[Web address]

2021

-2022 Revenue Interim Committee

Members

CHAIR

Sen. Jill Cohenour (D)

(406) 227-1144

VICE CHAIR

Rep. Becky Beard (R)

(406) 479-3048

Rep. Alice Buckley (D)

(406) 404-0891

Sen. Greg Hertz (R)

(406) 253-9505

Sen. Brian Hoven (R)

(406) 761-8533

Rep. Connie Keogh (D)

(406) 298-0985

Sen. Mike Lang (R)

(406) 654-7357

Sen. Edie McClafferty (D)

(406) 490-5873

Sen. Shannon O'Brien (D)

(406) 274-3805

Rep. Mark Thane (D)

(406) 552-3957

Rep. Jeremy Trebas (R)

(406) 899-5445

Rep. Tom Welch (R)

(406) 660-2988

Committee Staff:

Megan Moore, Lead Staff

megan.moore@legmt.gov

Jaret Coles, Attorney

jaret.coles@legmt.gov

Brochure Design:

Laura Sherley, Research Assistant

Data Visualizations:

Dan Kayser, Data Analyst

RESIDENTIAL

PROPERTY TAX

Revenue Interim Committee

HJ 36 Residential Property Tax Study

September 2022

https://leg.mt.gov/committees/interim/ric/

Residential Property Tax

What are property taxes?

A property tax is a tax levied on the value of property. Property taxes are

levied on land, buildings, and certain business property.

Residential property is valued in odd-numbered years. Taxes are billed

annually and due in two payments on November 30 and May 31.

Homeowners with a mortgage often pay property taxes with their mortgage

payments.

Property Taxes Are a Larger Share of State

and Local Revenue in Montana Than in the

U.S.

Property taxes in Montana account for 10% of state taxes compared with 2%

for all states combined. At the local level, Montana property taxes make up

97% of local taxes, considerably more than the 71% share for all states.

Under state law, the property tax is the only tax many cities and counties

may levy. A limited number of localities are permitted to impose local option

resort taxes and some counties levy marijuana taxes.

Property Tax Assistance and Appeals

Call your local Department of Revenue office to apply for a property tax

assistance program or appeal your property value.

Montana has four property tax assistance programs.

• Property Tax Assistance Program: Reduces the tax rate on the

first $200,000 of market value for a primary residence owned by a

single person with income below $23,385 or a married person or

head of household with income below $31,181.

• E

lderly Homeowner and Renter Tax Credit: Income tax credit

for homeowners or renters 62 years of age or older with

household income of less than $45,000. Refundable credit of up to

$1,150 based on property taxes or rent paid in the prior year on a

primary residence.

• D

isabled Veteran Program: Reduces the tax rate on the primary

residence of a disabled veteran or surviving spouse with income

below $54,067 for a single disabled veteran, $62,385 for a married

or head of household disabled veteran, or $47,136 for an

unmarried surviving spouse.

• I

ntangible Land Value Property Exemption: Exempts the

appraised land value that exceeds 150% of the appraised value of

the primary residence and improvements for property owned by a

family for at least 30 years.

The Department of Revenue mails notices of residential property values in

the summer of odd-numbered years. Property owners may appeal the

property value by following the instructions on the notification letter.

1

MONTANA LEGISLATIVE SERVICES DIVISION

Revenue Interim Committee

6

Source: U.S. Census Bureau, Montana Department of Revenue

Residential Property Tax

Taxes Levied by Jurisdiction Type, FY 2022

Taxing Jurisdiction Tax Revenue

Percent

of Total

Local Schools

$657,987,701

33.02%

County

$549,771,437

27.59%

State

$356,591,368

17.90%

Cities and Towns

$209,355,673

10.51%

County-Wide Schools

$129,563,295

6.50%

Fire and Miscellaneous

$89,350,291

4.48%

$1,992,619,764

100.00%

State Laws Limit Property Taxes

Cities and counties are permitted to levy mills to collect the amount of

revenue raised in the prior year plus an inflation factor. The maximum mill

levy is calculated using the current year's taxable value. The application of

the approved mill levy to new property may result in revenue growth. The

total taxable value varies based on the mix of property types, property

values, and the amount of exempt property in the taxing jurisdiction.

School districts use property taxes to fund multiple budgets based on

school funding formulas adopted by the state and based on local

preferences. The main budget for the district's general fund must meet a

minimum level of required funding and is subject to a maximum budget

limit.

Voters May Approve Property Taxes Above State Limits

State law allows cities, counties, school districts, and special districts to ask

voters to collect property taxes higher than those authorized in state law

and to levy property taxes to pay for bonds. These levy elections or bond

issue questions appear on school, city, or county election ballots.

Legislative and Local Government Decisions

Affect Tax Bills

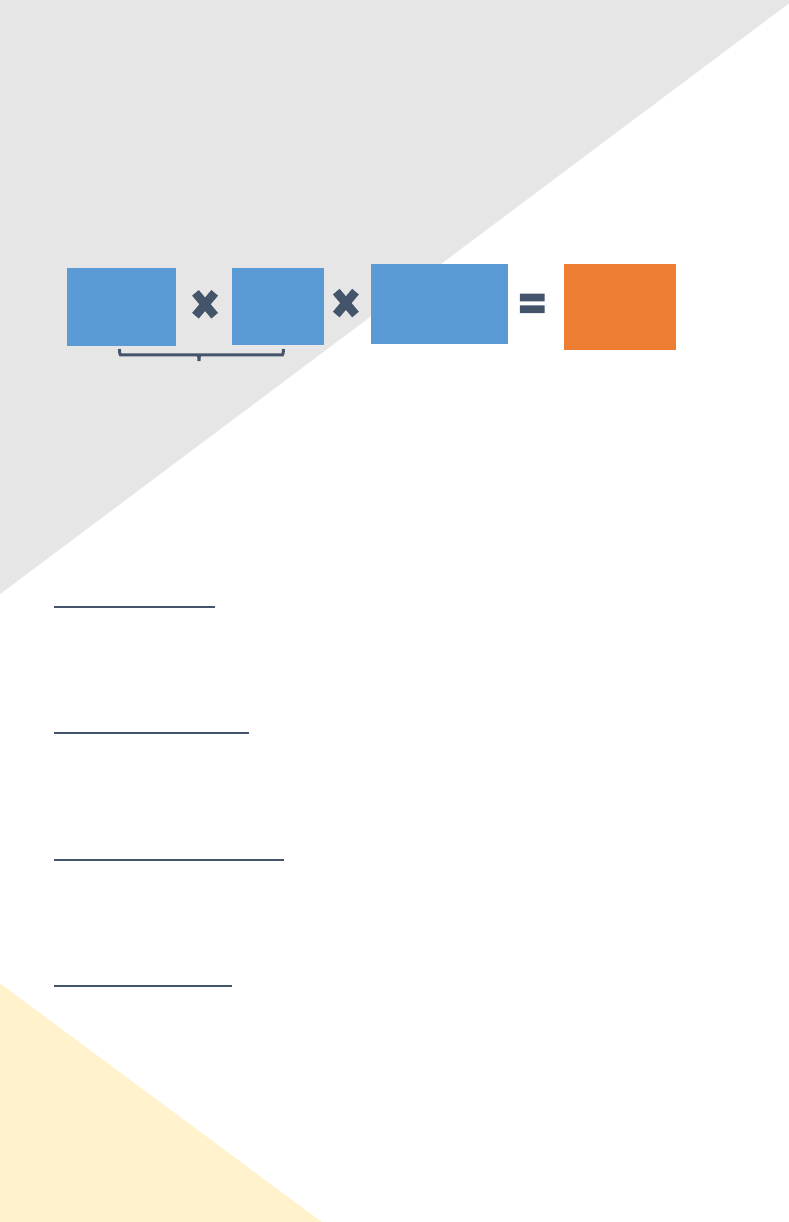

Property taxes are equal to market value times tax rate, known as taxable

value, times mill levies. One mill generates $1 for each $1,000 in taxable

value. State and local entities play a role in making property tax policy,

adopting budgets, and administering the tax.

State Legislature – The Legislature establishes property tax policy for

the state, including property classes, tax rates, valuation methods,

reappraisal cycles, property tax limits, appeal procedures, and property

tax assistance programs.

Taxing Jurisdictions – S

chool districts, cities, counties, and special

districts collect property taxes by setting budgets and mill levies. The

state levies 95 mills for K-12 education and 6 mills for the state university

system.

Department of Revenue – T

he Department of Revenue administers

property tax policies adopted by the Legislature. This includes classifying

property, appraising property, and providing taxable values to property

owners.

County Treasurers – C

ounty treasurers bill and collect property taxes

and distribute revenue to taxing jurisdictions.

5

MONTANA LEGISLATIVE SERVICES DIVISION

Revenue Interim Committee

2

Market

Value

Tax

Rate

Mill Rate/

1,000

Taxes

Source:

Department of Revenue

Taxable value

Example: $400,000 x 1.35% x 650/1,000 = $3,510

Residential Property Tax

Residential Property Pays the Largest Share

of Property Taxes

There are 16 classes of property in Montana with tax rates that vary by class

and range from 0.9% of market value to 100% of net proceeds of mines. In

2020, taxes levied on residential property accounted for 50% of the property

taxes collected in the state. Taxes on commercial property and nonelectrical

generating property of electric utilities each added another 15%.

Residential, commercial, and agricultural property are revalued every 2

years and forest property is revalued every 6 years. All other property is

valued annually.

More Than Half of Montana Property

Taxes Fund Schools

Of the $1.99 billion in property tax revenue collected in FY 2022, $1.12

billion funds K-12 education.

• Local school district property taxes totaled $658 million, or one-

third of collections.

• County-wide school levies make up another 6.5%, or $130

million.

• Of state property tax collections, $334 million is deposited in the

general fund. Though not directly earmarked for K-12 funding,

the revenue accounts for less than half of the $881 million in

general fund revenue budgeted for schools in FY 2022.

The remaining 44% of property taxes are distributed as follows: 27.6% to

counties, 10.5% to cities and towns, 4.5% to fire and miscellaneous

districts, and 1.1% to higher education.

3

MONTANA LEGISLATIVE SERVICES DIVISION

Revenue Interim Committee

4

Source: Department of Revenue

Source: Department of Revenue

Residential Property Tax

Residential Property Pays the Largest Share

of Property Taxes

There are 16 classes of property in Montana with tax rates that vary by class

and range from 0.9% of market value to 100% of net proceeds of mines. In

2020, taxes levied on residential property accounted for 50% of the property

taxes collected in the state. Taxes on commercial property and nonelectrical

generating property of electric utilities each added another 15%.

Residential, commercial, and agricultural property are revalued every 2

years and forest property is revalued every 6 years. All other property is

valued annually.

More Than Half of Montana Property

Taxes Fund Schools

Of the $1.99 billion in property tax revenue collected in FY 2022, $1.12

billion funds K-12 education.

• Local school district property taxes totaled $658 million, or one-

third of collections.

• County-wide school levies make up another 6.5%, or $130

million.

• Of state property tax collections, $334 million is deposited in the

general fund. Though not directly earmarked for K-12 funding,

the revenue accounts for less than half of the $881 million in

general fund revenue budgeted for schools in FY 2022.

The remaining 44% of property taxes are distributed as follows: 27.6% to

counties, 10.5% to cities and towns, 4.5% to fire and miscellaneous

districts, and 1.1% to higher education.

3

MONTANA LEGISLATIVE SERVICES DIVISION

Revenue Interim Committee

4

Source: Department of Revenue

Source: Department of Revenue

Residential Property Tax

Taxes Levied by Jurisdiction Type, FY 2022

Taxing Jurisdiction Tax Revenue

Percent

of Total

Local Schools

$657,987,701

33.02%

County

$549,771,437

27.59%

State

$356,591,368

17.90%

Cities and Towns

$209,355,673

10.51%

County-Wide Schools

$129,563,295

6.50%

Fire and Miscellaneous

$89,350,291

4.48%

$1,992,619,764

100.00%

State Laws Limit Property Taxes

Cities and counties are permitted to levy mills to collect the amount of

revenue raised in the prior year plus an inflation factor. The maximum mill

levy is calculated using the current year's taxable value. The application of

the approved mill levy to new property may result in revenue growth. The

total taxable value varies based on the mix of property types, property

values, and the amount of exempt property in the taxing jurisdiction.

School districts use property taxes to fund multiple budgets based on

school funding formulas adopted by the state and based on local

preferences. The main budget for the district's general fund must meet a

minimum level of required funding and is subject to a maximum budget

limit.

Voters May Approve Property Taxes Above State Limits

State law allows cities, counties, school districts, and special districts to ask

voters to collect property taxes higher than those authorized in state law

and to levy property taxes to pay for bonds. These levy elections or bond

issue questions appear on school, city, or county election ballots.

Legislative and Local Government Decisions

Affect Tax Bills

Property taxes are equal to market value times tax rate, known as taxable

value, times mill levies. One mill generates $1 for each $1,000 in taxable

value. State and local entities play a role in making property tax policy,

adopting budgets, and administering the tax.

State Legislature – The Legislature establishes property tax policy for

the state, including property classes, tax rates, valuation methods,

reappraisal cycles, property tax limits, appeal procedures, and property

tax assistance programs.

Taxing Jurisdictions – S

chool districts, cities, counties, and special

districts collect property taxes by setting budgets and mill levies. The

state levies 95 mills for K-12 education and 6 mills for the state university

system.

Department of Revenue – T

he Department of Revenue administers

property tax policies adopted by the Legislature. This includes classifying

property, appraising property, and providing taxable values to property

owners.

County Treasurers – C

ounty treasurers bill and collect property taxes

and distribute revenue to taxing jurisdictions.

5

MONTANA LEGISLATIVE SERVICES DIVISION

Revenue Interim Committee

2

Market

Value

Tax

Rate

Mill Rate/

1,000

Taxes

Source:

Department of Revenue

Taxable value

Example: $400,000 x 1.35% x 650/1,000 = $3,510

Residential Property Tax

What are property taxes?

A property tax is a tax levied on the value of property. Property taxes are

levied on land, buildings, and certain business property.

Residential property is valued in odd-numbered years. Taxes are billed

annually and due in two payments on November 30 and May 31.

Homeowners with a mortgage often pay property taxes with their mortgage

payments.

Property Taxes Are a Larger Share of State

and Local Revenue in Montana Than in the

U.S.

Property taxes in Montana account for 10% of state taxes compared with 2%

for all states combined. At the local level, Montana property taxes make up

97% of local taxes, considerably more than the 71% share for all states.

Under state law, the property tax is the only tax many cities and counties

may levy. A limited number of localities are permitted to impose local option

resort taxes and some counties levy marijuana taxes.

Property Tax Assistance and Appeals

Call your local Department of Revenue office to apply for a property tax

assistance program or appeal your property value.

Montana has four property tax assistance programs.

• Property Tax Assistance Program: Reduces the tax rate on the

first $200,000 of market value for a primary residence owned by a

single person with income below $23,385 or a married person or

head of household with income below $31,181.

• E

lderly Homeowner and Renter Tax Credit: Income tax credit

for homeowners or renters 62 years of age or older with

household income of less than $45,000. Refundable credit of up to

$1,150 based on property taxes or rent paid in the prior year on a

primary residence.

• D

isabled Veteran Program: Reduces the tax rate on the primary

residence of a disabled veteran or surviving spouse with income

below $54,067 for a single disabled veteran, $62,385 for a married

or head of household disabled veteran, or $47,136 for an

unmarried surviving spouse.

• I

ntangible Land Value Property Exemption: Exempts the

appraised land value that exceeds 150% of the appraised value of

the primary residence and improvements for property owned by a

family for at least 30 years.

The Department of Revenue mails notices of residential property values in

the summer of odd-numbered years. Property owners may appeal the

property value by following the instructions on the notification letter.

1

MONTANA LEGISLATIVE SERVICES DIVISION

Revenue Interim Committee

6

Source: U.S. Census Bureau, Montana Department of Revenue

[Web address]

2021

-2022 Revenue Interim Committee

Members

CHAIR

Sen. Jill Cohenour (D)

(406) 227-1144

VICE CHAIR

Rep. Becky Beard (R)

(406) 479-3048

Rep. Alice Buckley (D)

(406) 404-0891

Sen. Greg Hertz (R)

(406) 253-9505

Sen. Brian Hoven (R)

(406) 761-8533

Rep. Connie Keogh (D)

(406) 298-0985

Sen. Mike Lang (R)

(406) 654-7357

Sen. Edie McClafferty (D)

(406) 490-5873

Sen. Shannon O'Brien (D)

(406) 274-3805

Rep. Mark Thane (D)

(406) 552-3957

Rep. Jeremy Trebas (R)

(406) 899-5445

Rep. Tom Welch (R)

(406) 660-2988

Committee Staff:

Megan Moore, Lead Staff

megan.moore@legmt.gov

Jaret Coles, Attorney

jaret.coles@legmt.gov

Brochure Design:

Laura Sherley, Research Assistant

Data Visualizations:

Dan Kayser, Data Analyst

RESIDENTIAL

PROPERTY TAX

Revenue Interim Committee

HJ 36 Residential Property Tax Study

September 2022

https://leg.mt.gov/committees/interim/ric/