ISO-NE PUBLIC

2022 Annual Markets Report

© ISO New England Inc.

Internal Market Monitor

JUNE 5, 2023

2022 Annual Markets Report page ii

ISO-NE PUBLIC

Document Revision History

Date

Version

Remarks

6/5/2023

Original

Initial Posting

2022 Annual Markets Report page iii

ISO-NE PUBLIC

Preface/Disclaimer

The Internal Market Monitor (IMM) of ISO New England (ISO) publishes an Annual Markets

Report (AMR) that assesses the state of competition in the wholesale electricity markets

operated by the ISO. The 2022 Annual Markets Report covers the ISO’s most recent operating

year, January 1 to December 31, 2022. The report addresses the development, operation, and

performance of the wholesale electricity markets administered by the ISO and presents an

assessment of each market based on market data, performance criteria, and independent

studies.

This report fulfills the requirement of Market Rule 1, Appendix A, Section III.A.17.2.4, Market

Monitoring, Reporting, and Market Power Mitigation:

The Internal Market Monitor will prepare an annual state of the market report on market trends and the

performance of the New England Markets and will present an annual review of the operations of the New

England Markets. The annual report and review will include an evaluation of the procedures for the

determination of energy, reserve and regulation clearing prices, Net Commitment-Period Compensation costs

and the performance of the Forward Capacity Market and Financial Transmission Rights Auctions. The review

will include a public forum to discuss the performance of the New England Markets, the state of competition,

and the ISO’s priorities for the coming year. In addition, the Internal Market Monitor will arrange a non-public

meeting open to appropriate state or federal government agencies, including the Commission and state

regulatory bodies, attorneys general, and others with jurisdiction over the competitive operation of electric

power markets, subject to the confidentiality protections of the ISO New England Information Policy, to the

greatest extent permitted by law.

1

This report is being submitted simultaneously to the ISO and the Federal Energy Regulatory

Commission (FERC) per FERC order:

The Commission has the statutory responsibility to ensure that public utilities selling in competitive bulk power

markets do not engage in market power abuse and also to ensure that markets within the Commission’s

jurisdiction are free of design flaws and market power abuse. To that end, the Commission will expect to

receive the reports and analyses of a Regional Transmission Organization’s market monitor at the same time

they are submitted to the RTO.

2

This report presents the most important findings, market outcomes, and market design

changes of New England’s wholesale electricity markets for 2022. The executive summary gives

an overview of the region’s wholesale electricity market outcomes, the important market issues

and our recommendations for addressing these issues. It also addresses the overall

competitiveness of the markets, and market mitigation and market reform activities. Sections 1

through Section 8 include more detailed discussions of each of the markets, market results,

analysis and recommendations. A list of acronyms and abbreviations is included at the back of

the report.

1

ISO New England Inc. Transmission, Markets, and Services Tariff (ISO tariff), Section III.A.17.2.4, Market Rule 1, Appendix A,

“Market Monitoring, Reporting, and Market Power Mitigation”, http://www.iso-ne.com/static-

assets/documents/regulatory/tariff/sect_3/mr1_append_a.pdf.

2

FERC, PJM Interconnection, L.L.C. et al., Order Provisionally Granting RTO Status, Docket No. RT01-2-000, 96 FERC ¶ 61, 061

(July 12, 2001).

2022 Annual Markets Report page iv

ISO-NE PUBLIC

A number of external and internal audits are also conducted each year to ensure that the ISO

followed the approved market rules and procedures and to provide transparency to New

England stakeholders. Further details of these audits can be found on the ISO website.

3

All information and data presented are the most recent as of the time of writing. The data

presented in this report are not intended to be of settlement quality and some of the underlying

data used are subject to resettlement.

In case of a discrepancy between this report and the ISO New England Tariff or Procedures, the

meaning of the Tariff and Procedures shall govern.

Underlying natural gas data are furnished by the Intercontinental Exchange (ICE):

Underlying oil and coal pricing data are furnished by Argus Media.

3

See https://www.iso-ne.com/about/corporate-governance/financial-performance

2022 Annual Markets Report page ii

ISO-NE PUBLIC

Contents

Preface/Disclaimer......................................................................................................................................................................... iii

Contents ............................................................................................................................................................................................ ii

Figures ............................................................................................................................................................................................... ii

Tables................................................................................................................................................................................................. v

Executive Summary ........................................................................................................................................................................ 6

IMM Market Enhancement Recommendations ..................................................................................................................13

Section 1 Overall Market Conditions ........................................................................................................................................18

1.1 Wholesale Cost of Electricity ............................................................................................................................................18

1.2 Supply Conditions ...............................................................................................................................................................20

1.2.1 Generation and Capacity Mix ..................................................................................................................................20

1.2.2 Generation Fuel and Emissions Costs ....................................................................................................................27

1.2.3 Generator Profitability ..............................................................................................................................................31

1.3 Demand Conditions............................................................................................................................................................35

1.3.1 Energy Demand ..........................................................................................................................................................35

1.3.2 Reserve Requirement and Margin ..........................................................................................................................38

1.3.3 Capacity Market Requirements...............................................................................................................................40

1.4 Imports and Exports (External Transactions) ................................................................................................................42

Section 2 Market Structure and Competitiveness Assessment ..........................................................................................44

2.1 Energy Market.....................................................................................................................................................................45

2.1.1 C4 Concentration Ratio for Generation .................................................................................................................45

2.1.2 C4 Concentration Ratio for Load .............................................................................................................................46

2.1.3 Residual Supply Index and the Pivotal Supplier Test...........................................................................................47

2.1.4 Day-Ahead Price-Cost Markup ................................................................................................................................49

2.1.5 Real-Time Price-Cost Markup (Lerner Index)........................................................................................................51

2.1.6 Real-Time Economic Withholding...........................................................................................................................52

2.2 Energy Market Mitigation .................................................................................................................................................53

2.2.1 Mitigation Outcomes and Drivers...........................................................................................................................54

2.2.2 Energy Market Mitigation Assessment ..................................................................................................................58

2.3 Forward Capacity Market..................................................................................................................................................63

2.4 Forward Capacity Market Mitigation ..............................................................................................................................66

2.4.1 Supplier-Side Market Power ....................................................................................................................................66

2.4.2 Buyer-side Market Power (Minimum Offer Price Rule) ......................................................................................69

2.5 Financial Transmission Rights Market ............................................................................................................................70

2.6 Ancillary Services ................................................................................................................................................................72

2022 Annual Markets Report page iii

ISO-NE PUBLIC

2.6.1 Forward Reserve Market ..........................................................................................................................................72

2.6.2 Regulation Market .....................................................................................................................................................74

Section 3 Day-Ahead and Real-Time Energy Market .............................................................................................................76

3.1 Energy Prices .......................................................................................................................................................................76

3.1.1 Day-Ahead and Real-Time Energy Prices ...............................................................................................................77

3.1.2 Fast-Start Pricing: Impact on Real-Time Outcomes .............................................................................................81

3.1.3 Energy Price Convergence........................................................................................................................................85

3.2 Drivers of Energy Market Outcomes...............................................................................................................................88

3.2.1 Generation Costs........................................................................................................................................................89

3.2.2 Supply-Side Participation..........................................................................................................................................96

3.2.3 Reserve Adequacy Analysis Commitments ...........................................................................................................98

3.2.4 Load and Weather Conditions .............................................................................................................................. 100

3.2.5 Demand Bidding...................................................................................................................................................... 103

3.2.6 Load Forecast and Market Implications.............................................................................................................. 105

3.2.7 System Events During 2022................................................................................................................................... 109

3.2.8 Reliability Commitments and Posturing ............................................................................................................. 118

3.2.9 Transmission Congestion....................................................................................................................................... 122

3.2.10 Marginal Resources .............................................................................................................................................. 125

3.3 Net Commitment Period Compensation (Uplift) ....................................................................................................... 127

3.4 Demand Response Resources ....................................................................................................................................... 131

3.4.1 Energy Market Offers and Dispatch under PRD ................................................................................................ 131

3.4.2 Energy Market Compensation under PRD.......................................................................................................... 133

Section 4 Virtual Transactions and Financial Transmission Rights .................................................................................. 135

4.1 Virtual Transactions ........................................................................................................................................................ 135

4.1.1 Virtual Transaction Volume .................................................................................................................................. 136

4.1.2 Virtual Transaction Profitability ........................................................................................................................... 137

4.1.3 Virtual Transactions and Price Convergence ..................................................................................................... 141

4.2 Financial Transmission Rights........................................................................................................................................ 142

4.2.1 FTR Volume .............................................................................................................................................................. 142

4.2.2 FTR Funding.............................................................................................................................................................. 144

4.2.3 FTR Profitability ....................................................................................................................................................... 145

Section 5 External Transactions .............................................................................................................................................. 149

5.1 External Transactions...................................................................................................................................................... 150

5.1.1 External Transaction Volumes .............................................................................................................................. 150

5.1.2 External Transaction Offer Composition ............................................................................................................ 154

2022 Annual Markets Report page iv

ISO-NE PUBLIC

5.1.3 External Transaction Uplift (NCPC) Payments ................................................................................................... 156

5.2 Coordinated Transaction Scheduling ........................................................................................................................... 158

5.2.1 CTS Performance..................................................................................................................................................... 158

5.2.2 CTS and ISO Scheduling Efficiency ....................................................................................................................... 162

5.2.3 CTS and Participant Bidding Opportunities ........................................................................................................ 165

Section 6 Forward Capacity Market ....................................................................................................................................... 168

6.1 Review of Seventeenth Forward Capacity Auction (FCA)......................................................................................... 168

6.1.1 Qualified and Cleared Capacity ............................................................................................................................ 169

6.1.2 Results and Competitiveness................................................................................................................................ 170

6.1.3 Results of the Substitution Auction (CASPR)...................................................................................................... 171

6.2 Forward Capacity Market Outcomes ........................................................................................................................... 172

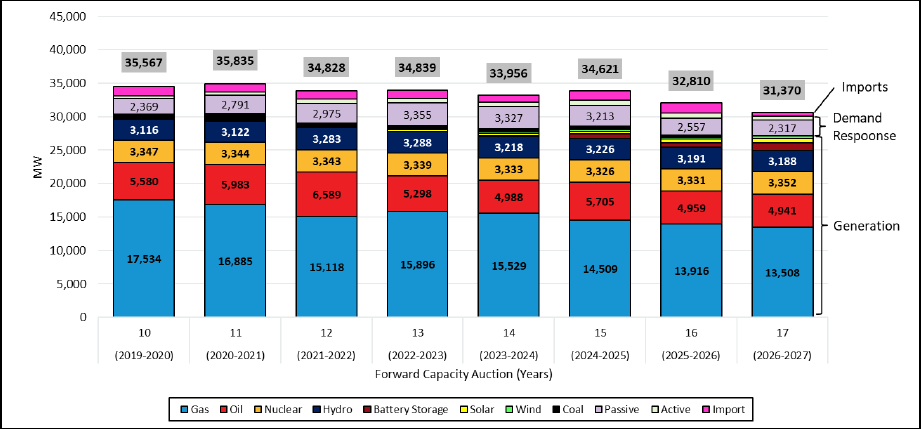

6.2.1 Capacity Resource Mix ........................................................................................................................................... 176

6.2.2 Pay-for-Performance Outcomes .......................................................................................................................... 180

6.2.3 Secondary Forward Capacity Market Results .................................................................................................... 181

Section 7 Ancillary Services...................................................................................................................................................... 183

7.1 Real-Time Operating Reserves ...................................................................................................................................... 184

7.1.1 Real-Time Operating Reserve Payments ............................................................................................................ 185

7.1.2 Real-Time Operating Reserve Prices and Frequency........................................................................................ 187

7.2 Forward Reserves ............................................................................................................................................................ 191

7.2.1 Market Requirements ............................................................................................................................................ 191

7.2.2 Auction Results........................................................................................................................................................ 194

7.2.3 FRM Payments......................................................................................................................................................... 195

7.3 Regulation ......................................................................................................................................................................... 197

7.3.1 Regulation Prices..................................................................................................................................................... 197

7.3.2 Regulation Payments ............................................................................................................................................. 198

7.3.3 Regulation Requirements, Resource Mix, and Performance .......................................................................... 199

Section 8 Market Design or Rule Changes ............................................................................................................................ 202

8.1 Major Design Changes Recently Implemented .......................................................................................................... 202

8.1.1 Transmission Cost Allocation to Network Customers with Behind-the-Meter Generation ...................... 202

8.1.2 Competitive Transmission Solicitation Enhancements .................................................................................... 203

8.1.3 Extended-Term Transmission Planning Tariff Changes.................................................................................... 203

8.2 Major Design or Rule Changes in Development or Implementation for Futur e Years ....................................... 204

8.2.1 Incorporate Solar into Do-Not-Exceed Dispatch ............................................................................................... 204

8.2.2 Inventoried Energy Program................................................................................................................................. 204

8.2.3 FERC Order 2222, Distributed Energy Resources .............................................................................................. 205

2022 Annual Markets Report page v

ISO-NE PUBLIC

8.2.4 Competitive Capacity Markets without a Minimum Offer Price Rule (MOPR)............................................ 206

8.2.5 Resource Capacity Accreditation (RCA) in the Forward Capacity Market (FCM) ........................................ 206

8.2.6 Day-Ahead Ancillary Services Initiative............................................................................................................... 207

8.3 Additional Notable Studies ............................................................................................................................................ 207

8.3.1 New England's Future Grid Initiative................................................................................................................... 207

Acronyms and Abbreviations .................................................................................................................................................. 209

2022 Annual Markets Report page ii

ISO-NE PUBLIC

Figures

Figure 1-1: Wholesale Costs ($ billions and $/MWh) and Average Natural Gas Prices ....................................................18

Figure 1-2: Average Output and Share of Native Electricity Generation by Fuel Type .....................................................21

Figure 1-3: Average Capacity by Fuel Type ...............................................................................................................................22

Figure 1-4: Capacity Factor by Fuel Type...................................................................................................................................23

Figure 1-5: Average Native Electricity Generation and Load by State .................................................................................24

Figure 1-6: Average Age of New England Generator Capacity by Fuel Type (2018 - 2022) .............................................25

Figure 1-7: Generator Additions, Retirements, and FCM Outcomes....................................................................................26

Figure 1-8: Average Fuel Prices by Quarter and Year..............................................................................................................27

Figure 1-9: New England vs. Henry Hub and Marcellus Natural Gas Prices ........................................................................28

Figure 1-10: Annual Estimated Average Costs of Generation and Emissions .....................................................................31

Figure 1-11: Estimated Net Revenue for New Gas -fired Generators ...................................................................................33

Figure 1-12: Average Hourly Load by Quarter and Year .........................................................................................................36

Figure 1-13: Load Duration Curves .............................................................................................................................................37

Figure 1-14: Average Quarterly Weather-Normalized Load with Energy Efficiency and Solar Impacts ........................38

Figure 1-15: Average System Reserve Requirements .............................................................................................................39

Figure 1-16: System Reserve Margin, Peak Load, and Available Capacity...........................................................................40

Figure 1-17: ICR, NICR, Local Sourcing Requirements, and Maximum Capacity Limits.....................................................41

Figure 1-18: Average Hourly Real-Time Pool Net Interchange by Quarter and Year ........................................................42

Figure 2-1: Real-time System-wide Supply Shares of the Four Largest Firms.....................................................................46

Figure 2-2: Real-time System-wide Demand Shares of the Four Largest Firms .................................................................47

Figure 2-3: System-wide Residual Supply Index Duration Curves.........................................................................................49

Figure 2-4: Hourly Real-time Economic Withholding During On-Peak Hours .....................................................................53

Figure 2-5: Energy Market Mitigation ........................................................................................................................................55

Figure 2-6: Potential Economic Withholding, General Threshold Energy ...........................................................................59

Figure 2-7: Supply Controlled by Pivotal Suppliers on June 13, 2022, During HE 18 (Interval 2) ...................................60

Figure 2-8: Generator Capacity Lacking a CSO by Asset Type................................................................................................61

Figure 2-9: LMP-Based and Marginal Cost Reference Prices .................................................................................................62

Figure 2-10: Capacity Market Residual Supply Index, by FCA and Zone ..............................................................................64

Figure 2-11: Overview of Suppliers, Pivotal Supplier, and Capacity Margin, by Zone.......................................................65

Figure 2-12: General Static De-list Bid Summary Statistics, by Key Milestone Action (FCAs 13 – 17)............................68

Figure 2-13: Reviewable Offer Request Summary Statistics, by Key Milestone Action (FCAs 13 – 17) .........................69

Figure 2-14: Average FTR MWs Held per Hour by Top Four FTR Holders by Year and Period.........................................71

Figure 2-15: Average Regulation Market Requirement and Available Capacity, 2022 .....................................................74

Figure 2-16: Average Regulation Requirement and Residual Supply Index ........................................................................75

Figure 3-1: Annual Simple Average Hub Price ..........................................................................................................................78

Figure 3-2: Simple-Average Hub and Load Zone Prices, 2022 ...............................................................................................79

Figure 3-3: Load-Weighted and Simple Average Hub Prices, 2022.......................................................................................80

Figure 3-4: Day-Ahead Load-Weighted Prices ..........................................................................................................................81

Figure 3-5: Reserve Prices in the Pricing vs. Dispatch Software on December 12, 2022..................................................85

Figure 3-6: Average Annual Day-Ahead Price Premium at the Hub and Average Day-Ahead Hub LMP ........................86

Figure 3-7: Average Hourly Day-Ahead to Real-Time Hub Price Differences, 2022...........................................................87

Figure 3-8: Estimated Generation Costs and On-Peak LMPs .................................................................................................89

Figure 3-9: Annual Average Natural Gas Price-Adjusted LMPs .............................................................................................91

Figure 3-10: Estimated Average Cost of RGGI CO

2

Allowances and Contribution of Emissions to Energy Production

Costs .................................................................................................................................................................................................92

Figure 3-11: Contributions of Emissions Cost to Energy Production Costs .........................................................................94

Figure 3-12: Massachusetts GWSA Auction Results ................................................................................................................95

2022 Annual Markets Report page iii

ISO-NE PUBLIC

Figure 3-13: Day-Ahead and Real-Time Supply Breakdown by Hour Ending, 2022 ...........................................................97

Figure 3-14: Priced and Unpriced Supply vs. Real-Time LMP, March 16, 2022 ..................................................................98

Figure 3-15: Average RAA Generator Commitments and the Day-Ahead Energy Gap .....................................................99

Figure 3-16: Average Demand and LMP by Hour, 2022....................................................................................................... 101

Figure 3-17: Seasonal vs. Five-Year Average Temperatures ............................................................................................... 102

Figure 3-18: Day-Ahead Cleared Demand as a Percentage of Real-Time Load by Bid Type ......................................... 104

Figure 3-19: Day-Ahead Cleared Demand as Percentage of Real -Time Load by Bid Type by hour, 2022 .................. 104

Figure 3-20: Components of Day-Ahead Cleared Demand as a Percentage of Total Day-Ahead Cleared Demand . 105

Figure 3-21: ISO Day-Ahead Load Forecast Error by Time of Year..................................................................................... 107

Figure 3-22: Impact of BTM Solar on Load Forecast Error .................................................................................................. 108

Figure 3-23: Price Difference and Forecast Error Relationship .......................................................................................... 109

Figure 3-24: Pricing, Demand and the Reserve Margin during System Events in 2022 ................................................. 110

Figure 3-25: LMP Duration Curves for Top 1% of Real-Time Pricing Hours...................................................................... 113

Figure 3-26: Actual vs. Forecasted Load on May 21 ............................................................................................................. 114

Figure 3-27: Real-Time Prices on May 21, 2022 .................................................................................................................... 114

Figure 3-28: December 24 Event Timeline ............................................................................................................................. 115

Figure 3-29: Day-Ahead vs. Real-Time Net Import Deviations by Interface..................................................................... 116

Figure 3-30: Differences between Hourly Real-time and Day-Ahead Generation Obligations .................................... 117

Figure 3-31: Average Hourly Energy Output from Reliability Commitments, Peak Load Hours................................... 119

Figure 3-32: Day-Ahead and Real-Time Average Out-of-Rate Energy from Reliability Commitments, Peak Load

Hours, 2022.................................................................................................................................................................................. 120

Figure 3-33 Monthly Postured Energy and NCPC Payments............................................................................................... 121

Figure 3-34: Average Day-Ahead Hub LMP, Congestion Revenue Totals and as Percent of Total Energy Cost ........ 123

Figure 3-35: New England Pricing Nodes Most Affected by Congestion, 2022 ............................................................... 124

Figure 3-36: Day-Ahead Marginal Resource by Transaction Type ..................................................................................... 126

Figure 3-37: Real-Time Marginal Resource by Transaction Type ....................................................................................... 127

Figure 3-38: Total Uplift Payments by Year and Category................................................................................................... 129

Figure 3-39: Economic Uplift by Sub-Category ...................................................................................................................... 130

Figure 3-40: Demand Response Resource Offers in the Real-Time Energy Market ....................................................... 132

Figure 3-41: Demand Response Resource Dispatch in the Real -Time Energy Market ................................................... 133

Figure 3-42: Energy Market Payments to Demand Response Resources......................................................................... 134

Figure 4-1: Average Hourly Submitted and Cleared Virtual Transaction Volumes by Time of Day, 2022 .................. 136

Figure 4-2: Average Annual Gross and Net Profits for Virtual Transactions .................................................................... 138

Figure 4-3: Virtual Transaction Volumes and Price Convergence ...................................................................................... 141

Figure 4-4: Average FTR MWs in Effect per Hour by Year ................................................................................................... 143

Figure 4-5: FTR Funding and Congestion Revenue Fund Components by Year ............................................................... 144

Figure 4-6: FTR Costs, Revenues, and Profits......................................................................................................................... 146

Figure 4-7: FTR Profits and Costs for FTRs Sourcing from Roseton ................................................................................... 148

Figure 5-1: Hourly Average Day-Ahead and Real-Time Pool Net Interchange ................................................................ 151

Figure 5-2: Real-Time Net Interchange at Canadian Interfaces .......................................................................................... 152

Figure 5-3: Real-Time Net Interchange at New York Interfaces ......................................................................................... 153

Figure 5-4: Transaction Types by Market and Direction at Canadian Interfaces (Average MW per hour) ................ 154

Figure 5-5: Transaction Types by Market and Direction at New York Interfaces (Average MW per hour) ................ 155

Figure 5-6: CTS Outcome Summary ......................................................................................................................................... 160

Figure 5-7: CTS Unused Capacity, 2022 .................................................................................................................................. 162

Figure 5-8: Price Sensitivity of Offered CTS Transactions .................................................................................................... 166

Figure 6-1: Qualified and Cleared Capacity in FCA 17 .......................................................................................................... 169

Figure 6-2: System-wide FCA 17 Demand Curve, Prices, and Quantities ......................................................................... 170

Figure 6-3: FCA Clearing Prices in the Context of Market Rule Changes .......................................................................... 173

2022 Annual Markets Report page iv

ISO-NE PUBLIC

Figure 6-4: Forward Capacity Auction Clearing Prices ......................................................................................................... 174

Figure 6-5: FCM Payments and FCA Volumes by Commitment Period............................................................................. 175

Figure 6-6: Capacity Mix by Fuel Type..................................................................................................................................... 176

Figure 6-7: New Generation Capacity by Fuel Type.............................................................................................................. 179

Figure 6-8: FCA Import De-list MW.......................................................................................................................................... 180

Figure 6-9: Total PfP Payments by Resource Type (December 2022) ............................................................................... 181

Figure 6-10: Traded Volumes in Reconfiguration Auctions................................................................................................. 182

Figure 7-1: Ancillary Service Costs by Product....................................................................................................................... 184

Figure 7-2: Real-Time Reserve Payments ............................................................................................................................... 186

Figure 7-3: Impact of Fast-Start on Reserve Payments ........................................................................................................ 187

Figure 7-4: Frequency and Average of Non-Zero Reserve Prices ....................................................................................... 188

Figure 7-5: Average Real-Time Reserve Prices for all Pricing Intervals ............................................................................. 189

Figure 7-6: Reserve Constraint Penalty Factor Activation Frequency ............................................................................... 190

Figure 7-7: Forward Reserve Market System-wide Requirements .................................................................................... 192

Figure 7-8: Aggregate Local Forward Reserve (TMOR) Requirements.............................................................................. 193

Figure 7-9: Forward Reserve Prices by FRM Procurement Period ..................................................................................... 194

Figure 7-10: FRM Payments and Penalties by Year ............................................................................................................. 195

Figure 7-11: Regulation Payments ........................................................................................................................................... 199

Figure 7-12: Average Hourly Regulation Requirement, 2022 ............................................................................................. 200

Figure 7-13: Regulation Resource Mix ................................................................................................................................... 200

2022 Annual Markets Report page v

ISO-NE PUBLIC

Tables

Table 2-1: Residual Supply Index and Intervals with Pivotal Suppliers (Real-time) ...........................................................48

Table 2-2: Day-Ahead Price-Cost Markup, % ............................................................................................................................50

Table 2-3: Real-Time Price Cost Markup, % ..............................................................................................................................51

Table 2-4: Offer RSI in the FRM for TMNSR (system-wide) and TMOR (zones)..................................................................73

Table 3-1: Fast-Start Pricing Outcome Summary, 2022 ..........................................................................................................82

Table 3-2: Annual Average On-Peak Implied Heat Rates and Spark Spreads .....................................................................90

Table 3-3: Average, Peak and Weather-Normalized Load................................................................................................... 100

Table 3-4: OP-4 and M/LCC 2 Event Frequency..................................................................................................................... 111

Table 3-5: Frequency of Negative Reserve Margins (System Level) .................................................................................. 112

Table 3-6: Most Frequently Binding Interface Constraints in the Day-Ahead Market, 2022........................................ 125

Table 3-7: Energy and Uplift Payments................................................................................................................................... 128

Table 4-1: Top 10 Most Profitable Locations for Virtual Supply......................................................................................... 139

Table 4-2: Top 10 Most Profitable Locations for Virtual Demand ..................................................................................... 140

Table 4-3: Top 10 Most Profitable FTR Paths in 2022 .......................................................................................................... 146

Table 5-1: NCPC Credits at External Nodes ............................................................................................................................ 156

Table 5-2: Summary of CTS Flow Outcomes .......................................................................................................................... 159

Table 5-3: Forecast Error in CTS Solution ............................................................................................................................... 163

Table 5-4: Profit Scenarios, 2022 ............................................................................................................................................. 164

Table 6-1: Generating Resource Retirements over 50 MW ................................................................................................ 178

Table 7-1: Regulation Prices...................................................................................................................................................... 198

Table 8-1: Market Design or Rule Changes ............................................................................................................................ 202

2022 Annual Markets Report 6 ISO New England Inc.

ISO-NE PUBLIC

Executive Summary

The 2022 Annual Markets Report by the Internal Market Monitor (IMM) at ISO New England

(ISO) addresses the development, operation, and performance of the wholesale electricity

markets. The report presents an assessment of each market based on market data and

performance criteria. In addition to buying and selling wholesale electricity day-ahead and in

real time, the participants in the forward and real-time markets buy and sell operating reserve

products, regulation service, financial transmission rights, and capacity. These markets are

designed to ensure the competitive and efficient supply of electricity to meet the energy needs

of the New England region and secure adequate resources required for the reliable operation of

the power system.

To provide readers with additional background on our markets, this year, we have published a

supporting document, “An Overview of New England’s Wholesale Electricity Markets: A Market

Primer”. We expect that this document will be a useful in helping readers understand the

fundamental concepts and mechanics of our markets.

In this executive summary, we provide an overview and assessment of key market trends,

performance, and issues. We follow this with a consolidated list of recommended enhancements

to the market design and rules from this and prior IMM reports.

---------------------------------

The capacity, energy, and ancillary service markets performed well and exhibited competitive

outcomes in 2022. The day-ahead and real-time energy prices reflected changes in underlying

primary fuel prices, electricity demand and the region’s supply mix.

We saw record high energy prices in 2022; the annual average day-ahead price of $86/MWh

was almost 90% higher than last year, and was the highest since the market was implemented

in 2003. We need to go back to the 2005 and 2008 to find comparable pricing levels, before the

shale gas boom in the United States. Energy prices continued to be driven by the market price of

natural gas, which at $9.32/MMBtu was more than double last year’s price, and was the highest

average price since 2008.

Natural gas prices were driven by a combination of market conditions and events at an

international and national level, in addition to regional New England winter issues. The

Russian-Ukrainian conflict exacerbated global uncertainty in natural gas inventories and prices,

and caused a significant uptick in international demand for Liquefied Natural Gas (LNG). Prices

at major trading hubs in the United States were higher due to international LNG demand and

higher US demand. In New England, periods of sustained cold weather led to increased demand

on a constrained pipeline system, and along with reduced injections from LNG terminals,

resulted in very high gas and electricity prices during the first quarter of the year. Oil-fired

generation made a more significant contribution to meeting the region’s energy demand than

recent years, by displacing natural gas generation and mitigating some of the energy price

impacts on days with extremely high gas prices.

While no major reliability issues occurred in 2022, in late December, the region experienced

only its second capacity scarcity condition in five years. This was due to lower imported energy

and generator outages during bitterly cold weather conditions at the tail end of Winter Storm

Elliott, which had a greater impact on other regions and markets, notably PJM. In this instance,

2022 Annual Markets Report 7 ISO New England Inc.

ISO-NE PUBLIC

the region was short of meeting its reserve requirement for about 1½ hours, but there was

sufficient supply to meet system load. High real-time energy and reserve scarcity prices and

capacity performance credits (peaking at over $6,300/MWh, combined) provided strong

market signals and incentives for supply resources to respond and correct the deficit.

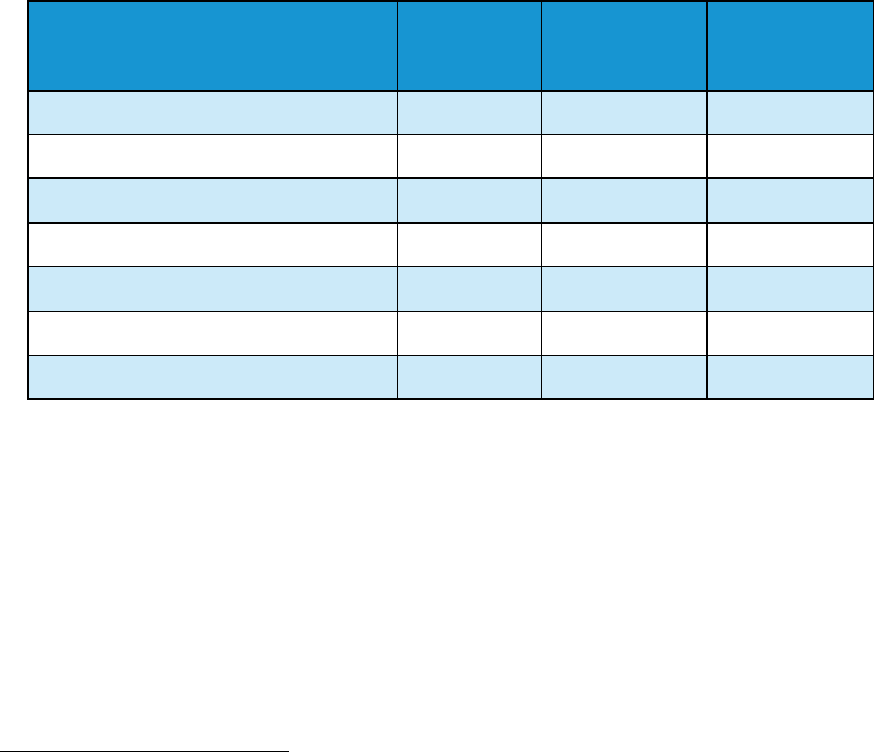

High–level market statistics for the five-year period covered in this report are presented below.

At a Glance: High-level Market Statistics

Demand (MW)

2018 2019 2020 2021 2022

% Change

'22 to '21

Sparkline

Load (avg. hourly) 14,095 13,614 13,309 13,566 13,576 0%

Weather-normalized load (avg. hourly)

[a]

13,725 13,558 13,279 13,419 13,472 0%

Peak load (MW) 26,024 24,361 25,121 25,801 24,780 -4%

Generation Fuel Costs ($/MWh)

[b]

Natural Gas 38.72 25.48 16.34 36.07 72.57 101%

Coal 54.52 40.58 37.82 67.77 144.87 114%

No.6 Oil 127.73 130.89 89.42 138.21 221.17 60%

Diesel 187.55 173.55 112.07 184.50 331.99 80%

Hub Electricity Prices: LMPs ($/MWh)

Day-ahead (simple avg.) 44.14 31.22 23.31 45.92 85.56 86%

Real-time (simple avg.) 43.54 30.67 23.37 44.84 84.92 89%

Day-ahead (load-weighted avg.) 46.88 32.82 24.57 48.30 91.36 89%

Real-time (load-weighted avg.) 46.85 32.32 24.79 47.34 91.07 92%

Estimated Wholesale Costs ($ billions)

Energy 6.0 4.1 3.0 6.1 11.7 92%

Capacity 3.6 3.4 2.7 2.3 2.0 -11%

Uplift (NCPC) 0.07 0.03 0.03 0.04 0.05 49%

Ancillary Services 0.1 0.1 0.1 0.1 0.1 127%

Regional Network Load Costs 2.3 2.2 2.4 2.7 2.8 2%

Total Wholesale Costs 12.1 9.8 8.1 11.2 16.7 49%

Supply Mix

[c]

Natural Gas 40% 39% 42% 45% 45% 0%

Nuclear 25% 25% 22% 22% 23% 0%

Imports 17% 19% 20% 16% 14% -2%

Hydro 7% 7% 7% 6% 6% 0%

Other

[d]

5% 5% 5% 5% 4% -1%

Wind 3% 3% 3% 3% 3% 0%

Solar 1% 1% 2% 2% 3% 0.8%

Coal 1% 0% 0% 0% 0.3% -0.20%

Oil 1% 0% 0% 0% 1.5% 1.34%

2022 Annual Markets Report 8 ISO New England Inc.

ISO-NE PUBLIC

Energy costs drove an overall increase in wholesale costs due to high natural gas prices,

comprising over two thirds of total costs

The total wholesale cost of electricity in 2022 was $16.7 billion, the equivalent of $140 per

MWh of load served.

4

These costs were at their highest level over the last five years and were

considerably higher than the 2021 total of $11.2 billion. This 50% increase (or $5.5 billion) was

driven by higher energy costs. Also, with the exception of capacity costs (down by $0.22 billion),

every other component of the wholesale cost of electricity increased in 2022.

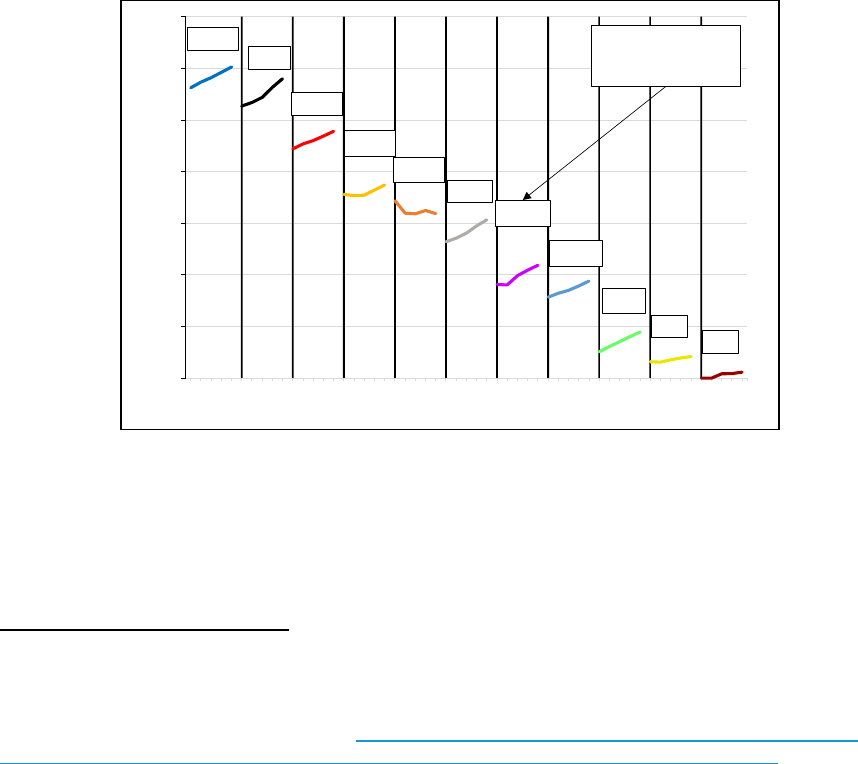

Wholesale Costs ($ billions and $/MWh) and Average Natural Gas Prices

Energy costs continued to comprise the largest share of wholesale costs, at 70%, a significant

jump from a 55% share in 2021. At their highest level since 2008, energy costs totaled $11.7

billion, up 92% (or $5.6 billion) on 2021 costs. With natural gas prices increasing by over 100%

year-over-year, day-ahead LMPs averaged $86.56/MWh, up 86% (or by $40.64/MWh) on 2021.

In addition, while there were increases in energy costs in each quarter, Quarter 1 (Q1)

accounted for 32% of the total annual change. Q1 2022 saw the highest natural gas prices since

Q1 2014, with gas generation costs exceeding $100/MWh on average. This resulted in an

4

The wholesale cost of electricity comprises energy, uplift, ancillary services and transmission costs.

[a] Weather-normalized results are those that would have been observed if the weather were the same as the long-term

average.

[b] Generation costs are calculated by multiplying the daily fuel price ($/MMBtu) by the average standard efficiency of

generators for each fuel (MMBtu/MWh)

[c] Capacity cost in 2022 includes the Mystic cost-of-service costs of $0.17 billion.

[d] Provides a breakdown of total supply, which includes net imports. Note that section 2 provides a breakdown of native

supply only.

[e] The "Other" fuel category includes landfill gas, methane, refuse and steam

denotes change is within a band of +/- 1%

Sparkline: Green = High Point, Red - Low Points

$6.0

$4.1

$3.0

$6.1

$11.7

$3.6

$3.4

$2.7

$2.3

$2.0

$2.3

$2.2

$2.4

$2.7

$2.8

$12.1

$9.8

$8.1

$11.2

$16.7

$0

$3

$6

$9

$12

$15

$0

$3

$6

$9

$12

$15

$18

2018 2019 2020 2021 2022

Natural Gas ($/MMBtu)

Costs ($ billion)

Billions

Energy NCPC Ancillary Services Capacity Regional Network Load Natural Gas Price

$49

$34

$26

$51

$98

$29

$29

$23

$19

$17

$18

$18

$20

$23

$23

$98

$82

$69

$94

$140

$0

$30

$60

$90

$120

$150

2018 2019 2020 2021 2022

$ per MWh of Load

2022 Annual Markets Report 9 ISO New England Inc.

ISO-NE PUBLIC

average day-ahead LMP of $115.23/MWh, also the highest since Q1 2014. This upward pressure

on LMPs from natural gas prices was attenuated by more frequent in-merit oil generation than

prior years.

Net Commitment Period Compensation (NCPC), or uplift, costs remained relatively low at just

$53 million, or 0.5% of total energy payments. There were few out-of-market commitments or

dispatch decisions impacting NCPC. In fact, the vast majority of uplift (95%) uplift was paid to

resources committed and dispatched in economic merit order, with the remaining 5% (just $1.1

million) required to meet the costs of out-of-merit reliability commitments. There were

significantly fewer out-of-merit local reliability commitments needed to address impactful

transmission outages.

Capacity, which comprised just 12% of total wholesale costs, continued to decline as the market

maintains surplus capacity over the system’s capacity requirement. Costs totaled $2 billion and

were down by 10% (or $0.22 billion) on 2021. The costs were a function of lower combined

clearing prices in the twelfth and thirteenth Forward Capacity Auctions (FCAs 12 and 13).

When compared against 2021 capacity costs, lower auction clearing prices more than offset

supplemental payments under the Cost of Service (CoS) agreement during 2022 for the Mystic 8

and 9 generators ($166 million in 2022) that began in summer 2022.

Natural gas prices drive high wholesale energy prices in New England

Natural gas prices in New England increased significantly in 2022, with an average price of

$9.32/MMBtu, up from $4.62/MMBtu in 2021. This price increase was driven by local market

conditions, New England's reliance on a constrained natural gas transmission system, and

events at a national and international level, particularly the Russian-Ukrainian conflict.

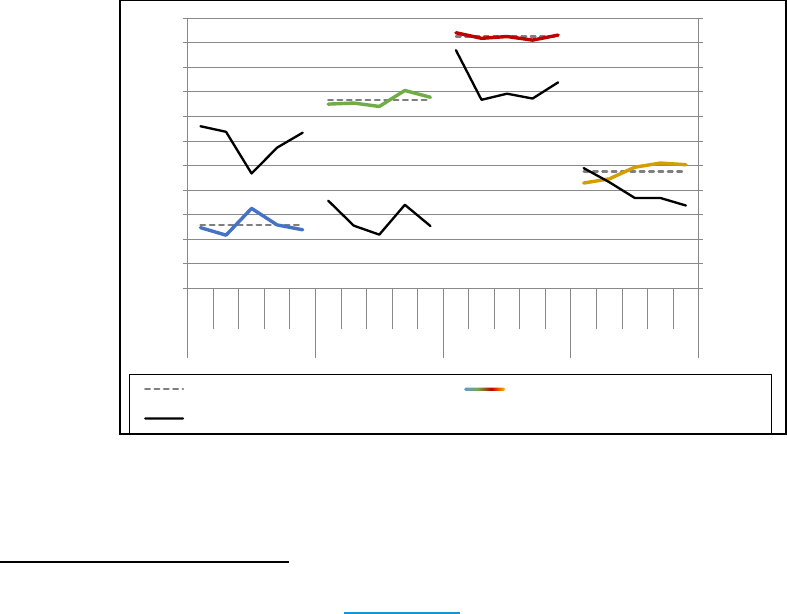

New England vs. Henry Hub and Marcellus Natural Gas Prices

Prices at supply basins also increased, with Henry Hub averaging $6.38/MMBtu and Marcellus

averaging $5.46/MMBtu. New England's natural gas traded at a premium of $2.94/MMBtu and

$3.86MMBtu compared to Henry Hub and Marcellus, respectively. During Q1 2022, New

England's natural gas price reached its highest quarterly price since 2014, at $13.86/MMBtu,

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2018 2019 2020 2021 2022

Natrual Gas Price ($/MMBtu)

New England Marcellus Henry Hub

2022 Annual Markets Report 10 ISO New England Inc.

ISO-NE PUBLIC

due to decreased LNG injections and increased reliance on interstate pipeline gas. However, the

highest daily natural gas prices of the year were in Q4. While the quarterly natural gas price

averaged $8.41/MMBtu, a cold snap from December 24 to December 27 drove the average daily

natural gas price to $35.37/MMBtu over the four days. These were the highest daily averages

since Q4 2018.

The trend of decreasing load may have reached an inflection point

Net Energy for Load (NEL) averaged 13,576 MW per hour in 2022, which was comparable to

2021. On a weather-adjusted basis, load has been declining, which reflects the long-term trend

of increased energy efficiency (EE) and, more recently, the adoption of behind-the-meter (BTM)

solar generation. However, weather-normalized load increased slightly over the past two years.

While it is difficult to attribute this directly to any particular driver, this change is consistent

with the ISO forecast that average load will increase each year with the continued adoption of

electricity-fueled transportation and electric heating.

In 2022, EE reduced weather-normalized annual average load by an estimated 2,538 MW (by

16%), which was a 2% decrease (40 MW) compared to 2021. This is in line with the ISO’s

expectation that EE will decline over time due to rising costs of eligible EE measures and the

associated baselines used to calculate claimable savings. By contrast, BTM solar generation

reduced weather-normalized load by 426 MW (by ~3%) which was a 15% increase (57 MW)

compared to 2021, and is expected to continue this upward trend in future years.

Net interchange with neighboring control areas continued to decrease

In 2022, net interchange (or net imports) averaged 1,914 MWs per hour, an 11% (or 231 MW)

decrease compared to 2021, and the lowest amount over the past five years. Net imports met

just 14% of New England’s electric demand, compared to up to 19% during the 2018-2020

period.

Net imports fell at the New York North and New Brunswick interfaces. At New York North,

average net interchange decreased by 189 MW per hour compared to 2021 (401 MW vs. 590

MW). The retirement of the Indian Point nuclear generator in New York in April 2021 and

increased planned transmission outages in New York led to increased congestion and higher

energy prices relative to New England prices. At the New Brunswick interface, average net

interchange decreased by 68 MW (228 MW vs. 296 MW) compared to 2021 due to the extended

outage of a nuclear generator in New Brunswick, which has since returned to service.

Price formation is generally robust but we recommend a review of reserve pricing under

the fast start pricing rules

Large volumes of unpriced (or fixed) supply can have important implications for pricing

outcomes because it increases the likelihood of low or negative prices. We expect this impact to

become more prevalent as additional capacity from renewable generation (e.g., wind, solar)

with low marginal costs enter the energy markets. At present, we generally find that energy

price formation is robust under current levels of unpriced supply. Further, as more low

marginal cost generation participates in the wholesale market, we would expect to see a market

response in terms of more price-responsive supply, particularly with more energy storage

devices joining the market; otherwise, there is a higher risk of energy prices not covering short-

run production costs.

2022 Annual Markets Report 11 ISO New England Inc.

ISO-NE PUBLIC

The Fast Start Pricing rules in the real-time energy market are working as intended by better

reflecting the production cost of fast-start generators in LMPs, and reducing uplift costs.

However, we have observed frequent non-zero reserve pricing in scenarios when resources’

dispatch instructions were not impacted by the reserve constraint and the system had a surplus

of reserves.

Due to tradeoffs presented by the separation of the dispatch and pricing software, the ISO chose

a pricing optimization methodology that minimizes false negatives (i.e., no reserve pricing when

there is a physical reserve constraint binding) but allows false positives (i.e., reserve pricing

when there is not a physical reserve constraint binding). This was an intentional decision when

fast-start pricing was implemented, however, the frequency in which we have observed reserve

pricing when there is not a physical reserve constraint binding has exceeded our expectations.

In 2022 alone, $13.7 million in reserve payments were made when there was a reserve surplus

(over half of the $26.9 million in total reserve payments during the year), despite dispatch being

unaffected by the reserve constraint.

We recommend that the ISO revisits reserve pricing mechanics under fast-start pricing to

address the frequency of non-zero reserve pricing when there is a physical reserve surplus.

Low levels of structural market power and mitigations in the energy market, but not in the

Forward Reserve Auction

In 2022, the market concentration among the four largest firms controlling supply in the real-

time market was in line with the values of the last five years, at 44%. There was an increase in

the amount of time when structural market power was evident in real-time because of less

reserve supply, leading to slightly lower total operating reserve margins. There was at least one

pivotal supplier in a quarter of all hours. However, operating reserve margins remained

relatively high on average compared to the underlying requirement, and mitigation remained

relatively infrequent, which tempers any significant concerns regarding the exercise of market

power.

Markups, which estimate the impact of above-cost bidding on clearing prices, were close to zero

or negative in the real-time and day-ahead markets. In 2022, the quantity of withheld economic

capacity was relatively low (below ~ 2%) and generally in line with levels seen in past years.

While the mitigation process for the energy markets has functioned reasonably well in recent

years, we have identified a number of potential issues with the current rules that we

recommend the ISO and stakeholders consider. For example, the current thresholds allow for

considerable latitude in supply offer levels over competitive benchmarks (300% and 50%);

these thresholds have been in place for many years with little empirical support. With the

benefit today of a rich history of supply offer data and robust simulation tools to measure

impact and incentives, an assessment should consider whether the current thresholds

adequately limit the exercise of market power under a plausible set of system scenarios.

Another area of concern is with the structural competitiveness of the Forward Reserve Auction

(FRA). Forward Reserve Market (FRM) auction prices for Ten Minute Non-Spinning Reserve

(TMNSR) have frequently been below $2,000/MW-month over the last few years. However, the

most recent auctions (Summer 2022 and Winter 2022-23) have seen increasing price levels and

have not been structurally competitive. The Summer 2022 auction, in particular, had TMNSR

prices of $7,386/MW-month, reflecting a significant increase in participant offer prices. While

2022 Annual Markets Report 12 ISO New England Inc.

ISO-NE PUBLIC

we reviewed participant offers in the Summer 2022 auction and did not find evidence of the

exercise of market power, we remain concerned about the structural competitiveness of this

auction and the lack of market power mitigation measures. We note, and support, the ISO’s

plans to sunset this market, coinciding with the implementation of day-ahead ancillary service

in early 2025.

Low capacity costs continue as older fossil-fueled generators are replaced with renewable

resources

Capacity market outcomes remained relatively constant in the past two auctions, driven by an

unchanged FCA 16 and 17 (rest-of-pool) clearing price of $2.59/kW-month. Since FCA 10,

capacity prices have decreased 63% ($4.44/kW-month) and Net ICR has decreased 11% (3,846

MW), resulting in a record low $0.9 billion in projected capacity payments for CCP 2026-2027.

Prices are reflective of continued surplus supply conditions and recent reductions in the

capacity requirement.

The capacity market has been structurally competitive at the system level over the past five

auctions and competitiveness indices have further improved in the past two auctions due to

reductions in NICR, along with the absence of major retirements. In FCA 17, Southeast New

England (SENE) was not modelled as an import constrained zone due to a decrease in the zonal

load forecast and an increase in the import capability limit into the zone. This also enhanced the

overall structural competitiveness of the capacity market.

New entrants to New England have varied over the past seven auctions, with gas and energy

efficiency resources making up a majority of new capacity additions from FCA 10-13. Since FCA

13, renewable technologies, typically sponsored-policy resources, have made up 56% of all new

generator additions. Major retirements have comprised nuclear, oil-, and gas-fired resources,

and an additional 1,100 MW of new gas-fired resources have been terminated since FCA 10 for

failing to meet critical development milestones.

From FCA 10-16, the volume of cleared import capacity has fluctuated between 1,000 MW to

1,500 MW across the four external ties in the auction, with most capacity at the New York AC

lines (50%) and Phase II (30%). However, cleared import capacity was down significantly in the

most recent auction, FCA 17, at just 567 MW, comprising 390 MW at New York and 177 MW at

New Brunswick. In FCA 17, we observed the largest percentage of import capacity de-listing

(85%). Despite an import limit of 1,600 MW, import resources cleared at the lowest level over

the five-year period; a key factor driving reduced import capacity is the expected value of

capacity in the neighboring control area.

December 2022 saw the first Pay-for-Performance event since 2018. The December 2022 event

lasted for 17 five-minute intervals and resulted in the transfer of $35.9 million from under-

performing resources to over-performing resources. Import and nuclear resources received the

most performance credits. While cold weather led to forced outages for some of the gas fleet,

the leading cause of gas resource under-performance was high gas prices. Spot natural gas

prices climbed to over $30/MMBtu, resulting in gas generation being pushed out of economic

merit order and, instead, relatively cheaper oil generation was scheduled in the day-ahead

energy market.

5

Once system conditions tightened in real-time and system-wide LMPs

5

More information on fuel prices in Q4 2022 can be found in Section 1.2.2.

2022 Annual Markets Report 13 ISO New England Inc.

ISO-NE PUBLIC

increased significantly, operating limitations prevented many gas-fired resources from coming

online in time to contribute to meeting the load and reserve requirement.

IMM Market Enhancement Recommendations

One of the IMM’s key functions is to recommend rule changes to enhance the performance of

the markets. In practice, we communicate our recommendations through our reports,

particularly our quarterly markets performance reports, and through comments filed with

FERC on proposed rules changes.

The table below summarizes the IMM’s recommended market enhancements, first showing

issues with an “open” status, followed by recently closed issues. Recommendations included in

this report for the first time are identified as “*NEW*”. A hyperlink is provided to the document

in which the recommendation was first put forward, along with the IMM's priority ranking of

each recommendation.

The priority ranking (High, Medium or Low) considers the potential market efficiency gains, as

well as the potential complexity and cost of implementing each recommendation. High priority

recommendations may deliver significant market efficiency gains, with the benefit outweighing

the cost of implementing them. At the other end of the scale, low priority recommendations are

not intended to indicate low importance, but rather issues which may not have as significant

long-term efficiency gains (compared to high priority recommendations) and/or may be very

costly to implement.

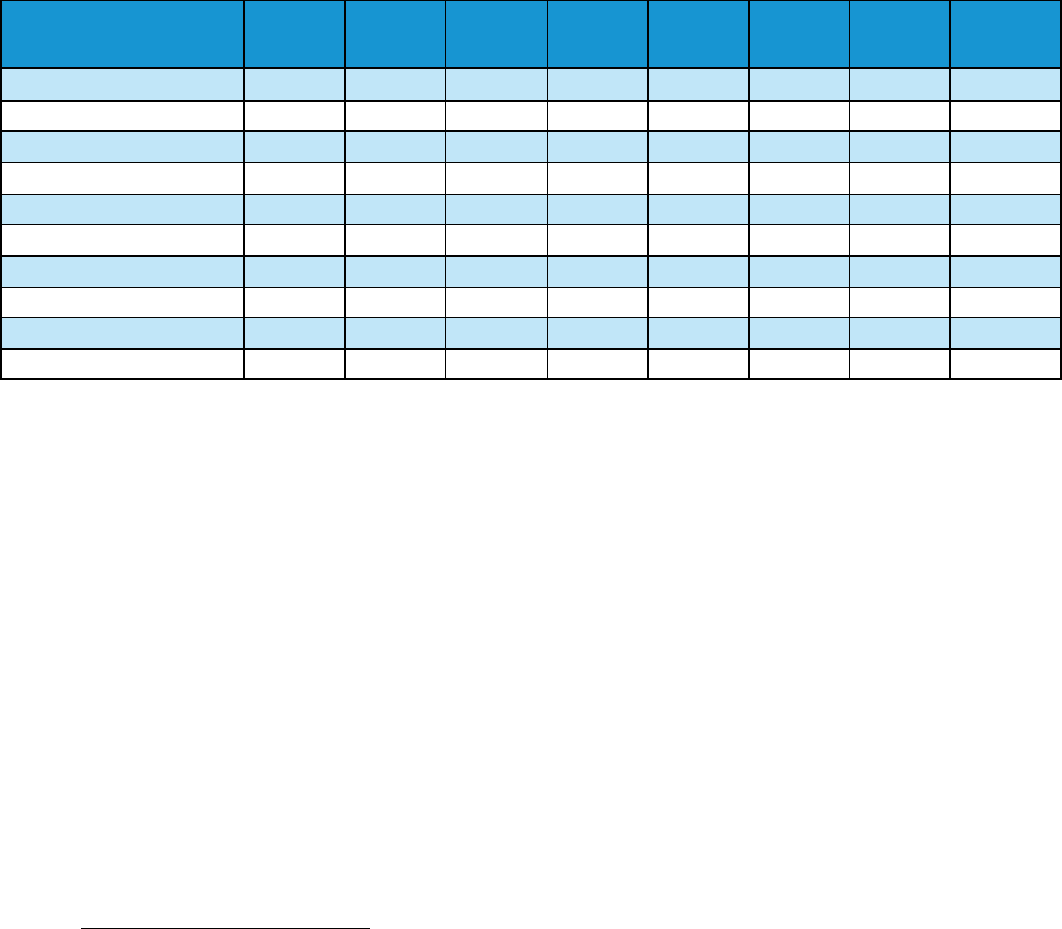

ID

Recommendation

When made

Status

Priority

Ranking

2023-1

*NEW* Review energy mitigation thresholds

and reference level methodologies, eliminate

mitigation exemptions for non-capacity

resources, and extend mitigation to export-

constrained area. Market power mitigation

rules need to strike a reasonable balance

between producer and consumer interests, and

in turn prescribe adequate threshold tests to

determine when market monitors override

generators supply offers. The IMM has

identified a number of potential rule

improvements to better serve the mitigation

function.

1. Review of the current energy mitigation

thresholds that apply to instances of system-

wide and local market power. The current

thresholds allow for considerable latitude in

supply offers levels over competitive

benchmarks (300% and 50%) and have been in

place for many years with little empirical

support.

2. Eliminate the energy offer mitigation

exemption for non-capacity resources in the

day-ahead energy market.

3. Extend the scope of offer mitigation to cover

the potential exercise of market power in

export-constrained areas.

4. Review the methodologies for determining

reference levels, which are used to evaluate if

2022 AMR

New Recommendation – the

IMM will work with the ISO

to assess the

implementation

requirements for this

project.

Medium

2022 Annual Markets Report 14 ISO New England Inc.

ISO-NE PUBLIC

ID

Recommendation

When made

Status

Priority

Ranking

an offer is competitive (the “conduct test”).

Currently, reference levels can be based on

marginal cost, or historical fuel-adjusted

accepted supply offers or LMPs. We have

observed instances in which the latter two

methodologies produce unreasonably high

reference levels.

2023-2

*NEW* Review reserve pricing mechanics

under fast-start pricing. Under current fast-

start pricing rules, we have observed frequent

non-zero reserve pricing in scenarios when

resources’ dispatch instructions were not

impacted by the reserve constraint and the

system had a surplus of reserves. Due to

tradeoffs presented by the separation of the

dispatch and pricing software, the ISO chose a

pricing optimization methodology that

minimizes false negatives (no reserve pricing

when there is a physical reserve constraint

binding) but allows false positives (reserve

pricing when there is not a physical reserve

constraint binding). This was an intentional

decision when fast-start pricing was

implemented, however, the frequency in which

we have observed reserve pricing when there is

not a physical reserve constraint binding has

exceeded the frequency in which we expected

these scenarios to occur, and the cost of

reserve payments in these intervals warrants

additional consideration of other solutions.

2022 AMR

IMM and ISO to assess the

implementation

requirements for this

project.

Medium

2022-1

Incentive rebuttal component of proposed

Buyer-side Mitigation Rules. The ISO's

proposed buyer-side mitigation rules will allow

a Project Sponsor to demonstrate a lack of

incentive through a Net Benefits Test to avoid

mitigation of a below-cost supply offer from

certain resources. The IMM has recommended

that removing the incentive rebuttal provision

from the proposal would make the buyer-side

mitigation review more predictable and

capable of being administered more reliably

and with less subjectivity.

Filed

Comments

with FERC on

MOPR

Elimination

and Buyer-side

Mitigation

Rules (Apr

2022)

The ISO /NEPOOL proposal

was approved by FERC. The

IMM will keep this

recommendation under

review, which will be

informed by implementation

experience.

Medium

2021-1

Develop Offer Review Trigger Price (ORTP) for

co-located solar/battery facilities

Under the current rules, the ORTP for a co-

located battery and solar project is based on

the weighted average of the individual

technologies. This results in a value that is

below the true “missing money” for the

combined resource, allowing such resources to

offer in at prices below competitive levels

Filed

Comments

with FERC on

ORTP

Recalculation

(Apr 2021

The value of this

recommendation is low in

the context of the

elimination of MOPR in FCA

19. The IMM will reassess

this recommendation

pending the outcome of the

MOPR elimination proposal.

Low

2022 Annual Markets Report 15 ISO New England Inc.

ISO-NE PUBLIC

ID

Recommendation

When made

Status

Priority

Ranking

without review and mitigation, and

undermining the protections put in place by the

minimum offer price rule (MOPR). In our

opinion, a bottom-up calculation is preferable

because it accurately represents the

constraints that co-located solar/battery

facilities face and results in a more precise cost

estimate.

2020-1

Reference level flexibility for multi-stage

generation Given that recommendation 2017-1

below is not part of the ISO’s work plan, and is

unlikely to be developed for some time, we

recommend related changes that could be

made to the market power mitigation function

in the meantime. We believe these changes will

be less resource-intensive and complex to

adopt, compared to incorporating multi-stage

generation modeling into the day-ahead and

real-time market and systems software.

However, it is not a replacement of the above

recommendation. The recommendation is to

provide generators with the ability to

dynamically select their active or planned

configuration and to adjust reference levels to

be consistent with their operating costs and

their supply offers. This will address the current

ris k of false positive and negative errors in

mitigation, given the potentially high costs

differences between configurations. It may also

eliminate a potential deterrent to generators

from offering configurations to avoid the risk of

mitigation, which may ultimately be more cost

effective to consumers.

Winter 2020

QMR (May

2020)

Not in the scope of the ISO’s

current work plan.

Medium

2018-1

Unoffered Winter Capacity in the FCM The

IMM is concerned that generators may be

contracting at, or close to, their maximum

capacity (i.e., their winter qualified capacity), as

determined by the ISO, even though that

capacity is not deliverable in certain months

given expected ambient temperatures. The

IMM recommends that the ISO review its

existing qualification rules to address the

disconnect between the determination of

qualified capacity for two broad time horizons

(summer and winter), the ability of the

generators to transact on a monthly basis, and

the fluctuations in output capability based on

ambient conditions. A possible solution would

be for the ISO to develop more granular (e.g.,

monthly) ambient temperature-adjusted

qualified capacity values, based on forecasted

temperatures and the existing

output/temperature curves that the ISO

currently has for each generator.

Fall 2018 QMR

(Mar 2019)

While this recommendation

remains open it may need to

be reviewed by the IMM in

the context of the design

effort to revise the

methodology for calculating

qualified capacity (the

resource capacity

accreditation project).

Medium

2022 Annual Markets Report 16 ISO New England Inc.

ISO-NE PUBLIC

ID

Recommendation

When made

Status

Priority

Ranking

2017-1

Treatment of multi-stage generation Due to

the ISO’s current modeling limitations, multi-

stage generator commitments can result in

additional NCPC payments and suppressed