NBER WORKING PAPER SERIES

CHEAP TALK, ROUND NUMBERS, AND THE ECONOMICS OF NEGOTIATION

Matthew Backus

Tom Blake

Steven Tadelis

Working Paper 21285

http://www.nber.org/papers/w21285

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

June 2015

We thank Panle Jia Barwick, Willie Fuchs, Brett Green, and Greg Lewis for helpful discussions, and

many seminar participants for helpful comments. We are grateful to Chad Syverson for sharing data

on real estate transactions in the State of Illinois. The views expressed herein are those of the authors

and do not necessarily reflect the views of the National Bureau of Economic Research. eBay Inc has

provided the data that is the basis of this study.

At least one co-author has disclosed a financial relationship of potential relevance for this research.

Further information is available online at http://www.nber.org/papers/w21285.ack

NBER working papers are circulated for discussion and comment purposes. They have not been peer-

reviewed or been subject to the review by the NBER Board of Directors that accompanies official

NBER publications.

© 2015 by Matthew Backus, Tom Blake, and Steven Tadelis. All rights reserved. Short sections of

text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit,

including © notice, is given to the source.

Cheap Talk, Round Numbers, and the Economics of Negotiation

Matthew Backus, Tom Blake, and Steven Tadelis

NBER Working Paper No. 21285

June 2015

JEL No. C78,D82,D83,M21

ABSTRACT

Can sellers credibly signal their private information to reduce frictions in negotiations? Guided by

a simple cheap-talk model, we posit that impatient sellers use round numbers to signal their willingness

to cut prices in order to sell faster, and test its implications using millions of online bargaining interactions.

Items listed at multiples of $100 receive offers that are 5% - 8% lower but that arrive 6 - 11 days sooner

than listings at neighboring "precise" values, and are 3% - 5% more likely to sell. Similar patterns

in real estate transactions suggest that round-number signaling plays a broader role in negotiations.

Matthew Backus

Department of Economics

Cornell University

Uris Hall 466

Ithaca, NY 14853

Tom Blake

ebay Research Labs

Steven Tadelis

Haas School of Business

University of California, Berkeley

545 Student Services Building

Berkeley, CA 94720

and NBER

1 Introduction

Bargaining is pervasive. We bargain over goods, services, salaries, real estate, territorial

boundaries, mergers and acquisitions, household chores, and more. As the Coase Theorem

demonstrates, when property rights are well-defined and negotiating parties have perfect

information, bargaining leads to efficient outcomes (Coase, 1960). At least since Myerson

and Satterthwaite (1983), however, economists have understood the potential for bargaining

failure. When the parties’ valuations are not commonly known, each has an incentive to

overstate the strength of their position in order to extract surplus, resulting in efficiency

losses. These losses can manifest in the form of delays, or the complete breakdown of

negotiations, with real economic costs. We ask whether these informational frictions can be

mitigated with the use of cheap talk, which serves as a framework for modeling negotiation.

Namely, are some market participants willing and able to signal a weak bargaining position

in order to secure a timely sale at a less advantageous price?

We take this question to a novel dataset of millions of bargaining transactions on the

eBay.com “Best Offer” platform, where sellers offer items at a listed price and invite buyers

to engage in alternating, sequential-offer bargaining, very much in the spirit of Rubinstein

(1982). Guided by a simple model, we show that many sellers find it beneficial to signal

bargaining weakness in order to sell their items faster, albeit at lower prices.

We begin by introducing a puzzling pattern in the data. Sellers who post items

at “round-number” prices—namely multiples of $100—obtain first-round offers that are

significantly lower than the offers obtained by sellers whose posted prices are not round

numbers. This is puzzling because rather than post an item at, say $200, it seems that a

seller would be better off by choosing a lower “precise” number such as $198. And yet, such

round-number listings are very common in our setting, even among experienced sellers.

How can this be consistent with equilibrium behavior in a well-functioning marketplace

with millions of participants?

We develop a stylized model in which round numbers, such as multiples of $100, are

chosen strategically as a cheap-talk signal by impatient sellers who are willing to take a

price cut in order to sell faster. The intuition is quite simple: if round numbers are a

credible cheap-talk signal of eager (impatient) sellers, then by signaling weakness, a seller

will attract buyers faster who rationally anticipate the better deal. In equilibrium, patient

1

sellers prefer to hold out for a higher price, and hence have no incentive to signal weakness,

so they choose precise-number listings.

Our model yields a set of testable hypotheses that we take to the eBay data. First,

round-number listings not only attract lower offers, but sell at prices that are 5%

−

8% lower

on average than nearby precise-number listings. Second, round-number listings receive

offers much sooner, approximately 6 to 11 days sooner on average than precise-number

listings. Third, round-number listings are 3%

−

5% more likely to sell than precise-number

listings. These findings all support the premise of our model, that round numbers are a

cheap-talk signal used by impatient sellers. We also find that sellers who use precise listing

prices are less likely to accept similar offers than those using round listing prices, and

conditional on countering, they make more aggressive counter-offers. This is consistent

with a connection between a seller’s eagerness to sell—or, formally, their private type—and

their propensity to list at round numbers.

A concern with the basic empirical findings may be that, for round-number listings,

there are unobservable differences in the seller attributes or in the products themselves,

resulting in lower offers and lower prices. There are several plausible reasons this could

be the case, and such unaccounted-for heterogeneity—observable to bidders but not to

us as econometricians—can bias our estimates. We address this possibility by taking

advantage of the fact that items listed on eBay’s site in the United Kingdom (ebay.co.uk)

will sometimes appear in search results for user queries on the U.S. site (ebay.com). A

feature of the platform is that U.S. buyers who see items listed by U.K. sellers will observe

prices that are automatically converted into dollars at the contemporaneous exchange rate.

Hence, some items will be listed at round numbers in the U.K., while at the same time

appear to be precise-number listings in the U.S. Assuming that U.S. buyers perceive that

same unobserved heterogeneity as their U.K. counterparts, we can compare their behavior

to difference out the bias and demonstrate the existence of a causal effect of roundness.

Another concern may be that what we find is an artifact special to the eBay bargaining

environment. We obtain data from the Illinois real estate market that has been used by

Levitt and Syverson (2008) where we observe both the original listing price and the final

sale price. The data does not let us perform the vast number of tests of we can for eBay’s

large data set, but we do find evidence that homes that were listed at round numbers sell

for less than those listed at precise numbers.

2

Our theoretical framework is closely related to Farrell and Gibbons (1989) and Cabral

and S´akovics (1995), who show that cheap talk may influence bargaining with asymmetric

information. Single crossing in their model comes from the differential cost of bargaining

breakdown for high- and low-valuation parties.

1

Our single-crossing comes from differences

in patience, and we discus this and other possible mechanisms in Section 3 and 6.

Our primary contribution is empirical: we document a signaling equilibrium in the

spirit of Spence (1973) and Nelson (1974). This is challenging because the essential

components of signaling equilibria — beliefs, private information, and signaling costs

— are usually unobservable to the econometrician. The oldest thread in this literature

concerns “sheepskin effects,” or the effect of education credentials on employment outcomes

(Layard and Psacharopoulos, 1974; Hungerford and Solon, 1987). Regression discontinuity

has become the state of the art for estimating these effects following Tyler et al. (2000), who

use state-by-state variation in the pass threshold of the GED examination to identify the

effect on wages for young white men on the margin of success. By holding attributes such as

latent ability or educational inputs constant, they isolate the value of the GED certification

itself, i.e. the pure signaling content, rather than its correlates. We complement this

literature by identifying not only the effect of the signal, but also the equilibrium trade-off

that makes separating equilibrium possible in a cheap-talk setting. In this sense our

detailed data allows us to go further in proving the empirical relevance of signaling models.

Additionally, there is a small literature in empirical IO studying costly signaling games

in a variety of settings e.g. limit pricing in Gedge et al. (2013) and borrowing in Kawai

et al. (2013), as well as a growing literature on the empirics of bargaining and negotiation

(Ambrus et al., 2014; Bagwell et al., 2014; Grennan, 2013, 2014; Larsen, 2014; Shelegia

and Sherman, 2015).

Our work is also related to a literature on numerosity and cognition; in particular, how

nominal features of the action space of a game might affect outcomes. Recent work in

consumer psychology and marketing has studied the use of round numbers in bargaining

(Janiszewski and Uy, 2008; Loschelder et al., 2013; Mason et al., 2013). These papers argue

from experimental and observational evidence that using round numbers in bargaining

1

Intuitively, high-valuation buyers (or low-valuation sellers) have more to lose from bargaining break-

down, and therefore may be willing to sacrifice some bargaining advantage to increase the likelihood of

transacting. Our approach is similar in that we use the probability of transacting to obtain single crossing,

but different in that we do so by modeling the matching process of buyers to sellers. This approach is

related to a more recent literature on directed search (Menzio, 2007; Kim, 2012; Kim and Kircher, 2013)

but unlike papers in that literature we do not employ a matching function.

3

leads to “worse” outcomes (i.e. lower prices). By way of explanation they offer an array of

biases, from anchoring to linguistic norms, and come to the brusque conclusion that round

numbers are to be avoided by the skillful negotiator.

2

This literature leaves unanswered

the question of why, then, as we demonstrate below, round numbers are so pervasive in

bargaining, even among experienced sellers. We reconcile these facts with an alternative

hypothesis: that round numbers are an informative signal, sometimes used to sellers’

advantage despite the negative signal they send about one’s own bargaining strength.

2 Online Bargaining and Negotiations

The eBay marketplace became famous for its use of simple auctions to facilitate trade. In

recent years, however, the share of auctions on eBay’s platform has been surpassed by

fixed-price listings, many listed by businesses (Einav et al., 2013). For fixed-price listings,

eBay’s platform offers sellers the opportunity to sell their items using a bilateral bargaining

procedure with a feature called “Best Offer”. We conjecture that, like auctions, Best Offer

serves as a demand discovery mechanism for sellers.

The feature modifies the listing page as demonstrated in Figure 1 by enabling the

“Make Offer” button that is shown just below the “Buy It Now” button. Upon clicking the

Make Offer button, a prospective buyer is prompted for an offer in a standalone numerical

field.

3

Submitting an offer triggers an email to the seller who then has 48 hours to accept,

decline, or make a counter-offer. Once the seller responds, the buyer is then sent an email

prompting to accept and checkout, make a counter-offer, or move on to other items. This

feature has been growing in popularity and bargained transactions currently account for

nearly 10 percent of total transaction value in the marketplace.

4

2

From NPR (2013), Malia Mason of Mason et al. (2013) NPR interview on All Things Considered

June 3, 2013: Rob Siegel: “What do you mean don’t pick a round number?” Malia Mason: “[...] so if

you’re negotiating for, lets say, a car– you’re buying a used car from someone, [...] don’t suggest that

you’ll pay 5,000 dollars for the car. Say something like: I’ll pay you 5,225 dollars for the car, or say 4,885

dollars for the car.” Rob Siegel: “Why should that be a more successful tactic for negotiating?” Malia

Mason: “It signals that you have more knowledge about the value of the good being negotiated.”

3

The buyer can also send a message with their offer, as seen in frame (b) of Figure 1. We leave the

analysis of those messages, which requires a different approach, for future work.

4

Analyzing sellers’ choice of mechanism between auctions, fixed prices, and fixed prices with bargaining,

is beyond the scope of this paper. We conjecture that Best Offer and auctions are alternative price

discovery mechanisms. The 30-day duration of fixed price listings may be appealing when there are few

potential buyers because the 10-day maximum duration of auctions constrains its effectiveness.

4

Figure 1: Best Offer on eBay

(a) Listing Page

(b) Make an Offer

Notes: Frame (a) depicts a listing with the Best Offer feature enabled, which is why the “Make Offer” button appears

underneath the “Buy It Now” and “Add to Cart” buttons. When a user clicks the Make Offer button, a panel appears as

in frame (b), prompting an offer and, if desired, an accompanying message.

5

Table 1: Summary Statistics

V

ariable Mean (Std. Dev.) N

Listing

Price (BIN) 166.478 (118.177) 10472614

Round $100 0.053 (0.225) 10472614

BIN in [99,99.99] 0.114 (0.318) 10472614

Offers / Views 0.027 (0.09) 10395821

Avg First Offer $ 95.612 (77.086) 2804521

Avg Offer $ 105.875 (1062.989) 2804521

Avg first Offer ratio (Offer/BIN) 0.631 (3.849) 2804521

Avg Counter Offer 148.541 (7896.258) 1087718

Avg Sale $ 123.136 (92.438) 2088516

Search Result Hits/Day 212.718 (292.657) 10472614

Views/Day 2.093 (5.941) 10472614

Time to Offer 28.153 (56.047) 2804521

Time to Sale 39.213 (67.230) 2088516

Lowest Offer $ 89.107 (74.702) 2804521

Highest Offer 125.06 (7381.022) 2804521

Pr(Offer) 0.268 (0.443) 10472614

Pr(BIN) 0.049 (0.216) 10472614

Pr(Sale) 0.199 (0.4) 10472614

Listing Price Revised 0.570 (0.495) 4045843

# Seller’s Prior BO Listings 69974.77 (322691.987) 10472614

# Seller’s Prior Listings 87806.748 (387681.096) 10472614

# Seller’s Prior BO Threads 2451.256 (5789.343) 2804521

Notes: This table presents summary statistics for the main dataset of BO-enabled collectibles listings

created on eBay.com between June 2012 and May 2013 with BIN prices between $50 and $550.

We restrict attention to items in eBay’s Collectibles marketplace which includes coins,

antiques, toys, memorabilia, stamps, art and other like goods. Our results generalize to

other categories, but we believe that the signaling mechanism is naturally greatest in

collectibles where there is greater heterogeneity in valuations.

Our data records each bargaining offer, counter-offer, and transaction for any Best Offer

listing. We have constructed a dataset of all single-unit Best Offer enabled listings (items

for sale) that started between June 2012 and May 2013. We then limit to listings with an

initial “Buy It Now” (BIN) price between $50 and $550. This drops listings from both

sides of our sample: inexpensive listings, in which the costs of bargaining dominate the

potential surplus gains, and the right tail of very expensive listings. We are left with 10.5

million listings, of which 2.8 million received an offer and 2.1 million sold.

5

We construct

several measures of bargaining outcomes, which are summarized in Table 1.

5

Note that these figures are not representative of eBay listing performance generally because we have

selected a unique set of listings that are suited to bargaining.

6

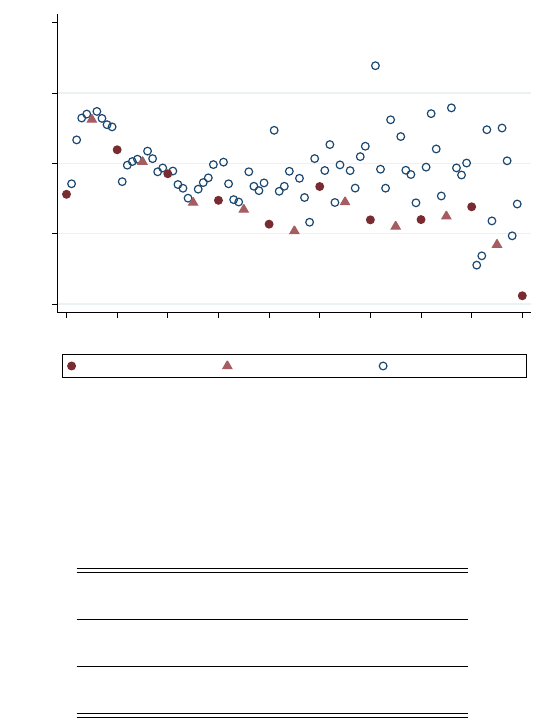

Figure 2: Average First Offers by BIN Price

.55 .6 .65 .7 .75

Average First−Offer Ratio (Offer/Listing Price)

0 100 200 300 400 500 600

Buy It Now (Listing) Price

Round $100 Round $50 Other $ Increment

Notes: This scatterplot presents average first offers, normalized by the BIN price to be between zero and

one, grouped by unit intervals of the BIN price, defined by (

z −

1

, z

]. When the BIN price is on an interval

rounded to a number ending in “00”, it is represented by a red circle; “50” numbers are represented by a

red triangle.

Sale prices average near 79 percent of listed prices but vary substantially. Buyers start

far more aggressively, with the average starting offer at 63 percent of the posting price.

Sellers wait quite a while for (the first) offers to arrive, 28 days on average, and do not

sell for 39 days. This would be expected for items in thin markets for which the seller

would prefer a price discovery mechanism like bargaining. Finally, we also record the count

of each seller’s prior listings (with and without Best Offer enabled) as a measure of the

sellers’ experience level.

To motivate the rest of the analysis, consider the scatterplot in Figure 2. On the

horizontal axis is the listing price of the goods listed for sale, and on the vertical axis we

have the average ratio of the first offer to the listed price. For example, imagine that there

were a total of three listed items at a price of $128 that received an offer from some buyer.

The first item received an offer of $96, or 75% of $128, the second item received an offer of

$80, or 62.5% of $128, and the third received an offer of $64, or 50% of $128. The average

7

Figure 3: Buy it Now Prices for Best Offer Listings

0 100000 200000 300000 400000 500000

Frequency

100 200 300 400 500 600

BIN Price

Notes: This is a histogram of seller’s chosen listing prices for our dataset. The bandwidth is one and unit

intervals are generated by rounding up to the nearest integer.

of these first offer ratios is

1

3

(0

.

75 + 0

.

625 + 0

.

5) = 0

.

625

.

As a result, the corresponding

data point on the scatterplot would have

x

= 128 and

y

= 0

.

625. Because listings can be

made at the cent level, we create bins that round up the listing price to the nearest dollar

so that each listing is group into the range (

z −

1

, z

] for all integers

z ∈

[50

,

550]. That

is, a listing at $26.03 will be grouped together with a listing of $26.95, while a listing of

$24.01 will be grouped together with a listing of $25. Each point in Figure 2 represents,

at that listing price, an average across all initial buyer offers for items in our sample of 2.8

million listings that received an offer.

What is remarkable about this scatterplot is that when the asking price is a multiple

of $100, the average ratio of the first offer to the listed price is at least five percentage

points lower than the same average for nearby non-round listing prices. It suggests a non-

monotonicity– that sellers who list at round numbers could improve their offers by either

lowering or raising their price by a small amount. However, this is not borne out by seller

behavior. We see many listings at these round numbers. Figure 3 presents a histogram

of listing prices from our dataset, showing that round numbers are disproportionately

more frequent. Moreover, as we document in Appendix H, choosing round-number

listings is prevalent even among the most experienced sellers. This observation — that

8

even experienced sellers seem to be selecting listing prices that elicit lower sale prices —

motivates our theoretical framework.

3 Theoretical Framework

This section presents a stylized model in which round numbers are chosen strategically

as a signal by impatient sellers who are willing to take a price cut in order to sell faster.

The intuition is quite simple: if round numbers are a credible cheap-talk signal of eager

(impatient) sellers, then by signaling weakness, a seller will attract buyers faster who

rationally anticipate the better deal. In equilibrium, patient sellers prefer to hold out for a

higher price, and hence have no incentive to signal weakness. In contrast, impatient sellers

avoid behaving like patient sellers because this will delay the sale.

The model we have constructed is deliberately simple, and substantially less general

than it could be. There are three essential components: the form of seller heterogeneity

(here, in discount rates), the source of frictions (assumptions on the arrival and decision

process), and the bargaining protocol (Nash). A very general treatment of the problem is

beyond the scope of this paper, but we appeal to the fact that there are numerous models

in the literature which share our intuition but differ in the above components.

6

It is also important to note that we use a rather standard “non-behavioral” approach

that imposes no limits on cognition or rationality. One may be tempted to connect

roundness and precision with ideas about how limited cognition among sellers and buyers

may impact outcomes. Perhaps, a round listing price reflects “cluelessness” or uncertainty

about demand for the product listed. This idea is particularly compelling because it is

intuitive that sellers use the Best Offer feature on eBay as a demand discovery mechanism.

If, however, round-number sellers were more uncertain about demand then they should

solicit more offers and take longer to sell; instead we find that they sell substantially sooner

6

With respect to seller heterogeneity, the intuition requires heterogeneity in sellers’ reserve prices.

Farrell and Gibbons (1989) impose this directly, while Menzio (2007) takes as primitive heterogeneity in

the joint surplus possible with each employer. Finally, Kim (2012) describes a market with lemons, so that

sellers have heterogeneous unobserved quality. Another critical ingredient is explaining why sellers who

offer buyers less surplus in equilibrium also have non-zero market share. In a frictionless world of Bertrand

competition, this is impossible. To address this, frictions are an essential part of the model. In Farrell

and Gibbons (1989) this is accomplished by endogenous bargaining breakdown probabilities. Recent work

used matching functions to impose mechanical search frictions in order to smooth expected market shares.

All that we require of the bargaining mechanism is that outcomes depend on sellers’ private information.

Farrell and Gibbons (1989) do the general case of bargaining mechanisms, while Menzio (2007) uses a

limiting model of alternating offers bargaining from Gul and Sonnenschein (1988).

9

than precise-number sellers. It is for this reason that we build our model on heterogeneity

in discounting rather than heterogeneity in seller informedness because the latter fails to

fit the empirical facts. However, in general we acknowledge that alternative cheap-talk

signaling models could be specified with similar predictions (e.g., with heterogeneity

in seller costs)— our intention is not to sort between them, but rather to provide an

illustrative example, to derive predictions, and to use them to prove the empirical relevance

of cheap-talk signaling in bargaining.

3.1 A Simple Model of Negotiations

Consider a market in which time is continuous and buyers arrive randomly with a Poisson

arrival rate of

λ

b

. Each buyer’s willingness to pay for a good is 1, and their outside option

is set at 0. Once a buyer appears in the marketplace he remains active for only an instant

of time, as he makes a decision to buy a good or leave instantaneously.

There are two types of sellers: high types (

θ

=

H

) and low types (

θ

=

L

), where types

are associated with the patience they have. In particular, the discount rates are

r

H

= 0

and

r

L

=

r >

0 for the two types, and both have a reservation value (cost) of 0 for the

good they can sell to a buyer. The utility of a seller of type

θ

from selling his good at a

price of p after a period of time t from when he arrived in the market is e

−r

θ

t

p.

We assume that at most one

H

and one

L

type sellers can be active at any given

instant of time. If an

H

type seller sells his good then he is replaced immediately, so that

there is always at least one active

H

type seller. Instead, if an

L

type seller sells his good

then he is replaced randomly with a Poisson arrival rate of

λ

s

. Hence, the expected time

between the departure of one

L

type seller and the arrival of another is

1

λ

s

. This captures

the notion of a diverse group of sellers, where patient sellers are abundant and impatient

sellers appear less frequently.

Buyers and sellers interact in the marketplace as follows. First, upon each buyer arrival

to the marketplace, each active seller sends the buyer a cheap-talk signal “Weak” (

W

) or

“Strong” (

S

). Being cheap-talk signals, these are costless and unverifiable, but they may

affect the buyer’s beliefs in equilibrium. Second, the buyer chooses a seller to match with.

Third and finally, upon matching with a seller, the two parties split the surplus of trade

between them given the buyer’s beliefs about the seller’s type.

7

7

For a similar continuous time matched-bargaining model see Ali et al. (2015). This split-the-surplus

“Nash bargaining” solution is defined for situations of complete information, where the payoff functions are

10

When a buyer arrives at the marketplace she observes the state of the market, which

is characterized by either one or two sellers. The assumptions on the arrival of seller types

imply that if there is only one seller, then the buyer knows that he is an

H

type seller,

while if there are two sellers, then the buyer knows that there is one of each type. A buyer

chooses who to “negotiate” with given her belief that is associated with the sellers’ signals.

Nash bargaining captures the idea that bargaining power will depend on the buyers’ beliefs

about whether the seller is patient (S) or impatient (W ).

We proceed to construct a separating Perfect Bayes Nash Equilibrium in which the

L

type chooses to reveal his weakness by selecting the signal

W

to negotiate a sale at a low

price once a buyer arrives, while the

H

type chooses the signal

S

and only sells if he is

alone for a high price. We verify that this is an equilibrium in the following steps.

1. High type’s price:

Let

p

H

denote the equilibrium price that a

H

type receives

if he choose the signal

S

. The

H

type does not care about when he sells because

his discount rate is

r

H

= 0, implying that his endogenous reservation value is

p

H

.

Splitting the surplus, i.e. Nash bargaining in this setting, requires that

p

H

be halfway

between that endogenous reservation value and 1, and therefore p

H

= 1.

2. Low type’s price:

Let

p

L

denote the equilibrium price that a

L

type receives from

a buyer if he chooses the signal

W

. If he waits instead of settling for

p

L

immediately,

then in equilibrium he will receive

p

L

from the next buyer. The Poisson arrival

rate of buyers implies that their inter-arrival time is distributed exponential with

parameter

λ

b

, so the expected value of waiting is

p

L

E

t

[

e

−rt

], where the discount can

be solve analytically:

E

t

[e

−rt

] =

Z

∞

0

e

−rx

λ

b

e

−λ

b

x

dx

=

λ

b

r + λ

b

Z

∞

0

(r + λ

b

)e

−x(r+λ

b

)

dx

| {z }

=1

=

λ

b

r + λ

b

. (1)

common knowledge. We take the liberty of adopting the solution concept to a situation where one player

has a belief over the payoff of the other player, and given that belief, the two players split the surplus.

11

The integral in the second line is equal to one by the definition of the exponential

distribution. Nash bargaining therefore implies

p

L

=

1

2

p

L

λ

b

r + λ

b

+

1

2

1 ⇒ p

L

=

r + λ

b

2r + λ

b

. (2)

3. Incentive compatibility:

It is obvious that incentive compatibility holds for

H

types. Imagine then that the

L

type chooses

S

instead of

W

. Because there is always

an

H

type seller present, once a buyer arrives we assume that each seller gets to

transact with the buyer with probability

1

2

. Hence, the deviating

L

type either sells

at

p

H

= 1 or does not sell and waits for

p

L

, each with equal probability. Incentive

compatibility holds if

p

L

≥

1

2

λ

b

r+λ

b

p

L

+

1

2

1, but this holds with equality from the Nash

bargaining solution that determines the L type’s equilibrium price.

8

3.2 Equilibrium Properties and Empirical Predictions

In equilibrium, if both sellers are present in the market then any new buyer that arrives will

select to negotiate with an

L

type in order to obtain the lower price of

p

L

. Furthermore,

an

H

type will sell to a buyer if and only if there is no

L

type seller in parallel. Because

L

types are replaced with a Poisson rate of

λ

s

, the

H

type will be able to sometimes sell in

the period of time after one

L

type sold and another

L

type arrives in the market. As a

result, the equilibrium has the following properties: First, the

L

type sells at price

p

L

<

1

and the

H

type sells at price

p

H

= 1. Second, the

L

type sells with probability 1 to the

first arriving buyer while the

H

type sells only when there is no

L

type. This implies a

longer waiting time for a sale for

H

. In turn, this implies for any given period of time, the

probability that an H type will sell is lower than that of an L type.

These equilibrium properties lend themselves immediately to several empirical predic-

tions that we can take to our data. In light of the regularity identified in Figure 2, we take

round numbers in multiples of $100 to be signals of weakness, justified further in Section

4.1. As such, the testable hypotheses of the model are as follows:

8

Because we use the Nash solution for the negotiation stage of the game, there is no deviation to

consider there. One could consider an alternative game in which sellers commit to a single, public signal

of their type which will be visible to all buyers. Then we should verify that the

L

type does not want to

deviate and commit to choose the

S

signal forever until he makes a sale. If the

L

type commits to this

strategy then his expected payoff can be written recursively as

v

=

1

2

1 +

1

2

v

λ

b

r+λ

b

. By analogy with (2)

this implies v = p

L

and so we conclude that such a deviation is not profitable.

12

H1: Round-number listings get discounted offers and sell for lower prices.

H2: Round-number listings receive offers sooner and sell faster.

H3:

Round-number listings sell with a higher probability (Because listings expire, even

L

types may not sell).

H4: In “thick” buyer markets (higher λ

b

) discounts are lower.

We have chosen to model bargaining and negotiation using Nash Bargaining rather

than specifying a non-cooperative bargaining game. As Binmore et al. (1986) show, the

Nash solution can be obtained as a reduced form outcome of a non-cooperative strategic

game, most notably as variants of the Rubinstein (1982) alternating offers game. Building

such a model is beyond the scope of this paper, but analyses such as those in Admati and

Perry (1987) suggest that patient bargainers will be tough and willing to suffer delay in

order to obtain a better price. Hence, despite the fact that within-bargaining offers and

counter-offers are not part of our formal model, the existing theoretical literature suggests

the following hypotheses:

H5:

Conditional on receiving an offer, round-number sellers are more likely to accept

rather than counter.

H6:

Conditional on countering, round-number sellers make less aggressive counter-offers.

In the above we have taken as given that round numbers are the chosen signal of

bargaining weakness. A natural question would be, why don’t impatient sellers just reduce

their listing price rather than choose a round number? In practice, sellers may be trying

to signal many dimensions of the item and their preferences simultaneously, and the level

of the price is more likely to be useful for signaling item quality to buyers. As we show

in Section 4.5 below, these signals are directing buyer search at an early stage, before

buyers are exposed to— i.e. make the investment in examining— full item descriptions or

multiple photographs. Therefore, if a seller has an item that he believes can sell for about

$70, but is willing to sell it faster at $65, then by listing it at $65 buyers may infer that it

is of lower quality and not explore the item in more detail. Instead, the round number of

$100 signals to buyers “I’m ready to cut a deal.”

13

4 Empirical Analysis

The goal of our empirical analysis is to test the six hypotheses using our data on Best

Offer bargaining. Figure 2 is suggestive that, on average, listings at round-number prices

receive lower offers than those at close-by precise-number prices. We proceed to develop

an identification strategy based on local comparisons to estimate the magnitude of these

discontinuities in expected bargaining outcomes conditional on the listing price. This

strategy allows us to test hypotheses H1- H3.

A particular challenge is the presence of listing-level heterogeneity that may be ob-

servable to market participants but not to us. We address this problem in Section 4.3

using a sample of internationally visible listings from the ebay.co.uk website. Currency

exchange rates obfuscate roundness of the listing price seen by U.K. buyers but not by

those in the U.S., which lends itself to a difference-in-differences-style approach to show

that unaccounted-for attributes correlated with roundness do not explain our results.

In addition, we exploit detailed offer-level and behavioral data to offer supplementary

evidence for the signaling role of round numbers. This allows us to test hypotheses H4-H6,

as well as to identify the role of round prices in guiding buyer search, by which we can

shed some light on the signaling mechanism.

4.1 Framework and Identification

We are interested in identifying and estimating point discontinuities in

E

[

y

j

|BIN price

j

],

where

y

j

is a bargaining outcome for listing

j

, e.g., the average first offer or the time to

the first offer. Assuming finitely many such discontinuities, z ∈ Z, we can write:

E[y

j

|BIN price

j

] = g(BIN price

j

) +

X

z∈Z

1

z

{BIN price

j

}β

z

, (3)

where

g

(

·

) is a continuous function,

1

z

is an indicator function equal to 1 if the argument

is equal to

z

and 0 otherwise, and

Z

is the set of points of interest. Therefore

β

is the

vector of parameters we would like to estimate. Note that the set of continuous functions

g

(

·

) on

R

+

and the set of point discontinuities (

1

z

, z ∈ Z

) are mutually orthonormal; this

shape restriction, i.e. continuity of

g

(

·

), is critical to separately identify these two functions

of the same variable. However,

g

(

·

) remains an unknown, potentially very complicated

function of the BIN price, and so we remain agnostic about its form and exploit the

14

assumption of continuity by focusing on local comparisons. Consider two points

z ∈ Z

and (z + ∆) /∈ Z, and define the difference in their outcomes by π

z

(∆), i.e.:

π

z

(∆) ≡ E[y|z + ∆] − E[y|z] = g(z + ∆) − g(z) − β

z

. (4)

For ∆ large, this comparison is unhelpful for identifying

β

z

absent the imposition

of an arbitrary parametric structure on

g

(

·

).

9

However, as ∆

→

0, continuity implies

g(z + ∆) − g(z) → 0, offering a nonparametric approach to identification of β

z

:

β

z

= − lim

∆→0

π

z

(∆). (5)

Estimation of this limit requires estimation of

g

(

·

), which can be accomplished semi-

parametrically using sieve estimators or, more parsimoniously, by local linear regression in

the neighborhood of

z

. In this sense our identification argument is fundamentally local. It

is particularly important to be flexible in estimating

g

(

·

) because our theoretical framework

offers no guidance as to its shape. Still, intuitively, one might suspect that it would be

monotonically increasing, and this intuition motivates an informal specification test that

we present in Appendix A2. There we show that failing to account for discontinuities at

z

creates non-montonicities in a smoothed estimate of g(·).

A few remarks comparing our approach to that in regression discontinuity (RD) studies

are worthwhile. Though our identification of

β

z

is fundamentally local, there remain two

basic differences: the first stems from studying point rather than jump discontinuities:

where RD cannot identify treatment effects for interior points (i.e., when the forcing

variable is strictly greater than the threshold), we have no such interior. Consistent with

this, we avoid the “boundary problems” of nonparametric estimation because we have

“untreated” observations on both sides of each point discontinuity. Second, RD relies

on error in assignment to the treatment group so that, in a small neighborhood of the

threshold, treatment is quasi-random. We cannot make such an argument because our

model explicitly stipulates nonrandom selection on round numbers, that sellers deliberately

and deterministically select into this group. It is therefore incumbent upon us to show

that our results are not driven by differences in unaccounted-for attributes between round-

and non-round listings, which we address in Section 4.3.

9

For instance, if

g

(

x

) =

αx

, then the model would be parametrically identified and estimable using

linear regression on

x

and

1

z

. Our results for the more flexible approach described next suggest that the

globally linear fit of g(·) would be a poor approximation; see Appendix C and Table A-3 in particular.

15

For the construction of

Z

we have chosen to focus on round-number prices because

they appear, from the histogram in Figure 3, to be focal points. A disproportionate

number of sellers choose to use round numbers despite their apparent negative effect on

bargaining outcomes. To further motivate this choice, in Appendix A4 we employ a LASSO

model selection approach to detect salient discontinuities in the expected sale price. The

LASSO model consistently and decisively selects a regression model that includes dummy

variables for the interval (

z −

1

, z

], where

z ∈ {

100

,

200

,

300

,

400

,

500

}

, and discards other

precise-number dummy variables.

4.2 Round Numbers and Seller Outcomes

This section implements the identification strategy outlined above using local linear

regression in the neighborhood of

z ∈ {

100

,

200

,

300

,

400

,

500

}

to estimate

β

z

, following

the intuition of Equation (5). Our primary interest is in identifying

β

z

, and therefore

standard kernels and optimal bandwidth estimators, which are most often premised on

minimizing mean-squared error over the entire support, would be inappropriate. In order

to identify

β

z

we are interested in minimizing a mean-squared error locally, i.e. at those

points

z ∈ Z

, rather than over the entire support of

g

(

·

). This problem has been solved for

local linear regression using a rectangular kernel by Fan and Gi

`

jbels (1992).

10

Therefore

we use a rectangular kernel, which can be interpreted as a linear regression for an interval

centered at

z

of width 2

h

z

, where

h

z

is a bandwidth parameter that optimally depends on

local features of the data and the data-generating process. See Appendix B for the details

of the estimation of the optimal variable bandwidth.

We use separate indicators for when the BIN price is exactly a round number and

when it is “on the nines”, i.e., in the interval [

z −

1

, z

) for each round number

z ∈ Z

, to

account for any “left-digit” effect. Therefore, conditional on our derived optimal bandwidth

h

z

and choice of rectangular kernel, we restrict attention to listings

j

with BIN prices

x

j

∈ [z − h

z

, z + h

z

], and use OLS to estimate:

y

j

= a

z

+ b

z

x

j

+ β

z,00

1{x

j

= z} + β

z,99

1{x

j

∈ [z − 1, z)} +

j

. (6)

10

Imbens and Kalyanaraman (2012) extend the optimal variable bandwidth approach to allow for

discontinuities in slope as well as level. This is important in the RD setting when the researcher wants to

allow for heterogeneous treatment effects which, if correlated with the forcing variable, will generate a

discontinuity in slope at jump discontinuity. We do not face this problem because we study a point rather

than a jump discontinuity, with untreated—and therefore comparable—observations on either side.

16

The nuisance parameters

a

z

and

b

z

capture the the local shape of

g

(

·

),

β

z,00

captures

the round-number effect, and

β

z,99

captures any effect of being listed “on the nines.” We

estimate this model separately for each z ∈ {100, 200, 300, 400, 500}.

4.2.1 Offers and Prices: Testing H1

Our first set of results concerns cases where

y

j

is the average first buyer offer and the final

sale price of an item if sold, which tests of H1, i.e., that round-number sellers receive lower

offers and settle on a lower final sale price. Estimates for this specification are presented

in Table 2. All results show estimates with and without eleven category-level fixed effects

in order to address one source of possible heterogeneity between listings.

Each cell in the table reports results for a local linear fit in the neighborhood of the

round number indicated (e.g., BIN=100), using the dependent variable assigned to that

column. Table 2 reports the coefficient on the indicator for whether listings were exactly

at the round number so that only

β

z,00

is shown. Columns 1 and 2 report estimates for all

items that receive offers while Columns 3 and 4 report estimates for all items that sell,

including non-bargained sales. Results on sales are similar if the sample is restricted to

only bargained items, and remain significant when standard errors are clustered at the

category level. We discuss results of the buyers’ choice to bargain in Appendix E.

The estimates show a strong and consistently negative relationship between the round-

ness of listed prices and both offers and sales. The effects are, remarkably, generally

log-linear in the BIN price, a regularity that is not imposed by our estimation procedure.

In particular, they suggest that for round BIN price listings, offers and final prices are lower

by 5%-8% as a factor of the listing price compared to their precise-number neighbors. The

estimates are slightly larger for the $500 listing value. The statistically and economically

meaningful differences in outcomes of Table 2 provide strong evidence for H1.

Ancillary coefficients, i.e. the slope, and intercept of the linear approximation of

g

(

·

)

are reported and discussed in Appendix C. Importantly, we find substantial variance in the

slope parameters at different round numbers, which confirms the importance of treating

g

(

·

) flexibly. Coefficients on the indicator for the “99”s, i.e. [

z −

1

, z

) intervals, are reported

in Appendix D. We find that, contrary to prior work on pricing “to the nines,” in our

bargaining environment these numbers yield outcomes that are remarkably similar to those

of their round neighbors. This suggests that 99 listings also signal weakness. In Appendix

A we present estimates from a sieve estimator approach using orthogonal basis splines to

17

Table 2: Offers and Sales for Round $100 Signals

(1) (2) (3) (4)

Avg First Offer $ Avg First Offer $ Avg Sale $ Avg Sale $

BIN=100 -5.372

∗∗∗

-4.283

∗∗∗

-5.579

∗∗∗

-5.002

∗∗∗

(0.118) (0.115) (0.127) (0.127)

BIN=200 -11.42

∗∗∗

-8.849

∗∗∗

-10.65

∗∗∗

-9.310

∗∗∗

(0.376) (0.369) (0.401) (0.393)

BIN=300 -18.74

∗∗∗

-14.78

∗∗∗

-17.04

∗∗∗

-15.94

∗∗∗

(0.717) (0.475) (0.863) (0.629)

BIN=400 -24.61

∗∗∗

-17.71

∗∗∗

-17.98

∗∗∗

-15.80

∗∗∗

(0.913) (0.894) (1.270) (1.186)

BIN=500 -39.43

∗∗∗

-28.58

∗∗∗

-35.76

∗∗∗

-30.55

∗∗∗

(1.320) (1.232) (1.642) (1.478)

Category FE YES YES

Notes: Each cell in the table reports the coefficient on the indicator for roundness from a separate local

linear fit according to Equation (6) in the neighborhood of the round number indicated for the row, using

the dependent variable shown for each column. Ancillary coefficients for each fit are reported in Table

A-3. Heteroskedacticity-robust standard errors are in parentheses,

∗

p < .1,

∗∗

p < .05,

∗∗∗

p < .01.

approximate

g

(

·

). Although this approach requires choosing tuning parameters (knots

and power), it has an advantage in that pooling across wider ranges of BIN prices allows

us to include seller fixed effects to control for seller attributes and to attempt several

specification tests. Estimates from the cardinal basis spline approach are consistent with

those from Table 2.

4.2.2 Offer Arrivals and Likelihood of Sale: Testing H2 and H3

Predictions H2 and H3 of the model are essential to demonstrate incentive compatibility

in a separating equilibrium— in particular, that round-number listings are compensated

for their lower sale price by a faster arrival of offers and a higher probability of sale. To

test this in the data, we employ specification (6) for three additional cases: where

y

j

is

the time to first offer, the time to sale, and the probability of sale for a listing in its first

60 days. Results for these tests are presented in Table 3. Columns 1 and 2 show that

round-number listings receive their first offers between 6 and 11 days sooner, on an average

of about 28 days as shown in Table 1. Columns 3 and 4 show that round-number listings

also sell faster, between 10 and 14 days faster on a mean of 39 days. Hence, sellers can cut

their time on the market by up to a third when listing at round numbers. Columns 5 and

18

Table 3: Throughput Effects of Round $100 Signals

(1) (2) (3) (4) (5) (6)

Days to Offer Days to Offer Days to Sale Days to Sale Pr(Sale) Pr(Sale)

BIN=100 -11.02

∗∗∗

-11.09

∗∗∗

-13.80

∗∗∗

-14.38

∗∗∗

0.0478

∗∗∗

0.0522

∗∗∗

(0.333) (0.331) (0.434) (0.432) (0.00177) (0.00176)

BIN=200 -11.53

∗∗∗

-11.52

∗∗∗

-15.15

∗∗∗

-15.64

∗∗∗

0.0550

∗∗∗

0.0590

∗∗∗

(0.526) (0.514) (0.734) (0.729) (0.00254) (0.00251)

BIN=300 -9.878

∗∗∗

-7.390

∗∗∗

-11.15

∗∗∗

-11.95

∗∗∗

0.0407

∗∗∗

0.0317

∗∗∗

(0.655) (0.384) (0.784) (0.673) (0.00303) (0.00217)

BIN=400 -7.908

∗∗∗

-6.125

∗∗∗

-10.73

∗∗∗

-10.87

∗∗∗

0.0329

∗∗∗

0.0319

∗∗∗

(0.509) (0.392) (0.849) (0.862) (0.00245) (0.00244)

BIN=500 -9.431

∗∗∗

-8.832

∗∗∗

-10.31

∗∗∗

-10.77

∗∗∗

0.0306

∗∗∗

0.0354

∗∗∗

(0.637) (0.619) (1.004) (1.009) (0.00347) (0.00348)

Category FE YES YES YES

Notes: Each cell in the table reports the coefficient on the indicator for roundness from a separate local

linear fit according to Equation (6) in the neighborhood of the round number indicated for the row, using

the dependent variable shown for each column. Ancillary coefficients for each fit are reported in Table

A-4. Heteroskedacticity-robust standard errors are in parentheses,

∗

p < .1,

∗∗

p < .05,

∗∗∗

p < .01.

6 shows that round listings also have a consistently higher probability of selling, raising

conversion by between 3 and 6 percent on a base conversion rate of 20 percent. Note

that listings may be renewed beyond 60 days, however our estimates for the effect on the

probability of sale are similar when we use alternative thresholds (30, 90, or 120 days).

11

4.2.3 Effects of Market Thickness: Testing H4

Testing H4, that “thick” markets have lower price discounts, is more challenging than the

previous three hypotheses because it requires a measure of market thickness. One could

select products that are more standardized and for which markets are likely to be thick,

compared to “long-tail” items for which markets are thin. Two drawbacks of this approach

are first, that standardized items will have less scope for price discovery and bargaining,

11

A thoughtful question we have received is whether we can calculate a discount rate consistent with

our results that identifies the “indifferent” seller— indifferent between using a round- and a nearby

precise-number listing price. In order to calculate this number we would need to make assumptions about

sellers’ costs as well as their outside option in the event of a failure to sell. We computed this estimate

under a wide array of specifications, and the resulting discount rates ranged from arbitrarily large and

negative to arbitrarily large and positive. We take from this exercise that it is impossible to learn about

the discount rate itself absent more information on the seller?s problem, however we also take that our

findings alone do not imply an unreasonably high or low discount rate.

19

and second, that any such selection would be ad hoc. Instead, we use behavioral data on

Search Result Page (SRP) and View Item (VI) page visits to measure market thickness.

In particular, more popular items with higher traffic, as measured by SRP and VI

counts can be categorized as having more buyers interested in them, and hence, thicker

markets than items with lower view counts. These items are different in myriad other

characteristics, so we consider the results only suggestive.

12

The way in which traffic and

item popularity are measured is explained in more detail in Appendix F.

Listings are divided into deciles in increasing order of SRP and VI visit frequency. We

then replicate our local linear approach from equation (6) to estimate the effect of round

listing prices on mean first offers within each decile. Figure A-3 in Appendix F plots the

point estimates and confidence intervals of the discounts at round numbers. We find lower

relative discounts for item deciles with higher view rates, which is consistent with H4. If

we use search counts as a measure of popularity, we see a U-shaped pattern where both

very low and very high search counts have lower discounts than the mid range of search

counts. Nonetheless, this relationship is still positive as suggested by H4 — a linear fit of

these coefficients has a significant positive slope.

4.3 Selection on Unobservable Listing Attributes

A natural concern with the results of Section 4.2 is that there may be unaccounted-for

differences between round and non-round listings. There is substantial heterogeneity in

the quality of listed goods that is observable to buyers and sellers but controlled for in our

main specification. This includes information in the listing title, the listing description, as

well as in the photographs. If round-number listings are of lower quality in an unobserved

way, then this would offer an alternative explanation for the correlations we find. To

formalize this idea, let the unobservable quality of a product be indexed by

ξ

with a

conditional distribution

H

(

ξ|BIN price

) and a conditional density

h

(

ξ|BIN price

). In this

light we rewrite equation (3), the expectation of y

j

conditional on observables, as

E[y

j

|BIN price

j

] =

Z

g(BIN price

j

, ξ)dH(ξ|BIN price

j

) +

X

z∈Z

1

z

{BIN price

j

}β

z

. (7)

12

Our measure is an imperfect proxy for market thickness because traffic is only indirectly correlated

with the arrival of buyers. Perhaps quirky yet undesired items receive traffic because they are interesting.

20

From equation (7) it is clear that the original shape restriction—continuity of

g

(

·

)—is

insufficient to identify

β

z

: we also require continuity of the conditional distribution of

unobserved heterogeneity in the neighborhood of each element in

Z

. Formally, consider

the analogue of equation (5), which summarized the identification argument from Section

4.1:

lim

∆→0

π(∆) = lim

∆→0

Z

g(z, ξ)[h(ξ|z + ∆) − h(ξ|z)]dξ

| {z }

≡γ

z

−β

z

. (8)

The first term on the right-hand side of equation (8), denoted

γ

z

, is a potential source

of bias. Now, if we assume that the conditional distribution

h

(

ξ|BIN price

) is continuous

in the BIN price, then that bias is equal to zero and therefore the estimates from Section

4.2 are robust to unobserved heterogeneity. This is important: unobserved heterogeneity

alone does not threaten our identification argument— mathematically, the concern is

discontinuities in the conditional distribution of unobserved heterogeneity. However, such

discontinuities may exist: for example, if sellers are systematically more likely to round

up than round down, then listings at round numbers will have a discontinuously lower

expected unobserved quality (

ξ

) than nearby precise listings. Moreover, a similar outcome

results if the propensity of sellers to round is correlated with

ξ

conditional on the BIN

price, e.g. if sellers of used or defective items are more likely to round. These are both

plausible stories that raise concern over the identification argument of Section 4.2.

The ideal experiment would be to somehow hold

ξ

fixed and observe the same product

listed at both round and non-round BIN prices. With observational data this is possible if

we restrict attention to well-defined products, but such products will also have a well-defined

market price that leaves little room for bargaining.

13

A similar problem arises for field

experiments: if one were to create multiple listings for the same product, experimentally

varying roundness, they would generate their own competition. It wold be interesting,

though outside of the ambition of this paper, to construct a field experiment with a diverse

set of listings that is large enough to make the unobserved heterogeneity average out.

Instead, here we adopt a strategy that takes advantage of the unique data already at our

disposal.

We address the problem of unobserved heterogeneity by considering a special sample

of listings that allows us to separate

γ

z

, the bias term defined in equation (8), and

β

z

.

Sellers who list on the U.K. eBay site (ebay.co.uk) enter a price in British Pounds, which

13

H4 suggests that in such “thick” markets, we should see little or no discount associated with roundness.

21

Figure 4: Example of Round UK Listing on US Site

(a) Search Results

(b) Listing Page

Notes: Frame (a) depicts a UK listing appearing in a US user’s search results; the price has converted

from British pounds into US dollars. The listing itself appears in frame (b), where the price is available in

both British pounds and US dollars.

is displayed to U.K. buyers. The sellers can choose to make their listing visible on the U.S.

site as well. U.S. buyers viewing those U.K. listings, however, observe a BIN price in U.S.

dollars as converted at a daily exchange rate. Figure 4a gives an example of how a U.S.

buyer sees an internationally cross-listed good. Because of the currency conversion, even

if the original listing price is round, the U.S. buyer will observe a non-round price when

these items appear in search results.

14

This motivates a new identification strategy that is close in spirit to the “ideal”

experiment described above: For listings that are round in British Pounds, we difference

the offers of U.S. and U.K. buyers. This differencing removes the common effect of listing

quality (

γ

z

), which is observed by both U.S. and U.K. buyers, leaving the causal effect

of the round-number listing price (

β

z

). To formalize this, let

C ∈ {UK, US}

denote the

country in which the offers are made, and define

14

We use daily exchange rates to confirm that extremely few US buyers observe a round price in U.S.

dollars for U.K. listings. This sample is too small to identify a causal effect of coincidental roundness.

22

π

z,C

(∆) ≡ g

C

(z + ∆) − g

C

(z) − 1{C = UK}β

z

. (9)

The construction in Equation (9) generalizes Equation (4) to the two-country setting.

Now, differencing π

z,U K

(∆) and π

z,U S

(∆), we obtain:

π

z,U K

(∆) − π

z,U S

(∆) = [g

UK

(z + ∆) − g

UK

(z)] − [g

US

(z + ∆) − g

US

(z)] − β

z

. (10)

Following the logic of the identification argument in 4.1, we take the limit of Equation

(10) as ∆

→

0 in order to construct an estimator for

β

z

based on local comparisons. Recall

that as ∆ → 0, [g

C

(z + ∆) − g

C

(z)] → γ

z

so that,

β

z

= − lim

∆→0

[π

z,U K

(∆) − π

z,U S

(∆)],

which extends the identification argument by differencing out the local structure of

g

(

·

),

which is common to U.K. and U.S. buyers. As in Section 4.2, we employ the results from

Fan and Gi

`

jbels (1992) and use a rectangular kernel with the optimal variable bandwidth;

see Appendix B for details. Then, parameters are estimated with OLS using listings with

BIN prices (denoted x

j

, in £) in [z − h, z + h] and offers y

j

with the specification:

y

j

=(a

z,U K

+ b

z,U K

(z − x

j

))

1

UK,j

(a

z,U S

+ b

z,U S

(z − x

j

))

1

US,j

+ γ

z,00

1{x

j

= z} + β

z,00,U K

1

UK,j

1{x

j

= z}

+ γ

z,99

1{x

j

∈ (z − 1, z)} + β

z,99

1

UK,j

1{x

j

∈ (z − 1, z)} + ε

j

. (11)

In contrast with the estimator from Equation (6), here the unit of observation is the

buyer offer. The approach is similar in spirit to a a difference-in-differences estimation

across U.S. and U.K. buyers and round- and non-round listings. In the regression,

γ

z

captures the common, unobservable characteristics of the listing (observed to both U.S.

and U.K. buyers), while

β

z

is the round-number effect, and is identified by the difference

in the discontinuous response of U.K. and U.S. buyers to roundness of the listing price in

British Pounds. Systematic differences between U.K. and U.S. buyers that are unrelated

to roundness, e.g. shipping costs, are captured by allowing the nuisance constant and

slope parameters to vary by the nationality of the buyer.

23

Table 4: Effect of Roundness on Offers from the UK Specification

(1) (2)

Offer $ Offer $

UK x Round £100 -2.213

∗∗∗

-2.048

∗∗∗

(0.354) (0.352)

UK x Round £200 -6.409

∗∗∗

-6.386

∗∗∗

(1.000) (0.964)

UK x Round £300 -9.418

∗∗∗

-6.764

∗∗∗

(1.556) (1.413)

UK x Round £400 -16.60

∗∗∗

-18.05

∗∗∗

(2.500) (2.426)

UK x Round £500 -15.33

∗∗∗

-19.06

∗∗∗

(3.539) (3.180)

Category FE YES

Notes: Each cell in the table reports the coefficient on the interaction of an indicator for roundness with an

indicator for a U.K. buyer from a separate local linear fit according to Equation (11) in the neighborhood

of the round number indicated for the row, with the level of an offer, either from a U.K. buyer or a U.S.

one, as the dependent variable. Heteroskedacticity-robust standard errors are in parentheses,

∗

p < .

1,

∗∗

p < .05,

∗∗∗

p < .01.

Note that on the listing page (depicted in Figure 4b), which appears after a buyer

chooses to click on an item seen on the search results page (depicted in Figure 4a), the

original U.K. price does appear along with the price in U.S. dollars. This means that

buyers see the signal after selecting the item to place an offer. The late revelation of

the signal will bias our results, but in the “right” direction because it will attenuate

any difference between U.S. and U.K. offers which is a causal effect of round numbers.

To the extent that we find any causal effect, we hypothesize that it survives due to the

non-salience of the U.K. price in British Pounds during the search phase of activity, and

we posit that it is a lower bound on the true causal effect of the round signal.

Our sample includes all U.K.-based listings created between June 2010 and June

2013 that are internationally visible. We then take as our dependent variable all initial

offers made to these listings from a U.K. or U.S. buyer. This results in a total of 2.3

million offer-level observations over 600 thousand listings. In our sample we find that U.K.

buyers tend to bid on slightly more expensive listings (£184 versus £163, on average) and

correspondingly make somewhat higher offers (£113 versus £104, on average). Results

from the estimation of Equation (11) are presented in Table 4. The estimated effects are

smaller than in those in Section 4.2, which could be due to either selection on unobservable

characteristics or attenuation from some U.S. buyers observing the roundness of the listing

24

price in British Pounds after they select to view an item. Nonetheless, the fact that the

differential response of U.S. versus U.K. bidders is systematically positive and statistically

significant confirms that our evidence for H1 cannot be fully discounted by selection on

unobservables.

4.4 Further Evidence for a Separating Equilibrium: H5 and H6

In addition to predictions for bargaining outcomes, i.e. H1-H4 from Section 3.2, our

theoretical framework also offers predictions on the bargaining process based on the

separation of patient versus impatient sellers. If sellers who use precise listing prices are in

fact less patient, then we should also see that these sellers are more likely to accept a given

offer (H5), and also less aggressive in their counteroffers (H6). To test these predictions

we take advantage of our offer-level data to see whether, holding fixed the level of the offer,

the sellers’ type (as predicted by roundness/precision) is correlated with the probability of

acceptance or the mean counteroffer. Results are presented in Figure 5.

In panel 5a we plot a smoothed estimate of the probability of acceptance against the

ratio of the buyers’ first offer in a bargaining interaction to the corresponding seller’s

listing price. Normalizing by the listing price allows us to compare disparate listings and

hold constant the level of the offer. We plot this for sellers who use round and precise

listing prices separately. The results show a clear and statistically significant difference:

precise number sellers act as if they have a higher reservation price and are more likely to

reject offers at any ratio of the listing price, consistent with H5.

15

Panel 5b plots the level of the seller’s counteroffer, conditional on making one, again

normalized by the listing price, against the ratio of the buyer’s offer to the listing price.

Note that, unlike the results for the probability of acceptance, this sample of counteroffers

is selected by the seller’s decision to make a counteroffer at all. Again we see that precise

sellers seem to behave as if they have a higher reservation price than round sellers; their

counteroffers are systematically higher, consistent with H6.

15

It may seem surprising that offers close to 100% of the list price are accepted only about half the

time. We conjecture that many sellers do not respond to the email that alerts them of an offer.

25

Figure 5: Seller Responses to Lower Offers

0 .1 .2 .3 .4 .5

Pr(Accept)

0 .2 .4 .6 .8 1

Offer / BIN

Round Precise 95% CI

(a) First Offer Acceptance

.6 .7 .8 .9 1

Counter / BIN

0 .2 .4 .6 .8 1

Offer / BIN

Round Precise 95% CI

(b) Counter Offer Value

Notes: Frame (a) depicts the polynomial fit of the probability of acceptance for a given offer (normalized by the BIN) on

items with listing prices between $85 and $115, plotted separately for $100 ‘Round’ listings and the remaining ‘Precise’

listings. Frame (b) depicts the polynomial fit of the counteroffer (normalized by the BIN) made by a seller, similarly

constructed.

4.5 Signaling and Buyer Search Behavior

In this section we take advantage of our access to detailed data on eBay user behavior to

isolate the effect of roundness as a signal on buyers’ search behavior. Our model is, like

other cheap talk models, agnostic about the form of the signal itself. Why should sellers

use roundness as a signal instead of, for instance, language in the detailed description or

a colored border on the photograph? We shed light on this by identifying the point at

which this signal affects buyers’ search behavior.

In order to do this we leverage eBay’s data infrastructure to tabulate the total number

of search events that returns each listing. A search result page (SRP) contains many entries

similar to that shown in Figure 4a. We also collect the total number of times users view

the item (VI) detail page, an example of which is shown in Figure 1a. We normalize these

counts by the number of days that each listing was active to compute the exposure rate

per day for each metric. Figure 6 replicates Figure 2 for these two normalized measures

of exposure. Table 5 presents the results from a local linear estimation of the effect of a

round BIN price on these two outcomes. Note that while the absolute magnitudes are

smaller in Columns (3) and (4), they are quite a bit larger relative to the average levels

that can be inferred from Figure 6. Round listings do not have a higher search exposure

rate than non-round listings, but theys have a substantially higher view-item rate.

26

Figure 6: Search and View Item Detail Counts

100 200 300 400 500 600

Search Result Hits/Day

0 100 200 300 400 500 600

Buy It Now (Listing) Price

Round $100 Round $50 Other $ Increment

(a) SRP Counts

1 2 3 4

Views/Day

0 100 200 300 400 500 600

Buy It Now (Listing) Price

Round $100 Round $50 Other $ Increment

(b) VI Count

Notes: This plot presents average SRP and VI events per day by unit intervals of the BIN price, defined

by (

z −

1

, z

]. On the

x

axis is the BIN price of the listing, and on the

y

axis is the average number of

SRP arrivals per day, in panel (a), or the average number of VI arrivals per day, in panel (b). When the

BIN price is on an interval rounded to a “00” number, it is represented by a red circle; “50” numbers are

represented by a red triangle.

This is strong evidence that buyers select into round listings when seeing only infor-

mation on the search result page. That information is limited to the item title, an image

thumbnail, and the BIN price (or, currency-converted BIN price). This helps to explain

why sellers would use a price-based signal: it attracts buyers at the moment they are

looking at all similar items on the search page. There are of course, other potential signals

on the search page, but these are not cheap: the photograph conveys important information,

and Backus et al. (2014) observed that savvy sellers fill the title with descriptive words

to generate SRP exposure. More importantly, however, the structure of the title and the

photograph are eBay-specific; we conjecture that roundness of the asking price is used as

a signal precisely because it is generic to bargaining marketplaces. Indeed, as we show in

the next section, there is reason to believe that roundness may be a universal signal.

5 Further Evidence from Real Estate Listings

One might wonder whether the evidence presented thus far is particular to eBay’s mar-

ketplace. Although that fact is interesting in itself, there is nothing specific to the Best

Offer platform that would lead to the equilibrium we propose. There are many bargaining

settings where buyers and sellers would want to signal weakness in exchange for faster and

27

Table 5: Roundness and Search and View Item Detail

(1) (2) (3) (4)

SRP Hits Per Day SRP Hits Per Day VI Count Per Day VI Count Per Day

BIN=100 -40.18

∗∗∗

-23.25

∗∗∗

0.654

∗∗∗

0.703

∗∗∗

(0.640) (0.659) (0.0180) (0.0178)

BIN=200 -58.54

∗∗∗

-51.42

∗∗∗

1.005

∗∗∗

0.925

∗∗∗

(0.882) (1.042) (0.0378) (0.0365)

BIN=300 -66.59

∗∗∗

-50.42

∗∗∗

1.246

∗∗∗

0.944

∗∗∗

(1.291) (1.261) (0.0452) (0.0394)

BIN=400 -74.99

∗∗∗

-53.72

∗∗∗

1.469

∗∗∗

1.325

∗∗∗

(1.822) (1.657) (0.0540) (0.0524)

BIN=500 -95.67

∗∗∗

-82.99

∗∗∗

1.627

∗∗∗

1.384

∗∗∗

(2.100) (2.051) (0.0629) (0.0616)

Category FE YES YES

Notes: Each cell in the table reports the coefficient on the indicator for roundness from a separate local

linear fit according to Equation (6) in the neighborhood of the round number indicated for the row,

using the dependent variable shown for each column. Heteroskedacticity-robust standard errors are in

parentheses,

∗

p < .1,

∗∗

p < .05,

∗∗∗

p < .01.

more likely sales. We consider the real estate market as another illustration of the role

of cheap-talk signaling in bargaining. In contrast to eBay, real estate is a market with

large and substantial transactions. Sellers are often assisted by professional listing agents

making unsophisticated behavior unlikely.

We make use of the Multiple Listing Service (“MLS”) data from Levitt and Syverson

(2008) that contains listing and sales data for Illinois in from 1992 through 2002. We

consider round-number listings to be multiples of $50,000 after being rounded to the