traumatic times with only nominal

yield declines is very gratifying. But revenues

are only half of the equation. The impact of

our aggressive cost controls was apparent again

in 2002 as we cut operating and SG&A

expenses by 7.4 percent per available berth. We

are resolute in managing our business as effi-

ciently as possible, constantly seeking – and

finding – ways to control or avoid costs.

By launching a combined seven new ships

and 16,500 berths in 2001 and 2002 –

peak years in a decade of expansion – we

raised our profile in the eyes of vacationers

RRiicchhaarrdd DD.. FFaaiinn

Chairman and CEO

2

ROYAL CARIBBEAN CRUISES LTD.

CHAIRMAN’S LETTER

March 24, 2003

DEAR SHAREHOLDERS:

WWiinnee bbaarr

VViinnttaaggeess oonn

NNaavviiggaattoorr ooff

tthhee SSeeaass

3

ROYAL CARIBBEAN CRUISES LTD.

but also raised our operating and financial

leverage. That leverage will become a posi-

tive force in the near future as the pace of

our capital expenditures subsides. Our

remaining three ships under construction

represent $1.3 billion of the approximately

$5.5 billion in combined contract com-

mitments for 13 ships in 1999-2004. We

have successfully absorbed double-digit

capacity increases of 20.8 percent and 15.0

percent the past two years. Our capacity

growth slows to 12.2 percent and 10.4 per-

cent this year and next, respectively, and

thereafter drops quickly.

Royal Caribbean International and Celebrity

Cruises served a record 2.8 million guests

last year – a million more than as recently as

1999 – and logged 18.1 million guest cruise

days. The occupancy rate of 104.5 percent

(double occupancy equals 100 percent) was

one of our highest ever. Each succeeding year

that we attract one million people cruising

for the

first time

, as we did in both 2001 and

2002 and will do again in 2003, we broaden

a highly satisfied customer base.

As always, the safety of our guests is our high-

est priority. We are continuing to operate at

the highest security level with measures such as

comprehensive screening of everyone and

everything coming onboard our ships. Our

SeaPass computerized photo ID system, for

example, verifies the identity of each guest and

crew member as they come on or off a ship.

A MILESTONE TO CELEBRATE

Despite the gravity of world events, we reached

an exciting and significant milestone in 2002

– the company surpassed 50,000 berths.

Celebrity Cruises completed its stylish

Millennium class with Constellation, the fourth

ship in the series. Celebrity, the fastest-grow-

ing of the premium brands, has doubled its

capacity to 16,350 berths, compared to 1999.

Brilliance of the Seas and Navigator of the Seas joined

the Royal Caribbean International fleet. These

newbuilds from three European shipyards

expanded our fleet to 25 ships with a capacity of

53,000 berths. By the fourth quarter of 2003,

when both Serenade of the Seas and Mariner of the Seas

are afloat, our 58,200 berths will be triple the

capacity of a scant seven years ago. Jewel of the Seas

RRhhaappssooddyy ooff tthhee SSeeaass

mmaaddee GGaallvveessttoonn,,

TTeexxaass,, aa yyeeaarr--rroouunndd

hhoommeeppoorrtt.. NNeeww

ddiinniinngg ooppttiioonnss

((ooppppoossiittee ppaaggee))

oonn NNaavviiggaattoorr ooff tthhee SSeeaass

iinncclluuddeedd JJaaddee,, wwiitthh

AAssiiaann ffuussiioonn ffooooddss..

4

ROYAL CARIBBEAN CRUISES LTD.

5

ROYAL CARIBBEAN CRUISES LTD.

will conclude our current expansion in June

2004 and lift us above 60,000 berths.

We completed a $20-million renovation of

CocoCay, our private island in the

Bahamas, with new snorkeling and water-

sports facilities, a new dining venue, and

additional bars and shops. Enhancements

to our distribution system powered our

2002 performance. Specifically, we reor-

ganized and expanded our 158-person sales

force to become the largest and strongest in

the industry. Our travel-agent-only web-

site www.cruisingpower.com was upgraded to

consolidate all online communication with

travel agents. In a distinctive marketing

effort that doubled awareness of the

Celebrity Cruises brand, we targeted savvy

travelers in “A True Departure” campaign.

Meanwhile, Royal Caribbean International

continued its acclaimed “Get Out There”

advertising campaign and also launched

communication of GOLD Anchor Service

to emphasize the outstanding, friendly

service that has pleased millions of guests

for more than 30 years.

DEPLOYMENT STRATEGIES

Flexibility in deployment – a unique strength

of the cruise industry – enabled us to open or

expand promising markets in 2002. This was

especially true in Galveston, Texas, where

Rhapsody of the Seas established our first year-

round homeport on the Gulf of Mexico,

and in Baltimore, where Galaxy cultivated a

following on Chesapeake Bay. Galaxy also

tapped an emerging market in Charleston,

South Carolina. By targeting large popula-

tions within driving distance of U.S. ports,

cruising has maintained high occupancy

rates even when some vacationers are reluc-

tant to fly to embarkation ports.

Other winter deployments in the Gulf of

Mexico in late 2002 included Nordic Empress and

Horizon in Tampa, Splendour of the Seas in

Galveston, and Grandeur of the Seas in New

Orleans. In June 2003, we will re-establish our

presence in Los Angeles with short cruises to

Mexico on Monarch of the Seas.

We will deploy five ships and almost 10,000

berths in Europe this summer – three ships

6

ROYAL CARIBBEAN CRUISES LTD.

from Royal Caribbean International and

two from Celebrity. Sailings in Europe

account for 8 percent of our annual capaci-

ty. Island Cruises, our joint venture with

United Kingdom tour operator First Choice

Holidays, experienced some startup diffi-

culties in 2002 with Island Escape, but by sum-

mer, the ship was earning much higher

customer-satisfaction ratings.

Of course, the dominant segment of our

cruise offerings remains the seven-night

Caribbean sailing (42 percent of capacity).

In November, we will deploy the fifth

of our five magnificent Voyager-class ships

when Mariner of the Seas becomes our first new-

build to sail from Port Canaveral.

CREATING VALUE

When reciting shipbuilding statistics and

enumerating the recent newbuilds, it is

worth noting that these are not assembly-

line clones with a different name painted on

the hull. Every succeeding ship is the result

of a decade of continuous innovation and

creative enhancements. We believe that by

offering the widest array of amenities in an

affordable, nearly all-inclusive package, we

are creating value and winning customers

for Royal Caribbean International and

Celebrity Cruises. For example, each of our

13 ships built from 1999 to 2004 features

575 to 760 balcony staterooms, whereas with

rare exceptions, the cruise industry’s new

ships in the 1990s were designed with no

more than 280 balcony staterooms.

Navigator of the Seas, our fourth Voyager-class

ship, entered service in December 2002 and

exemplified this evolution (and innovation)

in amenities. There are still the trendsetting

recreational features – the rock-climbing

wall, ice-skating rink, and inline skating

track – and, of course, the spectacular Royal

Promenade. But the look, inside and out, is

somewhat new. Viewed from dockside,

Navigator of the Seas casts a distinctively brighter

glow with more of a glass-sheathed appear-

ance. That is because her balconies are no

longer recessed into the structure for load-

bearing, which proved unnecessary. On the

inside, new concepts on Navigator of the Seas

AA ppaarraaddee ooff wwaaiitteerrss

sseerrvveess ccoommpplliimmeennttaarryy

ssoorrbbeett aatt ppoooollssiiddee

oonn MMiilllleennnniiuumm..

RRooyyaall CCeelleebbrriittyy

TToouurrss ((ooppppoossiittee

ppaaggee)) nnooww hhaass ffoouurr

ggllaassss--ddoommeedd ttrraaiinn--

ccaarrss iinn AAllaasskkaa..

7

ROYAL CARIBBEAN CRUISES LTD.

include the wine bar Vintages, the cruise

industry’s first wine education and enter-

tainment venue; Boleros, the first Latin jazz

bar at sea; Chops Grille, a popular steak-

house borrowed from our Radiance-class

ships; Ben & Jerry’s Ice Cream Parlor,

another first; and Jade, a buffet-style spe-

cialty restaurant with Asian fusion foods.

Each of the 13 ships in our 1999-2004

expansion has a personality all her own. The

cumulative effect is an extremely high level of

customer satisfaction. In the “2002 Reader’s

Choice Awards” poll by Condé Nast Traveler, our

company claimed 16 of the top 26 places in

the Best Large Ships category. The previous

year, we garnered 14 of the top 23 places.

STRONGEST CASH FLOW

Even as our financial health grew more

robust in 2002, we were disappointed when

our proposed combination with P&O

Princess Cruises plc was scuttled in favor of

a nominally higher offer. We received a ter-

mination fee of $62.5 million, resulting in

net proceeds of $33 million that were

included in our fourth-quarter results.

We ended the year with $1.2 billion in

liquidity and the strongest cash flow in our

history. As we near completion of our recent

capital expansion program, we believe we

have also seen the peak of our leverage posi-

tion. Now that we have achieved the critical

mass for our brands, we are working to

reduce our leverage with a smaller newbuild

program and a continued strong cash flow.

We ended 2002 with a net debt-to-capital

ratio of 56.3 percent, and we expect it to fall

rapidly as our capital commitments decline.

In 2003, we will happily welcome three

million guests onboard our ships. It was only

in 1997 that we topped one million guests for

the first time. Industry-wide, the North

American market grew to 7.4 million guests

in 2002, and Cruise Lines International

Association predicts demand will keep rising

– an estimated 8 million cruisers in 2003.

In addition to our cruise offerings, Royal

Celebrity Tours continued to establish itself as

8

ROYAL CARIBBEAN CRUISES LTD.

a premier provider of land tours in Alaska

during 2002. Royal Celebrity Tours

achieved a 38-percent increase in the num-

ber of guests in our second year of operation,

and we anticipate a similar gain this year. We

set upon the rails our third and fourth glass-

domed “Wilderness Express” traincars in

2002 and doubled our motorcoach fleet.

AND, THANKFULLY . . .

There are thousands of reasons for our suc-

cess in 2002 and our ability to meet future

challenges. My deepest thanks go first to the

more than 30,000 shipboard and shoreside

employees of Royal Caribbean International

and Celebrity Cruises whose talent, job ded-

ication, and professionalism never waver. I

am also very grateful to the many experi-

enced pros in the travel-agent community,

the lifeblood of our distribution system.

Finally, I thank our Board of Directors for

their wisdom and vision in helping build a

strong and resilient company. A special debt

of gratitude is owed to a company founder,

Arne Wilhelmsen, a stalwart member of our

board who is retiring after 35 years of dis-

tinguished service. Quite simply, Arne has

been the very bedrock upon which Royal

Caribbean grew. Amazingly, he never missed

a board meeting in 35 years. He steered us

from our start with

Song of Norway

, the ship

that featured a distinctive cocktail lounge

encircling the funnel, to a spectacular 25-

ship fleet with rock-climbing walls ascending

the funnel. Arne helped us climb, and the

company will always welcome his wise coun-

sel. We are fortunate that the Wilhelmsen

tradition will be upheld as Arne’s son, Alex,

takes his place on the board. Together, we

will build an exciting future.

Sincerely,

RICHARD D. FAIN

Chairman and

Chief Executive Officer

RRooyyaall CCaarriibbbbeeaann

IInntteerrnnaattiioonnaall uurrggeess

vvaaccaattiioonneerrss wwiitthh

aaccttiivvee lliiffeessttyylleess ttoo

""GGeett OOuutt TThheerree..""

CCeelleebbrriittyy CCrruuiisseess

pprroommootteess ""AA TTrruuee

DDeeppaarrttuurree"" bbyy ttaarr--

ggeettiinngg tthhee ssaavvvvyy

ttrraavveelleerrss wwhhoo aarree

ooffffeerreedd lluuxxuurriioouuss

sseettttiinnggss,, ssuucchh aass

TThhee OOllyymmppiicc

ddiinniinngg rroooomm

((ooppppoossiittee ppaaggee))

oonn MMiilllleennnniiuumm..

9

ROYAL CARIBBEAN CRUISES LTD.

AAlloonnggssiiddee aa

ggaass--ttuurrbbiinnee eennggiinnee

tthhaatt ppoowweerrss aallll

MMiilllleennnniiuumm-- aanndd

RRaaddiiaannccee--ccllaassss sshhiippss,,

CChhiieeff EEnnggiinneeeerr

IIrraakklliiss BBaallttssaavviiaass

((ppooiinnttiinngg)) eexxppllaaiinnss

aa mmaaiinntteennaannccee

pprroocceedduurree ttoo

CCaapptt.. GGeerraassiimmooss

AAnnddrriiaannaattooss.. FFiirrsstt

EEnnggiinneeeerr GGeeoorrggee

SSppiirreelllliiss mmaakkeess

tthhee aaddjjuussttmmeenntt..

10

ROYAL CARIBBEAN CRUISES LTD.

Royal Caribbean International and Celebrity Cruises sail to more than 200 ports of call,

equipping our fleet with the most advanced environmental technologies while upholding the

most stringent environmental policies. We understand that because we make our living from

the sea, we must adhere to the highest standards of marine conservation.

Our Environmental Management System, for which both brands have met ISO 14001 envi-

ronmental standards, stresses continual improvement. We have a dedicated position for an

Environmental Officer on every ship. This senior officer provides oversight and verification

of the ship’s environmental operations, making sure that all waste streams are managed prop-

erly. Additionally, the Environmental Officer is responsible for maintaining crew training for

our Save The Waves

®

, ISO 14001, and health and safety programs.

RECOGNITION AND PROTECTION

In 2002, Celebrity Cruises was the only cruise line to be awarded the prestigious William M.

Benkert Award for Environmental Excellence, the top national award for marine environmen-

tal protection given by the U.S. Coast Guard. This award recognizes Celebrity’s commitment

to an environmental program that far exceeds mere compliance with regulatory standards.

Our industry-leading use of gas turbines was recognized in 2002 by

Lloyd’s List

, a leading

maritime publication, when

Millennium

received the “Innovation in Shipbuilding” award.

Porthole Cruise Magazine

acknowledged Royal Caribbean International’s environmental

stewardship by naming it “Best Eco-Friendly Cruise Line” for 2002.

Conservation International just published an interim summary report on the cruise

industry, “A Shifting Tide – Environmental Challenges and Cruise Industry Response,”

that applauds numerous aspects of the environmental practices and policies of Royal

Caribbean International and Celebrity Cruises.

ENVIRONMENTAL LETTER

11

ROYAL CARIBBEAN CRUISES LTD.

In 2002, our fleet conducted reviews with onboard testing of several advanced wastewater

treatment systems. Research concluded that some systems purify wastewater almost to

drinking-water standards. By summer 2003, half of our combined Alaska fleet will have

the most advanced wastewater treatment systems onboard. We participated last summer in

separate studies of cruise-vessel discharges by Alaska’s Department of Environmental

Conservation and the Environmental Protection Agency, which determined that the

effluent has no discernable impact when purified to regulatory standards. The EPA study,

for example, found that dilution rates of discharges from ships at sea were far better than

anticipated – up to one part per 640,000.

Our pursuit of advanced technologies has made our fleet more and more environmental-

ly friendly. With

Constellation

and

Brilliance of the Seas

in 2002, we launched our fifth

and sixth ships equipped with smokeless gas-turbine engines. This technology drastically

reduces exhaust emissions of nitrous oxide (by 85 percent) and sulfur oxides (by more than

90 percent). By June 2004, eight of our ships will be so equipped.

COMMITMENT TO THE FUTURE

Royal Caribbean Cruises Ltd. has remained steadfast in its support of ocean research with

the oceanic and atmospheric laboratories operating the past 2 1/2 years onboard Explorer of

the Seas. Our joint venture with the University of Miami’s Rosenstiel School of Marine and

Atmospheric Science provides valuable tools for researchers to study ocean phenomena in

the eastern Caribbean (

www.rsmas.miami.edu

).

We also support marine conservation through our Ocean Fund. In 6 1/2 years, we have donated

$6 million to 37 different organizations for projects ranging from marine science education to

the protection of coral reefs, marine mammals, sea turtles, and endangered fish populations.

Separately, the crew of Sovereign of the Seas, the company’s 2001 Environmental Ship of the

Year, donated its $25,000 prize to establish an artificial reef in the Bahamas. Through the

Reef Ball Foundation, concrete reef balls seeded with coral polyps are strategically placed

where new reefs are desired. Monarch of the Seas, the 2001 Innovative Ship of the Year, used

its prize to educate children in Key West on protecting reefs through proper waste dispos-

al and recreational boating practices.

I am proud of the commitments and progress we have made to ensure that our ships are

equipped with the latest technologies to protect our fragile ocean environment. I am also

proud of the men and women who serve on our ships and their dedication to our commit-

ment to our ABC (Above and Beyond Compliance) program.

Sincerely,

CAPT. WILLIAM S. WRIGHT

Senior VP, Safety & Environment

12

(from left to right)

EDWIN W. STEPHAN

Royal Caribbean Cruises Ltd.

WILLIAM K. REILLY

Aqua International Partners

LAURA LAVIADA

Pro Mujer

RICHARD D. FAIN

Royal Caribbean Cruises Ltd.

THOMAS J. PRITZKER

The Pritzker Organization, LLC

ARNE WILHELMSEN

A. Wilhelmsen AS

EYAL OFER

Carlyle M.G. Limited

ARVID GRUNDEKJOEN

Awilco ASA

GERT W. MUNTHE

Ferd Private Equity

BERNARD W. ARONSON

ACON Investments, LLC

TOR B. ARNEBERG

Nightingale & Associates, Inc.

JOHN D. CHANDRIS

Chandris (UK) Limited

EXECUTIVE OFFICERS

RICHARD D. FAIN

Chairman and

Chief Executive Officer,

Royal Caribbean Cruises Ltd.

JACK L. WILLIAMS

President and

Chief Operating Officer,

Royal Caribbean International

and Celebrity Cruises

BONNIE S. BIUMI

Acting Chief Financial Officer,

Vice President and Treasurer,

Royal Caribbean Cruises Ltd.

ADAM GOLDSTEIN

Executive Vice President,

Brand Operations

Royal Caribbean International

ROYAL CARIBBEAN CRUISES LTD.

BOARD OF DIRECTORS

13

ROYAL CARIBBEAN CRUISES LTD.

FINANCIAL TABLE OF CONTENTS

14 Management’s Discussion and Analysis of

Financial Condition and Results of Operations

24 Consolidated Statements of Operations

25 Consolidated Balance Sheets

26 Consolidated Statements of Cash Flows

27 Consolidated Statements of Shareholders’ Equity

28 Notes to the Consolidated Financial Statements

40 Report of Independent Certified Public Accountants

41 Shareholder Information

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

14

ROYAL CARIBBEAN CRUISES LTD.

As used in this document, the terms "Royal Caribbean," "we," "our" and "us" refer to Royal

Caribbean Cruises Ltd., the term "Celebrity" refers to Celebrity Cruise Lines Inc. and the terms

"Royal Caribbean International" and "Celebrity Cruises" refer to our two cruise brands. In accor-

dance with industry practice, the term "berths" represents double occupancy capacity per cabin

even though many cabins can accommodate three or more guests.

Certain statements under this caption "Management's Discussion and Analysis of Financial

Condition and Results of Operations," in our letter to shareholders and elsewhere in this docu-

ment constitute forward-looking statements under the Private Securities Litigation Reform Act

of 1995. Forward-looking statements do not guarantee future performance and may involve

risks, uncertainties and other factors which could cause our actual results, performance or

achievements to differ materially from the future results, performance or achievements

expressed or implied in those forward-looking statements. Examples of these risks, uncertain-

ties and other factors include, but are not limited to:

• general economic and business conditions,

• vacation industry competition, including cruise industry competition,

• changes in vacation industry capacity, including cruise capacity,

• the impact of tax laws and regulations affecting our business or our principal shareholders,

• the impact of changes in other laws and regulations affecting our business,

• the impact of pending or threatened litigation,

• the delivery of scheduled new ships,

• emergency ship repairs,

• incidents involving cruise ships at sea,

• reduced consumer demand for cruises as a result of any number of reasons, including armed

conflict, terrorist attacks, geo-political and economic uncertainties or the unavailability of

air service,

• changes in interest rates or oil prices, and

• weather.

The above examples are not exhaustive and new risks emerge from time to time. We undertake

no obligation to publicly update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise.

GENERAL

SUMMARY

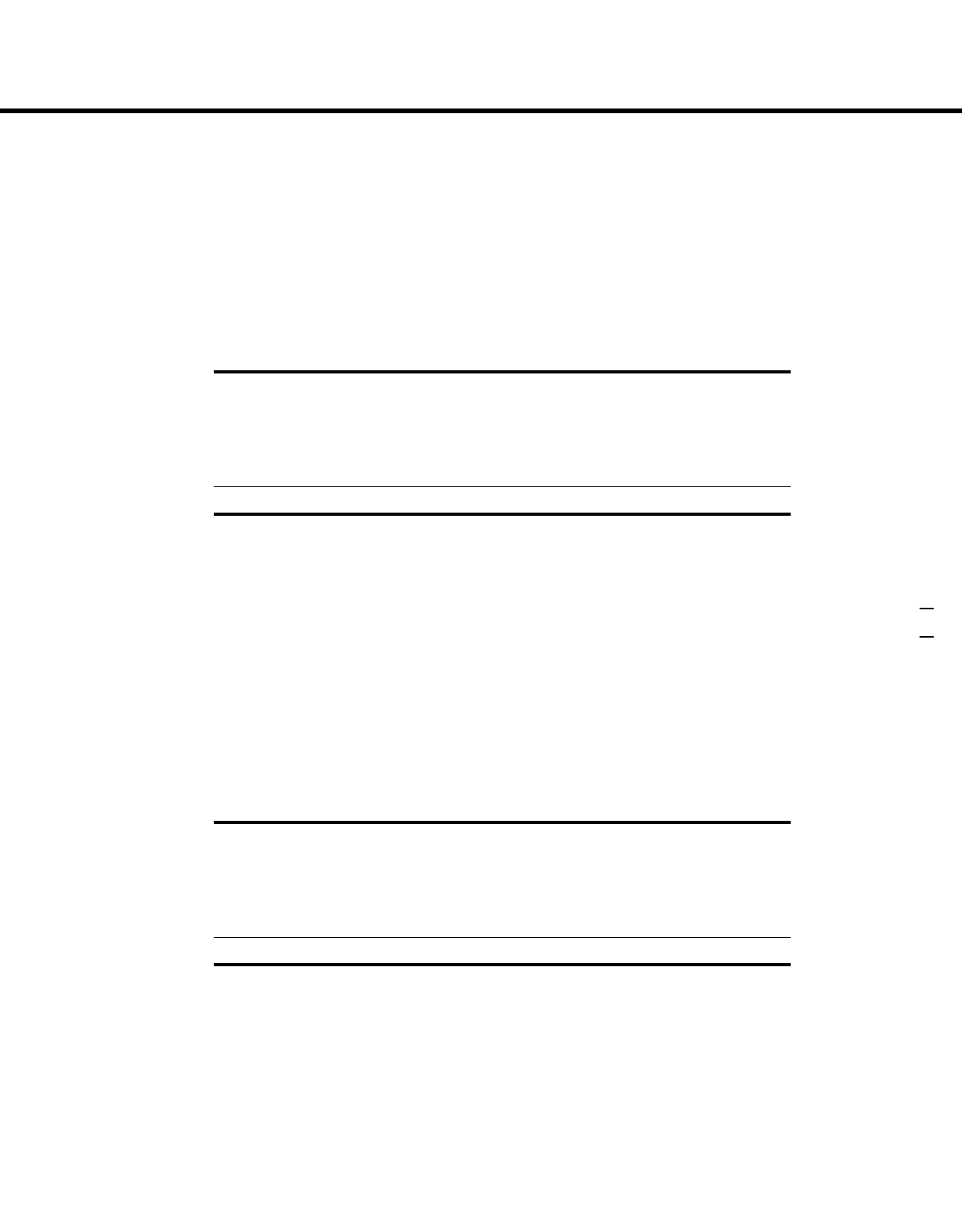

We reported revenues, operating income, net income and earnings per share as shown in the

following table:

Year Ended December 31,

(in thousands, except per share data)

2002 2001 2000

Revenues

$3,434,347 $3,145,250 $2,865,846

Operating Income

550,975 455,605 569,540

Net Income

351,284 254,457 445,363

Basic Earnings Per Share

$ 1.82 $ 1.32 $ 2.34

Diluted Earnings Per Share $ 1.79 $ 1.32 $ 2.31

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

15

Unaudited selected statistical information is shown in the following table:

Year Ended December 31,

2002 2001 2000

Guests Carried

2,768,475 2,438,849 2,049,902

Guest Cruise Days

18,112,782 15,341,570 13,019,811

Occupancy Percentage 104.5% 101.8% 104.4%

Net income increased 38.1% to $351.3 million or $1.79 per share on a diluted basis in 2002

compared to $254.5 million or $1.32 per share in 2001. The increase in net income was prima-

rily the result of an increase in capacity associated with the addition of

Infinity

,

Radiance of the

Seas

,

Summit

and

Adventure of the Seas

in 2001 and

Constellation

,

Brilliance of the Seas

and

Navigator of the Seas

in 2002.

Net income for 2002 included net proceeds of $33.0 million received in connection with the

termination of our merger agreement with P&O Princess Cruises plc (“P&O Princess”) and a

charge of approximately $20.0 million recorded in connection with a litigation settlement. (See

Note 12 – Commitments and Contingencies.) Net income for 2001 was adversely impacted

by approximately $47.7 million due to lost revenues and extra costs directly associated with

passengers not being able to reach their departure ports during the weeks following the ter-

rorist attacks of September 11, 2001 and costs associated with business decisions taken in

the aftermath of the attacks.

We have canceled a total of five weeks of sailings in the first quarter of 2003 due to the un-

anticipated drydock of one ship, which we estimate will negatively impact net income by

approximately $0.06 per share.

TERMINATION OF PROPOSED COMBINATION WITH P&O PRINCESS

In October 2002, our proposed combination with P&O Princess was terminated prior to its con-

summation and P&O Princess paid us a break fee of $62.5 million. We incurred approximately

$29.5 million of merger-related costs. We also agreed to terminate, effective as of January 1,

2003, our joint venture with P&O Princess. The venture was terminated before it commenced

business operations.

FLEET EXPANSION

Our current fleet expansion program encompasses three distinct ship designs known as the

Voyager class, Millennium class and Radiance class. Since 1999, we have taken delivery of four

Voyager, four Millennium and two Radiance-class ships. We currently operate 25 ships with

53,042 berths.

We have three ships on order for the Royal Caribbean International brand. The planned berths

and expected delivery dates of the ships on order are as follows:

Ship Expected Delivery Date Berths

Voyager class:

Mariner of the Seas

4th Quarter 2003 3,114

Radiance class:

(1)

Serenade of the Seas

3rd Quarter 2003 2,076

Jewel of the Seas

2nd Quarter 2004 2,076

(1) We have options on two Radiance-class ships with delivery dates in the fourth quarters of 2005 and 2006.

We believe the Voyager-class ships are the largest and the most innovative passenger

cruise ships ever built. The Radiance-class ships are a progression from Royal Caribbean

International's Vision-class ships.

ROYAL CARIBBEAN CRUISES LTD.

16

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

CRITICAL ACCOUNTING POLICIES

Our consolidated financial statements are prepared in accordance with accounting principles

generally accepted in the United States, which require us to make estimates. (See Note 1 –

General and Note 2 – Summary of Significant Accounting Policies.) Certain of our accounting

policies are deemed "critical," as they require management's highest degree of judgment, esti-

mates and assumptions. We have discussed these accounting estimates and disclosures with

the audit committee of our board of directors. A discussion of what we believe to be our most

critical accounting policies follows:

SHIP ACCOUNTING

Our ships represent our most significant assets and we state them at cost less accumulated

depreciation and amortization. Depreciation of ships, which includes amortization of ships under

capital leases, is computed net of a 15% projected residual value using the straight-line method

over estimated service lives of primarily 30 years. Improvement costs that we believe add value

to our ships are capitalized as additions to the ship and depreciated over the improvements’

estimated useful lives. Repairs and maintenance activities are charged to expense as incurred.

Our depreciation and amortization assumptions take into consideration the impact of antici-

pated technological changes, long-term cruise and vacation market conditions and historical

useful lives of similarly-built ships. Given the very large and complex nature of our ships, our

accounting estimates related to ships and determinations of ship improvement costs to be

capitalized require considerable judgment and are inherently uncertain. Should certain factors

or circumstances cause us to revise our estimate of ship service lives or projected residual

values, depreciation expense could be materially lower or higher. If circumstances cause us to

change our assumptions in making determinations as to whether ship improvements should be

capitalized, the amounts we expense each year as repairs and maintenance costs could

increase, partially offset by a decrease in depreciation expense.

VALUATION OF LONG-LIVED ASSETS AND GOODWILL

We review long-lived assets for impairment whenever events or changes in circumstances indi-

cate that the carrying amount of these assets may not be fully recoverable. The assessment of

possible impairment is based on our ability to recover the carrying value of our asset based on

our estimate of its undiscounted future cash flows. If these estimated future cash flows are less

than the carrying value of the asset, an impairment charge is recognized for the difference

between the asset's estimated fair value and its carrying value. In addition, goodwill is reviewed

annually, or earlier, if there is an indication of impairment.

The determination of fair value is based on quoted market prices in active markets, if available.

Such markets are often not available for used cruise ships. Accordingly, we also base fair value

on independent appraisals, sales price negotiations and projected future cash flows discounted

at a rate determined by management to be commensurate with our business risk. The estima-

tion of fair value utilizing discounted forecasted cash flows includes numerous uncertainties

which require our significant judgment when making assumptions of revenues, operating costs,

marketing, selling and administrative expenses, interest rates, ship additions and retirements,

cruise industry competition and general economic and business conditions, among other factors.

We believe we made reasonable estimates and judgments in determining whether our long-lived

assets and goodwill have been impaired; however, if there is a material change in the assumptions

used in our determination of fair values or if there is a material change in the conditions or cir-

cumstances influencing fair value, we could be required to recognize a material impairment charge.

17

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

CONTINGENCIES – LITIGATION

On an ongoing basis, we assess the potential liabilities related to any lawsuits or claims brought

against us. While it is typically very difficult to determine the timing and ultimate outcome of

such actions, we use our best judgment to determine if it is probable that we will incur an

expense related to the settlement or final adjudication of such matters and whether a reason-

able estimation of such probable loss, if any, can be made. In assessing probable losses, we

take into consideration estimates of the amount of insurance recoveries, if any. We accrue a

liability when we believe a loss is probable and the amount of loss can be reasonably estimat-

ed. Due to the inherent uncertainties related to the eventual outcome of litigation and potential

insurance recoveries, it is possible that certain matters may be resolved for amounts material-

ly different from any provisions or disclosures that we have previously made.

PROPOSED STATEMENT OF POSITION

On June 29, 2001, the Accounting Standards Executive Committee of the American Institute

of Certified Public Accountants issued a proposed Statement of Position (“SOP”),

“Accounting for Certain Costs and Activities Related to Property, Plant and Equipment.” Under

the proposed SOP, we would be required to adopt a component method of accounting for our

ships. Using this method, each component of a ship would be identified as an asset and depre-

ciated over its own separate expected useful life. In addition, we would have to expense dry-

docking costs as incurred which differs from our current policy of accruing future drydocking

costs evenly over the period to the next scheduled drydocking. Lastly, liquidated damages

received from shipyards as mitigation of consequential economic costs incurred as a result of

the late delivery of a new ship would have to be recorded as a reduction of the ship's cost basis

versus our current treatment of recording liquidated damages as nonoperating income. We

have not yet analyzed the impact that this proposed SOP would have on our results of opera-

tion or financial position, as we are uncertain whether, or in what form, it will be adopted.

RESULTS OF OPERATIONS

The following table presents operating data as a percentage of revenues:

Year Ended December 31,

2002 2001 2000

Revenues

100.0% 100.0% 100.0%

Expenses:

Operating

61.5 61.5 57.7

Marketing, selling and administrative

12.6 14.4 14.4

Depreciation and amortization 9.9 9.6 8.0

Operating Income

16.0 14.5 19.9

Other Income (Expense) (5.8) (6.4) (4.4)

Net Income 10.2% 8.1% 15.5%

18

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

Year Ended December 31, 2002 Compared to Year Ended December 31, 2001

REVENUES

Revenues increased 9.2% to $3.4 billion from $3.1 billion in 2001. The increase in revenues

was primarily due to a 15.0% increase in capacity, partially offset by a 5.1% decline in gross

revenue per available passenger cruise day. The increase in capacity was associated with the

additions of

Infinity

,

Radiance of the Seas

,

Summit

and

Adventure of the Seas

during 2001,

and

Constellation

,

Brilliance of the Seas

and

Navigator of the Seas

in 2002, partially offset by

the transfer of

Viking Serenade

to Island Cruises, our joint venture with First Choice Holidays

PLC. The decline in gross revenue per available passenger cruise day was primarily associat-

ed with a lower percentage of guests who chose to book their air passage through us, lower

cruise ticket prices following the events of September 11, 2001, a general softness in the

United States economy and an increase in industry capacity. Net revenue per available pas-

senger cruise day (“net yields”) for 2002 declined 0.7% from 2001. Net revenue represents

gross revenues less costs of air transportation, travel agent commissions and other direct

costs of sales. Occupancy for 2002 was 104.5% compared to 101.8% in 2001.

Each year the cruise industry generally experiences a period of increased bookings, referred to as

the “wave period,” that begins in early January and typically extends through February. In recent

years, there has been a trend towards bookings closer-in to the sail dates. On January 30, 2003,

we noted that this trend has reduced the importance of the wave period as an indicator of full year

booking patterns while making it even more relevant for first quarter bookings. We also noted that

bookings for the 2003 wave period were slower than we had anticipated, especially for sailings

earlier in the year. We believe this can be attributed to uncertainty about the conflict in Iraq coupled

with a weaker economy and the impact of last December’s publicity concerning stomach flu.

While wave period bookings were lower than 2002, we had very strong bookings for 2003 sail-

ings in late 2002 and we did not have to replace bookings as we did in late 2001 and early 2002

to make up for the bookings lost in the aftermath of September 11, 2001. As a result, we expect-

ed to achieve an increase in net yields for the first quarter of 2003 in the range of 2% to 4%.

Since then, bookings have become even softer and the war in Iraq makes it even more difficult

to make predictions. Nevertheless, we still expect net yields for the first quarter to increase in

the range of 2% to 4%. We also expect that net yields in the second quarter will be below last

year’s level.

EXPENSES

Operating expenses increased 9.2% to $2.1 billion in 2002 compared to $1.9 billion in 2001.

Included in operating expenses in 2002 is a charge of $20.0 million recorded in connection with

a litigation settlement. (See Note 12 – Commitments and Contingencies.) Operating costs per

available passenger cruise day in 2002 declined 5.0% from 2001. The decline on a per available

passenger cruise day basis was associated with fewer guests purchasing air passage through

us and lower commissions resulting from reduced cruise ticket prices.

Marketing, selling and administrative expenses decreased 5.1% to $431.1 million in 2002 com-

pared to $454.1 million in 2001. Marketing, selling and administrative expenses as a percentage of

revenues were 12.6% and 14.4% in 2002 and 2001, respectively. Included in 2001 were charges

associated with business decisions taken subsequent to the events of September 11, 2001 involv-

ing itinerary changes, office closures and severance costs related to a reduction in force. On a per

available passenger cruise day basis, marketing, selling and administrative expenses in 2002

decreased 17.5% from 2001 primarily due to economies of scale and cost reduction initiatives.

Operating and marketing, selling and administrative expenses, on a per available passenger

cruise day basis, are expected to increase 6% to 8% in 2003 attributable in part to increases

in fuel costs, changes in our concession arrangement for the Celebrity brand food service,

the full year impact of the operating lease for

Brilliance of the Seas,

and higher insurance

and security costs.

Depreciation and amortization increased 12.6% to $339.1 million in 2002 from $301.2 million in

2001. The increase was primarily due to incremental depreciation associated with the addition

of new ships, partially offset by the elimination of $10.4 million of goodwill amortization in 2002.

(See Note 2 – Summary of Significant Accounting Policies.)

19

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

OTHER INCOME (EXPENSE)

Gross interest expense, excluding capitalized interest, was $290.3 million in 2002, essentially

unchanged from 2001. The increase in the average debt level associated with our fleet expan-

sion program was offset by a decrease in interest rates. Capitalized interest decreased to $23.4

million in 2002 from $37.0 million in 2001 due to a lower average level of investment in ships

under construction and lower interest rates.

Included in Other income (expense) in 2002 was $33.0 million of net proceeds received in con-

nection with the termination of the P&O Princess merger agreement. Also included in Other

income (expense) in 2002 and 2001 were $20.3 million and $19.4 million, respectively, of divi-

dend income from our investment in convertible preferred stock of First Choice Holidays PLC

as well as $12.3 million and $7.2 million, respectively, of compensation from shipyards related

to the late delivery of ships, partially offset by $6.6 million and $1.6 million, respectively, of loss-

es from affiliated operations as well as other miscellaneous items.

Year Ended December 31, 2001 Compared to Year Ended December 31, 2000

REVENUES

Revenues increased 9.7% to $3.1 billion from $2.9 billion in 2000. The increase in revenues was

primarily due to a 20.8% increase in capacity, partially offset by a 9.1% decline in gross revenue

per available passenger cruise day. The increase in capacity was primarily due to the addition of

Millennium

and

Explorer of the Seas

in 2000, and

Infinity

,

Radiance of the Seas

,

Summit

and

Adventure of the Seas

in 2001. The increase in new capacity was partially offset by the can-

cellation of 14 weeks of sailings due to ship incidents and the events of September 11, 2001.

The decline in gross revenue per available passenger cruise day was primarily attributed to the

events related to September 11, 2001, a general softness in the United States economy and a

significant growth of our fleet capacity. Net yields for 2001 declined 9.1% from the prior year.

Occupancy for 2001 was 101.8% compared to 104.4% in 2000.

EXPENSES

Operating expenses increased 17.1% to $1.9 billion in 2001 compared to $1.7 billion for the

same period in 2000. The increase is primarily due to additional costs associated with in-

creased capacity.

Marketing, selling and administrative expenses increased 10.0% to $454.1 million in 2001 from

$412.8 million in 2000. On a per available passenger cruise day basis, marketing, selling and

administrative expenses decreased 8.9% primarily due to economies of scale and cost con-

tainment efforts, partially offset by business decisions taken subsequent to the events of

September 11, 2001 involving itinerary changes, office closures and severance costs related to

a reduction in force. Marketing, selling and administrative expenses as a percentage of rev-

enues were 14.4% for 2001 and 2000.

Cost savings initiatives from 2000 and 2001 contributed to a 4.5% reduction in operating costs

and marketing, selling and administrative expenses on a per available passenger cruise day

basis, excluding fuel costs, in 2001 compared to 2000.

Depreciation and amortization increased 30.4% to $301.2 million in 2001 from $231.0 million

in 2000. The increase is primarily due to incremental depreciation associated with the addition

of new ships.

OTHER INCOME (EXPENSE)

Gross interest expense, excluding capitalized interest, increased to $290.2 million in 2001 com-

pared to $198.5 million in 2000. The increase is primarily due to an increase in the average debt

level associated with our fleet expansion program, partially offset by a reduction in our weighted-

average interest rate. Capitalized interest decreased from $44.2 million in 2000 to $37.0 million

in 2001 due to a lower average level of investment in ships under construction and lower inter-

est rates.

20

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

Included in Other income (expense) in 2001 and 2000 is $19.4 million and $9.2 million, respec-

tively, of dividend income from our investment in convertible preferred stock of First Choice

Holidays PLC and $7.2 million and $10.2 million in 2001 and 2000, respectively, of compensa-

tion from a shipyard related to the late delivery of ships.

LIQUIDITY AND CAPITAL RESOURCES

SOURCES AND USES OF CASH

Net cash provided by operating activities was $870.5 million in 2002 compared to $633.7 mil-

lion in 2001 and $703.3 million in 2000. The change in each year was primarily due to the tim-

ing of cash receipts related to customer deposits and fluctuations in net income.

During the year ended December 31, 2002, our capital expenditures were approximately $1.0

billion compared to approximately $2.1 billion in 2001 and $1.3 billion in 2000. The largest por-

tion of capital expenditures related to the deliveries of

Constellation

and

Navigator of the Seas

in 2002;

Infinity

,

Radiance of the Seas

,

Summit

and

Adventure of the Seas

in 2001; and

Millennium

and

Explorer of the Seas

in 2000, as well as progress payments for ships under

construction in all years.

Capitalized interest decreased to $23.4 million in 2002 from $37.0 million in 2001 and $44.2

million in 2000 due to a lower average level of investment in ships under construction and

lower interest rates.

In July 2002, we financed the addition of

Brilliance of the Seas

to our fleet by novating our orig-

inal ship building contract and entering into a long-term operating lease denominated in British

pound sterling. The total lease term is 25 years cancelable by either party at years 10 and 18.

In connection with the novation of the contract, we received $77.7 million for reimbursement of

shipyard deposits previously made.

During 2002, we obtained financing of $0.3 billion related to the acquisition of

Constellation

. In

2001, we received net cash proceeds of $1.8 billion from the issuance of Senior Notes, Liquid

Yield Option™ Notes, Zero Coupon Convertible Notes, term loans, and drawings on our revolv-

ing credit facility as well as obtained financing of $0.3 billion related to the acquisition of

Summit

.

During 2000, we received net proceeds of $1.2 billion from the issuance of term loans and

drawings on our revolving credit facility. These funds were used for ship deliveries and general

corporate purposes, including capital expenditures. (See Note 6 – Long-Term Debt.)

The Liquid Yield Option™ Notes and the Zero Coupon Convertible Notes are zero coupon

bonds with yields to maturity of 4.875% and 4.75%, respectively, due 2021. Each Liquid Yield

Option™ Note and Zero Coupon Convertible Note was issued at a price of $381.63 and

$391.06, respectively, and will have a principal amount at maturity of $1,000. The Liquid Yield

Option™ Notes and Zero Coupon Convertible Notes are convertible at the option of the hold-

er into 17.7 million and 13.8 million shares of common stock, respectively, if the market price

of our common stock reaches certain levels. These conditions were not met at December 31,

2002 for the Liquid Yield Option™ Notes or the Zero Coupon Convertible Notes and therefore,

the shares issuable upon conversion are not included in the earnings per share calculation.

We may redeem the Liquid Yield Option™ Notes beginning on February 2, 2005, and the Zero

Coupon Convertible Notes beginning on May 18, 2006, at their accreted values for cash as a

whole at any time, or from time to time in part. Holders may require us to purchase any out-

standing Liquid Yield Option™ Notes at their accreted value on February 2, 2005 and February

2, 2011 and any outstanding Zero Coupon Convertible Notes at their accreted value on May

18, 2004, May 18, 2009, and May 18, 2014. We may choose to pay the purchase price in cash

or common stock or a combination thereof. In addition, we have a three-year, $345.8 million

unsecured variable rate term loan facility available to us should the holders of the Zero Coupon

Convertible Notes require us to purchase their notes on May 18, 2004.

21

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

In July 2000, we invested approximately $300 million in convertible preferred stock issued by

First Choice Holidays PLC. (See Note 5 – Other Assets.) Independently, we entered into a joint

venture with First Choice Holidays PLC to launch a new cruise brand, Island Cruises. As part

of the transaction, ownership of

Viking Serenade

was transferred to the joint venture at a valu-

ation of $95.4 million. The contribution of

Viking Serenade

represented our 50% investment in

the joint venture, as well as $47.7 million in proceeds used towards the purchase price of the

convertible preferred stock.

We made principal payments totaling approximately $603.3 million, $45.6 million and $128.1

million under various term loans, senior notes, revolving credit facility and capital leases during

2002, 2001 and 2000, respectively.

During 2002, 2001 and 2000, we paid quarterly cash dividends on our common stock totaling

$100.1 million, $100.0 million and $91.3 million, respectively. In April 2000, we redeemed all

outstanding shares of our convertible preferred stock and dividends ceased to accrue. We paid

quarterly cash dividends on our convertible preferred stock totaling $3.1 million in 2000.

FUTURE COMMITMENTS

We currently have three ships on order for an additional capacity of 7,266 berths. The aggre-

gate contract price of the three ships, which excludes capitalized interest and other ancillary

costs, is approximately $1.3 billion, of which we have deposited $0.2 billion as of December 31,

2002. We anticipate that overall capital expenditures will be approximately $1.1 billion, $0.5 bil-

lion and $0.1 billion for 2003, 2004 and 2005, respectively.

We have options to purchase two additional Radiance-class ships with delivery dates in the

fourth quarters of 2005 and 2006. The options have an aggregate contract price of $0.8 billion

and expire on September 19, 2003. Under the terms of the options, the shipyard has the abili-

ty to terminate them upon providing us advance notice.

We have $5.4 billion of long-term debt of which $0.1 billion is due during the 12-month period

ending December 31, 2003. Included in Long-term debt are two ships financed with capital

leases. (See Note 6 – Long-Term Debt.)

We are obligated under noncancelable operating leases primarily for a ship, office and warehouse

facilities, computer equipment and motor vehicles. As of December 31, 2002, future minimum

lease payments under noncancelable operating leases aggregated to $413.9 million, due through

2028. We have future commitments to pay for our usage of certain port facilities, maintenance

contracts and communication services aggregating to $261.6 million, due through 2027. (See

Note 12 – Commitments and Contingencies.)

Under the

Brilliance of the Seas

long-term operating lease, we have agreed to indemnify the les-

sor to the extent its after-tax return is negatively impacted by unfavorable changes in corporate

tax rates and capital allowance deductions. These indemnifications could result in an increase in

our annual lease payments. We are unable to estimate the maximum potential increase in such

lease payments due to the various circumstances, timing or combination of events that could trig-

ger such indemnifications. Current facts indicate that an indemnification is not probable; howev-

er, if one occurs, we may have remedies available to us under the terms of the lease agreement.

As a normal part of our business, depending on market conditions, pricing and our overall

growth strategy, we continuously consider opportunities to enter into contracts for the building

of additional ships. We may also consider the sale of ships. We continuously consider potential

acquisitions and strategic alliances. If any of these were to occur, they would be financed

through the incurrence of additional indebtedness, the issuance of additional shares of equity

securities or through cash flows from operations.

22

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

FUNDING SOURCES

As of December 31, 2002, our liquidity was $1.2 billion consisting of approximately $0.2 billion

in cash and cash equivalents and $1.0 billion available under our $1.0 billion unsecured revolv-

ing credit facility. Our $1.0 billion revolving credit facility expires in June 2003. Any amounts out-

standing at that time will be payable immediately if the facility is not replaced. We intend to

replace this facility prior to its expiration date, although such replacement may be at an amount

less than $1.0 billion. In addition, we have commitments for export financing for up to 80% of

the contract price of two ships on order,

Serenade of the Seas

and

Jewel of the Seas

, not to

exceed $624.0 million in aggregate. Capital expenditures and scheduled debt payments will be

funded through a combination of cash flows from operations, drawdowns under our available

credit facilities, the incurrence of additional indebtedness and the sales of equity or debt secu-

rities in private or public securities markets. Geo-political and economic uncertainties coupled

with market volatility have adversely impacted terms and availability of financing in the financial

markets, and it is indeterminable how long this situation will continue. Therefore, there can be

no assurances that cash flows from operations and additional financing from external sources

will be available in accordance with our expectations.

Our financing agreements contain covenants that require us, among other things, to maintain

minimum liquidity, net worth, and fixed charge coverage ratio and limit our debt to capital ratio.

We are in compliance with all covenants as of December 31, 2002.

We believe our availability under current existing credit facilities, cash flows from operations and

our ability to obtain new borrowings and/or raise new capital will be sufficient to fund opera-

tions, debt payment requirements and capital expenditures over the next year.

FINANCIAL INSTRUMENTS AND OTHER

GENERAL

We are exposed to market risk attributable to changes in interest rates, foreign currency

exchange rates and fuel prices. We minimize these risks through a combination of our normal

operating and financing activities and through the use of derivative financial instruments

pursuant to our hedging practices and policies. The financial impacts of these hedging instru-

ments are primarily offset by corresponding changes in the underlying exposures being hedged.

We achieve this by closely matching the amount, term and conditions of the derivative instrument

with the underlying risk being hedged. We do not hold or issue derivative financial instruments

for trading or other speculative purposes. Derivative positions are monitored using techniques

including market valuations and sensitivity analyses. (See Note 11 – Financial Instruments.)

INTEREST RATE RISK

Our exposure to market risk for changes in interest rates relates to our long-term debt obli-

gations and our operating lease for

Brilliance of the Seas

. We enter into interest rate swap

agreements to modify our exposure to interest rate movements and to manage our interest

expense and rent expense.

Market risk associated with our long-term fixed rate debt is the potential increase in fair value

resulting from a decrease in interest rates. At December 31, 2002, our interest rate swap

agreements effectively changed $375.0 million of fixed rate debt with a weighted-average

fixed rate of 7.58% to LIBOR-based floating rate debt. The estimated fair value of our long-

term fixed rate debt at December 31, 2002, excluding our Liquid Yield Option™ Notes and

Zero Coupon Convertible Notes, was $2.2 billion using quoted market prices, where avail-

able, or using discounted cash flow analyses based on market rates available to us for simi-

lar debt with the same remaining maturities. The fair value of our associated interest rate

swap agreements was estimated to be $64.0 million as of December 31, 2002 based on

quoted market prices for similar or identical financial instruments to those we hold. A hypo-

thetical one percentage point decrease in interest rates at December 31, 2002 would

increase the fair value of our long-term fixed rate debt, excluding our Liquid Yield Option™

Notes and Zero Coupon Convertible Notes, by approximately $80.3 million, net of an

increase in the fair value of the associated interest rate swap agreements.

23

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

Market risk associated with our floating rate debt is the potential increase in interest expense

from an increase in interest rates. At December 31, 2002, 58% of our debt was effectively fixed

and 42% was floating. A hypothetical one percentage point increase in interest rates would

increase our 2003 interest expense by approximately $15.7 million. At December 31, 2002, we

have interest rate swap agreements that effectively change $25.0 million of LIBOR-based float-

ing rate debt to fixed rate debt of 4.395% beginning January 2005.

Market risk associated with our operating lease for

Brilliance of the Seas

is the potential increase

in rent expense from an increase in interest rates. A hypothetical one percentage point increase in

interest rates would increase our 2003 rent expense by approximately $4.5 million. At December

31, 2002, we have interest rate swap agreements that effectively change British pound sterling

50.0 million of sterling LIBOR-based operating lease payments to fixed rate lease payments with

a weighted-average rate of 5.05% beginning January 2004.

CONVERTIBLE NOTES

The fair values of our Liquid Yield Option™ Notes and Zero Coupon Convertible Notes fluctu-

ate with the price of our common stock and at December 31, 2002 were $575.4 million and

$365.0 million, respectively. A hypothetical 10% decrease or increase in our December 31,

2002 common stock price would decrease or increase the value of our Liquid Yield Option™

Notes and Zero Coupon Convertible Notes by $10.2 million and $9.3 million, respectively.

FOREIGN CURRENCY EXCHANGE RATE RISK

Our primary exposure to foreign currency exchange rate risk relates to our firm commitments

under one ship construction contract denominated in euros. We entered into foreign currency

forward contracts to manage this risk and were substantially hedged as of December 31, 2002.

The fair value of these forward contracts at December 31, 2002, was an unrealized gain of

$31.0 million which is recorded, along with an offsetting $31.0 million fair value asset related to

our ship construction contracts, on our accompanying 2002 balance sheet. A hypothetical 10%

strengthening of the United States dollar as of December 31, 2002, assuming no changes in

comparative interest rates, would result in a $75.8 million decrease in the fair value of these

contracts. This decrease in fair value would be fully offset by a decrease in the United States

dollar value of the related foreign currency denominated ship construction contract.

We are also exposed to foreign currency exchange rate fluctuations on the United States dollar

value of our foreign currency denominated forecasted transactions. To manage this exposure, we

take advantage of any natural offsets of our foreign currency revenues and expenses and enter into

foreign currency forward contracts and/or option contracts for a portion of the remaining expo-

sure related to these forecasted transactions. Our principal net foreign currency exposure relates

to the Norwegian kroner and the euro. At December 31, 2002, the estimated fair value of such

contracts was an unrealized gain of approximately $6.4 million based on quoted market prices for

equivalent instruments with the same remaining maturities. The estimated unrealized gain has

been deferred and, if realized, will be recorded in earnings when the transactions being hedged

are recognized in 2003. A hypothetical 10% strengthening of the United States dollar as of

December 31, 2002, assuming no changes in comparative interest rates, would decrease the fair

value of these contracts by approximately $3.6 million. This decrease in fair value would be fully

offset by a decrease in the United States dollar value of the forecasted transactions being hedged.

FUEL PRICE RISK

Our exposure to market risk for changes in fuel prices relates to the consumption of fuel on our

ships. Fuel cost, as a percentage of our revenues, was approximately 4.5% in 2002, 3.7% in 2001,

and 3.3% in 2000. We use fuel swap agreements and zero cost collars to mitigate the financial

impact of fluctuations in fuel prices. As of December 31, 2002, we had fuel swap agreements and

zero cost collars to pay fixed prices for fuel with an aggregate notional amount of approximately

$39.4 million, maturing through 2003. The fair value of these contracts at December 31, 2002 was

an unrealized gain of $7.5 million. The effective portion of the estimated unrealized gain has been

deferred and, if realized, will be recorded in earnings when the transactions being hedged are rec-

ognized in 2003. We estimate that a hypothetical 10% increase in our weighted-average fuel price

for the year ended December 31, 2002 would increase our 2003 fuel cost by approximately $18.1

million. This increase would be partially offset by a $1.5 million increase in the fair value of our fuel

swap agreements.

24

ROYAL CARIBBEAN CRUISES LTD.

CONSOLIDATED STATEMENTS OF OPERATIONS

Year Ended December 31,

(in thousands, except per share data)

2002 2001 2000

INCOME STATEMENT

Revenues $3,434,347 $3,145,250 $2,865,846

Expenses

Operating 2,113,217 1,934,391 1,652,459

Marketing, selling and administrative

431,055 454,080 412,799

Depreciation and amortization 339,100 301,174 231,048

2,883,372 2,689,645 2,296,306

Operating Income 550,975 455,605 569,540

Other Income (Expense)

Interest income 12,413 24,544 7,922

Interest expense, net of capitalized interest

(266,842) (253,207) (154,328)

Other income (expense) 54,738 27,515 22,229

(199,691) (201,148) (124,177)

Net Income $ 351,284 $ 254,457 $ 445,363

EARNINGS PER SHARE:

Basic $ 1.82 $ 1.32 $ 2.34

Diluted $ 1.79 $ 1.32 $ 2.31

The accompanying notes are an integral part of these financial statements.

25

ROYAL CARIBBEAN CRUISES LTD.

CONSOLIDATED BALANCE SHEETS

As of December 31,

(in thousands, except share data)

2002 2001

ASSETS

Current Assets

Cash and cash equivalents $ 242,584 $ 727,178

Trade and other receivables, net

79,535 72,196

Inventories

37,299 33,493

Prepaid expenses and other assets 88,325 53,247

Total current assets

447,743 886,114

Property and Equipment – at cost less accumulated depreciation and amortization 9,276,484 8,605,448

Goodwill – less accumulated amortization of $138,606 278,561 278,561

Other Assets 535,743 598,659

$10,538,531 $10,368,782

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current Liabilities

Current portion of long-term debt $ 122,544 $ 238,581

Accounts payable

171,153 144,070

Accrued expenses and other liabilities

308,281 283,913

Customer deposits 567,955 446,085

Total current liabilities

1,169,933 1,112,649

Long-Term Debt 5,322,294 5,407,531

Other Long-Term Liabilities 11,610 92,018

Commitments and Contingencies (Note 12)

Shareholders’ Equity

Common stock ($.01 par value; 500,000,000 shares authorized;

192,982,513 and 192,310,198 shares issued)

1,930 1,923

Paid-in capital

2,053,649 2,045,904

Retained earnings

1,982,580 1,731,423

Accumulated other comprehensive income (loss)

3,693 (16,068)

Treasury stock (515,868 and 475,524 common shares at cost) (7,158) (6,598)

Total shareholders’ equity 4,034,694 3,756,584

$10,538,531 $10,368,782

The accompanying notes are an integral part of these financial statements.

26

ROYAL CARIBBEAN CRUISES LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31,

(in thousands)

2002 2001 2000

OPERATING ACTIVITIES

Net income $351,284 $ 254,457 $ 445,363

Adjustments:

Depreciation and amortization 339,100 301,174 231,048

Accretion of original issue discount

46,796 36,061 –

Changes in operating assets and liabilities:

Increase in trade and other receivables, net (7,339) (18,587) (150)

Increase in inventories

(3,806) (3,378) (3,717)

(Increase) decrease in prepaid expenses and other assets

(8,469) 3,305 1,865

Increase (decrease) in accounts payable

27,083 (14,073) 55,102

(Decrease) increase in accrued expenses and other liabilities

(2,240) 75,645 (8,204)

Increase (decrease) in customer deposits

121,870 2,674 (21,622)

Other, net 6,191 (3,589) 3,631

Net cash provided by operating activities 870,470 633,689 703,316

INVESTING ACTIVITIES

Purchases of property and equipment (689,991) (1,737,471) (1,285,649)

Investment in convertible preferred stock

– – (305,044)

Net proceeds from ship transfer to joint venture

– – 47,680

Other, net (6,275) (46,501) (21,417)

Net cash used in investing activities (696,266) (1,783,972) (1,564,430)

FINANCING ACTIVITIES

Proceeds from issuance of long-term debt, net – 1,834,341 1,195,000

Repayments of long-term debt

(603,270) (45,553) (128,086)

Dividends

(100,127) (99,955) (94,418)

Other, net 44,599 10,818 2,958

Net cash (used in) provided by financing activities (658,798) 1,699,651 975,454

Net (Decrease) Increase in Cash and Cash Equivalents

(484,594) 549,368 114,340

Cash and Cash Equivalents at Beginning of Year 727,178 177,810 63,470

Cash and Cash Equivalents at End of Year $242,584 $ 727,178 $ 177,810

SUPPLEMENTAL DISCLOSURES

Cash paid during the year for:

Interest, net of amount capitalized $236,523 $ 203,038 $ 146,434

Noncash investing and financing activities:

Acquisition of ship through debt $319,951 $ 326,738 $ –

The accompanying notes are an integral part of these financial statements.

27

ROYAL CARIBBEAN CRUISES LTD.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Accumulated

Other Total

Preferred Common Paid-in Retained Comprehensive Treasury Shareholders’

(in thousands)

Stock Stock Capital Earnings Income (Loss) Stock Equity

Balances at January 1, 2000 $ 172,200 $1,812 $1,866,647 $1,225,976 $ – $(5,479) $3,261,156

Issuance under preferred

stock conversion (172,200) ,106 172,094 ,0– ,00– ,00––

Issuance under employee

related plans ,00– ,003 4,370 ,0– ,00 – (559) ,003,814

Preferred stock dividends ,00– ,00– ,00– (3,121) ,00– ,00– (3,121)

Common stock dividends ,00– ,00– ,00– (91,297) – ,00– (91,297)

Net income ,00– ,00– ,00– 445,363 ,0 0– ,00– ,445,363

Balances at December 31, 2000 ,0 – 1,921 2,043,111 1,576,921 ,0 ,nn– (6,038) 3,615,915

Issuance under employee

related plans ,00– ,nn2 2,793 ,000,nn– ,0 ,nn– (560) ,002,235

Common stock dividends ,00– ,00– ,0 ,nn– (99,955) ,0 ,nn– ,00– (99,955)

Transition adjustment

SFAS No. 133 ,00– ,00– ,0 ,nn– ,0 ,nn– 7,775 ,00– 7,775

Changes related to cash flow

derivative hedges ,00– ,00– ,0 ,nn– ,0 ,nn– (23,843) ,00– (23,843)

Net income ,00– ,00– ,0 ,nn– 254,457 ,00– ,00– 254,457

Balances at December 31,2001 ,0 – 1,923 2,045,904 1,731,423 (16,068) (6,598) 3,756,584

Issuance under employee

related plans ,00– ,007 7,745 ,0 ,nn– ,00– (560) 7,192

Common stock dividends ,00– ,00– ,0 ,nn– (100,127) ,00– ,00– (100,127)

Changes related to cash flow

derivative hedges ,00– ,00– ,0 ,nn– ,0 ,nn– 19,761 ,00– 19,761

Net income ,00– ,00– ,0 ,nn– 351,284 ,00– ,00– 351,284

Balances at December 31,2002 $ ,0 – $1,930 $2,053,649 $1,982,580 $ 3,693 $(7,158) $4,034,694

Comprehensive income is as follows:

Year Ended December 31,

(in thousands)

2002 2001 2000

Net income

$351,284 $254,457 $445,363

Transition adjustment SFAS No. 133

– 7,775 –

Changes related to cash flow derivative hedges 19,761 (23,843) –

Total comprehensive income $371,045 $238,389 $445,363

The accompanying notes are an integral part of these financial statements.

28

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. GENERAL

DESCRIPTION OF BUSINESS

We are a global cruise company. We operate two cruise brands, Royal Caribbean International

and Celebrity Cruises, with 16 cruise ships and 9 cruise ships, respectively, at December 31,

2002. Our ships operate on a selection of worldwide itineraries that call on approximately 200

destinations.

BASIS FOR PREPARATION OF CONSOLIDATED FINANCIAL STATEMENTS

The consolidated financial statements are prepared in accordance with accounting principles

generally accepted in the United States and are presented in United States dollars. Estimates

are required for the preparation of financial statements in accordance with generally accepted

accounting principles. Actual results could differ from these estimates. All significant intercom-

pany accounts and transactions are eliminated in consolidation.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

CRUISE REVENUES AND EXPENSES

Deposits received on sales of guest cruises represent unearned revenue and are initially record-

ed as customer deposit liabilities on our balance sheet. Customer deposits are subsequently

recognized as cruise revenues, together with revenues from shipboard activities and all associ-

ated direct costs of a voyage, upon completion of voyages with durations of ten days or less

and on a pro rata basis for voyages in excess of ten days. Minor amounts of revenues and

expenses from pro rata voyages are estimated.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash and marketable securities with original maturities

of less than 90 days.

INVENTORIES

Inventories consist of provisions, supplies and fuel carried at the lower of cost (weighted-

average) or market.

PROPERTY AND EQUIPMENT

Property and equipment are stated at cost less accumulated depreciation and amortization. We

capitalize interest as part of the cost of construction. Improvement costs that we believe add

value to our ships are capitalized as additions to the ship and depreciated over the improve-

ments’ estimated useful lives, while costs of repairs and maintenance are charged to expense

as incurred. We review long-lived assets for impairment whenever events or changes in cir-

cumstances indicate, based on estimated future cash flows, that the carrying amount of these

assets may not be fully recoverable.

Depreciation of property and equipment, which includes amortization of ships under capi-

tal leases, is computed using the straight-line method over estimated useful lives of pri-

marily 30 years for ships, three to twelve years for other property and equipment and the

shorter of the lease term or related asset life for leasehold improvements. (See Note 4 –

Property and Equipment.)

29

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

ADVERTISING COSTS

Advertising costs are expensed as incurred except those costs which result in tangible assets,

such as brochures, which are treated as prepaid expenses and charged to expense as

consumed. Advertising expenses consist of media advertising as well as brochure, production

and direct mail costs. Media advertising was $97.9 million, $103.4 million and $98.9 million, and

brochure, production and direct mail costs were $69.5 million, $77.5 million and $79.2 million

for the years 2002, 2001 and 2000, respectively.

DRYDOCKING

Drydocking costs are accrued evenly over the period to the next scheduled drydocking and are

included in accrued expenses and other liabilities.

FINANCIAL INSTRUMENTS

We enter into various forward, swap and option contracts to manage our interest rate exposure

and to limit our exposure to fluctuations in foreign currency exchange rates and fuel prices.

Derivative instruments are recorded on the balance sheet at their fair value. On an ongoing

basis, we assess whether derivatives used in hedging transactions are "highly effective" in off-

setting changes in fair value or cash flow of hedged items and therefore qualify as either a fair

value or cash flow hedge. A derivative instrument that hedges the exposure to changes in the

fair value of a recognized asset or liability, or a firm commitment is designated as a fair value