TABLE OF CONTENTS

Welcome to SEMA Future Trends

3

What’s the Outlook for the Future?

4

Industry Outlook

5

Economic Forecast

11

Vehicle Trends in the United States

22

Electric Vehicles

36

ADAS and Autonomous

43

Supply-Chain Insights

47

Aftermarket Trends and Opportunity

56

Additional Information

67

Contact Information

69

TABLE OF CONTENTS

WELCOME TO SEMA FUTURE TRENDS

Welcome to the 2023 edition of “SEMA Future Trends.” Last year, we forecast that the U.S. economy would improve slowly amid challenges in 2022 but return to

pre-pandemic levels by the end of 2023. While the economy shows signs of strength (such as low unemployment), lingering supply-chain issues, high interest rates,

and rising inflation have put a damper on things. It has also slowed recovery for auto sales. All of this has led to entering 2023 with mixed signals about the coming

year. However, the recession many said was imminent still has not happened, and consumers continue to spend. Even more importantly for us, enthusiasts continue

to modify and accessorize their vehicles and industry companies continue to report solid sales performance and demand.

Is a recession coming? If it does, will it be mild? When will prices return to normal? When will there be more microchips available? How far away are electric

vehicles? These are just a few of the questions that we’ve heard over the past year. In this report, we’ll try to address these questions and provide our take on where

we think things are going in the future.

Particularly, we’ll focus on the following:

• Industry Outlook and Opportunities: Industry performance continues to be solid, but challenges remain on the horizon. We’ll look at how we see

industry sales changing in 2023 and beyond, as well as discuss areas of potential opportunity and growth.

• Economic Outlook: We’ll discuss where we think things are going with the economy, inflation, spending and unemployment, as well as potential impacts

on the specialty-equipment market.

• Vehicle Trends: The pandemic slowed auto sales. Yet, significant changes are coming to new vehicles. We’ll walk you through our forecast for sales and

production as the industry continues to recover. We’ll also look farther ahead to how drivetrains are changing, the emergence of electric vehicles, the

emergence of autonomous technology, and how these things will impact our industry.

• Lingering Supply Chain Issues: Supply-chain issues remain a hot topic, and we’ll revisit it to see how things are doing and where they’re going.

Forecasting is difficult, and we can’t truly predict your future. There very likely will be things that happen over the next year that none of us expected that will affect

industry performance. However, we hope that this report gives you perspective on where things are going for the economy and our industry, so that you can better

plan for and adapt to what’s ahead.

Kyle Cheng

Senior Manager, Market Research

SEMA

3

4

WHAT’S THE OUTLOOK FOR THE FUTURE?

SPECIALTY-EQUIPMENT INDUSTRY U.S. ECONOMY

VEHICLE TRENDS SUPPLY CHAIN

Sales growth for specialty-equipment parts is projected to have

slowed last year, growing only 2% to $51.75 billion. Unless

economic conditions significantly decline, industry sales growth

should normalize in 2023 and return to the 3%–4% growth seen

during typical years going forward.

Key Impacts : Consumer demand, supply-chain issues, high costs and

prices, economic conditions, automotive sales

Key Impacts: Inflation, consumer spending, disposable income and

demand, labor market

Key Impacts: Automotive sales, prices, electrification, advanced vehicle

technology

Key Impacts: Semiconductor (chip) delivery lead times, port congestion,

trucking industry, transportation prices

The U.S. economy is showing mixed signals right now. Despite

some positive indicators, like low unemployment, the economy

is expected to slow in Q3 2023, potentially dipping into a

recession, before bouncing back in the first half of 2024. The

severity of a recession, if it even happens, is hard to predict.

Because of ongoing supply issues, high prices and increasing

interest rates, full recovery for automotive sales in the United

States likely won’t happen until 2025. Vehicles are becoming

more complex and computerized. Battery electric vehicle sales

are growing—projected to hit 39% of new sales by 2035.

The issues that plagued the supply chain both globally and

within the United States have abated and things are returning

toward normal. Supply should continue to normalize in 2023.

However, it will still take time for availability of some things, like

semiconductors (or chips), to fully recover.

5

INDUSTRY

OUTLOOK

6

SPECIALTY-EQUIPMENT INDUSTRY OUTLOOK

FORECAST

Momentum for Future

Potential Challenges

Sales growth for the specialty-

equipment industry slowed over the

last year, amid ongoing challenges.

Unless economic conditions worsen,

industry sales should normalize and

return to pre-pandemic growth levels

going forward.

• Consumer Demand. Demand for specialty-equipment parts was strong

during the pandemic and continues to be strong.

• Sales and Revenue Expectations. Most of the industry expects solid

sales and revenue over the coming year, despite economic uncertainty.

• Consumers are holding onto their cars longer. Consumers are holding

onto their vehicles longer, as new- and used-vehicle sales slow. They

will likely turn to aftermarket parts in the meantime.

• Ongoing supply-chain issues. Supply-chain issues, like for

semiconductors, continue. While improving, they are putting downward

pressure on inventory levels and upward pressure on prices.

• High costs and prices. Costs are still high for businesses right now and

are being passed to consumers. Costs should start to normalize in 2023.

• Economic conditions. As a discretionary spend sector, any impacts on

disposable income (such as a recession and uncertainty) will negatively

impact how much consumers spend on aftermarket parts.

7

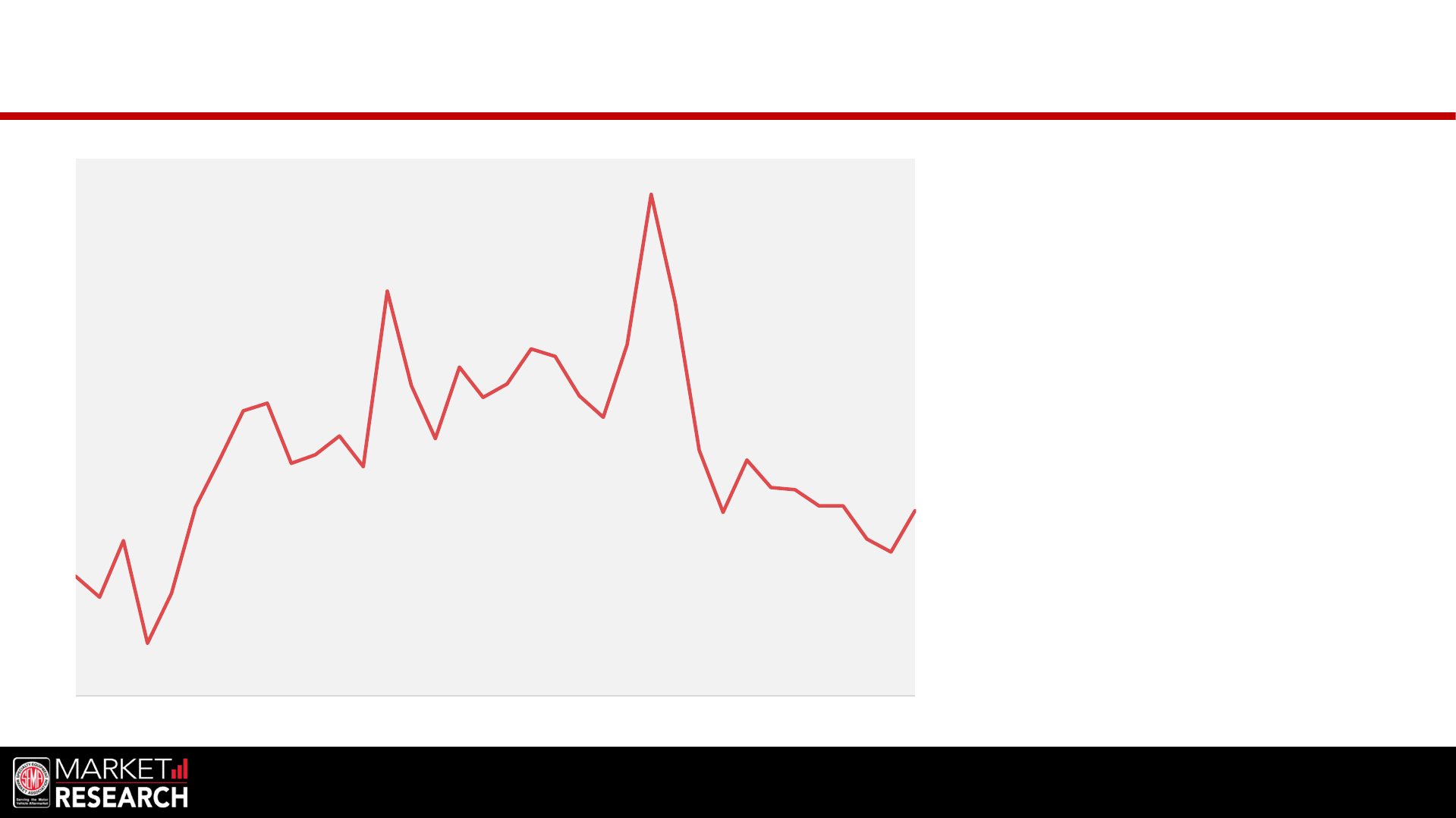

FORECAST

2014

$37.18

2015

$39.09

2016

$41.16

2017

$42.92

2018

$44.59

2019

$46.20

2020

$47.89

2021

$50.90

2022

$51.75

2023

$53.71

2024

$56.13

2025

$58.66

$0

$10

$20

$30

$40

$50

$60

$70

$80

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

PROJECTION FOR INDUSTRY GROWTH

U.S Specialty-Equipment Market Size Forecast

Over the course of the pandemic, the specialty-equipment

industry not only recovered, but many companies thrived. In

2021, demand for specialty-aftermarket parts was strong, with

some companies recording their best sales ever. In fact, retail

sales hit a record high of $50.9 billion—a growth of over 6% from

2020. This was despite looming challenges on the horizon.

These challenges materialized more in 2022, such as rising

inflation and supply-chain challenges—both of which led to lower

inventories and higher prices. Additionally, consumers had more

options to spend their money on, as most sectors of the economy

that closed during the pandemic were open once again. While the

official market size for our industry will be released soon, we

project that sales growth slowed in 2022 to around 2%. Looking

forward, we expect both prices and supply-chain issues to

normalize. Additionally, slow vehicle sales will likely push

consumers to hold onto their vehicles longer and purchase more

aftermarket parts. As a result, unless economic conditions change

significantly, we expect our industry to return to normal growth

levels of 3% to 4% in 2023 and beyond.

Of course, these projections are dependent on what happens to

the economy over the coming year and how it affects consumer

spending. Right now, many are projecting some economic slowing

towards the end of 2023 and potentially a recession as the

Federal Reserve attempts to combat inflation. However, if the

recession is deeper and more severe, then projections for our

industry as well as other sectors will end up being more

pessimistic. Bottom line, no one knows what exactly what will

happen in the coming year but as of right now, our industry

remains optimistic for the future.

Source: SEMA Market Research

8

INDUSTRY PERFORMANCE OVER PAST FEW YEARS

Increased Stayed Same Decreased

7%

16%

28%

14%

10%

9%

28%

22%

25%

25%

20%

20%

20%

30%

69%

57%

47%

66%

70%

71%

42%

Spring

2019

Fall

2019

Fall

2020

Spring

2021

Fall

2021

Spring

2022

Fall

2022

10%

15%

34%

23%

19%

15%

30%

33%

25%

28%

17%

20%

27%

36%

53%

59%

38%

60%

60%

58%

34%

Spring

2019

Fall

2019

Fall

2020

Spring

2021

Fall

2021

Spring

2022

Fall

2022

10%

14%

41%

30%

26%

19%

24%

33%

28%

27%

30%

30%

41%

42%

56%

57%

32%

40%

43%

40%

34%

Spring

2019

Fall

2019

Fall

2020

Spring

2021

Fall

2021

Spring

2022

Fall

2022

Manufacturer Distributor

Retailer/Installer

Company Sales Performance Over Time

Change vs. Past 12 Months

During the pandemic, many companies within the industry reported record growth as consumers continued to work on their vehicles when everything else had closed. Our industry continues to report solid

sales, but sales growth has largely returned to more normal levels that were seen prior to the pandemic.

Source: SEMA State of the Industry Report, Fall 2022

9

INDUSTRY OUTLOOK FOR 2023

Expectations for Company Sales

Over Coming Year

Increase Stay Same Decrease

18%

16%

13%

35%

37%

44%

47%

48%

44%

Manufacturer Distributor Retailer/Installer

Despite ongoing uncertainty around the economy as well as

lingering issues with the global supply chain, most companies

within the specialty-equipment industry expect company sales to

stay the same or grow over the next year. Companies do expect

the costs of doing business, especially production and supplier

costs, to remain elevated but are still optimistic about consumer

demand and profits. Additionally, more than 130,000 people

attended the 2022 SEMA Show in November 2022, a 30% growth

over 2021. This is a strong indicator of the expected demand for

aftermarket parts over the next year.

Source: SEMA State of the Industry Report, Fall 2022

130,000+

Attendees and Exhibitors at

the 2022 SEMA Show

+30% vs. 2021 SEMA Show

10

INDUSTRY OUTLOOK FOR 2023

79%

34%

39%

30%

21%

18%

45%

40%

49%

52%

3%

21%

21%

22%

27%

Business Metric Expectations for 2023

71%

68%

44%

46%

36%

32%

23%

27%

40%

35%

38%

43%

6%

5%

16%

20%

26%

24%

Supplier Costs

Production Costs

Number of Customers

Revenue

Consumer Demand

Inventory Levels

70%

33%

38%

28%

30%

22%

41%

38%

43%

46%

9%

26%

25%

30%

24%

Manufacturer Distributor Retailer/Installer

Companies within our industry expect revenue, number of customers and consumer demand to remain solid in 2023. However, the costs for doing business and producing products are still expected to

be expensive in 2023. Companies also remain concerned about inventory and supply-chain issues.

Source: SEMA State of the Industry Report, Fall 2022

ECONOMIC

FORECAST

12

U.S. ECONOMIC OUTLOOK

FORECAST

Economic signals are mixed, but we

enter 2023 with some momentum—

especially with low unemployment and

strong consumer spending. Many

expect the economy to slow down in

the second half of 2023, potentially

dipping into a mild recession in Q3, but

it should bounce back quickly in the

first half of 2024.

• Inflation and high prices. Prices right now for consumers are very

high, and costs are also very high for producers and manufacturers.

Inflation will likely fall as the Federal Reserve implements aggressive

interest rate hikes in 2023, but the economy may slow as a result,

potentially pushing the economy into a recession—the severity of

which, if it occurs at all, is hard to predict.

• Unemployment rates. The labor market remains tight, and

companies continue to hold on to their workers. Unemployment is

at its lowest levels since the 1960s, but things may change if the

economy slows. While some tech companies have begun layoffs

after ramping up employment the last two year, few other sectors

have followed suit.

• Consumer spending, disposable income and demand. Consumer

spending right now remains strong, but disposable income is

tightening as post-pandemic stimulus has dried up and costs for

consumers rise. As costs return to normal and the economy slows,

how consumers change their spending will be important to monitor.

13

FORECAST

3.2%

2.4%

-35%

-25%

-15%

-5%

5%

15%

25%

35%

45%

2006 2007 2008 2009 2011 2012 2013 2014 2016 2017 2018 2019 2021 2022 2023 2024

Source: U.S. Bureau of Economic Analysis, Real Gross Domestic Product. Data as of December 22, 2022.

Source: Wells Fargo & Company. Economic Forecast as of January 13, 2023.

WHERE IS THE U.S. ECONOMY GOING?

Despite all the uncertainty over the past year, the U.S. economy

enters 2023 with momentum. The second half of 2022 showed

resiliency, with real GDP up 3.2% at an annualized rate for Q3

and projected to finish above 3% for Q4 as well. Unemployment

hit 3.5% in December 2022, its lowest level since the start of the

pandemic and matching levels that haven’t been seen since

before the oil crisis in the 1970s. Consumer spending likewise

remains strong—especially for retail. On top of this, rising

inflation appears to have peaked and is dropping.

However, not all economic data have been positive. The housing

market, thanks to high interest rates, has retracted. While

unemployment has improved, labor demand hasn’t increased. A

few high-profile companies, such as Facebook, have also

announced layoffs recently. While inflation is improving, prices

remain high. This has led many consumers to take on high levels

of debt, especially on their credit cards. Additionally, the Federal

Reserve will likely continue to take aggressive steps with

interest rates to slow the economy and bring prices down.

Ongoing supply issues, especially for the automotive industry,

have stalled full recovery as well. All of these are things we’re

monitoring as we enter 2023.

No one knows what will happen over the next year, and

whether a recession will happen or not. Many economists

expect that the economy will slow in the later half of 2023 (Q3),

potentially entering a mild recession, before returning to normal

levels in the first half of 2024.

U.S. Economic Growth Forecast

Real GDP, Seasonally Adjusted, Compound Annual Growth Rate Quarter-Over-Quarter

Q4

2024

Q3

2022

14

FORECAST

7.1%

2.4%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011 2014 2017 2020 2023

Source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average. Data as of January 12, 2023.

Source: Wells Fargo & Company. Economic Forecast as of January 13, 2023.

INFLATION REMAINS HIGH, BUT IS IMPROVING

Inflation Forecast

Consumer Price Index for All Consumers (All Items in U.S. Cities Average), Year-Over-Year Change

Q4

2024

Q4

2022

As both consumers and businesses can attest, prices right now

are very high and have risen precipitously over the past two

years. In fact, inflation hit a record-high of 9.1% in June 2022, its

highest level since the early 1980s. But what’s really causing

this? It’s hard to pinpoint an exact cause and is a result of

several factors. The pandemic caused a severe disruption in the

global supply chain, which reduced supply of consumer goods

and drove up prices. Amid these shortages, stimulus programs

helped keep up demand by giving consumers more disposable

income and further constraining things. Additionally, geo-

political issues—such as the war in Ukraine—drove up the cost

of fuel and other commodities, leading to increased prices.

These are just some of the things that helped push prices to

where they are.

That said, things look like they are improving. Inflation was

7.1% in Q4 2022, a decline from it’s peak earlier in the year. The

rise in prices will likely continue to drop this year. By the end of

2023, the inflation rate should normalize back to around 2%.

The aggressive steps the Federal Reserve has taken to increase

interest rates has contributed to this reduction in inflation.

However, the rate remains high, and the Fed will likely continue

to take aggressive measures in 2023. This in turn will slow down

the economy, potentially causing a recession. Many are

predicting a “soft-landing” recession that avoids major impacts

to the economy, but it’s impossible to predict as of right now.

15

FUEL AND FOOD HAVE SEEN THE BIGGEST SPIKES

IN PRICE

Rank Product Type

12-Month Change in

Price (Dec 2022)

1 Fuel oil +41.5%

2 Airline fare +28.5%

3 Natural gas (piped) +19.3%

4 Cereals and bakery products +16.1%

5 Energy services +15.6%

6 Dairy and related products +15.3%

7 Transportation services +14.6%

8 Electricity +14.3%

9 Motor vehicle insurance +14.2%

11 Motor vehicle maintenance and repair +13.0%

25 New vehicles +5.9%

36 Gasoline (all types) -1.5%

37 Used cars and trucks -8.8%

Biggest Price Shifts in the Consumer Price Index (CPI)

With inflation starting to cool off, what products are showing the

biggest swing in price? Right now, it’s energy. Fuel oil is currently the

biggest contributor to inflation, up 41.5% from last year. Fuel oil is an

aggregate category that includes fuels that are burned to generate

heat or power. Much of the spikes we’re seeing now are driven by

unpredictable weather and the geopolitical concerns stemming from

the war in Ukraine. Unleaded gasoline is down slightly from last year,

but other fuels like diesel remain very expensive.

Airline fares are exceptionally high right now thanks to high demand

for travel, staff shortages, delays and increased fuel costs. Food is also

very expensive, due to supply-chain shortages. There currently is a

shortage of Tabasco sauce thanks to poor pepper crops stemming

from poor weather. An increase in avian flu on chicken farms has also

led to a shortage of eggs in stores and is driving up prices.

The price of new vehicles remains high thanks to continued supply

issues (especially chips). Slowing demand, however, is starting to put

downward pressure on this. Used vehicles are also down 8.8% from

last year. The cost of using a vehicle, such as insurance and

maintenance, is up due to increased driving. Consumers are driving

more now that many have returned to the office and because of the

high prices of other forms of transportation.

Source: Bureau of Labor Statistic, “Consumer Price Index.” Data as of January 12, 2023.

Bolded items indicate automotive-related categories.

16

FORECAST

8.9%

2.3%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Source: U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Final Demand. Data as of December 9, 2022.

Source: Wells Fargo & Company. Economic Forecast as of January 13, 2023.

PRICES ARE ALSO EXPENSIVE FOR PRODUCERS AND

MANUFACTURERS

Producer Cost Forecast

Producer Price Index (Final Demand), Year-Over-Year Change

Q4

2024

Much of the attention surrounding prices these days has been on

inflation as it relates to consumer prices. However, prices have

also been extremely high for manufacturers and producers of

products. Producer prices in Q2 2022 were up 11.1% from 2021—

a record high.

Much of this price increase can be attributed to the pandemic and

supply issues. Prices for raw materials has increased substantially

thanks to shortages, which has significantly driven up costs for

companies.

Thankfully, things are projected to get better. As supply-chain

issues resolve and demand slows, price increases will slow.

Producer prices have likely peaked and are set to improve over

the coming year. By the end of 2023, prices should return to more

normal levels.

Q3

2022

17

Source: University of Michigan, Survey of Consumers. Index of Consumer Sentiment. Data as of December 23, 2022.

CONSUMER CONFIDENCE REMAINS DOWN

55.3

55.8

101.0

56.8

40

50

60

70

80

90

100

110

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Consumer Sentiment

University of Michigan, Consumer Sentiment Index 1966:Q1=100, Monthly, Not Seasonally Adjusted

Nov

2022

Feb

2020

Aug

2011

Nov

2008

Thanks to high interest rates, fears of a potential

recession, persistently high prices and geo-political

issues, consumers have a lot on their mind right now.

Political division in U.S. society is at an all-time high as

well, compounded by mistrust in both the government

and the media. The result has been a negative impact on

how consumers perceive things are going in the United

States today.

However, consumer sentiment is a perception based on

many factors and not necessarily an accurate measure of

economic reality. As inflation returns to more normal

levels and some of the current economic and political

uncertainty dissipates, consumer confidence should

improve.

18

FORECAST

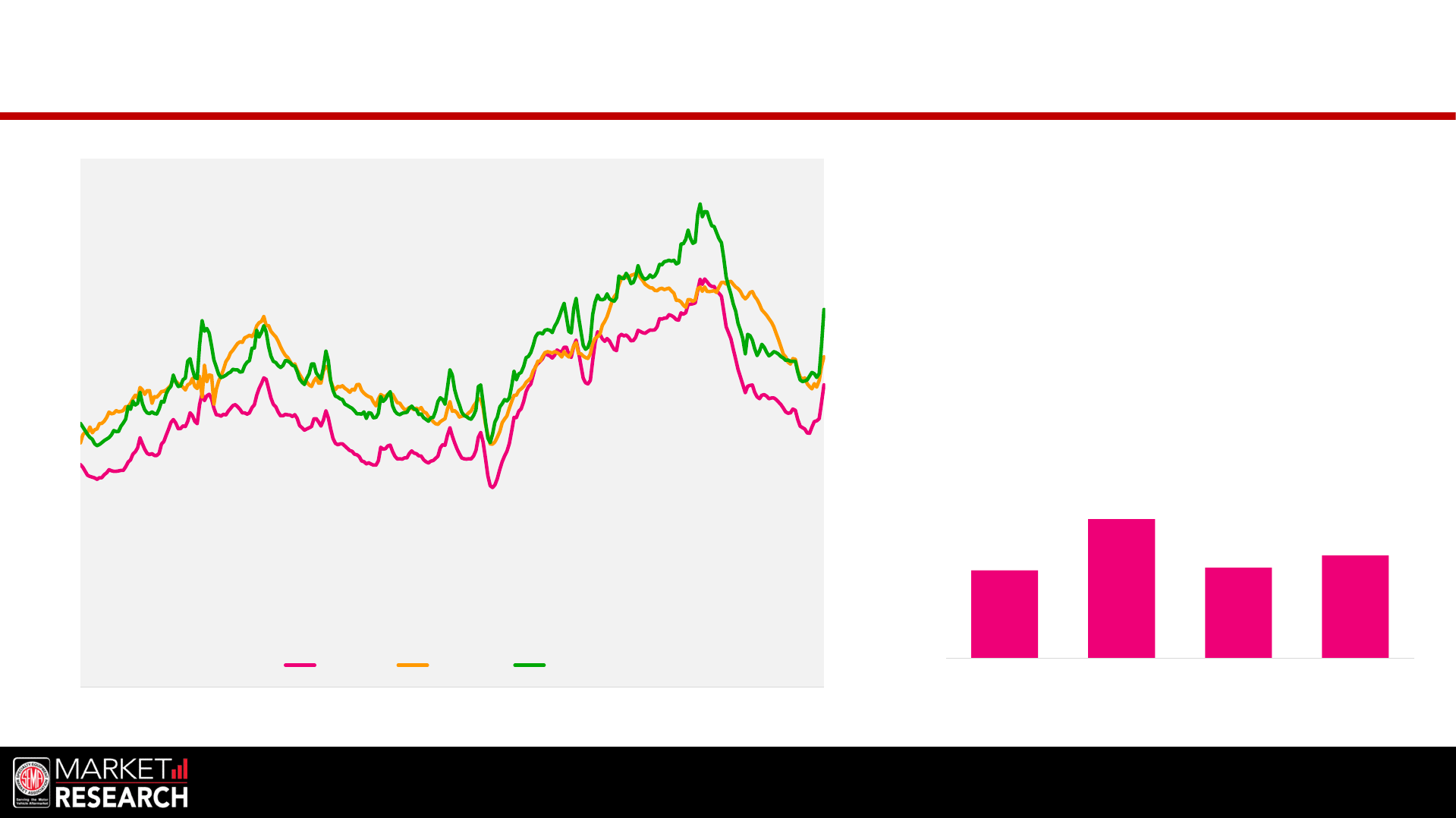

3.8%

13.0%

3.6%

4.9%

0%

2%

4%

6%

8%

10%

12%

14%

16%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

UNEMPLOYMENT AT ITS LOWEST SINCE LATE 1960S

Unemployment Rate

Q2

2020

2020

8.1%

2021

5.4%

2022 3.6%

2023*

4.1%

2024*

5.1%

Annual Unemployment

The unemployment rate dropped to 3.6% in Q4 2022, its

lowest level in the last decade and a level not seen since the

late 1960s (before the oil crisis). By all objective measures, it

is strong sign for the U.S. economy and has provided some

momentum for the economy entering 2023.

Given the difficulty of filling open positions over the last

year, many companies are remaining content to maintain

staff levels. There have been sporadic layoffs in certain

sectors recently, most notably the tech sector. Despite this,

most economists agree that the labor market remains tight.

However, payrolls did post their smallest gain in two years to

end 2022, and both hiring plans and job openings have

edged down recently. These are things we’ll need to keep an

eye on in 2023.

Moving forward, as interest rates rise and the economy

slows towards the later half of 2023, there is an expectation

among economists that there will be an uptick on

unemployment claims. However, things should improve

again in 2024.

Q1

2020

Q4

2022

Q4

2024

*Estimate as of December 2022

Source: U.S. Bureau of Labor Statistics, Unemployment Rate. Data as of January 6, 2023.

Source: Wells Fargo & Company. Economic Forecast as of January 13, 2023.

19

FORECAST

$45.2T

$47.5T

$0T

$10T

$20T

$30T

$40T

$50T

$60T

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

FORECAST

$42.5T

$43.2T

$0T

$10T

$20T

$30T

$40T

$50T

$60T

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

Consumers have spent a lot of money over the last year amid high prices and elevated demand. At $45.2 trillion dollars in Q3 2022, consumer spending is at its highest point in U.S. history. A strong labor

market has contributed to this, with many reporting significant income growth. Looking forward, it’s likely many households will encounter tougher financial situations in mid-2023 as the Federal Reserve

tightens its monetary policy to fight inflation. During the pandemic, thanks to generous stimulus, many households had excess savings and disposable income to spend. Given high prices, it’s likely excess

savings have largely run dry. With some slowing in the economy in the later half of 2023 and a potential recession, it’s possible consumers may pull back some on spending. However, that depends on

the severity of the recession—if it even happens.

One thing to keep an eye on is credit card debt. In Q3 2022, average credit card debt per borrower rose to $5,474 according to Transunion. This is a 13% increase from Q3 2021. It’s not just vacations and

shopping sprees. With inflation outpacing income, many consumers are using credit cards to pay for everyday needs. Likewise, fewer are paying off their balance. As credit card debt increases, this may

also constrain how much consumers are able to spend.

CONSUMER SPENDING IS SOLID, BUT CHALLENGES

REMAIN

Disposable Personal Income

Real Disposable Personal Income, Trillions of Chained 2012 Dollars, Quarterly, Seasonally Adjusted

Q3

2022

Q4

2024

Consumer Spending

Real Personal Consumer Expenditure, Trillions of Chained 2012 U.S. Dollars, Seasonally Adjusted

Q3

2022

Q4

2024

Source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures. Data as of December 23, 2022.

Source: U.S. Bureau of Economic Analysis, Disposable Personal Income. Data as of December 23, 2022.

Source: Wells Fargo & Company. Economic Forecast as of January 13, 2023.

20

FORECAST

$2.05T

$1.98T

$0.0T

$0.5T

$1.0T

$1.5T

$2.0T

$2.5T

2006 2008 2010 2012 2014 2016 2018 2020 2022 2024

Retail Sales: Retail Trade and Food Services Forecast

Advance Sales, Trillions of Dollars, Quarterly, Seasonally Adjusted

RETAIL SALES WERE STRONG OVER PAST TWO YEARS

$66.2B

$126.5B

$0B

$20B

$40B

$60B

$80B

$100B

$120B

$140B

$160B

2006 2008 2010 2012 2014 2016 2018 2020 2022

Retail Sales: Motor Vehicle and Parts Dealers

Advance Sales, Billions of Dollars, Monthly, Seasonally Adjusted

Q4

2024

Apr

2020

Alongside the uptick in consumer spending, retail sales have also shown strong growth over 2021 and 2022. Retail sales (both retail trade and food service) hit a record high in Q3 2022 of $2.05 trillion.

They’re projected to hit even higher levels in Q4 2022. Sales at motor vehicle and parts dealers has been especially strong. After seeing a big spike in sales thanks to stimulus payments earlier on in the

pandemic, things have returned to more normal levels, hitting $126.5 billion in November 2022. Some of this increase in retail spending is due to inflation and an increase in prices. However, it’s also due to

strong consumer demand, of which the specialty-equipment industry has benefited.

Moving forward, as the economy slows, it’s likely retail sales will fall in the later half of 2023, before leveling off and returning to growth in 2024. Even with this decline, it’s expected that sales will still

surpass pre-pandemic levels. For automotive parts, retail sales may also soften some, but a significant decline is not expected. Consumers will likely hold onto their vehicles longer and will continue to buy

parts, given the high prices for both new and used vehicles.

Q3

2022

Nov

2022

Source: U.S. Census Bureau, Advance Retail Sales: Retail Trade and Food Services. Data as of December 15, 2022.

Source: Wells Fargo & Company. Economic Forecast as of January 13, 2023.

Source: U.S. Census Bureau, Advance Retail Sales: Motor Vehicle and Parts Dealers. Data as of December 15, 2022.

21

HOW DOES OUR INDUSTRY VIEW THE ECONOMY?

13%

45%

42%

Good

Just Okay/Average

Bad

Good Just Okay/Average Bad

15%

31%

54%

Improve

Stay the Same

Worsen

Improve Stay the Same Worsen

Like many in the United States, companies within the specialty-equipment industry also have concerns about the U.S. economy. Increased costs and supply-chain issues are putting downward pressure

on businesses, and while sales remain solid right now, economic conditions remain a concern. Right now, nearly 60% of our industry views the economy as either good or just average. However,

perceptions are less optimistic about the next year, with most expecting the economy to worsen in 2023.

How Industry Companies View

U.S. Economy and Business Climate

Industry Expectations for U.S. Economy

and Business Climate Over Next Year

Source: SEMA Market Research

22

VEHICLE TRENDS

IN THE UNITED

STATES

23

U.S. VEHICLE TRENDS AND INSIGHTS

OUTLOOK

Full recovery for automotive sales in

the United States will likely take until

2025. Sales of electric vehicles are

growing and expected to hit 39% by

2035. However, it will take decades

before these vehicles replace all the

traditional ICE engines currently in

operation on roads today.

• Vehicle Sales. Due to ongoing supply-chain issues, high prices and

rising interest rates, it’s likely both new and used light-vehicle sales

in the United States won’t return to pre-pandemic levels until 2025.

Prices will stabilize over the next year or two, but it will take time

before sales levels normalize.

• Electrification. While more electric vehicles are coming, they won’t

take over roads any time soon. Significant challenges remain to their

full-scale adoption in the United States. SEMA projects that by 2035,

fully electric vehicles will make up 39% of new light-vehicle sales.

Additionally, specialty-equipment parts for electric vehicles will

likely remain just a small share of our industry’s sales over the

foreseeable future.

• Vehicle Technology Is Changing. Advanced driver-assist systems

(ADAS) and other technologies are making cars more complex. These

changes will impact how aftermarket parts affect new vehicles.

24

0

2M

4M

6M

8M

10M

12M

14M

16M

18M

1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Small Car Midsize/Large Car Sports Car Alternative Power CUV SUV Pickup Van

CUVS DOMINATE U.S. ROADS, FOLLOWED BY PICKUPS

Vehicle Population Forecast

2025 2030 2035

Total VIO 298.8M 317.3M 332.8M

284.9 Million

Cars and light trucks currently

on the road today.

Today, there are more than 284 million vehicles in operation. Thanks to their ever-growing popularity, CUVs continue

to dominate U.S. roads. Nearly a quarter of all registered vehicles in the United States today are crossovers. Pickups,

given their functionality, versatility and longevity, are popular platforms as well. Alternative-power vehicles, of which

electric vehicles are a part, only make up around 3% of vehicles on the road. While that number is expected to grow

in coming years across multiple segments as their sales increase, it will take a while before electrics take over.

By 2025, we project the vehicle population in the United States to be just under 300 million and, by 2035, anticipate

that number will cross 330 million.

Current Registered Vehicles/Vehicles-in-Operation (VIO) by Model Year

Data as of Q3 2022

10.3M

52.1M

69.8M

37.2M

31.0M

59.5M

16.2M

Total

8.9M

Source: ©2023 Experian. Vehicle-in-Operation (VIO) registration counts as of September 30, 2022.

Source: SEMA Estimates

25

LICENSE RATES BY AGE

9.7M

16.0M

36.7M

42.2M

36.0M

22.7M

27.3M

9.6M

17.5M

36.3M

37.3M

41.4M

34.3M

33.7M

8.4M

17.3M

39.9M

38.2M

37.4M

39.4M

47.7M

Under 19

20–24

25–34

35–44

45–54

55–64

65+

2000

2010

2020

Licensed Drivers by Age Group

There are more drivers today than at any point in U.S. history. In 2020, there were

228 million licensed drivers in the United States. This was 18 million more than

there were in 2010 and 37 million more than in 2000.

Young people do still drive, despite popular belief. While license rates for those

under age 19 have fallen over the years, likely due to the increased cost of both

insurance and the vehicles themselves, young people very much age into driving.

By their early 20s, the majority end up getting their driver's license. These younger

drivers tend to also be more enthusiast when it comes to the aftermarket.

One shift that has happened is that there are more older drivers today than ever

before. This is a natural byproduct of an aging population. Despite this growth of

older drivers, it is not translating to more accessorization—emphasizing that young

people do care about cars and are critical to the specialty-equipment industry.

Source: U,S, Department of Transportation, Federal Highway Administration. “License Rates by Age and Gender.” Data as of January 2023.

Total Licensed Drivers

2020: 228M (+9% vs. 2010)

2010: 210M

2000: 191M

48%

33%

44%

84%

80%

81%

92%

87%

87%

93%

92%

90%

96%

91%

93%

93%

93%

99%

78%

88%

85%

26

FORECAST

16.1M

13.2M

10.4M

11.6M

12.7M

14.4M

15.5M

16.4M

17.4M

17.5M

17.1M

17.2M

17.0M

14.5M

14.9M

13.7M

14.9M

15.9M

16.5M

16.7M

16.7M

16.7M

16.6M

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029

Small Car Middle Car Large Car Luxury Car CUV SUV Pickup Van

U.S. LIGHT-VEHICLE SALES FORECAST

5%

0.4%

48%

5%

11%

21%

4%

By

2029

U.S. New Light-Vehicle Sales Forecast

6%

In the “2021 Future Trends” report, we projected that new-vehicle sales in the United States would return to pre-pandemic levels by the end of 2023. However, due to supply shortages, rising interest

rates, high prices and slowing sales, it’s likely that sales won’t return to pre-pandemic levels until 2025. In 2022, 13.7 million new vehicles were sold—roughly 1.2 million units below 2021 and 3.3

million units below 2019. New vehicles are very expensive right now and interest rates are high, making it difficult for consumers to purchase them. On top of that, the industry continues to run into

supply issues—especially around semiconductors (or chips). Although things have improved, hundreds of thousands of vehicles are still sitting in lots waiting for their final components to be installed.

In terms of sales trends, the shift towards light trucks (CUVs, SUVs, pickups, vans) away from passenger cars is ongoing. By 2029, it’s expected that more than 85% of new vehicles will be a light truck,

of which 48% will be CUVs. This transformation was helped by the pandemic, which forced OEMs to prioritize their most profitable models, which happen to be light trucks (especially pickups). An

additional consideration is the growth of electric vehicles across multiple vehicle segments, which we’ll discuss later.

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of December 16, 2022.

27

NEW-VEHICLE INVENTORY FINALLY SURPASSING SALES

1.3M

1.7M

499K

0K

500K

1M

2M

2M

3M

3M

4M

4M

5M

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Sales Inventory Production

U.S. New Light-Vehicle Sales, Inventory and Production

For the first time since early 2021, new light-vehicle

inventory outpaced sales by a significant margin.

Thanks to their high cost, rising interest rates and

limited availability, sales slowed in the later half of

2022. As a result of this, in addition to supply-chain

issues, production among OEMs declined at the end

of 2022.

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of January 10, 2023.

Dec

2022

New-vehicle inventory levels

as of December 2022 are 52%

below December 2019, but

56% above January 2022.

28

THE PRICE FOR A NEW VEHICLE IS AT A RECORD HIGH

$49,507

$25,000

$30,000

$35,000

$40,000

$45,000

$50,000

Jan 2016 Apr 2017 Jul 2018 Oct 2019 Jan 2021 Apr 2022

Average Transaction Price of New Vehicles in United States

Excluding applied consumer incentives

Despite increasing inventory levels, the average prices

for new vehicles continues to grow. The average

transaction price, without applied consumer incentives,

hit $49,507 in December 2022—the highest price on

record. Today, the best-selling new vehicle in the United

States is the Ford F-Series pickup, and the average price

for a new one is $66,451. This is well into luxury

territory. Likewise, the average price for an electric is

$61,448, pricing out these vehicles for many consumers.

Ultimately, these prices as well as increasing interest

rates are putting downward pressure on sales for dealers

and automakers across the country.

As supply-chain issues ease and sales continue to soften,

prices should come down. However, interest rates are

likely to remain high for a while as the Federal Reserve

tries to lower inflation.

Dec

2022

Source: Kelly Blue Book. Data as of January 11, 2022.

$49,507

Average Transaction Price in

December 2022

+4.9% vs. December 2021

+28.1% vs. December 2019

29

IT’S HARD FOR CONSUMERS TO BUY NEW RIGHT NOW

77%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2006 2008 2010 2012 2014 2016 2018 2020 2022

Share of Consumers That Think It’s a Bad Time to Buy a Car

University of Michigan, Survey of Consumers

The average price of a new passenger car or light truck in

the United States today is $49,507. In December, the

average interest rate for a new vehicle was 5.16%. This,

along with the fact that model availability is still limited

make it difficult for consumers to purchase new right

now. In fact, according to the University of Michigan’s

Survey of Consumers, 77% of consumers think it’s a bad

time to buy a car, a 32-point increase from 2008 at the

height of the Great Recession.

2022*

Source: University of Michigan, Survey of Consumers. Index of Consumer Sentiment. Data as of December 23, 2022.

Source: Kelly Blue Book / Nerd Wallet

*As of November 2022.

77%

of consumers think it’s a bad

time to buy a car (2022)

+44% vs. 2019

+32% vs. 2008

30

THE SHIFT TO LIGHT TRUCKS BY BRAND

26%

44%

42%

69%

74%

56%

58%

31%

44%

65%

66%

97%

56%

35%

34%

3%

35%

57%

60%

91%

65%

43%

40%

9%

33%

45%

67%

100%

67%

55%

33%

1992 2002 2012 2022

3% 3%

17%

79%

97% 97%

83%

21%

1992 2002 2012 2022

29%

34%

41%

65%

71%

66%

59%

35%

60%

76%

69%

90%

40%

24%

31%

10%

The transition to light trucks is even more apparent when you look at new-vehicle sales by

brand. In 2022, light trucks made up 97% of sales for Ford. In fact, they currently only offer one

passenger car model: the Mustang. The change is also drastic if you look at sales over the past

three decades. In 1992, 100% of sales for Honda brands were from passenger cars. In 2022,

that share was only 33%. In 1992, 97% of the Volkswagen group’s sales were from passenger

cars. That share was only 21% in 2022.

All Brands

All Brands

All Brands

All Brands

All Brands

Share of New U.S. Light-Vehicle Sales by Type

Light Truck (CUV, SUV, Van, Pickup)

Passenger Car

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of January 10, 2023.

31

ENGINE INSTALLATIONS BY DISPLACEMENT

15.8M

17.2M

17.7M

17.6M

16.9M

17.5M

17.0M

16.4M

14.9M

14.5M

0

2M

4M

6M

8M

10M

12M

14M

16M

18M

20M

'12 '13 '14 '15 '16 '17 '18 '19 '20 '21

Model Year

Under 2.0L 2.0–2.9L 3.0–3.9L 4.0–4.9L 5L and Above Electric/Fuel Cell

Engine Installations by Displacement on New Light Vehicles

By Model Year

Over the two decades, gas efficiency was a priority for OEMs as

they developed new models and engine platforms. Instead of

building bigger engines with larger displacements, they opted

to build more cars with smaller engines that got better gas

mileage, and then turbocharge them for better performance.

However, with the emergence of alternative energy platforms

(especially electric vehicles or EVs), we’ve seen OEMs shift

towards these platforms instead of smaller engines. For

example, the share of new vehicles with under 2.0L dropped

from 18% (2017) to 14% (2021), and from 28% (2017) to 26%

(2021) for 3–3.9L engines. Vehicles with 2–2.9L engines remain

popular, especially for CUVs, and are often turbocharged.

Interestingly, the share of cars with a 5L+ engine jumped from

13% (2017) to 15% (2021)—a shift away from the traditional

efficiency paradigm.

18%

37%

28%

2%

13%

14%

41%

26%

2%

15%

2%

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of June 2022.

32

ENGINE INSTALLATIONS BY CYLINDERS

15.8M

17.2M

17.7M

17.6M

16.9M

17.5M

17.0M

16.4M

14.9M

14.5M

0

2M

4M

6M

8M

10M

12M

14M

16M

18M

20M

'12 '13 '14 '15 '16 '17 '18 '19 '20 '21

Model Year

3 4 5 6 8 10+ Electric/Fuel Cell

Engine Cylinder Installations on New Light Vehicles

By Model Year

55%

31%

13%

52%

29%

15%

2%

2%

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of June 2022.

This same trend also applies to engine cylinders in new cars and

light trucks. The share of big engines (8 cylinders) in new light

vehicles increased from 13% (2017) of new-vehicle sales to

15% (2021). At the same time, the share of 4-cylinder and 6-

cylinder engines decreased. As more hybrid and electric models

come out, expect these engine installations to decrease

further. The increase of 3-cylinder engine installations is likely

due to the increase of hybrid and plug-in hybrid vehicles

being sold.

Share of New Vehicles with 4 Cylinders

Share of New Vehicles with 6 Cylinders

55% 52%

31% 29%

MY17 MY21

MY17 MY21

33

USED-VEHICLE SALES ARE ALSO DOWN

Like the market for new vehicles, used-vehicle sales are also

down. Sales for 2022 are projected to have finished more than

4 million units below their 2021 levels. Consumers keep their

vehicles longer as they buy new vehicles less, which means less

used inventory is available and puts upward pressure on prices.

On top of this, interest rates for used vehicles on average are

even higher than those for a new vehicle loan.

As with new-vehicle sales, we project that it will take until 2025

for used-vehicle sales to return to their pre-pandemic levels of

around 40 million units per year.

42.6M

41.4M

36.5M

35.5M

36.9M 36.9M

37.6M

35.8M

36.2M

37.3M

38.6M

39.2M

40.2M

40.8M

37.3M

40.9M

36.3M

38.0M

39.3M

40.7M

0M

5M

10M

15M

20M

25M

30M

35M

40M

45M

50M

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

U.S. Used Light-Vehicle Sales

Source: Bureau of Transportation Statistics, U.S. Department of Transportation. “New and Used Passenger Car and Light Truck Sales and Leases.” Data as of

September 2022.

Source: Cox Automotive / SEMA Forecasts

34

IT’S VERY EXPENSIVE TO BUY USED AS WELL

0

50

100

150

200

250

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Manheim Used-Vehicle Value Index

Similar to new light vehicles in the United States, it’s

expensive to buy a used vehicle as well. As of November

2022, the average price of a used vehicle was $27,143. On

top of this, the average interest rate on a used-car loan is

exceptionally high at 9.34% (December 2022), significantly

higher than that for a new vehicle. These prices, along with

diminished inventory, are helping to soften sales as well.

Now that used-vehicle sales have cooled off, prices are

expected to normalize and become less volatile over the

next year or two.

Average Listing Price of a Used Car in the U.S.

As of January 2023

$27,143

Source: Mannheim / Cox Automotive. Data as of January 2023.

Source: Nerd Wallet

9.34%

Average Interest Rate for Used-Car Loan

December 2022

35

USED CAR PRICES ARE STARTING TO BACK DOWN

While still expensive, used-vehicle prices are down across

the board as used-car sales have softened. However, there is

some variation by segment, indicating that some vehicle

segments are holding their value better in the used market

than others.

For example, the prices for pickups and vans seem to have

declined less than other segments. This has been likely

helped by the demand for work vehicles. Conversely, the

segment that dropped the most in price were SUVs and

CUVs. This is surprising, given the popularity of CUVs among

new car buyers.

-14.9%

-13.5%

-15.8%

-15.2%

-12.2%

-16.6%

-12.0%

-20%

-18%

-16%

-14%

-12%

-10%

-8%

-6%

-4%

-2%

0%

Total Compact Car Midsize Car Luxury Car Pickup SUV/CUV Van

Change in Manheim Used Car Value Index by Segment

Year-over-Year Change for December 2022

Source: Mannheim / Cox Automotive. Data as of January 2023.

36

ELECTRIC

VEHICLES

37

EV OUTLOOK

OUTLOOK

The electric vehicle market is poised for

significant growth over the next decade.

But EV growth will likely be much slower

than many proponents have claimed.

Many of the currently promoted EV goals

will be very difficult to achieve without

significant infrastructure buildout.

With nearly 300 million gas powered cars

and trucks on US roads, EVs won’t displace

ICE vehicles as the dominant mode of

transportation for many decades.

• Automakers are aggressively pushing EV. All current automakers

have announced plans to move toward an all-EV fleet.

• Green is in. It’s easy to sell the idea of no tailpipe emissions as a

positive benefit for society.

• Government goals. The White House has stated goals of 50% new EV

sales by 2035. California is more aggressive with 100% new EV sales

by 2035, which may be taken up by other states.

• Reduced costs for automakers. Ultimately, the reduced supply chain

and lower number of parts needed to build an EV will bring down

production costs, and potentially raise profits, for automakers.

Headwinds

Tailwinds

• EV production capacity limited. Most announced plans to convert or

build EV or battery factories are a ways from opening.

• Hidden environmental costs. Expanded strip mining of toxic heavy

metals and storing used EV battery waste are growing concerns.

• EV sales goals are unrealistic. Electric vehicles “are just going to take

longer than the media would like us to believe,” says Akio Toyoda.

• Consumers are not demanding EVs. Most consumers still have

reservations about EV technology and the speed and availability of

charging, particularly for those that can’t home charge.

• EV prices are high. It’s not a guarantee that supply chains for

batteries will efficiently produce enough capacity to lower EV prices.

• Infrastructure. Investment is flowing into charging stations, but can

the electrical grid handle all the additional load?

38

FORECAST

17.4M

17.5M

17.1M

17.2M

17.0M

14.5M

14.9M

13.7M

14.9M

15.9M

16.5M

16.7M

16.7M

16.7M

16.6M

16.7M 16.7M 16.7M 16.7M 16.7M 16.7M

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Gasoline

Diesel

Hybrid

Electric

Plug-in Hybrid

Fuel Cell/CNG

U.S. LIGHT-VEHICLE POWERTRAIN OUTLOOK

By

2035

2%

42%

4%

39%

12%

1%

U.S. Light-Vehicle Powertrain Sales Forecast

Source: SEMA Market Research Forecasts and Estimates

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of December 16, 2022.

Electric vehicles (EVs), have gotten a lot of attention recently in the United States—with many OEMS making commitments to shift their new-vehicle fleet to electric models over the next two decades.

Additionally, the California Air Resource Board (CARB) said it would require all new vehicles sold by 2035 to be either fully electric vehicles or plug-in hybrid electric vehicles (PHEVs). However, challenges

remain to full-scale electrification of the new vehicle fleet that make this difficult, including infrastructure challenges, high prices and lingering supply-chain issues. Automakers will need to significantly

ramp up their production capabilities to produce these vehicles; as of 2022, EVs only represented 5% of new vehicles sold. There are also lingering questions around battery safety and vehicle longevity.

With this in mind, we project that 56% of all new light-vehicles sold in 2035 will be alternative power, of which 39% will be fully electric. Electric vehicles are coming, and the specialty-equipment industry

needs to be ready. However, it will take a long time before the 270 million+ non-electric vehicles on U.S. roads today cycle out of operation.

39

GAS STILL DOMINATING BRAND SALES

1.8M

1.7M

1.5M

881K

724K

694K

685K

683K

557K

525K

518K

456K

351K

332K

301K

295K

259K

191K

187K

135K

Toyota Ford Chevrolet Honda Hyundai Kia Jeep Nissan Subaru Ram GMC Tesla Mercedes

Benz

BMW VW Mazda Lexus Dodge Audi Cadillac

Gas

Diesel

Hybrid

Electric

Plug-in Hybrid

CNG/Fuel Cell

Number of New U.S. Light Vehicles Sold in 2022 by Brand (Top 20 Brands)

Share of New-Vehicle Sales by Brand and Powertrain, Data as of January 4, 2023

Fully electric and other alternative power vehicles right now only make up a

small share of vehicles sold today. Tesla, for example, only sold 456,000 cars

in 2022. Toyota, which sold the most vehicles in 2022, only sold around a

thousand electrics. It’s clear that the automakers have a lot of ground to

cover to meet their aggressive EV promises.

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of December 16, 2022.

40

INDUSTRY STILL EVALUATING EV OPPORTUNITY

15% 23% 37% 24%

12% 20% 37% 31%

Electric Vehicles

When it comes to electric vehicles, the specialty-equipment industry is still

evaluating the opportunity for parts and upgrades. Less than 40% of industry

companies view the electric vehicle segment as having moderate to high

opportunity. Part of the reasoning for this is that EVs remain a very small share

of vehicles on the road. So far, they have also only represented a very small

share of sales for the specialty-equipment industry. In 2021, retail parts sales for

alternative power vehicles was only $1.88 billion, of which electric vehicles only

represented just over a half a billion dollars.

$1.88

Billion

2021 U.S. Consumer Purchases of

Specialty-Equipment Parts for

Alternative Power Vehicles

(Hybrid, Electric, etc.)

Manufacturer Retailer/Installer

Where Does the Industry View Opportunity?

High Opportunity Moderate Opportunity Low Opportunity Don’t Know

Source: SEMA Market Research

41

FORECAST

$0.5 $0.5

$0.6

$0.9

$1.1

$1.4

$1.8

$2.2

$2.7

$3.3

$3.9

$4.6

$5.4

$6.4

$7.5

$50.9

$51.7

$53.7

$56.1

$58.7

$60.7

$62.8

$65.0

$67.3

$69.7

$72.1

$74.6

$77.2

$79.9

$82.7

$0B

$20B

$40B

$60B

$80B

$100B

2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Electric Vehicles Total Industry

FORECAST FOR EV SPECIALTY-EQUIPMENT PART SALES

U.S. Market Size Projections for EV Specialty-Equipment Products (Billions)

Source: SEMA Market Research

In 2021, retail sales of specialty-equipment parts for electric vehicles only represented around $500 million. As more EV models are released and sold over the next two decades, we project that

aftermarket part sales will grow, but remain only a small share of our industry. By 2025, we project that part sales will more than double and reach $1.1 billion. By 2035, we project retail sales to

hit $7.5 billion. While this is significant growth from where we are currently, this still only represents 9% of total retail sales for the specialty-equipment industry in 2035.

Bottom line, electric vehicles are coming. Our industry needs to be ready and prepared for the shifting of the vehicle landscape. However, the sky isn’t falling. Electric vehicles aren’t taking over

the roads anytime soon—despite increased sales. And for at least the short term, parts sales for the EV segment will remain small.

42

EV MODEL SNAPSHOT

Ford F-150 Lightning Ford Mustang

Mach-E

Tesla Model 3 Chevrolet Bolt Hyundai Ioniq 5

• Dedicated EV platform

in MY27

Not Available 305K 1.3M

22K (EV)

68K (EUV)

273K

• MY25 refresh

• MY27 redesign

• MY30 refresh

• MY26 redesign• MY28 redesign

• Discontinued for

MY25

54K 645K

101K (EV)

18K (EUV)

18K

Vehicles-in-

Operation

(Q3 2022)

Projected

Sales

(2023-2029)

Projected

Changes

16K*

*2022 U.S. Sales Estimate

Ford

Ford

Courtesy of Tesla, Inc.

GM Hyundai

Source: ©2023 Experian. Vehicle-in-Operation (VIO) registration counts as of September 30, 2022.

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of December 16, 2022.

43

ADAS AND

AUTONOMOUS

44

Forward-Collision

Avoidance Systems

•Forward-Collision Warning (FCW)

•Automated Emergency Braking (AEB)

•Automated Integrated Emergency

Intervention

Lateral Collision

Avoidance Systems

•Lane-Departure Warning (LDW)

•Blind-Spot Warning (BSW)

•Lane Keep Assist “Nudge” (LKA)

•Lane Centering

Automated Performance

Enhancement Systems

•Anti-Lock Braking Systems (ABS)

•Traction Control (TC)

•Electronic Stability Control (ESC)

•Specialty Applications

Advanced Cruise

Control Systems

•Adaptive Cruise Control (ACC)

•Low-Speed ACC: Traffic-Jam Assist

•Full-Speed ACC

•Cooperative Adaptive Cruise Control:

Platooning (CACC)

Parking-Assistance Systems

•Passive Parking Assist

•Automated Parking Assistance

•Autonomous Valet

Driver Vision Augmentation

•Adaptive Headlights

•Dynamic Responsive Headlights

•Infrared Night-Vision Display

•Heads-Up Display (HUD)

Connected Vehicle Systems

•Dedicated Short-Range Communication

(DSRC)

•Commercial Cellular

•Other Communication Technologies

WHAT ARE ADVANCED DRIVER ASSIST SYSTEMS (ADAS)?

1 2 3

4 5 6

7

For more information on ADAS systems and

aftermarket opportunity for them, download the

“SEMA Advanced Technology Opportunity Report–

2017” at www.sema.org/research.

SEMA Garage Detroit offers member companies

access to the ADAS Technology Center, which helps

companies recalibrate ADAS on a vehicle after

modifying or accessorizing them. For more

information, check out www.semagarage.com.

45

ADAS IS BECOMING MORE COMMON

100%

82%

82% 82% 82%

76%

75%

71%

70%

69%

69%

66%

57%

56%

43%

42%

Rear Object

Camera

Collision

Warning

Total

Collision

Mitigation

City Speed

Mitigation

Low Speed

Mitigation

Lane

Departure

Warning

Active

Pedestrian

Detection

Blindspot

Alert

Moderate

Speed

Mitigation

High Speed

Mitigation

Cross Traffic

Alert

Lane Keep

Assist

Adaptive

Cruise

Control

Rear Object

Sensor

Adaptive

Stop & Go

Conventional

Cruise

Control

ADAS Installation Rates on Model-Year 2021 New Light Vehicles

Advanced driver assist systems (ADAS) and other advanced technologies are becoming more common in new vehicles being sold. As of May 2018, all new passenger cars and light trucks

sold required a rear camera. However, many other systems are also common. For model year 2021 vehicles, more than 80% of them had a collision warning or speed reduction/mitigation

system in place. Over three-quarters had active pedestrian detection or lane-departure warning systems. As these new systems become even more common in the future and as vehicles

become more complex, it will be important for the specialty-equipment industry to understand how modifications to a new vehicle (such as lifting a truck) will affect ADAS systems.

Source: ©Copyright 2023, Wards Intelligence, a division of Informa. Data as of April 2022.

46

FULLY SELF-DRIVING CAR FLEET IS A LONG WAY OFF

McKinsey estimated that more than $530 billion has been spent

on autonomous, connected, electrified, and shared mobility

over the last dozen years. But, they estimate that only 6% of

that investment came from traditional automakers. Investment

and high-tech companies have been chasing autonomous as the

next great technology horizon (and hoping to replicate Tesla’s

stock performance).

But an automobile is a mechanical thing. Even though cars are

now computers on wheels, those wheels make a huge

difference. A “blue screen of death” sitting on you desk is an

annoyance, but a similar glitch rushing down the road at 60

MPH can literally live up to the name.

Gartner lists autonomous vehicles within their “Trough of

Disillusionment” and projects it’s more than 10 years away

from productivity. AV has gone through the hype and inflated

expectations and now the realities of how difficult the problems

really are have set in.

Argo AI, one of the most high-profile AV companies, recently

folded. Even with a reported $6.5 billion dollars in investments

from Ford, VW, and others, they couldn’t find a quick enough

path to make AV feasible. Many other companies have folded

or combined as the free money has dried up.

Gravity and the laws of motion are, so far, stymying what many

technologists once thought would be a quick victory.

Sources: Gartner, McKinsey, Automotive News.

Lead time for chip delivery is the gap between when

a company orders a chip from a manufacturer and

the time it is delivered.

47

SUPPLY-CHAIN

INSIGHTS

48

SUPPLY-CHAIN OUTLOOK

OUTLOOK

The supply-chain issues that impacted

the United States over the past few years

largely peaked and are starting to

recover. It’s expected things will continue

to improve in 2023. However, it will take

time for everything to recover, especially

for supplies that affect the automotive

sector like semiconductors (or chips).

• The specialty-equipment industry has been affected. More than

90% of companies have been moderately or severely impacted

by supply-chain issues. Most expect things to normalize by the

end of 2023 or into 2024.

• Ports are less congested. Container ports in the United States,

like in Los Angeles or Long Beach, are no longer as congested

with container ships waiting for berths. As a result, prices have

largely returned to pre-pandemic levels.

• Trucking is improving nationwide. Demand for cross-country

hauling by truckers has eased and the number of trucks available

to ship things has increased. Prices have also dropped from their

record highs.

• Semiconductor, or chip, shortage continues. Shortages, most

notably for the automotive sector, continue to linger. Average

lead delivery times for chips have decreased but remain high at

approximately 25.5 weeks as of October 2022.

KEY TAKEAWAYS

49

SUPPLY-CHAIN ISSUES CONTINUE TO HAVE AN IMPACT

Significant

Impact

Moderate

Impact

Little to No

Impact

5%

3%

6%

40%

34%

45%

54%

62%

48%

Manufacturer Distributor Retailer/Installer

Impact of Supply-Chain Challenges

Over the Past Year

Don’t

Know

When Will Supply Chains Return to Normal?

9%

9%

18%

17%

30%

17%

9%

12%

16%

19%

30%

14%

6%

7%

15%

19%

28%

26%

End of 2022

Early 2023

Mid 2023

Late 2023

2024 or later

Don’t know

Manufacturer

Distributor

Retailer/Installer

Source: SEMA State of the Industry Report, Fall 2022

Like many sectors of the economy, the specialty-equipment industry has dealt with supply issues. In fact, more than 90% of industry companies say that supply-chain issues have

had a moderate or significant impact on business operations over the past year. Most companies expect these challenges to return to normal in 2023, but a subset believe that they

might last longer. Based on how supply-chain metrics have changed over the last year, we expect much of the disruption seen over the past two years will get better. However, it

will likely take some time before everything returns to how they were prior to the pandemic.

50

CONTAINER PORT CONGESTION HAS EASED

0

20

40

60

80

100

120

140

160

180

Jul 2021 Sep 2021 Nov 2021 Jan 2022 Mar 2022 May 2022 Jul 2022 Sep 2022 Nov 2022

All U.S. Container Ports LA-LB Savannah All Other Ports

Number of Container Ships Awaiting Berths at U.S. Ports

The pandemic caused significant disruption in cargo container traffic to

and from the United States, contributing to significant congestions at U.S.

ports of ships waiting for a berth—particularly on the West Coast. These

issues were compounded by significant demand for products from

aboard. At its height in February 2022, there were 155 ships waiting for a

berth outside all U.S. ports, of which 101 ships were outside the ports of

Los Angeles and Long Beach.

Thankfully, much of the congestion, especially on the West Coast, peaked

at the end of 2021 and early 2022. In fact, as of January 2023, there

weren’t any excess ships waiting for a berth within 40 miles of the ports

in Los Angeles or Long Beach. Moving container ships from Southern

California to other ports across the country helped, as well as easing

demand for oceanic product shipping and the loosening of COVID-19

restrictions globally. Reduced port congestion should continue to help

resolve supply-chain issues and reduce prices in 2023.

Source: MARAD Office of Policy and Plans / Marine Exchange of Southern California. Data as of January 3, 2023.

Number of Ships Waiting for a Berth

at all U.S. Container Ports

Feb 1, 2022: 155 Ships

Jan 3, 2023: 43 Ships (-72%)

51

OCEAN FREIGHT PRICES HAVE NORMALIZED FROM

THEIR RECORD HIGHS

$11,730

$2,420

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

Feb 2020 Jun 2020 Oct 2020 Feb 2021 Jun 2021 Oct 2021 Feb 2022 Jun 2022 Oct 2022

Ocean Freight Rates

Spot rate for a 40-ft. Container from Shanghai to Los Angeles

As traffic and congestion at U.S. ports eased over the last year,

especially on the West Coast, the prices for shipping a

container across the ocean decreased and returned to more

normal levels. As of November 2022, the price to ship a 40-ft.

container from the Port of Shanghai to the Port of Los Angeles

was down 79% from its record high in August 2021. Similar

price declines have been common at other ports in the United

States as well. Unless there is any further disruption, we

anticipate prices to stay at their current level or decrease

further toward their pre-pandemic levels.

Nov

2022

Source: U.S. Department of Agriculture, Agricultural Market Service, Container Ocean Freight Rates from Drewry Supply Chain Advisors' Container

Freight Rate Insight. Data as of November 2022.

Spot Freight Rates for a 40-ft. Container

from Shanghai to Los Angeles

August 2021: $11,730

November 2022: $2,420 (-79%)

Aug

2021

52

THE BALANCE BETWEEN DEMAND FOR TRUCKS AND

THE NUMBER OF LOADS TO SHIP HAS IMPROVED

9.34

3.45

0

2

4

6

8

10

Jan 2020 May 2020 Sep 2020 Jan 2021 May 2021 Sep 2021 Jan 2022 May 2022 Sep 2022

Van Load-to-Truck Ratio

Dec

2022

Over the course of the pandemic, due to extremely congested

ports, bad weather, a shortage of drivers, and increased

demand, the number of available trucks to haul product

across the United States was low. As a result, the ratio of the

number of loads posted per truck available skyrocketed. In

January 2022, that ratio peaked in at 9.34.

However, over the course of the last year, that ratio has

significantly improved. In December 2022, the ratio dropped

to 3.45—a decline of more than 60% since the beginning of

the year. While it is still above the pre-pandemic ratio average

of around 2, this steady improvement indicates an

improvement in both the number of available trucks for

shipping as well as normalizing demand levels. Moving

forward, we anticipate this ratio to continue to improve, but

some challenges ahead remain.

Source: DAT Fright Analytics. Data as of January 2022.

The load-to-truck ratio represents the number of loads posted for

every truck available. It’s an indicator of the balance between

market demand and capacity for cross-country shipping.

Jan

2022

53

THE PRICES TO SHIP BY TRUCK HAVE ALSO IMPROVED

$2.00

$2.19

$2.50

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2017 2018 2019 2020 2021 2022

Dry Van Flatbeds Refrigerated

Truck Spot Rates per Mile by Truck Type

Much like the cost to ship containers across the ocean has

decreased, the price to ship cargo and products on trucks has also

decreased. Since the end of 2021, prices have declined

precipitously as demand began to normalize and the number of

trucks available improved. Excluding a brief spike in prices towards

the end of December 2022 due to adverse winter weather in many

parts of the United States, the prices are very close to what they

were prior to the pandemic. Prices should continue to decline in

2023 to what they were prior to the pandemic.

Dec 25

2022

Source: DAT Fright Analytics. Data as of December 25, 2022.

$1.71

$2.70

$1.76

$2.00

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

1/6/2019 1/9/2022 12/4/2022 12/25/2022

Spot Rates per Mile for Dry Vans

54

THERE IS A LOT OF DEMAND FOR WORKERS IN THE

TRANSPORTATION SECTOR

482K

333K

197K

86K

0K

100K

200K

300K

400K

500K

600K

700K

Jan 2019 Jul 2019 Jan 2020 Jul 2020 Jan 2021 Jul 2021 Jan 2022 Jul 2022

Job Openings Hires Quits Layoffs and Discharges

Job Openings and Labor Turnover:

Transportation, Warehousing and Utilities Sector (Seasonally Adjusted)

As has been the case throughout the past two to three years, the number

of job openings in the transportation, warehousing and utilities sector

has outpaced the number of those hired. This shortage of workers has

contributed to the supply-chain disruption. There were some shortages

in port workers, including at the ports of Los Angeles and Long Beach,

which compounded the issues from the congestion of ships waiting for

available berths.

However, even if there had been enough workers to work 24-hour shifts

at the ports, there weren’t enough trucks and truck drivers to take the

product from the ports to their destinations across the country. The truck

driver shortage (especially for longer-haul transport) has been especially

significant and was an issue even before the pandemic. In 2021, the

American Truck Association (ATA) estimated that there was a shortage of

81,258 truck drivers in the United States. For 2022, they estimate that

the shortage was still near that high at nearly 78,000 drivers. The ATA

estimates that the industry needs to recruit 1.2 million new drivers over

the next decade to meet expected demand and to replace drivers exiting

the business.

Oct

2022

Source: U.S. Bureau of Labor Statistics - Job Openings and Labor Turnover Survey (JOLTS). Data as of October 2022.

55

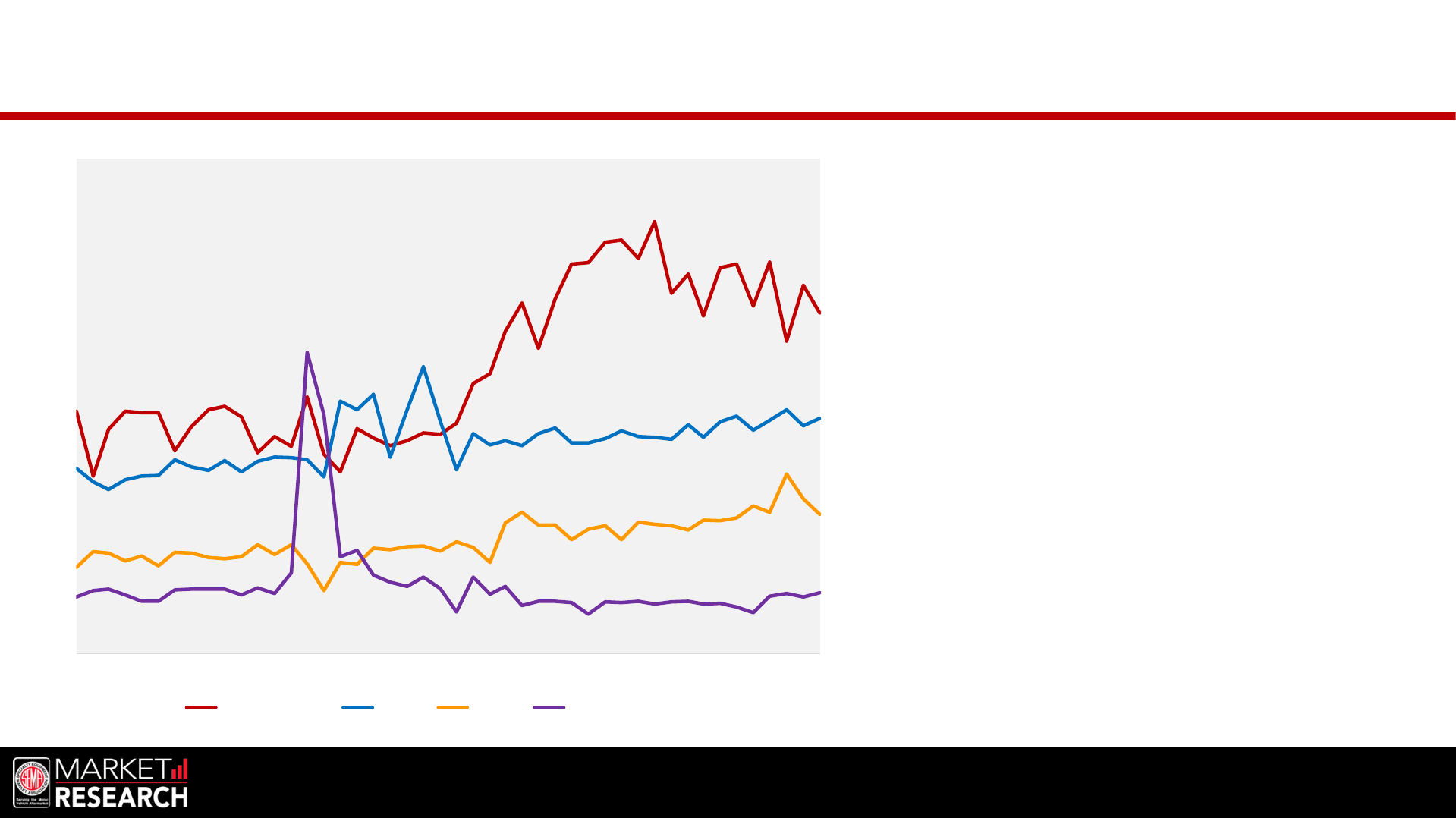

CHIP LEAD TIMES STILL VERY LONG, ESPECIALLY FOR

THE AUTOMOTIVE SECTOR

25.5

0

5

10

15

20

25

30

Mar 2017 Nov 2017 Jul 2018 Mar 2019 Nov 2019 Jul 2020 Mar 2021 Nov 2021 Jul 2022

Weeks

Chip Delivery Lead Time

in Weeks

Much of the media attention about the supply-chain disruption over the

last few years has been focused on the semiconductor (or chip) shortage.

As of October 2022, the delivery lead time shrank by six days to 25.5

weeks—the biggest drop since 2016. Around 70% of companies in the

industry say that they can now supply chips more quickly. Some also say

that demand is falling amid a weaker economy and consumer spending,

allowing shipments to move faster.

The lead time for Texas Instruments, one of the biggest chipmakers, was

down 25 days in October. Despite this, the supply of some of its products

that go into vehicles remains very tight and constrained. It’s likely that

these constraints will continue into 2023.

It’s not just because of the pandemic. Signs that semiconductor production

was already strained showed up well before the pandemic started. Since

the first quarter of 2019, fabrication capacity has run well above what is

considered ”full” production-rate utilization (which is around 80%). In

recent quarters, it has been more than 95%.

Source: Bloomberg / Susquehanna Financial Group. Data as of November 2022.

Lead time for chip delivery is the gap between when

a company orders a chip from a manufacturer and

the time it is delivered.

Oct

2022

56

AFTERMARKET

TRENDS AND

OPPORTUNITY

57

OFF-ROAD AND OVERLANDING

29%

25%

35%

28%

18%

20%

19%

27%

20%

17%

35%

23%

21%

27%

24%

33%

Manufacturer Retailer/Installer

Off-road

Overlanding

Where Does the Industry View Opportunity?

Off-road products and accessories are a significant segment for the specialty-

equipment industry, with most companies seeing a lot of opportunity in the

space. Pickups and SUVs (especially the Jeep Wrangler) are commonly

accessorized for off-road applications. In fact, 62% of pickup owners buy off-road

parts or take their vehicles off-road. Around 80% use their pickup for outdoor

recreation uses.

A relatively new trend in the specialty-equipment industry is overlanding. What

exactly is overlanding, though? Off-roading and overlanding overlap a fair degree,

but overlanding refers to a combination of remote travel, off-roading and

camping. When it comes to our industry, overlanding products would include

things like mounted tents. Overall, our industry sees opportunity in overlanding,

but less than it does in the off-road segment overall.

62%