Automotive

Aftermarket

Market Update

Q2 2023

Houlihan Lokey is a leading

global investment bank with

expertise in mergers and

acquisitions, capital markets,

financial restructuring, and

financial and valuation

advisory.

Our firm is the trusted advisor

to more top decision-makers

than any other independent

global investment bank.

We invite you to learn more

about how our advisors can

serve your needs:

ABOUT OUR FIRM

2

Learn More About

Corporate Finance

Learn More About

Financial Restructuring

Learn More About

Financial and Valuation Advisory

Learn More About

Our Industry Coverage

Key Facts and Figures

Our Ranking by Service

Houlihan Lokey Is a Global Firm

No. 1 Global M&A Advisor for

Transactions Under $1 Billion

Leading Capital Markets Advisor

No. 1 Global M&A Fairness Opinion

Advisor Over the Past 25 Years

1,000+ Annual Valuation Engagements

No. 1 Global Restructuring Advisor

1,500+ Transactions Completed Valued

at More Than $3.0 Trillion Collectively

Corporate Finance

Financial Restructuring

Financial and Valuation Advisory

Americas

Atlanta

Baltimore

Boston

Chicago

Dallas

Houston

Los Angeles

Miami

Minneapolis

New York

San Francisco

São Paulo

Washington,

D.C.

Europe and Middle East

Amsterdam

Antwerp

Dubai

Frankfurt

London

Madrid

Manchester

Milan

Munich

Paris

Stockholm

Tel Aviv

Zurich

Asia-Pacific

Beijing

Fukuoka

Gurugram

Hong Kong

SAR

Mumbai

Nagoya

Shanghai

Singapore

Sydney

Tokyo

2,000+

CLIENTS SERVED

ANNUALLY

326

MANAGING

DIRECTORS

(1,2)

~2,000

TOTAL FINANCIAL

PROFESSIONALS

36

LOCATIONS

WORLDWIDE

(1)

$1.8B

REVENUE

(4)

$6.5B

MARKET

CAPITALIZATION

(3)

26

Senior officers dedicated to

the sponsor community in the

Americas and Europe

Fully Integrated Financial Sponsors Coverage

1,000+

Sponsors covered, providing

market insights and

knowledge of buyer behavior

700+

Companies sold to financial

sponsors over the past five years

(1) As of June 30, 2023. (2) Excludes corporate MDs. (3) As of July 2023. (4) LTM ended June 30, 2023.

2022 Global Distressed Debt & Bankruptcy

Restructuring Rankings

Advisor

Deals

1

Houlihan Lokey

58

2

PJT Partners Inc

30

3

Lazard

29

4

Rothschild & Co

25

5

Moelis & Co

21

Source: Refinitiv

.

1998 to 2022 Global M&A Fairness

Advisory Rankings

Advisor

Deals

1

Houlihan

Lokey

1,232

2

JP Morgan

1,030

3

Duff & Phelps, A Kroll Business

938

4

Morgan Stanley

725

5

BofA

Securities Inc

710

Source: Refinitiv. Announced or completed transactions.

2022 M&A Advisory Rankings

Global Transactions Under $1 Billion

Advisor

Deals

1

Houlihan

Lokey

381

2

Rothschild & Co

369

3

JP Morgan

217

4

Lazard

206

5

Goldman Sachs & Co

203

Source: Refinitiv. Excludes accounting firms and brokers.

Houlihan Lokey’s Industrials

Group has earned a reputation

for providing superior service

and achieving outstanding

results in M&A advisory,

capital raising, restructuring,

and financial and valuation

advisory services.

According to data provided by

Refinitiv, our Industrials Group

was once again ranked as the

No. 1 M&A advisor for all U.S.

industrials transactions in

2022.*

*Excludes accounting firms and brokers.

ABOUT OUR INDUSTRIALS GROUP

3

Aerospace Advanced Manufacturing

and Engineered Products

Automotive, Truck, and

Automotive Technologies

Building Products Chemicals

Key Facts and Figures

Industry Sector Coverage

We cover a broad array of sectors, with bankers dedicated to each of our primary coverage areas.

160+

Dedicated Industrials Group bankers

75

Completed Industrials Group M&A/

private placement transactions in CY22

~$2B

In disclosed financing deals in CY22

Featured Industrials Group Transactions

Learn More About Our

Industrials Group Industry Coverage

2022 M&A Advisory Rankings

All U.S. Industrials Transactions

Advisor

Deals

1

Houlihan Lokey

35

2

Lincoln International

33

3

Goldman Sachs & Co

26

3

Stout

26

5

Benchmark International

25

5

Jefferies LLC

25

Source: Refinitiv. Excludes accounting firms and brokers.

Decarbonization

Products and Services

Defense Energy Services and

Technology

Government Services

and Technology

Industrial Technology

Metals and Engineered

Materials

Packaging, Plastics, and

Paper

Security and Safety

Solutions

Specialty Distribution

a portfolio company of

has been acquired by

Sellside Advisor

has been acquired by

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

has sold a majority interest in the

company to

Sellside Advisor

has acquired

a portfolio company of

Buyside Advisor

has been acquired by

Sellside Advisor

has been acquired by

Toyota Industries

Corporation

Sellside Advisor

has been acquired by

a portfolio company of

Sellside Advisor

Featured Transactions

Contact Us

Learn More About Us

Request a Meeting

Please reach out to us to schedule a call to discuss

this quarter’s market update or to explore how we can

serve your business needs.

Sector-Specific Expertise

The automotive aftermarket sector, which operates within Houlihan Lokey’s

Industrials Group, has earned a reputation for providing superior service and

achieving outstanding results in M&A advisory, capital raising, restructuring, and

financial and valuation advisory services.

Our transaction quality and client work benefit from our company culture, where

senior financial professionals are highly engaged in the execution of client projects,

and from our experience as leaders in the market for more than a decade, which

has given our professionals valuable exposure to a variety of situations and

challenges.

Car Wash

Collision Repair and Other

Auto Services

Commercial Vehicle Upfitting

Hard Parts Distribution

Lubricants, Coatings, and

Cleaning Chemicals

Mechanical Repair

Replacement Parts

Off-Road Enthusiast Parts

Performance Parts

Quick Lube

Retail and DTC E-Commerce

Software and Shop

Management

Tombstones included herein represent transactions closed from 2008 forward.

4

AUTOMOTIVE AFTERMARKET TEAM

Leadership

Christian Lunny

Managing Director

+61 2 9662 9001

Hisashi Yoshimura

Managing Director

Hisashi.Yoshimura@HL.com

+81 80 4368 3472

Nicolas Zintl

Managing Director

+49 (0) 69 256 246 121

Cory Hebenstreit

Director

+1 312.456.4704

a portfolio company of

has been acquired by

Sellside Co-Advisor

$40,000,000 HoldCo PIK Notes

Acquisition Financing

Exclusive Placement Agent

a portfolio company of

has been acquired by

a subsidiary of

Sellside Advisor

has been acquired by

Sellside & Financing Advisor

has been acquired by

a subsidiary of

Sellside Advisor

has successfully completed a $1.4

billion recapitalization, amending

and extending $860 million of 1L

credit facilities, equitizing $375mm

of unsecured notes and raising

$160 million of new money

Unsecured Noteholder Advisor

While Houlihan Lokey covers a broad range of automotive aftermarket subsectors, the Q2

2023 market update will focus on the enthusiast subsector, which serves consumers

upgrading the look or performance of their vehicles. The M&A market for enthusiast

businesses seems to have been rather constrained over the past year, and Houlihan Lokey

sees signs of optimism in 2H 2023 and beyond.

Despite SEMA estimating the specialty-equipment market growing at approximately 4% per

year, that growth has been inconsistent largely due to pandemic-related trends. Demand

accelerated in 2021, resulting in challenging year-over-year comparisons in 2022

exacerbated by supply chain challenges limiting product availability.

Houlihan Lokey analysis indicates that selected market participants’ demand concerns due

to rising interest rates are likely unfounded. Personal spending has historically been much

more strongly correlated to wages, which remain resilient in a job market with record-low

unemployment.

Because many upgrades are at the time of vehicle acquisition, whether new or “new to

you,” the slowdown in new vehicle production has provided an additional headwind that

seems to be clearing. Moreover, because pickup parts account for 27% of the specialty-

equipment market, it is important to note the top 10 list of U.S. auto sales in June 2023 and

their year-over-year growth from June 2022:

Introduction

1. Featured Sector News……………..……………….…….... 6

2. Additional Automotive Aftermarket M&A Highlights....….. 7

3. Demand Unlikely to Be Affected by Interest Rates or

Credit Availability.………………………………………..….. 8

4. 2020–2022 Demand Choppiness Has Seemingly

Abated…......................................................................…. 9

5. New Vehicle Production May Spur Upgrade Demand..... 10

6. Equity Market Index Performance.……………………….. 11

7. Public Company Valuations.………….............................. 13

8. Public Comparables.…………...…………………………… 14

9. Disclaimer……………………………………………………. 16

Table of Contents

AUTOMOTIVE AFTERMARKET UPDATE

Source: MarkLines.

5

1. Ford F-Series up 25%

2. Chevrolet Silverado up 8%

3. Ram Pickups up 3%

4. Toyota RAV4 up 20%

5. Tesla Model Y up 82%

6. Honda CR-V up 36%

7. Nissan Rogue up 125%

8. Toyota Camry up 18%

9. GMC Sierra up 28%

10. Jeep Grand Cherokee up 53%

The global auto aftermarket team at Houlihan Lokey would love to share further thoughts

about the enthusiast subsector and the broader aftermarket landscape. Please do not

hesitate to contact us with any questions you may have.

FEATURED RECENT TRANSACTION

Client Profile

Cardone Industries, Inc., is an industry

-leading automotive parts remanufacturer founded in 1970 and

based in Philadelphia. Cardone has a 50+ year track record of remanufacturing high

-quality, reliable,

and affordable parts. Remanufacturing is the process by which previously sold, worn out, or non

-

functional automotive products (cores) are returned to a “like

-new” or “better-than-new” condition. The

company promotes a circular economy by remanufacturing, providing sustainable products with the

quality and reliability of an original equipment manufacturer to more than 300 blue

-chip customers

across the U.S. The company has over 40,000 unique SKUs and more than 80 product lines with a

focus on steering, calipers, brakes, and electronics. The company’s seven facilities and more than

2,800 employees throughout the U.S. and Mexico serve a variety of North American retailers.

Cardone was previously acquired by Brookfield Asset Management in April 2019.

Our Role

Houlihan Lokey served as the exclusive financial advisor to Cardone, and King & Spalding LLP served

as legal counsel. We assisted in the negotiation and placement of third lien bridge financing from

Brookfield, leading to the initiation, structuring, and negotiation of the sale to a global automotive parts

company.

Transaction Snapshot

On June 30, 2023, Cardone Industries, Inc., a portfolio company of Brookfield Asset Management Ltd.,

was acquired by a global automotive parts company. This transaction builds on Houlihan Lokey’s

successes and expertise in the automotive aftermarket.

6

Cardone Industries, Inc.

Sources: Company website, press releases.

Date Company Subsectors Description Article Link

7/5/2023

Aftermarket Parts

PHINIA Inc. achieved independence by separating from BorgWarner, and it began

trading on the NYSE as “PHIN.” The company focused on delivering innovative systems

for sustainability and aiming for carbon neutrality in vehicles and industries.

Read More

6/26/2023

Aftermarket Retail

and Distribution

William C. Rhodes III will step down as President and CEO of AutoZone, transitioning to

Executive Chairman in January 2024. Philip B. Daniele III will take over as CEO and join

the board of directors.

Read More

5/30/2023

Aftermarket Parts

Atmus

Filtration Technologies, a global filtration industry leader, has successfully closed

its initial public offering of 16,243,070 shares of common stock. The shares were priced

at $19.50 per share, and trading began on the NYSE under the symbol “ATMU” on May

26, 2023. Cummins Inc. remains a major shareholder, owning approximately 80.5% of

outstanding shares.

Read More

5/25/2023

Aftermarket Parts

Fox Factory Holding Corp. appoints Dennis

Schemm

as Chief Financial Officer, effective

June 12, 2023. His extensive finance experience will support the company’s growth

journey. Mr.

Schemm succeeds Interim CFO, Maggie Torres, who will retire.

Read More

5/23/2023

Aftermarket Retail

and Distribution

Kevin Herron, President of U.S. Automotive Group at Genuine Parts Company (GPC),

will retire after 34 years. Randy Breaux will be promoted to Group President, GPC North

America on July 1, 2023. Herron will aid in a smooth transition until his retirement.

Read More

5/17/2023

Aftermarket Parts

Holley Inc. appoints Matthew Stevenson as President and CEO, effective June 6, 2023.

He brings extensive experience in leading organizational turnarounds and growth. Mr.

Stevenson replaces Interim President and CEO, Michelle

Gloeckler

, who remains on the

board of directors.

Read More

5/8/2023

Services

Gary W.

Ferrera has been appointed Executive VP and CFO of Driven Brands, effective

May 10, 2023. His extensive financial expertise and M&A experience will drive growth

and shareholder value. Mr.

Ferrera succeeds Tiffany Mason.

Read More

4/17/2023

Services

Mister Car Wash appointed Mary Porter as Chief People Officer to reinforce its people

-

centric approach. With extensive retail and HR experience, she will enhance the

company’s employee

-first culture, driving talent acquisition, engagement, and

organizational development. Ms. Porter’s belief in employee well

-being aligns with the

company’s values.

Read More

While there have been selected leadership changes announced, the public listings of PHINIA and Atmus Filtration Technologies

are potentially the most consequential changes to the aftermarket corporate landscape.

FEATURED SECTOR NEWS

7

$35.7 $13.0 $12.9 $27.7 $21.0 $7.2

326

311

301

437

361

192

2018 2019 2020 2021 2022 YTD 2023

Disclosed Value ($B) Deals

Automotive aftermarket M&A activity remains consistent

with broader trends; while the number of transactions is

on pace to be relatively steady in 2023, it seems to

comprise a relatively larger number of smaller add-on

acquisitions.

Recent acquisitions have tended to be more heavily

sk

ewed to nondiscretionary replacement parts and

services than enthusiast upgrade parts businesses.

Interest rates seem to have favored strategic buyers over

pri

vate equity parties in recent M&A activity.

Transaction Value and Deal Volume

Additional Notable Transactions

Key Takeaways

$ in Billions

Source: S&P Capital IQ.

Note: Data as of June 30, 2023.

ADDITIONAL AUTOMOTIVE AFTERMARKET M&A HIGHLIGHTS

Date Acquirer Target

6/26/2023

6/13/2023

6/8/2023

Horsepower Automotive

Group, LLC

6/6/2023

5/31/2023

5/23/2023

5/18/2023

5/9/2023

Assets of Zender’s Truck

& Equipment

5/9/2023

5/8/2023

Dealership Services

Business in United States

5/1/2023

4/18/2023

Bagnell Auto Supply, Inc.

4/18/2023

4/18/2023

4/5/2023

8

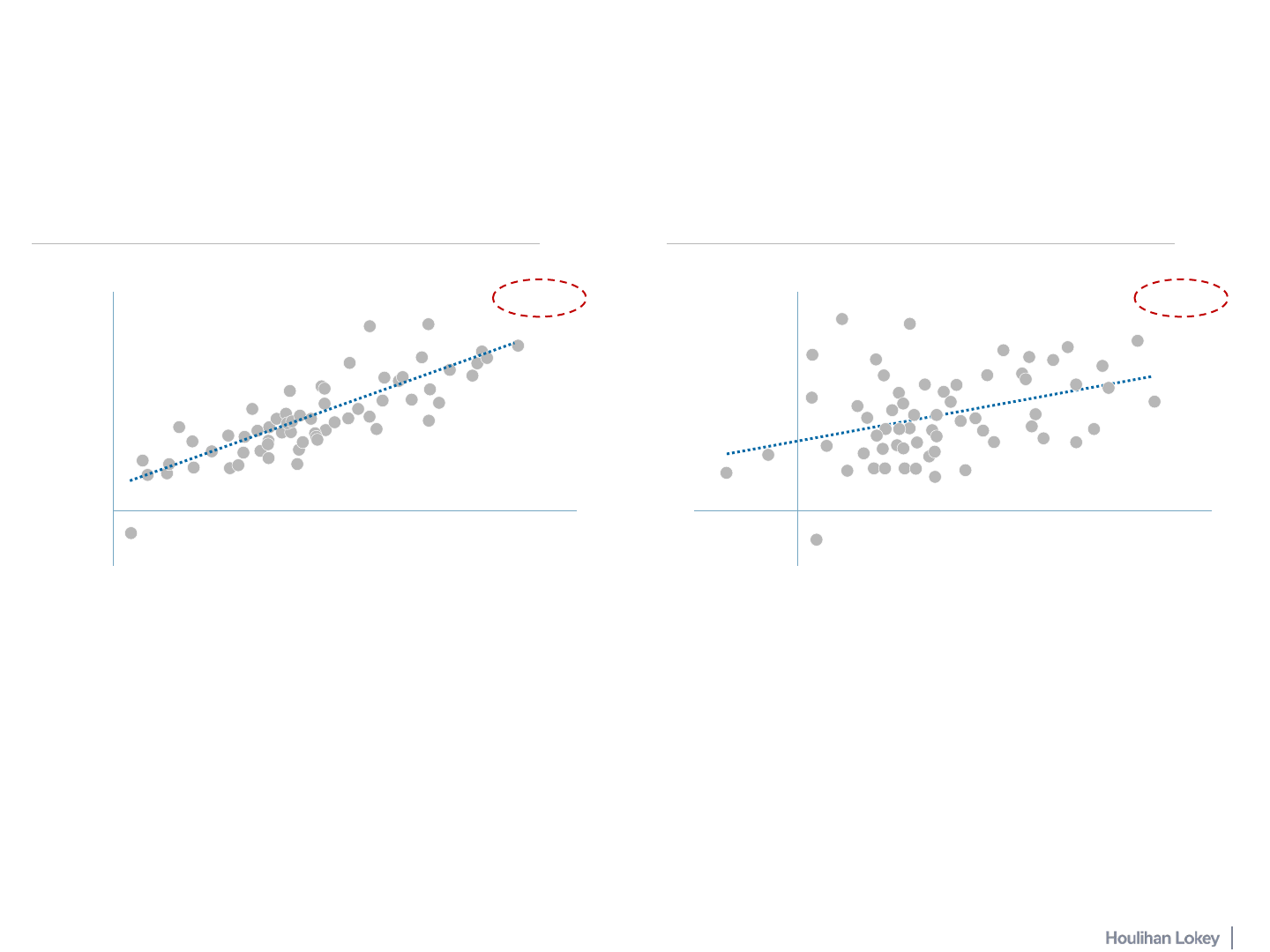

(5%) 0% 5% 10% 15% 20%

R² = 0.17

(4%)

(2%)

0%

2%

4%

6%

8%

10%

12%

14%

16%

0% 5% 10% 15%

Personal Spending

R² = 0.68

• Because parts or services to upgrade the performance or appearance of a vehicle are discretionary, it is critical for investors and

executives to understand demand drivers.

• 2021 was a very strong year for enthusiast parts and services with relative softness in 2022.

• Given the potentially distorting effects of COVID-19

and subsequent interest rate increases, it is important to utilize long-term data to

understand key reasons for recent historical trends.

• Data indicates that 2021’s strength was likely a pandemic-r

elated outlier, and 2022 was a return-to-normal affected by 2021 pull forward.

• For 2023 and 2024, interest rates and/or credit availability are unlikely to have as significant an impact on demand as wage grow

th.

DEMAND UNLIKELY TO BE AFFECTED BY INTEREST RATES OR

CREDIT AVAILABILITY

Historical demand indicates that personal spending, a driver of enthusiast upgrade parts and services, has a much stronger

correlation with income than consumer credit.

Total Wages and Government Transfers Total Consumer Credit

Relatively Strong Correlation Between

Spending and Wages

Relatively Weak Correlation Between

Spending and Credit

Sources: PitchBook, U.S. Department of Commerce Bureau of Economic Analysis.

9

Year-Over-Year Growth in Personal Income

• Because demand for enthusiast upgrade parts and services

seems to be driven significantly by wage growth, it is important

to understand historical implications.

• Annual growth trends for personal income show significant

distortions in the Q2 2020–Q3 2022 periods.

• Anecdotally, many auto aftermarket companies experienced

similar volatility in demand.

• Since the second half of 2022, personal income, and demand

for discretionary auto parts and services, have stabilized and

returned to long-term demand trends.

• Buyers and sellers of businesses in the sector may be more

comfortable understanding businesses and value in this more

stable demand environment, leading to increased M&A activity.

2020–2022 DEMAND CHOPPINESS HAS SEEMINGLY ABATED

Historical year-over-year growth by quarter was generally steady at approximately 5% before experiencing significant gyrations

from Q2 2020 through Q2 2022; growth has now returned to a pattern more consistent with long-term trends.

(5%)

0%

5%

10%

15%

20%

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q2 2022

Q3 2022

Q4 2022

Q1 2023

Source: U.S. Department of Commerce Bureau of Economic Analysis.

1

0

Key Takeaways

• Consumers tend to upgrade vehicles shortly following new

ownership.

• Because new vehicle production has continued to face

li

mitations due to supply chain challenges, a key driver for

vehicle upgrade demand has been inhibited.

• Near-ter

m historical monthly low point occurred in January

2022, when more than 1 million vehicles were produced.

• June 2023 saw just under 1.4 million vehicles produced

foll

owing nearly sequential monthly improvements throughout

2023.

• Steady improvement in new vehicle production and sales will

li

kely be a leading indicator for aftermarket upgrade parts

demand.

NEW VEHICLE PRODUCTION MAY SPUR UPGRADE DEMAND

Most aftermarket upgrades to a vehicle come within approximately the first 18 months of ownership; constrained new vehicle

production due to supply chain issues, particularly driven by lack of microchip availability, has largely returned to growth.

12,500,000

13,000,000

13,500,000

14,000,000

14,500,000

15,000,000

15,500,000

LTM U.S. New Vehicle Production

Past 12 Months U.S. New Passenger Vehicle

Production

Source: MarkLines.

11

90

100

110

Apr-23 May-23 Jun-23

S&P 500 Houlihan Lokey Automotive Aftermarket

90

100

110

120

130

Jul-22 Aug-22 Sep-22 Nov-22 Dec-22 Feb-23 Mar-23 May-23 Jun-23

S&P 500 Houlihan Lokey Automotive Aftermarket

Houlihan

Lokey

Automotive

Aftermarket

18.5%

S&P

500

16.3%

After outperforming broader

markets in Q4 2022 and Q1

2023, the aftermarket sector

has lagged recently.

Recent sector declines in

public market price

performance are largely

attributable to Advance

Auto Parts, which declined

40% in May and April after

cutting dividends.

Holley and Motorcar Parts

of America, Inc., enjoyed

significant stock price

increases on a percent

basis in recent periods.

LTM June 2023 Performance

April–June 2023 Performance

S&P

500

7.9%

Houlihan

Lokey

Automotive

Aftermarket

0.3%

(1)

(1)

Source: S&P Capital IQ.

Notes: Data as of June 30, 2023. All share prices are rebased to 100.

(1) The Houlihan Lokey Automotive Aftermarket Index consists of a diversified set of 21 companies across the automotive aftermarket

sector. See pages 14 and 15 for a complete list.

12

EQUITY MARKET INDEX PERFORMANCE

Recent strong performance in the enthusiast parts subsector may be a harbinger of a return to significant M&A activity.

LTM June 2023 Performance by Subsector

60

80

100

120

140

160

Jul-22 Sep-22 Dec-22 Mar-23 Jun-23

Enthusiast Parts Replacement Parts Aftermarket Retail and Distribution Services

YTD 2023 Performance Three-Year Performance (July 2020–June 2023)

27%

-8%

3%

5%

84%

-4%

106%

52%

Source: S&P Capital IQ.

Notes: Data as of June 30, 2023. All share prices are rebased to 100.

13

EQUITY MARKET INDEX PERFORMANCE (CONT.)

AUTOMOTIVE AFTERMARKET SUBSECTORS

Enthusiast Parts

35.8%

Services

32.0%

Aftermarket

Retail and

Distribution

18.7%

Replacement

Parts

(30.3%)

EV/2023E Revenue EV/2023E EBITDA Forward P/E

Enthusiast Parts

Replacement Parts

Aftermarket Retail

and Distribution

Services

15.0x

7.6x

12.1x

15.2x

3.2x

1.0x

1.3x

2.7x

21.9x

11.3x

17.6x

26.3x

14

PUBLIC COMPANY VALUATIONS (2023E)

Source: S&P Capital IQ.

Note: Data as of June 30, 2023.

15

PUBLIC COMPARABLES (LTM JUNE 2023)

AUTOMOTIVE AFTERMARKET

Source: S&P Capital IQ.

Note: Data as of June 30, 2023.

LTM TEV/

Revenue

USDm

EBITDA

USDm EBITDA Margin EPS Forward P/E LTM EBITDA LTM Revenue

Holley Inc. $479.2 $1,132.9 $624.9 7.0x $660.6 $89.1 13.5% $0.0 21.0x 12.7x 1.7x

Fox Factory Holding Corp. 4,590.3 4,916.1 219.6 0.7x 1,618.4 304.6 18.8% 4.4 20.1x 16.1x 3.0x

XPEL, Inc. 2,326.0 2,362.2 (1.3) N/M 356.3 77.8 21.8% 1.8 36.8x 30.4x 6.6x

ARB Corporation Ltd. 1,562.8 1,566.7 4.0 0.0x 461.4 109.7 23.8% 0.8 23.3x 14.3x 3.4x

Median $111.8 0.7x $561.0 $99.4 20.3% $1.3 22.1x 15.2x 3.2x

Mean $211.8 2.6x $774.2 $145.3 19.5% $1.7 25.3x 18.4x 3.7x

Dorman Products, Inc. $2,480.6 $3,251.3 $674.1 3.0x $1,798.9 $225.8 12.6% $2.9 14.1x 14.4x 1.8x

Standard Motor Products, Inc. 813.1 1,149.1 200.2 1.1x 1,370.7 183.2 13.4% 2.8 10.1x 6.3x 0.8x

Motorcar Parts of America, Inc. 150.9 419.1 201.4 3.7x 678.8 53.7 7.9% (0.3) 7.2x 7.8x 0.6x

PHINIA Inc. 1,480.5 2,443.5 442.0 0.7x 3,432.0 593.0 17.3% 5.0 N/A 4.1x 0.7x

Atmus Filtration Technologies Inc. 1,829.2 1,867.5 510.7 2.1x 1,618.6 240.4

14.9% 2.2 11.6x 7.8x 1.2x

Median $442.0 2.1x $1,618.6 $225.8 13.4% $2.8 10.9x 7.8x 0.8x

Mean $405.7 2.1x $1,779.8 $259.2 13.2% $2.5 10.8x 8.1x 1.0x

Advance Auto Parts, Inc. $4,178.2 $8,588.0 $1,674.1 1.0x $11,198.1 $1,665.6 14.9% $6.7 11.0x 5.2x 0.8x

AutoZone, Inc. 45,269.4 55,354.6 7,023.0 1.6x 17,114.9 4,266.4 24.9% 127.3 17.9x 13.0x 3.2x

O’Reilly Automotive, Inc. 58,157.7 65,202.1 4,815.8 1.2x 15,220.0 3,931.8 25.8% 36.0 24.9x 16.6x 4.3x

Genuine Parts Company 23,779.5 27,370.5 2,873.7 1.2x 22,879.0 2,421.4 10.6% 8.5 18.5x 11.3x 1.2x

LKQ Corp. 15,575.0 19,300.0 2,096.0 1.0x 12,902.0 2,099.0 16.3% 3.7 14.0x 9.2x 1.5x

CarParts.com, Inc. 239.4 234.5 (29.9) N/M 671.0 21.9 3.3% (0.0) N/M 10.7x 0.3x

Median $2,484.8 1.2x $14,061.0 $2,260.2 15.6% $7.6 17.9x 11.0x 1.3x

Mean $3,075.5 1.2x $13,330.9 $2,401.0 16.0% $30.4 17.3x 11.0x 1.9x

Mister Car Wash, Inc. $2,977.2 $4,618.8 $775.6 2.2x $894.8 $354.3 39.6% $0.3 28.4x 13.0x 5.2x

Boyd Group Services Inc. 4,098.4 5,129.1 1,004.5 3.2x

2,730.9 315.3 11.5% 3.4 40.3x 16.3x 1.9x

Monro, Inc. 1,276.5 1,940.5 371.6 1.9x 1,302.8 191.3 14.7% 1.1 22.8x 10.1x 1.5x

Driven Brands Holdings Inc. 4,534.2 8,396.1 2,658.9 4.2x 2,127.3 629.7 29.6% 0.2 20.8x 13.3x 3.9x

Valvoline Inc. 6,219.5 5,972.8 640.7 2.0x 1,388.9 316.0 22.7% 0.8 27.1x 18.9x 4.3x

D’Ieteren Group S.A. 9,387.2 10,630.6 1,203.6 3.6x 5,038.6 331.8 6.6% 6.6 13.6x 32.0x 2.1x

Median $890.1 2.7x $1,758.1 $323.9 18.7% $0.9 24.9x 14.8x 3.0x

Mean $1,109.2 2.9x $2,247.2 $356.4 20.8% $2.1 25.5x 17.3x 3.1x

Overall Median $640.7 1.9x $1,618.6 $315.3 14.9% $2.8 20.1x 13.0x 1.8x

Overall Mean $1,332.5 2.2x $5,022.1 $877.2 17.4% $10.2 20.2x 13.5x 2.4x

Services

Replacement

Parts

Net Debt/LTM

EBITDA

Market Cap

USDm

EV

USDm

Net Debt

USDm

Enthusiast

Parts

Aftermarket

Retail and

Distribution

Source: S&P Capital IQ.

Note: Data as of June 30, 2023.

16

PUBLIC COMPARABLES (2023E)

AUTOMOTIVE AFTERMARKET

EV/Revenue EV/EBITDA P/E EBITDA Margin

2022 2023E 2022 2023E 2022 2023E Revenue EBITDA 2022 2023E 2022 2023E

Holley Inc. 6.3x 1.6x 1.7x 11.5x 8.9x 28.6x 28.1x (1.9%) (8.6%) 14.3% 19.1% 13.3x 14.1x

Fox Factory Holding Corp. 0.7x 3.1x 2.9x 16.0x 15.2x 22.4x 21.0x 13.3% 14.1% 19.2% 19.4% 19.4x 19.6x

XPEL, Inc. N/M 7.3x 6.0x 35.3x 28.2x N/M 37.3x 22.8% 32.2% 20.7% 21.5% 41.5x 36.5x

ARB Corporation Ltd. 0.0x 3.4x 3.5x 14.3x 14.7x 22.8x 24.0x (5.9%) (15.0%) 23.8% 23.6% 21.0x 24.2x

Median 0.7x 3.2x 3.2x 15.1x 15.0x 22.8x 26.1x 5.7% 2.7% 19.9% 20.4% 20.2x 21.9x

Mean 2.4x 3.8x 3.5x 19.3x 16.7x 24.6x 27.6x 7.1% 5.7% 19.5% 20.9% 23.8x 23.6x

Dorman Products, Inc. 2.8x 1.9x 1.7x 13.6x 10.5x 20.5x 15.3x 21.0% 18.8% 13.8% 15.7% 15.6x 13.3x

Standard Motor Products, Inc. 1.1x 0.8x 0.8x 6.5x 8.7x 11.4x 10.6x 3.5% (13.7%) 12.9% 9.5% 10.3x 11.3x

Motorcar Parts of America, Inc. 4.4x 0.6x 0.6x 9.2x 4.9x

N/M 7.2x 5.1% 10.6% 7.0% 11.9% 2.9x 7.0x

PHINIA Inc. 0.8x 0.7x N/A 4.2x N/A N/A N/A N/A N/A 17.5% N/M N/A N/A

Atmus Filtration Technologies Inc. 2.4x 1.2x 1.2x 8.7x 6.5x N/A 11.6x 5.7% 15.3% 13.7% 18.0% N/A 11.3x

Median 2.4x 0.8x 1.0x 8.7x 7.6x 15.9x 11.1x 5.4% 13.0% 13.7% 13.8% 10.3x 11.3x

Mean 2.3x 1.1x 1.1x 8.5x 7.6x 15.9x 11.2x 8.8% 7.8% 13.0% 13.8% 9.6x 10.7x

Advance Auto Parts, Inc. 0.9x 0.8x 0.8x 4.8x 10.1x 8.5x 11.8x 1.0% (32.2%) 15.9% 7.6% 5.4x 11.1x

AutoZone, Inc. 1.7x 3.3x 3.1x 13.5x 13.6x 20.9x 18.5x 7.8% 1.8% 24.8% 23.1% 19.0x 18.0x

O’Reilly Automotive, Inc. 1.3x 4.5x 4.2x 17.2x 18.3x 28.6x 25.6x 8.4% (1.9%) 26.3% 22.8% 26.5x 23.9x

Genuine Parts Company 1.2x 1.2x 1.2x 11.5x 12.7x 20.4x 18.7x 11.3% 6.5% 10.8% 9.2% 20.1x 17.6x

LKQ Corp. 1.0x 1.5x 1.4x 9.2x 10.7x 14.1x 14.3x 3.0% (9.5%) 16.4% 13.0% 14.6x

14.0x

Car

Parts.com, Inc. N/M 0.4x 0.3x 10.6x 11.5x N/M N/M 8.5% 71.5% 3.4% 3.0% N/A N/M

Median 1.2x 1.4x 1.3x 11.0x 12.1x 20.4x 18.5x 8.1% (0.0%) 16.1% 11.1% 19.0x 17.6x

Mean 1.2x 2.0x 1.8x 11.1x 12.8x 18.5x 17.8x 6.7% 6.0% 16.2% 13.1% 17.1x 16.9x

Mister Car Wash, Inc. 2.2x 5.3x 5.0x 13.1x 16.6x 28.4x 29.9x 10.6% 54.0% 40.3% 30.0% 25.3x 28.5x

Boyd Group Services Inc. 3.8x 2.1x 1.7x 19.7x 13.9x N/M 43.4x 25.5% 33.0% 10.7% 12.5% 49.1x 35.3x

Monro, Inc. 1.8x 1.4x 1.5x 9.3x 11.4x 28.5x 28.5x (0.9%) (12.6%) 15.5% 13.0% 23.5x 25.7x

Driven Brands Holdings Inc. 4.3x 4.1x 3.6x 13.5x 15.6x N/M 22.1x 25.6% 7.1% 30.6% 23.2% 21.1x 26.8x

Valvoline Inc. 2.2x 4.7x 4.0x 20.9x 14.9x N/M 29.8x 49.1% 1.8% 22.3% 27.0% 34.3x 23.5x

D’Ieteren Group S.A. 3.6x 2.1x 0.9x 32.0x 17.3x 26.8x 13.6x 76.8% 102.1% 6.6% 5.1% 14.1x 13.3x

Median 2.9x 3.1x 2.7x 16.6x

15.2x 28.4x 29.

1x 25.6% 20.0% 18.9% 18.1% 24.4x 26.3x

Mean 3.0x 3.3x 2.8x 18.1x 14.9x 27.9x 27.9x 31.1% 30.9% 21.0% 18.5% 27.9x 25.5x

Overall Median 1.8x 1.9x 1.7x 13.1x 13.2x 22.4x 21.0x 8.4% 6.8% 15.9% 16.8% 19.7x 18.0x

Overall Mean 2.2x 2.5x 2.3x 14.0x 13.2x 21.7x 21.6x 14.5% 13.8% 17.4% 16.4% 20.9x 19.7x

Net Debt/2022

EBITDA

2021–23E CAGR Forward P/E

Services

Replacement

Parts

Aftermarket

Retail and

Distribution

Enthusiast

Parts

© 2023 Houlihan Lokey. All rights reserved. This material may not be reproduced in any format by any means or redistributed without the prior written consent of

Houlihan Lokey.

Houlihan Lokey is a trade name for Houlihan Lokey, Inc., and its subsidiaries and affiliates, which include the following licensed (or, in the case of Singapore, exempt)

entities: in (i) the United States: Houlihan Lokey Capital, Inc., and Houlihan Lokey Advisors, LLC, each an SEC-registered broker-dealer and member of FINRA

(www.finra.org

) and SIPC (www.sipc.org) (investment banking services); (ii) Europe: Houlihan Lokey Advisory Limited, Houlihan Lokey EMEA, LLP, Houlihan Lokey

(Corporate Finance) Limited, and Houlihan Lokey UK Limited, authorized and regulated by the U.K. Financial Conduct Authority; Houlihan Lokey (Europe) GmbH,

authorized and regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht); (iii) the United Arab Emirates, Dubai

International Financial Centre (Dubai): Houlihan Lokey (MEA Financial Advisory) Limited, regulated by the Dubai Financial Services Authority for the provision of advising

on financial products, arranging deals in investments, and arranging credit and advising on credit to professional clients only; (iv) Singapore: Houlihan Lokey (Singapore)

Private Limited and Houlihan Lokey Advisers Singapore Private Limited, each an “exempt corporate finance adviser” able to provide exempt corporate finance advisory

services to accredited investors only; (v) Hong Kong SAR: Houlihan Lokey (China) Limited, licensed in Hong Kong by the Securities and Futures Commission to conduct

Type 1, 4, and 6 regulated activities to professional investors only; (vi) India: Houlihan Lokey Advisory (India) Private Limited, registered as an investment adviser with

the Securities and Exchange Board of India (registration number INA000001217); and (vii) Australia: Houlihan Lokey (Australia) Pty Limited (ABN 74 601 825 227), a

company incorporated in Australia and licensed by the Australian Securities and Investments Commission

(AFSL number 474953) in respect of financial services

provided to wholesale clients only. In the United Kingdom, European Economic Area (EEA), Dubai, Singapore, Hong Kong, India, and Australia, this communication is

directed to intended recipients, including actual or potential professional clients (UK, EEA, and Dubai), accredited investors (Singapore), professional investors (Hong

Kong), and wholesale clients (Australia), respectively. No entity affiliated with Houlihan Lokey, Inc., provides banking or securities brokerage services and is not subject

to FINMA supervision in Switzerland or similar regulatory authorities in other jurisdictions. Other persons, such as retail clients, are NOT the intended recipients of our

communications or services and should not act upon this communication.

Houlihan Lokey gathers its data from sources it considers reliable; however, it does not guarantee the accuracy or completeness of the information provided within this

presentation. The material presented reflects information known to the authors at the time this presentation was written, and this information is subject to change. Any

forward-looking information and statements contained herein are subject to various risks and uncertainties, many of which are difficult to predict, that could cause actual

results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In addition, past

performance should not be taken as an indication or guarantee of future performance, and information contained herein may be subject to variation as a result of

currency fluctuations. Houlihan Lokey makes no representations or warranties, expressed or implied, regarding the accuracy of this material. The views expressed in this

material accurately reflect the personal views of the authors regarding the subject securities and issuers and do not necessarily coincide with those of Houlihan Lokey.

Officers, directors, and partners in the Houlihan Lokey group of companies may have positions in the securities of the companies discussed. This presentation does not

constitute advice or a recommendation, offer, or solicitation with respect to the securities of any company discussed herein, is not intended to provide information upon

which to base an investment decision, and should not be construed as such. Houlihan Lokey or its affiliates may from time to time provide financial or related services to

these companies. Like all Houlihan Lokey employees, the authors of this presentation receive compensation that is affected by overall firm profitability.

17

DISCLAIMER

Corporate Finance

Financial Restructuring

Financial and Valuation Advisory

HL.com