CONSUMER FINANCIAL PROTECTION BUREAU | MAY 2021

Office of Servicemember

Affairs Annual Report

January 1

– December 31 2020

1

Message from

Jim Rice

Assistant Director, Office of

Servicemember Affairs

The year 2020 was unpredictable and challenging for all Americans. The Consumer Financial

Protection Bureau’s Office of Servicemember Affairs (OSA) understands that our

servicemembers, veterans, and military families often face additional unique challenges that can

arise, such as short-notice deployments or being called to active duty during a national

emergency. Some servicemembers were faced with other significant financial challenges due to

the COVID-19 pandemic, especially when Permanent Change of Station (PCS) moves were

paused to mitigate the spread. These PCS changes were made for servicemember safety, but

there were unanticipated financial consequences to those servicemembers who had already

started making PCS plans.

1

This year, we utilized the technology and resources available at the Bureau to ensure that

servicemembers continue to receive the information and tools they need to make better-

informed financial decisions. While traditional in-person outreach events were canceled due to

the pandemic, we increased our digital presence through webinars, virtual conferences,

podcasts, blogs, email outreach, and social media. We also enhanced our Misadventures in

Money Management (MiMM) program, our flagship online educational product, to include a

module focused on military families to help those financially impacted by COVID-19.

In coordination with other Bureau offices, the OSA monitors complaints from servicemembers,

veterans, and military families. Over time, the number of complaints from the military

community has continued to increase as more people turn to the Bureau for help, and in 2020,

the Bureau received over 40,000 complaints from servicemembers, veterans, and their families.

1

See e.g. tpr.org/post/frozen-place-some-military-famil ies-have -waited-months-move-new-homes and

kpbs.org/news/2020/jul/02/thousands-mili tar y-moves-still-hold-cononavirus-re (visited October 9, 2020).

2

I am proud to share some of the great work done by the Bureau and the OSA in 2020,

highlighted in this report. Even though the pandemic has changed where we work and how we

interact with our colleagues, the Bureau remains committed to educating and empowering

servicemembers, monitoring their complaints, and coordinating with other state and federal

agencies to ensure their financial concerns are given the attention they deserve.

Sincerely,

Jim Rice

3

Contents

Contents .............................................................................................................................3

1. Executive summary......................................................................................................4

2. Educating and empowering military consumers..................................................6

2.1 COVID-19 response: financial help for servicemembers ......................... 6

2.2 Misadventures in Money Management .................................................... 7

2.3 Consumer Financial Protection Week and Military Consumer

Protection Month....................................................................................... 8

2.4 National Veterans and Military Families Month...................................... 9

2.5 Other education and empowerment outreach activities ........................... 10

3. Servicemember complaints ...................................................................................12

3.1 Complaints at a glance .................................................................................13

3.2 Servicemember complaint types ................................................................ 16

4. Military consumer research ...................................................................................32

4.1 Financially fit? Comparing the credit records of young servicemembers and civilians.. 32

4.2 Debt and delinquency after military service ............................................................... 35

5. The way ahead .........................................................................................................38

4

1. Executive summary

The Consumer Financial Protection Bureau’s (CFPB or Bureau) Office of Servicemember

Affairs (OSA) was created by the 2010 Dodd-Frank Wall Street Reform and Consumer

Protection Act (Dodd-Frank Act).

2

The OSA was given the following statutory

responsibilities:

3

• Educate and empower servicemembers and their families to make better-

informed decisions regarding consumer financial products and services;

• Monitor complaints by servicemembers and their families and responses to

those complaints by the Bureau or other appropriate federal or state agency;

and

• Coordinate efforts among federal and state agencies, as appropriate, regarding

consumer protection measures relating to consumer financial products and

services offered to, or used by, servicemembers and their families.

The OSA is also statutorily mandated to coordinate with the Federal Trade Commission

(FTC) and the Federal Reserve Board of Governors to ensure that servicemembers and their

families are educated and empowered to make better informed decisions regarding

consumer financial products and services offered by motor vehicle dealers, with a focus on

motor vehicle dealers near military installations. This partnership is meant to ensure that

complaints by servicemembers and their families concerning such motor vehicle dealers are

effectively monitored and responded to, and, where appropriate, enforcement action is

pursued by the authorized agencies.

4

The following report reviews our activities in fulfilling its statutory responsibilities

throughout the calendar year 2020, covering the period from January 1, 2020, to December

31, 2020.

Section 2 focuses on our work to educate and empower military consumers, including:

2

Pub. L. No. 111-203 (2010), 124 Stat. 1376.

3

See 12 U.S.C. § 5493(e).

4

Dodd-Frank Act, Pub. L. No. 111-203 (2010), § 1029(e).

5

• Activities to inform servicemembers about the financial education resources and tools

available to help them navigate economic challenges during the COVID-19 pandemic;

• Our flagship financial education program—Misadventures in Money Management

(MiMM)— and the release of its first military family learning module; and

• Outreach to the military community through meetings, training events, webinars,

briefings to leaders and stakeholders, and digital outreach through email, blog posts on

the Bureau’s website, and social media.

Section 2 also describes our coordination with federal and state government agencies in order to

create and disseminate financial education materials and streamline military consumers’ access

to protections and benefits in the financial marketplace.

Section 3 examines in-depth complaint data for the statutory function of monitoring complaints

from military consumers. The Bureau’s complaint process provides insights into the

fundamental problems that military consumers experience with financial products and services.

Finally, Section 4 summarizes landmark research in 2020 that examines servicemembers’ credit

profiles and how they co-evolve with military service. This research helps guide our financial

education and policy initiatives.

6

2. Educating and empowering

military consumers

The OSA works with offices across the Bureau, as well as external stakeholders, to educate

and empower military consumers to make better-informed decisions about consumer

financial products and services. In a traditional year, this work is accomplished through

financial education tools, educational briefings, and outreach events, but as a result of the

coronavirus pandemic, our resources shifted to virtual events and engagements.

Our statutory duties also include coordination with other federal and state agencies regarding

consumer protection measures relating to financial products and services offered to, or used by,

servicemembers and their families. In a normal year, this collaboration plays a significant role in

helping the Bureau reach and educate military consumers about financial protections. In 2020,

in particular, our work with federal and state agencies played a critical role in providing timely

support and addressing the immediate financial needs of servicemembers, veterans, and their

families who were financially impacted by the coronavirus pandemic.

2.1 COVID-19 response: financial help for

servicemembers

In response to COVID-19, the Bureau launched a dedicated online resource

to highlight tools

and information that consumers can use to protect themselves and manage their finances,

including information on topics such as mortgage and housing assistance, student loans, and

avoiding scams. For servicemembers specifically, the page links to an

OSA blog listing a host

of resources military personnel can access for immediate financial help during the pandemic

and to maintain their long-term financial well-being.

The highlighted resources include items such as:

• Emergency grants and zero-interest loans from the military aid societies;

• Special Department of Defense (DoD) pay and allowances for servicemembers

ordered to self-isolate or monitor for COVID-19;

7

• Mortgage forbearances authorized for servicemembers and veterans with

Department of Veterans Affairs (VA) home loans;

• Information on student loan forbearance; and

• Updates for student veterans regarding GI Bill benefits as classes converted to

online learning.

2.2 Misadventures in Money Management

In 2020, MiMM continued to serve as our flagship online educational product to provide

young servicemembers with a critical baseline of financial education through the power of

storytelling and gamification.

MiMM is a cutting edge, graphic novel where the user can choose their own adventure in a

virtual learning experience that trains future and current servicemembers to navigate

financial landmines in a fun and interactive way. It covers diverse topics, such as the

importance of building savings, purchasing an automobile, avoiding impulse purchases,

learning how debt can affect a military career, and understanding protections under the

Servicemembers Civil Relief Act.

Misadventures in Money Management (MiMM.gov) Character Selection Page

The program provides servicemembers with a learning environment using the latest

8

interactive gaming techniques and customizes their learning experience through characters

and elements within the game. The program is free and currently available for use by all

military personnel, including National Guard and Reserve members. The program is also

offered to future servicemembers in the military’s Delayed Entry Program, Junior Reserve

Officers’ Training Corps (JROTC), and Reserve Officers’ Training Corps (ROTC) to prepare

them for early-career financial decision-making.

In 2020, the MiMM experience was further enhanced by adding a

new module dedicated to

military families to address their specific financial needs. This module was created in

response to requests from nonprofit organizations that support military spouses. It is

important that the individual who manages the family finances has access to financial

education too, and often that person is the military spouse.

To date, MiMM has reached more than 40,000 future and current servicemembers, with

more than 91 percent of users reporting knowledge gained after using the platform.

2.3 Consumer Financial Protection Week

and Military Consumer Protection Month

In recognition of Consumer Financial Protection Week and Military Consumer Protection

Month in July 2020, we participated in a

joint webinar with the CFPB’s Office of Older

Americans and the Office of Community Affairs that highlighted specific initiatives for

vulnerable populations. Specifically, we talked about the importance of research in

understanding the financial well-being of military consumers and unveiled our first research

report that studied how the credit records of young servicemembers coevolve with military

service.

We also released two blogs for Military Consumer Protection Month. The first blog focused on

the ABCs of military consumer protection

and highlighted the Military Lending Act (MLA), the

Servicemembers Civil Relief Act (SCRA), the Fair Debt Collection Practices Act (FDCPA), and

the Fair Credit Reporting Act (FCRA). The second blog was co-authored with the FTC and DoD’s

Office of Financial Readiness (FINRED) and

spotlighted free tools, information and resources to

improve the financial well-being of military consumers not just during Military Consumer

Protection Month, but throughout the entire year.

9

2.4 National Veterans and Military Families

Month

During National Veterans and Military Families Month in November 2020, we worked on

a comprehensive and coordinated strategy with partner agencies and organizations to

reach and engage the military community with tools and resources to help them improve

their financial well-being. Specific initiatives included:

•

Released a blog kicking off National Veterans and Military Families Month

• Published OSA’s Debt and Delinquency after Military Service research report

• Released a joint blog with the VA and Department of Education (ED) on federal

student loan tools

• Participated in the Bureau’s Financial inTuition Repayment Podcast Series to

discuss tools to help with making decisions about financing an education and

selecting an educational institution

• Participated in a National Credit Union Administration (NCUA) Webinar to

promote Misadventures in Money Management (MiMM)

• Convened a virtual military consumer webinar with partner agencies and

organizations to discuss financial challenges facing servicemembers, veterans, and

their families in the financial marketplace

Our joint blog post with the VA and ED

highlighted some of the federal tools available to

help servicemembers, veterans, and military families pick the right school and make a

sound plan to pay for it. It’s critical that potential students do their own research before

using their GI Bill benefits as some schools have defrauded veterans by falsely promoting

educational benefits and using deceptive marketing tactics to target servicemembers,

veterans, and military families.

Our virtual military consumer webinar for National Veterans and Military Families Month

brought together over 225 attendees in addition to panelists from the VA, DoD,

Department of Housing and Urban Development (HUD), FTC, Federal Housing Finance

Agency (FHFA), and the Blue Star Families organization to showcase servicemembers’

experiences in the financial marketplace and highlight resources that protect and empower

them. During the conference, agencies discussed challenges facing today’s servicemembers

and highlighted some of the tools that they can use to overcome those challenges. A few of

the topics that were covered included identity theft, flexible options with VA home loans,

Military OneSource, and CFPB tools such as MiMM.

10

2.5 Other education and empowerment

outreach activities

In 2020, our outreach to servicemembers and stakeholders also included deploying and

amplifying our financial education tools through partners, engaging servicemembers and

military families at townhall-style listening sessions at military installations, convening

training events and conference presentations, and conducting digital outreach through

webinars, blog posts, email, and social media.

With a greater focus on virtual engagements as a result of the pandemic, we conducted

targeted webinars and digital engagements for military stakeholder groups with well-

established communications networks and nationally recognized professional associations

for financial educators, including:

• Co-Hosted the Financial Readiness Network Conference in February 2020 with

DoD’s FINRED to provide critical financial resources and educational tools to

servicemembers. The conference brought 112 representatives from 55 different

government and non-governmental organizations to discuss issues facing

servicemembers in the financial marketplace.

• Wrote a joint blog with DoD FINRED about

tax refund products and how

servicemembers can take advantage of free tax preparation services. This blog came to

fruition after first coordinating with the Internal Revenue Service (IRS) to better

understand how servicemembers file their tax returns and examining data around

their usage of tax refund products like Refund Anticipation Checks and Refund

Advance Loans.

• Coordinated with the IRS to provide military consumers with timely information on

the Economic Impact Payments (EIPs) in the Coronavirus Aid, Relief, and Economic

Security (CARES) Act. Specifically, our office was focused on helping veterans claim

EIPs and actively coordinated with the VA and many military and veteran service

organizations at the state and local levels to help disseminate this information,

including outreach to homeless veterans.

• Presented to military financial counselors during a CFPB FinEx Webinar for AFCPE®

(Association for Financial Counseling & Planning Education) on COVID-19 resources

for military personnel.

11

• Briefed military Personal Financial Managers on financial education tools during a

webinar hosted by DoD’s Military Families Learning Network.

• Participated in a roundtable panel discussion on military and veteran community

perspectives at the Association of Military Banks of America’s 2020 Virtual Fall

Workshop.

• Partnered with the DoD to conduct a virtual state-level financial education roundtable

with officials from the U.S. Air Force and the Montana National Guard.

• Collaborated with the Atlanta Federal Reserve Bank and the VA to conduct webinars

to ensure intermediaries in the field were aware of the Bureau’s tools and resources for

military consumers.

In a collaborative effort with federal government agency partners and non-profit

organizations, we distributed financial education campaign messages and publications for

servicemembers. For example, a partnership with DoD’s FINRED and the Defense Finance

and Accounting Service enabled us to reach 1.2M servicemembers through leave and earning

statements and promote the Bureau’s resources and tools for building emergency savings

and

saving in order to reach future financial goals.

12

3. Servicemember complaints

Consumer complaints made to the Bureau provide us with near real-time information about the

types of challenges consumers experience with financial products and services and how

companies are responding to their concerns. This function has been even more important

during the past year as the country faced a global pandemic that had repercussions across the

financial marketplace.

Due to the unique financial challenges servicemembers, veterans, and military families

(collectively referred to as “servicemembers”) face as a result of their service, our office actively

monitors complaints and the responses they receive from companies. In 2020, the Bureau

received over 40,800 servicemember complaints

5

– a 14 percent increase from 2019 – and the

largest annual complaint volume from servicemembers since the Bureau’s inception in 2011.

While complaints mentioning coronavirus or related keywords represented roughly 8% of

submissions from servicemembers in 2020, the absence of coronavirus keywords in a complaint

does not necessarily mean the complaint was not related to the financial impact of the

pandemic.

6

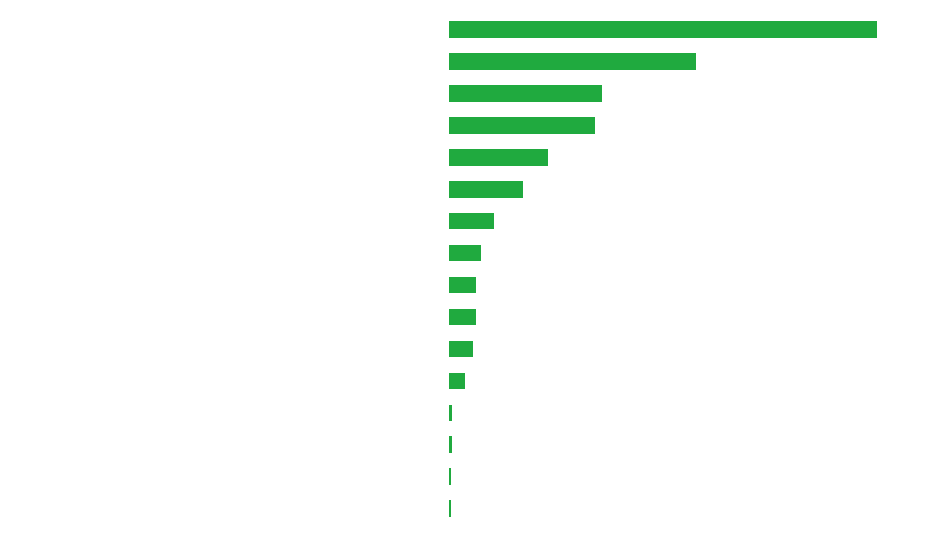

FIGURE 1: CUMULATIVE COMPLAINTS SUBMITTED BY SERVICEMEMBERS -- JULY 2011

TO DECEMBER 2020

5

When submitting a complaint to the Bureau, consumers have the option to identify their military status (active duty,

reserve, guard, veteran, or military dependent), branch of service, and rank. Consumers provided their

servicemember affiliation in approximately 40,800 complaints, or 8% of all Bureau complaints submitted in 2020.

6

For this report, “mentioned coronavirus or related keywords” is based on a search of complaint narratives using the

following search string: “covid OR coronavirus OR pandemic OR (corona AND virus) OR (global AND virus) OR

Stimulus OR PPP OR ‘paycheck protection’”. Use of this string enables the Bureau to identify a sub-population of

complaints for analysis.

13

0K

50K

100K

150K

200K

Runn

2012

2013 2014 2015 2016 2017 2018 2019 2020

The Bureau uses a variety of approaches to identify trends and possible consumer harm in

complaints received from servicemembers. Examples include:

• Reviewing company responses to complaints for accuracy, timeliness, and completeness.

• Conducting monthly reviews and summaries of complaints to identify emerging trends

and statistical anomalies.

• Utilizing data to develop policies, engagements and outreach initiatives in coordination

with other agencies like the DoD, FTC, and VA.

3.1 Complaints at a glance

In 2020, credit or consumer reporting, debt collection, and mortgages were the top consumer

financial products that received the most complaints from servicemembers. Compared to 2019

data, products with notable increases in complaints were credit reporting (up 30 percent),

money transfers and virtual currency (up 36 percent), and prepaid cards (up 66 percent). The

following section reviews these product categories and associated issues in further detail and

some of the challenges that can be felt by servicemembers in the financial marketplace due to

their military service.

FIGURE 2: COMPLAINT VOLUME BY FINANCIAL PRODUCT OR SERVICE FOR

SERVICEMEMBERS

2020 % change from 2019

Credit or consumer reporting

Debt collection

Mortgage

Credit card

Checking or savings

Money transfer or service, virtual currency

Vehicle loan or lease

Prepaid card

Personal loan

Student loan

Payday loan

Credit repair

Title loan

16,600 (41%)

8,900 (22%)

4,300 (11%)

3,600 (9%)

2,600 (6%)

1,200 (3%)

1,200 (3%)

200 (0.4%)

100 (0.3%)

100 (0.2%)

800 (2%)

600 (2%)

600 (1%)

30% (+3,800)

-35% (-300)

12% (+500)

17% (+500)

36% (+300)

10% (+100)

66% (+300)

-3% (-200)

-36% (-90)

-23% (-40)

-21% (-20)

5% (+100)

-4% (-30)

14

Servicemember versus non-servicemember

As you can see in Figure 3 below, servicemembers are more likely than non-servicemembers to

submit complaints about debt collection, mortgages, and credit cards.

FIGURE 3: COMPLAINTS SUBMITTED BY SERVICEMEMBERS AND NON-

SERVICEMEMBERS

15

Servicemember

Non-Servicemember

Credit or consumer reporting

Debt collection

Mortgage

Credit card

Checking or savings

Vehicle loan or lease

Money transfer or service, virtual currency

Prepaid card

Personal loan

Student loan

Payday loan

Credit repair

Title loan

41%

60%

22%

15%

11%

5%

9%

6%

6%

5%

3%

2%

3%

2%

2%

2%

0.8%

2%

1%

1%

0.4%

0.3%

0.3%

0.2%

0.2%

0.1%

Geographic Region

Servicemembers from all 50 states and the District of Columbia submitted complaints to the

Bureau, and recently, we enabled the ability for servicemembers to enter a location or military

base when submitting a complaint to help us better understand state and regional trends. Figure

4 shows that, on a per capita basis, more complaints were received from servicemembers from

the state of Georgia than anywhere else in the United States, followed by Nevada, Washington,

D.C., Maryland, Virginia, and South Carolina. The military bases with the most cumulative

complaints in 2020 were Ft. Bragg, Ft. Hood, and Camp Pendleton.

FIGURE 4: COMPLAINT SUBMISSIONS PER 1M POPULATION FOR SERVICEMEMBERS

16

WY

109

WV

53

WI

53

WA

94

VT

59

VA

195

UT

59

TX

150

TN

136

SD

54

SC

184

RI

78

PA

98

OR

73

OK

93

OH

113

NY

72

NV

272

NM

103

NJ

79

NH

52

NE

44

ND

35

NC

148

MT

104

MS

104

MO

73

MN

85

MI

88

ME

71

MD

196

MA

53

LA

151

KY

69

KS

56

IN

71

IL

85

ID

57

IA

44

HI

130

GA

302

FL

179

DE

161

DC

225

CT

68

CO

130

CA

107

AZ

144

AR

79

AL

121

AK

103

35 302

3.2 Servicemember complaint types

While complaint volume is important in examining trends, some of the most valuable insights

are found in the complaint narratives. The following sub-section looks at complaints by product

types and complaint narratives submitted by servicemembers in 2020.

Credit or consumer reporting

The Bureau received approximately 16,600 credit or consumer reporting complaints from

servicemembers in 2020 – an increase of almost 30 percent from 2019. Credit or consumer

reporting is the most complained about product in servicemember complaints. Figure 5 shows

17

the types of issues in credit or consumer reporting complaints where the company confirmed a

commercial relationship with the servicemember.

7

FIGURE 5: CREDIT OR CONSUMER REPORTING COMPLAINTS SUBMITTED BY

SERVICEMEMBERS

Incorrect information on your report

Problem with a company's investigation into an existing issue

Improper use of your report

Unable to get your credit report or credit score

Problem with fraud alerts or security freezes

Credit monitoring or identity theft protection services

Identity theft protection or other monitoring services

0.1%

56%

31%

7%

3%

2%

1%

Most credit reporting complaints from servicemembers pertain to incorrect information on their

credit reports. The remainder of credit reporting complaints relate to investigations into an

existing problem, improper use of a credit report, inability to obtain a credit report or score, and

issues with fraud alerts and security freezes.

Implications of inaccurate credit reporting on servicemembers’ security

clearances

Servicemembers are often obligated to hold security clearances, which require routine credit

checks. According to a 2009 report from the Department of the Navy, financial issues account

for roughly 40 percent of the instances when a security clearance is denied or revoked.

8

As a

result, inaccurate credit reporting can have a significant impact on a servicemember’s ability to

maintain a security clearance and perform their job.

“I have sent several complaints…about fraudulent accounts and inquiries…There is no

credit repair company helping me I [… am] the only one disputing these fraudulent

7

The analysis in this subsection reflects the data in the public Consumer Complaint Database as of February 1, 2021.

Complaints are listed in the database after a company responds or after it has had the complaint for 15 calendar

days, whichever comes first. Complaints that do not meet publication criteria may be removed from the database.

The publication criteria are available at consumerfinance.gov/f/201303_cfpb_Final-Policy-Statement-Disclosureof-

Consumer-Complaint-Data.pdf.

8

https://www.secnav.navy.mil/dusnp/Security%20Documents/NAVY%20GMT%20Training.pdf

18

charges and inquiries…My job and top-secret clearance is in jeopardy because of these

fraudulent accounts and inquiries. I have to provide for a family of seven.”

The OSA has taken many steps to educate the military community on the importance of

maintaining good credit and monitoring their reports for accuracy. We have

previously written

about this issue and how updated security clearance guidelines make it more important than

ever for servicemembers to stay on top of their finances and credit reports.

Debt Collection

In 2020, the Bureau received approximately 8,900 complaints from servicemembers regarding

debt collection, which is the second-most frequently mentioned product among

servicemembers. The figure below shows a breakdown of servicemember debt collection

complaints by issue.

FIGURE 6: DEBT COLLECTION COMPLAINTS BY ISSUE SUBMITTED BY

SERVICEMEMBERS

Attempts to collect debt not owed

Written notification about debt

Took or threatened to take negative or legal action

False statements or representation

Communication tactics

Threatened to contact someone or share information improperly

51%

19%

10%

9%

9%

2%

Servicemembers submit debt collection complaints at a higher rate than non-servicemembers.

While debt collection complaints accounted for 15 percent of non-servicemember 2020

complaints to the Bureau, 22 percent of 2020 servicemember complaints were about debt

collection.

This is cause for concern because we know servicemembers have often been targets of illicit debt

collection practices as companies have employed tactics like

contacting commanders

9

about a

servicemember’s debt or threatening disciplinary action under the Uniform Code of Military

Justice. Servicemembers are also more likely than non-servicemembers to complain about debt

9

https://www.consumerfinance.gov/ask-cfpb/im-a-servicemember-and-im-being-contacted-by-a-debt-collector-

about-a-debt-what-are-my-ri ghts-and-where-can-i-ge t-help-en-1495/

19

collectors threatening to contact a third party about the debt and threatening to take negative or

legal action.

Identity theft that leads to debt collection issues

Identity theft is one of the most common problems cited by servicemembers in debt collection

complaints. Many complaints arise from purchases made without the servicemember’s

knowledge. In 2020, the FTC released a report

that examined five years of identity theft data

and showed that active duty servicemembers are 76 percent more likely than non-

servicemembers to report fraudulent misuse of an existing account, such as a bank account or

credit card. The narrative below illustrates a common theme where the servicemember claims to

not recognize the debt.

“I filed a victim of identity theft [report] and the credit bureau never showed proof

that this was my debt and when I called the company they claim they don’t show a

record of this at all but somehow they are still reporting me as late on an account

that’s saying it’s been closed and charged off! I am in the process of closing on my

house and the [company] keeps updating my report showing I’m late. I have no idea

why this matter has not been removed when it’s clearly not my debt. I am a military

veteran who in that year was not even in the country…”

The Bureau has encouraged servicemembers to use

active duty or fraud alerts to protect their

credit from potential fraud or identity theft, and thanks to a 2018 law, the nationwide credit

reporting agencies now provide free electronic credit monitoring services to active duty

servicemembers and National Guard members. During National Veterans and Military Families

Month 2020, the OSA collaborated with the FTC on a webinar to promote awareness about

identity theft and how to take steps to prevent becoming a victim.

Leased communications equipment

Another debt collection issue uniquely impacting servicemembers involves returning leased

equipment for internet, phone, or cable TV services. Because servicemembers often change duty

locations and deploy overseas, issues involving leased equipment are often common.

The Veterans Benefits and Transition Act of 2018 updated the SCRA regulation to enable

servicemembers to cancel internet or TV programming contracts (in addition to mobile phone)

without penalty if they have deployment or relocation orders to a new location that doesn't offer

their current service. This change, however, did not address gaps where servicemembers often

don’t realize that the equipment wasn’t correctly returned or processed by the company until a

debt collector reaches out months and sometimes years later to collect on that debt.

Mortgages

Mortgage complaints are the third-most frequently mentioned product in complaints from

servicemembers, and the Bureau received approximately 4,300 mortgage-related complaint

submissions in 2020. As shown in Figure 7 below, many servicemembers choose to utilize VA

mortgages.

FIGURE 7: MORTGAGE COMPLAINTS BY TYPE SUBMITTED BY SERVICEMEMBERS

VA mortgage

46%

Conventional home mortgage

36%

FHA mortgage

8%

Other type of mortgage

4%

Home equity loan or line of credit (HELOC)

4%

Reverse mortgage

1%

The large plurality of mortgage complaints from servicemembers cite trouble with the payment

process. Furthermore, servicemembers are more likely than non-servicemembers to submit

complaints about the mortgage process and less likely to report struggling to pay their mortgage.

Figure 8 breaks down mortgage complaints by issue.

FIGURE 8: MORTGAGE COMPLAINTS BY ISSUE SUBMITTED BY SERVICEMEMBERS

Trouble during payment process

46%

Applying for a mortgage or refinancing an existing mortgage

21%

Struggling to pay mortgage

17%

Closing on a mortgage

12%

4%

Problem with a credit report or credit score

In 2020, we also continued to receive complaints from borrowers who received unsolicited

mailers about refinancing their current VA loans. Some borrowers mentioned that these mailers

were disguised to look like official notices from either the federal or state government. Veterans

and active duty servicemembers using VA loans are more likely to be targeted because of lower

interest rates and the loan program’s flexibility with refinancing.

20

21

“…I have been receiving solicitation letters from [company]. This company targets

veterans to take out refinance loans at a lower rate. I contacted the company by phone

and email and informed them that I was/am not interested in their product and did

no/do not want to do business with them. I called and was told by a person at their

call center that my name and information would be removed from their database and

that my personal information would not be sold or rented to any of their subsidiaries

or any private companies or organizations. I made that call after receiving countless

solicitation letters and calls... After I emailed a complaint to [the company’s] corporate

complaint email address I received a response stating that the solicitation letters

would stop. Well, I just received two more solicitation letters, and in total…I have

received 11 solicitation letters. I WANT THESE BULLY TACTICS TO STOP!!!!! Can you

help me.”

We had previously sounded the alarm on this issue in a

2017 blog post about VA refinancing

offers that sound too good to be true. In 2020, the Bureau had nine enforcement actions

stemming from a sweep of investigations of multiple companies that used deceptive mailers to

advertise VA-guaranteed mortgages. The Bureau commenced this sweep in response to concerns

raised by the VA about potentially unlawful advertising in the mortgage lending

market. Generally, these actions found that advertisements misrepresented the credit terms of

the advertised mortgage loan by stating terms that companies were not actually prepared to

offer consumers, including misrepresenting the annual percentage rate.

Educating servicemembers about mortgage forbearance during COVID-19

To address financial hardship caused by the pandemic, the Bureau – in conjunction with the VA,

HUD, and FHFA – created an

online hub to educate consumers and servicemembers about

housing protection and options for mortgage forbearance under the Coronavirus Aid, Relief, and

Economic Security (CARES) Act.

Credit cards

The Bureau received approximately 3,600 complaints from servicemembers regarding credit

cards in 2020. As Figure 9 below indicates, problems with a credit card purchase as the top

issue. Credit card complaints sent to companies about purchasers’ problems increased by 20

percent between April 1 and September 30, 2020, compared with October 1, 2019 through

March 31, 2020.

FIGURE 9: CREDIT CARD COMPLAINTS BY ISSUE SUBMITTED BY SERVICEMEMBERS

22

Problem with a purchase shown on your statement

Fees or interest

Other features, terms, or problems

Problem when making payments

Getting a credit card

Closing your account

Trouble using your card

Problem with a credit report or credit score

Advertising and marketing, including promotional offers

Struggling to pay your bill

31%

13%

12%

9%

9%

9%

6%

5%

4%

2%

Many of the complaints were also about disputed charges for unauthorized purchases as a result

of identity theft. Additionally, servicemembers complain about changes to fees or interest rates

by credit card companies at a higher rate than non-servicemembers. In 2020, “fees or interest”

represented 13% of servicemember complaints sent to companies compared to 11% of non-

servicemember total credit card complaints sent to companies.

Checking or savings account

The Bureau received 2,600 complaints in 2020 from servicemembers regarding checking or

savings accounts. Most of the checking or savings account complaints involved unauthorized

transactions, disputed bank errors, and issues with deposits and withdrawals.

FIGURE 10: CHECKING OR SAVINGS ACCOUNT COMPLAINTS BY ISSUE SUBMITTED BY

SERVICEMEMBERS

Managing an account

Closing an account

Problem with a lender or other company charging your account

Opening an account

Problem caused by your funds being low

Problem with a credit report or credit score

0.5%

61%

13%

12%

8%

5%

Overdraft fees were another frequent issue facing servicemembers, and in particular, the timing

of deposits and withdrawals. Sometimes, servicemembers make a payment on the same day as a

deposit, but are nonetheless charged overdraft fees since the deposit was still clearing. In other

situations, servicemembers aren’t aware that they have opted-in to overdraft protection with

23

their bank or credit union and don’t understand how this service impacts their account.

Servicemembers in this situation then complain when they often find not one, but multiple

overdraft fees that put can put their account deep into a negative balance.

“…I had some movies that were overdue with [company] which debited my account

$95.00. This started a downhill spiral with my account. [Bank] has let my account

continue to have charges debited from my account even though the funds were not

available in the bank account. Each time [they] paid a debit that I did not have funds

sufficient enough to cover the charges. They paid them and charged me $36.00 each

time. [This] has now cost over $288.00 in total fees they have charged me. Not a single

text or phone call email NOTHING, to let me know the account was over drawn…as of

[date] I have not received any letters in regard to my account being overdrawn. This

seems like an abusive practice to me…Why did they continue to pay transactions when

the money was not in the account.”

A 2017 Bureau study found that people who frequently attempt to overdraw their checking

accounts typically pay almost $450 more in fees if they opted-in to debit card and ATM

overdraft coverage. The study also found that most of these frequent overdrafters are financially

vulnerable, with lower daily balances and lower credit scores than people who do not overdraft

as often. For more information on overdraft fees, see our

blog on six steps you can take to reduce

or eliminate overdraft fees.

Vehicle loans or lease

In 2020, the Bureau received approximately 1,200 vehicle loan or lease complaints from

servicemembers. Figure 11 shows the types of vehicle loan or lease complaints, including

concerns managing the loan or lease, difficulty paying the loan, or problems at the end of the

loan or lease.

FIGURE 11: VEHICLE LOAN OR LEASE COMPLAINTS BY ISSUE SUBMITTED BY

SERVICEMEMBERS

Managing the loan or lease

Struggling to pay your loan

Problems at the end of the loan or lease

Problem with a credit report or credit score

Getting a loan or lease

36%

21%

20%

12%

11%

24

An issue observed in some servicemember vehicle loan complaints is confusion about SCRA rate

reductions and how this benefit only applies to loans opened prior to military service, and

benefits must be requested no later than one year after the servicemember’s active duty period

ends. We previously published a fact sheet on the SCRA

to help servicemembers better

understand this important protection.

Our Financially Fit research report highlighted in Section 4 showed that servicemembers tend to

take out auto loans soon after joining the military. Compared to civilians overall, between ages

18 and 24, servicemembers are also more likely to have an auto loan. As a result, OSA will

continue to work with the FTC and the Federal Reserve Board of Governors to ensure that

servicemembers are empowered to make better informed decisions regarding consumer

financial products and services offered by motor vehicle dealers.

Money transfers, money services, and virtual currencies

The Bureau received approximately 1,200 complaints from servicemembers regarding money

transfers, money services, and virtual currencies– an increase of about 36 percent from 2019.

Fraud is the most frequently raised issue, accounting for about a third of the total as seen in

Figure 12 below.

FIGURE 12: MONEY TRANSFER OR SERVICE, AND VIRTUAL CURRENCY COMPLAINTS BY

ISSUE

25

Fraud or scam

Other transaction problem

Unauthorized transactions or other transaction problem

Money was not available when promised

Managing, opening, or closing your mobile wallet account

Other service problem

Problem with customer service

Problem adding money

Confusing or missing disclosures

Wrong amount charged or received

Unexpected or other fees

Confusing or misleading advertising or marketing

Incorrect exchange rate

Overdraft, savings, or rewards features

Lost or stolen check

Lost or stolen money order

0.3%

0.3%

0.1%

0.1%

32%

19%

11%

11%

7%

6%

3%

2%

2%

2%

2%

1%

Servicemembers often complained about fraudulent transfers as a result of scams. Many of the

complaints were servicemembers who reported that they had difficulty obtaining recourse after

they initiated a money transfer.

“Someone gained access to my account, changed my … email and sent $380 to a new

added email from my checking account. I submitted a claim with [company] and they

said I was liable with no explanation, I escalated the claim…and same result with no

explanation. I have asked several times and they haven't solve(d) anything. They

made me create a new checking account and change all my login information. Still to

this day they haven't resolved the issue. I had back surgery on [date] and haven't been

able to leave my home, also military orders keep me at my location, one of the agents

did say they could see logins from an apple device, I do not own any apple devices,

and that the IP was also in Georgia but nowhere near my location. This has been

frustrating and [company] have shown little to no interest to resolve…$380 might not

sound like much, but military pay is not that great, we do it for our Country…”

Some of the complaints stated that they could not get the money back from the mobile payment

app because the recipient asked for payment to be made as ‘friends and family’ or ‘gift’ feature in

the app, which is not eligible for buyers purchase protection. Some servicemembers also

complained about their ability to access their virtual currency accounts to make withdrawals.

26

Other common complaints from servicemembers on virtual currencies include fraudulent

transactions and difficulty during the account verification process.

FIGURE 13: MONEY TRANSFER OR SERVICE, AND VIRTUAL CURRENCY COMPLAINTS BY

TYPE

Domestic (US) money transfer

Mobile or digital wallet

International money transfer

Virtual currency

Debt settlement

Check cashing service

Traveler's check or cashier's check

Refund anticipation check

Foreign currency exchange

Money order

0.7%

0.7%

34%

33%

12%

11%

4%

2%

2%

1%

Student loans

In 2020, the Bureau also received approximately 600 student loan complaints from

servicemembers. The majority of these complaints were related to dealing with their lender or

servicer or struggling to repay their loan.

FIGURE 14: STUDENT LOAN COMPLAINTS BY ISSUE SUBMITTED BY SERVICEMEMBERS

Dealing with your lender or servicer

Struggling to repay your loan

Problem with a credit report or credit score

Getting a loan

66%

19%

13%

2%

Americans owe more than $1.6 trillion in student loan debt, making student loans the second-

largest debt market in the United States behind mortgages.

10

More specifically, it’s estimated

that more than 200,000 servicemembers collectively owe more than $2.9 billion in student loan

10

See Board of Governors of the Federal Reserve System (FRB), Consumer Credit – G.19, Nov. 2019 (updated Jan. 8,

2020), available at https://www.federalreserve.gov/releases/g19/current/.

27

debt.

11

Our Financially Fit research report released in July 2020 showed that while young

servicemembers are less likely to have student debt than their non-servicemember counterparts,

roughly 25 percent of servicemembers between 18 and 24 still have a student loan.

12

This debt looms over servicemembers’ lives and can jeopardize their ability to focus on the

military mission at hand. Research has shown that financial readiness is a critical component of

military readiness, and student debt is an essential financial concern among servicemembers.

Congress has enacted a range of protections for servicemembers with student loans. Despite

these protections, we continue to hear from military borrowers struggling with loan servicing

breakdowns.

Public Service Loan Forgiveness (PSLF) program

We have previously reported on active duty servicemembers experiencing servicing breakdowns

in the PSLF program. Under the PSLF program, the remaining balance of a servicemember’s

debt will be forgiven after 120 qualifying monthly payments. While PSLF isn’t available to only

servicemembers, the program can provide a significant amount of financial relief to

servicemembers and military families. Military service is the quintessential public service, yet

we continue to hear from servicemembers who face problems accessing PSLF. Often, military

borrowers thought they were making qualifying payments when they weren’t.

“Every year, I need to submit an updated Public Service Loan Forgiveness (PSLF)

form and every year there are months missing. I have never missed a payment

because I have autopay setup and I do not want my security clearance with the Navy

to be jeopardized by missing a payment. I have emailed and spoken with the My

FedLoan representatives several times and all they say is it takes time...This is

ridiculous and unacceptable that my PSLF has not been fixed…Again, it has been over

four months since I spoke with someone regarding the correct and necessary

adjustment to my PSLF because they have miscalculated PSLF payments and thus

have shortchanged me nearly 20 months…I have provided the essential paperwork

11

Estimates are based on the Bureau’s analysis of data provided in Government Accountability Office (GAO), Student

Loans: Oversight of Servicemembers’ Interest Rate Cap Could Be Strengthened, GAO-17-4 (Nov. 15, 2016),

https://www.gao.gov/products/GAO-17-4

12

Financially Fit? Comparing the credit records of young servicemembers and civilians, available at:

https://files.consumerfinance.gov/f/documents/cfpb_financially-fit_credit-young-servicemembers-

civilians_report_2020-07.pdf

28

and the last two years especially the payments did not show 12 months of PSLF when I

have done so.”

The servicing problems that accompany repayment programs are a key issue, not just for

servicemembers who will serve over ten years, since one in five veterans go into public service

after leaving the military.

13

Personal loans

The Bureau received approximately 600 personal loan complaints from servicemembers in

2020. Figure 15 shows the top reported personal loan complaints.

FIGURE 15: PERSONAL LOAN COMPLAINTS BY ISSUE SUBMITTED BY SERVICEMEMBERS

Charged fees or interest you didn't expect

Problem when making payments

Problem with a credit report or credit score

Problem with the payoff process at the end of the loan

Struggling to pay your loan

Getting the loan

Getting a line of credit

Problem with additional add-on products or services

Credit limit changed

Problem with cash advance

Property was damaged or destroyed property

Property was sold

0.8%

0.3%

0.3%

31%

14%

12%

11%

11%

7%

6%

6%

1%

The top issues were the same in 2019, with the majority of servicemembers expressing concern

over being charged unexpected fees or interest on personal loans. Other problems include

difficulty making payments or with the application process, as well as issues with the payoff

process at the end of the loan.

“I never had copies of the documents I signed or any knowledge of the interest rate the

company was charging me. On [date], I requested copies of the documents I had signed and

13

See Bureau of Labor Statistics, Employment Situation of Veterans Summary (Mar. 22, 2017),

https://www.bls.gov/news.release/vet.nr0.htm

.

29

a statement of the balance because during a phone call, a representative of the company

informed me that I was being charged 360% interest and I was shocked. I had no idea I had

been paying that much interest since [date]. The company refused to send me the original

documents I signed to request the line of credit. They did send me a current statement of my

account, which reflected the 360% interest.”

Prepaid cards

The Bureau received approximately 800 prepaid card complaints from servicemembers in

2020—a 66 percent increase from 2019. More than half of the complaints were about a problem

obtaining a card or having trouble using the card.

FIGURE 16:

PREPAID COMPLAINTS BY ISSUE SUBMITTED BY SERVICEMEMBERS

Problem getting a card or closing an account

Trouble using the card

Problem with a purchase or transfer

Unexpected or other fees

Advertising

Problem with overdraft

0.2%

35%

29%

22%

11%

3%

Because some veterans use prepaid cards to receive their monthly VA disability compensation,

they use them as a debit card when paying for goods and services. As a result, we continue to see

complaints of fraud or disputed charges on those cards. A handful of other complaints stated

that consumers had difficulty obtaining a new card (due to expired old card or lost old card)

after calling the card issuer’s customer service line.

A unique issue relative to the coronavirus pandemic that contributed to the increase in prepaid

complaints from servicemembers in 2020 was that some consumers unknowingly received

COVID-19 stimulus payments on prepaid cards. Other servicemembers received the card, but

then encountered problems when they tried to use the card.

“On [date] the IRS said they mailed me a $1200 stimulus check. I never received it. The

2nd week of [month] I called and found out I was issued a debit card. I have still not

received it…I even paid extra to have the money within 10 business days and that

never happened. I called the IRS [and they] said I must call [company] there is

nothing they can do for me, I have tried to call [company] several times to no avail…”

30

The Bureau released resources on Economic Impact Payments (EIP) on prepaid debit cards back

in May 2020 to help spread awareness on the distribution of the cards and how to use them

without paying a fee.

Payday loans

The Bureau received approximately 160 payday loan complaints from servicemembers in 2020.

Figure 17 below shows the types of payday loan complaints reported by servicemembers, with

the majority involving unexpected fees or interest or difficulty repaying the loan.

FIGURE 17: PAYDAY LOAN COMPLAINTS BY ISSUE SUBMITTED BY SERVICEMEMBERS

Charged fees or interest you didn't expect

Struggling to pay your loan

Received a loan you didn't apply for

Problem with a credit report or credit score

Can't contact lender or servicer

Loan payment wasn't credited to your account

Problem with the payoff process at the end of the loan

Money was taken from your bank account on the

wrong day or for the wrong amount

Can't stop withdrawals from your bank account

Was approved for a loan, but didn't receive the money

34%

20%

9%

8%

7%

7%

6%

4%

3%

2%

Financial protections under the Military Lending Act (MLA)

When it comes to extensions of consumer credit, including payday loans and most installment

loans, the MLA established critical protections for active duty servicemembers and their

dependents, defined as “covered borrowers.” These protections include a maximum allowable

annual percentage rate of 36 percent, a Military Annual Percentage Rate (MAPR), a prohibition

against required arbitration, and certain mandatory loan disclosures.

In 2020, the Bureau announced two enforcement actions alleging violations of the MLA. In the

first enforcement action, the Bureau alleged that an online lender made

over 4,000 single-

payment or installment loans to over 1,200 covered borrowers in violation of the MLA.

Specifically, the Bureau alleged that the lender’s violations of the MLA included extending loans

with a MAPR that exceeded the MLA’s 36% cap, extending loans that required borrowers to

31

submit to arbitration, and failing to make sure required loan disclosures, including a statement

of the applicable MAPR. In January 2021, the Bureau settled with this lender and the court

entered a stipulated final judgment and order requiring the lender to provide $300,000 in

redress to consumers and to pay a $950,000 civil money penalty. The settlement also prohibited

the lender from committing future violations of the MLA and from collecting on, selling, or

assigning any debts arising from loans that failed to comply with the MLA. It also requires the

lender to correct or update the information it provided to consumer reporting agencies about

affected consumers.

One of the MLA’s other protections includes prohibiting that loans to covered borrowers be

required to be repaid by an “allotment.” In a second enforcement action, the Bureau issued a

consent order that found a lender violated the MLA’s prohibition against requiring repayment

by allotment. This lender required covered borrowers to repay their installment loans by

allotment. The Bureau found that, since October 2016, 99 percent of the lender’s loans to

covered borrowers were being repaid by allotment. In 2014, the Bureau

previously highlighted

how some businesses take advantage of the military’s allotment system when making loans to

servicemembers.

In light of these recent actions, we intend to continue to closely monitor MLA complaints and

continue to collaborate on our observations with our partners in the Supervision, Enforcement

and Fair Lending Division at the Bureau. It remains clear from complaint narratives that some

servicemembers are not all aware of the MLA and its protections.

“I was in a financial bind and received a letter from the [company]. The loan was

about the amount I needed, so I applied. The process was fast and I had the money

before days end. Once I realized it was all probably too good to be true, I dug deeper

into the interest rates, which can range from 600-760%. Astronomical…After I did

more searching, I found out about the MLA (Military Lending Act) where I saw that

this act is in place to prevent these high interest rates…”

In the past year, we released a MLA applicability flow chart

to help both practitioners and

servicemembers better understand the MLA, and the Bureau previously published a fact sheet

entitled

What is the MLA and what are my rights? We intend to continue educating

servicemembers, military families, and financial practitioners about these critical protections.

32

4. Military consumer research

In 2020, our office also released two landmark research reports focused on financial

patterns of servicemembers and veterans. These reports were unique in providing an

analysis based on de-identified credit record data drawn from a nationally representative

sample of consumers, which deepens our understanding of when young servicemembers

begin taking on debt, how entrants differ based on the age they join, and how their credit

profiles change after separation from the military.

4.1 Financially fit? Comparing the credit records of young

servicemembers and civilians

In July 2020, the OSA released its first report examining the credit profiles of young

servicemembers and how they compare to civilians of a similar age. The report utilized data

from the Bureau’s Consumer Credit Panel (CCP), which is comprised of a random sample of

credit files purchased from one of the three nationwide consumer reporting agencies (NCRAs).

The CCP data was merged with information about active duty dates from the Servicemember

Civil Relief Act (SCRA) database, allowing us to analyze credit trends for de-identified

individuals who have served on active duty at any point since 1985. The final sample was

comprised of 296,004 consumers born between 1989 and 1992, of whom 10,647 (3.6 percent)

joined active duty during a seven-year observation window.

Utilizing data based on the age at which servicemembers enter active duty and the time spent in

active duty, the findings clearly showed that servicemembers who remain in the military have

healthier credit records and are able to better manage their debt.

Servicemembers and civilians use different credit products

As shown in Figure A below, young servicemembers and civilians tend to use different types of

credit products. Between ages 18 and 24, servicemembers were more likely than civilians to have

had an auto loan or a credit card, and less likely to have had a student loan or debts being

collected by a third-party agency, including non-credit debt, such as medical or utility bills.

Servicemembers were also more likely to have personal installment loans.

33

FIGURE A: PERCENTAGE OF CONSUMERS WITH VARIOUS TYPES OF CREDIT ACCOUNTS

BETWEEN AGES 18 AND 24

Servicemembers begin opening credit accounts soon after entering the

military

Most servicemembers begin active duty service without an auto loan or a credit card, but they

begin opening these accounts three to six months after joining the military. Almost 75 percent of

young servicemembers have had an auto loan by age 24, and over 90 percent have had access to

some sort of revolving credit, such as a general-purpose credit card or retail credit card.

Servicemembers who stay in the military longer tend to maintain better

credit records

Servicemembers who complete at least three years of service have better credit records by age 24

than servicemembers who leave the military sooner. They have lower rates of delinquency and

default and are also less likely to have non-credit debt in collections, such as a cellphone bill or a

utility bill. Servicemembers who serve longer than five years, some of whom have reenlisted and

continued in service past their first term of duty, have lower rates of delinquency and better

34

credit scores than their civilian counterparts. The graph below shows that 35 percent of these

servicemembers maintain super-prime credit scores at age 24, compared to 26 percent of

civilians who never joined active duty.

Those who remain in service for at least five years have the healthiest credit records by age 24,

even compared to civilians as seen in Figure B. These servicemembers also accrue installment

debt and open revolving accounts shortly after joining the military but maintain higher credit

scores than other groups. Those in this group who exit the military during the observation

window do experience a decrease in credit score, after separation, of about 20 points but on

average, by age 24, this group of servicemembers, who stay for at least five years, have better

credit scores than civilians.

FIGURE B: CREDIT SCORES AT AGE 24, BY AMOUNT OF TIME SPENT IN ACTIVE DUTY SERVICE

35

Several caveats must be considered when drawing conclusions from the results. First, people

with no credit history cannot be observed in the CCP. However, estimates

14

suggest that the

credit invisibility rate (the fraction of individuals without a credit record) of those who join

active duty is similar to the invisibility rate of the rest of the population by age 24. Second, active

duty servicemembers differ from the comparison group of non-active-duty individuals in several

important ways. The servicemember population skews heavily male, is slightly less white, and

has a greater fraction of U.S. citizens and high school graduates than the general U.S.

population. The core CCP data doesn’t include any demographic information except for age, so

the analysis cannot control for these differences.

4.2 Debt and delinquency after military service

In a follow-up research report, we examined the credit records of young veterans in the year

after they separate from active duty and found decreased credit scores for enlisted

servicemembers immediately following departure from active-duty military service, particularly

for those who leave active duty before completing their first term contract. A sizeable fraction of

young enlisted servicemembers go delinquent on debt payments or have severe derogatory

marks (for example, defaults) on their credit record around the time they leave active duty.

These problems are most likely to arise in the six months following separation, compared to the

six months before. The report focuses on auto loans, revolving credit accounts (credit cards),

and personal or retail installment loans.

The findings show that among those who serve at least seven months, delinquencies and

defaults are between two and 10 times more likely to appear on a credit record in the six months

after separation as compared to the six months before.

Late payments are more common among those who served between seven and 35 months—

those who likely reached their first permanent assignment but separated before the end of their

first contract—compared to those who serve shorter or longer terms. For example, of all

servicemembers who exit with auto debt after seven to 35 months of service, one-third become

90 days delinquent or default on that debt within one year. By comparison, less than 15 percent

of auto debt holders with longer terms of service went delinquent or defaulted within one year

after separation. For both groups the post-separation rates of delinquencies and defaults for

revolving account holders and for those with less-common types of installment debt (such as

personal loans) are even higher than for auto debt.

14

https://files.consumerfinance.gov/f/documents/cfpb_financially-fit_credit-young-servicemembers-

civilians_report_2020-07.pdf, Appendix B.

36

FIGURE C: CREDIT SCORE RELATIVE TO QUARTER OF SEPARATION, BY TIME SPENT ON

ACTIVE DUTY

As a result of these negative outcomes, servicemembers’ credit scores decline just after

separation, and do not recover for at least one year after leaving the military. The drop is most

severe for those with tenures between seven and 35 months and for those who exit with a Near

prime credit score or below, as opposed to a Prime score or better.

The data used in this report cannot explain what causes the observed patterns of delinquency

and default. Publicly available statistics suggest medical and less-than-honorable discharges are

not common enough to explain delinquency and default among young veterans.

15

The data for

this report cannot connect credit outcomes with employment, so it is unclear whether those who

were struggling with debt are also the ones without a job or with lower levels of income. To

identify the proper policy response to young veterans struggling with debt, it would be critical to

15

https://files.consumerfinance.gov/f/documents/cfpb_debt-and-deli nquency-after-military-service_report_2020-

11.pdf, page 20.

37

understand the connection between delinquency and employment and whether they are in turn

connected to veterans’ service histories.

38

5. The way ahead

The Bureau and the Office of Servicemember Affairs (OSA) remain committed to ensuring that

servicemembers, veterans and their families have high levels of financial readiness, financial

inclusion, and consumer protection

to enable them to be focused on their military mission at

hand.

We will continue to employ an array of tools and resources to meet the Bureau’s core

obligations to educate and empower military consumers, to monitor their complaints, and to

coordinate with other state and federal agencies so that their financial concerns are given the

attention they deserve.

As conveyed in this report, we continue to listen to and engage with servicemembers of all ranks

and the veteran community to learn of emerging trends and issues, and when necessary alert

other components and agencies internal and external to the Bureau of the potential impact on

servicemembers. Monitoring consumer complaints to the Bureau provides us with invaluable

information through which we gain insight to the most common financial problems facing

military consumers. Complaint data continuously demonstrates how important the mission of

the OSA is – to work on consumer financial challenges affecting servicemembers – and how

important it is to inform the Bureau’s work.

We are also building upon our 2020 efforts and lessons learned in addressing servicemembers’

financial needs during the coronavirus pandemic. We will continue to examine the

repercussions of COVID-19 on military consumers and families and explore how we can best

assist those who have been impacted. We will continue to pursue outreach with an expanded

emphasis on digital events in order to best connect with our audience. Our goal is to reach

servicemembers, veterans, and their families, regardless of where they work or live.

Another critical policy priority for the Bureau going forward is improving economic and racial

equity in the financial marketplace. This is especially important for military families considering

that 31 percent of active duty servicemembers identify as a racial minority.

16

In the coming year,

we will continue our efforts to reach military members and families of color, understand their

experience in the financial marketplace, and develop new efforts to help improve their financial

well-being.

16

https://download.militaryonesource.mil/12038/MOS/Infographic/2019-demographics-active-duty-members.pdf

39

While much has happened with the work of the Office of Servicemember Affairs over the past

year, our mission remains the same – to work on consumer financial challenges affecting

servicemembers. Those who will serve, currently serve, or have served our country should not

have to worry about falling victim to unfair, deceptive, or abusive financial practices; inability to

access to financial services, or not having the tools and resources they need to make informed

decisions to bolster their financial well-being. It’s an honor for us to represent consumers in the

military community here at the CFPB and to make sure their concerns are heard and understood

– and that we work to address them.