DAIRY MARKET NEWS

WEEK OF AUGUST 19 - 23, 2024

VOLUME 91, REPORT 34

DAIRY MARKET NEWS AT A GLANCE

CME GROUP CASH MARKETS (8/23)

BUTTER: Grade AA closed at $3.1300. The weekly average for Grade

AA is $3.1590 (+0.0180).

CHEESE: Barrels closed at $2.1000 and 40# blocks at $2.0375. The

weekly average for barrels is $2.2250 (+0.0410) and blocks $2.0820

(+0.0325).

NONFAT DRY MILK: Grade A closed at $1.2825. The weekly

average for Grade A is $1.2790 (+0.0410).

DRY WHEY: Extra grade dry whey closed at $0.5650. The weekly

average for dry whey is $0.5610 (+0.0020).

BUTTER HIGHLIGHTS: In the West, domestic butter demand

varies from steady to stronger. For the Central region, domestic butter

demand is strengthening. In the East, domestic butter demand is

unchanged. Cream volumes are tight in the East and Central regions.

Although cream supplies in the West are looser and more balanced

comparatively, stakeholders in the region don’t describe cream

volumes as excessive either. Butter production paces vary from steady

to weaker. Many manufacturers are relying on contracted cream loads

to keep churns moving. Some butter makers convey unsalted butter

stocks available for spot buyers are tight. Bulk butter overages range

from minus 7 to 10 cents above market, across all regions.

CHEESE HIGHLIGHTS: Cheese production is trending

seasonally steady to lighter throughout the U.S. Milk availability

remains tight in the East. Milk available for Class III processors is

constrained by Class I pulls for schools, and cheese production

remains light in the region. Contacts anticipate more spot milk

availability after Labor Day. Retail demand is steady. Cheesemakers

in the Central region relay steady cheese demand. Contacts share

demand for barrels remains strong, but spot load availability is rare.

Spot milk availability, too, is limited and settled at $2.25 to $3-over

Class III. Cheese production is mixed in the West. Some processors

relay increased manufacturing while others note tight spot milk

availability is slowing manufacturing. Contacts note cheese

inventories vary throughout the region.

FLUID MILK: Fluid milk and cream production is mixed across

the United States. Steady to slightly increased milk production is

being reported in the Upper Midwest, Pacific Northwest, and

California’s Central Valley. In those areas, low temperatures in the

upper 60s and highs in the 70s have made an impact. Milk volumes in

the remainder of the country are still decreasing week to week.

Temperatures across the south from the high 80s to triple-digits

continue to affect cow comfort and stifle milk production. Milk

output in the Northeast remains tight despite cooler temperatures

brought by rain and cloud cover from Hurricane Ernesto. Strong

winds and flooding pose transportation obstacles that linger as

Ernesto makes its way into the North Atlantic. Spot milk availability

has not loosened and demand from Class I has increased in all

regions. Peak season bottling orders have increased as school

schedules pick up for the fall semester. Some processors do not

expect any relief in the spot market until after Labor Day. Spot milk

prices reported ranged from $2.25 - $3-over Class III. Milk merchants

state condensed skim availability is minimal. Condensed skim

demand is steady in the East and Midwest while demand is stronger

in the West. Cream accessibility is following milk, with tightness

keeping loads nearby to fulfill regional contract needs. Spot loads for

end users are nearly nonexistent in the Midwest. Some buyers in the

Midwest have been turned down by West cream sellers as contract

orders absorb what is available. Cream multiples are 1.36 – 1.52 in

the East, 1.29 – 1.45 in the Midwest, and 1.18 – 1.33 in the West.

DRY PRODUCTS: Low/medium heat nonfat dry milk (NDM)

prices increased in all regions. Tightening availability and slight

demand increases are culminating to create firm markets for NDM.

Dry buttermilk prices were steady to higher in the country this week.

In the West, more buttermilk solids are expected to become available

for drying in the near-term. Dry whole milk prices were slightly

higher this week, as active bottling for school milk is keeping a pinch

on availability for drying. Dry whey price movements were mixed

through the country, but general market sentiment is steady. Volumes

of dry whey are tightening along with milk supplies for Class III

production. Whey protein concentrate 34% prices increased, as

customers say available spot loads are difficult to find in recent

weeks. Lactose prices were steady to higher, as some manufacturers

are sold out through the rest of Q3. Acid and rennet casein prices

were unchanged. Lighter milk output in Europe is limiting casein

output on the continent.

ORGANIC DAIRY MARKET NEWS: New organic standards

established by the USDA with the updated Organic Livestock and

Poultry Standards aim to improve animal treatment on organic farms.

Certified organic operations must meet compliance with the new rules

by January 2, 2025. The Organic Integrity Learning Center is offering a

new course, the Organic Livestock and Poultry Standards (OLPS) Final

Rule Core Course, which was created to teach certifiers, inspectors, and

producers about updated USDA organic regulation requirements

established by the OLPS final rule. Federal Milk Market Order 1, in

New England, reported utilization of organic milk by pool plants during

July 2024, utilization of both organic whole and reduced fat milk was up

from the previous year. The retail ad survey contained an all-time high

for organic dairy ads during last week's retail survey, but the total

number of organic dairy ads declined in the week 34 survey.

CONTINUED ON PAGE 1A

TABLE OF CONTENTS

Product Highlights/CME/DMN at a Glance 1 Dry Whey/WPC 34%/Lactose/Casein 6 September Advanced Class Prices 11

Weekly CME Cash Trading/Butter Markets 2 U.S Dairy Cow Slaughter/Class Milk Prices/NDPSR/Futures 7 National Retail Report – Dairy

Cheese Markets 3 Organic Dairy Market News 8 Dairy Market News Contacts

Fluid Milk and Cream 4 July Milk Production 9

Nonfat Dry Milk/Dry Buttermilk/Dry Whole Milk 5 June Milk Sales 10

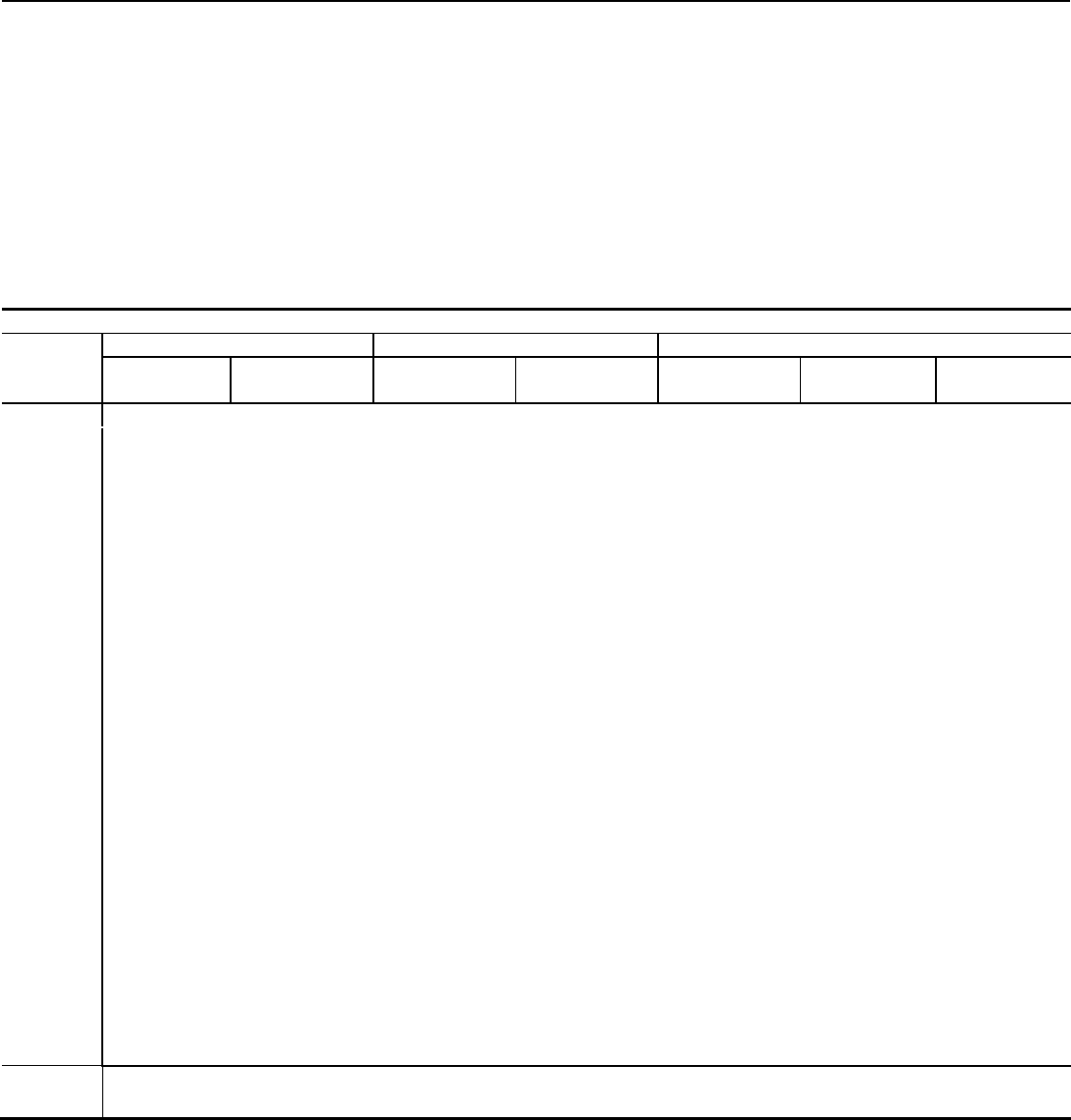

DAIRY MARKET NEWS PRICE SUMMARY FOR AUGUST 19 - 23

,

2024

PRICES

(

$/LB

)

& CHANGES FROM PREVIOUS PUBLISHED PRICES

Commodit

y

Ran

g

e Mostl

y

Commodit

y

Ran

g

e Mostl

y

Commodit

y

Ran

g

e Mostl

y

NDM DRY BUTTERMILK LACTOSE

Central Low/Med. Heat 1.2000 1.2700 1.2150 1.2500 Central/East 1.1000 1.2000 Central/West 0.2400 0.4250 0.3050 0.3700

Change 0.0200 0.0200 0.0150 0.0150 Change N.C. N.C. Change N.C. N.C. 0.0050 0.0025

Central High Heat 1.3150 1.3500 West 1.1300 1.2100 1.1700 1.2000

WPC 34%

Change 0.0250 N.C. Change 0.0300 0.0300 0.0300 0.0300 Central/West 0.9200 1.1500 0.9600 1.0300

West Low/Med. Heat 1.2000 1.3075 1.2100 1.2600

DRY WHEY

Change 0.0200 N.C. 0.0100 0.0200

Change 0.0300 0.0475 0.0300 0.0300 Central 0.4300 0.5950 0.5100 0.5500

CASEIN

West High Heat 1.2600 1.4300 Change -0.0300 N.C. 0.0100 N.C. Rennet 3.4000 3.8000

Change 0.0175 N.C. West 0.5000 0.6000 0.5300 0.5600 Change N.C. N.C.

DRY WHOLE MILK

Change 0.0200 N.C. 0.0100 N.C. Acid 3.6000 3.9000

National 2.2100 2.4100 Northeast 0.4775 0.5725 Change N.C. N.C.

Change 0.0100 0.0100 Change 0.0175 0.0400

ANIMAL FEED WHEY

Central 0.3500 0.3800

Change 0.0100 N.C.

WEEK OF AUGUST 19 - 23, 2024

DAIRY MARKET NEWS

VOLUME 91, REPORT 34

DAIRY MARKET NEWS AT A GLANCE

CONTINUED FROM PAGE 1

NATIONAL RETAIL REPORT: Conventional dairy ads

decreased by 2 percent and organic dairy ads decreased by 79 percent

this week. Conventional 6–8-ounce packages of sliced, shredded and

block cheese have weighted average advertised prices of $2.52, $2.45,

and $2.31, respectively. The weighted average advertised price for ice

cream in a 48–64-ounce container was $4.01, which represents a 33-

cent decrease from last week. The weighted average advertised prices

for conventional Greek yogurt in 4–6-ounce containers and 32-ounce

containers were $1.08 and $4.09, respectively. Conventional gallon

containers of milk and half gallon containers of milk had weighted

average advertised prices of $3.33 and $2.17, respectively. The

organic premium for a half gallon container of milk this week is

$2.86.

JULY MILK PRODUCTION (NASS): Milk production in the

24 major States during July totaled 18.2 billion pounds, down 0.2

percent from July 2023. June revised production, at 17.9 billion

pounds, was down 1.5 percent from June 2023. The June revision

represented a decrease of 137 million pounds or 0.8 percent from last

month's preliminary production estimate. Production per cow in the

24 major States averaged 2,047 pounds for July, 2 pounds above July

2023. The number of milk cows on farms in the 24 major States was

8.88 million head, 31,000 head less than July 2023, but 3,000 head

more than June 2024.

JUNE 2024 MILK SALES (FMMO): Total Fluid Products Sales

3.2 billion pounds of packaged fluid milk products were shipped by

milk handlers in June 2024. This was 2.9 percent lower than a year

earlier. Estimated sales of total conventional fluid milk products

decreased 3.4 percent from June 2023 and estimated sales of total

organic fluid milk products increased 4.4 percent from a year earlier.

SEPTEMBER 2024 ADVANCED CLASS PRICES (FMMO):

The base Class I price for September 2024 is $21.60 per cwt, an increase

of $0.28 per cwt when compared to August 2024. A Class I differential

for each order's principle pricing point (county) is added to the base

price to determine the Class I Price. For September 2024, the advanced

Class IV skim milk pricing factor is $9.39 per cwt, the Class II skim

milk price is $10.09 per cwt, and the Class II nonfat solids price is

$1.1211 per pound. The two-week product price averages for September

2024 are: butter $3.1061, nonfat dry milk $1.2212, cheese $1.9985, and

dry whey $0.4848.

NOTICE: The U.S. Department of Agriculture (USDA), on July 1,

2024, issued a Recommended Decision on its website proposing to

amend the pricing provisions in the 11 Federal milk marketing orders

(FMMOs). For more information, visit: https://www.ams.usda.gov/rules

-regulations/moa/dairy/hearings/national-fmmo-pricing-hearing The

official version of the recommended decision was published July 15,

2024 in the Federal Register. The deadline for comments is

September 13, 2024. USDA is under ex parte until a final decision is

published, so the FMMO Hearing Team is unable to respond to

substantive questions. For any process-related questions, please

email FMMOHea[email protected].

USDA MARKET NEWS MOBILE APP: The free USDA Market

News app is available in both IOS and Android versions and may be

downloaded through the Apple and Google Play stores. Search for

“USDA Market News Mobile Application” to download the app and

begin exploring its potential. The app allows the user to customize the

commodity areas and market types they wish to see. All Dairy Market

News reports that are available online are also available through the

mobile app.

-1A-

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024 -2- VOLUME 91, REPORT 34

COMMODITY

MONDAY

Aug 19

TUESDAY

Aug 20

WEDNESDAY

Aug 21

THURSDAY

Aug 22

FRIDAY

Aug 23

::

WEEKLY

CHANGE

::

WEEKLY

AVERAGE

CHEESE

BARRELS $2.2550 $2.2650 $2.2825 $2.2225 $2.1000 :: :: $2.2250

40 POUND BLOCKS

(N.C.)

$2.1000

(+0.0100)

$2.1000

(+0.0175)

$2.0950

(-0.0600)

$2.0775

(-0.1225)

$2.0375

::

::

(-0.1550) ::

::

(+0.0410)

$2.0820

(N.C.) (N.C.) (-0.0050) (-0.0175) (-0.0400) :: (-0.0625) :: (+0.0325)

NONFAT DRY MILK

GRADE A $1.2650 $1.2825 $1.2850 $1.2800 $1.2825 :: :: $1.2790

(+0.0100) (+0.0175) (+0.0025) (-0.0050) (+0.0025) :: (+0.0275) :: (+0.0410)

BUTTER

GRADE AA $3.1850 $3.1700 $3.1600 $3.1500 $3.1300 :: :: $3.1590

(+0.0050) (-0.0150) (-0.0100) (-0.0100) (-0.0200) :: (-0.0500) :: (+0.0180)

DRY WHEY

EXTRA GRADE $0.5500 $0.5575 $0.5675 $0.5650 $0.5650 :: :: $0.5610

(N.C.) (+0.0075) (+0.0100) (-0.0025) (N.C.) :: (+0.0150) :: (+0.0020)

NOTICE: Five days of trading information can be found at www.cmegroup.com/trading/agricultural/spot-call-data.html

Prices shown are in U.S. dollars per lb. in carlot quantities. Carlot unit weights: CHEESE, 40,000-44,000 lbs.; NONFAT DRY MILK, 41,000-45,000 lbs.; BUTTER, 40,000-43,000 lbs; DRY

WHEY, 41,000-45,000 lbs. Weekly Change is the sum of Daily Price Changes. Weekly Average is the simple average of the Daily Cash Close prices for the calendar week. Weekly Average

Change is the difference between current and previous Weekl

WWW.AMS.USDA.GOV/MARKET-NEWS/DAIRY

y Average. Computed by Dairy Market News for informational purposes. This data is available on the Internet at

BUTTER MARKETS

EAST

Butter makers relay churning is steady and that they are relying on

contracted loads of cream for churning new butter inventories. Cream

remains seasonally tight across the East; there is demand from butter

makers and steady demand from other Classes. Spot loads of cream are

tightening alongside lower milk production. Market participants state butter

inventories are stable. During August, the CME Grade AA butter weekly

average price has stayed within a 5-cent range thus far. The closing price

on Tuesday of this week was $3.1700.

Prices for: Eastern U.S., All First Sales, F.O.B., Grade AA, Conventional,

and Edible Butter

Bulk Basis Pricing - 80% Butterfat $/LB: +0.0500 - +0.1000

CENTRAL

Butter makers say demand is continuing its seasonal shift higher. Traders

echo that sentiment. They say bulk butter, the 80 percent salted variety,

remains available for near-term needs. They also say price points for bulk

are beginning to shift slightly higher as markets have begun to perk up both

in trading activity and pricing over the past week. Cream remains very tight

in the region. Butter churning is continuing its slowdown, as butter makers

are using contracted cream nearly exclusively. More cream has been

available in the South Central states, but Upper Midwest butter contacts say

spot cream shipments will be unlikely to appear until Labor Day weekend,

if then.

Prices for: Central U.S., All First Sales, F.O.B., Grade AA, Conventional,

and Edible Butter

Bulk Basis Pricing - 80% Butterfat $/LB: +0.0300 - +0.0700

WEST

Butter producers in the West report retail butter production lines are

generally steady, while bulk butter lines are churning at much slower

production paces comparatively. Cream demand is mixed. Stakeholders

indicate West region cream volumes are more balanced than Central/

Eastern region cream volumes. Butter demand varies from stronger to

steady. Salted butter loads are widely available. However, some butter

manufacturers convey stocks are tight for spot buyers looking for unsalted

butter loads. In terms of stocks built up for anticipated Q4 demands, butter

makers generally indicate inventories are adequate, but not heavy. The

CME butter price of $3.1600 for today is the highest Wednesday price

mark so far in 2024.

Prices for: Western U.S., All First Sales, F.O.B., Grade AA, Conventional,

and Edible Butter

Bulk Basis Pricing - 80% Butterfat $/LB: -0.0700 - +0.0300

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024

-3-

VOLUME 91, REPORT 34

CHEESE MARKETS

EAST

Ch

eese producers in the East are feeling the doldrums of summer.

Cheese production has slowed for another week. Schools are begin-

ning their fall schedules and milk is being pulled into Class I. Hurri-

cane Ernesto refrained from making landfall on the Atlantic coast,

but still managed to affect most of the coastal states with strong

winds and heavy rainfall. Cooler temperatures may be the only relief

milk producers see from the effects of Hurricane Ernesto. Milk avail-

ability is very tight in the East. Spot loads of milk remain a rarity.

Some processors say more milk is expected to be available after La-

bor Day. Class III demand remains strong. Foodservice demand is

steady and retail demand continues to pick up. Last week's National

Retail Report lists that shredded cheese in 6-8-ounce packages was

the most advertised conventional cheese item this week, with a

weighted average advertised price of $2.50, up 7 cents from last

week. Market prices on the CME were on the rise last week. Cheese

barrels closed Tuesday at $2.2650, and 40-pound blocks closed at

$2.1000.

CENTRAL

Ch

eese demand in the Upper Midwest is steady. Some manufacturers

say higher market prices only spurred near-term buying, but they

expect some hesitancy once the dust begins to settle on bullish pric-

ing movement. Barrel processors have said and continue to relay that

buyers' interests are hearty, but spot load availability for barrels has

been scant in recent weeks. Spot milk availability is drawing similar

comparisons to barrel cheese volumes. Even as some processors re-

ported some down days for maintenance/cleaning this week, they say

finding new homes for their milk has not been a difficulty. Spot milk

prices, at report time, are $2.25- to $3-over Class III. Cheese mar-

kets, as mentioned, have been on a bullish run for two weeks. Barrel

market prices, particularly, are moving higher at a stronger clip. Con-

tacts have shared concerns that the current gap between barrels and

blocks may create some flux in near-term market tones, as prices

typically correct to narrow the gap.

WEST

Cheese production varies from slightly stronger to slightly weaker in

the West. Although spot milk supplies are tight throughout most of

the region, cheese makers are securing enough volumes to accommo-

date production needs. In some cases, a few processors have adjusted

milk receiving caps to keep production lines closer to capacity. Block

cheese production is strengthening as new production capacities have

come on-line. Industry sources indicate butter price strength is incen-

tivizing some producers to allocate more milk fats in that direction

recently. Cheese makers report mixed inventories available for spot

purchasing. While some manufacturers suggest plenty of cheese is

available, others convey supplies are tight. Domestic demand varies

from stronger to steady. Export demand ranges from steady to mod-

erate.

FOREIGN

Eu

ropean demand for varietal cheeses is somewhat mixed. That said,

stakeholders convey retail demands are moving in the direction of

seasonal expectations. For the food service sector, demands are in

line with recent weeks. Vacationing season continues to give a boost

to food service demands. Requests for contracted loads are further

strengthening. Export demand varies from strong to steady. Howev-

er, industry participants convey price negotiations are meeting some

resistance. Stocks are sufficiently accommodating contracted obliga-

tions. However, spot load availability is tight in some cases. Stake-

holders convey intensified summer temperatures and herd health

challenges have contributed to declining European milk production.

Cheese production in Europe is trending weaker. Market tones are

firming.

COLD STOR

AGE

Butter Cheese

08/19/2024: 72,041 73,580

08/01/2024: 73,733 72,051

Change: (1,692) 1,529

% Change: (2) 2

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024 -4- VOLUME 91, REPORT 34

FLUID MILK AND CREAM

EAST

Farm level milk production is trending steady to lower throughout the

East region. In the Northeast, contacts continue to share seasonally

lighter milk production at the farm level. Class I bottling orders have

increased as schools are slated to reopen in the coming weeks.

Schools throughout New England are opening this week or next,

while schools in New York state are not opening until after Labor

Day weekend. Milk handlers continue to relay tight condensed skim

availability. Cream availability, too, remains tight. Demand for Class

II and III are steady. In the Mid-Atlantic, farm level milk outputs

remain tight. Class I processing is steady to stronger. Class II

manufacturing is steady to lighter. Contacts in the Southeast and

Florida share steady to lighter milk outputs at the farm level. Milk

handlers continue to relay they are moving spot loads of milk in from

other areas to meet Class I bottling demands. The All-Class cream

multiples range was unchanged from last week.

Northeastern U.S., F.O.B. Condensed Skim

Price Range - Class II, $/LB Solids: 1.25 - 1.30

Price Range - Class III, $/LB Solids: 0.99 - 1.04

Northeastern U.S., F.O.B. Cream

Price Range - All Classes, $/LB Butterfat: 4.2718 - 4.7743

Multiples Range - All Classes: 1.3600 - 1.5200

Price Range - Class II, $/LB Butterfat: 4.4916 - 4.7743

Multiples Range - Class II: 1.4300 - 1.5200

MIDWEST

Upper Midwest farm milk output is steadying, after some general

climactic improvements regarding cow comfort. There are some

warmer days in the forecast here and there, but highs in the 70s and

cooler nights have given farmers some optimism for near-term milk

output growth. Additionally, despite some rain in recent weeks,

fieldwork has been moving at a clip. The third cutting of hay is nearly

complete, while the fourth cutting is underway. All this said, milk

availability remains seasonally tight. Spot milk prices reported ranged

from $2.25- to $3-over Class III, despite some cheese plant downtime

being reported in the region. Last year, during week 34, spot milk

prices ranged from Class III to $.50-over. Processors do not expect

growth in spot milk availability until Labor Day weekend, if then.

Class I activity is increasing. Bottlers are pulling milk at a seasonally

busy pace, as schools are either already underway or will be within

the next two weeks throughout the region. Cream availability is

somewhat steady. Butter makers say spot cream availability is nearly

nonexistent in the region, but Class II and Class III manufacturers are

clearing spot cream at similar multiples to last week. Cream end users

suggest a similar sentiment as do fluid milk processors regarding the

potentiality of Labor Day availability.

Price Range - Class III Milk; $/CWT; Spot Basis: 2.25 - 3.00

Trade Activity: Moderate

Midwestern U.S., F.O.B. Cream

Price Range - All Classes; $/LB Butterfat: 4.0519 - 4.5545

Multiples Range - All Classes: 1.2900 - 1.4500

Price Range - Class II, $/LB Butterfat: 4.2718 - 4.5545

Multiples Range - Class II: 1.3600 - 1.4500

WEST

In California, milk production is seasonally weaker. However, some

handlers indicate preliminary records suggest August 2024 milk

output is up year-over-year compared to August 2023, above

anticipated volumes, and strengthening compared to last month.

Processors in the Central Valley convey milk volumes continue to be

comfortable. Spot milk availability is in line with recent weeks. Class

I demand is stronger as many educational institutions have started

sessions back up. Class II, III and IV demands are steady. Farm level

milk output is lighter in Arizona. Industry participants indicate tight

spot milk availability has not eased. Class I demand is stronger with

more educational facilities gearing up to start sessions. Demands for

all other Classes are steady. In New Mexico, milk production and spot

volumes are generally in accord with much of the southwest. All

Class demands are unchanged. Handlers report milk production is

steady and at anticipated volumes in the Pacific Northwest.

Stakeholders suggest spot volumes for the area are looser than

elsewhere in the region. All Class manufacturing demands are steady.

Farm level milk output in the mountain states of Idaho, Utah, and

Colorado varies from steady to slightly weaker. In Idaho, handlers

convey lower daytime/nighttime temperatures later this week should

improve milk output. Class I demand is stronger as many schools

throughout the mountain states have begun sessions this week. Class

II demand is stronger, particularly in Idaho, as some unexpected

busier production runs have taken place recently. Class III demand is

strengthening further. Spot sellers note sales of above Class III prices.

Class IV demand is steady. Industry participants describe cream

volumes for the West region mostly as comfortable and looser than

other regions in the country. However, spot availability is not

excessive either for most of the region. West region cream sellers

convey some requests from Midwest buyers for loads have been

turned down. Cream demand is steady. Cream multiples contracted

slightly. Condensed skim milk loads are tighter. Condensed skim milk

demand is stronger.

Western U.S., F.O.B. Cream

Price Range - All Classes; $/LB Butterfat: 3.7064 - 4.1775

Multiples Range - All Classes: 1.1800 - 1.3300

Price Range - Class II, $/LB Butterfat: 3.8948 - 4.1775

Multiples Range - Class II: 1.2400 - 1.3300

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024 -5-

VOLUME 91, REPORT 34

NONFAT DRY MILK, BUTTERMILK & W

HOLE MILK

Prices represent carlot/trucklot quantities for domestic and export sales packaged in 25 kg. or 50 lb. bags, or totes, spray process, dollars per pound.

NONFAT DRY MILK - CENTRAL AND EAST

Low/medium heat nonfat dry milk (NDM) prices moved higher at all

D

points of the range and mostly price series this week. In the East,

i

reported trading activity was light. Central region trading activity was

t

moderate. Demand tones, though, are changing. End users say offers

a

have become quieter in recent weeks. Condensed skim availability

p

has tightened with some rapidity since early summer, while demand

b

for condensed skim has picked up steam in that same timeframe.

b

Availability of spot loads of low/medium heat NDM have begun to

i

slide. Both domestic and Mexican demand tones are strengthening.

f

Therefore, low/medium heat NDM markets are in a firming phase.

i

High heat NDM prices moved higher on the bottom of the range.

High heat NDM availability is tight, as opportunities for drying high

Pr

Pr

heat NDM are limited.

M

Prices for: Eastern and Central U.S., All First Sales, F.O.B., Extra Grade & Grade A,

, Conventional, and Edible Nonfat Dry Milk

Price Range - Low & Medium Heat; $/LB: 1.2000 - 1.2700

Mostly Range - Low & Medium Heat; $/LB: 1.2150 - 1.2500

Prices for: Eastern and Central U.S., All First Sales, F.O.B., Extra Grade & Grade A

,

, Conventional, and Edible Nonfat Dry Milk

Price Range - High Heat; $/LB: 1.3150 - 1.3500

T

h

C

f

s

NONFAT DRY MILK - WEST

d

r

In the West, prices for low/medium heat nonfat dry milk (NDM

)

moved higher across all facets of price range and mostly price series

.

Pr

Domestic demand is stronger. Production paces are mixed. In som

e

Pr

cases, skim milk powder is receiving more production attention

.

Stakeholders indicate condensed skim availability and demand ar

e

both improving. Low/medium heat nonfat dry milk loads ar

e

generally available to accommodate spot buyers. However, amongs

t

individual manufacturers, non-contracted supplies vary somewha

t

widely. High heat NDM prices moved higher on the bottom end o

f

the range, while the top end of the range held this week. Demand i

s

steady. Production schedules are mixed.

Prices for: Western U.S., All First Sales, F.O.B., Extra Grade & Grade A,

Conventional, and Edible Nonfat Dry Milk

Price Range - Low & Medium Heat; $/LB: 1.2000 - 1.3075

Mostly Range - Low & Medium Heat; $/LB: 1.2100 - 1.2600

Prices for: Western U.S., All First Sales, F.O.B., Extra Grade & Grade A

,

Conventional, and Edible Nonfat Dry Milk

Price Range - High Heat; $/LB: 1.2600 - 1.4300

DRY BUTTERMILK - CENTRAL AND EAST

The Central and East dry buttermilk price series held steady thi

s

week. Liquid buttermilk volumes coming to processors are unvarie

d

as butter makers are far from churning capacity. Contacts share tha

t

churning activity is relatively unchanged as cream availabilit

y

remains tight. Demand for spot dry buttermilk is light. Processors ar

e

adjusting drying schedules to keep up with contractual obligation

s

and efficiently handle volumes from ongoing butter production.

Prices for: Eastern and Central U.S., All First Sales, F.O.B., Conventional, and Edible

Buttermilk

Price Range ; $/LB: 1.1000 - 1.2000

DRY BUTTERMILK - WEST

ry buttermilk prices moved higher in the West. Some manufacturers

ndicate stocks will be committed to filling contract obligations

hrough the remainder of Q3, while others report supplies are

vailable to accommodate spot purchasing interest. Dry buttermilk

roduction schedules are steady. Stakeholders suggest liquid

uttermilk volumes for drying will increase with more butter churns

ack in gear following maintenance project completions. Although

nventories are not heavy, dry buttermilk loads are generally available

or spot buyers to find. Demand is stronger both domestically and for

nternational purchasers.

ices for: Western U.S., All First Sales, F.O.B., Conventional, and Edible Buttermilk

ice Range ; $/LB: 1.1300 - 1.2100

ostly Range - ; $/LB: 1.1700 - 1.2000

DRY WHOLE MILK

he dry whole milk price range moved higher this week. Milk

andlers continue to relay seasonally light farm level milk production.

lass I demand has increased as schools reopen around the country,

urther limiting whole milk volumes available for drying. Processors

hare very limited drying activity and spot load availability. Current

omestic price points are higher than international prices, which has

esulted in light export activity.

ices for: U.S., All First Sales, F.O.B., Conventional, and Edible Dry Whole Milk

ice Range - 26% Butterfat; $/LB: 2.2100 - 2.4100

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024

-6-

VOLUME 91, REPORT 34

WHEY, WPC 34%, LACTOSE & CASEIN

Prices represent carlot/trucklot quantities for domestic and export sales packaged in 25 kg. or 50 lb. bags, or totes, spray process, dollars per pound.

DRY WHEY– CENTRAL

Dry whey prices slid on the bottom of the range, but moved a penny

higher on the bottom of the mostly price series. Market sentiment is

unchanged. Processors of brand-preferred whey are not only tight, but

sold out. They say they are trying to get caught up on demand, but

any fresh volumes are spoken for. International demand remains

quiet. Some contacts say domestic prices are higher than

competitively priced global offers. Milk availability is seasonally

tight for Class III production. Whey solids continue to be funneled

into high protein whey concentrate markets, which are still firm to

bullish. Animal feed whey prices ticked up on the bottom of the

range. All said, whey markets are quiet to quietly bullish.

Prices for: Central U.S., All First Sales, F.O.B., , Conventional, and Non-Edible Dry

Whey

Price Range - Animal Feed; $/LB: .3500 - .3800

Prices for: Central U.S., All First Sales, F.O.B., Extra Grade & Grade A,

Conventional, and Edible Dry Whey

Price Range - Non-Hygroscopic; $/LB: .4300 - .5950

Mostly Range - Non-Hygroscopic; $/LB: .5100 - .5500

DRY WHEY– EAST

The East dry whey price range made some moves on both ends this

week. The bottom of the range rose almost 2 cents and the top rose

almost 7 cents. Despite these price shifts, demand is not necessarily

robust. Dry whey availability is simply tight in the Eastern region. As

seasonal milk availability decreases, so goes Class III processing.

Additionally, processors are continuing to prioritize the strengthened

whey protein concentrate markets. Following demand, processors are

fulfilling contract loads and any additional dry whey is dispatched

into rare spot loads. Dry whey remains quiet on the CME, with prices

tarrying in the mid-$0.50s without much movement. This

Wednesday's closing price of $0.5675 merely regained from last

week's dip of 1.25 cents. Milk volumes remain tight in the East.

Hurricane Ernesto brought rain and has given a lot of the East some

respite from the heat, but the sheer volume of water deposited on the

region will surely pose transportation difficulties.

Prices for: Eastern U.S., All First Sales, F.O.B., Extra Grade & Grade A,

Conventional, and Edible Dry Whey

Price Range - Non-Hygroscopic; $/LB: .4775 - .5725

DRY WHEY– WEST

Dry whey prices ticked higher on the bottom ends of both the range

and mostly price series in the West. The top ends of both the range

and mostly price series were unchanged. Dry whey availability

remains on the tight end, especially for brand specific spot buyers.

For some manufacturers, certain grade specific dry whey stocks are

only sufficiently fulfilling contracted obligations currently. Dry whey

production schedules are mixed. Some processors are selling the

solids as liquid whey. Continued strength with whey protein

concentrates and isolate markets continues incentivizing processors

away from allocating whey solids to sweet whey production. Demand

varies from steady to slightly stronger.

Prices for: Western U.S., All First Sales, F.O.B., Extra Grade & Grade A,

,Conventional, and Edible Dry Whey

Price Range - Non-Hygroscopic; $/LB: .5000 - .6000

Mostly Range - Non-Hygroscopic; $/LB: .5300 - .5600

WHEY PROTEIN CONCENTRATE

The bottom of the whey protein concentrate 34% (WPC 34%) price

range moved higher. The WPC 34% mostly price series moved

higher. Contacts have shared that demand for WPC 34% has

increased sharply this week. Processors have prioritized building

whey protein isolate and WPC 80% inventory in the past weeks and

months, and contacts share WPC 34% inventories are tight. Market

participants share different sentiments on spot load availability. Some

share they have found loads of WPC 34% to purchase, while others

relay there is little if any inventory to be found. Some contacts

continue to share demand for liquid WPC is strong, with some

processors noting they do not intend to dry much, if any, WPC 34%

in Q4.

Prices for: Central and Western U.S., All First Sales, F.O.B., Extra Grade,

Conventional, and Edible Whey Protein Concentrate

Price Range - 34% Protein; $/LB: .9200 - 1.1500

Mostly Range - 34% Protein; $/LB: .9600 - 1.0300

LACTOSE

The lactose price range was unchanged this week while the mostly

price series moved higher. Contacts continue to share limited lactose

production and indicate inventories vary for different mesh sizes.

Lower mesh lactose is more available than higher mesh loads.

Contacts share there is limited spot availability. Domestic demand is

strong. Several contacts have shared demand out of China has

dropped in recent weeks, and some contracted loads have been freed

up. Additionally, contacts share some older lactose stock has been

made available in recent weeks. Some manufacturers are out of stock

for the balance of the quarter.

Prices for: Central and Western U.S., Spot Sales And Up to 3 Month Contracts,

F.O.B., Conventional, and Edible Lactose

Price Range - Non Pharmaceutical; $/LB: .2400 - .4250

Mostly Range - Non Pharmaceutical; $/LB: .3050 - .3700

CASEIN

The price ranges for acid and rennet casein held steady this week.

Demand for acid casein is strengthening in Oceania, but contacts

report demand from other regions remains lighter. Spot loads of acid

casein are available for purchasing. Contacts in South America say

processors in the region have shifted from making rennet casein to

acid casein throughout August. In Oceania, increasing milk output is

enabling processors to increase acid casein production. Demand for

rennet casein is softening somewhat. Declining milk output in Europe

is contributing to reduced rennet casein production. Contacts report

production of and demand for rennet casein have been well balanced

in recent weeks. Spot purchasers say loads of rennet casein are

available.

Prices for: Spot Sales And Up to 3 Month Contracts, Free on Board - Warehouse,

Non-Restricted, All Mesh Sizes, Conventional, and Edible Casein

Acid; Price Range - $/LB: 3.6000 - 3.9000

Rennet; Price Range - $/LB: 3.4000 - 3.8000

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024 -7- VOLUME 91, REPORT 34

U.S. Dairy Cow Slaughter (1000 head) under Federal Inspection

2024 WEEKLY 2024 2023 WEEKLY 2023

WEEK ENDING DAIRY COWS CUMULATIVE DAIRY COWS DAIRY COWS CUMULATIVE DAIRY COWS

8/10/2024 50.2 1,686.2 61.9 1,975.1

WEBSITE: http://www.ams.usda.gov/mnreports/ams_3658.pdf

SOURCE: The slaughter data are gathered and tabulated in a cooperative effort by the Agricultural Marketing Service, the Food Safety and Inspection Service, and the National

Agricultural Statistics Service, all of USDA

FEDERAL MILK ORDER CLASS III MILK PRICES (3.5% Butterfat)

YEAR

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

2019

13.96

13.89

15.04

15.96

16.38

16.27

17.55

17.60

18.31

18.72

20.45

19.37

2020

17.05

17.00

16.25

13.07

12.14

21.04

24.54

19.77

16.43

21.61

23.34

15.72

2021

16.04

15.75

16.15

17.67

18.96

17.21

16.49

15.95

16.53

17.83

18.03

18.36

2022

20.38

20.91

22.45

24.42

25.21

24.33

22.52

20.10

19.82

21.81

21.01

20.50

2023

19.43

17.78

18.10

18.52

16.11

14.91

13.77

17.19

18.39

16.84

17.15

16.04

FEDERAL MILK ORDER CLASS IV MILK PRICES (3.5% Butterfat)

YEAR

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

2019

15.48

15.86

15.71

15.72

16.29

16.83

16.90

16.74

16.35

16.39

16.60

16.70

2020

16.65

16.20

14.87

11.40

10.67

12.90

13.76

12.53

12.75

13.47

13.30

13.36

2021

13.75

13.19

14.18

15.42

16.16

16.35

16.00

15.92

16.36

17.04

18.79

19.88

2022

23.09

24.00

24.82

25.31

24.99

25.83

25.79

24.81

24.63

24.96

23.30

22.12

2023

20.01

18.86

18.38

17.95

18.10

18.26

18.26

18.91

19.09

21.49

20.87

19.23

FEDERAL MILK ORDER CLASS PRICES FOR 2024 (3.5% Butterfat)

CLASS

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

I (BASE)

18.48

17.99

18.80

19.18

18.46

20.08

21.11

21.32

21.60

II

20.04

20.53

21.12

21.23

21.50

21.60

21.82

III

15.17

16.08

16.34

15.50

18.55

19.87

19.79

IV

19.39

19.85

20.09

20.11

20.50

21.08

21.31

Further information may be found at: https://www.ams.usda.gov/rules-regulations/mmr/dmr

NATIONAL DAIRY PRODUCTS SALES REPORT

U.S. AVERAGES AND TOTAL POUNDS

WEEK ENDING

8/17/2024

BUTTER

3.1155

2,717,037

CHEESE 40# BLOCKS

1.9655

9,162,764

CHEESE BARRELS

38% MOISTURE

2.0070

11,329,371

DRY WHEY

.4925

6,595,638

NDM

1.2230

17,646,731

Further data and revisions may be found on the internet at: http://www.ams.usda.gov/rules-regulations/mmr/dmr

CME GROUP, INC FUTURES

Selected settling prices

CLASS III MILK FUTURES (Pit-Traded) ($/cwt)

DATE

08/16

08/19

08/20

08/21

08/22

AUG 24

20.57

20.62

20.60

20.65

20.67

SEP 24

21.91

22.30

22.50

22.61

21.98

OCT 24

22.04

22.45

22.68

22.85

22.19

CLASS IV MILK FUTURES (Pit-Traded) ($/cwt)

DATE

08/16

08/19

08/20

08/21

08/22

AUG 24

21.66

21.66

21.66

21.66

21.66

SEP 24

22.23

22.23

22.36

22.36

22.36

OCT 24

22.41

22.46

22.54

22.55

22.55

CASH SETTLED BUTTER FUTURES (Electronic-Traded) (¢/lb)

DATE

08/16

08/19

08/20

08/21

08/22

AUG 24

313.50

314.00

314.00

314.00

313.58

SEP 24

323.00

322.55

322.50

320.50

317.85

OCT 24

325.53

325.55

325.00

325.05

322.33

NONFAT DRY MILK FUTURES (Pit-Traded) (¢/lb)

DATE

08/16

08/19

08/20

08/21

08/22

AUG 24

122.63

122.63

122.65

122.65

122.65

SEP 24

125.10

125.50

126.78

126.73

126.73

OCT 24

126.00

126.43

127.88

127.65

128.20

WHEY (Electronic-Traded) (¢/lb)

DATE

08/16

08/19

08/20

08/21

08/22

AUG 24

49.00

49.00

49.00

49.00

49.00

SEP 24

53.50

54.50

54.00

54.75

54.00

OCT 24

55.00

55.00

55.53

56.25

55.00

BLOCK CHEESE CSC (Electronic-Traded) ($/lb)

DATE

08/16

08/19

08/20

08/21

08/22

AUG 24

1.96

1.96

1.96

1.96

1.97

SEP 24

2.11

2.13

2.14

2.14

2.08

OCT 24

2.13

2.13

2.13

2.14

2.09

Further information may be found at: http://www.cmegroup.com/market-data/daily-bulletin.html

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024

-8-

VOLUME 91, REPORT 34

ORGANIC DAIRY MARKET NEWS

Information gathered August 12 - 23, 2024

ORGANIC DAIRY MARKET OVERVIEW

The Transition to Organic Partnership Program (TOPP) was formed through

cooperative agreements between the USDA and non-profit organizations to

provide technical assistance and support for transitioning and existing organic

farmers. A calendar of events held by partner organizations can be found at the

following link: https://www.organictransition.org/events/

A selection of upcoming events is included below:

VABF's Demystifying Organic Workshop, Mineral VA - August 24

WVFFC's Barnyard Banter, virtual - August 25

OGRAIN's Organic Research Field Day, Arlington, WI - August 26

IAC's 2024 Pacific California Summit, Redwood Valley, CA - August 27-28

IOA's Wholesale Organic Dairy Production, Decorah, IA - August 27

University of Minnesota's Intro to Organic Grain, Glencoe, MN - August 28

The USDA AMS National Organic Program (NOP) provides an email notifica-

tion service to send out updates to the organic community. The Organic Insider

sent out on August 22nd discussed courses available online through the Organic

Integrity Learning Center. One new course, the Organic Livestock and Poultry

Standards (OLPS) Final Rule Core Course, was created to teach certifiers, in-

spectors, and producers about updated USDA organic regulation requirements

established by the OLPS final rule, published in November 2023. To read more

about available courses and the Organic Integrity Learning Center, view ar-

chives, or register to receive updates by email visit: https://www.ams.usda.gov/

reports/organic-insider

A non-profit third-party certification group, which requires businesses to meet

specific standards of performance, accountability, and transparency across the

supply chain, recognized an organic dairy company based in the US and one in

Australia. A spokesperson for both companies stated the recognition emphasiz-

es their dedication to responsible business and keeping sustainability at the

forefront for both companies. The spokesperson further stated the companies

are focused on having a culture which improves business for their employees,

the environment, and their communities.

New organic standards established by the USDA with the updated Organic

Livestock and Poultry Standards aim to improve animal treatment on organic

farms. The updated standards include providing livestock with maintained out-

door space year-round, increased minimum space available for animal, and

disease treatment to reduce pain, stress, and suffering for livestock. The new

rules further ban some practices, such as tail docking and wattling livestock.

Certified organic operations must meet compliance with the new rules by Janu-

ary 2, 2025. More information about the standards can be found by visiting:

https://www.ams.usda.gov/rules-regulations/organic-livestock-and-poultry-

standards

ORGANIC DAIRY FLUID OVERVIEW

The Agricultural Marketing Service (AMS) reported June 2024 estimated fluid

product sales. The U.S. sale of total organic milk products was 234 million

pounds, up 4.4 percent from the previous year and up 6.0 percent year-to-date.

Organic whole milk sales, 117 million pounds, rose 4.6 percent compared to a

year earlier and increased 12.7 percent year-to-date. Reduced fat milk (2%)

sales were 78 million pounds, up 7.6 percent from the previous year and up 4.0

percent year-to-date. Organic flavored whole milk sales, 1 million pounds,

increased 19.1 percent from the previous year and increased 12.4 percent year-

to-date.

In a recent report from a Pacific Northwest livestock auction, the top 10 organic

cull cows traded lower than conventional cull cows, and the overall average for

organic cull cow prices traded lower than the overall average for conventional

cull cows. The average price for the top 10 organic cows auctioned was

$121.53 per hundredweight, compared to an average price of $136.38 per hun-

dredweight for auctioned top 10 conventional cows. The average weight for the

top 10 conventional cows was 1598.5 pounds compared to 1362.0 pounds for

the top 10 organic cows. The overall average price for organic cows auctioned

was $94.95 per hundredweight with an average weight of 1200.58 pounds,

while the overall average price for conventional cows auctioned was $109.98

per hundredweight and with an average weight of 1265.48 pounds.

Federal Milk Market Order 1, in New England, reports utilization of types of

organic milk by pool plants. During July 2024, organic whole milk utilization

totaled 19.57 million pounds, up from 16.63 million pounds the previous year.

The butterfat content, 3.27 percent, is down from 3.28 a year ago. The utiliza-

tion of organic reduced fat milk, 15.97 million pounds, increased from 14.51

million pounds a year ago. The butterfat content, 1.47 percent, is up from 1.44

percent the previous year.

ESTIMATED TOTAL U.S. SALES OF ORGANIC FLUID MILK PRODUCTS

June 2024, with comparisons

Sales

1

Sales

1

% Change % Change

Product Name June Y-T-D Prev Yr. Y-T-D

Organic Production Practice

Whole Milk 117 778 4.6 12.7

Flavored Whole Milk 1 5 19.1 12.4

Reduced Fat Milk (2%) 78 478 7.6 4.0

Low Fat Milk (1%) 20 127 - 10.0 - 9.8

Fat-Free Milk (Skim) 10 67 - 6.4 - 12.3

Flavored Fat-Reduced Milk 7 41 47.2 - 2.9

Other Fluid Milk Products 0 2 77.8 6.8

Total Fat-Reduced Milk 115 712 4.5 - 0.5

Total Organic Milk Products 234 1,497 4.4 6.0

1. Sales in million pounds. Data may not add due to rounding

NATIONAL ORGANIC GRAIN FEEDSTUFF

Compared to last period: Trade was moderate on light to moderate demand.

Organic feed corn sold 10 cents higher delivered elevator with the bulk of mar-

ket activity on forward contracts delivering Q3 2024 through Q3 2025. Organic

feed soybeans sold 72 cents higher delivered elevator with forward contracts

delivering Q3 2024 through Q1 2025. There were no comparable spot market

trades for organic feed wheat and soybean meal. Organic soybean oil sold 4

cents higher FOB the crush facility. Trade inactive on all other organic grains.

The next available report will be Wednesday, September 4, 2024.

Grower FOB Farm Gate Organic Grain

Spot Transactions Forward Contracts

Feed Grade

Price Ran

g

e Av

g

. Chan

g

e Prior Year Price Ran

g

e Deliver

y

Period Price Ran

g

e

Yellow Corn 5.85 - 7.00 6.68 -0.19 9.11 5.85 - 7.20 Aug-24 - May-25 N/A - N/A

Soybeans 19.00 - 20.25 19.58 0.14 20.00 18.00 - 19.75 Aug-24 - Dec-24 N/A - N/A

Wheat N/A - N/A N/A N/A N/A N/A - N/A N/A - N/A N/A - N/A

Oats N/A - N/A N/A N/A N/A N/A - N/A N/A - N/A N/A - N/A

Barley N/A - N/A N/A N/A N/A N/A - N/A N/A - N/A N/A - N/A

Rye N/A - N/A N/A N/A N/A N/A - N/A N/A - N/A N/A - N/A

Sorghum N/A - N/A N/A N/A N/A N/A - N/A N/A - N/A N/A - N/A

*All prices in $/bu

Cash Bids

ORGANIC DAIRY RETAIL OVERVIEW

The retail ad survey contained an all-time high for organic dairy ads during last

week's retail survey after the total number of ads increased by 52 percent from

week 32. Following the week 33 retail ad survey, the total number of organic

dairy ads declined by 79 percent in the week 34 survey. Yogurt overtook milk

as the most advertised organic dairy commodity this week. Both commodities

appeared in fewer ads than in week 33, but the number of organic yogurt ads

decreased by 30 percent while organic milk ads dropped by 92 percent. Organic

ice cream appeared in the week 34 retail ad survey, after not appearing in the

week 33 survey.

CONTINUED ON PAGE 8A

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024

-8A-

VOLUME 91, REPORT 34

ORGANIC DAIRY MARKET NEWS

Information gathered August 12 - 23, 2024

CONTINUED FROM PAGE 8

The most advertised organic yogurt product during week 34 was regular yogurt

in 32-ounce containers, despite appearing in 46 percent fewer ads than in week

33. The weighted average advertised price of organic regular yogurt in 32-ounce

containers this week was $4.03, down 88 cents from last week. Conventional

regular yogurt in 32-ounce containers had a weighted average advertised price

of $2.67 this week. The organic premium for this item during week 34 was

$1.36.

Organic gallon milk did not appear in the week 34 retail ad survey after appear-

ing in last week's survey, and the number of ads for half gallon organic milk

declined by 90 percent this week. The weighted average advertised price for

organic half gallon milk was up 14 cents this week, to $5.03. The weighted

average advertised price for conventional half gallon milk was $2.17 in week

34, creating an organic premium of $2.86 this week.

Cheese had the largest percentage growth of organic dairy commodities during

the week 34 retail ad survey, growing by 317 percent from week 33. Cheese

sold in 6-8-ounce shred style packaging was the most advertised organic cheese

product in this week's survey, after not appearing in week 33. The weighted

average advertised price for conventional 6-8-ounce shred style cheese was

$2.45 this week, while the organic counterpart had a weighted average adver-

tised price of $3.00. The week 34 organic premium for 6-8-ounce shred style

cheese was 55 cents.

NATIONAL RETAIL ORGANIC DAIRY

WEIGHTED AVERAGE ADVERTISED PRICES

This Last Last

COMMODITY Week Week Year

Butter

1 lb. $7.49 $7.46 n.a.

Cheese

6-8 oz. Block n.a. n.a. $3.50

6-8 oz. Shred $3.00 n.a. $3.85

6-8 oz. Sliced $6.84 $5.57 $5.24

1 lb. Shred $8.99 n.a. n.a.

Cottage Cheese

16 oz. $4.49 $5.54 $4.99

Cream Cheese

8 oz. $5.79 $3.46 $5.39

Ice Cream

14-16 oz. $8.14 n.a. $5.19

Milk

Half Gal $5.03 $4.89 $5.51

Gallon n.a. $7.85 $6.98

Sour Cream

16 oz. $2.50 $4.12 $4.67

Yogurt

4-6 oz. Yogurt $1.25 n.a. $1.50

32 oz. Greek $5.33 $6.40 $5.17

32 oz. Yogurt $4.03 $4.91 $3.99

DAIRY MARKET NEWS, AUGUST 19 - 23, 2024 -9- VOLUME 91, REPORT 34

July Milk Production

Milk production in the 24 major States during July totaled 18.2 billion pounds, down 0.2 percent from July 2023. June revised

production, at 17.9 billion pounds, was down 1.5 percent from June 2023. The June revision represented a decrease of 137 million pounds

or 0.8 percent from last month's preliminary production estimate.

Production per cow in the 24 major States averaged 2,047 pounds for July, 2 pounds above July 2023.

The number of milk cows on farms in the 24 major States was 8.88 million head, 31,000 head less than July 2023, but 3,000 head more

than June 2024.

July 2024 Milk Cows and Milk Production, by States

State

Milk Cows

1

Milk per Cow

2

Milk Production

2

2023 2024 2023 2024 2023 2024

Change from

2023

(thousands) (pounds) (million pounds) (percent)

AZ 198

1,714

200

98

90

666

189 1,910 1,905 378 360 -4.8

CA 1,709 1,940 1,940 3,325 3,315 -0.3

CO 201 2,205 2,155 441 433 -1.8

FL 99 1,690 1,705 166 169 1.8

GA 85 1,780 1,865 160 159 -0.6

ID 667 2,195 2,170 1,462 1,447 -1.0

IL 79 78 1,810 1,800 143 140 -2.1

IN 190 189 2,005 2,015 381 381 -

IA 242 241 2,100 2,095 508 505 -0.6

KS 169 173 1,985 1,995 335 345 3.0

MI 439 436 2,360 2,355 1,036 1,027 -0.9

MN 451 442 2,000 1,960 902 866 -4.0

NM 270 239 1,995 2,055 539 491 -8.9

NY 630 630 2,200 2,195 1,386 1,383 -0.2

OH 253 252 1,900 1,920 481 484 0.6

OR 120 118 1,800 1,795 216 212 -1.9

PA 466 465 1,755 1,755 818 816 -0.2

SD 197 212 1,985 1,980 391 420 7.4

TX 635 653 2,110 2,175 1,340 1,420 6.0

UT 91 90 2,000 2,010 182 181 -0.5

VT 117 114 1,840 1,820 215 207 -3.7

VA 68 66 1,740 1,745 118 115 -2.5

WA 257 260 2,050 2,050 527 533 1.1

WI 1,269 1,270 2,180 2,175 2,766 2,762 -0.1

24 State

Total

8,909 8,878 2,045 2,047 18,216 18,171 -0.2

1

Includes dry cows. Excludes heifers not yet fresh.

2

Excludes milk sucked by calves.

Source: U.S. Department of Agriculture. National Agricultural Statistics Service. Agricultural Statistics Board. Milk Production,

(August 2024).

DAIRY MARKET NEWS, AUGUST 19 – 23, 2024 -10- VOLUME 91, REPORT 34

June 2024 Milk Sales

Total Fluid Products Sales 3.2 billion pounds of packaged fluid milk products were shipped by milk handlers in June

2024. This was 2.9 percent lower than a year earlier. Estimated sales of total conventional fluid milk products

decreased 3.4 percent from June 2023 and estimated sales of total organic fluid milk products increased 4.4 percent

from a year earlier.

Product Name

Sales

1 2

Change from:

Jun Year to Date Previous Year Year to Date

Conventional Production Practice (million pounds) (percent)

Whole Milk

1,196 7,542 -2.4 2.2

Flavored Whole Milk

55 362 -9.4 1.6

Reduced Fat Milk (2%)

910 5,847 -8.5 -4.8

Low Fat Milk (1%)

306 2,276 -7.2 0.9

Fat-Free Milk (Skim)

141 940 -13.9 -12.9

Flavored Fat-Reduced Milk

141 1,673 0.4 1.1

Buttermilk

33 218 -8.5 -2.2

Other Fluid Milk Products

178 961 56.1 41.3

Total Fat-Reduced Milk

3

1,497 10,736 -8.0 -3.6

Total Conventional Milk Products

2,959 19,818 -3.4 0.2

Organic Production Practice

Whole Milk

117 778 4.6 12.7

Flavored Whole Milk

1 5 19.1 12.4

Reduced Fat Milk (2%)

78 478 7.6 4.0

Low Fat Milk (1%)

20 127 -10.0 -9.8

Fat-Free Milk (Skim)

10 67 -6.4 -12.3

Flavored Fat-Reduced Milk

7 41 47.2 2.9

Other Fluid Milk Products

0 2 -77.8 6.8

Total Fat-Reduced Milk

3

115 712 4.5 -0.5

Total Organic Milk Products

234 1,497 4.4 6.0

Total Fluid Milk Products

2

3,192 21,316 -2.9 0.6

1

These figures are representative of the consumption of fluid milk products in Federal milk order marketing areas, which account for approximately 92 percent of total fluid milk sales in

the United States. An estimate of total U.S. fluid milk sales is derived by extrapolating the remaining 8 percent of sales from the Federal milk order data. Reported volumes do not include

added non-dairy ingredients such as sweeteners or flavorings.

2

Data may not add due to rounding.

3

Both conventional and organic fat-reduced milk categories are the total of reduced fat,

lowfat, skim and flavored fat-reduced milk.

Package Sales of Total Fluid Milk Products in Federal Milk Orders,

June 2024, with Comparisons

1

Marketing Area

Order

Number

Sales

2

Change from:

Jun Year to Date Previous Year Year to Date

(million pounds) (percent)

Northeast 001

515 3,375 -4.1 0.2

Appalachian 005

239 1,590 -5.5 -0.4

Florida 006

197 1,315 0.2 1.6

Southeast 007

253 1,740 -8.0 -0.4

Upper Midwest 030

210 1,414 -7.7 -3.2

Central 032

272 1,837 -3.4 1.4

Mideast 033

385 2,556 4.8 1.5

California 051

359 2,367 -3.6 0.1

Pacific Northwest 124

121 798 -4.6 -0.7

Southwest 126

306 2,086 -0.5 3.6

Arizona 131

79 532 -0.1 4.0

All Areas (Totals) ¹

2,937 19,610 -2.9 0.6

1

These figures are representative of the consumption of total fluid milk products in the respective area. Reported volumes do not include added non-dairy ingredients such as sweeteners

or flavorings.

2

Data may not add due to rounding.

DAIRY MARKET NEWS, AUGUST 19 – 23, 2024 -11-

VOLUME 91, REPORT 34

Advanced Class Prices by Order, September 2024

September 2024 Highlights

Base Class I Price: The base Class I price for September 2024 is $21.60 per cwt, an increase of

$0.28 per cwt when compared to August 2024. A Class I differential for each order's principle pricing

point (county) is added to the base price to determine the Class I Price.

Class II Price Information: For September 2024, the advanced Class IV skim milk pricing factor is

$9.39 per cwt, the Class II skim milk price is $10.09 per cwt, and the Class II nonfat solids price is

$1.1211 per pound.

Product Price Averages: The two-week product price averages for September 2024 are: butter

$3.1061, nonfat dry milk $1.2212, cheese $1.9985, and dry whey $0.4848.

Advanced Class Prices by Order for September 2024

Federal Milk Order Class I Price Information

1, 2

Sep 2024

Federal Milk Order

Marketing Area

3

Order

Number

Class I

Class I

Class I

Price

Skim Milk

Butterfat

(3.5%)

Price

4

Price

(dollars per cwt)

(dollars per cwt)

(dollars per pound)

Northeast (Boston)

001

24.85

12.74

3.5863

Appalachian (Charlotte)

005

25.00

12.89

3.5878

Florida (Tampa)

006

27.00

14.89

3.6078

Southeast (Atlanta)

007

25.40

13.29

3.5918

Upper Midwest (Chicago)

030

23.40

11.29

3.5718

Central (Kansas City)

032

23.60

11.49

3.5738

Mideast (Cleveland)

033

23.60

11.49

3.5738

California (Los Angeles)

051

23.70

11.59

3.5748

Pacific Northwest (Seattle)

124

23.50

11.39

3.5728

Southwest (Dallas)

126

24.60

12.49

3.5838

Arizona (Phoenix)

131

23.95

11.84

3.5773

All-Market Average

24.42

12.31

3.5820

1

To convert the Class I price per 100 pounds to the Class I price per gallon, divide by 11.63 - the approximate number of

gallons in 100 pounds of milk.

2

The mandatory $0.20 per cwt processor assessment under the Fluid Milk Promotion Order

is not included in the Class I prices shown in this table.

3

Names in parentheses are the major city in the principal pricing

point of the markets.

4

Please see the Advanced Prices and Pricing Factors Announcement:

https://www.ams.usda.gov/mnreports/dymadvancedprices.pdf

.

National Retail Report - Dairy

Agricultural Marketing Service

Dairy Market News Branch

Volume 91 - Number 34

Email us with accessibility issues with this report.

Friday, August 23, 2024

Fri Aug 23, 2024

Issued Weekly

Conventional dairy ads decreased by 2 percent and organic dairy ads decreased by 79 percent this week. Cheese was

easily on top in terms of the most advertised conventional dairy commodity. Conventional 6-8 ounce packages of sliced,

shredded and block cheese have weighted average advertised prices of $2.52, $2.45, and $2.31, respectively. Both the

sliced and shredded style cheeses made appearances in ads more than twice as often compared to the block style for the

6-8 ounce package size. However, the block style had the biggest price decrease for this package size compared to the

previous week, which was 30 cents.

Ice cream and yogurt were both heavily advertised this week. In the context of total conventional ads, ice cream was

slightly ahead of yogurt, despite a 24 percent decrease in total conventional ice cream ads this week compared to the

week prior. Ads for ice cream in a 48-64 ounce container were more prevalent than ice cream in a 14-16 ounce container.

The weighted average advertised price for ice cream in a 48-64 ounce container was $4.01, which represents a 33 cent

decrease from last week.

Conventional yogurt had a 5 percent increase in total ads, while organic yogurt had a 30 percent decrease in total ads.

Conventional Greek yogurt was more heavily advertised than conventional regular yogurt for both the 4-6 ounce and 32

ounce container sizes. The weighted average advertised prices for conventional Greek yogurt in 4-6 ounce containers and

32 ounce containers were $1.08 and $4.09, respectively.

For unflavored milk, total conventional milk ads had a marginal increase this week of 1 percent. Conventional gallon

containers of milk and half gallon containers of milk had weighted average advertised prices of $3.33 and $2.17,

respectively. The organic premium for a half gallon container of milk this week is $2.86.

Advertised Prices for Dairy Products at Major Retail Supermarket Outlets ending during

the period of 8/23/2024 to 8/29/2024

National Retail Report - Dairy Vol 91 - No. 34

Friday, August 23, 2024 - Page 2

National Retail Report - Dairy Vol 91 - No. 34

Friday, August 23, 2024 - Page 3

NATIONAL -- CONVENTIONAL DAIRY PRODUCTS

Dairy

THIS PERIOD

LAST WEEK

LAST YEAR

Commodity

Type

Pack Size

Stores

With Ads

Wtd Avg

Price

Stores

With Ads

Wtd Avg

Price

Stores

With Ads

Wtd Avg

Price

Butter

8 oz

2951

2.48

3245

2.49

606

2.95

Butter

1 lb

3072

4.70

2456

4.43

4254

4.20

Cheese

Natural Varieties

6-8 oz Block

5060

2.31

5445

2.61

4836

2.72

Cheese

Natural Varieties

6-8 oz Shred

12571

2.45

13184

2.50

6131

2.44

Cheese

Natural Varieties

6-8 oz Sliced

15221

2.52

12535

2.72

7423

2.19

Cheese

Natural Varieties

1 lb Block

1074

4.46

783

4.62

441

3.88

Cheese

Natural Varieties

1 lb Shred

3677

5.44

5800

5.52

508

4.89

Cheese

Natural Varieties

1 lb Sliced

2688

2.55

423

4.06

380

3.49

Cheese

Natural Varieties

2 lb Block

771

7.65

1207

6.53

523

8.74

Cheese

Natural Varieties

2 lb Shred

4155

7.71

4922

7.19

966

7.62

Cottage Cheese

16 oz

1967

2.71

1425

2.26

1630

2.82

Cottage Cheese

24 oz

5556

3.70

4610

3.76

369

3.49

Cream Cheese

8 oz

4562

2.87

4667

2.93

2900

2.68

Flavored Milk

All Fat Tests

Half Gallon

1400

2.33

240

3.77

2474

1.49

Flavored Milk

All Fat Tests

Gallon

425

4.55

199

4.78

Ice Cream

14-16 oz

7855

3.72

8611

4.06

8379

3.62

Ice Cream

48-64 oz

13194

4.01

18993

4.34

11850

3.91

Milk

All Fat Tests

Half Gallon

1584

2.17

426

1.52

3168

1.65

Milk

All Fat Tests

Gallon

5139

3.33

6207

3.42

2332

3.56

Sour Cream

16 oz

3631

2.09

4544

2.26

2462

2.41

Sour Cream

24 oz

792

2.84

1089

2.94

671

2.69

Yogurt

Greek

4-6 oz

6301

1.08

6646

1.11

3844

1.01

Yogurt

Yogurt

4-6 oz

3633

0.57

5907

0.61

2848

0.61

Yogurt

Greek

32 oz

5416

4.09

3799

4.03

3072

3.87

Yogurt

Yogurt

32 oz

5344

2.67

3388

2.97

391

3.14

National Retail Report - Dairy Vol 91 - No. 34

Friday, August 23, 2024 - Page 4

REGIONAL -- CONVENTIONAL DAIRY PRODUCTS

NORTHEAST U.S.

SOUTHEAST U.S.

MIDWEST U.S.

Commodity

Type

Pack Size

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Butter

8 oz

2.50 - 3.00

297

2.68

2.42

1341

2.42

Butter

1 lb

3.49 - 5.99

869

4.95

4.99 - 5.89

400

5.50

3.49 - 3.89

250

3.59

Cheese

Natural Varieties

6-8 oz Block

1.99 - 3.99

1143

2.56

1.99 - 3.00

1284

2.08

2.00

770

2.00

Cheese

Natural Varieties

6-8 oz Shred

1.77 - 3.99

3249

2.53

1.89 - 3.50

3537

2.34

1.99 - 3.00

1811

2.35

Cheese

Natural Varieties

6-8 oz Sliced

1.65 - 3.99

2737

2.36

1.65 - 3.50

4560

2.56

1.65 - 3.49

2042

2.58

Cheese

Natural Varieties

1 lb Block

3.99

404

3.99

3.99 - 4.99

419

4.86

5.99

83

5.99

Cheese

Natural Varieties

1 lb Shred

4.24 - 4.59

260

4.49

3.99 - 5.64

1760

5.46

5.99

83

5.99

Cheese

Natural Varieties

1 lb Sliced

2.48

1341

2.48

Cheese

Natural Varieties

2 lb Block

7.99

162

7.99

Cheese

Natural Varieties

2 lb Shred

7.99

352

7.99

7.47 - 9.99

1935

7.87

5.99

96

5.99

Cottage Cheese

16 oz

1.99 - 3.49

1188

2.59

2.50

73

2.50

2.00 - 2.50

332

2.28

Cottage Cheese

24 oz

3.50 - 3.99

137

3.71

3.29 - 3.94

1935

3.81

1.99 - 3.99

329

2.78

Cream Cheese

8 oz

3.00 - 3.99

379

3.28

1.99 - 4.00

1953

3.08

1.25 - 2.99

1193

2.44

Flavored Milk

All Fat Tests

Half Gallon

2.50

228

2.50

Flavored Milk

All Fat Tests

Gallon

3.99

83

3.99

Ice Cream

14-16 oz

2.99 - 6.99

1704

3.98

2.99 - 5.99

2523

3.50

2.99 - 4.99

841

3.47

Ice Cream

48-64 oz

2.88 - 6.89

3506

3.90

2.00 - 5.99

3125

3.47

2.99 - 4.99

1782

3.98

Milk

All Fat Tests

Gallon

3.70 - 4.09

992

3.90

3.20

1341

3.20

3.01 - 3.99

975

3.09

Sour Cream

16 oz

1.69 - 2.99

1354

2.24

1.89 - 2.00

347

1.96

1.25 - 2.29

497

1.77

Sour Cream

24 oz

2.49

119

2.49

Yogurt

Greek

4-6 oz

0.99 - 1.33

1720

1.17

0.70 - 1.25

1135

1.01

1.00

460

1.00

Yogurt

Yogurt

4-6 oz

0.40 - 0.70

874

0.59

0.40 - 0.75

684

0.65

0.49 - 0.59

866

0.52

Yogurt

Greek

32 oz

4.99 - 5.99

342

5.22

3.54 - 5.99

3349

4.02

Yogurt

Yogurt

32 oz

2.19 - 3.00

1041

2.78

2.49 - 2.56

2514

2.53

3.49 - 4.00

189

3.78

National Retail Report - Dairy Vol 91 - No. 34

Friday, August 23, 2024 - Page 5

SOUTH CENTRAL U.S.

SOUTHWEST U.S.

NORTHWEST U.S.

Commodity

Type

Pack Size

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Butter

8 oz

2.42 - 3.59

1313

2.50

Butter

1 lb

3.99 - 4.99

143

4.51

3.49 - 5.49

354

4.65

3.49 - 5.98

1027

4.47

Cheese

Natural Varieties

6-8 oz Block

1.99 - 3.50

778

2.57

2.00 - 2.50

734

2.41

1.97 - 2.00

285

1.98

Cheese

Natural Varieties

6-8 oz Shred

1.66 - 3.99

1820

2.87

1.97 - 3.00

1377

2.43

0.97 - 2.24

700

1.71

Cheese

Natural Varieties

6-8 oz Sliced

1.65 - 3.79

3713

2.60

1.65 - 2.99

1730

2.38

2.58 - 3.00

366

2.81

Cheese

Natural Varieties

1 lb Block

3.49 - 3.99

159

3.83

Cheese

Natural Varieties

1 lb Shred

3.99 - 6.49

1403

5.56

5.64

162

5.64

Cheese

Natural Varieties

1 lb Sliced

2.48 - 3.99

1347

2.62

Cheese

Natural Varieties

2 lb Block

6.99

115

6.99

6.99

352

6.99

8.98 - 9.99

142

9.41

Cheese

Natural Varieties

2 lb Shred

7.47

1221

7.47

6.99 - 9.99

551

7.81

Cottage Cheese

16 oz

3.49

374

3.49

Cottage Cheese

24 oz

3.87 - 3.94

2442

3.91

2.49 - 2.99

380

2.83

2.94 - 3.94

324

3.44

Cream Cheese

8 oz

1.79 - 3.49

660

2.85

2.49 - 2.99

359

2.85

Flavored Milk

All Fat Tests

Half Gallon

1.97

352

1.97

1.50 - 3.97

773

2.43

Flavored Milk

All Fat Tests

Gallon

3.04 - 6.32

324

4.68

Ice Cream

14-16 oz

2.47 - 5.49

891

4.26

2.99 - 5.00

1229

3.52

2.99 - 4.00

622

3.78

Ice Cream

48-64 oz

2.97 - 7.99

1923

5.31

2.99 - 7.99

1560

4.07

2.00 - 4.99

1219

3.63

Milk

All Fat Tests

Half Gallon

1.27 - 2.99

267

2.30

1.97

352

1.97

1.29 - 3.97

904

2.17

Milk

All Fat Tests

Gallon

1.97 - 3.00

1285

2.95

3.99

187

3.99

3.04 - 4.58

324

3.81

Sour Cream

16 oz

2.79

75

2.79

1.49 - 2.89

443

2.08

0.99 - 2.64

904

2.05

Sour Cream

24 oz

2.50

95

2.50

2.49 - 2.69

193

2.61

2.69 - 3.72

385

3.14

Yogurt

Greek

4-6 oz

0.80 - 1.50

582

1.10

0.99 - 1.25

1234

1.08

0.72 - 2.00

1118

1.00

Yogurt

Yogurt

4-6 oz

0.59 - 0.64

224

0.61

0.37 - 0.39

551

0.38

0.49 - 0.72

374

0.61

Yogurt

Greek

32 oz

3.54

1221

3.54

3.54 - 6.44

486

5.05

Yogurt

Yogurt

32 oz

2.56

1221

2.56

3.49

199

3.49

2.56

162

2.56

National Retail Report - Dairy Vol 91 - No. 34

Friday, August 23, 2024 - Page 6

ALASKA U.S.

HAWAII U.S.

Commodity

Type

Pack Size

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Price

Range

Stores

with

Ads

Wtd

Avg

Price

Butter

1 lb

4.26 - 5.57

29

4.86

Cheese

Natural Varieties

6-8 oz Block

1.97 - 2.33

20

2.17

3.00 - 3.47

46

3.23

Cheese