DEPARTMENT OF THE TREASURY

WASHINGTON, D.C. 20220

July 24, 2017

We are pleased to present the Summary of States’ Annual Reports for the U.S. Treasury’s State

Small Business Credit Initiative (SSBCI). SSBCI was created by the Small Business Jobs Act of

2010 to support state-level small business nancing programs in order to improve access to capital

in the wake of the Great Recession. Seven years later, SSBCI continues to address long-standing

nancing gaps for small businesses, including early stage and women and minority-owned

businesses. As the SSBCI was appropriated to run through 2017, Treasury’s administration of the

program sunsets this year, making this the nal summary of Annual Reports.

Cumulatively, from 2011 to 2016, states reported the following notable accomplishments:

• States expended $1.2 billion in SSBCI funds which supported new nancing to small

businesses totaling $10.7 billion.

• SSBCI programs have supported $8.95 in new nancing for every $1 of SSBCI funds.

• Small business owners reported that SSBCI funds will help create or save more than

240,000 jobs.

We commend the state program managers and their partners for enabling thousands of small

businesses to grow over the past six years, and for their ongoing efforts to recycle SSBCI funds

to support even more small businesses.

For more information about SSBCI, including the SSBCI Program Evaluation Report,

visit www.treasury.gov/ssbci.

Kipp Kranbuhl Jeffrey Stout

Deputy Assistant Secretary Director

Small Business, Community Development State Small Business Credit Initiative

And Affordable Housing Policy

SSBCI: Summary of States’ 2016 Annual Reports

I

Table of Contents

Overview. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

SSBCI-Supported Loans and Investments Financed Small Business Growth . . . . . . . . . 4

SSBCI Mobilized Local Sources of Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

SSBCI Program Performance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Appendix A:

State-by-State Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Participating Municipalities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Participating Territories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Appendix B:

SSBCI Funds Expended by State Program . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Appendix C:

Top 50 SSBCI Lenders by Dollar Amount Loaned and by Number of Loans . . . . . . . . 61

Appendix D:

Top 25 SSBCI CDFIs by Dollar Amount Loaned and by Number of Loans . . . . . . . . . . 65

Appendix E:

SSBCI Program Types . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Acknowledgements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

SSBCI: Summary of States’ 2016 Annual Reports

1

OVERVIEW

Overview

The State Small Business Credit Initiative

1

(SSBCI) awarded over $1.4 billion to agencies in every state

2

for small business nancing programs. States designed programs in response to local economic

conditions and targeted a range of challenges small businesses face securing nancing. These programs

spur private sector nancing by sharing the risk of repayment with lenders and investors—primarily

community banks, community development nancial institutions (CDFIs), and local investors. States

operated ve types of programs under SSBCI: capital access programs, loan guarantee programs, loan

participation programs, collateral support programs, and venture capital programs. SSBCI funds will

remain with states to be recycled to support more small businesses over time.

Each year Treasury releases a summary of data submitted to Treasury by the states in Annual Reports. As

Treasury’s administration of SSBCI sunsets in September 2017, this is the nal summary of Annual Reports.

1 The Small Business Jobs Act of 2010 authorized and funded SSBCI to operate through September 27, 2017.

2 SSBCI awarded funding to 47 states, the District of Columbia, ve territories, and municipalities in three states, collectively

referred to as “states” in this report.

SSBCI: Summary of States’ 2016 Annual Reports

2

OVERVIEW

Highlighted Outcomes

$10.7 billion in new nancing from over 21,000 loans and investments—From 2011 to 2016, the

total value of new nancing provided to small businesses supported by SSBCI funds reached $10.7 billion

or almost $9 for every $1 in SSBCI funds loaned to or invested in a small business.

Over 240,000 jobs created or retained—The small business owners who received SSBCI-supported

funds projected that they will create over 79,000 jobs within two years of the loan or investment and

will retain over 161,000 jobs that were at risk of loss.

Figure 1: New Financing Supported by SSBCI

$250 m – $500 m

$100 m – $250 m

$50 m – $100 m

$0 – $50 m

$500 m – $1.1bn

New Financing

ID

NW

AZ

AK

HI

NM

TX

CO

UT

MT

ND

SD

WY

NE

KS

OK

AR

LA

MO

IA

MN

WI

IL

IN

MI

OH

PA

NY

VT

ME

NH

MA

RI

CT

NJ

DE

DC

VA

WV

KY

TN

MS

AL

GA

NC

SC

FL

MD

WA

OR

CA

Puerto

Rico

American

Samoa

GuamU.S. Virgin

Islands

Northern

Mariana Islands

SSBCI: Summary of States’ 2016 Annual Reports

3

OVERVIEW

Over 80 new small business support programs—The availability of SSBCI funds resulted in a new

infrastructure of credit support programs across the country. SSBCI funded 154 programs nationwide,

more than half of which were created as a result of SSBCI. States dedicated $1 billion (70 percent)

to programs that support lending to small businesses and over $400 million (30 percent) to venture

capital programs targeting investment in early stage small businesses.

3 The data presented throughout this report are cumulative through December 31, 2016.

Figure 2: Summary of Program Outcomes by Objective, cumulative through

December 31, 2016

3

Objective Program Outcomes

Support nancing of small businesses Median business size: 3 full-time employees

Average business size: 11 full-time employees

Median loan/investment amount at closing: $33,000

Average loan/investment amount at closing: $381,700

Expand access to credit to businesses in low- and moderate-income

(LMI) areas, minority and other underserved communities

42.9 percent in LMI areas

41 percent to women or minority-owned businesses*

Leverage new nancing $8.95 in new nancing for each $1 in SSBCI funds expended

Create or retain jobs 240,669 projected jobs created or retained (79,193 created,

161,476 retained) within two years of loan or investment closing

as reported by small business owners

* This percentage does not reect all women or minority-owned businesses supported by SSBCI funds because only some states reported this data.

SSBCI: Summary of States’ 2016 Annual Reports

4

LOANS AND INVESTMENTS

SSBCI-Supported Loans and Investments

Financed Small Business Growth

SSBCI funds supported over 21,000 loans and investments made to small businesses representing

almost every major industry sector. States aligned programs with local economic development

goals by addressing nancing gaps facing neighborhood businesses, high-tech startups, and small

manufacturers, among others. This section highlights some types of businesses that received a

signicant concentration of SSBCI-supported nancing.

Small manufacturers

States sought to create additional economic

benets by supporting base industries like

manufacturing. SSBCI supported 2,520 loans

and investments totaling $2.5 billion in new

nancing to small manufacturers. These

businesses reported that SSBCI-supported

loans and investments would result in 41,000

jobs created or retained.

Women and minority-owned

businesses

SSBCI required states to develop a plan to

reach underserved communities but gave the

states exibility to dene “underserved.”

4

Many

states created programs specically tailored for

women and minority-owned businesses. More

than 41 percent of SSBCI-supported loans or

investments (totaling more than $1.6 billion)

were made to women or minority-owned

businesses.

5

4 Small Business Jobs Act of 2010, Sec 3005(e)(8).

5 Business ownership demographics (women-owned

and minority-owned) were optional data elds. In

total, 43 out of 56 states reported on a total of 13,479

transactions to either or both of these data elds. Of

those transactions, 9,057 transactions were reported

to be in a women- and/or minority-owned business.

Those 9,057 transactions were responsible for $1.6

billion in new nancing, representing just over 41

percent of the 21,963 total SSBCI transactions.

High growth potential businesses

Venture capital is highly concentrated in

certain states. Many states funded venture

capital programs that target early stage

businesses in markets where venture capital

is less accessible, which helped support over

$4 billion in new nancing through 1,623

investments.

Businesses in economically distressed

areas

SSBCI has been eective in supporting small

businesses in areas that were hit hardest by

the recession and where the need continues

to be the greatest. Over 42 percent of SSBCI-

supported loans and investments were made

to businesses in low- and moderate-income

(LMI) communities.

Very small businesses

Over 17,000 transactions or 78 percent of

all SSBCI-supported loans and investments

were to businesses with under $1 million in

revenues, a category of business that have

more diculty accessing capital.

6

6 Small Business Credit Survey. Federal Reserve

Banks. April 2017. Web accessed. Page iv. (https://

www.newyorkfed.org/medialibrary/media/

smallbusiness/2016/SBCS-Report-EmployerFirms-2016

.pdf)

SSBCI: Summary of States’ 2016 Annual Reports

5

LOANS AND INVESTMENTS

Featured Small Businesses

JSB Industrial Solutions (Kentucky)

Conventional nancing was out of reach when

Shane Wallingford tried to start a sheet metal

manufacturing company. A local Community

Development Financial Institution (CDFI),

the Mountain Association for Community

Economic Development (MACED), stepped in

with support from the Kentucky Cabinet for

Economic Development’s collateral support

program to provide a loan for equipment and

start-up costs. The loan enabled JSB Industrial

Solutions to start up and create ve new jobs

in an economically distressed county.

Jada Beauty (Indiana)

When Danielle McDowell and Janell Shaer

sought seed capital for their e-commerce

platform, Jada Beauty, Indiana’s SSBCI program

matched an investment from a member-

managed angel fund. Jada Beauty launched

and within 18 months was acquired by a

national brand. Indiana generated sizable

returns, providing additional early-stage

capital available to be invested in future

opportunities.

Prospect Mining (Alabama)

Special purpose buildings, such as a coal

washing facility, are more dicult to nance

because of limited resale demand. Alabama’s

SSBCI program guaranteed a $5 million loan to

Prospect Mining to nish construction of such

a facility, saving the company over one million

dollars per year on hauling expenses. Prospect

Mining estimates the facility will support

approximately 100 jobs in an economically

distressed region of the state.

Thai Zap (Idaho)

Obtaining traditional nancing can be dicult

for rst-time small business owners. Idaho’s

SSBCI program provided collateral support

to guarantee a $49,500 loan to start a food

truck serving Thai cuisine to the residents of

Pocatello, Idaho. The business owner was able

to hire three employees.

SSBCI: Summary of States’ 2016 Annual Reports

6

MOBILIZED CAPITAL

SSBCI Mobilized Local Sources of Capital

States addressed local nancing gaps by sharing risk with local lenders and investors. This section

highlights the types of lenders and investors that participated in SSBCI programs.

Community banks

Sixty-three percent of the dollar amount

of loans supported by SSBCI ($3.4 billion)

were made by community banks. Over 700

community banks participated in SSBCI

programs across the country.

Community Development Financial

Institutions (CDFIs)

CDFIs, lenders with a mission of community

development, accounted for 54 percent of

all SSBCI-supported loans or $835 million in

new nancing. The average CDFI borrower

had four full-time employees, which is dened

as a microbusiness by the Small Business

Administration.

Regional Banks

A number of regional banks were very active

participants in SSBCI. Seven of the top 25

lenders by volume were regional banks, which

primarily funded more established businesses

that averaged 22 full-time employees.

Equity Investors

Under SSBCI, 38 states funded venture capital

programs. These programs engaged a variety

of equity investors to improve access to equity

investments in innovative businesses.

7

SSBCI

venture capital programs helped support

$4.2 billion in new nancing.

7 Thirty-eight states funded venture capital programs.

As of December 31, 2016, 36 venture capital programs

had expended SSBCI dollars. In this report, those 36

programs will be referred to as active programs.

SSBCI: Summary of States’ 2016 Annual Reports

7

MOBILIZED CAPITAL

Featured Small Businesses

Servant’s Heart (North Carolina)

Servant’s Heart, a non-prot that provides

coordinated care for adults with mental and

developmental disabilities, received a loan to

buy a new building and expand its operations.

NewBridge Bank, a community bank, and The

North Carolina Rural Center, which operates

North Carolina’s Loan Participation Program,

came together to make the loan possible.

Southern Girl Desserts (California)

After turning to merchant cash advances to

nance the rapid expansion of Los Angeles-

based Southern Girl Desserts, the owners

faced monthly payments equal to 40 percent

of the company’s cash ow. They renanced

their high cost debt through California’s CAP

program with Opportunity Fund, a CDFI. The

renance cut their monthly payments by

ninety percent.

Earnest Products (Florida)

Earnest Products fabricates high-quality metal

used to manufacture custom parts. Fifth Third

Bank, a regional bank, nanced the company’s

recent expansion, including a $1.75 million

line of credit guaranteed by Florida’s SSBCI

program. The expansion created 25 new jobs

and the business anticipates creating 100 more

high-wage, skilled manufacturing jobs over the

next few years.

Moleculera Labs (Oklahoma)

The founders of Moleculera Labs developed a

test to help dierentiate autism from Pediatric

Acute-Onset Neuropsychiatric Syndrome (PANS).

Moleculera struggled to raise investment

to commercialize its test until i2E, a private

non-prot that administers Oklahoma’s

SSBCI program, invested over $1 million and

helped attract co-investment from local angel

investors. Moleculera now has 11 employees.

Initially, Moleculera’s client base was 12 clinicians,

but now nearly 850 order the test and over

5,000 patients have been tested and treated.

SSBCI: Summary of States’ 2016 Annual Reports

8

PROGRAM PERFORMANCE

SSBCI Program Performance

2016 marked the sixth year of SSBCI program activity. This section highlights measures of performance

assembled from the states’ 2016 Annual Reports.

8

Aggregate Performance

States designed SSBCI programs suited to their local communities and had the exibility to apply

funds to the types of programs that they deemed most successful. Figure 3 highlights performance by

program type.

Capital access programs (CAPs) provide a portfolio loan loss reserve for which the lender and

borrower contribute a share of the loan value (up to seven percent) that is matched on a dollar-for-

dollar basis with SSBCI funds. Losses may be recovered from the reserve until there is no additional

funding in the reserve. CAPs operate in 24 states, which allocated $40 million toward them. CAPs

expended 71 percent of their allocated amounts (includes administrative expenses) by making 13,965

small business loans.

Collateral support programs (CSPs) provide cash to lenders to boost the value of available collateral.

A collateral shortfall is a common issue in many areas where the economy has not fully recovered from

the Great Recession. CSPs operate in 17 states, which collectively allocated $269 million toward them.

States have expended 89 percent of the funds allocated to CSPs, totaling $238 million. The average

total nancing per small business loan in a CSP was $866,200.

Loan guarantee programs (LGPs) provide an assurance to lenders of partial repayment in the event

a loan goes into default. Guarantees typically support businesses that do not t standard lending

criteria. States allocated $246 million toward LGPs operating in 22 states, and have expended

$182 million of that amount, or 74 percent. State LGPs supported 2,779 loans averaging

$501,900 per loan.

8 The data throughout this report have not been veried or audited by Treasury.

Figure 3: Summary Data by Program Type

States with

Programs

Loans/

Investments

Total New Financing

($ millions)

Average New Financing

per Transaction

Leverage

Ratio

Jobs

Retained

Jobs

Created

Capital Access 24 13,965 $640 $45,849 22.54:1 65,073 14,553

Collateral Support 17 1,530 $1,325 $866,195 5.57:1 14,059 12,105

Loan Guarantee 22 2,779 $1,395 $501,891 7.66:1 44,447 16,793

Loan Participation 40 2,065 $3,157 $1,528,715 7.53:1 27,208 22,173

Venture Capital 38 1,623 $4,171 $2,569,664 12.76:1 10,689 13,569

SSBCI: Summary of States’ 2016 Annual Reports

9

PROGRAM PERFORMANCE

Loan participation programs (LPPs) purchase a portion of a loan that a lender makes or make a

direct loan from the state in conjunction with a private loan (companion loan). The state typically is

subordinate to the lender’s loan. LPPs operate in 40 states, which allocated $474 million—the largest

allocation of SSBCI funds for any program type—toward them. States have expended $419 million of

the allocation.

Venture capital programs (VCPs) provide nancing by purchasing an ownership interest or providing

equity-like loans to enterprises that typically do not participate in debt nancing markets due to

their business stage and structure. Forty states allocated $431 million toward VCPs, and expended 76

percent, or $327 million. VCPs supported $4.2 billion in new nancing, the most of any program type,

and achieved a leverage ratio of 12.76 to 1.

See Appendix E for additional details on performance by program type.

SSBCI: Summary of States’ 2016 Annual Reports

10

PROGRAM PERFORMANCE

New Financing Leveraged

Through 2016, $8.95 in new nancing resulted from every $1 of SSBCI funding (8.95:1 leverage ratio).

9

Figure 4 summarizes the ratio of new financing supported to dollars of SSBCI expended from

2011 to 2016.

CAPs and VCPs achieved signicantly higher leverage than LGPs, LPPs, and CSPs. CAPs achieve higher

leverage (22.54) by virtue of the program’s design in which the state’s contribution is limited to

two-to-seven percent of each loan and averaged four percent. VCPs achieved higher leverage

(12.76) in large part because initial rounds of nancing set the stage for future rounds.

SSBCI funds will continue to spur more new nancing as loans or investments are repaid and states

recycle SSBCI funds into new small businesses, even after the SSBCI program sunsets. Through 2016,

states recycled $280 million. Over half of all states reported recycling funds.

9 New nancing leverage calculations include SSBCI funds expended for administrative expenses and exclude

non-private sources.

Figure 4: New Financing Leveraged

Total New Financing Leveraged Including

Subsquent Private Financing ($ millions)

SSBCI Funds Expended ($ millions)

0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

0 $30 $80 $130 $180 $230 $280 $330 $380 $430

Loan Guarantee

Collateral Support

Loan Participation

Venture Capital

Capital Access

22.54

7.66

5.57

12.76

7.53

Figure 5: Leverage Ratios by Program Type

Program Type

SSBCI Funds Expended*

($ millions)

Total New Financing Leveraged including

Subsequent Private Financing**

($ millions)

Total Subsequent

Private Financing

($ millions) Leverage Ratio

Capital Access $28 $640 $0 22.54:1

Collateral Support $238 $1,325 $0 5.57:1

Loan Guarantee $182 $1,395 $0 7.66:1

Loan Participation $419 $3,157 $270 7.53:1

Venture Capital $327 $4,171 $2,035 12.76:1

Total $1,195 $10,688 $2,305 8.95:1

* Includes SSBCI funds expended for program administration

** Includes nancing leveraged with recycled SSBCI funds

SSBCI: Summary of States’ 2016 Annual Reports

11

PROGRAM PERFORMANCE

Size and Purpose of SSBCI-Supported Loans and Investments

Across all programs, the average loan or investment supported by SSBCI was $381,686 at closing

with an average of $62,121 in SSBCI support.

10

The average transaction size and the amount of SSBCI

support per loan or investment varied by program type. The average amount of a CAP loan was the

smallest, at approximately $46,000, with $1,752 of SSBCI support, whereas the average transaction size

of an LPP loan was $1,398,011, with 17.2 percent of SSBCI support, or $240,406.

In 2016 Treasury collected additional data elds through an optional transaction-level data collection.

Forty-one of 57 states reported transaction level data on the primary use of funds. Figure 7 shows that

half of all loans and investments for which optional data was reported were primarily used for wages,

working capital, and professional services.

10 The average level of SSBCI support for each loan or investment does not correlate directly with leverage ratios which

include activity generated by recycling SSBCI funds and subsequent private nancing for certain programs.

Figure 6: Average Transaction Size and Average Level of Support

$ in Thousands

Average Level of Support Average Transaction Size

$0

$800

$600

$400

$200

$1,000

$1,200

$1,400

$1,600

3.8%

CAP

20.8%

Collateral Support

17.6%

Loan Guarantee

17.2%

Loan Participation

15.1%

Venture Capital

Figure 7: Primary Use of Funds

Fund Construction Costs

Purchase Equipment

Purchase Real Estate

Refinance

Wages, Working Capital

& Professional Services

3%

3%

5%

50% 39%

SSBCI: Summary of States’ 2016 Annual Reports

12

PROGRAM PERFORMANCE

SSBCI-Supported Loans and Investments by Amount

Loans and investments of less than $100,000 made up only ve percent of the total dollar amount

of SSBCI-supported loans and investments through 2016, but they accounted for the bulk of all

transaction volume. Over two-thirds (69 percent) of SSBCI-supported loans or investments were less

than $100,000. Total nancings of greater than half a million dollars represented 81 percent of the total

dollar amount but just 14 percent of the total transaction volume.

Figure 8: SSBCI-Supported Loans or Investments

# of Loans/Investments

New Financing ($ millions)

# of Transactions New Financing

0 2,000 4,000 6,000 8,000

0 4,000 8,000 12,000 16,0002,000 6,000 10,000 14,000

>

$10 million

$500,000–$10 million

$100,000–$500,000

<

$100,000

51

$ 950

2,994

$ 7,608

3,742

15,175

$ 1,499

$ 631

SSBCI: Summary of States’ 2016 Annual Reports

13

PROGRAM PERFORMANCE

Jobs Created and Retained

Business owners projected that SSBCI-supported loans and investments would lead to the creation

and retention of 240,669 jobs—79,193 jobs created and 161,476 jobs retained. Business owners

estimated the number of full-time jobs that will be created within two years and that will be retained

that were at risk of loss.

11

11 Jobs Created include the number of new Full-Time Equivalent (FTE) jobs expected to be created as a direct result of the

loan; according to the business owner, these jobs will materialize within two years from the date of the loan closing. Jobs

Retained is the number of FTE jobs retained as a direct result of the loan that were at risk of loss. These numbers may

duplicate job estimates for any loans reported under federal programs such as the SBA CDC/504 Loan Program. Treasury

did not verify or audit these estimates.

Figure 9: Jobs Created and Retained by Program Type

Jobs Retained Jobs Created

0

20,000

40,000

60,000

80,000

CAP Collateral Support Loan Guarantee Loan Participation Venture Capital

79,626

26,164

61,240

49,381

24,258

SSBCI: Summary of States’ 2016 Annual Reports

14

PROGRAM PERFORMANCE

Loans or Investments Made in Low- and Moderate-Income (LMI) Communities

The LMI designation is one proxy for the various “underserved” populations targeted by states.

Treasury collected data on business location to analyze the percentage of states that used SSBCI

to reach underserved communities. More than four out of every ten SSBCI-supported loans or

investments were made to businesses in LMI communities.

12

12 Calculated from total number of loans or investments made in low- and moderate-income census tracts. The “Low and

Moderate Income” categorizations are derived from income data from the Census Bureau. The SSBCI Annual Report

transaction statistics are linked to 2010 data from the Census Bureau’s 5-year American Community Survey which is the

successor to the decennial census for census tract level data for income and poverty data. “Low income” households earn

less than 50 percent of area median income. “Moderate income” households earn between 50 percent and 80 percent of

area median income.

Figure 10: Percent of SSBCI-Supported Loans or Investments (by Number)

in LMI Communities by Program Type

0% 10% 20% 30% 40% 50%

Cumulative

All Other

CAP

42.9%

34.3%

48%

SSBCI: Summary of States’ 2016 Annual Reports

15

PROGRAM PERFORMANCE

Small Business Characteristics

This section highlights the variety of small businesses supported based on size (number of full-

time employees (FTEs) and revenue), age, and, in the case of venture capital, investment stage. The

percentages are based on the volume of loans and investments, not dollar amount. SSBCI funds

tended to support very small businesses. Over 80 percent of the loans and investments were made to

businesses with 10 or fewer full-time employees. Two-thirds of SSBCI-supported loans and investments

were made to businesses with revenue between $0 and $500,000. Additionally, over half of all SSBCI-

supported loans and investments were made to businesses less than ve years old.

VCPs had the option to report the stage at which SSBCI-supported investment was made in each

business during Treasury’s 2016 optional transaction-level data collection. Twenty-three states with

VCPs reported this information. Figure 14 shows that for the 967 investments reported, 85 percent

were made in businesses at the pre-seed, seed, and early stage.

Figure 11: Size of

Business, by FTEs

Figure 12: Size of

Business, by Revenue

Figure 13: Age of

Business, in Years

0–1 FTEs

2–10 FTEs

10+ FTEs

20%

32%

48%

<$100k

$100k–$500k

$500k–$1m

$1m–$5m

>$5m

15%

7%

39%

29%

10%

0–1 Years

2–5 Years

6–10 Years

>10 Years

24%

23%

30%

21%

Figure 14: Stage of Venture Capital Investments

Seed

Early Stage

Mezzanine

Growth

Pre-Seed

27%

4%

45%

11%

13%

SSBCI: Summary of States’ 2016 Annual Reports

16

PROGRAM PERFORMANCE

Based on the optional data provided by 43 states, at least 41 percent of all SSBCI-supported loans and

investments made were to a woman or minority-owned small business. The top three states which

reported the optional data represented 83 percent of the reported woman and minority-owned small

business loans and investments.

Figure 15: Loans and Investments to Woman or Minority-Owned Small Businesses

State Number of Transactions Percentage of State’s Transactions

California 6,360 61.8

New York 862 48.9

North Carolina 342 44.5

SSBCI: Summary of States’ 2016 Annual Reports

17

PROGRAM PERFORMANCE

Loans and Investments by Industry

SSBCI funds supported businesses in every major industry sector. Manufacturing, Professional,

Scientic & Technical Services, and Information (which includes a diverse collection of other industries)

accounted for large shares of SSBCI-supported loans or investments by total dollar amount, with

Manufacturing alone generating $2.5 billion of new nancing. The sector with the highest number of

transactions was Retail Trade followed by Accommodation and Food Services.

Figure 16: Industries by NAICS Sector

$145

$147

$163

$174

$188

$208

$263

$270

$327

$391

$585

$604

$864

$937

$1,080

$1,794

$2,548

319

320

453

1,014

41

381

1,943

1,789

494

1,586

1,230

1,172

3,646

2,602

681

1,771

2,520

0

# of Loans/Investments

2,000 4,000 6,000 8,000 10,000

Other Sectors

Educational Services

Agriculture, Forestry, Fishing and Hunting

Administrative and Support and Waste

Management and Remediation Services

Mining, Quarrying, and Oil and Gas Extraction

Arts, Entertainment, and Recreation

Transportation and Warehousing

Other Services (except Public Administration)

Real Estate and Rental and Leasing

Health Care and Social Assistance

Construction

Wholesale Trade

Retail Trade

Accommodation and Food Services

Information

Professional, Scientific

and Technical Services

Manufacturing

0 500 1,000 1,500 2,000 2,500 3,000

New Financing ($ millions)

# of Transactions New Financing

SSBCI: Summary of States’ 2016 Annual Reports

18

PROGRAM PERFORMANCE

Lender and Investor Characteristics

Most SSBCI-supported loans were made by lending institutions with less than $10 billion in assets.

Lenders with less than $10 billion in assets, including CDFIs, accounted for 95 percent of all SSBCI-

supported loans by volume and 86 percent of all SSBCI-supported loans by dollar amount. Community

banks alone accounted for 63 percent of all SSBCI-supported loans by dollar amount.

CDFI Participation in SSBCI Programs

CDFIs made nearly 11,000 loans or investments supported by SSBCI funds, totaling $835 million in new

nancing through 2016. CDFIs accounted for 93 percent of the total number of SSBCI-supported loans

and investments and 8 percent of the total dollar amount nanced.

Georgia and California loaned or invested the largest dollar amounts through CDFIs, followed by

Washington, Pennsylvania, and Mississippi.

CDFIs accounted for just over 86 percent of the total number of SSBCI-supported loans and

investments in Minnesota, followed by New York (86%), California (78%), Pennsylvania (60%), and

Washington (59%).

Figure 17: Lender Participation, by Size of Lender

> $10b

$1.2b–$10b < $1.2b

# of Transactions New Financing

0%

20%

40%

60%

80%

100%

82.6% 62.5%

12.3%

23.7%

5.1%

13.8%

Figure 18: CDFI v. Non-CDFI Summary

# of Transactions*

SSBCI Expended

($ millions)

New Financing

($ millions) Leverage** Jobs Supported

CDFI 10,923 $96.18 $835 8.69 x 56,658

Non-CDFI 9,416 $744.00 $5,682 7.64 x 159,752

Total 20,339 $840.18 $6,517 7.76 x 216,410

* The number of transactions does not include venture capital transactions.

** The leverage ratio does not include administrative expenses.

SSBCI: Summary of States’ 2016 Annual Reports

19

PROGRAM PERFORMANCE

Venture Capital Investor Characteristics

State VCPs spurred private investment in small businesses through a variety of organizations and

structures. This section presents the types of organizations that managed SSBCI dollars and the types

of private investors that co-invested with them. The organizations that managed SSBCI VCPs fall into

four general categories: funds, state-sponsored entities, co-investment funds, and state agencies.

• Funds—SSBCI dollars are obligated to private venture capital funds to be invested alongside private

capital in eligible deals

• State-Sponsored Entities—Quasi- or non-governmental entities are contracted by the state and

serve as intermediaries that manage investments

• Co-Investment Models—States set dened criteria for eligible investments and automatically

match eligible private investments on a formulaic basis

• State Agencies—Sta at the state agency source deals, conduct due diligence, and manage

investments directly, often with an external investment committee

All SSBCI programs required a minimum of 20 percent matching private capital at risk in all

transactions, and states targeted an overall private leverage ratio of 10 to 1. Within VCPs, the structural

categories attracted various sources of private capital. Overall, angel investors and in-state venture

funds were the most active co-investors in SSBCI venture capital transactions.

13 Primary source of co-investment was an optional data eld. In total, 21 of the 36 states with active VCPs reported data on

the primary source of co-investment, representing a total of 898 transactions, or over 55 percent of the total 1,623 SSBCI

VCP transactions.

Figure 19: Venture Capital Program Allocations by Category

VCP Category SSBCI Allocation ($ millions)

State Sponsored Entities (36%)

Co-Investment Models (11%)

State Agencies (6%)

Funds (46%)

Funds $197.8

State Supported Entities $156.7

Co-Investment Models $49.0

State Agencies $27.6

Total $431.1

Figure 20: Most Active Primary Co-Investor Type per Venture Capital Program

Category, by number of transactions

13

Venture Capital Program Category Most Active Primary Co-Investor Type

Funds Angel Investors

State-Sponsored Entities (SSE) Angel Investors

Co-Investment Models In-State Venture Capital Fund

State Agencies In-State Venture Capital Fund

SSBCI: Summary of States’ 2016 Annual Reports

20

PROGRAM PERFORMANCE

According to the National Venture Capital Association’s 2017 Yearbook, California, Massachusetts, and

New York account for 75 percent of U.S. venture capital dollars invested and 52 percent of total deals

in the U.S. The top ve states by the number of SSBCI VCP investments were Arkansas, Hawaii, Indiana,

Missouri, and New York. Together these ve states were responsible for 610 investments representing

over one third of the total 1,623 SSBCI-supported venture capital investments in small businesses.

Figure 21: SSBCI-Supported Venture Capital Investments Across the United States

* The Municipality of Anchorage, Hawaii, and Puerto Rico also expended SSBCI funds in VCPs, totaling $1.3 million, $5.2 million, and $1 million, respectively.

SSBCI: Summary of States’ 2016 Annual Reports

21

PROGRAM PERFORMANCE

Performance by State

This section breaks down performance by state. The charts show the total nancing supported by

SSBCI funds by state and each state’s leverage ratio.

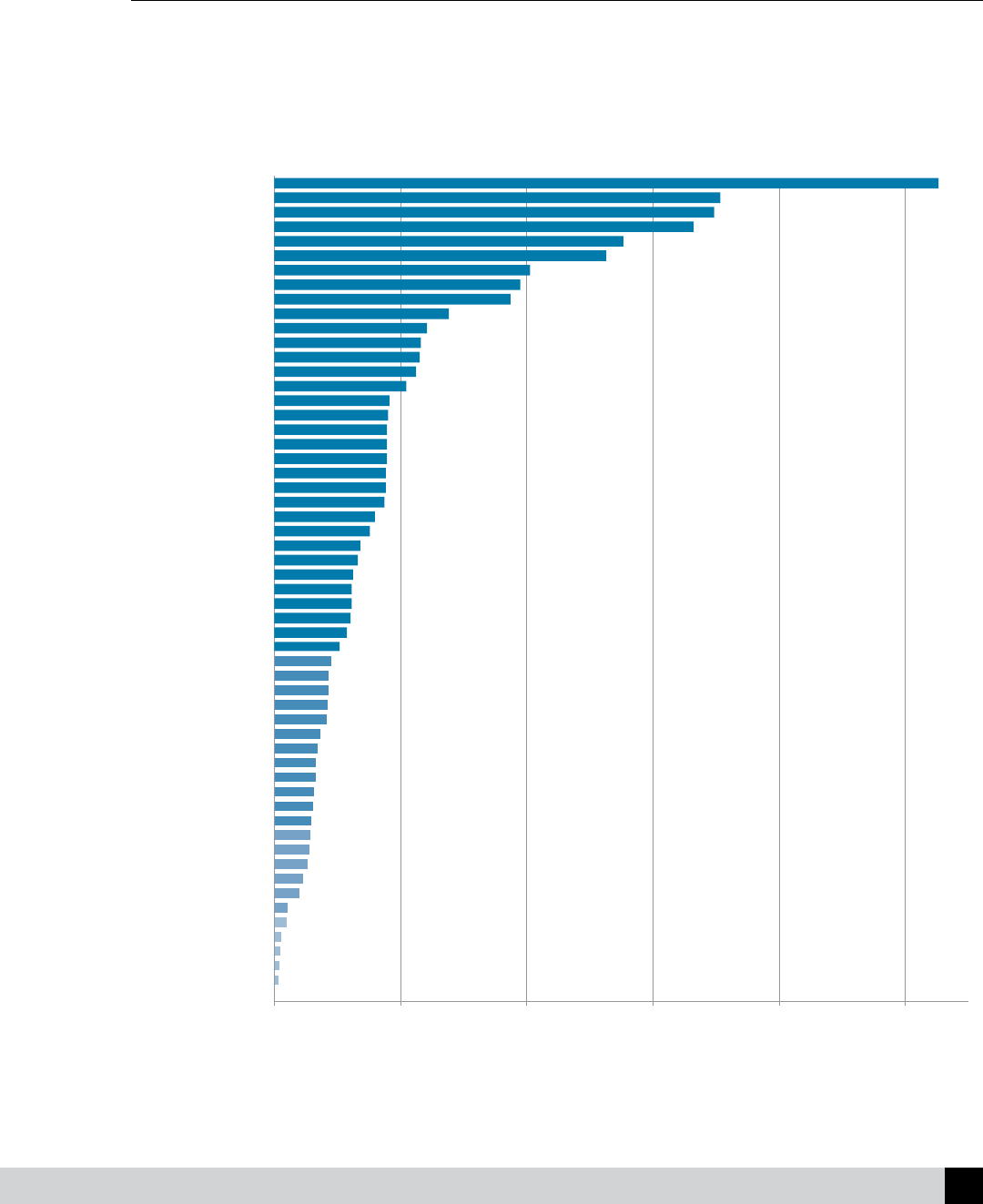

Figure 22: Amount of Financing (in millions) Supported by SSBCI by State

American Samoa

Alaska—Anchorage

North Dakota—Carrington

Northern Mariana Islands

Guam

U.S. Virgin Islands

District of Columbia

Nevada

Iowa

New Mexico

Louisiana

Maine

Wyoming—Laramie

Utah

Delaware

Puerto Rico

South Dakota

Indiana

Connecticut

Arizona

North Dakota—Mandan

Mississippi

Oklahoma

Nebraska

West Virginia

Virginia

Montana

Rhode Island

Kentucky

New Jersey

Massachusetts

Colorado

Wisconsin

Tennessee

Minnesota

South Carolina

New Hampshire

Vermont

Ohio

Washington

Oregon

Hawaii

Idaho

Arkansas

Alabama

Kansas

Pennsylvania

Georgia

Missouri

Florida

Maryland

Michigan

Texas

Illinois

New York

California

North Carolina

$0

$7

$8

$9

$10

$19

$20

$39

$46

$52

$56

$57

$59

$62

$63

$65

$66

$68

$73

$83

$84

$85

$86

$91

$103

$115

$121

$121

$122

$124

$133

$135

$152

$160

$175

$175

$177

$177

$178

$179

$179

$182

$208

$224

$231

$232

$241

$276

$374

$389

$405

$525

$553

$664

$697

$707

$1,052

0 200 400 600 800 1000

New Financing ($ millions)

SSBCI: Summary of States’ 2016 Annual Reports

22

PROGRAM PERFORMANCE

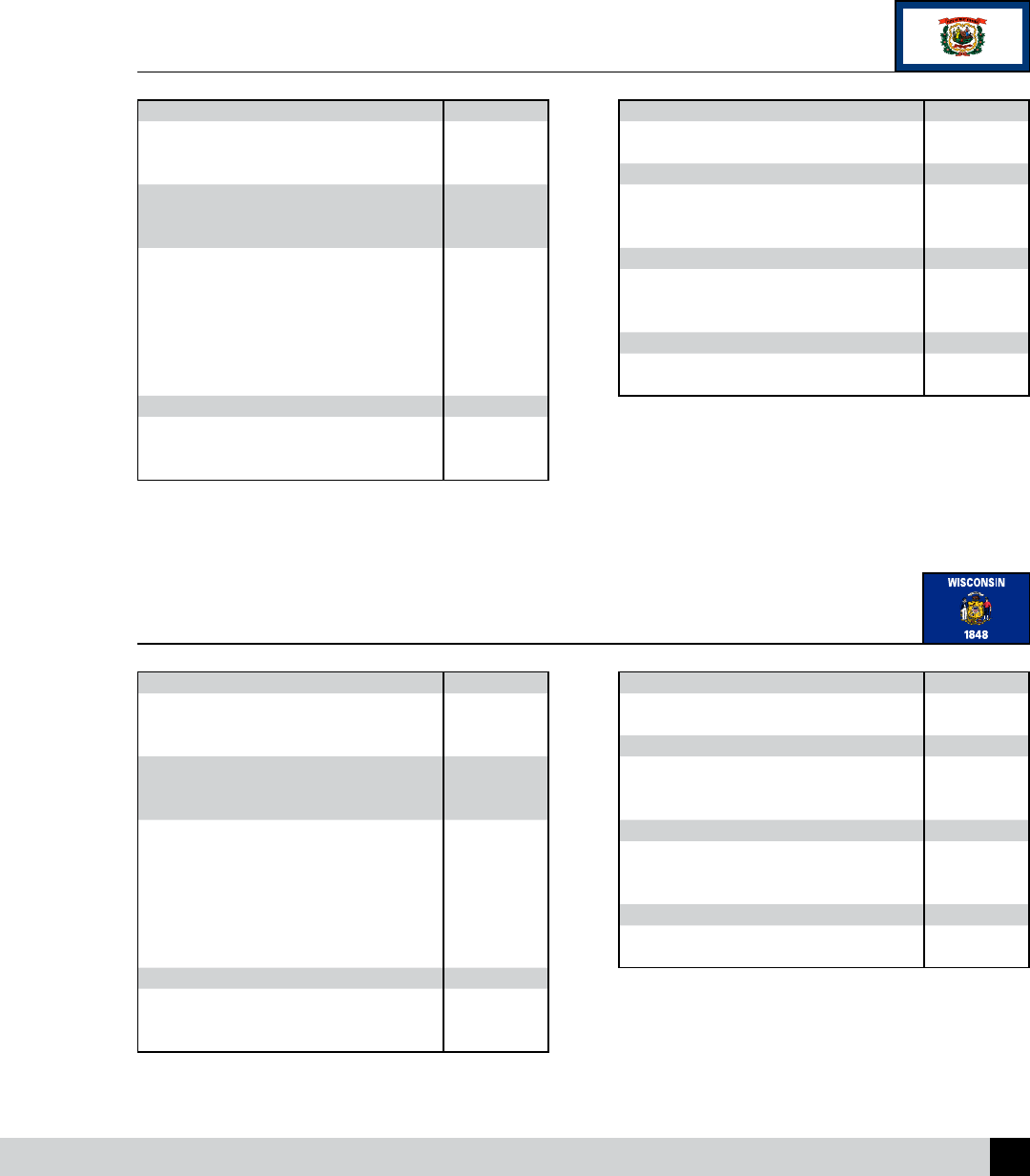

Figure 23: Leverage Ratios for Each State

Ohio

Utah

American Samoa

Guam

Northern Mariana Islands

District of Columbia

North Dakota

U.S. Virgin Islands

Indiana

Puerto Rico

Nevada

Arizona

Wyoming—Laramie

New Jersey

Alaska—Anchorage

Florida

Iowa

Tennessee

Connecticut

Louisiana

New Mexico

Massachusetts

Georgia

Virginia

Delaware

Maine

Michigan

Oklahoma

Mississippi

Nebraska

California

Colorado

Alabama

South Dakota

West Virginia

Kentucky

North Dakota—Mandan

South Carolina

Montana

Illinois

Washington

Oregon

Wisconsin

Pennsylvania

Vermont

Texas

New Hamphire

Rhode Island

Minnesota

North Carolina

Missouri

Idaho

New York

Arkansas

Kansas

Hawaii

Maryland

0.00 x

1.89 x

2.10 x

2.31 x

2.77 x

2.78 x

3.47 x

4.12 x

4.44 x

4.52 x

4.69 x

4.78 x

4.89 x

5.16 x

5.29 x

5.57 x

5.57 x

6.17 x

6.46 x

6.61 x

6.62 x

6.67 x

6.77 x

6.83 x

7.11 x

7.19 x

7.20 x

7.24 x

7.46 x

7.58 x

7.76 x

8.05 x

8.11x

8.22 x

8.35 x

8.37 x

8.85 x

9.70 x

9.83 x

9.84 x

10.52 x

11.14 x

11.53 x

13.17 x

13.63 x

13.84 x

14.04 x

15.22 x

15.30 x

15.95 x

16.34 x

16.45 x

16.88 x

17.93 x

18.64 x

29.36 x

34.72 x

0.00 x 5.00 x 10.00 x 15.00 x 20.00 x 25.00 x 30.00 x 35.00 x

Leverage Ratio

SSBCI: Summary of States’ 2016 Annual Reports

23

PROGRAM PERFORMANCE

Measuring Losses and Economic Development

This report does not present the aggregate nancial performance of state programs due to data

constraints. Nevertheless, data from states’ nal narratives, as well as the optional data reported by

some states provides a starting point for further inquiry.

States were required to submit a nal narrative at the end of the program, providing written response

to program evaluation questions. Among those questions, states were required to report data on

losses in excess of 50 percent of the original loan or investment amount. Where possible, this data was

supplemented by loss data collected through the optional data collection.

14

In total, states reported $16.4 million in losses or 1.2 percent of total SSBCI dollars expended in lending

programs. It is important to note that these gures represent a point in time and that programs will

continue to generate income and experience losses after SSBCI sunsets.

It is also important to note that in CAPs, states use SSBCI dollars to contribute a small percentage of a

loan—typically 2–5 percent on any one transaction—to a loan loss reserve, which is available to cover

up to 100 percent of any loans in the portfolio. This structure gives lenders an incentive to conduct

an increased quantity of loans to build up the reserve, while also ensuring the state’s liability is never

more than the xed 2–5 percent of total lending the program enables. However, this structure also

means SSBCI dollars lost as a percentage of SSBCI dollars expended tends to be high in CAPs despite

the relatively low percentage of transactions recording losses.

Venture capital funds assess nancial performance in terms of the net returns on investment over the life of

the fund. Because funds have a 10–15 year lifecycle, this report cannot present the nancial performance

of VCPs. However, states with VCPs did report data on losses through the nal narrative and optional data

collection.

15

This data is more complex due to variance in states management and reporting of losses in

14 In total, 32 states with lending programs reported on SSBCI dollars lost, of which 20 states reported having transactions

with losses. Those 32 states represented 15,707 transactions, or approximately 77 percent of all SSBCI lending transactions.

In dierence to the Final Narrative, optional data collected on SSBCI losses was inclusive of all losses, including losses less

than 50 percent of the original loan or investment amount.

15 In total, 20 states with VCPs reported on SSBCI dollars lost, of which 18 states reported having transactions with losses.

Those states represented 825 transactions, or approximately 51 percent of all SSBCI venture capital transactions. In

dierence to the Final Narrative, optional data collected on SSBCI losses was inclusive of all losses, including losses less

than 50 percent of the original loan or investment amount.

Figure 24: Loss Percentages by Loan Program Type

Program Type

SSBCI Losses

SSBCI Program Activity

(Including Recycled Dollars) Losses as Percent of Activity

Amount

($ millions)

Number of

Transactions

Amount

($ millions)

Number of

Transactions

Dollar Amount

(%)

Number of

Transactions (%)

CAP $2.5 388 $24.5 13,965 10.4 2.8

Collateral Support $2.8 23 $275.2 1,530 1.0 1.5

Loan Guarantee $5.4 44 $245.4 2,779 2.2 1.6

Loan Participation $5.7 41 $496.4 2,065 1.1 2.0

Total $16.4 496 $1,364.3 20,339 1.2 2.4

SSBCI: Summary of States’ 2016 Annual Reports

24

PROGRAM PERFORMANCE

VCPs. However, many of these states also reported on whether or not their portfolio companies were still in

operation as of December 31, 2016.

16

In total, these states reported that 157 transactions, or approximately

9.7 percent of total SSBCI venture capital transactions, were in companies that had ceased operation as of

the end of 2016. Ultimately, given that the participating funds are in the rst to sixth year of the lifecycle,

these data are not conclusive. Funds generate most of their returns from a minority of investments and a

valid measure of performance—net gain or loss—can only take place at the end of a fund’s life cycle.

In addition to nancial performance, state programs assess performance based on economic

development impacts such as jobs created and increased tax revenues. The data currently available

is not sucient to conrm job and revenue growth over time. However, SSBCI has matched rm

identiers reported through the optional data collection with the U.S. Census Bureau’s Longitudinal

Business Database, which utilizes IRS tax lings to track rm performance, such as jobs and revenues,

over time. The matched dataset is available to eligible researchers

17

through the Census Bureau’s

Federal Statistical Research Data Centers.

16 In total, 24 states with VCPs reported on active operations status. Those 24 states that reported active operation status

represented 1,067 transactions, or approximately 65.7 percent of all SSBCI venture capital transactions.

17 Researchers interested in gaining access to the matched dataset of SSBCI transactions and IRS tax lings providing

measurement of rm performance over time must obtain Special Sworn Status from the U.S. Census Bureau, passing a

background check and signing sworn agreements to protect condentiality for life, facing legal and nancial penalties

under Title 13 and Title 26 for failure to do so. Approved researchers must further submit a project proposal demonstrating

the need and use for the data to the U.S. Census Bureau for approval. All data is condential and cannot be accessed

outside of the Federal Statistical Research Data Centers.

SSBCI: Summary of States’ 2016 Annual Reports

25

APPENDIX A

Appendix A: State-by-State Results

Alabama

Allocation Amount: $31,443,076

Number of Loans/Investments 582

SSBCI Original Allocated Funds Expended $29,241,658

SSBCI Recycled Funds Expended $46,584,781

Total New Financing to Small Businesses $230,994,466

Leverage Ratio 7.90x

Transaction Size and Demographics

Median Principal Loan/Investment Size $150,000

Minimum Principal Loan/Investment Size $3,000

Maximum Principal Loan/Investment Size $5,000,000

LMI Census Tracts (by Number of Transactions) 33.8%

LMI Census Tracts (by Dollar Amount) 33.8%

Non-Metro Areas (by Number of Transactions) 43.1%

Non-Metro Areas (by Dollar Amount) 30.9%

Business Age and Size

Median Business Age at Loan/Investment 3

Median Business Size (FTEs) 3

Median Business Size (Annual Revenue) $254,156

Total Number of Jobs Created or Retained 6,533

Jobs Created 2,404

Jobs Retained 4,129

Top 3 Industries by Number of Transactions

Retail Trade 92

Manufacturing 69

Health Care and Social Assistance 57

Top 3 Industries by Dollar Amount

Retail Trade $36,200,264

Manufacturing $28,294,615

Health Care and Social Assistance $23,345,842

Lender Participation

Small Lenders* (by Number of Transactions) 86.3%

Small Lenders (by Dollar Amount) 68.6%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Arizona

Allocation Amount: $18,286,556

Number of Loans/Investments 61

SSBCI Original Allocated Funds Expended $18,286,556

SSBCI Recycled Funds Expended $2,201,144

Total New Financing to Small Businesses $82,710,192

Leverage Ratio 4.52x

Transaction Size and Demographics

Median Principal Loan/Investment Size $721,000

Minimum Principal Loan/Investment Size $61,709

Maximum Principal Loan/Investment Size $9,319,367

LMI Census Tracts (by Number of Transactions) 50.8%

LMI Census Tracts (by Dollar Amount) 37.9%

Non-Metro Areas (by Number of Transactions) 1.6%

Non-Metro Areas (by Dollar Amount) 9.0%

Business Age and Size

Median Business Age at Loan/Investment 5

Median Business Size (FTEs) 15

Median Business Size (Annual Revenue) $1,283,335

Total Number of Jobs Created or Retained 3,924

Jobs Created 2,445

Jobs Retained 1,479

Top 3 Industries by Number of Transactions

Manufacturing 16

Professional, Scientic, and Technical Services 8

Construction 8

Health Care and Social Assistance 8

Top 3 Industries by Dollar Amount

Manufacturing $20,939,839

Health Care and Social Assistance $13,078,476

Construction $8,554,046

Lender Participation

Small Lenders* (by Number of Transactions) 68.9%

Small Lenders (by Dollar Amount) 75.1%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

26

APPENDIX A

Arkansas

Allocation Amount: $13,227,911

Number of Loans/Investments 284

SSBCI Original Allocated Funds Expended $12,885,729

SSBCI Recycled Funds Expended $2,191,101

Total New Financing to Small Businesses $223,822,458

Leverage Ratio 17.37x

Transaction Size and Demographics

Median Principal Loan/Investment Size $30,000

Minimum Principal Loan/Investment Size $1,000

Maximum Principal Loan/Investment Size $12,490,000

LMI Census Tracts (by Number of Transactions) 43.0%

LMI Census Tracts (by Dollar Amount) 64.4%

Non-Metro Areas (by Number of Transactions) 12.7%

Non-Metro Areas (by Dollar Amount) 15.2%

Business Age and Size

Median Business Age at Loan/Investment 1

Median Business Size (FTEs) 2

Median Business Size (Annual Revenue) $25,000

Total Number of Jobs Created or Retained 1,776

Jobs Created 1,409

Jobs Retained 367

Top 3 Industries by Number of Transactions

Professional, Scientic, and Technical Services 83

Manufacturing 50

Retail Trade 46

Top 3 Industries by Dollar Amount

Retail Trade $99,417,101

Manufacturing $75,979,360

Professional, Scientic, and Technical Services $28,148,201

Lender Participation

Small Lenders* (by Number of Transactions) 47.9%

Small Lenders (by Dollar Amount) 30.7%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

California

Allocation Amount: $168,399,074

Number of Loans/Investments 10,286

SSBCI Original Allocated Funds Expended $139,805,884

SSBCI Recycled Funds Expended $10,810,456

Total New Financing to Small Businesses $1,051,906,582

Leverage Ratio 7.52x

Transaction Size and Demographics

Median Principal Loan/Investment Size $12,000

Minimum Principal Loan/Investment Size $500

Maximum Principal Loan/Investment Size $10,000,000

LMI Census Tracts (by Number of Transactions) 50.3%

LMI Census Tracts (by Dollar Amount) 39.8%

Non-Metro Areas (by Number of Transactions) 0.9%

Non-Metro Areas (by Dollar Amount) 0.8%

Business Age and Size

Median Business Age at Loan/Investment 5

Median Business Size (FTEs) 2

Median Business Size (Annual Revenue) $144,000

Total Number of Jobs Created or Retained 92,533

Jobs Created 14,233

Jobs Retained 78,300

Top 3 Industries by Number of Transactions

Retail Trade 2,262

Accommodation and Food Services 1,465

Transportation and Warehousing 1,299

Top 3 Industries by Dollar Amount

Accommodation and Food Services $135,432,512

Manufacturing $133,870,804

Retail Trade $120,891,706

Lender Participation

Small Lenders* (by Number of Transactions) 93.2%

Small Lenders (by Dollar Amount) 64.6%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

27

APPENDIX A

Colorado

Allocation Amount: $17,311,437

Number of Loans/Investments 219

SSBCI Original Allocated Funds Expended $17,234,247

SSBCI Recycled Funds Expended $3,858,552

Total New Financing to Small Businesses $135,061,244

Leverage Ratio 7.84x

Transaction Size and Demographics

Median Principal Loan/Investment Size $170,000

Minimum Principal Loan/Investment Size $2,500

Maximum Principal Loan/Investment Size $11,300,000

LMI Census Tracts (by Number of Transactions) 43.8%

LMI Census Tracts (by Dollar Amount) 37.5%

Non-Metro Areas (by Number of Transactions) 41.6%

Non-Metro Areas (by Dollar Amount) 19.1%

Business Age and Size

Median Business Age at Loan/Investment 4

Median Business Size (FTEs) 2

Median Business Size (Annual Revenue) $240,386

Total Number of Jobs Created or Retained 1,471

Jobs Created 989

Jobs Retained 482

Top 3 Industries by Number of Transactions

Accommodation and Food Services 41

Health Care and Social Assistance 31

Retail Trade 26

Top 3 Industries by Dollar Amount

Health Care and Social Assistance $31,019,500

Arts, Entertainment, and Recreation $15,869,232

Manufacturing $14,979,348

Lender Participation

Small Lenders* (by Number of Transactions) 78.5%

Small Lenders (by Dollar Amount) 47.4%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Connecticut

Allocation Amount: $13,361,288

Number of Loans/Investments 19

SSBCI Original Allocated Funds Expended $11,801,125

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $72,775,738

Leverage Ratio 6.17x

Transaction Size and Demographics

Median Principal Loan/Investment Size $1,775,850

Minimum Principal Loan/Investment Size $250,009

Maximum Principal Loan/Investment Size $10,000,000

LMI Census Tracts (by Number of Transactions) 36.8%

LMI Census Tracts (by Dollar Amount) 23.7%

Non-Metro Areas (by Number of Transactions) 0.0%

Non-Metro Areas (by Dollar Amount) 0.0%

Business Age and Size

Median Business Age at Loan/Investment 5

Median Business Size (FTEs) 5

Median Business Size (Annual Revenue) $0

Total Number of Jobs Created or Retained 271

Jobs Created 96

Jobs Retained 175

Top 3 Industries by Number of Transactions

Manufacturing 6

Professional, Scientic, and Technical Services 4

Wholesale Trade 3

Information 3

Top 3 Industries by Dollar Amount

Wholesale Trade $25,416,800

Manufacturing $15,120,250

Information $11,754,314

Lender Participation

Small Lenders* (by Number of Transactions) 0.0%

Small Lenders (by Dollar Amount) 0.0%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

28

APPENDIX A

Delaware

Allocation Amount: $13,227,911

Number of Loans/Investments 127

SSBCI Original Allocated Funds Expended $9,234,130

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $63,023,122

Leverage Ratio 6.83x

Transaction Size and Demographics

Median Principal Loan/Investment Size $61,900

Minimum Principal Loan/Investment Size $7,000

Maximum Principal Loan/Investment Size $20,000,000

LMI Census Tracts (by Number of Transactions) 28.3%

LMI Census Tracts (by Dollar Amount) 24.7%

Non-Metro Areas (by Number of Transactions) 29.1%

Non-Metro Areas (by Dollar Amount) 59.3%

Business Age and Size

Median Business Age at Loan/Investment 3

Median Business Size (FTEs) 3

Median Business Size (Annual Revenue) $176,418

Total Number of Jobs Created or Retained 1,606

Jobs Created 569

Jobs Retained 1,037

Top 3 Industries by Number of Transactions

Accommodation and Food Services 24

Retail Trade 18

Health Care and Social Assistance 13

Top 3 Industries by Dollar Amount

Accommodation and Food Services $27,608,843

Manufacturing $6,055,225

Finance and Insurance $5,652,650

Lender Participation

Small Lenders* (by Number of Transactions) 53.5%

Small Lenders (by Dollar Amount) 22.1%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

District of Columbia

Allocation Amount: $13,227,911

Number of Loans/Investments 33

SSBCI Original Allocated Funds Expended $8,910,279

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $20,268,500

Leverage Ratio 2.27x

Transaction Size and Demographics

Median Principal Loan/Investment Size $500,000

Minimum Principal Loan/Investment Size $25,000

Maximum Principal Loan/Investment Size $2,500,000

LMI Census Tracts (by Number of Transactions) 45.5%

LMI Census Tracts (by Dollar Amount) 58.3%

Non-Metro Areas (by Number of Transactions) 0.0%

Non-Metro Areas (by Dollar Amount) 0.0%

Business Age and Size

Median Business Age at Loan/Investment 7

Median Business Size (FTEs) 9

Median Business Size (Annual Revenue) $2,169,234

Total Number of Jobs Created or Retained 791

Jobs Created 165

Jobs Retained 626

Top 3 Industries by Number of Transactions

Construction 8

Accommodation and Food Services 6

Other Services (except Public Administration) 4

Manufacturing 4

Top 3 Industries by Dollar Amount

Construction $8,456,500

Utilities $3,100,000

Other Services (except Public Administration) $2,790,000

Lender Participation

Small Lenders* (by Number of Transactions) 84.8%

Small Lenders (by Dollar Amount) 86.5%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

29

APPENDIX A

Florida

Allocation Amount: $98,104,081

Number of Loans/Investments 278

SSBCI Original Allocated Funds Expended $76,229,668

SSBCI Recycled Funds Expended $32,914,972

Total New Financing to Small Businesses $389,390,741

Leverage Ratio 5.11x

Transaction Size and Demographics

Median Principal Loan/Investment Size $300,750

Minimum Principal Loan/Investment Size $2,500

Maximum Principal Loan/Investment Size $17,629,650

LMI Census Tracts (by Number of Transactions) 41.0%

LMI Census Tracts (by Dollar Amount) 36.5%

Non-Metro Areas (by Number of Transactions) 2.9%

Non-Metro Areas (by Dollar Amount) 4.0%

Business Age and Size

Median Business Age at Loan/Investment 4

Median Business Size (FTEs) 4

Median Business Size (Annual Revenue) $222,588

Total Number of Jobs Created or Retained 4,373

Jobs Created 3,300

Jobs Retained 1,073

Top 3 Industries by Number of Transactions

Information 35

Manufacturing 34

Accommodation and Food Services 27

Top 3 Industries by Dollar Amount

Accommodation and Food Services $91,175,292

Information $80,375,536

Manufacturing $60,319,728

Lender Participation

Small Lenders* (by Number of Transactions) 60.8%

Small Lenders (by Dollar Amount) 36.6%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Georgia

Allocation Amount: $48,024,748

Number of Loans/Investments 499

SSBCI Original Allocated Funds Expended $43,172,047

SSBCI Recycled Funds Expended $4,521,550

Total New Financing to Small Businesses $276,185,161

Leverage Ratio 6.40x

Transaction Size and Demographics

Median Principal Loan/Investment Size $200,000

Minimum Principal Loan/Investment Size $5,000

Maximum Principal Loan/Investment Size $13,200,000

LMI Census Tracts (by Number of Transactions) 33.5%

LMI Census Tracts (by Dollar Amount) 34.5%

Non-Metro Areas (by Number of Transactions) 10.4%

Non-Metro Areas (by Dollar Amount) 14.6%

Business Age and Size

Median Business Age at Loan/Investment 5

Median Business Size (FTEs) 4

Median Business Size (Annual Revenue) $150,000

Total Number of Jobs Created or Retained 4,027

Jobs Created 2,200

Jobs Retained 1,827

Top 3 Industries by Number of Transactions

Professional, Scientic, and Technical Services 143

Construction 68

Manufacturing 62

Top 3 Industries by Dollar Amount

Accommodation and Food Services $77,392,278

Professional, Scientic, and Technical Services $29,156,768

Real Estate and Rental and Leasing $26,563,439

Lender Participation

Small Lenders* (by Number of Transactions) 97.2%

Small Lenders (by Dollar Amount) 96.0%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

30

APPENDIX A

Hawaii

Allocation Amount: $13,227,911

Number of Loans/Investments 120

SSBCI Original Allocated Funds Expended $5,476,683

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $181,849,084

Leverage Ratio 33.20x

Transaction Size and Demographics

Median Principal Loan/Investment Size $25,000

Minimum Principal Loan/Investment Size $10,000

Maximum Principal Loan/Investment Size $15,000,000

LMI Census Tracts (by Number of Transactions) 28.3%

LMI Census Tracts (by Dollar Amount) 25.1%

Non-Metro Areas (by Number of Transactions) 10.0%

Non-Metro Areas (by Dollar Amount) 3.2%

Business Age and Size

Median Business Age at Loan/Investment 0

Median Business Size (FTEs) 3

Median Business Size (Annual Revenue) $0

Total Number of Jobs Created or Retained 678

Jobs Created 159

Jobs Retained 520

Top 3 Industries by Number of Transactions

Information 76

Professional, Scientic, and Technical Services 10

Manufacturing 9

Top 3 Industries by Dollar Amount

Information $57,351,974

Professional, Scientic, and Technical Services $50,529,919

Manufacturing $27,114,800

Lender Participation

Small Lenders* (by Number of Transactions) 0.0%

Small Lenders (by Dollar Amount) 0.0%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Idaho

Allocation Amount: $13,195,667

Number of Loans/Investments 315

SSBCI Original Allocated Funds Expended $13,136,543

SSBCI Recycled Funds Expended $10,559,488

Total New Financing to Small Businesses $208,186,678

Leverage Ratio 15.85x

Transaction Size and Demographics

Median Principal Loan/Investment Size $350,000

Minimum Principal Loan/Investment Size $4,765

Maximum Principal Loan/Investment Size $5,000,000

LMI Census Tracts (by Number of Transactions) 26.7%

LMI Census Tracts (by Dollar Amount) 28.9%

Non-Metro Areas (by Number of Transactions) 30.5%

Non-Metro Areas (by Dollar Amount) 27.7%

Business Age and Size

Median Business Age at Loan/Investment 6

Median Business Size (FTEs) 8

Median Business Size (Annual Revenue) $969,169

Total Number of Jobs Created or Retained 3,081

Jobs Created 1,051

Jobs Retained 2,030

Top 3 Industries by Number of Transactions

Health Care and Social Assistance 56

Retail Trade 42

Manufacturing 42

Top 3 Industries by Dollar Amount

Health Care and Social Assistance $46,408,816

Manufacturing $34,400,292

Retail Trade $24,676,978

Lender Participation

Small Lenders* (by Number of Transactions) 56.8%

Small Lenders (by Dollar Amount) 44.6%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

31

APPENDIX A

Illinois

Allocation Amount: $78,719,715

Number of Loans/Investments 240

SSBCI Original Allocated Funds Expended $70,374,955

SSBCI Recycled Funds Expended $4,450,000

Total New Financing to Small Businesses $663,822,904

Leverage Ratio 9.43x

Transaction Size and Demographics

Median Principal Loan/Investment Size $488,955

Minimum Principal Loan/Investment Size $7,500

Maximum Principal Loan/Investment Size $12,728,800

LMI Census Tracts (by Number of Transactions) 32.9%

LMI Census Tracts (by Dollar Amount) 44.5%

Non-Metro Areas (by Number of Transactions) 13.3%

Non-Metro Areas (by Dollar Amount) 7.5%

Business Age and Size

Median Business Age at Loan/Investment 6

Median Business Size (FTEs) 10

Median Business Size (Annual Revenue) $1,066,995

Total Number of Jobs Created or Retained 4,427

Jobs Created 2,957

Jobs Retained 1,470

Top 3 Industries by Number of Transactions

Manufacturing 73

Accommodation and Food Services 28

Professional, Scientic, and Technical Services 26

Top 3 Industries by Dollar Amount

Manufacturing $267,316,649

Wholesale Trade $126,301,007

Professional, Scientic, and Technical Services $61,837,773

Lender Participation

Small Lenders* (by Number of Transactions) 77.1%

Small Lenders (by Dollar Amount) 53.2%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Indiana

Allocation Amount: $34,494,392

Number of Loans/Investments 241

SSBCI Original Allocated Funds Expended $20,238,651

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $67,902,490

Leverage Ratio 3.36x

Transaction Size and Demographics

Median Principal Loan/Investment Size $100,000

Minimum Principal Loan/Investment Size $3,000

Maximum Principal Loan/Investment Size $5,136,000

LMI Census Tracts (by Number of Transactions) 30.7%

LMI Census Tracts (by Dollar Amount) 18.8%

Non-Metro Areas (by Number of Transactions) 7.1%

Non-Metro Areas (by Dollar Amount) 7.1%

Business Age and Size

Median Business Age at Loan/Investment 4

Median Business Size (FTEs) 5

Median Business Size (Annual Revenue) $349,000

Total Number of Jobs Created or Retained 1,294

Jobs Created 613

Jobs Retained 681

Top 3 Industries by Number of Transactions

Retail Trade 43

Professional, Scientic, and Technical Services 30

Construction 29

Top 3 Industries by Dollar Amount

Professional, Scientic, and Technical Services $13,961,836

Information $11,235,109

Manufacturing $10,709,720

Lender Participation

Small Lenders* (by Number of Transactions) 44.0%

Small Lenders (by Dollar Amount) 10.5%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

32

APPENDIX A

Iowa

Allocation Amount: $13,123,161

Number of Loans/Investments 45

SSBCI Original Allocated Funds Expended $8,398,788

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $45,866,763

Leverage Ratio 5.46x

Transaction Size and Demographics

Median Principal Loan/Investment Size $200,000

Minimum Principal Loan/Investment Size $6,000

Maximum Principal Loan/Investment Size $2,000,000

LMI Census Tracts (by Number of Transactions) 26.7%

LMI Census Tracts (by Dollar Amount) 6.3%

Non-Metro Areas (by Number of Transactions) 15.6%

Non-Metro Areas (by Dollar Amount) 2.2%

Business Age and Size

Median Business Age at Loan/Investment 2

Median Business Size (FTEs) 4

Median Business Size (Annual Revenue) $64,125

Total Number of Jobs Created or Retained 506

Jobs Created 303

Jobs Retained 204

Top 3 Industries by Number of Transactions

Manufacturing 10

Information 9

Professional, Scientic, and Technical Services 8

Top 3 Industries by Dollar Amount

Manufacturing $34,709,300

Professional, Scientic, and Technical Services $4,788,650

Information $3,959,100

Lender Participation

Small Lenders* (by Number of Transactions) 37.8%

Small Lenders (by Dollar Amount) 1.4%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Kansas

Allocation Amount: $13,227,911

Number of Loans/Investments 92

SSBCI Original Allocated Funds Expended $12,770,943

SSBCI Recycled Funds Expended $1,255,243

Total New Financing to Small Businesses $231,571,176

Leverage Ratio 18.13x

Transaction Size and Demographics

Median Principal Loan/Investment Size $1,605,500

Minimum Principal Loan/Investment Size $154,000

Maximum Principal Loan/Investment Size $12,852,843

LMI Census Tracts (by Number of Transactions) 35.9%

LMI Census Tracts (by Dollar Amount) 41.9%

Non-Metro Areas (by Number of Transactions) 35.9%

Non-Metro Areas (by Dollar Amount) 41.8%

Business Age and Size

Median Business Age at Loan/Investment 3

Median Business Size (FTEs) 7

Median Business Size (Annual Revenue) $237,688

Total Number of Jobs Created or Retained 1,769

Jobs Created 1,248

Jobs Retained 521

Top 3 Industries by Number of Transactions

Manufacturing 25

Accommodation and Food Services 17

Professional, Scientic, and Technical Services 9

Top 3 Industries by Dollar Amount

Manufacturing $56,771,917

Accommodation and Food Services $52,844,713

Agriculture, Forestry, Fishing and Hunting $30,685,569

Lender Participation

Small Lenders* (by Number of Transactions) 57.6%

Small Lenders (by Dollar Amount) 49.4%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

33

APPENDIX A

Kentucky

Allocation Amount: $15,558,051

Number of Loans/Investments 161

SSBCI Original Allocated Funds Expended $14,707,486

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $122,151,772

Leverage Ratio 8.31x

Transaction Size and Demographics

Median Principal Loan/Investment Size $262,000

Minimum Principal Loan/Investment Size $25,000

Maximum Principal Loan/Investment Size $6,100,000

LMI Census Tracts (by Number of Transactions) 44.1%

LMI Census Tracts (by Dollar Amount) 51.3%

Non-Metro Areas (by Number of Transactions) 46.0%

Non-Metro Areas (by Dollar Amount) 50.4%

Business Age and Size

Median Business Age at Loan/Investment 5

Median Business Size (FTEs) 5

Median Business Size (Annual Revenue) $365,802

Total Number of Jobs Created or Retained 2,420

Jobs Created 1,122

Jobs Retained 1,298

Top 3 Industries by Number of Transactions

Manufacturing 24

Accommodation and Food Services 22

Retail Trade 19

Health Care and Social Assistance 19

Top 3 Industries by Dollar Amount

Manufacturing $38,486,408

Accommodation and Food Services $22,387,063

Health Care and Social Assistance $11,558,809

Lender Participation

Small Lenders* (by Number of Transactions) 72.7%

Small Lenders (by Dollar Amount) 69.7%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Louisiana

Allocation Amount: $12,414,995

Number of Loans/Investments 85

SSBCI Original Allocated Funds Expended $8,822,637

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $55,645,857

Leverage Ratio 6.31x

Transaction Size and Demographics

Median Principal Loan/Investment Size $365,000

Minimum Principal Loan/Investment Size $25,000

Maximum Principal Loan/Investment Size $5,300,000

LMI Census Tracts (by Number of Transactions) 18.8%

LMI Census Tracts (by Dollar Amount) 16.6%

Non-Metro Areas (by Number of Transactions) 8.2%

Non-Metro Areas (by Dollar Amount) 14.8%

Business Age and Size

Median Business Age at Loan/Investment 2

Median Business Size (FTEs) 4

Median Business Size (Annual Revenue) $0

Total Number of Jobs Created or Retained 1,717

Jobs Created 918

Jobs Retained 800

Top 3 Industries by Number of Transactions

Manufacturing 17

Information 15

Professional, Scientic, and Technical Services 13

Top 3 Industries by Dollar Amount

Manufacturing $12,730,674

Information $9,836,050

Accommodation and Food Services $6,966,000

Lender Participation

Small Lenders* (by Number of Transactions) 38.8%

Small Lenders (by Dollar Amount) 35.3%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

SSBCI: Summary of States’ 2016 Annual Reports

34

APPENDIX A

Maine

Allocation Amount: $13,227,911

Number of Loans/Investments 74

SSBCI Original Allocated Funds Expended $8,323,874

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $57,357,394

Leverage Ratio 6.89x

Transaction Size and Demographics

Median Principal Loan/Investment Size $448,000

Minimum Principal Loan/Investment Size $73,774

Maximum Principal Loan/Investment Size $9,757,950

LMI Census Tracts (by Number of Transactions) 25.7%

LMI Census Tracts (by Dollar Amount) 31.2%

Non-Metro Areas (by Number of Transactions) 27.0%

Non-Metro Areas (by Dollar Amount) 19.5%

Business Age and Size

Median Business Age at Loan/Investment 3

Median Business Size (FTEs) 6

Median Business Size (Annual Revenue) $365,000

Total Number of Jobs Created or Retained 1,026

Jobs Created 334

Jobs Retained 692

Top 3 Industries by Number of Transactions

Manufacturing 11

Professional, Scientic, and Technical Services 11

Retail Trade 9

Top 3 Industries by Dollar Amount

Accommodation and Food Services $12,908,218

Manufacturing $12,687,230

Professional, Scientic, and Technical Services $7,208,372

Lender Participation

Small Lenders* (by Number of Transactions) 64.9%

Small Lenders (by Dollar Amount) 69.1%

* Includes Banks, Credit Unions, CDFIs, and Non-Financial Institution Lenders

with assets less than or equal to $1.22B

Maryland

Allocation Amount: $23,025,709

Number of Loans/Investments 55

SSBCI Original Allocated Funds Expended $14,125,270

SSBCI Recycled Funds Expended $0

Total New Financing to Small Businesses $405,245,372

Leverage Ratio 28.69x

Transaction Size and Demographics