EUROPEAN

COMMISSION

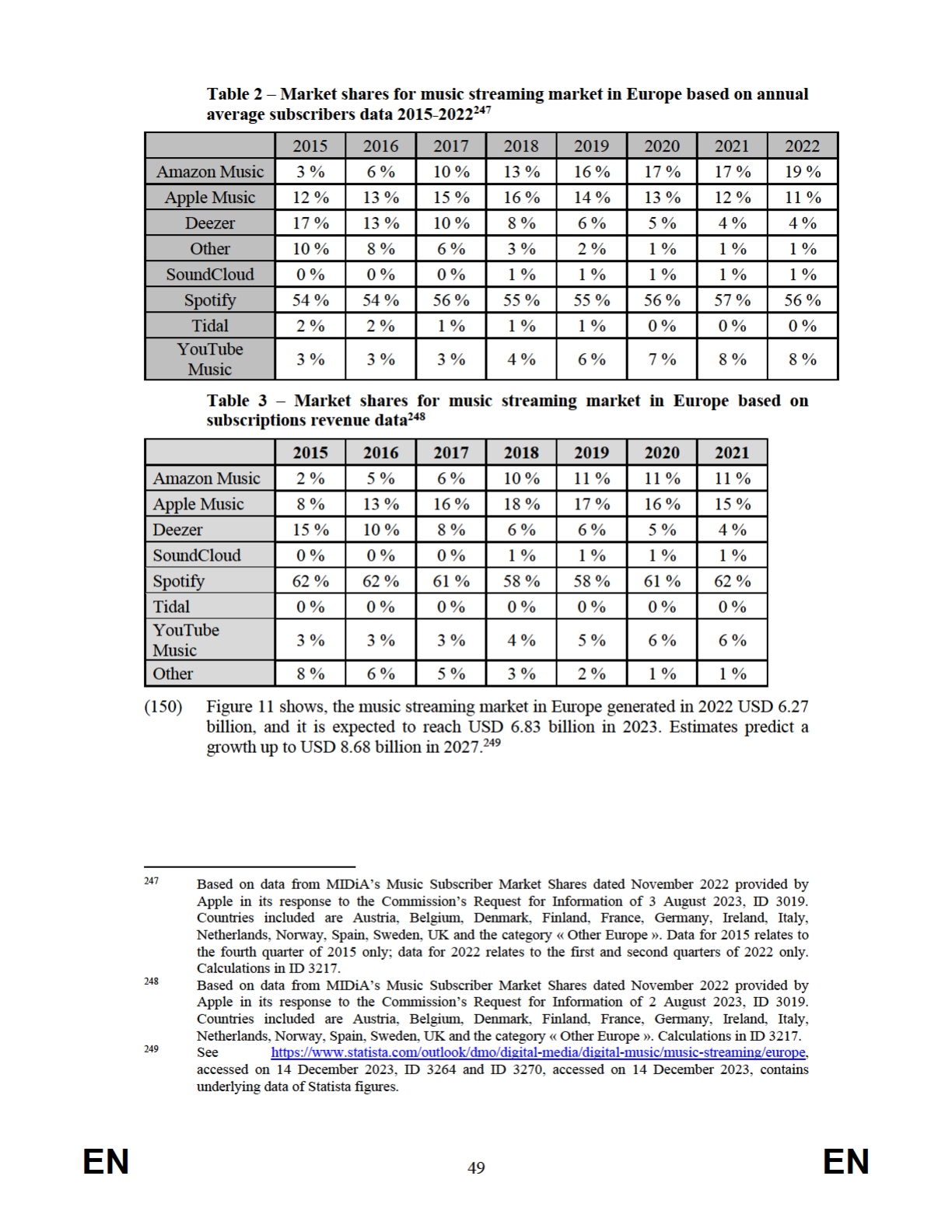

DG

Competition

CASE AT.40437 – Apple – App Store

Practices (music streaming)

(Only the English text is authentic)

ANTITRUST PROCEDURE

Council Regulation (EC) 1/2003

Article 7 Regulation (EC) 1/2003

Date: 04/03/2024

This is a provisional non-confidential version.

This text is made available for information purposes only. A summary of this decision will be

published in all EU languages in the Official Journal of the European Union.

Parts of this text have been edited to ensure that confidential information is not disclosed.

Those parts are replaced by a non-confidential summary in square brackets or are shown as

[…].

EN EN

EUROPEAN

COMMISSION

Brussels, 4.3.2024

C(2024) 1307 final

COMMISSION DECISION

of 4.3.2024

relating to a proceeding under Article 102 of the Treaty on the Functioning of the

European Union (the Treaty) and Article 54 of the EEA Agreement

(Case AT.40437 – Apple – App Store Practices (music streaming))

(Text with EEA relevance)

(

Onl

y

the En

g

lish text is authentic

)

EN 1 EN

TABLE OF CONTENTS

1. Introduction .................................................................................................................. 7

2. The undertaking ........................................................................................................... 8

3. The complainant ........................................................................................................... 9

3.1. Spotify .......................................................................................................................... 9

3.2. Spotify’s complaint .................................................................................................... 10

4. Procedure.................................................................................................................... 11

5. Apple’s allegations of procedural shortcomings ....................................................... 14

5.1. The Letter of Facts was an appropriate instrument and did not infringe Apple’s rights

of defence ................................................................................................................... 14

5.1.1. Apple’s arguments ..................................................................................................... 14

5.1.2. Assessment of Apple’s arguments ............................................................................. 15

5.1.2.1. The Letter of Facts was an appropriate instrument to communicate to Apple a

reduction of the objections and how the Commission intended to use the relevant

evidence in a potential decision ................................................................................. 15

5.1.2.2. The proposed change in the methodology of the fine did not warrant a supplementary

statement of objections ............................................................................................... 16

5.2. The Commission has taken appropriate investigatory steps and discharged the burden

of proof ...................................................................................................................... 16

5.2.1. Apple’s arguments ..................................................................................................... 16

5.2.2. Assessment of Apple’s arguments ............................................................................. 17

5.3. The Commission did not infringe Apple’s rights of defence in relation to minutes of

meetings ..................................................................................................................... 20

5.3.1. Apple’s arguments ..................................................................................................... 20

5.3.2. Principles .................................................................................................................... 20

5.3.3. Assessment of Apple’s arguments ............................................................................. 21

5.3.3.1. Meetings which do not constitute interviews pursuant to Article 19 Regulation (EC)

No 1/2003 ................................................................................................................... 21

5.3.3.2. Apple’s rights of defence have been preserved with respect to the meetings that may

constitute interviews pursuant to Article 19 Regulation (EC) No 1/2003 ................. 23

5.4. Conclusion.................................................................................................................. 27

6. The products concerned by the Decision .................................................................. 28

6.1. Smart mobile devices, operating systems and app stores .......................................... 28

6.2. Apple’s ecosystem and its business model with regard to its App Store ................... 34

6.2.1. Apple’s business model.............................................................................................. 34

6.2.2. Apple’s App Store ...................................................................................................... 37

6.2.3. Apple’s rules on the App Store .................................................................................. 38

EN 2 EN

6.2.4. Apple’s app and content distribution policy in the App Store ................................... 40

6.2.4.1. The obligation to use IAP .......................................................................................... 40

6.2.4.2. The reader and multiplatform rule ............................................................................. 44

6.2.5. Apple’s revenues in the App Store............................................................................. 45

6.3. The music streaming business .................................................................................... 48

6.3.1. Music streaming industry overview ........................................................................... 48

6.3.2. Apple Music ............................................................................................................... 51

7. The conduct subject of the Decision ......................................................................... 53

7.1. The current wording of the Anti-Steering Provisions ................................................ 53

7.2. Changes to the wording of the Anti-Steering Provisions over time ........................... 54

7.3. Interpretation and application of the Anti-Steering Provisions over time ................. 60

7.4. The Commission’s assessment of Apple’s arguments ............................................... 61

7.5. Impact of the Anti-Steering Provisions in the music streaming services market ...... 66

7.6. Summary of the scope and content of the Anti-Steering Provisions ......................... 71

8. Establishing the dominant position ............................................................................ 72

8.1. The relevant market .................................................................................................... 72

8.1.1. Principles .................................................................................................................... 72

8.1.2. Application to this case ............................................................................................. 74

8.1.3. Market for smart mobile devices ............................................................................... 74

8.1.3.1. The relevant product market ...................................................................................... 75

8.1.3.2. The geographic scope of the market .......................................................................... 77

8.1.3.3. Conclusion on the relevant market ............................................................................. 77

8.1.4. Market for the provision to developers of platforms for the distribution of music

streaming apps to iOS users ...................................................................................... 78

8.1.4.1. The relevant product market ...................................................................................... 78

8.1.4.2. The geographic scope of the market ......................................................................... 90

8.1.4.3. Conclusion on the relevant market ............................................................................. 91

8.1.5. Market for music streaming services ......................................................................... 91

8.1.5.1. The relevant product market ...................................................................................... 91

8.1.5.2. The geographic scope of the market .......................................................................... 95

8.1.5.3. Conclusion on the relevant market ............................................................................. 96

8.2. The dominant position of the addressee .................................................................... 96

8.2.1. Principles .................................................................................................................... 96

8.2.2. Application to this case ............................................................................................. 98

8.2.2.1. Market position and market shares of Apple ............................................................ 99

8.2.2.2. Barriers to entry and expansion .................................................................................. 99

EN 3 EN

8.2.2.3. Network effects ....................................................................................................... 100

8.2.2.4. Limited countervailing buyer power ....................................................................... 101

8.2.2.5. Constraints on Apple’s market power vis-à-vis music streaming service providers

from the consumer side of the App Store ................................................................. 102

8.2.3. Conclusion................................................................................................................ 154

9. The abuse ................................................................................................................. 154

9.1. Principles .................................................................................................................. 154

9.1.1. The relevant legal test .............................................................................................. 154

9.1.2. Assessment of Apple’s arguments ........................................................................... 156

9.2. Apple’s special responsibility under Article 102 of the Treaty ............................... 162

9.2.1. Introduction .............................................................................................................. 162

9.2.2. Apple’s monopoly on music streaming app distribution on iOS ............................. 162

9.2.3. Consumers predominantly use native apps on smart mobile devices to stream music

.................................................................................................................................. 163

9.2.4. Apple has full control in relation to apps for iOS devices ....................................... 163

9.2.5. Conclusion................................................................................................................ 163

9.3. Analysis of the unfair character of the Anti-Steering Provisions vis-à-vis iOS users of

music streaming services ......................................................................................... 164

9.3.1. Apple unilaterally imposes the Anti-Steering Provisions on music streaming service

providers ............................................................................... .................................... 164

9.3.2. The Anti-Steering Provisions are detrimental to the interests of iOS music streaming

users (consumers) ..................................................................................................... 165

9.3.2.1. Monetary harm to consumers ................................................................................... 168

9.3.2.2. Non-monetary harm to consumers ........................................................................... 184

9.3.3. The Anti-Steering Provisions are not necessary for the attainment of a legitimate

objective, and in any case they are disproportionate ................................................ 209

9.3.3.1. The Anti-Steering Provisions are not necessary to achieve a legitimate objective .. 209

9.3.3.2. The Anti-Steering Provisions are in any case disproportionate ............................... 215

9.3.4. The Anti-Steering conditions are not objectively justified ...................................... 216

9.4. Conclusion on the abusive behaviour ...................................................................... 217

10. Jurisdiction ............................................................................................................... 218

10.1. Principles .................................................................................................................. 218

10.2. Application to this case ............................................................................................ 218

11. Effect on trade between Member States ................................................................... 219

11.1. Principles .................................................................................................................. 219

11.2. Application to this case ............................................................................................ 220

12. Duration.................................................................................................................... 220

EN 4 EN

13. Addressees................................................................................................................ 221

13.1. Principles .................................................................................................................. 221

13.2. Application to this case ............................................................................................ 222

14. Single and continuous infringement ......................................................................... 222

14.1. Principles .................................................................................................................. 222

14.2. Application to this case ............................................................................................ 223

15. Remedies .................................................................................................................. 224

15.1. Principles .................................................................................................................. 224

15.2. Application to this case ............................................................................................ 225

15.2.1. Assessment of Apple’s arguments about the remedies ............................................ 226

15.2.2. Implementation of the remedies ............................................................................... 229

16. Periodic penalty payments ....................................................................................... 229

16.1. Principles .................................................................................................................. 229

16.2. Application to this case ............................................................................................ 229

17. Fines ......................................................................................................................... 230

17.1. Principles .................................................................................................................. 230

17.1.1. General methodology of the Guidelines on Fines .................................................... 231

17.1.2. Point 37 of the Guidelines on Fines ......................................................................... 232

17.2. Imposition of a fine .................................................................................................. 233

17.2.1. Intent and/or negligence ........................................................................................... 233

17.2.2. Joint and several liability ......................................................................................... 234

17.3. Amount of the fine ................................................................................................... 234

17.3.1. Application of the general methodology of the Guidelines on Fines ....................... 234

17.3.1.1. Determination of the basic amount of the fine ......................................................... 234

17.3.1.2. Conclusion on the basic amount .............................................................................. 237

17.3.1.3. Adjustments to the basic amount ............................................................................. 238

17.3.1.4. Mitigating factors ..................................................................................................... 240

17.3.1.5. Specific increase for deterrence ............................................................................... 240

17.3.1.6. Conclusion on the application of the general methodology ..................................... 240

17.3.2. Application of Point 37 of the Guidelines on Fines ................................................ 240

17.3.2.1. The particularities of the present case and the need to achieve deterrence justify a

departure from the general methodology set out in the Guidelines on Fines. ......... 240

17.3.2.2. Determination of the additional lump sum ............................................................... 242

17.3.2.3. Assessment of Apple’s arguments .......................................................................... 243

17.3.3. Application of Article 23(2) of Regulation (EC) No 1/2003 ................................... 249

17.3.4. Conclusion: final amount of the fine ........................................................................ 249

EN 5 EN

18. Conclusion................................................................................................................ 249

EN 6 EN

COMMISSION DECISION

of 4.3.2024

relating to a proceeding under Article 102 of the Treaty on the Functioning of the

European Union (the Treaty) and Article 54 of the EEA Agreement

(Case AT.40437 – Apple – App Store Practices (music streaming))

(Text with EEA relevance)

(Only the English text is authentic)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union

1

,

Having regard to the Agreement on the European Economic Area,

Having regard to Council Regulation (EC) No 1/2003, of 16 December 2002 on the

implementation of the rules on competition laid down in Articles 81 and 82 of the Treaty

2

,

and in particular Article 7, Article 23(2) and Article 24(1) thereof,

Having regard to the complaint lodged by Spotify AB on 11 March 2019, amended on 9 April

2019, alleging infringements of Article 102 of the Treaty and Article 54 of the EEA

Agreement by Apple Inc. and requesting the Commission to put an end to those

infringements,

Having regard to the Commission decision of 16 June 2020 to initiate proceedings in this

case,

Having given the undertaking concerned the opportunity to make known its views on the

objections raised by the Commission pursuant to Article 27(1) of Regulation (EC) No 1/2003

and Article 12 of Commission Regulation (EC) No 773/2004 of 7 April 2004 relating to the

conduct of proceedings by the Commission pursuant to Articles 81 and 82 of the Treaty

3

,

After consulting the Advisory Committee on Restrictive Practices and Dominant Positions,

Having regard to the final report of the hearing officer in this case,

Whereas:

1

OJ, C 115, 9.5.2008, p.47.

2

OJ L 1, 4.1.2003, p. 1. With effect from 1 December 2009, Articles 81 and 82 of the EC Treaty have

become Articles 101 and 102, respectively, of the Treaty on the Functioning of the European Union

(“the Treaty”). The two sets of provisions are, in substance, identical. For the purposes of this Decision,

references to Articles 101 and 102 of the Treaty should be understood as references to Articles 81 and

82, respectively, of the EC Treaty when where appropriate. The Treaty also introduced certain changes

in terminology, such as the replacement of “Community” by “Union” and “common market” by

“internal market”. Where the meaning remains unchanged, the terminology of the Treaty will be used

throughout this Decision.

3

OJ L 123, 27.4.2004, p. 18.

EN 7 EN

1. INTRODUCTION

(1) This Decision is addressed to Apple Inc. and Apple Distribution International

Limited. All the legal entities active within the corporate group of Apple Inc are

referred to in this Decision as “Apple”.

(2) This Decision concerns certain terms and conditions governing the use of Apple’s

App Store (“App Store”) by developers of software applications (“apps”) for music

streaming services on Apple’s smart mobile devices running on the operating

systems iOS and iPadOS

4

(namely, Apple’s smart mobile devices iPhone and iPad)

in the European Economic Area (“EEA”).

5

The Commission finds that Apple’s rules

laid down, in particular, in the various versions of the App Store Review Guidelines

applicable during the infringement period

6

(the “Guidelines”) and in the terms of the

Developer Program License Agreement

7

(the “License Agreement”) preventing

music streaming service providers from informing iOS users about alternative (and

often cheaper) subscription possibilities existing outside of those providers’ iOS

mobile app and from allowing iOS users to exercise an effective choice between

alternative subscription possibilities (the so-called “Anti-Steering Provisions”)

8

constitute a single and continuous infringement of Article 102 of the Treaty on the

Functioning of the European Union (“the Treaty”) and Article 54 of the Agreement

on the EEA (“EEA Agreement”).

(3) This Decision is structured as follows:

– Section 2 describes the undertaking concerned by this Decision;

– Section 3 provides an overview of the complainant in this case;

– Section 4 summarises the procedure relating to this case to date;

– Sections 5 addresses and rebuts Apple’s allegations of procedural

shortcomings;

– Section 6 provides a description of the products concerned by this Decision;

– Section 7 sets out the conduct subject to this Decision;

4

For the purposes of this Decision, “iOS” refers to smart mobile devices running on Apple’s mobile

operating systems iOS and iPadOS, hence iPhones and iPads, while “iOS users” refers to the users of

those devices.

5

Throughout this Decision, the EEA is understood to cover the 27 Member States of the European Union

(Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany,

Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal,

Romania, Slovakia, Slovenia, Spain and Sweden) and the United Kingdom (the “UK”), as well as

Iceland, Liechtenstein and Norway. Accordingly, any references made to the EEA in this Decision are

meant to also include the UK. Although the UK withdrew from the European Union as of

1 February 2020, according to Article 92 of the Agreement on the withdrawal of the United Kingdom of

Great Britain and Northern Ireland from the European Union and the European Atomic Energy

Community (OJ L 29, 31.1.2020, p. 7), the Commission continues to be competent to apply Union law

as regards the UK for administrative procedures which were initiated before the end of the transition

period.

6

Latest version of the App Store Review Guidelines applicable since 5 June 2023, provided by Apple in

response to the Commission’s request for information of 3 August 2023, IDs 3009 and 3011, as well as

previous versions applicable since 30 June 2015.

7

Latest version provided by Apple in response to the Commission’s request for information of 3 August

2023, ID 3015 (Apple Developer Program License Agreement); ID 3028 (Schedule 2), as well as

previous versions applicable since 30 June 2015.

8

Section 3.1.3 of the Guidelines, ID 3011.

EN 8 EN

– Section 8 describes the relevant product and geographic markets concerned by

this Decision, outlines general principles on dominance and concludes that

Apple holds a dominant position in the EEA on the market for the provision to

developers of platforms for the distribution of music streaming apps to iOS

users;

– Section 9 concludes that Apple has abused its dominant position in the EEA

market for the provision to developers of platforms for the distribution of

music streaming apps to iOS users since at least 2015. In particular, the abuse

consists in the imposition by Apple, through the Anti-Steering Provisions, of

unfair trading conditions within the meaning of Article 102(a) of the Treaty

upon music streaming service providers which are detrimental to the interests

of iOS users;

– Section 10 concludes that the Commission has jurisdiction to pursue this case;

– Section 11 concludes that Apple’s conduct has an effect on trade between

Member States;

– Section 12 concludes on the duration of the infringement;

– Section 13 sets out the addressees of this Decision;

– Section 14 finds that Apple’s conduct constitutes a single and continuous

infringement;

– Section 15 outlines the remedies imposed by this Decision;

– Section 16 describes the periodic penalty payments necessary to compel Apple

to bring effectively to an end the infringement of Article 102 of the Treaty;

– Section 17 sets out the methodology for calculating the fine and the amount of

the fine imposed; and

– Section 18 presents the Commission’s conclusion.

2. T

HE UNDERTAKING

(4) Apple is a multinational technology company headquartered in the United States of

America (“the US”). Apple designs, manufactures, and markets mobile

communication and media devices, personal computers and portable digital music

players as well as related software and digital services.

(5) The Apple group is composed of Apple and all companies controlled by Apple. The

Apple group encompasses companies incorporated in Ireland, namely Apple

Operations International Limited and Apple Distribution International Limited. The

latter company, which is one of the addressees of this Decision (see Section 13.2),

provides Apple’s App Store services (including Apple Music) to customers in the

EEA and is the company which developers appoint as a commissionaire for the

distribution of approved apps. In the past, other Apple entities were involved in the

provision of App Store related services.

9

9

From 1 January 2015 to 24 September 2016, iTunes Sàrl provided the App Store Services to customers

in the EEA. On 25 September 2016 iTunes Sàrl merged into Apple Distribution International in a cross-

border merger with Apple Distribution International as the surviving entity. Accordingly, Apple

Distribution International began to provide the services to EEA customers from the merger date and it

EN 9 EN

(6) Apple’s business model is based on a vertically integrated ecosystem centred around

its hardware devices, including iPhones and iPads, from which it generates the main

source of its revenue. Apple operates various services, including the App Store

which allows customers to discover and download apps. Apple also offers digital

content through subscription-based services, including Apple Music, which is a paid-

subscription based, on-demand music streaming service (for a more detail description

of Apple’s products business model, see Section 6.2).

(7) Apple is one of the highest valued companies worldwide. In June 2023, Apple

exceeded USD 3 000 000 000 in market value, making it the first company

worldwide to do so.

10

In Apple’s Financial Year (“FY”) 2023, which lasted from

25 September 2022 to 30 September 2023, Apple Inc.’s total worldwide consolidated

turnover amounted to EUR 359 674 000 000.

11

During Apple’s FY 2023, the App

Store commission fees paid by the main music streaming service providers active in

the EEA generated over EUR […].

12

3. T

HE COMPLAINANT

3.1. Spotify

(8) Spotify AB (“Spotify”) is a Swedish music streaming service provider, active in the

EEA and globally. It offers users the ability to search for or browse music according

to different criteria such as album, artist, genre, or record labels. Spotify users can

create, edit and share playlists, including on social media, and also make playlists

together with other users. Spotify’s listeners have the option to listen to content for

free with advertisements as well as to purchase a premium subscription to allow for

unlimited ad-free music streaming.

(9) Spotify was first launched in 2008 in Sweden and then in other European countries

and the U.S. by 2011. The music streaming service is available through Spotify's

website and can be used on various devices.

13

Spotify launched its iOS native mobile

app in September 2009 (see Section 6.3.2).

(10) As of the first quarter of 2023, Spotify had 210 million premium subscribers

worldwide, up from 182 million in the corresponding quarter of 2022.

14

In the first

quarter of 2023, it had over 500 million monthly active users worldwide (including

through its ad-supported tier).

15

In July 2023, Spotify reported that in the second

has continued to do so, exclusively, to the present. Apple Distribution International has subsequently

converted to an Irish limited liability company, effective on 6 February 2020, as a result of which its

name has changed to "Apple Distribution International Limited". Both iTunes Sàrl and Apple

Distribution International were at all times discussed above indirectly 100 %-owned subsidiaries of

Apple.

10

See https://www.wsj.com/articles/apple-becomes-first-u-s-company-to-reach-3-trillion-market-value-

11641235625, accessed on 13 January 2022, ID 2336;

https://www.forbes.com/sites/dereksaul/2023/06/30/apple-hits-3-trillion-market-value-and-could-soar-

another-800-billion/?sh=a968d7952b17, accessed on 10 October 2023, ID 3119.

11

Apple’s response to the Commission’s request for information of 1 December 2023, ID 3312.

12

Apple’s response to the request for information dated 1 December 2023, ID 3312 and Annex Q6, ID

3310.

13

Spotify’s Complaint, ID 1457, page 9, paragraph 25.

14

Statista, Spotify: number of premium subscribers worldwide 2023 | Statista, accessed on 10 October

2023, ID 3121. ID 3262, accessed on 14 December 2023, contains underlying data of Statista figures.

15

Statista, Spotify MAUs worldwide 2023 | Statista, accessed on 10 October 2023, ID 3120. ID 3289,

accessed on 14 December 2023, contains underlying data of Statista figures.

EN 10 EN

quarter of 2023 it had reached over 550 million monthly active users, out of which

220 million were premium subscribers worldwide,

16

representing almost 40 % of its

overall user base.

17

(11) In 2022, Spotify generated revenues of over EUR 11 700 000 000, up from

EUR 9 670 000 000 in the previous year. The majority of these revenues came from

Spotify’s premium subscribers.

18

Nevertheless, Spotify has been operating at a loss,

as also confirmed by recent figures: in 2022, Spotify had a net loss of

EUR 430 000 000;

19

for Q2 2023, it registered EUR 112 000 000 in adjusted

operating losses.

20

This is without prejudice of the existence of a few sporadic

profitable quarters. Indeed, since the beginning of 2017, Spotify reached a positive

net balance in only eight quarters in total, including in Q3 2023 where Spotify

generated EUR 62 000 000 net profit.

21

3.2. Spotify’s complaint

(12) In March 2019, the Commission received a formal complaint by Spotify against

Apple pursuant to Article 7(2) of Regulation (EC) No 1/2003 and an amended (final)

version on 9 April 2019 (“Spotify’s Complaint”). In this complaint, Spotify alleged

that Apple infringed Article 102 of the Treaty by (i) requiring developers that offer

paid digital content or subscriptions to such content, such as music streaming

subscriptions, in their iOS apps to make use of Apple’s in-app purchase mechanism

(“IAP”)

22

and pay a 30 % or 15 % commission fee to Apple, and (ii) preventing the

possibility for developers, such as music streaming service providers, from informing

iOS users about alternative (and often cheaper) subscription possibilities outside of

the app and allowing an effective choice.

(13) Spotify indicated that, between 2011 and 2014, it did not offer Premium

subscriptions in-app on iPhones or iPads and was therefore not using IAP. Spotify

signed up to IAP in June 2014 and started offering Premium subscriptions paid

through IAP. It increased the price of the Premium offer (for an individual

subscription) in its iOS app from EUR 9.99 (as available on its website and other

subscription channels) to EUR 12.99 to pass-on to users the commission fee charged

by Apple. However, in May 2016 – less than a year after Apple launched Apple

Music on 30 June 2015 at EUR 9.99 – Spotify decided to disable IAP and turned off

16

Spotify’s Q2 2023 update, available at

sec.gov/Archives/edgar/data/1639920/000114036123035965/brhc20056303_ex99-1.htm, accessed on

10 October 2023, ID 3149.

17

Spotify reports strong user growth as it is raising subscription price | TechCrunch, accessed on

10 October 2023, ID 3151.

18

See Spotify revenue 2013-2022 | Statista, accessed on 10 October 2023, ID 3150.

19

See https://www.statista.com/statistics/244990/spotifys-revenue-and-net-income/, accessed on

10 October 2023, ID 3152.

20

Spotify’s Q2 2023 update, available at

sec.gov/Archives/edgar/data/1639920/000114036123035965/brhc20056303_ex99-1.htm, accessed on

10 October 2023, ID 3149.

21

See https://www.statista.com/chart/26773/profitability-development-of-

spotify/#:~:text=Music%20streaming&text=At%20the%20end%20of%20September,62%20million%20

euros%20net%20profit, accessed on 25 October 2023, ID 3128 and

https://www.ft.com/content/dcb2e9ee-8baa-4442-b13d-5babbfee04e5, accessed on 25 October 2023, ID

3146.

22

In this Decision, Apple’s requirement vis-à-vis developers to use IAP is also referred to as “the IAP

obligation”. Through the use of IAP, Apple charges a 30

% commission fee to developers during the

first year of subscription and 15 % after the first year of uninterrupted subscription.

EN 11 EN

the ability to subscribe to its Premium offer in its iOS app, as it would otherwise

have been forced to continuously offer its premium subscription on its iOS app at a

higher price than outside the iOS environment (see Section 7.5).

(14) Spotify also alleged that Apple rejected without justification updates of its iOS app

and tightened the wording and interpretation of the Guidelines in such a manner as to

increasingly prevent it from advertising the existence of its Premium option within

and – to some extent – also outside the app, for instance through links to its website

(Spotify.com) or other “calls to action” addressed to its iOS users (for the current

wording of the Anti-Steering Provisions, see Section 7.1). As a result, Spotify

submitted having been effectively restricted from promoting subscription

possibilities available at a competitive price outside the iOS environment to iOS

users in its iOS app.

(15) Spotify claims that it makes substantial investments to increase the quality of its free

service as well as to target users of that service with promotional campaigns such as

reduced prices or free trials for the Premium offer that it communicates to the users

of its free tier by email, banners on its website, or pop-ups within the Spotify mobile

or desktop app.

4. P

ROCEDURE

(16) The Commission started to investigate Apple’s conduct in relation to the IAP

obligation and the Anti-Steering Provisions in July 2015.

23

(17) The Commission received Spotify’s Complaint on 9 April 2019. The Commission

transmitted Spotify’s Complaint to Apple, which provided comments. Subsequently,

the Commission organised a data room upon Apple’s request. Following the data

room, the Commission received observations from Spotify regarding further

comments to Spotify’s Complaint submitted by Apple.

(18) Between April 2019 and December 2020, the Commission sent a number of requests

of information under Article 18(2) and 18(3) of Regulation (EC) No 1/2003 to Apple

and, in 2019 and 2020, to Spotify as well as to a series of other music streaming

service providers active in the EEA, namely Amazon Music, Deezer, Google Play

Music, Napster (Rhapsody), SoundCloud, Qobuz, YouTube Music and Tidal. In

parallel, between October 2019 and March 2021, Apple submitted numerous papers

to the Commission.

(19) In February and July 2020, Spotify […] conducted surveys of users to analyse

consumer choice of smart mobile devices (and mobile OS) and […] ([…] “the

Spotify Survey” […]).

24

(20) On 16 June 2020, the Commission initiated proceedings vis-à-vis Apple in the

present case within the meaning of Article 2(1) of Commission Regulation

No 773/2004.

25

(21) On 30 June 2020, the Commission held a state of play meeting with Apple.

(22) On 12 February 2021, the Commission had a state of play call with Apple.

23

Commission’s request for information (2015/076377) of 31 July 2015, addressed to Spotify, ID 1486,

ID 1511 and ID 1512.

24

[…].

25

Decision n° C(2020) 4065 final adopted on 16 June 2020, ID 664.

EN 12 EN

(23) A Statement of Objections was issued in this case on 30 April 2021 (the “Statement

of Objections of 30 April 2021”). This statement of objections took issue with the

terms that govern the use of Apple’s App Store which: (i) require music streaming

app developers to exclusively and mandatorily use Apple’s IAP for the distribution

of paid content (i.e., music streaming service subscriptions) and which (ii) restrict the

developers’ ability to inform iOS users inside those providers’ iOS app and to a

certain extent also outside of that app, about alternative (cheaper) subscriptions

possibilities outside of the app and from allowing iOS users to exercise an effective

choice. The Statement of Objections of 30 April 2021 also preliminarily found that

the Anti-Steering Provisions constitute a standalone infringement of Article 102 of

the Treaty. Apple submitted its response to the Statement of Objections of

30 April 2021 on 17 September 2021. It did not request the opportunity to express its

views at an oral hearing pursuant to Article 12(1) of Regulation (EC) No 773/2004.

(24) The Statement of Objections of 30 April 2021 was subsequently replaced by a

revised statement of objections dated 28 February 2023 (the “Statement of

Objections of 28 February 2023”). The Statement of Objections of 28 February 2023

limited the scope of the objections raised in this case against Apple to Apple’s Anti-

Steering Provisions and presented the facts, the Commission’s preliminary objections

as well as the Commission’s legal analysis in a comprehensive manner. The cover

letter to the Statement of Objections of 28 February 2023, which was notified to

Apple on 1 March 2023, also addressed the comments in relation to the completeness

of the Commission’s case file previously raised by Apple. In addition, on

3 March 2023, the Commission sent Apple a corrigendum clarifying that some

modifications to the cover letter were necessary to reflect that the Statement of

Objections of 28 February 2023 did not supplement but rather replaced the Statement

of Objections of 30 April 2021.

26

(25) On 19 May 2023, Apple submitted its response to the Statement of Objections of

28 February 2023 and at the same time requested the opportunity to express its views

at an oral hearing pursuant to Article 12(1) of Regulation (EC) No 773/2004.

27

(26) The oral hearing took place on 30 June 2023 (hereinafter, the “oral hearing”).

28

Spotify and the European Consumer Organisation BEUC (“BEUC”) were admitted

to the oral hearing as complainant and interested third person, respectively, in

accordance with Article 6 of Decision 2011/695/EU.

29

(27) On 3 August 2023 the Commission sent a request for information to Apple,

30

to

which Apple replied on 4 and 28 September 2023.

31

26

The complainant Spotify as well as Google and BEUC – which, along with the Computer &

Communication Industry Association (‘CCIA’) were admitted as third interested parties within the

meaning of Article 5 of decision 2011/695/EU – submitted comments to the Statement of Objections of

28 February 2023, see documents entitled “BEUC comments as interested third person within the

meaning of Article 5 of decision 2011/695/EU on the Redacted Statement of Objections of 28.2.2023”

(hereinafter “BEUC’s comments to the Statement of Objections of 28 February 2023”), ID 2870;

“Google’s Observations on the EC’s Statement of Objections in Case AT.40437 – Apple App Store

Practices”, ID 2871; “Spotify’s observations on the Statement of Objections dated 28 February 2023,

ID 1972 and Addendum, ID 2869.

27

ID 2821.

28

Recording of the oral hearing in Case AT.40437, ID 3131.

29

Decision of the President of the European Commission of 13 October 2011 on the function and terms of

reference of the hearing officer in certain competition proceedings, OJ L 275, 20.10.2011, p. 29–37.

30

IDs 2987 and 2988.

EN 13 EN

(28) On 25 September 2023, the Commission sent a request for information to Spotify,

32

to which Spotify replied on 12 October 2023.

33

(29) On 1 December 2023, the Commission sent a request for information to Apple, to

which Apple replied on 20 December 2023.

34

(30) On 6 December 2023, the Commission sent Apple a letter of facts (the “Letter of

Facts”)

35

drawing Apple’s attention to additional evidence which had been added to

the case file after the adoption of the Statement of Objections of 28 February 2023 as

well as about updated evidence on which the Commission intended to rely for the

purposes of this Decision. The Letter of Facts set out that the Commission intended

to focus on the unfairness of Apple’s Anti-Steering Provisions vis-à-vis iOS users

and that it did not intend to further rely on its additional preliminary finding in the

Statement of Objections of 28 February 2023 that the Anti-Steering Provisions are

also unfair vis-à-vis music streaming service providers. In addition, the Letter of

Facts set out that the Commission intended to consider calculating the fine by (i)

relying only on the App Store commission fees that Apple obtains from music

streaming app developers under the general methodology of the Commission’s

Guidelines on the method of setting fines imposed pursuant to Article 23(2)(a) of

Regulation (EC) No 1/2003 (“the Guidelines on Fines”)

36

and, in addition, (ii)

imposing a lump sum on the basis of point 37 of the Guidelines on Fines which

would ensure that the fine imposed is sufficiently deterrent.

(31) On 7 December 2023, the Commission granted Apple access to the file following the

Letter of Facts.

(32) On 13 December 2023, Apple sent a letter to the Commission alleging, among

others, incompleteness of the Commission’s file to which it had obtained access on

7 December 2023. The Commission replied by letter of 15 December 2023 and

granted Apple, on the same day, supplementary access to the file.

(33) On 15 December 2023, Apple addressed a letter to the Hearing Officer where it

expressed, among others, concerns regarding the allegedly inappropriate use of a

Letter of Facts, and where it requested the Hearing Officer to issue observations in

that respect as well as to extend the deadline to reply to the Letter of Facts until the

Commission had issued a supplementary Statement of Objections. In its reply by

letter of 21 December 2023, the Hearing Officer rejected Apple’s requests.

(34) On 12 January 2024, Apple submitted its response to the Letter of Facts of

6 December 2023 (“the Response to the Letter of Facts”) where Apple criticised that

the Commission adopted a letter of facts rather than a new statement of objections

and requested an oral hearing to further present its views. The Commission rejected

Apple’s request for an oral hearing by letter of 17 January 2024. In reaction, Apple

referred the matter to the Hearing Officer. In its letter of 30 January 2024, the

Hearing Officer rejected Apple’s request for an oral hearing.

31

IDs 3009 and 3042.

32

ID 3050.

33

ID 3058.

34

ID 3312.

35

ID 3230.

36

Guidelines on the method of setting fines imposed pursuant to Article 23(2)(a) of Regulation No 1/2003

(Text with EEA relevance), OJ C 210, 1.9.2006, p. 2–5.

EN 14 EN

(35) On 25 January 2024, Apple announced changes to iOS, Safari and the App Store

rules in the European Union.

37

These announced changes are not in force on the day

of adoption of this Decision.

(36) On 6 February 2024, the Commission held a state of play meeting with Apple.

5. A

PPLE’S ALLEGATIONS OF PROCEDURAL SHORTCOMINGS

(37) In its Reponses to the Statement of Objections of 28 February 2023 and to the Letter

of Facts, Apple raised a number of alleged procedural shortcomings, in particular: (i)

that the Commission infringed Apple’s rights of defence by adopting a Letter of

Facts instead of a supplementary statement of objections; (ii) that the Commission

has not discharged its burden of proof by relying on outdated and incomplete

information and has not taken serious investigative steps to collect the evidence

required in support of its findings and (iii) that the investigation is vitiated by

procedural breaches as 29 minutes of meetings between the Commission and Spotify

and BEUC registered on the file are not sufficiently detailed and have not allowed

Apple to exercise its rights of defence properly.

(38) The Commission considers that these allegations are unfounded for the following

reasons.

5.1. The Letter of Facts was an appropriate instrument and did not infringe Apple’s

rights of defence

5.1.1. Apple’s arguments

(39) In the Response to the Letter of Facts, Apple argued that by adopting a letter of facts

instead of a new statement of objections the Commission infringed Apple’s rights of

defence.

38

(40) First, Apple argues that the use of a letter of facts was inappropriate because in its

view the Commission materially altered the allegations and body of evidence in the

Statement of Objections of 28 February 2023. Apple claims that considering its

conduct exclusively an exploitative abuse vis-à-vis consumers should be considered

as substantially supplementing the substance and scope of the objections in line with

the General Court’s judgment in Google Android.

39

(41) Second, Apple also considers that the use of a letter of facts was inappropriate

because the Commission changed the methodology for the calculation of the fine and

its magnitude. Apple argues that the change of methodology constitutes a departure

from the previous statements of objections and envisages a lump sum which could

result in an unprecedented large fine which could be higher than the fine proposed in

the Statement of Objections of 28 February 2023 under the standard methodology,

even if under such proposal Apple Music’s revenues would have been included.

40

37

“Apple announces changes to iOS, Safari, and the App Store in the European Union”, see:

https://www.apple.com/newsroom/2024/01/apple-announces-changes-to-ios-safari-and-the-app-store-

in-the-european-union/, accessed on 9 February 2024, ID 3367.

38

Apple’s Response to the Letter of Facts, ID 3330, paragraphs 27 to 42.

39

Apple’s Response to the Letter of Facts, ID 3330, paragraph 31, citing the judgement of 14 September

2022 in Case T-604/18 Google v Commission (Google Android judgement), EU:T:2022:541,

paragraphs 979 and 996.

40

Apple’s Response to the Letter of Facts, ID 3330, paragraph 41.

EN 15 EN

5.1.2. Assessment of Apple’s arguments

5.1.2.1. The Letter of Facts was an appropriate instrument to communicate to Apple a

reduction of the objections and how the Commission intended to use the relevant

evidence in a potential decision

(42) It is settled case law that adopting a supplementary statement of objections is only

required “if additional objections are issued or the intrinsic nature of the

infringement in question is altered”.

41

(43) The Letter of Facts informed Apple that the Commission did not intend to further

rely on its preliminary finding in the Statement of Objections of 28 February 2023

(Section 9.4) that the Anti-Steering Provisions give rise to the imposition of unfair

trading conditions to the detriment of developers of music streaming apps. In this

regard, in its Statement of Objections of 28 February 2023 the Commission set out its

preliminary conclusion that the Anti-Steering provisions at issue “give rise to the

imposition of unfair trading conditions to the detriment of iOS users, which in itself

is sufficient to qualify them as abusive under Article 102 (a) TFEU”. In addition, the

Commission reached the preliminary conclusion “that Apple’s Anti-Steering

Provisions also constitute unfair trading conditions which are detrimental to the

interests of competing music streaming service providers and that they are therefore

abusive under Article 102 (a) TFEU also on this ground”.

42

Therefore, the

Commission preliminarily concluded that the Anti-Steering provisions are

detrimental to the interests of consumers but additionally also to the interests of app

developers and thus constituted unfair trading conditions under Article 102 of the

Treaty vis-à-vis both groups separately.

43

The Commission did not infringe Apple’s

rights of defence by informing it in the Letter of Facts that the Commission was

dropping one of the two objections.

(44) The objection which was maintained concerning harm to consumers had been

explained and substantiated in detail in section 9.3 of the Statement of Objections of

28 February 2023. In particular, the Commission explained there that the unfair

trading conditions Apple imposes on developers of music streaming apps affect

consumers insofar as music streaming app developers are prevented from informing

iOS users about the options available to them and from allowing them to effectively

exercise an informed choice.

44

(45) The Statement of Objections of 28 February 2023 set out the two objections

comprehensively in different sections (Sections 9.3 and 9.4). Apple was therefore

well aware that both were seen to constitute separate objections for the purposes of

the Statement of Objections of 28 February 2023.

(46) Furthermore, the Letter of Facts set out, for each item of evidence, how it relates to

the harm to consumers and how the Commission intended to use it in a potential

decision and granted Apple the possibility of submitting written observations in this

regard.

41

Case T-682/14 Mylan Laboratories, EU:T:2018 :907, paragraph 316.

42

Statement of Objections of 28 February 2023, ID 2811, paragraph 738.

43

Statement of Objections of 28 February 2023, ID 2821, paragraph 621: “besides being detrimental to

iOS users ‘interest, are also detrimental to the interests of music streaming service providers”.

44

Statement of Objections of 28 February 2023, ID 2821, paragraphs 525 to 529.

EN 16 EN

(47) Consequently, the Commission considers that the Letter of Facts issued in this case

was an appropriate instrument as it did not materially alter the preliminary findings

set out in the Statement of Objections of 28 February 2023, but dropped the

additional objection concerning the unfairness of Anti-Steering provisions towards

music streaming app developers. Moreover, it allowed Apple to exercise its rights of

defence concerning the body of evidence the Commission intended to use in support

of the primary objection concerning the unfairness of Anti-Steering provisions

towards consumers.

5.1.2.2. The proposed change in the methodology of the fine did not warrant a supplementary

statement of objections

(48) It is settled case law that the Commission is required to set out in a statement of

objections the main factual and legal criteria on which it will base its calculation of

the amount of the potential fine, such as the gravity and the duration of the alleged

infringement.

45

However, a letter of facts is an appropriate instrument to inform the

investigated company of new elements or changes to the method for determining the

amount of the fine.

46

In this regard, the General Court clarified in Campine that an

increase of the fine on the basis of point 37 of the Guidelines on Fines in order to

take into account the particularities of the case and to achieve deterrence does not

constitute an element of fact and of law that the Commission is required to mention

in a statement of objections.

47

(49) The Commission informed Apple in the Statement of Objections of

28 February 2023 of its intention to impose a fine taking into account the gravity and

duration of the infringement and specified how it intended to calculate the potential

fine based on the facts of the case.

48

In addition, the Commission specifically

mentioned the need to ensure that fines have a sufficiently deterrent effect.

49

(50) In its Letter of Facts, the Commission informed Apple about the potential application

of point 37 of the Guidelines on Fines.

(51) In this way, Apple was made fully aware and given the opportunity to comment on

the method of determining the final amount of a potential fine.

5.2. The Commission has taken appropriate investigatory steps and discharged the

burden of proof

5.2.1. Apple’s arguments

(52) In its Responses to the Statement of Objections of 28 February 2023

50

and to the

Letter of Facts, Apple argued that the Commission failed to discharge its burden of

proof by relying on incomplete and inappropriate information.

(53) First, Apple considers that the Commission relies disproportionately and without

scrutiny on third-party sources such as market data from third-party reports, user

45

Case C-180/16 P Toshiba v Commission, EU:C:2017:520, paragraph 21 and Case T-15/02 BASF v

Commission, EU:T:2006:74, paragraph 48.

46

Case C-180/16 P Toshiba v Commission, EU:C:2017:520, paragraph 34 and Case T-240/17 Campine v

Commission, EU:T:2019:778, paragraphs 339 et seq.

47

Case T-240/17 Campine v Commission, EU:T:2019:778, paragraph 357.

48

Statement of Objections of 28 February 2023, ID 2821, paragraphs 770 to 775.

49

Statement of Objections of 28 February 2023, ID 2821, paragraphs 776.

50

Apple’s Response to the Statement of Objections of 28 February 2023, ID 2821, Section D.

EN 17 EN

comments on discussion forums and economic analysis prepared by the

complainant.

51

(54) Second, Apple argues that the Commission relies on outdated data and information

which cannot support an ongoing infringement.

52

In particular, Apple contests the

use of Spotify’ 2018 experiments

53

(see recitals (743) et seq.) and […]

54

[…]

55

(see

recitals (617) et seq.).

(55) Third, Apple claims that the Commission’s investigation is incomplete, as it failed to

collect information from essential stakeholders and hence the Commission has not

discharged its burden of proof.

56

In particular, Apple complains that the Commission

did not carry out a consumer survey to seek input from consumers and failed to

investigate the impact of out-of-the app communication tools to inform consumers.

57

(56) Fourth, Apple argues that the Commission has failed to collect the information and

evidence it needs to support its conclusions, which it was obliged to do pursuant to

the General Court’s Intel judgement.

58

In particular, Apple claims that following its

request in March 2022 and during the Oral Hearing the Commission should have

requested the following information from music streaming service providers which

Apple could not have access to in any other way: (i) the number of emails that music

streaming service providers sent to iOS and Android users within six months after

having obtained their email addresses through the sign-up function within the iOS

and Android apps, and (ii) a description of any differences in the music streaming

service providers’ practices between iOS and Android with respect to sending out

promotional emails, as well as internal documents of music streaming service

providers that refer to differences in platform-specific practices, if any.

59

5.2.2. Assessment of Apple’s arguments

(57) The Commission disagrees with Apple’s views and considers that it has taken all

necessary investigative steps to collect the appropriate evidence in support of its

conclusions. In particular, the Commission notes the following.

(58) First, the Commission relies on various data sources, including market data analytics

providers such as Statista, StatCounter and MIDiA. There is no indication that these

sources are erroneous or do not give a correct picture of the market. In fact, these

sources are recognised and accepted within the industry.

(59) Second, there have been no significant market developments which call into question

the results of the 2018 Spotify experiments or […](see in this regard recitals (166) to

(182)), which therefore have remained valid and support the Commission’s findings

for the whole duration of the infringement. In this regard, Apple continues to be

51

Apple’s Response to the Letter of Facts, ID 3330, paragraph 50 and Apple’s Response to the Statement

of Objections of 28 February 2023, ID 2821, paragraph 60.

52

Apple’s Response to the Letter of Facts, ID 3330, paragraphs 55 and Apple’s Response to the Statement

of Objections of 28 February 2023, ID 2821, paragraphs 61 to 67.

53

Statement of Objections of 28 February 2023, ID 2821, paragraphs 679 et seq.

54

[…]

55

Letter of Facts, ID 3230, paragraphs 539 et seq.

56

Apple’s Response to the Letter of Facts, ID 3330, paragraphs 56 to 67.

57

Apple’s Response to the Letter of Facts, ID 3330, paragraphs 7, 64 and 231.

58

Apple’s Response to the Letter of Facts, ID 3330, paragraphs 68 to 72 and Apple’s Response to the

Statement of Objections of 28 February 2023, ID 2821 paragraphs 57 to 67.

59

Apple’s Response to the Letter of Facts, ID 3330, paragraph 70.

EN 18 EN

dominant in the market for the provision to developers of platforms for the

distribution of music streaming apps to iOS users (recital (520)) and to impose Anti-

Steering Provisions unilaterally (see recitals (228) to (231). Therefore, their results

are perfectly suited to support the finding of an infringement, which started on

30 June 2015 and is ongoing at the date of the adoption of this Decision. Moreover,

the Commission does not uncritically rely on these two pieces of evidence to reach

conclusions but has made an overall assessment of all the circumstances and

information available to show harm to consumers.

(60) Third, concerning Apple’s criticisms that the investigation is incomplete, the

Commission notes that according to settled case law the Commission “cannot be

required to carry out further investigations where it considers that the preliminary

investigation of the case has been sufficient” and that “the Commission is not

required to reply to all the arguments of the party concerned, to carry our further

investigations […] where it considers that the preliminary investigation of the case

has been sufficient”.

60

In this regard, the Commission maintains that its investigation

is complete and sufficient.

(61) The Commission notes that its finding that Apple’s Anti-Steering Provisions are

detrimental to consumers is based on a sound body of evidence gathered throughout

the investigation. In particular, the monetary and non-monetary harm inflicted on

consumers is based, among others, on internal documents from Apple and

information collected from Apple and music streaming service providers through

requests for information, including data on conversion channels, as well as on the

2018 Spotify experiments and […] (see Section 9.3.2.1 on “Monetary harm to

consumers” and Section 9.3.2.2 on “Non-monetary harm to consumers”). The

Commission considers that the evidence collected was sufficient to prove the

infringement and in particular the harm to consumers so that no further investigation

was necessary.

(62) In addition, it should be noted that the consumer association BEUC, which represents

forty-five independent consumer organisations from thirty-one countries, was

admitted as an interested third party in this case on 31 May 2021.

61

BEUC provided

observations to the two statements of objections issued by the Commission and

participated in the oral hearing. The Commission considers that BEUC’s views as a

recognised European consumer association are fully representative of consumers’

views in this case and further supported the findings that Apple’s Anti-Steering

Provisions are detrimental vis-à-vis consumers.

(63) With respect to Apple’s allegation that the Commission has not taken into account

the effect of out-of-the app communications in its assessment, the Commission notes

that it examines this issue extensively in recitals (205) to (207) and (700), concluding

that these tools constitute inferior ways of communicating with users not equivalent

to effective in-app price information at the time when the user is engaging with the

service.

62

(64) Fourth, as regards Apple’s claim that the Commission had an obligation to obtain

certain information from music streaming service providers which Apple could not

60

Case T-758/14 Infineon, EU:T:2016:737, paragraphs 73 and 110.

61

Letter of admission of BEUC as an interested third-party, ID 1748.

62

See also Statement of Objections of 28 February 2023, ID 2821, paragraphs 948, 675 and 692; Letter of

Facts, ID 3230, paragraph 54 and footnote 152.

EN 19 EN

have accessed in any other way (see recital (56)), the Commission notes that in the

(annulled) Intel judgment invoked by Apple, the General Court stated that, “[w]here

an undertaking which is the subject of an investigation has become aware of the

existence of an exculpatory document, but is unable to obtain it itself or is prevented

from submitting it to the Commission, whereas the Commission is able to obtain that

document and use it, the Commission may be obliged in certain circumstances to

obtain that document following an express request to that effect by the undertaking

concerned”.

63

The General Court emphasised that “such an obligation must be

limited to exceptional cases”

64

and noted that “[t]he mere fact that certain documents

may contain exculpatory evidence does not suffice to establish an obligation on the

Commission to obtain them at the request of a party concerned by the

investigation”.

65

The case law more generally clarifies that the Commission “has a

margin of discretion in deciding whether it should obtain the documents [requested

by an investigated undertaking]. The parties to a procedure have no unconditional

right to the Commission’s obtaining certain documents, since it is for the

Commission to decide how it conducts the investigation of a case.”

66

(65) In this case, Apple has not “become aware of the existence of an exculpatory

document” but asked the Commission to obtain documents and information since, so

it claims, in their absence it “would be missing a key piece of potentially exculpatory

evidence that would demonstrate the effectiveness of one of the key alternative

acquisition channels for [Music Streaming Service] providers”.

67

In such a situation,

the Commission was not obliged to request the documents and information in

question. In exercising its margin of discretion, the Commission considered that its

file was sufficiently complete and that obtaining the information according to

Apple’s request was not necessary in view of the various other pieces of evidence

cited in this Decision concerning the effectiveness of promotional emails as a way of

conversion to premium subscriptions.

(66) In addition, according to the Commission’s assessment of the evidence on the file,

the possibility to send emails and run promotional campaigns outside of the app

conducted by music streaming providers are not effective ways of communicating

with users and do not end nor call into question the infringement (see recitals (189)

to (201), (700) and (769)). Consequently, the Commission considers that, contrary to

Apple’s claim,

68

obtaining the information requested by Apple from music streaming

providers concerning the frequency of email communications within six months after

obtaining the user’s email address and about differences among practices in the

Android and iOS platforms would have unlikely lead to obtaining exculpatory

evidence.

63

Case T‑286/09 Intel, EU:T:2014:547, paragraph 372 (emphasis added).

64

Ibid., paragraph 375.

65

Ibid., paragraph 379.

66

Case T-758/14 Infineon, EU:T:2016:737, paragraph 73.

67

Apple’s Response to the Letter of Facts, ID 3320, paragraph 71.

68

Apple’s Response to the Letter of Facts, ID 3330, paragraph 71.

EN 20 EN

5.3. The Commission did not infringe Apple’s rights of defence in relation to

minutes of meetings

5.3.1. Apple’s arguments

(67) Apple argues that the Commission has failed to properly record information received

during meetings with third parties with respect to 29 minutes of meetings with

Spotify and BEUC contained in the case file.

69

According to its view, those minutes

are insufficiently detailed to reflect the content of the discussions between the case

team and the complainant or interested party.

70

In addition, Apple claims that, to

exercise its rights of defence, it needed access to the information discussed during

each of those 29 meetings.

71

Lastly, Apple argues that the Commission

communicated minutes and sought comments from Spotify with delay, which in

Apple’s views questions the accuracy of such minutes.

72

5.3.2. Principles

(68) Pursuant to the case law of the Court of Justice, the Commission has a duty to record

and add to the case file the content of interviews aimed at collecting information on

the subject matter of the investigation and therefore falling within the scope of

Article 19 of Regulation (EC) No 1/2003.

73

The case law clarified over time that the

Commission must provide an indication of the content of the discussions which took

place during the interview, in particular the nature of the information provided from

the subjects, but is free to record the statements made by the persons interviewed in

the form of its choosing.

74

(69) In Intermarché Casino Achats, the Court of Justice stressed that interviews

conducted under Article 19 of Regulation (EC) No 1/2003 are those “conducted for

the purpose of collecting information relating to the subject matter of an

investigation, which presupposes that an investigation is ongoing”.

75

Therefore,

meetings discussing purely procedural or technical matters and not conducted for the

purpose of collecting information relating to the subject matter of the investigation

do not fall within the scope of Article 19 of Regulation (EC) No 1/2003 and therefore

do not trigger an obligation to record minutes.

(70) The Court of Justice further clarified that, in order to find an infringement of the

rights of defence of the investigated undertaking for lack or incompleteness of

interview records, the investigated company would need to establish that: (i) it did

not have access to certain exculpatory evidence and (ii) it could have used that

evidence for its defence.

76

69

Annex 5 to Apple’s Response to the Letter of Facts, ID 3320.

70

Apple’s Response to the Letter of Facts, ID 3330, paragraph 77 and Section II of Annex 5 to Apple’s

Response to the Letter of Facts, ID 3320.

71

Apple’s Response to the Letter of Facts, ID 3330, paragraph 78 and Section III of Annex 5 to Apple’s

Response to the Letter of Facts, ID 3320.

72

Apple’s Response to the Letter of Facts, ID 3330, paragraph 79 and Section IV of Annex 5 to Apple’s

Response to the Letter of Facts, ID 3320.

73

Case C-413/14 P Intel v Commission, EU:C:2017 :632, paragraphs 89-93.

74

Case C-413/14 P Intel v Commission, EU:C:2017 :632, paragraphs 90 and 91; Case T-604/18 Alphabet

v Commission (Google Android), EU:T:2022:541, paragraph 912.

75

Case C-693/20 P Intermarché Casino Achats v Commission, EU:C:2023:172, paragraph 112. See also

Case T-604/18 Alphabet v Commission (Google Android), EU:T:2022:541, paragraph 911.

76

Case C-413/14 P Intel v Commission, EU:C:2017:632, paragraph 98.

EN 21 EN

(71) In particular, the General Court established that in assessing procedural errors in

relation to records of interviews with third parties under Article 19 of Regulation

(EC) No 1/2003, it is necessary to determine whether, in view of the factual and legal

circumstances specific to the case, the investigated undertaking “has adequately

demonstrated that it would have been better able to ensure its defence had those

errors not occurred”. The General Court concluded that if that is not demonstrated,

no infringement of rights of defence can be established.

77

(72) Moreover, in Google Android the General Court took favourably into consideration

that in the absence of records of interviews the Commission (i) “endeavoured to

reconstitute their content in order to enable Google to exercise its rights of defence”

(ii) “had not made use of any of the notes provided as inculpatory evidence” and (iii)

“it had provided Google with all potential exculpatory evidence provided at each of

those meetings that could be useful for Google’s defence”.

78

5.3.3. Assessment of Apple’s arguments

(73) The Commission maintains that Apple’s rights of defence have been preserved with

respect to the minutes in question, in line with the principles set out by the case law

of the Union Courts for the following reasons.

5.3.3.1. Meetings which do not constitute interviews pursuant to Article 19 Regulation (EC)

No 1/2003

(74) First, it should be noted that not all of the meetings Apple takes issue with were

interviews pursuant to Article 19 of Regulation (EC) No 1/2003, as these did not all

collect information relating to the subject-matter of the investigation and were not

conducted for that purpose. In those meetings, the Commission discussed purely

technical or procedural aspects with third parties.

(75) This concerns the following meetings, which did not collect information relating to

the subject-matter of the investigation but for which the Commission, in the spirit of

full transparency, provided Apple with agreed minutes

79

:

(1) The first of these minutes concerns a call between the case team and Spotify on

12 March 2019, the day following the submission of its complaint.

80

The

content of the discussions were practicalities and procedural aspects following

the submission of the complaint, such as public disclosure to the press and next

steps of the procedure.

81

(2) Two minutes

82

concern calls between the case team and Spotify’s economic

advisors about the organisation of a data room which took place in June 2019.

On 4 and 19 June 2019, the case team discussed technical issues concerning the

display and replicability of the code and data submitted by Spotify in the

software available in the data room.

83

These calls aimed at making data and

77

Case T-604/18 Alphabet v Commission (Google Android), EU:T:2022:541, paragraph 934.

78

Case T-604/18 Alphabet v Commission (Google Android), EU:T:2022:541, paragraphs 941 and 942.

79

Agreed minutes were signed by Spotify or BEUC under the following formulation at the end of each

minute “Spotify/BEUC confirms that this note fully reflects the content of the discussions as held during

the videocall”.

80

Minutes of the meeting of 12 March 2019 (ID 1416).

81

The non-confidential version of the complaint was shared with Apple on 28 March 2019 (ID 93).

82

Minutes of the meetings of 4 June 2019 (ID 1414) and 19 June 2019 (ID 1420).

83

In addition to the agreed minutes Apple had access to email exchanges between the case team and

Spotify´s economic advisors (ID 273) in which the case team explained the technical issue it had

EN 22 EN

code available in the data room to Apple, and not at collecting or discussing

relevant information.

(3) Following the data room in June 2019, the case team organized a meeting on

3 July 2019

84

with Spotify’s economic advisors in order to verify that the

redacted version of the data room report prepared by Apple’s economic

advisors during the data room did not contain any confidential data from

Spotify.

85

The purpose of the meeting was to double check whether the non-

confidential version of the data room report was correct, and not to collect any

information.

(4) On 15 July, 8 and 19 November 2019,

86

the case team held calls with Spotify

concerning the set-up, methodology and questions of a survey to evaluate lock-

in of iPhone users into iOS and whether the pricing of music streaming